Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - NCS Multistage Holdings, Inc. | d296949dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 26, 2017

Registration No. 333-216580

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NCS Multistage Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1389 | 46-1527455 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

NCS Multistage Holdings, Inc.

19450 State Highway 249, Suite 200

Houston, TX 77070

(281) 453-2222

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

P. Kevin Trautner

Executive Vice President, General Counsel and Secretary

19450 State Highway 249, Suite 200

Houston, TX 77070

(281) 453-2222

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) |

J. David Kirkland Jr., Esq. James B. Marshall, Esq. Baker Botts L.L.P. 910 Louisiana Street Houston, Texas 77002 (713) 229-1234 (Phone) (713) 229-1522 (Fax) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☐ Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated April 26, 2017

PRELIMINARY PROSPECTUS

9,500,000 Shares

NCS Multistage Holdings, Inc.

Common Stock

This is an initial public offering of common stock by NCS Multistage Holdings, Inc. We are offering 9,500,000 shares of our common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $15.00 and $18.00. We have applied to have our common stock listed on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “NCSM.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 20.

| Price to Public |

Underwriting |

Proceeds to |

||||||||||

| Per Share |

$ | |||||||||||

| Total |

||||||||||||

| (1) | We refer you to “Underwriting (Conflicts of Interest),” beginning on page 130 of this prospectus, for additional information regarding total underwriter compensation. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters have an option to purchase up to an additional 1,425,000 shares from the selling stockholders identified in this prospectus at the initial public offering price less the underwriting discount. We will not receive any proceeds from the sale of shares by the selling stockholders.

The underwriters expect to deliver the shares against payment in New York, New York on , 2017.

| Credit Suisse | Citigroup | Wells Fargo Securities | ||

| J.P. Morgan | Simmons & Company International Energy Specialists of Piper Jaffray | |||

| Raymond James |

RBC Capital Markets | Tudor, Pickering, Holt & Co. | ||

Prospectus dated , 2017.

Table of Contents

| Page | ||||

| 1 | ||||

| 20 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 52 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

54 | |||

| 72 | ||||

| 78 | ||||

| 92 | ||||

| 100 | ||||

| 110 | ||||

| 113 | ||||

| 116 | ||||

| 122 | ||||

| 125 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

127 | |||

| 130 | ||||

| 138 | ||||

| 138 | ||||

| 138 | ||||

Neither we, nor the selling stockholders, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, nor the selling stockholders, nor the underwriters (or any of our or their respective affiliates) take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters (or any of our or their respective affiliates) are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any free-writing prospectus is only accurate as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Dealer Prospectus Delivery Obligation

Until , 2017 (25 days after the date of this prospectus), all dealers that buy, sell or trade in shares of these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Trademarks and Trade Names

We own or have the rights to use various trademarks, service marks and trade names referred to in this prospectus, including, among others, AirLock, GripShift, Mongoose, MultiCycle, Multistage Unlimited, ATRS, Vector Max, Vector-1 and NCS and their respective logos. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the TM, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, service marks or trade names appearing in this prospectus are the property of their respective owners.

i

Table of Contents

Market and Industry Information

Unless otherwise indicated, market data and industry information used throughout this prospectus is based on management’s knowledge of the industry and the good faith estimates of management. We also relied upon management’s review of independent industry surveys and publications, to the extent available, as well as other publicly available information prepared by a number of sources, including Spears & Associates, BP p.l.c. and the U.S. Energy Information Administration. All of the market data and industry information used in this prospectus involves a number of assumptions and limitations and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, neither we nor the underwriters can guarantee the accuracy or completeness of this information and neither we nor the underwriters have independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

ii

Table of Contents

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making a decision to participate in the offering. You should carefully read the entire prospectus before making an investment decision, including the information presented under “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes related thereto included elsewhere in this prospectus. Unless the context requires otherwise, references to “our company,” “we,” “us,” “our” and “NCS” refer to NCS Multistage Holdings, Inc. and its direct and indirect subsidiaries on a consolidated basis. References in this prospectus to “selling stockholders” refer to those entities identified as selling stockholders in “Principal and Selling Stockholders.” All dollar amounts refer to United States dollars unless otherwise indicated.

Overview

We are a leading provider of highly engineered products and support services that facilitate the optimization of oil and natural gas well completions and field development strategies. We provide our products and services primarily to exploration and production (“E&P”) companies for use in onshore wells, predominantly wells that have been drilled with horizontal laterals in unconventional oil and natural gas formations. Our products and services are utilized in oil and natural gas basins throughout North America and in selected international markets, including Argentina, China and Russia. We have provided our products and services to over 140 customers in 2016, including leading large independent oil and natural gas companies and major oil companies.

Our primary offering is our Multistage Unlimited family of completion products and services, which enable efficient pinpoint stimulation: the process of individually stimulating each entry point into a formation targeted by an oil or natural gas well. Our Multistage Unlimited products and services are typically utilized in cemented wellbores and enable our customers to precisely place stimulation treatments in a more controlled and repeatable manner as compared with traditional completion techniques. Our Multistage Unlimited products and services operate in conjunction with third-party providers of pressure pumping, coiled tubing and other services.

We began providing pinpoint stimulation products and services in 2006, and since then our technology has been used in the completion of more than 7,600 wells comprising over 155,000 individual frac stages. Our initial focus on the Canadian market has resulted in our products and services being used in 26% of all horizontal wells drilled in Canada in 2016. We began our efforts to increase our penetration of the U.S. market in 2013, and the United States accounted for approximately 23% of our revenue in 2016. We are focused on increasing our market share in the United States, particularly in the Permian Basin. Sales of our products and services in the Permian Basin contributed 56% and 43% of our revenue in the United States in 2016 and 2015, respectively.

Multistage Unlimited includes our casing-installed sliding sleeves and downhole frac isolation assembly. Customers typically purchase our casing-installed sliding sleeves, a consumable product that is cemented at intervals into the casing of the wellbore, and can also utilize services associated with our downhole frac isolation assembly. Our downhole frac isolation assembly is comprised of numerous subcomponents, including a resettable bridge plug for stage isolation, a sleeve locator to efficiently locate our sliding sleeves in the wellbore, an abrasive perforating sub that can perforate the casing where our sliding sleeves are not installed and gauge packages that can measure and record downhole data. Our personnel supervise the use of the downhole frac isolation assembly during completion operations. In addition, our downhole frac isolation assembly provides valuable downhole data, including recorded downhole temperatures and pressures, which can be analyzed and used in designing future completion strategies. Further, because our downhole frac isolation assembly is deployed on coiled tubing, our customers have access to real-time downhole pressure measurements which can be used to adjust strategies during a well completion. We offer two primary models of sliding sleeves: our

1

Table of Contents

GripShift sliding sleeves, which open one time, and our MultiCycle sliding sleeves, which can be opened and closed multiple times giving our customers the benefit of additional completion options and the ability to better optimize a well’s production phase. We hold 23 patents related to our technology and received the World Oil Best Completions Technology Award in 2014 and 2015 for our Multistage Unlimited products and services and MultiCycle sliding sleeves, respectively.

We complement our proprietary products and services with our in-house expertise in completions engineering, reservoir engineering and geology. These capabilities allow us to engage with our customers on well completion design and well spacing decisions, thereby supporting our customers’ completion optimization strategies and building lasting relationships. In addition, our extensive research and development efforts are influenced and driven by the needs of our customers, allowing us to introduce innovative and commercial solutions that improve customer efficiency and profitability.

Our revenue for the years ended December 31, 2016 and 2015, was $98.5 million and $114.0 million, respectively. Our net income (loss) for the years ended December 31, 2016 and 2015, was $(17.9) million and $28.0 million, respectively. Our Adjusted EBITDA for the years ended December 31, 2016 and 2015 was $13.9 million and $26.2 million, respectively. For the definition of Adjusted EBITDA and a reconciliation to its most directly comparable financial measure calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”), please read “Summary Historical Consolidated Financial and Other Data.”

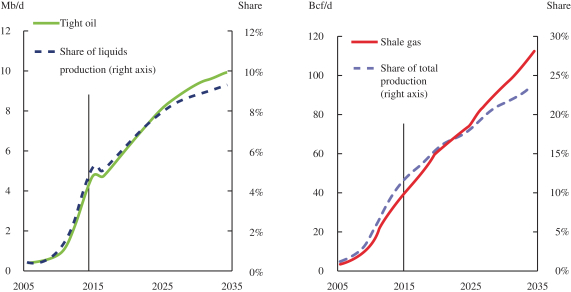

Our Industry

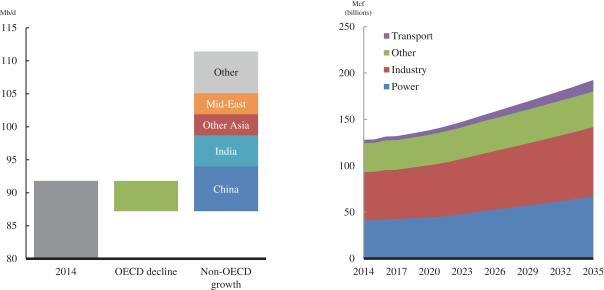

Over the past decade, E&P companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s unconventional oil and natural gas reservoirs by utilizing horizontal drilling and hydraulic fracturing. According to Spears & Associates (“Spears”), in 2016, over 55% of all onshore wells drilled in the United States and over 80% of all onshore wells drilled in Canada included horizontal well sections, or laterals, an increase from 30% and 62%, respectively, in 2011. According to Spears, horizontal wells accounted for 79% of total onshore drilling and completion spending in the United States and 95% of total onshore drilling and completion spending in Canada in 2016.

The most commonly used completion technique for unconventional wells is plug and perforate, or “plug and perf.” The plug and perf technique uses a tool called a perf gun to create clusters of holes, or perforations, in the casing of the wellbore. After the perf gun has been removed from the well, the formation is hydraulically fractured through the newly created clusters of perforations, connecting the wellbore to the surrounding reservoir. After the frac stage is completed, the well is temporarily plugged just above the recently stimulated section and the perforation and hydraulic fracturing process is repeated until the number of desired frac stages have been placed. This technique is most commonly applied in wells in which the well’s casing or lining has been cemented in place.

“Ball drop” is another technique commonly used in open hole, or uncemented, well configurations. This technique utilizes a series of sliding sleeves pre-installed in the well’s casing or lining during well construction. Rather than using a perf gun to create openings, a specially sized ball is dropped into the well prior to each stage being hydraulically fractured. The size of the ball allows it to pass through to a matching “seat” profile on a sleeve in the well, where it acts both to enable the shifting of the sleeve, exposing ports to the formation, and to plug the bottom of the wellbore, providing isolation. Ball drop systems typically rely on different ball sizes to activate the sleeves and, as a result, the wellbore will increasingly narrow toward the “toe,” or furthest point in the well, and the number of sleeves and stages that can be fractured can be limited by available ball sizes.

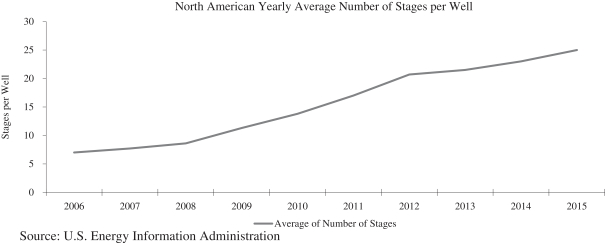

E&P companies have increasingly adopted techniques and equipment that drive more effective resource recovery, including longer-length well laterals, closer spacing of hydraulic fracturing stages, a higher number of

2

Table of Contents

stages per well and more volume of fluid and proppant used per well and per foot of lateral. Additionally, as E&P companies have begun to move toward infill and development drilling, the spacing between wells has decreased, and is expected to continue to decrease, increasing the need for more precise drilling and completion techniques.

While plug and perf and ball drop techniques have traditionally been used in unconventional well completions, these techniques have several drawbacks that limit their ability to optimize completions and maximize hydrocarbon recovery. Limitations associated with traditional well completion techniques include:

| • | inconsistent and uncontrollable placement of fractures that cannot be reliably repeated from stage to stage due to variable breakdown pressures, leading to under-stimulation of wells; |

| • | inability to monitor downhole pressure or measure pressures and temperatures during stimulation, limiting control and making optimization more challenging; |

| • | inability to close and reopen perforations and sleeves, limiting options following the initial completion; and |

| • | completion designs that result in under-stimulation of wells to reduce the likelihood of an operational issue referred to as a “screenout,” and the associated costly recovery process. |

To reduce the amount of under-stimulated reservoir area that can occur when using these traditional techniques, many E&P companies are reducing the spacing between stages, thereby increasing the number of stages per well. However, increasing stage counts with traditional completion techniques can result in other operational inefficiencies, such as increased time and expense in the case of plug and perf completions, or, in the case of ball drop completions, the inability to place the desired number of stages due to the limited number of ball and seat sizes available.

Competitive Strengths

We believe we are well positioned to achieve our business objectives based on the following competitive strengths:

| • | Patented and differentiated completions technology. Our value proposition is built on a foundation of patent-protected technology and industry leading technical capabilities. Our Multistage Unlimited products and services are designed to provide our customers with an enhanced degree of precision for more predictable, repeatable and verifiable well completions, in order to maximize reservoir connectivity while minimizing the impact of the completion on the productivity of offsetting wells. Our technology also provides E&P companies access to accurate real-time and recorded downhole information which can enhance completion and well spacing optimization strategies. This information is typically not available with traditional completion techniques. We believe that the benefits provided by our proprietary technology and our operating experience and know-how differentiate us from providers of traditional completion technologies, including plug and perf and ball drop, and from other pinpoint stimulation competitors. |

| • | Proven record of successfully introducing new technologies that drive completion and production optimization. Our research and development efforts are targeted to solve customer challenges and provide solutions that improve customer efficiency and profitability. Our in-house and field engineering teams are responsible for developing new technology to expand our product and service offerings and enhance the performance of our existing products. During the recent commodity price downturn, we accelerated our investment in these efforts, adding to our pipeline for future product and service introductions. We believe we are a leader in the development of new completions technology, which is reflected in our extensive and growing suite of patent-protected products and methods. We hold 9 U.S. patents and 14 related international patents and have 40 U.S. patent applications pending and 51 related international |

3

Table of Contents

| patents pending. We received the World Oil Best Completions Technology Award in 2014 and 2015 for our Multistage Unlimited products and services and MultiCycle sliding sleeves, respectively. We believe our engineering expertise, combined with our focus on completions technology, gives us a competitive advantage in designing and commercializing new completions technology. For example, we introduced our AirLock casing buoyancy system in late 2013 and this system has been utilized in over 1,650 wells since its introduction. The AirLock continues to increase its market penetration, with 50% more AirLocks sold during 2016 as compared to 2015, a time period in which the total number of horizontal wells drilled in the U.S. and Canada declined on a year-over-year basis. |

| • | Market leader in pinpoint stimulation. We believe we are a global leader in pinpoint stimulation products and services, based on the number of wells completed using our technology and the number of stages in the wells completed using our technology. Since our founding, our products and services have been utilized by our customers for the pinpoint completion of over 7,600 wells, resulting in the placement of over 155,000 frac stages. Our experience as a leader in pinpoint stimulation has given us the opportunity to gain valuable operational insights into the use of this stimulation technique. We have used these insights to continually improve upon our existing products and to develop new products. Our products and services have been utilized in all major unconventional oil and natural gas basins in North America and in selected global markets. Our leadership in pinpoint stimulation has led to the use of our products and services in a number of wells that include what we believe to be the highest number of stages in the following basins: 147 stages in a well in the Permian Basin, 116 stages in a well in the Marcellus shale, 134 stages in a well in the Montney, 123 stages in a well in the Duvernay, 106 stages in a well in the Cardium, 60 stages in a well in the Vaca Muerta region in Argentina and 30 stages in a well in the Khantos region in Russia. |

| • | Asset-light business model and strong balance sheet provide significant flexibility. Throughout the commodity price downturn, we have maintained attractive margins, which we believe validates our value proposition to our customers and reflects our ability to quickly adjust our cost structure. Our Adjusted EBITDA as a percentage of revenue was 14%, 23%, 43% and 46% for the years ended December 31, 2016, 2015, 2014 and 2013, respectively. Because our business is not capital intensive, we are able to generate significant free cash flow through business cycles, with free cash flow as a percentage of revenue of 9%, 3%, 18% and 8% for the years ended December 31, 2016, 2015, 2014 and 2013, respectively. However, we had a net loss of approximately $17.9 million for the year ended December 31, 2016, which was primarily due to the effects of the commodity price downturn. By focusing on downhole completion equipment and services, and not high-cost assets deployed on the surface, such as coiled tubing or pressure pumping units, our net property and equipment (“P&E”) at December 31, 2016 was $9.8 million. Sales of our products, which are consumable items, represented approximately 74% and 70% of our revenue for the years ended December 31, 2016 and 2015, respectively. We believe we have a strong balance sheet and ample liquidity to pursue our growth initiatives. At the closing of this offering, we expect to have no or minimal debt outstanding and $72.3 million in liquidity from cash on hand and $50.0 million of available borrowing capacity under our New Senior Secured Credit Facility (as defined below) that we expect to enter into concurrently with the closing of this offering. |

| • | Trusted advisor to a leading customer base. We have leveraged our extensive experience and differentiated products and services to establish strong relationships with our customers. For the last eight years, we have been the preferred completion technology provider to Crescent Point Energy (“Crescent Point”), our largest customer and one of Canada’s largest independent E&P companies. Our technology has been vetted and chosen by some of the largest, most sophisticated energy companies in the world, resulting in a customer base that includes more than 140 customers globally, including national, major and large independent oil companies, such as Apache Corporation, Crescent Point Energy Corp., Devon Energy Corporation, Gazprom Neft PJSC, Range Resources Corporation and Royal Dutch Shell plc. We established Anderson Thompson Reservoir Strategies (“ATRS”), a team of engineering consultants, in |

4

Table of Contents

| 2015 as a complement to our products and services to provide in-house expertise to assist our customers in optimizing their completion designs and development plans and to evaluate well performance. We believe our ATRS group has deepened our relationships with existing customers, helped us add new customers and effectively demonstrated the value proposition of our pinpoint stimulation offerings. In addition, several of our customers have worked with us to develop new completion technology for specific applications, highlighting their trust in our product development capabilities and adding to our pipeline of technologies available to all of our customers. |

| • | Experienced, entrepreneurial management team with strong culture of innovation. Our management team, led by co-founders, CEO, Robert Nipper, and President, Marty Stromquist, provides disciplined strategic direction and insight gained from multi-decade careers in the energy technology and oilfield service industries. Our founders, pioneers in pinpoint stimulation, led our company through a period of exceptional growth and provide the keystone for our culture. Our culture is defined by “The Promise,” a document that guides our relationships with our employees, customers, vendors and other stakeholders and affirms our commitment to quality and safety. We maintain our culture through the ongoing coaching of our employees and continuously measure ourselves to identify areas for improvement. Together, Mr. Nipper and Mr. Stromquist, have assembled a management team with extensive backgrounds in research and development, manufacturing, operations and finance, with an average of over 25 years of industry and otherwise relevant experience. |

Our Business Strategy

Our primary business objectives are to increase the adoption of our products and services in all geographies, continue to be an innovator of technology and create value for our stockholders. We intend to achieve these objectives through the execution of the following strategies:

| • | Focus on expansion in the United States while pursuing disciplined organic growth globally. We plan to continue to grow our business in all geographies in which we operate, with our current emphasis on profitably expanding our presence in the United States. We increased our efforts to target the U.S. market in 2013 and believe we can increase our share in all basins in the United States as our customers focus on optimizing completion designs in an effort to increase overall hydrocarbon recovery and improve financial returns from their assets. In 2016 the United States accounted for approximately 23% of our revenue. We continue to focus on growing our presence in the Permian Basin, the most active basin in the United States, which accounted for 56% of our revenue in the United States during the year ended December 31, 2016. During 2016, we expanded into a larger operational facility in Midland, Texas and directed additional sales efforts to customers operating in the Permian Basin. Outside of the United States, we plan to increase our market position in several deep basin plays in Canada, including the Montney formation, where we currently have lower, but growing, market shares relative to other regions in Canada. We also plan to increase our market position in Argentina, China, and Russia, regions where we have successful operations and which have significant unconventional resource development potential. |

| • | Develop and introduce innovative technologies that are aligned with customer needs. Our team of over 30 engineers and engineering technicians works closely with our technical services organization and our customers to identify specific product and service needs, develop business cases and bring new technology to market on an expedited basis. Collaborating with our customers allows us to identify unaddressed industry-wide needs and to develop new technologies, of which we have several under development. By introducing new technologies, we expand our product and service portfolio, grow our customer base and leverage our current customer relationships to generate additional revenue. We believe we have established strong working relationships with our customers, and we are collaborating with several of our customers on solutions for specific onshore and offshore completions needs, with NCS retaining the rights to the intellectual property derived from these projects. We expect to continue to work with our customers on specific solutions to supplement our in-house technology development efforts. |

5

Table of Contents

| • | Leverage technology leadership to grow market share. Our extensive experience, differentiated offerings and focus on responding to evolving customer needs has allowed us to establish strong relationships with our customers. Over the years we have added in-house capabilities that provide additional value-added expertise and services to our customers, including completions engineering and ATRS. We believe that by focusing on customer service, while continuing to introduce innovative completions solutions, we can strengthen our relationships with existing customers, grow our customer base and increase our revenues. We believe the benefits provided by our technology and our expertise position us to continue to increase our penetration of large independent and major oil companies. We believe these customers are typically more consistent in their capital budgeting, operate in multiple geographies and in many cases are focused on evaluating and deploying technology that can improve well performance. We believe that our ability to pair our in-house expertise, together with the data that is available through our Multistage Unlimited products and services have been key factors enabling us to increase our business with these customers, which represented 45% of our revenue for the year ended December 31, 2016, as compared with 47% and 37% for the years ended December 31, 2015 and 2014, respectively. |

| • | Maintain financial strength and flexibility. We expect to continue to employ a disciplined financial policy that maintains our financial strength and flexibility. We have maintained our financial flexibility by taking actions designed to preserve positive cash flows, minimize capital expenditures and reduce debt levels. We believe our resulting financial strength and flexibility provides us with the ability to execute our strategy through industry volatility and commodity price cycles, as evidenced by our performance throughout the recent commodity price downturn. For example, during the downturn we were able to leverage our supply chain through initiatives to reduce the number of vendors in our manufacturing operations, as well as reduce our manufacturing costs for certain products by over 30%, which has supported our gross margin. We believe that our cash on hand, expected borrowing capacity and ability to access debt and equity capital markets after this offering, combined with our ability to generate free cash flow, will provide the financial flexibility required to execute our growth strategies. |

| • | Selectively pursue complementary acquisitions and joint ventures. We believe there is an opportunity to enhance our existing product and service capabilities and geographic scope by selectively pursuing acquisitions and joint ventures. We intend to target strategic acquisitions that will enhance our market position and provide opportunities for synergies. We believe that being a public company will allow us to target a broader range of acquisition candidates. |

Our Products and Services

We provide products and services that enable pinpoint stimulation: the process of individually stimulating each entry point into a formation targeted by an oil or natural gas well. We believe that our products and services improve on traditional completion techniques. Our solutions and refined field processes are designed to enable efficient, controlled, verifiable and repeatable completions. We complement our multistage completion products and services with other efficiency-enhancing completions technologies and our multi-disciplinary engineering capabilities. Our key products and services include:

| • | Multistage Unlimited. Our Multistage Unlimited family of products and services encompasses our technology developed to enable efficient pinpoint stimulation and re-stimulation strategies. This suite of products is comprised of our casing-installed sliding sleeves and our downhole frac isolation assemblies, which are deployed using coiled tubing. Our services include advising customers on optimizing completion designs and operating the downhole frac isolation assemblies. |

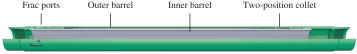

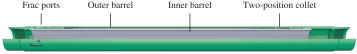

| • | Casing-installed sliding sleeves. Our casing-installed sliding sleeves are a consumable product, sold to our customers and cemented in place in a well’s casing. Over 112,000 of our casing-installed sliding sleeves have been installed, including over 30,000 of our MultiCycle sliding sleeves. We produce two primary models of sliding sleeves: our GripShift sliding sleeves, which can be opened only once, and |

6

Table of Contents

| our MultiCycle sliding sleeves, introduced in late 2013, which can be opened and closed multiple times throughout the life of a well. The image below illustrates one of our MultiCycle sliding sleeves. During completion operations, the downhole frac isolation assembly is placed in the sleeve and the inner barrel of the sleeve is shifted down, exposing the frac ports to the formation, allowing the completion of that stage to begin. |

Key features of both primary models of our sliding sleeves include:

| • | no practical limitation on the number of stages in a well; |

| • | a full-drift inner-diameter that is the same as the wellbore’s casing, with no plugs or ball seats to mill or drill out; |

| • | designed for use in cemented or open-hole wellbores; and |

| • | a cumulative sleeve shifting success rate of over 99%. |

Additionally, our MultiCycle sliding sleeves provide the ability to:

| • | close the sleeves immediately following the completion of a stage to mitigate proppant flowback, enhancing conductivity and reducing the need for post-completion well cleanouts; |

| • | close off zones producing high levels of water or unwanted natural gas; |

| • | execute high rate, pinpoint refracturing strategies; and |

| • | support the conversion of a producing well to an injector well for enhanced oil recovery (“EOR”) strategies, including floods and pressure maintenance. |

| • | Downhole frac isolation assembly. Our proprietary downhole frac isolation assembly is comprised of several subcomponents. The assembly is primarily used to locate our sliding sleeves, to establish wellbore isolation and to shift our sliding sleeves open or closed. We typically own the assemblies and utilize them in our service to our customers. Our personnel operate the assemblies during completion operations in coordination with other on-site service providers. The image below illustrates a downhole frac isolation assembly designed for use with our MultiCycle sliding sleeves. |

Key features of our downhole frac isolation assembly include:

| • | a resettable bridge plug enabling the completion of all stages in a well without having to remove the assembly from the wellbore; |

| • | an abrasive perforating subassembly, which can be utilized to add stages to a well with sliding sleeves installed or as the method to establish formation access in wells not utilizing our sleeves; |

| • | gauge packages located above and below the resettable bridge plug that record pressure and temperature data; |

7

Table of Contents

| • | benefits associated with having coiled tubing in the wellbore, including real-time bottom-hole pressure measurements, the ability to circulate fluids to the stage being completed and the ability to mitigate screenouts; and |

| • | a range of configurations allowing a variety of pinpoint stimulation and refracturing strategies. |

| • | Anderson Thompson Reservoir Strategies. Our specialized team of engineering consultants advises customers on optimized completion designs and field development strategies and evaluates well performance. ATRS helps us strengthen our relationships with our customers and has been effective at demonstrating the benefits of our Multistage Unlimited products and services as compared to traditional completion techniques. |

| • | AirLock casing buoyancy system. Our AirLock casing buoyancy system facilitates landing casing strings in horizontal wells without altering a customer’s preferred casing and cementing operations. The AirLock, which is installed with a well’s casing, allows the vertical casing section to be filled with fluid, while the lateral section remains air-filled and buoyant. The enhanced buoyancy significantly reduces sliding friction, while the enhanced weight of the vertical section provides the force needed to push the casing to the toe of the well, ensuring the casing reaches the desired depth and reducing casing running time and cost. |

| • | Liner hanger systems. Introduced in late 2014, our proprietary Vector Max and Vector-1 liner hanger systems are specifically designed to perform in complex horizontal wells and are fully compatible with our Multistage Unlimited products. The liner hanger is used to distribute the loads and weight of the liner to the supporting casing. |

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in gross revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other regulatory requirements for up to five years that are otherwise applicable generally to public companies. These provisions include, among other matters:

| • | requirement to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in a Registration Statement on Form S-1; |

| • | exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements; and |

| • | reduced disclosure about executive compensation arrangements. |

We will remain an emerging growth company until the end of the fiscal year following the fifth anniversary of this offering unless, prior to that time, we have more than $1.0 billion in annual gross revenue, have a market

8

Table of Contents

value for our common stock held by non-affiliates of more than $700 million as of the last day of our second fiscal quarter of the fiscal year and a determination is made that we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or issue more than $1.0 billion of non-convertible debt over a three-year period, whether or not issued in a registered offering.

We have availed ourselves of the reduced reporting obligations with respect to audited financial statements and related Management’s Discussion and Analysis of Financial Condition and Results of Operations and executive compensation disclosure in this prospectus and expect to continue to avail ourselves of the reduced reporting obligations available to emerging growth companies in future filings. We plan to comply with new and revised accounting standards on the relevant dates on which adoption of those standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

As a result of our decision to avail ourselves of certain provisions of the JOBS Act, the information that we provide may be different than what you may receive from other public companies in which you hold an equity interest. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may cause a less active trading market for our common stock and more volatility in our stock price.

Risks Associated With Our Business

Investing in our common stock involves a number of risks. These risks represent challenges to the successful implementation of our strategy and the growth of our business, which could cause a decrease in the price of our common stock and a loss of all or part of your investment. Some of these risks are:

| • | Our business depends on the oil and natural gas industry and particularly on the level of exploration and production activity within Canada and the United States, and the ongoing decline in prices for oil and natural gas have had, and may continue to have, a material adverse effect on our business, financial condition and results of operations. |

| • | A single customer constituted approximately 26% and 31% of our revenue for the years ended December 31, 2016 and 2015, respectively and the loss of that customer or any other of our significant customers, or their failure to pay the amounts they owe us, could cause our revenue to decline substantially. |

| • | Advancements in drilling and well completion technologies could have a material adverse effect on our business, financial condition, results of operations and cash flows. |

| • | We often have long sales cycles, which can result in significant time between initial contact with a prospective customer and sales of our products and services to that customer, making it difficult to project when, if at all, we will obtain new customers and when we will generate revenue from those customers. |

| • | Our success depends on our ability to develop and implement new technologies, products and services. |

| • | Our products are used in operations that are subject to potential hazards inherent in the oil and natural gas industry and, as a result, we are exposed to potential liabilities that may affect our financial condition and reputation. |

| • | We may be adversely affected by disputes regarding intellectual property rights and the value of our intellectual property rights is uncertain. |

| • | The adoption of climate change legislation or regulations restricting emissions of greenhouse gases (“GHGs”) could result in increased operating costs and reduced demand for oil and natural gas. |

9

Table of Contents

| • | We are controlled by funds (the “Advent Funds”), managed by Advent International Corporation (“Advent”), whose interests may differ from those of our public stockholders. |

For a discussion of these and other risks you should consider before making an investment in our common stock, see the section entitled “Risk Factors.”

Our Private Equity Sponsor

Founded in 1984, Advent has invested in more than 320 private equity transactions in 40 countries and as of December 31, 2016, had $41.2 billion in assets under management. Advent’s current portfolio is comprised of investments across five sectors—Retail, Consumer & Leisure; Financial and Business Services; Industrial; Technology, Media & Telecoms; and Healthcare. The Advent team includes more than 190 investment professionals across Europe, North America, Latin America and Asia.

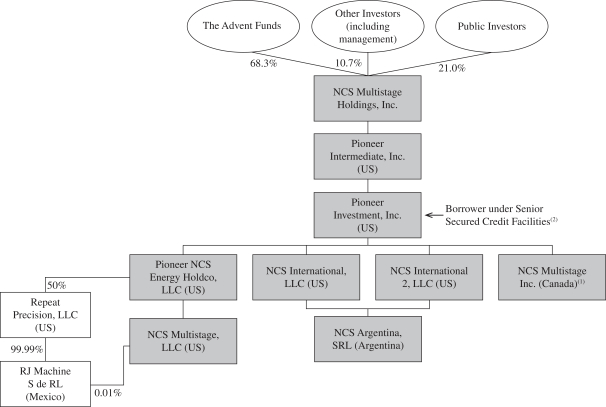

Following the closing of this offering, the Advent Funds are expected to own approximately 68.3% of our outstanding common stock, or 65.3%, if the underwriters’ option to purchase additional shares is fully exercised. As a result, Advent will be able to exercise significant voting influence over fundamental and significant corporate matters and transactions. We are also a party to certain other agreements with the Advent Funds and certain of their affiliates. See “Risk Factors—Risks Relating to This Offering and Ownership of Our Common Stock,” “Principal and Selling Stockholders” and “Certain Relationships and Related Party Transactions.”

Corporate Information

We were incorporated in Delaware on November 28, 2012, under the name “Pioneer Super Holdings, Inc.” On December 13, 2016, we changed our name to “NCS Multistage Holdings, Inc.” Our principal executive offices are located at 19450 State Highway 249, Suite 200, Houston, TX 77070, and our telephone number is (281) 453-2222. Our corporate website address is www.ncsmultistage.com. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus.

10

Table of Contents

Our Corporate Structure

The following chart illustrates our ownership structure after this offering:

| (1) | Certain holders of equity in NCS Multistage Inc. (Canada) hold an exchange right to convert 1,819,247 shares of common stock of NCS Multistage Inc. (Canada) for 1,819,247 shares of our common stock. |

| (2) | In connection with this offering, we intend to enter into a New Senior Secured Credit Facility (as defined below), NCS Multistage Holdings, Inc. and Pioneer Intermediate, Inc. will both be parent guarantors under the New Senior Secured Credit Facility and Pioneer Investment, Inc. and NCS Multistage Inc. will be borrowers under the New Senior Secured Credit Facility. |

Preliminary Estimate of Selected First Quarter 2017 Financial Results

Although our results of operations for the three months ended March 31, 2017 are not yet final, the following unaudited information reflects our preliminary estimates of selected results based on information currently available to management.

We have prepared these estimates on a materially consistent basis with the financial information presented elsewhere in this prospectus and in good faith based upon our current internal reporting as of and for the three months ended March 31, 2017. These estimated ranges are preliminary and unaudited and are thus inherently uncertain and subject to change as we complete our financial results as of and for the three months ended March 31, 2017. We are in the process of completing our customary quarterly close and review procedures as of and for the three months ended March 31, 2017, and there can be no assurance that our final results for this period will not differ from these estimates. During the preparation of our consolidated financial statements and

11

Table of Contents

related notes as of and for the three months ended March 31, 2017, we may identify items that cause our final reported results to be materially different from the preliminary financial estimates presented herein as a result of various factors, including those that are set forth under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

These estimates should not be viewed as a substitute for full interim financial statements prepared in accordance with GAAP. In addition, these estimates for the three months ended March 31, 2017 are not necessarily indicative of the results to be achieved for the remainder of 2017 or any future period. Our consolidated financial statements and related notes as of and for the three months ended March 31, 2017 are not expected to be filed with the SEC until after this offering is completed. The preliminary financial data included in this registration statement has been prepared by, and is the responsibility of, our management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled, or performed any procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

Based on currently available information, we estimate, on a preliminary basis, that revenue will be within a range of $57.0 million to $59.0 million for the three months ended March 31, 2017, as compared to $23.1 million for the same period in 2016. This increase was primarily attributable to an increase in the sale of our completions products and services due to higher drilling and well completion activity as a result of an improved commodity price environment in the first quarter of 2017 as compared to the first quarter of 2016.

Based on currently available information, we sold more than 17,000 sleeves during the three months ended March 31, 2017, as compared to 7,117 sleeves for the same period in 2016 and we were involved in the completion of more than 450 customer wells during the three months ended March 31, 2017 as compared to 259 customer wells for the same period in 2016.

Based on currently available information, we also estimate, on a preliminary basis, that net income will be within a range of $5.7 million to $7.7 million for the three months ended March 31, 2017, as compared to a net loss of $8.1 million for the same period in 2016. The improved results were primarily attributable to the factors discussed above.

In addition, based on currently available information, we estimate, on a preliminary basis, that Adjusted EBITDA will be within a range of $17.8 million to $19.8 million for the three months ended March 31, 2017, as compared to $2.7 million for the same period in 2016. The increase primarily related to increases in revenues during the first quarter of 2017 as compared to the first quarter of 2016, as discussed above, partially offset by increases in our cost of revenue and operating expense.

EBITDA and Adjusted EBITDA are not financial measures presented in accordance with GAAP. We define EBITDA as net income (loss) before interest expense, net, income tax expense (benefit) and depreciation and amortization. We define Adjusted EBITDA as EBITDA adjusted to exclude certain items which we believe are not reflective of ongoing performance, including (i) non-cash items, such as share-based compensation expense, the amortization of intangible assets recorded as a result of the Advent Transaction, described in more detail in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and realized and unrealized gains associated with fluctuations in foreign currency exchange rates and (ii) charges that do not relate to our operations, such as interest expense, and income tax provision. We believe that presenting Adjusted EBITDA enables investors to assess our performance from period to period using the same metric utilized by management and to evaluate our performance relative to other companies that are not subject to such factors. Adjusted EBITDA is also calculated in a manner consistent with the terms of the instruments governing our Senior Secured Credit Facilities (and the anticipated terms of our New Senior Secured Credit Facility).

12

Table of Contents

EBITDA and Adjusted EBITDA are not defined under GAAP, are not measures of net income, income from operations or any other performance measure derived in accordance with GAAP, and are subject to important limitations. Our use of the terms EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies in our industry and are not measures of performance calculated in accordance with GAAP. EBITDA and Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our financial performance as reported under GAAP and they should not be considered as alternatives to net income (loss) or any other performance measures derived in accordance with GAAP as measures of operating performance or as alternatives to cash flow from operating activities as measures of our liquidity. For example, EBITDA and Adjusted EBITDA, among other things:

| • | exclude certain tax payments that may represent a reduction in cash available to us; |

| • | do not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future; |

| • | do not reflect changes in, or cash requirements for, our working capital needs; and |

| • | do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt. |

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only for supplemental purposes.

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to the GAAP financial measure of net income (loss) for the three months ended March 31, 2017 (estimated) and 2016 (actual):

| Quarter Ended March 31, | ||||||||||||

| 2017 | 2016 | |||||||||||

| Low | High | Actual | ||||||||||

| (in thousands) | ||||||||||||

| Net income (loss) |

$ | 5,738 | $ | 7,738 | $ | (8,126 | ) | |||||

| Income tax expense (benefit) (a) |

1,685 | 1,685 | (3,458 | ) | ||||||||

| Interest expense |

1,509 | 1,509 | 1,466 | |||||||||

| Depreciation |

563 | 563 | 452 | |||||||||

| Amortization |

6,022 | 6,022 | 5,771 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

15,517 | 17,517 | (3,895 | ) | ||||||||

| Share based compensation (b) |

337 | 337 | 331 | |||||||||

| Restructuring charges (c) |

— | — | 103 | |||||||||

| Board fees and expenses (d) |

265 | 265 | 125 | |||||||||

| Professional fees (e) |

1,791 | 1,791 | 76 | |||||||||

| Unrealized foreign currency loss (f) |

79 | 79 | 5,904 | |||||||||

| Realized foreign currency loss (gain) (g) |

698 | 698 | (26 | ) | ||||||||

| Other (h) |

(855 | ) | (855 | ) | 72 | |||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 17,832 | $ | 19,832 | $ | 2,690 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Represents estimated income tax expense at mid-point of range. |

| (b) | Represents non-cash compensation charges related to share-based compensation granted to our officers, employees and directors. |

| (c) | Represents severance and other expenses associated with headcount reductions and other cost savings initiated as part of our restructuring initiatives. |

| (d) | Represents Board fees and travel expenses paid to members of our Board, which is an adjustment permitted by the terms of our Senior Secured Credit Facilities. |

13

Table of Contents

| (e) | Represents costs of professional services incurred in connection with our initial public offering, refinancings and the evaluation of proposed acquisitions. |

| (f) | Represents unrealized foreign currency translation gains and losses primarily in respect of our indebtedness. |

| (g) | Represents realized foreign currency translation gains and losses with respect to principal and interest payments related to our indebtedness. |

| (h) | Represents the impact of a research and development subsidy that is included in income tax benefit in accordance with GAAP, fees incurred in connection with refinancing our credit facilities, arbitration awards and other charges and credits. |

Concurrent Refinancing

Concurrently with the closing of this offering, we and certain of our subsidiaries intend to enter into an Amended and Restated Credit Agreement (the “Credit Agreement”) with the lenders party thereto, Wells Fargo Bank, National Association and Wells Fargo Bank, National Association, Canadian Branch, as administrative agents and the other parties thereto (the facilities provided thereunder, the “New Senior Secured Credit Facility”). The New Senior Secured Credit Facility consists of revolving credit facilities in aggregate principal amount of $50.0 million. The closing of this offering is not conditioned on consummation of the concurrent refinancing of our credit facilities. We cannot assure you that the refinancing will be completed or, if completed, on what terms it will be completed. See “Description of Material Indebtedness—New Senior Secured Credit Facility.”

14

Table of Contents

THE OFFERING

| Issuer |

NCS Multistage Holdings, Inc. |

| Common stock offered by us |

9,500,000 shares of common stock. |

| Common stock to be outstanding after this offering |

45,325,225 shares of common stock. |

| Option to purchase additional shares of common stock |

The underwriters have an option to purchase an additional 1,425,000 shares of common stock from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds from the sale of our common stock in this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $144.8 million based on an assumed initial public offering price of $16.50 per share (the midpoint of the price range set forth on the cover of this prospectus). We will not receive any proceeds from the sale of shares by the selling stockholders. |

| We intend to use these net proceeds to repay indebtedness under our Senior Secured Credit Facilities and use the remainder for general corporate purposes. See “Use of Proceeds.” |

| Conflicts of interest |

Because a repayment of the outstanding borrowings under our Senior Secured Credit Facilities could result in at least 5% of the net proceeds of this offering being paid to an affiliate of an underwriter who is a lender under our Senior Secured Credit Facilities, this offering is being made in compliance with the requirements of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”), which requires a “qualified independent underwriter,” as defined by the FINRA rules, to participate in the preparation of the registration statement and the prospectus and exercise the usual standards of due diligence in respect thereto, and Credit Suisse Securities (USA) LLC has served in that capacity and will not receive any additional fees for serving as qualified independent underwriter in connection with this offering. We have agreed to indemnify Credit Suisse Securities (USA) LLC against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. To comply with FINRA Rule 5121, Citigroup Global Markets Inc., Wells Fargo Securities, LLC and J.P. Morgan Securities LLC will not confirm sales to any account over which they exercise discretionary authority without the specific written approval of the transaction of the account holder. For more information, see “Underwriting (Conflicts of Interest).” |

15

Table of Contents

| Dividend policy |

We do not anticipate paying any dividends on our common stock for the foreseeable future; however, we may change this policy in the future. See “Dividend Policy.” |

| Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 475,000 shares of common stock, or approximately 5% of the shares offered by us in this prospectus, for sale to our directors and directors of our joint venture with one of our suppliers. If these individuals purchase reserved shares of common stock, this will reduce the number of shares of common stock available for sale to the public. Any reserved shares of common stock that are not so purchased will be offered by the underwriters to the public on the same terms as the other shares of common stock offered by this prospectus. For further information regarding our directed share program, see “Underwriting (Conflicts of Interest)—Directed Share Program.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See the “Risk Factors” section of this prospectus beginning on page 19 for a discussion of factors you should carefully consider before investing in our common stock. |

| Listing |

We have applied to have our common stock listed on NASDAQ under the symbol “NCSM.” |

Except as otherwise indicated, the number of shares of our common stock outstanding after this offering:

| • | excludes 3,112,548 shares of our common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $5.10 per share; |

| • | excludes an aggregate of 4,532,523 shares of our common stock that will be available for future equity awards under our 2017 Equity Incentive Plan (the “2017 Plan”); |

| • | gives effect to a 3.00 for 1.00 stock split of our common stock that was effected on April 13, 2017; |

| • | gives effect to the exchange of 1,819,247 shares of common stock of NCS Multistage, Inc. (Canada) that were offered as consideration in connection with Advent’s acquisition of NCS Energy Holdings, LLC (“HoldCo”) in 2012 for 1,819,247 shares of our common stock. See “Certain Relationships and Related Party Transactions—Cemblend Transactions”; |

| • | gives effect to our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect prior to the consummation of this offering; and |

| • | assumes the underwriters do not exercise their option to purchase additional shares from the selling stockholders. |

Unless otherwise indicated, this prospectus assumes an initial public offering price of $16.50 per share (the midpoint of the price range set forth on the cover of this prospectus).

16

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary historical consolidated financial and other data for the periods and as of the dates indicated. We derived the summary consolidated statement of operations data and the consolidated statement of cash flows data for the years ended December 31, 2016 and 2015 from the audited consolidated financial statements and related notes thereto included elsewhere in this prospectus. We derived the consolidated balance sheet data as of December 31, 2016 from the audited consolidated financial statements and related notes thereto included elsewhere in this prospectus. We derived the summary consolidated statement of operations data and consolidated statement of cash flows data for the years ended December 31, 2014 and 2013 from our audited consolidated financial statements and related notes thereto not included in this prospectus.

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below together with “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Capitalization” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | |||||||||||||

| (in thousands, except share and per share amounts and operating data) |

||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Product sales |

$ | 73,220 | $ | 80,079 | $ | 162,728 | $ | 92,194 | ||||||||

| Services |

25,259 | 33,926 | 57,278 | 40,456 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

98,479 | 114,005 | 220,006 | 132,650 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of sales: |

||||||||||||||||

| Cost of product sales, exclusive of depreciation and amortization expense shown below |

40,511 | 40,160 | 61,863 | 31,327 | ||||||||||||

| Cost of services, exclusive of depreciation and amortization expense shown below |

13,322 | 14,553 | 20,785 | 16,133 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of sales, exclusive of depreciation and amortization expense shown below |

53,833 | 54,713 | 82,648 | 47,460 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Selling, general and administrative expenses |

37,061 | 37,804 | 50,088 | 26,239 | ||||||||||||

| Depreciation |

1,766 | 2,695 | 1,969 | 1,417 | ||||||||||||

| Amortization |

23,801 | 24,576 | 27,922 | 29,726 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income from operations |

(17,982 | ) | (5,783 | ) | 57,379 | 27,808 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expenses) |

||||||||||||||||

| Interest expense, net |

(6,286 | ) | (8,064 | ) | (7,420 | ) | (6,021 | ) | ||||||||

| Prepayment penalty on debt extinguishments |

— | — | — | (2,500 | ) | |||||||||||

| Other income (expense), net |

45 | (131 | ) | (361 | ) | 396 | ||||||||||

| Foreign currency exchange (loss) gain |

(2,522 | ) | 25,779 | 8,981 | (226 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income |

(8,763 | ) | 17,584 | 1,200 | (8,351 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income before income tax |

(26,745 | ) | 11,801 | 58,579 | 19,457 | |||||||||||

| Income tax expense (benefit) |

(8,818 | ) | (16,224 | ) | 50,931 | 11,475 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

$ | (17,927 | ) | $ | 28,025 | $ | 7,648 | $ | 7,982 | |||||||

| Net (loss) income per share: |

||||||||||||||||

| Basic |

$ | (0.53 | ) | $ | 0.88 | $ | 0.24 | $ | 0.25 | |||||||

| Diluted(1) |

$ | (0.53 | ) | $ | 0.86 | $ | 0.24 | $ | 0.25 | |||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

34,007,505 | 29,965,946 | 29,804,608 | 29,783,294 | ||||||||||||

| Diluted(1) |

34,007,505 | 32,432,919 | 32,194,309 | 32,069,691 | ||||||||||||

17

Table of Contents

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | |||||||||||||

| (in thousands, except operating data) | ||||||||||||||||

| Consolidated Statement of Cash Flows Data: |

||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||

| Operating activities |

$ | 10,684 | $ | 4,369 | $ | 51,452 | $ | 16,261 | ||||||||

| Investing activities |

(1,840 | ) | (1,221 | ) | (12,917 | ) | (5,854 | ) | ||||||||

| Financing activities |

(315 | ) | (12,766 | ) | (24,216 | ) | (4,754 | ) | ||||||||

| Other Data: |

||||||||||||||||

| Adjusted EBITDA(2) |

$ | 13,880 | $ | 26,219 | $ | 95,569 | $ | 60,711 | ||||||||

| Free Cash Flow(3) |

$ | 8,844 | $ | 3,148 | $ | 38,535 | $ | 10,407 | ||||||||

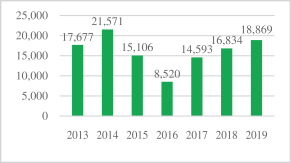

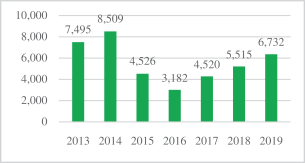

| Number of wells completed |

892 | 1,135 | 1,807 | 1,274 | ||||||||||||

| Number of sleeves sold |

25,816 | 24,395 | 37,610 | 21,851 | ||||||||||||

| As of December 31, 2016 | ||||||||

| Actual | As Adjusted(4) | |||||||

| (in thousands) | ||||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 18,275 | $ | 72,250 | ||||

| Totals assets |

326,827 | 380,802 | ||||||

| Total debt, net |

89,166 | — | ||||||

| Total liabilities |

149,349 | 60,183 | ||||||

| Total stockholders’ equity |

177,478 | 320,619 | ||||||

| (1) | The diluted weighted average shares outstanding amount excludes the impact of options which would be anti-dilutive. |

| (2) | We report our financial results in accordance with GAAP. To supplement this information, we have included supplemental non-GAAP financial measures in this prospectus, including EBITDA and Adjusted EBITDA. |

EBITDA is defined as net income (loss) before interest expense, net, income tax expense (benefit) and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted to exclude certain items which we believe are not reflective of ongoing performance or which, in the case of share-based compensation, are non-cash in nature. We were purchased in a leveraged buyout. Given the debt included in our capital structure, and the application of purchase price accounting which resulted in the recognition of our assets at fair value, including substantial amounts of amortizable intangible assets, we recognize high levels of interest expense and non-cash amortization charges on an ongoing basis. We believe that Adjusted EBITDA is an important measure that excludes many of the costs associated with our existing capital structure and excludes costs that management believes do not reflect our ongoing operating performance. Accordingly, Adjusted EBITDA is a key metric that management uses to assess the period-to-period performance of our core business operations. Adjusted EBITDA helps to identify trends in the performance of our core on going operations by excluding the effects related to (i) non-cash items, such as share-based compensation expense, the amortization of intangible assets recorded as a result of the Advent Transaction, described in more detail in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and realized and unrealized gains associated with fluctuations in foreign currency exchange rates and (ii) charges that do not relate to our operations, such as interest expense, and income tax provision. We believe that presenting Adjusted EBITDA enables investors to assess our performance from period to period using the same metric utilized by management and to evaluate our performance relative to other companies that are not subject to such factors. Adjusted EBITDA is also calculated in a manner consistent with the terms of the instruments governing our Senior Secured Credit Facilities (and the anticipated terms of our New Senior Secured Credit Facility).

EBITDA and Adjusted EBITDA are not defined under GAAP, are not measures of net income, income from operations or any other performance measure derived in accordance with GAAP, and are subject to important limitations. Our use of the terms EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies in our industry and are not measures of performance calculated in accordance with GAAP. EBITDA and Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our financial performance as reported under GAAP and they should not be considered as alternatives to net (loss) income or any other performance measures derived in accordance with GAAP as measures of operating performance or as alternatives to cash flow from operating activities as measures of our liquidity. For example, EBITDA and Adjusted EBITDA, among other things:

| • | exclude certain tax payments that may represent a reduction in cash available to us; |

| • | do not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future; |

| • | do not reflect changes in, or cash requirements for, our working capital needs; and |

| • | do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt. |

18

Table of Contents

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only for supplemental purposes.

A reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and from EBITDA to Adjusted EBITDA on a consolidated basis for the periods indicated is as follows:

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net (loss) income |

$ | (17,927 | ) | $ | 28,025 | $ | 7,648 | $ | 7,982 | |||||||

| Income tax expense (benefit) |

(8,818 | ) | (16,224 | ) | 50,931 | 11,475 | ||||||||||

| Interest expense |

6,286 | 8,064 | 7,420 | 6,021 | ||||||||||||

| Depreciation |

1,766 | 2,695 | 1,969 | 1,417 | ||||||||||||

| Amortization |

23,801 | 24,576 | 27,922 | 29,726 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA |