Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | d385971dex991.htm |

| 8-K - FORM 8-K - C. H. ROBINSON WORLDWIDE, INC. | d385971d8k.htm |

Earnings Conference Call – First Quarter 2017 April 26, 2017 John Wiehoff, Chairman & CEO Andrew Clarke, CFO Tim Gagnon, Director, Investor Relations Exhibit 99.2

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; competition and growth rates within the fourth party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight, and changes in relationships with existing truck, rail, ocean and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to integrate the operations of acquired companies with our historic operations successfully; risks associated with litigation and insurance coverage; risks associated with operations outside of the U.S.; risks associated with the potential impacts of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel prices and availability; changes to our share repurchase activity; risk of unexpected or unanticipated events or opportunities that might require additional capital expenditures; the impact of war on the economy; and other risks and uncertainties detailed in our Annual and Quarterly Reports. 2

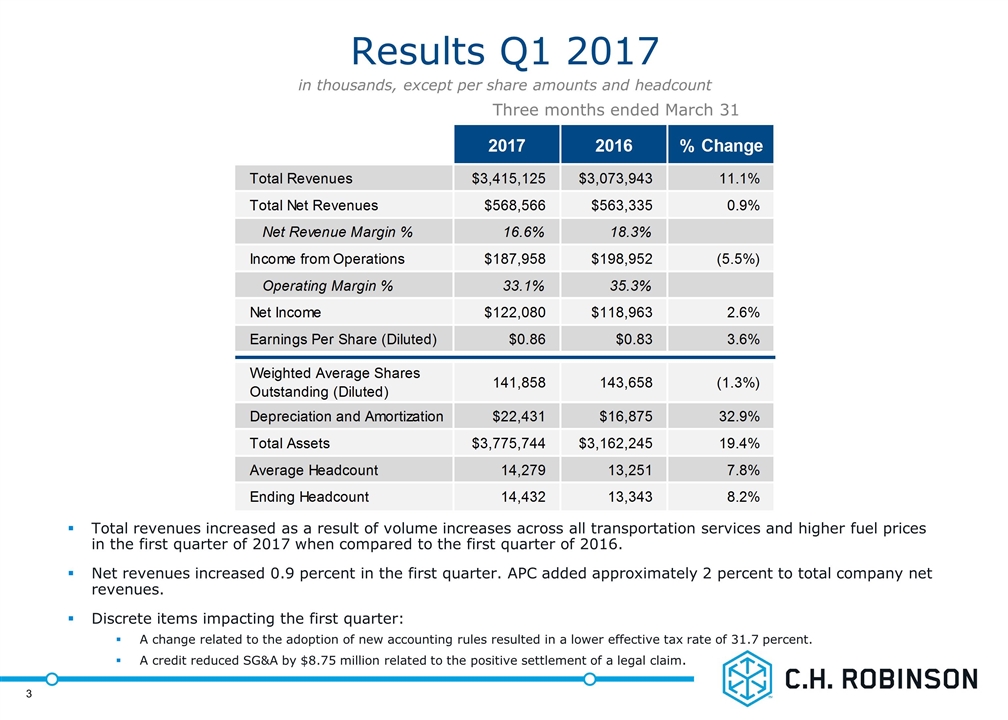

Results Q1 2017 Three months ended March 31 in thousands, except per share amounts and headcount Total revenues increased as a result of volume increases across all transportation services and higher fuel prices in the first quarter of 2017 when compared to the first quarter of 2016. Net revenues increased 0.9 percent in the first quarter. APC added approximately 2 percent to total company net revenues. Discrete items impacting the first quarter: A change related to the adoption of new accounting rules resulted in a lower effective tax rate of 31.7 percent. A credit reduced SG&A by $8.75 million related to the positive settlement of a legal claim. 3

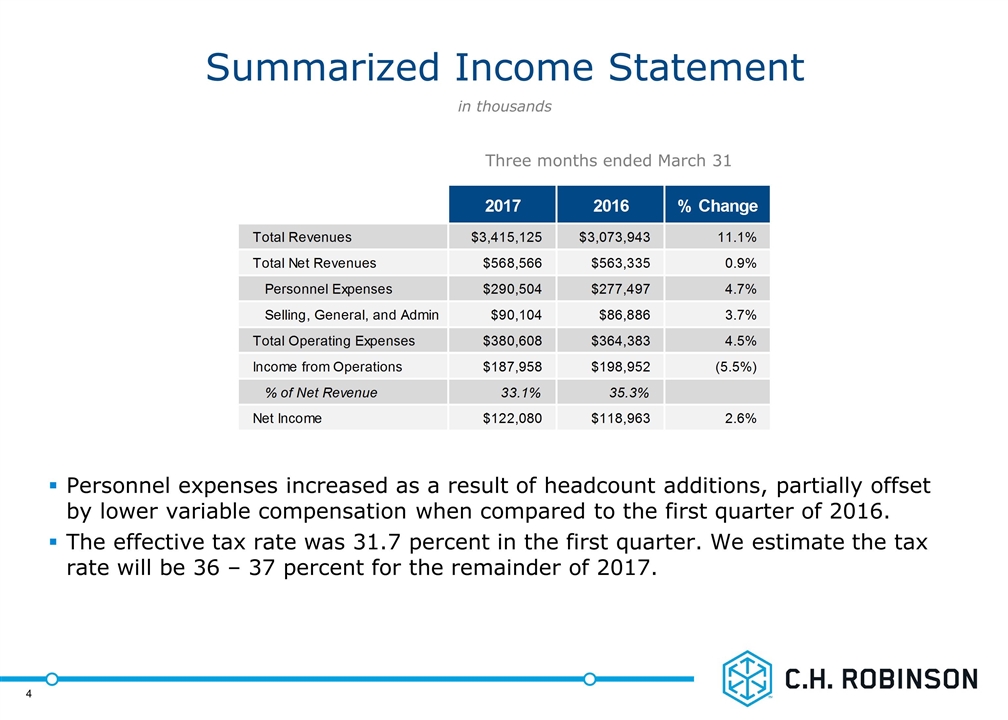

Summarized Income Statement Personnel expenses increased as a result of headcount additions, partially offset by lower variable compensation when compared to the first quarter of 2016. The effective tax rate was 31.7 percent in the first quarter. We estimate the tax rate will be 36 – 37 percent for the remainder of 2017. in thousands Three months ended March 31 4

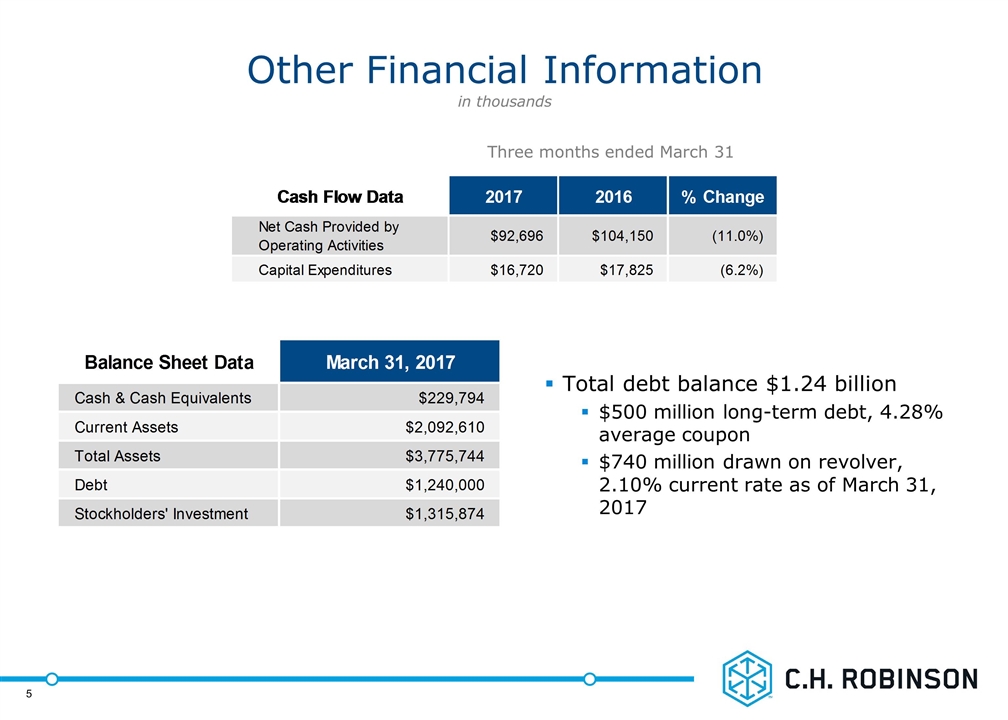

Other Financial Information Total debt balance $1.24 billion $500 million long-term debt, 4.28% average coupon $740 million drawn on revolver, 2.10% current rate as of March 31, 2017 in thousands Three months ended March 31 5

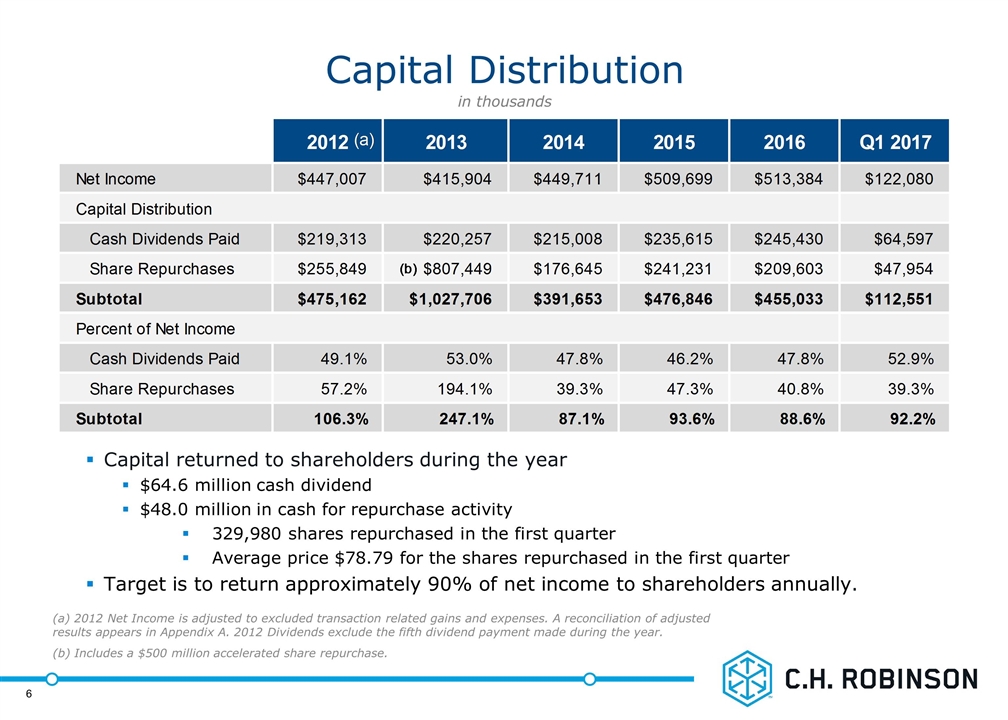

Capital Distribution Capital returned to shareholders during the year $64.6 million cash dividend $48.0 million in cash for repurchase activity 329,980 shares repurchased in the first quarter Average price $78.79 for the shares repurchased in the first quarter Target is to return approximately 90% of net income to shareholders annually. (a) 2012 Net Income is adjusted to excluded transaction related gains and expenses. A reconciliation of adjusted results appears in Appendix A. 2012 Dividends exclude the fifth dividend payment made during the year. (b) Includes a $500 million accelerated share repurchase. in thousands 6

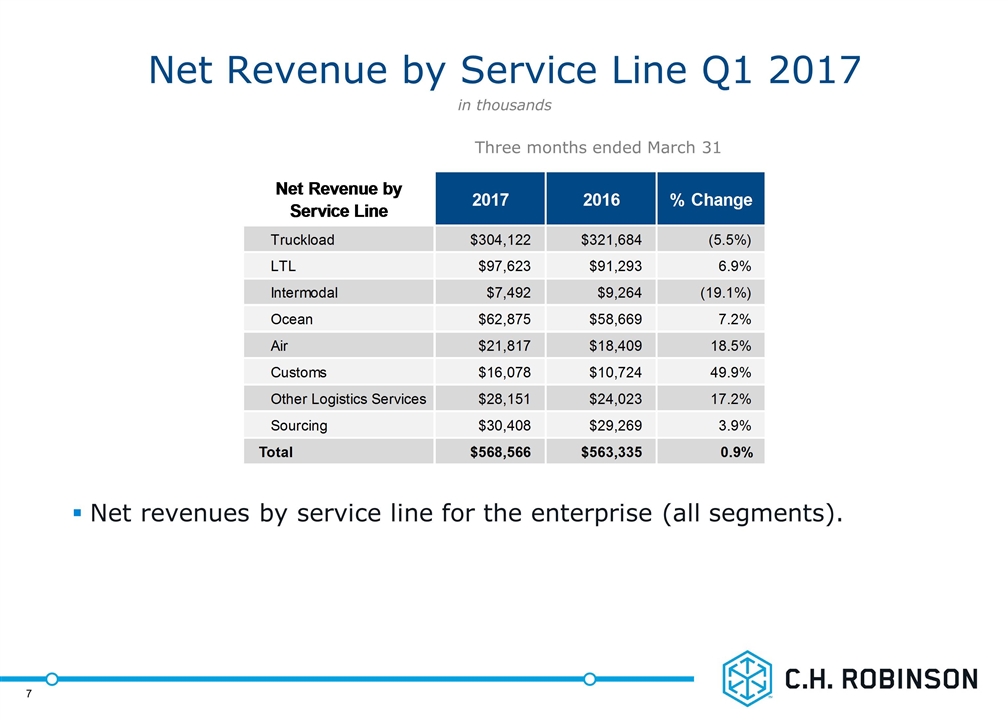

Net Revenue by Service Line Q1 2017 Net revenues by service line for the enterprise (all segments). in thousands Three months ended March 31 7

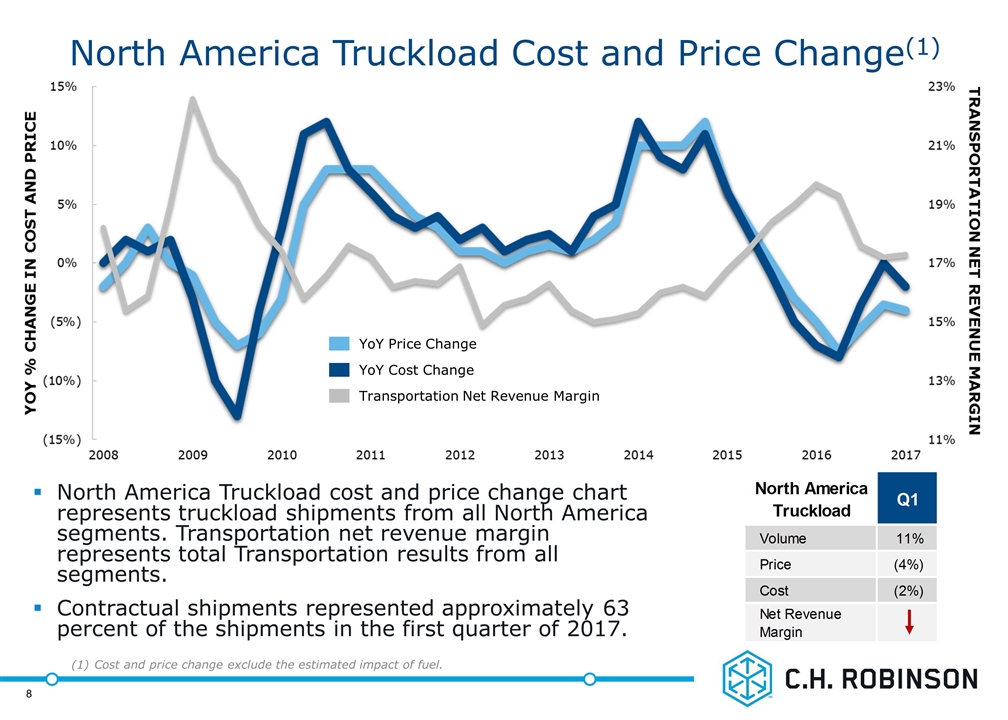

North America Truckload cost and price change chart represents truckload shipments from all North America segments. Transportation net revenue margin represents total Transportation results from all segments. Contractual shipments represented approximately 63 percent of the shipments in the first quarter of 2017. Cost and price change exclude the estimated impact of fuel. North America Truckload Cost and Price Change(1) 8 YoY Price Change YoY Cost Change Transportation Net Revenue Margin

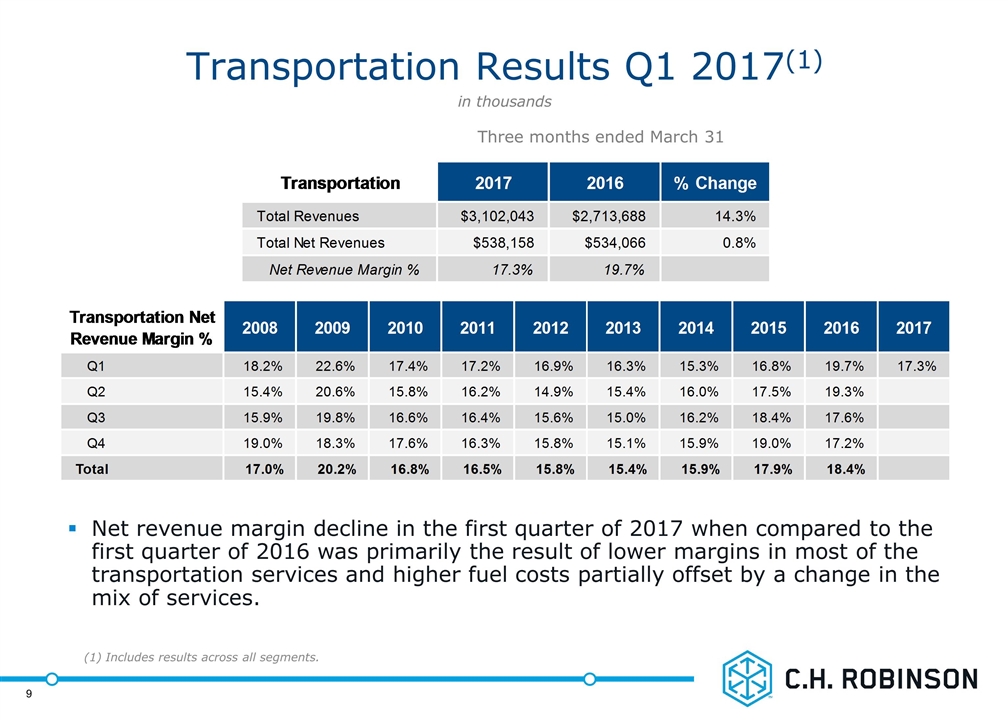

Transportation Results Q1 2017(1) in thousands Three months ended March 31 (1) Includes results across all segments. 9 Net revenue margin decline in the first quarter of 2017 when compared to the first quarter of 2016 was primarily the result of lower margins in most of the transportation services and higher fuel costs partially offset by a change in the mix of services.

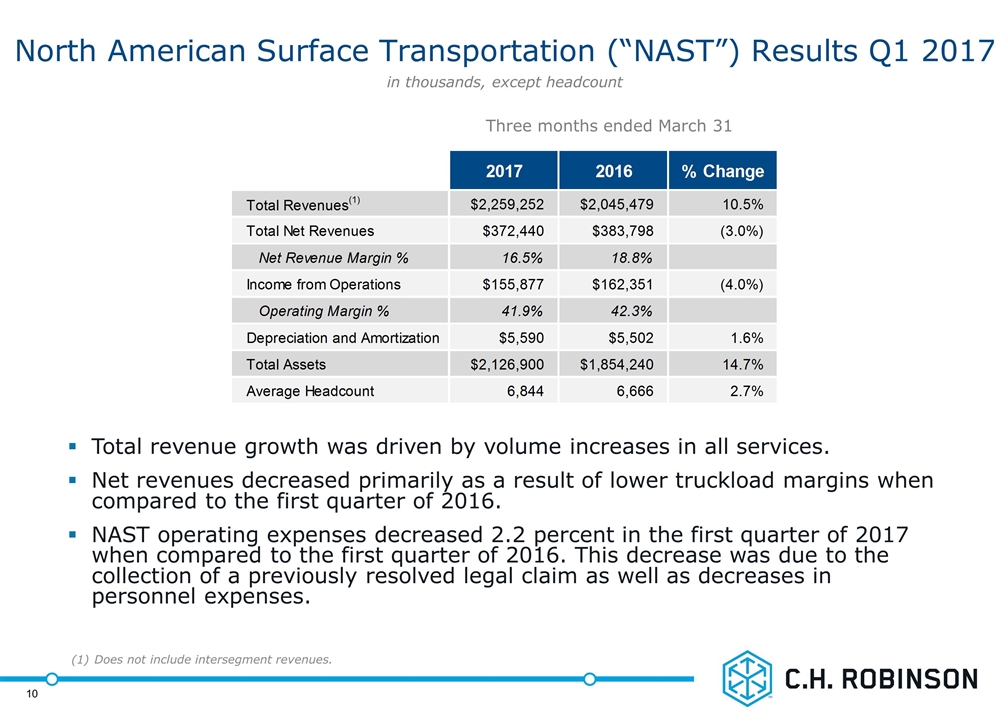

North American Surface Transportation (“NAST”) Results Q1 2017 Three months ended March 31 Total revenue growth was driven by volume increases in all services. Net revenues decreased primarily as a result of lower truckload margins when compared to the first quarter of 2016. NAST operating expenses decreased 2.2 percent in the first quarter of 2017 when compared to the first quarter of 2016. This decrease was due to the collection of a previously resolved legal claim as well as decreases in personnel expenses. in thousands, except headcount 10 Does not include intersegment revenues.

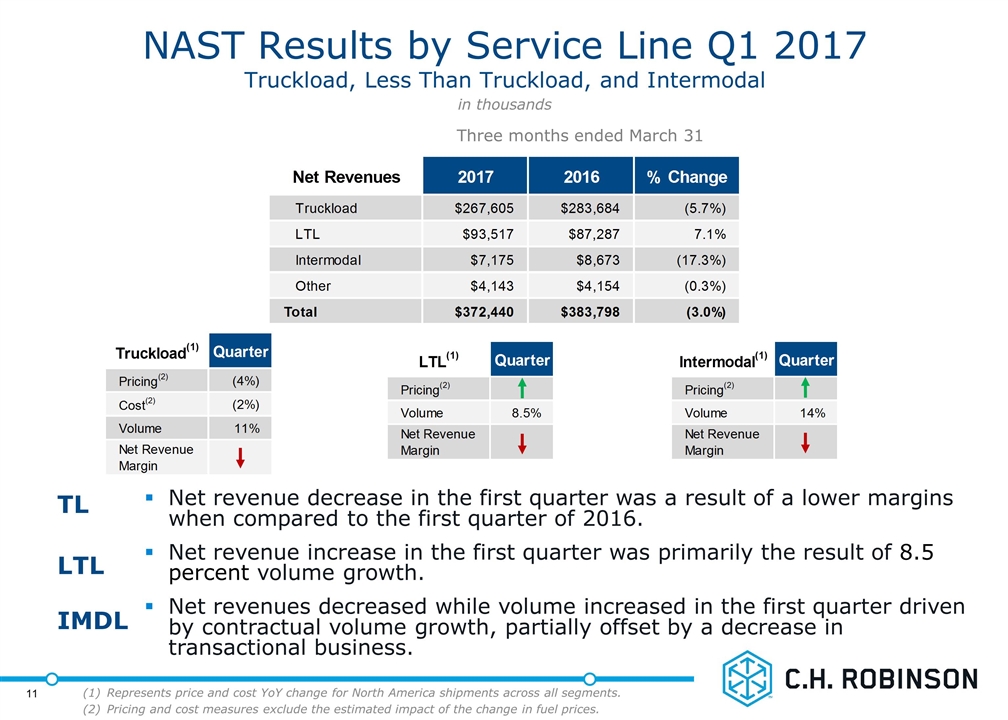

NAST Results by Service Line Q1 2017 Truckload, Less Than Truckload, and Intermodal Net revenue decrease in the first quarter was a result of a lower margins when compared to the first quarter of 2016. Net revenue increase in the first quarter was primarily the result of 8.5 percent volume growth. Net revenues decreased while volume increased in the first quarter driven by contractual volume growth, partially offset by a decrease in transactional business. in thousands Three months ended March 31 TL LTL IMDL 11 Represents price and cost YoY change for North America shipments across all segments. Pricing and cost measures exclude the estimated impact of the change in fuel prices.

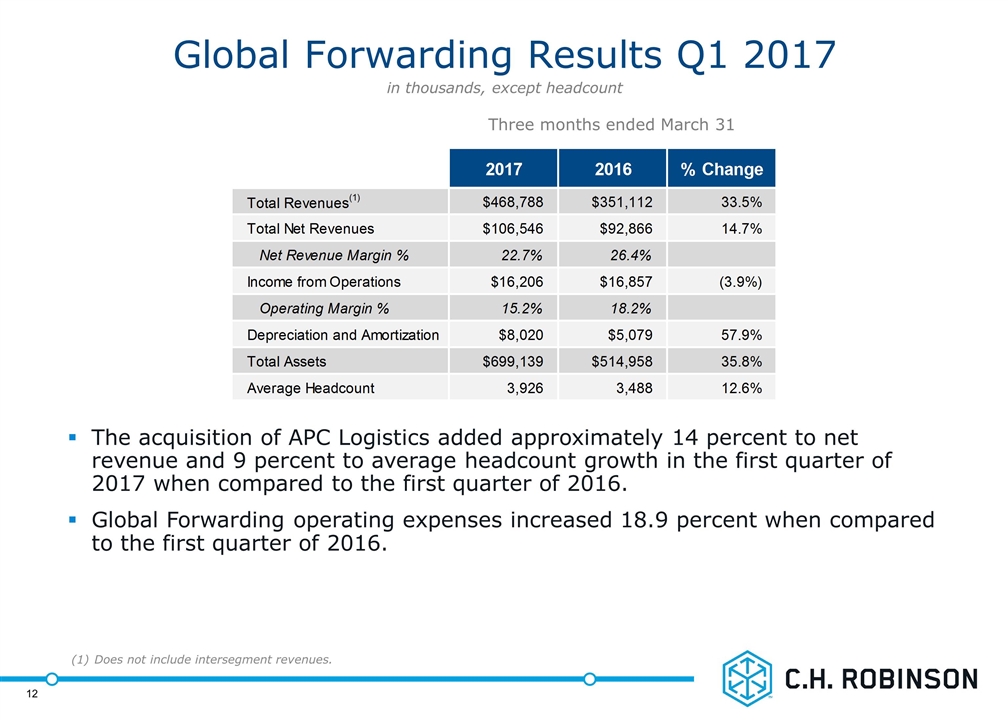

Global Forwarding Results Q1 2017 Three months ended March 31 The acquisition of APC Logistics added approximately 14 percent to net revenue and 9 percent to average headcount growth in the first quarter of 2017 when compared to the first quarter of 2016. Global Forwarding operating expenses increased 18.9 percent when compared to the first quarter of 2016. in thousands, except headcount 12 Does not include intersegment revenues.

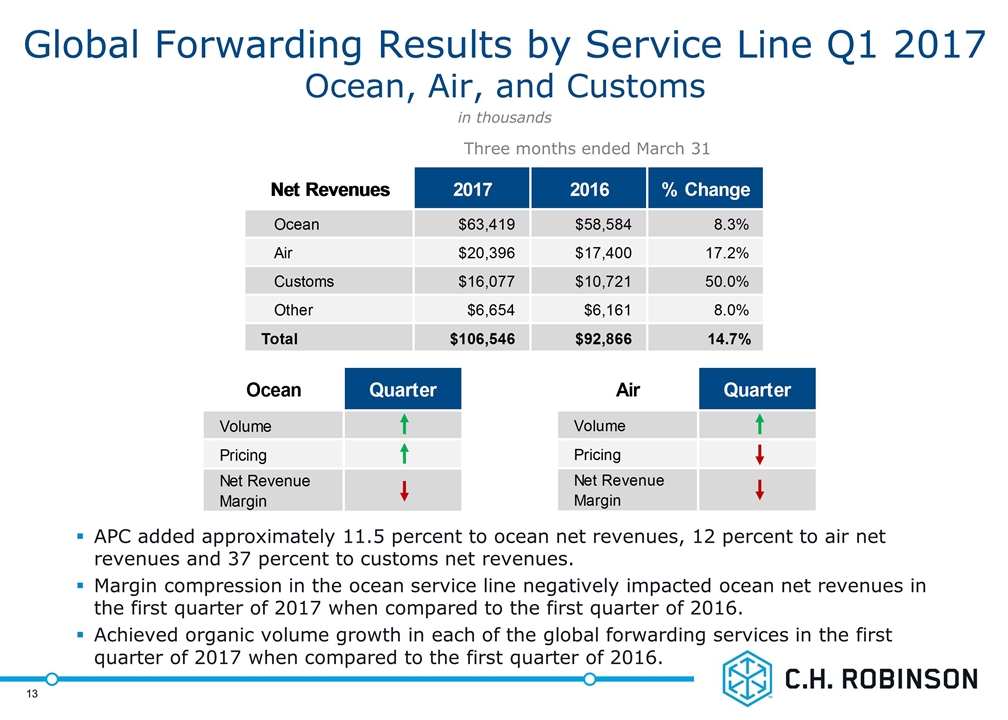

Global Forwarding Results by Service Line Q1 2017 Ocean, Air, and Customs APC added approximately 11.5 percent to ocean net revenues, 12 percent to air net revenues and 37 percent to customs net revenues. Margin compression in the ocean service line negatively impacted ocean net revenues in the first quarter of 2017 when compared to the first quarter of 2016. Achieved organic volume growth in each of the global forwarding services in the first quarter of 2017 when compared to the first quarter of 2016. in thousands Three months ended March 31 13

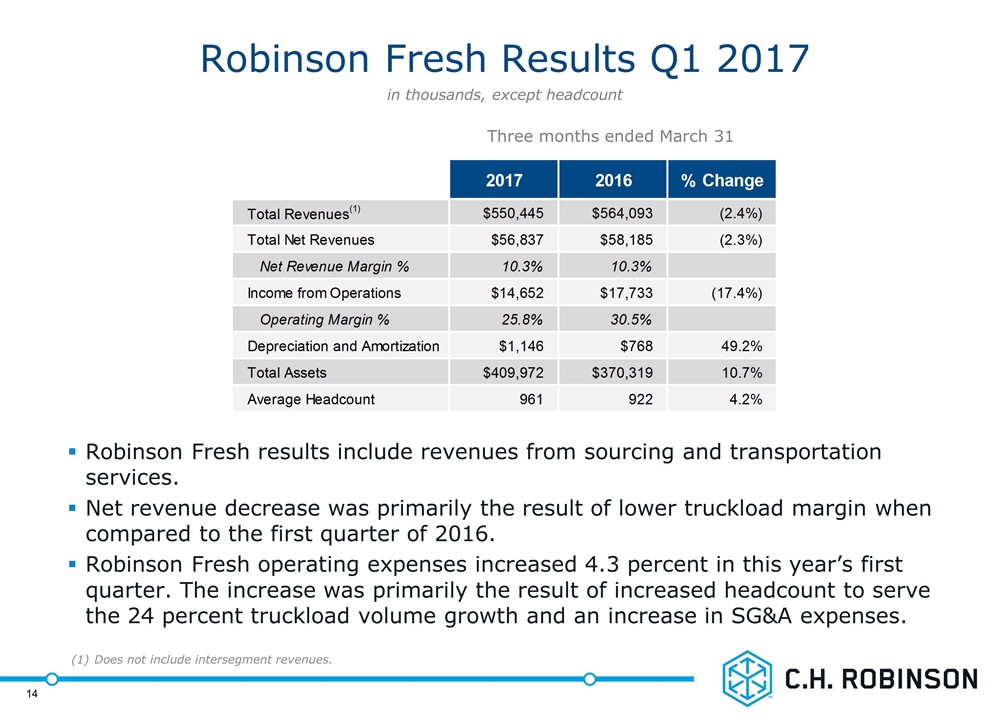

Robinson Fresh results include revenues from sourcing and transportation services. Net revenue decrease was primarily the result of lower truckload margin when compared to the first quarter of 2016. Robinson Fresh operating expenses increased 4.3 percent in this year’s first quarter. The increase was primarily the result of increased headcount to serve the 24 percent truckload volume growth and an increase in SG&A expenses. in thousands, except headcount Three months ended March 31 Robinson Fresh Results Q1 2017 14 Does not include intersegment revenues.

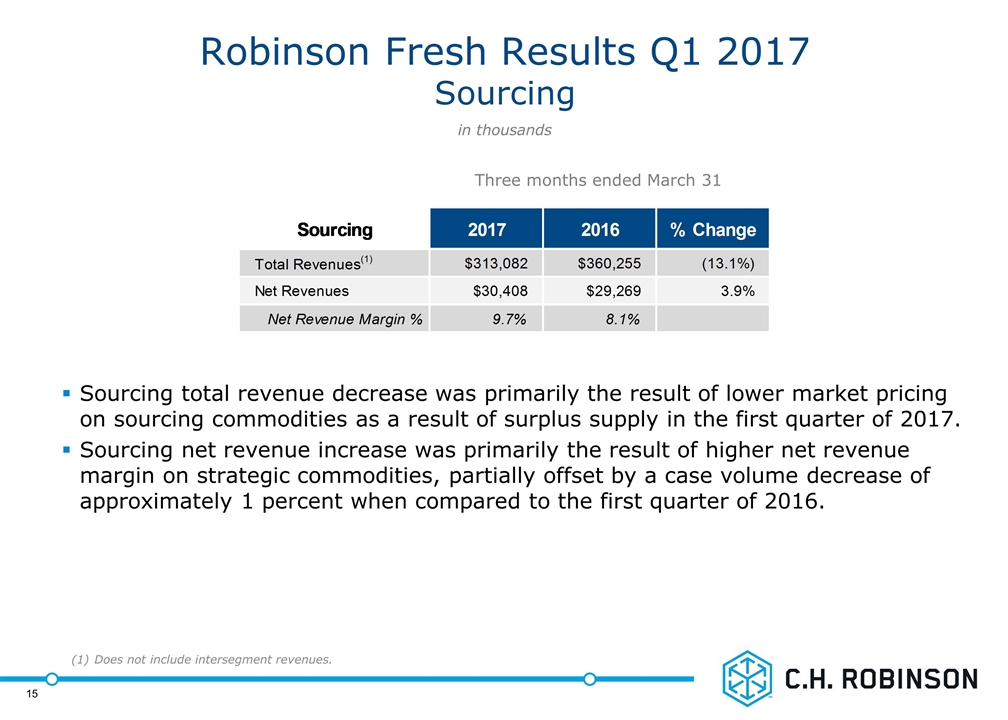

Robinson Fresh Results Q1 2017 Sourcing Sourcing total revenue decrease was primarily the result of lower market pricing on sourcing commodities as a result of surplus supply in the first quarter of 2017. Sourcing net revenue increase was primarily the result of higher net revenue margin on strategic commodities, partially offset by a case volume decrease of approximately 1 percent when compared to the first quarter of 2016. in thousands Three months ended March 31 15 Does not include intersegment revenues.

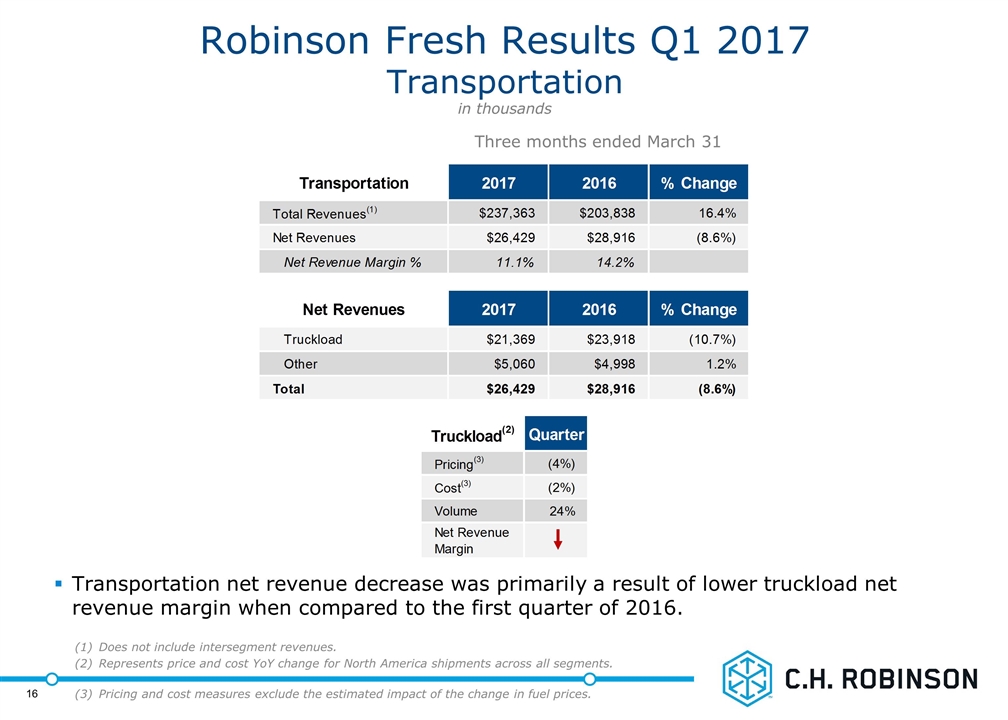

Robinson Fresh Results Q1 2017 Transportation Transportation net revenue decrease was primarily a result of lower truckload net revenue margin when compared to the first quarter of 2016. in thousands Three months ended March 31 16 Does not include intersegment revenues. Represents price and cost YoY change for North America shipments across all segments. Pricing and cost measures exclude the estimated impact of the change in fuel prices.

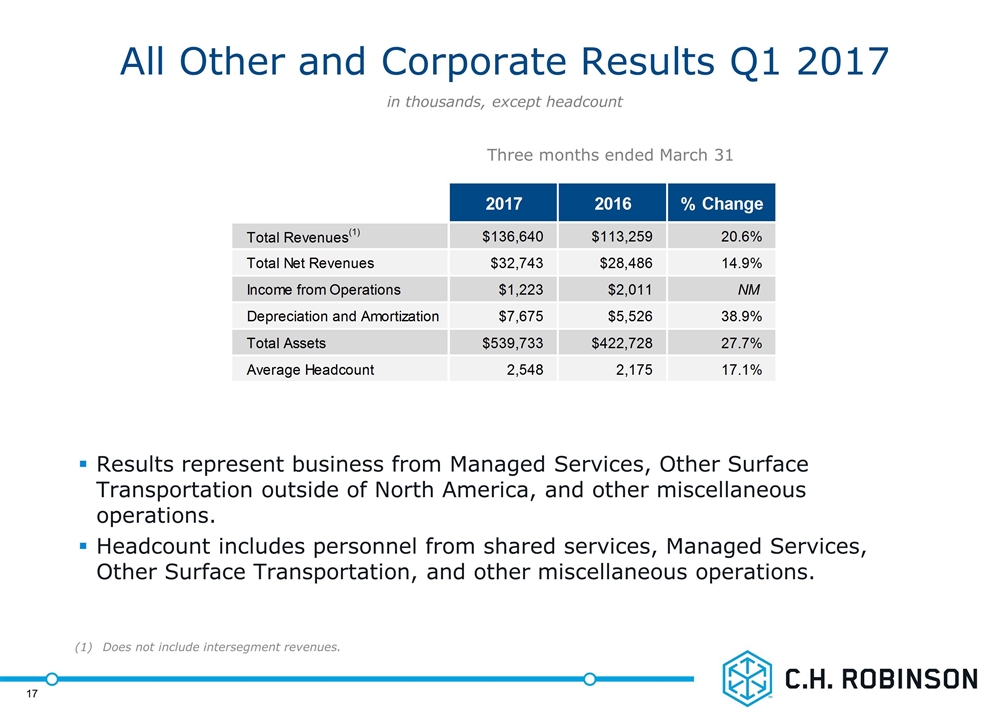

Results represent business from Managed Services, Other Surface Transportation outside of North America, and other miscellaneous operations. Headcount includes personnel from shared services, Managed Services, Other Surface Transportation, and other miscellaneous operations. All Other and Corporate Results Q1 2017 in thousands, except headcount Three months ended March 31 17 Does not include intersegment revenues.

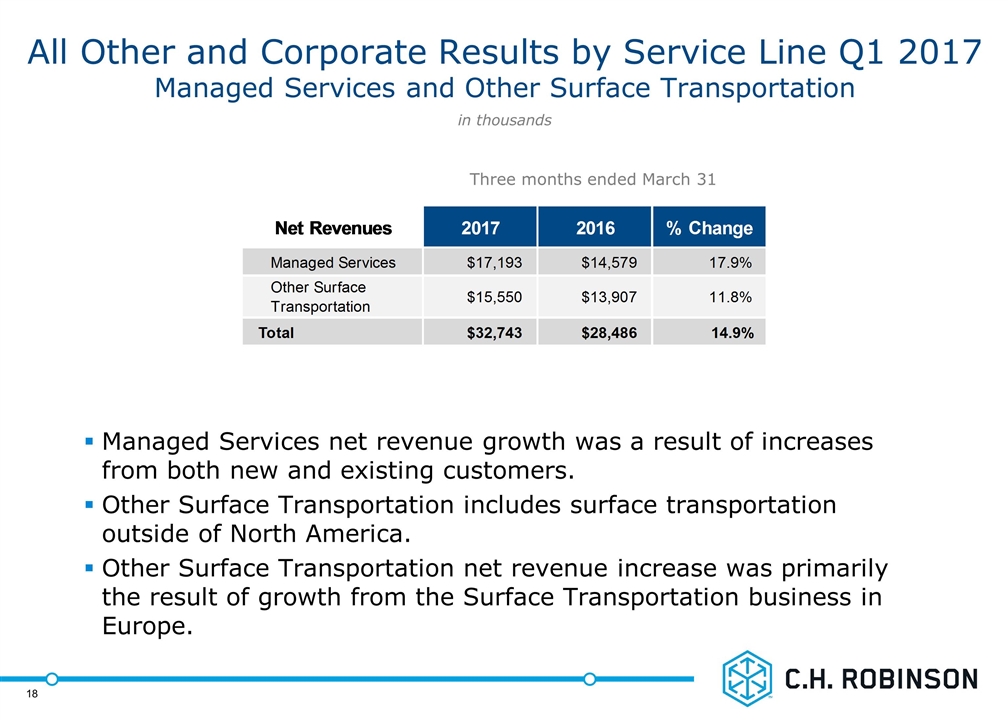

All Other and Corporate Results by Service Line Q1 2017 Managed Services and Other Surface Transportation Managed Services net revenue growth was a result of increases from both new and existing customers. Other Surface Transportation includes surface transportation outside of North America. Other Surface Transportation net revenue increase was primarily the result of growth from the Surface Transportation business in Europe. in thousands Three months ended March 31 18

Final Comments April to date total company net revenue per day, including APC Logistics, has decreased approximately 4 percent when compared to April 2016. Truckload volume growth remains consistent with the first quarter thus far in April. Investor Day, May 3, 2017 Segment strategies Capital allocation priorities Market share opportunities Competitive landscape Technology priorities 19

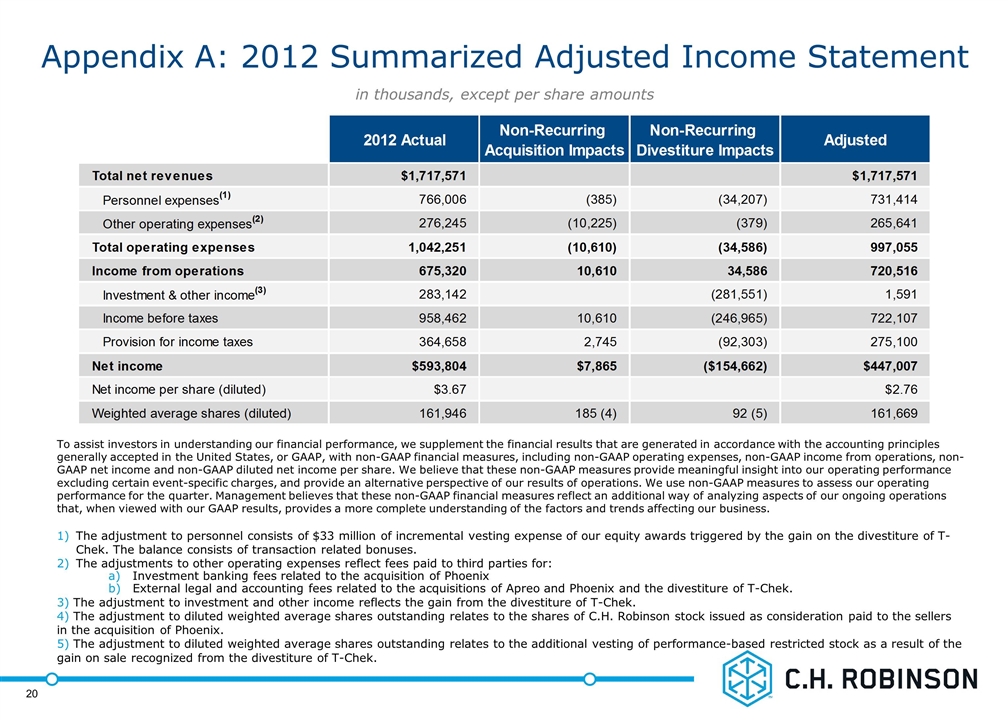

Appendix A: 2012 Summarized Adjusted Income Statement To assist investors in understanding our financial performance, we supplement the financial results that are generated in accordance with the accounting principles generally accepted in the United States, or GAAP, with non-GAAP financial measures, including non-GAAP operating expenses, non-GAAP income from operations, non-GAAP net income and non-GAAP diluted net income per share. We believe that these non-GAAP measures provide meaningful insight into our operating performance excluding certain event-specific charges, and provide an alternative perspective of our results of operations. We use non-GAAP measures to assess our operating performance for the quarter. Management believes that these non-GAAP financial measures reflect an additional way of analyzing aspects of our ongoing operations that, when viewed with our GAAP results, provides a more complete understanding of the factors and trends affecting our business. The adjustment to personnel consists of $33 million of incremental vesting expense of our equity awards triggered by the gain on the divestiture of T-Chek. The balance consists of transaction related bonuses. The adjustments to other operating expenses reflect fees paid to third parties for: Investment banking fees related to the acquisition of Phoenix External legal and accounting fees related to the acquisitions of Apreo and Phoenix and the divestiture of T-Chek. The adjustment to investment and other income reflects the gain from the divestiture of T-Chek. The adjustment to diluted weighted average shares outstanding relates to the shares of C.H. Robinson stock issued as consideration paid to the sellers in the acquisition of Phoenix. The adjustment to diluted weighted average shares outstanding relates to the additional vesting of performance-based restricted stock as a result of the gain on sale recognized from the divestiture of T-Chek. in thousands, except per share amounts 20