Attached files

| file | filename |

|---|---|

| EX-99.1 - COURTESY PDF OF 2016 SUMMARY ANNUAL REPORT - BERKSHIRE HILLS BANCORP INC | t1701098_ex99-1.pdf |

| 8-K - FORM 8-K - BERKSHIRE HILLS BANCORP INC | t1701098_8k.htm |

Exhibit 99.1

2016 Summary Annual Report

Culture As America's Most Exciting Bank®, we are passionate about practicing and living by the RIGHT values (Respect, Integrity, Guts, Having Fun, and Teamwork). Footprint We offer services across New England and New York state — reaching customers from Boston to Syracuse and multiple regions in between — and in Central New Jersey and Eastern Pennsylvania. Vision By bringing together a strong employee base, a dedicated strategy and operational efficiency, we can offer our customers the products and services they need, our employees an inspirational place to work, our communities the support they are looking for, and our shareholders the returns they deserve. THE POWER OF INVESTMENT DEAR SHAREHOLDERS, CUSTOMERS, AND EMPLOYEES: 2016 was another successful year for Berkshire. We reported record financial results and grew our franchise through additional products, services, and markets. We also made significant investments, strengthening our infrastructure and teams. Berkshire is a stronger and more valuable company as a result, and is delivering results for all of our constituencies — employees, customers, communities, and shareholders. The company’s financial performance also underscores the significance of Berkshire’s compelling value proposition: as a $9 billion financial institution, we strive to combine the products and services of larger banks with the local engagement and service of a community bank. Our success depends on continued commitment to our company culture and brand. Those intangible assets differentiate us from our competitors, fueling a unique customer experience and approach to banking. Record Financial Results We had a record year for revenue and earnings in 2016, and it was one of our best years for improving profits and expanding our business. We now serve more customers in more markets, with more products than ever before, and we are now operating multiple business lines in regional and national markets. Our focus continues to be on producing positive operating leverage through smart investments in our business and enthusiastic and efficient delivery of value to our customers. This approach produced an 18% improvement in net earnings and a 9% improvement in return on assets. Our team operates with an owner’s mentality, finding ways to work smarter and to redeploy operating costs into revenue generators. Loans grew 14% and deposits grew 18% for the year, as we capitalized on both good organic momentum and select acquisitions. Fee income rose 19%, improving our fee income-to-revenue ratio to 26% at year-end and further diversifying our income streams. Reaching More Markets Our business acquisition model added to our success in 2016, starting with the synergies realized from the Hampden Bancorp and Firestone Financial acquisitions 2016 Financial Highlights (Percent increase) 11% 18% 9% 23% Revenue Earnings Return on Assets Shareholders’ Equity 1 2016 Summary Annual Report

Rochester Syracuse Rome Utica NY Albany Manchester VT NH Pittsfield MA Springfield Burlington Boston Hartford CT RI Princeton Mercerville PA Philadelphia NJ in the prior year. In 2016, we completed the acquisition of the Philadelphia-area SBA lending team at 44 Business Capital. This was followed by an agreement to acquire First Choice Bank, headquartered near Princeton, New Jersey. With urgency and focus, we completed this acquisition in December and finished the year with all of these new businesses contributing to our 2017 outlook. Below are some highlights of what these new partnerships are bringing to our business model: Mid-Atlantic: 44 Business Capital added a seasoned business lending team and First Choice Bank added eight branches in the Princeton, NJ and Philadelphia, PA markets. As delineated in the adjacent map, our footprint for traditional banking has now expanded beyond our New England/New York roots into strong and growing, contiguous markets. Boston: We opened our first Boston branch on Congress Street in the financial district in February 2017. Complete with virtual teller technology and full service MyBankers, the innovative branch complements the lending and wealth management teams we’ve put in place over the last few years. We’re proud to be bringing our brand of revolutionary banking into this dynamic market. Specialized Lending: We formed a new Specialized Lending group to capitalize on our many recent commercial lending initiatives. Berkshire is now a Top 40 nationally ranked SBA lender – holding top spots for loan volume in many of our traditional markets, along with a significant share in Philadelphia. This momentum is fueling synergies with the Firestone Financial commercial equipment financing business and our growing Asset Based Lending group. Operating as partners, these business lines make us strongly competitive in financing business expansion in our regional and targeted national markets. Fee Income Businesses: In addition to the fee contributions from our SBA business, First Choice Loan Services operates a best-of-breed, national mortgage-banking platform that ranks among the top 50 U.S. bank residential mortgage lenders. This Select Financial Information Balance Sheet FY16 FY15 ($ millions - period end) Total Assets $9,163 $7,831 Total Securities 1,628 1,371 Total Loans 6,550 5,725 Goodwill and Intangibles 423 335 Deposits 6,622 5,589 Borrowings 1,314 1,263 Shareholders’ Equity 1,093 887 Operating Results ($ millions) FY16 FY15 Net Interest $232 $214 Non-Interest Income 66 54 Total Net Revenue 298 268 Provision for Loan Losses 17 17 Non-Interest Expense 203 197 Net Income 59 50 Per Share Data ($) FY16 FY15 Earnings, Diluted $1.88 $1.73 Earnings, Adjusted* 2.20 2.09 Dividends 0.80 0.76 Book Value 30.65 28.64 Tangible Book Value 18.81 17.84 * Note: Adjusted earnings per share is a non-GAAP financial measure; see Form 10-K for discussion and further detail. Berkshire Hills Bancorp, Inc.—BHLB // berkshirebank.com 2

disciplined business model allows us to add new customer relationships and fee income without tying up capital and liquidity. In the last quarter of 2016, we also acquired a seasoned financial advisory team in Rutland, Vermont, which complements our growing wealth business and adds another opportunity for relationship acquisition and fee income. Fee revenue will soon exceed our objective of 30% of total revenue and further bolster profitability. Investing in Our Future Berkshire is now near the $10 billion threshold of total assets — an important regulatory benchmark under the Dodd-Frank Wall Street Reform and Consumer Protection Act. Crossing this threshold requires significant investment in systems and controls. Our team has been preparing for this threshold for several years and we’ve absorbed these costs while still improving our overall efficiency. We have amply demonstrated the capacity to expand our business while maintaining the levels of financial, risk, and compliance controls appropriate for larger operations. We’ve also invested in our future with careful adherence to credit and interest rate risk disciplines. Our strong asset quality and positioning for higher rates are targeted to protect future results if market conditions change. Some market share and profitability have been sacrificed by maintaining these disciplines, but our strong and diversified platform allows us to maintain growth through this careful business selection. Engaging in Our Markets Our “owner’s approach” to running our business extends to a constant and passionate focus on our markets. We’ve been active in innovating our retail distribution strategy to stay ahead of market changes and industry dynamics. We’re investing in preeminent new locations with smart retail positioning while consolidating current offices and maintaining growth in existing markets. In 2016, we sold two offices; in early 2017, we consolidated three more. In addition to our new flagship location in Boston, we’re developing two new branches in the Hartford area. We’re also rolling out virtual teller technology in new and select existing locations, which frees up our customer teams to focus on relationship building and the delivery of more complex products and services at point of sale. We are the proud community sponsor of the Boston Seasons program at Boston City Hall Plaza. Berkshire Bank opened its flagship Boston branch on Congress Street adjacent to Post Office Square. 3 2016 Summary Annual Report

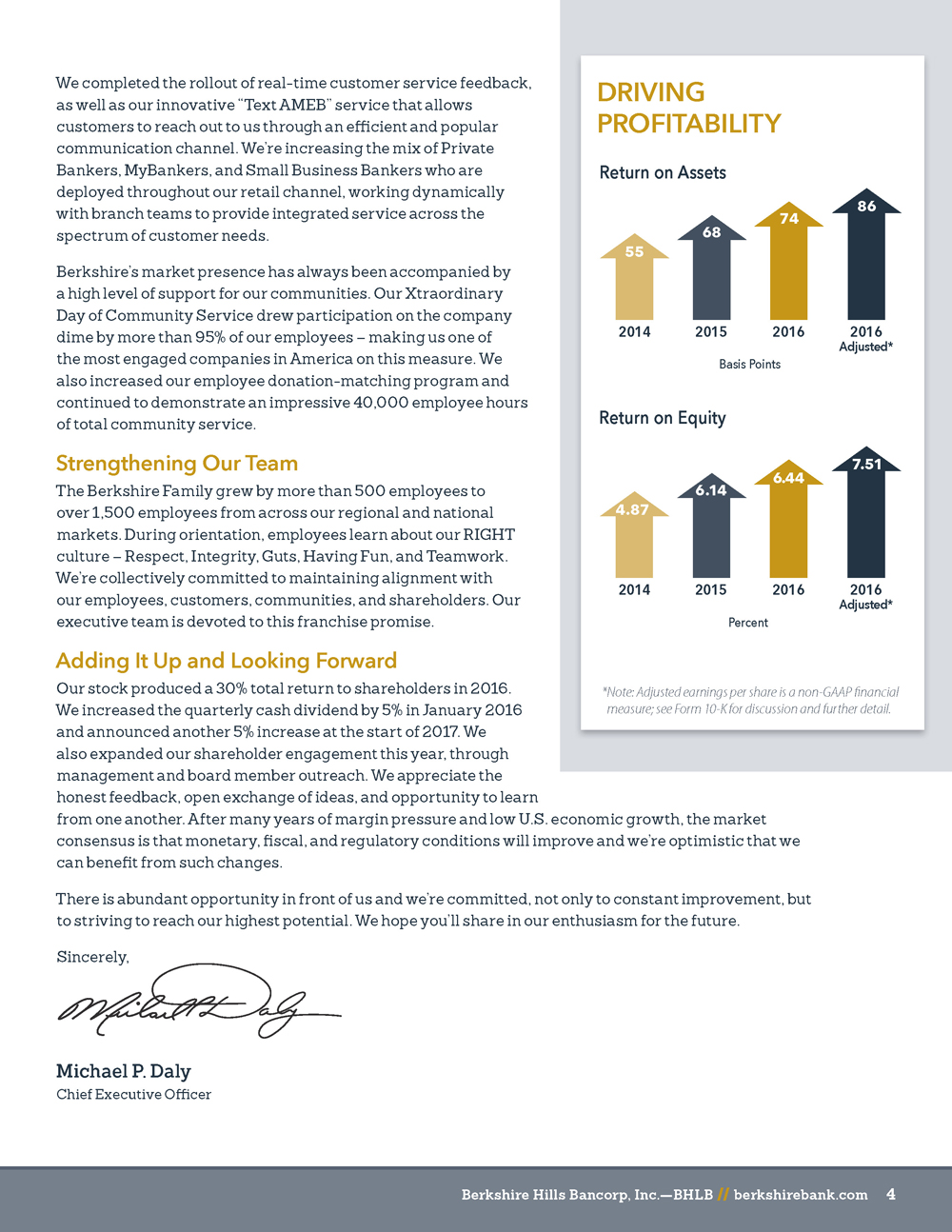

We completed the rollout of real-time customer service feedback, as well as our innovative “Text AMEB” service that allows customers to reach out to us through an efficient and popular communication channel. We’re increasing the mix of Private Bankers, MyBankers, and Small Business Bankers who are deployed throughout our retail channel, working dynamically with branch teams to provide integrated service across the spectrum of customer needs. Berkshire’s market presence has always been accompanied by a high level of support for our communities. Our Xtraordinary Day of Community Service drew participation on the company dime by more than 95% of our employees – making us one of the most engaged companies in America on this measure. We also increased our employee donation-matching program and continued to demonstrate an impressive 40,000 employee hours of total community service. Strengthening Our Team The Berkshire Family grew by more than 500 employees to over 1,500 employees from across our regional and national markets. During orientation, employees learn about our RIGHT culture – Respect, Integrity, Guts, Having Fun, and Teamwork. We’re collectively committed to maintaining alignment with our employees, customers, communities, and shareholders. Our executive team is devoted to this franchise promise. Adding It Up and Looking Forward Our stock produced a 30% total return to shareholders in 2016. We increased the quarterly cash dividend by 5% in January 2016 and announced another 5% increase at the start of 2017. We also expanded our shareholder engagement this year, through management and board member outreach. We appreciate the honest feedback, open exchange of ideas, and opportunity to learn from one another. After many years of margin pressure and low U.S. economic growth, the market consensus is that monetary, fiscal, and regulatory conditions will improve and we’re optimistic that we can benefit from such changes. There is abundant opportunity in front of us and we’re committed, not only to constant improvement, but to striving to reach our highest potential. We hope you’ll share in our enthusiasm for the future. Sincerely, Michael P. Daly Chief Executive Officer DRIVING PROFITABILITY Return on Assets 55 68 74 86 2014 2015 2016 2016 Adjusted* Basis Points Return on Equity 4.87 6.14 6.44 7.51 2014 2015 2016 2016 Adjusted* Percent * Note: Adjusted earnings per share is a non-GAAP financial measure; see Form 10-K for discussion and further detail. Berkshire Hills Bancorp, Inc.—BHLB // berkshirebank.com 4

CORPORATE PROFILE $9.2 Billion in Assets 97 Branch Locations Retail banking, commercial banking, insurance, and wealth management Branches located across New England, New York, New Jersey and Pennsylvania Wealth assets under management of $1.4 billion INVESTMENT CONSIDERATIONS Strong earnings momentum and improving profitability Diversified revenue drivers and controlled expenses Well-positioned footprint in attractive markets AMEB culture – results driven Acquisition discipline – a strength in a consolidating market Focused on profitability goals and building shareholder value STOCK INFORMATION as of 12/31/16 Ticker NYSE: BHLB Stock Price $36.85 Market Cap $1.3 billion P/E (FY16) 19.6x Price/Book 1.20x Price/Tangible Book 1.96x 52 Week Range $24.71–$37.35 Annualized Dividend (1Q17) $0.84 Dividend Yield 2.3% Shares Outstanding 35.7 million Average Daily Volume (FY16) 120,000 shares A Culture of Responsibility On June 7, 2016 we closed our doors to allow our employees to volunteer in our communities 95% employee volunteer rate 56 projects completed 4,500+ hours of service 228,000 lbs of paper recycled 32% of paper products used were from recycled sources 21% increase in eStatement usage 100% employee involvement in corporate volunteer program 40,000 hours (value of more than $1 million) Nearly $2 million annually in grants to aid 524 organizations Military and Veterans' Services Berkshire Bank is committed to making banking easier for our servicemen and servicewomen by providing discounts, money management tools and lending offers to save money. SBA Lender1 Berkshire County & Pioneer Valley MA Capital District & Central NY Connecticut & Vermont SBA Lender Nationwide2 1 As of SBA year-end 9/30/16. 2 Approved loan volume for SBA fiscal YTD through 2/28/17 5 2016 Summary Annual Report

LEADERSHIP TEAM Berkshire Bank Executive Team BACK: Gary F. Urkevich, Allison P. O’Rourke, George F. Bacigalupo, Tami M. Gunsch, Linda A. Johnston, Sean A. Gray, Michael P. Daly, Richard M. Marotta, James M. Moses, Gregory D. Lindenmuth, Allan J. Costello FRONT: Scott J. Houghtaling, Mark N. Foster, Deborah A. Stephenson, Michael D. Carroll Berkshire Bank Executive Team Michael P. Daly Chief Executive Officer Richard M. Marotta President Sean A. Gray Chief Operating Officer James M. Moses SEVP, Chief Financial Officer George F. Bacigalupo SEVP, Commercial Banking Linda A. Johnston SEVP, Human Resources Michael D. Carroll EVP, Specialty Lending Allan J. Costello EVP, Home Lending Mark N. Foster EVP, Regional Commercial Leader - Eastern Massachusetts and ABL Tami M. Gunsch EVP, Retail Banking Scott J. Houghtaling EVP, Regional Commercial Leader - New York Gregory D. Lindenmuth EVP, Chief Risk Officer Allison P. O’Rourke EVP, Finance Deborah A. Stephenson EVP, Compliance and Regulatory Gary F. Urkevich EVP, IT and Project Management Board of Directors William J. Ryan Chairman of the Board, Former Chairman & CEO of TD Banknorth Paul T. Bossidy President & CEO of Patripabre Capital LLC Robert M. Curley Berkshire Bank New York Chairman, Former Chairman & President for Citizens Bank in New York Michael P. Daly Chief Executive Officer of Berkshire Hills Bancorp, Inc. John B. Davies Former Executive Vice President of Massachusetts Mutual Life Insurance Company J. Williar Dunlaevy Former Chairman & CEO of Legacy Bancorp, Inc. & Legacy Banks Cornelius D. Mahoney Former Chairman, President & CEO of Woronoco Bancorp, Inc. & Woronoco Savings Bank Laurie Norton Moffatt Director & CEO of the Norman Rockwell Museum Richard J. Murphy Executive Vice President & Chief Operating Officer of the Tri-City ValleyCats Patrick J. Sheehan Owner & Manager of Sheehan Health Group D. Jeffrey Templeton Owner & President of The Mosher Company, Inc. Berkshire Hills Bancorp, Inc.—BHLB // berkshirebank.com 6

Corporate Offices Berkshire Hills Bancorp, Inc. 24 North Street Pittsfield, MA 01201 800-773-5601 berkshirebank.com Stock Listing Berkshire Hills Bancorp, Inc. is listed on the New York Stock Exchange under the symbol “BHLB”. Investor Information Investor Relations Attn: Erin Duggan Berkshire Hills Bancorp, Inc. P.O. Box 1308 Pittsfield, MA 01202 413-443-5601 investorrelations@berkshirebank.com The X Represents Excitement. Our hope is that our constituents come to see it as representing their exciting moments both big and small. Transfer Agent and Registrar Shareholders who wish to change the name, address, or ownership of stock, report lost stock certificates, inquire about the Dividend Reinvestment Plan or consolidate stock accounts should contact: Broadridge Corporate Issuer Solutions, Inc. P.O. Box 1342 Brentwood, NY 11717 844-458-9357 shareholder@broadridge.com shareholder.broadridge.com/bhlb 2017 Annual Meeting of Shareholders Thursday, May 18, 2017 | 10 a.m. ET The Crowne Plaza Hotel One West Street Pittsfield, MA 01201 This document contains forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) which involve significant risks and uncertainties; undue reliance should not be placed on these statements. Actual results may differ materially including factors discussed in “Forward-Looking Statements” in the Company’s 2016 Annual Report on Form 10-K, which is available at the Securities and Exchange Commission’s Internet website sec. gov and to which reference is hereby made. This Form can be obtained from ir.berkshirebank.com or will be furnished on written request without charge to persons who are beneficial owners of securities of the Company as of the record date for the Annual Meeting of Shareholders. Banking products are provided by Berkshire Bank: Member FDIC; Equal Housing Lender. Berkshire Bank is a Massachusetts chartered bank. Insurance and investment products as well as investment securities and obligations of Berkshire Hills Bancorp, Inc. are not FDIC-insured, are not a bank deposit, “NOT guaranteed BY THE BANK,” “NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY” and may lose value.