Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Triumph Bancorp, Inc. | tbk-ex991_7.htm |

| 8-K - 8-K EARNINGS RELEASE 03-31-2017 - Triumph Bancorp, Inc. | tbk-8k_20170419.htm |

Q1 2017 earnings release April 19, 2017 Exhibit 99.2

disclaimer Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: our limited operating history as an integrated company; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market area; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses and any future acquisitions; changes in management personnel; interest rate risk; concentration of our factoring services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of the Federal Deposit Insurance Corporation insurance and other coverages; failure to receive regulatory approval for future acquisitions; increases in our capital requirements; and risk retention requirements under the Dodd-Frank Act. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in Triumph’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 17, 2017. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided at the end of the presentation. Numbers in this presentation may not sum due to rounding. Unless otherwise referenced, all data presented is as of March 31, 2017. PAGE

company OVERVIEW PAGE Triumph Bancorp, Inc. (NASDAQ: TBK) is a financial holding company headquartered in Dallas, Texas. Triumph offers a diversified line of community banking and commercial finance products through its bank subsidiary, TBK Bank, SSB. www.triumphbancorp.com Community Banking Full suite of deposit products and services focused on growing core deposits Focused on business lending including CRE Minimal consumer lending and no active single-family mortgage origination Differentiated Model Focus on core deposit funding as well as commercial finance produces top decile net interest margins Multiple product types and broad geographic footprint creates a more diverse business model than other banks our size Executive team and business unit leaders have deep experience in much larger financial institutions Commercial Finance Factoring, asset based lending, equipment finance, and premium finance We focus on what we know: executives leading these platforms all have decades of experience in their respective markets Credit risk is well diversified across industries, product type, and geography

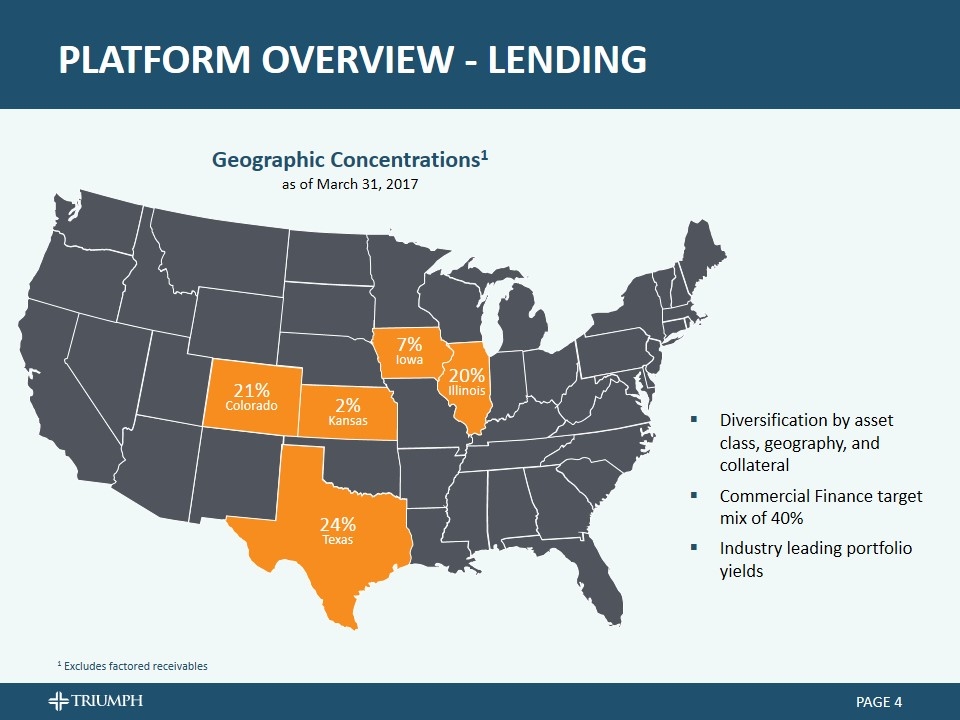

PLATFORM OVERVIEW - LENDING PAGE 24% Texas Geographic Concentrations1 as of March 31, 2017 Diversification by asset class, geography, and collateral Commercial Finance target mix of 40% Industry leading portfolio yields 1 Excludes factored receivables 21% Colorado 2% Kansas 7% Iowa 20% Illinois

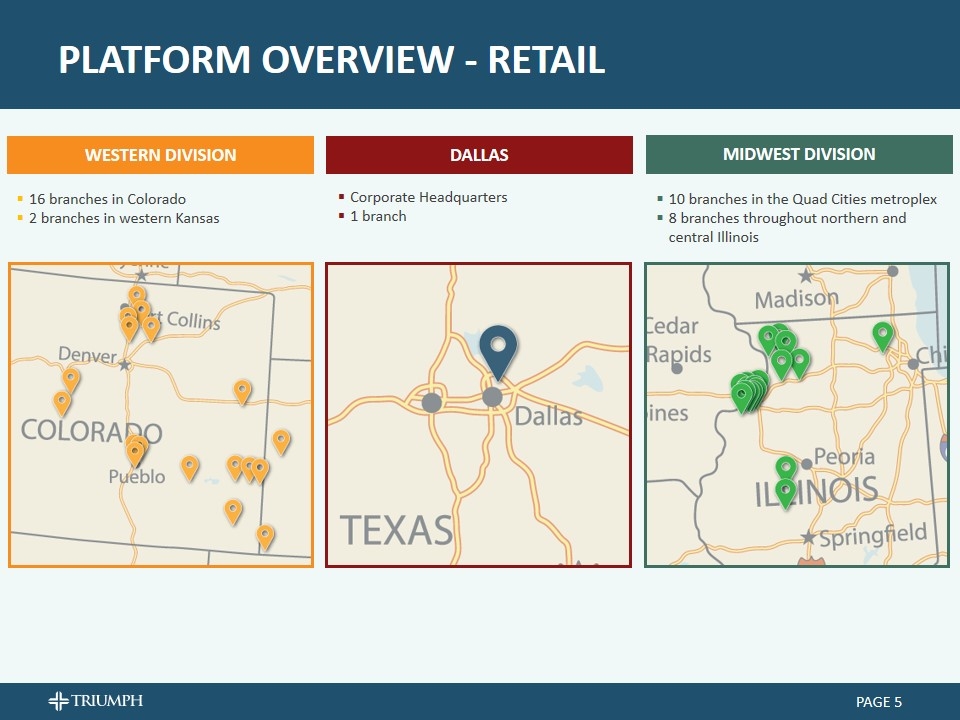

PLATFORM OVERVIEW - RETAIL PAGE team members(2) Western division 16 branches in Colorado 2 branches in western Kansas MIDwest division 10 branches in the Quad Cities metroplex 8 branches throughout northern and central Illinois Dallas Corporate Headquarters 1 branch

PLATFORM OVERVIEW – COMMERCIAL FINANCE PAGE Triumph Commercial Finance Asset Based Lending Borrowing base working capital lending Focus on facilities between $1MM - $20MM Core industries include manufacturing, distribution, services, and healthcare Equipment Finance Secured by revenue producing, essential-use equipment in broad resale markets Core markets include construction, road, transportation, oil & gas, waste, forestry, and machine tool Triumph Business Capital Commercial Finance Triumph Premium Finance Factoring Among the largest discount factors in the transportation sector Clients include small owner-operator trucking companies, mid-sized fleets, and freight broker relationships Expanding operations into staffing, distribution, and other sectors Premium Finance Customized premium finance solutions for the acquisition of property and casualty insurance coverage Our goal is to become a market leader for financial services to small businesses and the lower end of the middle market

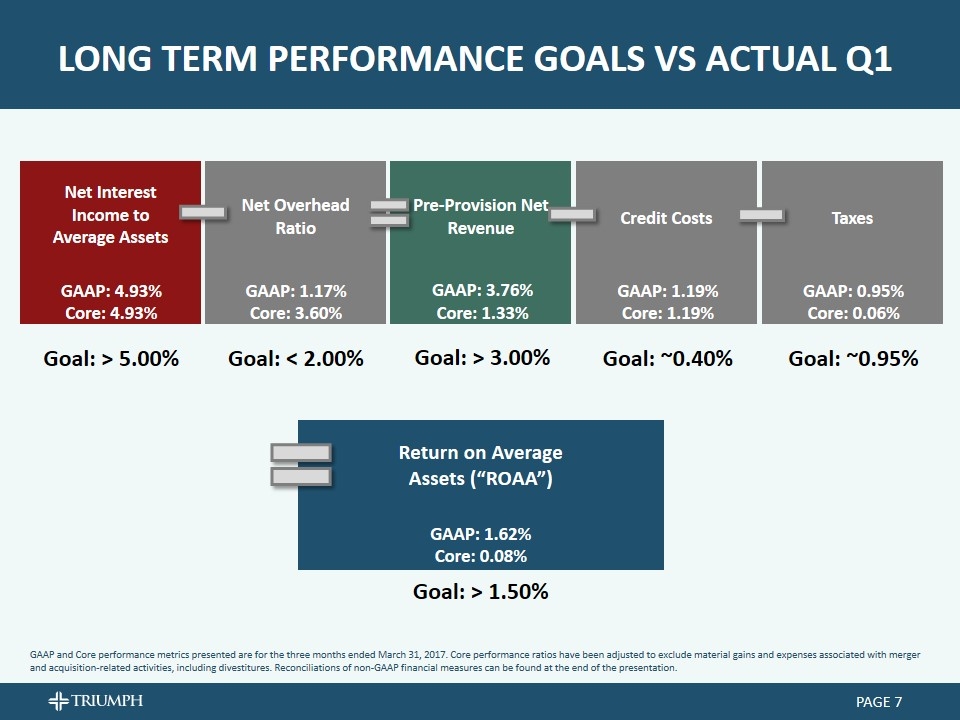

Return on Average Assets (“ROAA”) GAAP: 1.62% Core: 0.08% Goal: > 1.50% Net Overhead Ratio Net Interest Income to Average Assets Credit Costs Pre-Provision Net Revenue Taxes GAAP: 4.93% Core: 4.93% Goal: > 5.00% GAAP: 1.17% Core: 3.60% Goal: < 2.00% GAAP: 3.76% Core: 1.33% Goal: > 3.00% GAAP: 1.19% Core: 1.19% Goal: ~0.40% GAAP: 0.95% Core: 0.06% Goal: ~0.95% Long term performance goals vs Actual Q1 PAGE GAAP and Core performance metrics presented are for the three months ended March 31, 2017. Core performance ratios have been adjusted to exclude material gains and expenses associated with merger and acquisition-related activities, including divestitures. Reconciliations of non-GAAP financial measures can be found at the end of the presentation.

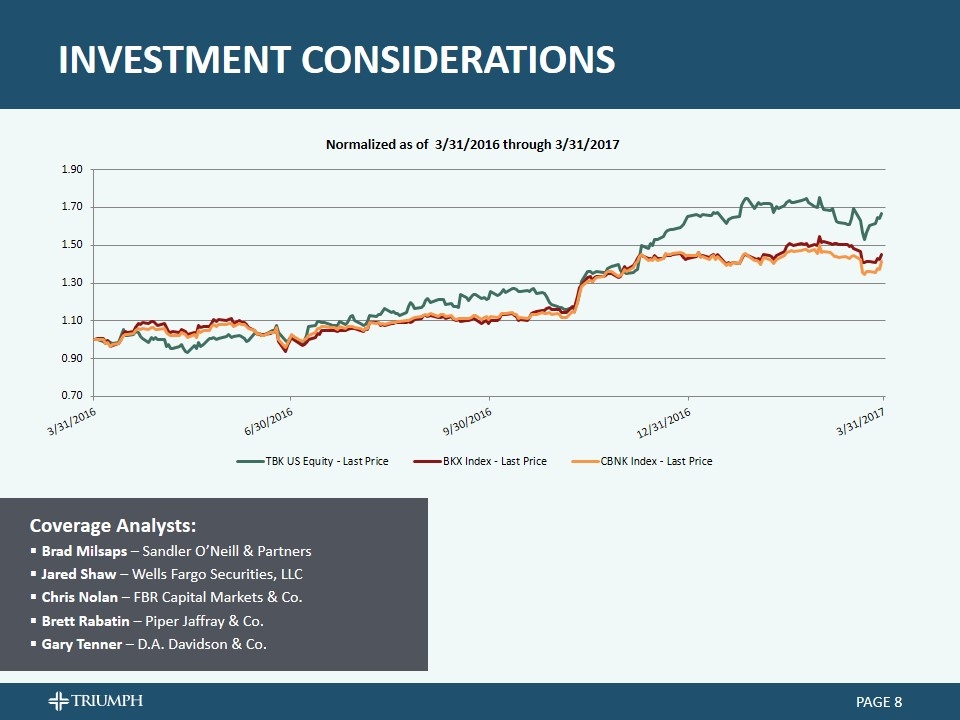

INVESTMENT CONSIDERATIONS PAGE Coverage Analysts: Brad Milsaps – Sandler O’Neill & Partners Jared Shaw – Wells Fargo Securities, LLC Chris Nolan – FBR Capital Markets & Co. Brett Rabatin – Piper Jaffray & Co. Gary Tenner – D.A. Davidson & Co.

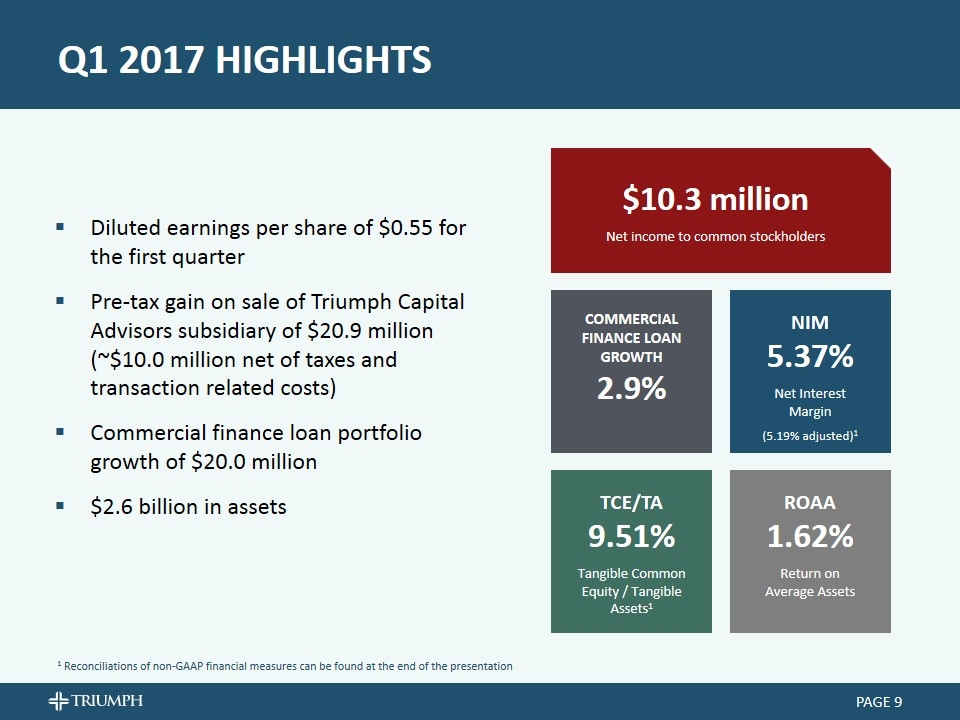

Q1 2017 HIGHLIGHTS PAGE Diluted earnings per share of $0.55 for the first quarter Pre-tax gain on sale of Triumph Capital Advisors subsidiary of $20.9 million (~$10.0 million net of taxes and transaction related costs) Commercial finance loan portfolio growth of $20.0 million $2.6 billion in assets $10.3 million Net income to common stockholders COMMERCIAL FINANCE LOAN GROWTH 2.9% NIM 5.37% Net Interest Margin (5.19% adjusted)1 ROAA 1.62% Return on Average Assets TCE/TA 9.51% Tangible Common Equity / Tangible Assets1 1 Reconciliations of non-GAAP financial measures can be found at the end of the presentation

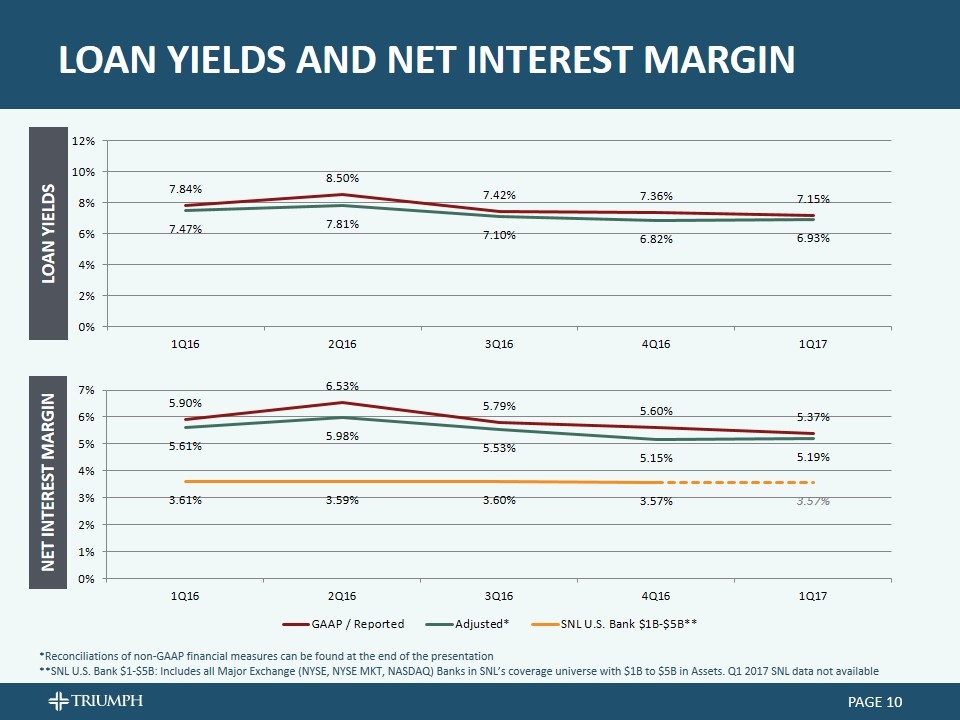

loan yields and NET INTEREST MARGIN PAGE *Reconciliations of non-GAAP financial measures can be found at the end of the presentation **SNL U.S. Bank $1-$5B: Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Banks in SNL’s coverage universe with $1B to $5B in Assets. Q1 2017 SNL data not available Net Interest Margin Loan yields

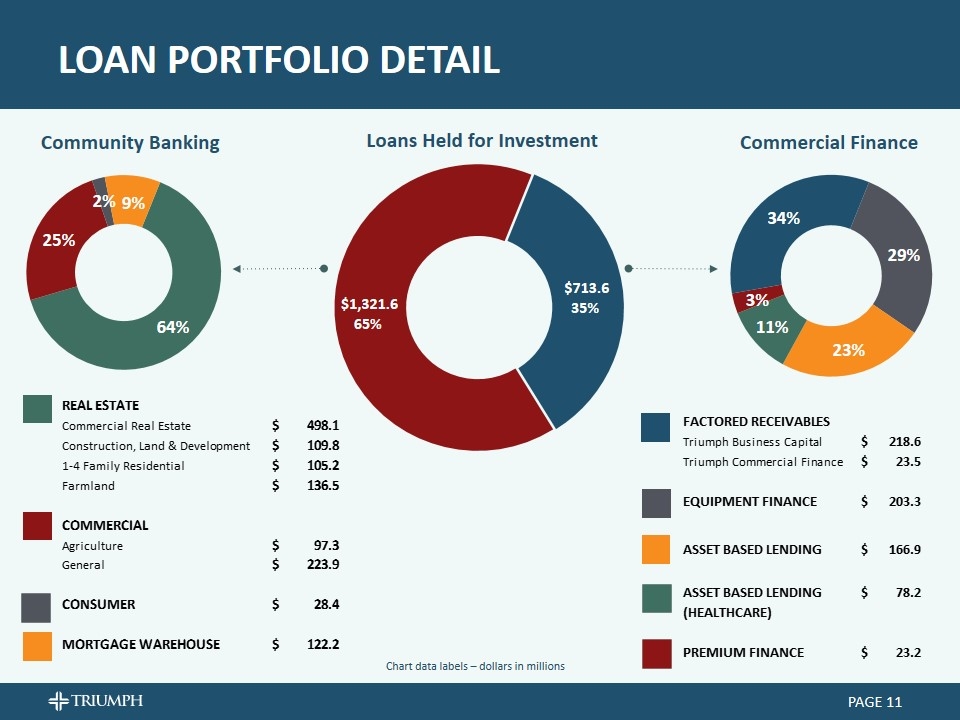

LOAN PORTFOLIO DETAIL PAGE Community Banking Commercial Finance Loans Held for Investment Chart data labels – dollars in millions 42460 42551 42643 42735 42825 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Community Banking 717.72799999999995 803.58500000000004 1,321.9390000000001 1,333.94 1,321.6 Equipment 159.755 167 181.98699999999999 190.393 203.251 0.28481046359768847 Commercial Finance: Asset based lending (General) 85.739000000000004 114.63200000000001 129.501 161.45400000000001 166.917 0.23389655230397571 Asset based lending (Healthcare) 79.58 81.664000000000001 84.9 79.668000000000006 78.207999999999998 0.10959088386796631 Premium Finance 3.5059999999999998 6.117 27.573 23.971 23.161999999999999 3.2456322270737463E-2 Factored receivables 199.53200000000001 237.52 213.95500000000001 238.19800000000001 242.09800000000001 0.33924577795963212 Q1 2017 Commercial Finance Products $713.63599999999997 Community Banking $1,321.6 Real Estate & Farmland $849.71500000000003 Commercial Real Estate $498.09899999999999 Commercial $321.22600000000006 Construction, Land Development, Land $109.849 Consumer $28.414999999999999 1-4 Family Residential Properties $105.23 Mortgage Warehouse $122.244 Farmland $136.53700000000001 Commercial $321.22600000000006 Consumer $28.414999999999999 Community Banking Mortgage Warehouse $122.244 Agriculture 97,314.860889999851 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $498.09899999999999 Construction, Land & Development $109.849 1-4 Family Residential $105.23 Farmland $136.53700000000001 0.64294415859564169 COMMERCIAL 0.24305841404358358 Agriculture $97.3 General $223.92600000000004 CONSUMER $28.414999999999999 2.1500453995157386E-2 MORTGAGE WAREHOUSE $122.244 9.2496973365617435E-2 FACTORED RECEIVABLES Triumph Business Capital $218.59800000000001 Triumph Commercial Finance $23.5 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $203.251 ASSET BASED LENDING $166.917 ASSET BASED LENDING $78.207999999999998 (HEALTHCARE) PREMIUM FINANCE $23.161999999999999 42460 42551 42643 42735 42825 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Community Banking 717.72799999999995 803.58500000000004 1,321.9390000000001 1,333.94 1,321.6 Equipment 159.755 167 181.98699999999999 190.393 203.251 0.28481046359768847 Commercial Finance: Asset based lending (General) 85.739000000000004 114.63200000000001 129.501 161.45400000000001 166.917 0.23389655230397571 Asset based lending (Healthcare) 79.58 81.664000000000001 84.9 79.668000000000006 78.207999999999998 0.10959088386796631 Premium Finance 3.5059999999999998 6.117 27.573 23.971 23.161999999999999 3.2456322270737463E-2 Factored receivables 199.53200000000001 237.52 213.95500000000001 238.19800000000001 242.09800000000001 0.33924577795963212 Q1 2017 Commercial Finance Products $713.63599999999997 Community Banking $1,321.6 Real Estate & Farmland $849.71500000000003 Commercial Real Estate $498.09899999999999 Commercial $321.22600000000006 Construction, Land Development, Land $109.849 Consumer $28.414999999999999 1-4 Family Residential Properties $105.23 Mortgage Warehouse $122.244 Farmland $136.53700000000001 Commercial $321.22600000000006 Consumer $28.414999999999999 Community Banking Mortgage Warehouse $122.244 Agriculture 97,314.860889999851 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $498.09899999999999 Construction, Land & Development $109.849 1-4 Family Residential $105.23 Farmland $136.53700000000001 0.64294415859564169 COMMERCIAL 0.24305841404358358 Agriculture $97.3 General $223.92600000000004 CONSUMER $28.414999999999999 2.1500453995157386E-2 MORTGAGE WAREHOUSE $122.244 9.2496973365617435E-2 FACTORED RECEIVABLES Triumph Business Capital $218.59800000000001 Triumph Commercial Finance $23.5 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $203.251 ASSET BASED LENDING $166.917 ASSET BASED LENDING $78.207999999999998 (HEALTHCARE) PREMIUM FINANCE $23.161999999999999

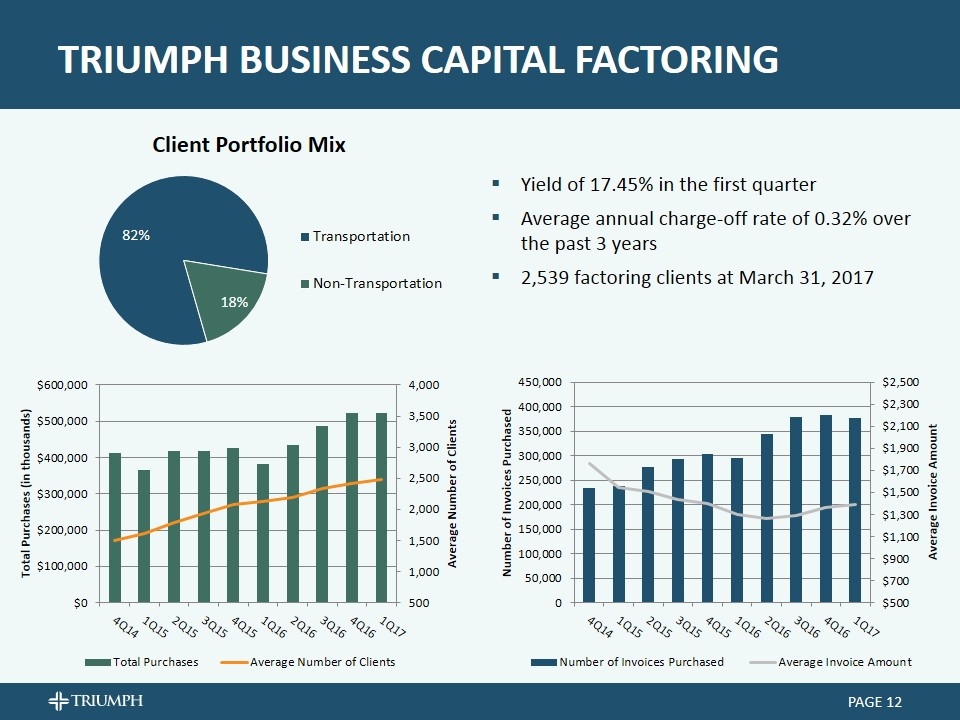

TRIUMPH BUSINESS CAPITAL FACTORING PAGE Yield of 17.45% in the first quarter Average annual charge-off rate of 0.32% over the past 3 years 2,539 factoring clients at March 31, 2017

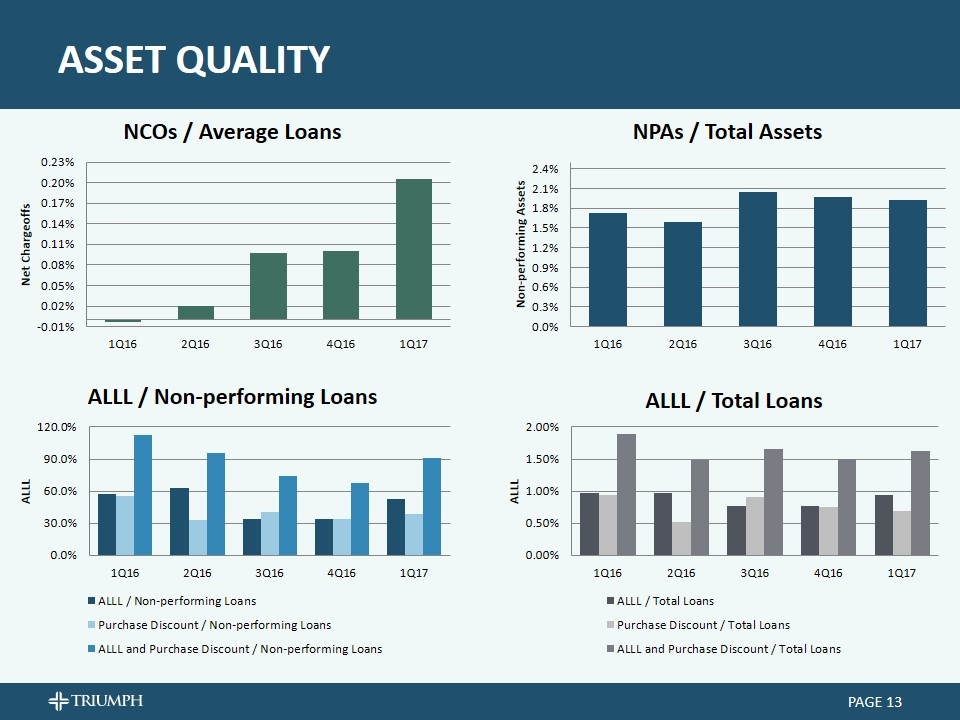

ASSET QUALITY PAGE

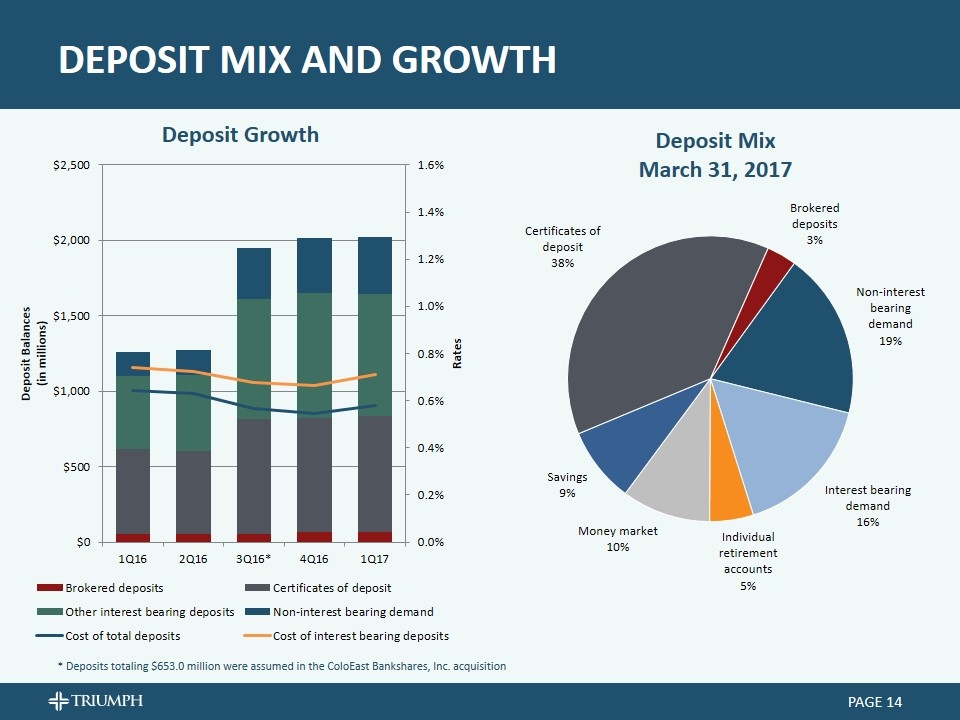

DEPOSIT MIX AND GROWTH PAGE * Deposits totaling $653.0 million were assumed in the ColoEast Bankshares, Inc. acquisition

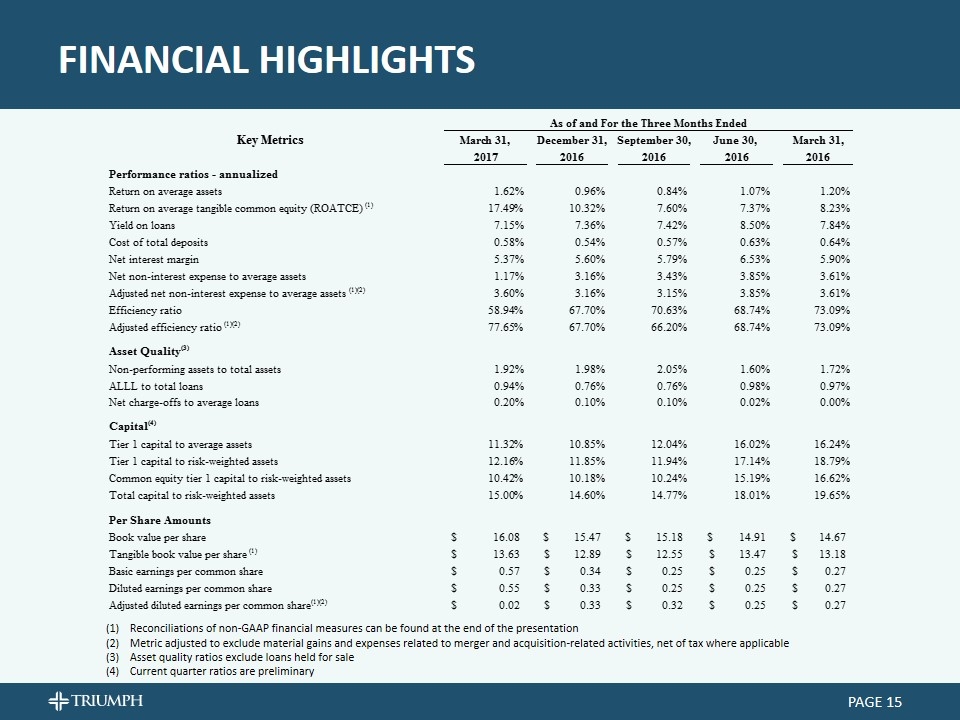

FINANCIAL HIGHLIGHTS PAGE Reconciliations of non-GAAP financial measures can be found at the end of the presentation Metric adjusted to exclude material gains and expenses related to merger and acquisition-related activities, net of tax where applicable Asset quality ratios exclude loans held for sale Current quarter ratios are preliminary 42825 42735 42643 42551 42460 As of and For the Three Months Ended Key Metrics March 31, December 31, September 30, June 30, March 31, 2017 2016 2016 2016 2016 Performance ratios - annualized Return on average assets Return on average assets 1.6216445432006316E-2 9.5677488032248834E-3 8.3787742863370169E-3 1.0674547900535052E-2 1.1966119434092952E-2 Return on average tangible common equity (ROATCE) Return on average tangible common equity (ROATCE) (1) 0.17489447171383407 0.10321717274515334 7.5977771610596309E-2 7.374386390880229E-2 8.228918603421137E-2 Yield on loans Yield on loans 7.1499999999999994E-2 7.3599999999999999E-2 7.4200000000000002E-2 8.5000000000000006E-2 7.8399999999999997E-2 Cost of total deposits Cost of total deposits 5.7870894220360073E-3 5.4395537180396535E-3 5.6539203948167633E-3 6.294009519880947E-3 6.4457419322120537E-3 Net interest margin Net interest margin 5.3712489446424407E-2 5.5967403968259437E-2 5.7941774080860785E-2 6.5285878056964272E-2 5.9042361671899191E-2 Net noninterest expense to average assets Net non-interest expense to average assets 1.1689734290029601E-2 3.1638892106589753E-2 3.4327383525417435E-2 3.8454449851627055E-2 3.6082516141338401E-2 Net noninterest expense to average assets * Adjusted net non-interest expense to average assets (1)(2) 3.6031186262048875E-2 3.1638892106589753E-2 3.1506819937881125E-2 3.8454449851627055E-2 3.6082516141338401E-2 Efficiency ratio Efficiency ratio 0.58938878398917471 0.67697687346489754 0.7063106929643318 0.68743871513102284 0.73088423190579521 Adjusted efficiency ratio * Adjusted efficiency ratio (1)(2) 0.77649901400000509 0.67697687346489754 0.66199304433551498 0.68743871513102284 0.73090644339279209 Asset Quality(3) Nonperforming assets to total assets Non-performing assets to total assets 1.9193976681725976E-2 1.9764739024038389E-2 2.046756151256654E-2 1.5954401576767908E-2 1.7213583403197664E-2 ALLL to total loans ALLL to total loans 9.3812216371958832E-3 7.597562467202992E-3 7.6087261557615232E-3 9.7637889059196698E-3 9.7067039106145253E-3 Net charge-offs to average loans Net charge-offs to average loans .20487983721% 99790302406003984.99790302406004% 97405498102362217.974054981023622% 20216707553661752.202167075536618% 0.000000000000000% Capital(4) Tier 1 capital to average assets Tier 1 capital to average assets 0.11315799999999999 0.108542 0.120437 0.16016301346287154 0.16239999999999999 Tier 1 capital to risk-weighted assets Tier 1 capital to risk-weighted assets 0.121583 0.118477 0.119351 0.17138530020339404 0.18790000000000001 Common equity tier 1 capital to risk-weighted assets Common equity tier 1 capital to risk-weighted assets 0.104185 0.10176200000000001 0.10238 0.15190831175754529 0.16619999999999999 Total capital to risk-weighted assets Total capital to risk-weighted assets 0.150001 0.145985 0.1477147 0.18009725306868427 0.19650000000000001 Per Share Amounts Book value per share Book value per share $16.078499990790306 $15.466093322543941 $15.175084224987739 $14.911910747666727 $14.67453038155141 Tangible book value per share Tangible book value per share (1) $13.631839395149086 $12.892230134924036 $12.554628142255437 $13.467204585968915 $13.18259962866262 Basic earnings per share Basic earnings per common share $0.57260226413786142 $0.3389603195784453 $0.25226796685973479 $0.24812873510521288 $0.27006809871285342 Diluted earnings per share Diluted earnings per common share $0.55378594711677598 $0.33364945402840507 $0.24889441121363498 $0.24561230832499889 $0.26759971928577253 Adjusted diluted earnings per share Adjusted diluted earnings per common share(1)(2) $1.7218681332149422E-2 $0.33 $0.32325014763265597 $0.25 $0.27 UPDATE MANUALLY

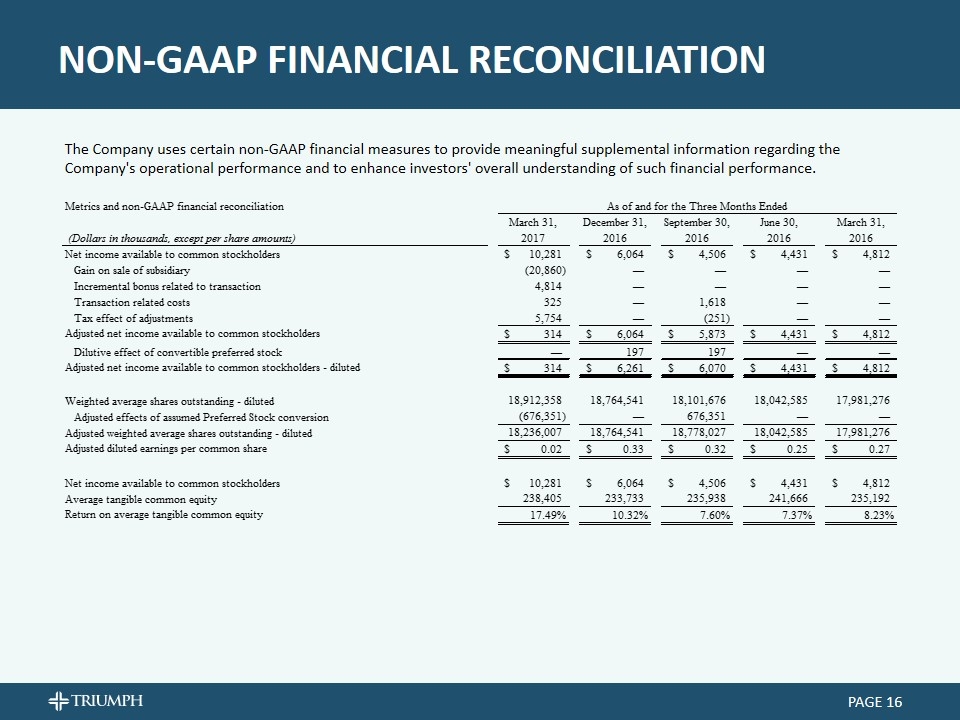

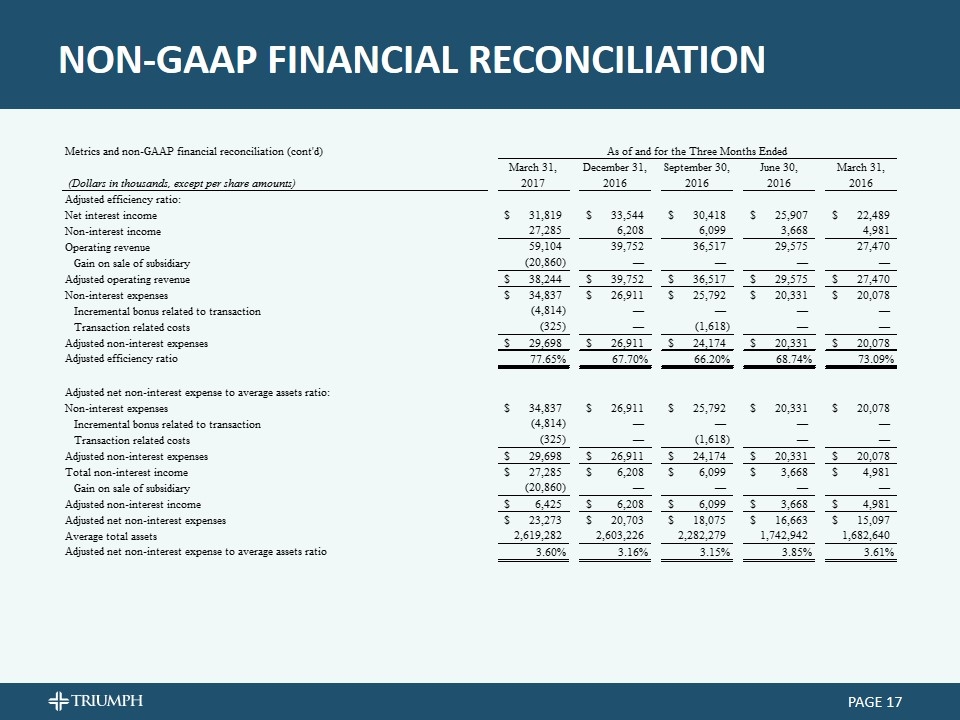

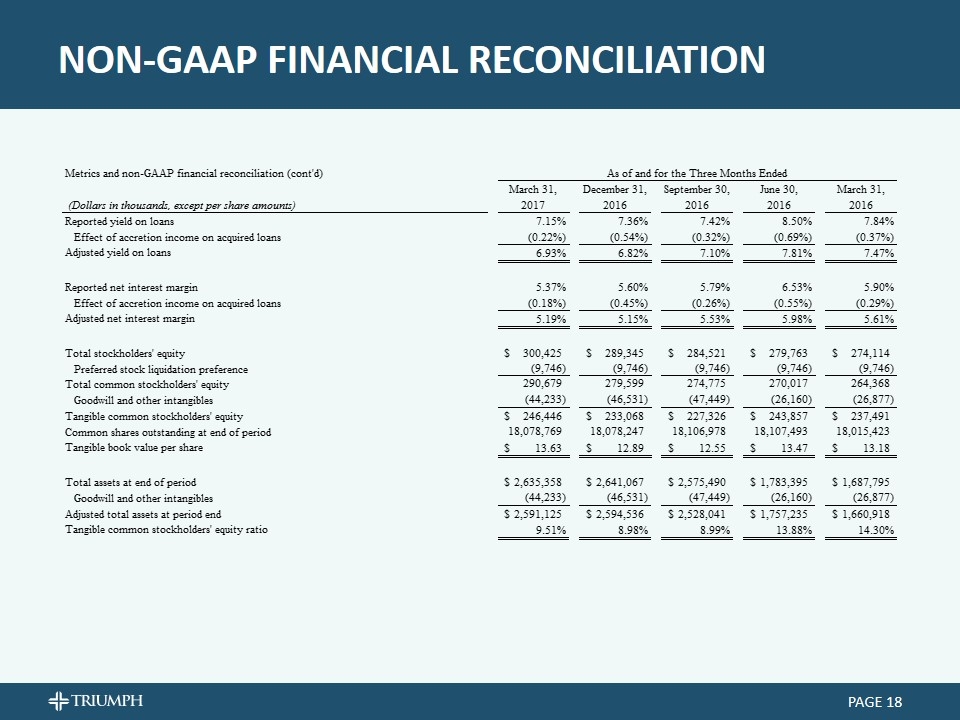

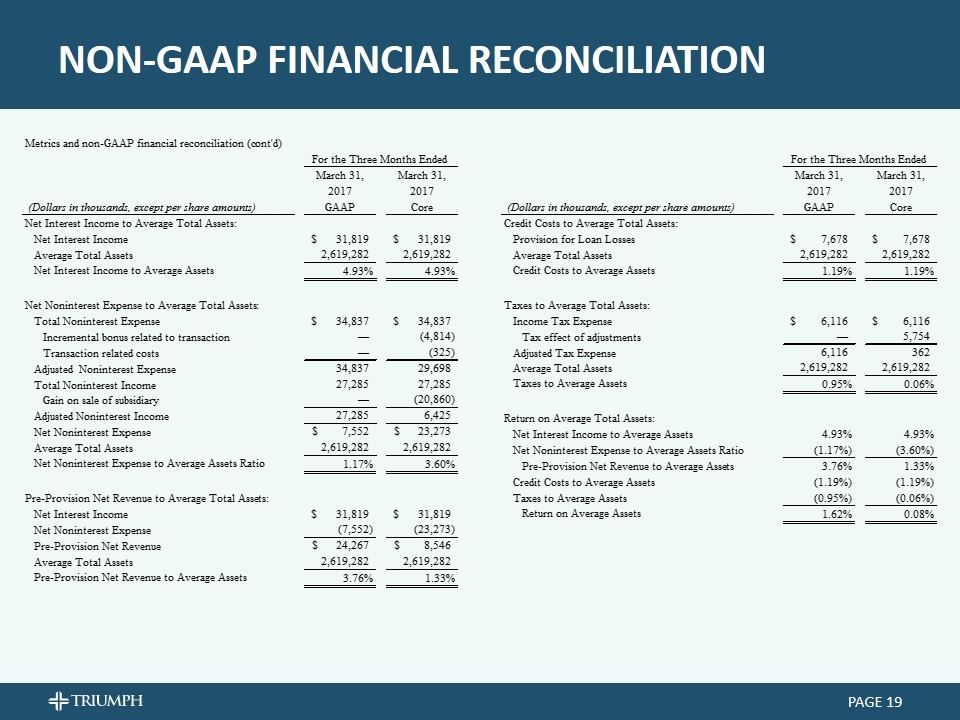

NON-GAAP FINANCIAL RECONCILIATION PAGE The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company's operational performance and to enhance investors' overall understanding of such financial performance. 42825QTD 42460QTD 42185QTD 42094QTD 42094QTD 42825 42735 42643 42551 42460 365 366 366 366 366 90 92 92 91 91 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Manual Adj Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Manual Adj Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Diluted_Shrs Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Manual Adj Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 AvgTangEq Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Manual Adj Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 AvgAssets Average total assets $2,619,282 $2,603,226 $2,282,279.2052168939 $1,742,942 $1,682,640.3261250083 CHECK ROUNDING $0 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% DisAcrLYLD Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% DisAcrLNIM Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Shares outstanding end of period Common shares outstanding 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 Average total assets 2,619,282 2,603,226 2,282,279.2052168939 1,742,942 1,682,640.3261250083 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Common shares outstanding at end of period 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Net Interest Income to Average Total Assets: Net Interest Income $31,819 $31,819 Average Total Assets 2,619,282 2,619,282 Net Interest Income to Average Assets 4.9299999999999997E-2 4.9299999999999997E-2 Net Noninterest Expense to Average Total Assets: Total Noninterest Expense $34,837 $34,837 Incremental bonus related to transaction 0 -4,814 Transaction related costs 0 -,325 Adjusted Noninterest Expense 34,837 29,698 Total Noninterest Income 27,285 27,285 Gain on sale of subsidiary 0 ,-20,860 Adjusted Noninterest Income 27,285 6,425 Net Noninterest Expense 7,552 23,273 Average Total Assets 2,619,282 2,619,282 Net Noninterest Expense to Average Assets Ratio 1.17E-2 3.5999999999999997E-2 Pre-Provision Net Revenue to Average Total Assets: Net Interest Income $31,819 $31,819 Less: Net Noninterest Expense 7,552 23,273 Pre-Provision Net Revenue 24,267 8,546 Average Total Assets 2,619,282 2,619,282 Pre-Provision Net Revenue to Average Assets 3.7600000000000001E-2 1.32E-2 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Credit Costs to Average Total Assets: Provision for Loan Losses $7,678 $7,678 Average Total Assets 2,619,282 2,619,282 Credit Costs to Average Assets 1.1900000000000001E-2 1.1900000000000001E-2 Taxes to Average Total Assets: Income Tax Expense $6,116 $6,116 Tax effect of adjustments 0 5,754 Adjusted Tax Expense 6,116 362 Average Total Assets 2,619,282 2,619,282 Taxes to Average Assets 9.4999999999999998E-3 5.9999999999999995E-4 Return on Average Total Assets:* Net Interest Income to Average Assets 4.93% 4.93% Less: Net Noninterest Expense to Average Assets Ratio -1.17% -3.6% Pre-Provision Net Revenue to Average Assets 3.76% 1.33% Less: Credit Costs to Average Assets -1.19% -1.19% Less: Taxes to Average Assets -0.95% .06% Return on Average Assets 1.6199999999999992E-2 7.9999999999999852E-4 0 9.9999999999999395E-5 0

NON-GAAP FINANCIAL RECONCILIATION PAGE 42825QTD 42460QTD 42185QTD 42094QTD 42094QTD 42825 42735 42643 42551 42460 365 366 366 366 366 90 92 92 91 91 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Manual Adj Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Manual Adj Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Diluted_Shrs Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Manual Adj Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 AvgTangEq Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Manual Adj Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 AvgAssets Average total assets $2,619,282 $2,603,226 $2,282,279.2052168939 $1,742,942 $1,682,640.3261250083 CHECK ROUNDING $0 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% DisAcrLYLD Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% DisAcrLNIM Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Shares outstanding end of period Common shares outstanding 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 Average total assets 2,619,282 2,603,226 2,282,279.2052168939 1,742,942 1,682,640.3261250083 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Common shares outstanding at end of period 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Net Interest Income to Average Total Assets: Net Interest Income $31,819 $31,819 Average Total Assets 2,619,282 2,619,282 Net Interest Income to Average Assets 4.9299999999999997E-2 4.9299999999999997E-2 Net Noninterest Expense to Average Total Assets: Total Noninterest Expense $34,837 $34,837 Incremental bonus related to transaction 0 -4,814 Transaction related costs 0 -,325 Adjusted Noninterest Expense 34,837 29,698 Total Noninterest Income 27,285 27,285 Gain on sale of subsidiary 0 ,-20,860 Adjusted Noninterest Income 27,285 6,425 Net Noninterest Expense 7,552 23,273 Average Total Assets 2,619,282 2,619,282 Net Noninterest Expense to Average Assets Ratio 1.17E-2 3.5999999999999997E-2 Pre-Provision Net Revenue to Average Total Assets: Net Interest Income $31,819 $31,819 Less: Net Noninterest Expense 7,552 23,273 Pre-Provision Net Revenue 24,267 8,546 Average Total Assets 2,619,282 2,619,282 Pre-Provision Net Revenue to Average Assets 3.7600000000000001E-2 1.32E-2 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Credit Costs to Average Total Assets: Provision for Loan Losses $7,678 $7,678 Average Total Assets 2,619,282 2,619,282 Credit Costs to Average Assets 1.1900000000000001E-2 1.1900000000000001E-2 Taxes to Average Total Assets: Income Tax Expense $6,116 $6,116 Tax effect of adjustments 0 5,754 Adjusted Tax Expense 6,116 362 Average Total Assets 2,619,282 2,619,282 Taxes to Average Assets 9.4999999999999998E-3 5.9999999999999995E-4 Return on Average Total Assets:* Net Interest Income to Average Assets 4.93% 4.93% Less: Net Noninterest Expense to Average Assets Ratio -1.17% -3.6% Pre-Provision Net Revenue to Average Assets 3.76% 1.33% Less: Credit Costs to Average Assets -1.19% -1.19% Less: Taxes to Average Assets -0.95% .06% Return on Average Assets 1.6199999999999992E-2 7.9999999999999852E-4 0 9.9999999999999395E-5 0

NON-GAAP FINANCIAL RECONCILIATION PAGE 42825QTD 42460QTD 42185QTD 42094QTD 42094QTD 42825 42735 42643 42551 42460 365 366 366 366 366 90 92 92 91 91 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Manual Adj Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Manual Adj Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Diluted_Shrs Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Manual Adj Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 AvgTangEq Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Manual Adj Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Manual Adj Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 AvgAssets Average total assets $2,619,282 $2,603,226 $2,282,279.2052168939 $1,742,942 $1,682,640.3261250083 CHECK ROUNDING $0 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% DisAcrLYLD Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% DisAcrLNIM Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Shares outstanding end of period Common shares outstanding 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Gain on sale of subsidiary ,-20,860 0 0 0 0 Incremental bonus related to transaction 4,814 0 0 0 0 Transaction related costs 325 0 1,618 0 0 Tax effect of adjustments 5,754 0 -,251 0 0 Adjusted net income available to common stockholders $314 $6,064 $5,873 $4,431 $4,812 Dilutive effect of convertible preferred stock 0 197 197 0 0 Adjusted net income available to common stockholders - diluted $314 $6,261 $6,070 $4,431 $4,812 Weighted average shares outstanding - diluted 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 17,981,276 Adjusted effects of assumed Preferred Stock conversion -,676,351 0 ,676,351 0 0 Adjusted weighted average shares outstanding - diluted 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 17,981,276 Adjusted diluted earnings per common share $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.26761170897994113 Net income available to common stockholders $10,281 $6,064 $4,506 $4,431 $4,812 Average tangible common equity ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,235,191.51529098698 Return on average tangible common equity 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 8.2289355624981242E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Adjusted efficiency ratio: Net interest income $31,819 $33,544 $30,418 $25,907 $22,489 Non-interest income 27,285 6,208 6,099 3,668 4,981 Operating revenue 59,104 39,752 36,517 29,575 27,470 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted operating revenue $38,244 $39,752 $36,517 $29,575 $27,470 Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Adjusted efficiency ratio 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.73090644339279209 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,837 $26,911 $25,792 $20,331 $20,078 Incremental bonus related to transaction -4,814 0 0 0 0 Transaction related costs -,325 0 -1,618 0 0 Adjusted non-interest expenses $29,698 $26,911 $24,174 $20,331 $20,078 Total non-interest income $27,285 $6,208 $6,099 $3,668 $4,981 Gain on sale of subsidiary ,-20,860 0 0 0 0 Adjusted non-interest income $6,425 $6,208 $6,099 $3,668 $4,981 Adjusted net non-interest expenses $23,273 $20,703 $18,075 $16,663 $15,097 Average total assets 2,619,282 2,603,226 2,282,279.2052168939 1,742,942 1,682,640.3261250083 Adjusted net non-interest expense to average assets ratio 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.6086025786411083E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2017 2016 2016 2016 2016 Reported yield on loans 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.84% Effect of accretion income on acquired loans -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.37% Adjusted yield on loans 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.4673496519255061E-2 Reported net interest margin 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.904236167189919% Effect of accretion income on acquired loans -0.18% -0.45% -0.26% -0.55% -0.29% Adjusted net interest margin 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.6056483316736079E-2 Total stockholders' equity $,300,425 $,289,345 $,284,521 $,279,763 $,274,114 Preferred stock liquidation preference -9,746 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,290,679 ,279,599 ,274,775 ,270,017 ,264,368 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Tangible common stockholders' equity $,246,446 $,233,068 $,227,326 $,243,857 $,237,491 Common shares outstanding at end of period 18,078,769 18,078,247 18,106,978 18,107,493 18,015,423 Tangible book value per share $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $13.182649111264276 Total assets at end of period $2,635,358 $2,641,067 $2,575,490 $1,783,395 $1,687,795 Goodwill and other intangibles ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-26,877 Adjusted total assets at period end $2,591,125 $2,594,536 $2,528,041 $1,757,235 $1,660,918 Tangible common stockholders' equity ratio 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 0.14298779349733098 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Net Interest Income to Average Total Assets: Net Interest Income $31,819 $31,819 Average Total Assets 2,619,282 2,619,282 Net Interest Income to Average Assets 4.9299999999999997E-2 4.9299999999999997E-2 Net Noninterest Expense to Average Total Assets: Total Noninterest Expense $34,837 $34,837 Incremental bonus related to transaction 0 -4,814 Transaction related costs 0 -,325 Adjusted Noninterest Expense 34,837 29,698 Total Noninterest Income 27,285 27,285 Gain on sale of subsidiary 0 ,-20,860 Adjusted Noninterest Income 27,285 6,425 Net Noninterest Expense 7,552 23,273 Average Total Assets 2,619,282 2,619,282 Net Noninterest Expense to Average Assets Ratio 1.17E-2 3.5999999999999997E-2 Pre-Provision Net Revenue to Average Total Assets: Net Interest Income $31,819 $31,819 Less: Net Noninterest Expense 7,552 23,273 Pre-Provision Net Revenue 24,267 8,546 Average Total Assets 2,619,282 2,619,282 Pre-Provision Net Revenue to Average Assets 3.7600000000000001E-2 1.32E-2 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended $42,825 $42,825 (Dollars in thousands, except per share amounts) Unadjusted Adjusted Credit Costs to Average Total Assets: Provision for Loan Losses $7,678 $7,678 Average Total Assets 2,619,282 2,619,282 Credit Costs to Average Assets 1.1900000000000001E-2 1.1900000000000001E-2 Taxes to Average Total Assets: Income Tax Expense $6,116 $6,116 Tax effect of adjustments 0 5,754 Adjusted Tax Expense 6,116 362 Average Total Assets 2,619,282 2,619,282 Taxes to Average Assets 9.4999999999999998E-3 5.9999999999999995E-4 Return on Average Total Assets:* Net Interest Income to Average Assets 4.93% 4.93% Less: Net Noninterest Expense to Average Assets Ratio -1.17% -3.6% Pre-Provision Net Revenue to Average Assets 3.76% 1.33% Less: Credit Costs to Average Assets -1.19% -1.19% Less: Taxes to Average Assets -0.95% .06% Return on Average Assets 1.6199999999999992E-2 7.9999999999999852E-4 0 9.9999999999999395E-5 0