Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Ontrak, Inc. | ex23-1.htm |

As filed with the Securities and Exchange Commission on April 20, 2017

Registration No. 333-216007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CATASYS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

8090 |

|

88-0464853 |

|

(State of Incorporation) |

|

(Primary Standard Industrial Classification |

|

(IRS Employer Identification No.) |

11601 Wilshire Boulevard, Suite 1100

Los Angeles, California 90025

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Terren S. Peizer

Chief Executive Officer

c/o Catasys, Inc.

11601 Wilshire Boulevard, Suite 1100

Los Angeles, California 90025

(310) 444-4300

(Name, address, including zip code, and telephone number, including, area code, of agent for service)

Copies to:

|

Kenneth R. Koch, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. The Chrysler Center 666 Third Avenue New York, NY 10017 (212) 935-3000 (telephone number) (212) 983-3115 (facsimile number) |

Mitchell S. Nussbaum, Esq. Lili Taheri, Esq. |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☒ |

| Emerging growth company | ☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act . ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED APRIL 20, 2017 |

|

$15,000,000 Shares of Common Stock

Catasys, Inc. |

|

|

We are offering up to of shares of our common stock, $0.0001 par value per share.

Our common stock is quoted on the OTCQB Marketplace under the symbol “CATS”. On March 30, 2017, the last reported sale price for our common stock as reported on the OTCQB Marketplace was $9.66 per share, as adjusted to reflect the 1:6 reverse stock split of the Company’s common stock that will be effected in connection with this offering. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “CATS”. No assurance can be given that our application will be approved.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors ” beginning on page 13 of this prospectus for a discussion of factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share |

Total |

|||||||

|

Public offering price |

$ | $ | ||||||

|

Underwriting discounts and commissions(1) |

$ | $ | ||||||

|

Proceeds, before expenses, to us |

$ | $ | ||||||

|

(1) |

Please refer to “Underwriting” beginning on page 65 of this prospectus for additional information regarding underwriting compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of our common stock on the same terms and conditions set forth above, solely to cover over-allotments, if any.

The underwriters expect to deliver the shares to the purchasers in the offering on or about , 2017, subject to customary closing conditions.

Joseph Gunnar & Co.

The date of this prospectus is , 2017

|

|

TABLE OF CONTENTS

|

|

Page |

|

Prospectus Summary |

1 |

|

Risk Factors |

8 |

|

Special Note Regarding Forward-Looking Statements |

23 |

|

Use of Proceeds |

24 |

|

Price Range of Our Common Stock |

25 |

|

Dividend Policy |

25 |

|

Capitalization |

26 |

|

Dilution |

28 |

|

Selected Consolidated Financial Data |

29 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

31 |

|

Business |

39 |

|

Management and Certain Corporate Governance Matters |

47 |

|

Executive Compensation |

52 |

|

Certain Relationships and Related Person Transactions |

57 |

|

Security Ownership of Certain Beneficial Owners and Management |

59 |

|

Description of Capital Stock |

61 |

|

Shares Eligible for Future Sale |

63 |

|

Underwriting |

65 |

|

Legal Matters |

73 |

|

Experts |

73 |

|

Where You Can Find Additional Information |

73 |

|

Index to Consolidated Financial Statements |

F-1 |

About This Prospectus

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the common stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our common stock in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our common stock in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, or will be filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

As used in this prospectus, unless the context indicates or otherwise requires, “the Company,” “our Company,” “we,” “us,” and “our” refer to Catasys, Inc., a Delaware corporation, and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary does not contain all of the information that should be considered before investing in our common stock. Investors should carefully read this prospectus, and the registration statement of which this prospectus is a part, in their entirety before investing in our common stock, including the information discussed under “Risk Factors” in this prospectus. As used in this prospectus, unless the context indicates or otherwise requires, “the Company,” “our Company,” “we,” “us,” and “our” refer to Catasys, Inc., a Delaware corporation, and its consolidated subsidiaries.

A 1:6 reverse stock split of our common stock will be effected prior to the closing of this offering. All share amounts in this prospectus have been retroactively adjusted to give effect to this reverse stock split, except for the financial statements and notes thereto.

Our Company

Overview

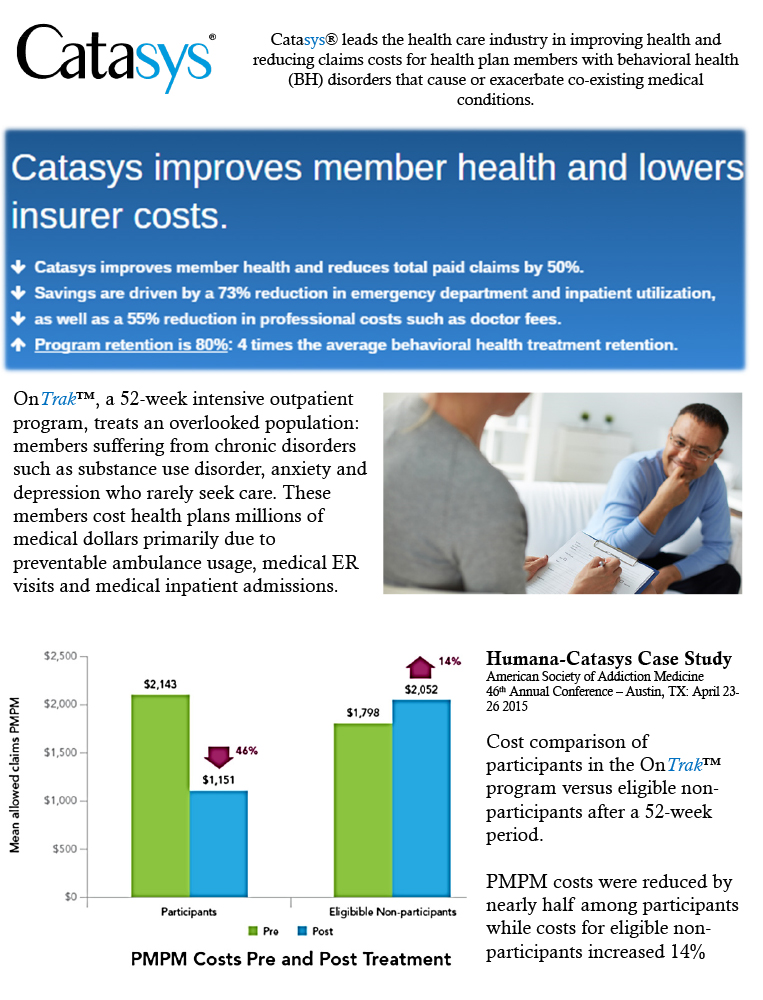

We provide data analytics based specialized behavioral health management and integrated treatment services to health plans through our OnTrak solution. Our OnTrak solution is designed to improve member health and at the same time lower costs to the insurer for underserved populations where behavioral health conditions are causing or exacerbating co-existing medical conditions. The program utilizes proprietary analytics, member engagement and patient centric treatment that integrates evidence-based medical and psychosocial interventions along with care coaching in a 52-week outpatient program. Our initial focus was members with substance use disorders, but we have expanded our solution to assist members with anxiety and depression. We currently operate our OnTrak solutions in Florida, Georgia, Illinois, Kansas, Kentucky, Louisiana, Massachusetts, Missouri, New Jersey, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia and Wisconsin. We provide services to commercial (employer funded), managed Medicare Advantage, and managed Medicaid and duel eligible (Medicare and Medicaid) populations.

Our Strategy

Our business strategy is to provide a quality integrated medical and behavioral program to help health plans and other organizations treat and manage health plan members whose behavioral health conditions are exacerbating co-existing medical conditions resulting in increased in-patient medical costs. Our initial focus was members with substance use disorder, and we have expanded our solution into anxiety disorders and depression.

Key elements of our business strategy include:

|

|

● |

Demonstrating the potential for improved clinical outcomes and reduced cost associated with using our OnTrak solution with key managed care and other third-party payors; |

|

|

● |

Educating third-party payors on the disproportionately high cost of their substance dependent population; |

|

|

● |

Providing our OnTrak solution to third-party payors for reimbursement on a case rate, fee for service, or monthly fee basis; and |

|

|

● |

Generating outcomes data from our OnTrak solution to demonstrate cost reductions and utilization of this outcomes data to facilitate broader adoption. |

As an early entrant into offering integrated medical and behavioral programs for substance dependence, we believe we will be well positioned to address increasing market demand. We believe our OnTrak solution will help fill the gap that exists today: a lack of programs that focus on smaller populations with disproportionately higher costs driven by behavioral health conditions that improve patient care while controlling overall treatment costs.

Recent Developments

Amendments to Outstanding Warrants and Extension of Existing Debentures

In March 2017, we entered into amendments with the holders of certain outstanding warrants issued on April 17, 2015 and July 30, 2015 to eliminate certain anti-dilution provisions in such warrants, which caused us to reflect an associated liability of $5.3 million on our balance sheet as of December 31, 2016. Such amendments are contingent upon and will not take effect until the closing of this offering, which must occur on or before April 30, 2017. For each warrant share underlying the warrants so amended, the holder received the right to purchase an additional .2 shares of common stock. Two of the holders of such warrants, which owners hold warrants to purchase an aggregate of 11,049 shares of common stock, did not agree to the amendment. The warrant holders agreeing to the amendment include Acuitas Group Holdings, LLC (“Acuitas”), one hundred percent (100%) of which is owned by Terren S. Peizer, Chairman and Chief Executive Officer of the Company, and another accredited investor, who will own warrants to purchase 187,002 and 79,545 shares of the Company’s common stock, respectively, if and when the amendments take effect.

Additionally, in March 2017, we and the holders of an aggregate of approximately $10 million of our existing convertible debentures agreed to extend the maturity dates of such debentures until the earlier of the closing of this offering or April 30, 2017.

Financing Activities

In January 2017, we entered into a Subscription Agreement (the “Subscription Agreement”) with Acuitas, pursuant to which we will receive aggregate gross proceeds of $1,300,000 (the “Loan Amount”) in consideration of the issuance of (i) an 8% Series B Convertible Debenture due March 31, 2017 (the “January 2017 Convertible Debenture”) at a conversion price of $0.85 and (ii) five-year warrants to purchase shares of our common stock in an amount equal to one hundred percent (100%) of the initial number of shares of common stock issuable upon the conversion of the January 2017 Convertible Debenture, at an exercise price of $5.10 per share (the “January 2017 Warrants”). The Loan Amount is payable in tranches through March 2017. In addition, any warrants issued in conjunction with the December 2016 Convertible Debenture currently outstanding with Acuitas have been increased by an additional 25% warrant coverage, exercisable for an aggregate of 127,883 shares of our common stock.

The January 2017 Warrants include, among other things, price protection provisions pursuant to which, subject to certain exempt issuances, the then exercise price of the January 2017 Warrants will be adjusted if we issue shares of our common stock at a price that is less than the then exercise price of the January 2017 Warrants. Such price protection provisions will remain in effect until the earliest of (i) the termination date of the January 2017 Warrants, (ii) such time as the January 2017 Warrants are exercised or (iii) contemporaneously with the listing of our shares of common stock on a registered national securities exchange. The holder of the January 2017 Convertible Debenture has agreed to extend the maturity of the January 2017 Convertible Debenture from March 31, 2017 to the earlier of the closing date of this offering or April 30, 2017.

In connection with the Subscription Agreement described above, the number of warrants to purchase shares of our common stock previously issued in December 2016 to Shamus, LLC, a company owned by David E. Smith, a member of the Company’s board of directors (the “Shamus Warrants”), were increased from 75% to 100% warrant coverage, exercisable for an aggregate of 58,824 shares of our common stock.

2017 Stock Incentive Plan

On February 27, 2017, our Board of Directors and our stockholders approved the adoption of the 2017 Stock Incentive Plan (the “2017 Plan”). The 2017 Plan allows the Company, under the direction of the Board of Directors or a committee thereof, to make grants of stock options, restricted and unrestricted stock and other stock-based awards to employees, including our executive officers, consultants and directors. The 2017 Plan allows for the issuance of up to 2,333,334 additional shares of Common Stock pursuant to new awards granted under the 2017 Plan and up to approximately 250,000 shares of Common Stock that are represented by options outstanding under the 2010 Plan (defined below) that are forfeited, expire or are cancelled without delivery of shares of Common Stock or which result in the forfeiture of shares of Common Stock back to the Company. This description is qualified in its entirety by reference to the actual terms of the 2017 Plan, a copy of which is attached as Exhibit B to the Company’s preliminary Information Statement on Schedule 14C, filed with the Securities and Exchange Commission on February 28, 2017.

New Directors

On March 11, 2017, our Board of Directors appointed Marc Cummins and Richard J. Berman to serve on our Board of Directors and our Audit Committee, effective immediately. There are no arrangements or understandings between Messrs. Cummins or Berman and any other person pursuant to which they were appointed as our directors. There are no transactions to which we are a party and in which Messrs. Cummins or Berman have a material interest that are required to be disclosed under Item 404(a) of Regulation S-K. Mr. Cummins previously served on our Board of Directors until his resignation on December 15, 2010, and Mr. Berman has not previously held any position at the Company. Neither individual has family relations with any of our directors or executive officers.

Risks Associated with Our Business

Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors” in this prospectus, as well as the other risks described in “Risk Factors.”

|

|

• |

We expect to continue to incur substantial operating losses and may be unable to obtain additional financing, causing our independent registered public accounting firm to express substantial doubt about our ability to continue as a going concern. |

|

|

• |

We will need additional funding, and we cannot guarantee that we will find adequate sources of capital in the future. |

|

|

• |

We depend on key personnel, the loss of which could impact the ability to manage our business. |

|

|

• |

Our OnTrak solutions may not become widely accepted, which could limit our growth. |

|

|

• |

We may be subject to future litigation, which could result in substantial liabilities that may exceed our insurance coverage. |

|

|

• |

If third-party payors fail to provide coverage and adequate payment rates for our OnTrak solution, our revenue and prospects for profitability will be harmed. |

|

|

• |

We may not be able to achieve promised savings for our OnTrak contracts, which could result in loss of customers and pricing levels insufficient to cover our costs or ensure profitability. |

|

|

• |

Confidentiality agreements with employees, treating physicians and others may not adequately prevent disclosure of trade secrets and other proprietary information. |

|

|

• |

We or our healthcare professionals may be subject to regulatory, enforcement and investigative proceedings, which could adversely affect our financial condition or operations. |

|

|

• |

We may not fully comply with complex and increasing regulation by state and federal authorities, which could negatively impact our business operations. |

|

|

• |

Our share price is volatile and may be influenced by numerous factors, some of which are beyond our control. |

|

• |

Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval. |

Annual Meetings

We are required by Section 2.1 of our by-laws and Sections 211(b) and (c) of the Delaware General Corporation Law to hold regular annual meetings. In light of our historical liquidity constraints, we have not held regular annual meetings, electing instead to handle matters by written consent of the Company’s stockholders to save on the financial and administrative resources required to prepare for and hold such meetings. While we believe that no material adverse consequences have resulted from the Company’s failure to hold regular annual meetings, we intend to hold such meetings in the future, beginning in 2018.

Corporate Information

We were incorporated in the State of Delaware on September 29, 2003. Our principal executive offices are located at 11601 Wilshire Blvd, Suite 1100, Los Angeles, California 90025, and our telephone number is (310) 444-4300.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

Our corporate website address is www.catasys.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. The Securities and Exchange Commission maintains an internet site that contains our public filings with the Securities and Exchange Commission and other information regarding our company, at www.sec.gov. These reports and other information concerning our company may also be accessed at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. The contents of these websites are not incorporated into this prospectus. Further, our references to the URLs for these websites are intended to be inactive textual reference only.

The Offering

|

Common stock offered by us |

shares |

|

Common stock to be outstanding after this offering |

shares (1) |

|

Common stock outstanding before this offering |

shares (1) |

|

Option to purchase additional shares |

We have granted the representative of the underwriters a 45-day option to purchase up to additional shares of our common stock from us at the public offering price, less underwriting discounts and commissions, to cover over-allotments, if any. |

|

Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to repay certain of our outstanding convertible debentures and for working capital and general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

|

Risk factors |

Investing in our securities involves a high degree of risk and purchasers may lose their entire investment. You should read the “Risk Factors” section of this prospectus beginning on page 14 for a discussion of certain factors to consider carefully before deciding to purchase any shares of our common stock. |

|

OTCQB Marketplace symbol |

“CATS”. |

|

Proposed NASDAQ Capital Market Symbol |

“CATS”. No assurance can be given that our shares of common stock will be approved for listing on NASDAQ. |

|

Lock-up |

We, our directors, officers and any other 5% or greater holder of outstanding shares of our common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of ninety (90) days after the date of this prospectus, without the prior written consent of the representative of the underwriters. See “Underwriting” section on page 65. |

(1) The number of shares of our common stock to be outstanding after this offering is based on 9,383,740 shares of common stock outstanding as of March 30, 2017, and assumes the effectiveness of a 1:6 reverse stock split of our common stock that will be effected prior to the closing of the offering and the sale of shares of common stock at $ per share, and excludes:

|

|

• |

243,853 shares of common stock issuable upon the exercise of outstanding stock options as of March 30, 2017, at a weighted average exercise price of $38.40 per share, as of March 30, 2017; |

|

|

• |

1,684,578 shares of common stock issuable upon the exercise of outstanding warrants as of March 30, 2017, at a weighted average exercise price of $4.88 per share, as of March 30, 2017; |

|

|

• |

50,774 shares of common stock reserved for future issuance under the 2010 Stock Incentive Plan, as of March 30, 2017; and |

|

|

• |

3,350,732 shares of common stock reserved for future issuance under our Convertible Debentures with conversion prices of $1.80 (2,363,055 shares), $5.10 (280,282 shares) and $6.60 (707,395 shares), as of March 30, 2017; and |

|

|

• |

_________ shares of common stock underlying the warrants to be issued to the representative of the underwriters in connection with this offering. |

Unless otherwise indicated, all information contained in this prospectus, and the number of shares of common stock outstanding, assumes no exercise by the underwriters of their option to purchase up to an additional of shares of our common stock to cover over-allotments, if any.

Summary Consolidated Financial Data

The following summary consolidated financial data should be read together with our audited consolidated financial statements and accompanying notes and “Management Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus. Our summary statements of operations data for the years ended December 31, 2016 and 2015 and the selected balance sheets data as of December 31, 2016 are derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of results to be expected for any future period. The summary financial data in this section are not intended to replace our audited consolidated financial statements and the related notes:

|

Twelve Months Ended |

||||||||

|

(In thousands, except per share amounts) |

December 31, |

|||||||

|

2016 |

2015 |

|||||||

|

Revenues |

||||||||

|

Healthcare services revenues |

$ | 7,075 | $ | 2,705 | ||||

|

Operating expenses |

||||||||

|

Cost of healthcare services |

4,670 | 2,433 | ||||||

| General and administrative | 8,838 | 9,049 | ||||||

|

Depreciation and amortization |

141 | 122 | ||||||

|

Total operating expenses |

13,649 | 11,604 | ||||||

|

Loss from operations |

(6,574 | ) | (8,899 | ) | ||||

|

Interest and other income |

106 | 64 | ||||||

|

Interest expense |

(5,354 | ) | (2,590 | ) | ||||

|

Loss on impairment of intangible assets |

- | (88 | ) | |||||

|

Loss on exchange of warrants |

- | (4,410 | ) | |||||

| Loss on debt extinguishment | (2,424 | ) | (195 | ) | ||||

|

Change in fair value of warrant liability |

2,093 | 11,665 | ||||||

|

Change in fair value of derivative liability |

(5,774 | ) | (2,761 | ) | ||||

|

Loss from operations before provision for income taxes |

(17,927 | ) | (7,214 | ) | ||||

|

Provision for income taxes |

9 | 9 | ||||||

|

Net loss |

$ | (17,936 | ) | $ | (7,223 | ) | ||

|

Basic and diluted net loss per share: |

$ | (1.95 | ) | $ | (1.07 | ) | ||

|

Basic weighted number of shares outstanding |

9,179 | 6,729 | ||||||

| As of December 31, 2016 | ||||||||||||

|

Actual |

|

Pro Forma As Adjusted |

||||||||||

|

(in thousands) |

(unaudited) |

(unaudited) |

||||||||||

|

Consolidated Balance Sheet Data: |

||||||||||||

|

Cash and cash equivalents |

$ | 851 | $ | 851 | $ | 11,528 | ||||||

|

Total assets |

3,104 | 3,104 | 13,781 | |||||||||

|

Total liabilities |

28,432 | 7,018 | 4,195 | |||||||||

|

Accumulated deficit |

(279,719 | ) | (274,506 | ) | (274,506 | ) | ||||||

|

Total stockholders’ equity (deficit) |

$ | (25,328 | ) | $ | (3,914 | ) | $ | 9,586 | ||||

The preceding table presents a summary of our audited balance sheet data as of December 31, 2016:

|

● |

on an actual basis; | |

|

● |

the unaudited pro forma balance sheet data as of December 31, 2016 gives effect to (i) the conversion of the 12% Original Issue Discount Convertible Debenture in the amount of $4,130, (ii) the conversion of the 8% Series B Convertible Debenture in the amount of $3,060, (iii) the partial elimination of the warrant liability by removing the anti-dilution provision in certain of the warrant agreements, and (iv) the payment of Terren Peizer’s deferred salary of $1,060 with common stock, each of which is expected to become effective as of the close of this offering; and | |

|

● |

on pro-forma as adjusted basis to give effect to the receipt of the estimated net proceeds from the sale of shares of common stock in this offering at the public offering price of $ per share, after deducting the underwriting discounts and commissions and estimated expenses payable by us and the use of $2,823 of the proceeds therefrom to pay Acuitas’ 8% Series B Convertible Debenture at closing. |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information contained in this prospectus, including our consolidated financial statements and the related notes, before making any decision to invest in shares of our common stock. This prospectus contains forward-looking statements. If any of the events discussed in the risk factors below occurs, our business, prospects, results of operations, financial condition and cash flows could be materially harmed. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks not currently known to us or other factors not perceived by us to present significant risks to our business at this time also may impair our business operations.

Risks related to our business

We have a limited operating history, expect to continue to incur substantial operating losses and may be unable to obtain additional financing, causing our independent registered public accounting firm to express substantial doubt about our ability to continue as a going concern.

We have been unprofitable since our inception in 2003 and expect to incur substantial additional operating losses and negative cash flow from operations for at least the next twelve months. As of December 31, 2016, these conditions raised substantial doubt as to our ability to continue as a going concern. At December 31, 2016, cash and cash equivalents was approximately $851,000 and accumulated deficit was approximately $280 million. During the year ended December 31, 2016, our cash and cash equivalents used by operating activities was $5.7 million. Although we have taken actions to increase our revenue and we are seeking to obtain additional financing, there can be no assurance that we will be successful in our efforts. We may not be successful in raising necessary funds on acceptable terms or at all, and we may not be able to offset our operating losses by sufficient reductions in expenses and increases in revenue. If this occurs, we may be unable to meet our cash obligations as they become due and we may be required to further delay or reduce operating expenses and curtail our operations, which would have a material adverse effect on us.

We may fail to successfully manage and grow our business, which could adversely affect our results of operations, financial condition and business.

Continued expansion could put significant strain on our management, operational and financial resources. The need to comply with the rules and regulations of the SEC will continue to place significant demands on our financial and accounting staff, financial, accounting and information systems, and our internal controls and procedures, any of which may not be adequate to support our anticipated growth. The need to comply with the state and federal healthcare, security and privacy regulation will continue to place significant demands on our staff and our policies and procedures, any of which may not be adequate to support our anticipated growth. We may not be able to effectively hire, train, retain, motivate and manage required personnel. Our failure to manage growth effectively could limit our ability to satisfy our reporting obligations, or achieve our marketing, commercialization and financial goals.

We will need additional funding, and we cannot guarantee that we will find adequate sources of capital in the future.

We have incurred negative cash flows from operations since inception and have expended, and expect to continue to expend, substantial funds to grow our business. As of March 30, 2017, we estimate that our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital requirements through April 30, 2017. Actual cash fees collected and expenses incurred may significantly impact this estimate. We will require additional funds before we achieve positive cash flows and we may never become cash flow positive.

If we raise additional funds by issuing equity securities, such financing will result in further dilution to our stockholders. Any equity securities issued also may provide for rights, preferences or privileges senior to those of holders of our common stock. If we raise funds by issuing debt securities, these debt securities would have rights, preferences and privileges senior to those of holders of our common stock, and the terms of the debt securities issued could impose significant restrictions on our operations.

We do not know whether additional financing will be available on commercially acceptable terms, or at all. If adequate funds are not available or are not available on commercially acceptable terms, we may need to continue to downsize, curtail program development efforts or halt our operations altogether.

Our programs may not be as effective as we believe them to be, which could limit our potential revenue growth.

Our belief in the efficacy of our OnTrak solution is based on a limited experience with a relatively small number of patients. Such results may not be statistically significant, have not been subjected to close scientific scrutiny, and may not be indicative of the long-term future performance of treatment with our programs. If the initially indicated results cannot be successfully replicated or maintained over time, utilization of our programs could decline substantially. There are no standardized methods for measuring efficacy of programs such as ours. Even if we believe our solutions are effective, our customers could determine they are not utilizing different outcomes measures. In addition, even if our customers determine our solutions are effective they may discontinue them because they determine that the aggregate cost savings are not sufficient or that our programs do not have a high enough return on investment. Our success is dependent on our ability to enroll third-party payor members in our OnTrak solutions. Large scale outreach and enrollment efforts have not been conducted and then only for limited time periods, and we may not be able to achieve the anticipated enrollment rates.

Our OnTrak solution may not become widely accepted, which could limit our growth.

Our ability to achieve further marketplace acceptance for our OnTrak solution may be dependent on our ability to contract with a sufficient number of third party payors and to demonstrate financial and clinical outcomes from those agreements. If we are unable to secure sufficient contracts to achieve recognition or acceptance of our OnTrak solution or if our program does not demonstrate the expected level of clinical improvement and cost savings, it is unlikely that we will be able to achieve widespread market acceptance.

Disappointing results for our Solutions or failure to attain our publicly disclosed milestones could adversely affect market acceptance and have a material adverse effect on our stock price.

Disappointing results, later-than-expected press release announcements or termination of evaluations, pilot programs or commercial OnTrak solutions could have a material adverse effect on the commercial acceptance of our solutions, our stock price and on our results of operations. In addition, announcements regarding results, or anticipation of results, may increase volatility in our stock price. In addition to numerous upcoming milestones, from time to time we provide financial guidance and other forecasts to the market. While we believe that the assumptions underlying projections and forecasts we make publicly available are reasonable, projections and forecasts are inherently subject to numerous risks and uncertainties. Any failure to achieve milestones, or to do so in a timely manner, or to achieve publicly announced guidance and forecasts, could have a material adverse effect on our results of operations and the price of our common stock.

Our industry is highly competitive, and we may not be able to compete successfully.

The healthcare business in general, and the behavioral health treatment business in particular, are highly competitive. While we believe our products and services are unique, we operate in highly competitive markets. We compete with other healthcare management service organizations, care management and disease management companies, including Managed Behavioral Healthcare Organizations (MBHOs), other specialty healthcare and managed care companies, and healthcare technology companies that are offering treatment and support of behavioral health on-line and on mobile devices. Most of our competitors are significantly larger and have greater financial, marketing and other resources than us. We believe that our ability to offer customers a comprehensive and integrated behavioral health solution, including the utilization of our analytical models and innovative member engagement methodologies, will enable us to compete effectively. However, there can be no assurance that we will not encounter more effective competition in the future, that we will have financial resources to continue to improve our offerings or that we will be successful improving them, which would limit our ability to maintain or increase our business.

Our competitors may develop and introduce new processes and products that are equal or superior to our programs in treating behavioral health conditions. Accordingly, we may be adversely affected by any new processes and products developed by our competitors.

We depend on key personnel, the loss of which could impact the ability to manage our business.

We are highly dependent on our senior management and key operating and technical personnel. The loss of the services of any member of our senior management and key operating and technical personnel could have a material adverse effect on our business, operating results and financial condition. We also rely on consultants and advisors to assist us in formulating our strategy. All of our consultants and advisors are either self-employed or employed by other organizations, and they may have conflicts of interest or other commitments, such as consulting or advisory contracts with other organizations, that may affect their ability to contribute to us.

We will need to hire additional employees in order to achieve our objectives. There is currently intense competition for skilled executives and employees with relevant expertise, and this competition is likely to continue. The inability to attract and retain sufficient personnel could adversely affect our business, operating results and financial condition.

We may be subject to future litigation, which could result in substantial liabilities that may exceed our insurance coverage.

All significant medical treatments and procedures, including treatment utilizing our programs, involve the risk of serious injury or death. While we have not been the subject of any such claims, our business entails an inherent risk of claims for personal injuries and substantial damage awards. We cannot control whether individual physicians and therapists will apply the appropriate standard of care in determining how to treat their patients. While our agreements typically require physicians to indemnify us for their negligence, there can be no assurance they will be willing and financially able to do so if claims are made. In addition, our license agreements require us to indemnify physicians, hospitals or their affiliates for losses resulting from our negligence.

We currently have insurance coverage for personal injury claims, directors’ and officers’ liability insurance coverage, and errors and omissions insurance. We may not be able to maintain adequate liability insurance at acceptable costs or on favorable terms. We expect that liability insurance will be more difficult to obtain and that premiums will increase over time and as the volume of patients treated with our programs increases. In the event of litigation, we may sustain significant damages or settlement expense (regardless of a claim's merit), litigation expense and significant harm to our reputation.

If third-party payors fail to provide coverage and adequate payment rates for our solutions, our revenue and prospects for profitability will be harmed.

Our future revenue growth will depend in part upon our ability to contract with health plans and other insurance payors for our OnTrak solutions. To date, we have not received a significant amount of revenue from our OnTrak solutions from health plans and other insurance payors, and acceptance of our OnTrak solutions is critical to the future prospects of our business. In addition, insurance payors are increasingly attempting to contain healthcare costs, and may not cover or provide adequate payment for our programs. Adequate insurance reimbursement might not be available to enable us to realize an appropriate return on investment in research and product development, and the lack of such reimbursement could have a material adverse effect on our operations and could adversely affect our revenues and earnings.

We may not be able to achieve promised savings for our OnTrak contracts, which could result in pricing levels insufficient to cover our costs or ensure profitability.

We anticipate that many of our OnTrak contracts will be based upon anticipated or guaranteed levels of savings for our customers and achieving other operational metrics resulting in incentive fees based on savings. If we are unable to meet or exceed promised savings, achieve agreed upon operational metrics, or favorably resolve contract billing and interpretation issues with our customers, we may be required to refund from the amount of fees paid to us any difference between savings that were guaranteed and the savings, if any, which were actually achieved; or we may fail to earn incentive fees based on savings. Accordingly, during or at the end of the contract terms, we may be required to refund some or all of the fees paid for our services. This exposes us to significant risk that contracts negotiated and entered into may ultimately be unprofitable. In addition, managed care operations are at risk for costs incurred to provide agreed upon services under our solution. Therefore, failure to anticipate or control costs could have a materially adverse effect on our business.

Our ability to utilize net operating loss carryforwards may be limited.

As of December 31, 2016, we had net operating loss carryforwards (NOLs) of approximately $222 million for federal income tax purposes that will begin to expire in 2024. These NOLs may be used to offset future taxable income, to the extent we generate any taxable income, and thereby reduce or eliminate our future federal income taxes otherwise payable. Section 382 of the Internal Revenue Code imposes limitations on a corporation's ability to utilize NOLs if it experiences an ownership change as defined in Section 382. In general terms, an ownership change may result from transactions increasing the ownership of certain stockholders in the stock of a corporation by more than 50% over a three-year period. In the event that an ownership change has occurred, or were to occur, utilization of our NOLs would be subject to an annual limitation under Section 382 determined by multiplying the value of our stock at the time of the ownership change by the applicable long-term tax-exempt rate as defined in the Internal Revenue Code. Any unused annual limitation may be carried over to later years. We may be found to have experienced an ownership change under Section 382 as a result of events in the past or the issuance of shares of common stock, or a combination thereof. If so, the use of our NOLs, or a portion thereof, against our future taxable income may be subject to an annual limitation under Section 382, which may result in expiration of a portion of our NOLs before utilization.

We have not held regular annual meetings in the past, and if we are required by the Delaware Court of Chancery to hold an annual meeting pursuant to Section 211(c) of the Delaware General Corporation Law (the “DGCL”), it could result in the unanticipated expenditure of funds, time and other Company resources.

Section 2.1 of the Company’s By-Laws provides that an annual meeting shall be held each year on a date and at a time designated by the Company’s Board of Directors, and Section 211(b) of the DGCL provides for an annual meeting of stockholders to be held for the election of directors. Section 211(c) of the DGCL provides that if there is a failure to hold the annual meeting for a period of 13 months after the latest to occur of the organization of the corporation, its last annual meeting or last action by written consent to elect directors in lieu of an annual meeting, the Delaware Court of Chancery may order a meeting to be held upon the application of any stockholder or director. Section 211(c) also provides that the failure to hold an annual meeting shall not affect otherwise valid corporate acts or result in a forfeiture or dissolution of the corporation.

We have not held regular annual meetings in the past because a substantial majority of our stock is owned by a small number of stockholders, making it easy to obtain written consent in lieu of a meeting when necessary. In light of our historical liquidity constraints, handling matters by written consent has allowed the Company to save on the financial and administrative resources required to prepare for and hold such annual meetings. Additionally, we have applied to list our common stock on The Nasdaq Capital Market and expect that our common stock will be listed on The Nasdaq Capital Market prior to the completion of this offering. Pursuant to Nasdaq’s corporate governance requirements, the Company will be obligated to hold regular annual meetings in the future, and it is currently contemplated that we will hold such meetings beginning in 2018.

To our knowledge, no stockholder or director has requested the Company’s management to hold such an annual meeting and no stockholder or director has applied to the Delaware Court of Chancery seeking an order directing the Company to hold a meeting. However, if one or more stockholders or directors were to apply to the Delaware Court of Chancery seeking such an order, and if the Delaware Court of Chancery were to order an annual meeting before the Company was prepared to hold one, the preparation for the annual meeting and the meeting itself could result in the unanticipated expenditure of funds, time, and other Company resources.

Risks related to our intellectual property

Confidentiality agreements with employees, treating physicians and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In order to protect our proprietary technology and processes, we rely in part on confidentiality provisions in our agreements with employees, treating physicians, and others. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover trade secrets and proprietary information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

We may be subject to claims that we infringe the intellectual property rights of others, and unfavorable outcomes could harm our business.

Our future operations may be subject to claims, and potential litigation, arising from our alleged infringement of patents, trade secrets, trademarks or copyrights owned by other third parties. Within the healthcare, drug and bio-technology industry, many companies actively pursue infringement claims and litigation, which makes the entry of competitive products more difficult. We may experience claims or litigation initiated by existing, better-funded competitors and by other third parties. Court-ordered injunctions may prevent us from continuing to market existing products or from bringing new products to market and the outcome of litigation and any resulting loss of revenues and expenses of litigation may substantially affect our ability to meet our expenses and continue operations.

Risks related to our industry

Recent changes in insurance and health care laws have created uncertainty in the health care industry.

The Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act, each enacted in March 2010, generally known as the Health Care Reform Law, significantly expanded health insurance coverage to uninsured Americans and changed the way health care is financed by both governmental and private payers. The 2016 federal elections, which resulted in the election of the Republican presidential nominee and Republican majorities in both houses of Congress, is likely to prompt renewed legislative efforts to significantly modify or repeal the Health Care Reform Law, is likely to impact how the executive branch implements the law, and may impact how the federal government responds to lawsuits challenging the Health Care Reform Law. We cannot predict what further reform proposals, if any, will be adopted, when they may be adopted, or what impact they may have on our business. There may also be other risks and uncertainties associated with the Health Care Reform Law. If we fail to comply or are unable to effectively manage such risks and uncertainties, our financial condition and results of operations could be adversely affected.

Our policies and procedures may not fully comply with complex and increasing regulation by state and federal authorities, which could negatively impact our business operations.

The healthcare industry is highly regulated and continues to undergo significant changes as third-party payors, such as Medicare and Medicaid, traditional indemnity insurers, managed care organizations and other private payors, increase efforts to control cost, utilization and delivery of healthcare services. Healthcare companies are subject to extensive and complex federal, state and local laws, regulations and judicial decisions. Our failure or the failure of our treating physicians, to comply with applicable healthcare laws and regulations may result in the imposition of civil or criminal sanctions that we cannot afford, or require redesign or withdrawal of our programs from the market.

We or our healthcare professionals may be subject to regulatory, enforcement and investigative proceedings, which could adversely affect our financial condition or operations.

We or one or more of our healthcare professionals could become the subject of regulatory, enforcement, or other investigations or proceedings, and our relationships, business structure, and interpretations of applicable laws and regulations may be challenged. The defense of any such challenge could result in substantial cost and a diversion of management’s time and attention. In addition, any such challenge could require significant changes to how we conduct our business and could have a material adverse effect on our business, regardless of whether the challenge ultimately is successful. If determination is made that we or one or more of our healthcare professionals has failed to comply with any applicable laws or regulations, our business, financial condition and results of operations could be adversely affected.

Our business practices may be found to constitute illegal fee-splitting or corporate practice of medicine, which may lead to penalties and adversely affect our business.

Many states, including California where our principal executive offices are located, have laws that prohibit business corporations, such as us, from practicing medicine, exercising control over medical judgments or decisions of physicians or other health care professionals (such as nurses or nurse practitioners), or engaging in certain business arrangements with physicians or other health care professionals, such as employment of physicians and other health care professionals or fee-splitting. The state laws and regulations and administrative and judicial decisions that enumerate the specific corporate practice and fee-splitting rules vary considerably from state to state and are enforced by both the courts and government agencies, each with broad discretion. Courts, government agencies or other parties, including physicians, may assert that we are engaged in the unlawful corporate practice of medicine, fee-splitting, or payment for referrals by providing administrative and other services in connection with our treatment programs. As a result of such allegations, we could be subject to civil and criminal penalties, our contracts could be found invalid and unenforceable, in whole or in part, or we could be required to restructure our contractual arrangements. If so, we may be unable to restructure our contractual arrangements on favorable terms, which would adversely affect our business and operations.

Our business practices may be found to violate anti-kickback, physician self-referral or false claims laws, which may lead to penalties and adversely affect our business.

The healthcare industry is subject to extensive federal and state regulation with respect to kickbacks, physician self-referral arrangements, false claims and other fraud and abuse issues.

The federal anti-kickback law (the “Anti-Kickback Law”) prohibits, among other things, knowingly and willfully offering, paying, soliciting, receiving, or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing, arranging for, or recommending of an item or service that is reimbursable, in whole or in part, by a federal health care program. “Remuneration” is broadly defined to include anything of value, such as, for example, cash payments, gifts or gift certificates, discounts, or the furnishing of services, supplies, or equipment. The Anti-Kickback Law is broad, and it prohibits many arrangements and practices that are lawful in businesses outside of the health care industry.

Recognizing the breadth of the Anti-Kickback Law and the fact that it may technically prohibit many innocuous or beneficial arrangements within the health care industry, the Office of Inspector General (“OIG”) has issued a series of regulations, known as the “safe harbors.” Compliance with all requirements of a safe harbor immunizes the parties to the business arrangement from prosecution under the Anti-Kickback Law. The failure of a business arrangement to fit within a safe harbor does not necessarily mean that the arrangement is illegal or that the OIG will pursue prosecution. Still, in the absence of an applicable safe harbor, a violation of the Anti-Kickback Law may occur even if only one purpose of an arrangement is to induce referrals. The penalties for violating the Anti-Kickback Law can be severe. These sanctions include criminal and civil penalties, imprisonment, and possible exclusion from the federal health care programs. Many states have adopted laws similar to the Anti-Kickback Law, and some apply to items and services reimbursable by any payor, including private insurers.

In addition, the federal ban on physician self-referrals, commonly known as the Stark Law, prohibits, subject to certain exceptions, physician referrals of Medicare patients to an entity providing certain “designated health services” if the physician or an immediate family member of the physician has any financial relationship with the entity. A “financial relationship” is created by an investment interest or a compensation arrangement. Penalties for violating the Stark Law include the return of funds received for all prohibited referrals, fines, civil monetary penalties, and possible exclusion from the federal health care programs. In addition to the Stark Law, many states have their own self-referral bans, which may extend to all self-referrals, regardless of the payor.

The federal False Claims Act imposes liability on any person or entity that, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment to the federal government. Under the False Claims Act, a person acts knowingly if he has actual knowledge of the information or acts in deliberate ignorance or in reckless disregard of the truth or falsity of the information. Specific intent to defraud is not required. Violations of other laws, such as the Anti-Kickback Law or the FDA prohibitions against promotion of off-label uses of drugs, can lead to liability under the federal False Claims Act. The qui tam provisions of the False Claims Act allow a private individual to bring an action on behalf of the federal government and to share in any amounts paid by the defendant to the government in connection with the action. The number of filings of qui tam actions has increased significantly in recent years. When an entity is determined to have violated the False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties of between $5,500 and $11,000 for each false claim. Conduct that violates the False Claims Act may also lead to exclusion from the federal health care programs. Given the number of claims likely to be at issue, potential damages under the False Claims Act for even a single inappropriate billing arrangement could be significant. In addition, various states have enacted similar laws modeled after the False Claims Act that apply to items and services reimbursed under Medicaid and other state health care programs, and, in several states, such laws apply to claims submitted to all payors.

On May 20, 2009, the Federal Enforcement and Recovery Act of 2009, or FERA, became law, and it significantly amended the federal False Claims Act. Among other things, FERA eliminated the requirement that a claim must be presented to the federal government. As a result, False Claims Act liability extends to any false or fraudulent claim for government money, regardless of whether the claim is submitted to the government directly, or whether the government has physical custody of the money. FERA also specifically imposed False Claims Act liability if an entity “knowingly and improperly avoids or decreases an obligation to pay or transmit money or property to the Government.” As a result, the knowing and improper failure to return an overpayment can serve as the basis for a False Claims Act action. In March 2010, Congress passed the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, collectively the ACA, which also made sweeping changes to the federal False Claims Act. The ACA also established that Medicare and Medicaid overpayments must be reported and returned within 60 days of identification or when any corresponding cost report is due.

Finally, the Health Insurance Portability and Accountability Act of 1996 and its implementing regulations created the crimes of health care fraud and false statements relating to health care matters. The health care fraud statute prohibits knowingly and willfully executing a scheme to defraud any health care benefit program, including a private insurer. The false statements statute prohibits knowingly and willfully falsifying, concealing, or covering up a material fact or making any materially false, fictitious, or fraudulent statement in connection with the delivery of or payment for health care benefits, items, or services. A violation of this statute is a felony and may result in fines, imprisonment, or exclusion from the federal health care programs.

Federal or state authorities may claim that our fee arrangements, our agreements and relationships with contractors, hospitals and physicians, or other activities violate fraud and abuse laws and regulations. If our business practices are found to violate any of these laws or regulations, we may be unable to continue with our relationships or implement our business plans, which would have an adverse effect on our business and results of operations. Further, defending our business practices could be time consuming and expensive, and an adverse finding could result in substantial penalties or require us to restructure our operations, which we may not be able to do successfully.

Our business practices may be subject to state regulatory and licensure requirements.

Our business practices may be regulated by state regulatory agencies that generally have discretion to issue regulations and interpret and enforce laws and rules. These regulations can vary significantly from jurisdiction to jurisdiction, and the interpretation of existing laws and rules also may change periodically. Some of our business and related activities may be subject to state health care-related regulations and requirements, including managed health care, utilization review (UR) or third-party administrator-related regulations and licensure requirements. These regulations differ from state to state, and may contain network, contracting, and financial and reporting requirements, as well as specific standards for delivery of services, payment of claims, and adequacy of health care professional networks. If a determination is made that we have failed to comply with any applicable state laws or regulations, our business, financial condition and results of operations could be adversely affected.

We may be subject to healthcare anti-fraud initiatives, which may lead to penalties and adversely affect our business.

State and federal government agencies are devoting increased attention and resources to anti-fraud initiatives against healthcare providers and the entities and individuals with whom they do business, and such agencies may define fraud expansively to include our business practices, including the receipt of fees in connection with a healthcare business that is found to violate any of the complex regulations described above. While to our knowledge we have not been the subject of any anti-fraud investigations, if such a claim were made, defending our business practices could be time consuming and expensive and an adverse finding could result in substantial penalties or require us to restructure our operations, which we may not be able to do successfully.

Our use and disclosure of patient information is subject to privacy and security regulations, which may result in increased costs.

In providing administrative services to healthcare providers and operating our treatment programs, we may collect, use, disclose, maintain and transmit patient information in ways that will be subject to many of the numerous state, federal and international laws and regulations governing the collection, use, disclosure, storage, privacy and security of patient-identifiable health information, including the administrative simplification requirements of the Health Insurance Portability and Accountability Act of 1996 and its implementing regulations (HIPAA) and the Health Information Technology for Economic and Clinical Health Act of 2009 (HITECH). The HIPAA Privacy Rule restricts the use and disclosure of patient information (“Protected Health Information” or “PHI”), and requires safeguarding that information. The HIPAA Security Rule and HITECH establish elaborate requirements for safeguarding PHI transmitted or stored electronically. HIPAA applies to covered entities, which may include healthcare facilities and also includes health plans that will contract for the use of our programs and our services. HIPAA and HITECH require covered entities to bind contractors that use or disclose protected health information (or “Business Associates”) to compliance with certain aspects of the HIPAA Privacy Rule and all of the HIPAA Security Rule. In addition to contractual liability, Business Associates are also directly subject to regulation by the federal government. Direct liability means that we are subject to audit, investigation and enforcement by federal authorities. HITECH imposes new breach notification obligations requiring us to report breaches of “Unsecured Protected Health Information” or PHI that has not been encrypted or destroyed in accordance with federal standards. Business Associates must report such breaches so that their covered entity customers may in turn notify all affected patients, the federal government, and in some cases, local or national media outlets. We may be required to indemnify our covered entity customers for costs associated with breach notification and the mitigation of harm resulting from breaches that we cause. If we are providing management services that include electronic billing on behalf of a physician practice or facility that is a covered entity, we may be required to conduct those electronic transactions in accordance with the HIPAA regulations governing the form and format of those transactions. Services provided under our OnTrak solution not only require us to comply with HIPAA and HITECH but also Title 42 Part 2 of the Code of Federal Regulations (“Part 2”). Part 2 is a federal, criminal law that severely restricts our ability to use and disclose drug and alcohol treatment information obtained from federally-supported treatment facilities. Our operations must be carefully structured to avoid liability under this law. Our OnTrak solution qualifies as a federally funded treatment facility which requires us to disclose information on members only in compliance with Title 42. In addition to the federal privacy regulations, there are a number of state laws governing the privacy and security of health and personal information. The penalties for violation of these laws vary widely and the area is rapidly evolving. We believe that we have taken the steps required of us to comply with health information privacy and security laws and regulations in all jurisdictions, both state and federal. However, we may not be able to maintain compliance in all jurisdictions where we do business. Failure to maintain compliance, or changes in state or federal privacy and security laws could result in civil and/or criminal penalties and could have a material adverse effect on our business, including significant reputational damage associated with a breach. If regulations change or it is determined that we are not in compliance with privacy regulations we may be required to modify aspects of our program which may adversely affect program results and our business or profitability. Under HITECH, we are subject to prosecution or administrative enforcement and increased civil and criminal penalties for non-compliance, including a new, four-tiered system of monetary penalties. We are also subject to enforcement by state attorneys general who were given authority to enforce HIPAA under HITECH.

Certain of our professional healthcare employees, such as nurses, must comply with individual licensing requirements.

All of our healthcare professionals who are subject to licensing requirements, such as our care coaches, are licensed in the state in which they provide professional services in person. While we believe our nurses provide coaching and not professional services, one or more states may require our healthcare professionals to obtain licensure if providing services telephonically across state lines to the state’s residents. Healthcare professionals who fail to comply with these licensure requirements could face fines or other penalties for practicing without a license, and we could be required to pay those fines on behalf of our healthcare professionals. If we are required to obtain licenses for our nurses in states where they provide telephonic coaching, it would significantly increase the cost of providing our product. In addition, new and evolving agency interpretations, federal or state legislation or regulations, or judicial decisions could lead to the implementation of out-of-state licensure requirements in additional states, and such changes would increase the cost of services and could have a material adverse effect on our business.

Security breaches, loss of data and other disruptions could compromise sensitive information related to our business, prevent us from accessing critical information or expose us to liability, which could adversely affect our business and our reputation.

In the ordinary course of our business, we collect and store sensitive data, including legally protected patient health information, personally identifiable information about our employees, intellectual property, and proprietary business information. We manage and maintain our applications and data utilizing an off-site co-location facility. These applications and data encompass a wide variety of business critical information including research and development information, commercial information and business and financial information.

The secure processing, storage, maintenance and transmission of this critical information is vital to our operations and business strategy, and we devote significant resources to protecting such information. Although we take measures to protect sensitive information from unauthorized access or disclosure, our information technology and infrastructure may be vulnerable to attacks by hackers, viruses, breaches or interruptions due to employee error or malfeasance, terrorist attacks, earthquakes, fire, flood, other natural disasters, power loss, computer systems failure, data network failure, Internet failure or lapses in compliance with privacy and security mandates. Any such virus, breach or interruption could compromise our networks and the information stored there could be accessed by unauthorized parties, publicly disclosed, lost or stolen. We have measures in place that are designed to detect and respond to such security incidents and breaches of privacy and security mandates. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, such as HIPAA, government enforcement actions and regulatory penalties. We may also be required to indemnify our customers for costs associated with having their data on our system breached. Unauthorized access, loss or dissemination could also interrupt our operations, including our ability to bill our customers, provide customer support services, conduct research and development activities, process and prepare company financial information, manage various general and administrative aspects of our business and damage our reputation, or we may lose one or more of our customers, especially if they felt their data may be breached, any of which could adversely affect our business.

Risks related to our common stock

Our common stock has limited trading volume, and it is therefore susceptible to high price volatility.

Our common stock is quoted on the OTCQB under the symbol “CATS” and has limited trading volume. As such, our common stock is more susceptible to significant and sudden price changes than stocks that are widely followed by the investment community and actively traded on an exchange. The liquidity of our common stock depends upon the presence in the marketplace of willing buyers and sellers. We cannot assure you that you will be able to find a buyer for your shares. If we successfully list the common stock on a securities exchange or obtain trading authorization, we will not be able to assure you that an organized public market for our securities will develop or that there will be any private demand for the common stock. We could also subsequently fail to satisfy the standards for continued national securities exchange trading, such as standards having to do with a minimum share price, the minimum number of public shareholders or the aggregate market value of publicly held shares. Any holder of our securities should regard them as a long-term investment and should be prepared to bear the economic risk of an investment in our securities for an indefinite period.

Our common stock is considered a “penny stock” and may be difficult to sell.