Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - At Home Group Inc. | home-20170128ex31107a759.htm |

| EX-32.1 - EX-32.1 - At Home Group Inc. | home-20170128ex321aca96b.htm |

| EX-31.2 - EX-31.2 - At Home Group Inc. | home-20170128ex312ff530a.htm |

| EX-21.1 - EX-21.1 - At Home Group Inc. | home-20170128ex211560233.htm |

| EX-10.21 - EX-10.21 - At Home Group Inc. | home-20170128ex1021a69d9.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 28, 2017

or

|

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-37849

AT HOME GROUP INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

45-3229563 |

|

(State of other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

1600 East Plano Parkway |

|

75074 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(972) 265-6227

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐ Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

|

Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

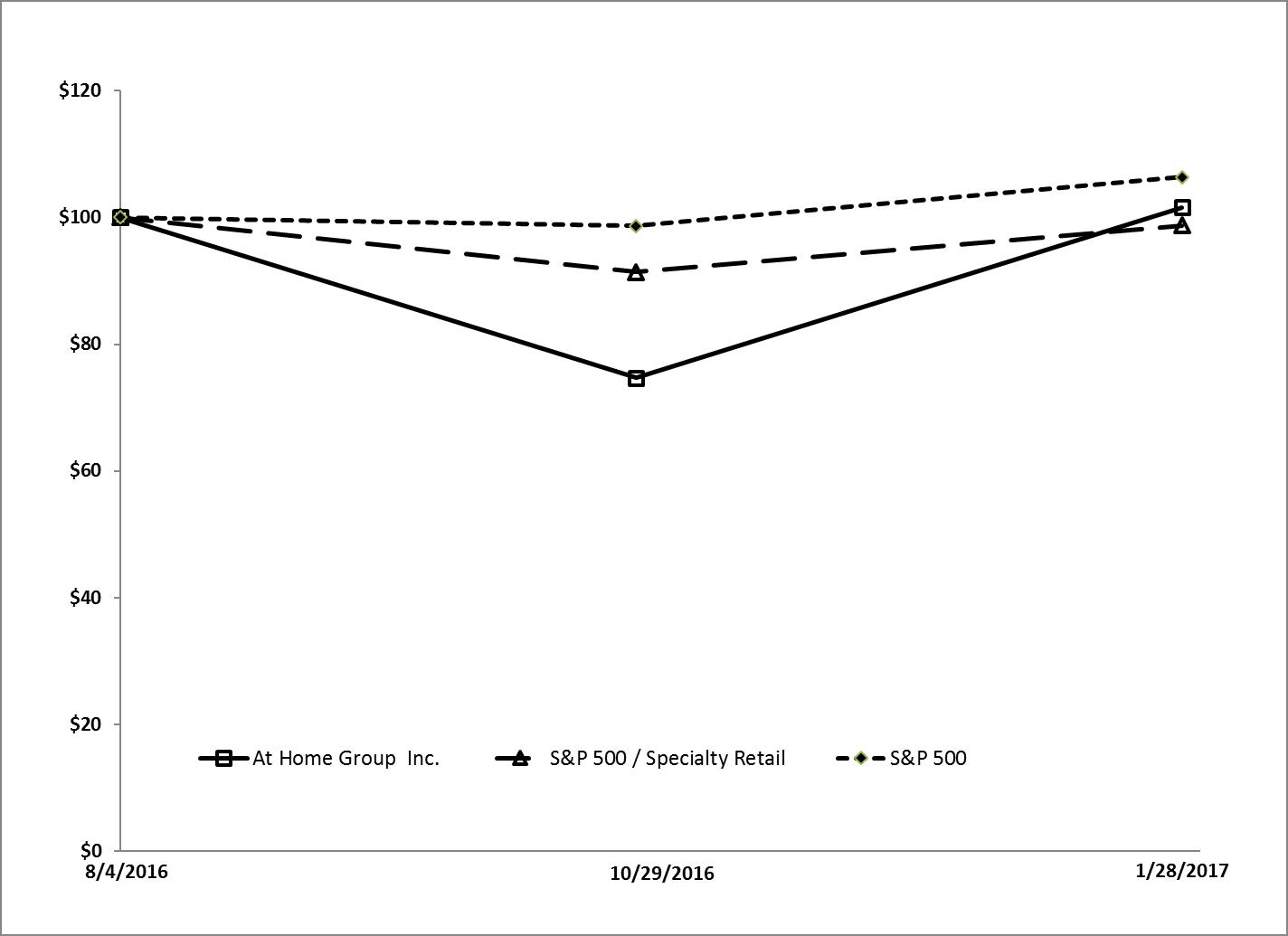

The aggregate market value of the common stock of the Registrant held by non-affiliates of the Registrant on August 4, 2016, based upon the closing price of $15.00 of the Registrant's common stock as reported on the New York Stock Exchange, was $129,840,000. The Registrant has elected to use August 4, 2016 as the calculation date, which was the initial trading date of the Registrant's common stock on the New York Stock Exchange, because as of July 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public market for the registrant’s common stock.

There were 60,366,768 shares of the registrant’s common stock, par value $0.01 per share, outstanding as of March 31, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for its 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended January 28, 2017.

AT HOME GROUP INC.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by our use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “seek”, “vision”, or “should”, or the negative thereof or other variations thereon or comparable terminology. In particular, statements about our expected new store openings, our real estate strategy, growth targets and potential growth opportunities and future capital expenditures and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance contained in this report are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, including the important factors described in the “Item 1A. Risk Factors” section of this Annual Report on Form 10-K, many of which are beyond our control. These and other important factors may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this report are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in this report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Annual Report on Form 10-K speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this report.

Unless the context otherwise requires, references in this Annual Report on Form 10-K to “the Company”, “At Home”, “we”, “us”, and “our” refer to At Home Group Inc. and its consolidated subsidiaries.

History and Company Overview

At Home is the leading home décor superstore based on the number of our locations and our large format stores that we believe dedicate more space per store to home décor than any other player in the industry. We are focused on providing the broadest assortment of products for any room, in any style, for any budget. We utilize our space advantage to out-assort our competition, offering over 50,000 SKUs throughout our stores. Our differentiated merchandising strategy allows us to identify on-trend products and then value engineer those products to provide desirable aesthetics at attractive price points for our customers. Over 70% of our products are unbranded, private label or specifically designed for us. We believe that our broad and comprehensive offering and compelling value proposition combine to create a leading destination for home décor with the opportunity to continue taking market share in a large, fragmented and growing market.

At Home (formerly known as Garden Ridge) was founded in 1979 in Garden Ridge, Texas, a suburb of San Antonio. We quickly gained a loyal following in our Texas home market and expanded thereafter. Throughout our history, we have cultivated a passionate customer base that shops our stores for the unique, wide assortment of products offered at value price points. After our Company was acquired in 2011 by an investment group led by AEA Investors LP ("AEA"), which included affiliates of Starr Investment Holdings, LLC ("Starr Investments" and, together with AEA, the “Sponsors”), we began a series of strategic investments in the business. We believe that the core strengths of our

1

business combined with the significant investments made in the years following our acquisition by our Sponsors position us to grow sales and expand our store base.

As of January 28, 2017, our store base is comprised of 123 stores across 30 states, averaging approximately 115,000 square feet per store. We utilize a flexible and disciplined real estate strategy that allows us to successfully open and operate stores from 80,000 to 165,000 square feet across a wide range of formats and markets. All of our stores that were open as of the beginning of the fiscal year are profitable, and stores that have been open for more than a year average over $6 million in net sales. Due in part to our past investments, our distribution center should be able to support up to approximately 220 stores. In addition, based on our internal analysis and research conducted for us by Buxton Company, a leading real estate analytics firm (referred to herein as “Buxton”), we believe that we have the potential to expand to at least 600 stores in the United States over the long term although we do not currently have an anticipated timeframe to reach this potential.

We have developed a highly efficient operating model that seeks to drive growth and profitability while minimizing operating risk. Our merchandising, sourcing and pricing strategies generate strong and consistent performance across our product offering and throughout the entire year. Through specialized in‑store merchandising and visual navigation elements, we enable a self‑service model that minimizes in‑store staffing needs and allows us to deliver exceptional value to our customers.

We believe that our differentiated home décor concept, flexible real estate strategy and highly efficient operating model create competitive advantages that have driven our financial success.

Initial Public Offering

On August 3, 2016, our Registration Statement on Form S-1 relating to our initial public offering was declared effective by the Securities and Exchange Commission (“SEC”) pursuant to which we registered an aggregate of 9,967,050 shares of our common stock (including 1,300,050 shares subject to the underwriters' over-allotment option). We issued and sold 8,667,000 of the shares registered at a price of $15.00 per share on August 9, 2016, resulting in net proceeds of $120.9 million after deducting underwriters' discounts and commissions of $9.1 million. On September 8, 2016, we issued and sold a further 863,041 shares of our common stock pursuant to the underwriters’ partial exercise of the over-allotment option. This exercise of the over-allotment option resulted in net proceeds to us of $12.0 million after deducting underwriters’ discounts and commissions of $0.9 million.

We used the net proceeds from the initial public offering and partial exercise of the over-allotment option, after deducting underwriters’ discounts and commissions, to repay in full the $130.0 million of principal amount of indebtedness outstanding under our $130.0 million second lien term loan (the “Second Lien Term Loan”).

Our common stock began trading on the New York Stock Exchange (the “NYSE”), on August 4, 2016 under the ticker symbol "HOME".

Our Growth Strategies

We expect to continue our strong sales growth and leading profitability by pursuing the following strategies:

Expand Our Store Base

We believe there is a tremendous whitespace opportunity to expand in both existing and new markets in the United States. Over the long term, we believe we have the potential to expand to at least 600 stores in the United States based on our internal analysis and research conducted by Buxton. During fiscal year 2017, we opened 23 new stores, net of one relocation. During fiscal year 2018, we plan to open 25 net new stores and we plan to open at least 25 new stores in each subsequent year for the foreseeable future. The rate of future growth in any particular period is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we do not currently have an anticipated timeframe to reach our long‑term potential. In addition, due in part to our investments, our systems, processes and controls should be able to support up to approximately 220 stores with limited incremental investment.

2

We have used our site selection model to score over 20,000 big box retail locations throughout the United States, which positions us to be able to act quickly as locations become available, and we have developed detailed market maps for each U.S. market that guide our deliberate expansion strategy. We have opened stores in a mix of existing and new markets. New stores in existing markets have increased our total market share due to higher brand awareness. We believe there is still considerable opportunity to continue adding locations in even our most established markets. In addition, we anticipate a limited number of relocations periodically as we evaluate our position in the market upon the impending expiration of lease terms. We have demonstrated our ability to open stores successfully in a diverse range of new markets across the country. Our portable concept has delivered consistent store economics across all markets, from smaller, less dense locations to larger, more heavily populated metropolitan areas. We have delivered over 20% year‑over‑year net sales growth in each of the past eleven consecutive quarters.

Our new store model combines high average unit volumes and high margins with low net capital investment and occupancy costs, resulting in cash flow generation early in the life of a store. Our stores typically mature within six months of opening. We target first year annualized sales of $5 million. Our new stores require, on average, approximately $3 million of net investment, varying based on our lease, purchase or build decisions, but with a target payback period of less than two years.

Drive Comparable Store Sales

We have achieved positive comparable store sales in each of the last twelve consecutive fiscal quarters, ranging from 0.9% to 11.4%, and averaging 5.2% growth over the period. Comparable store sales can be impacted by various factors from period to period, including our recent rebranding, as discussed in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—How We Assess the Performance of Our Business”. We will seek to continue to drive demand and customer spend by providing a targeted, exciting product selection and a differentiated shopping experience, including the following specific strategic initiatives:

|

· |

Continuously introduce new and on‑trend products to appeal to a wide range of customers and improve the mix of our assortment (“good / better / best” product offering); |

|

· |

Enhance inventory planning and allocation capabilities to get the right products in the right store at the right time; |

|

· |

Continue to strengthen our visual merchandising such as vignettes, end caps and feature tables to inspire our customers and generate in‑store demand; and |

|

· |

Grow the At Home brand through marketing and advertising as well as community engagements that target the home décor enthusiast to drive increased traffic to our stores. |

Build the At Home Brand and Create Awareness

During fiscal year 2015, we launched the At Home brand, which we believe better communicates our positioning as the leading home décor superstore. Additionally, we re‑established a marketing function and reinstated marketing spend to highlight our new brand, broad product offering and compelling value proposition. Given the newness and relatively limited awareness of the At Home brand, we believe there is a significant opportunity to grow our brand and build awareness for existing and new markets.

To address this opportunity, we intend to allocate our marketing spend across a range of strategic initiatives in order to highlight our differentiated value proposition. We will involve both traditional media platforms and unique, targeted strategies aimed at reaching the home décor enthusiast. Our marketing and brand building efforts will be enhanced by engaging in an ongoing dialogue with our customers through growing social and mobile channels. We believe we have an opportunity to leverage our growing social media and online presence to drive brand excitement and increase store visits within existing and new markets.

3

We have loyal, enthusiastic and diverse customers who are deeply passionate about, and love to decorate, their homes. Based on research completed by a third-party during fiscal year 2016, our current customer demographic consists primarily of women and we appeal to a broad income demographic. Our customers average 46 years of age, while customers under 34 years of age comprise almost 30% of our demographic, representing the fastest growing segment and indicating our cross-generational appeal. Regardless of age or income, we focus on customers who are highly engaged in, and spend substantial time and money on home décor.

Through our extensive customer research, we have learned that many home décor enthusiasts browse online for ideas, inspiration and general product information before visiting specific stores. In fiscal year 2017, we upgraded our website to enable our customers to view our product assortment online with robust search functionality and a mobile‑friendly website. This enhancement focuses on an inspirational shopping experience that showcases decorating ideas to drive traffic into our stores. We are exploring opportunities to provide various levels of e‑commerce capabilities but intend to focus on initiatives that maintain our industry‑leading profitability.

We believe increased brand awareness will not only drive traffic to existing stores, but also strengthen our business as we expand into new markets.

Our Industry

We compete in the large, growing and highly fragmented home furnishings and décor market. The industry had total sales of approximately $189 billion in 2015 according to Home Furnishings News, and has enjoyed stable growth at an annual rate of approximately 2.3% per year over the last five years according to Euromonitor. We attribute this growth to the industry’s broad consumer appeal, coupled with strong positive tailwinds from a growing housing market, rising property values and home sales and growing disposable incomes. This growth trend is expected to continue, with a forecasted growth rate of approximately 2.2% over the next five years according to Euromonitor.

Unlike other big box retail categories (e.g., office supplies, home improvement and electronics) where the top retailers hold a significant share of the overall market, the top three retailers in the home décor and furnishings category make up less than 25% of the market share. We believe we are uniquely positioned in the market, focused on providing the broadest assortment of home décor products at value price points. In addition, the size of our stores enables us to carry a broad offering of fully assembled, larger merchandise, unlike many of our competitors, who are space constrained from providing a similar offering. We believe our focus on a broad assortment at value price points also uniquely positions us for those times when the industry is growing below trend, as it allows us to gain share in a fragmented market while also supporting our customer’s passion about, and love for, decorating her home.

The home furnishings and décor market includes a diverse set of categories and retail formats. However, we believe that we do not have a direct competitor, as no retailer matches our size, scale or scope of the product assortment that we offer at everyday low prices. While we have no direct competitor, certain products that we offer do compete with offerings by companies in the following segments:

|

· |

Specialty Home Décor / Organization and Furniture retailers (e.g., Bed Bath & Beyond, The Container Store, Ethan Allen, Havertys, Home Goods, Pier 1 Imports and Williams‑Sonoma) have stores that are typically smaller (approximately 10,000 to 30,000 square feet) and we believe their home décor product offering is much narrower than ours and often is priced at a substantial premium. |

|

· |

Mass / Club retailers (e.g., Costco, Target and Wal‑Mart Stores) only dedicate a small portion of their selling spaces to home décor products and focus on the most popular SKUs. |

|

· |

Arts / Craft / Hobby retailers (e.g., Hobby Lobby, Jo‑Ann Stores and Michaels Stores) target customers who prefer to create the product themselves, whereas our customer prefers finished products. |

|

· |

Discount retailers (e.g., Big Lots, Burlington and Tuesday Morning) have a home décor product offering that is typically limited, offered at deep discounts and often dependent on their ability to purchase close‑out or liquidated merchandise from manufacturers. |

4

|

· |

Home Improvement retailers (e.g., Home Depot and Lowe’s) have a product offering that is primarily focused on home improvement and repair items, although we do compete with them in seasonal and outdoor products. |

|

· |

Online Home Décor retailers (e.g., Wayfair) offer a broad selection of products in home furnishings and décor that is typically weighted toward more expensive items (typically $200 to $300 per transaction) that can justify the high shipping, returns and damage costs and overall economics of their model. Conversely, we focus primarily on the attractive decorative accents and accessories portion of the market, generating an average basket of approximately $65, where we can employ our efficient operating model to generate attractive economics. For similar products, we believe we are able to offer comparable breadth of assortment to online retailers. |

Our Merchandise

We have the largest assortment of home décor products among all big box retailers. With eight main design archetypes, from traditional to country and from vintage to modern, we cover the full spectrum of home décor styles and we believe we have something for everyone. Over the past four years, we have evolved our merchandising strategy to increase our product offering of “better” and “best” level products, resulting in an increase in average basket size. We are advantageously situated as a value player in the home décor market, with an average price point of less than $15 and typical customer spend of approximately $65 per visit.

Our merchant organization is focused on finding or creating products that meet our customers’ aesthetic requirements at attractive price points. A core goal of our buyers is to ensure we deliver our targeted selling margins across our entire product portfolio and, as a result, we enjoy strong gross margins that are consistent across our product offering.

Our product design process begins with inspiration. We seek to capitalize on existing trends and home décor fashions across various price points and make them accessible rather than drive new trends. We monitor emerging trends through a wide range of home décor industry sources including competitors, media sources, vendors, trade shows, various online outlets and user generated content (e.g., Pinterest and Houzz) to stay current with consumer preferences. We then identify new product opportunities or any gaps in our offering and work closely with our vendors to design products to meet her needs at accessible price points. Our merchandising team also closely monitors our sales trends and new product launches to ensure our store offering remains fresh and relevant.

We employ an everyday low pricing strategy that offers our customers the best possible pricing without the need for periodic discounts or promotions. When customers view our prices, they can be confident in the value they receive and do not need to wait for sales or coupons to make purchasing decisions. We believe this results in consistent traffic to our stores. Over 80% of our net sales occur at full price, with the balance attributable to selective markdowns used to clear slow-moving inventory or post‑dated seasonal product. For the limited set of products that are directly comparable to products offered by other retailers, we seek to offer prices significantly below our specialty competitors and at or below our mass retail competitors. We allow for merchandise to be returned within 60 days from the purchase date.

Our merchant team consists of approximately 65 people and includes a Chief Merchandising Officer, divisional merchandising managers, buyers, assistant buyers and an inventory planning and allocation team. Our inventory planners work with our buyers to ensure that the appropriate level of inventory for each product is stocked across our store base. We purchase our inventory through a central system that buys for the entire chain versus individual stores. We believe this strategy allows us to take advantage of volume discounts and improves controls over inventory and product mix to ensure that we are disciplined about the level of inventory we carry.

5

Product Mix

Our broad and deep offering includes the following products:

|

Accent furniture |

Frames |

Pottery |

|

Bar stools |

Garden decor |

Rugs and mats |

|

Bedding & bath products |

Halloween decorations |

Sculptures |

|

Beds and mattresses |

Harvest decorations |

Silk flowers |

|

Candles |

Home organization |

Sofas |

|

Chairs |

Kitchenware |

Stands |

|

Christmas decorations |

Lamps |

Storage |

|

Consumables |

Mirrors |

Tables |

|

Easter decorations |

Patio |

Vases |

|

Floor plants and trees |

Pet items |

Wall art |

|

Food preparation items |

Pillows and cushions |

Window treatments |

Home furnishings, which generally consists of accent furniture, furniture, mirrors, patio cushions, rugs and wall art, comprised approximately 48%, 48% and 47% of total net sales for fiscal years 2017, 2016 and 2015, respectively. In addition, accent décor, which generally consists of artificial flowers and trees, bedding, candles, garden and outdoor décor, holiday accessories, home organization, pillows, pottery, vases and window treatments, comprised approximately 49%, 49% and 49% of total net sales for fiscal years 2017, 2016 and 2015, respectively. Our superstore format and unique approach to merchandising result in our ability to offer multiple styles, colors and design elements most other retailers are unable to carry.

Sourcing

We believe our sourcing model provides us with significant flexibility to control our product costs. We work very closely with over 500 vendors to value engineer products at price points that deliver excellent value to our customers. In fiscal year 2017, approximately 40% of our merchandise was purchased from domestic vendors and 60% was purchased from foreign vendors in countries such as China, Hong Kong, Belgium and Taiwan. Lead times vary depending on the product, ranging from one week to nine months. We plan to establish an overseas sourcing office in the future. An overseas office would allow us to continue to increase our direct purchases from overseas factories in Asia, rather than purchasing through domestic agents or trading companies. We believe this represents an opportunity to increase our access to unique and quality products.

We seek to build long‑term relationships with our vendor partners, who can provide support for our various marketing and in‑store merchandising initiatives. However, we believe we are not dependent on any one vendor and have no long‑term purchase commitments or arrangements. For many of our vendors, we are their fastest growing and, sometimes, largest account, which promotes collaboration between our companies. In fiscal year 2017, our top ten vendors accounted for approximately 20% of total purchases, with our largest vendor representing less than 5%. We believe our vendor partner relationships will continue to support our business growth.

Our Stores

We currently operate 127 stores in 31 states across the United States. A summary of our store locations by state as of January 28, 2017 is included in “Item 2. Properties”.

Store Layout

Our stores vary in size between 80,000 and 165,000 square feet with an average of approximately 115,000 square feet. Our locations have a similar store layout that is specifically designed to engage our customers. We design our stores as shoppable warehouses with wide aisles, an interior race track and clear signage that enable customers to easily navigate the store. We also have store maps available at the entrances for our customer to use while she shops.

6

Throughout our stores, we merchandise products logically by color, design and size in order to appeal to our core shopper’s buying preferences and use feature tables and end caps to create continuous visual interest and to highlight value. Additionally, we utilize product vignettes that offer design inspiration and coordinated product ideas to our customers. Our large store format allows us to maintain high in‑stock positions and sell larger‑sized and fully assembled products. To make her shopping experience easier and support our efficient operating model, we install fixture shelves lower to the ground so that products are easily reachable and require minimal staff assistance. We also utilize special fixtures for our products such as wall art, mirrors and rugs to allow easy viewing, improved shopability and minimized product damage. We have a centralized checkout lane with multiple registers that makes the checkout process simple and efficient.

To enhance our customer's self-help shopping experience in connection with our larger-sized products, we offer her the opportunity to engage Select Express, a third-party delivery service, to provide home delivery. Through this service, she is able to interface directly with the provider to schedule a convenient delivery time. Deliveries typically occur within 48 hours, but next-day service is also available. Select Express has experience nationwide with many major retailers. Nonetheless, deliveries from our stores follow completion of the sales transaction with our customer, thus minimizing any exposure we might have in connection with the delivery.

Store Operations

We centralize major decisions relating to merchandising, inventory and pricing in order to allow our in‑store team to focus on creating a clean and organized shopping environment. Our stores are typically led by a store director, a store manager and have a general staff averaging 25 employees. Store employees are broadly split into two functional groups, customer service and operations, thereby allowing us to maximize efficiencies while aligning employees to the function that best suits their skills. Our proprietary labor model optimizes staffing levels based on hourly sales and traffic volumes. Additionally, employees utilize downtime to stock shelves and displays with new inventory. This model provides us with the flexibility to meet various seasonal demands while enabling consistent labor margins throughout the year. Overall store supervision is managed by our Director of Store Operations, two regional managers and twelve district managers.

Our employees are a critical component of our success and we are focused on attracting, retaining and promoting the best talent in our stores. We recognize and reward team members who meet our high performance standards. All employees are eligible to participate in our bonus incentive program and store directors are able to participate in an unlimited bonus incentive program based primarily on exceeding store level sales targets. We also recognize individual performance through internal promotions and provide opportunities for advancement throughout our organization. We provide training for all new hires and ongoing training for existing employees.

Our stores are typically open seven days a week across the chain with regular hours of 9 a.m. to 10 p.m. Monday through Saturday and 9 a.m. to 9 p.m. on Sunday.

7

Real Estate Strategy

Expansion Opportunities

Our retail concept has been successful across a number of geographic markets spanning populations of 150,000 to over five million people. Our stores that have been open for more than twelve months as of January 28, 2017 perform consistently across small, mid‑level and large markets and generate average net sales of approximately $6.0 million to $7.0 million across these markets. Over the past five fiscal years, we have successfully opened 77 new stores in a mix of existing and new markets. Our recent store growth is summarized in the following table:

|

|

|

Fiscal Year Ended |

||||||||

|

|

|

January 26, 2013 |

|

January 25, 2014 |

|

January 31, 2015 |

|

January 30, 2016 |

|

January 28, 2017 |

|

Beginning of period |

|

51 |

|

58 |

|

68 |

|

81 |

|

100 |

|

Openings |

|

7 |

|

10 |

|

16 |

|

20 |

|

24 |

|

Relocations |

|

— |

|

— |

|

(2) |

|

— |

|

(1) |

|

Closures |

|

— |

|

— |

|

(1) |

|

(1) |

|

— |

|

Total stores at end of period |

|

58 |

|

68 |

|

81 |

|

100 |

|

123 |

We believe we have the whitespace to open at least 25 new stores per year for the foreseeable future. During fiscal year 2017, we opened 23 new stores, net of one relocated store. During fiscal year 2018, we plan to open 25 net new stores. Based on our internal analysis and research conducted for us by Buxton, we believe that we have the potential to expand to at least 600 stores in the United States over the long term, or approximately five times our footprint of 123 stores as of January 28, 2017. The rate of future growth in any particular period is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we do not currently have an anticipated timeframe to reach this potential. In addition, due in part to our investments, our systems, processes and controls should be able to support up to approximately 220 stores with limited incremental investment. We expect to continue to be disciplined in our approach to opening new stores, focusing on expanding our presence in existing markets while entering adjacent geographies. We also plan to act on compelling opportunities we identify in new markets.

Our store growth is supported by new store economics that we believe are compelling. Our new stores generate an average of $6 million of net sales within the first full year of operations and reach maturity within the first six months. The average investment varies by the type of site and whether the store is leased, purchased or built from the ground up. Each store requires net investment on average of approximately $3 million. Based on our model and historical results, we expect our new stores to pay back the initial investment within two years.

Site Selection and Availability

We have developed a highly analytical approach to real estate site selection with a stringent new store approval process. Our dedicated real estate team spends considerable time evaluating prospective sites before submitting a comprehensive approval package to our real estate committee, comprised of our Chief Executive Officer, Chief Financial Officer and Chief Development Officer. We target markets that meet our specific demographic and site evaluation criteria and complete substantial research before opening a new site. We use a proprietary model which takes into account several demand factors including population density of our target customer, median household income, home ownership rates, retail adjacencies, competitor presence and local economic growth metrics. Primary site evaluation criteria include availability of attractive lease terms, sufficient box size, co‑tenancy, convenient parking, traffic patterns, visibility and access from major roadways. We typically favor locations near other big box retailers that drive strong customer traffic to the area.

We believe there will continue to be an ample supply of large format real estate in the United States that is attractive to us, driven by multi‑chain, national retailers relocating or closing stores, a number of retailers shifting to smaller locations and the relative lack of new retail concepts using larger store formats. We believe we are one of the only growing, large format retailers in the country. As a result, we have become a direct beneficiary of this available real estate and of various retailers looking to quickly shed stores. We typically offer a convenient solution to any selling or leasing party as we are able to take a wide variety of boxes, move quickly and require little investment in time, resources or capital on their part. We take a disciplined approach to how we enter and build out our presence in markets and seek to optimize sales in a deliberate, carefully planned manner. In order to act quickly on new opportunities, we have scored

8

over 20,000 big box retail locations in the United States with a proprietary site selection model. As a result of our proven track record, we have developed strong relationships with brokers, landlords and big box retailers and are often the first to receive a call when locations become available.

Site Development and Financing

We have a flexible and balanced approach to site development that allows us to optimize the investment characteristics of each new store and maintain our robust new store pipeline. We can lease a second generation property, purchase a second generation building or build a new location from the ground up.

For purchased properties or new development builds, we can extract capital using sale‑leasebacks through a proven and disciplined approach. We have relationships with a number of the major publicly traded REITs, many of which have demonstrated interest in our portfolio of assets. We have completed six sale‑leaseback transactions generating approximately $188 million in proceeds in the past four years at a capitalization rate between 6.46% and 6.99%.

We have developed an efficient process from site selection through new store opening. Our three-pronged approach to site development allows us to negotiate very favorable real estate terms that typically include low occupancy costs, the ability to unilaterally “opt out” of leased locations, and other features that provide us with flexibility to manage our store portfolio.

Marketing

Our marketing and advertising strategies seek to effectively and efficiently communicate our compelling value proposition to an increasing base of home décor enthusiasts. Our goal is to develop a continuous dialogue with our core customers, while attracting new customers by building a distinctive connection to the At Home brand. We reinvigorated our marketing efforts, increasing spend from nearly zero in fiscal year 2013 to 2.0% of net sales in each of fiscal years 2015 and 2016 and 2.6% of net sales in fiscal year 2017.

The home décor enthusiast views her home as a place that is constantly evolving with each season as well as everyday events in her life. We connect with her on an ongoing basis by inspiring her with all of the ways she can refresh her home with our wide range of décor styles for any room, in any style, for any budget. We engage with her across various marketing channels before, during and after her store visit. We have increased our focus in social media building relationships with home décor influencers as well as facilitating the sharing of home décor ideas through user-generated content strategies leveraging Pinterest, Facebook, Instagram, Twitter and various blogs. We use weekly email marketing to inspire her with seasonally relevant décor, and will be growing the reach of these efforts as we focus on significantly building our customer database (currently over 2.3 million) through in-store email capture. We have entered into an agreement with Synchrony Bank to provide for a co-branded and private label consumer credit card program that includes loyalty incentives for our customers. This program is expected to launch during fiscal year 2018 and will allow At Home cardholders to take advantage of promotional financing offers on qualifying purchases, exclusive discounts, loyalty rewards and other benefits, including mobile account servicing.

We also use traditional media platforms (outdoor, radio and online advertising) to build broader brand awareness in markets where we can achieve the highest impact. To launch our brand during new store openings, we have evolved our strategy through tactical testing to get to an effective and cost efficient mix of direct mail, radio, outdoor, social, digital, public relations and events. Additionally, we leverage this same media mix in select markets to drive traffic during the key summer season with our outdoor product offering and during the important holiday season with our broad holiday décor assortments.

Through our customer research, we have learned that many home décor enthusiasts browse online for ideas, inspiration and general product information before visiting specific stores. In fiscal year 2017, we upgraded our website to enable our customers to view our product assortment online with a robust search functionality and mobile friendly website focused on an inspirational shopping experience that showcases decorating ideas with our broad product assortment to drive traffic into our stores. We are exploring opportunities to provide various levels of e-commerce capabilities but will focus on strategies that maintain our industry-leading profitability.

9

We believe that effective marketing will continue to grow our awareness which will drive brand excitement, increase our customer engagement leading to increased store visits and sales.

Distribution

We operate a 592,000 square foot distribution center in Plano, Texas, which also serves as our corporate headquarters. We also have an additional approximately 420,000 square feet of warehouse premises in Garland, Texas, for initial inventory build‑up for new store openings. We upgraded the distribution center over the past four years and it should be able to support up to approximately 220 stores. We have also invested over $9 million in automating our facility, implementing warehouse management software and robotics to efficiently handle daily product deliveries. This automation will continue to support our needs as we expand our store base.

The vast majority of our products are shipped directly to our distribution center, which serves as a cross‑dock facility, storing very limited inventory on site. In order to streamline store operations and reduce labor requirements, all of the merchandise in our distribution center is prepared for the sales floor prior to transport. Vendors pre‑ticket items with the appropriate price tags. Products are sorted onto pallets by zone such that they can be easily loaded onto trucks and then unloaded and placed directly in the sales zone with minimal back room storage. We arrange shipments in trucks in the most logical manner to expedite unloading and delivery. This approach to distribution supports our efficient store operating model.

Real‑time product replenishment in stores ensures that our customers have the broadest selection available and that we do not carry extra inventory. We generally ship merchandise to our stores between one and five times a week, depending on the season and the volume of a specific store, utilizing contract carriers for all shipments.

Information Systems

We believe that our management information systems will support our growth and enhance our competitive position. Our efficient operating model is supported by using industry standard applications in the areas of merchandising, store systems, replenishment, distribution and financial systems. We use a combination of these industry standard systems along with automated and easy to use proprietary systems to support all areas of our business. Over the past four years, we have invested in IT systems and infrastructure, including investments in merchandising, planning and allocation (JDA), POS systems (IBM/Toshiba), distribution center (PKMS) and finance and accounting (SAP) to ensure our systems are robust and scalable. Additionally, over the past four years we have invested in additional IT team members to provide appropriate support and project delivery capabilities needed for the growth of the Company.

Employees

As of January 28, 2017, we employed approximately 3,172 employees, including 2,913 store employees and 259 other employees across the corporate and distribution center functions. Of the 2,913 store employees, 364 were full‑time salaried level staff and the remaining employees consisted of a mix of full‑time and part‑time hourly workers. All of our full‑time employees earn a minimum wage of $10.00 per hour and all of our part‑time employees earn a minimum wage of $9.00 per hour. Based on the level of transactions experienced at different times of the day, week and year, store labor is planned to serve customers effectively during peak periods while minimizing overall labor costs. None of our employees are currently covered under any collective bargaining agreements.

Intellectual Property

We own a U.S. trademark registration for the trademark “at home” and design, which was registered by the United States Patent & Trademark Office on July 7, 2015 for a ten‑year term and is renewable every ten years thereafter. We also own the domain name athome.com and a number of other registered trademarks, pending trademark applications and domain names that we use in our business. Collectively, we consider our trademarks and domain names to be important assets of our operations and seek to actively monitor and protect our interest in this property.

10

Government Regulation

We are subject to labor and employment laws, laws governing truth‑in‑advertising, privacy laws, environmental laws, safety regulations and other laws, including consumer protection regulations that regulate retailers and govern the promotion and sale of merchandise and the operation of stores and warehouse facilities. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith, we file reports, proxy and information statements and other information with the SEC. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available through the investor relations section of our website at investor.athome.com. Reports are available free of charge as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K.

In addition to our website, you may read and copy public reports we file with or furnish to the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains our reports, proxy and information statements, and other information that we file electronically with the SEC at www.sec.gov.

The following risk factors may be important to understanding any statement in this Annual Report on Form 10-K or elsewhere. Our business, financial condition and operating results can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, results of operations and stock price.

Risks Relating to Our Business

General economic factors may materially adversely affect our business, revenue and profitability.

General conditions in the United States and global economy that are beyond our control may materially adversely affect our business and financial performance. As a retailer that is dependent upon consumer discretionary spending for home décor products, our customers may allocate less money for discretionary purchases as a result of increased levels of unemployment, reduced consumer disposable income, higher interest rates, higher fuel and other energy costs, higher tax rates and other changes in tax laws, foreclosures, bankruptcies, falling home prices, reduced availability of consumer credit, higher consumer debt levels, a decline in consumer confidence, inflation, deflation, recession, an overall economic slowdown and other factors that influence consumer spending. Any reduced demand for the merchandise that we sell could result in a significant decline in customer traffic and sales and decreased inventory turnover. Therefore, if economic conditions worsen, there may be a material adverse impact on our business, revenue and profitability.

In addition, our costs and expenses could be materially adversely impacted by general economic factors such as higher interest rates, higher fuel and other energy costs, higher transportation costs, higher commodity costs, higher costs of labor, insurance and healthcare, increased rental expense, inflation in other costs, higher tax rates and other changes in the tax law and changes in other laws and regulations. The economic factors that affect our operations also affect the operations and economic viability of our suppliers from whom we purchase goods, a factor that can result in an increase in the cost to us of merchandise we sell to our customers.

11

Volatility or disruption in the financial markets could materially adversely affect our business and the trading price of our common stock.

We rely on stable and efficient financial markets. Any disruption in the credit and capital markets could adversely impact our ability to obtain financing on acceptable terms. Volatility in the financial markets could also result in difficulties for financial institutions and other parties that we do business with, which could potentially affect our ability to access financing under our existing arrangements. We are exposed to the impact of any global or domestic economic disruption, including any potential impact of the recent vote by the United Kingdom to exit the European Union, commonly referred to as “Brexit”. Although we generally generate funds from our operations and our existing credit facilities to pay our operating expenses and fund our capital expenditures, our ability to continue to meet these cash requirements over the long term may require access to additional sources of funds, including equity and debt capital markets, and market volatility and general economic conditions may adversely affect our ability to access capital markets. In addition, the inability of our vendors to access capital and liquidity with which to maintain their inventory, production levels and product quality and to operate their businesses, or the insolvency of our vendors, could lead to their failure to deliver merchandise. If we are unable to purchase products when needed, our sales could be materially adversely impacted. Accordingly, volatility or disruption in the financial markets could impair our ability to execute our growth strategy and could have a material adverse effect on the trading price of our common stock.

Consumer spending on home décor products could decrease or be displaced by spending on other activities as driven by a number of factors.

Consumer spending on home décor products could decrease or be displaced by spending on other activities as driven by a number of factors including:

|

· |

shifts in behavior away from home decorating in favor of other products or activities, such as fashion, media or electronics; |

|

· |

general economic conditions and other factors that affect consumer discretionary spending; |

|

· |

natural disasters, including hurricanes, tornadoes, floods, droughts, heavy snow, ice or rain storms, which disrupt the ability of consumers to continue spending on home décor products; |

|

· |

man‑made disasters, such as terrorism or war, as well as other national and international security concerns; and |

|

· |

other matters that influence consumer confidence and spending. |

Total consumer spending may not continue to increase at historical rates due to slowed population growth and shifts in population demographics, and it may not increase in certain product markets given changes in consumer interests. Further, as we expand into new markets, we may not accurately predict consumer preferences in that market, which could result in lower than expected sales. If consumer spending on home décor products decline, our results of operations could be materially adversely affected.

We may not be able to successfully implement our growth strategy on a timely basis or at all, which could harm our growth and results of operations.

Our growth is dependent on our ability to open profitable new stores. Our ability to increase the number of our stores will depend in part on the availability of existing big box retail stores or store sites that meet our specifications. We may face competition from other retailers for suitable locations and we may also face difficulties in negotiating leases on acceptable terms. In addition, a lack of available financing on terms acceptable to real estate developers or a tightening credit market may adversely affect the retail sites available to us. Rising real estate costs and acquisition, construction and development costs and available lease financing could also inhibit our ability to open or acquire new stores.

12

Opening or acquiring stores involves certain risks, including constructing, furnishing, supplying and staffing a store in a timely and cost‑effective manner and accurately assessing the demographic or retail environment for a particular location, as well as addressing any environmental issues related to such locations. We cannot predict whether new stores will be successful. Our future sales at new stores may not meet our expectations, which could adversely impact our return on investment. For example, the costs of opening and operating new stores may offset the increased sales generated by the additional stores. Therefore, there can be no assurance that our new stores will generate sales levels necessary to achieve store‑level profitability or profitability comparable to that of existing stores. New stores also may face greater competition and have lower anticipated sales volumes relative to previously opened stores during their comparable years of operation. In addition, a significant portion of our management’s time and energy may be consumed with issues related to store expansion and we may be unable to hire a sufficient number of qualified store personnel or successfully integrate the new stores into our business. Furthermore, our vendors may be unable to meet the increased demand of additional stores in a timely manner. We cannot guarantee that we will be able to obtain and distribute adequate merchandise to new stores or maintain adequate warehousing and distribution capability at acceptable costs.

In addition, our expansion in existing and new markets may present competitive, distribution, merchandising and regulatory challenges that differ from our current challenges, including competition among our stores, diminished novelty of our store design and concept, added strain on our distribution center, additional information to be processed by our information technology systems and diversion of management attention from operations. New stores in new markets, where we are less familiar with the population and are less well‑known, may face different or additional risks and increased costs compared to stores operating in existing markets or new stores in existing markets. For example, we may need to increase marketing and advertising expenditures in new or smaller markets in which we have less store density. Additionally, we may not accurately predict consumer preferences in new markets, which could result in lower than expected sales. Expansion into new markets could also bring us into direct competition with retailers with whom we have no past experience as direct competitors. To the extent that we are not able to meet these new challenges, our sales could decrease and our operating costs could increase. Furthermore, our margins may be impacted in periods in which incremental expenses are incurred as a result of new store openings. Additionally, although our distribution center currently should be able to support a store base of up to approximately 220 stores, any unanticipated failure of or inability to support our growing store base could have a material adverse effect on our business. Therefore, there can be no assurance that we will be successful in opening, acquiring or operating any new stores on a profitable basis.

Accordingly, we cannot assure you that we will achieve our planned growth or, even if we are able to grow our store base as planned, that any new stores will perform as planned. If we fail to successfully implement our growth strategy, we will not be able to sustain the growth in sales and profits that we expect, which would likely have an adverse impact on the price of our common stock.

Failure to manage our inventory effectively and inability to satisfy changing consumer demands and preferences could materially adversely impact our operations.

Due to the nature of our business, we make decisions regarding merchandise several months in advance of each of the seasons in which such merchandise will be sold, particularly with respect to our merchandise that is manufactured, purchased and imported from countries around the world. We must maintain sufficient inventory levels to operate our business successfully. However, if we misjudge consumer preferences or demands, we could have excess inventory that may need to be held for a long period of time, written down or discarded in order to clear excess inventory, especially seasonal and holiday merchandise. Conversely, if we underestimate consumer demand, we may not be able to provide certain products in a timely manner to our customers in order to meet their demand, which can result in lost sales. Either event could have a material adverse impact on our business, financial condition and results of operations. In addition, we recently upgraded to a new inventory planning and allocation system. If the new inventory planning and allocation system is unsuccessful, our ability to properly allocate inventory to stores could be adversely affected.

There can be no assurance that we will be able to continue to offer assortments of products that appeal to our customers or that we will satisfy changing consumer demands and preferences in the future. Accordingly, our business, financial condition and results of operations could be materially adversely affected if:

|

· |

we miscalculate either the market for the merchandise in our stores or our customers’ purchasing habits; |

13

|

· |

consumer demand unexpectedly shifts away from the merchandise we offer or if there are unanticipated shifts in consumer preferences in some seasons; or |

|

· |

we are unable to anticipate, identify and respond to changing consumer demands or emerging trends, including shifts in the popularity of certain products or increased consumer demand for more enhanced customer service and assistance, home delivery or online sales and services. |

In addition, inventory shrinkage (inventory theft, loss or damage) rates could negatively impact our financial results. Furthermore, failure to control merchandise returns could also adversely affect our business. We have established a provision for estimated merchandise returns based upon historical experience and other known factors. However, if actual returns are greater than those projected by management, additional reductions of revenue could be recorded in the future. In addition, to the extent that returned merchandise is damaged or otherwise not appealing to our customers, we may not receive full retail value from the resale or liquidation of the returned merchandise.

Our business model currently relies on purchasing all inventory centrally through our home office in Plano, Texas. At this office, all product samples are developed and/or received and reviewed; in addition, all purchase orders are placed, fulfilled and allocated from the same location. Major catastrophic events such as natural disasters, localized labor issues or wages increases, fire or flooding, malfunction or disruption of the information systems, a disruption in communication services, power outages or shipping interruptions could delay or otherwise adversely affect inventory purchasing or allocation, as well as the ultimate distribution of inventory to our stores and customers. Such disruptions could have a negative impact on our sales and results of operations. Our business model of central purchasing could also fail to account for differences in consumer preferences by market. In such cases, and where our focus of providing the broadest assortment of products for any room similarly did not account for differences in consumer preferences by market, our sales and results of operations could be adversely affected.

The loss of, or disruption in, or our inability to efficiently operate our distribution network could have a materially adverse impact on our business.

We operate a single cross‑dock distribution center in Plano, Texas, which services all of our stores, as well as warehouse premises in Garland, Texas. The majority of our inventory is shipped directly from suppliers to our distribution center where the inventory is processed and then shipped to our stores. Only mattresses and some food items are shipped directly to stores. We rely in large part on the orderly operation of this receiving and distribution process, which depends on our automated distribution system, adherence to shipping schedules and effective management of our distribution network. If complications arise with our distribution facility or if the facility or warehouse premises (or a significant portion of inventory located there) is severely damaged or destroyed, our ability to receive and deliver inventory on a timely basis will be significantly impaired. There can be no assurance that disruptions in operations due to natural or man‑made disasters, fire, flooding, terrorism or other catastrophic events, system failure, labor disagreements or shipping problems will not result in delays in the delivery of merchandise to our stores. Such delays could materially adversely impact our business. In addition, we could incur significantly higher costs and longer lead times associated with distributing merchandise to our stores during the time it takes for us to reopen or replace our distribution center. Moreover, our business interruption insurance may not be adequate to cover or compensate us for any losses that may occur. In addition, our distribution center should have the capacity to support up to approximately 220 stores. To the extent that we grow to larger than 220 stores, we will need to expand our current distribution center and/or add new distribution capabilities.

We rely upon various means of transportation through third parties, including shipments by air, sea, rail and truck, to deliver products to our distribution center from vendors and from our distribution center to our stores, as well as for direct shipments from vendors to stores. Labor shortages or capacity constraints in the transportation industry, disruptions to the national and international transportation infrastructure, fuel shortages or transportation cost increases (such as increases in fuel costs or port fees) could materially adversely affect our business and operating results, particularly as we receive and deliver our seasonal and holiday merchandise.

14

We are subject to a number of risks because we import a significant portion of our merchandise.

Approximately 60% of our merchandise was purchased from vendors in foreign countries such as China, Hong Kong, Belgium and Taiwan during fiscal year 2017. In addition, many of our domestic vendors purchase a portion of their products from foreign sources. For example, we purchase merchandise from domestic vendors that is imported from China or that is manufactured in China and assembled in the United States. Currently, we do not employ any resources on the ground in Asia to manage our procurement process and various vendor relationships. Instead, we often rely on trading companies to handle sourcing and logistics with Asian factories.

Foreign sourcing subjects us to a number of risks generally associated with doing business abroad such as the following:

|

· |

long lead times; |

|

· |

work stoppages and strikes; |

|

· |

delays in shipment, shipping port and ocean carrier constraints; |

|

· |

freight cost increases; |

|

· |

product quality issues; |

|

· |

raw material shortages and factory consolidations; |

|

· |

employee rights issues and other social concerns; |

|

· |

epidemics and natural disasters; |

|

· |

political instability, international conflicts, war, threats of war, terrorist acts or threats, especially threats to foreign and U.S. ports and piracy; |

|

· |

economic conditions, including inflation; |

|

· |

the imposition of tariffs, duties, quotas, taxes, import and export controls and other trade restrictions; |

|

· |

governmental policies and regulations; and |

|

· |

the status of trade relations with foreign countries, including the loss of “most favored nation” status with the United States for a particular foreign country. |

Adverse events could have a greater impact on us than if our operations were in more dispersed geographical regions.

We currently operate 127 stores in 31 states, primarily in the South Central, Southeastern and Midwestern regions of the United States, including 25 stores in Texas. In addition, we operate a single distribution center and warehouse premises in Texas, which service all of our stores. Accordingly, the effect on us of adverse events in these regions, especially in Texas, such as weather (including hurricanes, tornadoes, floods, droughts, heavy snow, ice or rain storms), natural or man‑made disasters, catastrophic events, terrorism, blackouts, widespread illness or unfavorable regional economic conditions, may be greater than if our operations or inventory were more geographically dispersed throughout the country or abroad. Such events could result in physical damage to or destruction or disruption of one or more of our properties, physical damage to or destruction of our inventory, the closure of one or more stores, the lack of an adequate workforce in parts or all of our operations, supply chain disruptions, data and communications disruptions and the inability of our customers to shop in our stores.

15

In addition, increases in our selling, general and administrative expenses due to overhead costs could affect our profitability more negatively than if we had a larger store base. One or more unsuccessful new stores, or a decline in sales or profitability at an existing store, will have a more significant effect on our results of operations than if we had a larger store base.

Because of our international operations, we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti‑bribery and anti‑kickback laws.

We source over half of our products abroad. The U.S. Foreign Corrupt Practices Act and other similar laws and regulations generally prohibit companies and their intermediaries from making improper payments to non‑U.S. officials for the purpose of obtaining or retaining business. While our policies mandate compliance with these anti‑bribery laws, we cannot assure you that we will be successful in preventing our employees or other agents from taking actions in violation of these laws or regulations. Such violations, or allegations of such violations, could disrupt our business and result in a material adverse effect on our financial condition, results of operations and cash flows.

Our rebranding may not be successful.

During fiscal year 2015, we launched a significant rebranding initiative through which we spent over $20 million in capital and expenses to change our brand and corporate name and convert and refresh all of our stores. There is no assurance that our rebranding initiative will be successful or result in a positive return on investment. In addition, we have a limited operating history under the At Home brand. We believe that maintaining and enhancing our brand is integral to our business and to the implementation of our strategies for expanding our business. Therefore, we could be required to devote significant additional resources to advertising and marketing, which could have an adverse impact on our operations.

We are subject to risks associated with leasing substantial amounts of space.

We lease certain of our retail properties, our distribution center and our corporate office. The profitability of our business is dependent on operating our current store base with favorable margins, opening and operating new stores at a reasonable profit, renewing leases for stores in desirable locations and, if necessary, identifying and closing underperforming stores. We lease a significant number of our store locations, ranging from short‑term to long‑term leases. Typically, a large portion of a store’s operating expense is the cost associated with leasing the location.

The operating leases for our retail properties, distribution center and corporate office expire at various dates through 2036. A number of the leases have renewal options for various periods of time at our discretion. We are typically responsible for taxes, utilities, insurance, repairs and maintenance for these retail properties. Rent expense for the fiscal years ended January 31, 2015, January 30, 2016 and January 28, 2017 totaled approximately $42.9 million, $52.3 million and $68.1 million, respectively. Our future minimum rental commitments for all operating leases in existence as of January 28, 2017 for fiscal year 2018 is approximately $70.8 million and total approximately $856.2 million for fiscal years 2019 through 2035. We expect that many of the new stores we open will also be leased to us under operating leases, which will further increase our operating lease expenditures and require significant capital expenditures. We depend on cash flows from operations to pay our lease expenses and to fulfill our other cash needs. If our business does not generate sufficient cash flow from operating activities, and sufficient funds are not otherwise available to us from borrowings under our Asset-Based Lending Credit Facility (“ABL Facility”), as described in Note 5 – Revolving Line of Credit, to our audited consolidated financial statements included in “Item 15. Exhibits and Financial Statement Schedules,” or other sources, we may not be able to service our lease expenses or fund our other liquidity and capital needs, which would materially affect our business.

Over time current store locations may not continue to be desirable because of changes in demographics within the surrounding area or a decline in shopping traffic, including traffic generated by other nearby stores. Although we have the right to terminate some of our leases under specified conditions by making certain payments (typically within two to three years after opening a store), we may not be able to terminate a particular lease if or when we would like to do so. If we decide to close stores, we are generally required to either continue to pay rent and operating expenses for the balance of the lease term or, for certain locations, pay exercise rights to terminate, which in either case could be expensive. Even if we are able to assign or sublease vacated locations where our lease cannot be terminated, we may remain liable on the lease obligations if the assignee or sublessee does not perform.

16

In addition, when leases for the stores in our ongoing operations expire, we may be unable to negotiate renewals, either on commercially acceptable terms, or at all, which could cause us to close stores in locations that may be desirable. We may be unable to relocate these stores cost‑effectively or at all and there can be no assurance that any relocated stores will be successful.

We are subject to risks associated with our sale‑leaseback strategy.

From time to time, we engage in sale‑leaseback transactions. The net proceeds from such transactions have been used to reduce outstanding debt and fund future capital expenditures for new store development. However, the sale‑leaseback market may cease to be a reliable source of additional cash flows for us in the future if capitalization rates become less attractive, other unfavorable market conditions develop or the perceived value of our owned property declines. For example, should the sale‑leaseback market require significantly higher yields (which may occur as interest rates rise), we may not enter into sale‑leaseback transactions, which could adversely affect our ability to reduce outstanding debt and fund capital expenditures for future store development.

We operate in a highly competitive retail environment.

The retail business is highly competitive. The marketplace for home décor products is highly fragmented as many different retailers compete for market share by using a variety of store formats and merchandising strategies, dedicating a portion of their selling space to a limited selection of home décor, seasonal and holiday merchandise. Although we are the only big box concept solely dedicated to the home décor space, for all of our major products we compete with a diverse group of retailers, including mass merchants (such as Target and Wal‑Mart), home improvement stores (such as Home Depot and Lowe’s), craft retailers (such as Hobby Lobby, Jo‑Ann Stores and Michaels Stores), home specialty/décor retailers (such as Bed Bath & Beyond, The Container Store, Home Goods and Pier 1 Imports), as well as various other small, independent retailers. In addition, to a lesser extent, we compete with Internet‑based retailers (such as Wayfair), which competition could intensify in the future.

We compete with these and other retailers for customers, retail locations, management and other personnel. Some of our competitors are larger and have greater resources, more customers and greater store brand recognition. They may secure better terms from vendors, adopt more aggressive pricing and devote more resources to technology, distribution and marketing. Competitive pressures or other factors could cause us to lose customers, sales and market share, which may require us to lower prices, increase marketing and advertising expenditures or increase the use of discounting or promotional campaigns, each of which could materially adversely affect our margins and could result in a decrease in our operating results and profitability. We cannot guarantee that we will continue to be able to compete successfully against existing or future competitors. Further, although we do not currently engage in e‑commerce, there is no assurance that we will not in the future, and the use of e‑commerce by our competitors could have a material adverse effect on our business. Expansion into markets served by our competitors, entry of new competitors, expansion of existing competitors into our markets or the adoption by competitors of innovative store formats and retail sale methods, including e‑commerce, could cause us to lose market share and could be detrimental to our business, financial condition and results of operations.

We face risks related to our substantial indebtedness.