Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SELECT INCOME REIT | sir_exhibit991x33117.htm |

| 8-K - 8-K - SELECT INCOME REIT | sir_33117x8-kxdocument.htm |

1

7958 South Chester Street, Centennial, CO

Square Feet: 167,917

United Launch Alliance Corporate Headquarters

First Quarter 2017

Supplemental Operating and Financial Data

Select Income REIT Exhibit 99.2

All amounts in this report are unaudited.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 2

TABLE OF CONTENT

S

PAGE/EXHIBIT

CORPORATE INFORMATION

Company Profile 7

Investor Information 8

Research Coverage 9

FINANCIALS

Key Financial Data 11

Condensed Consolidated Balance Sheets 12

Condensed Consolidated Statements of Income 13

Condensed Consolidated Statements of Cash Flows 15

Debt Summary 16

Debt Maturity Schedule 17

Leverage Ratios, Coverage Ratios and Public Debt Covenants 18

Capital Expenditures Summary 19

Property Acquisitions and Dispositions Information Since 1/1/17 20

Calculation of Property Net Operating Income (NOI) and Cash Basis NOI 21

Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI 22

Calculation of EBITDA and Adjusted EBITDA 23

Calculation of Funds from Operations (FFO) Attributed to SIR and Normalized FFO Attributed to SIR 24

Definitions of Certain Non-GAAP Financial Measures 25

PORTFOLIO INFORMATION

Portfolio Summary by Property Type 27

Same Property Results of Operations 28

Leasing Summary 30

Occupancy and Leasing Analysis by Property Type 31

Tenant Diversity and Credit Characteristics 32

Tenants Representing 1% or More of Total Annualized Rental Revenue 33

Three Year Lease Expiration Schedule by Property Type 34

Portfolio Lease Expiration Schedule 35

Hawaii Land Rent Reset Summary 36

EXHIBIT

Property Detail A

TABLE OF CONTENTS

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 3

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”,

“INTEND”, “PLAN”, “ESTIMATE”, “WILL”, “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE

FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO

OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• THE LIKELIHOOD THAT OUR TENANTS WILL PAY RENT OR BE NEGATIVELY AFFECTED BY CYCLICAL ECONOMIC CONDITIONS,

• THE LIKELIHOOD THAT OUR TENANTS WILL RENEW OR EXTEND THEIR LEASES OR THAT WE WILL BE ABLE TO OBTAIN REPLACEMENT TENANTS,

• OUR ACQUISITIONS OF PROPERTIES,

• OUR SALES OF PROPERTIES,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS AND TENANCIES EFFECTIVELY,

• THE LIKELIHOOD THAT OUR RENTS MAY INCREASE WHEN RENTS ARE RESET AT OUR LEASED LANDS IN HAWAII,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND THE AMOUNT OF SUCH DISTRIBUTIONS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• OUR ABILITY TO RAISE EQUITY OR DEBT CAPITAL,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR CREDIT RATINGS,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS

ARRANGED BY AIC,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT,

• THE CREDIT QUALITIES OF OUR TENANTS, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL

CONDITION, FUNDS FROM OPERATIONS, OR FFO, ATTRIBUTED TO SELECT INCOME REIT, OR SIR, NORMALIZED FUNDS FROM OPERATIONS, OR NORMALIZED FFO, ATTRIBUTED TO

SIR, NET OPERATING INCOME, OR NOI, CASH BASIS NOI, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR

ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE, BUT ARE NOT LIMITED TO:

• THE IMPACT OF CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR TENANTS,

• COMPETITION WITHIN THE REAL ESTATE INDUSTRY, PARTICULARLY IN THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME

TAX PURPOSES,

WARNING CONCERNING FORWARD LOOKING STATEMENTS

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 4

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (CONTINUED

)

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, THE RMR GROUP LLC, OR RMR LLC, RMR INC.,

GOVERNMENT PROPERTIES INCOME TRUST, OR GOV, AIC, AND OTHERS AFFILIATED WITH THEM, AND

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL.

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A

NUMBER OF FACTORS, INCLUDING OUR FUTURE EARNINGS, THE CAPITAL COSTS WE INCUR TO LEASE OUR PROPERTIES AND OUR WORKING CAPITAL REQUIREMENTS. WE

MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE

REDUCED OR ELIMINATED,

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES AND LEASE THEM FOR RENTS,

LESS PROPERTY OPERATING COSTS, THAT EXCEED OUR CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE

ACCEPTABLE PURCHASE PRICES, ACQUISITION FINANCING OR LEASE TERMS FOR NEW PROPERTIES,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES MAY NOT OCCUR, MAY BE DELAYED OR

THE TERMS OF SUCH TRANSACTIONS MAY CHANGE,

• RENTS THAT WE CAN CHARGE AT OUR PROPERTIES MAY DECLINE BECAUSE OF CHANGING MARKET CONDITIONS OR OTHERWISE,

• A SIGNIFICANT NUMBER OF OUR HAWAII PROPERTIES ARE LANDS LEASED FOR RENTS THAT ARE PERIODICALLY RESET BASED ON THEN CURRENT FAIR MARKET VALUES.

REVENUES FROM OUR PROPERTIES IN HAWAII HAVE GENERALLY INCREASED DURING OUR OWNERSHIP AS THE LEASES FOR THOSE PROPERTIES HAVE BEEN RESET OR

RENEWED. ALTHOUGH WE EXPECT THAT RENTS FOR OUR HAWAII PROPERTIES WILL INCREASE IN THE FUTURE, WE CANNOT BE SURE THEY WILL. FUTURE RENTS FROM

THESE PROPERTIES COULD DECREASE OR NOT INCREASE TO THE EXTENT THEY HAVE IN THE PAST,

• WE MAY NOT SUCCEED IN FURTHER DIVERSIFYING OUR REVENUE SOURCES AND ANY DIVERSIFICATION WE MAY ACHIEVE MAY NOT MITIGATE OUR PORTFOLIO RISKS OR

IMPROVE THE SECURITY OF OUR REVENUES OR OUR OPERATING PERFORMANCE,

• WE ARE CURRENTLY DEVELOPING A 35,000 SQUARE FOOT EXPANSION OF A BUILDING ON A PROPERTY WE OWN IN OKLAHOMA. WE EXPECT TO SPEND

APPROXIMATELY $5.2 MILLION TO COMPLETE THIS EXPANSION. IN ADDITION, AS OF MARCH 31, 2017, WE HAVE ESTIMATED UNSPENT LEASING RELATED OBLIGATIONS

OF $22.5 MILLION WHICH EXCLUDES THE ESTIMATED EXPANSION COSTS NOTED IN THE PRECEDING SENTENCE. IT IS DIFFICULT TO ACCURATELY ESTIMATE DEVELOPMENT

COSTS. THIS DEVELOPMENT PROJECT AND OUR UNSPENT LEASING RELATED OBLIGATIONS MAY COST MORE OR LESS AND MAY TAKE LONGER TO COMPLETE THAN WE

CURRENTLY EXPECT, AND WE MAY INCUR INCREASING AMOUNTS FOR THESE AND SIMILAR PURPOSES IN THE FUTURE,

• OUR POSSIBLE REDEVELOPMENT OF CERTAIN OF OUR HAWAII PROPERTIES MAY NOT BE REALIZED OR BE SUCCESSFUL,

• THE UNEMPLOYMENT RATE OR ECONOMIC CONDITIONS IN AREAS WHERE OUR PROPERTIES ARE LOCATED MAY BECOME WORSE IN THE FUTURE. SUCH CIRCUMSTANCES OR

OTHER CONDITIONS MAY REDUCE DEMAND FOR LEASING OFFICE AND INDUSTRIAL SPACE. IF THE DEMAND FOR LEASING OFFICE AND INDUSTRIAL SPACE IS REDUCED, WE

MAY BE UNABLE TO RENEW LEASES WITH OUR TENANTS AS LEASES EXPIRE OR ENTER INTO NEW LEASES AT RENTAL RATES AS HIGH AS EXPIRING RATES, AND OUR FINANCIAL

RESULTS MAY DECLINE,

• OUR BELIEF THAT THERE IS A LIKELIHOOD THAT TENANTS MAY RENEW OR EXTEND OUR LEASES WHEN THEY EXPIRE WHENEVER THEY HAVE MADE SIGNIFICANT

INVESTMENTS IN THE LEASED PROPERTIES, OR BECAUSE THOSE PROPERTIES MAY BE OF STRATEGIC IMPORTANCE TO THEM, MAY NOT BE REALIZED,

• SOME OF OUR TENANTS MAY NOT RENEW EXPIRING LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN OR INCREASE THE HISTORICAL OCCUPANCY

RATES OF, OR RENTS FROM, OUR PROPERTIES,

• WE MAY INCUR SIGNIFICANT COSTS TO PREPARE A PROPERTY FOR A TENANT, PARTICULARLY FOR SINGLE TENANT PROPERTIES,

• A TENANT OF TWO OF OUR PROPERTIES HAS FILED FOR BANKRUPTCY AND REJECTED ITS TWO LEASES WITH US. ALTHOUGH WE HOLD A SECURITY DEPOSIT OF $3.7 MILLION

FROM THIS TENANT, OUR ABILITY TO APPLY THAT SECURITY DEPOSIT MAY BE SUBJECT TO BANKRUPTCY COURT APPROVAL. IN ADDITION, WE WOULD NOT RECEIVE ANY

ADDITIONAL CASH PAYMENT WHEN WE APPLY THE SECURITY DEPOSIT. ALTHOUGH THE SUBTENANT AT ONE OF THE TWO PROPERTIES CONTINUES TO PAY RENT TO US IN AN

AMOUNT EQUAL TO THE RENT UNDER THE FORMER TENANT'S LEASE, THE SUBTENANT HAS CERTAIN RIGHTS TO TERMINATE ITS SUBLEASE, INCLUDING UPON ONE YEAR'S

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED)

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 5

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (CONTINUED

)

ADVANCE NOTICE. WE ARE IN DISCUSSIONS WITH THIS SUBTENANT TO CONVERT ITS SUBLEASE TO A DIRECT LEASE WITH US. WE CAN PROVIDE NO ASSURANCE THAT WE WILL BE

SUCCESSFUL IN REACHING AGREEMENT WITH THIS SUBTENANT OR THAT THE TERMS OF ANY AGREEMENT WITH THE SUBTENANT WILL BE SIMILAR TO THE TERMS OF THE

REJECTED LEASE WITH THE BANKRUPT FORMER TENANT, INCLUDING THE AMOUNT OF RENT UNDER ANY SUCH AGREEMENT,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CUSTOMARY

CREDIT FACILITY CONDITIONS THAT WE MAY BE UNABLE TO SATISFY,

• ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE CREDIT FACILITIES WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND

EXPENSES ASSOCIATED WITH SUCH FACILITIES,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN MAY BE INCREASED TO UP TO $2.2 BILLION ON A COMBINED BASIS IN CERTAIN

CIRCUMSTANCES; HOWEVER, INCREASING THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN IS SUBJECT TO OUR OBTAINING

ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS; HOWEVER, THE

APPLICABLE CONDITIONS MAY NOT BE MET,

• WE RECEIVED AN ASSESSMENT FROM THE STATE OF WASHINGTON FOR REAL ESTATE EXCISE TAX, INTEREST AND PENALTIES OF $2.8 MILLION ON CERTAIN PROPERTIES WE

ACQUIRED IN CONNECTION WITH OUR ACQUISITION OF COLE CORPORATE INCOME TRUST, INC. IN JANUARY 2015. ALTHOUGH WE BELIEVE WE ARE NOT LIABLE FOR THIS TAX AND

ARE DISPUTING THIS ASSESSMENT, WE MAY NOT SUCCEED IN HAVING ALL OR ANY PART OF THIS ASSESSMENT NULLIFIED,

• THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY

TERMINATION IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS OR FOR

SHORTER TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., GOV, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND

PROVIDE US WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE

RELATIONSHIPS MAY NOT MATERIALIZE, AND

• THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND TERM LOAN AND THE FACILITY FEE PAYABLE ON OUR REVOLVING

CREDIT FACILITY ARE BASED ON OUR CREDIT RATINGS. FUTURE CHANGES IN OUR CREDIT RATINGS MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM,

NATURAL DISASTERS, CHANGES IN OUR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND FOR LEASED SPACE OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY

GENERALLY.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION "RISK FACTORS" IN OUR PERIODIC

REPORTS, OR INCORPORATED THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS

WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR

OTHERWISE.

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED)

6

CORPORATE INFORMATION

6

45101 Warp Drive, Sterling, VA

Square Feet: 337,228

Orbital ATK (NYSE: OA) Corporate Headquarters

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 7

COM

PAN

Y PROFIL

E

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 796-8303

(f) (617) 796-8335

Stock Exchange Listing:

Nasdaq

Trading Symbol:

Common Shares: SIR

Issuer Ratings:

Moody’s: Baa2

Standard & Poor’s: BBB-

The Company:

Select Income REIT, or SIR, we, our or us, is a real estate investment trust, or REIT, which owns properties that are

primarily leased to single tenants. As of March 31, 2017, we owned 362 buildings with approximately 44.8 million rentable

square feet located in 35 states, including 229 buildings, leasable land parcels and easements with approximately 17.8

million square feet which are primarily leasable industrial and commercial lands located in Hawaii. We have been

investment grade rated since 2014, and we are included in the Russell 2000® Index and the MSCI US REIT Index.

COMPANY PROFILE

Management:

SIR is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an

alternative asset management company that was founded in 1986 to manage real estate companies and related

businesses. RMR primarily provides management services to four publicly owned REITs and three real estate related

operating businesses. In addition to managing SIR, RMR manages Hospitality Properties Trust, a REIT that owns hotels

and travel centers, Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical

office buildings, and Government Properties Income Trust, a REIT that primarily owns properties leased to the U.S. and

state governments. RMR also provides management services to TravelCenters of America LLC, a publicly traded operator

of travel centers along the U.S. Interstate Highway System, convenience stores and restaurants, Five Star Senior Living

Inc., a publicly traded operator of senior living communities, and Sonesta International Hotels Corporation, a privately

owned franchisor and operator of hotels and cruise ships. RMR also manages publicly traded securities of real estate

companies and private commercial real estate debt funds through wholly owned SEC registered investment advisory

subsidiaries. As of March 31, 2017, RMR had $27.6 billion of real estate assets under management and the combined

RMR managed companies had approximately $11 billion of annual revenues, over 1,400 properties and more than 53,000

employees. We believe that being managed by RMR is a competitive advantage for SIR because of RMR’s depth of

management and experience in the real estate industry. We also believe RMR provides management services to us at

costs that are lower than we would have to pay for similar quality services.

(1) Includes 229 buildings, leasable land parcels and easements with approximately 17.8 million square feet which are primarily

leasable industrial and commercial lands located in Hawaii.

(2) See page 24 for the calculation of FFO attributed to SIR and Normalized FFO attributed to SIR and a reconciliation of net

income attributed to SIR determined in accordance with U.S. generally accepted accounting principles, or GAAP, to those

amounts.

Key Data (as of 3/31/2017):

(dollars and sq. ft. in 000s)

Total buildings (1) 362

Total sq. ft. 44,813

Percent leased 95.9%

Q1 2017 total revenue $ 116,294

Q1 2017 net income attributed to SIR $ 6,728

Q1 2017 Normalized FFO attributed

to SIR (2) $ 52,361

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 8

INVES

TOR INFORM

ATIO

N

INVESTOR INFORMATION

Board of Trustees

Donna D. Fraiche William A. Lamkin Jeffrey P. Somers

Independent Trustee Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy

Managing Trustee Managing Trustee

Senior Management

David M. Blackman John C. Popeo

President and Chief Operating Officer Chief Financial Officer and Treasurer

Contact Information

Investor Relations Inquiries

Select Income REIT Financial inquiries should be directed to John C. Popeo,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 796-8303

255 Washington Street, Suite 300 or jpopeo@sirreit.com.

Newton, MA 02458-1634

(t) (617) 796-8303 Investor and media inquiries should be directed to

(f) (617) 796-8335 Christopher Ranjitkar, Director, Investor Relations,

(e-mail) info@sirreit.com at (617) 796-8320 or cranjitkar@sirreit.com.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 9

RESEARCH COVERAG

E

RESEARCH COVERAGE

Equity Research Coverage

Bank of America / Merrill Lynch

James Feldman

(646) 855-5808

james.feldman@baml.com

FBR Capital Markets & Co.

Bryan Maher

(646) 885-5423

bmaher@fbr.com

JMP Securities

Mitch Germain

(212) 906-3546

mgermain@jmpsecurities.com

Morgan Stanley

Vikram Malhotra

(212) 761-7064

vikram.malhotra@morganstanley.com

RBC Capital Markets

Michael Carroll

(440) 715-2649

michael.carroll@rbccm.com

SIR is followed by the analysts and its credit is rated by the rating agencies listed above. Please note that any opinions,

estimates or forecasts regarding SIR’s performance made by these analysts or agencies do not represent opinions,

forecasts or predictions of SIR or its management. SIR does not by its reference above imply its endorsement of or

concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

Rating Agencies

Moody’s Investors Service

Griselda Bisono

(212) 553-4985

griselda.bisono@moodys.com

Standard & Poor’s

Michael Souers

(212) 438-2508

michael.souers@standardandpoors.com

10

FINANCIALS

10

350 Spectrum Loop, Colorado Springs, CO

Square Feet: 155,808

FedEx Corporation (NYSE: FDX) Rocky Mountain Tech Center

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 11

KE

Y FINANCIA

L D

AT

A KEY FINANCIAL DATA

(dollars in thousands, except per share data)

As of and For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Selected Balance Sheet Data:

Total gross assets (1) $ 4,876,465 $ 4,882,310 $ 4,880,238 $ 4,853,401 $ 4,876,990

Total assets $ 4,614,065 $ 4,639,682 $ 4,657,256 $ 4,649,793 $ 4,692,810

Total liabilities $ 2,562,862 $ 2,565,720 $ 2,565,322 $ 2,553,157 $ 2,591,733

Total shareholders' equity $ 2,051,203 $ 2,073,962 $ 2,091,934 $ 2,096,636 $ 2,101,077

Selected Income Statement Data:

Total revenues $ 116,294 $ 114,835 $ 115,036 $ 114,904 $ 117,232

Net income $ 6,728 $ 24,222 $ 28,568 $ 30,752 $ 32,812

Net income attributed to SIR (2) $ 6,728 $ 24,222 $ 28,568 $ 30,752 $ 32,779

NOI (3) $ 92,584 $ 90,551 $ 89,887 $ 91,747 $ 93,986

Adjusted EBITDA (4) $ 73,797 $ 84,444 $ 83,322 $ 85,472 $ 87,359

FFO attributed to SIR (5) $ 40,468 $ 63,228 $ 61,934 $ 64,157 $ 66,204

Normalized FFO attributed to SIR (5) $ 52,361 $ 63,463 $ 61,947 $ 64,157 $ 66,262

Per Share Data:

Net income attributed to SIR - basic and diluted $ 0.08 $ 0.27 $ 0.32 $ 0.34 $ 0.37

FFO attributed to SIR - basic and diluted (5) $ 0.45 $ 0.71 $ 0.69 $ 0.72 $ 0.74

Normalized FFO attributed to SIR - basic and diluted (5) $ 0.59 (6) $ 0.71 $ 0.69 $ 0.72 $ 0.74

Dividends:

Annualized dividends paid per share $ 2.04 $ 2.04 $ 2.04 $ 2.00 $ 2.00

Annualized dividend yield (at end of period) 7.9% 8.1% 7.6% 7.7% 8.7%

Normalized FFO payout ratio (5) 86.4% (6) 71.8% 73.9% 69.4% 67.6%

(1) Total gross assets is total assets plus accumulated depreciation.

(2) Excludes an 11% noncontrolling interest of a third party in one property for the period of time the noncontrolling interest existed during the three months ended March 31, 2016. In February 2016, we

purchased this 11% interest and the noncontrolling interest was eliminated.

(3) See page 21 for the calculation of NOI and a reconciliation of net income determined in accordance with GAAP to that amount.

(4) See page 23 for the calculation of Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to that amount.

(5) See page 24 for the calculation of FFO attributed to SIR and Normalized FFO attributed to SIR and a reconciliation of net income attributed to SIR determined in accordance with GAAP to those amounts.

(6) Excluding the non-cash write-off of straight line rents receivable of $12,517 recorded during the three months ended March 31, 2017, Normalized FFO attributed to SIR would have been $0.73 per

common share and the Normalized FFO payout ratio would have been 69.9%.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 12

CONDENSED CONSOLID

ATED BALANCE SHEET

S

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

March 31, December 31,

2017 2016

ASSETS

Real estate properties:

Land $ 1,038,963 $ 1,038,686

Buildings and improvements 3,105,382 3,103,734

4,144,345 4,142,420

Accumulated depreciation (262,400) (242,628)

3,881,945 3,899,792

Acquired real estate leases, net 486,932 506,298

Cash and cash equivalents 18,101 22,127

Restricted cash 44 44

Rents receivable, including straight line rents of $106,433 and $117,008, respectively, net

of allowance for doubtful accounts of $809 and $873, respectively 111,688 124,089

Deferred leasing costs, net 11,094 10,051

Other assets, net 104,261 77,281

Total assets $ 4,614,065 $ 4,639,682

LIABILITIES AND SHAREHOLDERS' EQUITY

Unsecured revolving credit facility $ 342,000 $ 327,000

Unsecured term loan, net 348,497 348,373

Senior unsecured notes, net 1,431,368 1,430,300

Mortgage notes payable, net 245,418 245,643

Accounts payable and other liabilities 80,931 101,605

Assumed real estate lease obligations, net 75,411 77,622

Rents collected in advance 18,678 18,815

Security deposits 8,341 11,887

Due to related persons 12,218 4,475

Total liabilities 2,562,862 2,565,720

Commitments and contingencies

Shareholders' equity:

Common shares of beneficial interest, $.01 par value: 125,000,000 shares authorized;

89,427,869 shares issued and outstanding 894 894

Additional paid in capital 2,179,669 2,179,669

Cumulative net income 448,035 441,307

Cumulative other comprehensive income 36,593 20,472

Cumulative common distributions (613,988) (568,380)

Total shareholders' equity 2,051,203 2,073,962

Total liabilities and shareholders' equity $ 4,614,065 $ 4,639,682

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 13

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF INCOM

E

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share data)

For the Three Months Ended March 31,

2017 2016

Revenues:

Rental income $ 97,344 $ 97,860

Tenant reimbursements and other income 18,950 19,372

Total revenues 116,294 117,232

Expenses:

Real estate taxes 10,843 10,288

Other operating expenses 12,867 12,958

Depreciation and amortization 33,740 33,469

Acquisition related costs — 58

General and administrative (1) 14,888 6,976

Write-off of straight line rents receivable, net (2) 12,517 —

Loss on asset impairment (2) 4,047 —

Total expenses 88,902 63,749

Operating income 27,392 53,483

Dividend income 397 —

Interest expense (including net amortization of debt issuance costs, premiums and discounts

of $1,404 and $1,374, respectively) (21,087) (20,609)

Income before income tax expense and equity in earnings of an investee 6,702 32,874

Income tax expense (102) (139)

Equity in earnings of an investee 128 77

Net income 6,728 32,812

Net income allocated to noncontrolling interest — (33)

Net income attributed to SIR $ 6,728 $ 32,779

Weighted average common shares outstanding - basic 89,331 89,286

Weighted average common shares outstanding - diluted 89,348 89,295

Net income attributed to SIR per common share - basic and diluted $ 0.08 $ 0.37

Additional Data:

General and administrative expenses / total revenues 12.8% 6.0%

General and administrative expenses / total assets (at end of period) 0.3% 0.1%

Non-cash straight line rent adjustments included in rental income (3) $ 5,391 $ 6,302

Lease value amortization included in rental income (3) $ 434 $ 436

Non-cash amortization included in other operating expenses (4) $ 213 $ 213

Non-cash amortization included in general and administrative expenses (4) $ 345 $ 345

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 14

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF INCOME (CONTINUED

)

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (CONTINUED)

(dollars in thousands, except per share data)

(1) General and administrative expenses include estimated business management incentive fee expense of $7,846 for the three months ended March 31, 2017.

(2) In March 2017, one of SIR's tenants filed for bankruptcy and rejected two leases; one for a property located in Huntsville, AL with approximately 1.4 million rentable square feet and an

original lease term until August 2032; and one for a property in Hanover, PA with approximately 502,000 rentable square feet and an original lease term until September 2028. The Huntsville

property is occupied by a subtenant that continues to pay rent to SIR in an amount equal to the rent under the rejected lease. The sublease term runs concurrently with the former tenant’s

original lease term, subject to certain termination rights by the subtenant. SIR expects that the lost rents plus carrying costs, such as real estate taxes, insurance, security and other operating

costs, from a fully vacant Hanover property may total approximately $3,800 per year. SIR is holding a security deposit of $3,739 from the tenant with respect to the Hanover property, which

SIR expects to retain and, therefore, has offset the amount of the security deposit against its lease rejection damages. SIR recorded a non-cash charge of $12,517 to write off straight line

rents receivable (net of the $3,739 security deposit) related to leases with the former tenant at both properties plus an impairment charge of $4,047 related to the write-off of lease intangibles

related to the property located in Hanover, PA.

(3) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also

includes non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any.

(4) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. This

liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fees and property management fees, which are included in

general and administrative and other operating expenses, respectively.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 15

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Three Months Ended March 31,

2017 2016

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 6,728 $ 32,812

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 19,862 19,458

Net amortization of debt issuance costs, premiums and discounts 1,404 1,374

Amortization of acquired real estate leases and assumed real estate lease obligations 13,109 13,292

Amortization of deferred leasing costs 410 321

Write-off of straight line rents and provision for losses on rents receivable 12,454 103

Straight line rental income (5,391) (6,302)

Loss on asset impairment 4,047 —

Other non-cash expenses, net (311) (285)

Equity in earnings of an investee (128) (77)

Change in assets and liabilities:

Restricted cash — 1,127

Rents receivable 1,599 (1,235)

Deferred leasing costs (1,346) (3,411)

Other assets (5,510) (3,428)

Accounts payable and other liabilities (17,519) (15,001)

Rents collected in advance (137) (856)

Security deposits 193 (7)

Due to related persons 7,743 653

Net cash provided by operating activities 37,207 38,538

CASH FLOWS FROM INVESTING ACTIVITIES:

Real estate acquisitions and deposits (5,977) —

Real estate improvements (4,559) (1,395)

Net cash used in investing activities (10,536) (1,395)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from borrowings 80,000 40,000

Repayments of borrowings (65,089) (15,064)

Distributions to common shareholders (45,608) (44,687)

Purchase of noncontrolling interest — (3,908)

Distributions to noncontrolling interest — (66)

Net cash used in financing activities (30,697) (23,725)

(Decrease) increase in cash and cash equivalents (4,026) 13,418

Cash and cash equivalents at beginning of period 22,127 17,876

Cash and cash equivalents at end of period $ 18,101 $ 31,294

(dollars in thousands)

SUPPLEMENTAL DISCLOSURES:

Interest paid $ 33,233 $ 32,821

Income taxes paid $ (30) $ (83)

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 16

DEBT SUMMA

RY DEBT SUMMARY

(dollars in thousands)

Coupon Interest Principal Maturity Due at Years to

Rate (1) Rate (2) Balance (3) Date Maturity Maturity

As of March 31, 2017:

Unsecured Floating Rate Debt:

Revolving credit facility (LIBOR + 105 bps) (4) (6) 1.994% 1.994% $ 342,000 3/29/2019 $ 342,000 2.0

Term loan (LIBOR + 115 bps) (5) (6) 1.934% 1.934% 350,000 3/31/2020 350,000 3.0

Subtotal / weighted average unsecured floating rate debt 1.964% 1.964% 692,000 692,000 2.5

Unsecured Fixed Rate Debt:

Senior notes due 2018 2.850% 2.985% 350,000 2/1/2018 350,000 0.8

Senior notes due 2020 3.600% 3.775% 400,000 2/1/2020 400,000 2.8

Senior notes due 2022 4.150% 4.360% 300,000 2/1/2022 300,000 4.8

Senior notes due 2025 4.500% 4.755% 400,000 2/1/2025 400,000 7.8

Subtotal / weighted average unsecured fixed rate debt 3.781% 3.976% 1,450,000 1,450,000 4.1

Secured Fixed Rate Debt:

One property (two buildings) in Carlsbad, CA 5.950% 4.200% 17,427 9/1/2017 17,314 0.4

One property (one building) in Harvey, IL 4.500% 3.280% 1,976 6/1/2019 1,902 2.2

One property (one building) in Columbus, OH 4.500% 3.280% 2,371 6/1/2019 2,282 2.2

One property (one building) in Ankeny, IA 3.870% 3.380% 12,360 7/19/2020 12,360 3.3

One property (one building) in Philadelphia, PA (7) 2.983% 4.160% 41,000 8/3/2020 39,635 3.3

One property (one building) in Chester, VA 3.990% 3.480% 48,750 11/1/2020 48,750 3.6

One property (three buildings) in Seattle, WA 3.550% 3.790% 71,000 5/1/2023 71,000 6.1

One property (one building) in Chicago, IL 3.700% 3.590% 50,000 6/1/2023 50,000 6.2

Subtotal / weighted average secured fixed rate debt 3.777% 3.749% 244,884 243,243 4.5

Total / weighted average debt 3.254% 3.369% $ 2,386,884 $ 2,385,243 3.7

(1) Reflects the interest rate stated in, or determined pursuant to, the contract terms.

(2) Includes the effect of interest rate protection and mark to market accounting for certain mortgages and discounts on senior unsecured notes. Excludes upfront transaction costs.

(3) Principal balance excludes unamortized premiums, discounts and certain issuance costs related to these debts. Total debt outstanding as of March 31, 2017, net of unamortized premiums,

discounts and certain issuance costs totaling $19,601, was $2,367,283.

(4) We have a $750,000 revolving credit facility which has a maturity date of March 29, 2019, interest payable on borrowings of LIBOR plus 105 basis points and a facility fee of 20 basis points.

Both the interest rate premium and the facility fee for our revolving credit facility are subject to adjustment based on changes to our credit ratings. Upon the payment of an extension fee and

meeting other conditions, we have the option to extend the maturity date to March 29, 2020. Principal balance represents the amount outstanding on our $750,000 revolving credit facility at

March 31, 2017. Interest rate is as of March 31, 2017 and excludes the 20 basis points facility fee.

(5) We have a $350,000 term loan with a maturity date of March 31, 2020 and an interest rate on the amount outstanding of LIBOR plus 115 basis points. The interest rate premium for our term

loan is subject to adjustment based on changes to our credit ratings. Principal balance represents the amount outstanding on our $350,000 term loan at March 31, 2017. Interest rate is as of

March 31, 2017.

(6) The maximum borrowing availability under our revolving credit facility and term loan, combined, may be increased to up to $2,200,000 in certain circumstances.

(7) Interest is payable at a rate equal to LIBOR plus a premium. The interest charge has been fixed by a cash flow hedge which sets the interest rate at approximately 4.16% until August 3, 2020,

which is the maturity date of the mortgage note. Coupon rate is as of March 31, 2017.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 17

DEBT M

ATURIT

Y SCHEDUL

E

DEBT MATURITY SCHEDULE

(dollars in thousands)

Scheduled Principal Payments As of March 31, 2017

Unsecured Unsecured Secured

Floating Fixed Fixed

Year Rate Debt Rate Debt Rate Debt Total (3)

4/1/2017 - 12/31/2017 $ — $ — $ 17,482 $ 17,482

2018 — 350,000 304 350,304

2019 342,000 (1) — 4,926 346,926

2020 350,000 (2) 400,000 101,172 851,172

2021 — — — —

2022 — 300,000 — 300,000

2023 — — 121,000 121,000

2024 — — — —

2025 — 400,000 — 400,000

Total $ 692,000 $ 1,450,000 $ 244,884 $ 2,386,884

Percent 29.0% 60.7% 10.3% 100.0%

(1) Represents the amount outstanding on our $750,000 revolving credit facility at March 31, 2017. We have a $750,000 revolving credit facility which has a maturity date of March

29, 2019, interest payable on borrowings of LIBOR plus 105 basis points and a facility fee of 20 basis points. Both the interest rate premium and the facility fee for our revolving

credit facility are subject to adjustment based on changes to our credit ratings. Upon the payment of an extension fee and meeting other conditions, we have the option to extend

the maturity date to March 29, 2020.

(2) Represents the amount outstanding on our $350,000 term loan at March 31, 2017. We have a $350,000 term loan with a maturity date of March 31, 2020 and an interest rate on

the amount outstanding of LIBOR plus 115 basis points. The interest rate premium for our term loan is subject to adjustment based on changes to our credit ratings.

(3) Total debt outstanding as of March 31, 2017, net of unamortized premiums, discounts and certain issuance costs totaling $19,601, was $2,367,283.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 18

LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

As of and For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 48.5% 48.2% 48.4% 48.3% 49.0%

Total debt (book value) (1) / gross book value of real estate assets (3) 49.9% 49.6% 49.9% 49.6% 50.6%

Total debt (book value) (1) / total market capitalization (4) 50.7% 51.1% 49.5% 50.2% 53.7%

Secured debt (book value) (1) / total assets 5.3% 5.3% 6.1% 6.2% 6.1%

Variable rate debt (book value) (1) / total debt (book value) (1) 29.2% 28.7% 29.0% 28.5% 30.0%

Coverage Ratios:

Adjusted EBITDA (5) / interest expense 3.5x (6) 4.1x 4.0x 4.2x 4.2x

Total debt (book value) (1) / annualized Adjusted EBITDA (5) 8.0x (6) 7.0x 7.1x 6.9x 6.8x

Public Debt Covenants:

Total debt / adjusted total assets (7) (maximum 60%) 49.3% 49.2% 49.6% 49.7% 50.4%

Secured debt / adjusted total assets (7) (maximum 40%) 5.1% 5.1% 5.9% 6.0% 6.0%

Consolidated income available for debt service (8) / annual debt service (minimum 1.50x) 4.1x 4.4x 4.5x 4.5x 4.6x

Total unencumbered assets (7) / unsecured debt (minimum 150%) 203.7% 203.9% 202.5% 202.4% 198.8%

(1) Debt amounts are net of unamortized premiums, discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties at cost, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any.

(4) Total market capitalization is total debt plus the market value of our common shares at the end of each period.

(5) See page 23 for the calculation of Adjusted EBITDA and for a reconciliation of net income determined in accordance with GAAP to that amount.

(6) Excluding the non-cash write-off of straight line rents receivable of $12.5 million recorded during the three months ended March 31, 2017, the ratios of Adjusted EBITDA to interest expense and total debt (book

value) to annualized Adjusted EBITDA would have been 4.1x and 6.9x, respectively.

(7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP and exclude depreciation and amortization, accounts receivable, other

intangible assets and impairment writedowns, if any.

(8) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, taxes, loss on asset impairment and gains and losses on acquisitions and

sales of assets and early extinguishment of debt, determined together with debt service on a pro forma basis for the four consecutive fiscal quarters most recently ended.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 19

CAPI

TA

L EXPENDITURES SUMMA

RY CAPITAL EXPENDITURES SUMMARY

(dollars in thousands)

For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Tenant improvements (1) $ 328 $ 3,046 $ 1,343 $ 902 $ 14

Leasing costs (2) 1,402 627 227 121 3,139

Building improvements (3) 694 946 561 1,021 104

Recurring capital expenditures 2,424 4,619 2,131 2,044 3,257

Development, redevelopment and other activities (4) 721 1,274 613 1,187 748

Total capital expenditures $ 3,145 $ 5,893 $ 2,744 $ 3,231 $ 4,005

(1) Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space.

(2) Leasing costs include leasing related costs, such as brokerage commissions, legal costs and tenant inducements.

(3) Building improvements generally include (i) expenditures to replace obsolete building components and (ii) expenditures that extend the useful life of existing assets.

(4) Development, redevelopment and other activities generally include (i) capital expenditures that are identified at the time of a property acquisition and incurred within a short time

period after acquiring the property and (ii) capital expenditure projects that reposition a property or result in new sources of revenues.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 20

PROPERT

Y

ACQUISITIONS

AND DISPOSITIONS INFORM

ATION SINCE 1/1/17

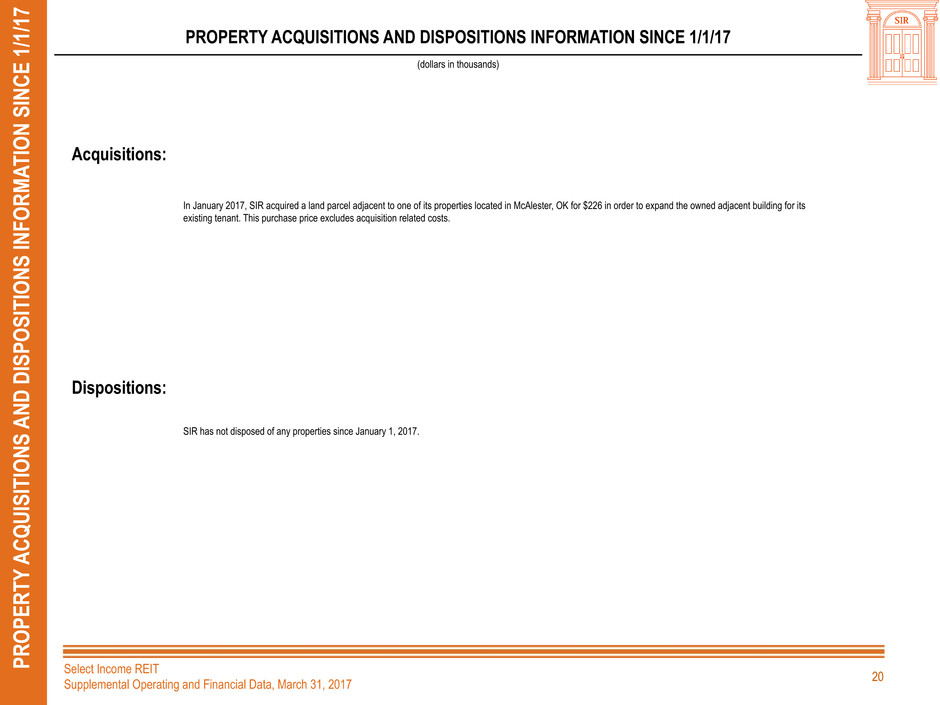

PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/17

(dollars in thousands)

Acquisitions:

Dispositions:

SIR has not disposed of any properties since January 1, 2017.

In January 2017, SIR acquired a land parcel adjacent to one of its properties located in McAlester, OK for $226 in order to expand the owned adjacent building for its

existing tenant. This purchase price excludes acquisition related costs.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 21

CALCUL

ATION OF PROPERT

Y NET OPER

ATING INCOME (NOI)

AND CASH BASIS NO

I

CALCULATION OF PROPERTY NET OPERATING INCOME (NOI) AND CASH BASIS NOI (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description of how we use

these measures.

(2) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non-cash amortization of intangible

lease assets and liabilities and lease termination fees, if any.

(3) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. A portion of this liability is being amortized on a

straight line basis through December 31, 2035 as a reduction to property management fees, which are included in other operating expenses.

(4) SIR recorded a $12,517 non-cash write-off of straight line rents receivable related to leases associated with a tenant bankruptcy at two properties located in Huntsville, AL and Hanover, PA and a $4,047 loss on asset impairment

for unamortized lease intangibles during the three months ended March 31, 2017 related to a lease associated with a tenant bankruptcy at the property located in Hanover, PA.

For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Calculation of NOI and Cash Basis NOI:

Rental income $ 97,344 $ 96,503 $ 96,037 $ 96,615 $ 97,860

Tenant reimbursements and other income 18,950 18,332 18,999 18,289 19,372

Real estate taxes (10,843) (11,314) (10,755) (10,522) (10,288)

Other operating expenses (12,867) (12,970) (14,394) (12,635) (12,958)

NOI 92,584 90,551 89,887 91,747 93,986

Non-cash straight line rent adjustments included in rental income (2) (5,391) (5,690) (6,483) (6,269) (6,302)

Lease value amortization included in rental income (2) (434) (434) (443) (419) (436)

Non-cash amortization included in other operating expenses (3) (213) (213) (213) (213) (213)

Cash Basis NOI $ 86,546 $ 84,214 $ 82,748 $ 84,846 $ 87,035

Reconciliation of Net Income to NOI and Cash Basis NOI:

Net income $ 6,728 $ 24,222 $ 28,568 $ 30,752 $ 32,812

Equity in earnings of an investee (128) (30) (13) (17) (77)

Income tax expense 102 78 107 124 139

Income before income tax expense and equity in earnings of an investee 6,702 24,270 28,662 30,859 32,874

Interest expense 21,087 20,737 20,690 20,584 20,609

Dividend income (397) (396) (397) (475) —

Operating income 27,392 44,611 48,955 50,968 53,483

Loss on asset impairment (4) 4,047 5,484 — — —

Write-off of straight line rents receivable, net (4) 12,517 — — — —

General and administrative 14,888 6,699 7,553 7,374 6,976

Acquisition related costs — 235 13 — 58

Depreciation and amortization 33,740 33,522 33,366 33,405 33,469

NOI 92,584 90,551 89,887 91,747 93,986

Non-cash straight line rent adjustments included in rental income (2) (5,391) (5,690) (6,483) (6,269) (6,302)

Lease value amortization included in rental income (2) (434) (434) (443) (419) (436)

Non-cash amortization included in other operating expenses (3) (213) (213) (213) (213) (213)

Cash Basis NOI $ 86,546 $ 84,214 $ 82,748 $ 84,846 $ 87,035

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 22RECONCILI

ATION OF NOI

TO SAME PROPERT

Y NOI

AND CALCUL

ATION OF SAME PROPERT

Y

CASH BASIS NO

I RECONCILIATION OF NOI TO SAME PROPERTY NOI AND

CALCULATION OF SAME PROPERTY CASH BASIS NOI (1)

(dollars in thousands)

For the Three Months Ended

3/31/2017 3/31/2016

Reconciliation of NOI to Same Property NOI (2):

Rental income $ 97,344 $ 97,860

Tenant reimbursements and other income 18,950 19,372

Real estate taxes (10,843) (10,288)

Other operating expenses (12,867) (12,958)

NOI 92,584 93,986

Less:

NOI of properties not included in same property results (383) —

Same property NOI $ 92,201 $ 93,986

Calculation of Same Property Cash Basis NOI (2):

Same property NOI $ 92,201 $ 93,986

Less:

Non-cash straight line rent adjustments included in rental income (3) (5,248) (6,302)

Lease value amortization included in rental income (3) (443) (436)

Non-cash amortization included in other operating expenses (4) (213) (213)

Same property Cash Basis NOI $ 86,297 $ 87,035

(1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a

description of how we use these measures.

(2) For the three months ended March 31, 2017, same property NOI and Cash Basis NOI are based on properties we owned as of March 31, 2017, and which we owned continuously since January 1, 2016.

(3) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non-cash

amortization of intangible lease assets and liabilities and lease termination fees, if any.

(4) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. A portion of this liability

is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees, which are included in other operating expenses.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 23

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(dollars in thousands)

For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Net income $ 6,728 $ 24,222 $ 28,568 $ 30,752 $ 32,812

Plus: interest expense 21,087 20,737 20,690 20,584 20,609

Plus: income tax expense 102 78 107 124 139

Plus: depreciation and amortization 33,740 33,522 33,366 33,405 33,469

EBITDA 61,657 78,559 82,731 84,865 87,029

Plus: acquisition related costs — 235 13 — 58

Plus: general and administrative expense paid in common shares (2) 247 166 578 607 272

Plus: estimated business management incentive fees (3) 7,846 — — — —

Plus: loss on impairment of real estate assets (4) — 5,484 — — —

Plus: loss on asset impairment (5) 4,047 — — — —

Adjusted EBITDA $ 73,797 (6) $ 84,444 $ 83,322 $ 85,472 $ 87,359

(1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of EBITDA and Adjusted EBITDA and a description of why we believe they

are appropriate supplemental measures.

(2) Amount represents equity based compensation to our trustees, officers and certain other employees of RMR’s operating subsidiary, RMR LLC.

(3) Amount represents estimated incentive fees under our business management agreement calculated based on common share total return, as defined. In

calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third

quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include such expense

in the calculation of Adjusted EBITDA until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is

determined. Incentive fees for 2017, if any, will be payable in cash in January 2018.

(4) We recorded a $5,484 loss on impairment of real estate assets during the three months ended December 31, 2016 in connection with one vacant property located

in Maynard, MA.

(5) We recorded a $4,047 loss on asset impairment for unamortized lease intangibles during the three months ended March 31, 2017 related to a lease associated

with a tenant bankruptcy at a property located in Hanover, PA.

(6) Excluding the non-cash write-off of straight line rents receivable of $12,517 recorded during the three months ended March 31, 2017, Adjusted EBITDA would

have been $86,314.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 24CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

A

TTRIBUTED

TO SIR

AND NORMALIZE

D

FFO

A

TTRIBUTED

TO SI

R

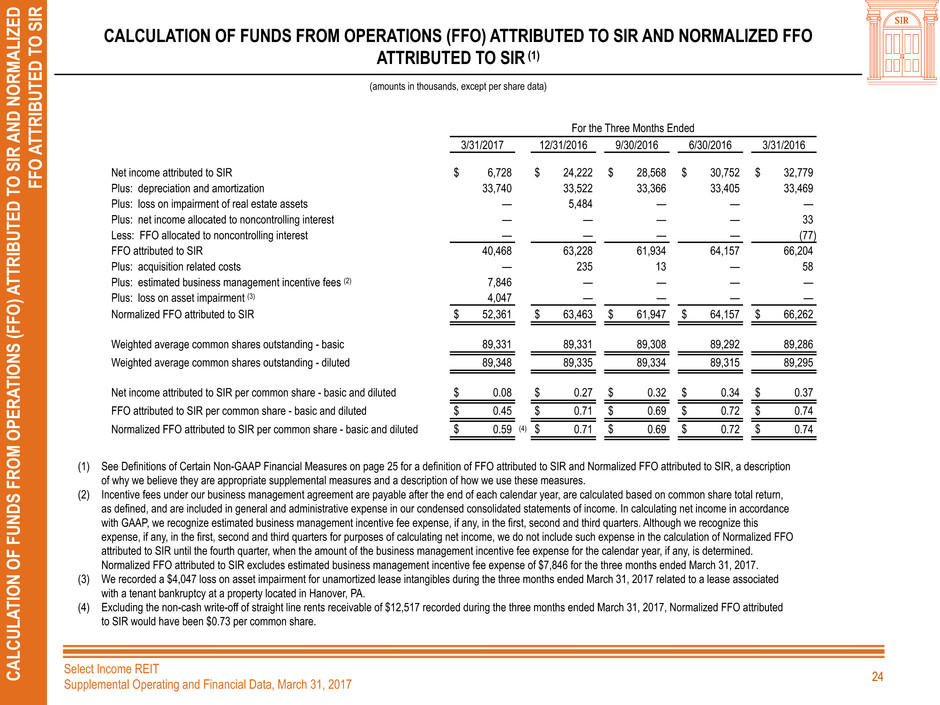

CALCULATION OF FUNDS FROM OPERATIONS (FFO) ATTRIBUTED TO SIR AND NORMALIZED FFO

ATTRIBUTED TO SIR (1)

(amounts in thousands, except per share data)

For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Net income attributed to SIR $ 6,728 $ 24,222 $ 28,568 $ 30,752 $ 32,779

Plus: depreciation and amortization 33,740 33,522 33,366 33,405 33,469

Plus: loss on impairment of real estate assets — 5,484 — — —

Plus: net income allocated to noncontrolling interest — — — — 33

Less: FFO allocated to noncontrolling interest — — — — (77)

FFO attributed to SIR 40,468 63,228 61,934 64,157 66,204

Plus: acquisition related costs — 235 13 — 58

Plus: estimated business management incentive fees (2) 7,846 — — — —

Plus: loss on asset impairment (3) 4,047 — — — —

Normalized FFO attributed to SIR $ 52,361 $ 63,463 $ 61,947 $ 64,157 $ 66,262

Weighted average common shares outstanding - basic 89,331 89,331 89,308 89,292 89,286

Weighted average common shares outstanding - diluted 89,348 89,335 89,334 89,315 89,295

Net income attributed to SIR per common share - basic and diluted $ 0.08 $ 0.27 $ 0.32 $ 0.34 $ 0.37

FFO attributed to SIR per common share - basic and diluted $ 0.45 $ 0.71 $ 0.69 $ 0.72 $ 0.74

Normalized FFO attributed to SIR per common share - basic and diluted $ 0.59 (4) $ 0.71 $ 0.69 $ 0.72 $ 0.74

(1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for a definition of FFO attributed to SIR and Normalized FFO attributed to SIR, a description

of why we believe they are appropriate supplemental measures and a description of how we use these measures.

(2) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return,

as defined, and are included in general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance

with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this

expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include such expense in the calculation of Normalized FFO

attributed to SIR until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is determined.

Normalized FFO attributed to SIR excludes estimated business management incentive fee expense of $7,846 for the three months ended March 31, 2017.

(3) We recorded a $4,047 loss on asset impairment for unamortized lease intangibles during the three months ended March 31, 2017 related to a lease associated

with a tenant bankruptcy at a property located in Hanover, PA.

(4) Excluding the non-cash write-off of straight line rents receivable of $12,517 recorded during the three months ended March 31, 2017, Normalized FFO attributed

to SIR would have been $0.73 per common share.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 25

DEFINITIONS OF CER

TAIN NON-GAA

P FINANCIA

L MEASURE

S

DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

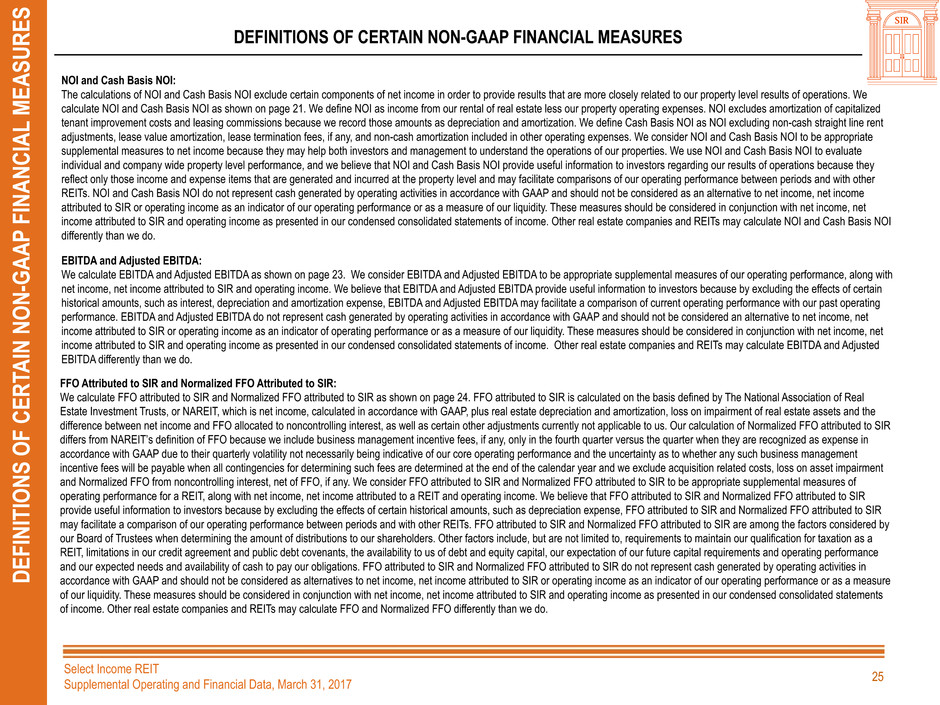

NOI and Cash Basis NOI:

The calculations of NOI and Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to our property level results of operations. We

calculate NOI and Cash Basis NOI as shown on page 21. We define NOI as income from our rental of real estate less our property operating expenses. NOI excludes amortization of capitalized

tenant improvement costs and leasing commissions because we record those amounts as depreciation and amortization. We define Cash Basis NOI as NOI excluding non-cash straight line rent

adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. We consider NOI and Cash Basis NOI to be appropriate

supplemental measures to net income because they may help both investors and management to understand the operations of our properties. We use NOI and Cash Basis NOI to evaluate

individual and company wide property level performance, and we believe that NOI and Cash Basis NOI provide useful information to investors regarding our results of operations because they

reflect only those income and expense items that are generated and incurred at the property level and may facilitate comparisons of our operating performance between periods and with other

REITs. NOI and Cash Basis NOI do not represent cash generated by operating activities in accordance with GAAP and should not be considered as an alternative to net income, net income

attributed to SIR or operating income as an indicator of our operating performance or as a measure of our liquidity. These measures should be considered in conjunction with net income, net

income attributed to SIR and operating income as presented in our condensed consolidated statements of income. Other real estate companies and REITs may calculate NOI and Cash Basis NOI

differently than we do.

EBITDA and Adjusted EBITDA:

We calculate EBITDA and Adjusted EBITDA as shown on page 23. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance, along with

net income, net income attributed to SIR and operating income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain

historical amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating

performance. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered an alternative to net income, net

income attributed to SIR or operating income as an indicator of operating performance or as a measure of our liquidity. These measures should be considered in conjunction with net income, net

income attributed to SIR and operating income as presented in our condensed consolidated statements of income. Other real estate companies and REITs may calculate EBITDA and Adjusted

EBITDA differently than we do.

FFO Attributed to SIR and Normalized FFO Attributed to SIR:

We calculate FFO attributed to SIR and Normalized FFO attributed to SIR as shown on page 24. FFO attributed to SIR is calculated on the basis defined by The National Association of Real

Estate Investment Trusts, or NAREIT, which is net income, calculated in accordance with GAAP, plus real estate depreciation and amortization, loss on impairment of real estate assets and the

difference between net income and FFO allocated to noncontrolling interest, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO attributed to SIR

differs from NAREIT’s definition of FFO because we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in

accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management

incentive fees will be payable when all contingencies for determining such fees are determined at the end of the calendar year and we exclude acquisition related costs, loss on asset impairment

and Normalized FFO from noncontrolling interest, net of FFO, if any. We consider FFO attributed to SIR and Normalized FFO attributed to SIR to be appropriate supplemental measures of

operating performance for a REIT, along with net income, net income attributed to a REIT and operating income. We believe that FFO attributed to SIR and Normalized FFO attributed to SIR

provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO attributed to SIR and Normalized FFO attributed to SIR

may facilitate a comparison of our operating performance between periods and with other REITs. FFO attributed to SIR and Normalized FFO attributed to SIR are among the factors considered by

our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a

REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance

and our expected needs and availability of cash to pay our obligations. FFO attributed to SIR and Normalized FFO attributed to SIR do not represent cash generated by operating activities in

accordance with GAAP and should not be considered as alternatives to net income, net income attributed to SIR or operating income as an indicator of our operating performance or as a measure

of our liquidity. These measures should be considered in conjunction with net income, net income attributed to SIR and operating income as presented in our condensed consolidated statements

of income. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do.

26

PORTFOLIO INFORMATION

26

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 27

PORTFOLIO SUMMA

RY

B

Y PROPERT

Y TYP

E

PORTFOLIO SUMMARY BY PROPERTY TYPE

(dollars and sq. ft. in thousands)

(1) Includes buildings, leasable land parcels and easements which are primarily leasable industrial and commercial lands located in Hawaii.

(2) See page 21 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts.

As of and For the Three Months Ended March 31, 2017

Mainland Mainland Subtotal Mainland Hawaii

Key Statistic Office Industrial Properties Properties (1) Total

Leasable buildings 87 46 133 229 362

Percent of total 24.0% 12.7% 36.7% 63.3% 100.0%

Total square feet 12,720 14,315 27,035 17,778 44,813

Percent of total 28.4% 31.9% 60.3% 39.7% 100.0%

Leased square feet 12,335 13,813 26,148 16,819 42,967

Percent leased 97.0% 96.5% 96.7% 94.6% 95.9%

Total revenues $ 72,152 $ 20,529 $ 92,681 $ 23,613 $ 116,294

Percent of total 62.0% 17.7% 79.7% 20.3% 100.0%

NOI (2) $ 55,941 $ 18,123 $ 74,064 $ 18,520 $ 92,584

Percent of total 60.4% 19.6% 80.0% 20.0% 100.0%

Cash Basis NOI (2) $ 52,013 $ 16,962 $ 68,975 $ 17,571 $ 86,546

Percent of total 60.1% 19.6% 79.7% 20.3% 100.0%

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 28

SAME PROPERT

Y RESU

LTS OF OPER

ATION

S

SAME PROPERTY RESULTS OF OPERATIONS

(dollars and sq. ft. in thousands)

As of and For the Three Months Ended (1)

3/31/2017 3/31/2016

Leasable Buildings:

Mainland Office 85 85

Mainland Industrial 46 46

Subtotal Mainland Properties 131 131

Hawaii Properties (2) 229 229

Total 360 360

Square Feet (3):

Mainland Office 12,613 12,613

Mainland Industrial 14,315 14,315

Subtotal Mainland Properties 26,928 26,928

Hawaii Properties (2) 17,778 17,778

Total 44,706 44,706

Percent Leased (4):

Mainland Office 96.9% 100.0%

Mainland Industrial 96.5% 100.0%

Subtotal Mainland Properties 97.7% 100.0%

Hawaii Properties 94.6% 94.3%

Total 95.9% 97.8%

Total Revenues:

Mainland Office $ 71,624 $ 73,326

Mainland Industrial 20,529 20,567

Subtotal Mainland Properties 92,153 93,893

Hawaii Properties 23,613 23,339

Total $ 115,766 $ 117,232

(1) Consists of properties that we owned continuously since January 1, 2016.

(2) Includes 229 buildings, leasable land parcels and easements with approximately 17,778 square feet which are primarily leasable industrial and commercial lands located in Hawaii.

(3) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases.

(4) Includes (i) space being fitted out for occupancy pursuant to existing leases, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 29

SAME PROPERT

Y RESU

LTS OF OPER

ATIONS (CONTINUED

)

SAME PROPERTY RESULTS OF OPERATIONS (CONTINUED)

(dollars in thousands)

As of and For the Three Months Ended (1)

3/31/2017 3/31/2016

NOI (2):

Mainland Office $ 55,558 $ 57,617

Mainland Industrial 18,123 17,917

Subtotal Mainland Properties 73,681 75,534

Hawaii Properties 18,520 18,452

Total $ 92,201 $ 93,986

Cash Basis NOI (2):

Mainland Office $ 51,765 $ 52,947

Mainland Industrial 16,962 16,464

Subtotal Mainland Properties 68,727 69,411

Hawaii Properties 17,570 17,624

Total $ 86,297 $ 87,035

NOI % Change:

Mainland Office -3.6%

Mainland Industrial 1.1%

Subtotal Mainland Properties -2.5%

Hawaii Properties 0.4%

Total -1.9%

Cash Basis NOI % Change:

Mainland Office -2.2%

Mainland Industrial 3.0%

Subtotal Mainland Properties -1.0%

Hawaii Properties -0.3%

Total -0.8%

(1) Consists of properties that we owned continuously since January 1, 2016.

(2) See page 21 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts, and see page 22 for the

calculation and a reconciliation of same property NOI and same property Cash Basis NOI.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 30

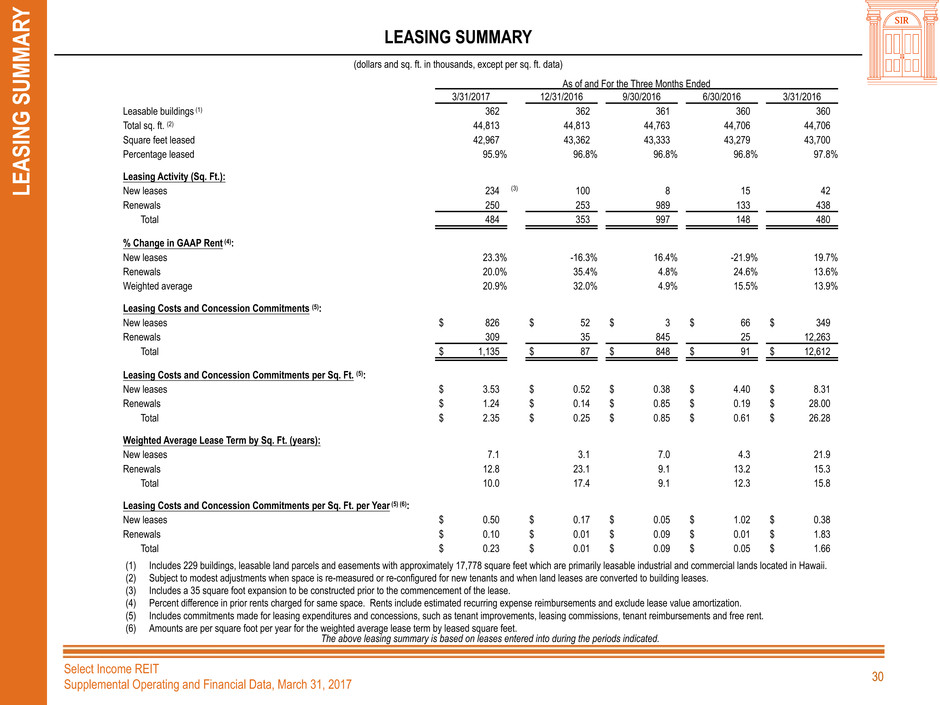

LEASING SUMMA

RY LEASING SUMMARY

(dollars and sq. ft. in thousands, except per sq. ft. data)

The above leasing summary is based on leases entered into during the periods indicated.

As of and For the Three Months Ended

3/31/2017 12/31/2016 9/30/2016 6/30/2016 3/31/2016

Leasable buildings (1) 362 362 361 360 360

Total sq. ft. (2) 44,813 44,813 44,763 44,706 44,706

Square feet leased 42,967 43,362 43,333 43,279 43,700

Percentage leased 95.9% 96.8% 96.8% 96.8% 97.8%

Leasing Activity (Sq. Ft.):

New leases 234 (3) 100 8 15 42

Renewals 250 253 989 133 438

Total 484 353 997 148 480

% Change in GAAP Rent (4):

New leases 23.3% -16.3% 16.4% -21.9% 19.7%

Renewals 20.0% 35.4% 4.8% 24.6% 13.6%

Weighted average 20.9% 32.0% 4.9% 15.5% 13.9%

Leasing Costs and Concession Commitments (5):

New leases $ 826 $ 52 $ 3 $ 66 $ 349

Renewals 309 35 845 25 12,263

Total $ 1,135 $ 87 $ 848 $ 91 $ 12,612

Leasing Costs and Concession Commitments per Sq. Ft. (5):

New leases $ 3.53 $ 0.52 $ 0.38 $ 4.40 $ 8.31

Renewals $ 1.24 $ 0.14 $ 0.85 $ 0.19 $ 28.00

Total $ 2.35 $ 0.25 $ 0.85 $ 0.61 $ 26.28

Weighted Average Lease Term by Sq. Ft. (years):

New leases 7.1 3.1 7.0 4.3 21.9

Renewals 12.8 23.1 9.1 13.2 15.3

Total 10.0 17.4 9.1 12.3 15.8

Leasing Costs and Concession Commitments per Sq. Ft. per Year (5) (6):

New leases $ 0.50 $ 0.17 $ 0.05 $ 1.02 $ 0.38

Renewals $ 0.10 $ 0.01 $ 0.09 $ 0.01 $ 1.83

Total $ 0.23 $ 0.01 $ 0.09 $ 0.05 $ 1.66

(1) Includes 229 buildings, leasable land parcels and easements with approximately 17,778 square feet which are primarily leasable industrial and commercial lands located in Hawaii.

(2) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases.

(3) Includes a 35 square foot expansion to be constructed prior to the commencement of the lease.

(4) Percent difference in prior rents charged for same space. Rents include estimated recurring expense reimbursements and exclude lease value amortization.

(5) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent.

(6) Amounts are per square foot per year for the weighted average lease term by leased square feet.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 31

OCCU

PANC

Y

AND LEASING

ANA

LYSIS B

Y PROPERT

Y TYP

E

OCCUPANCY AND LEASING ANALYSIS BY PROPERTY TYPE

(sq. ft. in thousands)

Total Sq. Ft. (1) Sq. Ft. Leases Executed During

As of the Three Months Ended 3/31/2017

Property Type 3/31/2017 New (2) Renewals Total

Mainland Office 12,720 — 101 101

Mainland Industrial 14,315 — 24 24

Subtotal Mainland Properties 27,035 — 125 125

Hawaii Properties 17,778 199 125 324

Total 44,813 199 250 449

Sq. Ft. Leased

As of 12/31/2016 New and Acquisitions / As of 3/31/2017

Property Type 12/31/2016 % Leased (3) Expired Renewals (2) (Sales) 3/31/2017 (2) % Leased

Mainland Office 12,335 97.0% (101) 101 — 12,335 97.0%

Mainland Industrial 14,315 100.0% (526) 24 — 13,813 96.5%

Subtotal Mainland Properties 26,650 98.6% (627) 125 — 26,148 96.7%

Hawaii Properties 16,712 94.0% (217) 324 — 16,819 94.6%

Total 43,362 96.8% (844) 449 — 42,967 95.9%

(1) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases.

(2) Square footage excludes a 35 square foot expansion to be constructed prior to the commencement of the lease.

(3) Excludes effects of space remeasurements during the period, if any. Percent leased includes (i) space being fitted out for occupancy pursuant to

existing leases as of the date, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 32

TENANT DIVERSIT

Y

AND CREDIT CHARACTERISTIC

S

TENANT DIVERSITY AND CREDIT CHARACTERISTICS

As of March 31, 2017

% of Annualized

Tenant Industry Rental Revenue (1)

Technology & Communications 24.3%

Retail & Food 18.8%

Real Estate & Financial 13.1%

Manufacturing & Transportation 11.4%

Energy Services 10.4%

Industrial 8.2%

Legal & Consulting 7.8%

Other 6.0%

100.0%

% of Annualized

Tenant Credit Characteristics Rental Revenue (1)

Leased Hawaii lands 15.1% (2)

Investment grade rated 43.0% (3)

Unrated or non-investment grade 41.9%

100.0%

% of Annualized Rental Revenue (1)

% of Annualized Rental Revenue (1)

(1) We define annualized rental revenue as the annualized contractual rents, as of March 31, 2017, from tenants pursuant to existing leases, including straight line rent adjustments but

excluding lease value amortization. Annualized rental revenue also includes amortization of tenant concessions, including free rent and amounts reimbursed to tenants, and estimated

recurring expense reimbursements from tenants pursuant to existing leases.

(2) Excludes certain Hawaii lands which are leased by investment grade rated tenants and are included in the investment grade rated tenant credit category.

(3) Includes certain Hawaii lands which are leased by investment grade rated tenants.

Technology & Communications

Retail & Food

Real Estate & Financial

Manufacturing &

Transportation

Energy Services

Industrial

Legal & Consulting

Other

24.3%

18.8%

13.1%

11.4%

10.4%

8.2%

7.8%

6.0%

Leased Hawaii lands (2)

Investment grade rated (3)

Unrated or non-investment

grade

15.1%

43.0%

41.9%

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 33

TENANTS REPRESENTING 1% OR MORE OF

TO

TA

L ANNUALIZED REN

TA

L REVENU

E

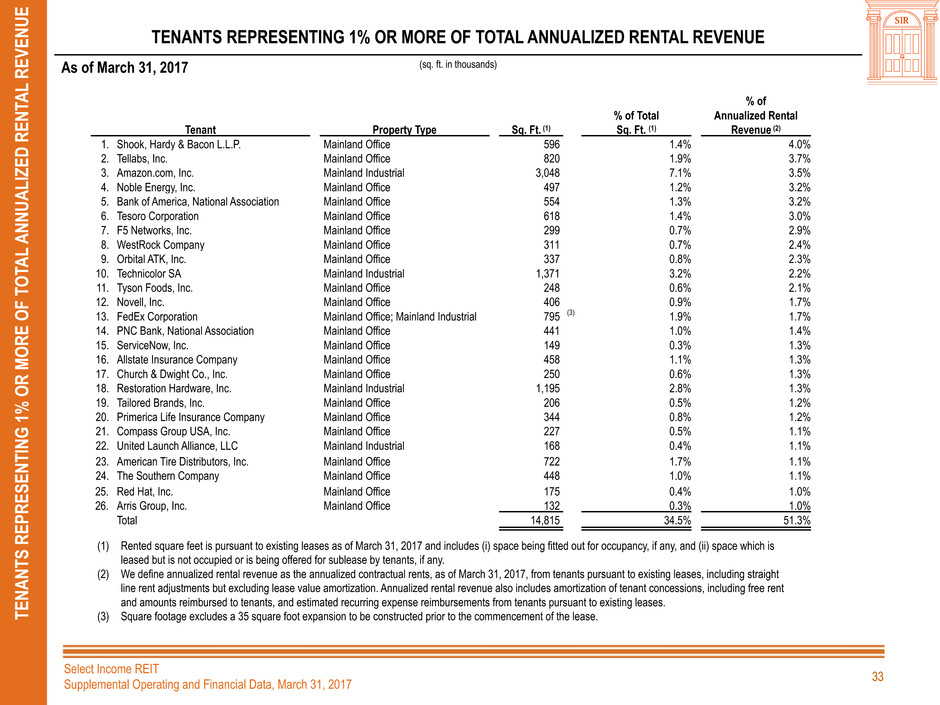

TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL REVENUE

(sq. ft. in thousands)

% of

% of Total Annualized Rental

Tenant Property Type Sq. Ft. (1) Sq. Ft. (1) Revenue (2)

1. Shook, Hardy & Bacon L.L.P. Mainland Office 596 1.4% 4.0%

2. Tellabs, Inc. Mainland Office 820 1.9% 3.7%

3. Amazon.com, Inc. Mainland Industrial 3,048 7.1% 3.5%

4. Noble Energy, Inc. Mainland Office 497 1.2% 3.2%

5. Bank of America, National Association Mainland Office 554 1.3% 3.2%

6. Tesoro Corporation Mainland Office 618 1.4% 3.0%

7. F5 Networks, Inc. Mainland Office 299 0.7% 2.9%

8. WestRock Company Mainland Office 311 0.7% 2.4%

9. Orbital ATK, Inc. Mainland Office 337 0.8% 2.3%

10. Technicolor SA Mainland Industrial 1,371 3.2% 2.2%

11. Tyson Foods, Inc. Mainland Office 248 0.6% 2.1%

12. Novell, Inc. Mainland Office 406 0.9% 1.7%

13. FedEx Corporation Mainland Office; Mainland Industrial 795 (3) 1.9% 1.7%

14. PNC Bank, National Association Mainland Office 441 1.0% 1.4%

15. ServiceNow, Inc. Mainland Office 149 0.3% 1.3%

16. Allstate Insurance Company Mainland Office 458 1.1% 1.3%

17. Church & Dwight Co., Inc. Mainland Office 250 0.6% 1.3%

18. Restoration Hardware, Inc. Mainland Industrial 1,195 2.8% 1.3%

19. Tailored Brands, Inc. Mainland Office 206 0.5% 1.2%

20. Primerica Life Insurance Company Mainland Office 344 0.8% 1.2%

21. Compass Group USA, Inc. Mainland Office 227 0.5% 1.1%

22. United Launch Alliance, LLC Mainland Industrial 168 0.4% 1.1%

23. American Tire Distributors, Inc. Mainland Office 722 1.7% 1.1%

24. The Southern Company Mainland Office 448 1.0% 1.1%

25. Red Hat, Inc. Mainland Office 175 0.4% 1.0%

26. Arris Group, Inc. Mainland Office 132 0.3% 1.0%

Total 14,815 34.5% 51.3%

As of March 31, 2017

(1) Rented square feet is pursuant to existing leases as of March 31, 2017 and includes (i) space being fitted out for occupancy, if any, and (ii) space which is

leased but is not occupied or is being offered for sublease by tenants, if any.

(2) We define annualized rental revenue as the annualized contractual rents, as of March 31, 2017, from tenants pursuant to existing leases, including straight

line rent adjustments but excluding lease value amortization. Annualized rental revenue also includes amortization of tenant concessions, including free rent

and amounts reimbursed to tenants, and estimated recurring expense reimbursements from tenants pursuant to existing leases.

(3) Square footage excludes a 35 square foot expansion to be constructed prior to the commencement of the lease.

Select Income REIT

Supplemental Operating and Financial Data, March 31, 2017 34

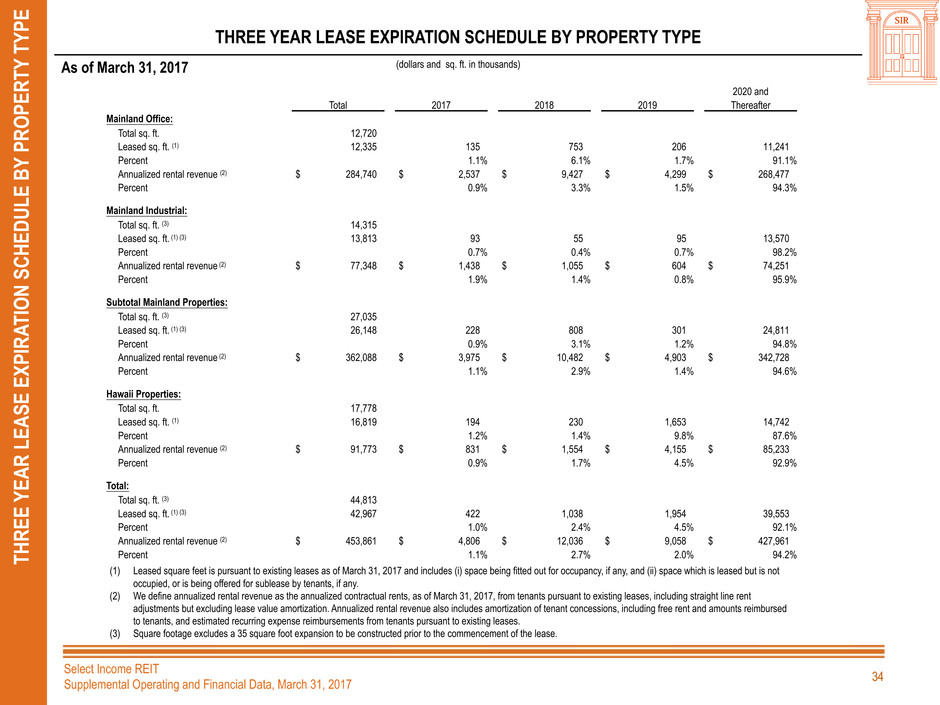

THREE

YEAR LEASE EXPIR

ATION SCHEDULE B

Y PROPERT

Y TYP

E

THREE YEAR LEASE EXPIRATION SCHEDULE BY PROPERTY TYPE

(dollars and sq. ft. in thousands)As of March 31, 2017

2020 and

Total 2017 2018 2019 Thereafter

Mainland Office:

Total sq. ft. 12,720

Leased sq. ft. (1) 12,335 135 753 206 11,241

Percent 1.1% 6.1% 1.7% 91.1%

Annualized rental revenue (2) $ 284,740 $ 2,537 $ 9,427 $ 4,299 $ 268,477

Percent 0.9% 3.3% 1.5% 94.3%

Mainland Industrial:

Total sq. ft. (3) 14,315

Leased sq. ft. (1) (3) 13,813 93 55 95 13,570

Percent 0.7% 0.4% 0.7% 98.2%

Annualized rental revenue (2) $ 77,348 $ 1,438 $ 1,055 $ 604 $ 74,251

Percent 1.9% 1.4% 0.8% 95.9%

Subtotal Mainland Properties:

Total sq. ft. (3) 27,035

Leased sq. ft. (1) (3) 26,148 228 808 301 24,811

Percent 0.9% 3.1% 1.2% 94.8%

Annualized rental revenue (2) $ 362,088 $ 3,975 $ 10,482 $ 4,903 $ 342,728

Percent 1.1% 2.9% 1.4% 94.6%

Hawaii Properties:

Total sq. ft. 17,778

Leased sq. ft. (1) 16,819 194 230 1,653 14,742

Percent 1.2% 1.4% 9.8% 87.6%

Annualized rental revenue (2) $ 91,773 $ 831 $ 1,554 $ 4,155 $ 85,233

Percent 0.9% 1.7% 4.5% 92.9%

Total:

Total sq. ft. (3) 44,813

Leased sq. ft. (1) (3) 42,967 422 1,038 1,954 39,553

Percent 1.0% 2.4% 4.5% 92.1%

Annualized rental revenue (2) $ 453,861 $ 4,806 $ 12,036 $ 9,058 $ 427,961

Percent 1.1% 2.7% 2.0% 94.2%

(1) Leased square feet is pursuant to existing leases as of March 31, 2017 and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not

occupied, or is being offered for sublease by tenants, if any.

(2) We define annualized rental revenue as the annualized contractual rents, as of March 31, 2017, from tenants pursuant to existing leases, including straight line rent