Attached files

| file | filename |

|---|---|

| 10-K - 10-K - WELLS REAL ESTATE FUND XIII L P | fund13201610k.htm |

| EX-32.1 - EXHIBIT 32.1 - WELLS REAL ESTATE FUND XIII L P | fund13q42016ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - WELLS REAL ESTATE FUND XIII L P | fund13q42016ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - WELLS REAL ESTATE FUND XIII L P | fund13q42016ex311.htm |

LEASE

Between

Wells Fund XIII-REIT Joint Venture Partnership,

Between

Wells Fund XIII-REIT Joint Venture Partnership,

a Georgia joint venture partnership

and

Charter Communications Holding Company, LLC,

a Delaware limited liability company

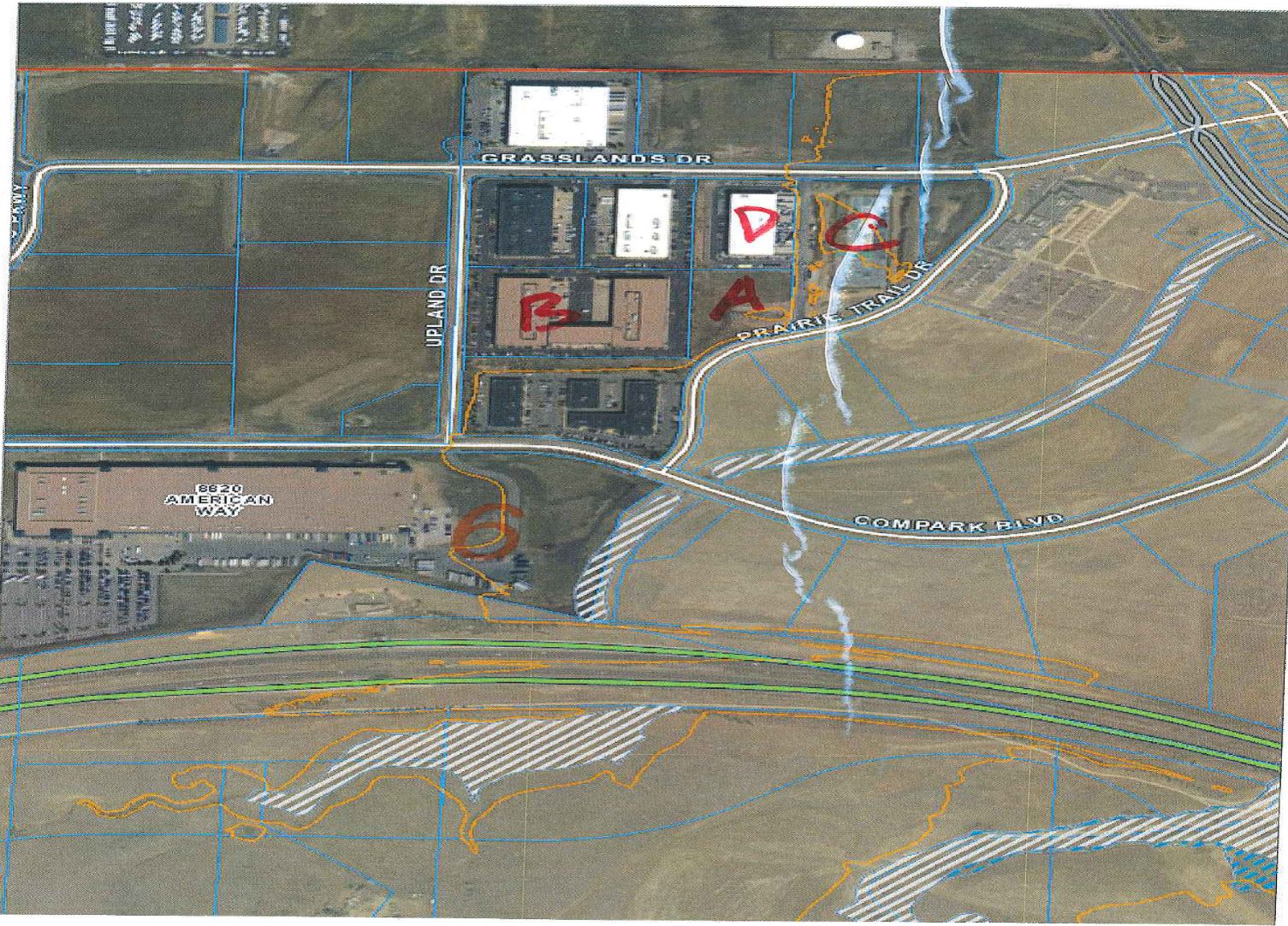

8560 UPLAND DRIVE, ENGLEWOOD, COLORADO

LP 11729723.10 \ 33651-106517

TABLE OF CONTENTS

Page No. | |||

ARTICLE 1 | Premises and Term | 1 | |

ARTICLE 2 | Base Rent | 2 | |

ARTICLE 3 | Additional Rent | 3 | |

ARTICLE 4 | Use and Rules | 6 | |

ARTICLE 5 | Services and Utilities | 8 | |

ARTICLE 6 | Alterations and Liens | 9 | |

ARTICLE 7 | Repairs | 10 | |

ARTICLE 8 | Casualty Damage | 11 | |

ARTICLE 9 | Insurance, Subrogation, and Waiver of Claims | 12 | |

ARTICLE 10 | Condemnation | 14 | |

ARTICLE 11 | Return of Possession | 15 | |

ARTICLE 12 | Holding Over | 16 | |

ARTICLE 13 | No Waiver | 16 | |

ARTICLE 14 | Attorneys' Fees and Jury Trial | 17 | |

ARTICLE 15 | Personal Property Taxes, Rent Taxes and Other Taxes | 17 | |

ARTICLE 16 | Subordination, Attornment and Mortgagee Protection | 17 | |

ARTICLE 17 | Estoppel Certificate | 18 | |

ARTICLE 18 | Assignment and Subletting | 18 | |

ARTICLE 19 | Rights Reserved By Landlord | 21 | |

ARTICLE 20 | Landlord's Remedies | 22 | |

ARTICLE 21 | Landlord Default | 25 | |

ARTICLE 22 | Conveyance by Landlord and Liability | 26 | |

ARTICLE 23 | Indemnification | 26 | |

ARTICLE 24 | Safety and Security Devices, Services and Programs | 27 | |

ARTICLE 25 | Communications and Computer Lines | 27 | |

ARTICLE 26 | Hazardous Materials | 28 | |

ARTICLE 27 | Offer | 30 | |

ARTICLE 28 | Notices | 30 | |

ARTICLE 29 | Real Estate Brokers | 31 | |

ARTICLE 30 | Security Deposit | 31 | |

ARTICLE 31 | Exculpatory Provisions | 31 | |

ARTICLE 32 | Mortgagee's Consent | 32 | |

ARTICLE 33 | Miscellaneous | 32 | |

ARTICLE 34 | Entire Agreement | 33 | |

ARTICLE 35 | Parking | 34 | |

ARTICLE 36 | Signage | 36 | |

ARTICLE 37 | Right of First Offer | 37 | |

ARTICLE 38 | New UPS | 38 | |

ARTICLE 39 | Opportunity to Purchase | 39 | |

ARTICLE 40 | Termination Option | 39 | |

i

RIDER ONE RULES | |||

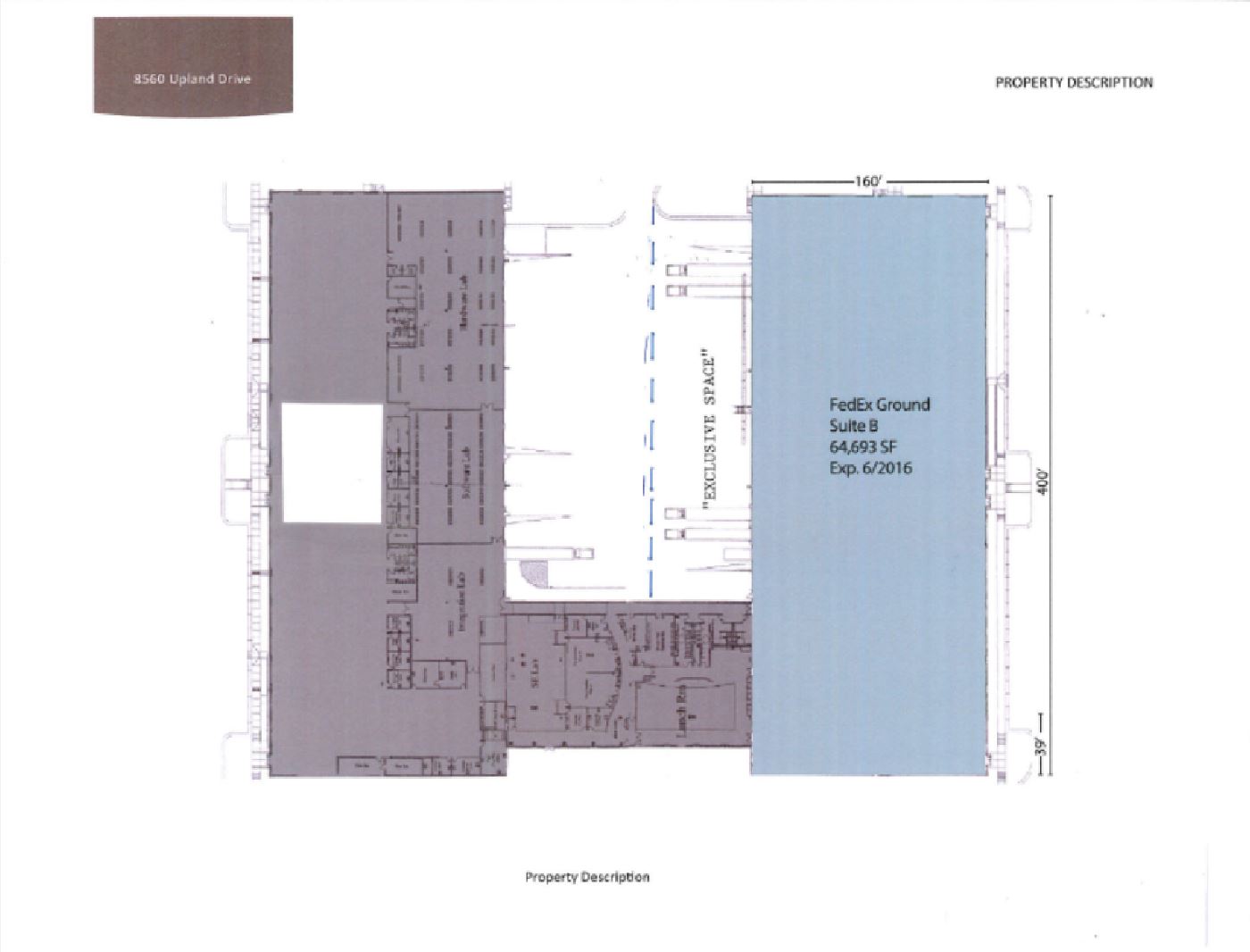

EXHIBIT A | FLOOR PLAN SHOWING PREMISES | ||

EXHIBIT B | WORKLETTER AGREEMENT | ||

EXHIBIT B-1 | DEPICTION OF ADJACENT PARKING PARCEL | ||

EXHIBIT B-2 | LEGAL DESCRIPTION OF ADJACENT PARKING PARCEL | ||

EXHIBIT B-3 | ALTERNATE MONUMENT SIGN LOCATION | ||

EXHIBIT C | RENEWAL OPTION | ||

EXHIBIT D | LEGAL DESCRIPTION | ||

EXHIBIT E | COMMENCEMENT DATE CERTIFICATE | ||

ii

List of Defined Terms

270 Day Period | 12 |

Abatement Period | 3 |

ACM | 30 |

ADA | 7 |

Additional Rent | 6 |

Adjacent Parking Parcel | 35 |

Affiliate | 21 |

Alterations | 9 |

Base Rent | 2 |

Building | 1 |

Commencement Date | 1 |

Completion Estimate | 12 |

Default | 23 |

Default Rate | 25 |

Expiration Date | 1 |

Force Majeure Delays | 33 |

Hazardous Material | 29 |

Holder | 18 |

Landlord | 1 |

Law | 33 |

Lease Month | 2 |

Lease Year | 2 |

Lines | 28 |

Mortgage | 18 |

MSDS | 29 |

New UPS | 39 |

OFAC | 34 |

Offer Notice | 38 |

Offer Space | 38 |

Operating Expenses | 3 |

Other Lease | 25 |

Permitted Alterations | 10 |

Permitted Transfer | 21 |

Permitted Transferee | 21 |

Permitted Use | 7 |

Person | 33 |

Premises | 1 |

Prime Rate | 24 |

Property | 1 |

Rent | 6 |

Rules | 7 |

Statement | 5 |

Subject Space | 19 |

Systems and Equipment | 1 |

Tangible Net Worth | 21 |

Taxes | 3 |

Tenant | 1 |

Tenant Work | 9 |

Tenant's Prorata Share | 3 |

iii

List of Defined Terms

Term | 1 |

Termination Date | 40 |

Termination Fee | 40 |

Termination Notice | 40 |

Termination Option | 40 |

Transfer Premium | 20 |

Transferee | 19 |

Transfers | 19 |

Workletter | 2 |

iv

LEASE

THIS LEASE is made as of the 30th day of December, 2016, between Wells Fund XIII-REIT Joint Venture Partnership, a Georgia joint venture partnership ("Landlord"), and Charter Communications Holding Company, LLC, a Delaware limited liability company ("Tenant").

WITNESSETH:

ARTICLE 1

Premises and Term

Premises and Term

(A) Premises, Building and Property. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord approximately 64,693 square feet ("Premises") described or shown on Exhibit A attached hereto, in the building commonly known as 8560 Upland Drive, Englewood, Colorado 80134 (the “Building”), subject to the terms of this Lease. The term "Property" shall mean the Building, and any common or public areas or facilities, easements, corridors, lobbies, sidewalks, loading areas, driveways, landscaped areas, skywalks, parking garages and lots, and any and all other structures or facilities operated or maintained in connection with or for the benefit of the Building, and all parcels or tracts of land on which all or any portion of the Building or any of the other foregoing items are located, and any fixtures, machinery, equipment, apparatus, Systems and Equipment, furniture and other personal property located thereon or therein and used in connection therewith owned or leased by Landlord. Possession of areas necessary for utilities, services, safety and operation of the Property, including the Systems and Equipment, fire stairways, perimeter walls, together with the right to install, maintain, operate, repair and replace the Systems and Equipment, including any of the same in, through, under or above the Premises in locations that will not materially interfere with Tenant's use of the Premises, are hereby excepted and reserved by Landlord, and not demised to Tenant. "Systems and Equipment" shall mean any common (shared) plant, machinery, transformers, duct work, cable, wires, and other equipment, facilities, and systems designed to supply heat, ventilation, air conditioning and humidity or any other services or utilities, or comprising or serving as any component or portion of the electrical, gas, steam, plumbing, sprinkler, communications, alarm, security, or fire/life/safety systems or equipment, or any other mechanical, electrical, electronic, computer or other systems or equipment serving more than one tenant at the Property. Supplemental HVAC, Tenant’s backup power systems and equipment, and other mechanical equipment installed to address Tenant’s special electrical, cooling and ventilating needs shall not be part of “Systems and Equipment” and shall be Tenant’s responsibility to repair, maintain, and replace.

(B) Commencement Date: The “Commencement Date” "shall be the earlier of (a) the date on which Tenant begins conducting business operations in the Premises, or (b) May 1, 2017. The "Term" of this Lease shall be approximately one hundred twenty-six (126) months, commencing on the Commencement Date and ending at 5:00 p.m. local time on the last day of the 126th full calendar month following the Commencement Date ("Expiration Date"), subject to adjustment and earlier termination as provided herein. Landlord and Tenant agree that for purposes of this Lease the square footage of the Premises is approximately sixty four thousand six hundred ninety-three (64,693) square feet. Tenant shall be entitled to enter the Premises from and after the mutual execution of this Lease, but prior to the Commencement Date in order to perform the Work (defined in Exhibit B) and for the purpose of installing Tenant’s fixtures, personal property, cabling or other telecommunications network, and for any other purpose permitted by Landlord, subject to all the terms and conditions of this Lease other than those requiring payment of Base Rent, Taxes and Operating Expenses.

1

(C) Workletter; Commencement Date Agreement. The workletter attached hereto as Exhibit B ("Workletter") is made a part hereof. Landlord and Tenant approve of the form of commencement date certificate attached hereto as Exhibit E.

(D) Required Tenant Deliveries. Landlord will not be obligated to deliver possession of the Premises to Tenant until Landlord has received from Tenant all of the following: (i) this Lease fully executed by Tenant; (ii) the first monthly installment of Base Rent; and (iii) executed copies of policies of insurance or certificates thereof as required under Article 9 of this Lease. Failure to timely deliver any of the foregoing shall not defer the Commencement Date or impair Tenant's obligation to pay Rent.

(E) Acceptance. Tenant has inspected the Premises, Property, Systems and Equipment and agrees to accept the same "as is" without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements, except as required pursuant to this Lease, and no representations respecting the condition of the Premises or the Property have been made to Tenant by or on behalf of Landlord, except as expressly provided in this Lease or in the Workletter.

ARTICLE 2

Base Rent

Base Rent

Tenant shall pay Landlord Base Rent ("Base Rent") of:

Annual Base Rent Monthly

Time Period Per Square Foot Amount

Lease Months 1-18 $11.50 $61,997.46*

Lease Months 19-30 $11.85 $63,884.34 |

Lease Months 31-42 $12.20 $65,771.22 |

Lease Months 43-54 $12.57 $67,765.92 |

Lease Months 55-66 $12.94 $69,760.62 |

Lease Months 67-78 $13.33 $71,863.14 |

Lease Months 79-90 $13.73 $74,019.57 |

Lease Months 91-102 $14.14 $76,229.92 |

Lease Months 103-114 $14.57 $78,548.08 |

Lease Months 115-126 $15.00 $80,866.25 |

in advance on or before the first day of each calendar month during the Term, except that Base Rent for the first full calendar month for which Base Rent shall be due shall be paid within 10 days after Tenant executes this Lease. If the Term commences on a day other than the first day of a calendar month, or ends on a day other than the last day of a calendar month, then the Base Rent for such month shall be prorated on the basis of the number of days in that month. Rent shall be paid without any prior demand or notice therefor and without any deduction, set-off or counterclaim except as set forth in this Lease, or relief from any valuation or appraisement laws. Landlord may apply payments received from Tenant to any obligations of Tenant then accrued, without regard to such obligations as may be designated by Tenant. As used herein, the term “Lease Month” shall mean each calendar month during the Term (and if the Commencement Date does not occur on the first day of a calendar month, the period from the Commencement Date to the first day of the next calendar month shall be included in the first Lease Month for purposes of determining the duration of the Term and the monthly Base Rent rate applicable for such partial month) and the term "Lease Year" shall mean each consecutive period of twelve (12) Lease Months.

2

*Notwithstanding the foregoing, provided Tenant is not in Default (after expiration of any notice and cure period) under this Lease, Tenant’s obligation to pay Base Rent shall be abated for the first six (6) calendar months after the Commencement Date (the “Abatement Period”). To illustrate, if the Commencement Date occurs on February 27, 2017, then the Abatement Period will commence on the Commencement Date and end on August 26, 2017. If the Abatement Period does not end on the last day of a calendar month, then on the day following the Abatement Period, Tenant shall make a prorated Base Rent payment for the remainder of such month. If Tenant commits a material, monetary Default and fails to cure before Landlord files suit to terminate this Lease or regain possession of the Premises, then all sums so abated shall be immediately due and payable to Landlord. Notwithstanding such abatement of Base Rent, all other sums due under the Lease shall be payable as provided in this Lease.

ARTICLE 3

Additional Rent

Additional Rent

(A) Taxes. Tenant shall pay Landlord Tenant's Prorata Share of Taxes. "Taxes" shall mean all federal, state, county, or local taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary (including without limitation, real estate taxes, general and special assessments, transit taxes, water and sewer rents, rent taxes, sales taxes, gross receipts taxes, any tax or charge for fire protection, street lighting, streets, sidewalks, road maintenance, refuse or other services, and personal property taxes imposed upon Landlord) that are applicable to the Term of this Lease (i.e. calculated on a cash basis). However, "Taxes" shall not include: Landlord's income taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, and estate taxes; provided that if an income or excise tax is levied by any governmental entity in lieu of or as a substitute for ad valorem real estate taxes (in whole or in part), then any such tax or excise shall constitute and be included within the term "Taxes." Taxes shall include the costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Property. Tenant waives all rights to protest or appeal the appraised value of the Premises and the Property. If Taxes for any period during the Term or any extension thereof, shall be increased after payment thereof by Landlord for any reason, Tenant shall pay Landlord upon demand Tenant's Prorata Share of such increased Taxes. Notwithstanding the foregoing, if any Taxes shall be paid based on assessments or bills by a governmental or municipal authority using a fiscal year other than a calendar year, Landlord may elect to average the assessments or bills for the subject calendar year, based on the number of months of such calendar year included in each such assessment or bill. "Tenant's Prorata Share" of Taxes and Operating Expenses shall be the rentable area of the Premises divided by the 148,870 square feet, which is the square footage of the Building, excluding any parking facilities (i.e. 43.456%).

(B) Operating Expenses. Tenant shall pay Landlord Tenant's Prorata Share of Operating Expenses. "Operating Expenses" shall mean all expenses of every kind (other than Taxes) which are paid, incurred or accrued for, by or on behalf of Landlord during any calendar year any portion of which occurs during the Term, in connection with the management, repair, maintenance, restoration and operation of the Property (which includes expenses attributable to the business campus of which the Property is a part to the extent such expenses are appropriately and proportionately assessed to the Property), including without limitation, any amounts paid for: (a) utilities for the Property, including but not limited to gas, steam, chilled water, oil or other fuel, water, sewer, common area electric, lighting, heating, air conditioning and ventilating (including, without limitation, taxes on utility usage), (b) intentionally omitted,(c) insurance applicable to the Property, but not limited to the amount of coverage Landlord is required to provide under this Lease and reasonable insurance deductibles not to exceed $100,000, (d) supplies, tools, equipment and materials used in the operation, repair and maintenance of the Property including, without limitation, costs of the maintenance, operation, and repair of the HVAC systems serving the Building if any, exclusive of systems which serve only a particular tenant’s space, (e) accounting, legal, inspection, and other services relating to

3

the operation and management of the Property, (f) any equipment rental of any kind (or installment equipment purchase or equipment financing agreements), (g) management fees of not more than three percent (3%) of the gross revenues of the Building, (h) intentionally omitted, (i) wages, salaries and other compensation and benefits (including travel costs not to exceed $3,000 per year) for all persons engaged in the operation, management, maintenance or security of the Property, and employer's Social Security taxes, unemployment taxes or insurance, and any other taxes which may be levied on such wages, salaries, compensation and benefits, provided that such wages and benefits for persons who do not work full time at the Building shall be prorated based on time spent working on Building matters, (j) payments under any easement agreement, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs in any planned development, association or business park to the extent such payments are appropriately and proportionately assessed to the Property, (k) operation, repair, and maintenance of all Systems and Equipment and components thereof (including replacement of components), alarm and security service, window cleaning, trash removal, cleaning of walks, parking facilities and Property walls, removal of ice and snow, maintenance and replacement of shrubs, trees, grass, sod and other landscaped items, irrigation systems, drainage facilities, fences, curbs, and walkways, re-paving and re-striping parking facilities, and roof repairs; (l) intentionally omitted; (m) any carbon tax, carbon credit, or other so-called carbon offset cost payable by Landlord with respect to Building operations, whether pursuant to a cap and trade carbon emission system or otherwise; (n) costs to repair, operate and maintain the Building’s parking facilities, (o) intentionally omitted, (p) if any, costs of the Building’s common generator(s) and all systems and equipment related thereto (as opposed to any New UPS); and (q) costs incurred by Landlord in connection with any environmental initiative and/or operations & maintenance plan implemented by Landlord at the Property whether or not such initiatives are mandated by law including, without limitation, costs to: install water efficient irrigation, plumbing and fixtures; reduce heat islands; control stormwater; reduce chemical emissions; manage refrigerants; optimize energy performance and increase efficiencies; store and collect recyclables; promote usage of recycled content; and implement sustainable purchasing and waste management policies. Notwithstanding the foregoing, Operating Expenses shall not include:

(i) depreciation, interest and amortization on Mortgages, and other debt costs or ground lease payments, if any; legal fees in connection with leasing, tenant disputes or enforcement of leases; marketing costs and other costs and expenses incurred in connection with negotiation and enforcement of leases; real estate brokers' leasing commissions; improvements or alterations to tenant spaces; the cost of providing any service directly to and paid directly by, any tenant; any costs expressly excluded from Operating Expenses elsewhere in this Lease; costs of any items to the extent Landlord receives reimbursement from insurance proceeds or from a third party (such proceeds to be deducted from Operating Expenses in the year in which received); any and all costs arising from the presence, removal, abatement, or remediation of Hazardous Materials (as defined in Article 26 below) in or about the Property, not placed therein by Tenant; costs arising from latent defects in the base, shell or core of the Building; and

(ii) capital expenditures, except those that reduce Operating Expenses, or made to comply with any Laws or other governmental requirements that were not applicable to the Property as of the date of this Lease, provided, all such permitted capital expenditures (together with reasonable financing charges) shall be amortized for purposes of this Lease over the shorter of: (i) their useful lives or (ii) the period during which the reasonably estimated savings in Operating Expenses equals the expenditures.

With respect to any calendar year or partial calendar year in which the Building is not occupied to the extent of 100% of the rentable area thereof, Operating Expenses which vary with occupancy for such period shall, for the purposes hereof, be increased to the amount which would have been incurred had the Building been occupied to the extent of 100% of the rentable area thereof.

4

(C) Manner of Payment. Taxes and Operating Expenses shall be paid in the following manner:

(i) Landlord may reasonably estimate in advance the amounts Tenant shall owe for Taxes and Operating Expenses for any full or partial calendar year of the Term. In such event, Tenant shall pay such estimated amounts, on a monthly basis in installments equal to one-twelfth of the annual estimate, on or before the first day of each calendar month, together with Tenant's payment of Base Rent. Such estimate may be reasonably adjusted from time to time by Landlord.

(ii) Within one hundred twenty (120) days after the end of each calendar year, or as soon thereafter as practicable, Landlord shall provide a statement (the "Statement") to Tenant showing: (a) the amount of actual Taxes and Operating Expenses for such calendar year, with a listing of amounts for major categories of Operating Expenses, (b) any amount paid by Tenant towards Taxes and Operating Expenses during such calendar year on an estimated basis, and (c) any revised estimate of Tenant's obligations for Taxes and Operating Expenses for the current calendar year.

(iii) If the Statement shows that Tenant's estimated payments were less than Tenant's actual obligations for Taxes and Operating Expenses for such year, Tenant shall pay the difference. If the Statement shows an increase in Tenant's estimated payments for the current calendar year, Tenant shall pay the difference between the new and former estimates, for the period from January 1 of the current calendar year through the month in which the Statement is sent. Tenant shall make such payments within thirty (30) days after Landlord sends the Statement.

(iv) If the Statement shows that Tenant's estimated payments exceeded Tenant's actual obligations for Taxes and Operating Expenses, Tenant shall receive a credit for the difference against payments of Rent next due. If the Term shall have expired and no further Rent shall be due, Tenant shall receive a refund of such difference, within thirty (30) days after Landlord sends the Statement.

(v) So long as Tenant's obligations hereunder are not materially adversely affected thereby, Landlord reserves the right to reasonably change, from time to time, the manner or timing of the foregoing payments. In lieu of providing one Statement covering Taxes and Operating Expenses, Landlord may provide separate statements, at the same or different times. No delay by Landlord in providing the Statement (or separate statements) shall be deemed a default by Landlord or a waiver of Landlord's right to require payment of Tenant's obligations for actual or estimated Taxes or Operating Expenses.

(D) Proration. If the Term commences other than on January 1, or ends other than on December 31, Tenant's obligations to pay estimated and actual amounts towards Taxes and Operating Expenses for such first or final calendar years shall be prorated to reflect the portion of such years included in the Term. Such proration shall be made by multiplying the total estimated or actual (as the case may be) Taxes and Operating Expenses, for such calendar years, by a fraction, the numerator of which shall be the number of days of the Term during such calendar year, and the denominator of which shall be three hundred and sixty-five (365).

(E) Landlord's Records. Landlord shall maintain records respecting Taxes and Operating Expenses and determine the same in accordance with generally accepted accounting and management practices, consistently applied. Provided no uncured Default then exists, after receiving an annual Statement and giving Landlord thirty (30) days prior written notice thereof, Tenant may inspect or audit Landlord's records relating to Operating Expenses for the period of time covered by such Statement in accordance with the following provisions. If Tenant fails to object to the calculation of Operating Expenses on an annual

5

Statement within sixty (60) days after the Statement has been delivered to Tenant or if Tenant fails to conclude its audit or inspection within ninety (90) days after the Statement has been delivered to Tenant, then Tenant shall have waived its right to object to the calculation of Operating Expenses for the year in question and the calculation of Operating Expenses set forth on such Statement shall be final. Tenant's audit or inspection shall be conducted where Landlord maintains its books and records within the continental United States, shall not unreasonably interfere with the conduct of Landlord's business, and shall be conducted only during business hours reasonably designated by Landlord. Tenant shall pay the cost of such audit or inspection unless the total Operating Expenses for the period in question is determined to be in error by more than 4% in the aggregate, in which case Landlord shall pay the audit cost. Tenant may not conduct an inspection or have an audit performed more than once during any calendar year. If such inspection or audit reveals that an error was made in the Operating Expenses previously charged to Tenant, then Landlord shall refund to Tenant any overpayment of such costs, or Tenant shall pay to Landlord any underpayment of such costs, as the case may be, within thirty (30) days after notification thereof. Tenant shall maintain the results of each such audit or inspection confidential and shall not be permitted to use any third party to perform such audit or inspection other than an independent firm of certified public accountants with at least ten (10) years of experience reviewing office building expense reconciliations: (1) which is not compensated on a contingency fee basis or in any other manner which is dependent upon the results of such audit or inspection (and Tenant shall deliver the fee agreement or other similar evidence of such fee agreement to Landlord upon request), and (2) which agrees with Landlord in writing to maintain the results of such audit or inspection confidential. Nothing in this section shall be construed to limit, suspend, or abate Tenant's obligation to pay Rent when due, including Additional Rent.

(F) Rent and Other Charges. "Additional Rent" means Tenant's Prorata Share of Taxes and Tenant's Prorata Share of Operating Expenses. Base Rent, Additional Rent and any other amounts which Tenant is or becomes obligated to pay Landlord under this Lease or other agreement entered in connection herewith, are sometimes herein referred to collectively as "Rent," and all remedies applicable to the non-payment of Rent shall be applicable thereto. Rent shall be paid at any office maintained by Landlord or its agent at the Property or at such other place as Landlord may designate.

(G) Notwithstanding the foregoing, with respect to Tenant’s obligation to pay Tenant’s Prorata Share of Taxes under this Lease, if the aggregate amount of Taxes paid by Landlord is reduced pursuant to C.R.S. § 39-3-124 or a similar statutory provision, then for purposes of Article 3 of the Lease, the portion of Taxes after giving effect to such reduction shall be grossed up to reflect the amount of Taxes as if it had not been reduced pursuant to C.R.S. § 39-3-124. (By way of example, if the Building is comprised of 100,000 square feet, has 10 tenants, each occupying 10,000 square feet and Taxes for the Property are $100,000. Each tenant’s pro-rata share is 10% (10,000 square feet/100,000 square feet) of the Taxes or $10,000. If a state entity takes one of the spaces and is exempt from Taxes, the Landlord’s Tax bill will be reduced by $10,000 and the state entity would receive the total benefit of the reduced Tax through a rent credit and the Tax bill would be revised for a new Tax bill of $90,000. Therefore, the remaining tenants’ pro-rata share of Taxes would be adjusted as follows: (i) Building size is now 90,000 square feet, (ii) the other tenants’ pro-rata shares are now 10,000/90,000 or 11.11111%, and (iii) Taxes for the other tenants would be calculated as 11.11111% multiplied by $90,000 = $10,000. Thus, resulting in no change in the other tenant’s Tax responsibility as the Tax is equitably adjusted.

ARTICLE 4

Use and Rules

Use and Rules

(A) Tenant shall use the Premises for warehouse and office use (the “Permitted Use”), and for no other purpose whatsoever, in compliance with all applicable Laws and all covenants, conditions and

6

restrictions of record applicable to Tenant's use or occupancy of the Premises, and without unreasonably disturbing or interfering with any other tenant or occupant of the Property. Landlord represents and warrants that, to its actual knowledge, (1) as of the date of this Lease, the Premises and the Property comply with all applicable Laws, including the ADA (as defined below), and (2) as of the date of this Lease, the Premises and the entire Building are fully sprinklered in accordance with all applicable building codes and fire department codes.

(B) Tenant at its sole cost and expense shall be responsible for taking any and all measures which are required to comply with the Americans with Disabilities Act of 1990 (the "ADA") and other Laws concerning (1) Tenant Work (whether made pursuant to Exhibit B, Article 6 or otherwise), and (2) the Premises and the business conducted in the Premises during the Term. Any Alterations made or constructed by Tenant which require compliance with the ADA shall be done in accordance with this Lease; provided, that Landlord's consent to such Alterations shall not constitute either Landlord's assumption, in whole or in part, of Tenant's responsibility for compliance with the ADA, or representation or confirmation by Landlord that such Alterations comply with the provisions of the ADA. Landlord shall be responsible for taking any and all measures which are required to comply with the ADA and other Laws concerning the common areas of the Property, unless compliance costs are created by Tenant's actions, in which case such compliance costs shall be Tenant's responsibility.

(C) Tenant shall comply with, and shall use reasonable efforts to cause its permitted subtenants, permitted assignees, invitees, employees, contractors and agents to comply with, all rules set forth in Rider One attached hereto (the "Rules"). In addition, all contractors shall be required to follow Landlord's reasonable rules and regulations for construction in the Building and Landlord may require that, prior to performing any work in the Building, each contractor execute a copy of Landlord's rules to evidence such contractor's agreement to so comply. Landlord shall have the right to reasonably amend such Rules and supplement the same with other reasonable Rules (not expressly inconsistent with this Lease and provided the same do not increase any costs to Tenant more than a nominal amount) relating to the Property, or the promotion of safety, care, cleanliness or good order therein, and all such amendments or new Rules shall be binding upon Tenant after 20 days' prior written notice thereof to Tenant. All Rules shall be applied on a non-discriminatory basis, but nothing herein shall be construed to give Tenant or any other Person any claim, demand or cause of action against Landlord arising out of the violation of such Rules by any other tenant, occupant, or visitor of the Property, or out of the enforcement or waiver of the Rules by Landlord in any particular instance.

(D) Tenant shall use reasonable efforts to cooperate with Landlord (at no additional cost to Tenant), at all times, in abiding by all regulations and requirements which Landlord may prescribe for the proper functioning and protection of all utilities and services necessary for the operation of the Premises or the complex and such other rules and regulations Landlord may prescribe in connection with any so-called green/LEED program(s) undertaken or maintained by Landlord, including, without limitation, surveys adopted by Landlord from time to time for the Building and maintaining and reporting utility consumption data in a format prescribed by Landlord. Landlord and its contractors shall have free access to any and all mechanical installations in the Premises at all reasonable times and upon prior written notice to Tenant (provided that no such notice or reasonable time requirement shall be required in the case of emergency or to perform repairs or other services otherwise required by Landlord under this Lease). Further, Tenant shall not use or operate the Premises in any manner that will cause the Premises, Building or complex or any part thereof not to conform to Landlord's sustainability practices or the certification of the Premises, Building or complex issued pursuant to any so-called green/LEED program(s) undertaken or maintained by Landlord.

(E) If Tenant discovers the existence of any mold or conditions that reasonably can be expected to give rise to mold, such as by way of example but not limitation, water damage, mold growth, repeated complaints of respiratory ailments or eye irritation by persons occupying the Premises or any notice from a

7

governmental authority of complaints of indoor air quality at the Premises, Tenant will notify Landlord and Landlord shall retain an industrial hygienist or other professional mold consultant to conduct an inspection and prepare a report for Tenant and Landlord. If the inspection report concludes that mold is present in the Premises and such presence is due to the actions, omissions or negligence of Tenant, Tenant will be responsible for the cost of such inspection and the cost of remediation. If the inspection report concludes that mold is present in the Premises and is not due to actions, omissions or negligence of Tenant, Landlord will be responsible for the cost of such inspection and the cost of remediation. If the inspection report concludes that mold is present in the Premises, Landlord will hire a contractor that specializes in mold remediation to prepare a remediation plan for the Premises and upon Landlord’s approval of the plan, the contractor will promptly carry out the work contemplated in the plan in accordance with applicable Laws. To the extent required by applicable state or local health or safety requirements, occupants and visitors to the Premises will be notified of the conditions and the schedule for the remediation. The contractor performing the remediation will provide a written certification to Landlord and Tenant that the remediation has been completed in accordance with applicable Laws.

ARTICLE 5

Services and Utilities

Services and Utilities

Landlord represents and warrants to Tenant that, as of the date of this Lease, water, sewer, gas, telephone and electricity are available to the Premises and the Building. Tenant is solely responsible for contracting directly for all services and utilities Tenant desires in connection with Tenant's use and occupancy of the Premises. Tenant is also solely responsible for paying directly to the applicable service or utility companies, prior to delinquency, all charges of every nature, kind or description for services and utilities furnished to the Premises or chargeable against the Premises (including, without limitation, charges imposed by any utility or service company as a condition precedent to furnishing or continuing to furnish utilities or services to the Premises), including all charges for water, sewage, heat, gas, light, garbage and rubbish removal, electricity, telecommunications, cable, steam, power, or other public or private utilities and services and any charges or fees for present or future water or sewer capacity to serve the Premises, any charges for the underground installation of gas or other utilities or services, and other charges relating to the extension of or change in the facilities necessary to provide the Premises with adequate utilities and services. However, if any services or utilities are jointly metered with other property, Landlord shall make a reasonable determination of Tenant's proportionate share of the cost of such utilities and services (at rates that would have been payable if such utilities and services had been directly billed by the utilities or service providers) and Tenant shall pay such share to Landlord within 30 days after receipt of Landlord's written statement. Subject to Force Majeure, Landlord shall provide lighting of the exterior portions of the Property and all entrances and exits to the Property, seven days a week, 365 days a year. Subject to Force Majeure and the terms of this Lease, Tenant will be entitled to access to the Premises, 24 hours per day, seven days per week. The Premises are currently not separately metered for electricity, but electricity usage for the Premises is determinable by Landlord based on existing submetering for the common areas and for other leasable space in the Building. Tenant may either install a separate meter for the Premises, at Tenant’s expense, and pay the utility company directly or pay Landlord for actual electric usage by Tenant from the Premises as set forth above in this Article.

No interruption in, or temporary stoppage of, any utility or service to the Premises shall render Landlord liable for any damages caused thereby, be a constructive eviction of Tenant, constitute a breach of any implied warranty, or, except as provided in the next sentence, entitle Tenant to any abatement of Tenant’s obligations hereunder. Notwithstanding anything to the contrary contained herein, if any utility or service is interrupted for any reason within Landlord's reasonable control and such interruption shall continue for more than four consecutive days after notice of such interruption or failure from Tenant to Landlord, and if such interruption or failure shall render any material portion of the Premises unusable for the conduct of

8

Tenant's business, and if Tenant in fact does not use or occupy such material portion of the Premises during the period of such interruption or failure, then all Base Rent and Additional Rent payable hereunder with respect to such unusable portion of the Premises shall be abated for the period beginning on the fifth consecutive day of such interruption or failure and such rental abatement shall continue until such portion of the Premises is tenantable again or Tenant recommences use or occupancy of such portion of the Premises, whichever occurs first.

ARTICLE 6

Alterations and Liens

Alterations and Liens

Tenant shall not make any additions, changes, alterations or improvements ("Alterations") outside the Premises, except in accordance with Exhibit B. Except for Permitted Alterations, Tenant shall not make any Alterations within the Premises ("Tenant Work") without the prior written consent of Landlord, which shall not be unreasonably withheld. If Landlord does not consent or object in writing to a proposed Alteration within 10 days after its receipt of Tenant’s request for consent, Tenant may send Landlord a second written notice requesting consent, which must disclose that it is a second notice. If Landlord does not respond within five (5) days of receipt of the second notice, Landlord’s consent to the requested Alteration will be deemed given. Except with respect to Permitted Alterations (as defined below) Landlord may impose reasonable requirements as a condition of such consent including without limitation the submission of plans and specifications for Landlord's prior written approval, obtaining necessary permits, posting bonds, obtaining insurance, prior approval of contractors, subcontractors and suppliers, prior receipt of copies of all contracts and subcontracts, contractor and subcontractor lien waivers, affidavits listing all contractors, subcontractors and suppliers, use of union labor (if Landlord uses union labor), affidavits from engineers acceptable to Landlord stating that the Tenant Work will not adversely affect the Systems and Equipment or the structure of the Property, and requirements as to the manner and times in which such Tenant Work shall be done. All Tenant Work shall be performed in a good and workmanlike manner and all materials used shall be of a quality comparable to or better than those in the Premises and Property and, except with respect to Permitted Alterations, shall be in accordance with plans and specifications approved by Landlord, and, except with respect to Permitted Alterations, Landlord may require that all such Tenant Work be performed under Landlord's supervision. Tenant shall reimburse Landlord for all out of pocket costs incurred by Landlord in reviewing Tenant's plans and specifications and supervising the Tenant Work. Consent or supervision by Landlord shall not be deemed a warranty as to the adequacy of the design, workmanship or quality of materials, and Landlord hereby expressly disclaims any responsibility or liability for the same. Landlord shall under no circumstances have any obligation to repair, maintain or replace any portion of the Tenant Work.

Notwithstanding anything in this Lease to the contrary other than Exhibit B with respect to the initial Work, without (1) Landlord’s consent, (2) submission of any plans and specifications to Landlord, (3) supervision by Landlord, or (4) payment to Landlord of any plan review or supervision fees (but subject to the other requirements of this Lease), Tenant may make cosmetic Alterations to the Premises that do not affect Systems and Equipment or structural components, that do not require a building permit or raise building code issue(s), do not impact the quiet enjoyment of other Building tenants, and that are not visible outside the Premises, the cost of which must not exceed $75,000 in any instance or series of related instances (collectively, “Permitted Alterations”).

Tenant shall keep the Property and Premises free from any mechanic's, materialman's or similar liens or other such encumbrances in connection with any Tenant Work on or respecting the Premises not performed by or at the request of Landlord, and shall indemnify and hold Landlord harmless from and against any claims, liabilities, judgments, or costs (including reasonable attorneys' fees) arising out of the same or in connection therewith. Tenant shall give Landlord notice at least five (5) days prior to the commencement

9

of any Tenant Work (or such additional time as may be necessary under applicable Laws); in addition Tenant shall post a written or printed notice on the Premises stating that Landlord’s interest shall not be subject to any liens pursuant to §38-22-105(2) of the Colorado Revised Statutes or any similar statute enacted after the Commencement Date. Landlord shall also have the right to post and keep posted notices such as those provided for by §38-22-105(2) of the Colorado Revised Statutes or to take any further reasonable action that Landlord may deem to be proper for the protection of Landlord’s interest in the Premises. Tenant shall remove any such lien or encumbrance by bond or otherwise within thirty (30) days after written notice by Landlord, and if Tenant shall fail to do so, Landlord may pay the amount necessary to remove such lien or encumbrance, without being responsible for investigating the validity thereof. The amount so paid shall be deemed additional Rent under this Lease payable upon demand, without limitation as to other remedies available to Landlord under this Lease. Nothing contained in this Lease shall authorize Tenant to do any act which shall subject Landlord's title to the Property or Premises to any lien or encumbrance whether claimed by operation of law or express or implied contract. Any claim to a lien or encumbrance upon the Property or Premises arising in connection with any Tenant Work on or respecting the Premises not performed by or at the request of Landlord shall be null and void, or at Landlord's option shall attach only against Tenant's interest in the Premises and shall in all respects be subordinate to Landlord's title to the Property and Premises.

All contractors and subcontractors shall be required to procure and maintain insurance against such risks, in such amounts, and with such companies as Landlord may reasonably require. Certificates of such insurance, with paid receipts therefor, must be received by Landlord before any work is commenced. All contracts between Tenant and a contractor must explicitly require the contractor to (a) name Landlord and Landlord’s agents as additional insureds and (b) indemnify and hold harmless Landlord and Landlord’s agents.

ARTICLE 7

Repairs

Repairs

Landlord represents and warrants to Tenant that, as of the date of this Lease, the existing heating, ventilating, air conditioning, mechanical, electrical, plumbing, fire suppression, life safety and sprinkler systems serving the Premises are in good working order.

Tenant shall keep the interior of the Premises in good condition, working order and repair (including without limitation, doors, plumbing and other fixtures, security and safety devices, equipment, alterations and improvements whether installed by Landlord or Tenant, to the extent the same are located within the Premises after the point of entry). In the event that any such repairs, maintenance or replacements are required, Tenant shall promptly arrange for the same through contractors approved in writing in advance by Landlord. If Tenant does not promptly make such arrangements, Landlord may, but need not, make such repairs, maintenance and replacements, and the costs paid or incurred by Landlord therefor shall be reimbursed by Tenant promptly after request by Landlord. Except to the extent caused by the negligence or willful misconduct of Landlord (and except to the extent covered by property insurance policies required to be carried by Landlord under this Lease or actually carried by Landlord), Tenant shall indemnify Landlord and pay for any repairs, maintenance and replacements to areas of the Property outside the Premises, caused, in whole or in part, as a result of moving any furniture, fixtures, or other property to or from the Premises, or by the negligence or willful misconduct of Tenant or its employees, agents, contractors, or visitors (as used herein, “agents, contractors or visitors” shall not include UPS, Federal Express, USPS and other national delivery service companies).

Except as provided in the preceding sentence, or for damage covered under Article 8, Landlord shall (1) maintain, repair and replace the common areas of the Property, which shall include, without limitation, timely removal of any snow and ice from the common areas in a manner consistent with snow removal services typically provided to comparable buildings in the Southeast Denver Suburban market; regular pickup

10

of trash and garbage at the Property; cleaning, sweeping and restriping the parking areas on the Property; lighting (including replacement of bulbs and ballasts) the common areas; and maintaining plants and landscaping, and (2) keep the Systems and Equipment in good condition, working order and repair (and the costs incurred under (1) and (2) above shall be included in Operating Expenses to the extent permitted under Article 3 above). Additionally, Landlord will maintain, repair, and replace in good condition and repair: (a) the roof, (b) the exterior walls; (c) the structure and foundation of the Building; (d) utility lines located outside the Premises, and the pipes and conduits located outside the Premises; (e) the under-slab electrical and plumbing services; and (f) the base building fire suppression, life safety and sprinkler systems serving the Building and the Premises. The costs incurred under (a) through (f) above shall be included in Operating Expenses to the extent permitted under Article 3 above. Notwithstanding anything to the contrary set forth in this Lease, Landlord shall, at its sole cost and expense (and not subject to reimbursement as an Operating Expense) replace the roof of the Building, as opposed to repair the roof of the Building, if the aggregate cost in any calendar year to repair the roof would exceed 25% of the cost to replace the roof.

ARTICLE 8

Casualty Damage

Casualty Damage

Subject to Article 6 and the remainder of this Article 8, Landlord shall use available insurance proceeds to restore the Premises or any common areas of the Property providing access thereto which are damaged by fire or other casualty during the Term. Such restoration shall be to substantially the condition prior to the casualty, except for modifications required by zoning and building codes and other Laws or by any Holder, any other modifications to the common areas deemed desirable by Landlord (provided access to the Premises is not materially impaired), and except that Landlord shall not be required to repair or replace any of Tenant's furniture, furnishings, fixtures or equipment, or any of Tenant’s alterations or improvements in the Premises, which Tenant covenants to rebuild at Tenant’s expense promptly after the casualty. Landlord shall not be liable for any inconvenience or annoyance to Tenant or its visitors, or injury to Tenant's business resulting in any way from such damage or the repair thereof. However, from the date of the casualty until Landlord completes Landlord’s repairs, Landlord shall allow Tenant a proportionate abatement of Rent during the time and to the extent the Premises are unfit for occupancy for the purposes permitted under this Lease and not occupied by Tenant as a result thereof (unless Tenant or its employees or agents intentionally caused the damage). Notwithstanding the foregoing, Landlord may terminate this Lease by giving Tenant written notice of termination within sixty (60) days after the date of damage (such termination notice to include a termination date providing at least ninety (90) days for Tenant to vacate the Premises), if the Property shall be damaged by fire or other casualty such that: (a) repairs to the Premises and access thereto cannot reasonably be completed within two hundred seventy (270) days after the casualty without the payment of overtime or other premiums, (b) more than twenty-five percent (25%) of the Premises is affected by the damage and fewer than 24 months remain in the Term, (c) the damage is not fully covered by Landlord's insurance policies (excluding the deductible), provided that Landlord is maintaining the insurance required to be maintained by Landlord in accordance with this Lease, or (d) the cost of the repairs, alterations, restoration or improvement work would exceed twenty-five percent (25%) of the replacement value of the Property, or (e) the nature of such work would make termination of this Lease necessary and Landlord also terminates the leases of all other similarly situated tenants. If Landlord does not elect to terminate the Lease as provided above, Landlord shall send Tenant a written estimate, from an independent architect or general contractor selected by Landlord, of the amount of time reasonably required to repair and restore the Premises and access thereto, as the case may be (“Completion Estimate”). Tenant may terminate this Lease by giving Landlord written notice of termination within thirty (30) days after Tenant’s receipt of the Completion Estimate (such termination notice to include a termination date providing not more than ninety (90) days for Tenant to vacate the Premises), if the Property shall be damaged by fire or other casualty such that: (a) the Completion Estimate estimates that Landlord’s repairs to the Premises and access thereto cannot reasonably be completed

11

within two hundred seventy (270) days after the casualty without the payment of overtime or other premiums, or (b) more than twenty-five percent (25%) of the Premises is affected by the damage and fewer than 24 months remain in the Term. Furthermore, if neither Landlord nor Tenant terminates this Lease as provided above and Landlord undertakes but fails to substantially complete Landlord’s restoration of the Premises and access thereto within two hundred seventy (270) days after the casualty (“270 Day Period”) Tenant may terminate this Lease by giving Landlord written notice of termination at any time after the 270 Day Period but prior to such substantial completion (such termination notice to include a termination date providing not more than thirty (30) days for Tenant to vacate the Premises). Tenant agrees that Landlord's obligation to restore, the abatement of Rent and the termination options provided herein, shall be Tenant's sole recourse in the event of such damage, and waives any other rights Tenant may have under any applicable Law to terminate the Lease by reason of damage to the Premises or Property. Tenant acknowledges that this Article represents the entire agreement between the parties respecting casualty damage to the Premises or the Property.

ARTICLE 9

Insurance, Subrogation, and Waiver of Claims

Insurance, Subrogation, and Waiver of Claims

(A) Tenant shall not conduct or permit to be conducted any activity, or place or permit to be placed any equipment or other item in or about the Premises, the Building or the Property, which will in any way increase the rate of property insurance or other insurance on the Property. If any increase in the rate of property or other insurance is due to any activity, equipment or other item of Tenant, then (whether or not Landlord has consented to such activity, equipment or other item) Tenant shall pay as additional rent due hereunder the amount of such increase. The statement of any applicable insurance company that an increase is due to any such activity, equipment or other item shall be conclusive evidence thereof.

(B) Throughout the Term, Tenant shall obtain and maintain the following insurance coverages written with companies with an A.M. Best A-, X or better rating and S&P rating of at least A-:

(i) Commercial General Liability insurance, written on an occurrence basis, with limits not less than Two Million Dollars ($2,000,000) per occurrence, Two Million Dollars ($2,000,000) general aggregate, Two Million Dollars ($2,000,000) products/completed operations aggregate, Two Million Dollars ($2,000,000) personal and advertising injury liability, and Fifty Thousand Dollars ($50,000) fire damage legal liability. The insurance shall be written on a current ISO occurrence form (or a substitute form providing equivalent or broader coverage) and shall cover liability including, but not limited to, arising from premises, operations, independent contractors, products-completed operations, personal injury, and advertising injury.

(ii) Workers' Compensation insurance as required by the applicable state law, and Employer's Liability insurance with limits not less than One Million Dollars ($1,000,000) each accident, One Million Dollars ($1,000,000) disease policy limit, and One Million Dollars ($1,000,000) disease each employee.

(iii) Commercial Auto Liability insurance (if applicable) covering automobiles owned, non-owned, hired or used by Tenant in carrying on its business with limits not less than One Million Dollars ($1,000,000) combined single limit each accident.

(iv) Umbrella/Excess Liability insurance on a follow form basis in excess of the Commercial General Liability, Employer's Liability and Commercial Auto Liability policies with limits not less than Ten Million Dollars ($10,000,000) per occurrence and Ten Million Dollars ($10,000,000) annual aggregate.

12

(v) Special form Property insurance, including sprinkler leakage, covering Tenant's Work; Tenant's property, furniture, furnishings, fixtures, improvements; Alterations; and Tenant’s equipment located at the Building, on a replacement cost basis. If Tenant is responsible for any machinery and equipment, Tenant shall maintain mechanical breakdown insurance. Landlord shall not carry insurance on, and shall not be responsible for damage to, Tenant's personal property or any Alterations (including Tenant's Work), and Landlord shall not carry insurance against, or be responsible for any loss suffered by Tenant due to, interruption of Tenant's business.

(vi) Business Interruption and Extra Expense insurance in amounts typically carried by prudent tenants engaged in similar operations. Such insurance shall reimburse Tenant for direct and indirect loss of earnings and extra expenses attributable to all perils insured against.

(vii) Builder's Risk insurance during the course of construction, including during the performance of Tenant's Work, and until completion thereof, of any alteration or improvement, with an Installation Floater where applicable. Such insurance shall cover the interests of Landlord, Landlord's contractor or subcontractors, and Tenant and Tenant's contractors, as applicable, against loss or damage by fire, vandalism, theft and other such risks as are customarily covered by the Special form policy upon all Tenant improvements and alterations or Tenant's Work in place, including all materials, equipment, and temporary structures of all kinds incident to said alterations, improvements or Tenant's Work, all while forming a part of, or on the Premises or in transit, or when adjacent thereto, while on drives, sidewalks, streets or alleys, all on a completed value basis for the full insurable value at all times. Said Builder's Risk insurance shall contain an express waiver of any right of subrogation by the insurer against Landlord, its agents, employees and contractors.

All insurance required to be carried by Tenant may be carried under blanket policies of insurance covering the Premises and other locations of Tenant and its related entities.

(C) Landlord and Landlord’s designees shall be endorsed on each policy as Additional Insureds as it pertains to the Commercial General Liability, Umbrella/Excess Liability, and Auto Liability policies, and said coverage shall be primary and noncontributory to any insurance carried by Additional Insureds. The Additional Insureds will be entitled to the limits stated in this Lease. Landlord shall be a Loss Payee on the Property policy in respect of Tenant's improvements to the extent Landlord is responsible for the repair and replacement of same under this Lease. All insurance shall: (1) remain in full force and effect notwithstanding that the insured may have waived its right of action against any party prior to the occurrence of a loss. Tenant hereby waives its right of action and recovery against and releases Landlord, Landlord's property manager, affiliates, shareholders, partners, directors, officers, employees, agents and representatives from any and all liabilities, claims and losses for which they may otherwise be liable to the extent such claims are covered by property insurance policies required to be carried under this Lease, or any other property insurance actually carried by Tenant; (2) provide that the insurer thereunder waives all right of recovery by way of subrogation against Landlord and Landlord's representatives in connection with any loss or damage covered by such policy, and Tenant shall provide evidence of such waiver; and (3) be acceptable in form and content to Landlord. Tenant’s insurance carrier shall endeavor to provide Landlord with 30 days advance notice of any cancellation of Tenant's insurance coverage for any reason if it is reasonable and customary in the Building's submarket for such insurance carrier to do so. In the event Tenant's insurance carrier does not provide Landlord advance notice of cancellation, then Tenant shall give Landlord notice of cancellation no later than 14 days after Tenant learns of such cancellation. Notice of cancellation to Landlord may be made by any commercially reasonable means, including mail, electronic mail, or facsimile transmission to the contact name and email address provided by Landlord. It is the responsibility of Landlord to provide Tenant with up-to-date contact names and email addresses.

13

(D) No Commercial General Liability policy shall contain a deductible or self-insured retention greater than $500,000 except as otherwise approved in writing by Landlord, which approval shall not be unreasonably withheld. Landlord reserves the right from time to time to reasonably require higher minimum limits or different types of insurance if it is reasonable and customary in the market, so long as Landlord and Tenant execute an amendment to this Lease to confirm the new limits or insurance coverages. Tenant shall deliver an ACORD 25 certificate or its equivalent with respect to all liability and personal property insurance and an ACORD 28 certificate or its equivalent with respect to all commercial property insurance to Landlord on or before the date Tenant takes possession of the Premises and at least annually thereafter. If Tenant fails to provide evidence of insurance required to be provided by Tenant hereunder, prior to taking possession and thereafter within thirty (30) days following Landlord's request during the Term (and in any event within 14 days after the expiration date of any such coverage, any other cure or grace period provided in this Lease not being applicable hereto), Landlord shall be authorized (but not required) after ten (10) day's prior notice to Tenant to procure such coverage in the amount stated with all costs thereof to be chargeable to Tenant and payable as additional rent within 30 days after written invoice therefor. Throughout the Term of this Lease, Landlord agrees to carry and maintain Special form property insurance, on a replacement cost basis, covering the Building and Landlord's property therein, excluding property required to be insured by Tenant in amounts not less than their full replacement cost. Landlord hereby waives its right of recovery against Tenant and releases Tenant from any and all liabilities, claims and losses for which Tenant may otherwise be liable to the extent such claims are covered by property insurance policies required to be carried under this Lease, or any other property insurance actually carried by Landlord. Landlord shall secure a waiver of subrogation from its insurance carrier with respect to all property insurance policies required to be carried under this Lease, and Landlord shall provide evidence of such waiver. Landlord also agrees to carry and maintain Commercial General Liability insurance in limits it reasonably deems appropriate, but in no event less than the limits required by Tenant above. Any insurance required to be maintained by Landlord may be taken out under blanket insurance policies covering other buildings, property or insureds in addition to the Building and Landlord. Landlord may elect to carry such other additional insurance or higher limits as it reasonably deems appropriate. Tenant acknowledges that Landlord shall not carry insurance on, and shall not be responsible for damage to, Tenant's personal property or any Alterations (including Tenant's Work), and that Landlord shall not carry insurance against, or be responsible for any loss suffered by Tenant due to, interruption of Tenant's business. All insurance required to be carried by Landlord may be carried under blanket policies of insurance covering the Building and other locations of Landlord and its related entities.

(E) All contracts between Tenant and a contractor/vendor performing work or providing services in the Premises that requires the contractor/vendor to name Tenant as an additional insured must explicitly require the contractor/vendor: (a) to name Landlord and Landlord's agents as additional insureds, and (b) to indemnify, defend and hold harmless Landlord and Landlord's agents. Certificates of insurance from contractors/vendors must be received by Landlord before any work or services are commenced in the Premises.

ARTICLE 10

Condemnation

Condemnation

If (a) the whole or any material part of the Premises or the Property shall be taken by power of eminent domain or condemned by any competent authority for any public or quasi-public use or purpose; (b) any adjacent property or street shall be so taken or condemned, or reconfigured or vacated by such authority in such manner as to require the use, reconstruction or remodeling of any part of the Premises or the Property, or (c) Landlord shall grant a deed or other instrument in lieu of such taking by eminent domain or condemnation, then Landlord shall have the option to terminate this Lease upon ninety (90) days’ notice, provided such notice is given no later than one hundred eighty (180) days after the date of such taking, condemnation, reconfiguration, vacation, deed or other instrument. Tenant shall have reciprocal termination

14

rights if the whole or any material part of the Premises is permanently taken or if access to the Premises is permanently and materially impaired or if more than 25% of the parking spaces constructed on the Adjacent Parking Parcel (as defined in Article 35 below) is permanently taken. Landlord shall be entitled to receive the entire award or payment in connection therewith, except that Tenant shall have the right to file any separate claim available to Tenant for any taking of Tenant's personal property and of fixtures belonging to Tenant and removable by Tenant upon expiration of the Term and for moving expenses (so long as such claim does not diminish the award available to Landlord or any Holder, and such claim is payable separately to Tenant). All Rent shall be apportioned as of the date of such termination, or the date of such taking, whichever shall first occur. Rent shall be proportionately abated if any part of the Premises shall be taken and this Lease shall not be so terminated.

ARTICLE 11

Return of Possession

Return of Possession

At the expiration or earlier termination of this Lease or Tenant's right of possession of the Premises, Tenant shall surrender possession of the Premises in the condition required under Article 7, ordinary wear and tear excepted, and shall surrender all keys, any key cards, and any parking stickers or cards, to Landlord, and advise Landlord as to the combination of any locks or vaults then remaining in the Premises, and shall remove all trade fixtures and personal property. All improvements, fixtures and other items in or upon the Premises (except trade fixtures and personal property belonging to Tenant), whether installed by Tenant or Landlord, shall be Landlord's property and shall remain upon the Premises, all without compensation, allowance or credit to Tenant. However, by giving Tenant notice in writing, at the time the applicable improvement, fixture, Alteration or other item is installed, Landlord may require Tenant to promptly remove any or all of the foregoing items as are designated in such notice and repair any damage to the Premises or the Building caused by such removal. Notwithstanding the foregoing, in no event shall Landlord require Tenant to remove standard and customary installations. Examples of non-standard and non-customary installations include, but are not limited to, internal stairways, supplemental air conditioning systems, data centers, UPS, high density filing systems, demountable partitions, water features, stone or masonry walls, folding wall systems, raised flooring, vaults, or other structural work. Tenant shall not be required to restore the Premises to warehouse condition and Landlord expressly waives any right to reimbursement or claim against Tenant for the restoration of the Premises to warehouse configuration. Tenant shall remove its personal property and any free-standing work partitions and other furniture installed in the Premises by Tenant. If Tenant shall fail to perform any repairs or fail to remove any items from the Premises or the Property required hereunder, Landlord may do so, and Tenant shall pay Landlord the cost thereof upon demand. Any and all property that may be removed from the Premises or the Property by Landlord pursuant to any provisions of this Lease or any Law, to which Tenant is or may be entitled, may be handled, removed or stored in a commercial warehouse or otherwise by Landlord at Tenant's risk, cost or expense, and Landlord shall in no event be responsible for the value, preservation or safekeeping thereof. Tenant shall pay to Landlord, upon demand, any and all expenses incurred in any removal and all storage charges as long as the same is in Landlord's possession or under Landlord's control. Any property, which is not removed from the Premises or which is not retaken from storage by Tenant within thirty (30) days after expiration or earlier termination of this Lease or of Tenant's right to possession of the Premises, shall, at Landlord's option, be conclusively presumed to have been abandoned and thus to have been conveyed by Tenant to Landlord as if by bill of sale without payment by Landlord. Unless prohibited by applicable Law, Landlord shall have a lien against such property for the costs incurred in removing and storing the same.

15

ARTICLE 12

Holding Over

Holding Over

If after the expiration of this Lease, and provided that no uncured Default exists on the expiration of this Lease and that Tenant has provided Landlord with at least 90 days advance written notice of its election to hold over under the terms of this section at the end of the Term of this Lease, Tenant may elect, as set forth in its written notice, to remain in possession of the Premises and continue to pay Rent for the entire Premises for one to six months following the expiration of this Lease. Tenant’s notice shall designate the number of months that it desires to hold over pursuant to this section. Any such possession shall be subject to all provisions hereof (other than those relating to the Term of this Lease) but at a Monthly Rent equivalent to 125% of the last monthly Rent paid during the immediate prior Term of this Lease. Notwithstanding the foregoing, Landlord shall have the right to prohibit Tenant from exercising its short term extension option pursuant to this paragraph by written notice to Tenant given within five (5) business days of receipt of Tenant’s extension notice in the event that Landlord has a prospect for all or any portion of the Premises.

If Tenant fails to give notice at least 90 days in advance, and, unless Landlord expressly agrees otherwise in writing, if Tenant shall retain possession of the Premises or any part thereof after expiration or earlier termination of this Lease, Tenant shall occupy the Premises as a tenant at sufferance, except that Tenant shall pay Landlord one hundred fifty percent (150%) of the amount of Rent then applicable (or the highest amount permitted by Law, whichever shall be less) on a per month basis. In addition, Tenant shall be responsible for all consequential damages sustained by Landlord on account of Tenant holding over if Tenant holds over for more than sixty (60) days. The foregoing provisions shall not serve as permission for Tenant to holdover, nor serve to extend the Term (although Tenant shall remain bound to comply with all provisions of this Lease until Tenant vacates the Premises, and shall be subject to the provisions of Article 11). The provisions of this paragraph do not waive Landlord's right of re-entry or right to regain possession by actions at law or in equity or any other rights hereunder, and any receipt of payment by Landlord shall not be deemed a consent by Landlord to Tenant's remaining in possession or be construed as creating or renewing any lease or right of tenancy between Landlord and Tenant.

ARTICLE 13

No Waiver

No Waiver

No provision of this Lease will be deemed waived by either party unless expressly waived in writing signed by the waiving party. No waiver shall be implied by delay or any other act or omission of either party. No waiver by either party of any provision of this Lease shall be deemed a waiver of such provision with respect to any subsequent matter relating to such provision, and Landlord's consent or approval respecting any action by Tenant shall not constitute a waiver of the requirement for obtaining Landlord's consent or approval respecting any subsequent action. Acceptance of Rent by Landlord shall not constitute a waiver of any breach by Tenant of any term or provision of this Lease. No acceptance of a lesser amount than the Rent herein stipulated shall be deemed a waiver of Landlord's right to receive the full amount due, nor shall any endorsement or statement on any check or payment or any letter accompanying such check or payment be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord's right to recover the full amount due. The acceptance of Rent or of the performance of any other term or provision from any Person other than Tenant, including any Transferee, shall not constitute a waiver of Landlord's right to approve any Transfer.

16

ARTICLE 14

Attorneys' Fees and Jury Trial

Attorneys' Fees and Jury Trial

In the event of any litigation between the parties, the prevailing party shall be awarded, as part of the judgment, all reasonable attorneys' fees, costs and expenses incurred in connection with such litigation, except as may be limited by applicable Law. In the interest of obtaining a speedier and less costly hearing of any dispute, the parties hereby each irrevocably waive the right to trial by jury.

ARTICLE 15

Personal Property Taxes, Rent Taxes and Other Taxes

Personal Property Taxes, Rent Taxes and Other Taxes

Tenant shall pay prior to delinquency all taxes, charges or other governmental impositions assessed against or levied upon Tenant's fixtures, furnishings, equipment and personal property located in the Premises, and any Tenant Work to the Premises which is deemed to be personal property by any governmental agency or subdivision thereof. Whenever possible, Tenant shall cause all such items to be assessed and billed separately from the property of Landlord. In the event any such items shall be assessed and billed with the property of Landlord, Tenant shall pay Landlord its share of such taxes, charges or other governmental impositions within thirty (30) days after Landlord delivers a statement and a copy of the assessment or other documentation showing the amount of such impositions applicable to Tenant's property. Tenant shall pay any rent tax or sales tax, service tax, use tax, transfer tax or value added tax, or any other applicable tax on Rent or services provided herein or otherwise respecting this Lease.

ARTICLE 16

Subordination, Attornment and Mortgagee Protection

Subordination, Attornment and Mortgagee Protection

Landlord hereby represents and warrants to Tenant that no Mortgage presently encumbers the Property. This Lease is subject and subordinate to all Mortgages hereafter placed upon the Property, and all other encumbrances and matters of public record applicable to the Property. Notwithstanding the foregoing, such subordination shall not be effective unless the Holder (as defined below) delivers to Tenant a commercially reasonable written agreement that Tenant’s rights under this Lease shall not be disturbed by such Holder so long as Tenant has paid all amounts then owing and is otherwise not in default beyond applicable notice and cure periods under this Lease. If any foreclosure proceedings are initiated by any Holder or a deed in lieu is granted (or if any ground lease is terminated), Tenant agrees to attorn and pay Rent to any Holder which is a successor to Landlord hereunder or a purchaser at a foreclosure sale and to execute and deliver any instruments necessary or appropriate to evidence or effectuate such attornment (provided such Holder or purchaser shall agree in writing in any such instrument to accept this Lease and not disturb Tenant's occupancy, so long as Tenant does not default and fail to cure within the time permitted hereunder). However, in the event of attornment, no Holder shall be: (i) liable for any act or omission of Landlord, or subject to any offsets or defenses which Tenant might have against Landlord (prior to such Holder becoming Landlord under such attornment) except to the extent the same relate to a continuing default under the Lease for which the Holder has been provided notice prior to becoming Landlord, (ii) liable for any security deposit or bound by any prepaid Rent (paid more than one month in advance) not actually received by such Holder, or (iii) be liable for any accrued obligation, act or omission of any prior landlord (including, without limitation, Landlord), whether prior to or after foreclosure or termination of the superior lease, as the case may be except to the extent the same relate to a continuing default under this Lease for which the Holder has been provided notice prior to becoming Landlord. "Holder" shall mean the holder of any Mortgage at the time in question, and where such Mortgage is a ground lease, such term shall refer to the ground lessor. "Mortgage" shall mean all mortgages, deeds of trust, ground leases and other such encumbrances now or hereafter placed upon the Property or any part thereof and all renewals, modifications, consolidations, replacements or

17