Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATIONS PURSUANT TO SECTION 906 - AB Private Credit Investors Corp | d368968dex32.htm |

| EX-31.2 - CERTIFICATION PURSUANT TO SECTION 302 - AB Private Credit Investors Corp | d368968dex312.htm |

| EX-31.1 - CERTIFICATION PURSUANT TO SECTION 302 - AB Private Credit Investors Corp | d368968dex311.htm |

| EX-14.1 - CODE OF BUSINESS CONDUCT AND ETHICS - AB Private Credit Investors Corp | d368968dex141.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission file number 814-01196

AB Private Credit Investors Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | 81-2491356 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 1345 Avenues of the Americas New York, NY |

10105 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (212) 969-1000

Not applicable

Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report.

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Common stock, par value $0.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-Accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

There is no established public market for the issuer’s common stock.

The issuer had 100 shares of common stock, $0.01 par value per share, outstanding as of March 31, 2017.

Table of Contents

AB PRIVATE CREDIT INVESTORS CORPORATION

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2016

| Index |

Page | |||||

| 1 | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

30 | |||||

| Item 1B. |

51 | |||||

| Item 2. |

51 | |||||

| Item 3. |

51 | |||||

| Item 4. |

51 | |||||

| 52 | ||||||

| Item 5. |

52 | |||||

| Item 6. |

53 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

54 | ||||

| Item 7A. |

61 | |||||

| Item 8. |

F-1 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

62 | ||||

| Item 9A. |

63 | |||||

| Item 9B. |

64 | |||||

| 65 | ||||||

| Item 10. |

65 | |||||

| Item 11. |

70 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters |

71 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

72 | ||||

| Item 14. |

74 | |||||

| 75 | ||||||

| Item 15. |

75 | |||||

| Item 16. |

76 | |||||

| 77 | ||||||

i

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

| • | an economic downturn could impair our portfolio companies’ ability to continue to operate, which could lead to the loss of some or all of our investments in such portfolio companies; |

| • | such an economic downturn could disproportionately impact the companies that we intend to target for investment, potentially causing us to experience a decrease in investment opportunities and diminished demand for capital from these companies; |

| • | a contraction of available credit and/or an inability to access the equity markets could impair our lending and investment activities; |

| • | interest rate volatility could adversely affect our results, particularly if we elect to use leverage as part of our investment strategy; |

| • | our future operating results; |

| • | our business prospects and the prospects of our portfolio companies; |

| • | our contractual arrangements and relationships with third parties; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | competition with other entities and our affiliates for investment opportunities; |

| • | the speculative and illiquid nature of our investments; |

| • | the use of borrowed money to finance a portion of our investments; |

| • | the adequacy of our financing sources and working capital; |

| • | the loss of key personnel; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the ability of the Adviser to locate suitable investments for us and to monitor and administer our investments; |

| • | the ability of the Adviser to attract and retain highly talented professionals; |

| • | our ability to qualify and maintain our qualification as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and as a business development company (“BDC”); |

| • | the effect of legal, tax and regulatory changes; and |

| • | the other risks, uncertainties and other factors we identify under “Risk Factors” of this Annual Report on Form 10-K. |

Table of Contents

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this report should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Risk Factors” and elsewhere in this report. These forward-looking statements apply only as of the date of this report. Moreover, we assume no duty and do not undertake to update the forward-looking statements.

Table of Contents

| Item 1. | Business |

We were formed on February 6, 2015 as a corporation under the laws of the State of Maryland. We are currently in the development stage and have not commenced investment operations. Since inception, there has been no investment or operational activity. In conjunction with our formation, we issued and sold 100 shares of our common stock to AB Private Credit Investors LLC, our Adviser, for an aggregate purchase price of $1,000.

On October 6, 2016 we filed with the Securities and Exchange Commission (the “SEC”) an election to be treated as a BDC under the Investment Company Act of 1940, as amended (the “1940 Act”). We also intend as soon as reasonably practicable to elect to be treated, and intend to qualify annually thereafter, as a RIC under Subchapter M of the Code for U.S. federal income tax purposes. As a BDC and a RIC, respectively, we are and will be required to comply with certain regulatory requirements. See “Description of Business — Regulation as a Business Development Company” and “Description of Business — Material U.S. Federal Income Tax Considerations.”

We expect to have the initial closing of the Private Offering of our shares of common stock (the “Shares”) to investors in reliance on exemptions from the registration requirements of the Securities Act, as amended (the “Securities Act”) on or around June 30, 2017.

The Private Offering

We expect to enter into separate subscription agreements with investors providing for the private placement of Shares pursuant to the Private Offering. Each investor will make a capital commitment (a “Capital Commitment”) to purchase Shares pursuant to a subscription agreement. Investors will be required to make capital contributions to purchase Shares each time we deliver a capital call notice, which will be issued based on our anticipated investment activities and capital needs and delivered at least 10 business days prior to the required funding date. All purchases of our Shares will generally be made pro rata in accordance with each investor’s Capital Commitment, in an amount not to exceed each investor’s remaining capital commitment (“Remaining Commitment”), at a per-Share price equal to the net asset value per share of our common stock subject to any adjustments. Any adjustments would take into account a determination of changes to net asset value within 48 hours of the sale to assure compliance with Section 23(b) of the 1940 Act.

The Fund may accept additional Capital Commitments quarterly (“Subsequent Closings”) from new investors as well as existing investors that wish to increase their commitment and shareholding in the Fund. These Subsequent Closings are expected to occur on a calendar-quarter end based on investor interest as well as the state of the market and our capacity to invest the additional capital in a reasonable period. Each Capital Commitment will be for the life of the Fund or for a shorter period based on the investor’s liquidation election, subject to the Fund’s receipt of exemptive relief related to the New BDC, Liquidating Share Class and/or Limited Tender Offers (each as defined in “Description of Business — The Private Offering and Liquidity Options.”

The proposals to establish a Liquidating Share Class or a New BDC or to provide a Limited Tender Offer (collectively, the “Proposals”) would involve transactions that are currently prohibited by the 1940 Act and would require an SEC order in order to be established. The SEC has not previously granted orders with respect to a Liquidating Share Class or a New BDC, and it could take several years before the SEC determines whether relief is appropriate and it may ultimately deny the requests for any or all of the Proposals. If exemptive relief is not granted for any of the Proposals, the Board would need to consider other ways to permit shareholders to liquidate their investments. If you expect to need access to your investment in the near future, you should not invest in the Fund. Regardless of whether exemptive relief is granted for either the Liquidating Share Class, the New BDC or Limited Tender Offer, we will continue our operations in a manner otherwise set forth in this Annual Report on Form 10-K. See “Description of Business — The Private Offering and Liquidity Options.”

1

Table of Contents

General

We are a Maryland corporation, formed on February 6, 2015, structured as an externally managed, non-diversified closed-end management investment company. We expect to operate as a “private” BDC and to conduct a private offering to investors in reliance on exemptions from the registration requirements of the Securities Act while we invest the proceeds of the Private Offering. We are an “emerging growth company” under the JOBS Act. For so long as we remain an emerging growth company under the JOBS Act, we will be subject to reduced public company reporting requirements.

Our investment objective is to principally generate current income through direct investments in privately originated loans and notes and, to a lesser extent, long-term capital appreciation through private equity investments. At least 80% of Fund assets will be invested in debt instruments. We intend to invest in middle market businesses based in the United States, which we generally define as having enterprise values between $50 million and $500 million. However from time to time, we may invest in larger or smaller companies.

We will seek to build the Fund’s portfolio in a defensive manner that minimizes cyclical and correlated risks across individual names and sector verticals by targeting companies with strong underlying business models and durable intrinsic value.

We expect to make investments primarily through primary originations as well as secondary purchases. Our credit investments will principally take the form of first lien, stretch senior, unitranche, and second lien loans, although the actual mix of instruments pursued will vary over time depending on our views on how best to optimize risk-adjusted returns. We will also consider unsecured mezzanine debt, priority ranking structured preferred stock, and non-control equity co-investment opportunities, typically alongside a leading middle market financial sponsor and/or in partnership with a strong management group. We expect our loans will generally carry contractual maturities between four and six years. Our investments are typically not rated by any rating agency, but we believe that if such investments were rated, they would be below investment grade (rated lower than “Baa3” by Moody’s Investors Service and lower then “BBB-” by Fitch Ratings or S&P), which is an indication of having predominately speculative characteristics with respect to an issuer’s capacity to pay interest and repay principal. Investments that are rated below investment grade are sometimes referred to as “high yield bonds,” “junk bonds,” or “leveraged loans.”

We will pursue opportunities across a broad range of sectors, including but not limited to, the following end markets: Alarm Monitoring; Communications and IT Infrastructure; Energy; Enterprise Software (including Software-as-a-Service); Equipment Finance; Financial Technology / Transaction Processing; Franchisors, Franchisees, and Restaurants; Healthcare and Healthcare IT; Non-discretionary Consumer (including certain Multi-site Retailers); Specialized, Value-Added Manufacturing; Specialty Finance; and Technology-Enabled Services.

The Board of Directors

Our board of directors (the “Board”) has ultimate authority as to our investments, but we expect it will delegate authority to AB Private Credit Investors LLC (the “Adviser”) to select and monitor our investments, subject to the supervision of the Board. The Board consists of five members. A majority of the Board will at all times consist of directors who are not “interested persons” of the Fund, of the Adviser or of any of their respective affiliates, as defined in the 1940 Act (“Independent Directors”). The Board is divided into three classes, each serving staggered, three-year terms. The terms of our Class I directors will expire in 2017 and are subject to approval by the sole stockholder of the Fund and then will expire at the 2020 annual meeting of stockholders; the terms of our Class II directors will expire at the 2018 annual meeting of stockholders; and the terms of our Class III directors will expire at the 2019 annual meeting of stockholders.

2

Table of Contents

About Our Investment Adviser

Our investment activities will be managed by our external investment adviser, AB Private Credit Investors LLC. We expect to benefit from the Adviser’s ability to identify attractive investment opportunities, conduct due diligence to determine credit risk, and structure and price investments accordingly, as well as manage a diversified portfolio of investments. The Adviser, a wholly-owned subsidiary of AllianceBernstein L.P. (“AB”), was formed in April 2014 upon the acquisition of the former senior leadership group of Barclays Private Credit Partners LLC (“BPCP LLC”), the SEC-registered investment advisor to Barclays Private Credit Partners Fund, L.P.1 AB is one of the world’s largest investment management firms, with approximately $480 billion in assets under management as of December 31, 2016, and a global client base that includes institutions, private clients and retail investors. AB has dedicated economic, fundamental equity, fixed income, and quantitative research groups, as well as experts focused on multi-asset and alternatives strategies.

The Adviser is part of AB’s alternative private credit business which, in addition to the Fund and other private corporate credit strategies managed by the Adviser, consists of investment products and strategies involving commercial real estate debt and residential mortgage credit. AB’s private credit business is also part of AB’s larger Alternatives division, which includes hedge funds of funds, nontraditional bond strategies, and long/short equity strategies for a range of products and strategies in public mutual fund and private fund vehicles. The Adviser benefits from the resources afforded to it by AB’s robust global infrastructure, namely risk management, compliance and investor relations, as well the AB’s established public and private credit franchises. The Adviser draws on these resources throughout its operational and investment processes, as it benefits from the knowledge and oversight of its investment committee (the “Investment Committee”), which includes individuals from other areas within AB. This creates a forum through which AB’s global perspectives inform our investment efforts in private middle market corporate credit.

The majority of the professionals of the Adviser are based in Austin, Texas. As of December 31, 2016, the Adviser consisted of 30 investment professionals and managed approximately $1.5 billion in capital commitments. J. Brent Humphries, our President and Chairman of our Board, is President of the Adviser, which is responsible for all investment decisions for the Fund. Mr. Humphries joined AB in 2014 as a founding member and President of the Adviser, where he has primary responsibility for overseeing all aspects of the business, including investor relations, investment originations, structuring and underwriting, as well as ongoing portfolio management and compliance. He previously held the same position with BPCP LLC. Prior to joining Barclays, Mr. Humphries served as group head, generalist financial sponsor coverage for the Goldman Sachs Specialty Lending Group, and later led its structured private equity initiative. Before that, he served as a partner and managing director of the Texas Growth Fund, a middle-market private equity firm. Mr. Humphries previously worked in leveraged finance with NationsBank and J.P. Morgan, and as a financial analyst with Exxon. Mr. Humphries holds a B.B.A. in finance with an emphasis in accounting from the University of Oklahoma and an M.B.A. from the Harvard Business School. We believe that Mr. Humphries’ experience in middle market corporate credit will be a significant competitive advantage for the Fund.

Mr. Humphries is joined by four founding team members that have worked together as a group for six years: Jay Ramakrishnan (Managing Director), Patrick Fear (Managing Director), Shishir Agrawal (Managing Director) and Wesley Raper (Chief Operating Officer). Mr. Humphries and Ms. Ramakrishnan have prior experience working with each other since 2004 at Goldman Sachs Specialty Lending Group and served as the initial senior leadership of BPCP LLC since its inception in 2008. Shishir Agrawal and Wesley Raper joined BPCP LLC in 2008, with Patrick Fear becoming a senior team member in May 2011. The Founding Team has been supplemented over the past two years by what we believe is a talented group of senior professionals with strong sourcing relationships and underwriting expertise, including Kevin Alexander (Managing Director), Bob Bielinski (Managing Director), Evan Cohen (Managing Director), Patrick Gimlett (Director), Justin Grimm (Managing Director), Leon Han (Director), Drew Miller (Director), Hardeep Saini (Managing Director) and Daniel Weiss (Director).

| 1 | None of Barclays, BPCP LLC or any of their affiliates or related persons have participated in the preparation of this information or any materials used in connection with the presentation thereof and do not accept any responsibility or liability to any person for the information contained herein or the presentation thereof (including with respect to the accuracy or inaccuracy of such information or the manner of such presentation) or the performance of any investments presented herein or of any other investment vehicle. |

3

Table of Contents

Investment Advisory Agreement

Pursuant to the investment advisory agreement we intend to enter into with the Adviser (the “Advisory Agreement”), which was approved by the Board on June 28, 2016, we will pay the Adviser a fee for investment advisory and management services consisting of two components — a base management fee and an incentive fee. The cost of both the base management fee and the incentive fee will ultimately be borne by our stockholders.

Base Management Fee

The base management fee will be payable quarterly in arrears and calculated at an annual rate of 1.50%. The base management fee will be calculated based on a percentage of the average outstanding assets of the Fund (which equals the gross value of equity and debt instruments, including investments made utilizing leverage), excluding cash assets, during such fiscal quarter. The average outstanding assets will be calculated by taking the average of the amount of assets of the Fund at the beginning and end of each month that occurs during the calculation period. The base management fee will be calculated and paid quarterly in arrears but will be amortized monthly by the Fund over the fiscal quarter for which such base management fee is paid.

The base management fee for any partial month or quarter will be appropriately prorated.

Incentive Fee

The incentive fee, which provides the Adviser with a share of the income that the Adviser generates for us, will consist of an income-based incentive fee component and a capital-gains component, which are largely independent of each other, with the result that one component may be payable even if the other is not.

Income-Based Incentive Fee: The income-based incentive fee is calculated and payable quarterly in arrears based on our net investment income prior to any deductions with respect to such income-based incentive fees and capital gains incentive fees (“pre-incentive fee net investment income”) for the quarter. Pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence, managerial and consulting fees or other fees we receive from portfolio companies) that we accrue during the fiscal quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable under the administration agreement we intend to enter into (the “Administration Agreement”) with a third party administrator (the “Administrator”), and any interest expense and dividends paid on any issued and outstanding indebtedness or preferred stock, respectively, but excluding, for avoidance of doubt, the income-based incentive fee accrued under U.S. generally accepted accounting principles (“GAAP”)). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind interest and zero coupon securities), accrued income that we have not yet received in cash. Our Adviser is not under any obligation to reimburse us for any part of the income-based incentive fees it received that was based on accrued interest that we never actually received. See “Risk Factors—Risks Relating to Our Business—There are significant potential conflicts of interest which could impact our investment returns” and “Risk Factors—Risks Relating to Our Business—Even in the event the value of your investment declines, the base management fee and, in certain circumstances, the incentive fee will still be payable to the Adviser.”

Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. Because of the structure of the income-based incentive fee, it is possible that we may accrue such fees in a quarter where we incur a net loss. For example, if we receive pre-incentive fee net investment income in excess of the hurdle rate (as defined below) for a quarter, we will accrue the applicable income-based incentive fee even if we have incurred a loss in that quarter due to realized and/or unrealized capital losses. However, cash payment of the incentive fee may be deferred in this situation, subject to the restrictions detailed at the end of this section.

Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets (defined as total assets, excluding investments purchased with borrowed funds, less liabilities) at the end of the immediately preceding fiscal quarter, will be compared to a “hurdle rate” of 1.5% per quarter (approximately 6% per annum).

4

Table of Contents

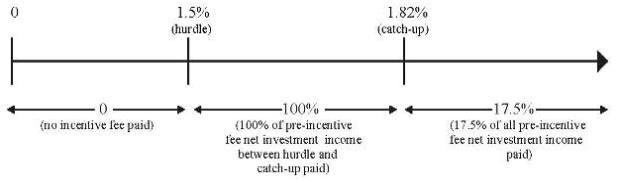

We pay our Adviser an income-based incentive fee with respect to our pre-incentive fee net investment income in each calendar quarter as follows:

| • | no income-based incentive fee in any calendar quarter in which our pre-incentive fee net investment income does not exceed the hurdle rate; |

| • | 100% of our pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 1.82% in any calendar quarter. We refer to this portion of our pre-incentive fee net investment income (which exceeds the hurdle rate but is less than 1.82%) as the “catch-up” provision. The “catch-up” is meant to provide our investment adviser with 17.5% of the pre-incentive fee net investment income as if a hurdle rate did not apply if this net investment income exceeded 1.82% in any calendar quarter; and |

| • | 17.5% of the amount of our pre-incentive fee net investment income, if any, that exceeds 1.82% in any calendar quarter. |

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Quarterly Incentive Fee Based on Net Investment Income

Pre-incentive fee net investment income (expressed as a percentage of the net value of net assets)

Capital Gains Incentive Fee: The capital gains incentive fee is determined and payable at the end of each fiscal year as 17.5% of our aggregate cumulative realized capital gains from the date of our election to be regulated as a BDC through the end of that year, computed net of all aggregate cumulative realized capital losses and aggregate cumulative unrealized depreciation through the end of such year, less the aggregate amount of any previously paid capital gain incentive fees. For the foregoing purpose, our “aggregate cumulative realized capital gains” will not include any unrealized appreciation. It should be noted, however, that we will accrue an incentive fee for accounting purposes taking into account any unrealized appreciation in accordance with GAAP. The capital gains incentive fee is not subject to any minimum return to stockholders. If such amount is negative, then no capital gains incentive fee will be payable for such year. Additionally, if the Advisory Agreement is terminated as of a date that is not a calendar year end, the termination date will be treated as though it were a calendar year end for purposes of calculating and paying the capital gains incentive fee.

We will defer cash payment of any income-based incentive fee and/or any capital gains incentive fee otherwise earned by the Adviser if, during the most recent four full fiscal quarter period ending on or prior to the date such payment is to be made, the sum of (a) the pre-incentive fee net investment income, (b) the realized capital gain / loss and (c) the unrealized capital appreciation/depreciation, expressed as a rate of return on the value of our net assets, is less than 6.0%. Any such deferred fees are carried over for payment in subsequent calculation periods to the extent such payment is payable under the Advisory Agreement.

5

Table of Contents

Example 1—Income Based Fee(1):

Assumptions

| • | Hurdle rate(2) = 1.5% |

| • | Management fee(3) = 0.375% |

| • | Other expenses (legal, accounting, custodian, transfer agent, etc.)(4) = 0.20% |

Alternative 1

Additional Assumptions

| • | Investment income (including interest, dividends, fees, etc.) = 1.25% |

| • | Pre-incentive fee net investment income |

(investment income - (management fee + other expenses)) = 0.675%

Pre-incentive fee net investment income does not exceed the hurdle rate, therefore there is no income based fee.

| (1) | The hypothetical amount of pre-incentive fee net investment income shown is based on a percentage of total net assets. The example assumes that during the most recent four full calendar quarter period ending on or prior to the date the payment set forth in the example is to be made the sum of (a) the pre-incentive fee net investment income, (b) the realized capital gain / loss and (c) the unrealized capital appreciation/depreciation, expressed as a rate of return on the value of our net assets, is at least 6.0% |

| (2) | Represents a quarter of the 6.0% annualized hurdle rate. |

| (3) | Represents a quarter of the 1.5% annualized management fee. |

| (4) | Excludes offering expenses. |

Alternative 2

Additional Assumptions

| • | Investment income (including interest, dividends, fees, etc.) = 2.30% |

| • | Pre-incentive fee net investment income |

(investment income - (management fee + other expenses)) = 1.725%

Pre-incentive fee net investment income exceeds hurdle rate, therefore there is an income based incentive fee.

| Income Based Fee |

= | 100% × “Catch-Up” + the greater of 0% AND (17.5% × (pre-incentive fee net investment income – 1.8182%) | ||||

| = | (100% × (1.7250% – 1.5000%)) + 0% | |||||

| = | 100% × 0.2250% | |||||

| = | 0.2250% |

Alternative 3

Additional Assumptions

| • | Investment income (including interest, dividends, fees, etc.) = 2.70% |

| • | Pre-incentive fee net investment income |

(investment income - (management fee + other expenses)) = 2.125%

Pre-incentive fee net investment income exceeds hurdle rate, therefore there is an income based fee.

| Income Based Fee |

= | 100% × “Catch-Up” + the greater of 0% AND (17.5% × (pre-incentive fee net investment income - 2.1875%) | ||

| = | (100% × (1.8182% - 1.5000%)) + (17.5% × (2.1250% - 1.8182%)) | |||

| = | 0.3182% + (17.5% × 0.3068%) | |||

| = | 0.3182% + 0.0537% | |||

| = | 0.3719% |

6

Table of Contents

Example 2—Capital Gains Incentive Fee:

Alternative 1:

Assumptions

| • | Year 1: $20 million investment made in Company A (“Investment A”), and $30 million investment made in Company B (“Investment B”) |

| • | Year 2: Investment A is sold for $50 million and fair value (“FV”) of Investment B determined to be $32 million |

| • | Year 3: FV of Investment B determined to be $25 million |

| • | Year 4: Investment B sold for $31 million |

The capital gains incentive fee, if any, would be:

| • | Year 1: None (No sales transactions) |

| • | Year 2: $5.25 million (17.5% multiplied by $30 million realized capital gains on sale of Investment A) |

| • | Year 3: None; $4.375 million (17.5% multiplied by ($30 million realized cumulative capital gains less $5 million cumulative capital depreciation)) less $5.25 million (previous Capital Gains Fee paid in Year 2) |

| • | Year 4: $175,000; $5.425 million (17.5% multiplied by $31 million cumulative realized capital gains) less $5.25 million (Capital Gains Fee paid in Year 2) |

Alternative 2

Assumptions

| • | Year 1: $20 million investment made in Company A (“Investment A”), $30 million investment made in Company B (“Investment B”) and $25 million investment made in Company C (“Investment C”) |

| • | Year 2: Investment A sold for $50 million, FV of Investment B determined to be $25 million and FV of Investment C determined to be $25 million |

| • | Year 3: FV of Investment B determined to be $27 million and Investment C sold for $30 million |

| • | Year 4: FV of Investment B determined to be $35 million |

| • | Year 5: Investment B sold for $20 million |

The capital gains incentive fee, if any, would be:

| • | Year 1: None (No sales transactions) |

| • | Year 2: $4.375 million (17.5% multiplied by $25 million ($30 million realized capital gains on Investment A less $5 million unrealized capital depreciation on Investment B)) |

| • | Year 3: $1.225 million ($5.6 million (17.5% multiplied by $32 million ($35 million cumulative realized capital gains less $3 million unrealized capital depreciation)) less $4.375 million (Capital Gains Fee paid in Year 2)) |

| • | Year 4: None (No sales transactions) |

7

Table of Contents

| • | Year 5: None ($4.375 million (17.5% multiplied by $25 million (cumulative realized capital gains of $35 million less realized capital losses of $10 million)) less $5.6 million (cumulative Capital Gains Fee paid in Year 2 and Year 3) |

Example 3—Deferral of Cash Payment of Incentive Fees:

Assumptions

| • | Year 1: $20 million investment made in Company A (“Investment A”) |

| • | Year 2, Quarter 4: Fair value (“FV”) of Investment A determined to be $19 million |

| • | Net Assets for the 2 year period = $20mm(1) |

| Period |

Hurdle Rate |

Management Fee |

Other Expenses |

Investment Income |

Pre- Incentive Fee Net Investment Income |

Income- Based Fee(2) |

||||||||||||||||||

| Year 1, Quarter 1 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 1, Quarter 2 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 1, Quarter 3 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 1, Quarter 4 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 2, Quarter 1 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 2, Quarter 2 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 2, Quarter 3 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

| Year 2, Quarter 4 |

1.5 | % | 0.375 | % | 0.20 | % | 2.70 | % | 2.125 | % | 0.3719 | % | ||||||||||||

Most recent four full fiscal quarter period ending Year 2, Quarter 4:

| a) | Pre-incentive fee net investment income as a return on net assets = 2.125% * 4 = 8.5% |

| b) | Realized capital gain / (loss) = zero |

| c) | Unrealized capital appreciation / (depreciation) = ($1mm), as a return on net assets = (5%) |

Sum of a), b) and c) = 3.5%, therefore the income-based incentive fee for Year 2, Quarter 4 will not be paid and will be carried over for payment in subsequent periods

| (1) | Assumes all net investment income is distributed to investors |

| (2) | See Example 1, Alternative 3 for calculation |

Payment of Our Expenses

All professionals of the Adviser, when and to the extent engaged in providing investment advisory and management services to us, and the compensation and routine overhead expenses of personnel allocable to these services to us, will be provided and paid for by the Adviser and not by us. We will bear all other out-of-pocket costs and expenses of our operations and transactions, including, without limitation, those relating to:

| • | reasonable and documented organization and offering expenses to the extent reimbursement of such expenses is included in any future agreement with the Adviser; |

| • | calculating our net asset value (including the cost and expenses of any independent valuation firm); |

| • | fees and expenses payable to third parties, including agents, consultants or other advisers, in connection with monitoring financial (including advising with respect to our financing strategy) |

8

Table of Contents

| and legal affairs for us and in providing administrative services, monitoring our investments and performing due diligence on our prospective portfolio companies or otherwise relating to, or associated with, evaluating and making investments; |

| • | interest payable on debt, if any, incurred to finance our investments; |

| • | sales and purchases of our common stock and other securities; |

| • | base management fees and incentive fees payable to the Adviser; |

| • | transfer agent and custodial fees; |

| • | federal and state registration fees; |

| • | all costs of registration and listing our securities on any securities exchange; |

| • | U.S. federal, state and local taxes; |

| • | independent directors’ fees and expenses; |

| • | costs of preparing and filing reports or other documents required by the SEC, the Financial Industry Regulatory Authority or other regulators; |

| • | costs of any reports, proxy statements or other notices to stockholders, including printing costs; |

| • | our allocable portion of any fidelity bond, directors’ and officers’ errors and omissions liability insurance, and any other insurance premiums; |

| • | direct costs and expenses of administration, including printing, mailing, long distance telephone, copying, secretarial and other staff, independent auditors and outside legal costs; |

| • | all other expenses incurred by us, the Administrator or the Adviser in connection with administering our business including payments under the Administration Agreement with the Administrator and payments under the Expense Reimbursement Agreement based on our allocable portion of the Adviser’s overhead in performing its obligations under the Expense Reimbursement Agreement, including the allocable portion of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs. |

Duration and Termination

Unless terminated earlier as described below, the Advisory Agreement will continue in effect for a period of two years from its effective date. It will remain in effect from year to year thereafter if (i) (A) approved annually by our Board or (B) by the affirmative vote of the holders of a majority of our outstanding voting securities and (ii) approved by a majority of our Independent Directors. The Advisory Agreement automatically terminates in the event of its assignment, as defined in the 1940 Act, by the Adviser and may be terminated by either party without penalty upon 60 days’ written notice to the other. The holders of a majority of our outstanding voting securities may also terminate the Advisory Agreement without penalty upon 60 days’ written notice. See “Risk Factors — Risks Related to our Business and Structure —the Adviser and the Administrator will have the right to resign on 60 days’ notice, and we may not be able to find a suitable replacement for either within that time, or at all, resulting in a disruption in our operations that could adversely affect our financial condition, business and results of operations.”

The Advisory Agreement provides that, absent criminal conduct, willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations under the Advisory Agreement, the Adviser and its professionals and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Adviser’s services under the Advisory Agreement or otherwise as our investment adviser.

9

Table of Contents

Board Approval of the Advisory Agreement

Our Board determined at a meeting held on June 28, 2016 to approve the Advisory Agreement. In its consideration of the approval of the Advisory Agreement, the Board focused on current, historical and projected information it had received relating to, among other things:

| • | the nature, quality and extent of the advisory and other services to be provided to us by the Adviser over the term of the Advisory Agreement; |

| • | comparative data with respect to advisory fees or similar expenses currently paid by other business development companies with similar investment objectives; |

| • | our historical and projected operating expenses and expense ratio compared to business development companies with similar investment objectives; |

| • | any existing and potential sources of indirect income to the Adviser from its relationship with us and the profitability of such relationship, including through the Advisory Agreement; |

| • | information about the services to be performed and the personnel performing such services under the Advisory Agreement, including the capacity of the Adviser to handle the anticipated size and nature of our portfolio in the future; |

| • | the organizational capability and financial condition of the Adviser and its affiliates; |

| • | The Adviser’s practices regarding the selection and compensation of brokers that may execute our portfolio transactions and the brokers’ provision of brokerage and research services to the Adviser; and |

| • | the possibility of obtaining similar services from other third party service providers or through an internally managed structure, including both the potential benefits and relative costs and expenses involved. |

Deferral of Incentive Fees in Certain Instances

The terms of the Advisory Agreement provide that we will defer cash payment of any income-based incentive fee and/or any capital gains incentive fee otherwise earned by the Adviser if during the most recent four full fiscal quarter period ending on or prior to the date such payment is to be made the sum of (a) the pre-incentive fee net investment income, (b) the realized capital gain / loss and (c) the unrealized capital appreciation/depreciation, expressed as a rate of return on the value of our net assets, is less than 6.0%. Any such deferred fees are carried over for payment in subsequent calculation periods to the extent such payment is payable under the Advisory Agreement.

Administrative Services and Certain Expense Reimbursements

We expect that the Adviser, certain of the Adviser’s affiliates, and the Administrator will provide all administrative services necessary for us to operate. In addition to the Administration Agreement, we may enter into a separate expense reimbursement agreement with the Adviser (the “Expense Reimbursement Agreement”) under which any allocable portion of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs will be reimbursed by the Fund.

Administration Agreement

Pursuant to an Administration Agreement we will enter into prior to the initial closing of the Fund’s private placement, we expect that the Administrator will perform, or oversee the performance of, our required administrative services except those that are provided by the Adviser or an affiliate of the Adviser, and which includes being responsible for the financial records which we are required to maintain and preparing reports to our stockholders and reports filed with the SEC. In addition, we expect that the Administrator will assist us in determining and publishing our net asset value, overseeing the preparation and filing of our tax returns and the printing and dissemination of reports to our stockholders, and generally overseeing the payment of our expenses and the performance of administrative and professional services rendered to us by others. Payments under the Administration Agreement will be determined based on arms-length negotiations with the Administrator and will be based upon expenses incurred by the Administrator in performing its obligations under the Administration Agreement. Payments under the Expense Reimbursement Agreement will be based upon the compensation of our

10

Table of Contents

Chief Financial Officer and Chief Compliance Officer and other staff of the Adviser providing administrative services to the Fund as well as our allocable portion of overhead expenses. In accordance with the terms of the Administration Agreement and the Expense Reimbursement Agreement, we expect that overhead and other administrative expenses will be generally allocated between us and the Adviser by reference to the relative time spent by personnel in performing administrative and similar functions on our behalf as compared to performing investment advisory or administrative functions on behalf of the Adviser. The Administration Agreement and the Expense Reimbursement Agreement may be terminated by each party thereto without penalty upon 60 days’ written notice to the other party.

We expect that the Administration Agreement and Expense Reimbursement Agreement will provide that, absent criminal conduct, willful misfeasance, bad faith or gross negligence in the performance of their respective duties or by reason of the reckless disregard of their respective duties and obligations, the Administrator and Adviser and their respective officers, manager, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Administrator’s services under the Administration Agreement or the Adviser’s services under the Expense Reimbursement Agreement or otherwise as the Administrator.

Competition

Our primary competitors for investments include public and private credit investment funds, other BDCs, commercial and investment banks, commercial financing companies and, to the extent they engage in making private loans to middle market companies, investment advisors that also manage private equity and hedge funds. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, we believe some competitors may have access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC or to the distribution and other requirements we must satisfy to maintain our qualification as a RIC.

Notwithstanding these risks, we believe that the Adviser’s experience in middle market corporate lending, combined with its access to AB’s institutional infrastructure and established public and private credit franchises, provide us with market-leading competencies in the private corporate credit sector. We believe the Adviser has developed a best-in-class reputation due to the long-standing presence of its investment professionals in the middle market lending community and the significant relationships, skills and experience of its individual members, particularly as it relates to sourcing, structuring, and negotiating investment opportunities.

As it relates to strategy, we view the Adviser as being differentiated by its focus on what we believe is a less competitive segment of the market. There are a number of industry participants that finance middle market companies, but many of them focus on a particular area of the capital structure or industry sector. We believe the Adviser’s flexibility to invest across the capital structure, as well as its investing experience across industries, will optimize the relative risk / return profile for investors. Further, as opposed to traditional lenders such as banks and collateralized loan obligations that must structure loans to meet regulatory or contractual guidelines, we believe the Adviser has greater flexibility to tailor solutions for borrowers and, ideally, receive premium pricing for doing this.

The Adviser’s investment philosophy and process have a demonstrated track record of success. The Adviser is committed to the consistent application of its proven approach throughout the investment lifecycle, from deal selection to portfolio management, combining fundamental and valuation-based analytical tools and principles with proven underwriting frameworks to strive to achieve superior outcomes. We believe that the Adviser is highly selective and focuses on pursuing companies that we believe exhibit strong underlying business models and durable intrinsic value.

We believe the Adviser’s qualifications, experience, and track record of success will render us competitive in the BDC marketplace.

11

Table of Contents

For additional information concerning the competitive risks we face, see “Risk Factors — Risks Related to Our Business and Structure — We may face increasing competition for investment opportunities.”

Managerial Assistance

As a BDC, we will offer, and must provide upon request, managerial assistance to our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. We may also receive fees for these services. The Adviser will provide, or arrange for the provision of, such managerial assistance on our behalf to portfolio companies that request this assistance, subject to reimbursement of any fees or expenses incurred on our behalf by the Adviser in accordance with our Advisory Agreement.

Dividend Reinvestment Plan

We intend to adopt a dividend reinvestment plan that provides for stockholders to receive dividends or other distributions in cash unless a stockholder elects to reinvest his or her dividends and other distributions as provided below. As a result of adopting such a plan, if our Board authorizes, and we declare, a cash dividend or distribution, our stockholders who have opted in to our dividend reinvestment plan will have their cash dividends or distributions automatically reinvested in additional shares of our common stock, rather than receiving cash.

No action will be required on the part of a registered stockholder to have his or her cash dividends and distributions received in cash. A registered stockholder could instead elect to have a dividend or distribution reinvested in shares of our common stock by notifying the Adviser in writing. Those stockholders whose Shares are held by a broker or other financial intermediary could reinvest dividends and distributions in shares of common stock by notifying their broker or other financial intermediary of their election.

An Investor may elect to change its election by providing written notice to the Adviser no later than September 30th in any given fiscal year, to go into effect for the following fiscal year. Notwithstanding the foregoing, the Adviser may, in its sole and absolute discretion, accept such written notices on a later date. Such election may only be revoked prior to September 30th on such year unless otherwise determined by the Adviser. For example, an Investor who provides timely notice in a fiscal year to change its election to elect to receive cash distributions for the upcoming fiscal year will not receive distributions for income generated during the fourth quarter, as the amount of such distributions will be reflected in its net asset value until the date of the change in election.

Stockholders who receive dividends and distributions in the form of stock are generally subject to the same U.S. federal, state and local tax consequences as are stockholders who elect to receive their dividends and distributions in cash. However, since an electing stockholder’s cash dividends and distributions will be reinvested in our common stock, such stockholder will not receive cash with which to pay applicable taxes on reinvested dividends and distributions. A stockholder’s basis for determining gain or loss upon the sale of stock received in a dividend or distribution from us will generally be equal to the cash that would have been received if the stockholder had received the dividend or distribution in cash, unless we were to issue new shares that are trading at or above net asset value, in which case, the stockholder’s basis in the new shares will generally be equal to their fair market value. Any stock received in a dividend or distribution will have a new holding period for tax purposes commencing on the day following the day on which the shares are credited to the U.S. stockholder’s account.

The plan will be terminable by the Fund upon notice in writing mailed to each stockholder of record at least 30 days prior to any record date for the payment of any distribution by the Fund.

Staffing

We do not currently have any employees and do not expect to have any employees. Services necessary for our business will be provided by individuals who are employees of the Administrator, the Adviser or its affiliates, pursuant to the terms of the Advisory Agreement, the Administration Agreement and the Expense Reimbursement

12

Table of Contents

Agreement. Each of our executive officers described under “Directors, Executive Officers and Corporate Governance” is an employee of the Adviser or its affiliates. Our day-to-day investment operations will be managed by the Adviser. The services necessary for the origination and administration of our investment portfolio will be provided by investment professionals employed by the Adviser or its affiliates. This investment team will focus on origination and transaction development and the ongoing monitoring of our investments. In addition, we may reimburse the Adviser for any allocable portion of the compensation paid by the Adviser (or its affiliates) to the Fund’s Chief Compliance Officer and Chief Financial Officer (based on the percentage of time such individuals devote, on an estimated basis, to the business and affairs of the Fund) and any internal audit staff, to the extent internal audit performs a role in our Sarbanes-Oxley internal control assessment. See “Description of Business—General—Investment Advisory Agreement; Administration Agreement.”

Our day-to-day investment and administrative operations will be managed by the Adviser and its affiliates and the Administrator. The Adviser’s Investment Committee is supported by a team of additional experienced investment professionals. The Adviser and the Administrator may hire additional investment and administrative professionals in the future to provide services to us, based upon our needs. See “ — Investment Advisory Agreement” and “ — Administration Agreement.”

The Private Offering and Liquidity Options

The Private Offering

We expect to enter into separate subscription agreements with investors providing for the private placement of Shares pursuant to the Private Offering. Each investor will make a Capital Commitment to purchase Shares pursuant to a subscription agreement. Investors will be required to make capital contributions to purchase Shares each time we deliver a capital call notice, which will be issued based on our anticipated investment activities and capital needs and delivered at least 10 business days prior to the required funding date, in an aggregate amount not to exceed each investor’s respective Remaining Commitment. All purchases of our common stock will generally be made pro rata in accordance with each investor’s Capital Commitment, in an amount not to exceed each investor’s Remaining Commitment, at a per-share price equal to the net asset value per share of our common stock subject to any adjustments. Any adjustments would take into account a determination of changes to net asset value within 48 hours of the sale to assure compliance with Section 23(b) of the 1940 Act.

The Fund expects to accept additional Capital Commitments through Subsequent Closings from new investors as well as existing investors that wish to increase their commitment and investment in the Fund. These Subsequent Closings are expected to occur on a calendar-quarter end based on investor interest as well as the state of the market and our capacity to invest the additional capital in a reasonable period. Each Capital Commitment will be for the life of the Fund or for a shorter period based on the investor’s liquidation election, subject to the Fund’s receipt of exemptive relief related to the Liquidating Share Class and the New BDC, as described below.

Liquidity Options

We may seek exemptive relief to offer liquidity to our investors as follows:

Spinoff BDC. We intend to apply for exemptive relief from the SEC which, if granted, would provide a liquidity option to allow investors to exchange their Shares for shares of common stock in a newly formed entity (the “New BDC”) that will elect to be treated as a BDC under the 1940 Act, and that will effectuate an orderly wind down after the third anniversary of the initial closing of the Fund’s private placement, and every three years thereafter.2 Investors will also be able to retain their existing Shares and investments in the Fund and to receive distributions in the ordinary course. In order to effectuate this option, the Fund expects it would need to, among other things, transfer to the New BDC, in exchange for newly issued shares of the New BDC, a pro rata portion of its assets and liabilities corresponding to the aggregate net asset value of the Shares of the investors that have elected

| 2 | The Fund may delay its initial offer of shares of the New BDC by one year until after the fourth anniversary of the initial closing of the Fund’s private placement (i) to provide the Fund with additional time to seek the exemptive relief required to effectuate the New BDC Spinoff or (ii) for another reason as determined appropriate by the Adviser. |

13

Table of Contents

to invest in the New BDC (the “Transfer Assets”), and thereafter exchange the New BDC shares received for the Shares of the electing investors. Such transfer of assets and liabilities and the mechanics relating thereto are referred to herein as the “New BDC Spin-Off”. Upon execution of the New BDC Spin-Off, investors owning shares of the New BDC will be released from any further obligation to purchase additional Fund Shares but their Remaining Commitment, if any, may be called in exchange for additional shares of the New BDC. Such Remaining Commitments will not be called to fund new investments in the New BDC and investors owning shares of the New BDC will not be required to fund their respective Remaining Commitments with respect to such shares of the New BDC except to the extent necessary to cover any required post commitment period obligations.

Because the Adviser would be managing both the Fund and the New BDC, and the 1940 Act prohibits entities under common control from engaging in certain transactions, the Fund will be required to rely on obtaining exemptive relief from the SEC to permit the transfer of assets from the Fund to the New BDC, as well as with respect to other aspects relating to the New BDC Spin-Off. There can be no assurance that the Fund will be able to obtain such exemptive relief from the SEC. Assuming the Fund is able to obtain exemptive relief, the Board will then make the determination as to if and when it is appropriate to effectuate the New BDC Spin-Off. Upon the execution of each New BDC Spinoff, the Fund would effectively be divided into two separate BDCs. The Fund will continue to operate as an externally managed BDC and to conduct private offerings to raise capital and, in connection therewith, accept other subscription agreements from current and new investors wishing to invest in the Fund. Each New BDC will operate as an externally managed BDC by the Adviser and will effectuate an orderly wind down consistent with its investment objective.

Liquidating Share Class. The Fund may also apply for exemptive relief from the SEC which, if granted, would allow the Fund to offer its stockholders the option to exchange their Shares, in whole or in part, for shares of a liquidating class of common stock (each share, a “Liquidation Share” and the class, the “Liquidating Share Class”). This offer would be made after the third anniversary of the initial closing of the Fund’s private placement, and every year thereafter.3 This offer will be made with respect to each stockholder beginning on the end of each calendar year that falls on or after the third anniversary of the date of the acceptance of the Investor’s commitment, and each subsequent calendar year end thereafter (an Investor holding matured Shares per this timeline being deemed an “Eligible Stockholder”). The Liquidation Shares will therefore have a series for each year that this is offered (e.g., 2020 Series, 2021 Series, etc.). If exemptive relief for the Liquidating Share Class is granted by the SEC, the Fund intends to continue operations in perpetuity (or until the Adviser determines an alternative liquidity option is in the best interest of the stockholders). Eligible Stockholders will have the right to obtain one Liquidation Share for each Share owned as of the last day of each calendar year (each, a “Liquidating Share Exchange Date”) by providing at least 90 days’ prior written notice to the Fund. Eligible Stockholders may also have the right as part of the process for electing (or declining) to exchange Shares for Liquidation Shares (each exchange, a Liquidating Share Exchange,”) to call, in whole or in part, any Remaining Commitments pursuant to their subscription agreement, and may do so after the Liquidating Share Exchange. Such Remaning Commitments will not be called to fund new investments in the Fund and Investors owning shares of the Liquidating Share Class will not be required to fund their respective Remaining Commitments with respect to such Liquidation Shares except to the extent necessary to cover any required post commitment period obligations.

For avoidance of doubt, no stockholder will have the right to commence the process of obtaining Liquidation Shares with respect to such stockholder’s Shares if such stockholder is not an Eligible Stockholder.

On each Liquidating Share Exchange Date, the Fund will allocate a pro rata portion of the Fund’s assets and liabilities corresponding to the aggregate net asset value of the Shares held by the Eligible Stockholders electing to exchange such Shares for Liquidation Shares on such date (each such Eligible Stockholder, after such Liquidating Share Exchange Date, with respect to the amount of Shares exchanged for Liquidation Shares, a “Liquidating

| 3 | The Fund may delay its initial offer of the Liquidating Share Class by one year until after the fourth anniversary of the initial closing of the Fund’s private placement (i) to provide the Fund with additional time to seek the exemptive relief required to effectuate the New BDC Spinoff or (ii) for another reason as determined appropriate by the Adviser. |

14

Table of Contents

Investor”). The Fund will make distributions (“Liquidation Distributions”) to Liquidating Investors, to the extent distribution proceeds are available, on each Liquidation Payment Date, after the deduction of any allocated expenses (including the base management fee and the incentive fee). Each “Liquidation Payment Date” will be on or prior to the 90th day following the end of each fiscal quarter of the Fund.

There can be no assurance that the Fund will be able to obtain such exemptive relief from the SEC. Assuming the Fund is able to obtain exemptive relief, the Board will then make the determination as to if and when it is appropriate for it to effectuate any such Liquidating Share Exchange.

Limited Tender Offers. If, in the judgment of the Fund Board in exercising its fiduciary duty, and subject to the receipt of Exemptive Relief from the SEC, the completion of any New BDC Spinoff or Liquidation Distributions would not make economic sense and/or would not be in the best interest of the Fund stockholders taken as a whole, then the Fund may instead conduct a limited tender offer (with respect to each such New BDC Spinoff or Liquidating Share Class, a “Limited Tender Offer”) to those Fund stockholders who had opted to exchange their Fund Shares for shares of the New BDC or who had elected to opt into the Liquidating Share Class. Pursuant to each Tender Offer, the Fund would repurchase that number of Fund Shares from the Fund stockholders who had opted to exchange their Fund Shares for shares of the New BDC or who had elected to opt into the Liquidating Share Class that corresponds to the amount of cash, cash equivalents and assets that can easily be liquidated to generate cash that the Fund determines in its discretion to be available and as disclosed in communications with respect to the Limited Tender Offer. Each per share Limited Tender Offer price would be based on the then current net asset value per share of the Fund. The Fund may also conduct any such Limited Tender Offer in conjunction with any such New BDC Spinoff or Liquidating Share Exchange. There can be no assurance that the Fund will be able to obtain such exemptive relief from the SEC. Assuming the Fund is able to obtain exemptive relief, the Board will then make the determination as to if and when it is appropriate for it to effectuate any such Limited Tender Offer.

Regardless of whether exemptive relief is granted for either the Liquidating Share Class, the New BDC or the Limited Tender Offer, we will continue our operations in a manner otherwise set forth in this Annual Report on Form 10-K.

The proposals to establish a Liquidating Share Class or a New BDC or to provide a Limited Tender Offer (collectively, the “Proposals”) would involve transactions that are currently prohibited by the 1940 Act and would require an SEC order in order to be established. The SEC has not previously granted orders with respect to a Liquidating Share Class or a New BDC, and it could take several years before the SEC determines whether relief is appropriate and it may ultimately deny the requests for any or all of the Proposals. If exemptive relief is not granted for any of the Proposals, the Board would need to consider other ways to permit shareholders to liquidate their investments. If you expect to need access to your investment in the near future, you should not invest in the Fund.

Other Liquidity Options

We also may offer liquidity to our investors as follows:

IPO or Wind Up. Regardless of whether exemptive relief is granted for either the Liquidating Share Class, the New BDC Spin-Off, or the Tender Offer, the Fund will continue its operations in a manner otherwise set forth in this Annual Report on Form 10-K, including potentially pursuing a Qualified IPO before the third anniversary of the Initial Closing, subject to the Adviser’s option to extend this by up to one (1) year beyond the third anniversary of the Initial Closing Date (a “Qualified IPO” is an IPO of the Fund’s Shares that results in an unaffiliated public float of at least 15% of the aggregate amount of capital committed to the Fund by investors received prior to the date of such IPO). In the event exemptive relief is not granted for the Liquidating Share Class, the New BDC Spin-Off, or the Limited Tender Offer, and a Qualified IPO has not been completed before the third anniversary of the Initial Closing, subject to the Adviser’s option to extend this by up to one (1) year beyond the third anniversary of the initial closing date, the Fund may wind up in accordance with this Annual Report on Form 10-K. Upon a Qualified IPO or commencement of a wind-up, investors will be released from any further commitment to purchase additional Shares subject to certain exceptions contained in their subscription agreements.

15

Table of Contents

General Tender Offer. Subject to the discretion of the Board, the Fund may commence a general tender offer pursuant to which it intends to conduct tender offers, at the Board’s discretion, in accordance with the requirements of Rule 13e-4 under the 1934 Act and the 1940 Act, to allow each Investor to tender their Shares at a price equal to the current net offering price per share in effect on each date of repurchase. The general tender offer will include numerous restrictions that limit an Investor’s ability to sell its shares. If the Fund obtains exemptive relief with respect to the New BDC Spinoff or Liquidating Share Class, the general tender offer may also be conducted in conjunction with either of a New BDC Spinoff or Liquidating Share Class.

The Fund expects that general tender offers made in each quarter will be limited to a percentage, to be determined by the Board, of the weighted average number of shares of the Fund’s common stock outstanding in the prior 12-month period. At the discretion of the Board, the Fund may use cash on hand, cash available from borrowings, and cash from the sale of our investments as of the end of the applicable period to repurchase Shares pursuant to a general tender offer. Each Investor may tender all of the Shares that it owns. To the extent that the number of Shares tendered to the Fund pursuant to a general tender offer exceeds the number of Shares that the Fund is able to purchase, the Fund will repurchase Shares on a pro rata basis. There is no tender priority for an Investor under the circumstances of death or disability of any stockholder. Further, the Fund will have no obligation to repurchase Shares if the repurchase would violate the restrictions on distributions under federal law or Maryland law. The general tender offer has many limitations, including the limitations described above, and should not in any way be viewed as the equivalent of a secondary market. Any periodic repurchase offers will be subject in part to the Fund’s available cash and compliance with the RIC qualification and diversification rules and the 1940 Act. Investors will not pay a fee to the Fund in connection with any repurchase of shares under the share repurchase program.

Other than in connection with an election to exchange Shares for Shares of the New BDC in connection with the New BDC Spin-Off, to enter into a Liquidating Share Class, pursuant to a Limited Tender Offer, or participation in a general tender offer, no Investor who participated in the Private Offering will be permitted to sell, assign, transfer or otherwise dispose of its Shares or Capital Commitment unless the Fund provides its prior consent and the transfer is otherwise made in accordance with applicable law.

While the Fund expects each subscription agreement to reflect the terms and conditions summarized in the preceding paragraphs, the Fund reserves the right to enter into subscription agreements that contain different terms and conditions or which contain terms and conditions not found in subscription agreements entered into with other investors, subject to applicable law.

Material U.S. Federal Income Tax Considerations

The following discussion is a general summary of the material U.S. federal income tax considerations applicable to us and to an investment in shares of our common stock. This discussion is based on the provisions of the Code and the regulations of the U.S. Department of Treasury promulgated thereunder, or “Treasury regulations,” each as in effect as of the date of this Annual Report on Form 10-K.

These provisions are subject to differing interpretations and change by legislative or administrative action, and any change may be retroactive. This discussion does not constitute a detailed explanation of all U.S. federal income tax aspects affecting us and our stockholders and does not purport to deal with the U.S. federal income tax consequences that may be important to particular stockholders in light of their individual investment circumstances or to some types of stockholders subject to special tax rules, such as financial institutions, broker dealers, insurance companies, tax-exempt organizations, partnerships or other pass-through entities, persons holding our common stock in connection with a hedging, straddle, conversion or other integrated transaction, non-U.S. stockholders (as defined below) engaged in a trade or business in the United States, persons who have ceased to be U.S. citizens or to be taxed as resident aliens or individual non-U.S. stockholders present in the United States for 183 days or more during a taxable year. This discussion also does not address any aspects of U.S. estate or gift tax or foreign, state or local tax. This discussion assumes that our stockholders hold their shares of our common stock as capital assets for U.S. federal income tax purposes (generally, assets held for investment). No ruling has been or will be sought from the IRS regarding any matter discussed herein.

16

Table of Contents

A “U.S. stockholder” is a beneficial owner of shares of our common stock that is for U.S. federal income tax purposes:

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation created or organized in or under the laws of the United States, any state therein or the District of Columbia; |

| • | an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

| • | a trust if a court within the United States is able to exercise primary jurisdiction over the administration of the trust and one or more U.S. persons have authority to control all substantial decisions of the trust. |

A “non-U.S. stockholder” means a beneficial owner of shares of our common stock that is for U.S. federal income tax purposes not a U.S. stockholder.

If a partnership or other entity classified as a partnership, for U.S. federal income tax purposes, holds our shares, the U.S. tax treatment of the partnership and each partner generally will depend on the status of the partner, the activities of the partnership and certain determinations made at the partner level. A partnership considering an investment in our common stock should consult its own tax advisers regarding the U.S. federal income tax consequences of the acquisition, ownership and disposition of shares by the partnership.

Taxation of the Fund

As soon as is reasonably practicable, we intend to elect to be treated and to qualify each year as a RIC under Subchapter M of the Code. As a RIC, we generally will not be required to pay corporate-level U.S. federal income taxes on any ordinary income or capital gains that we timely distribute to our stockholders as dividends.

To qualify as a RIC, we must, among other things:

| • | derive in each taxable year at least 90% of our gross income from dividends, interest, payments with respect to certain securities loans, gains from the sale or other disposition of stock, securities or foreign currencies, other income derived with respect to our business of investing in stock, securities or currencies, or net income derived from an interest in a “qualified publicly traded partnership,” or “QPTP,” hereinafter the “90% Gross Income Test;” and |

| • | diversify our holdings so that, at the end of each quarter of each taxable year: |