Attached files

| file | filename |

|---|---|

| EX-3.5 - EXHIBIT 3.5 - Protea Biosciences Group, Inc. | v463651_ex3-5.htm |

| EX-3.4 - EXHIBIT 3.4 - Protea Biosciences Group, Inc. | v463651_ex3-4.htm |

| EX-3.3 - EXHIBIT 3.3 - Protea Biosciences Group, Inc. | v463651_ex3-3.htm |

| EX-3.2 - EXHIBIT 3.2 - Protea Biosciences Group, Inc. | v463651_ex3-2.htm |

| 8-K - FORM 8-K - Protea Biosciences Group, Inc. | v463651_8k.htm |

Exhibit 3.1

AMENDED AND RESTATED

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

Protea Biosciences Group, Inc.

Up to $5,000,000

500 Units of Securities Consisting of

Shares of Common Stock and Warrants to Purchase Common Stock

This Amended and Restated Confidential Private Placement Memorandum together with all exhibits and documents incorporated by reference (the “Memorandum”) relates to an offering (“Offering”) by Protea Biosciences Group, Inc., a Delaware corporation (“”Protea,” the “Company,” “we,” “us” and “our”) of up to $5,000,000 of units of our securities (the “Units”), consisting of a maximum of (a) 66,666,667 shares of common stock, par value $0.0001 per share (the “Common Stock”), (b) 18 month warrants to purchase up to 66,666,667 shares of Common Stock at an exercise price of $0.09 per share (the “Class A Warrants”), and (c) five year warrants purchase up to 66,666,667 shares of Common Stock at an exercise price of $0.1125 per share (the “Class B Warrants” and together with the Class A Warrants the “Warrants”). The Common Stock and the Warrants are sometimes referred to herein collectively as the “Securities.”

A minimum of 50 Units for aggregate gross proceeds of $500,000 (the “Minimum Offering”) and a maximum of 500 Units for aggregate gross proceeds of $5,000,000 (the “Maximum Offering”) are being offered by the Company in this Offering. Each Unit consists of (a) 133,333.33shares of Common Stock, (b) Class A Warrants to purchase 133,333.33 shares of Common Stock at an exercise price of $0.09 per share, and (c) Class B Warrants to purchase 133,333.33 shares of Common Stock at an exercise price of $0.1125 per share. The minimum subscription from qualified investors shall be one full Unit for a minimum purchase price of $10,000. However, the Company and the Placement Agent described below may accept subscriptions from qualified investors for a lesser amount at their sole discretion. The Company and the Placement Agent reserve the right to reject any proposed subscription.

On October 24, 2016, we amended our Certificate of Incorporation which now currently permits us to issue up to 500,000,000 shares of Common Stock. Our 134,226,310 outstanding shares of Common Stock, plus all additional shares of Common Stock that are issuable upon conversion of currently outstanding notes and exercise of currently outstanding options and warrants (the “Common Stock Equivalents”) totals 243,957,380 shares of Common Stock. In addition, we intend to consummate a 1-for-25 reverse stock split of our outstanding Common Stock following the Termination Date of this Offering (the “Reverse Stock Split”), which reverse split has previously been authorized by our stockholders, thereby reducing the outstanding number of shares of Common Stock and Common Stock Equivalents to 19,742,923 shares of Common Stock after giving effect to the sale of the Maximum offering offered hereby. Consummation of the Reverse Stock Split will require (a) the filing of an amendment to our Certificate of Incorporation with the Delaware Secretary of State, and (b) obtaining the approval of the Financial Industry Regulatory Authority (“FINRA”).

The number of shares of Common Stock included in the Units and the number of shares of Common Stock issuable upon the exercise of the Warrants (the “Warrant Shares”) are each subject to equitable pro-rata adjustment based on the 1:25 Reverse Stock Split or any other subsequent forward or reverse stock split.

Upon acceptance by the Company after the date hereof of subscriptions from qualified investors for the Minimum Offering, the Placement Agent (as defined herein) and the Company shall have the right at any time and prior to the Termination Date (as defined below), to effect periodic closings (each a “Closing”) for subscriptions for Securities from investors until the earlier of (i) the date upon which subscriptions for the Maximum Offering offered hereunder have been accepted, (ii) December 31, 2016 (subject to the right of the Company and the Placement Agent to extend the Offering until March 31, 2017 without further notice to investors), or (iii) the date upon which the Company elects to terminate the Offering (the “Termination Date”). The Securities are being offered by the Company on an “all-or-none” basis for the Minimum Offering and on a “reasonable best efforts” basis for the Maximum Offering. No assurance can be given that all or any portion of the Securities offered hereby will be sold. The Company may terminate the Offering at any time even if Units having an aggregate purchase price equal to the Maximum Offering has not been sold. The subscription amount for the Units of Securities will be held in escrow for the benefit of subscribers by Signature Bank (the “Escrow Agent”) until completion of the Minimum Offering and satisfaction of all the conditions to each Closing.

Neither the Common Stock nor the Warrants included in the Units will be listed on any securities exchange. The Company’s Common Stock is currently traded on the OTC Markets under the symbol “PRGB.” On October 28, 2016, the last reported sale price of our Common Stock on the OTC Markets was $0.14 per share.

This Memorandum amends and restates in its entirety, the Company’s private placement memorandum dated September 29, 2016.

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO UNITED STATES PERSONS UNLESS THE SECURITIES ARE REGISTERED UNDER THE SECURITIES ACT OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT IS AVAILABLE. THESE SECURITIES ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND SUCH LAWS. NEITHER THE SECURITIES AND EXCHANGE COMMISSION (THE “COMMISSION”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, NOR HAVE ANY OF THE FOREGOING PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE ARE SPECULATIVE SECURITIES WHICH INVOLVE A HIGH DEGREE OF RISK. ONLY THOSE INVESTORS WHO CAN BEAR THE LOSS OF THEIR ENTIRE INVESTMENT SHOULD INVEST IN THESE SECURITIES. PLEASE SEE THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 21 OF THIS PRIVATE PLACEMENT MEMORANDUM (THE “MEMORANDUM”).

|

Aggregate Offering Price (1) |

Placement Agent Commissions (2) |

Proceeds to the Company (3) (4) | |

| Minimum Offering | $500,000 | $60,000 | $440,000 |

| Maximum Offering | $5,000,000 | $600,000 | $4,400,000 |

The Units of Securities offered hereby are speculative securities and involve a high degree of risk. See “Risk Factors.”

(see footnotes on following page)

LAIDLAW & COMPANY (UK) LTD.

Placement Agent

the date of this Memorandum is October 31, 2016

| 2 |

| (1) | The price of the securities was determined by negotiation and may not bear any relationship to the price of our Common Stock, assets, book value or results of operations or any other generally accepted criteria of value. |

We have agreed to pay Laidlaw & Company (UK) Ltd. (the “Placement Agent” or “Laidlaw”) (i) a cash commission in the amount often percent (10%) of the gross proceeds of the Offering received from investors other than certain investors previously identified to the Placement Agent by the Company (“Protea Investors”), (ii) two percent (2%) of the gross proceeds of the Offering received from Protea Investors, and (iii) an activation fee of $25,000. In addition, the Placement Agent will be entitled to receive three (3) year warrants to purchase such number of shares of Common Stock of the Company equal to (x) ten percent (10%), in the case of investors other than Protea Investors, of the aggregate number of securities sold in the Offering at an exercise price equal to the lowest price per share of the securities sold in the Offering. The Placement Agent shall also be entitled to a non-allocable expense reimbursement in the amount of two percent (2%) of the gross proceeds of the Offering, including amounts received from Protea Investors. After the Termination Date, assuming the closing on at least $1,000,000 in gross proceeds for the Units, the Company will pay the Placement Agent a non-refundable financial advisory fee of $150,000, to be paid monthly, at the rate of $25,000 per month for a term of six months beginning on the Termination Date. For additional information regarding the Placement Agent, see the section entitled “Offering Period and Subscription Procedures.” We shall also issue legal counsel to the Placement Agent one Unit of the Securities at the closing of the Minimum Offering.

| (2) | The amount of total proceeds set forth in the above table does not include deductions for expenses related to this Offering, including filing, printing, current and accrued legal fees, accounting fees, transfer agent and other miscellaneous expenses, estimated to be approximately $400,000. |

| (3) | No assurance can be given that all or any portion of the Securities offered hereby will be sold. The Placement Agent and Company have established an escrow account (the “Escrow Account”) with Signature Bank as escrow agent. The subscription amount for the Securities will be paid to the Escrow Account by wire and held in escrow until satisfaction of all the conditions to a closing. |

The Securities offered hereby are speculative, involve a high degree of risk and should not be purchased by anyone who cannot afford the loss of their entire investment. Prospective investors should consider carefully the information under “Risk Factors” before purchasing such SECURITIES.

NONE OF THE SECURITIES HAVE been registered with or approved by the Commission or any state securities commission, nor has any commission or state authority passed on the accuracy or adequacy of this memorandum. Any representation to the contrary is a criminal offense. This memorandum does not constitute an offer in any jurisdiction in which an offer is not authorized.

SUBSCRIPTIONS WILL BE ACCEPTED ONLY FROM “ACCREDITED INVESTORS” AS DEFINED IN RULE 501 OF REGULATION D (SEE “INVESTOR SUITABILITY STANDARDS”).

This Memorandum contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in such forward-looking statements. Factors that might cause differences include, but are not limited to, those discussed in “Risk Factors.”

The Securities has not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or any state securities laws. These securities are being offered and sold in reliance upon an exemption provided by section 4(A)(2) and Rule 506 of Regulation D of the securities act and similar available exemptions under the securities laws of the states relating to a transaction not involving a public offering. The Securities are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act pursuant to registration or exemption therefrom. The Securities has not been approved or disapproved by the Securities and Exchange Commission or any other federal or state regulatory authorities, nor have any federal or state authorities passed upon or endorsed the merits of this Offering, the Securities or the accuracy or adequacy of this Memorandum. Any representation to the contrary is a criminal offense.

Investment in the Securities offered by the Company involves a high degree of risk. In making an investment decision you must rely on your own examination of the issuer and the terms of this Offering, including the merits and risks involved. You should retain your own professional advisors to review and evaluate the financial, economic, tax and other consequences of this investment. You should not invest any funds in this Offering unless you can afford to lose your entire investment.

| 3 |

The Securities will be “restricted securities” for the purposes of federal and state securities laws. There is no public market for the Securities and it is expected that there will not be a market for the resale of the Securities in the near future. The Securities may not be offered, sold, or pledged except pursuant to an effective registration statement under the Securities Act, or an exemption from registration under the Securities Act. We may require an opinion of counsel that an exemption is available, and such counsel and opinion must be reasonably satisfactory to us. Therefore, you should only acquire the Securities for investment, solely for your own account, and without any view toward resale or distribution. You should be aware that you will be required to bear the financial risks of this investment for an indefinite period of time.

All documents referred to in this Memorandum are provided herewith, available upon request from the Company, or will be provided prior to the signing of the Subscription Agreement and should be reviewed by you and your advisors for a complete understanding of their provisions. The statements in this Memorandum with respect to any documents are necessarily summaries of the document’s terms and are qualified in their entirety by reference to the underlying document.

In making an investment decision, you must rely on your own examination of the Company and the terms of the Subscription Agreement, including the merits and risks involved. We will endeavor to make available to every investor, during the course of their investigation and prior to any purchase of Securities, the opportunity to ask questions of and receive answers concerning the terms and conditions of this Offering and to provide any appropriate additional information necessary to verify the accuracy of the information contained in this Memorandum. You and your advisors are encouraged to ask questions concerning this Offering and such other matters as you deem pertinent in connection with understanding the information in the Memorandum. We will make every effort to respond fully to such questions and supply all available information that you or your advisors reasonably request. You agree to advise us in writing if you are relying on any such information.

Any requests for additional information should be made to Mr. Stephen Turner, CEO of the Company at 1311 Pineview Drive, Suite 501, Morgantown, West Virginia 26505, telephone (304) 292-2226; Stephen.turner@proteabio.com.

The Securities are subject to prior sale, cancellation, withdrawal or modification of the Offering without notice. We may accept or reject subscriptions received in this Offering without notice, in whole or in part, for any reason. We are not required to accept subscriptions in the order in which they are received. Except as required by certain state’s securities laws, subscriptions that have we have accepted may not be withdrawn by any subscriber.

CONFIDENTIALITY AND LIMITATIONS OF THIS PRIVATE PLACEMENT MEMORANDUM

This Memorandum contains information that is confidential and proprietary to the Company. It discusses trade and business secrets of the Company and is intended for use only by the party to whom it is transmitted by our employees or agents, and only for the purposes of permitting such persons to decide whether to purchase the Securities described herein. This Memorandum may not be reproduced in whole or in part, or used for any other purpose; nor may any of its contents be disclosed without our prior written consent. The recipient agrees to return this Memorandum to us upon request. Acceptance of this Memorandum constitutes agreement to the above conditions.

The information contained in this Memorandum may at times represent our best estimate of our expected business performance, based upon assumptions believed to be reasonable. No representation or warranty is made, however, as to the accuracy or completeness of such assumptions, and nothing contained herein should be relied upon as a promise or representation as to any future performance or event. In addition, investors should take note that the information contained herein is only offered to be accurate as of the date of this Memorandum. Neither the delivery of this Memorandum, nor any sale made hereunder, shall, under any circumstances, create the implication that there has been no change in the affairs of our business, or that the information contained herein is correct as of any date other than the date of its creation referenced on the cover page.

The distribution of this Memorandum and this Offering of the securities described herein may be restricted by law in certain jurisdictions.

This Memorandum does not constitute, and may not be used for or in connection with, an offer or solicitation by anyone in any jurisdiction in which such offering or solicitation is not authorized, or to any person to whom it is unlawful to make such offer or solicitation. We have not taken any action that would permit an offering of the securities or the circulation or distribution of this Memorandum or any offering materials in relation to our business or the Securities in any country or jurisdiction where action for that purpose is required by law.

Prospective investors are not to construe the contents of this Memorandum as legal, investment or tax advice. Prospective investors should consult their advisors as to legal, investment, tax and related matters concerning an investment by such prospective investors in the company.

| 4 |

information provided outside this Memorandum

No person has been authorized to give any information outside of this Memorandum or to make any representation in connection with this Offering. If any such information is given or if any such representations are made, such information or representation must not be relied upon as having been authorized by us.

Any sale of Securities shall be made solely by and in accordance with the terms of the Subscription Agreement, which may be accepted or rejected, in whole or in part, by us in our sole discretion for any reason.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This Memorandum contains “forward-looking statements” as defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements involve risks and uncertainties and include, but are not limited to, statements regarding future events and our plans and expectations. The words “believes,” “anticipates,” “expects,” “intends,” “projects,” “plans,” “forecasts,” “estimates,” “will” and other similar expressions identify forward-looking statements pertaining to, among other things, financial projections regarding our operations, and our allocation and use of the funds raised in this Offering. Such statements reflect only current views with respect to future events and financial performance or operations and speak only as of the date the statements are made.

Our actual results may differ materially from our forward looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in the section “Risk Factors” as well as those discussed elsewhere in this Memorandum and the documents referenced herein.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of the assumptions could prove inaccurate. There can be no assurance that the results contemplated in such forward-looking statements will be realized and our actual results are likely to differ from those anticipated in our forward-looking statements. In addition, as disclosed under “Risk Factors,” the business and operations of the Company are subject to substantial risks that increase the uncertainties inherent in the forward-looking statements included in this Memorandum.

The inclusion of forward-looking information should not be regarded as a representation by us or any other person that the future events, plans or expectations contemplated will be achieved. We disclaim any obligation to revise forward-looking statements to reflect subsequent events or circumstances or the occurrence of unanticipated events.

BY ACCEPTING DELIVERY OF THIS MEMORANDUM, OR ANY OTHER MATERIAL IN CONNECTION WITH THIS OFFERING, THE OFFEREE AGREES TO KEEP STRICTLY CONFIDENTIAL THE CONTENTS OF THIS MEMORANDUM AND SUCH OTHER MATERIAL, AND TO NOT DISCLOSE SUCH CONTENTS TO ANY THIRD PARTY OR OTHERWISE USE THE CONTENTS FOR ANY PURPOSE OTHER THAN EVALUATION BY SUCH OFFEREE OF AN INVESTMENT IN THE SHARES. INVESTORS SHALL NOT COPY ALL OR ANY PORTION OF THIS MEMORANDUM OR ANY SUCH OTHER MATERIAL AND RETURN THIS MEMORANDUM AND ALL SUCH OTHER MATERIAL TO THE COMPANY IF THE OFFEREE DOES NOT SUBSCRIBE TO PURCHASE ANY SHARES, OR IF THE OFFEREE’S SUBSCRIPTION IS NOT ACCEPTED, OR IF THIS OFFERING IS TERMINATED OR WITHDRAWN.

EXCLUSIVE NATURE OF PRIVATE PLACEMENT MEMORANUDM

EXCEPT FOR SUCH INFORMATION THAT IS CONTAINED IN THIS MEMORANDUM OR IS OTHERWISE PROVIDED BY THE COMPANY IN RESPONSE TO REQUESTS FROM PROSPECTIVE INVESTORS OR THEIR ADVISORS, NO PERSON OR ENTITY HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OR THE SECURITIES REFERENCED HEREIN, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION(S) SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY.

THE COMPANY DISCLAIMS ANY AND ALL LIABILITIES FOR REPRESENTATIONS OR WARRANTIES EXPRESSED OR IMPLIED, CONTAINED IN, OR OMISSIONS FROM, THIS MEMORANDUM, OR ANY OTHER WRITTEN OR ORAL COMMUNICATION TRANSMITTED OR MADE AVAILABLE TO THE RECIPIENT.

THIS MEMORANDUM DOES NOT PURPORT TO BE ALL-INCLUSIVE OR TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE INVESTOR MAY DESIRE IN EVALUATING AN INVESTMENT IN THE COMPANY.

STATEMENTS MADE IN THIS MEMORANDUM ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE STATED AND ARE SUBJECT TO CHANGE, COMPLETION OR AMENDMENT WITHOUT NOTICE. NEITHER THE DELIVERY OF THIS MEMORANDUM, AT ANY TIME, NOR THE SALE OF THE SECURITIES HEREUNDER, SHALL UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THE INFORMATION HEREIN IS CORRECT AS OF ANY TIME SUBSEQUENT TO THE DATE HEREOF.

| 5 |

CERTAIN PROVISIONS OF VARIOUS AGREEMENTS ARE SUMMARIZED IN THIS MEMORANDUM, BUT PROSPECTIVE INVESTORS SHOULD NOT ASSUME THAT THE SUMMARIES ARE COMPLETE.

THIS MEMORANDUM DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY ANY UNIT OR SECURITY OTHER THAN THOSE OFFERED HEREBY, NOR DOES IT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY FROM ANY PERSON IN ANY STATE OR OTHER JURISDICTION IN WHIH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL, OR IN WHICH THE PERSON OR ENTITY MAKING SUCH OFFER OR SOLICITATION IS NOT QUALIFIED TO DO SO, OR TO A PERSON OR ENTITY TO WHOM IT IS UNLAWFUL TO MAKE SUCH AN OFFER OR SOLICITATION.

THE COMPANY RESERVES THE RIGHT AT ITS SOLE DISCRETION AND FOR ANY REASON WHATSOEVER TO MODIFY, AMEND AND/OR WITHDRAW ALL OR A PORTION OF THE OFFERING, AND/OR ACCEPT OR REJECT IN WHOLE OR IN PART ANY PROSPECTIVE INVESTMENT IN THE SHARES, OR TO ALLOT TO ANY PROSPECTIVE INVESTOR LESS THAN THE AMOUNT OF SHARES SUCH INVESTOR DESIRES TO PURCHASE. THE COMPANY SHALL HAVE NO LIABILITY WHATSOEVER TO ANY OFFEREE AND/OR INVESTOR IN THE EVENT THAT ANY OF THE FOREGOING SHALL OCCUR.

SPECULATIVE; HIGH RISK; DUE DILIGENCE

THE SECURITIES REFERENCED HEREIN ARE HIGHLY SPECULATIVE AND ANY INVESTMENT INVOLVES A HIGH DEGREE OF RISK. INVESTORS SHOULD BE PREPARED TO BEAR THE ECONOMIC RISK OF THEIR INVESTMENT FOR AN INDEFINITE PERIOD OF TIME AND BE AWARE THAT THEY MAY SUSTAIN A LOSS OF THEIR ENTIRE INVESTMENT.

EACH INVESTOR WILL BE REQUIRED TO REPRESENT THAT THEY ARE FAMILIAR WITH AND UNDERSTAND THE TERMS, RISKS, AND MERITS OF THE OFFERING DESCRIBED HEREIN AND ALL ATTACHMENTS TO THIS MEMORANDUM.

THIS MEMORANDUM HAS BEEN PREPARED FOR INFORMATIONAL PURPOSES ONLY IN ORDER TO ASSIST PROSPECTIVE INVESTORS IN EVALUATING AN INVESTMENT IN THE COMPANY. PROSPECTIVE INVESTORS ARE EXPECTED TO CONDUCT THEIR OWN INVESTIGATIONS WITH REGARD TO THE COMPANY AND ITS PROSPECTS. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST CONDUCT AND RELY ON THEIR OWN EXAMINATIONS OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED IN MAKING AN INVESTMENT DECISION WITH RESPECT TO THIS MEMORANDUM.

SECURITIES LAWS; REGISTRATION

THE OFFER AND SALE OF THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS IN RELIANCE UPON EXEMPTIONS FROM REGISTRATION PROVIDED BY SECTION 4(2) OF THE SECURITIES ACT OF 1933, AS AMENDED, AND REGULATION D PROMULGATED THEREUNDER, AND SIMILAR EXEMPTIONS FROM REGISTRATION PROVIDED B Y CERTAIN STATE SECURITIES LAWS.

THE SECURITIES HAVE NOT BEEN REGISTERED WITH OR APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR BY ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY SUCH STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PRIVATE PLACEMENT MEMORANDUM.

RESTRICTIONS; TRANSFERABILITY

THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE. THE SECURITIES MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, APPLICABLE STATE SECURITIES LAWS PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM, AND/OR THE COMPANY’S OPERATING AGREEMENT.

REGULATION D PROMULGATED UNDER THE SECURITIES ACT; INVESTOR SUITABILITY; DISCLOSURES; BACKGROUND CHECKS

| 6 |

THE SECURITIES HEREIN ARE BEING OFFERED IN RELIANCE UPON CERTAIN EXEMPTION(S) FROM THE REGISTRATION REQUIREMENTS OF THE ACT. IN PARTICULAR, THE SECURITIES ARE BEING OFFERED IN RELIANCE UPON RULE 506(BB), PROMULGATED UNDER REGULATION D OF THE ACT. ACCORDINGLY, NEITHER THE ISSUER OF SUCH SECURITY OR THE SECURITIES THEMSELVES ARE SUBJECT TO COMPLIANCE WITH THE SPECIFIC DISCLOSURE REQUIREMENTS APPLICABLE TO SECURITIES WHICH ARE REGISTERED UNDER THE ACT.

THE SECURITIES HEREIN ARE BEING OFFERED EXCLUSIVELY TO THOSE CERTAIN INVESTORS WHO MAY QUALIFY AS “ACCREDITED INVESTORS” AND POSSESS THE QUALIFICATIONS NECESSARY TO PERMIT THE SECURITIES TO BE OFFERED AND SOLD IN RELIANCE UPON CERTAIN EXEMPTIONS AND/OR AS DEFINED IN REGULATION D UNDER THE SECURITIES ACT OF 1933.

INVESTORS ARE ADVISED THAT THEY MAY NEED TO MEET CERTAIN MINIMUM ANNUAL INCOME OR NET WORTH THRESHOLDS PROVIDED IN THE INVESTOR SUITABILITY QUESTIONNAIRE AS WELL AS OTHER ADDITIONAL SUITABILITY REQUIREMENTS AS MAY BE DETERMINED BY THE COMPANY. INVESTORS ARE FURTHER ADVISED THAT THEY MAY IN CONNECTION WITH SUCH SUITABILITY REQUIREMENTS, BE REQUIRED TO SUBMIT FINANCIAL STATEMENTS,W-2 FORMS, 1099 FORMS, SCHEDULE K-1 OF 1065 FORMS, 1040 FORMS, TAX RETURNS, A SUITABILITY QUESTIONNAIRE, AND/OR OTHER DOCUMENTATION WHICH MAY INCLUDE BANK STATEMENTS, BROKERAGE STATEMENTS, CERTIFICATES OF DEPOSITS, TAX ASSESSMENTS AND CREDIT REPORTS.

THE COMPANY WILL TAKE REASONABLE STEPS TO VERIFY AN INVESTORS “ACCREDITED INVESTOR” STATUS AND THE COMPANY MAY, IN ITS SOLE DISCRETION, DECLINE TO ADMIT ANY PROSPECTIVE INVESTOR OF THE INTEREST DESCRIBED HEREIN.

NOTICE TO NON-UNITED STATES RESIDENTS

IT IS THE RESPONSIBILITY OF ANY ENTITY WISHING TO PURCHASE THE COMMON STOCK HEREIN TO SATISFY THEMSELVES AS TO FULL OBSERVANCE OF THE LAWS OF ANY RELEVANT TERRITORY OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY SUCH PURCHASE, INCLUDING OBTAINING ANY REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER APPLICABLE FORMALITIES.

You should rely only on the information contained in this Memorandum or any Memorandum supplement or amendment. We have not authorized any other person to provide you with information that is different from, or adds to, that contained in this Memorandum. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this Memorandum is accurate only as of the date of this Memorandum, regardless of the time of delivery of this Memorandum or of any sale of our Securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction.

| 7 |

TABLE OF CONTENTS

| ABOUT THIS MEMORANDUM | 9 |

| MARKET DATA | 9 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 9 |

| COMPANY SUMMARY | 10 |

SUMMARY OF THE OFFERING |

17 |

| RISK FACTORS | 21 |

| USE OF PROCEEDS | 35 |

| DIVIDEND POLICY | 35 |

| CAPITALIZATION | 36 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 37 |

| BUSINESS | 38 |

| MANAGEMENT | 54 |

| PRINCIPAL STOCKHOLDERS | 56 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 58 |

| DESCRIPTION OF CAPITAL STOCK | 59 |

| RESTRICTIONS ON TRANSFER OF SECURITIES | 62 |

| INVESTOR SUITABILITY STANDARDS | 62 |

| OFFERING PERIOD AND SUBSCRIPTION PROCEDURES | 63 |

| REPORTS AND AVAILABLE INFORMATION | 65 |

| ADDITIONAL INFORMATION | 65 |

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Memorandum. You must not rely on any unauthorized information or representations. This Memorandum is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Memorandum is current only as of its date.

LIST OF EXHIBITS

| Exhibit A | Subscription Agreement |

| Exhibit B: | Registration Rights Agreement |

| Exhibit C: | Form of Class A Warrant |

| Exhibit D: | Form of Class B Warrant |

| Exhibit E: | Annual Report on Form 10-K for the fiscal year ended December 31, 2015 |

| Exhibit F: | Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 |

We encourage all potential Investors to review carefully the attached exhibits and this Memorandum

| 8 |

ABOUT THIS MEMORANDUM

Throughout this Memorandum, unless otherwise designated or the context suggests otherwise,

| · | all references to the “Company,” the “registrant,” “Protea,” “we,” “our,” or “us” in this Memorandum mean Protea Biosciences Group, Inc. and its consolidated subsidiaries; |

| · | “year” or “fiscal year” mean the year ending December 31; |

| · | all dollar or $ references when used in this Memorandum refer to United States dollars. |

MARKET DATA

Market data and certain industry data and forecasts used throughout this Memorandum were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this Memorandum, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Memorandum.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Memorandum contains “forward-looking statements.” Forward-looking statements reflect the current view about future events. When used in this Memorandum, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this Memorandum relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| · | the results of clinical trials and the regulatory approval process; |

| · | our ability to raise capital to fund continuing operations; |

| · | market acceptance of any products that may be approved for commercialization; |

| · | our ability to protect our intellectual property rights; |

| · | the impact of any infringement actions or other litigation brought against us; |

| · | competition from other providers and products; our ability to develop and commercialize new and improved products and services; |

| · | changes in government regulation; |

| · | our ability to complete capital raising transactions; |

| · | and other factors (including the risks contained in the section of this Memorandum entitled “Risk Factors”) relating to our industry, our operations and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| 9 |

COMPANY SUMMARY

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire Memorandum carefully, especially the risks of investing in our Common Stock discussed under “Risk Factors.” Some of the statements contained in this Memorandum, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this Memorandum.

About Our Business

Protea is an emerging growth, molecular information company that has developed a revolutionary platform technology, which enables the direct analysis, mapping and display of biologically active molecules in living cells and tissue samples. The technology platform offers new, unprecedented capabilities useful to the pharmaceutical, diagnostic, clinical research, agricultural and life science industries.

“Molecular information” refers to the generation and bioinformatic processing of very large data sets, known as “big data,” obtained by applying the Company’s technology to identify and characterize the proteins, metabolites, lipids and other molecules which are the biologically active molecular products of all living cells and life forms.

Our technology is used to improve pharmaceutical development and life science research productivity and outcomes, and to extend and add value to other technologies that are used in research and development (“R&D”), such as three-dimensional tissue models, biomarker discovery, synthetic biologicals and mass spectrometry. In particular, the Company believes that its ability to rapidly provide comprehensive molecular image-based datasets addresses a universal need of the pharmaceutical, diagnostic and clinical research and life science industries.

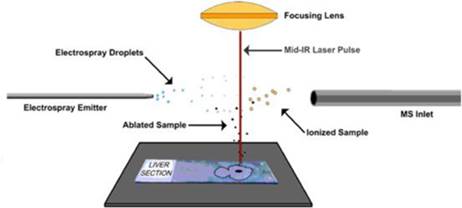

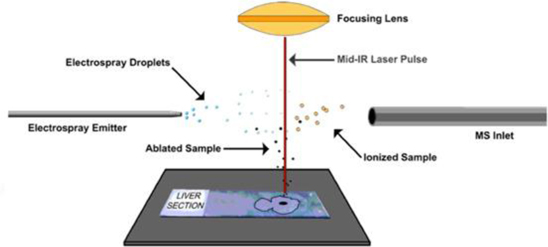

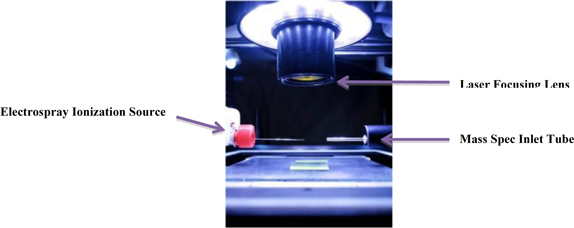

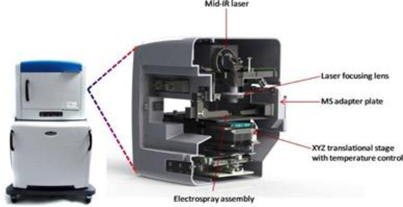

Known as LAESI ® (Laser Ablation Electrospray Ionization), our technology platform is exclusively licensed from The George Washington University (“GWU”). We have subsequently completed the development of the first fully automated LAESI instruments and requisite proprietary software suites, used for LAESI data analysis and for molecular imaging – the direct analysis and visualization of molecules in cells and tissue. LAESI technology is currently the subject of eleven issued patents and over 40 peer-reviewed publications.

LAESI is intended to meet the broad need of the biologist for the direct, unbiased identification and characterization of molecules in biological samples. By virtue of LAESI’s improved speed and the comprehensive datasets it generates, the Company is pursuing its vision of what it believes will be a new era of human molecular information, where the molecular networks of human disease will be clearly elucidated, with data more rapidly available, thereby accelerating pharmaceutical development and improving healthcare.

Our Business Strategy and Products and Services

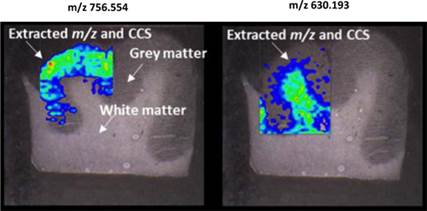

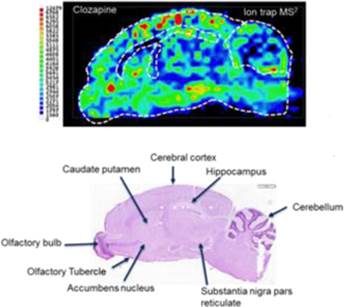

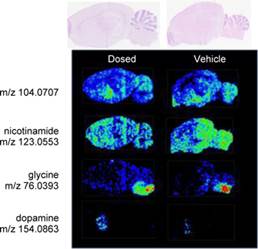

Protea has applied its core technology to establish commercial leadership in the emerging field of mass spectrometry imaging (“MSI”) services. MSI is a revolutionary capability that for the first time enables the identification of all classes of biologically active molecules produced by cells and combines this with the ability to instantly spatially-display the molecules in tissue histology sections. MSI can be performed with no sample preparation and no labeling or antibody techniques, thereby integrating direct molecular identification with tissue pathology.

The Company intends to achieve its business objectives by leveraging its core MSI technology and associated bioanalytical mass spectrometry platforms to improve the availability, comprehensiveness and usefulness of molecular information to address the needs of pharmaceutical research, biomarker discovery, agriculture and other life science research markets.

The Company’s commercial development is centered in three business lines:

| · | Molecular Information Services – the Company believes that it is the commercial leader in providing multimodal MSI, combining LAESI, MALDI, and optical microscopy. Our proprietary services enable the identification and quantitation of both small molecules (e.g., lipids and metabolites) and large molecules (e.g. proteins) and our services portfolio, inclusive of MSI, proteomics, metabolomics, lipidomics and bioinformatics is unique in the industry. Our clients include major pharmaceutical, chemical and biotechnology companies; |

| 10 |

| · | LAESI Instruments, Software and Consumables – we offer our proprietary LAESI DP-1000 instrument, software and bioanalytical consumables to corporate and academic research laboratories; and |

| · | Molecular Diagnostics and Clinical Research – we apply our multimodal MSI technologies and workflows in partnership with top-tier medical research institutions to co-develop new, molecular diagnostic tests that the company believes can be used to improve the diagnosis and prognosis of cancer and provide requisite information useful in predicting the outcome of cancer treatment. Our current test development programs target the differential diagnosis and prognosis of malignant melanoma and the molecular profiling of subpopulations of cells in lung adenocarcinoma. |

Molecular Information Services

We believe we are the commercial leader in the offering of MSI services. Our clients send their tissue and biofluid samples directly to the Company’s laboratory, where samples are analyzed by the Company’s state of the art mass spectrometry instrumentation, scientific staff and bioinformatics capabilities. We combine our proprietary LAESI platform with matrix-assisted laser desorption ionization (“MALDI”), and liquid chromatography mass spectrometry (LCMS) workflows. Our clients include major pharmaceutical, biotechnology, chemical and medical device and consumer products companies, and both academic and government institutions. The services unit is operated within a Quality by Design environment, which is necessary to meet the internal research and development standards of pharmaceutical and clinical research clients.

The Company’s MSI services represent a revolutionary capability that for the first time enables the identification of all classes of biologically-active molecules produced by cells, and combines this with the ability to instantly spatially-display the molecules (both two- and three-dimensional) in tissue histology sections. MSI can be performed without sample preparation, labeling or antibody techniques, thereby integrating direct molecular identification with tissue pathology for the first time. Since the sample is not touched, data is unbiased and more rapidly available. Providing molecular information that rapidly answers questions critical to the drug development process, such as, “is my drug actually getting inside the target cells,” “is my immune modulating agent changing the molecular output of the tumor cell,” or “how long did it take for the drug to enter the target cells” as well as questions of drug concentration and duration.

We have, in collaboration with industry leaders, developed advanced bioanalytical workflows for the characterization of protein biotherapeutics, such as monoclonal antibodies, to address regulatory requirements for safety, efficacy, and bioactivity in manufacturing and storage of these products. To this end, we have applied proteomics and metabolomics technologies along with LAESI direct analysis to aid in optimizing the expression systems used to produce monoclonal antibodies for drug discovery purposes. Key collaborations and partnerships have been formed to address the bioinformatics analysis required including statistical and pathway analysis.

In January 2014, the Company, as a subcontractor to GWU, was awarded a multi-year project with the Defense Advanced Research Projects Agency (“DARPA”). In addition to Protea, The Stanford Research Institute International and GE Global Research also collaborate on the project entitled, “New Tools for Comparative Systems Biology of Threat Agent Action Mechanisms.” A $15 million five year project, the goal of DARPA’s Rapid Threat Assessment (“RTA”) program is to develop new tools and methods to elucidate the mechanism of action of a threat agent, drug, biologic or chemical on living cells within 30 days from exposure. Uncovering the mechanism of action of such agents in 30 days, compared to the years currently required, could be key to the development of effective countermeasures. The molecular networks within living cells are vast and complex. Conventional approaches fail to capture the system-wide response of a living cell to a threat agent. The Company believes this technology will be applicable to preclinical drug research as well.

LAESI instruments, software and consumables

LAESI technology was invented in the laboratory of Professor Akos Vertes, Ph.D., Dept. of Chemistry, GWU, in 2007 and was exclusively-licensed to Protea in 2008. The LAESI DP-1000 instrument, the Company’s prototype embodiment of its proprietary LAESI technology, integrates with laboratory instruments known as mass spectrometers. LAESI employs a proprietary (patented) method that utilizes the water content in a sample (native or applied) to transition the sample into a gas state, where it can be analyzed by a mass spectrometer. LAESI accomplishes this without requiring the sample to be touched. By eliminating sample preparation, the biological sample can be analyzed without the possible contamination, bias or sample loss that occurs with current techniques, which require the introduction of chemicals or the destruction of the sample itself in order to enable analysis by mass spectrometry.

This technology enables the direct identification of proteins, lipids and metabolites in tissues, cells and biofluids such as serum and urine. Data is available in seconds to minutes, allowing rapid time to results and the capacity to analyze thousands of samples in a single work period. As an example, a researcher testing a new drug’s effects on living cells can analyze changes in the cells’ metabolism across a specific time course, thereby almost immediately obtaining data as to the activity of the new drug. The Company believes that LAESI technology has the potential to significantly improve the availability of molecular information in pharmaceutical research as well as many other fields including agriculture, pathology, biomarker discovery, biodefense and forensics.

| 11 |

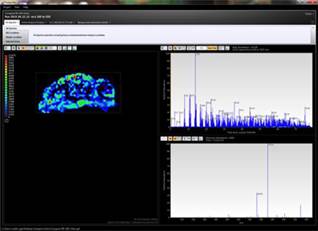

LAESI instruments employ proprietary software developed by the Company that creates “molecular maps” - the ability to instantly display the distribution of molecules throughout tissue sample in both two- and three-dimensional imaging. The Company currently offers the LAESI Desktop Software and ProteaPlot software that facilitates operating the instrument and the storage and display of datasets in a user friendly, intuitive software environment. The ProteaPlot software includes tools for post-processing of LAESI-MS data, generation of molecular maps/images and mass spectral comparison for regions of interest. LAESI software displays the data obtained by mass spectrometry analysis combined with actual images of the tissue and cell samples. Thus, mass spectrometry data can be integrated with a sample’s tissue architecture.

We have developed and brought to market related, proprietary consumable products for use in molecular analysis including REDIchips TM (Resonance-Enhanced Desorption Ionization - sample target plates with nanopost array surfaces for matrix-free laser desorption ionization of small molecules) and Progenta TM (acid labile surfactants use to solubilize proteins for mass spectrometry analysis).

Molecular Diagnostics and Clinical Research

The Company is employing both its proprietary LAESI platform and MALDI methodologies to create comprehensive, tissue-based molecular profiles to improve the differential diagnosis of cancer. Our bioinformatics capability allows the integration of the Company’s MSI data files with related pathology, gene expression and demographic datasets, with the purpose of improving human disease state detection, assessment and management. The Company has entered into collaborative research partnerships with top tier academic centers to develop and validate new, proprietary, MSI–based cancer diagnostic tests.

We have established a collaborative research partnership with the Memorial Sloan-Kettering Cancer Center and the Dana-Farber Cancer Institute. The first target of the collaboration is early stage lung adenocarcinoma. The objectives of the collaboration are to demonstrate that different cancer cell sub-groups within a lung cancer will have different molecular profiles and will behave differently. The goal is to define these molecular differences and to identify the sub-group of cancer cells with the worst prognosis that are most likely to recur thereby enabling earlier treatment intervention, and to use these findings to achieve lung adenocarcinoma tumor cell “molecular profiling,” leading to more precise treatment selection and higher survivor rates.

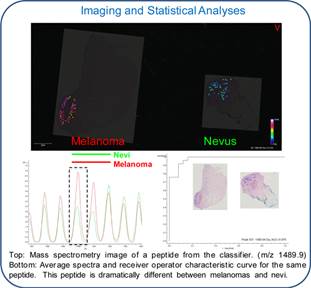

We established a collaborative research initiative with The Yale University School of Medicine that employs our MSI technology to differentiate benign melanocytic nevi from malignant melanoma. We believe that our core MSI technology can identify unique protein expression profiles that can discriminate between benign melanocytic nevi and malignant melanoma.

In April 2016 we entered into an exclusive license agreement for technology with Yale University related to the differential diagnosis of melanoma, specifically designated as a "Method of Differentiating Benign Melanocytic Nevi from Malignant Melanoma." The technology was co-invented by Dr. Rossitza Lazova, of the Department of Dermatology at Yale School of Medicine, and Dr. Erin Seeley our Clinical Imaging Principal Investigator. Under the terms of the license agreement, we have been granted the exclusive worldwide rights to commercialize the technology. We are obligated to pay expenses for the preparation, filing and prosecution of future related patent applications governed by the license agreement and related license fees. Unless earlier terminated in accordance with its terms, the Yale license agreement expires upon the later of 20 years from the effective date or the end of the term of the last underlying patent to expire.

To support our MSI–based diagnostic development, we developed new software known as “Histology Guided Mass Spec Imaging (HG-MSI)” that enables pathologists to combine traditional microscopy and histology with high resolution mass spectrometry molecular imaging. Clinicians can share, annotate and direct the analysis of specific tissue morphologies and cell subpopulations by MSI. Molecular profiling data are collected from discrete locations within a tissue section using a histology stained section as a guide. The digital tissue scans are visually analyzed by pathologists by logging onto a secure website portal and they then annotate specific cellular areas for further analysis.

We intend to expand our collaborations with major medical research centers to develop additional molecular profiles for the improved differential diagnosis and prognosis of cancer.

Recent Developments

We entered into a Memorandum of Understanding (the “MOU”) with Agilent Technologies, Inc. (NYSE: A) (“Agilent”), to develop new bioanalytical workflows in order to meet the emerging needs of the growing biopharmaceutical industry. Under the terms of the MOU, Protea, using Agilent instrumentation combined with its expertise, will develop workflows to improve the characterization of protein therapeutics including monoclonal antibodies and new methods for the field of metabolomics. We believe, along with Agilent, that the field of biotherapeutics is advancing rapidly and is in need of new, innovative solutions that identify changes in the metabolic profiles of cells due to disease processes and drug interactions.

We have announced new workflows to support the bioanalytical needs of immuno-oncology, an emerging frontier of cancer treatment that utilizes the body’s own immune system to fight diseases. Our new workflows help provide both visual and analytical certainty of therapeutic efficacy and apply the Company’s core MSI technology to the analysis of drug target tissues and tumor microenvironments.

| 12 |

We have commercialized a consumable product out of the DARPA research grant that is currently being sold to research laboratories performing small molecule analysis. This product called REDIchip (Resonance-Enhanced Desorption Ionization - sample target plates with nanopost array surfaces for matrix-free laser desorption ionization of small molecules) enables researchers to rapidly profile small molecules and metabolites utilizing a MALDI platform. This product does not require the addition of a traditional chemical matrix, but is able to detect and quantitate small molecules due to the highly structured nanopost array. These products are being used with researchers investigating metabolites and small molecule drugs, and they have potential applications within clinical mass spectrometry pain panel management operations.

In April 2016, we entered into an exclusive license agreement for technology with Yale University related to the differential diagnosis of melanoma, specifically designated as a "Method of Differentiating Benign Melanocytic Nevi from Malignant Melanoma." The technology was co-invented by Dr. Rossitza Lazova, of the Department of Dermatology at Yale School of Medicine, and Dr. Erin Seeley our Clinical Imaging Principal Investigator. Under the terms of the license agreement, we have been granted the exclusive worldwide rights to commercialize the technology. We are obligated to pay expenses for the preparation, filing and prosecution of future related patent applications governed by the license agreement and related license fees. Unless earlier terminated in accordance with its terms, the Yale license agreement expires upon the later of 20 years from the effective date or the end of the term of the last underlying patent to expire.

Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this Memorandum titled “Risk Factors,” which begins on page 21 of this Memorandum and includes:

| · | We have a history of losses; | |

| · | We will be required to raise additional financing; | |

| · | We have a significant amount of indebtedness; | |

| · | We may be unable to protect our intellectual property; | |

| · | Market acceptance of our products is still uncertain; | |

| · | We face significant competition; and | |

| · | Investors in this offering will incur substantial dilution. |

The Senior Notes

In March 2016, the Company sold $655,000 principal amount of original issue discount unsecured note due September 4, 2016 and providing an estimated 23% yield to maturity (the “CV Note”) to one accredited investor, pursuant to which the Company received an aggregate gross proceeds of $500,000. The CV Note does not accrue additional interest and included legal fees of $5,000, which was added to the principal amount. The Company also issued to the investor an aggregate of 108,675 shares of our common stock and five year warrants to purchase up to 1,637,500 additional shares of common stock at an exercise price of $0.75, subject to adjustment in certain events as provided therein.

In connection with our sale of the 2016 CV Note, the Company paid to Laidlaw & Company (UK) Ltd., who acted as the placement agent, an aggregate of approximately $60,000 in cash compensation, representing fees and an expense allowance. In addition, we issued to the placement agent (or its designees) a five-year warrant to purchase an aggregate of approximately 19,650 shares of our common stock at an exercise price of $6.25 per share.

On September 8, 2016, the Company paid off the CV Note with the proceeds of a 10% original issue discount secured promissory note of the Company purchased for $650,000 in cash by another private lender (the “Secured Note”). The Secured Notes is in the principal face amount of $720,000, and is due and payable on October 15, 2016. Our obligation to repay the Secured Note is secured by a continuing first priority lien and security interest in the accounts receivable and inventory of the Company and its subsidiary, Protea Biosciences Group, Inc.

In the event that we are unable to retire the Secured Note by its October 15, 2016 maturity date, the holder may commence suit against the Company and seek to foreclose on the accounts receivable and inventory of our operating subsidiary. Such actions would have a material adverse effect on our financial condition and business prospects. See “Risk Factors.”

| 13 |

The Bridge Note Offerings.

The Prior Bridge Note Offerings.

In May, June, July and September 2016, the Company received an aggregate of $1,736,000 in gross cash proceeds from 37 accredited investors in connection with the sale of a total principal amount of $2,170,000 of 20% OID unsecured convertible debentures (the “Bridge Notes”) due November 20, 2016, November 30, 2016, December 10, 2016 December 30, 2016, January 29, 2017 and March 26, 2017, being six months following the dates of issuance of each of the Bridge Notes. Such Bridge Notes (a) were issued with (b) bear interest at a rate of 10% per annum, and (c) are convertible at any time by the holders into our common stock at a conversion price of $0.25. In addition, we issued to the note holders three-year warrants to purchase up to 6,510,001 shares of common stock of the Company at an exercise price of $0.325 per share (the “Bridge Note Warrants”).

In connection with our sale of the Bridge Notes, we paid to Laidlaw, who acted as the placement agent, an aggregate of approximately $206,400.00 in cash compensation, representing fees and an expense allowance. In addition, we issued to the placement agent (or its designees) a five-year warrant to purchase an aggregate of approximately 1,519,000 shares of our common stock at an exercise price of $0.25 per share.

The Bridge Notes and Warrants issued in connection with sales made in May, June, July and September 2016 contained weighted average anti-dilution adjustment provisions, whereas, the Bridge Notes and Warrants sold in the September 2016 contain full-ratchet anti-dilution provisions which, in substance entitles the holder to reduce his or its conversion or exercise price then in effect to any lower price in which the Company sells Common Stock or other convertible securities or warrants (with limited exceptions). In addition, the issuance of the CV Note and the Secured Note violated certain contractual covenants contained in the Bridge Notes subscription agreements issued in connection with the May, June and July 2016 sales of Bridge Notes and Warrants Accordingly, we offered to the holders of the May, June, July and September 2016 Bridge Notes and Warrants (i) an opportunity to exchange such securities for the Bridge Notes and Warrants containing full-ratchet anti-dilution protection, and (ii) requested that such holders waive the default resulting from our sale of the CV Note and Secured Note. As at the date hereof, all holders of such Bridge Notes and Warrants agreed to the exchange and waived the default.

Our Capitalization

We are currently authorized by our Certificate of Incorporation to issue up to 500,000,000 shares of Common Stock. As of September 30, 2016, there were (i) issued and outstanding, an aggregate of 134,226,310 shares of our Common Stock, (ii) 82,946,270 additional shares of Common Stock issuable upon exercise of outstanding warrants, (iii) 10,134,800 additional shares of Common Stock issuable upon conversion of outstanding convertible notes, and (iv) 10,800,086 additional shares of Common Stock issuable upon exercise of stock options. Accordingly, as of September 30, 2016, our fully-diluted Common Stock was approximately 243,957,380 shares of Common Stock. After giving effect to the sale of all 500 Units in this Offering (assuming none are sold to Protea Investors), our fully-diluted Common Stock would be up to approximately 443,956,880 shares of Common Stock (including the warrants to be issued to the Placement Agents and shares of Common Stock we will be required to issue as a result of existing anti-dilution adjustment provisions).

The Increase in Authorized Capital Stock and Reverse Stock Split

The closing market price of our Common Stock on the OTCQB at October 28, 2016 was $0.14 per share, and during the six months ended September 30, 2016 the closing market prices for our Common Stock on the OTCQB ranged between $0.27 and $0.095 per share. On December 1, 2015, we obtained shareholder approval to seek discretionary authority to consummate a reverse stock split of our issued and outstanding shares of Common Stock within a range of between one-for-15 to one-for-25, as and when determined by our Board to be in our best interests without further approval from our stockholders. Such stockholder approval granted our Board discretionary authority to determine the exact ratio of the reverse stock split based upon the market price of our Common Stock on the date of such determination and with such reverse stock split to be effective at such time and date, if at all, as determined by the Board in its sole discretion.

We filed with the SEC a definitive consent solicitation statement on Schedule Rule 14A (the “Proxy Statement”) on September 23, 2016, obtained written consents from the holders of record on August 22, 2016 of a majority of our 134,226,310 outstanding shares of Common Stock for an amendment to our certificate of incorporation increasing our authorized Common Stock to 500,000,000 shares (the “Charter Amendment”). We filed the Charter Amended in Delaware on October 24, 2016.

We intend to consummate a 1-for-25 reverse stock split of our outstanding Common Stock which has previously been authorized by our stockholders following to the Termination Date of this Offering described below (the “Reverse Stock Split”), thereby reducing the outstanding number of shares of Common Stock and Common Stock Equivalents to prior to this Offering to 5,326,820 shares of Common Stock and 10,007,520 shares of Common Stock, assuming the sale of all 500 Units of Securities offered hereby. Consummation of the Reverse Stock Split will require (a) the filing with the Delaware Secretary of State of a further amendment to our Certificate of Incorporation, and (b) obtaining the approval of the Financial Industry Regulatory Authority (“FINRA”).

| 14 |

No fractional shares of Common Stock will be issued in connection with the Reverse Stock Split, and all such fractional interests will be rounded down to the nearest whole number. Issued and outstanding stock options, convertible notes and warrants will be split on the same basis and exercise prices will be adjusted accordingly.

There can be no assurance that we will receive FINRA approval to consummate the Reverse Stock Split.

Additional information regarding our issued and outstanding securities may be found in the section of this Memorandum titled “Description of Securities.”

Organizational History

We were incorporated as SRKP 5, Inc., in Delaware on May 24, 2005. Prior to the Reverse Merger (as defined below) and split-off (as described below), our business was to provide software solutions to deliver geo-location targeted coupon advertising to mobile internet devices.

On September 2, 2011, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Protea Biosciences, Inc., a Delaware corporation (“PBI”), and our wholly-owned subsidiary formed to complete the merger. Under the terms of the Merger Agreement, our subsidiary merged with and into PBI, as a result of which PBI became our wholly owned subsidiary (the “Reverse Merger”). In the Reverse Merger, each share of PBI Common Stock was automatically converted into one share of our Common Stock, all shares of PBI Common Stock in treasury were canceled and we assumed all of PBI’s rights and obligations for outstanding convertible securities and warrants. Upon the Reverse Merger, we discontinued our prior business, and our business became the business of PBI and its subsidiaries.

Corporate Information

Our principal executive office is located 1311 Pineview Drive, Suite 501, Morgantown, West Virginia 26505. Our telephone number is 1-304-292-2226. Our web address is http://proteabio.com. Information included on our website is not part of this Memorandum.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (i) December 31, 2019, the last day of the fiscal year following the fifth anniversary of the date of the first sale of our Common Stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before December 31, 2019. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the "JOBS Act," and references herein to "emerging growth company" have the meaning associated with it in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure; |

| · | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements; |

| · | reduced disclosure obligations regarding executive compensation; and |

| · | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

| 15 |

For as long as we continue to be an emerging growth company, we expect that we will take advantage of the reduced disclosure obligations available to us as a result of that classification. We have taken advantage of certain of those reduced reporting burdens in this Memorandum. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

| 16 |

SUMMARY OF THE OFFERING

| The Offering: |

The Company proposes to offer, only to “accredited investors,” as that term is defined in Rule 501 of Regulation D, as promulgated under the Securities Act of 1933, as amended (the “Securities Act”), up to of up to $5,000,000 of units of our securities (the “Units”). The Units consist of a maximum of:

· 66,666,667 shares of our common stock, par value $0.0001 per share (the “Common Stock”),

· 18 month warrants to purchase up to 66,666,667 shares of common stock, par value $0.0001 per share (the “Common Stock”), at an exercise price of $0.09 per share (the “Class A Warrants”), and

· five year warrants purchase up to 66,666,667 shares of Common Stock at an exercise price of $0.1125 per share (the “Class B Warrants” and together with the Class A Warrants the “Warrants”).

The Common Stock and the Warrants are sometimes referred to herein collectively as the “Securities.”

A minimum of 50 Units for aggregate gross proceeds of $500,000 (the “Minimum Offering”) and a maximum of 500 Units for aggregate gross proceeds of $5,000,000 (the “Maximum Units”) are being offered by the Company in this Offering. Each Unit consists of:

· 133,333.33 shares of Common Stock,

· Class A Warrants to purchase 133,333.33 shares of Common Stock at an exercise price of $0.09 per share, and

· Class B Warrants to purchase 133,333.33 shares of Common Stock at an exercise price of $0.1125 per share.

The minimum subscription from qualified investors shall be one full Unit for a minimum purchase price of $10,000. However, the Company and the Placement Agent described below may accept subscriptions from qualified investors for aa lesser amount in their sole discretion...

The Company and the Placement Agent reserve the right to reject any proposed subscription.

The Offering will be made as a private placement to such accredited investors (the “Purchasers”) pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506 promulgated thereunder.

|

| Terms of the Warrants |

The Class A Warrants will have a term of 18 months and will entitle the holders to purchase up to 66,666,667 shares of Common Stock at an exercise price of $0.09 per share, if all 500 Units are sold in this Offering. Upon consummation of the Reverse Stock Split, the maximum number of shares of Common Stock issuable upon full exercise of the Class A Warrants will be 2,666,660 shares of Common Stock (the “Class A Warrant Shares”).

The Class B Warrants will have a term of five years and will entitle the holders to purchase up to 66,666,667 shares of Common Stock at an exercise price of $0.1125 per share, if all 500 Units are sold in this Offering. Upon consummation of the Reverse Stock Split, the maximum number of shares of Common Stock issuable upon full exercise of the Class B Warrants will be 2,666,660 shares (the “Class B Warrant Shares” and together with the Class A Warrant Shares, the “Warrant Shares”).

Upon consummation of the 1:25 Reverse Stock Split, the 133,333,000 Warrant Shares shall be reduced to 5,333,320 Warrant Shares, and the exercise prices of the Class A Warrants and Class B Warrants shall be increased to $2.25 and $2.8125, respectively.

The exercises prices of the Class A Warrants and Class B Warrants as well as the number of shares issuable upon exercise of the Class A and Class B Warrants shall both be adjusted if the Company sells Common Stock or securities convertible into or issuable for common stock at a price per share that is lower than their respective exercise prices (as adjusted by the Reverse Stock Split); in which event, the exercise prices would be adjusted to the lower price.

|

| 17 |

| Registration Rights |

The Company will be required to file within 45 days of the Termination Date (the “Filing Deadline”) a registration statement (the “Registration Statement”) registering for resale all shares of Common Stock and all shares of shares of Common Stock issuable upon exercise of the Warrants (collectively, the “Registrable Shares”). The Company has agreed to use its reasonable best efforts to have the Registration Statement declared effective within 30 days of being notified by the SEC that the Registration Statement will not be reviewed by the SEC (and in such case of no SEC review, not later than 60 days after the Filing Deadline) or within 180 days after the Filing Deadline in the event the SEC provides comments to the Registration Statement (the “Effectiveness Deadline”). If the Registration Statement is not filed on or before the Filing Deadline declared effective on or before the Effectiveness Deadline or after the effective date of a Registration Statement, such Registration ceases for any reason to remain continuously effective as to all Registrable Securities included in such registration statement, or the holders are otherwise not permitted to utilize the prospectus therein to resell such Registrable Securities, for more than ten (10) consecutive calendar days or more than an aggregate of fifteen (15) calendar days (which need not be consecutive calendar days) during any 12-month period (the “Continuing Effectiveness”), then the Company shall pay to each holder of Registrable Shares an amount in cash equal to one-percent (1.0%) of such holder’s investment in the Offering on every thirty (30) day anniversary of such Filing Deadline failure, Effectiveness Deadline failure, or Continuing Effectiveness failure until such failure is cured. The payment amount shall be prorated for partial thirty (30) day periods. The maximum aggregate amount of payments to be made by the Company as the result of such failures, whether by reason of a Filing Deadline failure, Effectiveness Deadline failure Continuing Effectiveness failure, or any combination thereof, shall be an amount equal to 6% of each holder’s investment amount. Notwithstanding the foregoing, no payments shall be owed with respect to any period during which all of the holder’s Registrable Shares may be sold by such holder under Rule 144 without volume or manner-of-sale restrictions pursuant to Rule 144. Moreover, no such payments shall be due and payable with respect to any Registrable Shares if the Company is unable to register due to limits imposed by the SEC’s interpretation of Rule 415 under the Securities Act. The Company shall maintain the Registration Statement until all Registrable Securities covered by such Registration Statement have been sold, thereunder or pursuant to Rule 144 or until Rule 144 of the Securities Act is available to investors without volume or manner-of-sale restrictions pursuant to Rule 144, whichever is earlier.

The registration rights agreement provides that the Company and the managing underwriter in connection with any public offering shall, in the exercise of their joint good faith judgment, determine that immediate resales by holders of Registrable Securities could have a material adverse effect on the Company’s ability to complete the any public offering, the Company and such managing underwriter or placement agent may restrict resales of such Registrable Securities (a “Lock-Up”) for a period of up to ninety (90) days following such public offering. It is anticipated therefore, that Investors’ Registrable Securities may not be publicly sold by them for a period of 90 days after the date the Commission declares any registration statement related to such public offering is declared effective.

|

| SEC Filings |

The Company will be responsible for timely filing of all required documents including Form D, and will pay for all legal opinions of Company counsel associated with all future Rule 144 sales of the Common Stock and Warrant Shares.

|

| Investors: | All investors must be “accredited investors” as defined under Rule 501 of Regulation D and amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act, and meet all other suitability requirements set forth herein under the caption “Investor Suitability Requirements,” and as contained in the subscription documents attached as Exhibits to this Memorandum. |

| Escrow: |

It is anticipated that all funds from this Offering shall be held in a non-interest bearing trust escrow/trust account with Signature Bank, or another nationally recognized escrow agent, as escrow agent, and shall comply with all applicable FINRA and Commission rules, and state and federal laws. The subscription amount for the Units will be paid to the escrow account established by the escrow agent, by either check or wire, and held in escrow until satisfaction of all the conditions to the Closing.

|

| Subscription Procedures: |

Accredited investors interested in subscribing for Units in this Offering must do the following:

· Deliver a completed and executed Subscription Agreement, which is attached to this Memorandum as Exhibit A, to the Placement Agent at the address provided in the Subscription Agreement.

· Deliver the purchase price in the amount of $10,000 per Unit to the Escrow Agent by check or by wire transfer using the wire transfer instructions provided in the Subscription Agreement.

Funds and executed documents will be held in escrow until a Closing of this Offering at which time escrowed funds and documents will be released by the Escrow Agent. Promptly following a Closing, certificates for the Common Stock and Warrants purchased in this Offering will be issued to the subscribers. If this Offering is not completed for any reason, all proceeds deposited into escrow will be returned to the subscribers without interest or deduction.

|

| 18 |

| Restrictions on Transfer: |