Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - STAGE STORES INC | ssi-2017_ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - STAGE STORES INC | ssi-2017_ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - STAGE STORES INC | ssi-2017_ex311.htm |

| EX-24.2 - EXHIBIT 24.2 - STAGE STORES INC | ssi-2017_ex242.htm |

| EX-24.1 - EXHIBIT 24.1 - STAGE STORES INC | ssi-2017_ex241.htm |

| EX-23 - EXHIBIT 23 - STAGE STORES INC | ssi-2017_ex23.htm |

| EX-21 - EXHIBIT 21 - STAGE STORES INC | ssi-2017_ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 28, 2017

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File No. 1-14035

Stage Stores, Inc.

(Exact Name of Registrant as Specified in Its Charter)

NEVADA (State or Other Jurisdiction of Incorporation or Organization) | 91-1826900 (I.R.S. Employer Identification No.) |

2425 WEST LOOP SOUTH, HOUSTON, TEXAS (Address of Principal Executive Offices) | 77027 (Zip Code) |

Registrant’s telephone number, including area code: (800) 579-2302

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Common Stock ($0.01 par value) | Name of each exchange on which registered New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer þ Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of July 29, 2016 (the last business day of the registrant’s most recently completed second quarter), the aggregate market value of the voting and non-voting common stock of the registrant held by non-affiliates of the registrant was $154,962,842 (based upon the closing price of the registrant’s common stock as reported by the New York Stock Exchange on July 29, 2016).

As of March 21, 2017, there were 27,168,594 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to the registrant’s Annual Meeting of Shareholders to be held on June 1, 2017, which will be filed within 120 days of the end of the registrant’s fiscal year ended January 28, 2017 (“Proxy Statement”), are incorporated by reference into Part III of this Form 10-K to the extent described therein.

2

TABLE OF CONTENTS | ||

Page | ||

3

References to a particular year are to Stage Stores, Inc.’s fiscal year, which is the 52- or 53-week period ending on the Saturday closest to January 31st of the following calendar year. For example, a reference to “2014” is a reference to the fiscal year ended January 31, 2015, “2015” is a reference to the fiscal year ended January 30, 2016 and “2016” is a reference to the fiscal year ended January 28, 2017. 2014, 2015 and 2016 each consisted of 52 weeks. Similarly, references to a particular quarter are to Stage Stores, Inc.’s fiscal quarters.

PART I

ITEM 1. BUSINESS

Our Business

Stage Stores, Inc. and its subsidiary (“we,” “us” or “our”) operate specialty department stores primarily in small and mid-sized towns and communities. We provide customers a welcoming and comfortable shopping experience in our stores and through our direct-to-consumer business. Our merchandise assortment is a well-edited selection of moderately priced brand name and private label apparel, accessories, cosmetics, footwear and home goods. As of January 28, 2017, we operated 798 specialty department stores in 38 states under the BEALLS, GOODY’S, PALAIS ROYAL, PEEBLES and STAGE nameplates and a direct-to-consumer business.

Our History

Stage Stores, Inc. was formed in 1988 when the management of Palais Royal, together with several venture capital firms, acquired the family-owned Bealls and Palais Royal chains, both of which were originally founded in the 1920s. At the time of the acquisition, Palais Royal operated primarily larger stores, located in and around the Houston metropolitan area, while Bealls operated primarily smaller stores, principally located in rural Texas towns.

Our Market and Target Customer

Our distinct store environment and well-edited assortments offer name brand, trend-right apparel, accessories, cosmetics, footwear and home goods. While our broad assortments attract a wide demographic, our primary target customers are style and value savvy women over the age of 35 who are married, employed full time and have an average household income of $55,000. Our customer research reveals our target customer loves shopping and enjoys a shopping experience that brings her style, value and inspiration where she lives.

Competition

The retail industry is highly competitive, with competition coming from both brick-and-mortar stores as well as e-commerce. We view our ability to provide our customers the options of shopping both in store and online, particularly in underserved markets, as a competitive advantage. Additional competitive advantages over local retailers and small regional chains in the small to mid-sized communities include (i) economies of scale (ii) strong vendor relationships (iii) a widely used private label credit card and (iv) extensive experience in small and mid-size markets. In larger markets where we compete against other national department store chains, we distinguish ourselves by striving to offer a high level of customer service and the advantage of generally being in neighborhood locations with convenient parking and easy access.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and are key drivers of our success:

Unique Real Estate Positioning and Strong Store Economics. Our stores are predominantly located in small towns and communities with populations of less than 150,000 people. We predominantly lease our locations and are generally secondary users of space, allowing us to secure advantageous occupancy terms. Our average store of 18,000 square feet creates an opportunity to offer a selection that feels comprehensive and curated in an inviting environment.

4

Trend-Right, Brand Name Merchandise Delivered at a Compelling Value. Our stores and direct-to-consumer business carry a broad selection of trend-right, brand name apparel, accessories, cosmetics, footwear and home goods for the entire family. Our buyers identify and purchase nationally recognized, quality brands and trend-right styles our customers find compelling from respected brands such as Adidas, Calvin Klein, Carters, Chaps, Clinique, Dockers, Estee Lauder, Izod, Levi’s, Nautica, Nike, Nine West and Skechers. Our value proposition for moderately priced, brand name merchandise includes discount and promotional offers. We believe our use of discount and promotional offers generates customer excitement and drives loyalty and repeat shopping.

Experienced Management Team with a Disciplined Operating Philosophy. Our senior management team has extensive experience across a wide range of disciplines in the retail industry, including merchandising, marketing, store operations, human resources, information systems and finance. Our management team has built a solid operating foundation based on sound retail principles and is focused on taking care of our customers and providing great merchandise and a great experience.

Stores

Store Openings and Closures. We did not open any new stores during 2016 and do not plan to open new stores in 2017. As part of a strategic evaluation of our store portfolio in 2015, we announced a multi-year plan to close stores that we believe do not have the potential to meet our sales productivity and profitability standards. Since then, we have closed 60 stores, including 37 stores during 2016. We expect to close approximately 100 stores in total through 2019, with 15 to 20 store closures anticipated for 2017. We continually review the profitability of each store and will consider closing a store if the expected store performance does not meet our financial hurdle rates. The closure of these stores is expected to improve our ability to effectively allocate capital, deliver higher sales productivity and be accretive to earnings.

Expansion, Relocation and Remodeling. During 2016, we completed 86 store remodels, relocations and expansions. Since we began our store remodel initiative in 2015, we have updated over 200 stores representing approximately 45% of our sales base. We believe that our investment in these stores improves the store environment and helps us create an inviting and differentiated shopping experience. Our store remodels are designed to create a bright, fun and comfortable environment and include upgrades ranging from improved lighting, flooring, paint, fixtures, fitting rooms, visual merchandising and signage, to more extensive expansion projects.

Store count and selling square footage by nameplate are as follows:

Number of Stores | Selling Square Footage (in thousands) | |||||||||||||||||

January 30, 2016 | 2016 Activity Net Changes(a) | January 28, 2017 | January 30, 2016 | 2016 Activity Net Changes | January 28, 2017 | |||||||||||||

Bealls | 205 | (1 | ) | 204 | 4,119 | 43 | 4,162 | |||||||||||

Goody's | 250 | (26 | ) | 224 | 3,949 | (480 | ) | 3,469 | ||||||||||

Palais Royal | 52 | (3 | ) | 49 | 1,110 | (47 | ) | 1,063 | ||||||||||

Peebles | 193 | (6 | ) | 187 | 3,523 | (94 | ) | 3,429 | ||||||||||

Stage | 134 | — | 134 | 2,429 | 36 | 2,465 | ||||||||||||

Total | 834 | (36 | ) | 798 | 15,130 | (542 | ) | 14,588 | ||||||||||

(a) One store, which had been temporarily closed and was not included in the store count as of January 30, 2016, was relocated and reopened in 2016. | ||||||||||||||||||

5

Utilizing a ten-mile radius from each store, approximately 65% of our stores are located in communities with populations below 50,000 people, while an additional 19% of our stores are located in communities with populations between 50,000 and 150,000 people. The remaining 16% of our stores are located in higher-density markets with populations greater than 150,000 people, such as Houston, San Antonio and Lubbock, Texas. The store count and selling square footage by market area population are as follows:

Number of Stores | Selling Square Footage (in thousands) | |||||||||||||||||

Population | January 30, 2016 | 2016 Activity Net Changes(a) | January 28, 2017 | January 30, 2016 | 2016 Activity Net Changes | January 28, 2017 | ||||||||||||

Less than 50,000 | 538 | (15 | ) | 523 | 8,717 | (165 | ) | 8,552 | ||||||||||

50,000 to 150,000 | 167 | (18 | ) | 149 | 3,412 | (310 | ) | 3,102 | ||||||||||

Greater than 150,000 | 129 | (3 | ) | 126 | 3,001 | (67 | ) | 2,934 | ||||||||||

Total | 834 | (36 | ) | 798 | 15,130 | (542 | ) | 14,588 | ||||||||||

(a) One store, which had been temporarily closed and was not included in the store count as of January 30, 2016, was relocated and reopened in 2016. | ||||||||||||||||||

Direct-to-Consumer

In our ongoing effort to enhance the customer experience, we are focused on providing customers with a seamless experience across our channels. Our direct-to-consumer business, which consists of our e-commerce website and Send program, enables us to reach customers with additional convenience and assortment of merchandise, acquire customers beyond our local markets, and further build our brand. Our e-commerce website, which we launched in 2010, features a broader assortment of the merchandise categories found in our stores, as well as additional product offerings. Our in-store Send program allows customers to have merchandise shipped directly to their homes if the preferred size or color is not available in their local store.

As our omni-channel strategy continues to mature, it is increasingly difficult to distinguish between store sales and direct-to-consumer sales. Below are few examples of how our stores and direct-to-consumer business intersect:

• | Stores increase online sales by providing customers opportunities to view, touch and/or try on physical merchandise before ordering online. |

• | Many customers preview our merchandise online before making a purchase in our stores. |

• | Most online purchases can easily be returned in our stores. |

• | In 2016, we introduced buy online, ship to store, which gives our customers the option to have online purchases shipped for free to a local store. |

• | Style Circle Rewards® can be redeemed online or in stores regardless of where they are earned. |

• | Customers may apply coupons from our website or mobile app to their purchase when they check out in the store. |

• | Online orders may be shipped from one of our distribution centers, a store, a direct ship vendor or any combination of the above. |

Providing our customers the opportunity to engage with us through multiple channels is part of a cohesive business strategy that helps us build our brand loyalty. Customers that shop with us both online and in stores spend, on average, 3 times more than customers that shop only in our stores.

6

Merchandising

We offer a well-edited selection of moderately priced, branded merchandise within distinct merchandise categories of women’s, men’s and children’s apparel, accessories, cosmetics, footwear and home goods. Our direct-to-consumer business allows us to extend the breadth of our assortments and offer additional products.

The following table sets forth the distribution of net sales among our various merchandise categories:

Fiscal Year | |||||||||

Merchandise Category | 2016 | 2015 | 2014 | ||||||

Women’s | 37 | % | 38 | % | 38 | % | |||

Men’s | 17 | 17 | 17 | ||||||

Children's | 12 | 11 | 11 | ||||||

Footwear | 13 | 13 | 13 | ||||||

Accessories | 7 | 7 | 8 | ||||||

Cosmetics/Fragrances | 10 | 10 | 9 | ||||||

Home/Gifts/Other | 4 | 4 | 4 | ||||||

100 | % | 100 | % | 100 | % | ||||

Merchandise selections reflect current styles and trends and merchandise mix may also vary from store to store to accommodate differing demographic, regional and climate characteristics. Our buying and planning team uses technology tools such as size pack optimization and store level markdown optimization. These tools allow us to better fulfill customer needs by tailoring size assortments by store and by being more targeted in how we markdown merchandise by climate and store.

Approximately 82% of sales consist of nationally recognized brands such as Adidas, Calvin Klein, Carters, Chaps, Clinique, Dockers, Estee Lauder, G by Guess, Izod, Jessica Simpson, Levi’s, Nike, Nine West and Skechers, while the remaining 18% of sales are private label merchandise.

Our private label portfolio brands are developed and sourced through agreements with third party vendors. We believe our private label and exclusive brands offer a compelling mix of style, quality and value. We continue to refine the positioning of our private brands and we see them as an avenue for growth.

Merchandise Distribution

We currently distribute all merchandise to our stores through distribution centers located in Jacksonville, Texas, South Hill, Virginia and Jeffersonville, Ohio. Incoming merchandise received at the distribution centers is inspected for quality control purposes.

Integrated merchandising and warehouse management systems support all corporate and distribution center locations. All of our distribution centers are equipped with modern sortation equipment which enables us to meet specific store merchandise assortment needs. The majority of stores receive merchandise within three days of shipment from the distribution centers. We utilize third party contract carriers to deliver merchandise from the distribution centers to our stores.

Direct-to-consumer orders are predominantly filled from our distribution center in Jacksonville, Texas and to a lesser extent from our Jeffersonville, Ohio distribution center, select stores and directly from our vendors.

7

Marketing

Our marketing strategy is designed to establish and reward brand loyalty. The strategy supports each store’s position as the destination for desirable styles and nationally recognized brands at an attractive value in a comfortable and welcoming environment. Our marketing strategy leverages (i) consumer insight from brand and customer research, (ii) identified customer purchase history and (iii) emerging technology and trends in retail marketing.

We use a multi-media advertising approach, including broadcast media, digital media, mobile media, local newspaper inserts and direct mail. In addition, we leverage our private label credit card to create strong customer loyalty through compelling offers, dedicated events for cardholders, and updates on the latest deliveries in our stores.

We consider our private label credit card program and Style Circle Rewards®, our tender-neutral loyalty program, to be vital components of our business because these loyalty programs (i) enhance customer loyalty, (ii) allow us to identify and regularly contact our best customers and (iii) create a comprehensive database that enables us to implement targeted and personalized marketing messages. Private label credit card purchases represented 47%, 44% and 40% of our sales in 2016, 2015 and 2014, respectively. In the third quarter of 2016, we launched Style Circle Rewards® to encourage and reward customer loyalty for both private label credit cardholders and non-cardholders. These loyalty programs allow us to better understand and respond to our customers’ shopping habits and are powerful tools to drive higher transaction value and frequency of visits.

Brand image is an important part of our marketing program. Our principal trademarks, including the BEALLS, GOODY’S, PALAIS ROYAL, PEEBLES and STAGE trademarks, have been registered with the U.S. Patent and Trademark Office. We have also registered trademarks used in connection with our private label merchandise. We regard our trademarks and their protection as important to our success.

We maintain a connection to the communities we serve and operate a locally based giving campaign called 30 Days of Giving under our Community Counts program. In 2016, through our Community Counts program and other efforts like our Bears that Care program, we helped raise approximately $2.1 million for the communities we serve.

Customer Service

We strive to provide exceptional customer service through conveniently located stores staffed with well-trained and motivated sales associates. In order to ensure consistency of execution, each sales associate is evaluated based on the attainment of specific customer service standards, such as offering a friendly greeting, providing prompt assistance, helping open private label credit card accounts, thanking customers and inviting return visits. We also conduct customer satisfaction surveys to measure and monitor attainment of customer service expectations. The results of customer surveys are used to provide feedback to reinforce and improve customer service. To further reinforce our focus on customer service, we have various programs in place to recognize our sales associates for providing outstanding customer service.

8

Information Systems

We support our business by using multiple, highly integrated systems in areas such as merchandising, store operations, distribution, sales promotion, personnel management, store design and accounting. Our core merchandising systems assist in planning, ordering, allocating and replenishing merchandise assortments for each store, based on specific characteristics and recent sales trends. Our replenishment/fulfillment system allows us to maintain planned levels of in-stock positions in basic items such as jeans and underwear. In addition, a fully integrated warehouse management system is in place in all three distribution centers.

We have a store level markdown optimization tool, which is focused on pricing items on a style-by-style basis at the appropriate price, based on inventory levels and sales history to maximize revenue and profitability. Our assortment planning system allows us to create customer-centric assortments aligned to sales strategies. The system also facilitates cleaner seasonal transitions and fresher merchandise in stores. We continue to expand the utilization and effectiveness of our merchandise planning system in order to maximize the generation of sales and gross margin. In 2016, we implemented new systems to support our Style Circle Rewards® loyalty program and omni-channel order management, and we introduced buy online, ship to store.

We utilize a point-of-sale (“POS”) platform with bar code scanning, electronic credit authorization, instant credit, a returns database and gift card processing in all our stores. The POS platform allows us to capture customer specific sales data for use in our merchandising, marketing and loss prevention systems, while servicing our customers. The POS platform also manages coupon and deal-based pricing, which streamlines the checkout process and improves store associate adherence to promotional markdown policies.

Our Employees

At January 28, 2017, we employed approximately 12,400 hourly and salaried employees. Employee levels vary during the year as we traditionally hire additional sales associates and increase the hours of part-time sales associates during peak seasonal selling periods. We consider our relationship with our employees to be good, and there are no collective bargaining agreements in effect with respect to any of our employees.

Seasonality

Our business is seasonal and sales are traditionally lower during the first three quarters of the fiscal year (February through October) and higher during the last quarter of the fiscal year (November through January). The fourth quarter usually accounts for approximately 32% of our annual sales, with each of the other quarters accounting for approximately 22% to 24%. Working capital requirements fluctuate during the year as well and generally reach their highest levels during the third and fourth quarters.

9

Available Information

We make available, free of charge, through the “Investor Relations” section of our website (www.stagestoresinc.com)

under the “Financial Reports” caption, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). In this Form 10-K, we incorporate by reference certain information from parts of our Proxy Statement for our 2017 Annual Meeting of Shareholders (“Proxy Statement”).

Also in the “Investor Relations” section of our website (www.stagestoresinc.com) under the “Corporate Governance” and “Financial Reports” captions, the following information relating to our corporate governance may be found: Corporate Governance Guidelines; charters of our Board of Directors’ Audit, Compensation, and Corporate Governance and Nominating Committees; Code of Ethics and Business Conduct; Code of Ethics for Senior Officers; Chief Executive Officer and Chief Financial Officer certifications related to our SEC filings; and transactions in our securities by our directors and executive officers. The Code of Ethics and Business Conduct applies to all of our directors and employees. The Code of Ethics for Senior Officers applies to our Chief Executive Officer, Chief Financial Officer, Controller and other individuals performing similar functions, and contains provisions specifically applicable to the individuals serving in those positions. We intend to post amendments to and waivers from, if any, our Code of Ethics and Business Conduct (to the extent applicable to our directors and executive officers) and our Code of Ethics for Senior Officers in the “Investor Relations” section of our website (www.stagestoresinc.com) under the “Corporate Governance” caption. We will provide any of the foregoing information without charge upon written request to our Secretary. The contents of our websites are not part of this report.

10

ITEM 1A. RISK FACTORS

Cautionary Statement Concerning Forward-Looking Statements for Purposes of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995

The Private Securities Litigation Reform Act of 1995 (“Act”) provides a safe harbor for forward-looking statements to encourage companies to provide prospective information, so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that may cause actual results to differ materially from those discussed in the statements. We wish to take advantage of the “safe harbor” provisions of the Act.

Certain statements in this report are forward-looking statements within the meaning of the Act, and such statements are intended to qualify for the protection of the safe harbor provided by the Act. The words “anticipate,” “estimate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “may,” “target,” “forecast,” “guidance,” “outlook,” and similar expressions generally identify forward-looking statements. Similarly, descriptions of our objectives, strategies, plans, goals or targets are also forward-looking statements. Forward-looking statements relate to the expectations of management as to future occurrences and trends, including statements expressing optimism or pessimism about future operating results or events and projected sales, earnings, capital expenditures and business strategy.

Forward-looking statements are based upon a number of assumptions and factors concerning future conditions that may ultimately prove to be inaccurate and could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements that are made herein and in other reports and releases are not guarantees of future performance and actual results may differ materially from those discussed in such forward-looking statements as a result of various factors. These factors include, but are not limited to, the ability for us to maintain normal trade terms with vendors, the ability for us to comply with the various covenant requirements contained in the Revolving Credit Facility agreement (as defined in “Liquidity and Capital Resources”), the demand for apparel, and other factors. The demand for apparel and sales volume can be affected by significant changes in economic conditions, including an economic downturn, employment levels in our markets, consumer confidence, energy and gasoline prices, the value of the Mexican peso, and other factors influencing discretionary consumer spending. Other factors affecting the demand for apparel and sales volume include unusual weather patterns, an increase in the level of competition, competitors’ marketing strategies, changes in fashion trends, changes in the average cost of merchandise purchased for resale, availability of product on normal payment terms and the failure to achieve the expected results of our merchandising and marketing plans as well as our store opening or relocation plans. Additional assumptions, factors and risks concerning future conditions are discussed in the Risk Factors section of this Form 10-K, and may be discussed from time to time in our other filings with the SEC, including Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Most of these factors are difficult to predict accurately and are generally beyond our control.

Forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Although management believes the expectations expressed in forward-looking statements are based on reasonable assumptions within the bounds of our knowledge, forward-looking statements, by their nature, involve risks, uncertainties and other factors, any one or a combination of which could materially affect our business, financial condition, results of operations or liquidity.

Readers should carefully review this Form 10-K in its entirety, including, but not limited to our financial statements and the accompanying notes, and the risks and uncertainties described in this Item 1A. Readers should consider these risks, uncertainties and other factors carefully in evaluating forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. Forward-looking statements contained in this Form 10-K are made as of the date of this Form 10-K. We undertake no obligation to publicly update forward-looking statements whether as a result of new information, future events or otherwise. Readers are advised, however, to consult any further disclosures we make on related subjects in our public announcements and SEC filings.

Our ability to achieve the results contemplated by forward-looking statements is subject to a number of factors, any one, or a combination, of which could materially affect our business, financial condition, results of operations, or liquidity. Described below are certain risk factors that management believes are applicable to our business and the industry in which we operate. There may also be additional risks that are presently immaterial or unknown.

11

If we are unable to successfully execute our strategies, our operating performance may be significantly impacted. There is a risk that we will be unable to meet our operating performance targets and goals in the future if our strategies and initiatives are unsuccessful. Our ability to develop and execute our strategic plan and to execute the business activities associated with our strategic and operating plans, may impact our ability to meet our operating performance targets.

An economic downturn or decline in consumer confidence may negatively impact our business and financial condition. Our results of operations are sensitive to changes in general economic and political conditions that impact consumer discretionary spending, such as employment levels, taxes, energy and gasoline prices and other factors influencing consumer confidence. We have extensive operations in the South Central, Southeastern and Mid-Atlantic states. Many stores are located in small towns and rural environments that are substantially dependent upon the local economy. We also have concentrations of stores in areas where the local economy is heavily dependent on the oil and gas industry, particularly in portions of Texas, Louisiana, Oklahoma, and New Mexico. A decline in crude oil prices may negatively impact employment in those communities, resulting in reduced consumer confidence and discretionary spending. Additionally, approximately 3% of our stores contributing approximately 6% of our 2016 sales are located in cities that either border Mexico or are in close proximity to Mexico. A devaluation of the Mexican peso will reduce the purchasing power of those customers who are citizens of Mexico. In such an event, revenues attributable to these stores could be reduced. In 2015 and 2016, we experienced pressure on our business in areas that are heavily dependent on the oil industry and near the Mexican border. If those pressures continue or there is an additional economic downturn or decline in consumer confidence, particularly in the South Central, Southeastern and Mid-Atlantic states and any state from which we derive a significant portion of our net sales (such as Texas or Louisiana), our business, financial condition and cash flows will be negatively impacted and such impact may be material.

Unusual weather patterns or natural disasters may negatively impact our financial condition. Our business depends, in part, on normal weather patterns in our markets. We are susceptible to unseasonable and severe weather conditions, including natural disasters, such as hurricanes and tornadoes. Any unusual or severe weather, especially in states such as Texas and Louisiana, may have a material and adverse impact on our business, financial condition and cash flows. In addition, our business, financial condition and cash flow may be adversely affected if the businesses of our key vendors or their merchandise manufacturers, shippers, carriers and other merchandise transportation service providers, including those outside of the United States, are disrupted due to severe weather, such as, but not limited to, hurricanes, typhoons, tornadoes, tsunamis or floods.

Our failure to anticipate and respond to changing customer preferences in a timely manner may adversely affect our operations. Our success depends, in part, upon our ability to anticipate and respond to changing consumer preferences and fashion trends in a timely manner. We attempt to stay abreast of emerging lifestyles and consumer preferences affecting our merchandise. However, any sustained failure on our part to identify and respond to such trends may have a material and adverse effect on our business, financial condition and cash flows.

Failure to successfully operate our e-commerce website or fulfill customer expectations may adversely impact our business and sales. Our e-commerce platform provides another channel to generate sales. We believe that our e-commerce website will drive incremental sales by providing existing customers another opportunity to shop with us and allowing us to reach new customers. If we do not successfully meet the challenges of operating an e-commerce website or fulfilling customer expectations, our business and sales may be adversely affected.

We face significant competition in the retail apparel industry, which may adversely affect our sales and profitability. The retail apparel business is highly competitive. We compete with local, regional, national and online retailers, including department, specialty and discount stores, direct-to-consumer businesses and other forms of retail commerce. The Internet and evolving technologies in retail have led to increased competition as there are fewer barriers to entry and consumers are able to quickly and conveniently comparison shop. We compete on many factors, such as, merchandise assortment, advertising, price, quality, convenience, customers’ shopping experience, store environment, service, loyalty programs and credit availability. Unanticipated changes in the pricing and other practices of our competitors may create downward pressure on prices and lower demand for our products, which may adversely impact our sales and profitability.

There can be no assurance that our liquidity will not be affected by changes in economic conditions. Due to our operating cash flow and availability under the Revolving Credit Facility, we continue to believe that we have the ability to meet our financing needs for the foreseeable future. However, there can be no assurance that our liquidity will not be materially and adversely affected by changes in economic conditions.

12

Failure to obtain merchandise product on normal trade terms and/or our inability to pass on any price increases related to our merchandise may adversely impact our business, financial condition and cash flows. We are highly dependent on obtaining merchandise product on normal trade terms. Failure to meet our performance objectives may cause key vendors and factors to become more restrictive in granting trade credit. The tightening of credit, such as a reduction in our lines of credit or payment terms from the vendor or factor community, may have a material adverse impact on our business, financial condition and cash flows. We are also highly dependent on obtaining merchandise at competitive and predictable prices. In the event we experience rising prices related to our merchandise, whether due to cost of materials, inflation, transportation costs, or otherwise, and are unable to pass on those rising prices to our customers, our business, financial condition and cash flows may be adversely and materially affected.

Risks associated with our vendors from whom our products are sourced may have a material adverse effect on our business and financial condition. Our merchandise is sourced from a variety of domestic and international vendors. All of our vendors must comply with applicable laws, including our required standards of conduct. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs and other factors relating to foreign trade, the ability to access suitable merchandise on acceptable terms and the financial viability of our vendors are beyond our control and may adversely impact our performance.

Risks associated with our carriers, shippers and other providers of merchandise transportation services may have a material adverse effect on our business and financial condition. Our vendors rely on shippers, carriers and other merchandise transportation service providers (collectively “Transportation Providers”) to deliver merchandise from their manufacturers, both in the United States and abroad, to the vendors’ distribution centers in the United States. Transportation Providers are also responsible for transporting merchandise from their vendors’ distribution centers to our distribution centers. We also rely on Transportation Providers to transport merchandise from our distribution centers to our stores and to our customers in the case of direct-to-consumer sales. However, if work slowdowns, stoppages, weather or other disruptions affect the transportation of merchandise between the vendors and their manufacturers, especially those manufacturers outside the United States, between the vendors and us, or between us and our e-commerce customers, our business, financial condition and cash flows may be adversely affected.

A catastrophic event adversely affecting any of our buying, distribution or other corporate facilities may result in reduced revenues and loss of customers. Our buying, distribution and other corporate operations are in highly centralized locations. Our operations may be materially and adversely affected if a catastrophic event (such as, but not limited to, fire, hurricanes, tornadoes or floods) impacts the use of these facilities. While we have contingency plans that would be implemented in the event of a catastrophic event, there are no assurances that we would be successful in obtaining alternative servicing facilities in a timely manner in the event of such a catastrophe.

War, acts of terrorism, Mexican border violence, public health issues and natural disasters may create uncertainty and may result in reduced revenues. We cannot predict, with any degree of certainty, what effect, if any, war, acts of terrorism, Mexican border violence, public health issues and natural disasters, if any, will have on us, our operations, the other risk factors discussed herein and the forward-looking statements we make in this Form 10-K. However, the consequences of these events may have a material adverse effect on our business, financial condition and cash flows.

A disruption of our information technology systems may have a material adverse impact on our business and financial condition. We are heavily dependent on our information technology systems for day-to-day business operations, including sales, warehousing, distribution, purchasing, inventory control, merchandise planning and replenishment, and financial systems. Certain of our information technology support functions are performed by third-parties in overseas locations. While we believe that we are diligent in selecting the vendors that assist us in maintaining the reliability and integrity of our information technology systems, failure by any of these third-parties to implement and/or manage our information systems and infrastructure effectively and securely could result in future disruptions, service outages, service failures or unauthorized intrusions. Despite our precautionary efforts, our information technology systems are vulnerable to damage or interruption from, among other things, natural or man-made disasters, technical malfunctions, inadequate systems capacity, power outages, computer viruses and security breaches, which may require significant investment to fix or replace, and we may suffer loss of critical data and interruptions or delays to our operations in the interim. In addition, as part of our normal course of business, we collect, process and retain sensitive and confidential customer information. Potential risks include, but are not limited to, the following: (i) an intrusion by a hacker, (ii) the introduction of malware (virus, Trojan horse, spyware), (iii) hardware failure, (iv) outages due to software defects and (v) human error. Although we run anti-virus and anti-spyware software and take other steps to ensure that our information technology systems will not be disabled or otherwise disrupted, there are no assurances that disruptions will not occur. The consequences of a disruption, depending on the severity, may have a material adverse effect on our business and financial condition and may expose us to civil, regulatory and industry actions and possible judgments, fees and fines.

13

A security breach that results in unauthorized disclosure of customer, employee, vendor or our company information may adversely impact our business, reputation and financial condition. In the standard course of business, we receive, process and store information about our customers, employees, vendors and our business, some of which is entrusted to third-party service providers and vendors. We also work with third-party service providers and vendors that provide technology, systems and services that we use in connection with the receipt, storage and transmission of this information. Hardware, software or applications obtained from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise our information security. We rely on commercially available systems, software, tools (including encryption technology) and monitoring to provide security and oversight for processing, transmission, storage and the protection of confidential information. Despite the security measures we have in place, our facilities and systems (and those of our vendors and third party service providers) may be vulnerable to security breaches, acts of vandalism and theft, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. Our employees, contractors, vendors or third party service providers may attempt to circumvent our security measures in order to misappropriate such information, and may purposefully or inadvertently cause a breach involving such information. Additionally, unauthorized parties may attempt to gain access to our systems or facilities through fraud, trickery, or other means of deceit. We have programs in place to detect, contain and respond to data security incidents. However, because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently, we may be unable to anticipate these techniques or implement adequate preventive measures to safeguard against all data security breaches or misuses of data. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential customer, employee or company information may severely damage our reputation, cause us to incur significant remediation costs, expose us to the risks of legal proceedings (including fines or other regulatory sanctions), disrupt our operations, attract a substantial amount of negative media attention, damage our customer relationships, and otherwise have a material adverse impact on our reputation, business, operating results, financial condition and cash flows.

We are subject to payment-related risks that may increase our operating costs, expose us to fraud or theft, subject us to potential liability and potentially disrupt our business. We accept payments using a variety of methods, including cash, checks, credit and debit cards, and gift cards, and we may offer new payment options over time. Acceptance of these payment options subjects us to rules, regulations, contractual obligations and compliance requirements, including payment network rules and operating guidelines, data security standards and certification requirements, and rules governing electronic funds transfers. These requirements may change over time or be reinterpreted, making compliance more difficult or costly. We rely on third parties to provide payment processing services and pay interchange and other fees, which may increase over time and raise our operating costs. On October 1, 2015, the payment cards industry began shifting liability for certain debit and credit card transactions to retailers who do not accept Europay, MasterCard and Visa (“EMV”) chip technology transactions. We have not yet implemented EMV chip technology. Implementation of the EMV chip technology and receipt of final certification is subject to the time availability of third-party service providers and may require upgrades to our systems and hardware. Further, we may experience a decrease in transaction volume if we cannot process transactions for cardholders whose card issuer has migrated entirely from magnetic strip to EMV chip enabled cards. Until we are able to fully implement and certify the EMV chip technology in our stores, we may be liable for chargebacks related to counterfeit transactions generated through EMV chip enabled cards, which could negatively impact our operational results, financial position and cash flows.

Our failure to attract, develop and retain qualified employees may negatively impact the results of our operations. We strive to have well-trained and motivated sales associates provide customers with exceptional service. Our success depends in part upon our ability to attract, develop and retain a sufficient number of qualified employees, including store, service and administrative personnel. Competition for key personnel in the retail industry is intense and our future success will depend on our ability to recruit, train, and retain our senior executives and other qualified personnel.

Changes in the regulatory or administrative landscape could adversely affect our financial condition and results of operations. Laws and regulations at the local, state, federal, and international levels frequently change, and the ultimate cost of compliance cannot be precisely estimated. In addition, we cannot predict the impact that may result from changes in the regulatory or administrative landscape. Any changes in regulations, the imposition of additional regulations, or the enactment of any new or more stringent legislation that impacts employment and labor, trade, product safety, transportation and logistics, health care, tax, privacy, operations, or environmental issues, among others, could have an adverse impact on our financial condition and results of operations.

14

Our business may be materially and adversely affected by changes to fiscal and tax policies. The new U.S. presidential administration has called for substantial change to fiscal tax policies, which may include comprehensive tax reform. We cannot predict the impact, if any, of these changes to our business. It is likely that some policies adopted by the new administration will benefit us and others will negatively affect us. Until we know what changes are enacted, we will not know whether in total we will benefit from, or be negatively affected by, the changes.

We may be subject to periodic litigation and regulatory proceedings which may adversely affect our business and financial performance. From time to time, we are involved in lawsuits and regulatory proceedings. Due to the inherent uncertainties of such matters, we may not be able to accurately determine the impact on us of any future adverse outcome of such matters. The ultimate resolution of these matters may have a material adverse impact on our financial condition, results of operations and liquidity. In addition, regardless of the outcome, these matters may result in substantial cost to us and may require us to devote substantial attention and resources to defend ourselves.

If our trademarks are successfully challenged, the outcome of those disputes may require us to abandon one or more of our trademarks. We regard our trademarks and their protection as important to our success. However, we cannot be sure that any trademark held by us will provide us a competitive advantage or will not be challenged by third parties. Although we intend to vigorously protect our trademarks, the cost of litigation to uphold the validity and prevent infringement of trademarks can be substantial and the outcome of those disputes may require us to abandon one or more of our trademarks.

Our dependence upon cash flows and net earnings generated during the fourth quarter, including the holiday season, may have a disproportionate impact on our results of operations. The seasonal nature of the retail industry causes a heavy dependence on earnings in the fourth quarter. A large fluctuation in economic or weather conditions occurring during the fourth quarter may adversely impact our earnings. In preparation for our peak season, we may carry a significant amount of inventory in advance. If, however, we do not manage inventory appropriately or customer preferences change we may need to increase markdowns or promotional sales to dispose of inventory which will negatively impact our financial results.

Changes in our private label credit card program may adversely affect our sales and/or profitability. Our private label credit card (“PLCC”) program facilitates sales and generates additional revenue under our profit sharing agreement with the unrelated third party which owns the PLCC accounts receivable. PLCC sales represented 47% of total sales in 2016, and PLCC customers spend more on average than non-PLCC customers. We receive a share of the net finance charges, late fees, other cardholder fees, write-offs, and operating expenses generated by the program. Changes in credit granting standards maintained by the third party, which may be due to macroeconomic trends, could impact our ability to generate new PLCC accounts. Changes in customer payment patterns could impact profit sharing by impacting fee income, write-offs, and operating expense. If the sales or profit share which we receive from the PLCC decreases due to economic, legal, social, or other factors that we cannot control or predict, our operating results, financial condition and cash flows may be adversely affected.

The Revolving Credit Facility contains covenants that may impose operating restrictions and limits our borrowing capacity to the value of certain of our assets. The Revolving Credit Facility agreement contains covenants which, among other things, restrict (i) the amount of additional debt or capital lease obligations we may incur, and (ii) our payment of dividends and repurchase of common stock under certain circumstances. A violation of any of these covenants may permit the lenders to restrict our ability to further access loans and letters of credit and may require the immediate repayment of any outstanding loans. Our failure to comply with these covenants may have a material adverse effect on our capital resources, financial condition, results of operations and liquidity. In addition, any material or adverse developments affecting our business may significantly limit our ability to meet our obligations as they become due or to comply with the various covenant requirements contained in the Revolving Credit Facility agreement. In addition, borrowings under the Revolving Credit Facility are limited to the availability under a borrowing base that is determined principally on eligible inventory, and our inventory, cash and cash equivalents are pledged as collateral under the Revolving Credit Facility. In the event of any material decrease in the amount of or appraised value of our inventory, our borrowing capacity would decrease, which may adversely impact our business and liquidity. In the event of a default that is not cured or waived, the lenders’ commitment to extend further credit under the Revolving Credit Facility may be terminated, our outstanding obligations may become immediately due and payable, outstanding letters of credit may be required to be cash collateralized, and remedies may be exercised against the collateral. If we are unable to borrow under the Revolving Credit Facility, we may not have the necessary cash resources for our operations and, if any event of default occurs, there is no assurance that we would have the cash resources available to repay such accelerated obligations, refinance such indebtedness on commercially reasonable terms, or at all, or cash collateralize our letters of credit, which would have a material adverse effect on our business, financial condition, results of operations and liquidity.

15

The inability or unwillingness of one or more lenders to fund their commitment under the Revolving Credit Facility may have a material adverse impact on our business and financial condition. We use the Revolving Credit Facility to provide financing for working capital, capital expenditures and other general corporate purposes, as well as to support our outstanding letters of credit requirements. The lenders under the Revolving Credit Facility are: Wells Fargo Bank, National Association, JPMorgan Chase Bank, N.A., Regions Bank, Bank of America, N.A. and SunTrust Bank. Notwithstanding that we may be in full compliance with all covenants contained in the Revolving Credit Facility, the inability or unwillingness of one or more of those lenders to fund their commitment under the Revolving Credit Facility may have a material adverse impact on our business and financial condition.

Unexpected costs may arise from our current insurance program and our financial performance may be affected. Our insurance coverage is subject to deductibles, self-insured retentions, limits of liability and similar provisions that we believe are prudent based on the dispersion of our operations. However, we may incur certain types of losses that we cannot insure or which we believe are not economically reasonable to insure, such as losses due to acts of war, employee and certain other crime and some natural disasters. If we incur these losses and they are material, our business could suffer. Certain material events, including property losses caused by various natural disasters and other types of casualties, may result in sizable losses for the insurance industry and adversely impact the availability of adequate insurance coverage or result in excessive premium increases. To offset negative cost trends in the insurance market, we may elect to self-insure, accept higher deductibles or reduce the amount of coverage in response to these market changes. In addition, we self-insure a portion of expected losses under our workers’ compensation, general liability and group health insurance programs. Unanticipated changes in any applicable actuarial assumptions and management estimates underlying our recorded liabilities for these losses, including potential increases in medical and indemnity costs, could result in materially different amounts of expense than expected under these programs, which may have a material adverse effect on our financial condition and results of operations. Although we continue to maintain property insurance for catastrophic events, we are self-insured for losses up to the amount of our deductibles. If we experience a greater number of self-insured losses than we anticipate, our financial performance may be adversely affected.

The price of our common stock as traded on the New York Stock Exchange may be volatile. Our stock price may fluctuate substantially as a result of factors beyond our control, including but not limited to, general economic and stock market conditions, risks relating to our business and industry as discussed above, strategic actions by us or our competitors, variations in our quarterly operating performance, our future sales or purchases of our common stock and investor perceptions of the investment opportunity associated with our common stock relative to other investment alternatives.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

16

ITEM 2. PROPERTIES

Our stores are primarily located in strip shopping centers. We own six of our stores and lease the balance. The majority of leases, which are typically for an initial 10-year term and often with two renewal options of five years each, provide for our payment of base rent plus expenses, such as common area maintenance, utilities, taxes and insurance. Certain leases provide for contingent rents that are not measurable at inception. These contingent rents are primarily based on a percentage of sales that are in excess of a predetermined level. Stores range in size from approximately 5,000 to 67,000 selling square feet, with the average being approximately 18,000 selling square feet. At January 28, 2017, we operated 798 stores, in 38 states located within 5 regions, as follows:

Number of Stores | Number of Stores | |||||

South Central Region | Midwestern Region | |||||

Arkansas | 22 | Illinois | 6 | |||

Louisiana | 52 | Indiana | 24 | |||

Oklahoma | 35 | Iowa | 2 | |||

Texas | 227 | Kansas | 9 | |||

336 | Michigan | 15 | ||||

Mid-Atlantic & Northeastern Region | Missouri | 14 | ||||

Delaware | 3 | Ohio | 30 | |||

Maryland | 6 | Wisconsin | 4 | |||

New Jersey | 5 | 104 | ||||

Pennsylvania | 32 | Northwestern & Southwestern Region | ||||

Virginia | 35 | Arizona | 7 | |||

West Virginia | 10 | Colorado | 6 | |||

Massachusetts | 2 | Idaho | 3 | |||

New Hampshire | 2 | Nevada | 5 | |||

New York | 20 | New Mexico | 19 | |||

Vermont | 4 | Oregon | 4 | |||

119 | Utah | 3 | ||||

Southeastern Region | Wyoming | 1 | ||||

Alabama | 28 | 48 | ||||

Florida | 6 | |||||

Georgia | 33 | |||||

Kentucky | 34 | Total Stores | 798 | |||

Mississippi | 21 | |||||

North Carolina | 24 | |||||

South Carolina | 19 | |||||

Tennessee | 26 | |||||

191 | ||||||

17

We own our distribution centers in Jacksonville, Texas and South Hill, Virginia and lease our distribution center in Jeffersonville, Ohio, which have square footages and provide capacity of servicing stores as follows:

Location | Square Footage | Number of Stores Capable of Servicing |

Jacksonville, Texas | 437,000 | 600 |

South Hill, Virginia | 162,000 | 240 |

Jeffersonville, Ohio | 202,000 | 310 |

801,000 | 1,150 | |

We also lease a 176,000 square foot facility in Jacksonville, Texas to provide capacity expansion for our growing e-commerce business.

In addition to the stores and distribution facilities listed above, we lease our corporate office in Houston, Texas.

We consider these principal properties to be suitable and adequate for their intended purpose.

ITEM 3. LEGAL PROCEEDINGS

No response is required under Item 103 of Regulation S-K.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

18

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market and Dividend Information

Our common stock trades on the New York Stock Exchange under the symbol “SSI”. The following table sets forth the high and low market prices per share of our common stock as reported by the New York Stock Exchange and the amount of cash dividends per common share we paid during each quarter in 2016 and 2015:

Fiscal Year | |||||||||||||||||||||||

2016 | 2015 | ||||||||||||||||||||||

High | Low | Dividend | High | Low | Dividend | ||||||||||||||||||

1st Quarter | $ | 9.00 | $ | 6.60 | $ | 0.150 | $ | 23.26 | $ | 19.09 | $ | 0.140 | |||||||||||

2nd Quarter | 7.57 | 4.44 | 0.150 | 20.27 | 15.85 | 0.140 | |||||||||||||||||

3rd Quarter | 6.56 | 4.97 | 0.150 | 18.05 | 8.85 | 0.150 | |||||||||||||||||

4th Quarter | 5.88 | 2.72 | 0.150 | 10.70 | 6.00 | 0.150 | |||||||||||||||||

We paid aggregate cash dividends in 2016 and 2015 of $16.7 million and $18.7 million, respectively. The declaration and payment of future quarterly cash dividends remain subject to the review and discretion of our Board. Future determinations to pay dividends will continue to be evaluated in light of our results of operations, cash flow and financial condition, as well as meeting certain criteria under the Revolving Credit Facility (as defined in “Liquidity and Capital Resources”) and other factors deemed relevant by our Board.

Holders

As of the close of trading on the New York Stock Exchange on March 21, 2017 there were approximately 242 holders of record of our common stock.

19

Performance Graph

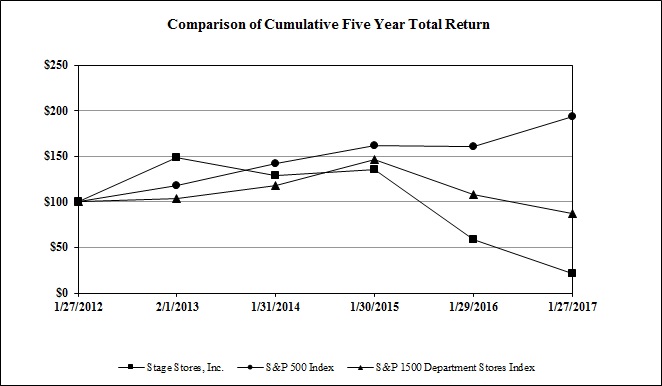

The annual changes for the five-year period shown in the following graph are based on the assumption that $100 had been invested in each of our common stock, the S&P 500 Index and the S&P 1500 Department Stores Index on January 27, 2012 (the last trading date of 2011), and that all quarterly dividends were reinvested at the closing prices of the dividend payment dates. Subsequent measurement points are the last trading days of 2012, 2013, 2014, 2015 and 2016. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on January 27, 2017 (the last trading date of 2016). The calculations exclude trading commissions and taxes. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

Date | Stage Stores, Inc. | S&P 500 Index | S&P 1500 Department Stores Index | |||

1/27/2012 | $100.00 | $100.00 | $100.00 | |||

2/1/2013 | 148.29 | 117.61 | 103.75 | |||

1/31/2014 | 129.39 | 141.49 | 117.53 | |||

1/30/2015 | 135.75 | 161.61 | 146.46 | |||

1/29/2016 | 59.02 | 160.54 | 107.54 | |||

1/27/2017 | 21.76 | 194.04 | 87.15 | |||

20

Stock Repurchase Program

On March 7, 2011, our Board approved a stock repurchase program (“2011 Stock Repurchase Program”) which authorized us to repurchase up to $200.0 million of our outstanding common stock. The 2011 Stock Repurchase Program will expire when we have exhausted the authorization, unless terminated earlier by our Board. Through January 28, 2017, we repurchased approximately $141.6 million of our outstanding common stock under the 2011 Stock Repurchase Program. Also in March 2011, our Board authorized us to repurchase shares of our outstanding common stock equal to the amount of the proceeds and related tax benefits from the exercise of stock options, stock appreciation rights (“SARs”) and other equity grants. Purchases of shares of our common stock may be made from time to time, either on the open market or through privately negotiated transactions, and are financed by our existing cash, cash flow and other liquidity sources, as appropriate.

The table below sets forth information regarding our repurchases of our common stock during the fourth quarter of 2016:

ISSUER PURCHASES OF EQUITY SECURITIES | ||||||||||||||

Period | Total Number of Shares Purchased (a) | Average Price Paid Per Share (a) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (b) | ||||||||||

October 30, 2016 to November 26, 2016 | 5,481 | $ | 4.78 | — | $ | 58,351,202 | ||||||||

November 27, 2016 to December 31, 2016 | 9,194 | 4.71 | — | 58,351,202 | ||||||||||

January 1, 2017 to January 28, 2017 | 2,710 | 3.59 | — | 58,351,202 | ||||||||||

Total | 17,385 | $ | 4.56 | — | ||||||||||

(a) Although we did not repurchase any of our common stock during the fourth quarter of 2016 under the 2011 Stock Repurchase Program:

• | We reacquired 3,718 shares of our common stock from certain employees to cover tax withholding obligations from the vesting of restricted stock at a weighted average acquisition price of $4.46 per share; and |

• | The trustee of the grantor trust established by us for the purpose of holding assets under our deferred compensation plan purchased an aggregate of 13,667 shares of our common stock in the open market at a weighted average price of $4.58 in connection with the option to invest in our stock under the deferred compensation plan and reinvestment of dividends paid on our common stock held in trust in the deferred compensation plan. |

(b) Reflects the $200.0 million authorized under the 2011 Stock Purchase Program, less the $141.6 million repurchased as of January 28, 2017 using our existing cash, cash flow and other liquidity sources since March 2011.

21

ITEM 6. SELECTED FINANCIAL DATA

The following sets forth selected consolidated financial data for the periods indicated. Financial results for 2016, 2015, 2014, and 2013 are based on a 52-week period. Financial results for 2012 are based on a 53-week period. The selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements included herein. All amounts are stated in thousands, except for per share data, percentages and number of stores.

Fiscal Year | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Statement of operations data: | |||||||||||||||||||

Net sales | $ | 1,442,718 | $ | 1,604,433 | $ | 1,638,569 | $ | 1,609,481 | $ | 1,627,702 | |||||||||

Cost of sales and related buying, occupancy and distribution expenses | 1,144,666 | 1,208,002 | 1,188,763 | 1,172,995 | 1,168,907 | ||||||||||||||

Gross profit | 298,052 | 396,431 | 449,806 | 436,486 | 458,795 | ||||||||||||||

Selling, general and administrative expenses | 356,064 | 387,859 | 386,104 | 393,126 | 389,495 | ||||||||||||||

Interest expense | 5,051 | 2,977 | 3,002 | 2,744 | 3,011 | ||||||||||||||

Income from continuing operations before income tax | (63,063 | ) | 5,595 | 60,700 | 40,616 | 66,289 | |||||||||||||

Income tax expense (benefit) | (25,166 | ) | 1,815 | 22,847 | 15,400 | 24,373 | |||||||||||||

Income (loss) from continuing operations | (37,897 | ) | 3,780 | 37,853 | 25,216 | 41,916 | |||||||||||||

Loss from discontinued operations, net (a) | — | — | (7,003 | ) | (8,574 | ) | (3,737 | ) | |||||||||||

Net income (loss) | $ | (37,897 | ) | $ | 3,780 | $ | 30,850 | $ | 16,642 | $ | 38,179 | ||||||||

Adjusted net income (loss) (non-GAAP) (b) | $ | (24,078 | ) | $ | 16,182 | $ | 37,853 | $ | 39,986 | $ | 46,296 | ||||||||

Basic earnings (loss) per share data: | |||||||||||||||||||

Continuing operations | $ | (1.40 | ) | $ | 0.12 | $ | 1.18 | $ | 0.78 | $ | 1.32 | ||||||||

Discontinued operations | — | — | (0.22 | ) | (0.27 | ) | (0.12 | ) | |||||||||||

Basic earnings (loss) per share | $ | (1.40 | ) | $ | 0.12 | $ | 0.96 | $ | 0.51 | $ | 1.20 | ||||||||

Basic weighted average shares outstanding | 27,090 | 31,145 | 31,675 | 32,034 | 31,278 | ||||||||||||||

Diluted earnings (loss) per share data: | |||||||||||||||||||

Continuing operations | $ | (1.40 | ) | $ | 0.12 | $ | 1.18 | $ | 0.77 | $ | 1.31 | ||||||||

Discontinued operations (a) | — | — | (0.22 | ) | (0.26 | ) | (0.12 | ) | |||||||||||

Diluted earnings (loss) per share | $ | (1.40 | ) | $ | 0.12 | $ | 0.96 | $ | 0.51 | $ | 1.19 | ||||||||

Adjusted diluted earnings (loss) per share (non-GAAP) (b) | $ | (0.89 | ) | $ | 0.51 | $ | 1.18 | $ | 1.22 | $ | 1.44 | ||||||||

Diluted weighted average shares outstanding | 27,090 | 31,188 | 31,763 | 32,311 | 31,600 | ||||||||||||||

Margin and other data: | |||||||||||||||||||

Gross profit margin | 20.7 | % | 24.7 | % | 27.5 | % | 27.1 | % | 28.2 | % | |||||||||

Selling, general and administrative expense rate | 24.7 | % | 24.2 | % | 23.6 | % | 24.4 | % | 23.9 | % | |||||||||

Capital expenditures | $ | 74,257 | $ | 90,695 | $ | 70,580 | $ | 61,263 | $ | 49,489 | |||||||||

Construction allowances from landlords | 7,079 | 3,444 | 5,538 | 4,162 | 4,193 | ||||||||||||||

Stock repurchases | — | 41,587 | 2,755 | 31,367 | 61 | ||||||||||||||

Cash dividends per share | 0.60 | 0.58 | 0.53 | 0.48 | 0.38 | ||||||||||||||

22

Fiscal Year | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Store data: | |||||||||||||||||||

Comparable sales growth (decline) (c) | (8.8 | )% | (2.0 | )% | 1.4 | % | (1.5 | )% | 5.7 | % | |||||||||

Store openings (d) | — | 3 | 18 | 28 | 25 | ||||||||||||||

Store closings (d) | 37 | 23 | 12 | 10 | 5 | ||||||||||||||

Number of stores open at end of period (d) | 798 | 834 | 854 | 848 | 830 | ||||||||||||||

Total selling area square footage at end of period (d) | 14,588 | 15,130 | 15,409 | 15,313 | 15,255 | ||||||||||||||

January 28, | January 30, | January 31, | February 1, | February 2, | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Balance sheet data: | |||||||||||||||||||

Working capital | $ | 296,091 | $ | 344,880 | $ | 299,279 | $ | 293,995 | $ | 259,260 | |||||||||

Total assets | 786,989 | 848,099 | 824,677 | 810,837 | 794,871 | ||||||||||||||

Debt obligations | 170,163 | 165,723 | 47,388 | 63,225 | 12,329 | ||||||||||||||

Stockholders' equity | 380,160 | 429,753 | 475,930 | 454,444 | 464,870 | ||||||||||||||

(a) Discontinued operations reflect the results of Steele’s, which was divested in 2014.

(b) See Reconciliation of Non-GAAP Financial Measures on page 24 for additional information and reconciliation to the most directly comparable U.S. GAAP financial measure.

(c) We follow the retail reporting calendar, which included an extra week of sales in the fourth quarter of 2012. However, many retailers report comparable sales on a shifted calendar, which excludes the first week of 2012 rather than the fifty-third week. On this shifted basis, comparable sales decreased 1.1% for 2013.

(d) Excludes Steele’s stores which are reflected in discontinued operations.

23

Reconciliation of Non-GAAP Financial Measures

To provide additional transparency, we have disclosed the results of operations for the years presented on a basis in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and on a non-GAAP basis to show earnings excluding certain items presented below. We believe this supplemental financial information enhances an investor’s understanding of our financial performance as it excludes those items which impact comparability of operating trends. The non-GAAP financial information should not be considered in isolation or viewed as a substitute for net income, cash flow from operations, diluted earnings per common share or other measures of performance as defined by GAAP. Moreover, the inclusion of non-GAAP financial information as used herein is not necessarily comparable to other similarly titled measures of other companies due to the potential inconsistencies in the method of presentation and items considered. The following tables set forth the supplemental financial information and the reconciliation of GAAP disclosures to non-GAAP financial measures (in thousands, except diluted earnings per share):

Fiscal Year | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Net income (loss) (GAAP) | $ | (37,897 | ) | $ | 3,780 | $ | 30,850 | $ | 16,642 | $ | 38,179 | ||||||||

Loss from discontinued operations, net of tax benefit of $4,228, $5,237 and $2,172, respectively (GAAP)(a) | — | — | 7,003 | 8,574 | 3,737 | ||||||||||||||

Income (loss) from continuing operations (GAAP) | (37,897 | ) | 3,780 | 37,853 | 25,216 | 41,916 | |||||||||||||

Consolidation of corporate headquarters (pretax)(b) | 110 | 3,538 | — | — | — | ||||||||||||||

Severance charges associated with workforce reductions and pension settlement (pretax)(c) | 1,632 | 2,633 | — | — | — | ||||||||||||||

Store closures, impairments and other strategic initiatives (pretax)(d) | 21,256 | 12,186 | — | — | — | ||||||||||||||

South Hill Consolidation related charges (pretax)(e) | — | — | — | 23,789 | 3,618 | ||||||||||||||

Former Chief Executive Officer resignation related charges (pretax)(f) | — | — | — | — | 3,308 | ||||||||||||||

Income tax impact(g) | (9,179 | ) | (5,955 | ) | — | (9,019 | ) | (2,546 | ) | ||||||||||

Adjusted net income (loss) (non-GAAP) | $ | (24,078 | ) | $ | 16,182 | $ | 37,853 | $ | 39,986 | $ | 46,296 | ||||||||

Diluted earnings (loss) per share (GAAP) | $ | (1.40 | ) | $ | 0.12 | $ | 0.96 | $ | 0.51 | $ | 1.19 | ||||||||

Loss from discontinued operations (GAAP)(a) | — | — | (0.22 | ) | (0.26 | ) | (0.12 | ) | |||||||||||

Diluted earnings (loss) per share from continuing operations (GAAP) | (1.40 | ) | 0.12 | 1.18 | 0.77 | 1.31 | |||||||||||||

Consolidation of corporate headquarters (pretax)(b) | — | 0.11 | — | — | — | ||||||||||||||

Severance charges associated with workforce reduction and pension settlement (pretax)(c) | 0.06 | 0.08 | — | — | — | ||||||||||||||

Store closures, impairments and other strategic initiatives (pretax)(d) | 0.78 | 0.39 | — | — | — | ||||||||||||||

South Hill Consolidation related charges (pretax)(e) | — | — | — | 0.73 | 0.11 | ||||||||||||||

Former Chief Executive Officer resignation related charges (pretax)(f) | — | — | — | — | 0.10 | ||||||||||||||

Income tax impact(g) | (0.33 | ) | (0.19 | ) | — | (0.28 | ) | (0.08 | ) | ||||||||||

Adjusted diluted earnings (loss) per share (non-GAAP) | $ | (0.89 | ) | $ | 0.51 | $ | 1.18 | $ | 1.22 | $ | 1.44 | ||||||||

24

(a) Discontinued operations reflect the results of Steele’s, which was divested in 2014. |

(b) Reflects duplicate rent expense and moving related costs associated with the consolidation of our corporate headquarters into a single location, which was completed in February 2016. |

(c) Includes severance charges associated with workforce reductions and pension settlement of $0.7 million in 2015 as a result of lump sum payments exceeding interest cost for 2015. |

(d) Charges in 2016 reflect impairment charges recognized as a result of deteriorating operating performance of our stores (see Notes 3 and 4 to the financial statements) and costs related to our strategic store closure plan and other initiatives announced in 2015. Charges reflected for 2015 are related to our strategic store closure plan and primarily consist of impairment charges as well as fixture moving costs and lease termination charges, and other strategic initiatives. |

(e) Reflects charges associated with the consolidation of our operations in South Hill, Virginia, into our corporate headquarters. The charges were primarily for transitional payroll and benefits, recruiting and relocation costs, severance, property and equipment impairment and inventory markdowns. |

(f) Reflects charges incurred associated with the resignation of our former Chief Executive Officer. |

(g) Taxes were allocated based on the annual effective tax rate. |

25

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Business

We are a retailer operating specialty department stores primarily in small and mid-sized towns and communities. We provide customers a welcoming and comfortable shopping experience in our stores and online. Our merchandise assortment is a well-edited selection of moderately priced brand name and private label apparel, accessories, cosmetics, footwear and home goods. As of January 28, 2017, we operated 798 specialty department stores located in 38 states under the BEALLS, GOODY’S, PALAIS ROYAL, PEEBLES and STAGE nameplates and a direct-to-consumer business.