Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - EXP World Holdings, Inc. | exp_8k-040317.htm |

| EX-99.1 - PRESS RELEASE - EXP World Holdings, Inc. | exp_8k-ex9901.htm |

Exhibit 99.2

OTCQB: EXPI Investor Presentation April 2017

2 OTCQB: EXPI | Safe Harbor This presentation contains forward - looking statements, as defined in the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward - looking statements, including without limitation, those regarding activities, events, financial results or developments that we intend, plan, expect, believe, project, forecast or anticipate will or may occ ur in the future. Examples of forward - looking statements include, but are not limited to, statements we make regarding the potential size of the market for our products, impacts of future legislation and regulatory action, forecasts of future performance, financial con dition and results of operations, plans to expand to other markets, development of new technologies, potential acquisitions and the possibility of up - listing or cross - listing our equity securities. These statements reflect our management’s current views with r espect to future events, are not guarantees of future performance, and involve risks and uncertainties that are difficult to predict . F urther, forward - looking statements are based upon assumptions of future events that may not prove to be accurate. Such assumptions and assessments are made in light of our experience and perception of historical trends, current conditions and expected future r esu lts. These statements involve known and unknown risks, uncertainties, assumptions and other factors many of which are out of our control and difficult to forecast which may cause actual results to differ materially from those that may be described or imp lie d herein. Such factors include but are not limited to: general economic conditions; competitive factors; political, economic, a nd regulatory changes affecting the real estate industry and various other factors, both referenced and not referenced above, an d o ther factors that are described in our filings with the Securities and Exchange Commission (the “Commission”), including our perio dic reports on Forms 10 - K and 10 - Q. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements may vary materially from those set forth in this presentation. Y ou should not place undue reliance on any forward - looking statements and are advised to carefully review and consider the various disclosures in our filings with the Commission. Except as required by law, we neither intend nor assume any obligation to rev ise or update these forward - looking statements, which speak only as of their dates. We nonetheless reserve the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specifi c reference to this financial outlook. No such update shall be deemed to indicate that other statements not addressed by such u pda te remain correct or create an obligation to provide any other updates. Excluding the information from sources indicated, the content of this presentation is copyright 2017 eXp World Holdings, Inc. All Rights Reserved.

3 OTCQB: EXPI | Company Overview eXp World Holdings, Inc. ( OTCQB: EXPI) Share Price 1 $3.67 Market Cap 1 $192.3M Debt $0 2016 Revenues 2 $54.2M 2016 Adj. EBITDA 2,3 $1.6M Shares Outstanding 2 52.4M Float 2 14.4 M Insider Holdings 74% Headquarters Bellingham, WA Founded 2009 Employees (FT) 53 • eXp World Holdings, Inc. operates eXp Realty, a cloud - based, international real estate brokerage firm • Our cloud - based brokerage dramatically reduces the costs associated with physical brick - and - mortar offices & related support staff • Activities generally provided by traditional brokerage companies are instead conducted through our exclusive “Cloud Campus,” which provides our agents with all of the support they would otherwise receive at a traditional real estate office • Currently operating in 43 U.S. States + D.C. & Alberta, Canada with +3,000 agents 1) At March 30, 2017. 2) At December 31, 2016. 3) Adjusted EBITDA includes add - back of stock compensation and stock option expense. Please see reconciliation for additional information.

4 OTCQB: EXPI | Our Approach: A Cloud - Based Brokerage • Eliminates expenses, enabling the brokerage to share the additional funds with its agents & benefits to shareholders • Creates a collaborative community & allows for interaction with top industry professionals around the world • Unique broker training, tools & mentoring • Full suite of streamlined back office, technical, transaction & operations support • Provides agents & brokers the ability to work from any location • Significant potential for accelerated SUSTAINABLE GROWTH Our cloud campus offers real estate agents & brokers full - spectrum support — from transaction support to professional development & collaboration — without the brick & mortar infrastructure

5 OTCQB: EXPI | Key Highlights Cloud - based Residential Real Estate Brokerage • Limited brick & mortar footprint (except as required by law) • Low cost of entry into new markets Operating in 43 States + D.C. and Part of Canada • Exposure to both U.S. and Canadian markets with scalability worldwide • ~180 different multiple listing service (MLS) market areas Agent - Centric Model • As a public company subsidiary, eXp Realty provides a revenue sharing program whereby agents & brokers earn both revenue & equity ownership awards One of the Fastest Growing Real Estate Brands in N.A. • 178% agent growth in 2016 (Currently +3,000 Agents/Brokers) Tech Company Growth with Foundations in Real Estate • 2011 - 2016: • Revenue experienced a 53% CAGR • Gross profit experienced a 46% CAGR • 2016 Financials: Revenues of $54.2M & Adj. EBITDA of $1.6M 1 eXp Realty’s Footprint 1) Adj. EBITDA includes add - back of stock compensation and stock option expense. Please see reconciliation for additional informati on.

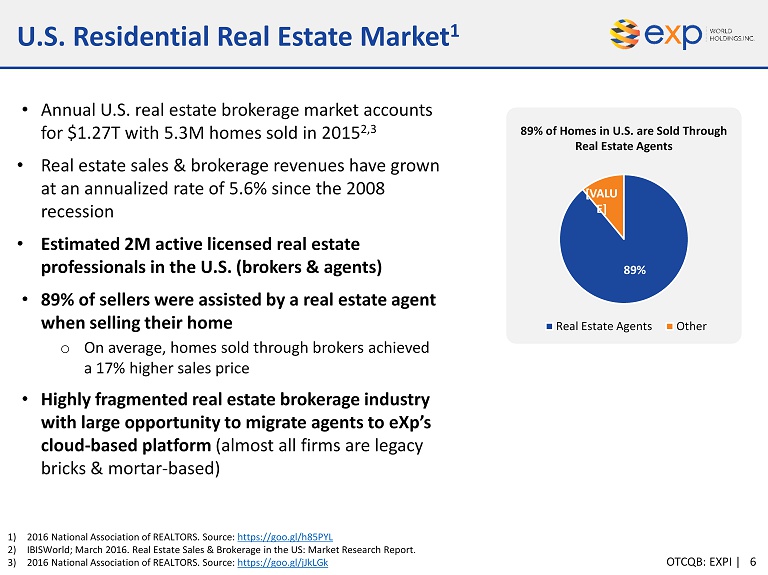

6 OTCQB: EXPI | U.S. Residential Real Estate Market 1 • Annual U.S. real estate brokerage market accounts for $1.27T with 5.3M homes sold in 2015 2,3 • Real estate sales & brokerage revenues have grown at an annualized rate of 5.6% since the 2008 recession • Estimated 2M active licensed real estate professionals in the U.S. (brokers & agents) • 89% of sellers were assisted by a real estate agent when selling their home o On average, homes sold through brokers achieved a 17% higher sales price • Highly fragmented real estate brokerage industry with large opportunity to migrate agents to eXp’s cloud - based platform (almost all firms are legacy bricks & mortar - based) 1) 2016 National Association of REALTORS. Source: https://goo.gl/h85PYL 2) IBISWorld; March 2016. Real Estate Sales & Brokerage in the US: Market Research Report. 3) 2016 National Association of REALTORS. Source: https://goo.gl/jJkLGk 89% [VALU E] Real Estate Agents Other 89% of Homes in U.S. are Sold Through Real Estate Agents

7 OTCQB: EXPI | The Agent - Owned Cloud Brokerage® Mission : Deliver maximum value to our agents, brokers & staff while building an international brand as the leading Agent - Owned Cloud Brokerage “eXp Realty’s family of agents and brokers build their own businesses while establishing a direct ownership interest in eXp World Holdings, Inc. as a shareholder and business partner. We believe our offering of equity ownership will continue to resonate and reshape the traditional realty brokerage model.” - Glenn Sanford, CEO & Founder Click Here to Watch: What is a Cloud Real Estate Brokerage?

8 OTCQB: EXPI | Explosive Agent & Revenue Growth We continue to experience accelerated growth in both agent count & revenues as a result of our commitment to agent ownership, support & engagement $ Millions $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 - 500 1,000 1,500 2,000 2,500 3,000 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Revenues Agents eXp Realty Ending Agents & Revenue By Quarter Revenues Agent Count

9 OTCQB: EXPI | Value to Agents & Brokers OWN and build a lasting business with equity • Agent Ownership Culture • Agent - Centric Co - Branding • Attraction (Passive) Income • Publicly - Traded Stock Ownership LEARN where and how you want • Collaborative Cloud Community • On Demand Training • Individualized Coaching • International Peer Network • Transaction/Broker Support SELL more with great tools and support • Lead Generation • International Referral Network • Content Marketing • Transaction Technology Tools/Resources EARN more with lower costs • High Split • Low Cap • Few Fees

10 OTCQB: EXPI | Unique Model Incentivizes Agents & Brokers Low Startup Costs & Fees Favorable Commissions Agents are Incentivized Agent Ownership 10 OTCQB: EXPI | Very low startup costs & commitment One - time Costs: • $99 one - time setup fee includes business cards & folders Ongoing Costs: • $50 monthly technology fee • $420 yearly eXp University tuition paid annually on the anniversary of when the agent joined eXp University is a virtual classroom where agents & brokers can receive +25 hours of training per week

11 OTCQB: EXPI | Unique Model Incentivizes Agents & Brokers Low Startup Costs & Fees Favorable Commissions Agents are Incentivized Agent Ownership 11 • Agents receive an 80/20 split on first $80,000 gross commi s sion income (GCI) o $16,000 yearly cap paid out to eXp (20% of $80,000) • Agents keep 100% of commission for the remainder of their respective commission year Per Transaction Fee • $25 Broker Review • $30 E&O Insurance For Capped Agents – 100% Commission • $250 Transaction Fee ($5,000 cap/year) • $25 Broker Review • $30 E&O Insurance ($500 cap/year) OTCQB: EXPI | Highly attractive commission structure for brokers & agents

12 OTCQB: EXPI | Unique Model Incentivizes Agents & Brokers Low Startup Costs & Fees Favorable Commissions Agents are Incentivized Agent Ownership 12 OTCQB: EXPI | • Only one employee has incentive to grow the business (Branch Manager) • Limited bandwidth to grow (typically a broker & assistant) • Very capital intensive (brick & mortar infrastructure) • Limited to single location (physical location of office) • All agents are highly incentivized to grow the business (attractive commission sharing program) • Exponential bandwidth as agent count grows (+3,000 currently) • Minimal capital required • eXp’s agents can conduct business from any location Traditional Brokerage eXp Realty vs. eXp can scale its business very quickly by incentivizing & empowering all agents & brokers

13 OTCQB: EXPI | Unique Model Incentivizes Agents & Brokers Low Startup Costs & Fees Favorable Commissions Agents are Incentivized Agent Ownership 13 Earn ownership through incentive program • 75 shares for first closing • 250 shares for capping • 250 shares for each recruit Agent Equity Commission Program • Voluntarily get 5% of gross commission income paid in EXPI stock • +36% of agents and brokers are part of the program • Average additional paid in capital from program in excess of $150,000/month Icon Agent Program • Top agents can receive their personal cap back in the form of EXPI equity for actively collaborating with others (joining panels, taking classes, etc.) • 25% vests Immediately • 75% vests at 3 year anniversary of award • Icons attract attention of others in their marketplace OTCQB: EXPI | Agents & brokers are less likely to pursue other opportunities if they are shareholders

14 OTCQB: EXPI | Growth Opportunities Real Estate Brokerage Title & Escrow Services Mortgage Origination Homeowners Insurance Affiliated services offers eXp World Holdings notable growth opportunities, which could grow gross profit on select real estate transactions by several fold Affiliated Services: • Currently, the brokerage derives its revenues primarily from its portion of the commission split on non - capped real estate transactions • Possible areas of expansion could include mortgage origination services, title & escrow services, and homeowners insurance • In the next 12 months, eXp World Holdings plans to launch some affiliated services in select areas where the company has reached critical mass

15 OTCQB: EXPI | Select Financials (USD $ in Millions) FY 2016 FY 2015 Revenue $54.2 $22.9 Net Income (L oss) ($26.0) ($4.6) Non - GAAP Adjusted EBITDA 1 $1.6 $0.3 (USD $ in Millions) Dec 31, 2016 Dec 31, 2015 Cash & Cash Equivalents $1.7 $0.6 Debt $0.04 $0.0 Total Stockholder’s Equity $2.5 $0.6 1) Adjusted EBITDA includes add - back of stock compensation and stock option expense. Please see reconciliation for additional infor mation. • Strong revenue growth • Zero net debt • $0.7M deferred net tax assets at Dec. 31, 2016 (offset by full valuation allowance) $6.7 $10.7 $13.4 $22.9 $54.2 ($0.1) $0.0 $0.3 $0.3 $1.6 FY12 FY13 FY14 FY15 FY16 Revenue Adj. EBITDA $ Millions 2 3

16 OTCQB: EXPI | Experienced Management Glenn Sanford, Founder, CEO & Chairman - Since 2002 , Mr . Sanford has been actively involved in the online real estate space . In 2007 , he launched BuyerTours Realty, LLC which, using a combination of web and traditional bricks and mortar, grew to three offices in two states . After the drop off of the market in 2008 , Mr . Sanford and his executive team went back and rewrote the entire business model in recognition of the “perfect storm” of lower revenues, fixed or rising overhead costs, and a consumer with more information and access than ever before . eXp Realty, LLC was launched in 2009 . From 2004 to 2007 , Mr . Sanford ran a large mega - agent team and consulted to Keller Williams International as a member of the Agent Technology Council in the areas of online client acquisition, client conversion and technology . Russ Cofano , President & General Counsel - Prior to joining eXp, Mr . Cofano was Senior VP of Industry Relations for Move, Inc . , operator of realtor . com . At Move, he was instrumental in reinvigorating realtor . com’s relationship with MLSs and associations and was a key influencer in realtor . com product improvements . Prior to Move, Mr . Cofano was CEO for Missouri REALTORS ® . Mr . Cofano was also previously VP and General Counsel to John L . Scott Real Estate, and helped JLS weather the great recession . He is a noted author, speaker and consultant in organized real estate, having worked at executive levels in nearly every segment of the industry . He was also a private practice attorney for many years where he advised on matters involving real estate brokerage, REALTOR associations, MLSs, technology and intellectual property, mergers and acquisitions, business transactions and franchising . Jason Gesing , CEO Real Estate Division - In May , 2016 , Mr . Gesing was appointed CEO of eXp Realty, the Company’s real estate brokerage division . As CEO of eXp Realty, Mr . Gesing is actively engaged in driving company growth while working with the rest of the eXp executive team to ensure that systems, processes and infrastructure exist to support rapid expansion . Mr . Gesing participates regularly in business model profitability discussions with owners of leading independent brokerages demonstrating eXp’s high - engagement, cloud - based model and its dramatic impact on cost, profitability and the synergies that exist when agents and brokers of a publicly - traded real estate brokerage are also its shareholders . Alan Goldman, CFO - Mr . Goldman joins the Company from PCAOB - registered Ingenium Accounting Associates, where he was a Partner focused on providing auditing services, attestation - related services, and outsourced CFO consulting services for both public and private companies . Mr . Goldman possesses expertise in financial reporting, business planning and financial business modeling, accounting software implementations, risk assessment, and back office operations . Mr . Goldman brings to eXp a thorough understanding and application of public company accounting standards and joins eXp after providing services for the Company in a consultative role for approximately the past three years .

17 OTCQB: EXPI | Independent Directors Darren Jacklin Independent Director For over 19 years, Mr. Jacklin has worked with companies in an advisory capacity especially in Sales and Marketing and Entrepreneurship. He has personally trained over 150 Fortune 500 companies such as Microsoft, AT&T, Black & Decker and Barclays Bank. Randall Miles Independent Director For over 25 years Mr. Miles has held senior leadership positions in global financial services, financial technology and investment banking companies including LIONMTS, Syngence Corporation, AtlasBanc Holdings Corp, Advantage Funding / NAFCO Holdings, SCM Capital Group and Tigress Financial Partners. Laurie Hawkes Independent Director With over 35 years of investment banking, realty and finance experience, Ms. Hawkes has been a pioneer in bringing institutional capital to the single - family rental sector. She co - founded American Residential Properties, and led the financing and operations from a start - up entity to a $2 billion enterprise. Rick Miller Independent Director Mr. Miller has held senior leadership positions in companies ranging from a Fortune 10 to a startup for over 25 years. His extensive experience as a turnaround specialist and an expert in sustainable growth has been applied as an executive inside organizations and as a confidant advising from outside companies.

18 OTCQB: EXPI | Key Takeaways • Full - service, national real estate brokerage providing 24/7 access to collaborative tools, training & socialization for brokers & agents through our 3 - D cloud office environment • Minimal startup & ongoing costs – Absence of physical brick - and - mortar offices allows for a highly scalable business model and superior agent incentives • One of the fastest growing brokerages in the country o 2016 revenue of +$54.2M (137% YoY growth) o 2016 EBITDA of +$1.6M (397% YoY growth) o +178% agent growth in 2016 with +3,000 agents & brokers in 43 states + D.C. & Alberta, Canada • Unique, agent - centric business model o Favorable commission splits (80/20) with low cap ($16,000) o Aggressive referral incentives (commission sharing program & equity ownership awards) • Experienced leadership with high insider ownership (+74%) • Strong balance sheet ($0.04 million in debt) 18 OTCQB: EXPI | $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 - 500 1,000 1,500 2,000 2,500 3,000 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 eXp Realty Ending Agents & Revenue By Quarter Revenues Agent Count

1321 King Street #1 Bellingham, WA 98229 Main: 360 - 685 - 4206 www.eXpRealty.com Company Contact: Alan Goldman CFO - eXp World Holdings, Inc. Main: 775 - 432 - 6394 alan.goldman@exprealty.com Investor Relations Contact: Greg Falesnik Managing Director – MZ North America Main: 949 - 385 - 6449 greg.falesnik@mzgroup.us www.mzgroup.us 88.761.8208

APPENDIX 20 OTCQB: EXPI |

21 OTCQB: EXPI | Brokerage Market Competitive Landscape Innovators are valued by venture capital • Redfin : +$500M valuation (+$160M raised to - date) • Compass: +$1B valuation (+$210M raised to - date) • eXp Realty has been growing its geographic footprint faster while adding agents and brokers faster than the venture backed firms listed above • eXp Realty has required minimal capital inputs to date to achieve this growth • ZipRealty took 14 years to grow to 1,800 agents and $2.7B in real estate sales • eXp Realty is on track (based on the current growth trajectory) to do that in under 9 years from launch • Realogy Holdings (RLGY) • Remax Holdings (RMAX) • Berkshire Hathaway (BRK - A) • The last small publicly traded brokerage ( ZipRealty ) was acquired by Realogy in 2014 for $166M o $2.7 Billion in Residential Real Estate Sales (2013) o 1800 real estate professionals o Launched in 1999 o Minimal revenue growth & essentially breakeven Limited opportunity in the public company arena and no significant growth players outside eXp Realty

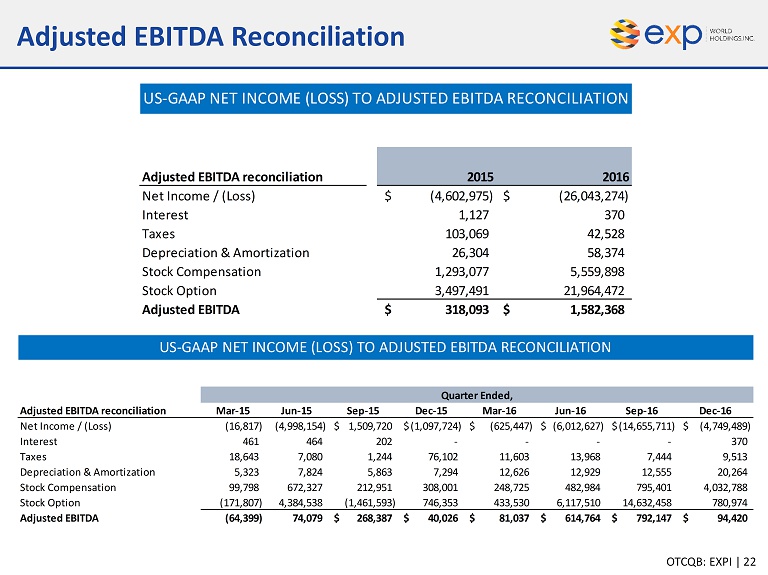

22 OTCQB: EXPI | Adjusted EBITDA Reconciliation Adjusted EBITDA reconciliation 2015 2016 Net Income / (Loss) (4,602,975)$ (26,043,274)$ Interest 1,127 370 Taxes 103,069 42,528 Depreciation & Amortization 26,304 58,374 Stock Compensation 1,293,077 5,559,898 Stock Option 3,497,491 21,964,472 Adjusted EBITDA 318,093$ 1,582,368$ US-GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA RECONCILIATION Adjusted EBITDA reconciliation Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Net Income / (Loss) (16,817) (4,998,154) 1,509,720$ (1,097,724)$ (625,447)$ (6,012,627)$ (14,655,711)$ (4,749,489)$ Interest 461 464 202 - - - - 370 Taxes 18,643 7,080 1,244 76,102 11,603 13,968 7,444 9,513 Depreciation & Amortization 5,323 7,824 5,863 7,294 12,626 12,929 12,555 20,264 Stock Compensation 99,798 672,327 212,951 308,001 248,725 482,984 795,401 4,032,788 Stock Option (171,807) 4,384,538 (1,461,593) 746,353 433,530 6,117,510 14,632,458 780,974 Adjusted EBITDA (64,399) 74,079 268,387$ 40,026$ 81,037$ 614,764$ 792,147$ 94,420$ US-GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA RECONCILIATION Quarter Ended,