Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Function(x) Inc. | form8-ka4x3x2017presentati.htm |

Confidential ©2017 Function(x), Inc. All Rights Reserved

Forward-Looking Financial Information

This presentation contains forward-looking statements of the Company that relate to the current expectations, business plans and

views of future events. Forward-looking statements often, but not always, are identified by the use of words such as “seek”,

“anticipate”, “believe”, “plan”, “estimate”, “expect”, “target” and “intend” and statements that an event or result “may”, “will”,

“should”, “could” or “might” occur or be achieved or other similar expressions and include statements in respect of the Company’s

business plans and its ability to grow revenues and attract new customers and B2B partners, as examples only. Forward-looking

statements are based on assumptions and analysis made by the Company in light of its experience and perception of historical

trends, current conditions and expected future developments and other factors the Company believes are appropriate, and involve

a number of risks and uncertainties. Should one or more of the risks materialize or should assumptions underlying the forward-looking

statements prove incorrect, actual events or results might differ materially from events or results projected or suggested in these

forward-looking statements. Given these risks, uncertainties and assumptions, prospective purchasers of securities should not place

undue reliance on these forward-looking statements. These risks, uncertainties, assumptions and other factors could cause the

Company’s actual results, performance, achievements and experience to differ materially from the expectations, future results,

performance or achievements expressed or implied by the forward-looking statements. The forward-looking statements made in this

Presentation relate only to events or information as of the date of this Presentation and the Company does not intend, nor assume

any obligation, to update these forward-looking statements. Investors should read this Presentation with the understanding that the

Company’s actual future results and achievements may be materially different from expectations.

Risk Factors

Investors should read our risk factors set forth in our quarterly report on Form 10-Q for the quarter ended December 31, 2016 and the

annual report on Form 10-K for the fiscal year ended June 30, 2016.

Disclosures

2

INTRODUCTION

3

4

Led by Experienced Management

Management Team is comprised of experienced professionals with

complementary skill sets

Robert F.X. Sillerman, Chairman & CEO

• Media Entrepreneur known for identifying market trends and scalable

opportunities with multiple billion dollar exits

• American Idol, Elvis Presley Enterprises, Muhammad Ali Enterprises, SFX

Broadcasting, SFX Entertainment I, Marquee Sports, Action Media

Group and more

Brian Rosin

CHIEF OPERATING OFFICER

Sean Beckner*

16+ years as a media and technology

entrepreneur with a proven track record

of increasing revenue and driving

profitability. Has led successful media

properties such as ViralNova

6+ years in digital media with a focus

on monetization and analytical

reporting, and a proven track record

of driving revenue growth

Michelle Lanken

CHIEF FINANCIAL OFFICER

15+ years experience in the

preparation of SEC filings,

accounting and financial controls

with top accounting firms and

Fortune 500 companies

* Should Potential BumpClick Acquisition Close

About

▪ Function(x), a social publishing and interactive media platform, is building on a

distribution network of over 90 million social followers by delivering engaging

content and leveraging relationships with social influencers and celebrities:

▪Wetpaint is a leading online destination for entertainment news for millennial

women, covering the latest in television, music and pop culture.

▪Rant is a leading digital publisher with original content spanning multiple verticals,

most notably sports, entertainment and pets.

▪ViralNova* publishes content with a blend of personalization and informative

story-telling, providing a unique voice that entertains, intrigues, and uplifts.

▪Goodfullness* is an emerging brand that aspires to help people live a

healthier, happier life.

A 21st Century Interactive Media Platform

5

* Includes Potential BumpClick Acquisition - On March 7, 2017, the Company entered into a binding term sheet to acquire

BumpClick LLC. The transaction is subject to a number of conditions precedent that must be satisfied prior to the closing of

the transaction. There can be no assurance that the transaction will close or that the terms of the transaction will be the

same as those in the binding term sheet.

Social Media Landscape

MAUs

500M

150M

Facebook

YouTube

Instagram

Snapchat

1.71B

1B

Average Person

Spends

1 Hour 40

Minutes

On Social Media

Each Day

6

Ad Opportunity

Digital Advertising Surpasses Television in 2016

Interest in influencer

marketing has risen

more than

90X

since 2013

US Digital ad spend is

expected to reach

$100 BILLION

by the year 2020

7

The Numbers

8

Reach and Usage

WEB TRAFFIC SOCIAL SCALE

27.0

million

20.2

million

39.8

million

30.6

million

9

Global Monthly UVs

US Monthly UVs

Global Monthly Sessions

US Monthly Sessions

93

million

118

million

339

million

Social Following

Monthly Engagements

Monthly Reach

75

million

Monthly Video Views

(Shown on combined basis assuming

closing of BumpClick acquisition)

The Technology

10

Nova CMS

▪ Multi-Publisher Platform

▪ Asset Management System

▪ Layout Testing

▪ Campaign Management

▪ Financial Reporting

Home Grown Enterprise Class CMS

11

(Technology currently utilized and owned by BumpClick)

Social Distribution System (SDS)

Technology that systematically captures, reengages, and activates

audience from social networks

12

SOCIAL

ENGINE

ActivateEngage

Capture

Fans

Content

Website

The Distribution

13

Fans Engagement

Reach

93

million

118

million

339

million

Facebook Pages

Using premium Facebook pages to drive distribution and revenue

14

*Rolling 28 Days as of March 31, 2017

(Shown on combined basis assuming

closing of BumpClick acquisition)

The Results

(Does Not Include BumpClick)

15

▪ Optimized ad stack and

monetization model has taken

effect, resulting in significant

revenue growth.

▪ Anticipating continued growth

as we continue to develop new

and exciting content.

$20,000

$120,000

$220,000

$320,000

$420,000

$520,000

$620,000

Jul Aug Sep Oct Nov Dec Jan Feb Mar

Revenue

Strong Growth Since July: Revenue

16

Figures Do Not Include BumpClick Performance

* Represents current Function(X) Publishing Segment, does not include pending BumpClick acquisition

** All figures shown are unaudited, March are preliminary and shown through 3/31/17

*** These are revenue numbers only and are not meant to represent the profit or loss position of the company

▪ Increase in pageviews has

helped increase monetization

per 1,000 visit.

▪ Continue to target increase in

RPMv through user engagement.

▪ RPMv has not grown at the same

rate as revenue, indicating there

is future opportunity for growth.

$2.00

$7.00

$12.00

$17.00

$22.00

$27.00

Jul Aug Sep Oct Nov Dec Jan Feb Mar

RPMv

Strong Growth Since July: RPMv Rev. per 1,000 Visits

17 * Represents current Function(X) Publishing Segment, does not include pending BumpClick acquisition

** All figures shown are unaudited, March are preliminary and shown through 3/31/17

Figures Do Not Include BumpClick Performance

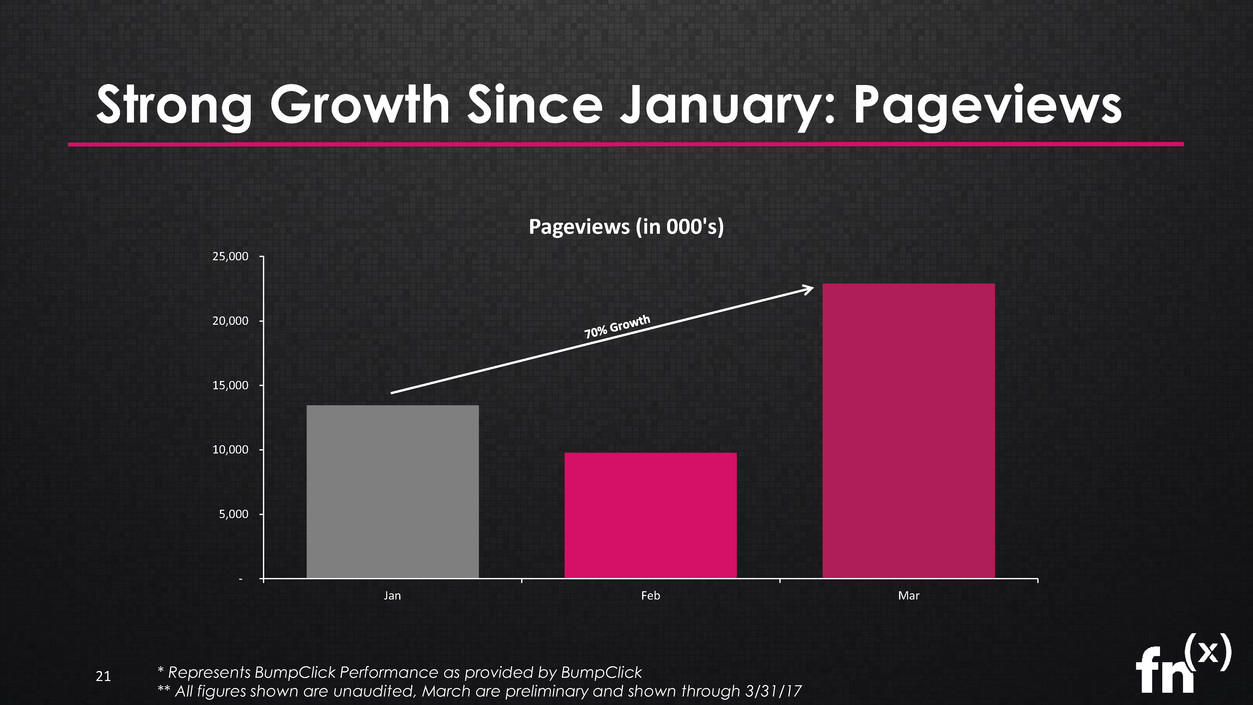

▪ Growth in pageviews signals

increased user engagement.

▪ Increase directly correlates to an

increase in revenue.

▪ Continue to target increased

pageviews.

10,000

30,000

50,000

70,000

90,000

110,000

130,000

150,000

170,000

190,000

210,000

Jul Aug Sep Oct Nov Dec Jan Feb Mar

Pageviews (in 000's)

Strong Growth Since July: Pageviews

18 * Represents current Function(X) Publishing Segment, does not include pending BumpClick acquisition

** All figures shown are unaudited, March are preliminary and shown through 3/31/17

Figures Do Not Include BumpClick Performance

The Results

(BumpClick Only)

19

$20,000

$70,000

$120,000

$170,000

$220,000

$270,000

$320,000

$370,000

$420,000

$470,000

Jan Feb Mar

Revenue

Strong Growth Since January: Revenue

20 *Represents BumpClick Performance as provided by BumpClick

** All figures shown are unaudited, March are preliminary and shown through 3/31/17

-

5,000

10,000

15,000

20,000

25,000

Jan Feb Mar

Pageviews (in 000's)

Strong Growth Since January: Pageviews

21 * Represents BumpClick Performance as provided by BumpClick

** All figures shown are unaudited, March are preliminary and shown through 3/31/17

The Opportunity

22

▪ Completed Equity Offering for $4.8MM in gross proceeds in February 2017.

▪ Robert F.X. Sillerman converted approximately $37MM of preferred equity into

common stock.

▪ All debentures bought except for two, who hold under 15% of the original issue.

Negotiations continue with these two holders.

▪ Non-core assets to be moved into a subsidiary to facilitate financing for working

capital needs.

▪ Announced intent to acquire all equity interests in BumpClick LLC.

Recent Developments

23

Industry Comparables by Uniques

Multiple by Unique Visits Indicates Disjointed Valuation

UNIQUE VISITORS 27

Million

44.5

Million

59.8

Million

80.4

Million

27.0*

Million

LATEST ROUND

VALUATION

$500

Million

$442

Million

$850

Million

$1.5

Billion

$15.3

Million**

IMPLIED MULTIPLE 19x 10x 14x 19x 0.57x

24

*Includes Pending BumpClick Acquisition

** Market Cap = 27.4MM shares x 3/31/17 close

*** Implied Multiple = Valuation / Unique Visitors

Strategy for the Future

▪ Acquire brands and assets with strong traffic & distribution.

▪ Build unparalleled distribution network and a diversified revenue stream.

▪ Improve and capitalize on demonstrated ability to substantially increase

monetization and margin on acquired properties.

▪ Unify all assets with proprietary technology.

▪ Use A-list celebrities and cross media partnerships with traditional and new

media to create exclusive original content and build brand equity.

Become the preeminent interactive digital platform

25

Thank You

An Interactive Media Platform

______

Contact: Michelle Lanken, Chief Financial Officer

Phone: 212.231.0092

Email: info@functionxinc.com

Web: functionxinc.com

Confidential©2017 Function(x), Inc. All Rights Reserved26