Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Touchpoint Group Holdings Inc. | s105815_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Touchpoint Group Holdings Inc. | s105815_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Touchpoint Group Holdings Inc. | s105815_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Touchpoint Group Holdings Inc. | s105815_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016.

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-10822

One Horizon Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-3561419 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| T1-017 Tierney Building, University of Limerick, Limerick, Ireland. |

||

| N/A | ||

| (Address of principal executive offices) | (Zip Code) |

+353-61-518477

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| n/a | n/a |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company þ |

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the 35,347,283 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $ 26.86 million as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $0.76 per share, as reported on Nasdaq.

As of April 3, 2017, 37,316,714 shares of the registrant’s common stock, par value $0.0001, were outstanding.

TABLE OF CONTENTS

| 2 |

Introductory Note

Unless otherwise noted, references to the “Company” in this Report include One Horizon Group, Inc. and all of its subsidiaries.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

The statements made in this Report, and in other materials that the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as any statements regarding the evaluation of strategic alternatives. These forward-looking statements are based on the current plans and expectations of management, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Among these risks and uncertainties are the competition we face; our ability to adapt to rapid changes in the market for voice and messaging services; our ability to retain customers and attract new customers; our ability to establish and expand strategic alliances; governmental regulation and related actions and taxes in our international operations; increased market and competitive risks, including currency restrictions, in our international operations; risks related to the acquisition or integration of future businesses or joint ventures; our ability to obtain or maintain relevant intellectual property rights; intellectual property and other litigation that may be brought against us; failure to protect our trademarks and internally developed software; security breaches and other compromises of information security; our dependence on third party facilities, equipment, systems and services; system disruptions or flaws in our technology and systems; uncertainties relating to regulation of VoIP services; liability under anti-corruption laws; results of regulatory inquiries into our business practices; fraudulent use of our name or services; our ability to maintain data security; our dependence upon key personnel; our dependence on our customers' existing broadband connections; differences between our service and traditional phone services; our ability to obtain additional financing if required; our early history of net losses and our ability to maintain consistent profitability in the future. These and other matters the Company discusses in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes. The Company assumes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

| 3 |

One Horizon Group, Inc. and its Subsidiaries (the “Company”) is the inventor of the patented SmartPacketTM Voice over Internet Protocol (“VoIP”) platform. Our software is designed to capitalize on numerous industry trends, including the rapid adoption of smartphones, the adoption of cloud based Internet services, the migration towards all IP voice networks and the expansion of enterprise bring-your-own-device to work programs.

The Company designs, develops and sells white label SmartPackettm software and services to large Tier-1 telecommunications operators. Our licensees deliver an operator-branded mobile Internet communication solution to smartphones including VoIP, multi-media messaging, video, and mobile advertising; and the Business to Business (“B2B”) business. Current licensees include some of the world’s largest operators such as Singapore Telecommunications and Philippines Smart Communication.

The SmartPacket™ platform, significantly improves the efficiency by which voice signals are transmitted from smartphones over the Internet resulting in a 10X reduction in mobile bandwidth and reduced battery usage while transmitting a VoIP call on a smartphone. This is of commercial interest to operators that wish to have a high quality VoIP call on congested metropolitan networks and on legacy 2G and 3G cellular networks.

By leveraging its SmartPacketTM solution, the Company is also a VoIP as a Service (“VaaS”) cloud communications leader for hosted smartphone VoIP that run globally on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector; and the “VaaS” business. Our existing licensees come from around the world including Zimbabwe, Ghana, China, United Kingdom, Singapore, Canada and Hong Kong.

Based on the SmartPacketTM solution, the Company is the sole owner and operator of its own branded retail smartphone VoIP, messaging and advertising service in the People’s Republic of China called AishuoTM; the “Aishuo” business. Since its inception in the second quarter of 2015 Aishuo has been downloaded over 40 million times since 2015 and has produced revenues throughout 2016. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus additional innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a free VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Our business model is focused on winning new B2B Tier-1 telecommunications operators, winning new VaaS subscribers and driving Aishuo retail revenues. We are also commercially focused on expanding sales of new and existing licensed products and services to existing customers, and renewing subscriptions and software support agreements. We target customers of all sizes and across a broad range of industries.

We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Hong Kong and Latin America.

| 4 |

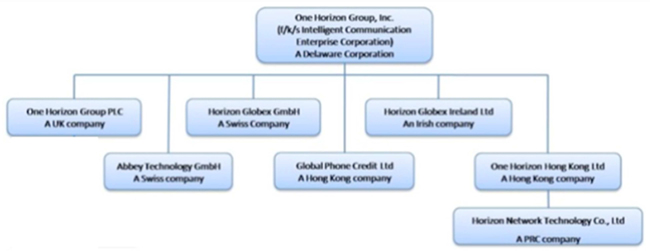

Current Structure of the Company

The Company has the following wholly owned subsidiaries:

| · | One Horizon Group PLC |

| · | Abbey Technology GmbH |

| · | Horizon Globex GmbH |

| · | Global Phone Credit Ltd |

| · | Horizon Globex Ireland Ltd |

| · | One Horizon Hong Kong Ltd |

| · | Horizon Network Technology Co. Ltd |

In addition to the subsidiaries listed above, Suzhou Aishuo Network Information Co., Ltd (“Suzhou Aishuo”) is a limited liability company, organized in China and controlled by us via various contractual arrangements. Suzhou Aishuo is treated as one of our subsidiaries for financial reporting purpose in accordance with generally accepted accounting principles in the United States (“GAAP”).

| 5 |

Current Business Operations

In 2015, we announced the rollout of our platform in China, brand named Aishuo (http://www.ai-shuo.cn/). This rollout entailed multiple strategies including advertisements, search engine optimization, press releases, event marketing, business-traveler direct marketing, as well as on and off-line promotions and leveraging the brand new One Horizon Sponsored-Call platform. Based on the SmartPacketTM solution, we are the owner and operator of this retail smartphone VoIP, messaging and advertising service in the People’s Republic of China.

Since its commercial availability in the second quarter of 2015, Aishuo has to date, been downloaded over 43 million times. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Aishuo is operated by, Suzhou Aishuo Network Information Co., Ltd. a Chinese company controlled by us and headquartered in Nanjing, China.

| 6 |

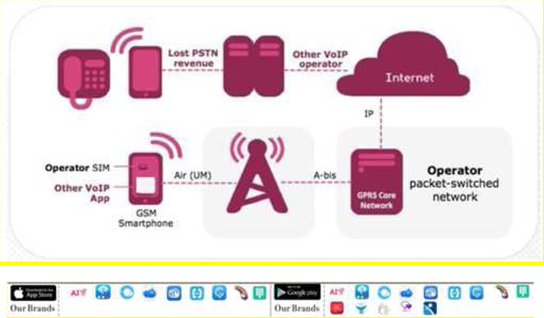

Figure 1. Aishuo Retail

At the end of Q1 2017, we announced the rollout of our VoIP as a Service “VaaS” platform on the Microsoft Azure cloud. We sell our software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector. The Company was showcased by Microsoft Corp. for its Azure technology (https://customers.microsoft.com/en-us/story/onehorizon).

Figure 2. VaaS Hosted Offering

| 7 |

Figure 3. Cloud-based Secure, Fault Tolerant and Low Latency Architecture

Figure 4. Microsoft Showcases One Horizon Group Inc.

Our B2B platform is being used by a pre-paid VoIP Smartphone application launched by different carriers respectively, some of which are listed as follows:

| · | Smart Communications, Inc, (“Smart”). Smart is the Philippines' leading wireless services provider with 62.8 million subscribers on its GSM network as of December 2016. |

| 8 |

| · | Singapore Telecommunications (“Singtel”). Singtel is the Singapore’s leading wireless services provider with a combined mobile subscriber base of 600 million customers from its own operations and regional associates in 25 countries at end of July 2016. |

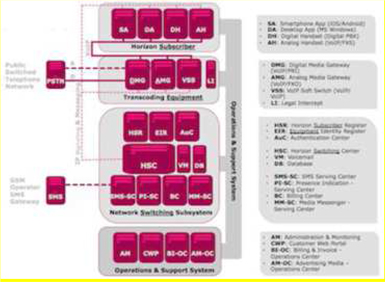

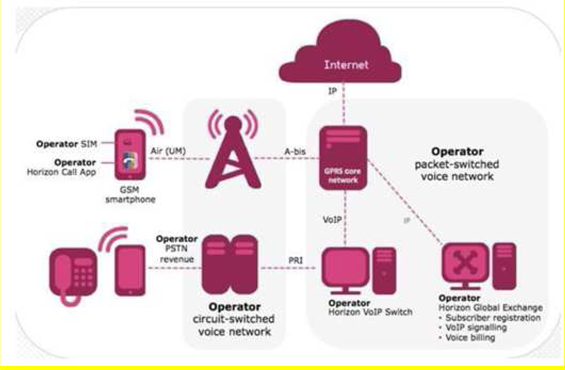

Figure 1. Horizon B2B Operator Core Network

Offering and Market Related

In September 2016, we sold 198,413 shares of common stock to certain institutional investors at a purchase price of $0.63 for aggregate gross proceeds of $125,000 pursuant to a securities purchase agreement. In connection with the purchase of common stock the purchasers received a warrant to acquire 148,810 shares of common stock at an exercise price of $0.819 per share. The warrants became exercisable on the date of issuance for a three-year term.

In October 2016, we sold 320,512 shares of common stock to certain institutional investors at a purchase price of $0.39 for aggregate gross proceeds of $125,000 pursuant to a securities purchase agreement.. In connection with the purchase of common stock the purchasers received a warrant to acquire 240,385 shares of common stock at an exercise price of $0.5616 per share. The warrants became exercisable on the date of issuance for a three-year term.

In December 2016, we sold 500,000 shares of common stock to certain institutional investors at a purchase price of $0.30 for aggregate gross proceeds of $150,000 pursuant to a securities purchase agreement. . In connection with the purchase of common stock the purchasers received a warrant to acquire 375,000 shares of common stock at an exercise price of $0.35 per share. The warrants became exercisable on the date of issuance for a three-year term.

The above financings are conducted as at-the-market shelf-take down under our registration statement on Form S-3 (File No. 333-205049).

On August 10, 2015, in connection with an Underwriting Agreement dated August 4, 2015 (the “Underwriting Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), we closed a firm commitment underwritten public offering of 1,714,286 shares of Common Stock, and warrants to purchase up to an aggregate of 857,143 shares of Common Stock at a combined offering price of $1.75 per share and accompanying Warrant. Pursuant to the Underwriting Agreement, the Underwriters exercised an option to purchase 151,928 additional shares of Common Stock and 75,964 additional warrants. The net proceeds from the offering were approximately $2.89 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

| 9 |

The warrants offered have a per share exercise price of $2.50 (subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash, stock or other property to our stockholders), are exercisable immediately and will expire three years from the date of issuance. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

Recent Developments

Notice of Delisting or Failure to Satisfy a Continued Listing Rule

On August 30, 2016, the Company received a written alert from Nasdaq Listing Qualifications that our listed security has not regained compliance with the minimum $1 bid price per share requirement, within the 180 calendar days. However, the Staff has determined that the Company is eligible for an additional 180 calendar day period, pursuant to Listing Rule 5810(c)(3)(a). If at any time during this 180 day period the closing bid price of our common stock is at least $1 for a minimum of ten consecutive business days, we will regain compliance. In order to regain compliance, we may have to affect a reverse stock-split. If we are required to effect a reverse stock-split, it would have to be completed at least 10 days prior to the expiration of the date by which we must regain compliance with Rule 5550(a)(2).

On February 28, 2017, the Company received a notice from The Nasdaq Stock Market LLC (“Nasdaq”) Listing Qualifications Staff (the “Staff”) stating that the Staff has determined, unless the Company timely requests an appeal of the Staff’s determination, before Nasdaq’s Hearing Panel (the “Panel”), by March 7, 2017, to delist the Company’s common stock from the Nasdaq Capital Market because the Company is not in compliance with the $1.00 minimum bid price requirement (the “Minimum Bid Price”) for continued listing set forth in the Nasdaq Listing Rule 5550(a)(2). The Company filed a request for a hearing before the Panel, on March 2, 2017, which request will stay any delisting or suspension action by the Staff pending the issuance of the Panel’s decision and the expiration of any extension granted by the Panel.

On March 3, 2017, the Staff informed the Company that they were granted a hearing to be held on April 20, 2017 (the “Hearing”). As such, the delisting action, referenced above, has been stayed, pending a final written decision by the Panel at the Hearing.

At the Hearing, we will present its plan to regain compliance with the Minimum Bid Price by effecting a reverse stock split. On March 20, 2017, the Company filed a definitive proxy statement with the Securities and Exchange Commission in connection with special meeting of stockholders (the “Stockholders’ Meeting”) to be held on April 14, 2017. The proposal being submitted is for a vote of the stockholders at the Stockholders’ Meeting is the approval of a 6 to 1 reverse stock split of all of the issued and outstanding shares of the Company’s common stock. Management believes that effecting the reverse stock split will allow our common stock to regain compliance with Nasdaq Listing Rule 5550(a)(2), which should allow the Company’s common stock to continue to trade on the Nasdaq Capital Market. Assuming the reverse stock split proposal is approved by the Company’s stockholders, the Company’s board of directors currently intends to effect the reverse stock split immediately after the Stockholders’ Meeting, unless it determines that doing so would not have the desired effect of satisfying the Minimum Bid Price requirement.

| 10 |

Industry

Rapid Growth in Global Mobile Voice over IP Service Market

We aim to deliver our patented smartphone software to the ever expanding mobile Voice over IP (“mVoIP”) user. By 2019 there are expected to be over 2.7 billion smartphones consumers, or more than one-third of all people worldwide (Source: https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide. Each new smartphone represents an opportunity for us to deliver our innovative mobile VoIP, Messaging over IP and Advertising over IP solution in whatever mobile app brand is attractive to the end user throughout the globe.

By partnering with national carriers and delivering our solution as a licensed service to regional mobile operators, we leverage the power of their brand and join them to fight back against already lost revenues, or potential revenue loss, to network bandwidth-intensive Over The Top (“OTT”) VoIP apps; such as SkypeTM in the USA or LineTM in Japan and the like.

In the past mobile operators relied upon blocking VoIP on their networks but they have realized that this is no longer a viable option. They must embrace innovations in VoIP software, especially on the smartphone, from businesses like ours. Not only can we offer a multi-media, multi-faceted software solution to smartphones, but we are the only company that offers a package that aids the operators in the rollout, expansion, maintenance and upgrade of their mobile network in metro and rural areas to cater for smartphones.

From the beginning of the first smartphones in 2008, our software was specifically targeted to be a disruptive technology, which was and has been explicitly designed, and patented, to work on congested wireless Internet connections; the absolute fundamental basis of mobile phones in 2016 and beyond.

As more and more smartphones come online, each one places a significantly higher load on the existing cellular infrastructure; as smartphone users now use smartphone to check for emails, surf the Internet, check the weather, read the news, etc. while in the past, all a mobile phone did was calling and Short Messaging (SMS). In order for carriers to keep up with the explosive growth of smartphones and their increased network consumption they are in need of any possible tool to assist them in managing their network and maintaining relevance on the users’ device.

We offer operators a mobile VoIP call that has ten (10) times less bandwidth than a standard telephone call over GSM or legacy mobile VoIP solutions such as Session Initiation Protocol (“SIP”). This gives operators a higher quality call on busy and legacy networks such as 2G, 3G and congested metro-based 4G using less bandwidth; meaning more bang for their “spectrum buck”. We will not replace traditional calls nor prevent the delivery of newer call types such as Voice over LTE (“VoLTE”) etc., but we give operators yet another tool in their arsenal to deliver the best quality voice, for the best value, for their diversified customer bases.

| 11 |

Our Technology

Our Technology

We have a very detailed knowledge of these wireless data network issues and have invented a totally new solution to successfully deliver a high quality voice call over a wireless Internet connection. Our solution is designed specifically to address such issues as call latency (i.e. delay) and network jitter (i.e. lost data) in a way that achieves a much higher likelihood of a voice packet (i.e. tiny piece of recorded voice) arriving in time and not being lost or delayed. Our awareness of these problems led us to develop a completely new algorithm for sending and receiving (and ordering) voice packets so as to reduce the likelihood of packet loss due to congestion, which we call SmartPacket™; and to the end user this just means near HD audio at a fraction of the cellular consumption.

| 12 |

SmartPacket™ Technology

The core of the Horizon solution is our truly innovative, and patented, SmartPacket™ technology. This enables VoIP from only 2 kilobytes/second (kbps) compared to around 8kbps and upwards from other VoIP platforms available today. This industry-leading solution has been developed in-house and is fully compatible with digital telecommunications standards. This technology is capable of interconnecting any phone system over IP - on mobile, fixed and satellite networks. Our SmartPacket™ technology is not based on legacy SIP (Session Initiation Protocol) or RTP (Real-time Transport Protocol). Rather, the Horizon signaling protocol is much simpler and benchmark testing has shown that it consumes significantly less bandwidth for the same audio quality score. Our SmartPacket™ technology is the world’s most bandwidth efficient IP communication platform designed for mobile communications. The technology optimizes voice flow, delivery and playback and delivers excellent call quality, reduced delays and drops. As a further illustration, the technology is considerably more efficient in the way it handles silence. Traditional VoIP calls send the same amount of data in both directions, regardless of whether or not someone is speaking. SmartPacket™ technology is designed to detect silence and send tiny “indications of silence”, rather than the silence itself. This massively reduces the amount of data transmitted, lowers the load on the cellular infrastructure which, in turn, means that more data can get through. This results in higher audio quality and a better user experience.

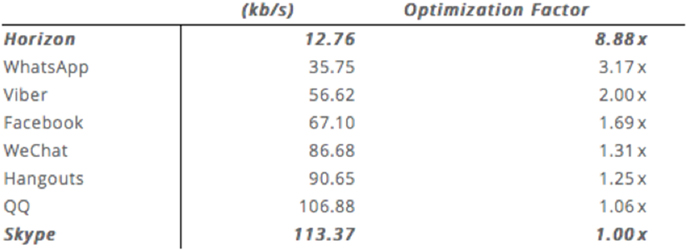

Our Benchmark Testing: Horizon vs the biggest smartphone VoIP technologies in the world

University published testing has shown that Horizon is up to 8.8 times more efficient, depending on which one of our voice compression settings is selected by the user.

Proprietary Technology

The Horizon Platform has been developed entirely in-house, patented, and is fully compatible with digital telecommunications standards. It is capable of interconnecting any phone system over IP – on mobile, fixed and satellite networks.

The Horizon Platform was initially developed for the burgeoning smartphone market and the challenging mobile VoIP over satellite market by Abbey Technology to make the best use of the limited wireless bandwidth available and to minimize the amount of data consumed.

We further developed the Horizon Platform for the broader telecommunications market on Apple’s iOS, Google’s Android and a Windows PC client focusing on the mobile Internet sector. This sector also benefits from our optimized mobile VoIP as it allows voice calls over new and legacy cellular telecom data networks. With the explosive growth in smartphone sales and increased usage of mobile data services, mobile operators face the challenge of dealing with increasingly congested networks, more dropped calls and rising levels of churn. Since the wireless spectrum is a finite resource, it is not always possible, or can be cost prohibitive, to increase network capacity. For these reasons, we believe that the demand for solutions to optimize the use of IP bandwidth will inevitably increase.

| 13 |

Our Strategy

We have developed a mobile application template called “Horizon Call,” that enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or Satellite connection. Our Horizon Call application is currently available for the iPhone and for Android handsets and we use it to showcase all of our functions, features, our call quality and the level of software innovation that we can brand for our potential clients.

Unlike the majority of mobile VoIP applications, Horizon Call creates a white-label business-to-business solution for mobile operators. Telecommunications operators are able to license from us, brand with us and deploy with us a completely new “white-labeled” solution so that they can optimize their highly pressurized mobile internet bandwidth and deliver innovation that in turn brings them new smartphone users. The operators decide how to integrate our application within their portfolio, how to offer it commercially and can customize it according to their own branding. Our solution helps them to manage increased traffic volumes while combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

We are positioning ourselves as an operator-enabler by licensing our technology to mobile operators in a manner that can be fully customized to the needs of their subscribers. As shown below, operators are able to offer our platform to deliver branded smartphone applications to their existing customers to reduce lost Voice/Text revenue and minimize customer churn.

| 14 |

By offering Horizon Call to their existing customer base, our customers can offer innovative data-based voice and data services that are different from the existing Over The Top (“OTT”) data applications running on their networks. OTT refers to voice and messaging services that are delivered by a third party to an end user’s smartphone, leaving the mobile network provider responsible only for transporting internet data packets and not the value-added content. The Horizon Call voice services allow mobile operators’ customers to make VoIP calls under mobile operators’ call plans, thereby allowing mobile operators to capture value-added content, including voice calls, text messaging, voice messaging, group messaging, multimedia messaging, and advertising, that would have otherwise gone to the providers of other OTT services.

Horizon Call runs on both smartphone and tablet devices and, as networks become more congested, software services such as Horizon Call become ever more relevant. We believe that although more network capacity will eventually come on stream with 4G/LTE, it, like all other highways, will quickly become congested and this is why we believe that Horizon Call is ideally placed to add value to mobile data networks.

Incumbent mobile operators are suffering a reduction in revenue per user due to the OTT software services on mobile devices. OTT applications, such as Skype and Line, can negatively impact mobile operators’ traditional revenue streams of voice and SMS (short message service). As shown below, the Horizon Platform positions the Company to enable mobile operators to operate their own OTT solution branded in their image allowing use on all mobile data networks.

| 15 |

In addition to delivering new data services to their existing customers, mobile operators can offer their brand of Horizon Call on any other operators’ handsets. Because the Horizon Call application can be installed on the smartphone from the Internet, the potential customer base for the operators’ data application surpasses the customer base that they can reach through traditional mobile phone SIM card distribution. We believe that this service innovation, coupled with the fact that the Horizon Call application can also use existing mobile operator pre-paid credit redemption and distribution services, presents a very compelling service against OTT services.

We believe that emerging markets represent a key opportunity for Horizon Call because these are significant markets with high population densities, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. It is forecast that over 2.7 billion people will use smartphones in 2019. Asia-Pacific will account for over half of all smartphone users in 2016, estimated at 1.1 billion users. Globally, China is the largest smartphone market with an estimated 563.1 million handsets. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, where necessary, we have created our own brand in China, called Aishuo, formed a number of strategic ventures with local partners in regions of various emerging markets to seize upon this opportunity.

| 16 |

Marketing

Our marketing objective is to become a broadly adopted solution in the regions of the world with large concentrations of smartphone users and high network congestion. We aim at becoming the preferred solution for carriers who wish to deploy branded VoIP solutions that enable them to minimize revenue erosion, reduce churn, increase the effective capacity of their network infrastructure and improve user experience. We employ an integrated multi-channel approach to marketing, whereby we evaluate and focus our efforts on selling through telecommunications companies to enable them to provide the Horizon Platform to their customers. We routinely evaluate our marketing efforts and try to reallocate budgets to identify more effective media mixes.

We conduct marketing research to gain consumer insights into brand, product, and service performance, and utilize those findings to improve our messaging and media plans. Market research is also leveraged in the areas of testing, retention marketing, and product marketing to ensure that we bring compelling products and services to market.

Sales

Direct Sales. Our primary sales channel for the products and services of Horizon Platform is the sale of Horizon Platforms to Tier 1 and Tier 2 telecommunications companies to enable them to provide the product and services to their customers. We continue our efforts to develop new customers globally but particularly in Asia, Africa and Latin America.

Strategic Ventures. In addition to our direct sales channel, we also offer increased sales through our strategic venture channel. In this context, as mentioned above, we are working towards forming a number of strategic ventures in areas where regulatory issues require local representation.

Target Markets. The markets for our primary and joint venture channels will have high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Competition

Our direct competitors for its technology primarily consist of systems integrators that combine various elements of SIP (Session Initiation Protocol) dialers and media gateways. Other dial-back solutions exist but they are not IP-based. Because SIP dialers and media gateways currently are unable to provide a low bandwidth solution, they do not currently compete with the Company’s technology in those markets in which their high bandwidth needs are unsupported by the existing cellular networks. They do, however, compete in those markets where the cellular networks are accessible by those SIP dialers and gateways.

We license the Horizon Platform to mobile operators, who in turn may offer the application to their end-user subscribers. The Company’s principal competitors for the mobile operators’ end-users are Skype, Viber, WeChat, and WhatsApp. Having a mobile operator’s subscriber opt to use the operator’s (branded) Horizon Call service instead of existing OTT services means that the mobile operator will gain market share of some of the OTT voice and messaging traffic. We are currently unaware of any other companies that seek to license VoIP technology directly to mobile operators.

| 17 |

One of our key competitive advantages is that we are not a threat to mobile operators. Rather, the Company’s Horizon Platform is a tool that can be used by mobile operators to compete against the OTT provider’s applications that are running on their networks. Through the Horizon Platform, mobile operators are able to compete directly with OTT services that, by their design, divert voice and messaging services away from mobile operators. The solution is delivered completely and is easy to install and operate. This means that a mobile operator has a turnkey mobile voice and messaging solution to deploy to its customer (i.e., the end-user).

The turnkey Horizon software platform and the Horizon SmartPacket™ technology give us a competitive advantage by managing credit, routing, rating, security, performance, billing and monitoring. Horizon SmartPacket™ is the world’s lowest bandwidth voice compression and transmission protocol and is 100% developed and owned by the Company. Though other software companies can offer part of this solution space, we believe none offers it in such a complete and integrated fashion as we do. We believe it will take a substantial number of years to copy/replicate the Horizon Platform in its entirety, by which time we believe the Horizon Platform will have improved and further distanced itself from potential competition.

Intellectual Property

Our strategy with respect to our intellectual property is to patent our core software concepts wherever possible. The Company’s current software patent has been approved in the United States and is pending in other jurisdictions around the world. Our patent strategy serves to protects the Horizon Platform and the central processing service of the Horizon Platform.

The Company endeavors to protect its internally developed systems and technologies. All of our software is developed “in-house,” and then licensed to our customers. We take steps, including by contracts, to ensure that any changes, modifications or additions to the Horizon Platform requested by our customers remain the sole intellectual property of the Company.

Research and Development and Software Products

We have spent approximately $0.5 million on capitalizable research and development during 2016.

Throughout 2016 we continued with our focus on innovation and our research and development teams (“R&D”) brought us software that allows our customer to offer call and messaging Bundles. This is a common feature for SIM cards and popular with mobile subscribers whereby the user pre-purchases bulk minutes at a lower per minute rate that when they pay for a call minute by minute. The Company now offers such innovations to its subscribers right inside the operators’ smartphone app supplied to Company thereby driving up the operator’s revenue per user.

We also expanded our R&D effort into the cellular operators' core network with a feature set that allows our service to directly connect to an operators Unstructured Supplementary Service Data (USSD) service thereby allowing all mobile prepaid subscribers to add credit to their mobile account in a traditional way and then allowing this USSD top up to be applied to a mobile VoIP smartphone app, an industry first.

The Cyber-Security R&D team also delivered a cyber-secure VoIP service that leverages the low bandwidth benefits of Company’s patented technology to allow VoIP over the strongest security protocols on the Internet. By leveraging the power of Virtual Private Networks (VPN) native client on the smartphone the Company’s VoIP protocols work where other traditional VoIP solutions cannot due to call quality issues with high data consumption protocols. Management expect this platform to drive a new revenue stream for Cyber Secure VoIP.

Also in 2016 our Cyber-Security R&D team delivered a stand alone version of our optimized VoIP core network server software for vertical markets covering Government, Banks and Small to Medium Enterprises that ensures privacy of their internal voice and messaging services in a cryptographically secure way. Our stand alone service can be installed on-site at the customer and requires minimal operational support thereby delivering secure communications in a cost efficient manner.

| 18 |

R&D also delivered a standalone Lawful Intercept module for operators that are legally required to have call recording features. This service is capable of recording calls from VoIP application on the handset to another handset or to the traditional telephone network. Such features are required by regulators in certain jurisdictions around the world. This feature also allows our mobile solution to internet connect with Microsoft's Skype for Business Unified Communication platform.

R&D also delivered a complete mobile app telephone conferencing service where a user of our VoIP service can bring in other parties to an on-going call, an ad-hoc conference. This feature is targeting the B2B user that may need multi-party calls on lower quality or congested mobile data networks.

R&D delivered a complete integration into one of Africa's largest micropayments platforms, Ecocash. App users can now securely pay for their calls from inside the app using this widely used payment solution.

Cyber-Security team delivered a completely new security messaging solution with external key-broker for the ultimate in message security. Using our solution, not even the service-host can decrypt the app-app messages as the keys are not available inside the core network. Our distributed key broker can be located anywhere in the world, independent of the service-host passing messages thereby guaranteeing message security for the end to end communication.

R&D delivered a bespoke real-time network quality monitor that automatically adjusts the bandwidth consumed by a handset for a VoIP call depending out network strength. This allow for a much smoother call with reduced jitter and enhanced user acceptance.

R&D commenced the development work on iOS for the latest Apple CallKit service.

Cyber-Security R&D team commenced development on an encrypted call solution that can avail of the independent key broker service for the ultimate in VoIP security.

| 19 |

Employees

As of December 31, 2016, we had 23 employees, all of whom were full-time employees.

We do not currently own any real property. In March 2017, we leased the following offices:

| Location | Approximate size | Approximate monthly rent | ||||

| Ireland | 840 sqft | $ | 2,050 | |||

| China | 1,900 sqft | $ | 1,400 | |||

| UK | 120 sqft | $ | 1, 250 | |||

Executive Offices

Our executive offices are located at T1-017 Tierney Building, University of Limerick, Limerick, Ireland.

We are not a party to any material legal proceedings and no material legal proceedings have been threatened by us or, to the best of our knowledge, against us except the following:

Since 2014 the Company has been involved in legal proceedings with Broadband Satellite Services Limited (“BSS”) to whom we sold had sold former subsidiaries in 2012. In December 2016 the parties agreed to drop their respective claims and counterclaims without any payment required to paid by either party. As a result we have written off receivable amounts due by BSS totaling $455,000 in the Company’s books having provided previously an amount totaling $605,000 against the original unpaid sales invoices.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 20 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the NASDAQ Capital Market under the symbol OHGI.

The following table sets forth the high and low bid information, as reported by Nasdaq on its website, www.nasdaq.com, for our common stock for each quarterly period in 2016 and 2015.

| Low | High | |||||||

| Fiscal year ending December 31, 2016: | ||||||||

| Quarter ended December 31 | $ | 0.22 | $ | 0.65 | ||||

| Quarter ended September 30 | 0.52 | 1.27 | ||||||

| Quarter ended June 30 | 0.61 | 0.85 | ||||||

| Quarter ended March 31 | 0.78 | 1.17 | ||||||

| Fiscal year ending December 31, 2015: | ||||||||

| Quarter ended December 31 | $ | 0.90 | $ | 1.62 | ||||

| Quarter ended September 30 | 1.11 | 3.34 | ||||||

| Quarter ended June 30 | 1.03 | 5.84 | ||||||

| Quarter ended March 31 | 1.21 | 3.92 | ||||||

As of April 3, 2017, the closing bid price of the common stock was $0.28 and we had approximately 37,316,714 record holders of our common stock. This number excludes any estimate by us of the number of beneficial owners of shares held in street name, the accuracy of which cannot be guaranteed.

| 21 |

Dividend Policy

The payment of cash dividends by us is within the discretion of our board of directors and depends in part upon our earnings levels, capital requirements, financial condition, any restrictive loan covenants, and other factors our board considers relevant. Since the share exchange in 2012, we have not declared or paid any dividends on our common stock and we do not anticipate paying such dividends in the foreseeable future. We intend to retain earnings, if any, to finance our operations and expansion.

Description of Equity Compensation Plans Approved by Shareholders

Prior to the Share Exchange, One Horizon UK had authorized securities for issuance under equity compensation plans that have not been approved by the stockholders, but none under equity compensation plans that were approved by the stockholders. The following table shows the aggregate amount of securities authorized for issuance under all equity compensation plans as of December 31, 2016:

| Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted- average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||||||||

| Equity compensation plans approved by security holders | 847,500 | $ | 2.47 | 4,936,000 | ||||||||

The securities referenced in the table above reflect stock options granted and approved by security holders pursuant to the 2013 plan.

In addition share options were issued to employees under previous unapproved plans, 875,700 of such options are fully vested. 583,800 of such options are expiring in 2020; and 291,900 are expiring in 2022. The number of options in the table above reflect a conversion that occurred in connection with the Share Exchange, whereby the number of options (to purchase One Horizon UK shares) held by each employee was increased by 175.14 times and the exercise price was decreased by the option exercise price divided by 175.14, and additionally reflect a 1-for-600 reverse stock split effected as of August 6, 2013.

Repurchases of Equity Securities

We have not repurchased any equity securities during the periods covered by this Report.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

| 22 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our audited consolidated financial statements and notes for the fiscal years ended December 31, 2016 and 2015. The following discussion and analysis contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

See “Cautionary Note Concerning Forward-Looking Statements.”

Overview

One Horizon Group, Inc. and its Subsidiaries (the “Company”) is the inventor of the patented SmartPacketTM Voice over Internet Protocol (“VoIP”) platform. Our proprietary software is designed to capitalize on numerous industry trends, including the rapid adoption of smartphones, the adoption of cloud based Internet services, the migration towards all IP voice networks and the expansion of enterprise bring-your-own- device to work programs.

The Company designs, develops and sells white label SmartPacketTM VoIP software and services to large Tier-1 telecommunications operators. Our licensees market and deliver an operator-branded mobile Internet communication solution to smartphones including VoIP, multi-media messaging, video, conference calling, and mobile advertising to their retail subscribers; and to their Business to Business (“B2B”) business subscribers.

The SmartPacket™ platform, significantly improves the efficiency by which voice signals are transmitted from smartphones over the Internet resulting in a 10X reduction in mobile bandwidth and reduced battery usage while transmitting a VoIP call on a smartphone. This is of commercial interest to operators that wish to have a high quality VoIP call on congested metropolitan 4G networks and on legacy 2G and 3G cellular networks and our optimizations benefits operators by reducing their payments by over 10x to overseas operators when their subscribers make VoIP calls whilst roaming.

| 23 |

The following diagram (source GSMA Intelligence, GSMA Mobile Economy 2016) shows the global penetration of mobile broadband and with the Company’s patented technology being one of the leading mobile VoIP solution for all mobile network types management believes that this represents a very large opportunity for future growth in sales.

| 24 |

By leveraging its SmartPacketTM solution, the Company is also a VoIP as a Service (“VaaS”) cloud communications leader for hosted smartphone VoIP that run globally on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector; and the “VaaS” business. Our existing licensees come from around the world including USA, China, United Kingdom, Singapore, Canada and Hong Kong.

Based on the SmartPacketTM solution, the Company is the sole owner and operator its own branded retail smartphone VoIP, messaging and advertising service in the People’s Republic of China called AishuoTM; Since its inception in the second quarter of 2015 Aishuo has been downloaded over 40 million times and has increased its revenues for the first 5 quarters of operations. Aishuo offers subscribers very competitive telephone call rates and a travel-SIM rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a free VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Our business model is focused on winning new B2B Tier-1 telecommunications operators, winning new VaaS subscribers and driving Aishuo retail revenues. We are also commercially focused on expanding sales of new and existing licensed products and services to existing customers, and renewing subscriptions and software support agreements. We target customers of all sizes and across a broad range of industries.

We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Singapore, Hong Kong and Latin America.

In February 2015, we announced the rollout of our platform in China, brand named, Aishuo. The Aishuo platform provides VoIP services, a travel SIM solution delivered through a People’s Republic of China (“PRC”) entity controlled by us via various contractual arrangements, Suzhou Aishuo. The Aishuo product has been delivered to the major stores in Chinese App marketplace including Baidu’s 91.com and Baidu.com, the Tencent App store MyApp.com, 360 Qihoo store 360.cn, Apple’s iTunes and the ever growing Xiaomi store mi.com. The Aishuo smartphone app is expected to drive multiple revenue streams from the supply of its value-added services including the rental of Chinese telephone phone numbers linked to the app, low cost local and international calling plans and sponsorship from advertisers. Subscribers can top up their app credit from the biggest online payment services in China including AliPay (from Alibaba), Union Pay, PayPal and Tencent’s WeChat payment service.

Aishuo sought to acquire 15 million new app subscribers for the smartphone app over a two-year period and expects to achieve industry average revenues per user (ARPU) for similar social media apps. By the end of September 30, 2016, we had exceeded our two year target of 15 million and in December 2016 had grown to over 40 million downloads of Aishuo smartphone app.

Also during 2016 Company was granted a 20-year patent for Invention in the People's Republic of China for its mobile VoIP software solution.

In addition to the developments in the rollout of Aishuo smartphone app brand in mainland China, we delivered a data roaming VoIP solution with, Smart Communications, the Philippines' leading wireless service provider with an estimated 55 million prepaid subscribers. For the first time, prepaid subscribers that travel abroad are now able to call home on their operators' data roaming service free from roaming fees (http://smart.com.ph/smartroamer). The management expect this commercial rollout of an optimized data voice solution for roamers to drive further mobile operator interest in the Company’s products and to drive revenues from its rollout to Filipinos throughout 2017.

| 25 |

Corporate Governance

Research & Development

During the fiscal year 2016, we spent approximately $500,000 on capitalizable research and development together with approximately $600,000 on expensed research and development.

| 26 |

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States, or GAAP. Our significant accounting policies are described in notes accompanying the consolidated financial statements. The preparation of the consolidated financial statements requires our management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, expenses, and related disclosure of contingent assets and liabilities. Estimates are based on information available as of the date of the financial statements, and accordingly, actual results in future periods could differ from these estimates. Significant judgments and estimates used in the preparation of the consolidated financial statements apply critical accounting policies described in the notes to our consolidated financial statements.

We consider our recognition of revenues, accounting for the consolidation of operations, accounting for stock-based compensation, accounting for intangible assets and related impairment analyses, the allowance for doubtful accounts and accounting for equity transactions, to be most critical in understanding the judgments that are involved in the preparation of our consolidated financial statements.

Additionally, we consider certain judgments and estimates to be significant, including those relating to the timing of revenue recognition from the sales of perpetual licenses to certain Tier 1 and Tier 2 telecom entities, those relating to the determination of vendor specific objective evidence (“VSOE”) for purposes of revenue recognition, allowance for doubtful accounts, useful lives for amortization of intangibles, determination of future cash flows associated with impairment testing of long-lived assets, determination of the fair value of stock options and other assessments of fair value. We base our estimates on historical experience, current conditions and on other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates and assumptions.

Together with our critical accounting policies set out above, our significant accounting policies are summarized in Note 2 of our audited financial statements as of December 31, 2016.

Revenue Recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company establishes persuasive evidence of a sales arrangement for each type of revenue transaction based on a signed contract with the customer and that delivery has occurred or services have been rendered, price is fixed and determinable, and collectability is reasonably assured.

| · | Software and licenses – revenue from sales of perpetual licenses to telecom entities is recognized at the date of invoices raised for installments due under the agreement, unless payment terms exceed one year, as described below, presuming all other relevant revenue recognition criteria are met. |

| · | Revenue for user licenses purchased by customers is recognized when the user license is delivered except as set out below. |

| · | Revenue for maintenance services is recognized over the period of delivery of the services except as set out below. |

| · | Effective as of October 1, 2014, the Company amended certain existing customer contracts with respect to the terms under which those customers would pay the Company for perpetual licenses, user licenses and maintenance services provided by the Company. Existing customer contracts required payments for maintenance services to be made based on contractually specified fixed amounts, which were billed regularly through September 2014. Through that date the Company recorded revenue for licenses and maintenance services when those licenses and services were billed. Revenue for user licenses was recorded as earned and revenue for maintenance services was recorded based on a fixed annual fee, billed quarterly. The Company has modified the payment terms under certain of those existing customer contracts by entering into Revenue Sharing agreements with those customers. Under the terms of these Revenue Sharing agreements, future payments will be due from the customer when that customer has generated revenue from its customers who subscribe to use the Horizon products and services. Effective October 1, 2014 revenue will be recorded by the Company when it invoices the customer for the revenue share due to the Company. Certain customers who entered into revenue sharing arrangements had outstanding balances due to the Company as of September 30, 2014, which balances were included in accounts receivable at that date. Payments received after September 30, 2014, from those customers under revenue sharing agreements have been applied to the customer’s existing accounts receivable balances first. For those customers having balances due at September 30, 2014, revenue related to perpetual and user licenses and maintenance services will be recorded only after existing accounts receivable balances are fully collected. |

| 27 |

| · | Revenues from Aishuo retail sales are recognized when the PSTN calls and texts are made |

Where the Company has entered into a Revenue Share with the customer then all future revenue from granting of user licenses and for maintenance services will be recognized when the Company has delivered user licenses and is entitled to invoice.

We enter into arrangements in which a customer purchases a combination of software licenses, maintenance services and post-contract customer support (“PCS”). As a result, judgment is sometimes required to determine the appropriate accounting, including how the price should be allocated among the deliverable elements if there are multiple elements. PCS may include rights to unspecified upgrades, when and if available, support, updates and enhancements. When vendor specific objective evidence (“VSOE”) of fair value exists for all elements in a multiple element arrangement, revenue is allocated to each element based on the relative fair value of each of the elements. VSOE of fair value is established by the price charged when the same element is sold separately. Accordingly, the judgments involved in assessing the fair values of various elements of an agreement can impact the recognition of revenue in each period. Changes in the allocation of the sales price between deliverables might impact the timing of revenue recognition, but would not change the total revenue recognized on the contract. When elements such as software and services are contained in a single arrangement, or in related arrangements with the same customer, we allocate revenue to each element based on its relative fair value, provided that such element meets the criteria for treatment as a separate unit of accounting. In the absence of fair value for a delivered element, revenue is first allocated to the fair value of the undelivered elements and then allocated to the residual delivered elements. In the absence of fair value for an undelivered element, the arrangement is accounted for as a single unit of accounting, resulting in a delay of revenue recognition for the delivered elements until the undelivered elements are fulfilled. No sales arrangements to date include undelivered elements for which VSOE does not exist.

For purposes of revenue recognition for perpetual licenses, the Company considers payment terms exceeding one year as a presumption that the fee in the transaction is not fixed and determinable.

| 28 |

If the presumption cannot be overcome due to a lack of such evidence, revenue is recognized as payments become due, assuming all other revenue recognition criteria has been met.

Results of Operations

The following table sets forth information from our statements of operations for the year ended December 31, 2016 and 2015.

Comparison of year ended December 31, 2016 and 2015 (in thousands)

| For the Year Ended December 31, | Year to Year Comparison | |||||||||||||||

| 2016 | 2015 (restated) | Increase/ (decrease) | Percentage Change | |||||||||||||

| Revenue | $ | 1,615 | $ | 1,532 | $ | 83 | 5.4 | % | ||||||||

| Cost of revenue | ||||||||||||||||

| Hardware, calls and network charges | 98 | 116 | (18 | ) | (15.5 | )% | ||||||||||

| Amortization of software development costs | 2,010 | 2,111 | (101 | ) | (4.8 | )% | ||||||||||

| 2,108 | 2,227 | |||||||||||||||

| Gross margin | (493 | ) | (695 | ) | (202 | ) | (29.1 | )% | ||||||||

| Operating Expenses | ||||||||||||||||

| General and administrative | 3,267 | 3,326 | (59 | ) | (0.2 | )% | ||||||||||

| Increase in Allowance for doubtful accounts | 455 | 934 | (501 | ) | (53.6 | )% | ||||||||||

| Depreciation | 59 | 67 | (8 | ) | (11.9 | )% | ||||||||||

| Research and development | 605 | 579 | 26 | 4.5 | % | |||||||||||

| Total Operating Expenses | 4,386 | 4,906 | (520 | ) | (10.6 | )% | ||||||||||

| Loss from Operations | (4,879 | ) | (5,601 | ) | (722 | ) | (12.9 | )% | ||||||||

| Other Income(Expense) | ||||||||||||||||

| Interest expense | (712 | ) | (722 | ) | 10 | 1.4 | % | |||||||||

| Interest expense - related parties | - | (2 | ) | 2 | 100 | % | ||||||||||

| Gain on settlement of lease | - | 36 | (36 | ) | (100 | )% | ||||||||||

| Foreign Exchange gain/(loss), net | 9 | (29 | ) | 38 | 131.0 | % | ||||||||||

| Interest income | - | 2 | (2 | ) | (100 | )% | ||||||||||

| Loss for continuing operations before income taxes | (5,582 | ) | (6,316 | ) | (734 | ) | (11.3 | )% | ||||||||

| Income tax recovery | (43 | ) | (20 | ) | (23 | ) | (115.0 | )% | ||||||||

| Net loss for the year | (5,539 | ) | (6,296 | ) | (757 | ) | (12.0 | )% | ||||||||

Revenue: Our revenue for the year ended December 31, 2016 was approximately $1.6 million as compared to approximately $1.5 million for the year ended December 31, 2015, an increase of roughly $0.1 million or 5%. The increase was primarily due to increase in B2B business primarily in the Asia region.

| 29 |

Cost of Revenue: Cost of revenue for hardware calls and network charges was approximately $0.1 million for the year ended December 31, 2016, compared to approximately the same amount for the year ended December 31, 2015. Our cost of sales is primarily composed of the amortization of software development costs together with the costs of hardware, calls and network charges.

Gross Profit: Gross profit before the amortization charge for the year ended December 31, 2016 was approximately $1.5 million as compared to $1.4 million for the previous year. Our gross profits increased by 6% from 2015 to 2016. The increase was mainly due to the increase in B2B business primarily in the Asia region.

Operating Expenses: Operating expenses including general and administrative expenses, allowance for doubtful accounts, depreciation and research and development expenses were approximately $ 4.4 million or 272% of revenue for the year ended December 31, 2016, as compared to approximately $4.9 million, or 322% of sales for the same period in 2015, a decrease of $0.5 million. The decrease in expenses arose due to the reduction in provision for doubtful accounts of $0.4 million in the year ended December 31, 2016 when compared to the same period in 2015. General and administrative expenses were approximately $3.3 million for the year ended December 31, 2016 as compared to approximately the same amount as the same period in 2015.

Net Loss: Net loss for the year ended December 31, 2016 was approximately $5.5 million as compared to a net loss of $6.3 million for the same period in 2015. Going forward, management expects to generate a growth in revenue based on the roll out of the products primarily in the China, Asia and Latin America regions. Going forward, management believes the Company will continue to grow the business and increase profitability if we are successful in selling the Horizon B2B solution to new telecommunications company customers globally and the B2C service to end users.

Foreign Currency Translation Adjustment: Our reporting currency is the U.S. dollar. Our local currencies, Swiss Francs, Euro, British pounds and Chinese Renminbi, are our functional currencies. Results of operations and cash flow are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rate at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Currency translation adjustments resulting from this process are included in accumulated other comprehensive income in the consolidated statement of shareholders' equity and amounted to approximately $65,000 for the year ended December 31, 2016.

Liquidity and Capital Resources

As we continue to pursue our operations and our business plan, we expect to incur further losses in 2017 which when combined with our continued investment in our intellectual property, will generate negative cash flows. As of December 31, 2016 the Company did not have any available credit facilities. As a result we are in the process of seeking new financing by way of sale of either convertible debt or equities. Whilst we have been successful in the past in obtaining the necessary capital to support our investment and operations there is no assurance that we will be able to obtain additional financing under acceptable terms and conditions, or at all. As a result , our auditors’ report for our 2016 Financial Statements, which are included as part of this report, contains a statement concerning our ability to continue as a “going concern”.

| 30 |

Years Ended December 31, 2016 and December 31, 2015

The following table sets forth a summary of our approximate cash flows for the periods indicated:

| For the Years Ended December 31 (in thousands) | ||||||||

| 2016 | 2015 | |||||||

| Net cash used in operating activities | (1,303 | ) | (2,115 | ) | ||||

| Net cash used in investing activities | (475 | ) | (1,072 | ) | ||||

| Net cash provided by financing activities | 334 | 1,787 | ||||||

Net cash used by operating activities was approximately $1.3 million for the year ended December 31, 2016 as compared to approximately $2.1 million for the same period in 2015. The decrease in cash used in operating activities is largely due to the deferral of payments to vendors during 2016

Net cash used in investing activities was approximately $0.5 million and $1.1 million for the years ended December 31, 2016 and 2015, respectively. Net cash used in investing activities was primarily focused on investment in software development costs.

Net cash provided by financing activities amounted to approximately $0.3 million for 2016 and $1.8 million for 2015. Cash provided by financing activities in 2016 primarily from the sale of Common Stock in September, October and December 2016, net of related costs. Cash provided by financing activities in 2015 was primarily due to the sale of Common Stock in August and September 2015.

Our working capital deficit as of December 31, 2016, was approximately $1.9 million, as compared to working capital of approximately $3.9 million for the same date in 2015.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on its financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our financial statements, including the independent registered public accounting firm’s report on our financial statements, are included beginning at page F-1 immediately following the signature page of this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

(a) Dismissal of Independent Certifying Accountant.

(1) Previous Independent Public Accounting Firm

On October 12, 2016, Peterson Sullivan LLP (“Peterson”) resigned as One Horizon Group, Inc.’s (the “Company”) independent registered public accounting firm. The report of Peterson on the Company’s financial statements for the year ended December 31, 2014, did not contain an adverse opinion or disclaimer of opinion, and such report was not qualified or modified as to uncertainty, audit scope, or accounting principles. During the year ended December 31, 2014, there were no disagreements between the Company and Peterson on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. No reportable event, as described in Item 304(a)(1)(v) of Regulation S-K, has occurred from the resignation of Peterson.

As a result of Peterson’s resignation, Peterson determined not to reissue their report on our financial statements for fiscal year ended December 31, 2015.

| 31 |

(2) New Independent Public Accounting Firm

On October 12, 2016, the Company entered into an engagement with Cherry Bekaert LLP (“Cherry”) to retain Cherry as the Company’s independent public accounting firm. On October 12, 2016, the audit committee of the Company approved and ratified the engagement of Cherry as its new independent registered public accounting firm.

Cherry re-audited our financial statements for the fiscal year ended December 31, 2015 and determined there is no material change to the prior report issued by Peterson for that period, but for the emphasis of matter paragraph with respect to the restatement of the previously reported consolidated financial statement as of and for the year ended December 31, 2015.

| 32 |

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including its chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Limitations on the Effectiveness of Disclosure Controls. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management necessarily is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our management, including our chief executive officer and our chief financial officer, we carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures for the period ended December 31, 2016. Based on the foregoing, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) were not operating effectively as of December 31, 2016. Our disclosure controls and procedures were not effective because of the “material weaknesses” described below under “Management’s Annual Report on Internal Controls Over Financial Reporting”.

Management’s Report on Internal Control over Financial Reporting

Our management is also responsible for establishing and maintaining adequate internal controls over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, our principal executive and principal financial officers and effected by our Board of Directors (notably, the Audit Committee thereof), management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

· Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company;

· Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

· Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Because of its inherent limitations, our internal control over financial reporting may not prevent or detect all misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

| 33 |

Our management, including our Chief Executive Officer and our Chief Financial Officer, has assessed the effectiveness of our internal control over financial reporting as of December 31, 2016. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Tread way Commission (COSO) in Internal Control—Integrated Framework. Because of the material weaknesses described in the following paragraphs, management believes that, as of December 31, 2016, our internal control over financial reporting was not effective based on those criteria.

A “material weakness” is defined under the SEC rules as a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis by our internal controls. As a result of its review, management concluded that we had material weaknesses in our internal control over financial reporting process consisting of the following:

(i) Lack of in-house US GAAP Expertise. Currently we do not have sufficient in-house expertise in US GAAP reporting. Instead, we rely on the expertise and knowledge of external financial advisors to account for transactions in accordance with US GAAP.

During the years ended December 31, 2015 and 2016, we implemented the following measures to remediate the material weaknesses identified:

During 2015 and 2016, the Company engaged external CPA consultants to provide the Company with improved in-house US GAAP expertise. Despite these measures which were intended to address the identified material weaknesses as well as to enhance our overall internal control environment, management concluded that as of December 31, 2016, the material weaknesses identified above had not been fully remediated.

Management Plan to Remediate Material Weaknesses

We intend to continue in the future using external financial advisors throughout the year to assist on the reporting of complex transactions and the overall review of the quarterly and annual filings.

Changes in Internal Control over Financial Reporting

Other than described above, during the fourth quarter of the fiscal year ended December 31, 2016, there were no other changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

None.

| 34 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers