Attached files

| file | filename |

|---|---|

| EX-23.2 - Pay My Time Ltd | ex23-2.htm |

| EX-21 - Pay My Time Ltd | ex21.htm |

| EX-5.1 - Pay My Time Ltd | ex5-1.htm |

| EX-3.I - Pay My Time Ltd | ex3i.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Amendment No. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PAY MY TIME LTD

(Exact name of registrant as specified in its charter)

England and Wales

(State or other jurisdiction of incorporation or organization)

7372

(primary Standard Industrial Classification Code Number)

Not applicable

(IRS Employer ID No.)

30, Percy Street, London W1T2DB

United Kingdom

(Address of principal offies) (zip code)

+4402074671700

(Registrant’s telephone number, including area code)

Robert L. B. Diener, Esq.

Law Offices of Robert Diener

41 Ulua Place

Haiku, HI 96708

(808) 573-6163

From time to time following the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b- 2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer (Do not check if a smaller reporting company) [ ] Smaller reporting company [X]

CALCULATION OF REGISTRATION FEE

| Title

of each class of securities to be registered | Amount

to be registered | Proposed

maximum offering price per share(1) | Proposed maximum aggregate offering price | Amount

of registration fee | ||||||||||||

| Ordinary Shares offered by the Company | 500,000 | $ | 10.00 | $ | 5,000,000 | $ | 579.50 | |||||||||

| Ordinary Shares offered by Selling Shareholders | 1,000,000 | $ | 10.00 | $ | 10,000,000 | $ | 1,159.00 | |||||||||

| Total | 1,500,000 | $ | 10.00 | $ | 15,000,000 | $ | 1,738.50 | |||||||||

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. The shareholders may not sell these securities until the registration statement filed with the Securities Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Explanatory Note

The purpose of this Amendment #1 to the Form S-1 Registration Statement filed on March 3, 2017 is to make revisions and amendments based upon the Commission’s comment letter dated March 30, 2017.

PROSPECTUS

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE OR JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

PAY MY TIME LTD

500,000 Ordinary Shares

1,000,000 Selling Shareholder Ordinary Shares

This is the initial offering of ordinary shares of Pay My Time Ltd and no public market currently exists for the securities being offered. We are offering for sale a total of 500,000 Ordinary Shares at a fixed price of $10.00 per share. In addition, selling shareholders are offering an additional 1,000,000 Ordinary Shares. There is no minimum number of shares that must be sold by the Company for the offering to proceed, and we will retain the proceeds from the sale of any of the shares offered by the Company. The offering of shares by the Company is being conducted on a self-underwritten, best efforts basis, which means the Company will attempt to sell the shares. This Prospectus will permit the Company to sell the shares directly to the public, with no commission or other remuneration payable to it for any shares it may sell. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The shares will be offered at a fixed price of $10.00 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus. The offering shall terminate on the earlier of (i) when the offering period ends (180 days from the effective date of this prospectus), (ii) the date when the sale of all 500,000 shares is completed or (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all 500,000 shares registered under the Registration Statement of which this Prospectus is part .

| 2 |

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our Ordinary Shares are not traded on any exchange or market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application for our Ordinary Shares to be eligible for public trading. Ultimately, the Company would intend, when eligible, to apply to be traded on the NYSE MKT or other additional markets. To be eligible for quotation on the NYSE MKT, issuers must remain current in their quarterly and annual filings with the SEC. If we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the NYSE MTK. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our Ordinary Shares will ever be quoted on a stock exchange or a quotation service or that any market for our Common Shares will develop. We are not a blank check company as defined in Rule 419 of Regulation C under the Securities Act and have no plans or intentions to engage in a business combination after the offering.

Pay My Time Ltd is an early development stage company and has recently started its operation. To date we have been involved primarily in organizational activities and have not yet made any sales. We do not have sufficient capital for operations. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE SECTION OF THIS PROSPECTUS ENTITLED “RISK FACTORS” BEFORE BUYING ANY ORDINARY SHARES OF PAY MY TIME LTD.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information contained in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by PAY MY TIME LTD with the Securities and Exchange Commission. The selling shareholders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated __________, 2017

| 3 |

TABLE OF CONTENTS

| 4 |

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

For purposes of this prospectus, unless otherwise indicated or the context otherwise requires, all references herein to “PMT” “we,” “us,” the “Company” and “our,” refer to PAY MY TIME LTD, a Company registered in England and Wales.

Without taking into account the offering, we will run out of funds approximately June 30, 2017. Following this offering, we will additionally incur public company reporting costs of approximately $100,000 per year or $25,000 per quarter. To fund the Company’s operating expenses following June 30, 2017, the Company will clearly require additional funding for ongoing operations and to finance additional growth. There is no guarantee that we will be able to raise any additional capital and have no current arrangements for any such financing.

Our near term financing requirement (less than 6 months), is anticipated to be approximately $250,000, which includes a monthly overhead burn rate of $30,000, public reporting costs and the remainder allocated to the Company’s general working capital.

Beyond our near term financing requirement (more than 6 months), we will need an additional approximately $5,000,000 to implement the Company’s plan of operations. Of this amount, we anticipate that we will need approximately $1,500,000 of the total amount required by the end of calendar year 2017.

The foregoing represents the Company’s best estimates as of the date of this Prospectus and may materially vary based upon actual experience.

The inability to obtain this funding either in the near term and/or longer term will materially affect the ability of the Company to implement its business plan of operations and jeopardize the viability of the Company. In that case, the Company may need to suspend its operations and reevaluate and revise its plan of operations

Business Overview

From inception (December 19, 2014) with his fully owned Swiss subsidiary PMTP Sa, Pay My Time LTD (the “Company”) was organized to develop and market systems which run in conjunction with emails to monetize the ordinary exchange of e-mails. In this regard, the Company seeks to reshape the current email market by delivering a new suite of services providing added value to the user while supporting profitable email utilization, processing and management. The Company’s suite of services includes:

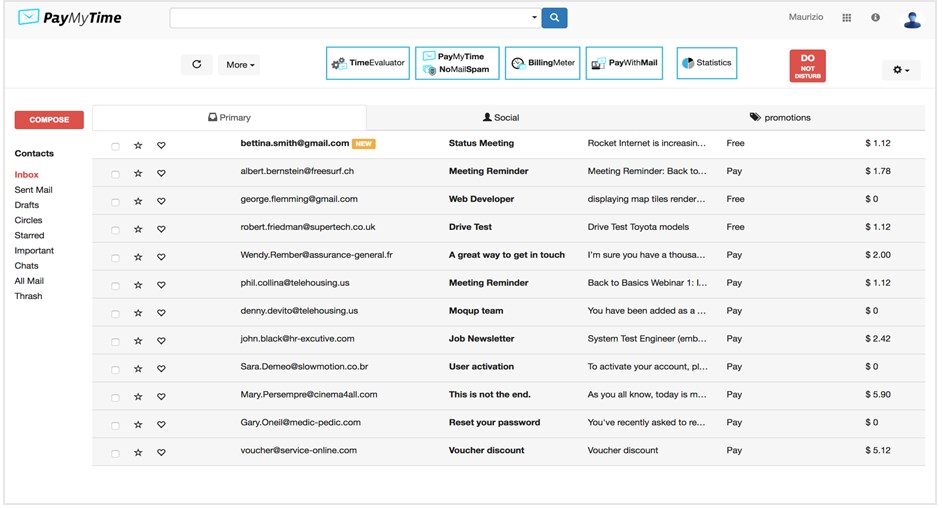

| ● | PayMyTime®—a system under which the user receives only emails of relevance, and gets paid received email based on the user’s time evaluation and relationship with the sender; the service enables the user to bill its contacts for the messages they wish to send to the user; the user defines the database and chooses whom to bill, when to bill and how much to bill. |

http://www.paymytime.com/pmt/investors-documentation/video-paymytime/

| 5 |

| ● | NoMailSpam®—a system which enables the user to cut the receipt of spam received by the user by 100%; all received emails are filtered by the Company’s engine which only permits emails which have been screened by the user’s established parameters. | |

| http://www.paymytime.com/pmt/investors-documentation/video-nomailspam/ | ||

| ● | BillingMeter®—a system which tracks time spent on emails and other documents and delivers certified bills to email senders based on user-established algorithms. | |

| http://www.paymytime.com/pmt/investors-documentation/video-billingmeter/ |

| 6 |

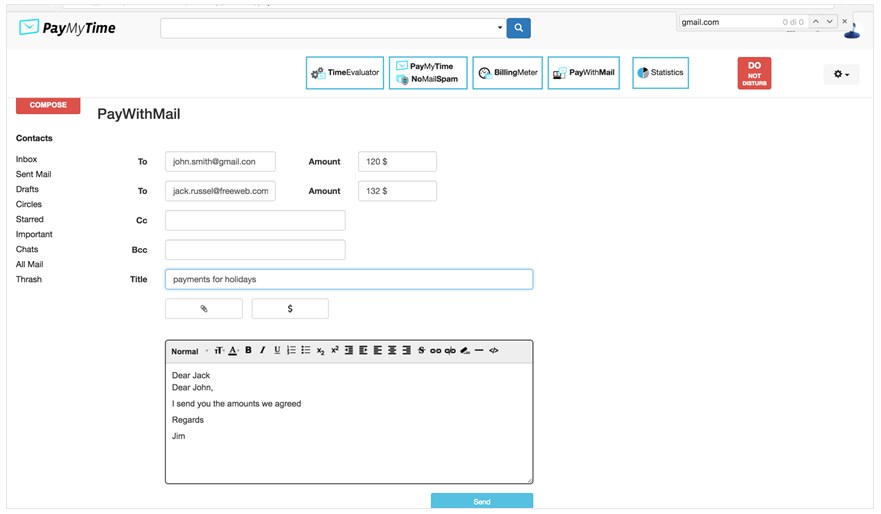

| ● | PayWithMail®—a system which enables the user to send and receive payments via email by simply attaching the payment to an email and sending the email. |

http://www.paymytime.com/pmt/investors-documentation/video-paywithmail/

| 7 |

Each of these products can be delivered as standalone services or as a seamlessly integrated system. At this time, the Company has four pending patents related to the PayMyTime® services:

| ● | 14/937,234 A SYSTEM FOR MANAGING TRANSMISSION OF EMAILS FROM A SENDER TO A RECIPIENT | |

| ● | PCT/IB2016/056650 A SYSTEM FOR MANAGING TRANSMISSION OF EMAILS FROM A SENDER TO A RECIPIENT | |

| ● | 15/132,725 A METHOD FOR GENERATING AN EVALUATION OF THE ACTIVITIES OF A USER ON A VIRTUAL DOCUMENT | |

| ● | 15/158,612 A SYSTEM FOR MANAGING VIRTUAL TRANSMISSION OF MONEY FROM A SENDER TO A RECIPIENT | |

| ● | 15/345,974 A SYSTEM AND A METHOD FOR LINITING THE WASTE OF TIE OF READING NON-USEFUL EMAILS |

The core of the Company’s platform of services is PayMyTime®.

http://www.paymytime.com/pmt/investors-documentation/pmtsuite/

http://www.paymytime.com/pmt/investors-documentation/video-pmt-investors/

Through PayMyTime®, the Company seeks to introduce an innovative means of addressing email consultation and use. By implementing the Company’s services and products, the goal is to lighten the users time commitment to reviewing and responding to emails by delivering only those emails which are essential to the user’s work and monetizing emails to support the user’s business. Pursuant to the Company’s business model, the Company will collect a percentage fee from each paid and received email. Users are not required to pay any subscription or license fee for the service. Once an email is received by the user, the Company retains a variable percentage of the sum payable to the user. At this time, the Company has one pending patent related to the PayMyTime® services.

BillingMeter® is a Swiss-based service that analyzes and certifies the time spent by users on particular bodies of work. Its mission is to provide time certification for business users who work on time-based fees, and thereby enable and simplify work time tracking and reporting through reliable and certified analysis systems. BillingMeter® is provided to all users of PayMyTime® after payment of a monthly subscription fee of $10.00. The subscription includes the BillingMeter® software that delivers time-certified bills to customers. At this time, the Company has one pending patent related to the BillingMeter® services.

PayWithMail® gives users better ways to send and receive payments, helping them safely access and move their money, offering the possibility of making cash transactions via email. The objective of PayWithMail ® is to make payments as easy as sending an email. PayWithMail ®, will charge a minimal fee on every transaction.

The Company intends to utilize a viral-based diffusion of the services it offers. In this manner, through low charges and direct benefits to users, the Company believes that it will be able to distribute its product and service offerings to a vast number of users in a relatively short timeframe.

All of the Company’s products and services are fully-developed and ready for immediate roll-out, which the Company intends to begin commencing in the 4nd calendar quarter of 2017.

| 8 |

Initial Capital Formation

PMT Sa, a Swiss company was formed on December 19, 2014 with a equity capital of 20,000 Swiss Francs. (US$ 20,200). The equity capital was increase to 40,000 Swiss Francs (US$ 40,000) on December 28 2015, and to 100,000 Swiss Franc (US$ 101,000) on June 2, 2016. On June 29, 2016, 100% of PMT’s Sa shares were sold for a a purchase price of 1,300,000 Swiss Franc (US$ 1,313,000) to Pay My Time LTD. Pay My Time LTD raised an additional US$ 313,000 in a private offering completed June 30, 2016 wherein it sold shares comprising a 16% interest in the Company based on a pre-money company valuation of US$1,956,250. The Registrant sold these Company shares under an exemption from registration provided by Section 4(2) of the Securities Act of 1933 (“Securities Act”) and to offshore holders, under an exemption from registration provided by Regulation S promulgated under the Securities Act.

Without taking into account this offering, we would have run out of funds approximately on June 30, 2017. We expect that the funds raised in this offering (if fully committed) will provide us with cash to fund our operations for January 2020.

Following our becoming a reporting company, we will additionally incur public company reporting costs of approximately $100,000 per year or $25,000 per quarter. To fund the Company’s operating expenses following June 30, 2017, the Company will clearly require additional funding for ongoing operations. There is no guarantee that we will be able to raise any additional capital and have no current arrangements for any such financing.

Emerging Growth Company Status Under the Jumpstart Our Business Startups (“JOBS”) Act

Because we generated less than $1 billion in total annual gross revenues during our most recently completed fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups (“JOBS”) Act.

We will lose our emerging growth company status on the earliest occurrence of any of the following events:

1. On the last day of any fiscal year in which we earn at least $1 billion in total annual gross revenues, which amount is adjusted for inflation every five years;

2. On the last day of the fiscal year of the issuer following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement;

3. On the date on which we have, during the previous 3-year period, issued more than $1 billion in non- convertible debt; or

4. On the date on which such issuer is deemed to be a “large accelerated filer”, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. A “large accelerated filer” is an issuer that, at the end of its fiscal year, meets the following conditions:

a. It has an aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of $700 million or more as of the last business day of the issuer’s most recently completed second fiscal quarter;

b. It has been subject to the requirements of section 13(a) or 15(d) of the Act for a period of at least twelve calendar months; and

c. It has filed at least one annual report pursuant to section 13(a) or 15(d) of the Act.

As an emerging growth company, exemptions from the following provisions are available to us:

1. Section 404(b) of the Sarbanes-Oxley Act of 2002, which requires auditor attestation of internal controls;

2. Section 14A(a) and (b) of the Securities Exchange Act of 1934, which require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation;

3. Section 14(i) of the Exchange Act (which has not yet been implemented), which requires companies to disclose the relationship between executive compensation actually paid and the financial performance of the company;

4. Section 953(b)(1) of the Dodd-Frank Act (which has not yet been implemented), which requires companies to disclose the ratio between the annual total compensation of the CEO and the median of the annual total compensation of all employees of the companies; and

5. The requirement to provide certain other executive compensation disclosure under Item 402 of Regulation S-K. Instead, an emerging growth company must only comply with the more limited provisions of Item 402 applicable to smaller reporting companies, regardless of the issuer’s size.

Pursuant to Section 107 of the JOBS Act, an emerging growth company may choose to forgo such exemption and instead comply with the requirements that apply to an issuer that is not an emerging growth company. We have elected to maintain our status as an emerging growth company and take advantage of the JOBS Act provisions.

| 9 |

This Prospectus

The 500,000 shares to be issued in connection with this Offering would not be eligible for re-sale unless duly registered with the U.S. Securities and Exchange Commission. The purpose of this registration statement is to register the shares sold in that offering.

| Shares currently outstanding | 3,000,000 shares(1) |

| Shares offered by the Company | 500,000 shares |

| Shares offered by the Selling Shareholders | 1,000,000 shares |

| Use of proceeds | Working capital to develop the technology and the products to be launched during 2017. |

| (1) | Shares outstanding as of December 31, 2016 |

USE OF PROCEEDS

If the Company’s Offering of 500,000 new shares is fully subscribed, the Company will raise the gross amount of $5,000,000. The following shows use of the proceeds of the Company Offering at various levels of funding commitments.

| Assuming Net $5.0 million raised (100% of shares offered): | $2,500,000 for Technical Department Development | |

| $1,700,000 for Marketing and general administration | ||

| $500,000 for Sales Department Salaries & Expenses | ||

| $ 300,000 for Board and Management Salaries & Expenses | ||

| Assuming Net $4.0 million raised (80% of shares offered): | $2,200,000 for Technical Department Development | |

| $1,200,000 for Marketing and general administration | ||

| $500,000 for Sales Department Salaries & Expenses | ||

| $100,000 for Board and Management Salaries & Expenses | ||

| Assuming Net $2.5 million raised (50% of shares offered): | $1,500,000 for Technical Department Development | |

| $500,000 for Marketing and general administration | ||

| $500,000 for Sales Department Salaries & Expenses | ||

| $0 for Board and Management Salaries & Expenses | ||

| Assuming Net $1.25 million raised (25% of shares offered): | $500,000 for Technical Department Development | |

| $500,000 for Marketing and general administration | ||

| $250,000 for Sales Department Salaries & Expenses | ||

| $0 for Board and Management Salaries & Expenses |

We will not receive any proceeds from the sale of shares by selling shareholders in this offering.

Before you invest in our securities, you should be aware that there are various risks. You should consider carefully these risk factors, together with all of the other information included in this annual report before you decide to purchase our securities. If any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially adversely affected.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue as a going concern and our ability to obtain future financing.

In their report dated January 31, 2017 our independent auditors stated that our financial statements for the period ended December 31, 2016 were prepared assuming that we would continue as a going concern and they expressed substantial doubt about our ability to continue as a going concern. This doubt is based entirely upon the Company’s current lack of resources to execute its business plan. Our ability to continue as a going concern is an issue as we have just commenced operations as a development stage company. In our early stages of operations, we expect to experience net losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. If we are unable to continue as a going concern, you may lose your entire investment.

| 10 |

Without taking into account the offering, we will run out of funds approximately June 30, 2017. Following this offering, we will additionally incur public company reporting costs of approximately $100,000 per year or $25,000 per quarter. To fund the Company’s operating expenses following June 30, 2017, the Company will clearly require additional funding for ongoing operations and to finance such additional business it may identify. There is no guarantee that we will be able to raise any additional capital and have no current arrangements for any such financing.

Our near term financing requirement (less than 12 months), is anticipated to be approximately $500,000, which includes a monthly overhead burn rate of $30,000, public reporting costs and the remainder allocated to general working capital. Beyond our near term financing requirement (more than 12 months), we will need an additional approximately $5,000,000 to implement the Company’s plan of operations.

The foregoing represents the Company’s best estimates as of the date of this Prospectus and may materially vary based upon actual experience.

The inability to obtain this funding either in the near term and/or longer term will materially affect the ability of the Company to implement its business plan of operations and jeopardize the viability of the Company. In that case, the Company may need to suspend its operations and reevaluate and revise its plan of operations

We were formed in December 2014 and have a limited operating history and, accordingly, you will not have any basis on which to evaluate our ability to achieve our business objectives.

We are an early development stage company with no operating results to date. Since we do not have an established operating history and have not recorded any sales yet, you will have no basis upon which to evaluate our ability to achieve our business objectives.

The absence of any significant operating history for us makes forecasting our revenue and expenses difficult, and we may be unable to adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As a result of the absence of any operating history for us, it is difficult to accurately forecast our future revenue. In addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to forecast because they generally depend on our ability to promote and sell our services. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which would result in further substantial losses. We may also be unable to expand our operations in a timely manner to adequately meet demand to the extent it exceeds expectations.

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

We are currently in the early stages of developing our business. There can be no assurance that at this time that we will operate profitably or that we will have adequate working capital to meet our obligations as they become due.

Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks include the following:

| ● | Competition |

| 11 |

| ● | ability to anticipate and adapt to a competitive market; | |

| ● | ability to effectively manage expanding operations; amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, and infrastructure; and | |

| ● | dependence upon key personnel to market and sell our services and the loss of one of our key managers may adversely affect the marketing of our services. |

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected and we may not have the resources to continue or expand our business operations.

We have no profitable operating history and May Never Achieve Profitability

From inception of the Swiss fully owned subsidiary, in December 2014, Pay My Time Ltd (the “Company”) was organized to develop and market systems which run in conjunction with emails to monetize the ordinary exchange of e-mails. In this regard, the Company seeks to reshape the current email market by delivering a new suite of services providing added value to the user while supporting profitable email utilization, processing and management. As of the date of this prospectus, the Company has yet to engage in any meaningful business activities and is an early development stage company. Through December 31, 2016, the Company has not generated any revenues and the principals of the Company have worked without salary and the Company has operated with minimal overhead. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, low-capitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies, and unanticipated difficulties regarding the marketing and sale of our services. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our Ordinary Shares could become worthless and investors in our Ordinary Shares or other securities could lose their entire investment.

The inability to obtain this funding either in the near term and/or longer term will materially affect the ability of the Company to implement its business plan of operations and jeopardize the viability of the Company. In that case, the Company may need to suspend its operations and reevaluate and revise its plan of operations.

Dependence on our Management, without whose services Company business operations could cease.

At this time, our management is wholly responsible for the development and execution of our business plan. Our management is under no contractual obligation to remain employed by us, although they have no present intent to leave. If our management should choose to leave us for any reason before we have hired additional personnel our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our Ordinary Shares or other securities could lose their entire investment.

Our officers and directors devote limited time to the Company’s business and are engaged in other business activities

At this time, none of our officers and directors devotes his full-time attention to the Company’s business and each expect to devote approximately ten (10) hours per week to the Company’s business . Without full-time devoted management, the Company could be forced to cease operations and investors in our Ordinary Shares or other securities could lose their entire investment.

| 12 |

Our current officers and directors currently do not own any Ordinary Shares. Our current officers and directors have the power to make all major decisions regarding our affairs, including decisions regarding whether or not to issue stock and for what consideration, whether or not to sell all or substantially all of our assets and for what consideration and whether or not to authorize more stock for issuance or otherwise amend our charter or bylaws.

Our two largest shareholders hold a controlling interest in the Company.

Our two largest shareholders, Mount Street Gardens Holdings Ltd. (47.8% ownership) and Kerbstone Ltd. (25.2% ownership), in the aggregate own 73% of the outstanding stock of the Company. As such, these parties have the ability to cast a majority of votes on all matters which are submitted to the shareholders. There is no guarantee that they will use this voting majority to act in the best interests of all shareholders of the Company.

Lack of additional working capital may cause curtailment of any expansion plans while raising of capital through sale of equity securities would dilute existing shareholders’ percentage of ownership

Without taking into account the offering, we will run out of funds approximately June 30, 2017. Following this offering, we will additionally incur public company reporting costs of approximately $100,000 per year or $25,000 per quarter. To fund the Company’s operating expenses following June 30, 2017, the Company will clearly require additional funding for ongoing operations and to finance additional products and services it may identify. There is no guarantee that we will be able to raise any additional capital and have no current arrangements for any such financing. A shortage of capital would affect our ability to fund our working capital requirements. If we require additional capital, funds may not be available on acceptable terms, if at all. In addition, if we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. If funds are not available, we could be placed in the position of having to cease all operations.

We do not presently have a traditional credit facility with a financial institution. This absence may adversely affect our operations

We do not presently have a traditional credit facility with a financial institution. The absence of a traditional credit facility with a financial institution could adversely impact our operations. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and product development efforts. Without such credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve a critical mass of revenues could adversely affect our financial condition

No assurance can be given that we will be able to successfully achieve a critical mass of revenue in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of revenues, the Company could be forced to cease operations.

Our success is substantially dependent on general economic conditions and business trends, a downturn of which could adversely affect our operations

The success of our operations depends to a significant extent upon a number of factors relating to consumer spending. These factors include economic conditions, activity in the financial markets, general business conditions, personnel cost, inflation, interest rates and taxation. Our business is affected by the general condition and economic stability of our consumers and their continued willingness to accept our products and services. An overall decline in the economy could cause a reduction in our sales and the Company could face a situation where it never achieves a critical mass of revenues and thereby be forced to cease operations.

| 13 |

Changes in generally accepted accounting principles could have an adverse effect on our business financial condition, cash flows, revenue and results of operations

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with no current full-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

We incur costs associated with SEC reporting compliance.

The Company made the decision to become an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys’ fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $100,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

| 14 |

The availability of a large number of authorized but unissued shares of common stock may, upon their insurance, lead to dilution of existing shareholders.

As of December 1, 2016, 3,000,000 shares were issued and outstanding and we expect to issue up to an additional 500,000 shares in this Offering. At this time, the Company does not have any limitation on the number of additional shares it may issue. In this regard, additional shares may be issued by our board of directors without further shareholder approval. The issuance of large numbers of shares, possibly at below market prices, is likely to result in substantial dilution to the interests of other shareholders. In addition, issuances of large numbers of shares may adversely affect the market price of our common stock.

Our need for additional capital that could dilute the ownership interest of investors.

We require substantial working capital to fund our business. If we raise additional funds through the issuance of equity, equity-related or convertible debt securities, these securities may have rights, preferences or privileges senior to those of the rights of holders of our Ordinary Shares and they may experience additional dilution. We cannot predict whether additional financing will be available to us on favorable terms when required, or at all. Since our inception, we have experienced negative cash flow from operations and expect to experience significant negative cash flow from operations in the future. The issuance of additional Ordinary Shares or Preference Shares by the Company may have the effect of further diluting the proportionate equity interest and voting power of holders of our Ordinary Shares.

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. Our board of directors has not designated an Audit Committee and we do not have any outside directors. We do not have a dedicated full time Chief Financial Officer. We hope to develop an adequate internal accounting control to budget, forecast, manage and allocate our funds and account for them. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

We may not have adequate insurance coverage

We currently have only general liability insurance and we cannot assure you that we would not face liability upon the occurrence of any uninsured event which could result in any loss or damages being assessed against the Company.

We are subject to numerous laws and regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to extensive national, state and local laws and regulations relating to the financial markets. Future laws or regulations, any adverse change in the interpretation of existing laws and regulations or our failure to comply with existing legal requirements may result in substantial penalties and harm to our business, results of operations and financial condition. We may be required to make large and unanticipated capital expenditures to comply with governmental regulations. Our operations could be significantly delayed or curtailed and our cost of operations could significantly increase as a result of regulatory requirements or restrictions. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

| 15 |

We do not intend to pay cash dividends in the foreseeable future

We currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

There is currently no market for our securities and there can be no assurance that any market will ever develop or that our common stock will be listed for trading.

There has not been any established trading market for our common stock and there is currently no market for our securities. Even if we are ultimately approved for trading on the NYSE Standard 2 or other market(s), there can be no assurance as the prices at which our Ordinary Shares will trade if a trading market develops, of which there can be no assurance. Until our Ordinary Shares are fully distributed and an orderly market develops, (if ever) in our Ordinary Shares, the price at which it trades is likely to fluctuate significantly.

Prices for our Ordinary Shares will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for the Ordinary Shares, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of us and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for our Ordinary Shares. Due to the anticipated low price of the securities, many brokerage firms may not be willing to effect transactions in the securities.

Our Ordinary Shares are subject to the Penny Stock Regulations

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our common stock, when and if a trading market develops, may fall within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker- dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market- maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the ‘penny stock’ rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

Our Ordinary Shares are illiquid and subject to price volatility unrelated to our operations

The market price of our Ordinary Shares could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our Ordinary Shares, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock. Sales of substantial amounts of Ordinary Shares, or the perception that such sales could occur, could adversely affect the market price of our Ordinary Shares and could impair our ability to raise capital through the sale of our equity securities.

| 16 |

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our shares. Our failure to apply these funds effectively could have a material adverse effect on our business, stunt the growth of our business domestically and in foreign markets, and cause the price of our Ordinary Shares to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the price per Ordinary Share being offered is substantially higher than the net tangible book value per Ordinary Share, you will suffer substantial dilution in the net tangible book value of the Ordinary Shares you purchase in this offering. Based on the public offering price of $10.00 per share, if you purchase Ordinary Shares in this offering, you will suffer immediate and substantial dilution of $10.00 per share in the net tangible book value of the Ordinary Shares. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase Ordinary Shares in this offering.

You may experience future dilution as a result of future equity offerings and other issuances of our common stock or other securities. In addition, this offering and future equity offerings and other issuances of our Ordinary Shares or other securities may adversely affect our Ordinary Share price.

In order to raise additional capital, we may in the future offer additional shares of our Ordinary Shares or other securities convertible into or exchangeable for our common stock, including but not limited to Preference Shares and convertible debt. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional Ordinary Shares or securities convertible into Ordinary Shares in future transactions may be higher or lower than the price per share in this offering. In addition, the sale of shares in this offering and any future sales of a substantial number of Ordinary Shares in the public market, or the perception that such sales may occur, could adversely affect the price of our Ordinary Shares. We cannot predict the effect, if any, that market sales of those shares of Ordinary Shares or the availability of those Ordinary Shares for sale will have on the market price of our Ordinary Shares.

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or other Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, shareholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

| 17 |

We may be deemed to be a “shell company”

Rule 405 promulgated under the Securities Act of 1933 defines a “shell company” as a registrant… that has: no or nominal operations; and either (a) no or nominal assets; (b) assets consisting solely of cash and cash equivalents; or (c) assets consisting of any amount of cash and cash equivalents and nominal other assets. While the Company does not believe that it is a “shell company”, designation as a “shell company” could result in the application of Rule 144(i), which would limit the availability of the exemption from registration provided in Rule 144 for certain shares of Company common stock and could result in certain persons affiliated with the Company being deemed “statutory underwriters under Rule 145(c). In addition, if the Company were to be deemed a “shell company”, it would be prohibited from filing a registration statement on Form S-8 and be subject to certain enhanced reporting requirements. Designation as a “shell company” could also have a detrimental impact on the Company’s ability to attract additional capital through subsequent unregistered offerings.

For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies.

In April 2012, President Obama signed into law the Jumpstart Our Business Startups Act, or the JOBS Act. The JOBS Act contains provisions that, among other things, relax certain reporting requirements for “emerging growth companies,” including certain requirements relating to accounting standards and compensation disclosure. We are classified as an emerging growth company. For as long as we are an emerging growth company, which may be up to five full fiscal years, unlike other public companies, we will not be required to, among other things, (1) provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes Oxley Act of 2002, (2) comply with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer, (3) comply with any new audit rules adopted by the PCAOB after April 5, 2012 unless the SEC determines otherwise, (4) provide certain disclosure regarding executive compensation required of larger public companies or (5) hold shareholder advisory votes on executive compensation.

Further, our independent registered public accounting firm is not yet required to formally attest to the effectiveness of our internal controls over financial reporting, and will not be required to do so for as long as we are an “emerging growth company” pursuant to the provisions of the JOBS Act.

Under the JOBS Act we have elected to use an extended period for complying with new or revised accounting standards.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1), which allows us to delay adoption of new or revised accounting standards that have different effective dates for public and private until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

| 18 |

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

If the market does not accept or embrace our offerings of products and services, our business may fail.

The products and services we are offering have not been tested in the market on a large-scale basis. As a result, we can only speculate as to the market acceptance of these products and services. No assurance can be given that the market will accept our products and services, or any of them. If the public fails to accept our products and services to a satisfactory degree, our business may fail.

Our market is highly competitive.

The market for computer software is highly competitive and most competitive companies and products will be far better financed and capitalized and have substantially greater resources than ours. While we believe that our products and services are competitive with services provided by other companies, there is no guarantee that we will be able to effectively compete against them, and if we do not effectively compete, our business may fail.

If we fail to protect our intellectual property and proprietary rights adequately, our business could be adversely affected.

We seek to protect our intellectual property through trade secrets, copyrights, confidentiality, non-compete and nondisclosure agreements, trademarks, domain names and other measures, some of which afford only limited protection. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our intellectual property or to obtain and use property that we regard as proprietary. We cannot assure you that our means of protecting our proprietary rights will be adequate. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as the laws of the United States. Intellectual property protections may also be unavailable, limited or difficult to enforce in some countries, which could make it easier for competitors to steal our intellectual property. Our failure to protect adequately our intellectual property and proprietary rights could adversely affect our business, financial condition and results of operations.

An assertion by a third party that we are infringing its intellectual property could subject us to costly and time-consuming litigation or expensive licenses and our business might be harmed.

We might not prevail in any intellectual property infringement litigation given the complex technical issues and inherent uncertainties in such litigation. Defending such claims, regardless of their merit, could be time- consuming and distracting to management, result in costly litigation or settlement, cause development delays, or require us to enter into licensing agreements.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. This prospectus includes statements regarding our plans, goals, strategies, intent, beliefs or current expectations. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished. These forward looking statements can be identified by the use of terms and phrases such as “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions “may,” “could,” “should,” etc. Items contemplating or making assumptions about, actual or potential future sales, market size, collaborations, and business opportunities also constitute such forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward- looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward- looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

| 19 |

DETERMINATION OF OFFERING PRICE

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of the shares was arbitrarily determined. The offering price of the Company’s shares has been determined arbitrarily by us and does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. Although our common stock is not listed on a public exchange, we will be initially filing to obtain a listing on the NYSE MKT, utilizing Standard 2, concurrently with or shortly after the filing of this prospectus. In order to be quoted on the NYSE MKT under listing standard 2, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial public offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

Our historical net tangible book value as of December 31, 2016 was approximately ($143,150), or approximately ($0.0477) per share of Ordinary Stock (after adjusting for all forward stock splits). Our historical net tangible book value is the amount of our total tangible assets less our liabilities. Historical net tangible book value per common share is our historical net tangible book value divided by the number of shares of Ordinary Stock outstanding as of December 31, 2016.

After giving effect to the sale of 500,000 shares of our Ordinary Stock and in this offering at the public offering price of $10.00 per share of common stock and after deducting the estimated offering expenses payable by us, our as-adjusted net tangible book value as of December 31, 2016 would have been approximately $4,756,850 or approximately $1.36 per share of Ordinary Stock. This represents an immediate increase in pro forma net tangible book value of approximately $1.41 per share to our existing Ordinary stockholders, and an immediate dilution of approximately $8.59 per Ordinary Share to new investors purchasing securities in this offering at the assumed public offering price.

The following table illustrates this dilution on a per share basis:

| Assumed Public Offering Price per Share | $ | 10.00 | ||

| Historical net tangible book value per Ordinary Share as of December 31, 2016 | $ | (0.0477 | ) | |

| Pro forma increase in net tangible book value per share attributable to investors in this offering | $ | 1.40 | ||

| As adjusted net tangible book value per Ordinary Share after this offering | $ | 1.36 | ||

| Dilution per share to investors participating in this offering | $ | 8.59 |

| 20 |

The foregoing discussion and table are based on 3,000,000 shares of Ordinary Stock outstanding as of December 31, 2016.

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

Holders

As of December 31, 2016, there were 5 record holders of our Ordinary Shares. As of December 31, 2016, there were 3,000,000 Ordinary Shares issued and outstanding. No public market currently exists for shares or preference shares. We intend to apply to have our shares initially listed for quotation on the NYSE MKT and/or other trading market(s).

The Securities Enforcement and Penny Stock Reform Act of 1990

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

A purchaser is purchasing penny stock which limits the ability to sell the stock. The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stocks for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Commission, which:

| ● | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; | |

| ● | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended; | |

| ● | contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price; | |

| ● | contains a toll-free telephone number for inquiries on disciplinary actions; | |

| ● | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and | |

| ● | contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation; |

| 21 |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, to the customer:

| ● | the bid and offer quotations for the penny stock; | |

| ● | the compensation of the broker-dealer and its salesperson in the transaction; | |

| ● | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and | |

| ● | monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, shareholders may have difficulty selling their securities.

Equity Compensation Plan Information

We have no outstanding stock option or other equity compensation plans. The Selling Shareholders have agreed (on a pro-rata basis) to deliver, without consideration, the following shares to the Company’s directors as compensation for their services upon listing of the Company’s shares in the public market:

Michele Collini 5,000 shares

Tom Brooks 5,000 shares

Alon Goldreich 5,000 shares

Reports

Upon effectiveness of our initial registration statement, we will be subject to certain reporting requirements and will furnish annual financial reports to our shareholders, certified by our independent accountants, and will furnish unaudited quarterly financial reports in our quarterly reports filed electronically with the SEC. All reports and information filed by us can be found at the SEC website, www.sec.gov.

Stock Transfer Agent

The stock transfer agent for our securities is Island Stock Transfer, Inc.0 Roosevelt Blvd, Suite 301, Clearwater, FL 33760

Dividend Policy

We have not previously declared or paid any dividends on our shares and do not anticipate declaring any dividends in the foreseeable future. The payment of dividends on our shares is within the discretion of our board of directors. We intend to retain any earnings for use in our operations and the expansion of our business. Payment of dividends in the future will depend on our future earnings, future capital needs and our operating and financial condition, among other factors that our board of directors may deem relevant. We are not under any contractual restriction as to our present or future ability to pay dividends.

| 22 |

FINANCIAL INFORMATION SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated statement of operations data contains consolidated statement of operations data and consolidated balance sheet for the years ended December 31, 2016 and December 31, 2015. The consolidated statement of operations data and balance sheet data were derived from the audited consolidated financial statements. Such financial data should be read in conjunction with the consolidated financial statements and the notes to the consolidated financial statements starting on page F-1 and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| As

of 12/31/2016 |

As

of 12/31/2015 |

|||||||

| Balance Sheet Data: | ||||||||

| Assets | $ | 123,566 | $ | 35,201 | ||||

| Liabilities | $ | 156,087 | $ | 1,513 | ||||

| Total Shareholders’ Equity (Deficit) | $ | (32,521 | ) | $ | 33,688 | |||

| Statement of Operations Data: | ||||||||

| Revenue | $ | - | $ | - | ||||

| Operating Expenses | $ | 456,890 | $ | 5,929 | ||||

| Other Expenses | $ | - | $ | - | ||||

| Net Loss | $ | (456,890 | ) | $ | (5,929 | ) | ||

| Basis and Diluted Loss Per Share | $ | (0.23 | ) | $ | (0.01 | ) | ||

| Weighted Average Number of Shares Outstanding | 2,004,000 | 506,762 | ||||||

| 23 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operation for the periods ending December 31, 2016 and December 31, 2015 and should be read in conjunction with the financial statements and the notes to those statements that are included elsewhere in this report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the “Risk Factors,” “Cautionary Notice Regarding Forward-Looking Statements” and “Our Business” sections in this Form S-1. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Overview

The Company was originally registered as a private limited company in Switzerland on December 19, 2014. The Company was organized to develop and market systems which run in conjunction with emails to monetize the ordinary exchange of e-mails. In this regard, the Company seeks to reshape the current email market by delivering a new suite of services providing added value to the user while supporting profitable email utilization, processing and management. The Company’s suite of services include:

● PayMyTime®—a system under which the user receives only emails of relevance, and gets paid received email based on the user’s time evaluation and relationship with the sender; the service enables the user to bill its contacts for the messages they wish to send to the user; the user defines the database and chooses whom to bill, when to bill and how much to bill.

● NoMailSpam®—a system which enables the user to cut the receipt of spam received by the user by 100%; all received emails are filtered by the Company’s engine which only permits emails which have been screened by the user’s established parameters.

● BillingMeter®—a system which tracks time spent on emails and other documents and delivers certified bills to email senders based on user-established algorithms, and

● PayWithMail®—a system which enables the user to send and receive payments via email by simply attaching the payment to an email and sending the email.

To date we have not generated any revenues. As we proceed through 2017, we expect to generate revenue streams through the use of our systems.

Plan of Operation

The core of the Company’s platform of services is PayMyTime®. Through PayMyTime®, the Company seeks to introduce an innovative means of addressing email consultation and use. By implementing the Company’s services and products, the goal is to lighten the users time commitment to reviewing and responding to emails, by delivering only those emails which are essential to the user’s work and monetizing emails to support the user’s business. Pursuant to the Company’s business model, the Company will collect a percentage fee from each received email. Users are not required to pay any subscription or license fee for the service. Once an email is received by the user, the Company retains a variable percentage of the sum payable to the user.

BillingMeter® is a Swiss-based service that analyzes and certifies the time spent by users on particular bodies of work. Its mission is to provide time certification for business users who work on time-based fees, and thereby enable and simplify work time tracking and reporting through reliable and certified analysis systems. BillingMeter® is provided to all users of PayMyTime® after payment of a monthly subscription fee of $10.00. The subscription includes the BillingMeter® software that delivers time-certified bills to customers. At this time, the Company has one pending patent related to the BillingMeter® services.

| 24 |

PayWithMail® gives users better ways to send and receive payments, helping them safely access and move their money, offering the possibility of making cash transactions via email. The objective of PayWithMail ® is to make payments as easy as sending an email. PayWithMail ®, will charge a minimal fee on every transaction.

The Company intends to utilize a viral-based diffusion of the services it offers. In this manner, through low charges and direct benefits to users, the Company believes that it will be able to distribute its product and service offerings to a vast number of users in a relatively short timeframe.

All of the Company’s products and services are fully-developed and ready for immediate roll-out, which the Company intends to begin commencing in the fourth calendar quarter of 2017.

The following chart shows milestones in the development and roll-out of the Company’s products, affiliated resources, milestone dates, challenges and minimum estimated financial resources required.

| Action | Counterparts | Due date | Challenges | Resources (estimated) | ||||||

| $5,000,000 Equity Placement | UK Broker and swiss investors | End of June 2017 | Initial Commitments of $1,000,000. Company to raise another $4,000,000 | $ | 100,000 | |||||

| Hiring personal | Executive Recruiters in Switzerland and London | From April to September, 2017 (as required) | Shortage of qualified personnel in Switzerland, | $ | 100,000 | |||||

| Development activities to go live in November 2017 | Various consultants | To go live November 2017 – after other developments | Potential delays due to changes in scope of work | $ | 1,600,000 | |||||

| Execution of Agreements with Software Developer | Arobs Transilvania (development agreement already executed) | April 2017 | Potential technical issues | $ | 500,000 | |||||

| Agreement with financial platform provider | Financial platform providers | June 2017 | Integration of new technologies with legacy technology | $ | 250,000 | |||||