Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Independent Bank Group, Inc. | exhibit991q12017.htm |

| 8-K - 8-K - Independent Bank Group, Inc. | form8-kibgpressrelease4x24.htm |

First Quarter 2017

Earnings Release Presentation

April 25, 2017

Exhibit 99.2

Safe Harbor Statement

2

From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,”

“targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or

similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements.

Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and

other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii)

statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are based on

Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank

Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor

guarantees or assurances of future performance. Factors that could cause actual results to differ from those discussed in the forward-looking statements

include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and

our assessment of that impact; (2) volatility and disruption in national and international financial markets; (3) government intervention in the U.S. financial

system, whether through changes in the discount rate or money supply or otherwise; (4) changes in the level of non-performing assets and charge-offs; (5)

changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (6)

adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (7) inflation, deflation, changes in

market interest rates, developments in the securities market, and monetary fluctuations; (8) the timely development and acceptance of new products and

services and perceived overall value of these products and services by customers; (9) changes in consumer spending, borrowings, and savings habits; (10)

technological changes; (11) the ability to increase market share and control expenses; (12) changes in the competitive environment among banks, bank

holding companies, and other financial service providers; (13) the effect of changes in laws and regulations (including laws and regulations concerning taxes,

banking, securities, and insurance) with which we and our subsidiaries must comply; (14) the effect of changes in accounting policies and practices, as may

be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other

accounting standard setters; (15) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; and (16) our

success at managing the risks involved in the foregoing items and (17) the other factors that are described in the Company’s Annual Report on Form 10-K

filed on March 8, 2017, under the heading “Risk Factors”, and other reports and statements filed by the Company with the SEC. Any forward-looking

statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual

results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to

publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Today's Presenters

David R. Brooks

Chairman of the Board, CEO and President, Director

• 37 years in the financial services industry; 29 years at Independent Bank

• Active in community banking since the early 1980s - led the investor group that

acquired Independent Bank in 1988

Michelle S. Hickox

Executive Vice President, Chief Financial Officer

•27 years in the financial services industry; 5 years at the Company

•Previously a Financial Services Audit Partner at McGladrey LLP

3

First Quarter Key Highlights

• Core (non-gaap) net income was $16.0 million, or $0.84 per diluted

share, compared to $15.5 million, or $0.83 per diluted share, for

fourth quarter 2016, representing an increase in linked quarter core

net income of 3.2%

• Solid organic loan growth of 11.5% annualized for the quarter

• Positive increase in net interest margin to 3.67%, up from 3.59% for

fourth quarter 2016

• Continued strong credit quality metrics

• Return on average assets remained above 1% for the quarter,

improving to 1.08% from 1.03% for fourth quarter 2016

4

First Quarter Selected Financial Data

($ in thousands except per share data)

As of and for the Quarter Ended

Balance Sheet Data March 31, 2017 December 31, 2016 March 31, 2016

Linked Quarter

Change Annual Change

Total assets $ 6,022,614 $ 5,852,801 $ 5,261,967 2.9 % 14.5 %

Loans held for investment (gross) 4,702,511 4,572,771 4,130,496 2.8 13.8

Total deposits 4,722,203 4,577,109 4,171,952 3.2 13.2

Total borrowings (excluding trust preferred securities) 568,115 568,045 444,745 — 27.7

Total capital 688,469 672,365 616,258 2.4 11.7

Earnings and Profitability Data

Net interest income $ 47,867 $ 46,526 $ 45,660 2.9 % 4.8 %

Net interest margin 3.67 % 3.59 % 4.08 % 2.2 % (10.0 )%

Non-interest income $ 4,583 $ 5,224 $ 4,470 (12.3 )% 2.5 %

Non-interest expense 28,028 27,361 28,519 2.4 % (1.7 )%

Net income 15,671 14,775 12,452 6.1 % 25.9 %

Basic EPS $ 0.83 $ 0.79 $ 0.67 5.1 % 23.9 %

Diluted EPS $ 0.82 $ 0.79 $ 0.67 3.8 % 22.4 %

Core net interest margin (1) (2) 3.66 % 3.58 % 3.96 % 2.2 % (7.6 )%

Core net income (1) $ 15,990 $ 15,541 $ 12,438 2.9 % 28.6 %

Core basic EPS (1) $ 0.85 $ 0.83 $ 0.67 2.4 % 26.9 %

Core diluted EPS (1) $ 0.84 $ 0.83 $ 0.67 1.2 % 25.4 %

5

(1) See Appendix for Non-GAAP reconciliation

(2) Excludes income recognized on acquired loans of $123, $51 and $1,333, respectively.

Earnings Per Share and Core Earnings Per Share Trends (1)

Consistent Earnings Growth

(1) See Appendix for Non-GAAP reconciliation

6

Interest Income Growth

7

Interest Income, Net Interest Income and NIM Trends

Core EPS (1)

Core Efficiency Ratio

Core Efficiency Ratio Trends (1)

(1) See Appendix for non-GAAP Reconciliation

8

Loan Portfolio Growth

Total Loans by Year and Current Annual Trend ($ in billions)(1)

(1) Includes loans held for sale.

9

Loan Portfolio Composition

Loan Composition at 03/31/2017 CRE Loan Composition at 03/31/2017

Loans by Region at 03/31/2017

10

Historically Strong Credit Culture

11

NPLs / Loans

Note: Financial data as of and for years ended December 31, and quarter ended December 31, 2016 for peer data and March 31, 2017 for IBTX. Interim chargeoff data annualized.

Source: U.S. and Texas Commercial Bank numbers from SNL Financial.

NCOs / Average Loans

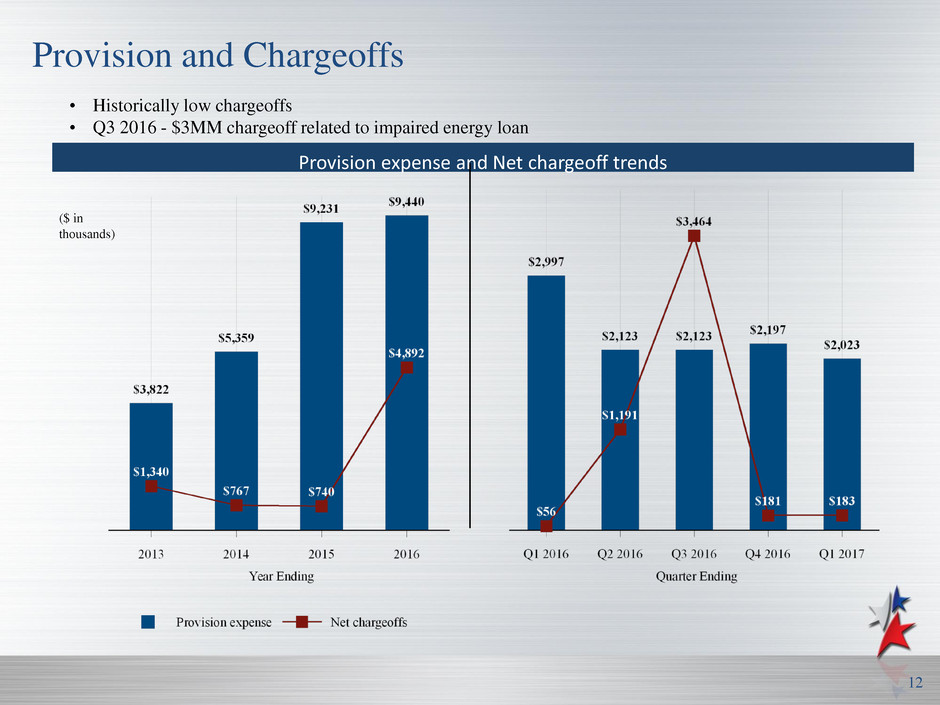

Provision expense and Net chargeoff trends

Provision and Chargeoffs

• Historically low chargeoffs

• Q3 2016 - $3MM chargeoff related to impaired energy loan

12

($ in

thousands)

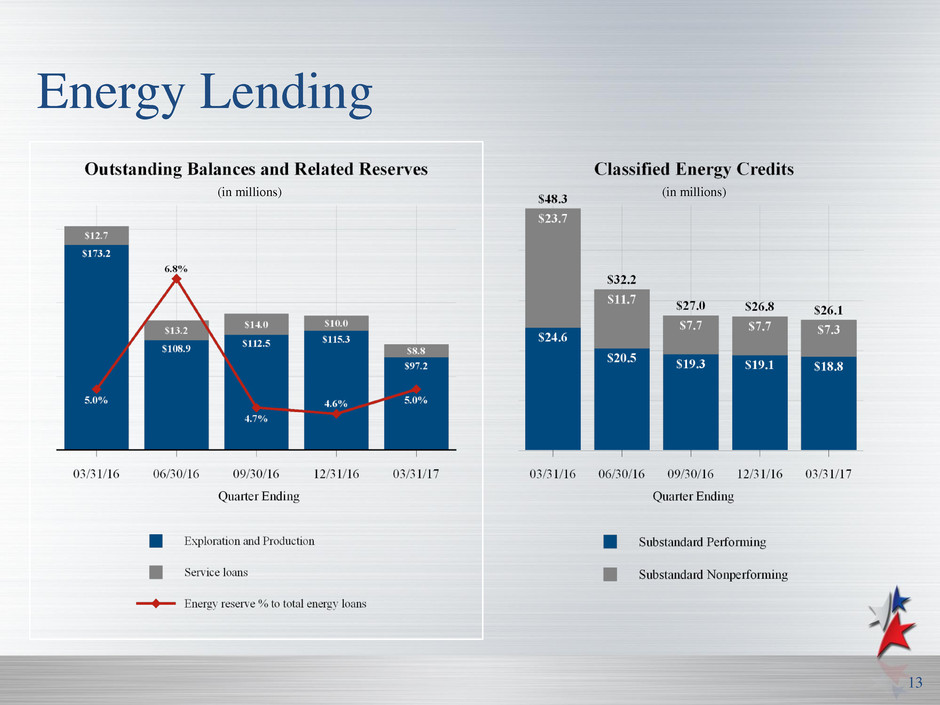

Energy Lending

(in millions)

13

(in millions)

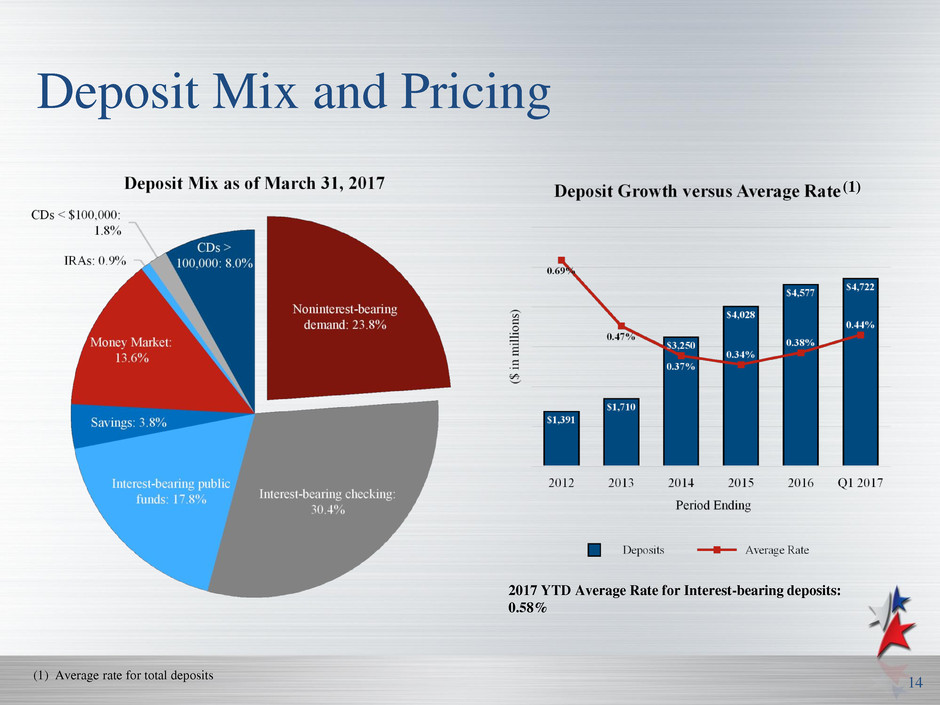

Deposit Mix and Pricing

(1)

(1) Average rate for total deposits

2017 YTD Average Rate for Interest-bearing deposits:

0.58%

14

Capital

Total Capital and TCE/TA Ratios (1)

(1) See Appendix for non-GAAP Reconciliation 15

($ in thousands except per share data) March 31, 2017 December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016

Net Interest Income - Reported (a) 47,867 46,526 45,737 45,883 45,660

Income recognized on acquired loans (123 ) (51 ) (116 ) (265 ) (1,333 )

Adjusted Net Interest Income (b) 47,744 46,475 45,621 45,618 44,327

Provision Expense - Reported (c) 2,023 2,197 2,123 2,123 2,997

Noninterest Income - Reported (d) 4,583 5,224 4,932 4,929 4,470

Loss on sale of branch — — 43 — —

Gain on sale of OREO/repossessed assets — — (4 ) (10 ) (48 )

Gain on sale of securities — — — (4 ) —

Loss / (Gain) on sale of PP&E (5 ) — 9 (3 ) (38 )

Adjusted Noninterest Income (e) 4,578 5,224 4,980 4,912 4,384

Noninterest Expense - Reported (f) 28,028 27,361 26,887 31,023 28,519

Senior leadership restructuring — — — (2,575 ) —

OREO impairment — — (51 ) — (55 )

IPO related stock grant and bonus expense (125 ) (127 ) (104 ) (156 ) (156 )

Acquisition expense (459 ) (1,075 ) (384 ) (475 ) (1,187 )

Adjusted Noninterest Expense (g) 27,444 26,159 26,348 27,817 27,121

Core Net Income (1) (b) - (c) + (e) - (g)= (h) 15,990 15,541 14,819 13,764 12,438

Core Efficiency Ratio (g) / (b + e) 52.45 % 50.60 % 52.07 % 55.05 % 55.68 %

Average shares for basic EPS (i) 18,908,679 18,613,975 18,478,289 18,469,182 18,444,284

Average shares for diluted EPS (j) 19,015,810 18,716,614 18,568,622 18,547,074 18,528,031

Core Basic EPS (h) / (i) $ 0.85 $ 0.83 $ 0.80 $ 0.75 $ 0.67

Core Diluted EPS (h) / (j) $ 0.84 $ 0.83 $ 0.80 $ 0.74 $ 0.67

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Core Earnings, Core Efficiency Ratio and Core EPS--Quarterly Periods

APPENDIX

(1) Assumes actual effective tax rate of 30.0%, 33.4%, 33.0%, 33.2% and 33.1%, for the quarters ended March 31, 2017, December 31, 2016, September 30, 2016, June 30, 2016 and March 31, 2016,

respectively. 16

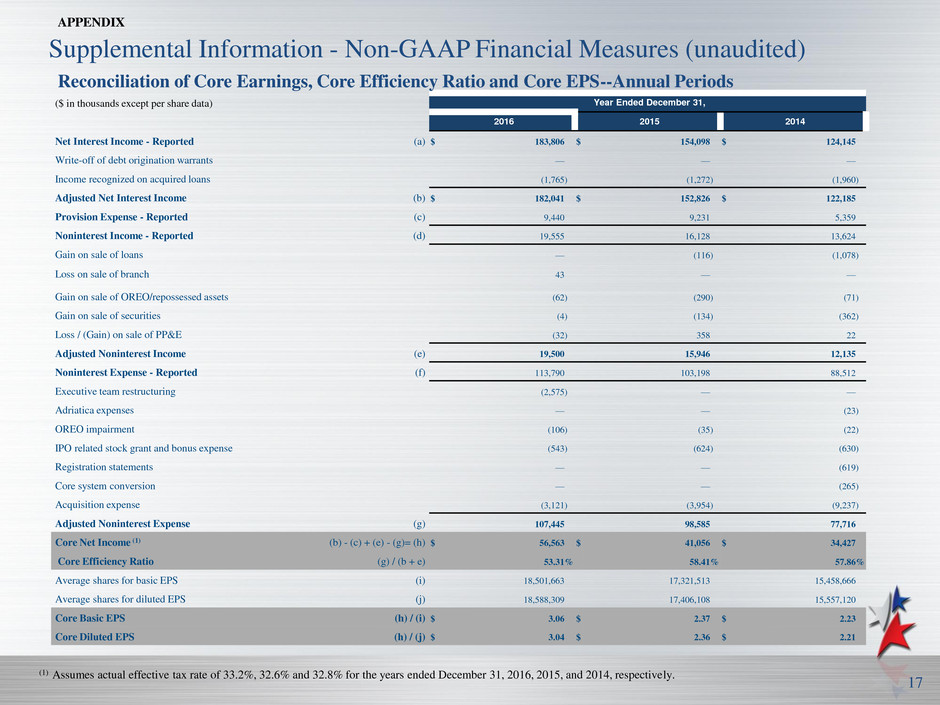

($ in thousands except per share data) Year Ended December 31,

2016 2015 2014

Net Interest Income - Reported (a) $ 183,806 $ 154,098 $ 124,145

Write-off of debt origination warrants — — —

Income recognized on acquired loans (1,765 ) (1,272 ) (1,960 )

Adjusted Net Interest Income (b) $ 182,041 $ 152,826 $ 122,185

Provision Expense - Reported (c) 9,440 9,231 5,359

Noninterest Income - Reported (d) 19,555 16,128 13,624

Gain on sale of loans — (116 ) (1,078 )

Loss on sale of branch 43 — —

Gain on sale of OREO/repossessed assets (62 ) (290 ) (71 )

Gain on sale of securities (4 ) (134 ) (362 )

Loss / (Gain) on sale of PP&E (32 ) 358 22

Adjusted Noninterest Income (e) 19,500 15,946 12,135

Noninterest Expense - Reported (f) 113,790 103,198 88,512

Executive team restructuring (2,575 ) — —

Adriatica expenses — — (23 )

OREO impairment (106 ) (35 ) (22 )

IPO related stock grant and bonus expense (543 ) (624 ) (630 )

Registration statements — — (619 )

Core system conversion — — (265 )

Acquisition expense (3,121 ) (3,954 ) (9,237 )

Adjusted Noninterest Expense (g) 107,445 98,585 77,716

Core Net Income (1) (b) - (c) + (e) - (g)= (h) $ 56,563 $ 41,056 $ 34,427

Core Efficiency Ratio (g) / (b + e) 53.31 % 58.41 % 57.86 %

Average shares for basic EPS (i) 18,501,663 17,321,513 15,458,666

Average shares for diluted EPS (j) 18,588,309 17,406,108 15,557,120

Core Basic EPS (h) / (i) $ 3.06 $ 2.37 $ 2.23

Core Diluted EPS (h) / (j) $ 3.04 $ 2.36 $ 2.21

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Core Earnings, Core Efficiency Ratio and Core EPS--Annual Periods

APPENDIX

(1) Assumes actual effective tax rate of 33.2%, 32.6% and 32.8% for the years ended December 31, 2016, 2015, and 2014, respectively.

17

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Tangible Common Equity to Tangible Assets

APPENDIX

Tangible Common Equity To Tangible Assets 3/31/17 12/31/16 12/31/2015 12/31/14 12/31/13

($ in thousands)

Tangible Common Equity

Total common stockholders' equity $ 688,469 $ 672,365 $ 603,371 $ 516,913 $ 233,772

Adjustments:

Goodwill (258,319 ) (258,319 ) (258,643 ) (229,457 ) (34,704 )

Core deposit intangibles, net (13,685 ) (14,177 ) (16,357 ) (12,455 ) (3,148 )

Tangible Common Equity $ 416,465 $ 399,869 $ 328,371 $ 275,001 $ 195,920

Tangible Assets

Total Assets $ 6,022,614 $ 5,852,801 $ 5,055,000 $ 4,132,639 $ 2,163,984

Adjustments:

Goodwill (258,319 ) (258,319 ) (258,643 ) (229,457 ) (34,704 )

Core deposit intangibles (13,685 ) (14,177 ) (16,357 ) (12,455 ) (3,148 )

Tangible Assets $ 5,750,610 $ 5,580,305 $ 4,780,000 $ 3,890,727 $ 2,126,132

Tangible Common Equity To Tangible Assets 7.24 % 7.17 % 6.87 % 7.07 % 9.21 %

18