Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Sunoco LP | d371595dex991.htm |

| EX-10.2 - EX-10.2 - Sunoco LP | d371595dex102.htm |

| EX-2.1 - EX-2.1 - Sunoco LP | d371595dex21.htm |

| 8-K - 8-K - Sunoco LP | d371595d8k.htm |

Exhibit 99.2

|

|

INVESTOR CONFERENCE CALL

DIVESTITURE OF RETAIL

OPERATIONS IN CONTINENTAL U.S.

April 6, 2017

FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES Some of the statements in this presentation constitute “forward-looking statements” about Sunoco LP (“SUN”, “we”, “our, and “us”) that involve risks, uncertainties and assumptions, including, without limitation, statements regarding SUN’s proposed sale of a majority of its convenience store locations to 7-Eleven, Inc. (the “Retail Divestment”), the expected future performance of SUN (including expected results of operations and financial guidance), and SUN’s future financial condition, operating results, strategy and plans. These forward-looking statements generally can be identified by use of phrases such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “forecast” or other similar words or phrases in conjunction with a discussion of future operating or financial performance. Descriptions of SUN’s and its affiliates’ objectives, goals, targets, plans, strategies, costs, anticipated capital expenditures, expected cost savings, potential acquisitions and related financial projections are also forward-looking statements. The following factors, among others, could cause actual results and events to differ materially from those expressed or implied in the forward-looking statements we make in this presentation: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the asset purchase agreement; (2) the inability to complete the Retail Divestment in a timely manner or at all, including due to the failure to obtain necessary regulatory approvals required to complete the transactions contemplated by the asset purchase agreement; (3) the risk of not fully realizing expected synergies in the timeframe expected or at all; (4) the risk that the proposed Retail Divestment disrupts current plans and operations, increases operating costs, results in management distraction and the potential difficulties in maintaining relationships with customers, suppliers and other third parties and employee retention as a result of the announcement and consummation of such transactions; and (5) the outcome of any legal proceedings instituted against the company following announcement of the Retail Divestment and transactions contemplated thereby. These statements represent present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement. We caution that forward-looking statements involve risks and uncertainties and are qualified by important factors that could cause actual events or results to differ materially from those expressed or implied in any such forward-looking statements. For a discussion of these factors and other risks and uncertainties, please refer to SUN’s filings with the Securities and Exchange Commission (the “SEC”), including those contained in SUN’s 2016 Annual Report on Form10-K and Quarterly Reports on Form10-Q which are available at the SEC’s website at www.sec.gov. This presentation includes certain non-GAAP financial measures as defined under SEC Regulation G. A reconciliation of those measures to the most directly comparable GAAP measures is provided in the appendix to this presentation. We define EBITDA as net income before net interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. Scott Grischow Director, Treasury & Investor Relations (214) 840-5660 scott.grischow@sunoco.com Investor Relations Contact Information: Patrick Graham Senior Analyst, Investor Relations & Finance

(214) 840-5678 patrick.graham@sunoco.com 2

|

|

DEAL TERMS OVERVIEW

Sunoco LP (“SUN”) entered into a definitive agreement to sell approximately 1,110 convenience stores to 7-Eleven, Inc. (“7-Eleven”) for a purchase price of $3.3 billion in cash, plus fuel, merchandise, supplies and other inventories at close

Assets divested: Approximately 1,110 convenience stores in 19 regions mainly along the East Coast and in Texas

Includes trademarks and intellectual property of the Laredo Taco Company and Stripes Excludes APlus trade name

Excludes approximately 200 convenience stores in North and West Texas, New Mexico and Oklahoma

Aloha Petroleum will remain a part of Sunoco

No impact to APlus franchisee-operated stores

Existing retail gallons will be supplied to 7-Eleven through a long-term, fixed-rate take-or-pay fuel supply agreement. The agreement will have required growth components to deliver expanding volumes in future years

– Structured around base volumes of 2.2 billion gallons per year

– Provides for committed growth of a half a billion gallons over the first four years with a focus on continuing to build a long-term strategic partnership

– Maintains Sunoco branded fuel at all current Sunoco branded locations

Estimated completion: By Q4 2017, subject to regulatory clearances and closing conditions

Use of proceeds: Debt repayment and general partnership purposes

3

|

|

FIRST STEP IN STRATEGIC DECISION TO DIVEST CONVENIENCE STORES IN CONTINENTAL U.S.

Convenience Stores Sold To 7-Eleven

Convenience Stores To Be Sold

Convenience Stores To Be Retained

Convenience Stores

To Be Sold

West Texas/New Mexico 182 Oklahoma/North Texas 25 Subtotal 207

To Be Retained

Hawaii 54

Pivotal first step in transformation to a premier nationwide fuel supplier

7- Eleven is a logical buyer of majority of SUN’s retail assets in the continental U.S.

SUN has retained JP Morgan to market the remaining convenience stores in the continental U.S., including assets in North and west Texas, New Mexico and Oklahoma

Aloha Petroleum continues as a highly-efficient, integrated, standalone operation within SUN

|

|

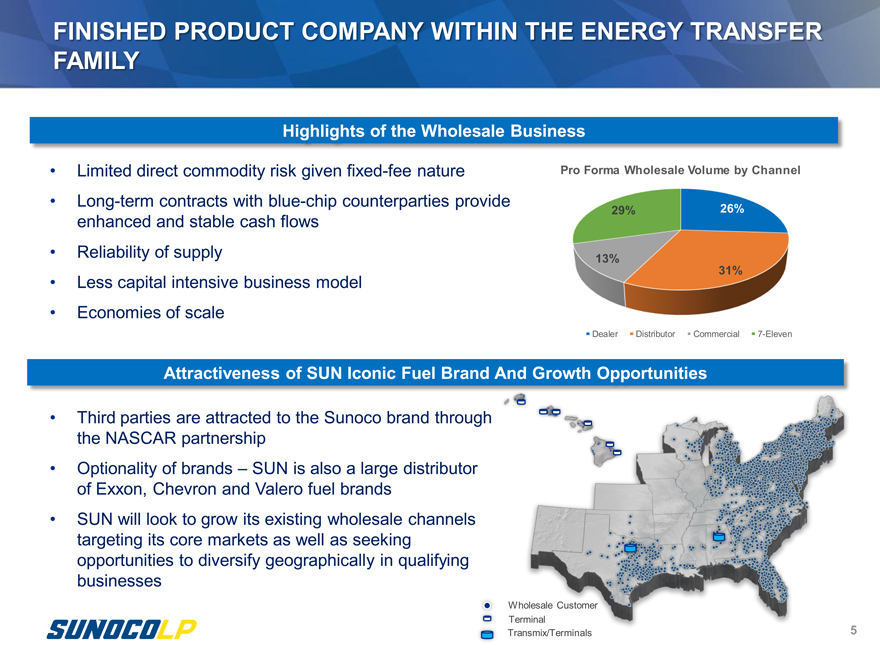

FINISHED PRODUCT COMPANY WITHIN THE ENERGY TRANSFER FAMILY

Highlights of the Wholesale Business

Limited direct commodity risk given fixed-fee nature Long-term contracts with blue-chip counterparties provide enhanced and stable cash flows Reliability of supply Less capital intensive business model Economies of scale

Pro Forma Wholesale Volume by Channel

29% 26% 13% 31%

Dealer Distributor Commercial &-Eleven

Attractiveness of SUN Iconic Fuel Brand and Growth Opportunities

Third parties are attracted to the Sunoco brand through the NASCAR partnership Optionality of brands – SUN is also a large distributor of Exxon, Chevron and Valero fuel brands SUN will look to grow its existing wholesale channels targeting its core markets as well as seeking opportunities to diversify geographically in qualifying businesses

Wholesale Customer Terminal Transmix/Terminals

5

|

|

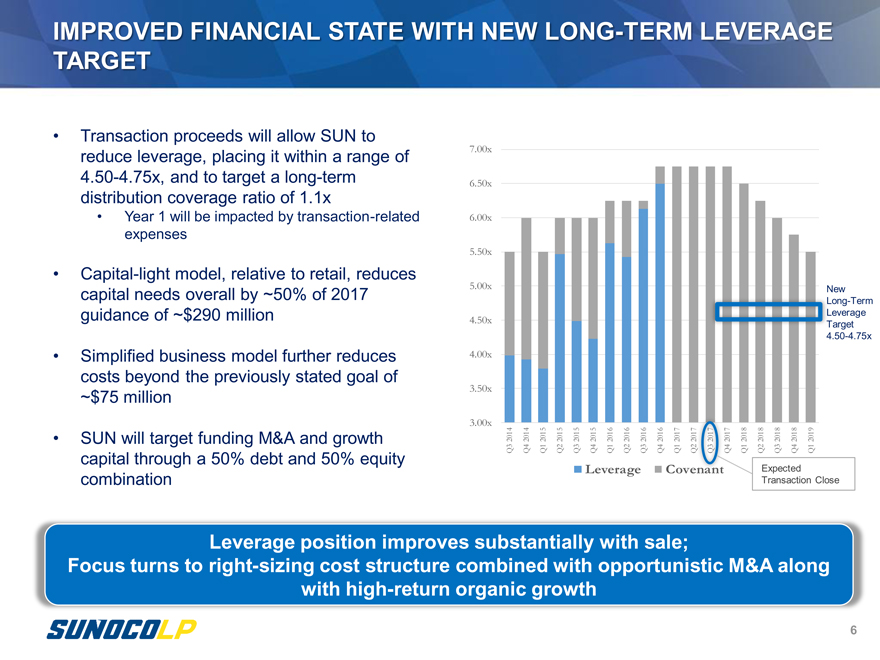

IMPROVED FINANCIAL STATE WITH NEW LONG-TERM LEVERAGE TARGET Transaction proceeds will allow SUN to reduce leverage, placing it within a range of 4.50-4.75x, and to target a long-term distribution coverage ratio of 1.1x Year 1 will be impacted by transaction-related expenses Capital-light model, relative to retail, reduces capital needs overall by ~50% of 2017 guidance of ~$290 million Simplified business model further reduces costs beyond the previously stated goal of ~$75 million SUN will target funding M&A and growth capital through a 50% debt and 50% equity combination 7.00x 6.50x 6.00x 5.50x 5.00x 4.50x 4.00x 3.50x 3.00x New Long-Term Leverage Target 4.50-4.75x Leverage Covenant Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Expected Transaction Close Leverage position improves substantially with sale; Focus turns to right-sizing cost structure combined with opportunistic M&A along with high-return organic growth 6

|

|

ILLUSTRATIVE TIMING AND STEPS Expected Timing From Announcement To Closing: 3 – 6 Months April 2017 Week of April 2nd –Sign Asset Purchase Agreement And Announce The Transaction Q2-Q3 2017 Regulatory and Counterparty Approvals By Q4 2017 Expected Transaction Close April 2017 Begin Marketing Process For Remaining Convenience Stores In Continental U.S. Summer 2017 Expected Divestiture Announcement By Q4 2017 Expected Divestiture Close By year end, SUN will be a focused, MLP qualifying business 7

|

|

KEY TAKEAWAYS

Pivotal first step in transforming to a premier nationwide fuel supplier

Opportunity to partner and grow with industry-leading counterparties

Stable cash flow profile

Immediate improvement in financial profile

First step in strategic shift away from convenience stores toward focus on MLP qualifying businesses Concentrated business model allows for greater focus on fuel supply operations SUN benefits from size, lower costs, and a simplified wholesale business model

With a robust 15-year fuel supply agreement in place, continue to build strong partnership with 7-Eleven Third parties are attracted to the visibility of the Sunoco brand – one of the most iconic brands in the motor fuels industry Continue to grow and develop relationships with best-in-class customers Continue to grow partnerships with and distribution of other major fuel brands

Fixed margin contracts provide stable cash flows supporting distributions to unitholders Going forward, SUN will concentrate on adding fixed-fee contracts

Credit-enhancing transaction allows SUN to recapitalize the balance sheet Sets the stage for strategic optionality Provides additional financial flexibility to take advantage of consolidation opportunities in the fragmented wholesale market targeting stable, fixed-fee volumes within existing markets and moving into new markets opportunistically

8