Attached files

| file | filename |

|---|---|

| EX-31.4 - CERTIFICATION PURSUANT TO RULE 13A-14(A)/15D-14(A) CERTIFICATIONS SECTION 302 OF - ADVANCED ENVIRONMENTAL RECYCLING TECHNOLOGIES INC | exhibit314-certificationb.htm |

| EX-31.3 - CERTIFICATION PURSUANT TO RULE 13A-14(A)/15D-14(A) CERTIFICATIONS SECTION 302 OF - ADVANCED ENVIRONMENTAL RECYCLING TECHNOLOGIES INC | exhibit313-certificationt.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment #1)

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended December 31, 2016

|

|

Or

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

Commission file number 1-10367

Advanced Environmental Recycling Technologies, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

71-0675758

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer

Identification No.)

|

|

914 N Jefferson Street

Springdale, Arkansas

|

72764

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s

telephone number, including area code:

(479) 756-7400

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Class A common stock, $.01 par value

(Title

of Class)

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check

mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check

mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☑ No ☐

Indicate by check

mark whether the registrant has submitted electronically and posted

on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of

Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or such shorter

period that the registrant was required to submit and post such

files).

Yes ☑ No ☐

Indicate by check

mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K (Section 229.405 of this chapter) is

not contained herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

☑

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☐ (Do not check if a smaller reporting

company)

|

Smaller

reporting company ☑

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

Indicate by check

mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act).

Yes ☐ No ☑

Number

of shares of Class A common stock outstanding at April 21, 2017:

Class A — 89,631,162

Documents

Incorporated by Reference: None

Table of Contents

|

Explanatory Note:

|

1

|

|

|

|

|

PART III

|

1

|

|

Item 10.

Directors, Executive Officers and Corporate

Governance.

|

1

|

|

Item 11.

Executive Compensation.

|

5

|

|

Item 12.

Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters.

|

8

|

|

Item 13.

Certain Relationships and Related Transactions

|

10

|

|

Item 14.

Principal Accounting Fees and Services.

|

10

|

|

|

|

|

PART IV

|

11

|

|

Item 15.

Exhibits and Financial Statement Schedules.

|

11

|

|

SIGNATURES

|

15

|

EXPLANATORY NOTE:

This

Amendment No. 1 to Form 10-K (this “Amendment”) amends

the Annual Report on

Form 10-K for the year ended December 31, 2016 originally filed on

March 17, 2017 (the “Original Filing”) by Advanced

Environmental Recycling Technologies, Inc. (the

“Company”, “AERT”, “we”,

“our” or “us”). We are filing this

Amendment to present the information required by Part III of Form

10-K as we will not file our proxy statement within 120 days of the

end of our fiscal year ended December 31, 2016.

This

Amendment also includes the currently dated certifications of our

principal executive officer and principal financial officer

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The

certifications of our principal executive officer and principal

financial officer are filed as Exhibits 31.3 and 31.4

hereto.

Except

as described above, this Amendment does not make any other changes

to the Original Filing. The Original Filing continues to speak as

of the date of the Original Filing and we have not modified or

updated any other disclosures set forth in the Original Filing to

reflect any events which occurred after the date the Original

Filing was filed.

The

directors and executive officers of the Company as of March 17,

2017 and their ages are as follows:

|

Name

|

|

Age

|

|

Position

|

Director Since

|

|

Timothy D. Morrison

|

|

58

|

|

Chief Executive Officer and Chairman

|

2009

|

|

J. R. Brian Hanna

|

|

64

|

|

Chief Financial Officer

|

N/A

|

|

Randall D. Gottlieb

|

|

43

|

|

President and Director

|

2015

|

|

Brent D. Gwatney

|

|

54

|

|

Senior Vice-President – Sales and Marketing

|

N/A

|

|

Alford E. Drinkwater

|

|

65

|

|

Senior Vice-President – Dev & Gov'tl Affairs

|

N/A

|

|

Vernon J. Richardson

|

|

50

|

|

Director

|

2010

|

|

Michael R. Phillips

|

|

42

|

|

Director

|

2011

|

|

Todd J. Ofenloch

|

|

41

|

|

Director

|

2011

|

|

Bobby J. Sheth

|

|

39

|

|

Director and Secretary

|

2011

|

Timothy D.

Morrison joined AERT as President in March 2008

and has served as a director since June 2009. On August 8,

2013, by special resolution of the Board of Directors, Mr. Morrison

was appointed the Chief Executive Officer for AERT. He was

appointed Chairman of the Board July 1, 2015, replacing Joe G.

Brooks who resigned on June 30, 2015.

Mr.

Morrison has a background in polymer engineering as well as

experience in turnaround management. He began his career with

Dow Chemical in the hydrocarbons and polyethylene group where he

held both operations and business positions. He led the Promix

Joint Venture with Dow, Texaco, and Enterprise Products before

moving to Harris Chemical in 1992 as an equity partner where he led

the turnaround of operations, customer service, information

technology (IT), purchasing, and logistics for the leveraged buyout

group. In 2000, Mr. Morrison joined Cyctec’s engineered

products composite business, managing the composites and adhesives

business. He brings experience in successfully servicing the

needs and requirements of big box retailers from Valspar, where he

served most recently as manager for Valspar’s Texas

Division.

Mr.

Morrison’s qualifications to serve on the Board include the

same demonstrated skills that qualify him to serve as Chief

Executive Officer of the Company, including his industry and

technology experience as a manager in various manufacturing

companies and with a chemical engineering background. Mr. Morrison

has a B.S. in Chemical Engineering from the University of Alabama,

an M.B.A. from the University of Southern California, and training

in both Lean Manufacturing and Six Sigma.

1

J. R. Brian Hanna

joined AERT as Chief Financial Officer

in November 2008. Mr. Hanna had most recently served as

Chief Financial Officer of JT Sports (formerly Brass Eagle Inc.)

from December 1, 1997 to October 31, 2008. Mr. Hanna

obtained his Chartered Accountant’s designation with Deloitte

& Touche in 1982 and later became a Certified Public

Accountant. Mr. Hanna’s background includes merger and

acquisition integrations, financial system/IT implementations in

addition to establishing internal controls, strategic planning, and

treasury functions.

Randall D. Gottlieb

joined AERT in 2013 assuming the role

of President. Mr. Gottlieb has a background in general management,

sales, and production. Mr. Gottlieb graduated from Miami University

in Oxford, Ohio in 1995 with a B.S. in Manufacturing

Engineering, cum laude. He received his M.B.A. from Duke University in

Durham, North Carolina in 2001.

Mr.

Gottlieb began his career in 1995 with Accenture of Chicago,

Illinois, where he resolved business and technical issues for a

variety of industries, including Caterpillar, Inc. for whom he

redesigned an order filling process and implemented changes through

software design. In 2001, through the North Mississippi Broadband

Access Initiative in Tupelo, Mississippi, Mr. Gottlieb created a

plan to provide broadband internet access within an underserved

16-county region in north Mississippi. During 2002 and 2003, while

at Tefen USA of New York City, Mr. Gottlieb worked with Pfizer,

Pharmacia and Schering Plough to increase testing efficiency. Mr.

Gottlieb came to AERT from Oldcastle, North America’s largest

manufacturer of building products and materials. During his time at

Oldcastle, Mr. Gottlieb was also General Manager of two production

facilities and later was responsible for the sales and marketing

effort related to Lowe’s in six product

categories.

Brent D. Gwatney joined AERT in October

2007 as the National Sales Manager for MoistureShield® sales. Mr.

Gwatney has over twenty-nine years in the building industry,

fourteen of which were as a manager of operations and sales in the

composite industry. He attended the Carlson School of Management

and Strategic Planning at the University of Minnesota. He served on

the board of NADRA (North American Deck and Rail Association) from

2012 through 2015. In August 2008, he was promoted to Vice

President of MoistureShield® Sales and in

2011 he was promoted to Senior Vice President of Sales and

Marketing for AERT.

Alford E. Drinkwater

has served as Senior Vice

President in various capacities since September 2003, and is

currently the Company’s Senior Vice President of Development

and Governmental Affairs. Prior to

joining the Company in May 2000, Mr. Drinkwater had been

the Assistant Director for the Established Industries Division of

the Arkansas Department of Economic Development. From

September 1986 until July 1988, he owned and operated

Town and Country Waste Services, Inc. a waste services company

engaging in the development of waste recycling, energy recovery,

and disposal systems. From April 1981 until January 1987,

Mr. Drinkwater was the Resource Recovery Manager for

Metropolitan Trust Company, and was primarily involved in

waste-to-energy systems development. From July 1974 until

April 1981, Mr. Drinkwater worked for the State of

Arkansas as Assistant to the Chief of the Solid Waste Control

Division of the Arkansas Department of Pollution Control &

Ecology and as the Manager of the Biomass and Resource Recovery

Program of the Arkansas Department of Energy.

Dr. Vernon J. Richardson is the

distinguished professor of Accounting in the Sam M. Walton College

of Business at the University of Arkansas. He received an M.B.A.

and undergraduate degrees in accounting from Brigham Young

University prior to receiving a Ph.D. in accounting from the

University of Illinois at Urbana-Champaign. Dr. Richardson then

joined the faculty of the University of Kansas, holding assistant

and associate professor positions from 1997 to 2005. He has been a

professor in the Sam M. Walton College of Business at the

University of Arkansas since 2005 and is currently the S. Robson

Walton Endowed Chair in Accounting. He served as department chair

of the accounting department for 8 years. Dr. Richardson has

served in various positions with the American Accounting

Association, and performs expert witness and consulting services.

He has served as a director at Reassure America Life Insurance

Company. Director qualifications include leadership, research,

technology and finance experience as an accounting professor and

chair of a university level accounting department.

Michael R. Phillips is a Partner with

Highland Consumer Partners, an independent venture capital firm.

Mr. Phillips has many years of experience in investing in and

advising middle market companies. Prior to Highland Consumer

Partners, Mr. Phillips was a Managing Director at H.I.G. Capital,

and also worked at Bain & Company, Electra Partners, and Lehman

Brothers. Mr. Phillips earned his B.S.in Engineering from Princeton

University and an M.B.A. from the Wharton School at the University

of Pennsylvania. Mr. Phillips’ experience in investment

banking, financial consulting, and risk management gives him a

valuable perspective and insight into the issues facing our company

today and is applicable to our business needs.

Todd J. Ofenloch is Managing Director in

the Boston office of H.I.G. Capital, a global private equity and

alternative assets investment firm. Mr. Ofenloch is responsible for

evaluating and executing new investment opportunities, as well as

working with certain existing portfolio companies. He has many

years of experience investing in middle market private equity

transactions and has worked on investments in a broad range of

industries. Prior to H.I.G. Capital, Mr. Ofenloch was an

investment professional at Parthenon Capital Partners and GTCR. He

began his career as an investment banker at Lazard Frères,

specializing in mergers and acquisitions advisory services.

Mr. Ofenloch graduated from the University of Illinois with a

B.S. in Accountancy and received an M.B.A. from Columbia Business

School. Mr. Ofenloch’s experience with business development,

strategic planning, and risk management is applicable to our

company needs. His knowledge and expertise in finance and assorted

business markets are beneficial on our Board.

2

Bobby J. Sheth is a Managing Director

and Head of Roynat Equity Partners, a private equity firm and

division of Roynat, Inc. and Scotiabank. Prior to joining Roynat

Equity Partners, Mr. Sheth worked for H.I.G. Capital as an

investment professional, where he participated in a variety of new

deal processes, divestitures, and financings. Mr. Sheth also sat on

the boards of several H.I.G. Capital's portfolio companies. Earlier

in his career Mr. Sheth worked as a consultant for Alvarez &

Marsal and as an Investment Banker for Citigroup. Mr. Sheth earned

a Bachelor of Commerce in Finance from the University of Toronto

and an M.B.A. from Harvard Business School. He is also a Chartered

Financial Analyst. Mr. Sheth's experience as a private equity

investor, investment banker as well as his knowledge in risk

management, business development, and strategic planning provides a

strong perspective into the needs of our company. Mr. Sheth has

also served as our Secretary since 2011.

Section 16(a) Beneficial Ownership Reporting

Compliance

Section

16(a) of the Exchange Act requires executive officers and

directors, a company’s chief accounting officer and persons

who beneficially own more than 10% of a company’s common

stock, to file initial reports of ownership and reports of changes

in ownership with the SEC. Executive officers, directors, the chief

accounting officer and beneficial owners of more than 10% of our

common stock are required by SEC regulations to furnish us with

copies of all Section 16(a) forms they file.

Based

solely on our review of copies of such reports and written

representations from our executive officers and directors, we

believe that our executive officers and directors complied with all

Section 16(a) filing requirements during 2016.

Corporate Governance

The

number of directors that serve on the Board is currently set at

seven. In accordance with the Company’s bylaws, directors are

elected for a term of one year and until their successors are duly

elected and qualified. Messrs. Morrison, Gottlieb and Richardson

were elected at the 2016 annual meeting of stockholders, and

Messrs. Phillips, Sheth, Ofenloch and Brain James were elected as

Series E Directors by H.I.G. AERT, LLC in 2016. Mr. James submitted

his resignation to the Board of Directors on October 28, 2016. The

resulting vacancy has not been filled.

Officers serve at

the discretion of the Board of Directors. No current-standing

director or officer of the Company has any pending or prior legal

involvement that would be material to an evaluation of the ability

or integrity of any director.

Independence of Directors

Our

common stock is listed on the OTCQB Tier of the OTC Markets Group,

Inc. The OTCQB does not have any director independence standards.

Therefore, pursuant to the regulations promulgated by the SEC under

the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), we have adopted the definition of

independent director as described in Rule 5605 of the NASDAQ

Listing Standards. Our Board has determined that Dr. Vernon J.

Richardson, a current director, qualifies as

“independent” under the rules promulgated by the SEC

under the Exchange Act and NASDAQ Listing Standards.

Board Leadership

Our

Board of Directors’ current leadership structure includes a

Chairman of the Board and Audit, Compensation and Governance

Committees. The Audit Committee is chaired by an independent

director.

Our Board has

reviewed our current Board leadership structure in light of the

composition of the Board, the Company’s size, the nature of

the Company’s business, the regulatory framework under which

the Company operates, and other relevant factors. Considering these

factors, the Board determined to have the same individual, Timothy

D. Morrison, serve as Chief Executive Officer and Chairman of the

Board. The Board does not have or appoint a lead independent

director. Combining the roles of Chief Executive Officer and

Chairman promotes unified leadership and direction of the Company,

allowing for operation effectiveness and efficiencies that ensure

the implementation of strategic initiatives and business plans to

optimize stockholder value.

The

Audit Committee provides oversight of management and handling risk.

Our Audit Committee oversees the integrity of our consolidated

financial statements; the overall effectiveness of our system of

internal controls; our policies and procedures for assessing and

managing risk; along with compliance, regulatory and legal matters.

Members of our Board of Directors receive frequent updates from

management regarding all aspects of the enterprise risk management,

including our performance versus budget. Our Board of

Directors’ leadership structure is consistent with our

approach to risk oversight, as the Chief Executive Officer is

involved directly with management, and the corporate governance

role is enacted by the Board of Directors as a whole.

3

Stockholder and Interested Parties Communications with the

Board

Stockholders and

other interested parties may contact any of the Company’s

directors, a committee of the Board of Directors, the Board’s

independent director, or the Board generally, by writing to them at

Advanced Environmental Recycling Technologies, Inc., c/o Corporate

Secretary, at the address shown on the cover of this report. In

general, any communication delivered to the Corporate Secretary for

forwarding to any of the Company’s directors individually, a

committee of the Board or the Board’s independent directors

will be forwarded in accordance with the stockholder’s or

other interested party’s instruction, except that the

Corporate Secretary reserves the right not to forward any abusive,

threatening or otherwise inappropriate materials.

The

Company has also implemented a “Corporate Compliance

Line” through which the Compensation Committee, the Audit

Committee, the Board of Directors, and the corporate compliance

officer may be contacted, as appropriate. This service and number

is available on our corporate website.

Code of Ethics

The Company has established a Code of Ethics that

demonstrates our commitment to conduct our affairs in compliance

with all applicable laws and regulations and observe the highest

standards of business ethics and seeks to identify and mitigate

conflicts of interest between our directors, officers and

employees, on the one hand, and AERT on the other hand. We intend

that the spirit, as well as the letter, of the Code of Ethics be

followed by all our directors, officers, and employees, including

our principal executive officer, principal financial officer, and

principal accounting officer. This is communicated to each new

officer and employee and will be communicated to any new director.

Any waiver of our Code of Ethics with respect to our executive

officers and directors may only be authorized by our Board of

Directors. Our Code of Ethics is available under the Corporate

Governance section of our website, www.aert.com.

We intend to satisfy the disclosure requirements of Form 8-K

regarding any amendment to, or a waiver from, any provision of our

Code of Business Conduct and Ethics by posting such amendment or

waiver on our website.

Board Meetings and Certain Committee Reports and

Meetings

During

the Company’s fiscal year ended December 31, 2016, the

Board of Directors held two meetings. All Board members attended

the January meeting and six of seven attended the June

meeting.

Three

of the seven Board members attended the 2016 annual stockholders

meeting. The Company encourages, but does not require, directors to

attend annual meetings of stockholders. During fiscal 2016, the

Company did not hold any executive sessions of the Board of

Directors in which only independent members of the Board were

present.

The Board has three standing committees: Audit

Committee, the Compensation Committee, and the Corporate

Governance and Nominating Committee.

The charters of the Audit and Compensation Committees are available

on the corporate website at http://www.aert.com.

The Corporate Governance and

Nominating Committee does not have a charter. The Board may

establish other committees as it deems necessary or appropriate

from time to time.

Audit Committee

The

Audit Committee consists of Dr. Richardson and Messrs. Sheth and

Ofenloch, with Dr. Richardson serving as the chair. During the year

ended December 31, 2016, the Audit Committee met four times. The

Board of Directors has determined that Vernon Richardson qualifies

as an “audit committee financial expert” as such term

is defined in rules of the SEC implementing requirements of the

Sarbanes-Oxley Act of 2002.

The

Audit Committee is directly responsible for the engagement of the

Company’s independent accountants and is responsible for

approving the services performed by the Company’s independent

accountants and for reviewing and evaluating the Company’s

accounting principles and its system of internal accounting

controls. In 2016, the Audit Committee engaged in quarterly

discussions with the Company’s auditors concerning their

quarterly reviews and annual audit of the Company’s financial

statements and with management concerning their preparation of the

financial statements.

4

Compensation Committee

The

Compensation Committee consists of Messrs. Phillips, Sheth and Dr.

Richardson, with Mr. Phillips serving as the chair. The Compensation Committee establishes and

administers the Company’s compensation plans on behalf of the

Board of Directors and makes recommendations to the Board of

Directors as to stock options, restricted stock awards or other

awards granted thereunder and other compensation

matters.

Corporate Governance and Nominating Committee

The

Corporate Governance and Nominating Committee consists of all

members of the Board of Directors and identifies candidates for

election to the Board of Directors. The Committee believes that candidates for director should have

certain minimum qualifications, including being able to read and

understand financial statements and having the highest personal

integrity and ethics. The Committee also considers such factors as

relevant expertise and experience, ability to devote sufficient

time to the affairs of the Company, demonstrated excellence in his

or her field, the ability to exercise sound business judgment and

the commitment to rigorously represent the long-term interests of

the Company’s stockholders. Candidates for director are

reviewed in the context of the current composition of the Board,

the operating requirements of the Company and the long-term

interests of stockholders. The Committee is responsible for recommending candidates for

nomination. When considering potential director nominees,

the Committee reviews available

information regarding each potential candidate including

qualifications, experience, skills and integrity as well as race,

gender and ethnic diversity. The Committee also considers past performance before nominating

any director for re-election. Although we do not have a formal

policy regarding diversity, the Committee views its diversity as a priority and seeks

diverse representation among members.

The Corporate Governance and Nominating

Committee does not have a formal

process for identifying and evaluating nominees for director.

Instead, it uses its network of contacts to identify potential

candidates. The Committee will

conduct any appropriate and necessary inquiries into the

backgrounds and qualifications of possible candidates after

considering the function and needs of the Board. The

Committee will meet to discuss and

consider such candidates’ qualifications and then select a

nominee by majority vote.

Summary Compensation Table

The

following table sets forth the aggregate compensation the Company

paid for the two years ended December 31, 2016 and 2015 to the

Chief Executive Officer, the Chief Financial Officer, and the

President.

|

|

|

|

Salary

|

Bonus

|

All Other

Compensation

|

Total

|

|

Name

and Principal Position

|

|

Year

|

($)

|

($)

|

($) (1)

|

($)

|

|

Timothy

D. Morrison

|

|

2016

|

260,000

|

428,000

|

-

|

688,000

|

|

Chief

Executive Officer

|

|

2015

|

270,000

|

100,000

|

-

|

370,000

|

|

J. R.

Brian Hanna

|

|

2016

|

230,792

|

393,000

|

-

|

623,792

|

|

Chief

Financial Officer

|

|

2015

|

238,846

|

70,000

|

-

|

308,846

|

|

Randall

D. Gottlieb

|

|

2016

|

230,518

|

393,000

|

-

|

623,518

|

|

President

|

|

2015

|

231,924

|

80,000

|

-

|

311,924

|

(1) Does not include perquisites and other personal benefits or

property with aggregate value of less than

$10,000.

Setting Executive Compensation

The

Compensation Committee strives to establish and periodically review

AERT’s compensation philosophy and the adequacy of

compensation plans and programs for directors, executive officers

and other AERT employees and make recommendations to the Board of

Directors regarding:

●

Compensation

arrangements and incentive goals for executive officers and

administration of the compensation plans and recommendations to the

Board of Directors with respect thereto;

5

●

The

performance of the executive officers and incentive compensation

awards and adjustment of compensation arrangements as appropriate

based upon performance; and

●

Management

development and succession plans and activities.

The

primary components of our executive compensation programs are: base

salary, discretionary awards, and long-term incentive

awards.

Base

Salary

Base

salaries are generally targeted at the middle of the competitive

marketplace (the “median”).

The

“market rate” for an executive position is determined

through an assessment by our human resources personnel under

the guidance and supervision of the Compensation Committee. This

assessment considers relevant industry salary practices, the

position’s complexity, and level of responsibility, its

importance to AERT in relation to other executive positions, and

the competitiveness of an executive’s total

compensation.

Subject

to the Compensation Committee’s approval, the level of an

executive officer’s base pay is determined on the basis

of:

●

Relevant

comparative compensation data; and

●

The

Chief Executive Officer’s assessment (except with respect to

himself) of the executive’s performance, experience,

demonstrated leadership, job knowledge, and management

skills.

Discretionary Awards

The

Compensation Committee may, at its discretion, authorize periodic

cash awards to executives. Discretionary awards are designed to

give the Compensation Committee the flexibility to provide

incentives that are comparable to those found in the marketplace in

which we compete for executive talent. In determining the extent

and nature of discretionary awards, the Compensation Committee

considers our cash flow, net income, progress toward short-term and

long-term business objectives, and other competitive compensation

programs.

When

considering discretionary awards, the Compensation Committee

identifies the employees who are eligible to participate and

computes and certifies the size of the discretionary pool based on

financial information supplied by our executive officers. The award

made to each eligible participant is based on the opportunity level

assigned to the participant and an assessment of his or her

performance and the performance of their business unit versus

corporate objectives.

Long-Term Incentive Awards

Long-term

executive incentives are designed to promote the interests of AERT

and its stockholders by attracting and retaining eligible

directors, executives and other key employees. The Compensation

Committee has the authority to determine the participants to whom

awards shall be granted.

The

Compensation Committee may issue incentive-based compensation under

the Company’s 2012 Stock Incentive Plan (the

“Plan”), which was approved by security holders at the

Company’s annual shareholders’ meeting on June 27,

2012. Awards may be granted under the Plan in the form of stock

options, restricted stock units, performance awards, and other

cash- and stock-based awards. No awards have been made under the

Plan.

Employment Agreements

On

March 12, 2012, the Company entered into employment agreements with

former President and current Chief Executive Officer, Timothy D.

Morrison and Chief Financial Officer, J. R. Brian Hanna. Both

agreements were effective January 1, 2012 and expired on December

31, 2015. Both agreements automatically renewed on the same terms

and conditions on January 1, 2016 and will continue to renew for

additional one-year periods unless the Company or the Executive

gives the other party written notice of its election not to renew

the employment period at least 60 days prior to the renewal

date.

6

The

Employment Agreements provide Messrs. Morrison, and Hanna an annual

base salary of no less than $260,000 and $220,000 (subject to

periodic review and increase), respectively, with an annual bonus

potential for each based on performance goals and criteria approved

by the Compensation Committee. Messrs. Morrison and Hanna are

eligible to participate in the Company’s equity incentive

plan which will be subject to customary vesting, buy back, and

other provisions as determined by the Compensation

Committee.

On

August 8, 2013, the Company entered into an employment agreement

with Randall D. Gottlieb, President. His current annual salary is

$232,000 with annual bonus potential based on performance goals and

criteria, approved by the Compensation Committee. The agreement is

considered “at-will” and can be terminated by either

party at any time.

In

addition, each of the foregoing executives is eligible to receive

discretionary awards as discussed in “Executive Compensation – Discretionary Awards” above.

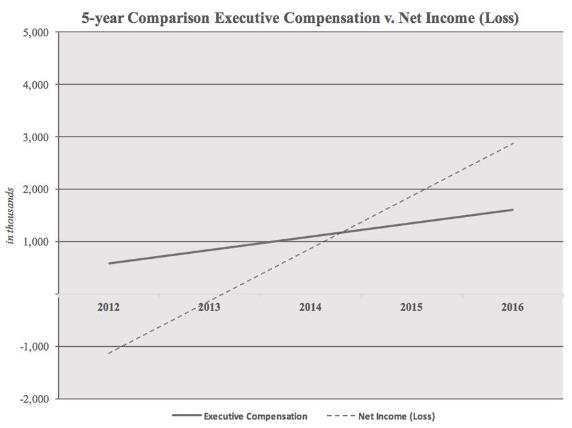

Executive Compensation vs. Net Income

The

following chart shows a five-year comparison of the aggregate

compensation the Company paid its executive officers versus the net

income (loss) before preferred dividends and income

tax.

7

401(k) Plan

The

Company sponsors the A.E.R.T. 401(k) Plan (the “401(k)

Plan”) for the benefit of all eligible employees. The 401(k)

Plan qualifies under Section 401(k) of the Internal Revenue

Code thereby allowing eligible employees to make tax-deferred

contributions to the 401(k) Plan. The 401(k) Plan provides that the

Company may elect to make discretionary-matching contributions

equal to a percentage of each participant’s voluntary

contribution. The Company may also elect to make a profit sharing

contribution to the 401(k) Plan. The Company approved a

discretionary match of $75,000 for the year ended December 31,

2016.

Director Compensation

Directors who are

also employees of AERT or H.I.G. Capital are not entitled to any

additional compensation by virtue of their service as a director,

except for reimbursement of any specific expenses attributable to

such service. The following table shows the compensation paid to

the non-employee directors of AERT during 2016:

|

Name

|

Fees Earned or

Paid in Cash

|

Total

|

|

Vernon J.

Richardson

|

$26,685

|

$26,685

|

Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder

Matters.

Equity Compensation Plan Information

The

following table provides information regarding shares outstanding

and available as of December 31, 2016 for issuance under our

2012 Stock Incentive Plan. No awards were issued in

2016.

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding

options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants

and rights

|

Number of securities remaining available for future issuance under

equity compensation plans (excluding securities reflected in the

first column of this table)

|

|

Equity

compensation plans approved by security holders

|

-

|

N/A

|

40,000,000

|

|

Equity

compensation plans not approved by security holders

|

-

|

N/A

|

-

|

|

|

-

|

-

|

40,000,000

|

Security Ownership of Certain Beneficial Owners and

Management

The

following table sets forth certain information with regard to the

beneficial ownership of the Company’s Class A common

stock and Series E Convertible Preferred Stock (the “Series E

Preferred Stock”) as of March 17, 2017 by: (1) each person,

or group of affiliated persons, known by us to beneficially own

more than 5% of our Common Stock or Preferred Stock. (2) each of

our directors; (3) each of our executive officers, and (4) all of

our directors and executive officers as a group.

8

Information

with respect to beneficial ownership has been furnished by each

director and executive officer. With respect to beneficial owners

of more than 5% of our outstanding Class A common stock and

Series E Preferred Stock, information is based on information filed

with the SEC. Except to the extent indicated in the footnotes to

the following table, each of the persons or entities listed therein

has sole voting and investment power with respect to the shares

which are reported as beneficially owned by such person or entity,

subject to applicable community property laws. Unless otherwise

noted below, the address of each beneficial owner listed in the

table is c/o Advanced Environmental Recycling Technologies, Inc.,

914 N. Jefferson St., Springdale, AR 72764.

|

Title of Class

|

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership (2)

|

|

Percent of Class (4)

|

|

|

|

|

|

|

|

|

|

Principal Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series E Preferred Stock

|

|

H.I.G. AERT, LLC (1)

|

|

20,524.149

|

|

100.0%

|

|

Class A Common Stock

|

|

H.I.G. AERT, LLC

|

|

408,373,979

|

(3)

|

84.6%

|

|

|

|

|

|

|

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock

|

|

Timothy D. Morrison

|

|

700,000

|

|

*

|

|

Class A Common Stock

|

|

J.R. Brian Hanna

|

|

500,000

|

|

*

|

|

Class A Common Stock

|

|

Randall D. Gottlieb

|

|

-

|

|

*

|

|

Class A Common Stock

|

|

Alford E. Drinkwater

|

|

100,000

|

|

*

|

|

Class A Common Stock

|

|

Brent D. Gwatney

|

|

60,000

|

|

*

|

|

Class A Common Stock

|

|

Vernon J. Richardson

|

|

10,000

|

|

*

|

|

Class A Common Stock

|

|

Michael R. Phillips

|

|

-

|

|

*

|

|

Class A Common Stock

|

|

Todd J. Ofenloch

|

|

-

|

|

*

|

|

Class A Common Stock

|

|

Bobby J. Sheth

|

|

-

|

|

*

|

|

Class A Common Stock

|

|

All Directors and Executive Officers as a Group (9

persons)

|

|

1,360,000

|

|

*

|

|

|

|

|

|

|

|

|

|

*Less than 1% of outstanding Class A common stock.

|

|

|

|

|

|

|

(1)

H.I.G.

AERT, LLC’s address is 1450 Brickell Avenue, 31st Floor,

Miami, Florida 33131.

(2)

Beneficial

ownership of shares was determined in accordance with

Rule 13d-3(d)(1) of the Exchange Act.

(3)

Includes

(i) 15,289,890 shares of Class A common and (ii) 393,084,089 shares

of Class A common stock issuable upon conversion of 20,524.149

shares of Series E Preferred Stock at the fixed rate of 19,152.27

shares of Class A common stock for each share of Series E Preferred

Stock, the “Conversion Rate” for the Series E Preferred

Stock pursuant to the Company’s Certificate of Designations,

Preferences and Rights of the Series E Convertible Preferred Stock

in the event of a fundamental transaction (which includes the

Merger, as defined below) occurs prior to August 1, 2017. Pursuant

to Schedule 13D/A last filed by H.I.G. AERT, LLC on April 1, 2016

with the SEC, (i) H.I.G. AERT, LLC has sole voting and dispositive

power over all the shares and no shared voting or dispositive power

with respect to any shares (ii) beneficial ownership of the

securities is shared with H.I.G. Capital Partners IV, L.P., Bayside

Opportunity Fund, L.P., H.I.G. Advisors IV, LLC, Bayside

Opportunity Advisors, LLC, H.I.G.-GPII, Inc., Sami W. Mnaymneh and

Anthony A. Tamer. Each such party expressly disclaims beneficial

ownership, except to the extent of its pecuniary interest in the

shares of Class A common stock. The shares of Series E Preferred

Stock are convertible into shares of Class A common stock at H.I.G.

AERT, LLC’s election and for no additional consideration

provided.

(4)

Class

A common stock beneficial ownership was calculated by dividing the

beneficial ownership of each stockholder by the sum of (i) the

total of 89,631,162 shares of Class A common stock outstanding as

of March 17, 2017 and (ii) in the case of each such stockholder,

any shares issuable to such stockholder upon the exercise or

conversion of any derivative securities that are currently

exercisable or become exercisable within 60 days of March 17, 2017

(which, with respect to H.I.G. AERT, LLC, includes 393,084,089

shares of Common Stock issuable to H.I.G. AERT, LLC in connection

with conversion of its Series E Preferred Stock).

9

Change in Control

On

March 16, 2017, the Company entered into an Agreement and Plan of

Merger (the “Merger Agreement”) with Oldcastle

Architectural, Inc., a Delaware corporation (“Parent”),

and Oldcastle Ascent Merger Sub, Inc., a Delaware corporation and

wholly-owned subsidiary of Parent (“Merger Sub”),

pursuant to which Merger Sub will merge with and into the Company,

with the Company continuing as the surviving corporation and a

wholly-owned subsidiary of Parent (the “Merger”). As a

result, the Company will cease to be an independent company traded

on the OTCQB.

At the

effective time of the Merger, each issued and outstanding share of

Class A common stock will be converted into the right to receive

$0.135936 in cash, less any required withholding taxes, and each

issued and outstanding share of Series E Preferred Stock will be

converted into the right to receive $2,603.483278 in cash, less any

required withholding taxes, in each case other than any shares of

Class A common stock and Series E Preferred Stock owned by the

Company and those shares of Class A common stock with respect to

which stockholders have properly exercised appraisal rights and

have not effectively withdrawn or lost their appraisal

rights.

From

time to time, the Company may enter into transactions with related

parties. In reviewing a transaction or relationship, the Board as a

whole, with the interested parties recusing themselves, will take

into account, among other factors it deems appropriate, whether the

transaction is on terms no more favorable than to an unaffiliated

third party under similar circumstances, as well as the extent of

the related party’s interest in the transaction.

Advisory Services Agreement with H.I.G. Capital

The

Company is party to an Advisory Services Agreement with H.I.G.

Capital, L.L.C. (“H.I.G. Capital”), an affiliate of

H.I.G. AERT, LLC (“H.I.G.”), that provides for an

annual monitoring fee between $250,000 and $500,000 and

reimbursement of all other out of pocket fees and expenses incurred

by H.I.G. Capital. In addition, pursuant to the terms of the

Advisory Services Agreement, H.I.G. Capital is entitled to a

financial advisory services fee and a supplemental management fee

in connection with any acquisition, disposition or material public

or private debt or equity financing of the Company, in each case

which has been introduced, arranged, managed and/or negotiated by

H.I.G. Capital or its affiliates. For a sale of the Company, or an

acquisition of 100% of any other company, the financial advisory

fee will be equal to one percent of the enterprise value of such

transaction and the supplemental management fee will be equal to

one percent of the enterprise value of such transaction.

Accordingly, H.I.G. Capital will be entitled to a financial

advisory fee of $1.17 million and a supplemental management fee of

$1.17 million in connection with the Merger, payable at the closing

of the Merger.

Directors Appointed by H.I.G.

Certain

members of the Board are affiliated with H.I.G. Mr. Ofenloch is a

Managing Director with H.I.G. Capital. Mr. Phillips was a Managing

Director with H.I.G. Capital and Mr. Sheth was a Principal with

H.I.G. Capital. Accordingly, such members of the Board may have an

indirect interest in the portion of the Merger Consideration to be

paid to H.I.G. In addition, such members may have an indirect

interest in the financial advisory fee of $1.17 million and the

supplemental management fee of $1.17 million payable to H.I.G.

Capital by the Company in connection with the Merger (as further

described above).

The

information below sets forth the fees charged by HoganTaylor LLP

during 2016 and 2015 for services provided to the Company in the

following categories and amounts:

|

|

2016

|

2015

|

|

Audit

fees

|

$156,650

|

$149,000

|

|

Audit-related

fees

|

14,500

|

11,000

|

|

Tax

fees

|

8,500

|

8,500

|

|

All

other fees

|

-

|

-

|

|

|

$179,650

|

$168,500

|

10

Audit

fees include amounts charged for the audit of the financial

statements for the year ended December 31, 2016, along with

fees for the review of the financial statements for the quarters

ended March 31, June 30, and September 30, 2016.

Audit-related fees include the audit of the financial statements of

the AERT, Inc. 401(k) Plan. Tax fees were paid for preparation of

federal and state tax returns, along with consulting services

related to certain tax issues.

Pre-Approval Policy

The

engagement of HoganTaylor LLP

as the Company’s independent registered public accounting

firm was approved in advance by the Audit Committee in accordance

with SEC rules and the Audit Committee’s Pre-Approval

Policies and Procedures, which provide that all engagements with

the independent registered public accounting firm for the provision

of audit or audit-related services to the Company must be

pre-approved by the Audit Committee or a designated member of the

Audit Committee. The Audit Committee’s pre-approval policy

also provides that the Company may engage the Company’s

independent registered public accounting firm for non-audit

services (i) only if such services are not prohibited from being

performed by the Company’s independent registered public

accounting firm under the Sarbanes-Oxley Act of 2002, Rule 2-01 of

Regulation S-X promulgated by the SEC thereunder, or any other

applicable law or regulation, and (ii) if such services are

tax-related services, such services are one or more of the

following tax-related services: tax return preparation and review;

advice on income tax, tax accounting, sales/use tax, excise tax and

other miscellaneous tax matters; and tax advice and implementation

assistance on restructurings, merger and acquisition matters and

other tax strategies. The pre-approval policy also provides that

any request for approval for the Company’s independent

registered public accounting firm to perform a permitted non-audit

service must be accompanied by a discussion of the reasons why the

Company’s independent registered public accounting firm

should be engaged to perform the services instead of an alternative

provider. None of the services described above were approved

pursuant to the de minimis exception provided in Rule

2-01(c)(7)(i)(C) of Regulation S-X promulgated by the

SEC.

All of

HoganTaylor LLP’s fees for 2016 and 2015 were pre-approved by

the Audit Committee in accordance with its policy by a formal

engagement letter with HoganTaylor LLP.

The

following documents are filed as part of this

Amendment:

1.

Financial

Statements – Not applicable

2.

Financial Statement

Schedules – Not applicable

3.

Exhibits –

See the list of exhibits beginning on the following

page.

11

|

Exhibit

|

INDEX TO EXHIBITS

|

|

|

|

No.

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

2.1

|

|

Securities

Exchange Agreement dated as of March 18, 2011 by and among the

Company and H.I.G. AERT, LLC, incorporated herein by reference to

Exhibit 10.1 to the Company’s Current Report on Form 8-K

filed with the SEC on March 22, 2011

|

|

|

|

|

|

|

|

2.2

|

|

Series

D Preferred Stock Exchange Agreement dated as of March 18, 2011 by

and among the Company and H.I.G. AERT, LLC, incorporated herein by

reference to Exhibit 10.2 to the Company’s Current Report on

Form 8-K filed with the SEC on March 22, 2011

|

|

|

2.3

|

|

Agreement

and Plan of Merger, dated as of March 16, 2017, by and among the

Company, Oldcastle Architectural, Inc. and Oldcastle Ascent Merger

Sub, Inc. incorporated herein by reference to the Company’s

Annual Report on Form 10-K filed with the SEC on March 17, 2017

(Schedules have been omitted pursuant to Item 601(b)(2) of

Regulation S-K. The Company hereby undertakes to furnish

supplementally copies of the omitted schedules upon request by the

SEC.)

|

|

|

|

|

|

|

|

3.1

|

|

Certificate

of Incorporation of the Company, as amended, incorporated herein by

reference to Exhibit 3.1 to the Company’s Annual Report on

Form 10-K filed with the SEC on March 10, 2016

|

|

|

|

|

|

|

|

3.2

|

|

Bylaws

of the Company, as amended, incorporated herein by reference to

Exhibit 3.2 to the Company’s Annual Report on Form 10-K filed

with the SEC on March 10, 2016

|

|

|

|

|

|

|

|

3.3

|

|

Amendment

to Bylaws of the Company incorporated herein by reference to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 17, 2017

|

|

|

|

|

|

|

|

4.1

|

|

Certificate

of Designations, Preferences and Rights of the Series E Convertible

Preferred Stock of the Company, incorporated herein by reference to

Exhibit 4.1 to the Company’s Current Report on Form 8-K filed

with the SEC on March 22, 2011.

|

|

|

4.2

|

|

Amendment

to Certificate of Designations, Preferences and Rights of the

Series E Convertible Preferred Stock of the Company incorporated

herein by reference to the Company’s Annual Report on Form

10-K filed with the SEC on March 17, 2017

|

|

|

|

|

|

|

|

10.1

|

|

Loan

Agreement dated July 1, 2010 by and between the Company and the

Oklahoma Department of Commerce, incorporated herein by reference

to Exhibit 10.17 to the Company’s Annual Report on Form 10-K

filed with the SEC on March 30, 2012

|

|

|

|

|

|

|

|

10.2

|

|

Promissory

Note issued by the Company to the Oklahoma Department of Commerce

dated July 1, 2010, incorporated herein by reference to Exhibit

10.18 to the Company’s Annual Report on Form 10-K filed with

the SEC on March 30, 2012

|

|

|

|

|

|

|

|

10.3†

|

|

Indemnity

Agreement dated as of March 18, 2011 by and between the Company and

Michael Phillips, incorporated herein by reference to Exhibit 10.5

to the Company’s Current Report on Form 8-K filed with the

SEC on March 22, 2011

|

|

|

|

|

|

|

|

10.4

|

|

Advisory

Services Agreement dated as of March 18, 2011 by and between the

Company and H.I.G. Capital, L.L.C., incorporated herein by

reference to Exhibit 10.3 to the Company’s Current Report on

Form 8-K filed with the SEC on March 22, 2011

|

|

|

|

|

|

|

|

10.5

|

|

Registration

Rights Agreement dated as of March 18, 2011 by and among the

Company and H.I.G. AERT, LLC, incorporated herein by reference to

Exhibit 10.12 to the Company’s Current Report on Form 8-K

filed with the SEC on March 22, 2011

|

|

|

|

|

|

|

|

10.6

|

|

Credit

Agreement dated as of March 18, 2011 among the Company, the lenders

party thereto and H.I.G. AERT, LLC, incorporated herein by

reference to Exhibit 10.6 to the Company’s Current Report on

Form 8-K filed with the SEC on March 22, 2011

|

|

|

|

|

|

|

|

10.7

|

|

Security

Agreement dated as of March 18, 2011 by and between the Company and

H.I.G. AERT, LLC, incorporated herein by reference to Exhibit 10.9

to the Company’s Current Report on Form 8-K filed with the

SEC on March 22, 2011

|

|

|

|

|

|

|

|

10.8

|

|

Series

A Term Note issued by the Company to H.I.G. AERT, LLC dated March

18, 2011, incorporated herein by reference to Exhibit 10.7 to the

Company’s Current Report on Form 8-K filed with the SEC on

March 22, 2011

|

|

12

|

10.9

|

|

Amended

and Restated Series B Term Note issued by the Company to H.I.G.

AERT, LLC dated October 20, 2011, incorporated herein by reference

to Exhibit 10.15 to the Company’s Current Report on Form 8-K

filed with the SEC on October 24, 2011

|

|

||

|

|

|

|

|

||

|

10.10

|

|

First

Amendment to Credit Agreement dated as of May 23, 2011 among the

Company, the lenders party thereto and H.I.G. AERT, LLC,

incorporated herein by reference to Exhibit 10.10 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

|

|

|

|

||

|

10.11

|

|

Second

Amendment to Credit Agreement dated as of October 20, 2011 among

the Company, the lenders party thereto and H.I.G. AERT, LLC,

incorporated herein by reference to Exhibit 10.11 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

|

|

|

|

||

|

10.12

|

|

Third

Amendment to Credit Agreement dated as of November 15, 2012 among

the Company, the lenders party thereto and H.I.G. AERT, LLC,

incorporated herein by reference to Exhibit 10.12 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

|

|

|

|

||

|

10.13

|

|

Fourth

Amendment to Credit Agreement dated as of October 30, 2015 among

the Company, the lenders party thereto and H.I.G. AERT, LLC,

incorporated herein by reference to Exhibit 10.13 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

|

|

|

|

||

|

10.14†

|

|

Employment

Agreement dated January 1, 2012 between the Company and Tim

Morrison, incorporated herein by reference to Exhibit 10.2 to the

Company’s Current Report on Form 8-K filed with the SEC on

March 15, 2012

|

|

||

|

|

|

|

|

||

|

10.15†

|

|

Employment

Agreement dated January 1, 2012 between the Company and Brian

Hanna, incorporated herein by reference to Exhibit 10.3 to the

Company’s Current Report on Form 8-K filed with the SEC on

March 15, 2012

|

|

||

|

|

|

|

|

||

|

10.16†

|

|

Advanced

Environmental Recycling Technologies, Inc. 2011 Stock Incentive

Plan, incorporated herein by reference to Exhibit 10.18 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

|

|

|

|

||

|

10.17

|

|

Accounts

Receivable Purchase Agreement dated February 20, 2015 between the

Company and the Bank of Montreal, incorporated herein by reference

to Exhibit 10.4 of the Company’s Quarterly Report on Form

10-Q filed with the SEC on August 11, 2015

|

|

||

|

|

|

|

|

||

|

10.18

|

|

Credit

and Security Agreement dated as of October 30, 2015 between the

Company and the Webster Business Credit Corporation, incorporated

herein by reference to Exhibit 10.20 to the Company’s Annual

Report on Form 10-K filed with the SEC on March 10,

2016

|

|

||

|

|

|

|

|

||

|

10.19

|

|

Amendment No. 1 to

the Credit and Security Agreement dated as of March 25, 2016

between the Company and the Webster Business Credit Corporation,

incorporated herein by reference to the Company’s Quarterly

Report on Form 10-Q filed with the SEC on May 13, 2016

|

|

||

|

|

|

|

|

||

|

10.21

|

|

Waiver

of Triggering Event Redemption Notice dated January 20, 2016,

incorporated herein by reference to Exhibit 10.23 to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 10, 2016

|

|

||

|

10.22

|

|

Waiver

of “Special Events Default” per Series A & B Term

Loan Interest dated April 13, 2016, incorporated herein by

reference to the Company’s Quarterly Report on Form 10-Q

filed with the SEC on May 13, 2016

|

|

||

|

10.23

|

|

Waiver

of “Special Events Default” per Series A & B Term

Loan Interest dated July 1, 2016 incorporated herein by reference

to the Company’s Quarterly Report on Form 10-Q filed with the

SEC on August 11, 2016

|

|

||

|

|

|

|

|

||

|

10.24

|

|

Waiver

of “Special Events Default” per Series A & B Term

Loan Interest dated September 30, 2016 incorporated herein by

reference to the Company’s Quarterly Report on Form 10-Q

filed with the SEC on November 14, 2016

|

|

||

|

|

|

|

|

||

|

10.25

|

|

Waiver

of Series A & B Interest dated December 31, 2016 incorporated

herein by reference to the Company’s Annual Report on Form

10-K filed with the SEC on March 17, 2017

|

|

||

13

|

10.26

|

|

Waiver

of Triggering Event Redemption Notice dated December 31, 2016

incorporated herein by reference to the Company’s Annual

Report on Form 10-K filed with the SEC on March 17,

2017

|

|

|

|

|

|

|

|

10.27†

|

|

Advanced

Environmental Recycling Technologies, Inc. Key Employee Incentive

Plan for Transaction Bonuses, as amended and restated incorporated

herein by reference to the Company’s Annual Report on Form

10-K filed with the SEC on March 17, 2017

|

|

|

|

|

|

|

|

23.1

|

|

Consent

of Independent Registered Public Accounting Firm incorporated

herein by reference to the Company’s Annual Report on Form

10-K filed with the SEC on March 17, 2017

|

|

|

|

|

|

|

|

24.1

|

|

Power

of attorney incorporated herein by reference to the Company’s

Annual Report on Form 10-K filed with the SEC on March 17,

2017

|

|

|

|

|

|

|

|

31.1

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 302) by the Company’s

chief executive officer incorporated herein by reference to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 17, 2017

|

|

|

|

|

|

|

|

31.2

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 302) by the Company’s

chief financial officer incorporated herein by reference to the

Company’s Annual Report on Form 10-K filed with the SEC on

March 17, 2017

|

|

|

|

|

|

|

|

31.3**

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 302) by the Company’s

chief executive officer

|

|

|

|

|

|

|

|

31.4**

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 302) by the Company’s

chief financial officer

|

|

|

|

|

|

|

|

32.1

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 906) by the Company’s

chief executive officer

|

|

|

|

|

|

|

|

32.2

|

|

Certification

per Sarbanes-Oxley Act of 2002 (Section 906) by the Company’s

chief financial officer

|

|

|

|

|

|

|

|

99.1

|

|

Press

Release, dated March 17, 2017 incorporated herein by reference to

the Company’s Annual Report on Form 10-K filed with the SEC

on March 17, 2017

|

|

|

|

|

|

|

|

101.DEF

|

|

XBRL

Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

|

|

101.LAB

|

|

XBRL

Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

|

|

101.PRE

|

|

XBRL

Taxonomy Extension Presentation Linkbase Document

|

|

|

|

|

|

|

|

101.DEF

|

|

XBRL

Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

|

|

101.LAB

|

|

XBRL

Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

|

|

101.PRE

|

|

XBRL

Taxonomy Extension Presentation Linkbase Document

|

|

**

Furnished

herewith

†

Management

contract or compensatory plan or arrangement

14

SIGNATURES

Pursuant to the

requirements of Section 13 or 15(d) of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

ADVANCED

ENVIRONMENTAL RECYCLING

TECHNOLOGIES, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Timothy D.

Morrison

|

|

|

|

|

Timothy D.

Morrison,

|

|

|

|

|

Chief Executive Officer and Chairman of the Board

(Principal Executive

Officer) |

|

|

|

|

|

|

|

|

By:

|

/s/

J. R. Brian

Hanna

|

|

|

|

|

J. R. Brian

Hanna,

|

|

|

|

|

Chief Financial Officer

(Principal

Financial Officer and Principal Accounting

Officer) |

|

Date:

April 21, 2017

Pursuant to the

requirements of the Securities Exchange Act of 1934, this report

has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates

indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ TIMOTHY D. MORRISON

|

|

Chief Executive Officer and

Chairman of the Board

|

April 21, 2017

|

|

|

Timothy D. Morrison

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

President and Director

|

|

April 21, 2017

|

|

Randall D. Gottlieb

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Secretary and Director

|

|

April 21, 2017

|

|

Bobby J. Sheth

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 21, 2017

|

|

Michael R. Phillips

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 21, 2017

|

|

Todd J. Ofenloch

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 21, 2017

|

|

Vernon J. Richardson

|

|

|

|

|

*By:

/s/ TIMOTHY D.

MORRISON

Timothy

D. Morrison

Attorney-in-Fact

pursuant to Power of Attorney included in the Original

Filing

15