Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - TEXAS CAPITAL BANCSHARES INC/TX | a04192017exhibit991.htm |

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | a04192017-8k.htm |

TCBI Q1 2017

Earnings

April 19, 2017

Certain matters discussed within or in connection with these materials may contain “forward-looking statements” as defined in federal

securities laws, which are subject to risks and uncertainties and are based on Texas Capital’s current estimates or expectations of future

events or future results. These statements are not historical in nature and can generally be identified by such words as “believe,” “expect,”

“estimate,” “anticipate,” “plan,” “may,” “will,” “intend” and similar expressions. A number of factors, many of which are beyond our

control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These

risks and uncertainties include, but are not limited to, the credit quality of our loan portfolio, general economic conditions in the United

States and in our markets, including the continued impact on our customers from declines and volatility in oil and gas prices, rates of

default or loan losses, volatility in the mortgage industry, the success or failure of our business strategies, future financial performance,

future growth and earnings, the appropriateness of our allowance for loan losses and provision for credit losses, the impact of increased

regulatory requirements and legislative changes on our business, increased competition, interest rate risk, the success or failure of new

lines of business and new product or service offerings and the impact of new technologies. These and other factors that could cause

results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties

that may affect our business, can be found in our Annual Report on Form 10-K and in other filings we make with the Securities and

Exchange Commission. Forward-looking statements speak only as of the date of this presentation. Texas Capital is under no obligation,

and expressly disclaims any obligation, to update, alter or revise its forward-looking statements, whether as a result of new information,

future events or otherwise.

2

3

Opening Remarks & Financial Highlights

Core

Earnings

Power

Strong

Balanced

Growth

Credit

Quality

• Solid traditional LHI growth in Q1-2017

• Mortgage finance balances down significantly as a result of seasonal impact and higher rates, offset

partially by significant growth in MCA

• More dramatic seasonal impact experienced in average DDAs and total deposits as base has grown

• Solid net revenue contribution despite seasonal impact, YOY net revenue growth significant

• Operating leverage acceptable with improvements expected later in the year

• Benefit of increase in rates, before decline in mortgage finance volumes, is as expected; additional rate

move will be impactful

• Credit metrics remain acceptable with Q1-2017 provision of $9 million as a result of continued

improvement in criticized loan balances

• NCOs for Q1-2017 $5.7 million, or 18 bps

• Meaningful decline in NPA levels since Q4-2016

• High allowance coverage ratios

Operating

Results

Net Income

$42.5 million

EPS

$0.80

ROE

CE

8.60%

Total

LHI

$16.7 billion

Total

Deposits

$16.6 billion

4

Energy & Houston Update

Energy Exposure

• Outstanding energy loans represented 5% of total loans, or $968.5 million, at Q1-2017 compared to $996.1 million at Q4-

2016

• Conservative underwriting provided appropriate protection from industry weakness

• Strong reserve position

‐ Allocated reserve of $57.4 million represents 6% of energy loans

‐ $7.1 million of energy net charge-offs in Q1-2017 previously reserved

‐ Strongest position compared to other energy lending peers in criticized assets, reserve coverage to criticized assets and

exposure to unfunded commitments

• Decrease in energy non-accruals

‐ Non-accruals $100.9 million at Q1-2017 compared to $121.5 million at Q4-2016

‐ Criticized energy loans decreased to 16% of energy loans at Q1-2017 from 20 % at Q4-2016

‐ Total criticized energy loans at Q1-2017 $154.9 million, includes classified of $137.9 million and all NPAs

Houston CRE

• Diversified exposure representing 5% of total LHI

• Limited new commitments since year-end 2014

• Credit quality remains strong with $3 million “special mention”, no substandard or nonaccrual at Q1-2017 compared to $8.3

million “special mention” $159,000 substandard, and no non-accrual at Q4-2016

• Confident of position due to conservative underwriting standards – still watching carefully

8

,

8

1

2

8

,

7

4

3

6

,

1

0

1

1

0

,

5

0

4

-

2,000

4,000

6,000

8,000

10,000

12,000

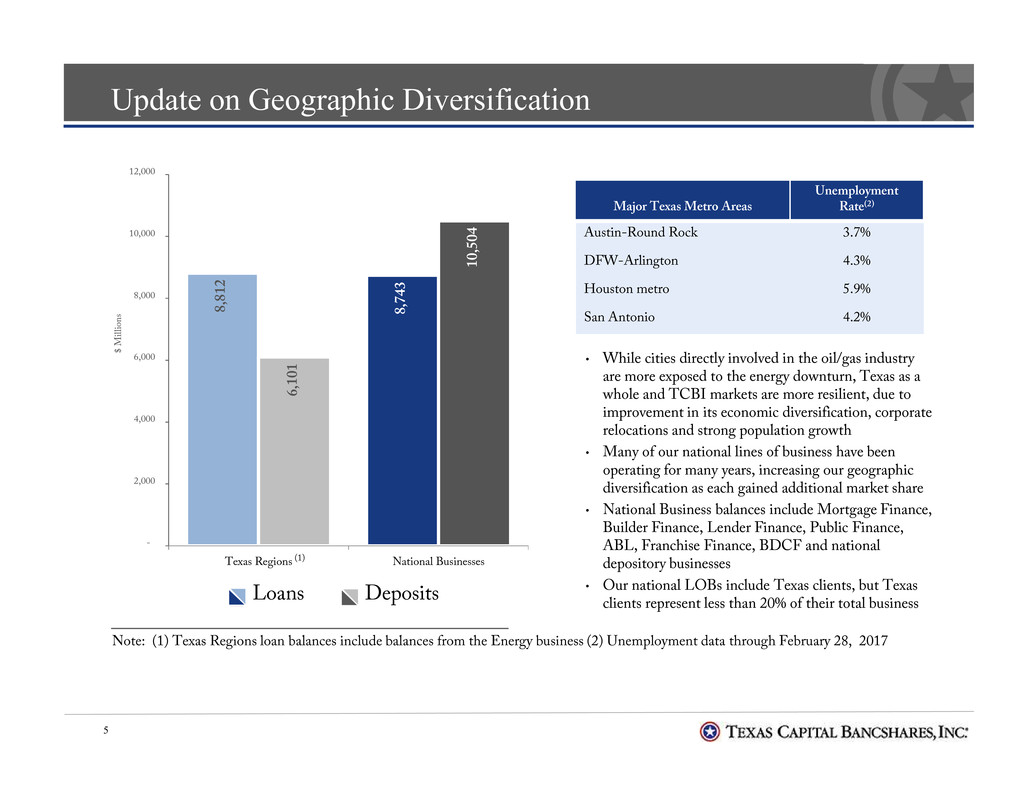

Texas Regions National Businesses

$

M

i

l

l

i

o

n

s

Loans Deposits

5

Update on Geographic Diversification

Note: (1) Texas Regions loan balances include balances from the Energy business (2) Unemployment data through February 28, 2017

• While cities directly involved in the oil/gas industry

are more exposed to the energy downturn, Texas as a

whole and TCBI markets are more resilient, due to

improvement in its economic diversification, corporate

relocations and strong population growth

• Many of our national lines of business have been

operating for many years, increasing our geographic

diversification as each gained additional market share

• National Business balances include Mortgage Finance,

Builder Finance, Lender Finance, Public Finance,

ABL, Franchise Finance, BDCF and national

depository businesses

• Our national LOBs include Texas clients, but Texas

clients represent less than 20% of their total business

Major Texas Metro Areas

Unemployment

Rate(2)

Austin-Round Rock 3.7%

DFW-Arlington 4.3%

Houston metro 5.9%

San Antonio 4.2%

(1)

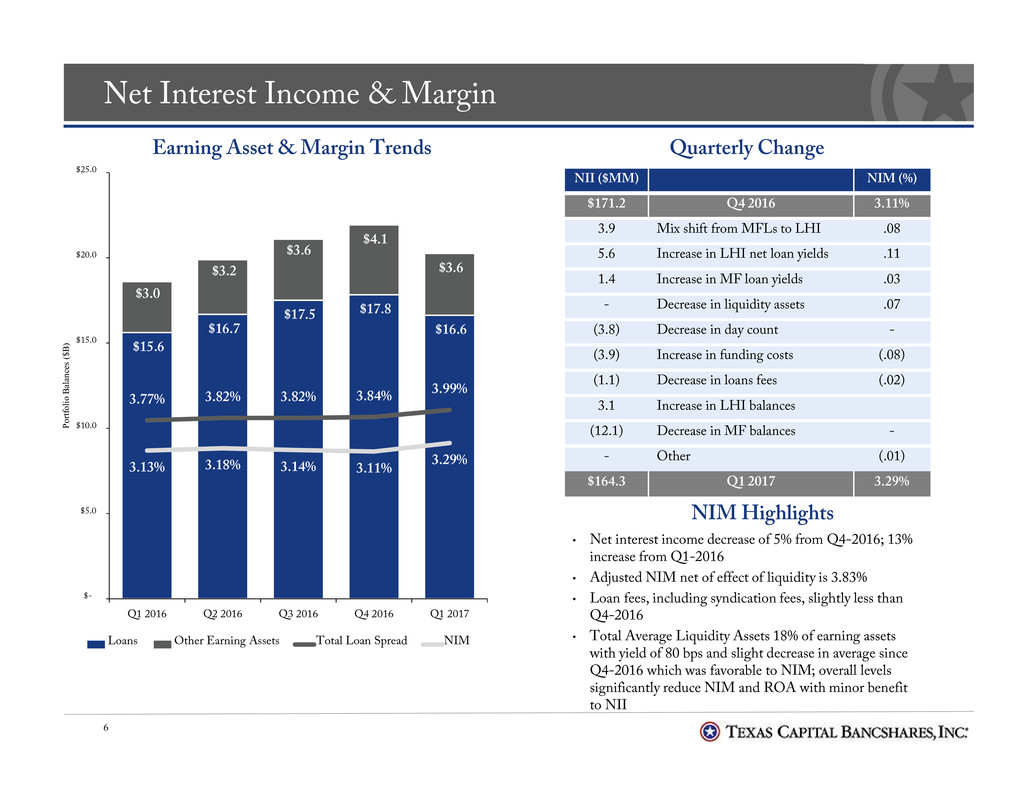

Net Interest Income & Margin

6

• Net interest income decrease of 5% from Q4-2016; 13%

increase from Q1-2016

• Adjusted NIM net of effect of liquidity is 3.83%

• Loan fees, including syndication fees, slightly less than

Q4-2016

• Total Average Liquidity Assets 18% of earning assets

with yield of 80 bps and slight decrease in average since

Q4-2016 which was favorable to NIM; overall levels

significantly reduce NIM and ROA with minor benefit

to NII

Quarterly Change

NII ($MM) NIM (%)

$171.2 Q4 2016 3.11%

3.9 Mix shift from MFLs to LHI .08

5.6 Increase in LHI net loan yields .11

1.4 Increase in MF loan yields .03

- Decrease in liquidity assets .07

(3.8) Decrease in day count -

(3.9) Increase in funding costs (.08)

(1.1) Decrease in loans fees (.02)

3.1 Increase in LHI balances

(12.1) Decrease in MF balances -

- Other (.01)

$164.3 Q1 2017 3.29%

Earning Asset & Margin Trends

$15.6

$16.7

$17.5 $17.8

$16.6

$3.0

$3.2

$3.6

$4.1

$3.6

3.77% 3.82% 3.82% 3.84%

3.99%

3.13% 3.18% 3.14% 3.11%

3.29%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

$-

$5.0

$10.0

$15.0

$20.0

$25.0

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

P

o

r

t

f

o

l

i

o

B

a

l

a

n

c

e

s

(

$

B

)

Loans Other Earning Assets Total Loan Spread NIM

NIM Highlights

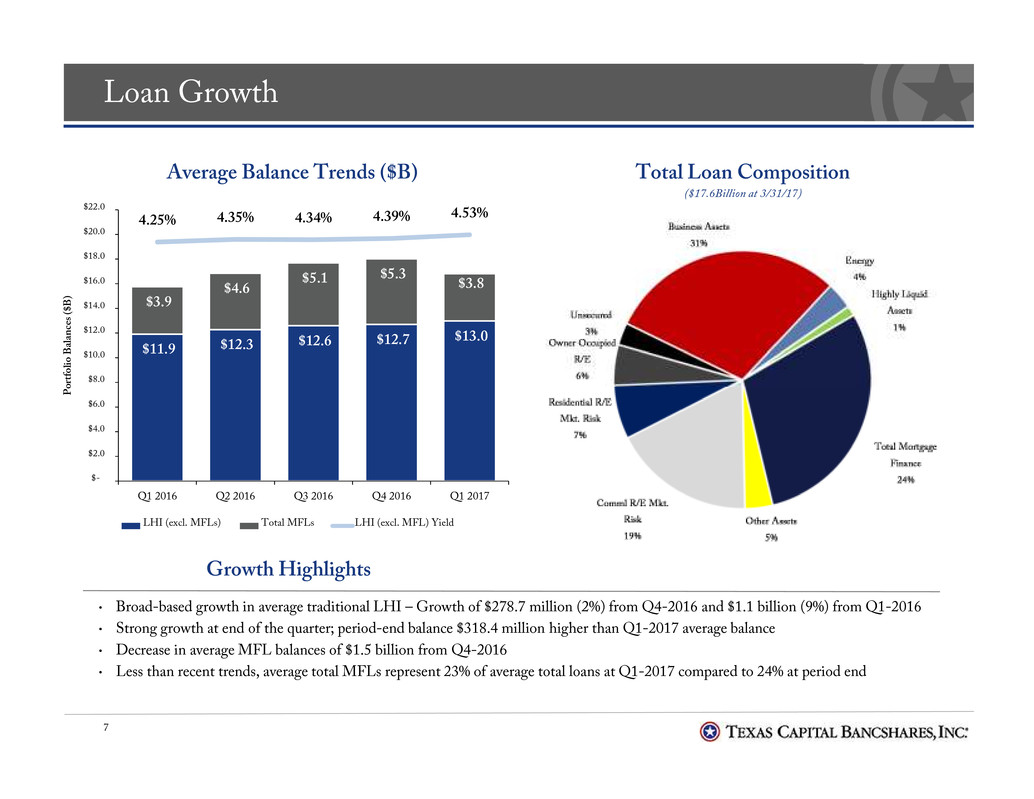

Loan Growth

7

• Broad-based growth in average traditional LHI – Growth of $278.7 million (2%) from Q4-2016 and $1.1 billion (9%) from Q1-2016

• Strong growth at end of the quarter; period-end balance $318.4 million higher than Q1-2017 average balance

• Decrease in average MFL balances of $1.5 billion from Q4-2016

• Less than recent trends, average total MFLs represent 23% of average total loans at Q1-2017 compared to 24% at period end

Growth Highlights

Average Balance Trends ($B) Total Loan Composition

($17.6Billion at 3/31/17)

$11.9 $12.3 $12.6

$12.7 $13.0

$3.9

$4.6

$5.1 $5.3 $3.8

4.25% 4.35% 4.34% 4.39% 4.53%

-5.00%

-3.00%

-1.00%

1.00%

3.00%

5.00%

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

$22.0

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

P

o

r

t

f

o

l

i

o

B

a

l

a

n

c

e

s

(

$

B

)

LHI (excl. MFLs) Total MFLs LHI (excl. MFL) Yield

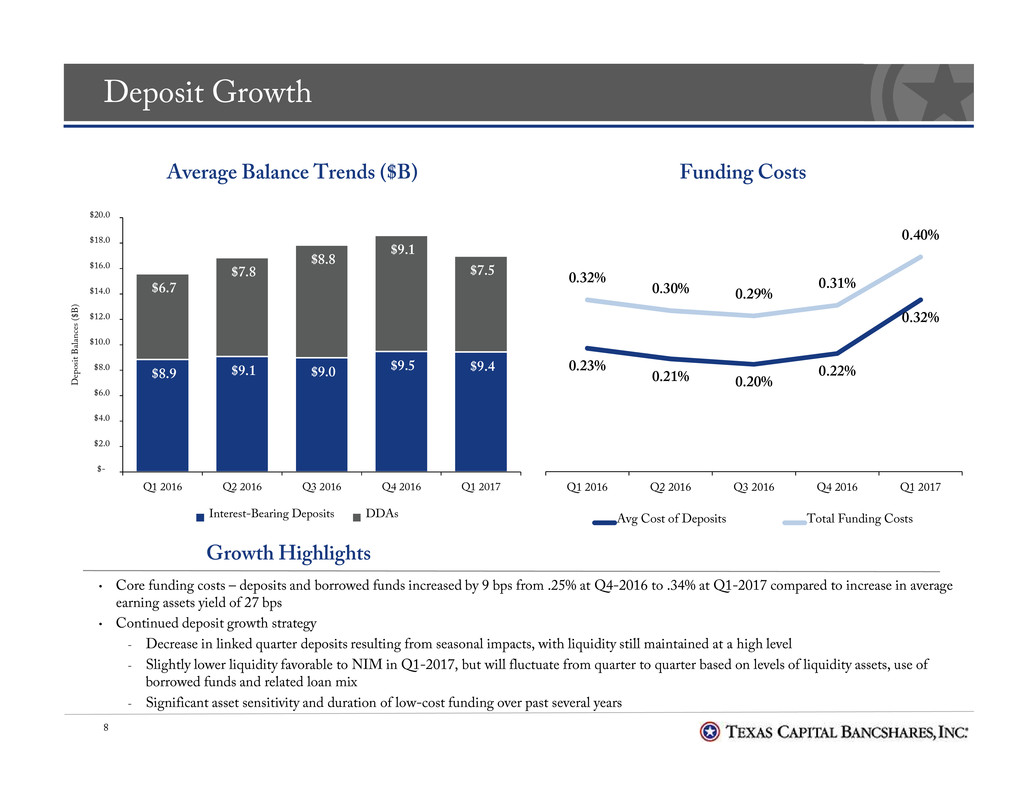

Deposit Growth

8

Average Balance Trends ($B) Funding Costs

• Core funding costs – deposits and borrowed funds increased by 9 bps from .25% at Q4-2016 to .34% at Q1-2017 compared to increase in average

earning assets yield of 27 bps

• Continued deposit growth strategy

‐ Decrease in linked quarter deposits resulting from seasonal impacts, with liquidity still maintained at a high level

‐ Slightly lower liquidity favorable to NIM in Q1-2017, but will fluctuate from quarter to quarter based on levels of liquidity assets, use of

borrowed funds and related loan mix

‐ Significant asset sensitivity and duration of low-cost funding over past several years

Growth Highlights

$8.9 $9.1 $9.0 $9.5 $9.4

$6.7

$7.8

$8.8

$9.1

$7.5

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

D

e

p

o

s

i

t

B

a

l

a

n

c

e

s

(

$

B

)

Interest-Bearing Deposits DDAs

0.23%

0.21% 0.20%

0.22%

0.32%

0.32%

0.30% 0.29%

0.31%

0.40%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Avg Cost of Deposits Total Funding Costs

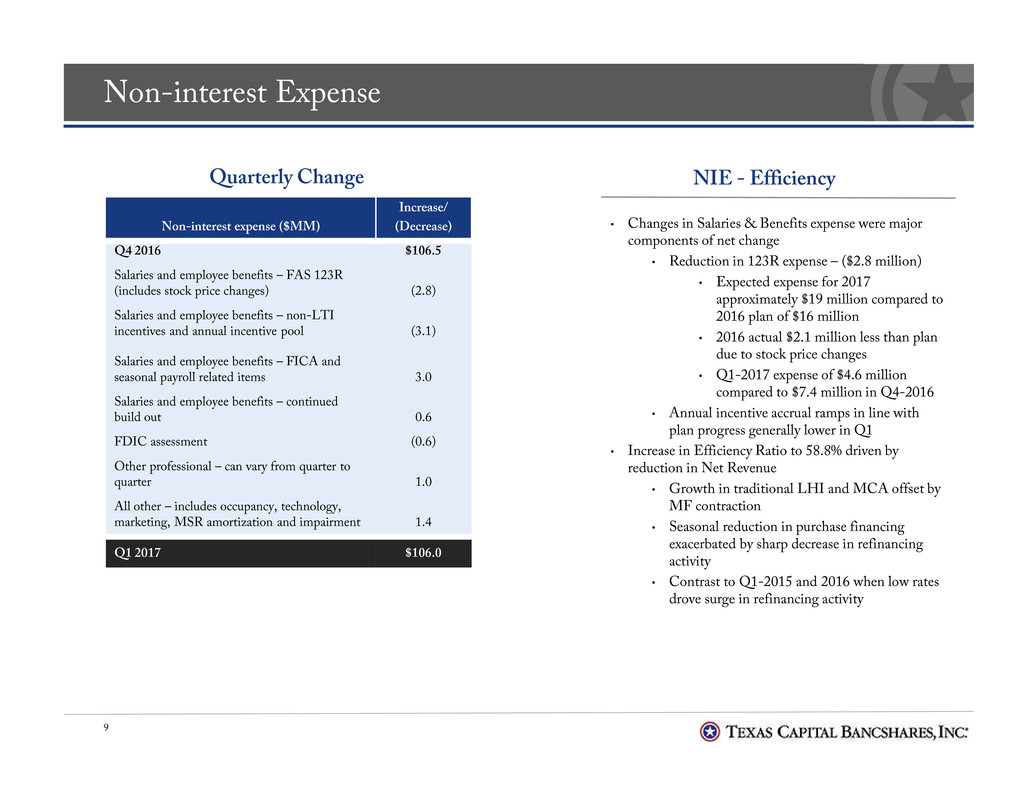

Non-interest Expense

9

Quarterly Change NIE - Efficiency

Non-interest expense ($MM)

Increase/

(Decrease)

Q4 2016 $106.5

Salaries and employee benefits – FAS 123R

(includes stock price changes) (2.8)

Salaries and employee benefits – non-LTI

incentives and annual incentive pool (3.1)

Salaries and employee benefits – FICA and

seasonal payroll related items 3.0

Salaries and employee benefits – continued

build out 0.6

FDIC assessment (0.6)

Other professional – can vary from quarter to

quarter 1.0

All other – includes occupancy, technology,

marketing, MSR amortization and impairment 1.4

Q1 2017 $106.0

• Changes in Salaries & Benefits expense were major

components of net change

• Reduction in 123R expense – ($2.8 million)

• Expected expense for 2017

approximately $19 million compared to

2016 plan of $16 million

• 2016 actual $2.1 million less than plan

due to stock price changes

• Q1-2017 expense of $4.6 million

compared to $7.4 million in Q4-2016

• Annual incentive accrual ramps in line with

plan progress generally lower in Q1

• Increase in Efficiency Ratio to 58.8% driven by

reduction in Net Revenue

• Growth in traditional LHI and MCA offset by

MF contraction

• Seasonal reduction in purchase financing

exacerbated by sharp decrease in refinancing

activity

• Contrast to Q1-2015 and 2016 when low rates

drove surge in refinancing activity

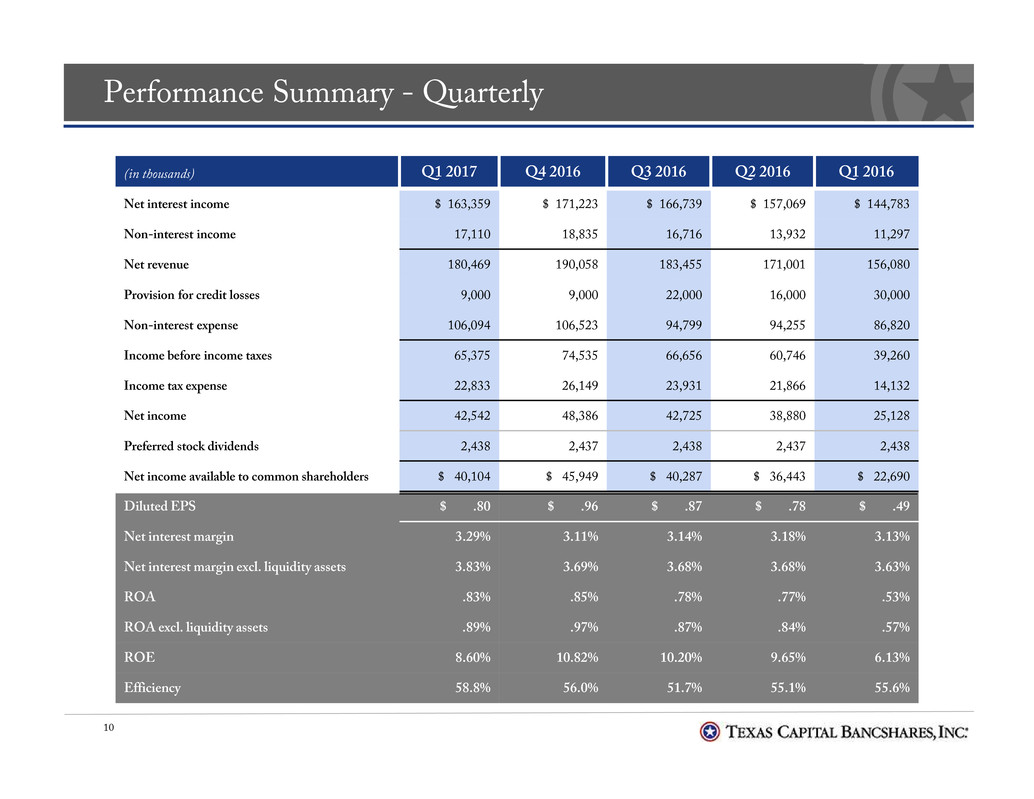

Performance Summary - Quarterly

10

(in thousands) Q1 2017 Q4 2016 Q3 2016 Q2 2016 Q1 2016

Net interest income $ 163,359 $ 171,223 $ 166,739 $ 157,069 $ 144,783

Non-interest income 17,110 18,835 16,716 13,932 11,297

Net revenue 180,469 190,058 183,455 171,001 156,080

Provision for credit losses 9,000 9,000 22,000 16,000 30,000

Non-interest expense 106,094 106,523 94,799 94,255 86,820

Income before income taxes 65,375 74,535 66,656 60,746 39,260

Income tax expense 22,833 26,149 23,931 21,866 14,132

Net income 42,542 48,386 42,725 38,880 25,128

Preferred stock dividends 2,438 2,437 2,438 2,437 2,438

Net income available to common shareholders $ 40,104 $ 45,949 $ 40,287 $ 36,443 $ 22,690

Diluted EPS $ .80 $ .96 $ .87 $ .78 $ .49

Net interest margin 3.29% 3.11% 3.14% 3.18% 3.13%

Net interest margin excl. liquidity assets 3.83% 3.69% 3.68% 3.68% 3.63%

ROA .83% .85% .78% .77% .53%

ROA excl. liquidity assets .89% .97% .87% .84% .57%

ROE 8.60% 10.82% 10.20% 9.65% 6.13%

Efficiency 58.8% 56.0% 51.7% 55.1% 55.6%

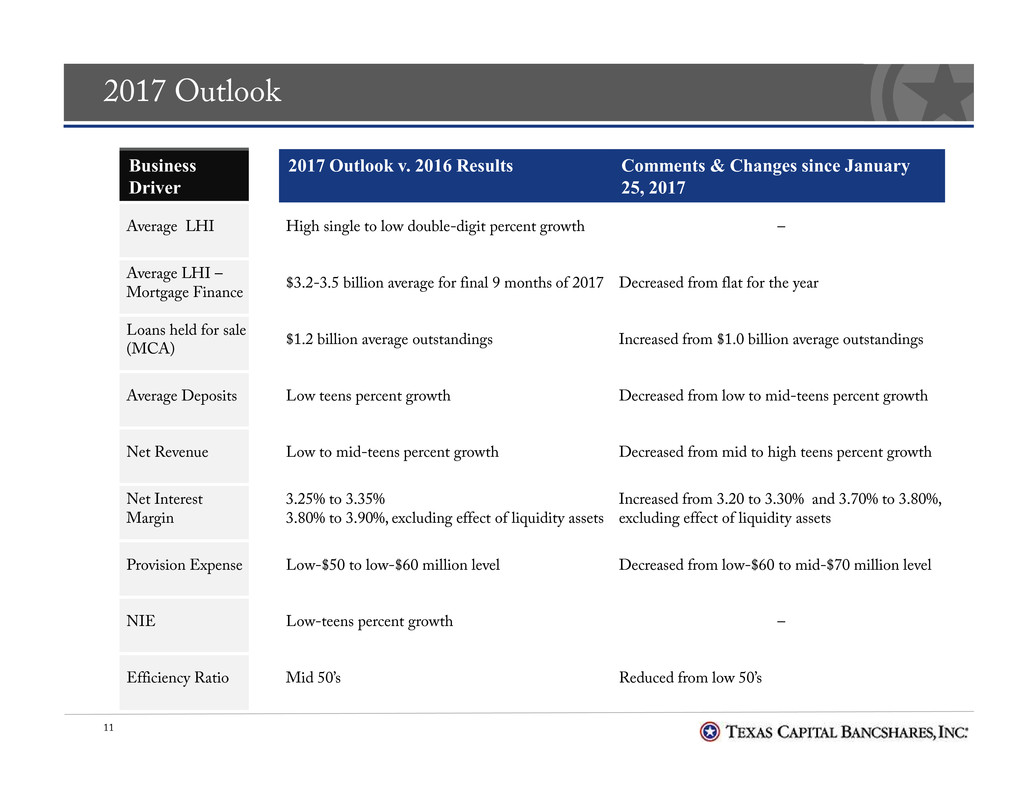

2017 Outlook

11

Business

Driver

2017 Outlook v. 2016 Results Comments & Changes since January

25, 2017

Average LHI High single to low double-digit percent growth –

Average LHI –

Mortgage Finance $3.2-3.5 billion average for final 9 months of 2017 Decreased from flat for the year

Loans held for sale

(MCA) $1.2 billion average outstandings Increased from $1.0 billion average outstandings

Average Deposits Low teens percent growth Decreased from low to mid-teens percent growth

Net Revenue Low to mid-teens percent growth Decreased from mid to high teens percent growth

Net Interest

Margin

3.25% to 3.35%

3.80% to 3.90%, excluding effect of liquidity assets

Increased from 3.20 to 3.30% and 3.70% to 3.80%,

excluding effect of liquidity assets

Provision Expense Low-$50 to low-$60 million level Decreased from low-$60 to mid-$70 million level

NIE Low-teens percent growth –

Efficiency Ratio Mid 50’s Reduced from low 50’s

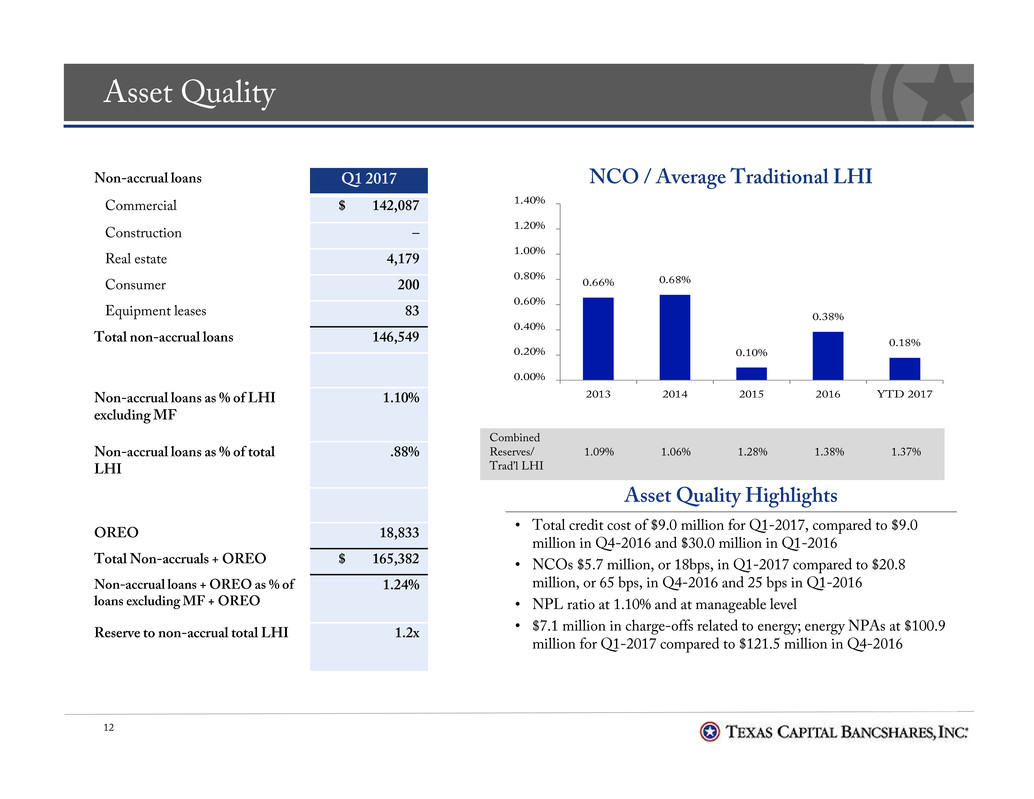

Asset Quality

12

• Total credit cost of $9.0 million for Q1-2017, compared to $9.0

million in Q4-2016 and $30.0 million in Q1-2016

• NCOs $5.7 million, or 18bps, in Q1-2017 compared to $20.8

million, or 65 bps, in Q4-2016 and 25 bps in Q1-2016

• NPL ratio at 1.10% and at manageable level

• $7.1 million in charge-offs related to energy; energy NPAs at $100.9

million for Q1-2017 compared to $121.5 million in Q4-2016

Asset Quality Highlights

Non-accrual loans Q1 2017

Commercial $ 142,087

Construction –

Real estate 4,179

Consumer 200

Equipment leases 83

Total non-accrual loans 146,549

Non-accrual loans as % of LHI

excluding MF

1.10%

Non-accrual loans as % of total

LHI

.88%

OREO 18,833

Total Non-accruals + OREO $ 165,382

Non-accrual loans + OREO as % of

loans excluding MF + OREO

1.24%

Reserve to non-accrual total LHI 1.2x

NCO / Average Traditional LHI

Combined

Reserves/

Trad’l LHI

1.09% 1.06% 1.28% 1.38% 1.37%

0.66% 0.68%

0.10%

0.38%

0.18%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

2013 2014 2015 2016 YTD 2017

Closing Comments

• Solid core earnings despite mortgage headwinds

• Consistent traditional LHI growth experienced in Q1-2017

• Remain optimistic about pipeline despite the fact that we’re not seeing any growth from Trump effect, as clients wait

for tangible changes

• Prospect of additional short term rate hike positive for our asset sensitive balance sheet

• Energy portfolio properly reserved for remaining losses; remain confident in underwriting standards, portfolio

composition and reserve level

• Lower provision in Q1-2017 reflective of continued improvement in criticized loan levels

• MFL balances down significantly resulting from seasonality and lack of refinance activity as rates were rising; first

time in several years the market has experienced the full effects of seasonality

• Continued focus on future ROE improvement from existing business with efficiencies, improved non-interest

income from new LOBs and targeted growth in highest return businesses

13

Q&A

14

Appendix

15

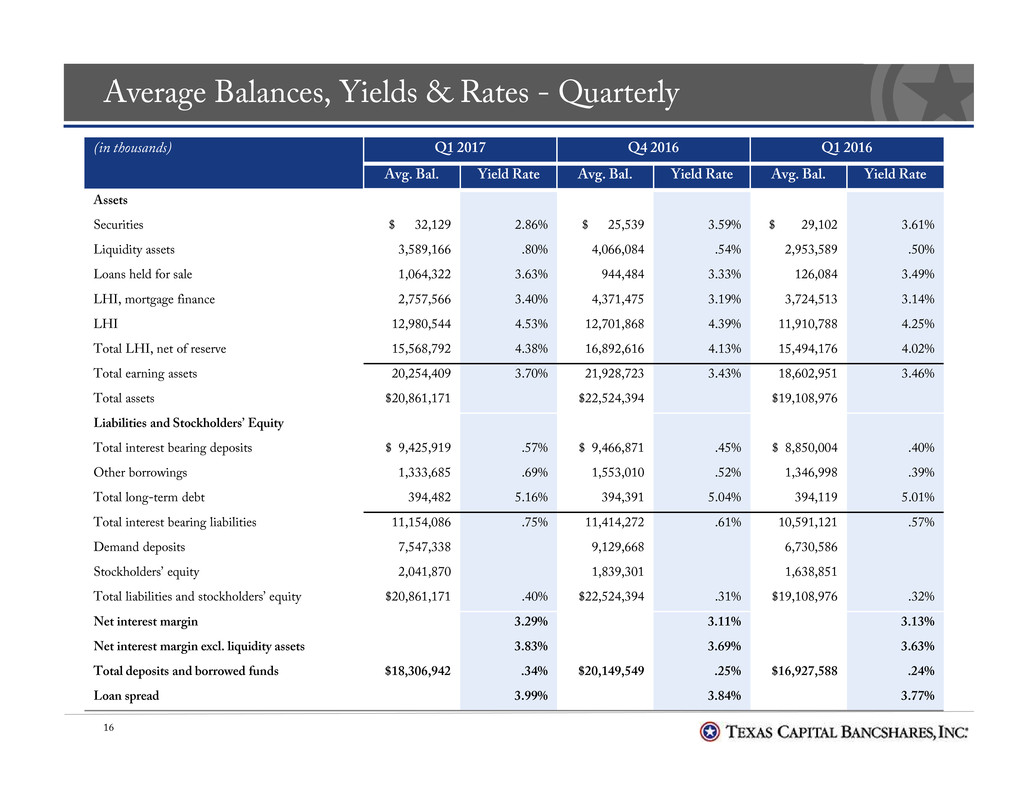

Average Balances, Yields & Rates - Quarterly

16

(in thousands) Q1 2017 Q4 2016 Q1 2016

Avg. Bal. Yield Rate Avg. Bal. Yield Rate Avg. Bal. Yield Rate

Assets

Securities $ 32,129 2.86% $ 25,539 3.59% $ 29,102 3.61%

Liquidity assets 3,589,166 .80% 4,066,084 .54% 2,953,589 .50%

Loans held for sale 1,064,322 3.63% 944,484 3.33% 126,084 3.49%

LHI, mortgage finance 2,757,566 3.40% 4,371,475 3.19% 3,724,513 3.14%

LHI 12,980,544 4.53% 12,701,868 4.39% 11,910,788 4.25%

Total LHI, net of reserve 15,568,792 4.38% 16,892,616 4.13% 15,494,176 4.02%

Total earning assets 20,254,409 3.70% 21,928,723 3.43% 18,602,951 3.46%

Total assets $20,861,171 $22,524,394 $19,108,976

Liabilities and Stockholders’ Equity

Total interest bearing deposits $ 9,425,919 .57% $ 9,466,871 .45% $ 8,850,004 .40%

Other borrowings 1,333,685 .69% 1,553,010 .52% 1,346,998 .39%

Total long-term debt 394,482 5.16% 394,391 5.04% 394,119 5.01%

Total interest bearing liabilities 11,154,086 .75% 11,414,272 .61% 10,591,121 .57%

Demand deposits 7,547,338 9,129,668 6,730,586

Stockholders’ equity 2,041,870 1,839,301 1,638,851

Total liabilities and stockholders’ equity $20,861,171 .40% $22,524,394 .31% $19,108,976 .32%

Net interest margin 3.29% 3.11% 3.13%

Net interest margin excl. liquidity assets 3.83% 3.69% 3.63%

Total deposits and borrowed funds $18,306,942 .34% $20,149,549 .25% $16,927,588 .24%

Loan spread 3.99% 3.84% 3.77%

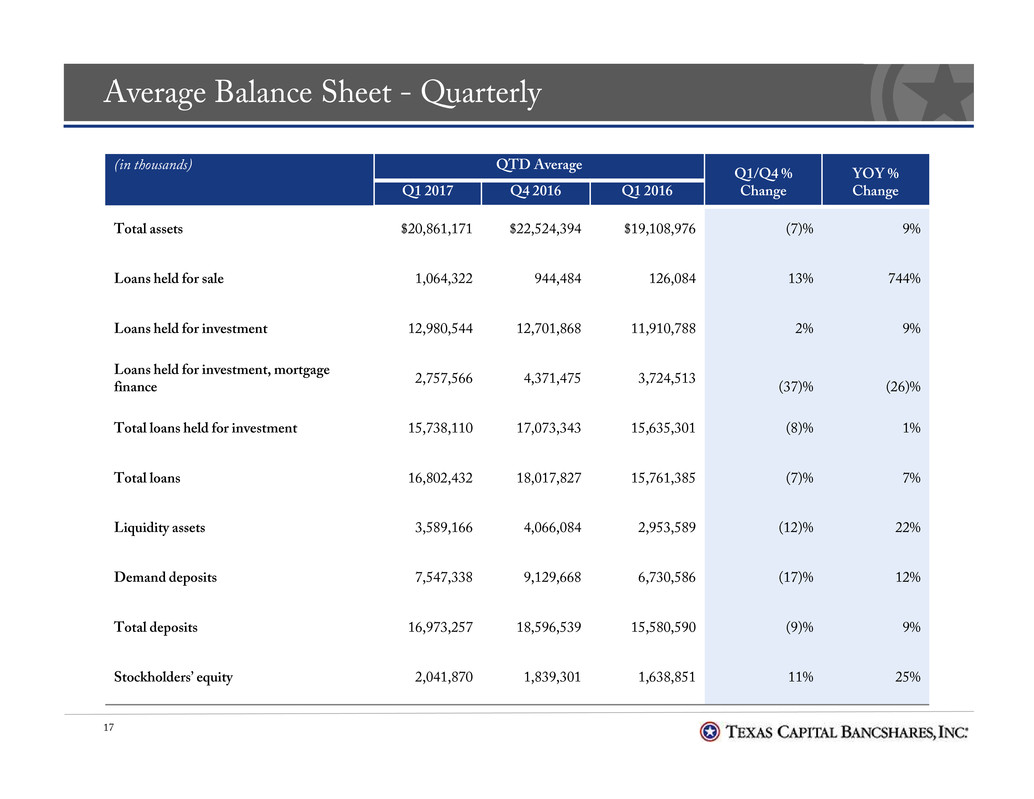

Average Balance Sheet - Quarterly

17

(in thousands) QTD Average

Q1/Q4 %

Change

YOY %

ChangeQ1 2017 Q4 2016 Q1 2016

Total assets $20,861,171 $22,524,394 $19,108,976 (7)% 9%

Loans held for sale 1,064,322 944,484 126,084 13% 744%

Loans held for investment 12,980,544 12,701,868 11,910,788 2% 9%

Loans held for investment, mortgage

finance

2,757,566 4,371,475 3,724,513 (37)% (26)%

Total loans held for investment 15,738,110 17,073,343 15,635,301 (8)% 1%

Total loans 16,802,432 18,017,827 15,761,385 (7)% 7%

Liquidity assets 3,589,166 4,066,084 2,953,589 (12)% 22%

Demand deposits 7,547,338 9,129,668 6,730,586 (17)% 12%

Total deposits 16,973,257 18,596,539 15,580,590 (9)% 9%

Stockholders’ equity 2,041,870 1,839,301 1,638,851 11% 25%

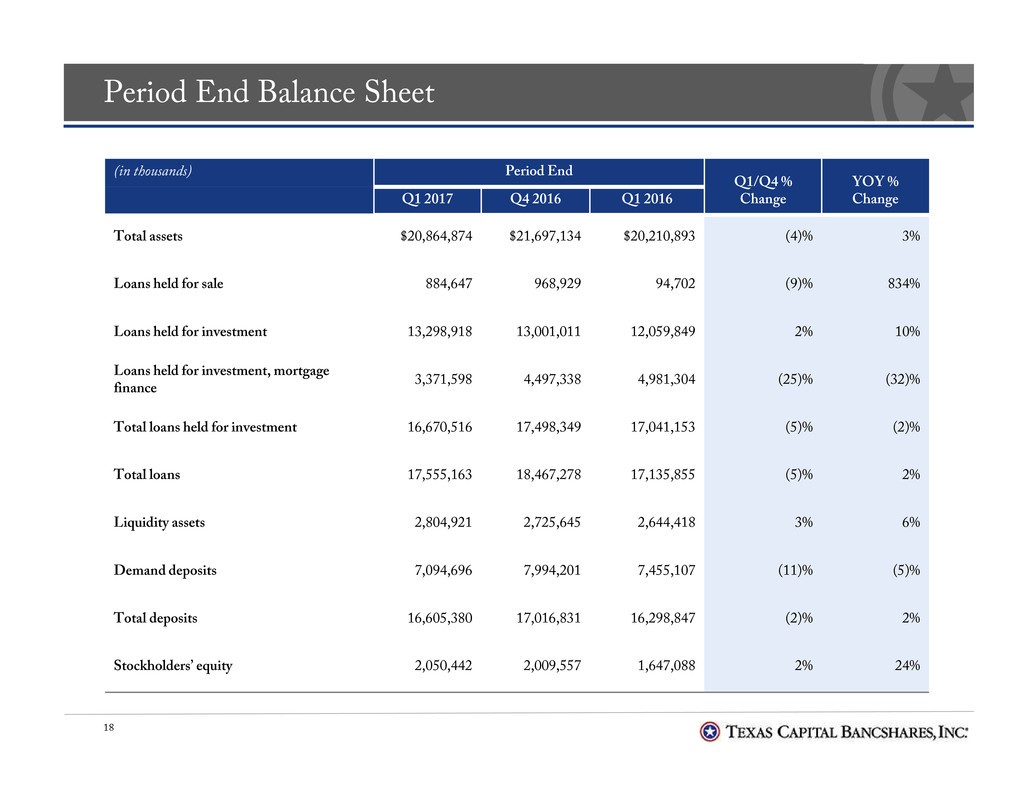

Period End Balance Sheet

18

(in thousands) Period End

Q1/Q4 %

Change

YOY %

ChangeQ1 2017 Q4 2016 Q1 2016

Total assets $20,864,874 $21,697,134 $20,210,893 (4)% 3%

Loans held for sale 884,647 968,929 94,702 (9)% 834%

Loans held for investment 13,298,918 13,001,011 12,059,849 2% 10%

Loans held for investment, mortgage

finance

3,371,598 4,497,338 4,981,304 (25)% (32)%

Total loans held for investment 16,670,516 17,498,349 17,041,153 (5)% (2)%

Total loans 17,555,163 18,467,278 17,135,855 (5)% 2%

Liquidity assets 2,804,921 2,725,645 2,644,418 3% 6%

Demand deposits 7,094,696 7,994,201 7,455,107 (11)% (5)%

Total deposits 16,605,380 17,016,831 16,298,847 (2)% 2%

Stockholders’ equity 2,050,442 2,009,557 1,647,088 2% 24%