Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Titan Energy, LLC | d346087d8k.htm |

| Exhibit 99.1

|

T Titan Energy Transforming in 2017 April 25, 2017

|

|

Forward Looking Statements Certain statements contained in this presentation may be forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based upon information presently available to the Company and assumptions that it believes to be reasonable. Risks, assumptions and uncertainties that could cause actual results to materially differ from the forward-looking statements include, but are not limited to: the prices of natural gas, oil, NGLs and condensate; future financial and operating results; actions that the Company may take in connection with its liquidity needs, including the ability to service its debt and satisfy covenants; the impact of the Company’s securities being quoted on the OTCQX Market rather than listed on a national exchange like the NYSE; success in efficiently developing and exploiting the Company’s reserves and economically finding or acquiring additional recoverable reserves and meeting substantial capital investment needs; potential changes in tax laws and environmental and other regulations which may affect the Company’s operations; the effects of unexpected operational events and drilling conditions, and other risks associated with drilling operations; general market, labor and economic conditions and uncertainties; and other risks, assumptions and uncertainties detailed from time to time in the Company’s reports filed with the SEC, including Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Annual Reports on Form 10-K. Investors are cautioned that all such statements involve risks and uncertainties. Forward-looking statements speak only as of the date hereof, and the Company assumes no obligation to update such statements, except as may be required by applicable law. Titan Energy 2

|

|

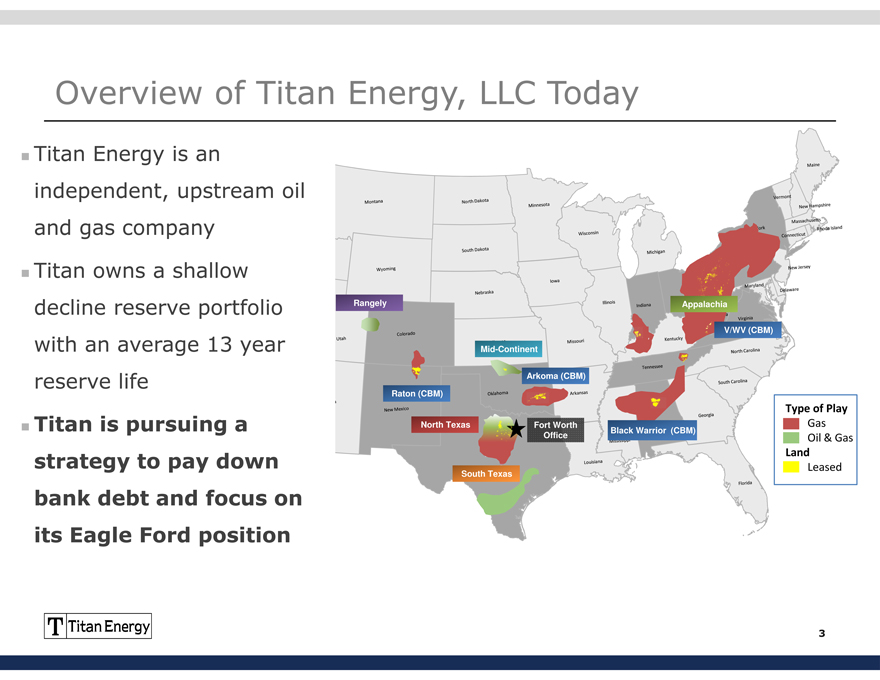

Overview of Titan Energy, LLC Today _ Titan Energy is an independent, upstream oil and gas company _ Titan owns a shallow decline reserve portfolio Rangely Appalachia V/WV (CBM) with an average 13 year Mid-Continent f Play s reserve life Arkoma (CBM) & Gas Raton (CBM) Type of Play Leased ased Titan is pursuing a North Texas Fort Worth Gas _ Office Black Warrior (CBM) Oil & Gas Land strategy to pay down Leased South Texas bank debt and focus on its Eagle Ford position Titan Energy 3

|

|

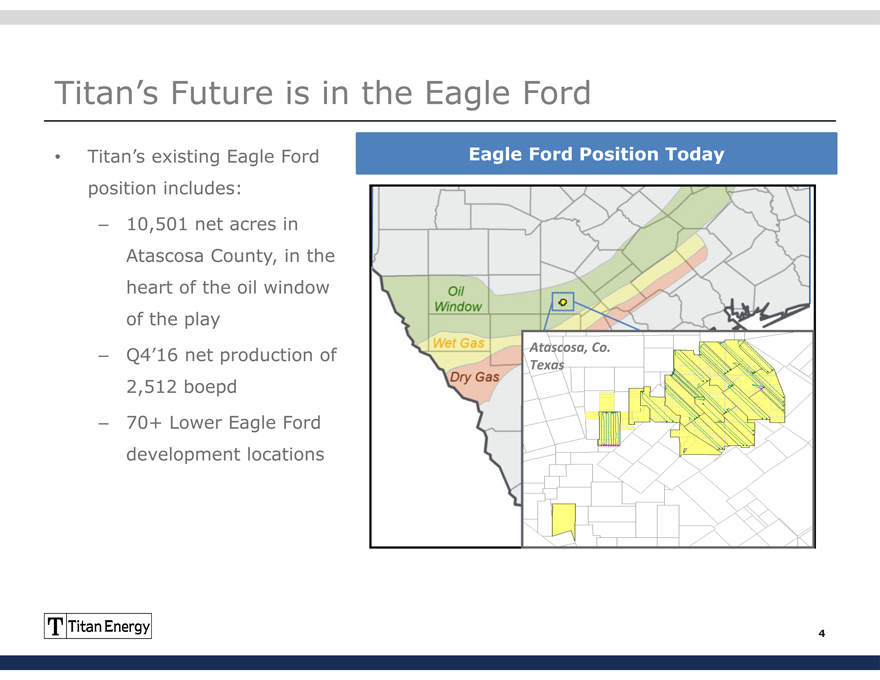

Titan’s Future is in the Eagle Ford Titan’s existing Eagle Ford Eagle Ford Position Today position includes: – 10,501 net acres in Atascosa County, in the heart of the oil window of the play Atascosa, Co. – Q4’16 net production of Texas 2,512 boepd – 70+ Lower Eagle Ford development locations Titan Energy 4

|

|

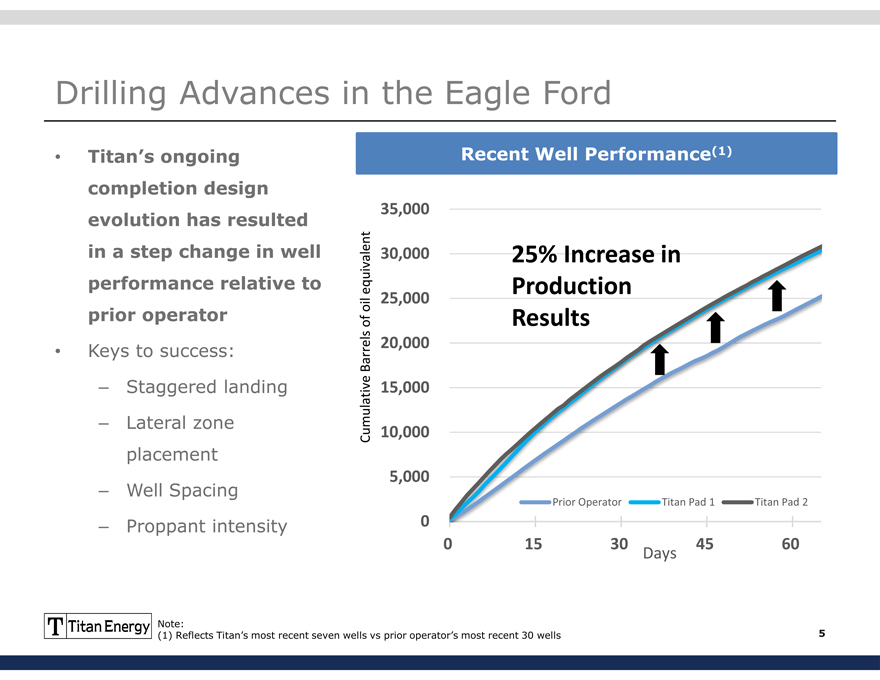

Drilling Advances in the Eagle Ford Titan’s ongoing Recent Well Performance(1) completion design 35,000 evolution has resulted in a step change in well 30,000 25% Increase in performance relative to equivalent Production oil 25,000 prior operator of Results 20,000 Keys to success: Barrels – Staggered landing 15,000 – Lateral zone Cumulative 10,000 placement 5,000 – Well Spacing Prior Operator Titan Pad 1 Titan Pad 2 – Proppant intensity 0 0 15 30 45 60 Days Titan Energy Note: (1) Reflects Titan’s most recent seven wells vs prior operator’s most recent 30 wells 5

|

|

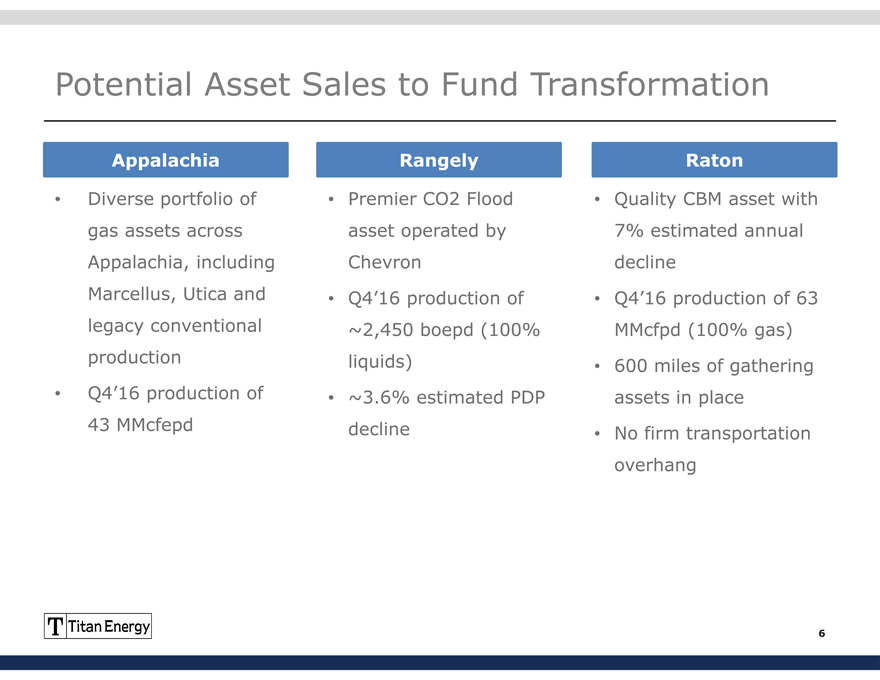

Potential Asset Sales to Fund Transformation Appalachia Rangely Raton Diverse portfolio of Premier CO2 Flood Quality CBM asset with gas assets across asset operated by 7% estimated annual Appalachia, including Chevron decline Marcellus, Utica and Q4’16 production of Q4’16 production of 63 legacy conventional ~2,450 boepd (100% MMcfpd (100% gas) production liquids) 600 miles of gathering Q4’16 production of ~3.6% estimated PDP assets in place 43 MMcfepd decline No firm transportation overhang Titan Energy 6

|

|

Titan Capitalization Titan is focused on transforming its business in 2017 Current Capitalization Projected Borrowing Base(1) $ millions, unless otherwise noted $500 $440 Value per Share (4/24/17) $11.50 $450 Fully Diluted Shares Outstanding (MM) 5.6 $400 $360 Equity Value $64 $350 First Lien (L+4%) $439 $300 Second Lien (2% Cash, 10% PIK) $268 $250 $200 Total Debt $707 $200 Less: Cash $20 $150 Net Debt $687 $100 Enterprise Value $751 $50 - Today 8/31/2017 10/31/2017 Note: (1) Reflects terms of third amendment to Titan’s first lien credit facility, which closed on April 19, 2017. Borrowing base includes both 7 conforming and non-conforming tranche. Further details regarding Titan’s credit facility and amendment available in the most recently filed 10-K and subsequent 8-K Titan Energy 7