Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NORTHERN TRUST CORP | form8-k.htm |

1 northerntrust.com | © 2017 Northern Trust

2017 Annual

Meeting of

Stockholders

NORTHERN TRUST CORPORATION

April 25, 2017

Frederick H. Waddell

Chairman &

Chief Executive Officer

Reminder:

Use of cameras, recording

devices, cell phones and

other electronic equipment

is strictly prohibited.

Thank you.

Michael G. O’Grady

President

2 northerntrust.com | © 2017 Northern Trust

2017 Annual

Meeting of

Stockholders

NORTHERN TRUST CORPORATION

April 25, 2017

Frederick H. Waddell

Chairman &

Chief Executive Officer

Michael G. O’Grady

President

3 northerntrust.com | © 2017 Northern Trust

FORWARD-LOOKING STATEMENTS

This presentation may include statements which constitute “forward-looking statements” within the

meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements are identified typically by words or phrases such as “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “project,” “likely,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or

conditional verbs such as “may,” “will,” “should,” “would,” and “could”. Forward-looking statements include

statements, other than those related to historical facts, that relate to Northern Trust’s financial results and

outlook, capital adequacy, dividend policy, anticipated expense levels, spending related to technology and

regulatory initiatives, risk management policies, contingent liabilities, strategic initiatives, industry trends,

and expectations regarding the impact of recent legislation. These statements are based on Northern

Trust’s current beliefs and expectations of future events or future results, and involve risks and

uncertainties that are difficult to predict and subject to change. These statements are also based on

assumptions about many important factors, including the factors discussed in Northern Trust’s most

recent annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission,

all of which are available on Northern Trust’s website. We caution you not to place undue reliance on any

forward-looking statement as actual results may differ materially from those expressed or implied by

forward-looking statements. Northern Trust assumes no obligation to update its forward-looking

statements.

4 northerntrust.com | © 2017 Northern Trust

$8.9

trillion

$1.0

trillion

$121

billion

ASSETS UNDER

CUSTODY/

ADMINISTRATION

ASSETS UNDER

MANAGEMENT

BALANCE

SHEET

Client-Centric

and Globally

Integrated

NORTHERN TRUST CORPORATION

Service

Expertise

Integrity

Relentless drive to provide

exceptional service.

Resolving complex challenges

with multi-asset class capabilities.

Acting with the highest ethics, utmost

honesty and unfailing reliability.

As of 3/31/2017

5 northerntrust.com | © 2017 Northern Trust

2016 FINANCIAL PERFORMANCE

($ IN MILLIONS, EXCEPT EPS, ROE)

2016

2016

vs. 2015

Trust, Inv. & Other Servicing Fees $3,108 +4%

Total Revenue 4,962 +6%

Non-Interest Expense 3,471 +6%

Net Income 1,032 +6%

Earnings Per Share 4.32 +8%

Return on Common Equity 11.9% +0.4 pts

($ IN BILLIONS, Period-end)

Assets under Custody / Administration $8,541 +10%

Assets under Custody 6,721 +11%

Assets under Management 942 +8%

6 northerntrust.com | © 2017 Northern Trust

1ST QUARTER 2017 FINANCIAL PERFORMANCE

($ IN MILLIONS, EXCEPT EPS, ROE)

1Q17

1Q17

vs. 1Q16

Trust, Inv. & Other Servicing Fees $808 +8%

Total Revenue 1,284 +8%

Non-Interest Expense 894 +8%

Net Income 276 +13%

Earnings Per Share 1.09 +6%

Return on Common Equity 11.6% -- pts

($ IN BILLIONS, Period-end)

Assets under Custody / Administration $8,925 +13%

Assets under Custody 7,108 +14%

Assets under Management 1,001 +11%

7 northerntrust.com | © 2017 Northern Trust

PROFITABILITY AND RETURNS

Return on Equity

Pre-tax Margin

Noninterest Expense as a % of Trust & Investment Fees

As of March 31, 2017

8.6%

9.3% 9.5%

10.0%

11.5% 11.9% 11.6%

23.4%

30.4%

131%

111%

2011 2012 2013 2014 2015 2016 1Q

2017

8 northerntrust.com | © 2017 Northern Trust

2008 2009 2010 2011 2012 2013 2014 2015 2016

$326

$281 $280

$353

$450

$609

$792

$830

$755

Dividends

Share repurchases

CAPITAL RETURN TO SHAREHOLDERS

($ IN MILLIONS)

9 northerntrust.com | © 2017 Northern Trust

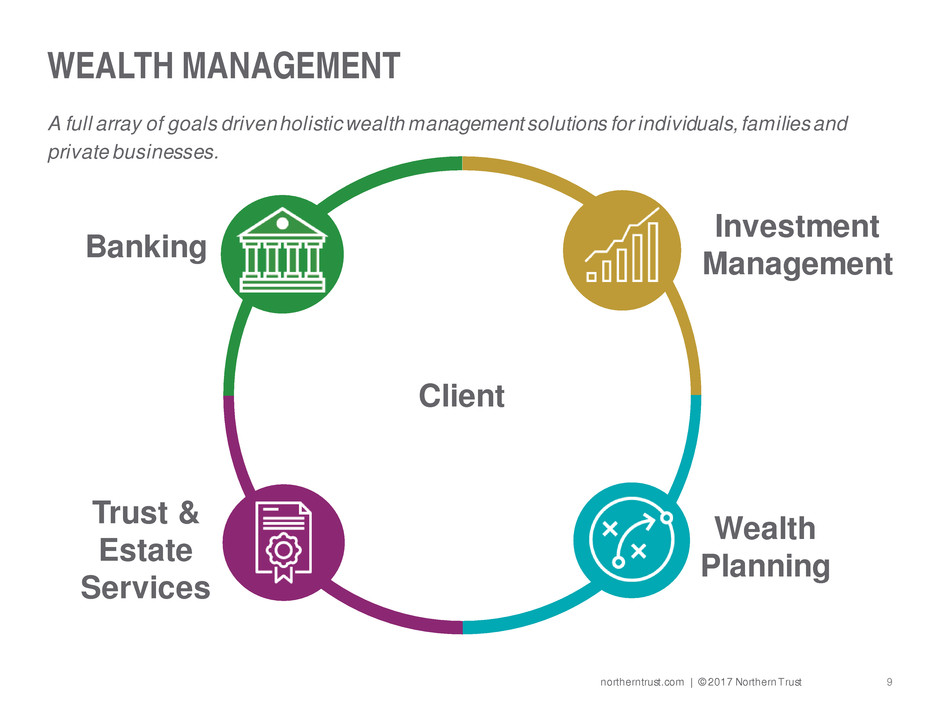

WEALTH MANAGEMENT

A full array of goals driven holistic wealth management solutions for individuals, families and

private businesses.

Client

Banking

Investment

Management

Trust &

Estate

Services

Wealth

Planning

10 northerntrust.com | © 2017 Northern Trust

GOALS DRIVEN WEALTH MANAGEMENT

An approach that aligns financial resources with personal goals creating an integrated strategy

that empowers a full understanding of how to achieve lifetime goals.

Banking

Trust &

Estate

Services

Investment

Management

Wealth

Planning

Client Client

Goals

11 northerntrust.com | © 2017 Northern Trust

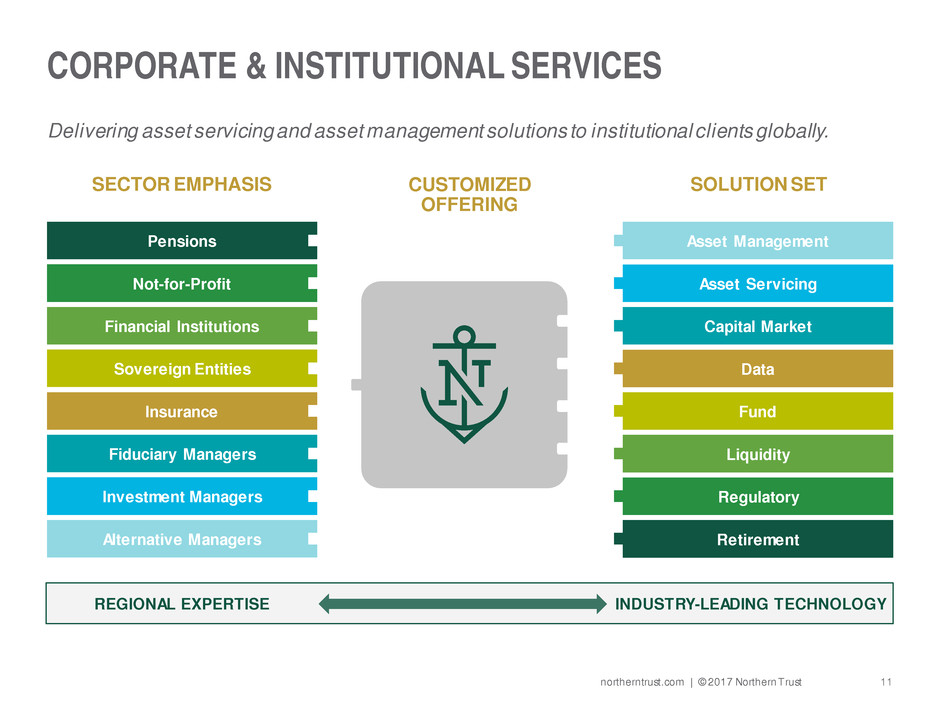

CORPORATE & INSTITUTIONAL SERVICES

Delivering asset servicing and asset management solutions to institutional clients globally.

SECTOR EMPHASIS SOLUTION SET CUSTOMIZED

OFFERING

Not-for-Profit

Pensions

Financial Institutions

Sovereign Entities

Insurance

Fiduciary Managers

Alternative Managers

Investment Managers

Asset Management

Asset Servicing

Capital Market

Data

Fund

Liquidity

Regulatory

Retirement

REGIONAL EXPERTISE INDUSTRY-LEADING TECHNOLOGY

12 northerntrust.com | © 2017 Northern Trust

CORPORATE & INSTITUTIONAL SERVICES

Delivering asset servicing and asset management solutions to institutional clients globally.

SECTOR EMPHASIS SOLUTION SET CUSTOMIZED

OFFERING

Sovereign Entities

Asset Management

Asset Servicing

Capital Market

Data

Fund

Liquidity

REGIONAL EXPERTISE INDUSTRY-LEADING TECHNOLOGY

13 northerntrust.com | © 2017 Northern Trust

ASSET MANAGEMENT

A leading global investment manager with a client-centric culture rooted in a fiduciary heritage.

Institutional

74% Equity

$517B

Fixed

Income

$462B

Other

$22B

Wealth & Retail

26%

Asset

Class

Client

Type

World’s 13th

largest asset

manager

$1.0 trillion

TOTAL ASSETS

UNDER MANAGEMENT

As of March 31, 2017. The above rankings are not indicative of future performance. Rankings are based on total worldwide assets under management of $875 bill ion as of December

31, 2015 by Pensions & Investments magazine’s 2016 Special Report on the Largest Money Managers.

$6.7

$8.4 $7.6

$11.8

$13.4

15 17

22

25 25

2013 2014 2015 2016 1Q 2017

Assets Under

Management ($B) No. of Funds

14 northerntrust.com | © 2017 Northern Trust

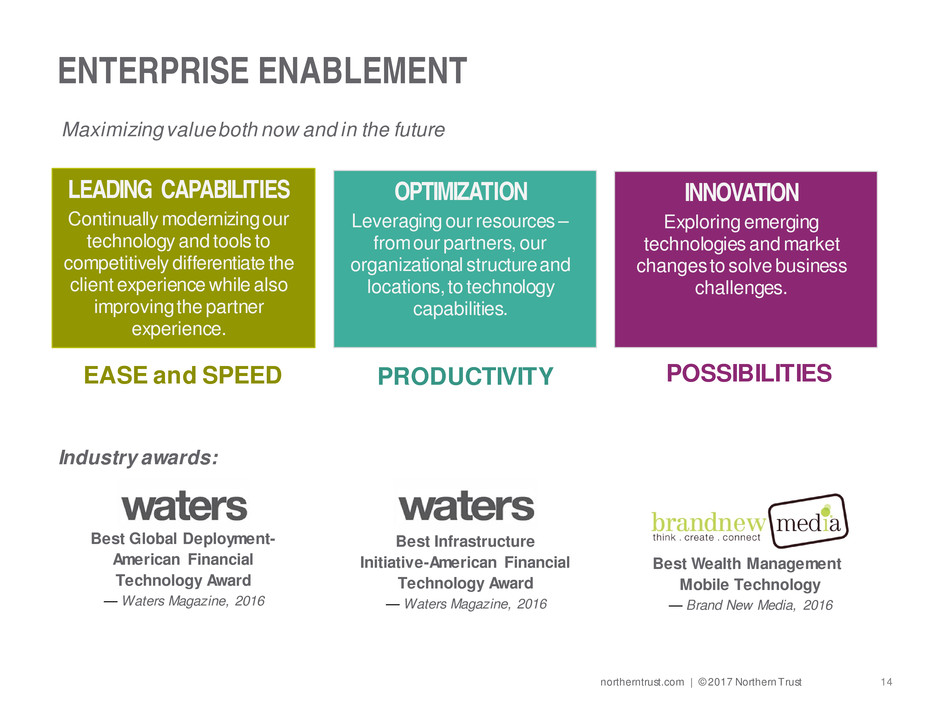

LEADING CAPABILITIES

Continually modernizing our

technology and tools to

competitively differentiate the

client experience while also

improving the partner

experience.

INNOVATION

Exploring emerging

technologies and market

changes to solve business

challenges.

ENTERPRISE ENABLEMENT

EASE and SPEED PRODUCTIVITY POSSIBILITIES

OPTIMIZATION

Leveraging our resources –

from our partners, our

organizational structure and

locations, to technology

capabilities.

Maximizing value both now and in the future

Best Wealth Management

Mobile Technology

— Brand New Media, 2016

Best Global Deployment-

American Financial

Technology Award

— Waters Magazine, 2016

Best Infrastructure

Initiative-American Financial

Technology Award

— Waters Magazine, 2016

Industry awards:

15 northerntrust.com | © 2017 Northern Trust

+8% +12% +9%

LONG-TERM SUCCESS THROUGH A FOCUSED STRATEGY

Relationship-focused strategy

Leader in attractive markets

History of organic growth

Proven record of investing for long-

term growth and profitability

ACHIEVE

GREATER

16 northerntrust.com | © 2017 Northern Trust