Attached files

| file | filename |

|---|---|

| EX-99.2 - ASHLAND GLOBAL HOLDINGS INC | ex99_2.htm |

| 8-K - ASHLAND GLOBAL HOLDINGS INC | form8-k.htm |

Exhibit 99.1

Ashland Global Holdings Inc. Announces Agreement to Acquire Pharmachem Laboratories, Inc. April 17, 2017

Forward-Looking StatementsThis presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Ashland has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “objectives,” “may,” “will,” “should,” “plans” and “intends” and the negative of these words or other comparable terminology. These forward-looking statements include statements relating to our expectation that the proposed acquisition of Pharmachem Laboratories, Inc. (Pharmachem) will be completed before the end of the June quarter and that the proposed acquisition will be accretive to earnings per share. In addition, Ashland may from time to time make forward-looking statements in its annual reports, quarterly reports and other filings with the SEC, news releases and other written and oral communications. These forward-looking statements are based on Ashland’s expectations and assumptions, as of the date such statements are made, regarding Ashland’s future operating performance and financial condition, the expected completion of the final separation of Valvoline Inc., the strategic and competitive advantages of each company, and future opportunities for each company, as well as the economy and other future events or circumstances. Ashland’s expectations and assumptions include, without limitation, internal forecasts and analyses of current and future market conditions and trends, management plans and strategies, operating efficiencies and economic conditions (such as prices, supply and demand, cost of raw materials, and the ability to recover raw-material cost increases through price increases), and risks and uncertainties associated with the following: Ashland’s substantial indebtedness (including the possibility that such indebtedness and related restrictive covenants may adversely affect Ashland’s future cash flows, results of operations, financial condition and its ability to repay debt); the impact of acquisitions and/or divestitures Ashland has made or may make, including the proposed acquisition of Pharmachem (including the possibility that Ashland may not complete the proposed acquisition of Pharmachem or Ashland may not realize the anticipated benefits from such transactions); and severe weather, natural disasters, and legal proceedings and claims (including environmental and asbestos matters). Various risks and uncertainties may cause actual results to differ materially from those stated, projected or implied by any forward-looking statements, including, without limitation, risks and uncertainties affecting Ashland that are described in Ashland’s most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC, which is available on Ashland’s website at http://investor.ashland.com or on the SEC’s website at http://www.sec.gov. Ashland believes its expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless legally required, Ashland undertakes no obligation to update any forward-looking statements made in this presentation whether as a result of new information, future events or otherwise. Information on Ashland’s website is not incorporated into or a part of this presentation.Regulation G: Adjusted ResultsThe information presented herein regarding certain unaudited adjusted results does not conform to generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Ashland has included this non-GAAP information to assist in understanding the operating performance of the company and its reportable segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information related to previous Ashland filings with the SEC has been reconciled with reported U.S. GAAP results.

Transaction Overview Purchase price of $660 millionTransaction to be funded with bank financing and available cashTransaction multiple of ~10.5x Pharmachem’s estimated fiscal 2017 adjusted EBITDA; ~7.5x after adjusting for expected cost synergies and tax optimizationExpected to be accretive to earnings per share (EPS) in first year following the acquisition; also expected to generate significant cash flowMeaningful synergies from leveraging our combined capabilitiesTransaction expected to close by the end of June quarter

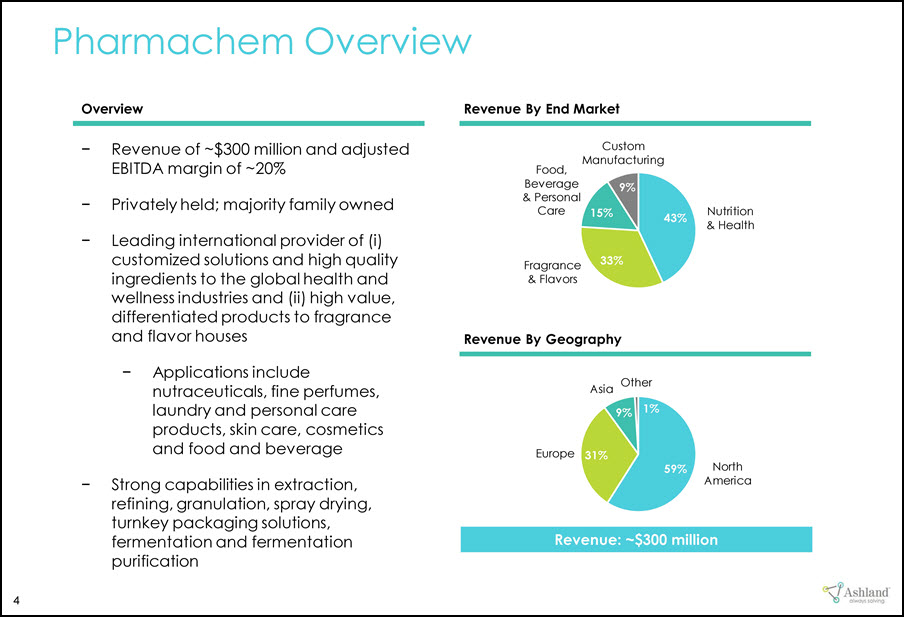

Pharmachem Overview Revenue of ~$300 million and adjusted EBITDA margin of ~20%Privately held; majority family ownedLeading international provider of (i) customized solutions and high quality ingredients to the global health and wellness industries and (ii) high value, differentiated products to fragrance and flavor housesApplications include nutraceuticals, fine perfumes, laundry and personal care products, skin care, cosmetics and food and beverageStrong capabilities in extraction, refining, granulation, spray drying, turnkey packaging solutions, fermentation and fermentation purification Overview Revenue By End Market Nutrition & Health Fragrance & Flavors Food, Beverage & Personal Care Custom Manufacturing North America Europe Asia Other Revenue By Geography Revenue: ~$300 million

Strategic Rationale Strengthens our existing business with advanced processingknow-how and formulation expertise Leverages our customization capabilities into niches where we create valueHigh customer-intimacy sales model emphasizing custom / tailored productsCreates unique industry offering: leveraging Pharmachem’s custom manufacturing capabilities with Ashland’s formulation knowledge and excipients expertiseLeverages our extensive sales channels, technical service network and global applications labs to accelerate Pharmachem growth outside of North AmericaEnhances Ashland’s food ingredient business by adding customized functional solutionsExpands scope / range of our products & service offeringsAdds high value, differentiated products sold to the major fragrance and flavor housesEnhances Ashland’s position in the high growth nutraceutical market – lying at the intersection of Pharma and NutritionExpands our presence in attractive end marketsFocused on attractive end markets including food, beverage, nutrition, and fragrance and flavors

Synergies Expected annual cost synergies of ~$10 million, primarily driven by leverage from Ashland’s scale and infrastructure, de-tolling opportunities and in-sourcing initiativesCost synergies expected to be realized by end of second year following transaction closeIncremental tax synergies with expected net present value of ~$110 millionDriven by integration of Pharmachem into Ashland’s global business structure

Financial Impact Expected to be accretive to EPS in first year following close of the transaction and to enhance long-term EPS growthStrong cash flow generation Attractive double-digit returnsAccretive to EBITDA marginsFinanced primarily with bank financing with remainder from cash on handAverage cost of debt (pre-tax) of approximately 3-4%Incremental ~$20 million of annual interest expenseEstimated pro forma net debt / adjusted EBITDA ratio at closing of 3.8x, with strong post-close de-leveraging profileRemain committed to targeting mid to high BB credit ratingsExpected gross debt / adjusted EBITDA below 3.5x(1) over time (1) Although Ashland provides forward-looking guidance for adjusted EBITDA, Ashland is not reaffirming or providing forward-looking guidance for U.S. GAAP-reported financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort.

Nutrition & Health Pro Forma Combination Revenue Revenue By End Market Net Debt / Adjusted EBITDA Pro Forma (Post-Valvoline Separation) (Post-Valvoline Separation) LTM as of December 31, 2016 $3.0 bn(1) $0.3 bn $3.3 bn 3.0x(2) 3.8x(3) Pharmachem Represents Ashland Specialty Ingredients and Ashland Performance Materials as reported in Q1 2017 Earnings Presentation.Net debt is calculated as Ashland’s reported net debt of $2,228 million as of December 31, 2016, adjusted for the Valvoline separation of $510 million. Adjusted EBITDA is calculated as Ashland’s reported trailing 12-month Adjusted EBITDA of $1,042 million as of December 31, 2016, adjusted for the Valvoline separation of $471 million.Net debt is calculated as Ashland’s reported net debt as of December 31, 2016, adjusted for the Valvoline separation and Pharmachem acquisition. Adjusted EBITDA is calculated as Ashland’s reported trailing 12-month Adjusted EBITDA as of December 31, 2016, adjusted for the Valvoline separation and Pharmachem acquisition.Please refer to Appendix of this presentation for reconciliations. Consumer Specialties Industrial Specialties I&S Ashland Specialty Ingredients Ashland Performance Materials Pharmachem Fragrance & Flavors Food, Beverage & Personal Care Custom Manufacturing Consumer Specialties Industrial Specialties Composites I&S Ashland Specialty Ingredients Ashland Performance Materials Composites

Summary Acquisition of Pharmachem strengthens our existing business with advanced processing know-how and formulation expertiseEnhances Ashland’s position in the high growth nutraceutical end markets and opens up a new market opportunity in fragrance and flavorsCreates unique industry offering by leveraging Pharmachem’s custom manufacturing capabilities with Ashland’s formulation knowledge and excipients expertiseExpected to be accretive to EPS in first year following close of transaction and to enhance long-term EPS growthAttractive double-digit returns driven by Pharmachem’s strong cash flow generationMore information to be shared during Ashland’s second-quarter earnings webcast on April 26 and at Investor Day in New York City on May 1 Acquisition of Pharmachem strategically and financially compelling

Near-Term Calendar Ashland plans to report financial results for Q2 FY 2017 after the NYSE closes on April 25 and to host a webcast with investors the following morning on April 26Ashland Investor Day scheduled for May 1 in New York CityThe full separation of Valvoline remains on trackSubject to market conditions and other factors, Ashland presently intends to distribute the remaining Valvoline shares following the release of Q2 FY 2017 earnings results by both Ashland and ValvolinePharmachem transaction expected to close by the end of June quarter

Ashland always solving

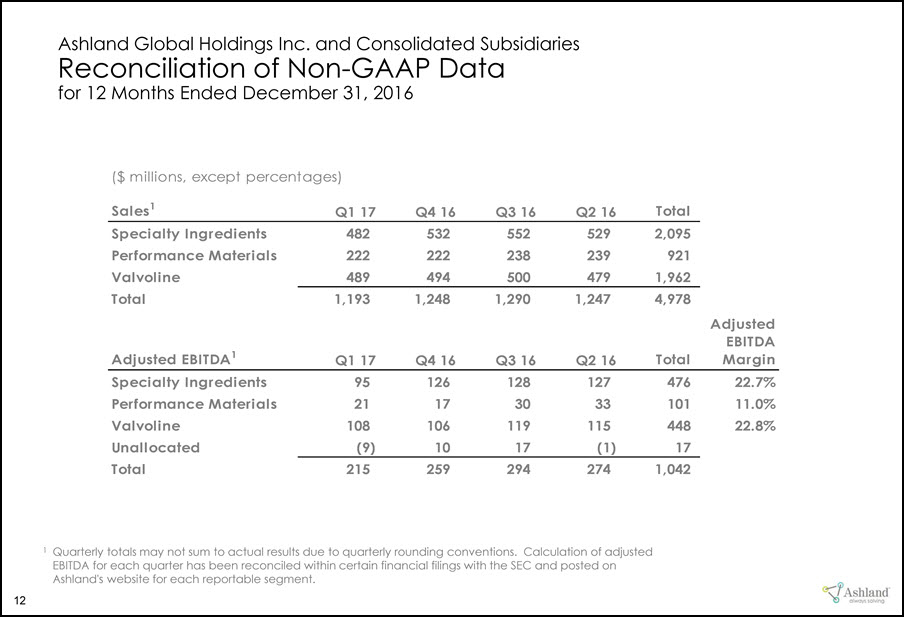

Ashland Global Holdings Inc. and Consolidated SubsidiariesReconciliation of Non-GAAP Data for 12 Months Ended December 31, 2016 North America2__% Asia Pacific__% LatinAmerica/Other - _% Europe __% AshlandSpecialtyIngredients__% AshlandPerformanceMaterials__% Valvoline__% 1 Quarterly totals may not sum to actual results due to quarterly rounding conventions. Calculation of adjusted EBITDA for each quarter has been reconciled within certain financial filings with the SEC and posted on Ashland's website for each reportable segment.