Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST BANCORP /PR/ | a51546374ex99_1.htm |

| 8-K - FIRST BANCORP. 8-K - FIRST BANCORP /PR/ | a51546374.htm |

Exhibit 99.2

Financial Results1Q 2017

2 This presentation may contain “forward-looking statements” concerning the Corporation’s future economic, operational and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “look forward,” “should,” “would,” “believes” and similar expressions are meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions readers not to place undue reliance on any such “forward-looking statements,” which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ materially from those expressed in, or implied by such forward-looking statements: the ability of the Puerto Rico government or any of its public corporations or other instrumentalities to repay its respective debt obligations, including as a result of payment defaults on the Puerto Rico government general obligations, bonds of the Government Development Bank for Puerto Rico and certain bonds of government public corporations, and recent and any future downgrades of the long-term and short-term debt ratings of the Puerto Rico government, which could exacerbate Puerto Rico’s adverse economic conditions and, in turn, further adversely impact the Corporation; uncertainty as to the ultimate outcomes of actions resulting from the enactment by the U.S. government of the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) to address Puerto Rico’s financial problems; uncertainty about whether the Corporation will be able to continue to fully comply with the written agreement dated June 3, 2010 that the Corporation entered into with the Federal Reserve Bank of New York (the “New York Fed”), that, among other things, requires the Corporation to serve as a source of strength to FirstBank and that, except with the consent generally of the New York Fed and the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”), prohibits the Corporation from paying dividends to stockholders or receiving dividends from FirstBank, making payments on trust preferred securities or subordinated debt and incurring, increasing or guaranteeing debt or repurchasing any capital securities and uncertainty whether such consent will be provided for future interest payments on the subordinated debt despite the consents that enabled the Corporation to pay all the accrued but deferred interest payments plus the interest for the second, third and fourth quarters of 2016 on the Corporation’s subordinated debentures associated with its trust preferred securities, and for future monthly dividend on its non-cumulative perpetual preferred stock, despite the consent that enabled the Corporation to pay monthly dividends on its non-cumulative perpetual preferred stock for December and January; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico; uncertainty as to the availability of certain funding sources, such as brokered CDs; the Corporation’s reliance on brokered CDs to fund operations and provide liquidity; the risk of not being able to fulfill the Corporation’s cash obligations or resume paying dividends to the Corporation’s common stockholders in the future due to the Corporation’s need to receive approval from the New York Fed, the Federal Reserve Board and the Office of the Commissioner of Financial Institutions of Puerto Rico to declare or pay any dividends and to take dividends or any other form of payment representing a reduction in capital from FirstBank or FirstBank’s failure to generate sufficient cash flow to make a dividend payment to the Corporation; the weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets, which have contributed and may continue to contribute to, among other things, high levels of non-performing assets, charge-offs and provisions for loan and lease losses and may subject the Corporation to further risk from loan defaults and foreclosures; the ability of FirstBank to realize the benefits of its deferred tax assets subject to the remaining valuation allowance; adverse changes in general economic conditions in Puerto Rico, the U.S., and the U.S. Virgin Islands and British Virgin Islands, including the interest rate environment, market liquidity, housing absorption rates, real estate prices, and disruptions in the U.S. capital markets, which reduced interest margins and affected funding sources, and has affected demand for all of the Corporation’s products and services and reduced the Corporation’s revenues and earnings, and the value of the Corporation’s assets, and may continue to have these effects; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be other-than-temporary, including additional impairments on the Puerto Rico government’s obligations; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, which could affect the Corporation’s financial condition or performance and could cause the Corporation’s actual results for future periods to differ materially from prior results and anticipated or projected results; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments, including those determined by the Federal Reserve Board, the New York Fed, the FDIC, government-sponsored housing agencies, and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact on the Corporation’s results of operations and financial condition of acquisitions and dispositions; a need to recognize additional impairments on the Corporation’s financial instruments, goodwill or other intangible assets relating to acquisitions; the risk that downgrades in the credit ratings of the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the impact on the Corporation’s businesses, business practices and results of operations of a potential higher interest rate environment; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws. Forward-Looking Statements

Agenda First Quarter 2017 Highlights Aurelio Alemán, President & Chief Executive OfficerFirst Quarter 2017 Results of Operations Orlando Berges, Executive Vice President & Chief Financial OfficerQuestions & Answers 3

Key Highlights 4 First Quarter 2017 Highlights

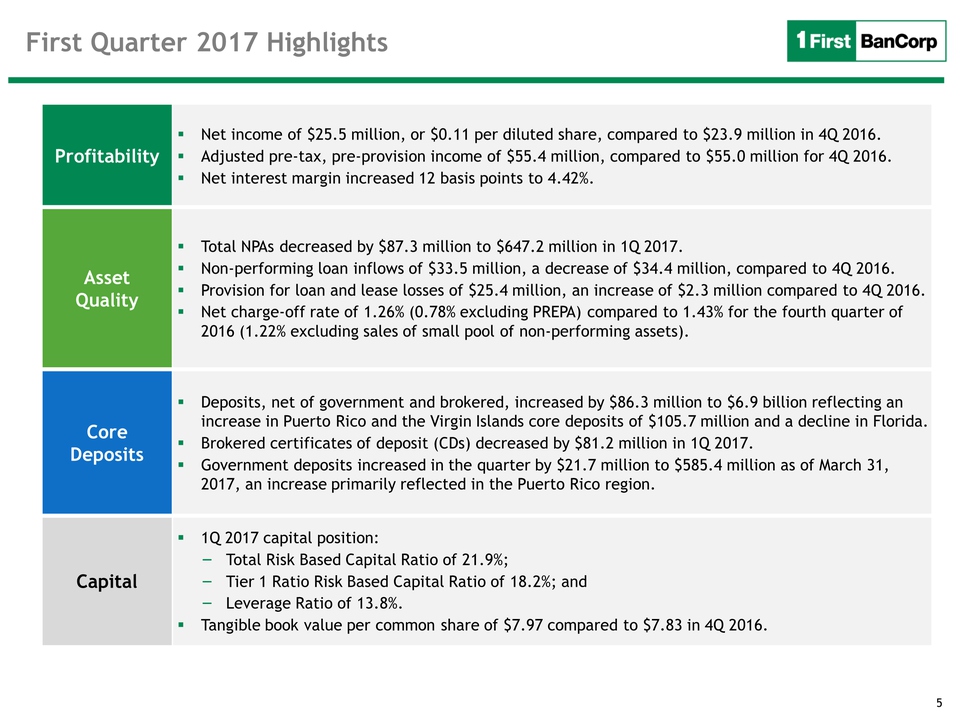

Profitability Net income of $25.5 million, or $0.11 per diluted share, compared to $23.9 million in 4Q 2016. Adjusted pre-tax, pre-provision income of $55.4 million, compared to $55.0 million for 4Q 2016. Net interest margin increased 12 basis points to 4.42%. Asset Quality Total NPAs decreased by $87.3 million to $647.2 million in 1Q 2017.Non-performing loan inflows of $33.5 million, a decrease of $34.4 million, compared to 4Q 2016.Provision for loan and lease losses of $25.4 million, an increase of $2.3 million compared to 4Q 2016.Net charge-off rate of 1.26% (0.78% excluding PREPA) compared to 1.43% for the fourth quarter of 2016 (1.22% excluding sales of small pool of non-performing assets). Core Deposits Deposits, net of government and brokered, increased by $86.3 million to $6.9 billion reflecting an increase in Puerto Rico and the Virgin Islands core deposits of $105.7 million and a decline in Florida.Brokered certificates of deposit (CDs) decreased by $81.2 million in 1Q 2017.Government deposits increased in the quarter by $21.7 million to $585.4 million as of March 31, 2017, an increase primarily reflected in the Puerto Rico region. Capital 1Q 2017 capital position: Total Risk Based Capital Ratio of 21.9%;Tier 1 Ratio Risk Based Capital Ratio of 18.2%; andLeverage Ratio of 13.8%.Tangible book value per common share of $7.97 compared to $7.83 in 4Q 2016. 5 First Quarter 2017 Highlights

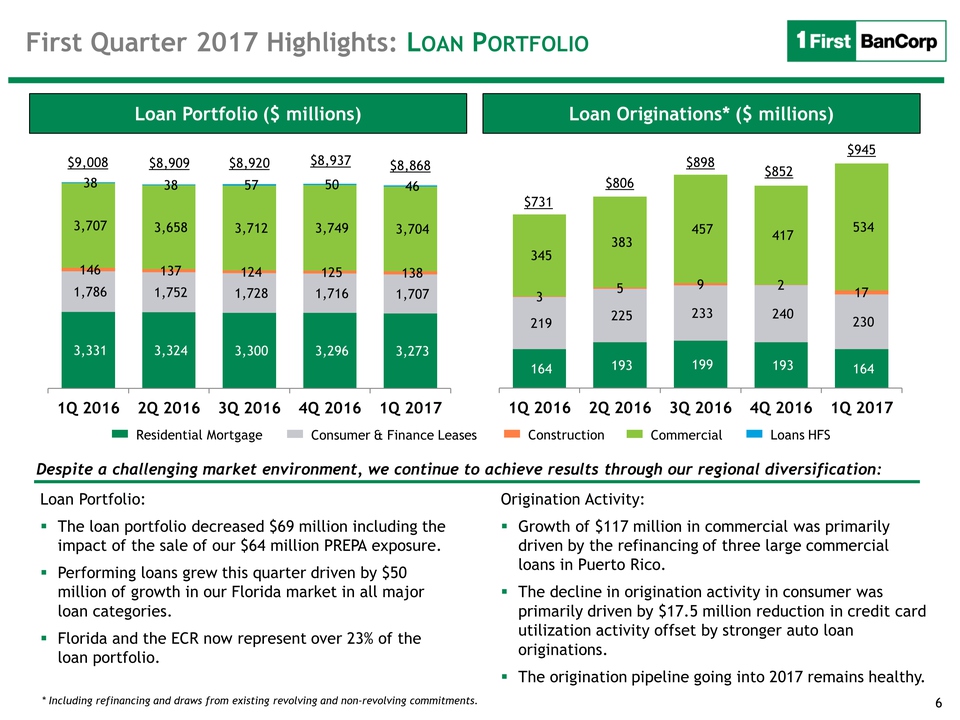

6 Loan Originations* ($ millions) Loan Portfolio ($ millions) Residential Mortgage Consumer & Finance Leases Construction Commercial Loans HFS Despite a challenging market environment, we continue to achieve results through our regional diversification: * Including refinancing and draws from existing revolving and non-revolving commitments. First Quarter 2017 Highlights: Loan Portfolio $898 $9,008 $731 $8,909 $806 $8,920 $8,937 $945 Loan Portfolio:The loan portfolio decreased $69 million including the impact of the sale of our $64 million PREPA exposure.Performing loans grew this quarter driven by $50 million of growth in our Florida market in all major loan categories.Florida and the ECR now represent over 23% of the loan portfolio. Origination Activity:Growth of $117 million in commercial was primarily driven by the refinancing of three large commercial loans in Puerto Rico.The decline in origination activity in consumer was primarily driven by $17.5 million reduction in credit card utilization activity offset by stronger auto loan originations.The origination pipeline going into 2017 remains healthy. $8,868 $852

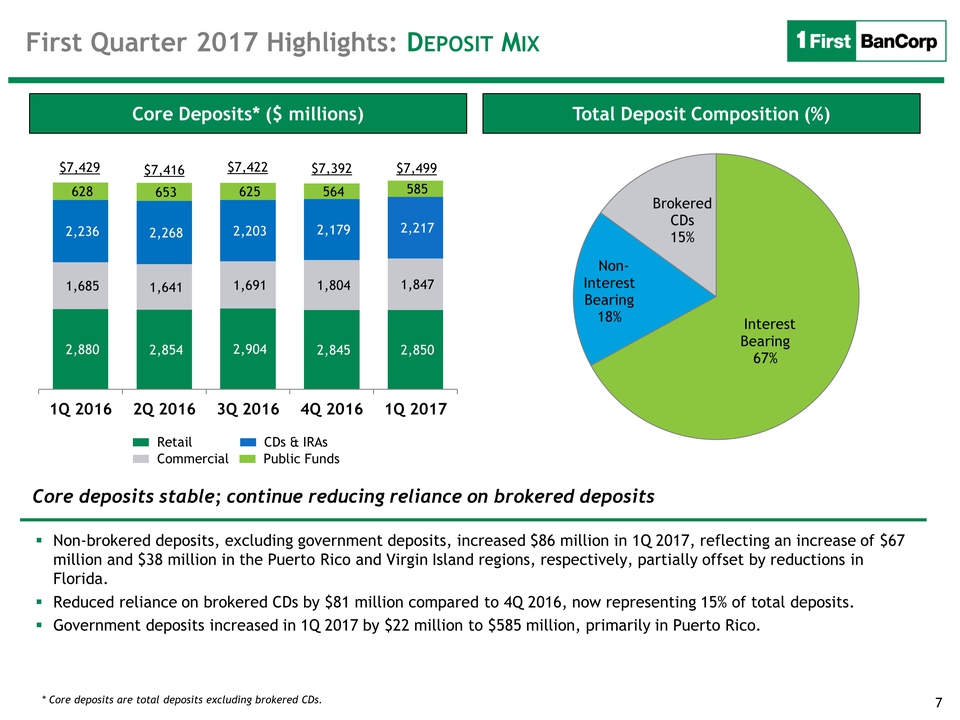

7 Total Deposit Composition (%) Core Deposits* ($ millions) * Core deposits are total deposits excluding brokered CDs. Core deposits stable; continue reducing reliance on brokered deposits First Quarter 2017 Highlights: Deposit Mix Retail Commercial CDs & IRAs Public Funds $7,429 $7,416 $7,422 $7,392 Non-brokered deposits, excluding government deposits, increased $86 million in 1Q 2017, reflecting an increase of $67 million and $38 million in the Puerto Rico and Virgin Island regions, respectively, partially offset by reductions in Florida. Reduced reliance on brokered CDs by $81 million compared to 4Q 2016, now representing 15% of total deposits.Government deposits increased in 1Q 2017 by $22 million to $585 million, primarily in Puerto Rico. $7,499

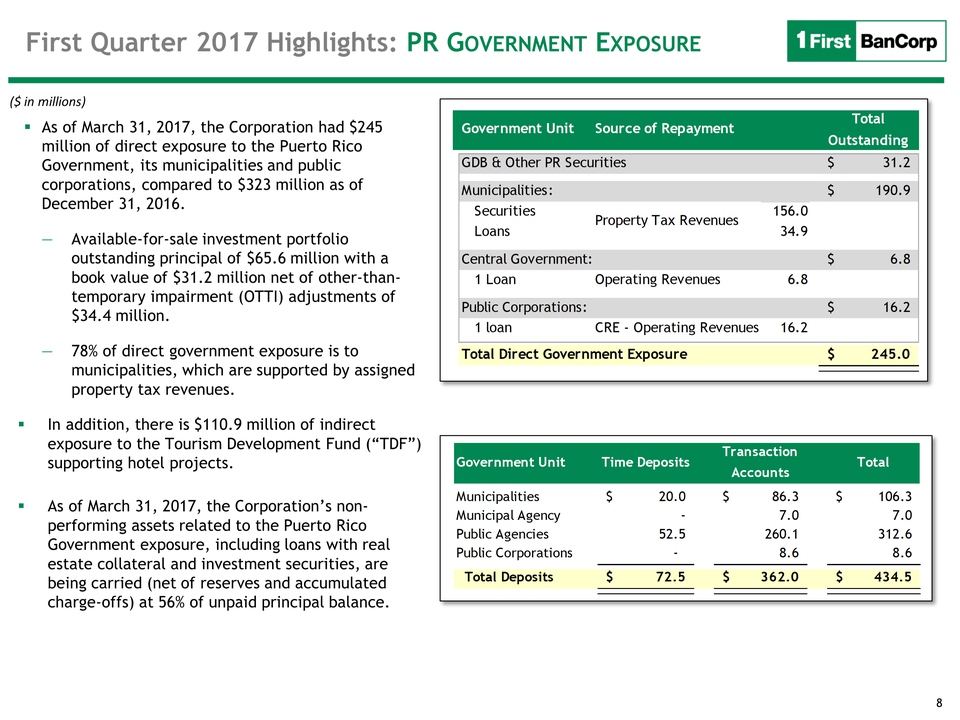

8 First Quarter 2017 Highlights: PR Government Exposure ($ in millions) As of March 31, 2017, the Corporation had $245 million of direct exposure to the Puerto Rico Government, its municipalities and public corporations, compared to $323 million as of December 31, 2016. Available-for-sale investment portfolio outstanding principal of $65.6 million with a book value of $31.2 million net of other-than-temporary impairment (OTTI) adjustments of $34.4 million.78% of direct government exposure is to municipalities, which are supported by assigned property tax revenues. In addition, there is $110.9 million of indirect exposure to the Tourism Development Fund (“TDF”) supporting hotel projects.As of March 31, 2017, the Corporation’s non-performing assets related to the Puerto Rico Government exposure, including loans with real estate collateral and investment securities, are being carried (net of reserves and accumulated charge-offs) at 56% of unpaid principal balance.

9 Results of Operations First Quarter 2017 Results

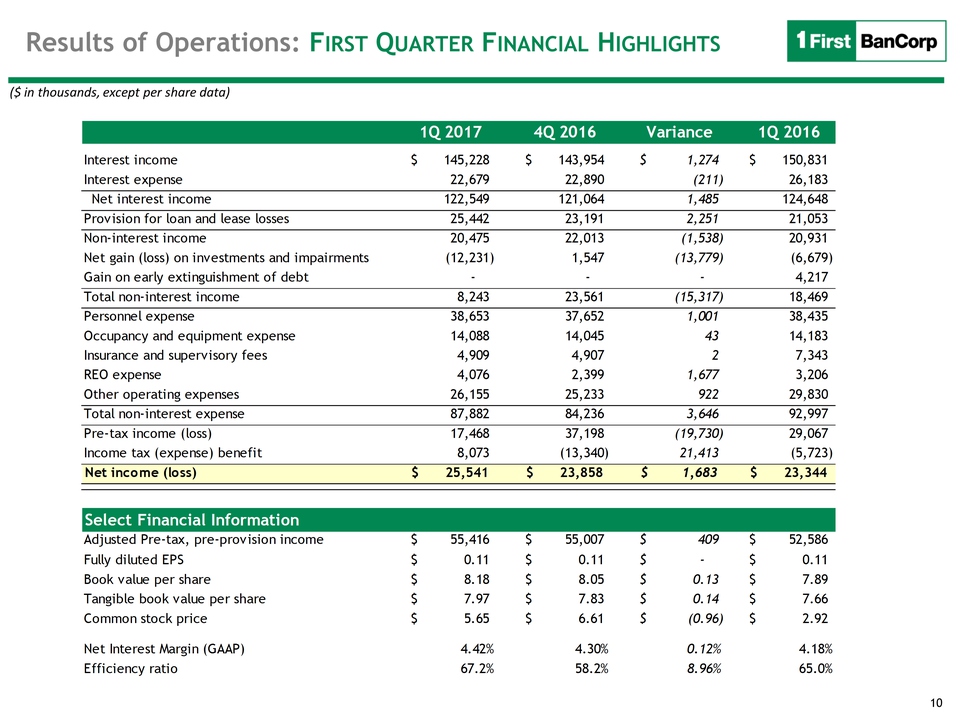

10 Results of Operations: First Quarter Financial Highlights ($ in thousands, except per share data) Select Financial Information

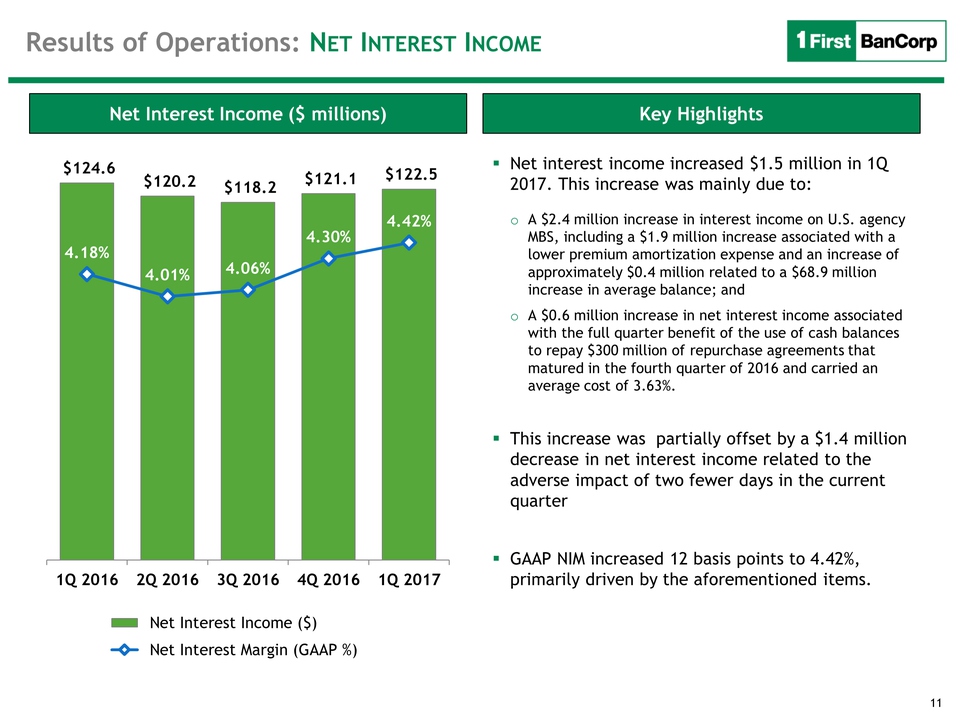

11 Key Highlights Net Interest Income ($ millions) Net interest income increased $1.5 million in 1Q 2017. This increase was mainly due to:A $2.4 million increase in interest income on U.S. agency MBS, including a $1.9 million increase associated with a lower premium amortization expense and an increase of approximately $0.4 million related to a $68.9 million increase in average balance; andA $0.6 million increase in net interest income associated with the full quarter benefit of the use of cash balances to repay $300 million of repurchase agreements that matured in the fourth quarter of 2016 and carried an average cost of 3.63%.This increase was partially offset by a $1.4 million decrease in net interest income related to the adverse impact of two fewer days in the current quarterGAAP NIM increased 12 basis points to 4.42%, primarily driven by the aforementioned items. Results of Operations: Net Interest Income

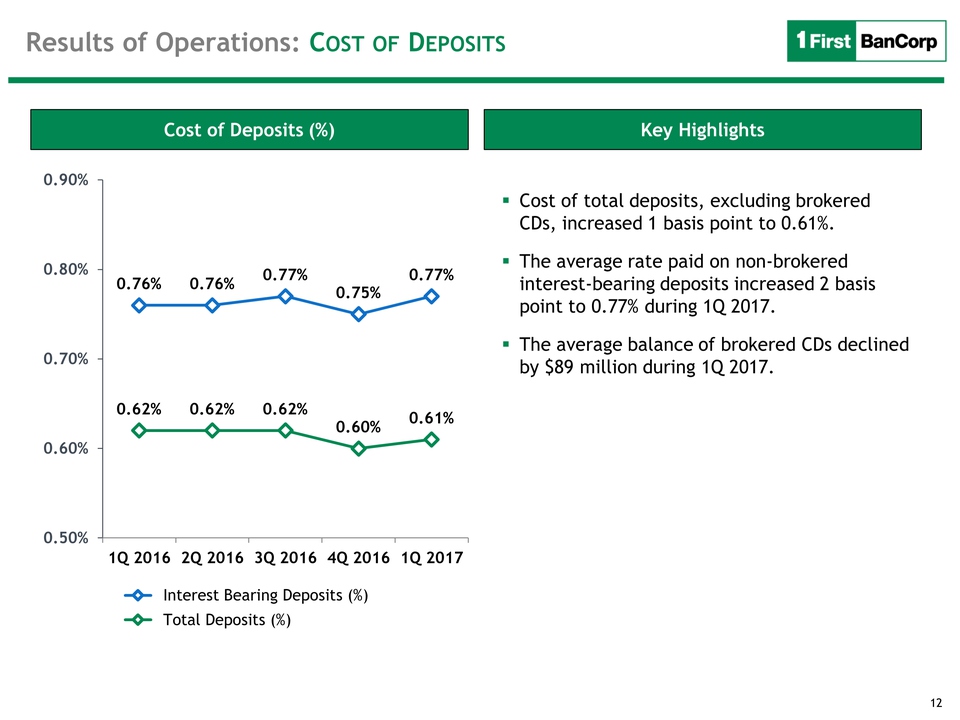

12 Key Highlights Cost of Deposits (%) Cost of total deposits, excluding brokered CDs, increased 1 basis point to 0.61%.The average rate paid on non-brokered interest-bearing deposits increased 2 basis point to 0.77% during 1Q 2017.The average balance of brokered CDs declined by $89 million during 1Q 2017. Results of Operations: Cost of Deposits

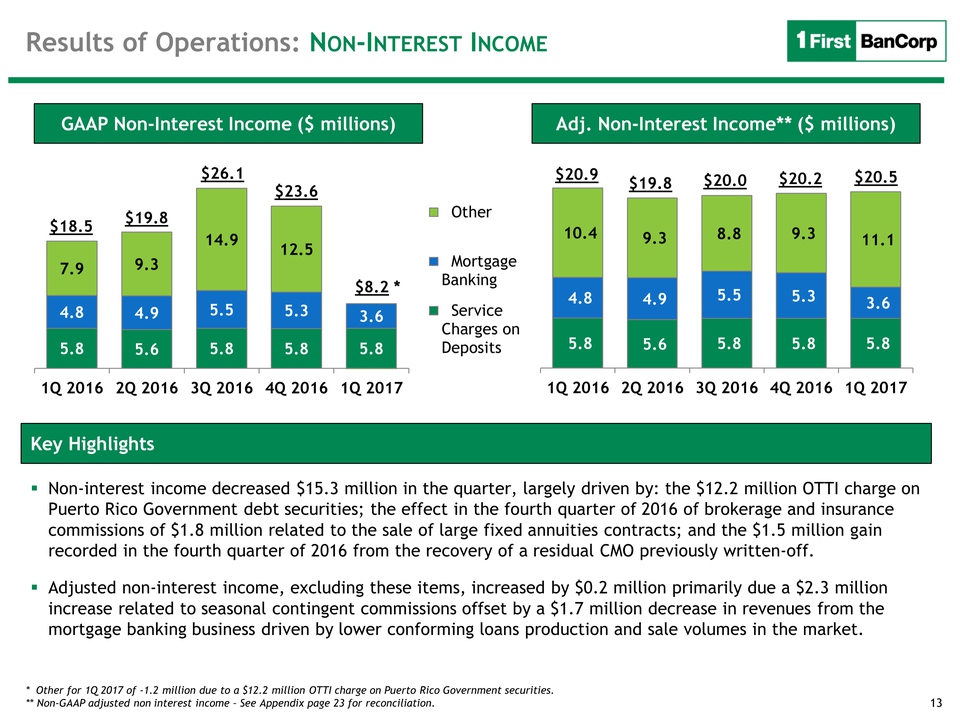

13 Key Highlights Adj. Non-Interest Income** ($ millions) * Other for 1Q 2017 of -1.2 million due to a $12.2 million OTTI charge on Puerto Rico Government securities.** Non-GAAP adjusted non interest income – See Appendix page 23 for reconciliation. Non-interest income decreased $15.3 million in the quarter, largely driven by: the $12.2 million OTTI charge on Puerto Rico Government debt securities; the effect in the fourth quarter of 2016 of brokerage and insurance commissions of $1.8 million related to the sale of large fixed annuities contracts; and the $1.5 million gain recorded in the fourth quarter of 2016 from the recovery of a residual CMO previously written-off. Adjusted non-interest income, excluding these items, increased by $0.2 million primarily due a $2.3 million increase related to seasonal contingent commissions offset by a $1.7 million decrease in revenues from the mortgage banking business driven by lower conforming loans production and sale volumes in the market. Results of Operations: Non-Interest Income $20.0 $20.9 $19.8 $20.2 GAAP Non-Interest Income ($ millions) $26.1 $18.5 $19.8 $23.6 $8.2 * $20.5

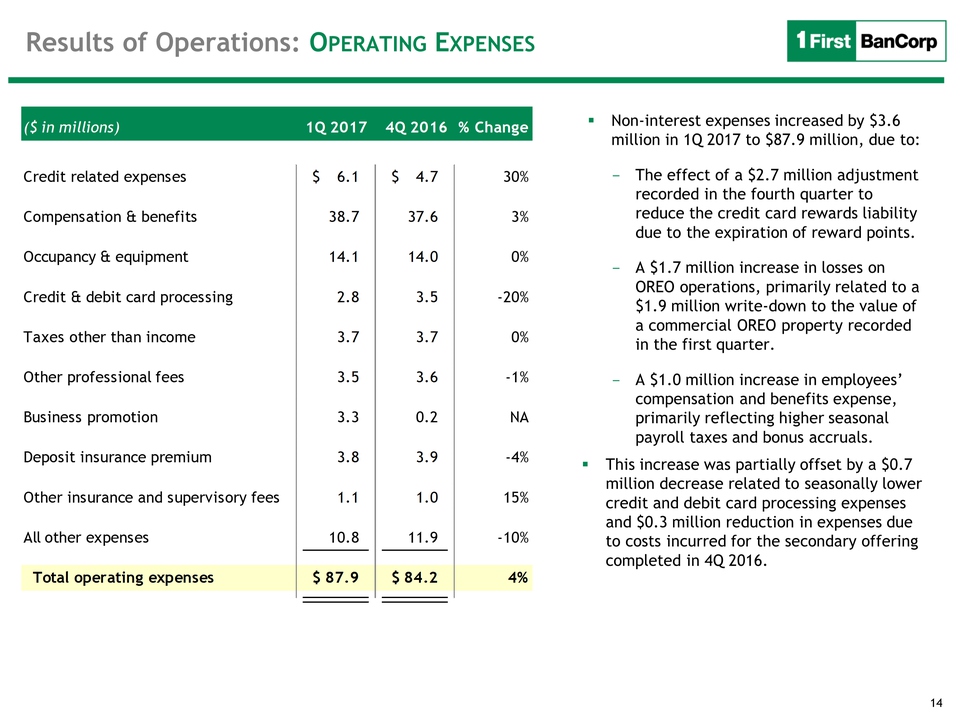

14 Results of Operations: Operating Expenses Non-interest expenses increased by $3.6 million in 1Q 2017 to $87.9 million, due to:The effect of a $2.7 million adjustment recorded in the fourth quarter to reduce the credit card rewards liability due to the expiration of reward points.A $1.7 million increase in losses on OREO operations, primarily related to a $1.9 million write-down to the value of a commercial OREO property recorded in the first quarter.A $1.0 million increase in employees’ compensation and benefits expense, primarily reflecting higher seasonal payroll taxes and bonus accruals.This increase was partially offset by a $0.7 million decrease related to seasonally lower credit and debit card processing expenses and $0.3 million reduction in expenses due to costs incurred for the secondary offering completed in 4Q 2016.

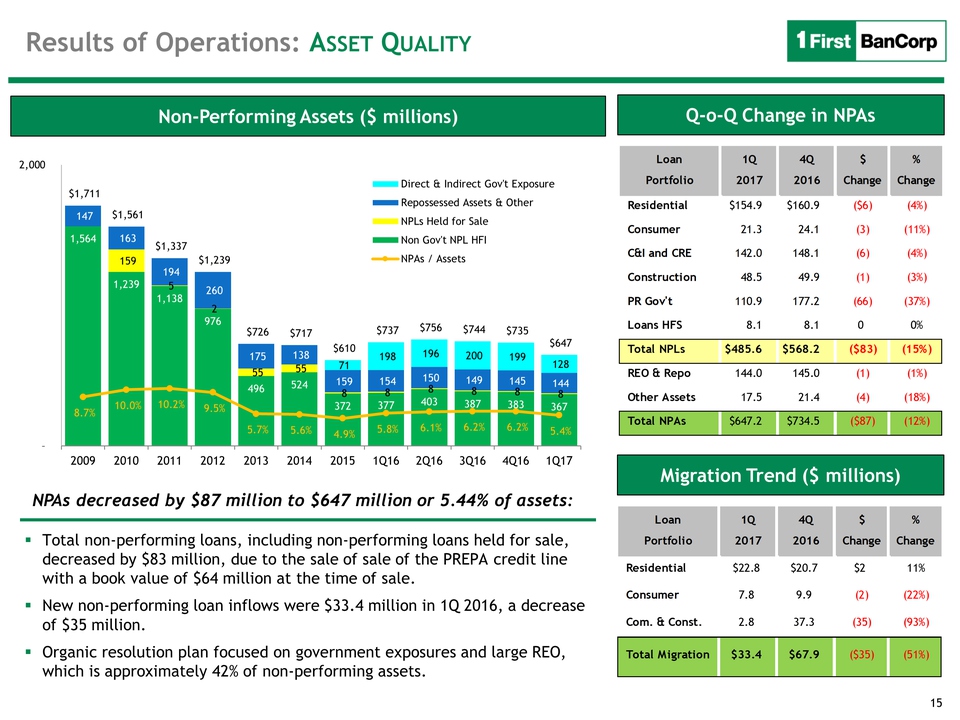

15 Non-Performing Assets ($ millions) Total non-performing loans, including non-performing loans held for sale, decreased by $83 million, due to the sale of sale of the PREPA credit line with a book value of $64 million at the time of sale. New non-performing loan inflows were $33.4 million in 1Q 2016, a decrease of $35 million.Organic resolution plan focused on government exposures and large REO, which is approximately 42% of non-performing assets. NPAs decreased by $87 million to $647 million or 5.44% of assets: Results of Operations: Asset Quality Q-o-Q Change in NPAs Migration Trend ($ millions)

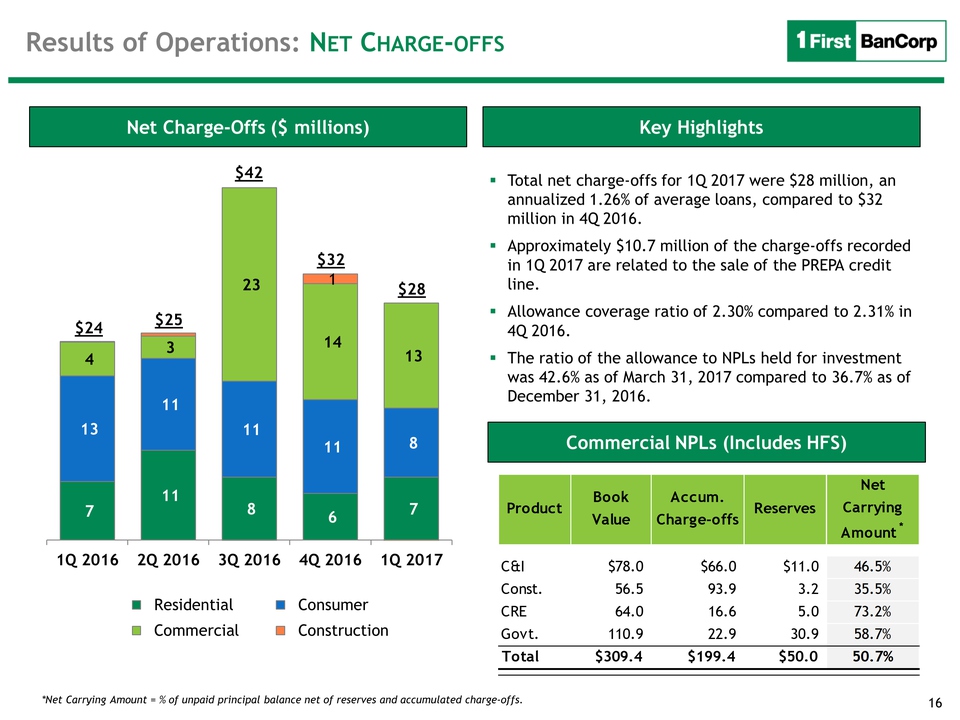

16 Key Highlights Net Charge-Offs ($ millions) Total net charge-offs for 1Q 2017 were $28 million, an annualized 1.26% of average loans, compared to $32 million in 4Q 2016. Approximately $10.7 million of the charge-offs recorded in 1Q 2017 are related to the sale of the PREPA credit line. Allowance coverage ratio of 2.30% compared to 2.31% in 4Q 2016. The ratio of the allowance to NPLs held for investment was 42.6% as of March 31, 2017 compared to 36.7% as of December 31, 2016. Commercial NPLs (Includes HFS) *Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. Results of Operations: Net Charge-offs $42 $25 $24 $32 $28

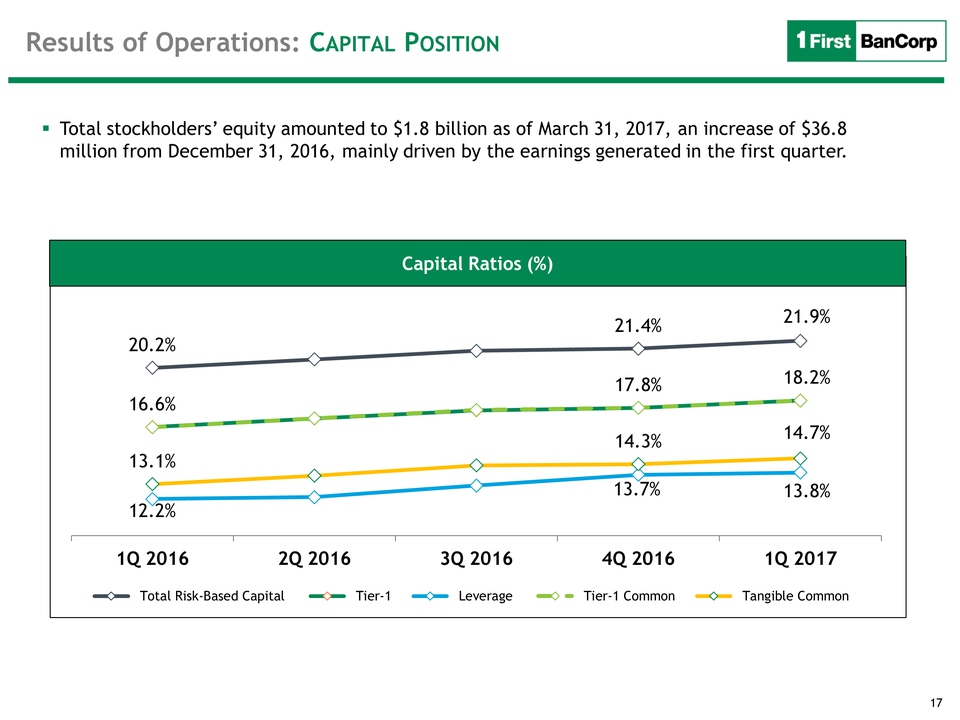

17 Results of Operations: Capital Position Capital Ratios (%) Total stockholders’ equity amounted to $1.8 billion as of March 31, 2017, an increase of $36.8 million from December 31, 2016, mainly driven by the earnings generated in the first quarter. Capital Ratios (%)

18 First Quarter Results Q & A

19 First Quarter Results Exhibits

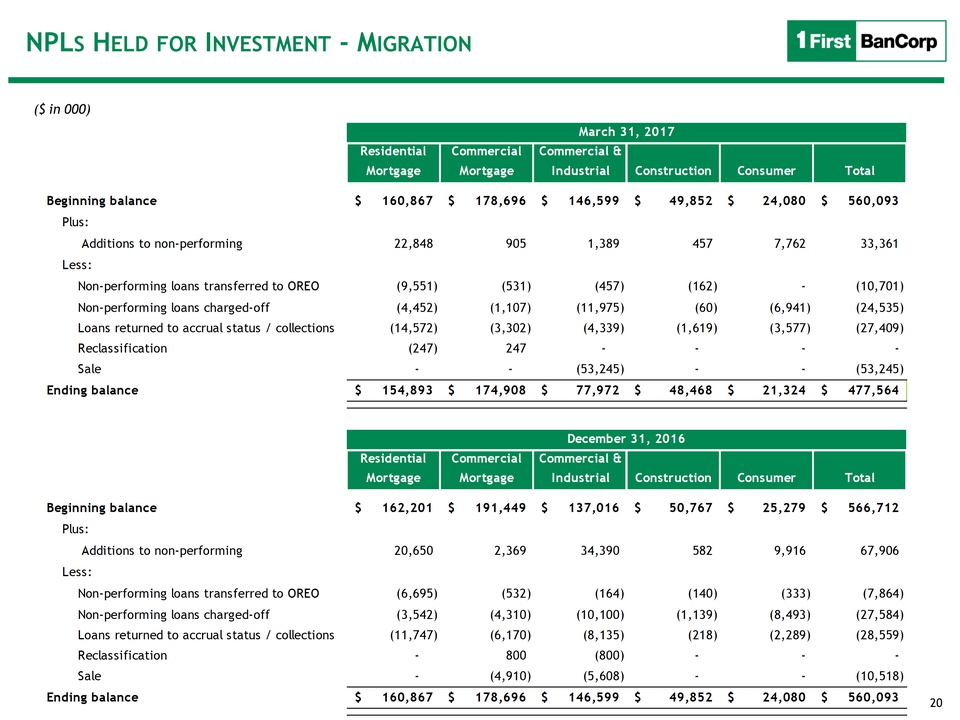

20 NPLs Held for Investment - Migration ($ in 000)

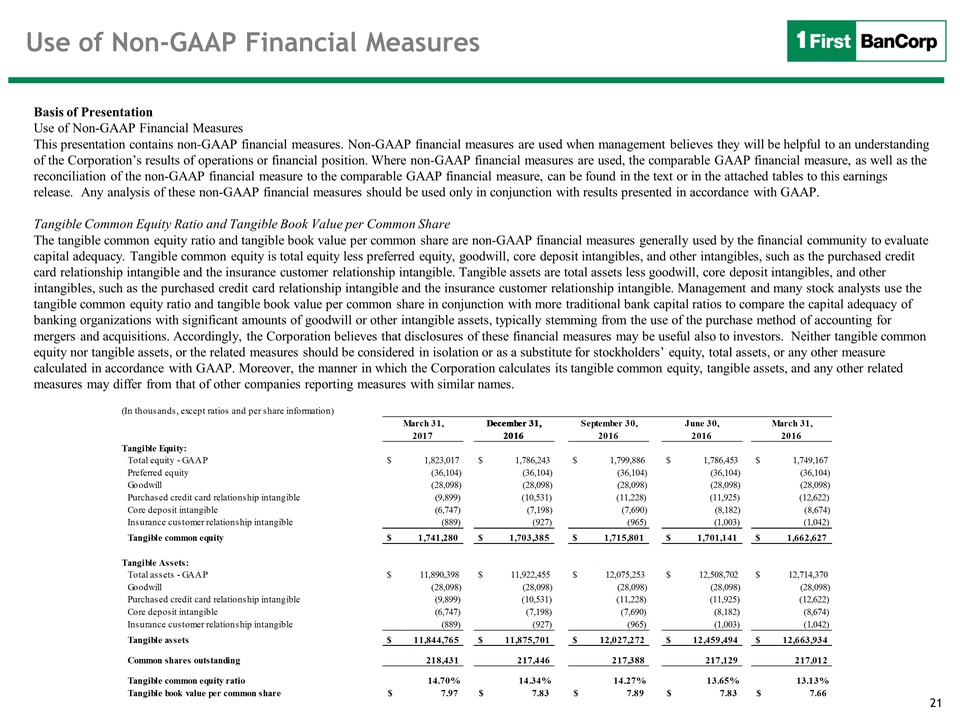

21 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP financial measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Tangible assets are total assets less goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosures of these financial measures may be useful also to investors. Neither tangible common equity nor tangible assets, or the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity, tangible assets, and any other related measures may differ from that of other companies reporting measures with similar names.

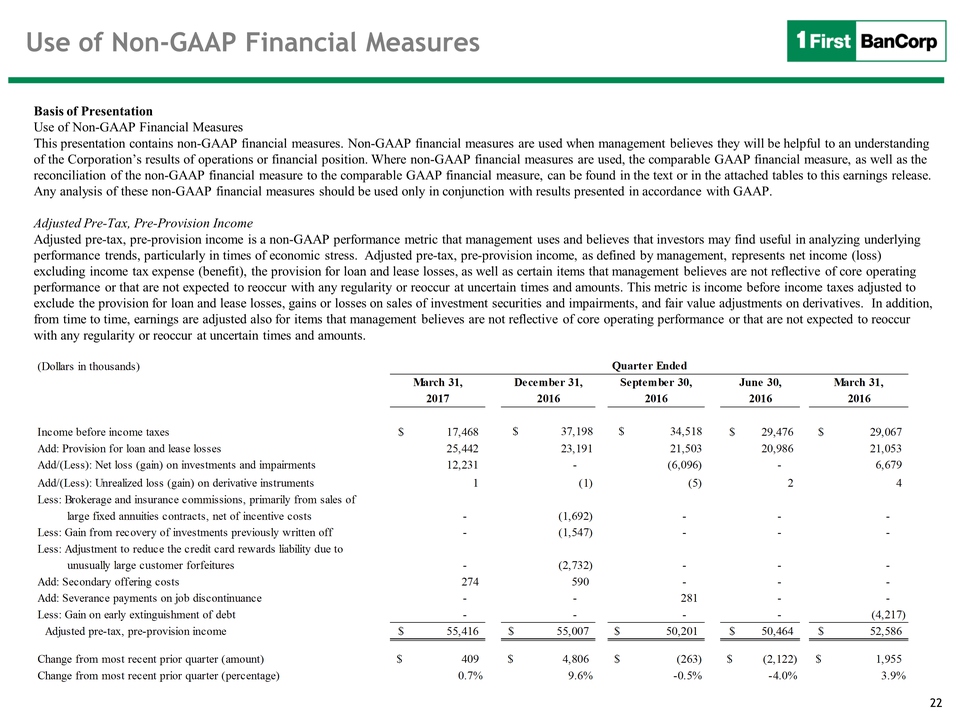

22 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Pre-Tax, Pre-Provision IncomeAdjusted pre-tax, pre-provision income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted pre-tax, pre-provision income, as defined by management, represents net income (loss) excluding income tax expense (benefit), the provision for loan and lease losses, as well as certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is income before income taxes adjusted to exclude the provision for loan and lease losses, gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives. In addition, from time to time, earnings are adjusted also for items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts.

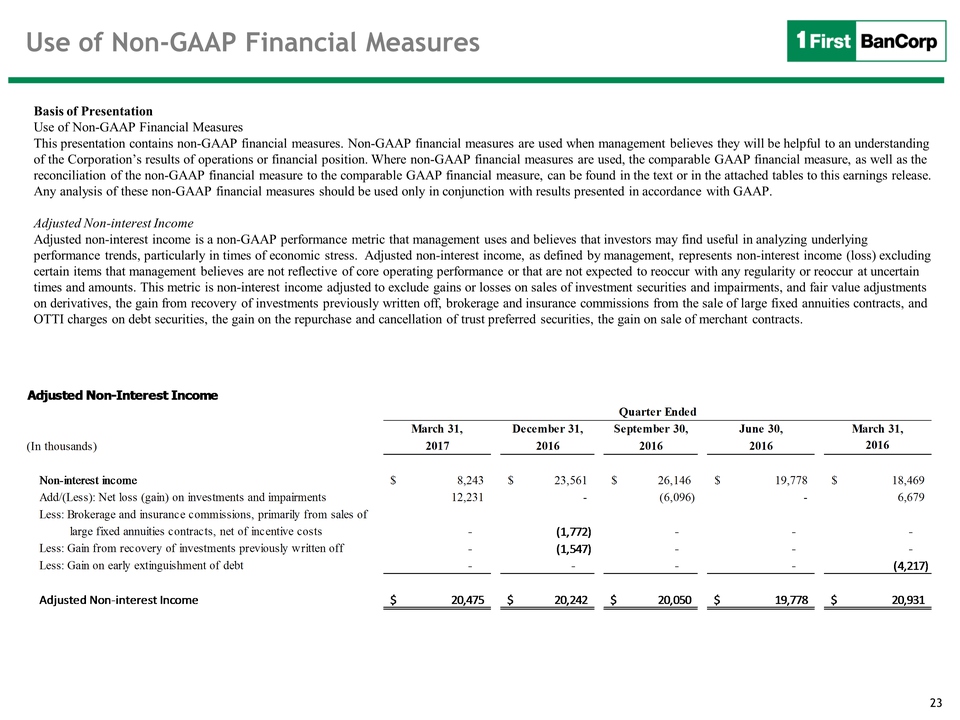

23 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Non-interest IncomeAdjusted non-interest income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted non-interest income, as defined by management, represents non-interest income (loss) excluding certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is non-interest income adjusted to exclude gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives, the gain from recovery of investments previously written off, brokerage and insurance commissions from the sale of large fixed annuities contracts, and OTTI charges on debt securities, the gain on the repurchase and cancellation of trust preferred securities, the gain on sale of merchant contracts.