Attached files

As filed with the Securities and Exchange Commission on April

11, 2017

Registration

No. 333-216052

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

Form S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Adgero Biopharmaceuticals Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

2834

|

47-5506831

|

|

|

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer Identification No.)

|

4365 US 1 South, Suite 211

Princeton, NJ 08540

Telephone: 609-917-9796

(Address, including zip code, and telephone number,

including area code, of principal executive offices)

Frank Pilkiewicz, PhD

Chief Executive Officer

Adgero Biopharmaceuticals Holdings, Inc.

4365 US 1 South, Suite 211

Princeton, NJ 08540

Telephone: 609-917-9796

(Address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Michael J. Lerner, Esq.

Steven M. Skolnick, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

Telephone: (212) 262-6700

Approximate

date of proposed sale to public: As soon as practicable on or after

the effective date of this registration statement.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated

filer,” “accelerated filer,” and smaller

reporting company’ in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

|

|

|

Non-accelerated

filer ☐

|

Smaller

reporting company ☒

|

(Do not

check if a smaller reporting company)

The

Registrant hereby amends this Registration Statement on such date

or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until this Registration Statement shall become

effective on such date as the Securities and Exchange Commission,

acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be

changed. We may not sell these securities until the Securities and

Exchange Commission declares our registration statement effective.

This prospectus is not an offer to sell nor does it seek an offer

to buy these securities in any state where the offer or sale is not

permitted.

|

Preliminary

Prospectus

|

|

Subject

to Completion, dated April 11, 2017.

|

Adgero Biopharmaceuticals Holdings, Inc.

3,467,680 Shares

Common Stock

This

prospectus relates to the offer for sale of up to an aggregate of

3,467,680 shares of common stock of Adgero Biopharmaceuticals

Holdings, Inc. by the selling stockholders named herein. We are not

offering any securities pursuant to this prospectus. The shares of

common stock offered by the selling stockholders include 1,749,272

shares of common stock underlying warrants with an exercise price

of $5.00 per share.

Our

common stock is not presently traded on any market or securities

exchange, and we have not applied for listing or quotation on any

exchange. We are seeking sponsorship for the trading of our common

stock on the Over-the-Counter, or OTC, Bulletin Board and/or OTCQB

Market operated by OTC Markets Group, Inc. (together, the

“OTCBB/OTCQB”) upon the effectiveness of the

registration statement of which this prospectus forms a part. The

3,467,680 shares of our common stock can be sold by selling

security holders at a fixed price of $5.00 per share until our

shares are quoted on the OTCBB/OTCQB and thereafter at prevailing

market prices or privately negotiated prices. There can be no

assurance that a market maker will agree to file the necessary

documents with the Financial Industry Regulatory Authority

(“FINRA”) nor can we provide assurance that our shares

will actually be quoted on the OTCBB/OTCQB or, if quoted, that a

viable public market will materialize or be sustained.

Following the

effectiveness of the registration statement of which this

prospectus forms a part, the sale and distribution of securities

offered hereby may be effected in one or more transactions that may

take place on the OTCBB/OTCQB, including ordinary brokers’

transactions, privately negotiated transactions or through sales to

one or more dealers for resale of such securities as principals, at

market prices prevailing at the time of sale, at prices related to

such prevailing market prices or at negotiated prices. Usual and

customary or specifically negotiated brokerage fees or commissions

may be paid by the selling stockholders. See “Plan of

Distribution.”

Certain

of the selling stockholders and intermediaries, who are identified

as broker-dealers in the footnotes to the selling stockholder table

contained in this prospectus, through whom such securities are sold

are deemed “underwriters” within the meaning of the

Securities Act of 1933, as amended (the “Securities

Act”), with respect to the securities offered hereby, and any

profits realized or commissions received may be deemed underwriting

compensation. We believe that all securities purchased by

broker-dealers or affiliates of broker-dealers were purchased by

such persons and entities in the ordinary course of business and at

the time of purchase, such purchasers did not have any agreements

or understandings, directly or indirectly, with any person to

distribute such securities.

We

are an “emerging growth company” under the federal

securities laws and, as such, we intend to comply with certain

reduced public company reporting requirements. Investing in our

common stock is highly speculative and involves a significant

degree of risk. See “Risk Factors” beginning on page 7

of this prospectus for a discussion of information that should be

considered before making a decision to purchase our common

stock.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

The date of this prospectus

is

, 2017.

TABLE OF CONTENTS

|

PROSPECTUS

SUMMARY

|

1

|

|

|

|

|

THE

OFFERING

|

5

|

|

|

|

|

RISK

FACTORS

|

7

|

|

|

|

|

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

|

37

|

|

|

|

|

USE OF

PROCEEDS

|

39

|

|

|

|

|

DIVIDEND

POLICY

|

40

|

|

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

41

|

|

|

|

|

BUSINESS

|

45

|

|

|

|

|

MANAGEMENT AND

BOARD OF DIRECTORS

|

67

|

|

|

|

|

EXECUTIVE

COMPENSATION

|

73

|

|

|

|

|

PRINCIPAL

STOCKHOLDERS

|

82

|

|

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

84

|

|

|

|

|

DESCRIPTION OF

SECURITIES

|

87

|

|

|

|

|

SELLING

STOCKHOLDERS

|

92

|

|

|

|

|

PLAN

OF DISTRIBUTION

|

99

|

|

|

|

|

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

101

|

|

|

|

|

LEGAL

MATTERS

|

101

|

|

|

|

|

EXPERTS

|

101

|

|

|

|

|

DISCLOSURE OF

COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

|

101

|

|

|

|

|

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

|

102

|

|

|

|

|

SIGNATURES

|

II-9

|

You

should rely only on the information contained in this prospectus.

We have not authorized any other person to provide you with

information different from or in addition to that contained in this

prospectus. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not making an offer

to sell these securities in any jurisdiction where an offer or sale

is not permitted. You should assume that the information appearing

in this prospectus is accurate only as of the date on the front

cover of this prospectus. Our business, financial condition,

results of operations and prospects may have changed since that

date.

Additional

risks and uncertainties not presently known or that are currently

deemed immaterial may also impair our business operations. The

risks and uncertainties described in this document and other risks

and uncertainties which we may face in the future will have a

greater impact on those who purchase our common stock. These

purchasers will purchase our common stock at the market price or at

a privately negotiated price and will run the risk of losing their

entire investments.

For investors outside the United States:

We have not done anything that would permit this offering or

possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United

States. You are required to inform yourselves about and to observe

any restrictions relating to this offering and the distribution of

this prospectus.

In this

prospectus, we rely on and refer to information and statistics

regarding our industry. We obtained this statistical, market and

other industry data and forecasts from publicly available

information.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of

this prospectus. Because it is a summary, it does not contain all

of the information that you should consider in making your

investment decision. Before investing in our common stock,

you should read the entire

prospectus carefully, including our consolidated financial

statements and the related notes included in this prospectus and

the information set forth under the headings “Risk

Factors” on page 7 and “Management’s Discussion

and Analysis of Financial Condition and Results of

Operations” on page 41.

When used herein, unless the context requires otherwise, references

to the “Company,” “Holdings,”

“we,” “our” and “us” refer to

Adgero Biopharmaceuticals Holdings, Inc., a Delaware corporation,

collectively with its wholly-owned subsidiary, Adgero

Biopharmaceuticals, Inc., a Delaware corporation.

All trademarks or trade names referred to in this prospectus are

the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus are referred to

without the ® and ™ symbols, but such references should

not be construed as any indicator that their respective owners will

not assert, to the fullest extent under applicable law, their

rights thereto. We do not intend the use or display of other

companies’ trademarks and trade names to imply a relationship

with, or endorsement or sponsorship of us by, any other

companies.

Our Company

General

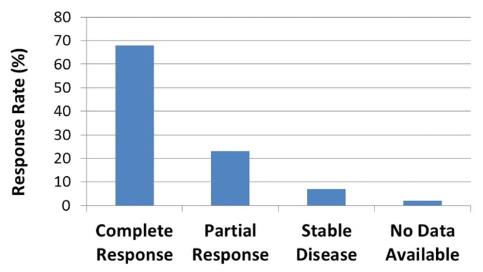

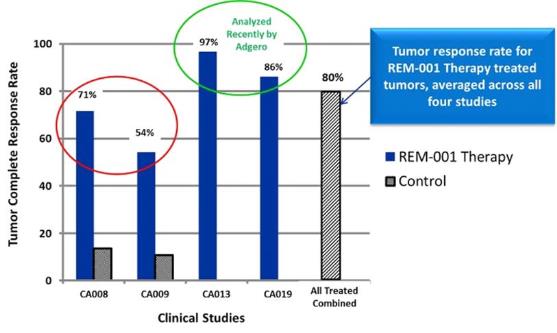

We are

a biopharmaceutical company, focused on the development of

photodynamic therapy (“PDT”) for the treatment of rare,

unmet medical needs. PDT is a treatment that uses light sensitive

compounds, or photosensitizers, that, when exposed to specific

wavelengths of light, act as a catalyst to produce a form of oxygen

that induces local tumor cell death. Our lead product candidate,

the REM-001 Therapy product, consists of three parts, the laser

light source, the light delivery device and the drug REM-001

(collectively, the “REM-001 Therapy”). REM-001 is a

second generation photosensitizer drug that has undergone late

stage clinical development and which we believe possesses multiple

advantages over earlier generation PDT compounds. Our lead

indication is unresectable cutaneous metastatic breast cancer

(“CMBC”), a disease that may strike individuals with

advanced breast cancer and for which effective treatment options

are limited. In four Phase 2 and/or Phase 3 clinical trials in CMBC

patients, primarily targeting patients who had

previously received chemotherapy

and failed radiation therapy, our REM-001 Therapy was able

to reduce or eliminate a substantial number of the treated CMBC

tumors. Specifically, our analysis of the data collected from these

trials indicates that in approximately 80% of evaluable tumor sites

treated with REM-001 Therapy, there was a complete response,

meaning that follow-up clinical assessments indicated no visible

evidence of the tumor remaining. We believe clinical data indicates

that REM-001 Therapy holds promise as a treatment to locally

eliminate or slow the growth of treated cutaneous cancerous tumors

in this difficult-to-treat patient population.

In

2012, we acquired certain assets and regulatory filings, including

REM-001 Therapy developed by Miravant Medical Technologies, and its

wholly-owned subsidiaries, a former public pharmaceutical and

research development company (collectively,

“Miravant”), and the associated technology, clinical

data and intellectual property, from a creditor of Miravant.

Between February 1996 and January 1999, Miravant, with support from

certain corporate partners, conducted the above-referenced four

Phase 2 and/or Phase 3 clinical trials for the treatment of CMBC

using REM-001 Therapy (collectively, the “Miravant CMBC

Trials”). The primary motivation behind our acquisition was

to secure the rights to the REM-001 Therapy and its associated

technology, proprietary processes and regulatory filings which have

already undergone substantial clinical development, which we

believe will help expedite the process of gaining regulatory

approval to market our REM-001 Therapy.

Our

initial product goal is to achieve marketing approval of REM-001

Therapy for the treatment of CMBC in the United States. We

conducted a first preliminary

analysis of all existing REM-001 Therapy clinical trial data for

CMBC, including data from the Miravant CMBC Trials. We then

conducted a more in-depth analysis that was overseen by regulatory experts who

have expertise in interacting with the Food and Drug Administration

(the “FDA”). The experts

we engaged were either former FDA employees with directly related

experience in reviewing similar oncology treatments or individuals

who have provided senior regulatory guidance to major

pharmaceutical or medical device companies in situations that led

to regulatory approval. The results of this second more in-depth

analysis were consistent with our original analysis. As a result of

our review, we submitted questions to FDA under a Type C

format to review the technology and results and determine

the anticipated requirements for regulatory approval. On

March 3, 2017, we received FDA’s written response to our

questions. Based on that response, we believe our plans to

manufacture REM-001 by revising the prior quality standards to meet

the currently recommended regulatory standards will be acceptable.

FDA also indicated our plans for utilizing light delivery devices

that have been shown to be functionally equivalent to the devices

used by Miravant will be acceptable. FDA also recognized that CMBC

represents an unmet clinical need and provided guidance on a number

of clinical pharmacology parameters they would like us to measure

in our planned clinical trial. Based on FDA’s responses, we

plan to conduct a clinical trial in CMBC to test the safety and

efficacy of REM-001 Therapy for marketing approval and we are

planning further discussions with FDA regarding the specifics of

such a trial.

1

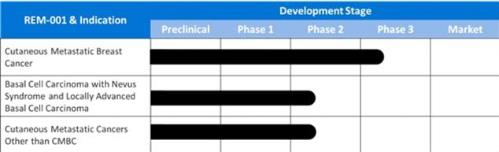

We also

believe REM-001 Therapy holds promise as a treatment for cutaneous

metastatic cancers other than CMBC as well as locally advanced

basal cell cancer such as often occurs in patients with Basal Cell

Nevus Syndrome and cutaneously recurrent basal cell

cancer.

Formation of Holdings

We are

a Delaware corporation. In connection with our formation in October

2015, we sold an aggregate of 1,000,000 shares of common stock for

an aggregate of $50,000 ($0.05 per share), which includes 500,000

shares of common stock owned by an affiliate of Aegis Capital

Corporation (“Aegis Capital”), the placement agent in

our 2016 Private Placement described below.

Recent Developments

The Merger Transaction

On

January 11, 2016, Adgero Biopharmaceuticals, Inc.

(“Adgero”) entered into a merger agreement (the

“Merger Agreement”) by and among Adgero, Adgero

Biopharmaceuticals Holdings, Inc. (“Holdings”), and

Adgero Acquisition, Inc. a Delaware corporation and our

wholly-owned subsidiary (“Merger Sub”). Pursuant to the

terms of the Merger Agreement, as a condition of and

contemporaneously with the initial closing of the 2016 Private

Placement, described below, (the “Initial Closing”),

Merger Sub merged with and into Adgero and Adgero became a

wholly-owned subsidiary of us. In connection with the merger (the

“Merger”), stockholders of Adgero received an aggregate

of 2,000,000 shares of our common stock. In addition, the holders

of warrants to purchase common stock of Adgero prior to the Merger

received warrants (the “Replacement Warrants”), to

purchase 30,864 shares of our common stock with an exercise price

of $5.00. The terms of the Replacement Warrants are substantially

similar to the Investor Warrants, described below. At the closing

of the Merger, the board of directors of Holdings consisted of

Frank Pilkiewicz, PhD, the Chief Executive Officer of Holdings and

Chief Executive officer of Adgero, Allen Bloom, PhD, JD, Roman

Perez-Soler, MD, Tim McInerney, and David Hochman, a Board designee

of Aegis Capital.

The

Merger was treated as a reverse acquisition and recapitalization of

Adgero for financial accounting purposes and the historical

financial statements of Adgero are our financial statements as a

result of the Merger. The parties to the Merger Agreement have

agreed to take all actions necessary to ensure the Merger is

treated as a “plan of reorganization” under Section

368(a) of the Internal Revenue Code of 1986, as

amended.

2016 Private Placement

We

conducted a private placement offering from January to September

2016 (the “2016 Private Placement”). We issued an

aggregate 1,873,299 shares of our common stock for $5.00 per share,

inclusive of 87,099 shares of our common stock issued pursuant to

the conversion of promissory notes in connection with the 2016

Private Placement, and warrants (the “Investor

Warrants”), to purchase 1,873,299 shares of our common stock

at an exercise price of $5.00, inclusive of Investor Warrants to

purchase 87,099 shares of our common stock issued pursuant to the

conversion of promissory notes in connection with the 2016 Private

Placement. The Investor Warrants have a five year term. Gross

proceeds totaled $8,931,000, plus an additional $435,495 in

connection with the conversion of certain promissory notes included

in the 2016 Private Placement, and net proceeds were $7,271,904.

Aegis Capital acted as the placement agent (the “Placement

Agent”), for the 2016 Private Placement. Pursuant to the

registration statement of which this prospectus is a part, we are

registering those shares of common stock and shares of common stock

underlying the Investor Warrants issued in the 2016 Private

Placement as described in the “Selling Stockholders”

section on page 89, as well as (i) 5,154 shares of common stock and

5,154 shares of common stock underlying warrants issued pursuant to

the conversion of a promissory note not included in the 2016

Private Placement (see “Certain Relationships and Related

Party Transactions - Bridge Offering Affiliate

Participation”) and (ii) the shares of common stock

underlying the Replacement Warrants, for public resale by the

selling stockholders named herein and their assigns.

In

connection with the 2016 Private Placement, we paid the Placement

Agent and selected dealers an aggregate cash fee of $1,164,110,

inclusive of a non-accountable expense allowance equal to $275,564,

and we incurred approximately $494,986 of other expenses related to

the financing. In addition, as part of its compensation for acting

as placement agent for the 2016 Private Placement, we issued

warrants (the “Placement Agent Warrants”) to the

Placement Agent to purchase 367,418 shares of our common stock with

an exercise price of $5.00 per share. Such warrants contain a

“cashless exercise” feature and are exercisable at any

time prior to five years from the date of grant.

December 2016 Private Placement

We

conducted a private placement offering in December 2016 (the

“December 2016 Private Placement”), which closed

in January 2017. We issued an aggregate 400,000 shares of

our common stock for $5.00 per share, and a warrant (the

“December 2016 Investor Warrant”), to purchase 400,000

shares of our common stock at an exercise price of $5.00. The

December 2016 Investor Warrant has a five year term. Gross proceeds

totaled $2,000,000, and net proceeds were $1,784,145. Aegis Capital

acted as the placement agent, for the December 2016 Private

Placement.

2

In

connection with the December 2016 Private Placement, we paid the

Placement Agent and selected dealers an aggregate cash fee of

$200,000, and we incurred $15,855 of other expenses related to the

financing. In addition, as part of its compensation for acting as

placement agent for the December 2016 Private Placement, we issued

warrants (the “December 2016 Placement Agent Warrants”)

to the Placement Agent to purchase 80,000 shares of our common

stock with an exercise price of $5.00 per share. Such warrants

contain a “cashless exercise” feature and are

exercisable at any time prior to five years from the date of

grant.

Our Risks

An

investment in our common stock involves a high degree of risk. You

should carefully consider the risks summarized below. These risks

are discussed more fully in the “Risk Factors” section

of this prospectus on page 7 herein. These risks include, but are

not limited to, the following:

|

|

●

|

we have

a limited operating history and have incurred operating losses of

approximately $3,383,000 from inception through

December 31, 2016 and we expect to incur substantial

losses for the foreseeable future and may never achieve or maintain

profitability which could materially limit our ability to raise

additional funds through the issuance of new debt or equity

securities or otherwise;

|

|

|

●

|

we will

need to obtain additional financing to complete clinical

development of REM-001 Therapy;

|

|

|

●

|

clinical

trials for our product candidate, REM-001 Therapy, may not be

successful and we may not obtain approval from the FDA or other

regulatory bodies in different jurisdictions for REM-001

Therapy;

|

|

|

●

|

we are

highly dependent on the success of our product candidate, REM-001

Therapy, which is still in clinical development;

|

|

|

●

|

we

expect to rely on third parties to manufacture the components of

REM-001 Therapy and to conduct our clinical trials;

|

|

|

●

|

we

currently do not have the infrastructure to commercialize REM-001

Therapy should we be successful in obtaining FDA

approval;

|

|

|

●

|

we face

significant competition from other biotechnology and pharmaceutical

companies;

|

|

|

●

|

even if

we obtain marketing approval for REM-001 Therapy, we will be

subject to ongoing obligations and continued regulatory review;

and

|

|

|

●

|

we rely

on our key employees and executives and the loss of the services of

our key employees and executives would adversely impact our

business prospects.

|

Implications of Being an Emerging Growth Company

We are

an “emerging growth company,” as defined in the

Jumpstart Our Business Startups Act of 2012 (the “JOBS

Act”), and, for as long as we continue to be an

“emerging growth company,” we may choose to take

advantage of exemptions from various reporting requirements

applicable to other public companies but not to “emerging

growth companies,” including, but not limited to, not being

required to comply with the auditor attestation requirements of

Section 404 of the Sarbanes-Oxley Act of 2002, as amended, reduced

disclosure obligations regarding executive compensation in our

periodic reports, proxy statements, and exemptions from the

requirements of holding a nonbinding advisory vote on executive

compensation and stockholder approval of any golden parachute

payments not previously approved. We could be an “emerging

growth company” for up to five years, or until the earliest

of (i) the last day of the first fiscal year in which our annual

gross revenues exceed $1 billion, (ii) the date that we become a

“large accelerated filer” as defined in Rule 12b-2

under the Securities Exchange Act of 1934, as amended, which would

occur if the market value of our common stock that is held by

non-affiliates exceeds $700 million as of the last business day of

our most recently completed second fiscal quarter, or (iii) the

date on which we have issued more than $1 billion in

non-convertible debt during the preceding three-year period. We

intend to take advantage of these reporting exemptions described

above until we are no longer an “emerging growth

company.” Under the JOBS Act, “emerging growth

companies” can also delay adopting new or revised accounting

standards until such time as those standards apply to private

companies. We have irrevocably elected not to avail ourselves of

this exemption from new or revised accounting standards and,

therefore, we will be subject to the same new or revised accounting

standards as other public companies that are not “emerging

growth companies.”

3

Corporate Information

We are

a Delaware corporation formed in 2015 under the name Adgero

Biopharmaceuticals Holdings, Inc. We are the parent company of

Adgero Biopharmaceuticals, Inc., our operating subsidiary, a

Delaware corporation.

Our

principal offices are located at 4365 US 1 South, Suite 211,

Princeton, NJ 08540. Our web address is www.adgerobiopharm.com.

Information contained in or accessible through our web site is not,

and should not be deemed to be, part of this

prospectus.

We

currently do not own or license any United States federal trademark

registrations or applications. Some trademarks referred to in this

prospectus are referred to without the ® and ™ symbols,

but such references should not be construed as any indicator that

their respective owners will not assert, to the fullest extent

under applicable law, their rights thereto. We do not intend the

use or display of other companies’ trademarks and trade names

to imply a relationship with, or endorsement or sponsorship of us

by, any other companies.

4

THE OFFERING

|

Common Stock Outstanding

|

5,398,531

shares (1)

|

|

|

|

|

Common Stock Offered by Selling Stockholders

|

3,467,680

shares (2)

|

|

|

|

|

Use of Proceeds

|

We will

not receive any proceeds from the sale of the common stock by the

selling stockholders. We would, however, receive

proceeds upon the exercise of the warrants held by the selling

stockholders which, if such warrants are exercised in full, would

be approximately $8,746,360. Proceeds, if any, received

from the exercise of such warrants will be used for working capital

and general corporate purposes. No assurances can be given that any

of such warrants will be exercised.

|

|

|

|

|

Quotation of Common Stock

|

Our

common stock is not presently traded on any market or securities

exchange, and we have not at this time applied for listing or

quotation on any exchange. We are seeking sponsorship

for the trading of our common stock on the Over-the-Counter, or

OTC, Bulletin Board and/or OTCQB Market operated by OTC Markets

Group, Inc. (together, the “OTCBB/OTCQB”) upon the

effectiveness of the registration statement of which this

prospectus forms a part. The 3,467,680 shares of our

common stock can be sold by selling stockholders at a fixed price

of $5.00 per share until our shares are quoted on the OTCBB/OTCQB

and thereafter at prevailing market prices or privately negotiated

prices. There can be no assurance that a market maker

will agree to file the necessary documents with the Financial

Industry Regulatory Authority (“FINRA”), nor can we

provide any assurance that our shares will actually be quoted on

the OTCBB/OTCQB or, if quoted, that a viable public market will

materialize.

|

|

|

|

|

Risk Factors

|

An

investment in our company is highly speculative and involves a

significant degree of risk. See “Risk

Factors” and other information included in this prospectus

for a discussion of factors you should carefully consider before

deciding to invest in shares of our common stock.

|

|

(1)

|

|

Excludes: (i)

outstanding options to purchase 1,283,937 shares of

our common stock at an exercise price of $5.00 per share; (ii) up

to 1,437,393 shares of our common stock that are available for

issuance under our stock option plan (subject to stockholder

approval of an amendment to adjust the total number of shares

authorized under the 2016 Equity Incentive Plan to

2,756,330); (iii) Investor Warrants exercisable for

1,873,299 shares of common stock at an exercise price of $5.00 per

share issued in our 2016 Private Placement, inclusive of Investor

Warrants exercisable for 87,099 shares of our common stock issued

pursuant to the conversion of promissory notes in connection with

the 2016 Private Placement, (iv) December 2016 Investor Warrant

exercisable for 400,000 shares of common stock at an exercise price

of $5.00 per share issued in our December 2016 Private Placement,

(v) Replacement Warrants exercisable for 30,864 shares of our

common stock at an exercise price of $5.00 per share, (vi) the

Placement Agent Warrants exercisable for 367,418 shares of our

common stock at an exercise price of $5.00 per share, (vii) the

December 2016 Placement Agent Warrants exercisable for 80,000

shares of our common stock at exercise price of $5.00 per share,

(viii) warrants exercisable for 73,998 shares of our common stock

at an exercise price of $5.00 per share issued in connection with

the conversion of senior convertible notes on August 3, 2016, (ix)

warrants exercisable for 5,154 shares of common stock at an

exercise price of $5.00 per share issued in connection with the

conversion of promissory notes on April 8, 2016 not included in the

2016 Private Placement, and (x) 35,000 restricted shares of our

common stock issued under our stock option plan.

|

5

|

(2)

|

|

Includes: (i)

Investor Warrants exercisable for 1,713,254 shares of common stock

at an exercise price of $5.00 per share issued in our 2016 Private

Placement, inclusive of Investor Warrants exercisable for 2,054

shares of common stock issued pursuant to the conversion of a

promissory note in connection with the 2016 Private Placement, (ii)

warrants exercisable for 5,154 shares of common stock at an

exercise price of $5.00 per share issued in connection with the

conversion of a promissory note on April 8, 2016 not included in

the 2016 Private Placement, and (iii) Replacement Warrants

exercisable for 30,864 shares of our common stock at an exercise

price of $5.00 per share. Excludes (i) 160,045 shares of our common

stock issued in our 2016 Private Placement to affiliates of the

Placement Agent and holders of certain convertible promissory notes

in connection with the 2016 Private Placement, for which no

registration rights were granted, and (ii) Investor Warrants

exercisable for 160,045 shares of our common stock at an exercise

price of $5.00 per share issued in our 2016 Private Placement to

affiliates of the Placement Agent and holders of certain

convertible promissory notes in connection with the 2016 Private

Placement, for which no registration rights were

granted.

|

6

RISK FACTORS

An investment in our common stock is speculative and illiquid and

involves a high degree of risk including the risk of a loss of your

entire investment. You should carefully consider the risks and

uncertainties described below and the other information contained

in this prospectus before purchasing shares of our common stock.

The risks set forth below are not the only ones facing us.

Additional risks and uncertainties may exist that could also

adversely affect our business, operations and prospects. If any of

the following risks actually materialize, our business, financial

condition, prospects and/or operations could suffer. In such event,

the value of our common stock could decline, and you could lose all

or a substantial portion of the money that you pay for our common

stock.

Risks Related to Our Financial Position and Need for

Capital

We are a biopharmaceutical company with a limited operating

history.

We

are a biopharmaceutical company with a limited operating history.

Marketing approval of our therapeutic product candidate, the

REM-001 Therapy product, consisting of three parts, the laser light

source, the light delivery device and the drug REM-001

(collectively, the “REM-001 Therapy”), requires

extensive clinical testing data to support the safety and efficacy

requirements needed for regulatory approval. Although we believe

substantial clinical safety and efficacy data exists for our

REM-001 Therapy in cutaneous metastatic breast cancer

(“CMBC”), from the trials completed by Miravant Medical

Technologies, and its wholly-owned subsidiaries, a former public

pharmaceutical and research development company (collectively,

“Miravant”), our recent interaction with

the Food and Drug Administration (the “FDA”) indicated

that further clinical trials by us are needed prior to approval in

this indication. In any other indications we may pursue, we will

need to undertake extensive clinical testing to demonstrate the

safety and efficacy of our REM-001 Therapy or any other product

candidates we develop. In addition, since REM-001 was previously

manufactured and tested in the clinical studies conducted by

Miravant, we intend to use very similar or the same procedures to

manufacture our clinical drug supply and based on our

interaction with FDA we believe that Adgero’s manufacturing

plan is in alignment with the FDA expectations. However, the FDA

may later determine that our proposed approach is not

acceptable and may request more extensive approaches be employed.

Similarly, the other two components of our REM-001 Therapy, namely

the laser and light delivery device, or their equivalents, were

used previously by Miravant in certain clinical studies. We intend

to use the same lasers, or commercially available FDA cleared

lasers that are functionally equivalent to the previously used

devices, in our clinical trials and we intend to manufacture

our light delivery devices using the same design that Miravant

used. Based on our recent interactions with FDA, we believe

this approach should be acceptable, but FDA may later

determine this proposed approach is not acceptable and may request

that more extensive approaches be

employed.

The

likelihood of success of our business plan must be considered in

light of the problems, substantial expenses, difficulties,

complications and delays frequently encountered in connection with

developing and expanding clinical-stage businesses and the

regulatory and competitive environment in which we operate.

Biopharmaceutical product development is a highly speculative

undertaking, involves a substantial degree of risk and is a

capital-intensive business.

Accordingly, you

should consider our prospects in light of the costs, uncertainties,

delays and difficulties frequently encountered by companies in the

clinical stages of development. Potential investors should

carefully consider the risks and uncertainties that a company with

a limited operating history will face. In particular, potential

investors should consider that we cannot assure you that we will be

able to:

|

|

●

|

successfully

implement or execute our current business plan, or that our

business plan is sound;

|

|

|

●

|

receive

FDA approval of clinical trial protocols so that anticipated

additional clinical trials of REM-001 Therapy

commence;

|

|

|

●

|

successfully

complete clinical trials and obtain regulatory approval for the

marketing of REM-001 Therapy;

|

|

|

●

|

successfully

contract for the manufacture of clinical drug product and establish

a commercial drug supply;

|

|

|

●

|

successfully

contract for the manufacture of light delivery devices for clinical

trials;

|

7

|

|

●

|

receive

FDA approval to use our existing lasers (or lasers that are

functionally equivalent) or light delivery devices in

clinical trials or for commercial release

|

|

|

●

|

secure

market exclusivity and/or adequate intellectual property protection

for REM-001 Therapy;

|

|

|

●

|

attract

and retain an experienced management and advisory team;

and

|

|

|

●

|

raise

sufficient funds in the capital markets to effectuate our business

plan including clinical development, regulatory approval and

commercialization for REM-001Therapy.

|

If we

cannot successfully execute any one of the foregoing, our business

may not succeed and your investment will be adversely

affected.

We have incurred operating losses in each year since our inception

and expect to continue to incur substantial losses for the

foreseeable future. We may never become profitable or, if achieved,

be able to sustain profitability.

We

expect to incur substantial expenses without corresponding revenues

unless and until we are able to obtain regulatory approval and

successfully commercialize REM-001 Therapy. To date, we have not

generated any revenue from REM-001 Therapy and we expect to incur

significant expense to complete our clinical program for REM-001

Therapy in the United States and elsewhere. We may never be able to

obtain regulatory approval for the marketing of REM-001 Therapy in

any indication in the United States or internationally. Even if we

are able to commercialize REM-001 Therapy or any other product

candidate, there can be no assurance that we will generate

significant revenues or ever achieve profitability. Our net loss

for the years ended December 31, 2016 and 2015 was

approximately $2,578,000 and $142,000, respectively.

At December 31, 2016, our accumulated deficit since

inception was approximately $3,383,000.

Until

we obtain FDA approval for our REM-001 Therapy, which we do not

expect until 2019 at the earliest, we expect that our

research and development expenses will continue to increase as we

advance our clinical trials for indications for the treatment of

CMBC and potentially other cutaneous metastatic cancers and locally

advanced basal cell carcinomas. We may elect to pursue FDA approval

for REM-001 Therapy in other indications including cutaneous

metastatic cancers other than CMBC as well as locally advanced

basal cell carcinomas such as in patients with Basal Cell Nevus

Syndrome (“BCNS”), which will result in significant

additional research and development expenses. As a result, we

expect to continue to incur substantial losses for the foreseeable

future, and these losses will be increasing. We are uncertain when

or if we will be able to achieve or sustain profitability. If we

achieve profitability in the future, we may not be able to sustain

profitability in subsequent periods. Failure to become and remain

profitable would impair our ability to sustain operations and

adversely affect the price of our common stock and our ability to

raise capital.

Our cash or cash equivalent will only fund our operations for a

limited time and we will need to raise additional capital to

support our development and commercialization efforts.

We are

currently operating at a loss and expect our operating costs will

increase significantly as we incur costs related to the clinical

trials for REM-001 Therapy. At December 31, 2016, we

had a cash and cash equivalents balance of approximately

$3,165,000 and certificates of deposit of

$2,802,000. We believe that our cash and cash

equivalents and certificates of deposit as of December 31,

2016, and the $2,000,000 of gross proceeds received

subsequent to December 31, 2016 through the December

2016 Private Placement that closed in January 2017,

will be sufficient to fund our operations for at least through the

next twelve months from the date of this

filing.

We do

not currently have any arrangements or credit facilities in place

as a source of funds, and there can be no assurance that we will be

able to raise sufficient additional capital on acceptable terms, or

at all. We may seek additional capital through a combination of

private and public equity offerings, debt financings and strategic

collaborations. Debt financing, if obtained, may involve agreements

that include covenants limiting or restricting our ability to take

specific actions, such as incurring additional debt, and could

increase our expenses and require that our assets secure such

debt.

Moreover, any debt

we incur must be repaid regardless of our operating results. At

December 31, 2016, we had no debt outstanding. All

debt outstanding at December 31, 2015 was exchanged for common

stock and warrants on July 29, 2016 and August 3, 2016. Equity

financing, if obtained, could result in dilution to our then

existing stockholders and/or require such stockholders to waive

certain rights and preferences. If such financing is not available

on satisfactory terms, or is not available at all, we may be

required to delay, scale back or eliminate the development of

business opportunities and our operations and financial condition

may be materially adversely affected. We can provide no assurances

that any additional sources of financing will be available to us on

favorable terms, if at all. In addition, if we are unable to secure

sufficient capital to fund our operations, we might have to enter

into strategic collaborations that could require us to share

commercial rights to REM-001 Therapy with third parties in ways

that we currently do not intend or on terms that may not be

favorable to us. If we choose to pursue additional indications

and/or geographies for REM-001 Therapy or otherwise expand more

rapidly than we presently anticipate we may also need to raise

additional capital sooner than expected.

8

Risks

Related to Product Development, Regulatory Approval, Manufacturing

and Commercialization

Our plan to achieve marketing approval of REM-001 Therapy depends

partly on the accuracy of our preliminary efficacy analysis of

REM-001Therapy CMBC trial data. While we believe the results of our

preliminary efficacy analysis accurately reflect the actual

clinical trial results, a detailed analysis overseen by regulatory

experts may yield different results.

We plan

to utilize existing REM-001 Therapy clinical trial data as

supportive data when seeking marketing approval of REM-001

Therapy for the treatment of CMBC. Between February 1996 and

January 1999, Miravant, with support from certain corporate

partners, conducted four clinical trials for the treatment of CMBC

using REM-001 Therapy. As part of our review of REM-001

Therapy’s data package, we noted that while Miravant’s

investigators had done a safety analysis of all treated patients,

these reports indicated an efficacy analysis was only performed on

two of their four clinical trials. Notably, there had been no

efficacy analysis on the other two trials which constituted

approximately half of the CMBC patients who were treated with

REM-001 Therapy. We originally performed a preliminary efficacy

analysis on the data from all four CMBC trials, including the two

that had not previously been analyzed. We then engaged regulatory experts who were either

former FDA employees with directly related experience in reviewing

similar oncology treatments who are now acting as independent

consultants or individuals who have provided senior regulatory

guidance to major pharmaceutical or medical device companies in

situations that led to regulatory approval. These individuals

guided us in conducting a second more in-depth analysis that

yielded results consistent with our original analysis. Following

that, we compiled a briefing document and submitted questions

to FDA. While we believe the results of our

preliminary efficacy analysis, and

subsequent analysis conducted under the guidance of these experts

which was consistent with our original preliminary analysis,

accurately reflect the actual clinical trial results and that the

age of the underlying data from the clinical studies is not

material, a more in-depth review may yield different conclusions.

Such differing results may negatively impact our ability to pursue

or achieve, or result in delays to obtain, marketing approval of

REM-001 Therapy. There can be no certainty that results from our

analyses done to date or results from future analyses that we may

undertake will be sufficiently complete to satisfy FDA requests or

that any results will be favorable to us.

Our REM-001 Therapy clinical trial data may not be deemed

acceptable by the FDA to support our new drug

applications.

In

seeking regulatory approval for REM-001, we intend to rely at

least in part upon data gathered by Miravant Medical

Technologies in its initial Phase 1 studies and in four later Phase

2/3 clinical studies that were conducted approximately 20 years

ago. Based on our initial interactions with the FDA, we

believe the agency will accept these results as supportive data but

we cannot ultimately be certain that the FDA will accept

data that old to support our new drug applications. Also

based on our initial interactions with the FDA, we believe our

plans for manufacturing investigational test materials will lead to

investigational test materials that FDA will recognize as being

sufficiently comparable to Miravant’s materials and also

suitable for further investigational trials but FDA may

later raise questions about the similarity of

Miravant’s investigational testing material versus our

manufactured investigational testing material, or may

raise questions about the processes and methods under which this

old data was collected or may raise additional concerns regarding

the elapsed time period. If the FDA does not accept this

data, we will have to incur significant costs which may require

additional capital to redo some or all of the Miravant studies or

supplement these studies with additional studies.

We depend entirely on the success of REM-001 Therapy, which has not

received FDA approval for the treatment of CMBC, our lead

indication. If we are unable to obtain regulatory approval for and

generate revenues from REM-001 Therapy, our ability to create

stockholder value will be limited.

We do

not generate revenues from any FDA approved drug products. Our only

product candidate is REM-001 Therapy, which we believe has

previously demonstrated safety and efficacy results in patients

suffering from CMBC in four late stage (Phase 2/3) clinical trials

completed by Miravant. However, we are not currently actively

engaged in clinical trials for this or any other product candidate.

Moreover, there can be no assurance that any positive clinical

results obtained for REM-001 Therapy in prior clinical studies will

be repeated in future clinical studies, or that such results will

be sufficient to obtain regulatory approval. If we do not obtain

regulatory approval, or the approval process for REM-001 Therapy

takes longer than we anticipate, our expenses and need for

additional capital will increase. Most drug candidates that reach

clinical development have only a small chance of successfully

completing clinical development and gaining regulatory approval.

Therefore, our business currently depends entirely on the

successful development, regulatory approval and commercialization

of REM-001 Therapy, which may never occur.

If we are not able to obtain any required regulatory approvals for

REM-001 Therapy, we will not be able to commercialize our only

product candidate, REM-001 Therapy, and we will not be able to

generate revenue.

We will

need to successfully complete additional clinical trials for

REM-001 Therapy before we can apply for its marketing approval,

including conducting a pivotal Phase 3 clinical trial (or

equivalent) in CMBC patients with the goal of submitting a

New Drug Application (“NDA”) for REM-001 Therapy.

However, we may never commence this trial, and if we do, there can

be no assurance that the trial will be successful. Even if this

clinical trial is successful, we may be required to conduct

additional clinical trials to establish REM-001 Therapy’s

safety and efficacy before the NDA for REM-001 Therapy in CMBC can

be approved, if at all.

9

Clinical trials are

expensive, difficult to design and implement, can take many years

to complete and are uncertain as to outcome. Success in early

phases of pre-clinical and clinical trials does not ensure that

later clinical trials will be successful and interim results of a

clinical trial do not necessarily predict final results. A failure

of one or more of our clinical trials can occur at any stage of

testing. We may experience numerous unforeseen events during, or as

a result of, the clinical trial process that could delay or prevent

our ability to receive regulatory approval for or commercialize

REM-001 Therapy. The research, testing, manufacturing, labeling,

packaging, storage, approval, sale, marketing, advertising and

promotion, pricing, export, import and distribution of drug

products are subject to extensive regulation by the FDA and other

regulatory authorities in the United States and other countries,

which regulations differ from country to country. We are not

permitted to market REM-001 Therapy, including the REM-001 drug and

associated device components, as a prescription pharmaceutical

product in the United States until we receive approval of an NDA

from the FDA, or in any foreign countries until we receive the

requisite approval from such countries. In the United States, the

FDA generally requires the completion of clinical trials of each

drug to establish its safety and efficacy and extensive

pharmaceutical development to ensure its quality before an NDA is

approved. Regulatory authorities in other jurisdictions impose

similar requirements. Of the large number of drugs in development,

only a small percentage result in the submission of an NDA to the

FDA and even fewer are eventually approved for commercialization.

We have not submitted an NDA to the FDA or comparable applications

to other regulatory authorities. If our development efforts for

REM-001 Therapy, including regulatory approval, are not successful

for its planned indications, or if adequate demand for REM-001

Therapy is not generated, our business will be materially adversely

affected.

Our

success depends on the receipt of regulatory approval and the

issuance of such regulatory approvals is uncertain and subject to a

number of risks, including the following:

|

|

●

|

the FDA

or comparable foreign regulatory authorities or institutional

review boards (“IRBs”), may disagree with the design or

implementation of our clinical trials;

|

|

|

●

|

we may

not be able to provide acceptable evidence of our product

candidate’s safety and efficacy;

|

|

|

●

|

the

results of our clinical trials may not be satisfactory or may not

meet the level of statistical or clinical significance required by

the FDA, European Medicines Agency (“EMA”), or other

regulatory agencies for marketing approval;

|

|

|

●

|

the

dosing of REM-001 Therapy in a particular clinical trial may not be

at an optimal level;

|

|

|

●

|

patients

in our clinical trials may suffer adverse effects for reasons that

may or may not be related to REM-001 Therapy;

|

|

|

●

|

the

data collected from clinical trials may not be sufficient to

support the submission of an NDA or other submission or to obtain

regulatory approval in the United States or elsewhere;

|

|

|

●

|

the FDA

or comparable foreign regulatory authorities may fail to approve

the manufacturing processes or facilities of third-party

manufacturers with which we contract for clinical and commercial

supplies; and

|

|

|

●

|

the

approval policies or regulations of the FDA or comparable foreign

regulatory authorities may significantly change in a manner

rendering our clinical data insufficient for approval.

|

Failure

to obtain regulatory approval for REM-001 Therapy for the foregoing

or any other reasons will prevent us from commercializing this

product candidate as a prescription product and generating revenue.

We cannot guarantee that regulators will agree with our assessment

of the results of the clinical trials conducted by Miravant or that

we may conduct in the future or that such trials will be

successful. The FDA, EMA and other regulators have substantial

discretion in the approval process and may refuse to accept any

application or may decide that our data is insufficient for

approval and require additional clinical trials or other studies.

In addition, varying interpretations of the data obtained from

clinical testing could delay, limit or prevent regulatory approval

of our product candidate.

10

We are

a clinical-stage company and we have not submitted an NDA or

received regulatory approval to market REM-001 Therapy in any

jurisdiction. We have only limited experience in filing the

applications necessary to gain regulatory approvals and expect to

rely on consultants and clinical CROs with expertise in this area

to assist us in this process. Securing FDA approval requires the

submission of pre-clinical, clinical, and/or pharmacokinetic data,

information about product manufacturing processes and inspection of

facilities and supporting information to the FDA for each

therapeutic indication to establish a product candidate’s

safety and efficacy for each indication. REM-001 Therapy may prove

to have undesirable or unintended side effects, toxicities or other

characteristics that may preclude our obtaining regulatory approval

or prevent or limit commercial use with respect to one or all

intended indications.

The

process of obtaining regulatory approvals is expensive, often takes

many years, if approval is obtained at all, and can vary

substantially based upon, among other things, the type, complexity

and novelty of the product candidates involved, the jurisdiction in

which regulatory approval is sought and the substantial discretion

of the regulatory authorities. Changes in the regulatory approval

policy during the development period, changes in or the enactment

of additional statutes or regulations, or changes in regulatory

review for a submitted product application may cause delays in the

approval or rejection of an application. Regulatory approval

obtained in one jurisdiction does not necessarily mean that a

product candidate will receive regulatory approval in all

jurisdictions in which we may seek approval, but the failure to

obtain approval in one jurisdiction may negatively impact our

ability to seek approval in a different jurisdiction. Failure to

obtain regulatory marketing approval for REM-001 Therapy in any

indication will prevent us from commercializing the product

candidate, and generating revenue.

We do not have a clinical supply of REM-001. Moreover, we do not

have our own manufacturing facilities nor have we identified a

third-party to manufacture the product for us. If we are unable to

identify a third-party manufacturer, or if this third-party

manufacturer fails to meet applicable regulatory requirements or to

supply us for any reason, we will be unable to complete clinical

trials for REM-001 Therapy and our business will be materially

impaired.

We do

not have a clinical supply of REM-001. We will need to

engage a third party manufacturer to produce the product for us. If

and when approved, we intend to have a third-party manufacture

commercial supplies of the product as well. We have not yet

identified a third-party manufacturer and our failure to timely do

so will delay the commencement of our clinical trials and the

submission of our NDA for REM-001 Therapy.

We do not have a clinical supply of light delivery devices for use

with REM-001 Therapy. Moreover, we do not have our own

manufacturing facilities nor have we identified a third-party to

manufacture these devices for us. If we are unable to identify a

third-party manufacturer, or if this third-party manufacturer fails

to meet applicable regulatory requirements or to supply us for any

reason, we will be unable to complete clinical trials for REM-001

Therapy and our business will be materially impaired.

We do

not have a clinical supply of REM-001 Therapy light delivery

devices. We will need to engage a third party

manufacturer to produce these devices for us. If and when approved,

we intend to have a third-party manufacture commercial supplies of

these devices as well. We have not yet identified a third-party

manufacturer and our failure to timely do so will delay the

commencement of our clinical trials and the submission of our NDA

for REM-001 Therapy.

We are planning to use our existing laser light devices, some of

which were used in certain of Miravant’s clinical trials,

or laser light devices that are functionally equivalent to

the Miravant devices, in our clinical trials. We have not

confirmed that these laser designs are still acceptable for use by

the FDA or other local regulatory bodies. If we are unable to use

these lasers we may need to arrange for the manufacture of new

lasers or significantly modify our existing laser units. We do not

have our own manufacturing facilities for conducting these

activities nor have we identified a third-party to manufacture or

modify these devices for us. If we need to perform either of these

steps and are unable to identify a third-party manufacturer, or if

this third-party manufacturer fails to meet applicable regulatory

requirements or to supply us for any reason, we will be unable to

complete clinical trials for REM-001 Therapy and our business will

be materially impaired.

11

Our

plan relies on our using our existing laser supply, some of which

are the same units used by Miravant in certain of their clinical

trials or laser light devices that are functionally

equivalent to the Miravant devices. We will need to engage a

third party manufacturer to modify these devices or to produce new

laser devices for us. We have not yet identified such a third-party

and our failure to timely do so will delay the commencement of our

clinical trials and the submission of our NDA for REM-001

Therapy.

REM-001 Therapy is our only product candidate. If we fail to

successfully commercialize REM-001 Therapy, we may need to acquire

additional product candidates or our business will be materially

adversely affected.

We have

never commercialized any product candidates and do not have any

other compounds in pre-clinical testing, lead optimization or lead

identification stages beyond REM-001 Therapy. We cannot be certain

that REM-001 Therapy will prove to be sufficiently effective and

safe to meet applicable regulatory standards for any indication. If

we fail to successfully commercialize REM-001 Therapy as a

treatment for CMBC or any other indication, whether as a

stand-alone therapy or in combination with other treatments, our

business would be materially adversely affected.

Even if we receive regulatory approval for REM-001 Therapy, we

still may not be able to successfully commercialize it and the

revenue that we generate from its sales, if any, may be

limited.

If

approved for marketing, the commercial success of REM-001 Therapy

will depend upon its acceptance by the medical community, including

physicians, patients and health care payors. The degree of market

acceptance of REM-001 Therapy will depend on a number of factors,

including:

|

|

●

|

demonstration

of clinical safety and efficacy;

|

|

|

●

|

relative

convenience, burden and ease of administration;

|

|

|

●

|

the

prevalence and severity of any adverse effects;

|

|

|

●

|

the

willingness of physicians to prescribe REM-001 Therapy and of the

target patient population to try new therapies;

|

|

|

●

|

efficacy

of REM-001 Therapy compared to competing products;

|

|

|

●

|

the

introduction of any new products that may in the future become

available to treat indications for which REM-001 Therapy may be

approved;

|

|

|

●

|

new

procedures or methods of treatment that may reduce the incidences

of any of the indications in which REM-001 Therapy may show

utility;

|

|

|

●

|

pricing

and cost-effectiveness;

|

|

|

●

|

the

inclusion or omission of REM-001 Therapy in applicable treatment

guidelines;

|

|

|

●

|

the

effectiveness of our or any future collaborators’ sales and

marketing strategies;

|

|

|

●

|

limitations

or warnings contained in FDA-approved labeling;

|

12

|

|

●

|

our

ability to obtain and maintain sufficient third-party coverage or

reimbursement from government health care programs, including

Medicare and Medicaid, private health insurers and other

third-party payors; and

|

|

|

●

|

the

willingness of patients to pay out-of-pocket in the absence of

third-party coverage or reimbursement.

|

If

REM-001 Therapy is approved, but does not achieve an adequate level

of acceptance by physicians, health care payors and patients, we

may not generate sufficient revenue and we may not be able to

achieve or sustain profitability. Our efforts to educate the

medical community and third-party payors on the benefits of REM-001

Therapy may require significant resources and may never be

successful.

In

addition, even if we obtain regulatory approvals, the timing or

scope of any approvals may prohibit or reduce our ability to

commercialize REM-001 Therapy successfully. For example, if the

approval process takes too long, we may miss market opportunities

and give other companies the ability to develop competing products

or establish market dominance. Any regulatory approval we

ultimately obtain may be limited or subject to restrictions or

post-approval commitments that render REM-001 Therapy not

commercially viable. For example, regulatory authorities may

approve REM-001 Therapy for fewer or more limited indications than

we request, may grant approval contingent on the performance of

costly post-marketing clinical trials, or may approve REM-001

Therapy with a label that does not include the labeling claims

necessary or desirable for the successful commercialization of that

indication. Further, the FDA or comparable foreign regulatory

authorities may place conditions on approvals such as risk

management plans and the requirement for a Risk Evaluation and

Mitigation Strategy (“REMS”) to assure the safe use of

the drug. If the FDA concludes a REMS is needed, the sponsor of the

NDA must submit a proposed REMS; the FDA will not approve the NDA

without an approved REMS, if required. A REMS could include

medication guidelines, physician communication plans, or elements

to assure safe use, such as restricted distribution methods,

patient registries and other risk minimization tools. The FDA may

also require a REMS for an approved product when new safety

information emerges. Any of these limitations on approval or

marketing could restrict the commercial promotion, distribution,

prescription or dispensing of REM-001. Moreover, product approvals

may be withdrawn for non-compliance with regulatory standards or if

problems occur following the initial marketing of the product. Any

of the foregoing scenarios could materially harm the commercial

success of REM-001 Therapy.

To obtain regulatory approval to market REM-001 Therapy in

indications other than CMBC, costly and lengthy clinical trials

will be required, and the results of the studies and trials are

highly uncertain.

As part

of the regulatory approval process, we must conduct, at our own

expense, clinical trials on humans for each indication that we

intend to pursue. We expect the number of nonclinical studies and

clinical trials that the regulatory authorities will require will

vary depending on the disease or condition the drug is being

developed to address and regulations applicable to the particular

drug. Generally, the number and size of clinical trials required

for approval varies based on the nature of the disease and size of

the expected patient population that may be treated with a drug. We

must demonstrate that our drug products are safe and efficacious

for use in the targeted human patients in order to receive

regulatory approval for commercial sale, and regulatory approval

for one indication does not guaranty regulatory approval of the

same drug for another indication. If we do not obtain regulatory

approval for any indication for which it is sought, our business

may be materially adversely impacted.

Even if we obtain marketing approval for REM-001 Therapy, we will

be subject to ongoing obligations and continued regulatory review,

which will result in significant additional expense. Additionally,

REM-001 Therapy could be subject to labeling and other restrictions

and withdrawal from the market and we may be subject to penalties

if we fail to comply with regulatory requirements or if we

experience unanticipated problems with REM-001

Therapy.

Even if

we obtain United States regulatory approval of REM-001 Therapy for

an indication, the FDA may still impose significant restrictions on

its indicated uses or marketing or the conditions of approval, or

impose ongoing requirements for potentially costly and

time-consuming post-approval studies, including Phase 4

clinical trials, and post-market surveillance to monitor safety and

efficacy. REM-001 Therapy will also be subject to ongoing

regulatory requirements governing the manufacturing, labeling,

packaging, storage, distribution, safety surveillance, advertising,

promotion, recordkeeping and reporting of adverse events and other

post-market information. These requirements include registration

with the FDA, as well as continued compliance with current Good

Clinical Practices regulations (“cGCPs”) for any

clinical trials that we conduct post-approval. In addition,

manufacturers of drug products and their facilities are subject to

continual review and periodic inspections by the FDA and other

regulatory authorities for compliance with current Good

Manufacturing Practices (“cGMP”), requirements relating

to quality control, quality assurance and corresponding maintenance

of records and documents.

13

The FDA

has the authority to require a REMS as part of an NDA or after

approval, which may impose further requirements or restrictions on

the distribution or use of an approved drug, such as limiting

prescribing to certain physicians or medical centers that have

undergone specialized training, limiting treatment to patients who

meet certain safe-use criteria or requiring patient testing,

monitoring and/or enrollment in a registry.

With

respect to sales and marketing activities by us or any future

partner, advertising and promotional materials must comply with FDA

rules in addition to other applicable federal, state and local laws

in the United States and similar legal requirements in other

countries. In the United States, the distribution of product

samples to physicians must comply with the requirements of the U.S.

Prescription Drug Marketing Act. Application holders must obtain

FDA approval for product and manufacturing changes, depending on

the nature of the change. We may also be subject, directly or

indirectly through our customers and partners, to various fraud and

abuse laws, including, without limitation, the U.S. Anti-Kickback

Statute, U.S. False Claims Act, and similar state laws, which

impact, among other things, our proposed sales, marketing, and

scientific/educational grant programs. If we participate in the

U.S. Medicaid Drug Rebate Program, the Federal Supply Schedule of

the U.S. Department of Veterans Affairs, or other government drug

programs, we will be subject to complex laws and regulations

regarding reporting and payment obligations. All of these

activities are also potentially subject to U.S. federal and state

consumer protection and unfair competition laws. Similar

requirements exist in many of these areas in other

countries.

In

addition, if REM-001 Therapy is approved for an indication, our

product labeling, advertising and promotion would be subject to

regulatory requirements and continuing regulatory review. The FDA

strictly regulates the promotional claims that may be made about

prescription products. In particular, a product may not be promoted