Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - MELINTA THERAPEUTICS, INC. /NEW/ | d371888dex312.htm |

| EX-31.1 - EX-31.1 - MELINTA THERAPEUTICS, INC. /NEW/ | d371888dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K/A

(Amendment No. 1)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 001-35405

CEMPRA, INC.

(Exact name of registrant specified in its charter)

| Delaware | 2834 | 45-4440364 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6320 Quadrangle Drive, Suite 360

Chapel Hill, NC 27517

(Address of Principal Executive Offices)

(919) 313-6601

(Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Name of Exchange on which Registered | |

| Common Stock, $0.001 Par Value | Nasdaq Global Market |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant, as of June 30, 2016, was approximately $655.8 million. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Global Market on June 30, 2016. For purposes of making this calculation only, the registrant has defined affiliates as including only directors and executive officers and shareholders holding greater than 10% of the voting stock of the registrant as of June 30, 2016.

As of February 24, 2017 there were 52,392,905 shares of the registrant’s common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

EXPLANATORY NOTE

We are filing this Amendment No. 1 (the “Amendment”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, as originally filed with the Securities and Exchange Commission (“SEC”) on February 28, 2017 (the “Original Form 10-K”), to include the information required by Part III (Items 10-14) of Form 10-K. At the time we filed the Original Form 10-K, we intended to file a definitive proxy statement for our 2017 Annual Meeting of Stockholders within 120 days after the end of our fiscal year pursuant to Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended. Given the recent undertaking of a review of our strategic business options, we now plan to hold our 2017 Annual Meeting of Stockholders, which we have historically held in May of each year, later in the year. Because we will not file the definitive proxy statement within such 120-day period, the information required by Part III (Items 10-14) of Form 10-K is filed herewith and provided below.

As a result, Part II, Item 9B and Part III, Items 10-14 of the Company’s Original 10-K are hereby amended and restated in their entirety. In addition, Item 15(b) of Part IV is being amended solely to file as exhibits certain new certifications in accordance with Rule 13a-14(a) promulgated by the SEC under the Securities Exchange Act of 1934.

Except as described above, no other changes have been made to the Original Form 10-K. This Amendment No. 1 continues to speak as of the date of the Original Form 10-K and we have not updated the disclosure herein to reflect any events that occurred at a later date other than as expressly stated herein. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K and with our filings made with the SEC subsequent to the filing of the Original Form 10-K.

Table of Contents

CEMPRA, INC.

Table of Contents

| Item 9B. | Other Information |

Given the recent undertaking of a review of our strategic business options, we now plan to hold our 2017 Annual Meeting of Stockholders, which we have historically held in May of each year, later in the year. As of the date of this filing, we have not determined the date on which we will hold our 2017 Annual Meeting of Stockholders.

| Item 10. | Directors, Executive Officers, and Corporate Governance |

Code of Ethics

We have adopted a written code of ethics and business conduct that applies to our directors, executive officers and all employees. We intend to disclose any amendments to, or waivers from, our code of ethics and business conduct that are required to be publicly disclosed pursuant to rules of the SEC by filing such amendment or waiver with the SEC. This code of ethics and business conduct can be found in the corporate governance section of our website, www.cempra.com.

Executive Officers

Our executive management changed in late 2016. Effective December 9, 2016, our board appointed David Zaccardelli, Pharm.D., one of our directors, as our Acting Chief Executive Officer and named David Moore as our President, in addition to his position as our Chief Commercial Officer. Simultaneously, Dr. Prabhavathi Fernandes retired as our President and Chief Executive Officer (positions she had held since our founding in 2006) as well as a director of our company, effective on December 9, 2016. Mr. Moore has served as our Chief Commercial Officer since January 2014. His additional appointment as our President did not result in any increased salary or other compensation.

As of February 24, 2017, our executive officers are Dr. David S. Zaccardelli, our Acting Chief Executive Officer, David S. Moore, our President and Chief Commercial Officer, Mark W. Hahn, our Chief Financial Officer, Dr. David W. Oldach, our Chief Medical Officer, and John D. Bluth, our Executive Vice President of Investor Relations and Corporate Communications. Information for each is provided below.

| Name |

Age (as of 02/24/17) |

Business Experience For Last Five Years | |||||

| David S. Zaccardelli, Pharm.D. | 52 | Dr. Zaccardellli joined our Board in August 2016. Prior to joining our Board, Dr. Zaccardelli served, from 2004 until 2016, in several senior management roles at United Therapeutics, including chief operating officer, chief manufacturing officer and executive vice president, pharmaceutical development and operations. Prior to joining United Therapeutics, Dr. Zaccardelli founded and led a startup company focused on contract pharmaceutical development services, from 1997 through 2003. From 1988 to 1996, Dr. Zaccardelli worked at Burroughs Wellcome & Co. and Glaxo Wellcome, Inc. in a variety of clinical research positions. He also served as director of clinical and scientific affairs for Bausch & Lomb Pharmaceuticals from 1996 to 1997. Dr. Zaccardelli received his doctor of pharmacy from the University of Michigan. | |||||

| David S. Moore | 43 | Mr. Moore joined us in January 2014 as our Chief Commercial Officer and assumed the additional role of President in December 2016. From July 2013 to December 2013, Mr. Moore was chief business officer of Ocera Therapeutics where he was responsible for developing the commercial plans for an orphan-designated advanced liver disease product for both the community and acute care markets. Mr. Moore was chief business officer of Tranzyme Pharma from December 2012 to July 2013, and vice president, commercial operations from August 2011 to January 2013, during which time he was responsible for building the commercial organization as well as in- and out-licensing clinical-stage assets. Between January 1998 and July 2011, Mr. Moore held increasing levels of responsibility in the Ortho-McNeil and Janssen divisions of Johnson & Johnson. Mr. Moore received his B.Sc. in Biology from Towson University and an M.B.A. from Lehigh University, and a second graduate degree in Health Policy Excellence from Thomas Jefferson University. | |||||

4

Table of Contents

| Name |

Age (as of 02/24/17) |

Business Experience For Last Five Years | |||||

| Mark W. Hahn | 54 | Mr. Hahn has been our Executive Vice President and Chief Financial Officer since February 2010. From 2008 to 2009, Mr. Hahn was the chief financial officer of Athenix Corp., an agricultural biotechnology company, leading its merger with Bayer CropScience, where he served as finance director into 2010. Mr. Hahn has been the chief financial officer of various companies including GigaBeam Corporation, a telecommunications equipment company, from 2007 to 2008; BuildLinks, Inc., a software company, from 2002 to 2007; PerformaWorks, Inc., a software company, from 2001 to 2002; and Charles & Colvard, Ltd., a consumer products company, from 1996 to 2001. Mr. Hahn also served in various capacities, culminating in senior manager, at Ernst & Young and its predecessors from 1984 until 1996. Mr. Hahn holds a B.B.A. in accounting and finance from the University of Wisconsin-Milwaukee and is a certified public accountant in the State of Maryland and North Carolina. | |||||

| David W. Oldach, M.D. | 59 | Dr. Oldach joined us in February 2011. From 2006 to 2011, Dr. Oldach directed clinical research at Gilead Sciences, Inc., where his drug development experience ranged from IND/first-in-human trial development and execution through NDA-supportive Phase 3 protocol development and execution. Dr. Oldach received his Medical Degree, Magna Cum Laude, from the University of Maryland School of Medicine and completed a residency in Internal Medicine at the Massachusetts General Hospital. He completed an Infectious Disease Fellowship at Johns Hopkins University School of Medicine, serving under John Bartlett. His academic clinical research included studies in community-acquired pneumonia and surgical infections, as well as HCV pathogenesis. At the time of his transition from academic medicine to industry, Dr. Oldach was a tenured associate professor of medicine at the University of Maryland School of Medicine and served as the infectious diseases section chief in the Baltimore Veterans Administration Hospital. | |||||

| John D. Bluth | 44 | Mr. Bluth joined us in August 2016. Prior to joining Cempra, Mr. Bluth was senior vice president of investor relations and corporate communications and served on the executive committee at PowerSecure International, Inc., a leading provider of energy technologies and services to electric utilities and their large industrial, commercial, institutional and municipal customers, a position he held since 2012. From 2009 to 2012, he was senior vice president of investor relations and group communications at German-based Elster Group, one of the world’s largest electricity, gas and water measurement and control providers. Mr. Bluth headed investor relations and corporate communications for biotechnology companies, CV Therapeutics, from 2002 to 2009, and Aviron Inc., from 1999 to 2002. Before joining Aviron, Mr. Bluth led the west coast healthcare practice for Fleishman-Hillard, an international public relations firm, where he worked from 1996 to 1999. | |||||

Directors

Our bylaws currently provide that the number of directors constituting the Board shall be not less than five nor more than nine. The Board may establish the number of directors within this range. There are eight directors presently serving on our Board. In addition, none of the nominees is related by blood, marriage or adoption to any other nominee or any of our executive officers.

| Name |

Age | Director Since |

Position(s) with Cempra | |||

| Richard Kent, M.D. | 67 | September 2010 | Director | |||

| Garheng Kong, M.D., Ph.D. | 41 | September 2006 | Chairman of the Board of Directors | |||

| P. Sherrill Neff | 65 | September 2011 | Director | |||

| Michael R. Dougherty | 59 | May 2013 | Director | |||

| David Gill | 62 | April 2012 | Director | |||

| Dov Goldstein | 49 | January 2008 | Director | |||

| John H. Johnson | 59 | June 2009 | Director | |||

| David Zaccardelli, Pharm.D. | 52 | August 2016 | Director and Acting Chief Executive Officer |

5

Table of Contents

Richard Kent, M.D. – Dr. Kent has served on our Board since September 2010. Dr. Kent has been a partner at Intersouth Partners, a venture capital firm, since 2008. From 2002 to 2008, Dr. Kent was the president and chief executive officer of Serenex, Inc., a drug development company, when it was acquired by Pfizer, Inc. From 2001 until he joined Serenex, Dr. Kent was president and chief executive officer of Ardent Pharmaceuticals, Inc. Before that, he held senior executive positions at GlaxoSmithKline plc, where he was senior vice president of global medical affairs and chief medical officer, at Glaxo Wellcome plc., where he was vice president of U.S. medical affairs and group medical director, and at Burroughs Wellcome plc., where he was international director of medical research. Dr. Kent served as a director of Cytomedix, Inc. (now Nuo Therapeutics, Inc.), a publicly traded biopharmaceutical company, from 2012 through 2014, and served as a director of Inspire Pharmaceuticals, Inc. from 2004 to 2011. He also serves on the boards of several private companies. Dr. Kent holds a B.A. from the University of California, Berkley and an M.D. from the University of California, San Diego. Among other experience, qualifications, attributes and skills, Dr. Kent’s knowledge and experience in the securities and investments industry and leadership roles in the pharmaceutical industry led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

Garheng Kong, M.D., Ph.D. – Dr. Kong has served on our Board since September 2006 and as Chairman of our Board since November 2008. Dr. Kong has been the managing partner of Sofinnova Healthquest, a healthcare investment firm, since July 2013. He was a general partner at Sofinnova Ventures, a venture firm focused on life sciences, from September 2010 to December 2013. From 2000 to September 2010, he was at Intersouth Partners, a venture capital firm, most recently as a general partner, where he was a founding investor or board member for various life sciences ventures, several of which were acquired by large pharmaceutical companies. Dr. Kong has also served on the board of directors of Histogenics Corporation (NASDAQ: HSGX), a regenerative medicine company, since July 2012, Alimera Sciences, Inc. (NASDAQ: ALIM), a biopharmaceutical company, since October 2012, has served on the board of Laboratory Corporation of America Holdings (NYSE: LH), a healthcare company, since December 2013, and has served on the board of StrongBridge BioPharma plc (NASDAQ: SBBP) since September 2015. Dr. Kong holds a B.S. from Stanford University. He holds an M.D., Ph.D. and M.B.A. from Duke University. Among other experience, qualifications, attributes and skills, Dr. Kong’s knowledge and experience in the venture capital industry and his medical training led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

P. Sherrill Neff – Mr. Neff has served on our Board since September 2011. Mr. Neff founded Quaker Partners Management, L.P. in 2002 and has since served as a partner at the investment firm. From 1994 to 2002, Mr. Neff was president and chief operating officer of Neose Technologies, Inc., a biopharmaceutical company, and a director from 1994 to 2003. From 1993 to 1994, he was senior vice president, corporate development at U.S. Healthcare. Prior to that time, Mr. Neff was managing director at investment bank Alex Brown & Sons for nine years. Mr. Neff holds a B.A. from Wesleyan University and a J.D. from the University of Michigan Law School. Mr. Neff serves on the board of directors of Resource Capital Corporation, (NYSE: RSO), a publicly traded real estate investment trust, as well as the following privately held organizations: Intact Vascular, Inc. and RainDance Technologies, Inc. and Vesper Medical, Inc. Mr. Neff also served on the board of directors of Amicus Therapeutics, Inc. from 1996 until 2011, Regado Biosciences, Inc. (NASDAQ: RGDO) from 2005 until 2015, and National Venture Capital Association from 2009 until 2014. Among other experience, qualifications, attributes and skills, Mr. Neff’s experience in the venture capital industry led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

Michael R. Dougherty – Mr. Dougherty joined our Board in May 2013. Mr. Dougherty was the executive chairman of Celator Pharmaceuticals, Inc. from August 2015 to July 2016. Mr. Dougherty was chief executive officer and a member of the board of directors of Kalidex Pharmaceuticals, Inc. from May 2012 to October 2012. Mr. Dougherty was the president and chief executive officer of Adolor Corp. (NASDAQ: ADLR) and a member of the board of directors of Adolor from December 2006 until December 2011. Mr. Dougherty joined Adolor as senior vice president of commercial operations in November 2002, and until his appointment as president and chief executive officer in December 2006, served in a number of capacities, including chief operating officer and chief financial officer. From November 2000 to November 2002, Mr. Dougherty was president and chief operating officer of Genomics Collaborative, Inc., a privately held functional genomics company. Previously, Mr. Dougherty served in a variety of senior positions at Genaera Corporation, formerly Magainin Pharmaceuticals Inc., a publicly-traded biotechnology company, including as president and chief executive officer, as well as a director, and at Centocor, Inc., a publicly-traded biotechnology company, including as senior vice president and chief financial officer. Mr. Dougherty is currently on the board of directors of Trevena, Inc. (NASDAQ: TRVN), Aviragen Therapeutics, Inc. (NASDAQ: AVIR), Foundation Medicine, Inc. (NASDAQ: FMI) and Marinus Pharmacueticals, Inc. (NASDAQ: MRNS). Mr. Dougherty was a member of the board of directors of Celator Pharmaceuticals, Inc. (NASDAQ: CPXX) from July 2103 to July 2016 and Viropharma Incorporated (NASDAQ: VPHM) from January 2004 to January 2014. Mr. Dougherty received a B.S. from Villanova University. Among other experience, qualifications, attributes and skills, Mr. Dougherty’s leadership roles in small and large pharmaceutical organizations led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

6

Table of Contents

David Gill – Mr. Gill joined our Board in April 2012. Mr. Gill served as chief financial officer of EndoChoice Holdings, Inc. (NYSE: GI), a publicly traded medical device company from August 2014 to November 2016, and as president and chief operating officer from March 2016 to November 2016. He served as the chief financial officer of INC Research Holdings Inc (NASDAQ: INCR), a clinical research organization, from February 2011 to August 2013, and served as a board member and audit committee chairman of INC Research from 2007 to 2010. From March 2009 to February 2011, Mr. Gill was the chief financial officer of TransEnterix, a then private medical device company. From July 2005 to November 2006, Mr. Gill was chief financial officer and Treasurer of NxStage Medical, Inc. (NASDAQ: NXTM), a publicly traded dialysis equipment company. He currently serves as a director and chair of the audit committee of Histogenics Corporation (NASDAQ: HSGX), a regenerative medicine company, positions he has held since February 2015. From 2006 to 2011, he served on several public and private company boards of directors, including those of LeMaitre Vascular (NASDAQ: LMAT), a publicly traded medical device company, and IsoTis, Inc. (NASDAQ: ISOT), a publicly traded orthobiologics company that was acquired by Integra LifeSciences Holdings Corporation in October 2007. From January 2002 to May 2005, Mr. Gill served as senior vice president and chief financial officer of CTI Molecular Imaging, Inc., (NASDAQ: CTMI) a publicly traded medical imaging company, until its sale to Siemens AG. Mr. Gill has led initial public offerings for four companies and has raised more than $600 million in equity and $600 million in debt over his career. Mr. Gill holds a B.S. degree, cum laude, in Accountancy from Wake Forest University and an M.B.A. degree, with honors, from Emory University. Mr. Gill was formerly a certified public accountant. Among other experience, qualifications, attributes and skills, Mr. Gill’s education and experience in accounting and finance, and his service as an officer and as a director of various publicly traded companies led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

Dov A. Goldstein, M.D. – Dr. Goldstein has served on our Board since January 2008. He is the managing partner at Aisling Capital, a private investment firm, a position he has held since January 2015, and served as a partner of Aisling Capital from April 2009 to June 2014 and a principal of Aisling Capital from September 2006 to April 2009. From June 2014 to January 2015, he was the chief financial officer of Loxo Oncology (NASDAQ: LOXO). From 2000 until its acquisition by Pfizer Inc. in 2005, Dr. Goldstein was executive vice president and chief financial officer of Vicuron Pharmaceuticals, Inc. He led the valuation and financial due diligence for the merger with Biosearch Italia (Nuovo mercato: BIO.MI), the first U.S. and Italian public-to-public company merger. Prior to Vicuron Pharmaceuticals, Dr. Goldstein was director of Venture Analysis at HealthCare Ventures, a privately held investment fund. Dr. Goldstein currently serves on the board of directors of ADMA Biologics, Inc. (NASDAQ: ADMA) and Esperion Therapeutics, Inc. (NASDAQ: ESPR). Dr. Goldstein has previously served on several company boards of directors, including those of Durata Therapeutics Inc. (acquired by Actavis PLC), Topaz Pharmaceuticals (acquired by Sanofi Pasteur S.A.), and Loxo Oncology, Inc. (NASDAQ: LOXO). Dr. Goldstein received his M.D. from Yale School of Medicine and completed an internship in the Department of Medicine at Columbia-Presbyterian Hospital. He received his M.B.A. from the Columbia Business School and his B.S. with honors from Stanford University. Among other experience, qualifications, attributes and skills, Dr. Goldstein’s knowledge and experience in the pharmaceutical industry and venture capital industry led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

John H. Johnson – Mr. Johnson has served on our Board since June 2009. He served as president and chief executive officer of Dendreon Corp., a publicly traded biotechnology company (NASDAQ: DNDN), from February 2012, became chairman in July 2013, and served in those roles until August 2014. He served as the chief executive officer and as a director of Savient Pharmaceuticals, Inc., a company that develops and commercializes specialty pharmaceuticals, from 2011 to January 2012. Mr. Johnson was senior vice president of Eli Lilly and Company and president of Lilly Oncology, Eli Lilly’s oncology business unit, from 2009 to 2011. From 2007 to 2009, Mr. Johnson was chief executive officer of ImClone Systems Incorporated, a biopharmaceutical development company, and was also a member of ImClone’s board of directors until it became a wholly owned subsidiary of Eli Lilly in 2008. From 2005 to 2007, Mr. Johnson served as company group chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit. Mr. Johnson served as chairman of the board of Tranzyme, Inc. (NASDAQ: TZYM), a publicly traded biopharmaceutical company, from December 2010 until July 2013. Mr. Johnson serves as the chairman of the board of Stonebridge Biopharma PLC, a global biopharmaceutical company, and also serves as a director of Sucampo Pharmaceuticals, Inc. (NASDAQ: SCMP), a global biopharmaceutical company, Portola Pharmaceuticals, Inc. (NASDAQ: PTLA), a biopharmaceutical company, and Histogenics Corporation (NASDAQ: HSGX), a regenerative medicine company. Mr. Johnson holds a B.S. in Education from East Stroudsburg University of Pennsylvania. Among other experience, qualifications, attributes and skills, Mr. Johnson’s leadership roles in large pharmaceutical organizations led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

David Zaccardelli, Pharm.D. – Dr. Zaccardelli has served on our Board since August 2016. From 2004 until 2016, Dr. Zaccardelli served in several senior management roles at United Therapeutics, including chief operating officer, chief manufacturing officer and executive vice president, pharmaceutical development and operations. Prior to joining United Therapeutics, Dr. Zaccardelli founded and led a startup company focused on contract pharmaceutical development services, from 1997 through 2003. From 1988 to 1996, Dr. Zaccardelli worked at Burroughs Wellcome & Co. and Glaxo Wellcome, Inc. in a variety of clinical research positions. He also served as director of clinical and scientific affairs for Bausch & Lomb Pharmaceuticals from 1996 to 1997. Dr. Zaccardelli currently serves on the board of directors of Evecxia, Inc. and CoreRx, Inc., both privately held companies. Dr. Zaccardelli received a Pharm.D. from the University of Michigan. Among other experience, qualifications, attributes and skills, Dr. Zaccardelli’s experience in the pharmaceutical industry led to the conclusion of our Board that he should serve as a director of our company in light of our business and structure.

7

Table of Contents

Audit Committee

Our Board has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act consisting of Mr. Gill (Chair), Mr. Dougherty and Dr. Kong. Mr. Gill, Mr. Dougherty and Dr. Kong are each independent within the meaning of Section 5605(a)(2) of the NASDAQ Marketplace Rules and meet the additional test for independence for audit committee members imposed by Securities and Exchange Commission, or SEC, regulation and Section 5605(c)(2)(A) of the NASDAQ Marketplace Rules. Our Board has determined that each of Mr. Gill, Mr. Dougherty and Dr. Kong qualifies as a financial expert.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires our officers and directors and persons who own more than 10% of our outstanding common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. These officers, directors and stockholders are required by regulations under the Securities Exchange Act to furnish us with copies of all forms they file under Section 16(a).

Based solely on our review of the copies of forms we have received, we believe that all such required reports have been timely filed, except for:

| • | A late report on Form 4 filed on behalf of Dr. Kent on October 20, 2016, to report his March 4, 2015 exercise of stock options to purchase 15,000 shares of common stock; and |

| • | A late report on Form 4 filed on behalf of Dr. Goldstein on January 6, 2016, to report the January 1, 2016 grant of 15,000 stock options. |

| Item 11. | Executive Compensation |

DIRECTOR COMPENSATION

Director Compensation in Fiscal 2016

The following table shows the compensation earned by each non-employee director of our company for the year ended December 31, 2016.

| Name |

Fees earned or paid in cash |

Option Awards(1)(2) |

All other compensation |

Total | ||||||||||||

| Michael R. Dougherty |

$ | 55,000 | $ | 294,242 | $ | — | $ | 349,242 | ||||||||

| David Gill |

60,000 | 294,242 | — | 354,242 | ||||||||||||

| Dov Goldstein, M.D. |

50,000 | 294,242 | — | 344,242 | ||||||||||||

| John H. Johnson |

45,000 | 294,242 | — | 339,242 | ||||||||||||

| Richard Kent, M.D. |

45,000 | 294,242 | — | 339,242 | ||||||||||||

| Garheng Kong, M.D., Ph.D. |

97,500 | 353,090 | — | 450,590 | ||||||||||||

| P. Sherrill Neff |

45,000 | 294,242 | — | 339,242 | ||||||||||||

| David Zaccardelli(3) |

16,220 | 370,368 | — | 386,588 | ||||||||||||

| (1) | The reported amounts represent the aggregate grant date fair value of the awards computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 2 of the financial statements included in our annual report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 28, 2017. |

| (2) | At December 31, 2016, the following directors held options to purchase common shares in the following amounts: Mr. Dougherty 70,000 shares; Mr. Gill, 85,000 shares; Dr. Goldstein, 24,158 shares; Mr. Johnson, 103,784 shares; Dr. Kent, 60,000 shares; Dr. Kong, 118,784 shares; Mr. Neff, 75,000 shares; and Dr. Zaccardelli, 25,000 shares. |

| (3) | Dr. Zaccardelli served as a non-employee director from August 10, 2016 to December 8, 2016. He became our Acting Chief Executive Officer on December 9, 2016. For compensation received in 2016 in his position as Acting Chief Executive Officer, see the Summary Compensation Table. |

8

Table of Contents

Director Compensation Plan

Our Board, with the assistance of Pay Governance, LLC, an independent compensation consultant, has determined that compensation for directors should be a mix of cash and equity-based compensation. Beginning on January 1, 2016, the annual cash retainer for all members of the Board was set at $40,000, the annual cash retainer for the chairman of each of our Audit Committee, Compensation Committee, and Nominating and Governance Committee was set at $20,000, $12,500, and $10,000, respectively. The additional retainer for members of our Audit Committee, Compensation Committee, and Nominating and Governance Committee was set at $10,000, $5,000, and $5,000, respectively. Each director receives an initial grant of 25,000 option shares when first appointed to the Board and thereafter annual grants of 15,000 option shares. The Chairman of the Board, if not a Named Executive Officer, receives an additional annual grant of 3,000 option shares.

EXECUTIVE COMPENSATION

Executive Summary

We have designed our executive compensation program to support our business goals and promote the long term growth of the company. Specifically, our executive compensation program is designed to promote the achievement of key strategic objectives by linking executives’ short- and long-term cash and equity incentives to the achievement of measurable corporate and individual performance goals.

Total compensation of each executive officer varies with overall attainment of corporate objectives as well as the performance of individual goals and objectives. The total compensation for each of our executive officers is benchmarked against the total compensation of executive officers in comparable positions at a peer group of companies of similar size and market capitalization in the biopharmaceutical industry, with a goal of compensating our executives appropriately and competitively. A portion of total compensation for our executive officers is tied to key corporate strategies and operational goals such as drug discovery initiatives, clinical trial progress, commercial launch preparation, regulatory milestones and other operational and financial measures.

Additionally, we provide a portion of our executive compensation in the form of stock options and restricted stock units that vest and become exercisable over time, which we believe helps to retain our executives and to align their interests with those of our stockholders by allowing our executives to participate in the longer term success of the Company. Our executive compensation program is structured to reflect the performance of our company overall by linking pay both to individual performance and to the achievement of pre-determined corporate objectives and goals. We believe that executive compensation should help to attract, retain and motivate those executives we depend on for our current and future success.

Overview

This Compensation Discussion and Analysis, or CD&A, explains our compensation philosophy, policies and practices with respect to our Chief Executive Officer, Chief Financial Officer, Chief Commercial Officer, Chief Medical Officer and Executive Vice President, Investor Relations and Corporate Communications, who are our only executive officers and who we refer to as our Named Executive Officers. Our Board has delegated responsibility for creating and reviewing the compensation of our entire senior management team, including our Named Executive Officers, to the Compensation Committee of our Board. The role of the Compensation Committee is to oversee our compensation and benefit plans and policies, to administer our equity incentive plans and to review and make recommendations to our Board, generally on an annual basis, regarding all compensation decisions for our Named Executive Officers.

The Chief Executive Officer and Chief Financial Officer attend Compensation Committee meetings by invitation to provide input with respect to compensation and performance assessments of executive officers.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Objectives

The primary objectives of the Compensation Committee with respect to executive compensation are to:

| • | attract, retain and motivate executive officers who will make important contributions to the achievement of our business goals and success; |

| • | have a substantial portion of each officer’s compensation contingent upon our company’s performance as well as upon his or her own level of performance and contribution towards our company’s performance and long-term strategic goals; and |

| • | align the interests of our executives with our company’s corporate strategies, business objectives and the long-term interests of our stockholders. |

9

Table of Contents

Our Compensation Committee has engaged Pay Governance, LLC, an independent compensation consultant, to review our executive compensation programs on an annual basis. In late 2016, the Compensation Committee, with the assistance of Pay Governance, updated our peer group of 15 public companies, which group was used by Pay Governance to conduct an executive compensation study. The composition of the peer group was based on the following criteria: (i) companies operating in a similar industry sector, (ii) publicly traded companies, (iii) companies of similar size, and (iv) companies of similar business operation and stage of research and development. The peer group companies considered by the Compensation Committee are:

| Alder Biopharmaceuticals, Inc. | Inovio Pharmaceuticals, Inc. | |

| Anacor Pharmaceuticals, Inc. | Insmed Incorporated | |

| ARIAD Pharmaceuticals, Inc. | Novavax, Inc. | |

| BioCryst Pharmaceuticals, Inc. | Ophthotech Corporation | |

| Celldex Therapeutics, Inc. | Portola Pharmaceuticals, Inc. | |

| Clovis Oncology, Inc. | Tesaro, Inc. | |

| Enanta Pharmaceuticals, Inc. | Theravance Biopharma, Inc. | |

| FibroGen, Inc. |

The Compensation Committee uses the benchmarks in various combinations in an effort to obtain comparative compensation information that reflects our particular facts and circumstances over the period of time for which the information is available. Market benchmarks is one element considered by the Compensation Committee when making compensation decisions.

We are required to conduct periodic say-on-pay votes. Our 2015 executive compensation was approved by our stockholders on an advisory basis at the 2016 Annual Meeting of Stockholders. The Compensation Committee intends to use information provided from the peer group review, the result of the say-on-pay vote, as well as information gathered by the Committee as it has done in the past, to guide our policies and procedures relating to executive compensation.

Based on these overall objectives and philosophy, the Compensation Committee has designed an executive compensation program that generally seeks to bring base salaries and total executive compensation in line with the companies at a similar stage of clinical development represented in the compensation data we review. Our program allows the Compensation Committee to determine each component of an executive’s compensation based on a number of factors, including (a) the executive’s overall experience and skills (with an emphasis on particular industry experience), (b) the executive’s position and responsibilities in comparison to other executives at the company, (c) individual performance, and (d) the demand within our market for the executive’s skills relative to other executives in our industry.

Compensation Governance Highlights

Our executive compensation program for our Named Executive Officers includes key features that align their interests with our business strategies and goals, as well as the interests of our stockholders.

What we do

| ✓ | Design our executive compensation program to align pay with performance |

| ✓ | Use equity for long-term incentive awards |

| ✓ | Utilize an independent compensation consultant |

| ✓ | Provide change in control benefits under double-trigger circumstances only |

| ✓ | Maintain a 100% independent Compensation Committee |

| ✓ | Review our peer group companies annually to obtain comparative compensation information |

| ✓ | Provide limited perquisites |

| ✓ | Require designated levels of stock ownership for executive officers and directors over time |

What we don’t do

| × | Provide excise tax gross-ups |

| × | Allow hedging, pledging or shorting of company stock by any employee or director |

| × | Re-price or buyback stock options |

| × | Provide guaranteed bonuses |

10

Table of Contents

Components of our Executive Compensation Program

The principal components of our executive compensation program are base salary, annual bonus, and long-term incentives. Our Compensation Committee believes that each component of executive compensation must be evaluated and determined with reference to competitive market data, individual and corporate performance, our recruiting and retention goals, internal equity and consistency, and other information we deem relevant. We believe that in the pharmaceutical industry, and for clinical stage companies, stock option and restricted stock unit awards are a primary motivator in attracting and retaining executives, in addition to salary and cash incentive bonuses. The Board, generally based on a recommendation of the Compensation Committee, approves all salary increases, as well as bonuses and stock option and restricted stock unit awards, if any, for our Named Executive Officers. Annual base salary increases, annual bonuses, and long-term incentives, to the extent granted, are generally implemented during the first calendar quarter of the year.

Annual Salaries. We provide base salaries for our Named Executive Officers to compensate them for their services rendered during the fiscal year. Base salaries for our Named Executive Officers have been established based on their position and scope of responsibilities, their prior experience and training, and competitive market compensation data we review for similar positions in our industry. Base salaries are reviewed periodically and may be increased for merit reasons based on the executive’s performance, for retention reasons or if the base salary is not competitive to salaries paid by comparative companies for similar positions. Additionally, we may adjust base salaries throughout the year for promotions or other changes in the scope or breadth of an executive’s role or responsibilities.

Annual Cash Bonus. We have also implemented an annual cash incentive performance program, under which annual corporate goals are proposed by management and approved by the Compensation Committee at the start of each calendar year. These corporate goals include the achievement of qualitative operational goals and predefined research and development milestones. Each goal is weighted as to importance by the Compensation Committee. The individual performance of our Named Executive Officers is based on the level of achievement of a combination of corporate goals and goals related to their respective areas of responsibility. Annual cash bonuses granted to our Named Executive Officers are tied to the achievement of these corporate goals. Additionally, the Board or the Compensation Committee may increase or decrease a Named Executive Officer’s bonus payment (above or below the target) based on its assessment of our company’s and the Named Executive Officer’s individual performance during the year.

Pursuant to her employment agreement, Dr. Fernandes was entitled to a 2016 annual target cash bonus opportunity of not less than 50% of her salary. Pursuant to his employment agreement, Dr. Zaccardelli is eligible for an annual incentive bonus for calendar years during his term, beginning in 2017, with a target bonus equal to 60% of his base salary. Our other Named Executive Officers are not entitled to any bonus unless the Board provides them. For 2016, the Board established for Dr. Fernandes a bonus of up to 50% of her salary and bonuses of 40% for each of Mr. Bluth, Mr. Hahn, Mr. Moore and Dr. Oldach.

Long-Term Incentives. Our equity-based long-term incentive program is designed to align our Named Executive Officers’ long-term incentives with stockholder value creation. We believe that long-term participation by our officers and employees, including our Named Executive Officers, in equity-based awards is a critical factor in the achievement of long-term company goals and business objectives. Our 2006 Plan allowed and our 2011 Plan allows the grant to officers and employees of stock options, as well as other forms of equity incentives, as part of our overall compensation program. Our practice is to make annual stock option awards as part of our overall performance management program at the beginning of each calendar year. In December 2016, we also began granting restricted stock units as part of our overall performance management program. Typically, these grants are made to ensure the officer’s average equity and option amounts are in line with similar positions at comparable companies. As with base salary and initial equity award determinations, a review of all components of the officer’s compensation is conducted when determining annual equity awards to ensure that an officer’s, including each Named Executive Officer, total compensation conforms to our overall philosophy and objectives.

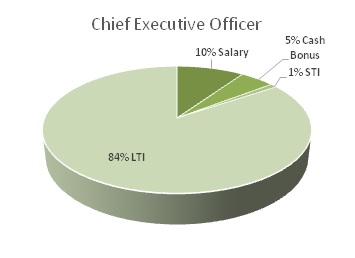

2016 Executive Compensation

In 2016, our Named Executive Officers’ total compensation was distributed between base salary, long-term incentives, or LTI, which includes option awards, and short-term incentives, or STI, which includes non-equity incentive plan compensation and all other benefits. The charts below depict the relative distributions of these three compensation components for our Chief Executive Officer and our other Named Executive Officers.

11

Table of Contents

|

|

2016 Performance Objectives and Achievement

The 2016 performance goals were determined by our Compensation Committee in the first quarter of the year and consisted of:

| • | Submitting new drug applications, or NDAs, to the U.S. Food and Drug Administration, or FDA, and a marketing authorization application, MAA, to the European Medicines Agency, or EMA for oral and IV solithromycin |

| • | Preparing the company for the potential commercial launch of solithromycin |

| • | Successfully completing the FDA Antimicrobial Drugs Advisory Committee, or AMDAC review of solithromycin |

| • | Achieving FDA approval for solithromycin |

| • | Achieving a full enrollment of patients in a Phase 3 acute bacterial skin and skin structure infection, or ABSSSI, trial and a specified level of enrollment of patients in a bone and joint infection, or BJI, study |

| • | Launching the pediatric Phase 2/3 trial for solithromycin and achieving a specified level of enrollment, and |

| • | Executing on certain business development and financial performance goals |

While we achieved the majority of the goals defined by the Compensation Committee for 2016, we only partially achieved the goal of successfully completing an FDA advisory committee review of solithromycin, and we did not achieve the goal of FDA approval for solithromycin because we received a complete response letter from the FDA.

A discussion of our specific performance against our 2016 goals is as follows.

| • | Submitting NDAs and an MAA for oral and IV solithromycin |

| ○ | This goal was fully achieved with the submissions of solithromycin NDAs to the FDA and MAAs to the EMA in the second quarter of 2016. The FDA accepted the NDAs for review, and the EMA validated the MAA, in the third quarter of 2016. |

| • | Preparing the company for the potential commercial launch of solithromycin |

| ○ | In the first and second quarters of 2016, we successfully hired a sales leadership team of 26 professionals with significant sales leadership experience in the pharmaceutical industry. |

| ○ | In addition, we built a team of 14 Medical Science Liaisons, a team of seasoned marketing, sales operations and managed care experts as well as a small commercial infrastructure support team. |

| ○ | Internal business processes and systems were developed and implemented to support the potential launch of solithromycin. |

| ○ | The Compensation Committee recognized the substantial preparation and readiness of the commercial organization to support a potential launch of solithromycin in 2017, but because by the end of 2016 it was clear that the launch would not occur as planned in 2017, the Compensation Committee felt this goal was only partially achieved. |

12

Table of Contents

| • | Successfully completing an FDA advisory committee review of solithromycin |

| ○ | In November 2016, the majority of the U.S. FDA Antimicrobial Drugs Advisory Committee voted (7-6) that efficacy results of solithromycin outweigh the risks for the treatment of community-acquired bacterial pneumonia, or CABP. Members of AMDAC voted unanimously (13-0) that there was substantial evidence of the efficacy of solithromycin for CABP. The committee also voted (12-1) that the risk of hepatotoxicity with solithromycin had not been adequately characterized and discussed a variety of potential approaches to further characterize the existing liver safety information on solithromycin. |

| ○ | Based on this outcome, the Compensation Committee determined the goal was partially achieved. |

| • | Achieving FDA approval for solithromycin |

| ○ | Based on the Complete Response Letter received by the FDA in December 2016, this goal was not achieved. |

| • | Achieving full enrollment of patients in a Phase 3 ABSSSI trial and a specified level of enrollment of patients in a BJI study |

| ○ | This goal was fully achieved with the Phase 3 ABSSSI trial completing enrollment ahead of plan and the BJI study achieving its specified enrollment level. |

| • | Launching the pediatric Phase 2/3 trial for solithromycin and achieving a specified level of enrollment |

| ○ | The Compensation Committee determined that this objective was partially met with the trial launching as planned but with lower than desired enrollment through the end of the year. |

| • | Executing on certain business development and financial performance goals |

| ○ | Because our spending in 2016 was within the pre-defined budget parameters set by the Board of Directors, the Compensation Committee determined that we achieved this goal. |

| ○ | The Compensation Committee evaluated our performance against specific pre-determined business development objectives and determined that we achieved this goal. |

The following table sets forth information concerning each Named Executive Officer’s target cash bonus achievement level in 2016.

| Named Executive Officer |

Total Weight of Company Goals |

Percentage of Company Goals Achieved |

Total Weight of Personal Goals |

Percentage of Personal Goals Achieved |

Total Percentage of Bonus Achieved |

|||||||||||||||

| Prabhavathi Fernandes, Ph.D.(1) |

— | — | — | — | — | |||||||||||||||

| Mark Hahn |

75 | % | 48 | % | 25 | % | 25 | % | 73 | % | ||||||||||

| David Moore |

75 | % | 48 | % | 25 | % | 23 | % | 71 | % | ||||||||||

| David Oldach, M.D. |

75 | % | 48 | % | 25 | % | 21 | % | 69 | % | ||||||||||

| John Bluth(2) |

75 | % | 48 | % | 25 | % | 25 | % | 73 | % | ||||||||||

| David Zaccardelli, Pharm.D(3) |

— | — | — | — | — | |||||||||||||||

| (1) | In lieu of Dr. Fernandes’ pro-rated annual bonus due under her employment agreement, we paid Dr. Fernandes a bonus for 2016 in the amount of $280,260. |

| (2) | Mr. Bluth received a pro-rated annual bonus to reflect his partial year of service. |

| (3) | Dr. Zaccardelli will be eligible for an annual incentive bonus beginning in 2017. |

13

Table of Contents

Other Compensation

We maintain limited broad-based benefits and perquisites that are provided to all eligible employees, including health insurance, life and disability insurance, dental insurance and paid vacation.

Compensation Consultant Agreement

The Compensation Committee of our board of directors has engaged Pay Governance to, among other things, review and analyze our compensation program. Pay Governance reports directly to the Compensation Committee and has regular meetings with the chairperson of the Compensation Committee.

Pay Governance does not provide any other services to the Company. The Compensation Committee has reviewed the nature of the relationship with its independent compensation consultants and determined that there were no conflicts that impacted the advice and guidance provided to the Compensation Committee.

Stock Ownership Requirements

We adopted stock ownership guidelines for certain executive officers and directors on February 25, 2016 with the objective of more closely aligning the interests of certain executive officers with those of our stockholders. The stock ownership guidelines will require the Chief Executive Officer to hold shares of our common stock with a market value of five times his or her annual base salary and will require the Chief Financial Officer, Chief Commercial Officer and Chief Medical Officer to hold two times their respective annual base salaries. Each director will be required to hold our common stock with a market value of four times his or her annual cash retainer. The stock ownership guidelines will be applicable at the later of (i) five years after the date the executive officer or director assumes his or her position or (ii) five years from the date of adoption of the stock ownership guidelines. Dr. Zaccardelli, a director and our Acting Chief Executive Officer, is subject to the stock ownership requirements for our directors.

Anti-Hedging and Anti-Pledging Policy

In 2015, our board of directors adopted an anti-hedging and anti-pledging policy. The anti-hedging and anti-pledging policy aligns the interests of our directors, executive officers and employees who are equity grant recipients with our shareholders. The policy prohibits our directors, executive officers, and employees who are equity grant recipients from engaging in any transaction which could hedge or offset decreases in the market value of our common stock, including the use of financial instruments such as exchange funds, prepaid variable forwards, equity swaps, puts, calls, collars, forwards and other derivative instruments, or through the establishment of a short position in our securities. Additionally, directors and executive officers are prohibited from pledging our securities as collateral for a loan, including through the use of traditional margin accounts with a broker.

Employment and Severance Agreements

On August 9, 2013, we entered into an employment agreement with Dr. Fernandes. On October 13, 2015, we amended Dr. Fernandes’ employment agreement. Prior to this agreement, we had no agreement with her. On December 9, 2016, we entered into a retirement and consulting agreement with Dr. Fernandes whereby, for one year, subject to monthly extension by mutual agreement, she will provide consulting services to us for up to 20 hours per week. For her consulting work, we will pay Dr. Fernandes $35,000 per month. In addition, all of Dr. Fernandes’s stock options will continue to vest during the consulting period.

Upon her retirement, Dr. Fernandes became entitled to the severance payments and benefits described in Section 10(d) of her employment agreement and the other benefits described in Section 4 of that agreement, as amended. In consideration of her waiver of the notice period provided under her employment agreement, we paid Dr. Fernandes $45,000. In lieu of her pro-rated annual bonus due under her employment agreement upon a termination of employment, we paid Dr. Fernandes an annual bonus for 2016 in the amount of $280,260. We will continue to pay Dr. Fernandes her base salary for 18 months, at the current annual rate of $540,000. In addition, we will pay Dr. Fernandes an amount equal to one and one half times her target bonus, based upon the average percentage of achievement of target objectives for the prior three years, which amount is $420,390, payable in 18 equal monthly payments. We will pay to Dr. Fernandes an amount equal to her applicable COBRA premiums for 18 months. If Dr. Fernandes dies prior to receiving any or all payments or benefits due her under the employment agreement, then we will pay them to her estate. Upon the conclusion of the consulting period, all of Dr. Fernandes’s then outstanding and unvested stock options will become fully vested. In addition, if the consulting period ends prior to December 9, 2018, those stock option awards will remain outstanding and exercisable until December 9, 2018, notwithstanding the termination of her employment and consulting services. In the event that after December 9, 2016 there occurs a “Change in Control” (as defined in our 2011 Equity Incentive Plan), then (i) upon such Change in Control all of Dr. Fernandes’s then outstanding and unvested stock options will become immediately vested and exercisable and (ii) all unpaid consulting fees will become immediately due and payable, within 10 business days following such Change in Control.

14

Table of Contents

We also amended the non-compete provision contained in Dr. Fernandes’s employment agreement to provide that, within the Restricted Territory (as defined in Section 7(b) of the agreement, and during the period set out in such section), Dr. Fernandes will not engage in any business or enterprise (whether as owner, partner, officer, director, employee, consultant, investor, lender or otherwise) that develops, manufactures, markets, licenses or sells any pharmaceutical antibiotic products that either (1) involve macrolides or fusidic acid or (2) compete with the products being sold or developed by us either during her employment with us or during the consulting period in any management or executive role in which she would perform duties that are the same or substantially similar to those duties actually performed by her for us prior to the termination of her employment or in any position where she or such business or enterprise would benefit from her use or disclosure of our proprietary information.

In connection with the hiring of Dr. Zaccardelli, we entered into an Executive Employment Agreement with him. The agreement will run for three months, provided that upon the three month anniversary of the agreement, and on each succeeding one month anniversary, the term shall be automatically extended by an additional month, unless either party gives at least 10 business days’ prior notice of non-renewal. If requested by our board of directors, Dr. Zaccardelli will resign as Acting Chief Executive Officer. Dr. Zaccardelli will be paid a base salary at the annual rate of $540,000 during his employment. In the event that he is still employed by us on the six month anniversary of his employment, our board will consider whether to adjust the base salary.

Pursuant to his employment agreement, Dr. Zaccardelli is eligible for an annual incentive bonus for calendar years during his term, beginning in 2017, with a target bonus equal to 60% of his base salary. This bonus will be subject to achievement of objectives established by the board, consistent with those established for our senior management team. In the event that Dr. Zaccardelli’s employment ends during a calendar year, he will remain eligible for a pro-rata annual incentive bonus for the portion of the year during which he was employed, based on actual performance.

Dr. Zaccardelli will remain a director of our company, but will not receive any compensation for serving in that capacity while employed as our Acting Chief Executive Officer. Effective with his employment, Dr. Zaccardelli resigned as a member of our board’s Compensation Committee.

On May 23, 2014, we entered into a change in control severance agreement with each of Mark W. Hahn, our Executive Vice President and Chief Financial Officer, and David Moore, our President and Chief Commercial Officer. On October 13, 2015, we entered into a change in control severance agreement with David W. Oldach, our Chief Medical Officer, and amended both of Mark W. Hahn and David Moore’s change in control severance agreements. On August 1, 2016 we entered into a change in control severance agreement with John D. Bluth. The four agreements are substantively identical. Pursuant to the severance agreements, if the executive’s employment is terminated without “cause” (as defined in the severance agreement) or he resigns for “good reason” (as defined in the severance agreement) within 12 months of a “change in control” of our company (as defined in the severance agreement), then, provided (i) such termination results in the executive incurring a “separation from service” as defined under Treasury Regulation 1.409A-1(h), (ii) the executive has not breached the severance agreement or the previously executed confidentiality and assignment of inventions agreement, and (iii) conditioned upon his execution of an effective release, we will pay the executive an amount equal to his then-current base salary for a period of 12 months and a lump sum payment of a pro rata bonus based upon the executive’s target bonus amount for the year of his termination, plus reimbursement of COBRA premiums for the lesser of 12 months or until he becomes eligible for insurance benefits from another employer. However, we have the option to terminate COBRA payments following a termination, and instead pay a lump sum amount equal to the remaining payments owed under the change in control severance agreement. In addition, all of the executive’s outstanding and unvested stock options and other equity in our company would become immediately and fully exercisable. If his employment is terminated due to his death, “disability” (as defined in the severance agreement), for “cause” by us, he resigns without “good reason” or the term of the severance agreement expires without renewal, The executive will not be entitled to any additional compensation under the severance agreement beyond that which had accrued as of the date of termination. The severance agreement provides that no compensation or benefit that qualifies as a nonqualified deferred compensation plan under Section 409A of the Internal Revenue Code of 1986, as amended, or the Code, will be paid or provided to the executive before the day that is six months plus one day after the termination date. In addition, if an excess parachute payment would be made to the executive in the event of a change in control, we may, at our election, reduce the amounts to be paid to the executive to the extent necessary to avoid its treatment as an excess parachute payment under the Code. The severance agreement has an initial term of five years and will automatically renew thereafter for additional one-year terms unless we provide the executive with notice of nonrenewal at least 90 days prior to the end of the initial five-year term or any additional one-year term.

Tax and Accounting Considerations

U.S. federal income tax generally limits the tax deductibility of compensation we pay to our Named Executive Officers to $1.0 million in the year the compensation becomes taxable to the executive officers. There is an exception to the limit on deductibility for performance-based compensation that meets certain requirements. Although deductibility of compensation is preferred, tax deductibility is not a primary objective of our compensation programs. Rather, we seek to maintain flexibility in how we compensate our executive officers so as to meet a broader set of corporate and strategic goals and the needs of stockholders, and as such, we may be limited in our ability to deduct amounts of compensation from time to time. Accounting rules require us to expense the cost of our stock option grants. Because of option expensing and the impact of dilution on our stockholders, we pay close attention to, among other factors, the type of equity awards we grant and the number and value of the shares underlying such awards.

15

Table of Contents

Pension Benefits

We do not maintain any qualified or non-qualified defined benefit plans. As a result, none of our Named Executive Officers participate in or have account balances in qualified or non-qualified defined benefit plans sponsored by us. Our Compensation Committee may elect to adopt qualified or non-qualified benefit plans in the future if it determines that doing so is in our best interests.

Nonqualified Deferred Compensation

None of our Named Executive Officers participate in or have account balances in nonqualified defined contribution plans or other non-qualified deferred compensation plans maintained by us. Our Compensation Committee may elect to provide our officers and other employees with non-qualified defined contribution or other non-qualified deferred compensation benefits in the future if it determines that doing so is in our best interests.

Summary Compensation Table

The following table sets forth information concerning the compensation paid or accrued to our Named Executive Officers in 2014, 2015 and 2016.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards(1) ($) |

Option awards(1) ($) |

Non-equity incentive plan compensation(2) ($) |

All other compensation(3) ($) |

Total ($) |

||||||||||||||||||||||||

| David Zaccardelli, Pharm.D.(4) |

||||||||||||||||||||||||||||||||

| Director and Acting Chief Executive Officer |

2016 | 32,884 | — | 385,000 | 826,554 | — | — | 1,244,438 | ||||||||||||||||||||||||

|

Prabhavathi Fernandes, Ph.D.(5) |

||||||||||||||||||||||||||||||||

| Former Director, President and Chief Executive Officer |

2016 | 517,500 | 280,260 | — | 3,600,934 | — | 55,047 | 4,453,741 | ||||||||||||||||||||||||

| 2015 | 510,000 | — | — | 2,015,472 | 199,410 | 52,737 | 2,777,619 | |||||||||||||||||||||||||

| 2014 | 475,000 | — | — | 1,604,915 | 205,112 | 50,700 | 2,335,727 | |||||||||||||||||||||||||

| Mark Hahn |

||||||||||||||||||||||||||||||||

| Executive Vice President and Chief Financial Officer |

2016 | 375,000 | — | — | 1,170,299 | 109,500 | 29,727 | 1,684,526 | ||||||||||||||||||||||||

| 2015 | 350,000 | — | — | 699,955 | 97,633 | 27,832 | 1,175,420 | |||||||||||||||||||||||||

| 2014 | 325,001 | — | — | 550,257 | 100,620 | 31,233 | 1,007,111 | |||||||||||||||||||||||||

| David Moore(7) |

||||||||||||||||||||||||||||||||

| President, Executive Vice President and Chief Commercial Officer |

2016 | 375,000 | — | — | 1,170,299 | 106,500 | 24,037 | 1,675,836 | ||||||||||||||||||||||||

| 2015 | 330,000 | — | — | 548,982 | 90,899 | 12,806 | 982,687 | |||||||||||||||||||||||||

| 2014 | 300,000 | — | — | 889,902 | 181,833 | 13,498 | 1,385,233 | |||||||||||||||||||||||||

| David Oldach, M.D.(8) |

||||||||||||||||||||||||||||||||

| Chief Medical Officer |

2016 | 350,000 | — | — | 900,243 | 96,600 | 25,304 | 1,372,147 | ||||||||||||||||||||||||

| 2015 | 300,000 | — | — | 347,237 | 84,210 | 23,090 | 754,537 | |||||||||||||||||||||||||

| John Bluth(6) |

||||||||||||||||||||||||||||||||

| Executive Vice President, Investor Relations and Corporate Communications |

2016 | 108,330 | — | — | 628,997 | 31,633 | 6,938 | 775,898 | ||||||||||||||||||||||||

16

Table of Contents

| (1) | The reported amounts represent the aggregate grant date fair value of the awards computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 2 of the financial statements included in our annual report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 28, 2017. |

| (2) | Non-equity incentive plan compensation represents amounts earned in 2014, 2015 and 2016 as annual performance awards, which were paid in 2015, 2016 and 2017, respectively. |

| (3) | These amounts represent the following in 2014, 2015 and 2016, respectively: Dr. Fernandes, $10,400, $10,600 and $10,600 in 401(k) matching contributions, $3,762, $2,906 and $2,909 in life, disability, and accidental death and dismemberment insurance premiums paid by us on her behalf, and $36,538, $39,231 and $41,538 in unused paid time off; Mr. Hahn, $10,400, $10,600 and $10,600 in 401(k) matching contributions, $3,970, $3,259 and $3,262 in life, disability, and accidental death and dismemberment insurance premiums paid by us on his behalf, and $16,863, $13,973 and $15,865 in unused paid time off; Mr. Moore, $9,500, $10,600 and $10,600 in 401(k) matching contributions, and $3,998, $1,571 and $3,341 in life, disability, and accidental death and dismemberment insurance premiums paid by us on his behalf, and $0, $635 and $10,096 in unused paid time off; Dr. Oldach, $10,600 and $10,600 in 401(k) matching contributions, $3,259 and $3,262 in life, disability, and accidental death and dismemberment insurance premiums paid by us on his behalf, and $9,231 and $11,442 in unused paid time off; and Mr. Bluth, $0 in 401(k) matching contributions, $1,088 in life, disability, and accidental death and dismemberment insurance premiums paid by us on his behalf, and $5,850 in unused paid time off. |

| (4) | Dr. Zaccardelli became our Acting Chief Executive Officer in December 2016. Dr. Zaccardelli received a pro-rated annual salary to reflect his partial year of service. |

| (5) | Dr. Fernandes retired in December 2016. |

| (6) | Mr. Bluth became our Executive Vice President, Investor Relations and Corporate Communications in August 2016. Mr. Bluth received a pro-rated annual salary to reflect his partial year of service. |

| (7) | Mr. Moore became a Named Executive Officer in 2014. He became our President in December 2016. |

| (8) | Dr. Oldach became a Named Executive Officer in 2015. |

Grants of Plan-Based Awards

The following table provides information regarding grants of plan-based awards made to our Named Executive Officers in 2016. The only plan-based awards granted were stock options and restricted stock units; no non-equity awards were granted. All stock options granted to our Named Executive Officers are incentive stock options, to the extent permissible under the Internal Revenue Code. The exercise price per share of each stock option granted to our Named Executive Officers was equal to the fair market value of our common stock as determined in good faith by our Board on the date of the grant. All stock options and restricted stock units listed below were granted under our 2011 Equity Incentive Plan.

| Name |

Grant date | Number of shares of stock or units(1) (#) |

Number of securities underlying options(2) (#) |

Exercise or base price of option awards ($/Sh) |

Grant date fair value of stock and option awards(3) ($) |

|||||||||||||||

| David Zaccardelli, Pharm.D. |

12/9/2016 | — | 150,000 | $ | 7.70 | $ | 826,554 | |||||||||||||

| 12/9/2016 | 50,000 | — | — | $ | 385,000 | |||||||||||||||

| Prabhavathi Fernandes, Ph.D. |

1/1/2016 | — | 183,570 | $ | 31.13 | $ | 3,600,934 | |||||||||||||

| Mark Hahn |

1/1/2016 | — | 59,660 | $ | 31.13 | $ | 1,170,299 | |||||||||||||

| John Bluth |

8/5/2016 | — | 40,000 | $ | 24.14 | $ | 628,997 | |||||||||||||

| David Moore |

1/1/2016 | — | 59,660 | $ | 31.13 | $ | 1,170,299 | |||||||||||||

| David Oldach, M.D. |

1/1/2016 | — | 45,893 | $ | 31.13 | $ | 900,243 | |||||||||||||

| (1) | Dr. Zaccardelli was the only Named Executive Officer to be granted restricted stock units in 2016. Dr. Zaccardelli’s restricted stock units will vest in full on December 9, 2017. |

| (2) | The Named Executive Officers were each granted the number of options provided next to their names in the table. The option grants to each Named Executive Officer vests according to the following schedule: 1/48th of the shares vest at the end of each month, beginning after January 1, 2016. Dr. Zaccardelli’s 12/9/2016 options vest 1/12th monthly at the end of each month, beginning after 12/9/2016. Mr. Bluth’s 8/5/2016 options vest according to the following schedule: 1/4th of the shares vest on 08/01/2017; and 1/36th of the remaining shares vest at the end of each month over the next 36 months. |

17

Table of Contents

| (3) | The grant date fair value of the restricted stock and option awards is calculated in accordance with FASB ASC Topic 718. |

Outstanding Equity Awards at Fiscal Year-End 2016

The following table contains certain information concerning unexercised options for the Named Executive Officers as of December 31, 2016.

OPTION AWARDS

| Name |

Grant date | Number of securities underlying unexercised options (#) exercisable |

Number of securities underlying unexercised options (#) unexercisable |

Option exercise price ($) |

Option expiration date |

|||||||||||||||

| David Zaccardelli, Pharm.D.(1) |

12/9/2016 | 12,500 | 137,500 | 7.70 | 12/8/2026 | |||||||||||||||

| 8/10/2016 | 10,417 | 14,583 | 22.77 | 8/9/2026 | ||||||||||||||||

| Prabhavathi Fernandes, Ph.D.(1) |

1/1/2016 | 45,893 | 137,677 | 31.13 | 12/31/2025 | |||||||||||||||

| 1/1/2015 | 66,744 | 66,755 | 23.51 | 12/31/2024 | ||||||||||||||||

| 1/8/2014 | 78,484 | 31,250 | 13.10 | 1/7/2024 | ||||||||||||||||

| 1/8/2014 | — | 50,000 | 13.10 | 1/7/2024 | ||||||||||||||||

| 3/7/2013 | 50,000 | — | 6.64 | 3/6/2023 | ||||||||||||||||

| 1/18/2013 | 150,000 | — | 6.63 | 1/17/2023 | ||||||||||||||||

| 3/20/2012 | 73,754 | — | 7.62 | 3/19/2022 | ||||||||||||||||

| 12/8/2010 | 40,698 | — | 2.09 | 12/7/2020 | ||||||||||||||||

| 7/28/2010 | 34,133 | — | 2.09 | 7/28/2020 | ||||||||||||||||

| 8/10/2009 | 64,194 | — | 2.09 | 8/9/2019 | ||||||||||||||||

| 6/3/2008 | 54,273 | — | 2.47 | 6/3/2018 | ||||||||||||||||

| Mark Hahn(1) |

1/1/2016 | 14,915 | 44,745 | 31.13 | 12/31/2025 | |||||||||||||||

| 1/1/2015 | 23,184 | 23,179 | 23.51 | 12/31/2024 | ||||||||||||||||

| 1/8/2014 | 33,750 | 11,250 | 13.10 | 1/7/2024 | ||||||||||||||||

| 1/8/2014 | — | 15,000 | 13.10 | 1/7/2024 | ||||||||||||||||

| 1/18/2013 | 50,000 | — | 6.63 | 1/17/2023 | ||||||||||||||||

| 3/20/2012 | 25,000 | — | 7.62 | 3/19/2022 | ||||||||||||||||

| 12/8/2010 | 9,074 | — | 2.09 | 12/7/2020 | ||||||||||||||||

| 7/28/2010 | 7,643 | — | 2.09 | 7/28/2020 | ||||||||||||||||

| 2/2/2010 | 46,890 | — | 2.09 | 2/1/2020 | ||||||||||||||||

| David Moore(1) |

1/1/2016 | 14,915 | 44,745 | 31.13 | 12/31/2025 | |||||||||||||||

| 1/1/2015 | 18,192 | 18,171 | 23.51 | 12/31/2024 | ||||||||||||||||

| 1/2/2014 | 62,500 | 37,500 | 12.79 | 1/1/2024 | ||||||||||||||||

| David Oldach, M.D.(1) |

1/1/2016 | 11,473 | 34,420 | 31.13 | 12/31/2025 | |||||||||||||||

| 1/1/2015 | 11,500 | 11,500 | 23.51 | 12/31/2024 | ||||||||||||||||

| 1/8/2014 | 5,625 | 1,875 | 13.10 | 1/7/2024 | ||||||||||||||||

| 3/7/2013 | 10,000 | — | 6.64 | 3/6/2023 | ||||||||||||||||

| 1/18/2013 | 14,087 | — | 6.63 | 1/17/2023 | ||||||||||||||||

| 3/21/2012 | 20,000 | — | 7.47 | 3/20/2022 | ||||||||||||||||

| 3/1/2011 | 16,347 | — | 2.28 | 3/2/2021 | ||||||||||||||||

| John Bluth(1) |

8/5/2016 | — | 40,000 | 24.14 | 8/04/2026 | |||||||||||||||

18

Table of Contents

| (1) | In respect of the award of 150,000 shares granted on December 9, 2016 to Dr. Zaccardelli, 1/12th of the shares vest monthly, beginning after December 9, 2016. In respect of the award of 25,000 shares granted on August 10, 2016 to Dr. Zaccardelli, 1/12th of the options vest at the end of each months over 12 months, beginning after August 10, 2016. In respect of the award of 40,000 shares granted on August 5, 2016 to Mr. Bluth, 1/4th of the shares vest on 08/01/2017; and 1/36th of the remaining shares vest at the end of each month over the next 36 months. In respect of the awards for 183,570 shares, 59,660 shares, 59,660 shares and 45,893 shares granted on January 1, 2016 to Dr. Fernandes, Mr. Hahn, Mr. Moore and Dr. Oldach respectively, 1/48th of the options vest at the end of each month over 48 months, beginning on January 1, 2016. In respect of the awards for 133,499 shares, 46,363 shares, 36,363 shares and 23,000 shares granted on January 1, 2015, to Dr. Fernandes, Mr. Hahn, Mr. Moore and Dr. Oldach respectively, 1/48th of the options vest at the end of each month over 48 months, beginning on January 1, 2015. In respect of the awards for 50,000 shares and 15,000 shares granted on January 8, 2014, to Dr. Fernandes and Mr. Hahn, respectively, 1/24th of the options vest at the end of each month over 24 months, beginning on January 1, 2017. In respect of the awards for 125,000 shares, 45,000 shares and 7,500 shares granted on January 8, 2014, to Dr. Fernandes, Mr. Hahn and Dr. Oldach respectively, 1/48th of the options vest at the end of each month over 48 months, beginning on January 1, 2014. In respect of the award for 100,000 shares granted on January 2, 2014, to Mr. Moore, one quarter of the options vested immediately and 18,750 options vest in four annual installments beginning on the one year anniversary of the vesting commencement date. |

STOCK AWARDS

| Name |

Number of restricted shares or restricted units of stock that have not vested (#) |

Market value of restricted shares or restricted units of stock that have not vested ($)(1) |

||||||

| David Zaccardelli, Pharm.D.(2) |

50,000 | 140,000 | ||||||

| Prabhavathi Fernandes, Ph.D. |

— | — | ||||||

| Mark Hahn |

— | — | ||||||

| David Moore |

— | — | ||||||

| David Oldach, M.D. |

— | — | ||||||

| John Bluth |

— | — | ||||||

| (1) | The market value equals the fair market value of the shares that could be acquired based on the closing sale price per share of our common stock on the NASDAQ Global Market on December 30, 2016, which was $2.80. |

| (2) | In respect of the awards for 50,000 restricted stock units to Dr. Zaccardelli, each restricted stock unit represents a contingent right to receive one share of common stock and all restricted stock units vest in full on December 9, 2017, subject to continued employment or Board service. |

Option Exercises

There were no exercises of options by the Named Executive Officers in 2016. No shares were acquired upon the vesting of restricted stock units in 2016.

Option Repricings

We did not engage in any repricings or other modifications to any of our Named Executive Officers’ outstanding options during the year ended December 31, 2016.

19

Table of Contents

Potential Payments on Change of Control