Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MidWestOne Financial Group, Inc. | a2017annualmeetingpresenta.htm |

Annual Shareholders Meeting

APRIL 20, 2017

IOWA CITY, IOWA

4/17/2017 1

4/17/2017 *Non-GAAP; excludes merger related expenses 2

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

2012 2013 2014 2015 2016

Net Income

$19,472*

$28,091*

$18,522

$25,118

$18,607

$16,534

$ In Thousands

$20,391

$25,118

$23,277*

4/17/2017

# Non-GAAP; excludes goodwill impairment charge;

* EPS excludes merger-related costs; $2.19 in 2014, $2.41 in 2015, $1.78 in 2016

3

$2.70*

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

#

2

0

0

9

2

0

1

0

2

0

1

1

2

01

2

2

0

1

3

2

0

1

4

*

2

0

1

5

*

2

0

1

6

*

$1.04

$1.47

$1.95

$2.19

$2.32*

Basic Earnings Per Share 2000 - 2016

ISB Financial Corp. MOFG

$2.03*

$1.78*

$2.42*

$2.20*

4/17/2017 *$39.6 million in deposits combined at the time of sale of the Barron, Rice Lake, and Davenport offices. 4

($ in thousands)

$1,399,733 $1,374,942 $1,408,542

$2,463,521

$2,480,448

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

2012 2013 2014 2015 2016

MOFG Total Deposits

$2,520,048*

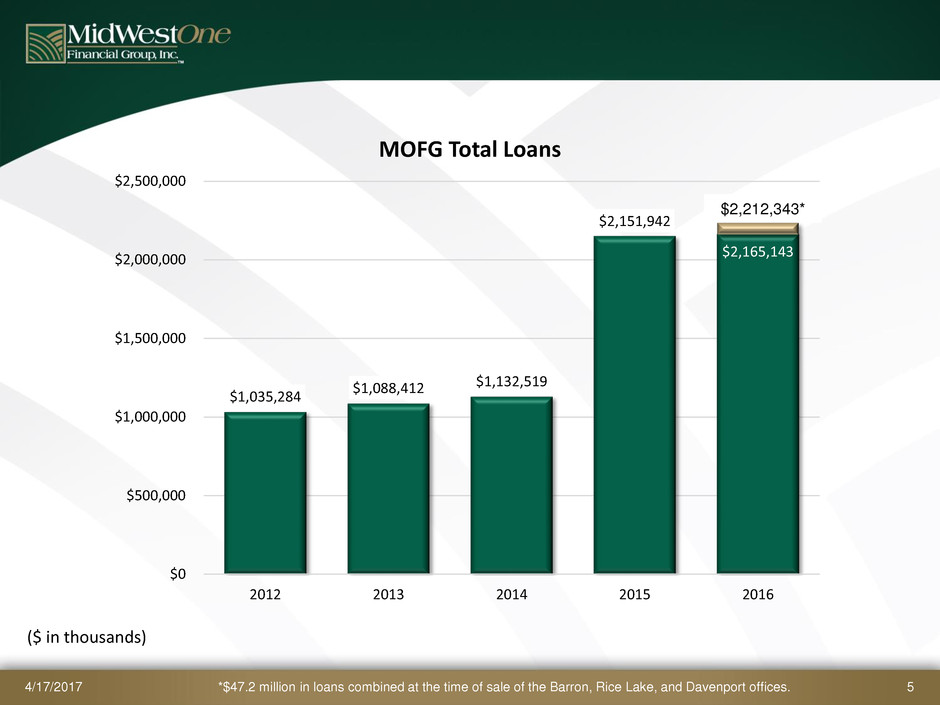

4/17/2017 *$47.2 million in loans combined at the time of sale of the Barron, Rice Lake, and Davenport offices. 5

($ in thousands)

$1,035,284

$1,088,412 $1,132,519

$2,151,942

$2,165,143

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

2012 2013 2014 2015 2016

MOFG Total Loans

$2,212,343*

4/17/2017 6

73.96%

79.16%

80.40%

87.35% 87.30%

65.00%

70.00%

75.00%

80.00%

85.00%

90.00%

2012 2013 2014 2015 2016

MOFG Loans to Deposit Ratio

9.22%

9.69%

10.29%

7.51% 7.62%

8.36%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

2012 2013 2014 2015 2016 03.31.2017

Tangible Common Equity to Tangible Asset Ratio

4/17/2017 7

MOFG’s Stated

Target: 8.00%

4/17/2017 8

10.95%

11.43%

10.61%

14.29%

10.13%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

14.00%

15.00%

2012 2013 2014 2015 2016

Return on Average Tangible Equity

4/17/2017 9

FACTORS CONTRIBUTING TO REDUCTION

IN 2016 NET INCOME

1.35%

1.43%

1.32%

0.95%

1.41%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

2012 2013 2014 2015 2016

Nonperforming Assets/Total Loans

4/17/2017 10

FACTORS CONTRIBUTING TO REDUCTION

IN 2016 NET INCOME

0.21%

0.11%

0.09%

0.11%

0.26%

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

0.30%

2012 2013 2014 2015 2016

Net Loans Charged Off to Average Loans

4/17/2017 11

FACTORS CONTRIBUTING TO REDUCTION

IN 2016 NET INCOME

$2,379

$1,350 $1,200

$5,132

$7,983

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2012 2013 2014 2015 2016

Provision for Loan Loses

4/17/2017 12

FACTORS CONTRIBUTING TO REDUCTION

IN 2016 NET INCOME

$87,806

$84,595

$82,000

$83,000

$84,000

$85,000

$86,000

$87,000

$88,000

$89,000

Non-Interest Expense

2016

Non-Interest Expense

2016 Budget

Increased Non-Interest Expenses

$4,568

$1,768

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

Merger Related Expenses

2016

Merger Related Expenses

2016 Budget

Increased Merger Expenses

$ in Thousands

4/17/2017 13

MOFG BY REGION

Twin Cities (MN) Iowa

2015 2016 % + or - 2015 2016 % + or -

Deposits $706,654 $719,615 +1.83% $1,390,936 $1,435,703 +3.22%

Loans $760,356 $823,397 +8.29% $1,134,110 $1,132,789 -0.12%

SW Florida Wisconsin

2015 2016 % + or - 2015 2016 % + or -

Deposits $84,890 $93,693 +10.37% $231,722 $232,444 +0.31%

Loans $118,442 $130,003 +9.76% $105,555 $94,454 -10.52%

4/17/2017 14

2017 OUTLOOK

• Strong Economy

• Iowa City, Twin Cities, and SW Florida

• Rural Iowa and Wisconsin in

Slow Growth / No Growth Stage

• Minimize Credit Problems

• Deposit and Loan Growth

• Continue to Improve Efficiency

• Capitalize on the Denver Opportunity

4/17/2017 15

WORK AS ONE TEAM

4/17/2017 16

SERVING OUR COMMUNITIES

4/17/2017 17

DENVER

4/17/2017 18

EMPLOYEE ENGAGEMENT

Top Bank Workplace in Iowa in Mid-Sized Category

Des Moines Register

4/17/2017 19

OUR OPERATING PRINCIPLES

1. Take good care of our customers

2. Hire and retain excellent employees

3. Always conduct yourself with the

utmost integrity

4. Work as one team

5. Learn constantly so we can

continually improve

4/17/2017 *Susan Evans announced a phased retirement in July 2016, which will be effective in late 2017.

20

SENIOR MANAGEMENT TEAM

Position

Banking

Experience

Years with

Company

Charles N. Funk President & CEO 38 Years 17 Years

Kevin E. Kramer Chief Operating Officer 22 Years First Year

Kent L. Jehle EVP, Chief Credit Officer 36 Years 31 Years

Katie A. Lorenson SVP, Chief Financial Officer 17 Years 6 Years

Susan L. Armbrecht Senior Retail Regional Officer, Twin Cities

and Cedar Valley Regional President

42 Years 8 Years

James M. Cantrell SVP, Chief Risk Officer 31 Years 8 Years

Mitchell W. Cook Senior Regional President, Twin Cities 15 Years 15 Years

Susan R. Evans* SVP, Special Projects 41 Years 16 Years

Barbara A. Finney SVP, Operations 25 Years 20 Years

Sondra J. Harney SVP, Director of Human Resources 38 Years 38 Years

John J. Henk SVP, Chief Information Officer 30 Years 11 Years

Karin M. Taylor SVP, Chief Risk Officer 27 Years 8 Years

Gregory W. Turner SVP, Wealth Management 20 Years 9 Years

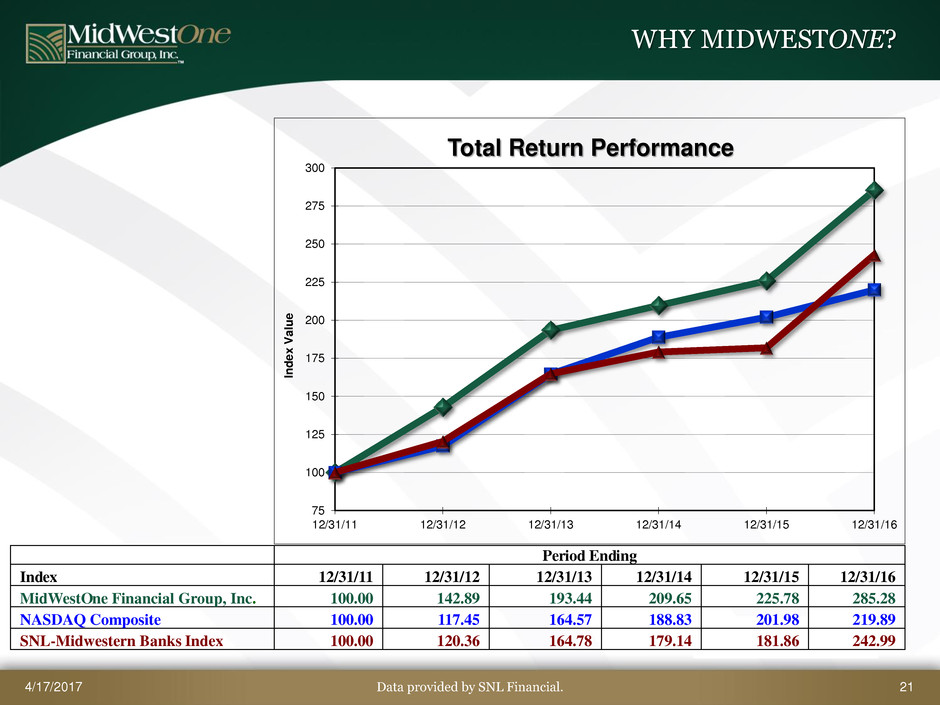

4/17/2017 Data provided by SNL Financial. 21

WHY MIDWESTONE?

Period Ending

Index 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16

MidWestOne Financial Group, Inc. 100.00 142.89 193.44 209.65 225.78 285.28

NASDAQ Composite 100.00 117.45 164.57 188.83 201.98 219.89

SNL-Midwestern Banks Index 100.00 120.36 164.78 179.14 181.86 242.99

75

100

125

150

175

200

225

250

275

300

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16

In

d

e

x

V

a

lu

e

Total Return Performance

4/17/2017

# Non-GAAP; excludes goodwill impairment charge;

* EPS excludes merger-related costs; $2.19 in 2014, $2.41 in 2015, $1.78 in 2016

22

$2.70*

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

#

2

0

0

9

2

0

1

0

2

0

1

1

2

01

2

2

0

1

3

2

0

1

4

*

2

0

1

5

*

2

0

1

6

*

$1.04

$1.47

$1.95

$2.19

$2.32*

Basic Earnings Per Share 2000 - 2016

ISB Financial Corp. MOFG

$2.03*

$1.78*

$2.42*

$2.20*

4/17/2017 23

PORTFOLIO LENDING TICKS DOWN IN 2016

Source: ABA Real Estate Lending Survey. Chart provided by ABA Banking Journal.

4/17/2017 24

THE MIDWESTONE FOOTPRINT