Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SIERRA BANCORP | v464887_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - SIERRA BANCORP | v464887_ex2-1.htm |

| 8-K - 8-K - SIERRA BANCORP | v464887_8k.htm |

Exhibit 99.2

SIERRA BANCORP Acquisition of OCB Bancorp Investor Presentation April 24, 2017

Saf e H arbor S t atem ent • Thi s p r e se n t a t i o n c o n t ains f o r w a r d - look i ng s t a t em e n ts th a t a r e: □ Sub je c t t o c o n ti n g encies & u nce r t a i n ties □ Not a g u a r a nt ee o f f u t u r e per f o r mance □ Based o n assum p ti on s t h a t m a y c h a n g e □ Not t o b e un d u l y r el i ed on • Th e s e f o r w a r d - look i n g s t a t em e n ts a r e s u bj e c t t o ma n y f ac t o r s be y on d ou r abi l ity t o c o n t r o l or p r ed i c t, inc l u d in g f ac t o r s s u c h as : □ I n t e r e s t r at e v olat i lity □ E c ono m ic c ondi t ions □ Ass e t per f o r mance □ Succ e s s f u l acqu i s iti o n ass i mi l a t i on • Pl ea s e s ee “R i sk F ac t o r s ” , “Ma n a g em e n t ’ s D i scussion and Anal y sis ” , and “ B u s i n e s s ” i n B SR R ’ s mo s t r ece n t F o r ms 10 - K and 10 - Q , and c aut i on ar y s t a t em e n ts i n i ts oth e r S E C filin g s .

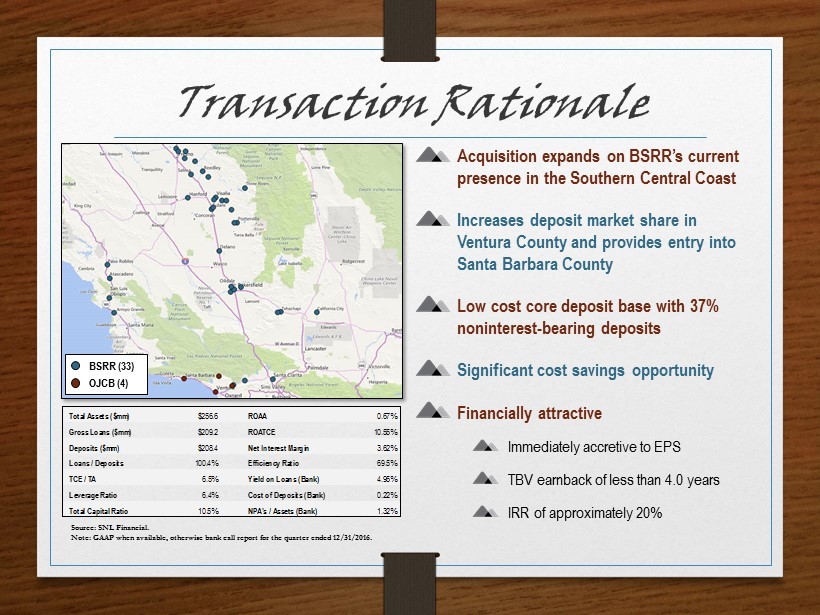

• BSRR (33) • OJCB (4) Acquisition expands on BSRR’s current presence in the Southern Central Coast Increases deposit market share in Ventura County and provides entry into Santa Barbara County Low cost core deposit base with 37% noninterest - bearing deposits Significant cost savings opportunity Financially attractive Immediately accretive to EPS TBV earnback of less than 4.0 years IRR of approximately 20% Transaction Rationale Total Assets ($mm) $256.6 ROAA 0.67% Gross Loans ($mm) $209.2 ROATCE 10.55% Deposits ($mm) $208.4 Net Interest Margin 3.62% Loans / Deposits 100.4% Efficiency Ratio 69.5% TCE / TA 6.5% Yield on Loans (Bank) 4.95% Leverage Ratio 6.4% Cost of Deposits (Bank) 0.22% Total Capital Ratio 10.5% NPA's / Assets (Bank) 1.32% Source: SNL Financial. Note: GAAP when available, otherwise bank call report for the quarter ended 12/31/2016.

Transaction Overview (1) Subject to adjustment as defined in the definitive agreement. (2) Based on BSRR closing stock price of $27.22 as of 4/21/2017. Transaction Details: Transaction Value Fixed Price per Share (1) Transaction Structure (2) Required Approvals Expected Closing Due Diligence Price / TBVPS 2018e EPS Impact TBV Earnback Internal Rate of Return Transaction Highlights: $35.7 million $14.00 100% stock ; 0.5143 exchange ratio Customary regulatory approvals and approval of OJCB shareholders Q4 2017 Comprehensive due diligence completed, including preliminary 3 rd party loan review 1.85x ~ 4.5% < 4.0 years ~ 20%

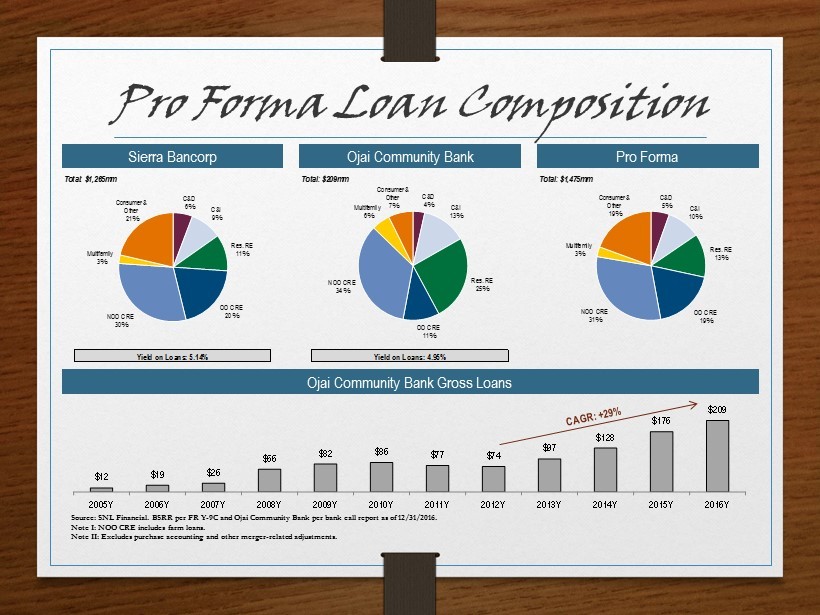

Pro Forma Loan Composition Source: SNL Financial. BSRR per FR Y - 9C and Ojai Community Bank per bank call report as of 12/31/2016. Note I: NOO CRE includes farm loans. Note II: Excludes purchase accounting and other merger - related adjustments. Sierra Bancorp Ojai Community Bank Gross Loans Ojai Community Bank Pro Forma Total: $1,265mm Yield on Loans: 5.14% Yield on Loans: 4.95% C&D 6% C&I 9% Res. RE 11% OO CRE 20% NOO CRE 30% Multifamily 3% Consumer & Other 21% Total: $209mm Yield on Loans: 4.95% C&D 4% C&I 13% Res. RE 25% OO CRE 11% NOO CRE 34% Multifamily 6% Consumer & Other 7% Total: $1,475mm C&D 5% C&I 10% Res. RE 13% OO CRE 19% NOO CRE 31% Multifamily 3% Consumer & Other 19% $12 $19 $26 $66 $82 $86 $77 $74 $97 $128 $176 $209 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

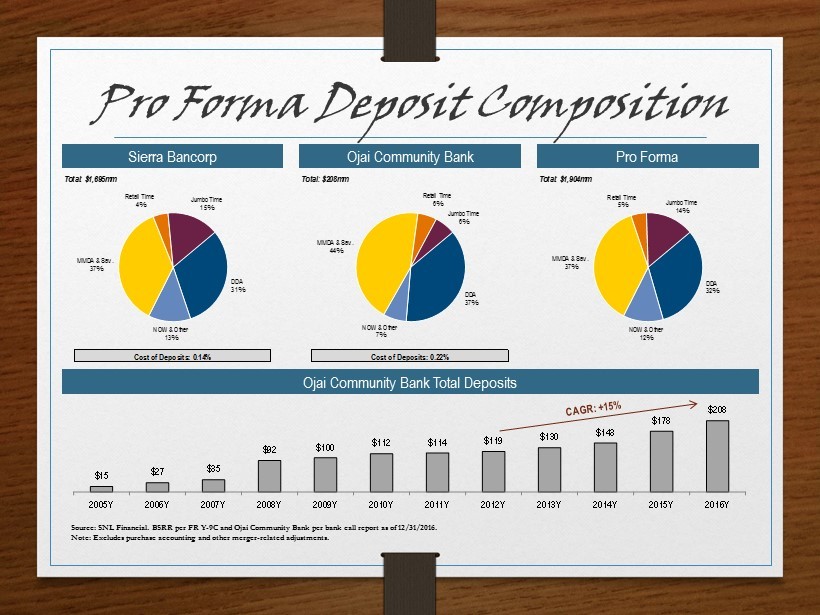

Pro Forma Deposit Composition Source: SNL Financial. BSRR per FR Y - 9C and Ojai Community Bank per bank call report as of 12/31/2016. Note: Excludes purchase accounting and other merger - related adjustments. Sierra Bancorp Ojai Community Bank Total Deposits Ojai Community Bank Pro Forma Total: $1,695mm Cost of Deposits: 0.14% Cost of Deposits: 0.22% DDA 31% NOW & Other 13% MMDA & Sav. 37% Retail Time 4% Jumbo Time 15% Total: $208mm Cost of Deposits: 0.22% DDA 37% NOW & Other 7% MMDA & Sav. 44% Retail Time 6% Jumbo Time 6% Total: $1,904mm DDA 32% NOW & Other 12% MMDA & Sav. 37% Retail Time 5% Jumbo Time 14% $15 $27 $35 $92 $100 $112 $114 $119 $130 $143 $178 $208 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

K E E P C L I M B I N G SIERRA BANCORP