Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - SiteOne Landscape Supply, Inc. | d373596dex231.htm |

Table of Contents

As filed with the U.S. Securities and Exchange Commission on April 24, 2017

Registration No. 333-217327

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SiteOne Landscape Supply, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 5040 | 46-4056061 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

300 Colonial Center Parkway, Suite 600

Roswell, Georgia 30076

(470) 277-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Briley Brisendine

Executive Vice President, General Counsel and Secretary

SiteOne Landscape Supply, Inc.

300 Colonial Center Parkway, Suite 600

Roswell, Georgia 30076

(470) 277-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

| Peter J. Loughran, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 |

John C. Ericson, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 24, 2017

8,500,000 Shares

SiteOne Landscape Supply, Inc.

Common Stock

All of the 8,500,000 shares of common stock are being offered by the selling stockholders identified in this prospectus. We will not receive any of the proceeds from the sale of the shares being sold in this offering.

The common stock of SiteOne Landscape Supply, Inc. is listed on the New York Stock Exchange under the symbol SITE. The last reported sale price of the common stock on April 21, 2017 was $48.29 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 18 of this prospectus.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

The underwriters also may purchase up to 1,275,000 additional shares from the selling stockholders at the public offering price less the underwriting discounts and commissions within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2017.

| Deutsche Bank Securities | Goldman, Sachs & Co. | UBS Investment Bank |

Baird

Barclays RBC Capital Markets SunTrust Robinson Humphrey William Blair

ING HSBC Natixis SMBC Nikko Mischler Financial Group, Inc.

Prospectus dated , 2017

Table of Contents

| 1 | ||||

| 13 | ||||

| 14 | ||||

| 18 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 48 | ||||

| 54 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders |

56 | |||

| 60 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

| 69 |

You should rely only on the information contained or incorporated by reference in this prospectus and any free writing prospectus we may authorize to be delivered to you. We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained or incorporated by reference in this prospectus and any related free writing prospectus. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is only accurate as of the date such information is presented, regardless of the time of delivery of this prospectus and any sale of shares of our common stock.

i

Table of Contents

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus, including the section entitled “Risk Factors” included in this prospectus and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included in our Annual Report on Form 10-K for the year ended January 1, 2017, or our “2016 Form 10-K,” which is incorporated by reference in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “we,” “our,” “us,” “SiteOne” and the “Company,” as used in this prospectus, refer to SiteOne Landscape Supply, Inc. and its consolidated subsidiaries. The term “Holdings” refers to SiteOne Landscape Supply, Inc. individually without its subsidiaries.

Our Company

We are the largest and only national wholesale distributor of landscape supplies in the United States and have a growing presence in Canada. Our customers are primarily residential and commercial landscape professionals who specialize in the design, installation and maintenance of lawns, gardens, golf courses and other outdoor spaces. As of April 2, 2017, we had 478 branch locations in 45 states and five provinces. Through our expansive North American network, we offer a comprehensive selection of more than 100,000 stock keeping units, or SKUs, including irrigation supplies, fertilizer and control products (e.g., herbicides), landscape accessories, nursery goods, hardscapes (including pavers, natural stones and blocks), outdoor lighting and ice melt products. We also provide value-added consultative services to complement our product offering and to help our customers operate and grow their businesses. Based on our net sales for the fiscal year ended January 1, 2017 (“2016 Fiscal Year”), we estimate that we are more than four times the size of our largest competitor and larger than the next two through ten competitors combined. We believe, based on management’s estimates, that we have either the number one or number two local market position in nearly 80% of metropolitan statistical areas, or MSAs, where we have one or more branches. Our market leadership, coast-to-coast presence, broad product selection and extensive technical expertise provide us with significant competitive advantages and create a compelling value proposition for both our customers and suppliers.

Our customers choose us for a number of reasons, including the breadth and availability of the products we offer, our high level of expertise, the quality of our customer service, the convenience of our branch locations and the consistency of our timely delivery. Our ability to provide a “one-stop shop” experience for our customers is aligned with the growing trend of landscape contractors providing an increasingly broad array of products and services. Because extensive technical knowledge and experience are required to successfully design, install and maintain outdoor spaces, we believe our customers find great value in the advice and recommendations provided by our knowledgeable sales and service associates, many of whom are former landscape contractors or golf course superintendents. Our consultative services include assistance with irrigation network design, commercial project planning, generation of sales leads, marketing services and product support, as well as a series of technical and business management seminars that we call SiteOne University. These value-added services foster an ongoing relationship with our customers that is a key element of our business strategy.

We have a diverse base of more than 180,000 customers, and our top 10 customers accounted for approximately 4% of our 2016 Fiscal Year net sales, with no single customer accounting for more than 2% of our 2016 Fiscal Year net sales. Our typical customer is a private landscape contractor that operates in a single market. We interact regularly with our customers because of the recurring nature of landscape services and because most contractors buy products on an as-needed basis. We believe our high-touch customer service model strengthens relationships, builds loyalty and drives repeat business. In addition, our broad product portfolio, convenient branch locations and nationwide fleet of over 1,400 delivery vehicles position us well to meet the needs of our customers and ensure timely delivery of products.

1

Table of Contents

Our strong supplier relationships support our ability to provide a broad selection of products at attractive prices. We believe we are the largest customer for many of our key suppliers, who benefit from the size and scale of our distribution network. We source our products from more than 2,500 suppliers, including the major irrigation equipment manufacturers, turf and ornamental fertilizer/chemical companies and a variety of suppliers who specialize in nursery goods, outdoor lighting, hardscapes and other landscape products. Some of our largest suppliers include Hunter, Rain Bird, Toro, Oldcastle, Bayer, Syngenta, BASF, Dow AgroSciences, Vista and NDS. We also develop and sell products under our proprietary and market-leading brands LESCO and Green Tech, which together accounted for approximately 19% of our 2016 Fiscal Year net sales. We believe these highly-recognized brands attract customers to our branches and create incremental sales opportunities for other products.

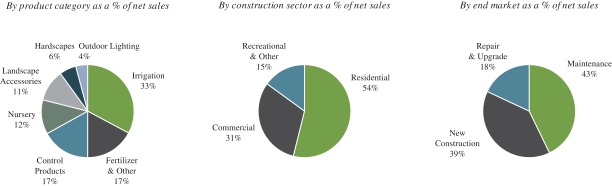

We have a balanced mix of sales across product categories, construction sectors and end markets. We derived approximately 54% of our 2016 Fiscal Year net sales from the residential construction sector, 31% from the commercial (including institutional) construction sector and 15% from the recreational and other construction sector. By end market, we derived approximately 43% of our 2016 Fiscal Year net sales from products for the maintenance of residential, commercial and recreational properties. The recurring nature of landscape maintenance demand helps to provide stability in our financial performance across economic cycles. Fertilizer and control products are the primary products used in maintenance. The sale of products relating to new construction of homes, commercial buildings and recreational spaces accounted for approximately 39% of our 2016 Fiscal Year net sales. These products primarily include irrigation, nursery, hardscapes, outdoor lighting and landscape accessories. We expect sales in the new construction end market to continue to grow as a result of the ongoing recovery in the demand for new single-family homes, multi-family housing units and non-residential buildings. Approximately 18% of our 2016 Fiscal Year net sales were derived from sales of products for the repair and upgrade of existing landscapes. These sales benefit from increasing existing home sales, increasing home prices and rising consumer spending.

Net Sales for 2016 Fiscal Year

As of April 2, 2017, we have completed the acquisition of 18 companies since the CD&R Acquisition (as defined below) in December 2013, and we intend to pursue additional acquisitions to complement our organic growth and achieve our strategic objectives. Our organic and acquisition-driven growth strategies have led to significant increases in net sales and Adjusted EBITDA. For our 2016 Fiscal Year, we generated net sales of $1,648.2 million, net income of $30.6 million and Adjusted EBITDA of $134.3 million, compared to net sales of $1,451.6 million, net income of $28.9 million and Adjusted EBITDA of $106.5 million for the fiscal year ended January 3, 2016 (“2015 Fiscal Year”). See “—Summary Financial Data” for a reconciliation of our Adjusted EBITDA to net income.

2

Table of Contents

Our Executive Leadership

Doug Black joined us as our Chief Executive Officer in April 2014. Mr. Black is the former President and Chief Operating Officer of Oldcastle, the North American arm of CRH plc, where he helped grow net sales by over ten times and oversaw more than 100 acquisitions, including Oldcastle’s expansion into building products distribution. Mr. Black has joined a strong operational team with top-tier associates who have positively contributed to our performance. Mr. Black has also strengthened the capabilities of our executive leadership team by bringing in highly-qualified senior managers with functional expertise in strategy development, mergers and acquisitions, talent management, marketing, category management, supply chain management, national sales and information technology. These individuals have prior experience at a number of well-known companies within the building products and industrial distribution sectors, including Oldcastle, HD Supply, Grainger, MSC Industrial Direct, Wesco, Newell Rubbermaid and The Home Depot.

Under Mr. Black’s leadership, we have established a focused business strategy to develop and attract industry-leading talent, deliver more value to customers, generate superior financial performance, drive organic growth, execute on attractive acquisitions and increase working capital efficiency. We are also undertaking a variety of initiatives targeting pricing, category management, sales force performance and supply chain management. At the local level, we have increased our focus on gaining market share by adding capabilities to our 50 geographic areas and 478 branches and by empowering area managers and their teams to develop local strategies. These initiatives are in the early stages of implementation, and we believe they will continue to enhance our growth and profitability.

Our Industry

Based on management’s estimates, we believe that our addressable market in North America for the wholesale distribution of landscape supplies represented approximately $17 billion in revenue in 2016. Growth in our industry is driven by a broad array of factors, including consumer spending, housing starts, existing home sales, home prices, commercial construction, repair and remodeling spending, and demographic trends. Within the wholesale landscape supply distribution industry, products sold for residential applications represent the largest construction sector, followed by the commercial and recreational and other construction sectors.

The wholesale landscape supply distribution industry is highly fragmented, consisting primarily of regional private businesses that typically have a small geographic footprint, a limited product offering and limited supplier relationships. Wholesale landscape supply distributors primarily sell to landscape service firms, ranging from sole proprietorships to national enterprises. Landscape service firms include general landscape contractors and specialty landscape firms, such as lawn care, tree and foliage maintenance firms. Over the past decade, professional landscape contractors have increasingly offered additional products and services to meet their customers’ needs. These firms historically needed to make numerous trips to branches in various locations to source their products. Consequently, landscape professionals have come to value distribution partners who offer a “one-stop shop” with a larger variety of products and services, particularly given the recurring nature of landscape maintenance services.

According to an August 2015 Freedonia Group report, the U.S. wholesale landscape supply distribution industry was expected to grow at a compound annual growth rate, or CAGR, meaningfully higher than that of the overall economy through 2019. Hardscape and outdoor lighting products were expected to grow the fastest of our major landscape product categories through 2019 at an estimated CAGR of 7.3% and 8.1%, respectively. Industry growth is being driven, in part, by the rebound in the new residential and new non-residential (including commercial and institutional) construction markets. Housing starts are expected to grow 6% in 2017 to 1.2 million and 8% in 2018 to 1.3 million, according to the National Association of Home Builders. Additionally, U.S. non-residential construction spending is forecasted to grow 7% in 2017 and 6% in 2018, according to Dodge Data & Analytics.

3

Table of Contents

Other growth drivers of the landscape products industry include rising interest in more complex, decorative and functional landscaping spurred by the recent popularity of home and garden television shows and magazines; the increasingly popular concept of “outdoor living,” which involves relaxation, entertainment and spending more time outdoors with family and friends, and which continues to drive higher demand for landscape solutions that provide more functional living space and increase the value of the home; and rising demand for eco-friendly landscape products that promote water conservation and efficiency.

Our Competitive Strengths

We believe we benefit from the following competitive strengths:

Clear Market Leader in an Attractive Industry

We are the largest wholesale distributor of landscape supplies in the United States. Based on our 2016 Fiscal Year net sales, we estimate that we are more than four times the size of our largest competitor and larger than the next two through ten competitors combined. We believe, based on management’s estimates, that we have either the number one or number two local market position in nearly 80% of the MSAs where we have at least one branch. Our industry is highly fragmented, comprised of thousands of small, private or family-run businesses that compete with us primarily on a local market basis. We are the only national distributor in the landscape supply industry, with an estimated market share of approximately 10% based on third quarter of 2016 Fiscal Year net sales. As a result, we believe we have significant opportunities to increase our market share. Our national scale, broad product and service offering and market leadership also enable us to play an important role in the landscape supplies value chain by connecting a large and diverse set of manufacturers with a highly fragmented customer base.

Broadest Product Offering

We believe we offer the industry’s most comprehensive portfolio of landscape products, with over 100,000 SKUs from more than 2,500 suppliers. This broad product offering creates a “one-stop shop” for our customers and positively distinguishes us from our competitors. We maintain a high standard of product availability and timely delivery, which generally allows our customers to avoid investing significant capital to maintain their own inventory. In addition, our branches order specialty products directly from suppliers on behalf of our customers, who thereby benefit from our national purchasing scale, and we are able to supply custom services and products, such as fertilizers and soil blends, to meet specific job requirements. We also provide several proprietary products, including our LESCO and Green Tech brands, as well as promotional items offered through arrangements with selected manufacturers.

Superior Customer Value

We offer a variety of complementary, value-added services to support the sale of our products. At the local branch level, we have teams of experienced sales and service associates, many of whom are former landscape contractors or golf course superintendents. Our local staff provides customers with consultative services such as product selection and support, assistance with the design and implementation of landscape projects, and potential sales leads for new business opportunities. Our sales and service associates also coordinate the delivery of customer orders and help us to maintain our high delivery standards and fill rates. In addition, through our SiteOne University, we provide customers with technical training, licensing and business management seminars. We also offer a loyalty program, which we refer to as our Partners Program, under which customers can earn points redeemable for gift cards, account credits and other attractive commercial benefits. Our Partners Program, which had more than 12,000 enrolled customers as of January 1, 2017, also offers customers the opportunity to leverage our national buying power to purchase services for their businesses and employees. We believe the services we provide are an important differentiator that enhances the strength and longevity of our customer relationships.

4

Table of Contents

Strong and Scalable Platform for Driving Growth

Our national scale and geographic footprint make us an attractive partner for our customers and suppliers. Over the past three years, we have invested in management, corporate infrastructure and information systems for operating a company significantly larger than our current scale. Our local area and branch managers benefit from the substantial business and industry knowledge of our executive and senior operational management teams to help grow our business in their markets. We believe our platform can be leveraged to expand our customer base and grow our business with existing products and services, as well as to support the launch of new product offerings in our existing markets. We expect our greatest opportunities to expand will be in markets in which we currently operate but do not yet have a leading market position in one or more of our product categories.

Proven Ability to Identify, Execute and Integrate Acquisitions

We are a leading player in the consolidation of the fragmented industry for wholesale distribution of landscape supplies. Our current management team has extensive experience in identifying, executing and integrating acquisitions. Our industry leadership position, geographic footprint, ability to integrate acquisitions and access to financial resources make us the buyer of choice for many of our potential targets and give us an advantage over competing potential acquirers. As a result, we are able to achieve attractive multiples in primarily negotiated transactions. As of April 2, 2017, we have completed the acquisition of 18 companies since the CD&R Acquisition in December 2013, which we have integrated or are in the process of integrating into our business. A key element of our integration strategy is to achieve synergies at acquired companies from procurement, overhead cost reduction, sales initiatives and sharing of best practices across our organization. Our recent acquisitions have moved us into the leading position in several additional local markets or product categories. We expect the execution of synergistic acquisitions to continue to be an integral part of our growth strategy, and we intend to continue expanding our product line, geographic reach, market share and operational capabilities through future acquisitions.

Balanced Mix of Maintenance, New Construction and Repair and Upgrade Business

We have strategically invested in our product portfolio to position us to benefit from the ongoing recovery in the residential and commercial construction markets and to continue to benefit from stable growth of our maintenance products. We believe the new construction and repair and upgrade end markets provide us substantial upside in an economic upturn, and we are well-positioned to grow our business as a result of the continuing recovery in the housing sector and in construction spending for commercial buildings and facilities. In addition, our distribution of maintenance products provides a steady stream of more recurring sales, which we expect will further support our business through economic cycles. We believe our balanced sales mix in support of the maintenance, new construction and repair and upgrade end markets positions us to achieve consistent growth through our branch networks nationally.

Experienced and Proven Management Team Driving Organic and Acquisition Growth

We believe our management team, including regional vice presidents, area managers, area business managers and branch managers, is among the most experienced in the industry. Members of our executive leadership team have a strong track record of improving performance and successfully driving both internal and acquisitive growth during their tenure with SiteOne and prior to joining our company. Our team not only has a clearly defined operational strategy to promote growth and profitability for SiteOne but also an ambitious vision to be a world-class leader in the industry. We believe the scale of our business and our leading market position will allow us to continue to attract and develop industry-leading talent.

5

Table of Contents

Our Strategies

We intend to leverage our competitive strengths to increase shareholder value through the following core strategies:

Build Upon Strong Customer and Supplier Relationships to Expand Organically

Our national footprint and broad supplier relationships, combined with our regular interaction with a large and diverse customer base, make us an important link in the supply chain for landscape products. Our suppliers benefit from access to our more than 180,000 customers, a single point of contact for improved production planning and efficiency, and our ability to bring new product launches quickly to market on a national scale. We intend to continue to increase our size and scale in customer, geographic and product reach, which we believe will continue to benefit our supplier base. Our customers in turn benefit from our local market leadership, talented associates, broad product offering and high inventory availability, timely delivery and complementary value-added services. We will continue to work with new and existing suppliers to maintain the most comprehensive product offering for our customers at competitive prices and enhance our role as a critical player in the supply chain. As we continue to grow, we believe our strong customer and supplier relationships will enable us to expand our market share in the landscape supplies industry.

Grow at the Local Level

The vast majority of our customers operate at a local level. We believe we can grow market share in our existing markets with limited capital investment by systematically executing local strategies to expand our customer base, increase the amount of our customers’ total spending with us, optimize our network of locations, coordinate multi-site deliveries, partner with strategic local suppliers, introduce new products and services, increase our share of underrepresented products in particular markets and improve sales force performance. We currently offer our full product line in only 24% of the U.S. MSAs where we have a branch, and therefore believe we have the capacity to offer significantly more product lines and services in our geographic markets.

Pursue Value-Enhancing Strategic Acquisitions

Through recently completed acquisitions, we have added new markets in the United States and Canada, new product lines, talented associates and operational best practices. In addition, we increased our sales by introducing products from our existing portfolio to customers of newly acquired companies. We intend to continue pursuing strategic acquisitions to grow our market share and enhance our local market leadership positions by taking advantage of our scale, operational experience and acquisition know-how to pursue and integrate attractive targets. We believe we have significant opportunities to add product categories in our existing markets through acquisitions. In addition, we currently have branches in 177 of the 381 U.S. MSAs and are focused on identifying and reviewing attractive new geographic markets for expansion through acquisitions. We will continue to apply a selective and disciplined acquisition strategy to maximize synergies obtained from enhanced sales and lower procurement and corporate costs.

Execute on Identified Operational Initiatives

We have undertaken significant operational initiatives, utilizing our scale to improve our profitability, enhance supply chain efficiency, strengthen our pricing and category management capabilities, streamline and refine our marketing process and invest in more sophisticated information technology systems and data analytics. In addition, we work closely with our local area team leaders to improve sales, delivery and branch productivity. Although we are still in the early stages of these initiatives, they have already contributed to improvement in our profitability, and we believe we will continue to benefit from these and other operational improvements.

6

Table of Contents

Be the Employer of Choice

We believe our associates are the key drivers of our success, and we aim to recruit, train, promote and retain the most talented and success-driven personnel in the industry. Our size and scale enable us to offer structured training and career path opportunities for our associates, while at the area and branch level we have built a vibrant and entrepreneurial culture that rewards performance. We promote ongoing, open and honest communication with our associates to ensure mutual trust, engagement and performance improvement. We believe that high-performing local leaders coupled with creative, adaptable and engaged associates are critical to our success and to maintaining our competitive position, and we are committed to being the employer of choice in our industry.

Recent Developments

Expected First Fiscal Quarter 2017 Results

For the three months ended April 2, 2017, we expect net sales to be $332.0 million to $337.0 million, an increase of $3.5 million to $8.5 million, or 1% to 3%, as compared to net sales of $328.5 million for the three months ended April 3, 2016; net loss to be $(11.2) million to $(10.2) million, a decrease of $5.6 million to $4.6 million, as compared to a net loss of $(5.6) million for the three months ended April 3, 2016; and Adjusted EBITDA to be $0.5 million to $1.5 million, a decrease of $4.0 million to $3.0 million, as compared to Adjusted EBITDA of $4.5 million for the three months ended April 3, 2016. Our expected net sales growth for the three months ended April 2, 2017 includes the impact of acquisitions and slightly negative organic daily sales growth, reflecting a return to normal spring weather patterns as compared to the early spring in 2016 when we experienced unusually strong organic daily sales growth compared to our historical first quarter experience. Our results for the quarter benefited from sales growth in the construction sector and gross margin improvement from our operational initiatives, offset by increased operating expenses due to our acquisitions and higher interest expense driven by the higher debt levels and a higher blended interest rate on our debt following our term loan refinancing and amendment transactions.

Our ongoing liquidity needs are expected to be funded by cash on hand, net cash provided by operating activities and, as required, borrowings under the ABL Facility (as defined in “Risk Factors—Risks Related to Our Substantial Indebtedness”). Our borrowing base capacity under the ABL Facility was approximately $114.8 million as of April 2, 2017 after giving effect to approximately $205.8 million of revolving credit loans under the ABL Facility, a $114.8 million increase from $91.0 million of revolving credit loans outstanding as of January 1, 2017, reflecting an increase in working capital in preparation for the spring selling season and the completion of four acquisitions in the first quarter.

The estimated results for the three months ended April 2, 2017 are preliminary, unaudited and subject to completion, reflect management’s current views and may change as a result of management’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary results are subject to the closing of the first fiscal quarter of 2017 and finalization of financial and accounting procedures (which have yet to be performed) and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). We caution you that the estimates of net sales, net income (loss) and Adjusted EBITDA are forward-looking statements and are not guarantees of future performance or outcomes and that actual results may differ materially from those described above. Factors that could cause actual results to differ from those described above are set forth in “Risk Factors” and “Forward-Looking Statements.” You should read this information together with the financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for prior periods included in our 2016 Form 10-K, which is incorporated by reference in this prospectus.

7

Table of Contents

Neither our independent registered public accounting firm nor any other independent registered public accounting firm has audited, reviewed or compiled, examined or performed any procedures with respect to the estimated results, nor have they expressed any opinion or any other form of assurance on the estimated results.

Adjusted EBITDA Description and Reconciliation

For the definition of Adjusted EBITDA, see “—Summary Financial Data.”

We present Adjusted EBITDA in this prospectus to evaluate the operating performance and efficiency of our business. Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA is not a measure of our liquidity or financial performance under GAAP and should not be considered as an alternative to net income (loss), operating income or any other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. The use of Adjusted EBITDA instead of net income (loss) has limitations as an analytical tool. Some of these limitations are further described in “—Summary Financial Data.”

The following table reconciles Adjusted EBITDA to net loss for the periods presented:

| Three months ended | ||||||||

| April 2, 2017 (preliminary) |

April 3, 2016 (actual) |

|||||||

| (in millions) (unaudited) |

||||||||

| Net loss |

$(11.2) – $(10.2) | $ | (5.6 | ) | ||||

| Income tax benefit |

(7.6) | (3.4 | ) | |||||

| Interest expense, net |

6.2 | 2.6 | ||||||

| Depreciation and amortization |

9.8 | 8.6 | ||||||

|

|

|

|

|

|||||

| EBITDA |

$(2.8) – $(1.8) | 2.2 | ||||||

| Stock-based compensation (a) |

1.4 | 0.7 | ||||||

| (Gain) loss on sale of assets (b) |

0.1 | (0.1 | ) | |||||

| Advisory fees (c) |

— | 0.5 | ||||||

| Rebranding, acquisitions and other adjustments (d) |

1.8 | 1.2 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA (e) |

$0.5 – $1.5 | $ | 4.5 | |||||

|

|

|

|

|

|||||

| (a) | Represents stock-based compensation expense recorded during the period. |

| (b) | Represents the gain or loss associated with the sale or write-down of assets not in the ordinary course of business. |

| (c) | Represents fees paid to Clayton, Dubilier & Rice, LLC (“CD&R”) and Deere & Company (“Deere”) for consulting services. In connection with our initial public offering, we entered into termination agreements with CD&R and Deere pursuant to which the parties agreed to terminate the related consulting agreements. See “Certain Relationships and Related Party Transactions—Consulting Agreements” included in our Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2017, or our “2017 Proxy Statement,” which is incorporated by reference in this prospectus. |

| (d) | Represents (i) expenses related to our rebranding to the name SiteOne and (ii) professional fees, retention and severance payments, and performance bonuses related to historical acquisitions. Although we have incurred professional fees, retention and severance payments, and performance bonuses related to acquisitions in several historical periods and expect to incur such fees and payments for any future acquisitions, we cannot predict the timing or amount of any such fees or payments. |

| (e) | Adjusted EBITDA excludes any earnings or loss of acquisitions prior to their respective acquisition dates for all periods presented. |

8

Table of Contents

Our History and Ownership

Our company was established in 2001, when Deere entered the market for wholesale landscape distribution through the acquisition of McGinnis Farms, a supplier of irrigation and nursery products with branches located primarily in the Southeastern United States. Subsequent acquisitions under Deere’s ownership included Century Rain Aid in 2001, United Green Mark in 2005 and LESCO Inc. (“LESCO”) in 2007, each of which significantly expanded our geographic footprint and broadened our product portfolio.

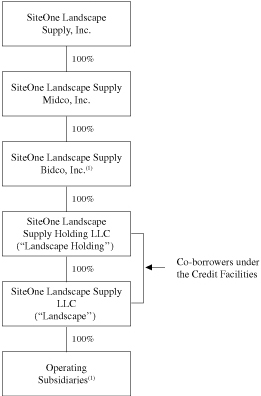

Holdings indirectly owns 100% of the membership interest in SiteOne Landscape Supply Holding LLC (“Landscape Holding”). Landscape Holding is the parent and sole owner of SiteOne Landscape Supply, LLC. Prior to the CD&R Acquisition described below, Deere was the sole owner of Landscape Holding.

In December 2013, CD&R Landscapes Holdings, L.P. (the “CD&R Investor”), an affiliate of CD&R, acquired a majority stake in us, which we refer to in this prospectus as the “CD&R Acquisition.” In May 2016, our registration statement on Form S-1 for our initial public offering was declared effective by the SEC, and the CD&R Investor and Deere together sold 11,500,000 shares of our common stock at a price of $21.00 per share.

In November 2016, Holdings registered on behalf of certain stockholders the offering and sale of 9,000,000 shares of common stock, as well as 1,350,000 shares of common stock sold to the underwriters pursuant to an option to purchase additional shares. On December 5, 2016, the selling stockholders completed the offering of 10,350,000 shares of common stock at a price of $33.00 per share. Holdings did not receive any of the proceeds from the aggregate 10,350,000 shares of common stock sold by the selling stockholders.

As of April 2, 2017, the common stock held by the CD&R Investor and Deere represented 27.9% and 14.9%, respectively, of the outstanding capital stock of Holdings. Both the CD&R Investor and Deere are selling stockholders in this offering.

After giving effect to the sale of the shares to be sold in this offering by the selling stockholders, the CD&R Investor and Deere will beneficially own 13.9% and 7.4%, respectively, of the shares of our outstanding common stock.

Founded in 1978, CD&R employs a distinctive approach to private equity investing, combining investment professionals and operating executives to pursue a strategy predicated on building stronger, more profitable businesses. Since inception, CD&R has managed the investment of more than $22 billion in 72 businesses with an aggregate transaction value of more than $100 billion. CD&R has a disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses.

Deere, a Delaware corporation, is a world leader in the manufacture and distribution of products and services for agriculture, construction, forestry and turf care. Deere also provides financial services and other related activities.

9

Table of Contents

Organizational Capital Structure

The following chart illustrates our organizational structure:

| (1) | SiteOne Landscape Supply Bidco, Inc. and each direct and indirect wholly-owned U.S. restricted subsidiary of Landscape are guarantors of the Term Loan Facility and the ABL Facility (together with Term Loan facility, the “Credit Facilities”). For definitions and descriptions of the Credit Facilities, see “Risk Factors—Risks Related to Our Substantial Indebtedness.” As of January 1, 2017, we had $91.0 million of outstanding borrowings under the ABL Facility and $297.9 million of outstanding borrowings under the Term Loan Facility. |

10

Table of Contents

Risks Related to Our Business

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects, that you should consider before making a decision to invest in our common stock. These risks are discussed more fully in “Risk Factors.” These risks include, but are not limited to, the following:

| • | cyclicality in residential and commercial construction markets; |

| • | general economic and financial conditions; |

| • | weather conditions, seasonality and availability of water to end users; |

| • | laws and government regulations applicable to our business that could negatively impact demand for our products; |

| • | public perceptions that our products and services are not environmentally friendly; |

| • | competitive industry pressures; |

| • | product shortages and the loss of key suppliers; |

| • | product price fluctuations; |

| • | inventory management risks; |

| • | ability to implement our business strategies and achieve our growth objectives; |

| • | acquisition and integration risks; |

| • | increased operating costs; |

| • | risks associated with our large labor force; |

| • | adverse credit and financial markets events and conditions; and |

| • | other factors set forth under “Risk Factors” in this prospectus. |

Market and Industry Data

This prospectus and the documents incorporated by reference in this prospectus include estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management’s knowledge of, and experience in, the landscape supply industry and market sectors in which we compete. Third-party industry publications and forecasts generally state that the information contained therein has been obtained from sources generally believed to be reliable. The industry data sourced from The Freedonia Group is derived from their Industry Study #3300, “Landscaping Products,” published in August 2015. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the captions “Risk Factors” and “Forward-Looking Statements” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2016 Form 10-K, which is incorporated by reference in this prospectus.

Service Marks, Trademarks and Trade Names

We own or have the right to use trademarks in connection with the operation of our business, including SiteOne and LESCO, which we consider important to our marketing activities. This prospectus also contains trademarks of other companies which to our knowledge are the property of their respective holders, and we do not intend our use or display of such marks to imply relationships with, or endorsements of us by, any other

11

Table of Contents

company. Solely for convenience, the trademarks referred to or incorporated by reference in this prospectus may appear without the ® or ™ symbols, but the absence of such symbols does not indicate the registration status of the trademarks and is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to such trademarks.

Corporate Information

Our corporate headquarters are located at 300 Colonial Center Parkway, Suite 600, Roswell, Georgia 30076. Our telephone number is (470) 277-7000.

12

Table of Contents

| Common stock offered by the selling stockholders |

8,500,000 shares. |

| Option to purchase additional shares of common stock |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 1,275,000 shares of common stock at the public offering price less underwriting discounts and commissions. |

| Common stock outstanding after this offering |

39,629,213 shares. |

| Use of proceeds |

We will not receive any proceeds from the sale of shares being sold in this offering, including from any exercise by the underwriters of their option to purchase additional shares. The selling stockholders will receive all of the net proceeds and bear all commissions and discounts from the sale of our common stock pursuant to this prospectus. |

| Dividend policy |

We do not currently anticipate paying dividends on our common stock for the foreseeable future. See “Dividend Policy.” |

| Trading symbol |

SITE. |

The number of shares of our common stock outstanding after this offering is based on the number of our shares of common stock outstanding as of April 2, 2017, and excludes:

| • | 3,434,729 shares of common stock issuable upon exercise of options to purchase shares outstanding as of April 2, 2017 at a weighted average exercise price of $11.32 per share; |

| • | 65,871 shares of common stock issuable pursuant to restricted stock units, or “RSUs,” as of April 2, 2017; |

| • | 27,778 shares of common stock issuable pursuant to deferred stock units, or “DSUs,” as of April 2, 2017; and |

| • | 1,375,129 shares of common stock reserved for future issuance under the SiteOne Landscape Supply, Inc. 2016 Omnibus Equity Incentive Plan (the “Omnibus Incentive Plan”) as of April 2, 2017. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares.

13

Table of Contents

The following tables set forth summary historical consolidated financial data as of the dates and for the periods indicated. The following tables set forth summary historical consolidated financial and other operating data as of the dates and for the periods indicated. The summary historical consolidated financial and other operating data as of January 1, 2017 and January 3, 2016 and for each of the years ended January 1, 2017, January 3, 2016 and December 28, 2014 have been derived from our audited consolidated financial statements and related notes included in our 2016 Form 10-K, which is incorporated by reference in this prospectus. The summary historical consolidated financial data as of December 28, 2014 has been derived from our consolidated financial statements and related notes not included in this prospectus or the documents incorporated by reference in this prospectus. The summary historical financial and other operating data are qualified in their entirety by, and should be read in conjunction with, our audited consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Selected Financial Data” included in Items 6 and 7 of our 2016 Form 10-K, which is incorporated by reference in this prospectus.

Our historical consolidated financial data may not be indicative of our future performance. The summary historical financial and operating data are qualified in their entirety by, and should be read in conjunction with, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included in our 2016 Form 10-K, which is incorporated by reference in this prospectus.

| Year Ended | ||||||||||||

| January 1, 2017 |

January 3, 2016 |

December 28, 2014 |

||||||||||

| (in millions, except share and per share data) | ||||||||||||

| Statement of operations data: |

||||||||||||

| Net sales |

$ | 1,648.2 | $ | 1,451.6 | $ | 1,176.6 | ||||||

| Cost of goods sold |

1,132.5 | 1,022.5 | 865.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

515.7 | 429.1 | 311.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross margin |

31.3 | % | 29.6 | % | 26.4 | % | ||||||

| Selling, general and administrative expenses |

446.5 | 373.3 | 269.0 | |||||||||

| Other income |

4.8 | 4.0 | 3.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

74.0 | 59.8 | 45.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Interest and other non–operating expenses |

22.1 | 11.4 | 9.1 | |||||||||

| Net income before taxes |

51.9 | 48.4 | 36.1 | |||||||||

| Income tax expense |

21.3 | 19.5 | 14.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 30.6 | $ | 28.9 | $ | 21.7 | ||||||

|

|

|

|

|

|

|

|||||||

| Less: |

||||||||||||

| Redeemable convertible preferred stock dividends |

9.6 | 25.1 | 21.8 | |||||||||

| Redeemable convertible preferred stock beneficial conversion feature |

— | 18.6 | 3.9 | |||||||||

| Special cash dividend paid to preferred stockholders |

112.4 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to common shares |

$ | (91.4 | ) | $ | (14.8 | ) | $ | (4.0 | ) | |||

|

|

|

|

|

|

|

|||||||

14

Table of Contents

| Year Ended | ||||||||||||

| January 1, 2017 |

January 3, 2016 |

December 28, 2014 |

||||||||||

| (in millions, except share and per share data) | ||||||||||||

| Net loss per common share: |

||||||||||||

| Basic |

$ | (3.01 | ) | $ | (1.04 | ) | $ | (0.29 | ) | |||

| Diluted |

$ | (3.01 | ) | $ | (1.04 | ) | $ | (0.29 | ) | |||

| Weighted average number of common shares outstanding: |

||||||||||||

| Basic |

30,316,087 | 14,209,843 | 13,818,138 | |||||||||

| Diluted |

30,316,087 | 14,209,843 | 13,818,138 | |||||||||

| Other financial data: |

||||||||||||

| Adjusted EBITDA (1) |

$ | 134.3 | $ | 106.5 | $ | 73.8 | ||||||

| Balance sheet data (at period end): |

||||||||||||

| Cash and cash equivalents |

$ | 16.3 | $ | 20.1 | $ | 10.6 | ||||||

| Working capital |

304.5 | 297.4 | 282.4 | |||||||||

| Total assets |

742.6 | 668.7 | 555.7 | |||||||||

| Total debt (2) |

375.5 | 177.7 | 121.7 | |||||||||

| Redeemable convertible preferred stock |

— | 216.8 | 192.6 | |||||||||

| Total stockholders’ equity |

148.8 | 87.8 | 78.8 | |||||||||

| Operations (at period end): |

||||||||||||

| Branch locations |

469 | 455 | 417 | |||||||||

| (1) | In addition to our net income (loss) determined in accordance with GAAP, we present Adjusted EBITDA in this prospectus to evaluate the operating performance and efficiency of our business. Adjusted EBITDA represents EBITDA as further adjusted for items permitted under the covenants of our Credit Facilities. EBITDA represents our net income (loss) plus the sum of income tax (benefit), depreciation and amortization and interest expense, net of interest income. Adjusted EBITDA is further adjusted for stock-based compensation expense, related party advisory fees, loss (gain) on sale of assets, other non-cash items, other non-recurring (income) and loss. We believe that Adjusted EBITDA is an important supplemental measure of operating performance because: |

| • | Adjusted EBITDA is used to test compliance with certain covenants under our Credit Facilities; |

| • | we believe Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results; |

| • | we believe Adjusted EBITDA is helpful in highlighting operating trends, because it excludes the results of decisions that are outside the control of operating management and that can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, age and book depreciation of facilities and capital investments; |

| • | we consider (gains) losses on the acquisition, disposal and impairment of assets as resulting from investing decisions rather than ongoing operations; and |

| • | other significant non-recurring items, while periodically affecting our results, may vary significantly from period to period and have a disproportionate effect in a given period, which affects comparability of our results. |

Adjusted EBITDA is not a measure of our liquidity or financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in

15

Table of Contents

accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. The use of Adjusted EBITDA instead of net income has limitations as an analytical tool. For example, this measure:

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect our interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | does not reflect our income tax (benefit) expense or the cash requirements to pay our income taxes; |

| • | does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and does not reflect any cash requirements for such replacements. |

Management compensates for these limitations by relying primarily on our GAAP results and by using Adjusted EBITDA only as a supplement to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, limiting its usefulness as a comparative measure. The following table presents a reconciliation of Adjusted EBITDA to net income:

| Year Ended | ||||||||||||

| January 1, 2017 |

January 3, 2016 |

December 28, 2014 |

||||||||||

| (in millions, unaudited) | ||||||||||||

| Net income |

$ | 30.6 | $ | 28.9 | $ | 21.7 | ||||||

| Income tax expense |

21.3 | 19.5 | 14.4 | |||||||||

| Interest expense, net |

22.1 | 11.4 | 9.1 | |||||||||

| Depreciation & amortization |

37.0 | 31.2 | 20.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

111.0 | 91.0 | 65.5 | |||||||||

| Stock-based compensation (a) |

5.3 | 3.0 | 2.1 | |||||||||

| Loss on sale of assets (b) |

— | 0.4 | 0.6 | |||||||||

| Advisory fees (c) |

8.5 | 2.0 | 2.0 | |||||||||

| Financing fees (d) |

4.6 | 5.5 | — | |||||||||

| Rebranding and other adjustments (e) |

4.9 | 4.6 | 3.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA (f) |

$ | 134.3 | $ | 106.5 | $ | 73.8 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Represents stock-based compensation expense recorded during the period. |

| (b) | Represents any gain or loss associated with the sale or write-down of assets not in the ordinary course of business. |

| (c) | Represents fees paid to CD&R and Deere for consulting services. In connection with our initial public offering, we entered into termination agreements with CD&R and Deere pursuant to which the parties agreed to terminate the related consulting agreements. See “Certain Relationships and Related Party Transactions—Consulting Agreements” included in our 2017 Proxy Statement, which is incorporated by reference in this prospectus. |

| (d) | Represents fees associated with our debt refinancing and credit agreement amendments, as well as fees incurred in connection with our initial public offering and secondary offering. |

16

Table of Contents

| (e) | Represents (i) expenses related to our rebranding to the name SiteOne and (ii) professional fees, retention and severance payments, and performance bonuses related to historical acquisitions. Although we have incurred professional fees, retention and severance payments, and performance bonuses related to acquisitions in several historical periods and expect to incur such fees and payments for any future acquisitions, we cannot predict the timing or amount of any such fees or payments. |

| (f) | Adjusted EBITDA excludes any earnings or loss of acquisitions prior to their respective acquisition dates for all periods presented. |

| (2) | Total debt includes current and non-current portion of long term debt offset by associated debt discount and excludes capital leases. |

17

Table of Contents

Investing in our common stock involves a high degree of risk. Our reputation, business, financial position, results of operations and cash flows are subject to various risks. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included or incorporated by reference in this prospectus, including our financial statements and related notes included in our 2016 Form 10-K, which is incorporated by reference in this prospectus, before making an investment decision. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us could materially and adversely affect our reputation, business, financial position, results of operations or cash flows. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below.

Risks Related to Our Business and Our Industry

Cyclicality in our business could result in lower net sales and reduced cash flows and profitability. We have been, and in the future may be, adversely impacted by declines in the new residential and commercial construction sectors, as well as in spending on repair and upgrade activities.

We sell a significant portion of our products for landscaping activities associated with new residential and commercial construction sectors, which have experienced cyclical downturns, some of which have been severe. The strength of these markets depends on, among other things, housing starts, consumer spending, non-residential construction spending activity and business investment, which are a function of many factors beyond our control, including interest rates, employment levels, availability of credit, consumer confidence and capital spending. Weakness or downturns in residential and commercial construction markets could have a material adverse effect on our business, operating results or financial condition.

Sales of landscape supplies to contractors serving the residential construction sector represent a significant portion of our business, and demand for our products is highly correlated with new residential construction. Housing starts are dependent upon a number of factors, including housing demand, housing inventory levels, housing affordability, foreclosure rates, demographic changes, the availability of land, local zoning and permitting processes, the availability of construction financing and the health of the economy and mortgage markets. Unfavorable changes in any of these factors could adversely affect consumer spending, result in decreased demand for homes and adversely affect our business. Beginning in mid-2006 and continuing through late-2011, the homebuilding industry experienced a significant downturn. The decrease in homebuilding activity had a significant adverse effect on our business during such time. According to the U.S. Census Bureau, 1.2 million housing units were started in 2016, representing an increase of approximately 5% from 2015. Nevertheless, housing starts in 2016 remained significantly below their historical long-term average. In addition, some analysts project that the demand for residential construction may be negatively impacted as the number of renting households has increased in recent years and as a shortage in the supply of affordable housing is expected to result in lower home ownership rates. The timing and extent of any recovery in homebuilding activity and the resulting impact on demand for landscape supplies are uncertain.

Our net sales also depend, in significant part, on commercial construction, which similarly recently experienced a severe downturn. Previously, downturns in the commercial construction market have typically lasted about two to three years, resulting in market declines of approximately 20% to 40%, while the most recent downturn in the commercial construction market lasted over four years, resulting in a market decline of approximately 60%. According to U.S. Census Bureau, total private commercial construction put in place began to recover in 2013 and increased approximately 20% in 2014, 6% in 2015 and 11% in 2016. However, 2016 new commercial construction spending was still well below pre-recession levels. We cannot predict the duration of the current market conditions or the timing or strength of any future recovery of commercial construction activity in our markets.

18

Table of Contents

We also rely, in part, on repair and upgrade of existing landscapes. High unemployment levels, high mortgage delinquency and foreclosure rates, lower home prices, limited availability of mortgage and home improvement financing, and significantly lower housing turnover, may restrict consumer spending, particularly on discretionary items such as landscape projects, and adversely affect consumer confidence levels and result in reduced spending on repair and upgrade activities.

Our business is affected by general business, financial market and economic conditions, which could adversely affect our financial position, results of operations and cash flows.

Our business and results of operations are significantly affected by general business, financial market and economic conditions. General business, financial market and economic conditions that could impact the level of activity in the wholesale landscape supply industry include the level of new home sales and construction activity, interest rate fluctuations, inflation, unemployment levels, tax rates, capital spending, bankruptcies, volatility in both the debt and equity capital markets, liquidity of the global financial markets, the availability and cost of credit, investor and consumer confidence, global economic growth, local, state and federal government regulation, and the strength of regional and local economies in which we operate. With respect to the residential construction sector in particular, spending on landscape projects is largely discretionary and lower levels of consumer spending or the decision by home-owners to perform landscape upgrades or maintenance themselves rather than outsource to contractors may adversely affect our business. There was a significant decline in economic growth in the United States, which began in the second half of 2007 and continued through the last quarter of 2009. There can be no guarantee that the improvements since that time in the general economy and our markets will be sustained or continue.

Seasonality affects the demand for our products and services and our results of operations and cash flows.

The demand for our products and services and our results of operations are affected by the seasonal nature of our irrigation, outdoor lighting, nursery, landscape accessories, fertilizers, turf protection products, grass seed, turf care equipment and golf course maintenance supplies. Such seasonality causes our results of operations to vary considerably from quarter to quarter. Typically, our net sales and net income have been higher in the second and third quarters of each fiscal year due to favorable weather and longer daylight conditions during these quarters. Our net sales and net income, however, are significantly lower in the first and fourth quarters due to lower landscaping, irrigation and turf maintenance activities in these quarters. Accordingly, results for any quarter are not necessarily indicative of the results that may be achieved for the full fiscal year.

Our operations are substantially dependent on weather conditions.

We supply landscape, irrigation and turf maintenance products, the demand for each of which is affected by weather conditions, including, without limitation, potential impacts, if any, from climate change. In particular, droughts could cause shortage in the water supply, which may have an adverse effect on our business. For instance, our supply of plants could decrease, or prices could rise, due to such water shortages, and customer demand for certain types of plants may change in ways in which we are unable to predict. Such water shortages may also make irrigation or the maintenance of turf uneconomical. Governments may implement limitations on water usage that make effective irrigation or turf maintenance unsustainable, which could negatively impact the demand for our products. In California, for instance, mandatory water restrictions went into effect across the state in 2015. We have also recently seen an increased demand in California for products related to drought-tolerant landscaping, including hardscapes and plants that require low amounts of water. There is a risk that demand for landscaping products will decrease overall due to persistent drought conditions in some of the geographic markets we serve, or that demand will change in ways that we are unable to predict.

Furthermore, adverse weather conditions, such as droughts, severe storms and significant rain or snowfall, can adversely impact the demand for our products, timing of product delivery, or our ability to deliver products at all. For example, severe winter storms can cause hazardous road conditions, which may prevent personnel from

19

Table of Contents

traveling or delivering to service locations. In addition, unexpectedly severe weather conditions, such as excessive heat or cold, may result in certain applications in the maintenance product cycle being omitted for a season or damage to or loss of nursery goods, sod and other green products in our inventory, which could result in losses requiring writedowns.

Laws and government regulations applicable to our business could increase our legal and regulatory expenses, and impact our business, financial position, results of operations and cash flows.

Our business is subject to significant federal, state, provincial and local laws and regulations. These laws and regulations include laws relating to consumer protection, wage and hour requirements, the employment of immigrants, labor relations, permitting and licensing, building code requirements, workers’ safety, the environment, employee benefits, marketing and advertising and the application and use of herbicides, pesticides and other chemicals. In particular, we anticipate that various federal, state, provincial and local governing bodies may propose additional legislation and regulation that may be detrimental to our business, may decrease demand for the products we supply or may substantially increase our operating costs, including proposed legislation, such as environmental regulations related to chemical or nutrient use, water use, climate change, equipment efficiency standards and other environmental matters; other consumer protection laws or regulations; or health care coverage. It is difficult to predict the future impact of the broad and expanding legislative and regulatory requirements affecting our businesses and changes to such requirements may adversely affect our business, financial position, results of operations and cash flows. In addition, if we were to fail to comply with any applicable law or regulation, we could be subject to substantial fines or damages, be involved in litigation, suffer losses to our reputation or suffer the loss of licenses or incur penalties that may affect how our business is operated, which, in turn, could have a material adverse impact on our business, financial position, results of operations and cash flows.

Public perceptions that the products we use and the services we deliver are not environmentally friendly or safe may adversely impact the demand for our products or services.

We sell, among other things, fertilizers, herbicides, fungicides, pesticides, rodenticides and other chemicals. Public perception that the products we use and the services we deliver are not environmentally friendly or safe or are harmful to humans or animals, whether justified or not, or the improper application of these chemicals, could reduce demand for our products and services, increase regulation or government restrictions or actions, result in fines or penalties, impair our reputation, involve us in litigation, damage our brand names and otherwise have a material adverse impact on our business, financial position, results of operations and cash flows.

Our industry and the markets in which we operate are highly competitive and fragmented, and increased competitive pressures could reduce our share of the markets we serve and adversely affect our business, financial position, results of operations and cash flows.

We operate in markets with relatively few large competitors, but barriers to entry in the landscape supply industry are generally low, and we may have several competitors within a local market area. Competition varies depending on product line, type of customer and geographic area. Some local competitors may be able to offer higher levels of service or a broader selection of inventory than we can in particular local markets. As a result, we may not be able to continue to compete effectively with our competitors. Any of our competitors may foresee the course of market development more accurately than we do, provide superior service, sell or distribute superior products, have the ability to supply or deliver similar products and services at a lower cost, or on more favorable credit terms, develop stronger relationships with our customers and other consumers in the landscape supply industry, adapt more quickly to evolving customer requirements than we do, develop a superior network of distribution centers in our markets or access financing on more favorable terms than we can obtain. As a result, we may not be able to compete successfully with our competitors.

Competition can also reduce demand for our products and services, negatively affect our product sales and services or cause us to lower prices. Consolidation of professional landscape service firms may result in

20

Table of Contents

increased competition for their business. Certain product manufacturers that sell and distribute their products directly to landscapers may increase the volume of such direct sales. Our suppliers may also elect to enter into exclusive supplier arrangements with other distributors.

Former associates may start landscape supply businesses similar to ours, in competition with us. Our industry faces low barriers to entry, making the possibility of former associates starting similar businesses more likely. Increased competition from businesses started by former associates may reduce our market share and adversely affect our business, financial position, results of operations and cash flows.

Our customers consider the performance of the products we distribute, our customer service and price when deciding whether to use our services or purchase the products we distribute. Excess industry capacity for certain products in several geographic markets could lead to increased price competition. We may be unable to maintain our operating costs or product prices at a level that is sufficiently low for us to compete effectively. If we are unable to compete effectively with our existing competitors or new competitors enter the markets in which we operate, our financial condition, operating results and cash flows may be adversely affected.

Product shortages, loss of key suppliers, failure to develop relationships with qualified suppliers or dependence on third-party suppliers and manufacturers could affect our financial health.

Our ability to offer a wide variety of products to our customers is dependent upon our ability to obtain adequate product supply from manufacturers and other suppliers. Any disruption in our sources of supply, particularly of the most commonly sold items, could result in a loss of revenues, reduced margins and damage to our relationships with customers. Supply shortages may occur as a result of unanticipated increases in demand or difficulties in production or delivery. When shortages occur, our suppliers often allocate products among distributors. The loss of, or a substantial decrease in the availability of, products from our suppliers or the loss of key supplier arrangements could adversely impact our financial condition, operating results, and cash flows.

Our ability to continue to identify and develop relationships with qualified suppliers who can satisfy our high standards for quality and our need to be supplied with products in a timely and efficient manner is a significant challenge. Our suppliers’ ability to provide us with products can also be adversely affected in the event they become financially unstable, particularly in light of continuing economic difficulties in various regions of the United States and the world, fail to comply with applicable laws, encounter supply disruptions, shipping interruptions or increased costs, or face other factors beyond our control.