Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - DUPONT E I DE NEMOURS & CO | d379338dex992.htm |

| EX-99.1 - EX-99.1 - DUPONT E I DE NEMOURS & CO | d379338dex991.htm |

| EX-2.1 - EX-2.1 - DUPONT E I DE NEMOURS & CO | d379338dex21.htm |

| 8-K - FORM 8-K - DUPONT E I DE NEMOURS & CO | d379338d8k.htm |

Summary of Transactions with FMC: Divestiture of Certain Crop Protection Assets and Acquisition of FMC’s Health & Nutrition Business 1 March 31, 2017 Exhibit 99.3

Cautionary Notes on Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed merger of equals transaction with The Dow Chemical Company (the “DowDuPont Merger”) and the proposed transaction with FMC Corporation (FMC) and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate the DowDuPont Merger or the proposed transaction or to make or take any filing or other action required to consummate such transactions in a timely manner or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the DowDuPont Merger and the proposed transaction on anticipated terms and timing, including obtaining regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s or the Health and Nutrition business’s operations and other conditions to the completion of the DowDuPont Merger and the proposed transaction, (ii) the possibility that the DowDuPont Merger and the proposed transaction may not close, including because the various approvals, authorizations and declarations of non-objections from certain regulatory and governmental authorities with respect to either the DowDuPont Merger or the proposed transaction may not be obtained, on a timely basis or otherwise, including that these regulatory or governmental authorities may not approve of FMC as an acceptable purchaser of the Ag business in connection with the proposed transaction or may impose conditions on the granting of the various approvals, authorizations and declarations of non-objections, including requiring the respective Dow, DuPont and FMC businesses, including the Health and Nutrition business (in the case of DuPont) and the Ag business (in the case of FMC), to divest certain assets if necessary to obtain certain regulatory approvals or otherwise limiting the ability of the combined company to integrate parts of the Dow and DuPont businesses and/or the DuPont and Health and Nutrition businesses, (iii) the ability of DuPont to integrate the Health and Nutrition business successfully and to achieve anticipated synergies, (iv) potential litigation or regulatory actions relating to the DowDuPont Merger or the proposed transaction that could be instituted against DuPont or its directors, (v) the risk that disruptions from the

Cautionary Notes on Forward Looking Statements, Continued DowDuPont Merger or the proposed transaction will harm DuPont’s business, including current plans and operations, (vi) the ability of DuPont to retain and hire key personnel, (vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the DowDuPont Merger or the proposed transaction, (viii) uncertainty as to the long-term value of DowDuPont common stock, (ix) continued availability of capital and financing and rating agency actions, (x) legislative, regulatory and economic developments, (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the DowDuPont Merger or the proposed transaction that could affect DuPont’s financial performance, (xii) certain restrictions during the pendency of the DowDuPont Merger or the proposed transaction that may impact DuPont’s ability to pursue certain business opportunities or strategic transactions and (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the DowDuPont Merger or the proposed transaction, are or will be more fully discussed in (1) DuPont’s most recently filed Form 10-K, 10-Q and 8-K reports, (2) DuPont’s subsequently filed Form 10-K and 10-Q reports and (3) the joint proxy statement/prospectus included in the Registration Statement filed with the SEC in connection with the DowDuPont Merger. While the list of factors presented here is, and the list of factors presented in the relevant Form 10-K, 10-Q and 8-K reports and the Registration Statement are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. DuPont assumes no obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Adjusted EBITDA Financial Information This document includes financial information described as “Adjusted EBITDA”, which is a financial term based on earnings before interest, taxes, depreciation and amortization. Adjusted EBTIDA does not conform to U.S. generally accepted accounting principles (GAAP) and is considered a non-GAAP measure. The Adjusted EBITDA presented represents management’s best estimate of 2016 financial performance for the portion of DuPont’s business to be divested inclusive of certain assumptions regarding allocations of costs and therefore a directly comparable measure that would be considered calculated and presented in accordance with GAAP is not available.

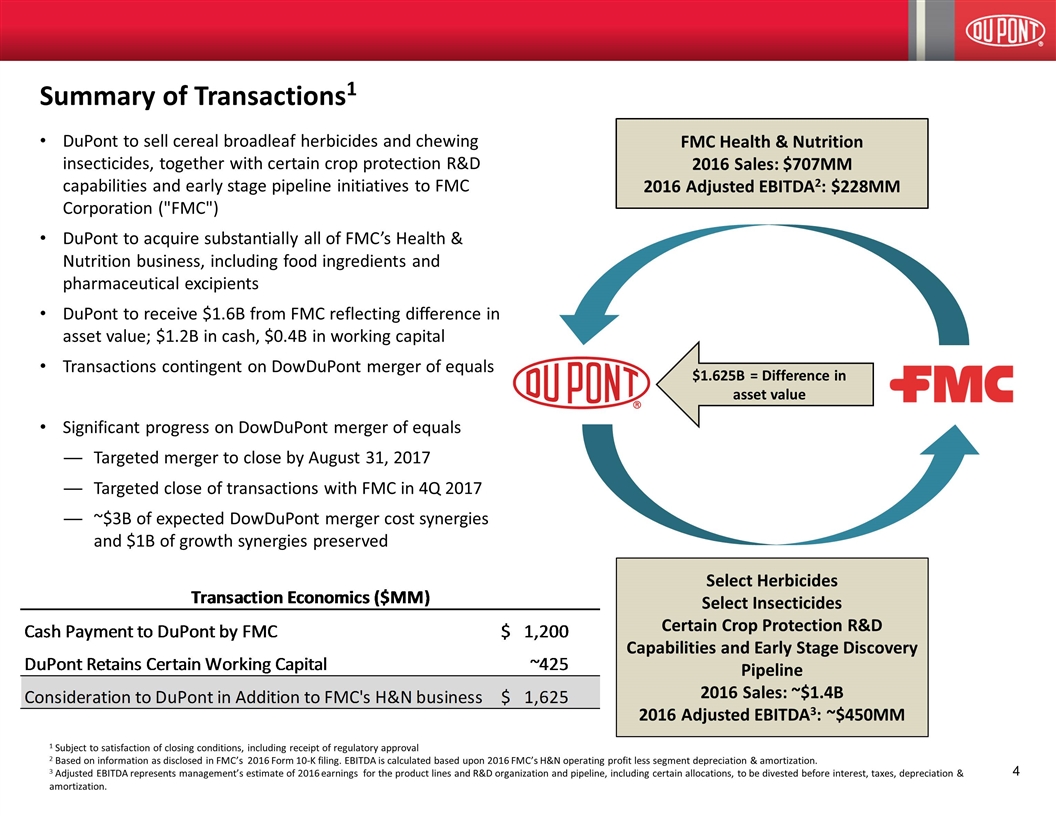

DuPont to sell cereal broadleaf herbicides and chewing insecticides, together with certain crop protection R&D capabilities and early stage pipeline initiatives to FMC Corporation ("FMC") DuPont to acquire substantially all of FMC’s Health & Nutrition business, including food ingredients and pharmaceutical excipients DuPont to receive $1.6B from FMC reflecting difference in asset value; $1.2B in cash, $0.4B in working capital Transactions contingent on DowDuPont merger of equals Significant progress on DowDuPont merger of equals Targeted merger to close by August 31, 2017 Targeted close of transactions with FMC in 4Q 2017 ~$3B of expected DowDuPont merger cost synergies and $1B of growth synergies preserved Summary of Transactions1 FMC Health & Nutrition 2016 Sales: $707MM 2016 Adjusted EBITDA2: $228MM Select Herbicides Select Insecticides Certain Crop Protection R&D Capabilities and Early Stage Discovery Pipeline 2016 Sales: ~$1.4B 2016 Adjusted EBITDA3: ~$450MM 1 Subject to satisfaction of closing conditions, including receipt of regulatory approval 2 Based on information as disclosed in FMC’s 2016 Form 10-K filing. EBITDA is calculated based upon 2016 FMC’s H&N operating profit less segment depreciation & amortization. 3 Adjusted EBITDA represents management’s estimate of 2016 earnings for the product lines and R&D organization and pipeline, including certain allocations, to be divested before interest, taxes, depreciation & amortization. $1.625B = Difference in asset value

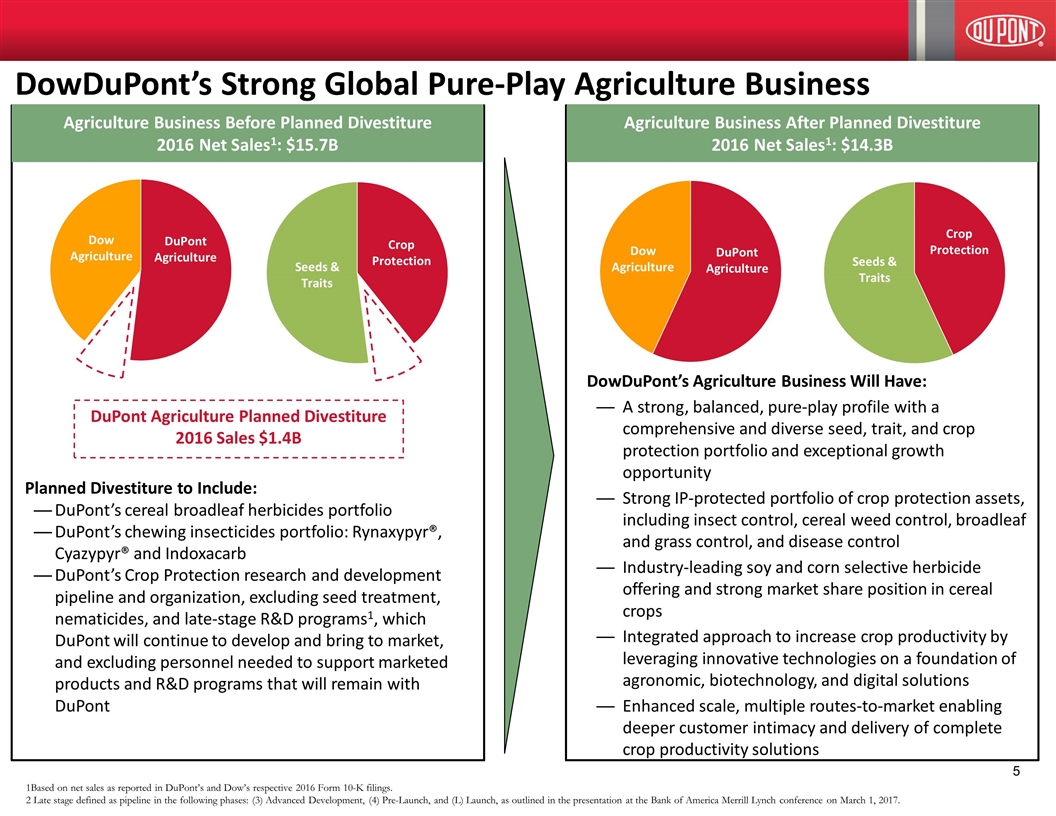

DowDuPont’s Strong Global Pure-Play Agriculture Business DuPont Agriculture Planned Divestiture 2016 Sales $1.4B 1Based on net sales as reported in DuPont’s and Dow’s respective 2016 Form 10-K filings. 2 Late stage defined as pipeline in the following phases: (3) Advanced Development, (4) Pre-Launch, and (L) Launch, as outlined in the presentation at the Bank of America Merrill Lynch conference on March 1, 2017. Agriculture Business Before Planned Divestiture 2016 Net Sales1: $15.7B Agriculture Business After Planned Divestiture 2016 Net Sales1: $14.3B DowDuPont’s Agriculture Business Will Have: A strong, balanced, pure-play profile with a comprehensive and diverse seed, trait, and crop protection portfolio and exceptional growth opportunity Strong IP-protected portfolio of crop protection assets, including insect control, cereal weed control, broadleaf and grass control, and disease control Industry-leading soy and corn selective herbicide offering and strong market share position in cereal crops Integrated approach to increase crop productivity by leveraging innovative technologies on a foundation of agronomic, biotechnology, and digital solutions Enhanced scale, multiple routes-to-market enabling deeper customer intimacy and delivery of complete crop productivity solutions Planned Divestiture to Include: DuPont’s cereal broadleaf herbicides portfolio DuPont’s chewing insecticides portfolio: Rynaxypyr®, Cyazypyr® and Indoxacarb DuPont’s Crop Protection research and development pipeline and organization, excluding seed treatment, nematicides, and late-stage R&D programs1, which DuPont will continue to develop and bring to market, and excluding personnel needed to support marketed products and R&D programs that will remain with DuPont

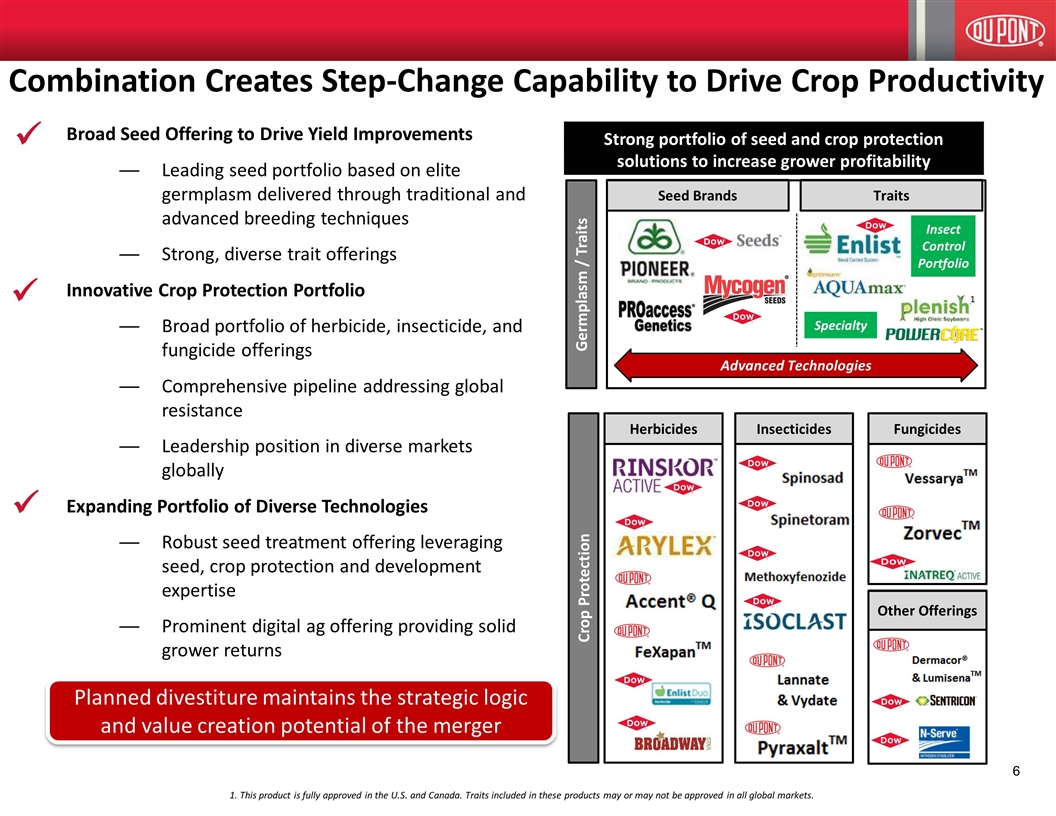

ü 1. This product is fully approved in the U.S. and Canada. Traits included in these products may or may not be approved in all global markets. Combination Creates Step-Change Capability to Drive Crop Productivity Strong portfolio of seed and crop protection solutions to increase grower profitability Crop Protection Germplasm / Traits Seed Brands Traits Insecticides Herbicides Fungicides Other Offerings Advanced Technologies Specialty Insect Control Portfolio 1 ü ü Planned divestiture maintains the strategic logic and value creation potential of the merger Broad Seed Offering to Drive Yield Improvements Leading seed portfolio based on elite germplasm delivered through traditional and advanced breeding techniques Strong, diverse trait offerings Innovative Crop Protection Portfolio Broad portfolio of herbicide, insecticide, and fungicide offerings Comprehensive pipeline addressing global resistance Leadership position in diverse markets globally Expanding Portfolio of Diverse Technologies Robust seed treatment offering leveraging seed, crop protection and development expertise Prominent digital ag offering providing solid grower returns

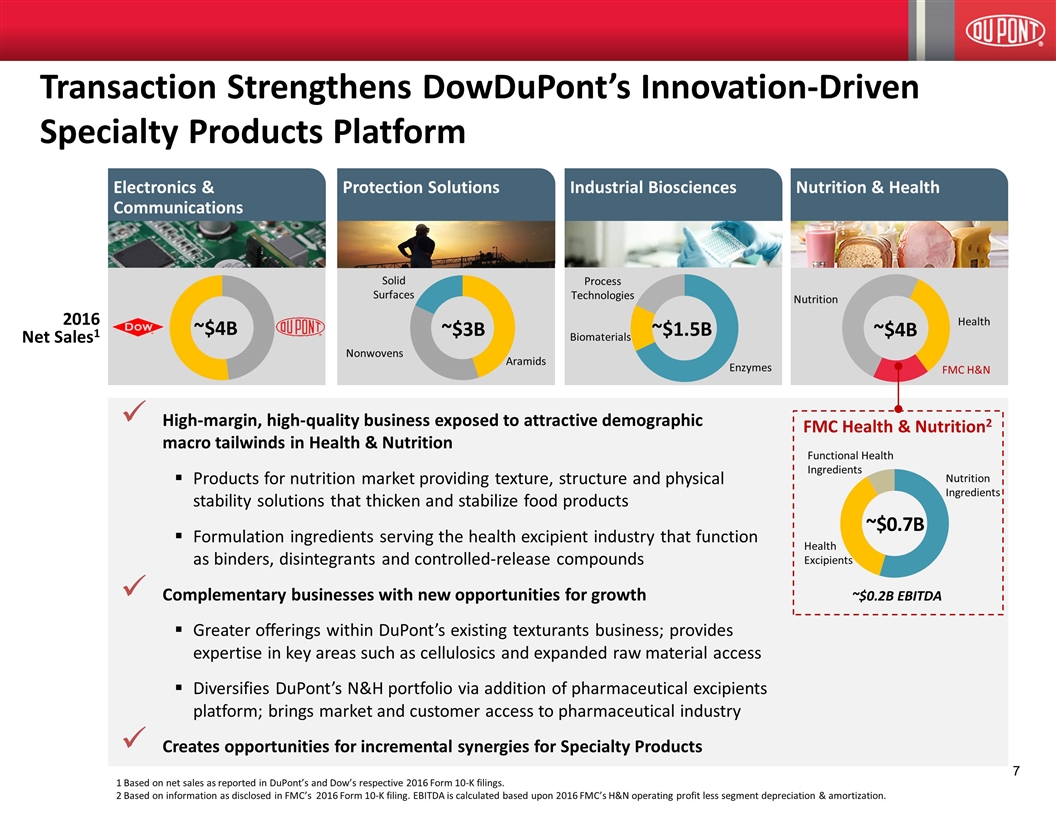

High-margin, high-quality business exposed to attractive demographic macro tailwinds in Health & Nutrition Products for nutrition market providing texture, structure and physical stability solutions that thicken and stabilize food products Formulation ingredients serving the health excipient industry that function as binders, disintegrants and controlled-release compounds Complementary businesses with new opportunities for growth Greater offerings within DuPont’s existing texturants business; provides expertise in key areas such as cellulosics and expanded raw material access Diversifies DuPont’s N&H portfolio via addition of pharmaceutical excipients platform; brings market and customer access to pharmaceutical industry Creates opportunities for incremental synergies for Specialty Products Transaction Strengthens DowDuPont’s Innovation-Driven Specialty Products Platform 2016 Net Sales1 FMC Health & Nutrition2 Nutrition Ingredients Health Excipients ~$0.7B Functional Health Ingredients ~$0.2B EBITDA Electronics & Communications Industrial Biosciences Protection Solutions Nutrition & Health ~$3B Aramids Nonwovens Solid Surfaces ~$1.5B Enzymes Biomaterials ~$4B Nutrition Health FMC H&N Process Technologies 1 Based on net sales as reported in DuPont’s and Dow’s respective 2016 Form 10-K filings. 2 Based on information as disclosed in FMC’s 2016 Form 10-K filing. EBITDA is calculated based upon 2016 FMC’s H&N operating profit less segment depreciation & amortization. ~$4B

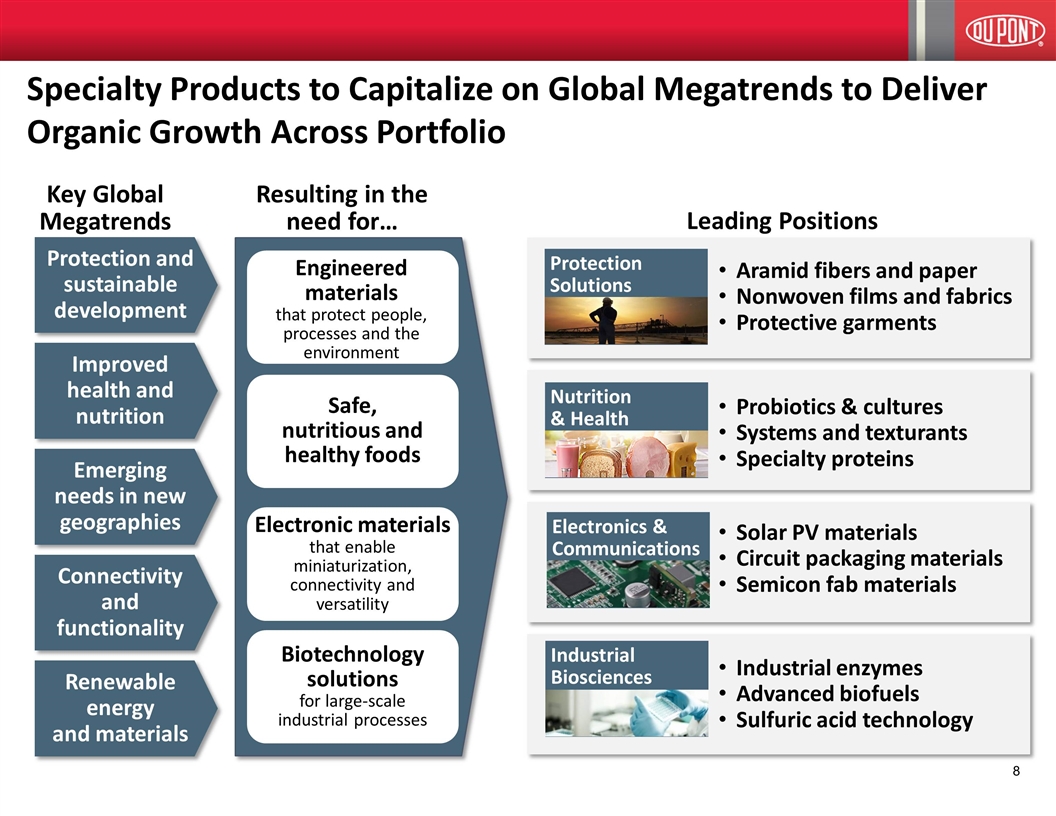

Specialty Products to Capitalize on Global Megatrends to Deliver Organic Growth Across Portfolio Resulting in the need for… Engineered materials that protect people, processes and the environment Biotechnology solutions for large-scale industrial processes Key Global Megatrends Leading Positions Aramid fibers and paper Nonwoven films and fabrics Protective garments Industrial enzymes Advanced biofuels Sulfuric acid technology Electronic materials that enable miniaturization, connectivity and versatility Solar PV materials Circuit packaging materials Semicon fab materials Safe, nutritious and healthy foods Probiotics & cultures Systems and texturants Specialty proteins Electronics & Communications Industrial Biosciences Protection Solutions Nutrition & Health Connectivity and functionality Protection and sustainable development Emerging needs in new geographies Improved health and nutrition Renewable energy and materials

Copyright © 2017 DuPont. All rights reserved. The DuPont Oval Logo, DuPontTM, The miracles of scienceTM, and all products, unless otherwise noted, denoted with ® or TM are trademarks or registered trademarks of E. I. du Pont de Nemours and Company. +Images reproduced by E. I. du Pont de Nemours and Company under license from the National Geographic Society.