Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - EVERSPIN TECHNOLOGIES INC | mram-20161231ex321d530df.htm |

| EX-31.2 - EX-31.2 - EVERSPIN TECHNOLOGIES INC | mram-20161231ex312d7fbd7.htm |

| EX-31.1 - EX-31.1 - EVERSPIN TECHNOLOGIES INC | mram-20161231ex3111a502e.htm |

| EX-23.1 - EX-23.1 - EVERSPIN TECHNOLOGIES INC | mram-20161231ex231961062.htm |

| EX-10.25 - EX-10.25 - EVERSPIN TECHNOLOGIES INC | mram-20161231ex1025abf4d.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

◻ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001‑37900

Everspin Technologies, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

26‑2640654 |

|

(State or other jurisdiction |

(I.R.S. Employer |

1347 N. Alma School Road, Suite 220

Chandler, Arizona 85224

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (480) 347‑1111

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.0001 Per Share; Common stock traded on the NASDAQ Stock Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b‑2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). YES ◻ NO ☒

The registrant’s common stock was not publicly traded as of the last business day of the registrant’s most recently completed second fiscal quarter. The number of shares of Registrant’s Common Stock outstanding as of March 23, 2017 was 12,500,178.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant’s fiscal year ended December 31, 2016, are incorporated by reference into Part III of this Report.

2

Forward-Looking Statements

This Annual Report on Form 10‑K contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements include, but are not limited to, statements about:

|

· |

estimates of our future revenue, expenses, capital requirements and our needs for additional financing; |

|

· |

the implementation of our business model and strategic plans for our products, technologies and businesses; |

|

· |

competitive companies and technologies and our industry; |

|

· |

our ability to manage and grow our business by expanding our sales to existing customers or introducing our products to new customers; |

|

· |

our ability to establish and maintain intellectual property protection for our products or avoid claims of infringement; |

|

· |

our ability to hire and retain key personnel; |

|

· |

our financial performance; |

|

· |

our estimates of the MRAM market opportunity; and |

|

· |

the volatility of our share price. |

Forward-looking statements are based on management’s current expectations, estimates, forecasts, and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this report may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this report. These statements, like all statements in this report, speak only as of their date, and we undertake no obligation to update or revise these statements in light of future developments. We caution investors that our business and financial performance are subject to substantial risks and uncertainties. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

3

Overview

We are the leading provider of magnetoresistive random access memory (MRAM) products. Our MRAM products offer the persistence of non-volatile memory, a type of memory that retains information even in the absence of power, with the speed and endurance of random access memory (RAM), and enable the protection of mission critical data particularly in the event of power interruption or failure. Our MRAM products allow our customers in the industrial, automotive and transportation, and enterprise storage markets to design high performance, power efficient and reliable systems without the need for bulky batteries or capacitors. We are the only provider of commercially available MRAM solutions, and over the past eight years we have shipped over 60 million MRAM units.

Our MRAM technology, unlike traditional semiconductor memory technologies, stores data as a magnetic state rather than an electrical charge, and is offered as either a discrete or embedded solution. Our products read and write data at speeds on par with most dynamic RAM (DRAM) and static RAM (SRAM). Our products offer the non-volatility of flash memory but with significantly superior endurance. We offer our MRAM products with different densities and interfaces to address the various needs of our customers. Our lower-density MRAM products, which we define as having bit densities from 128kb to 16Mb, offer write-speeds on par with SRAM, with virtually unlimited endurance. Our higher density products, which we define as having bit densities at or greater than 64Mb, offer write-speeds on par with DRAM and have superior endurance compared to most other non-volatile memory technologies.

Our lower-density products are optimized for use in industrial, and automotive and transportation applications, while our higher-density products are optimized for use in enterprise storage applications. In the enterprise storage market, we collaborate with industry-leading memory controller companies to enable compatibility of their controllers with our MRAM products, facilitating the adoption of our solutions into our customers’ existing end products. We have over 600 customers worldwide, including Honeywell, ifm, Nikkiso and Siemens in the industrial market, Airbus and Hyundai Mobis in the automotive and transportation market, and Broadcom, Dell, IBM and Lenovo in the enterprise storage market. We sell our products directly and through our established distribution channel to industry-leading original equipment manufacturers (OEMs) and original design manufacturers (ODMs)

We leverage both internal and outsourced manufacturing capabilities to produce our MRAM products. We purchase industry-standard complementary metal-oxide semiconductor (CMOS) wafers from semiconductor foundries and complete the processing of our products by inserting our magnetic-bit technology at our 200mm fabrication facility in Chandler, Arizona. We have entered into a manufacturing agreement with GLOBALFOUNDRIES for 300mm high-volume production of our higher-density products. We believe our strategic relationship with GLOBALFOUNDRIES accelerates the development of our MRAM solutions, provides us with leading-edge outsourced manufacturing capabilities, and enables us to operate a variable cost financial model. In addition, GLOBALFOUNDRIES has the ability to embed our technology in its products for sale to its customers, from which we would earn licensing or royalty revenue.

For the years ended December 31, 2016, 2015, and 2014 we recorded revenue of $27.1 million, $26.5 million, $24.9 million, gross margin of 54.3%, 52.7%, and 52.6%, and a net loss of $16.7 million, $18.2 million, and $10.2 million, respectively. As of December 31, 2016, we had 90 employees, more than half of whom are engaged in research and development. Our headquarters are located in Chandler, Arizona. Our principal design center is in Austin, Texas, and we have additional sales operations in the Americas, Europe and Asia-Pacific regions.

4

The Opportunity for Fast, Persistent MemoryMRAM

Traditional memory technologies have either fast write-speeds or are non-volatile, but not both. MRAM combines both features into a single solution, making it an ideal memory to protect data in the event of power interruption or failure, and to store data that is frequently written and accessed. We believe customers that employ MRAM in their systems are better able to design higher performance, lower power, more reliable and simpler systems than they would be able to design using other existing memory technologies. The following attributes make MRAM an increasingly important application specific memory solution for system architectures that require non-volatile memory with the speed and endurance of RAM:

Non-volatile. MRAM can retain data in the event of power interruption or failure, which enables end-system designers to create products without costly power-loss protection systems, such as batteries and capacitors.

Fast Write- Speeds. MRAM offers write-speeds that are on par with the fastest available volatile memory technologies, including most DRAM and SRAM and is significantly faster than other non-volatile memories used today. For example, MRAM writes a block over 100,000 times faster than NAND flash, a type of non-volatile flash memory.

Superior Write- Cycle Endurance. MRAM offers superior write-cycle endurance to existing non-volatile solutions, enabling end-systems designers to offer products that are not limited by memory wear-out. For example, MRAM write-cycle endurance is nearly 10 million times greater than NAND flash.

Scalable to Greater Densities and Smaller Process Geometries. MRAM’s write-speed and endurance are scalable with increasing bit densities and smaller geometries, which we believe will allow system designers to employ MRAM in applications that require more memory and smaller form factors.

Proven to be Manufacturable at High Volumes. MRAM can be manufactured in high volumes and in advanced nodes, and is compatible with standard CMOS.

Low Energy Requirement. MRAM utilizes energy efficiently over the duration of its write and read cycles. It has the ability to be completely powered down, consuming no energy while still retaining data, which data can be accessed quickly once power is restored.

These attributes enable MRAM to be used as a true Storage Class Memory, by which we mean a form of memory that has non-volatility that is similar to storage but with performance that is similar to DRAM or SRAM. MRAM has already proven its commercial viability as a discrete and embedded solution in application-specific memory markets and we believe it will become a mainstream memory technology in the future.

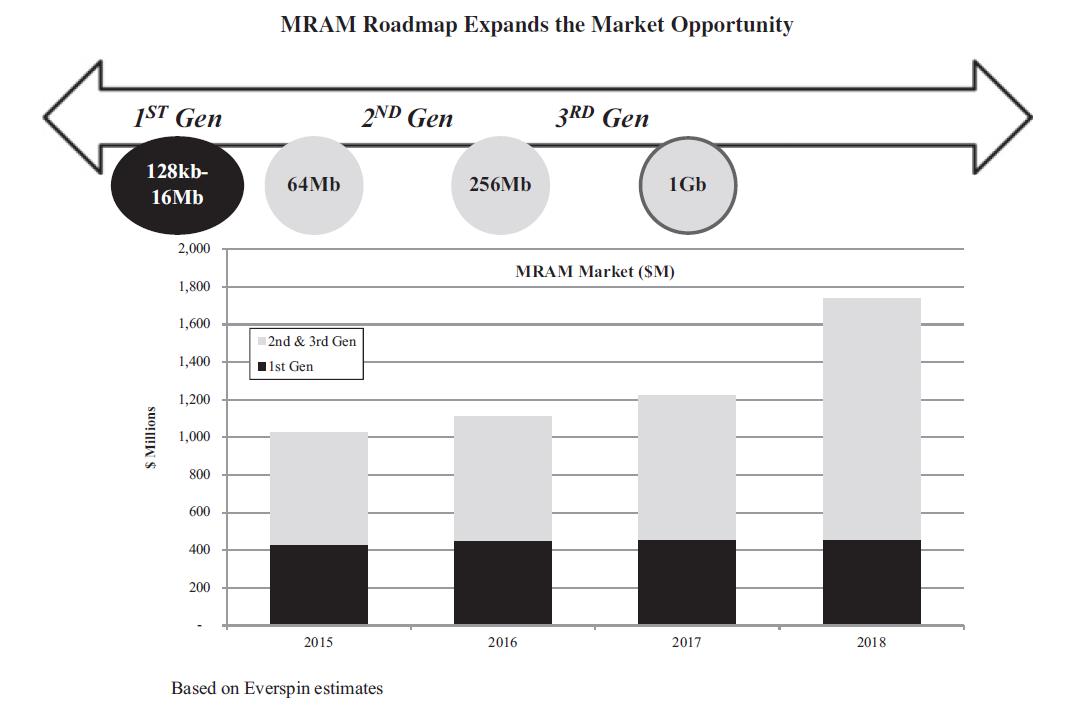

Discrete MRAM Market Opportunity

We estimate the market opportunity for application specific MRAM products to be approximately $1.8 billion by 2018, growing approximately at a 19% compound annual growth rate (CAGR) from approximately $1 billion in 2015. We expect the introduction of increasingly higher density MRAM solutions will result in greater adoption of MRAM technology into a wider range of applications and end markets.

We expect our first generation MRAM solutions, which have lower bit densities ranging from 128kb to 16Mb, to continue to serve customers in the industrial, automotive and transportation end markets, where products tend to have long product life cycles. As MRAM bit densities increase, we believe MRAM solutions will be well-suited to address a wider range of large and growing markets, such as server and storage, increasing the overall market opportunity for MRAM. We believe our second and third generation MRAM solutions, which are designed to have bit densities at or greater than 64Mb, will drive the rapid adoption of our products into enterprise storage applications. We believe the introduction of MRAM solutions with bit densities greater than 1Gb will extend the opportunity for MRAM into additional adjacent markets such as server and mobile computing.

5

Embedded MRAM Technology

In addition to use as a discrete product, MRAM can serve as embedded memory in a variety of CMOS technologies. Memory accounts for a significant portion of the area of System-on-a-Chips (SoCs), application-specific integrated circuits (ASICs), application-specific standard products, microcontrollers, baseband processors, storage controllers, application processors and field-programmable gate arrays. Memory that is integrated in these products is called embedded memory and offers similar performance to its discrete counterparts.

Today’s embedded memory solutions include embedded SRAM (eSRAM), embedded Flash (eFlash), and embedded DRAM (eDRAM). We believe these technologies have difficulties scaling to advanced CMOS processing nodes. Embedded MRAM’s (eMRAM) compatibility with CMOS processes, combined with its lower leakage, byte addressability and high write-cycle endurance make it well-suited as a replacement for eSRAM, eFlash and eDRAM. We believe the use of eMRAM will be more cost effective for foundries by maintaining compatibility with standard CMOS, thus improving manufacturing efficiency.

eSRAM, which uses six transistors (6‑T) to construct a memory bit, requires more silicon area and additional power due to leakage current from its multiple-transistor architecture. Embedded MRAM, which uses a single transistor architecture, results in less leakage current and requires a smaller area on an integrated circuit to achieve equivalent or better performance than eSRAM.

eFlash requires relatively high voltage and area overhead to program the memory bits, which is contrary to the trend of scaling down the CMOS process for lower power and less chip area. eFlash also has a limited number of write cycles, which can render it ineffective as working memory on the chip. Compared to eFlash,

eMRAM requires lower voltage to program bits, which results in greater power efficiency and it has higher write-cycle endurance. eMRAM is byte-addressable and has symmetric read and write timing, which makes it suitable as working memory. eFlash must be erased and programmed in pages, which is less efficient for intensive writing applications.

eDRAM is a volatile memory that does not retain data when power is off. eDRAM manufacturing requires additional process steps and costs to build a capacitor to store the data. This manufacturing process could diminish the functionality of the memory or logic components in the integrated circuit. eMRAM, however, can be added towards the end of the manufacturing process, which does not impact the overall performance of the integrated circuit.

6

The versatility of eMRAM can simplify the design and architecture of the overall integrated circuit by providing the ability to have one memory type serve as both working memory and code storage memory.

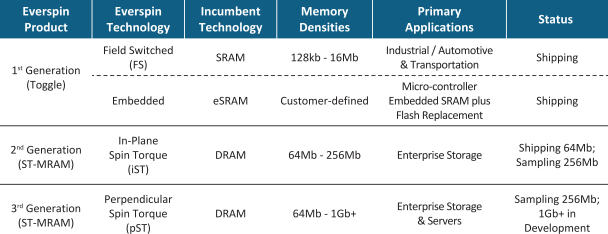

Our Solutions

We are the only commercial provider of MRAM products. We have a strong track record of innovation in MRAM technology, as demonstrated by our successive introduction of MRAM products that address an increasingly broad spectrum of applications. Our three generations of MRAM discrete solutions are set forth in the following table.

First Generation

Our first generation products, which we have been shipping since 2008, are primarily designed to address applications in the industrial, automotive and transportation markets. Our customers in these markets require memory technology that is non-volatile, writes continuously at high speeds to limit data loss, operates in harsh environments, and maintains endurance over long product lifecycles. To address these requirements, we designed our first generation of MRAM products to offer the persistence of non-volatile memory, speeds comparable to SRAM, reliability across a wide temperature range, and virtually unlimited write-cycles. We have designed our first generation products to be compatible with industry standard interfaces, including standard SRAM, SPI (Serial Peripheral Interface) and QSPI (Quad SPI) interfaces, enabling our customers to replace incumbent memory solutions with our first generation MRAM solutions. We believe this has been important for the initial success and early adoption of our first generation products.

Second Generation

Our second generation products, which began shipping in 2014, are principally designed to address the requirements of the enterprise storage market, which includes high performance Solid-State Drives (SSDs), Redundant array of independent disks (RAID) systems and servers. Our customers require low latency, protection of data against power interruption and failure, high density and reliability. Our second generation products offer performance comparable to DRAM, and are up to five orders of magnitude faster than flash block writes, non-volatile to protect against power loss, four times the density of our largest first generation product, and offer endurance superior to flash. We have designed our second generation products to be compatible with industry standard DDR3 interfaces, enabling our customers to realize the benefits of higher performance and power efficiency as compared to traditional memory products requiring batteries or super capacitors.

Third Generation

Our third generation products, which are currently in development, are initially targeted for enterprise-class storage and server applications. We use our Perpendicular Magnetic Tunnel Junction (PMTJ) technology to deliver further bit density and power efficiency increases to create a true Storage Class Memory solution. Our third generation products are designed to be compatible with standard DDR3, DDR4, SPI, and QSPI interfaces, which we believe will facilitate market adoption of our products in the enterprise storage and server markets.

7

Embedded MRAM

We offer embedded MRAM (eMRAM) to our customers for integration in their SoC solutions. We also enable GLOBALFOUNDRIES to offer eMRAM in the solutions they manufacture for their customers. Our embedded memory solutions offer high performance, low cost and low power and can be manufactured using standard CMOS. eMRAM offers significant advantages over existing embedded memory solutions, particularly in endurance, bandwidth, energy and area requirements, leakage and persistence. We believe our eMRAM solutions offer the performance benefits and process compatibility to become the embedded memory of choice for our current and future foundry partners.

Sensors

We have developed and are currently shipping a high performance, high-reliability magnetic sensor, which is based on our Magnetic Tunnel Junction (MTJ) technology, which is at the core of our memory technology. Our magnetic sensor offers three-axis orientation in a single die, and is integrated into consumer electronics applications as an electronic compass. We believe our magnetic sensor technology can be used for additional power management applications in the industrial, and automotive and transportation, end markets. We currently license our magnetic sensor technology to third parties for their commercial use and plan to continue this strategy.

Aerospace

Aerospace and satellite electronic systems require memory that is able to withstand exposure to the levels of radiation encountered in avionics and space applications. MRAM is not susceptible to radiation induced errors because data is stored as a magnetic state rather than as an electrical charge. Aerospace and satellite equipment manufacturers license our technology for use in their electronic systems. Through license agreements, we provide manufacturing service and technology access to certain of our customers, and we sell products to value added subcontractors.

Our Technology

Memory Architecture

Our MRAM solutions are based on our MTJ technology, which writes data by establishing a stable magnetic state, and reads data by measuring the resistance of the MTJ. MTJ devices are multilayered structures, including thin metal and dielectric layers, which are fabricated with methods commonly used in semiconductor manufacturing. The resistance is determined by the orientation of the magnetic field in the free layer relative to the fixed layer.

First Generation MRAM Technology

Our first generation MRAM technology uses a magnetic field to program, or write, bits. A significant advantage of this “field switching” is virtually unlimited write endurance, as reversing the free-layer magnetization with a magnetic field does not have any wear-out mechanism. Field Switched MRAM products are currently in production at the 180nm and 130nm nodes.

Field Switched MRAM bit cell. Each bit cell comprises an MTJ connected in series with a select transistor.

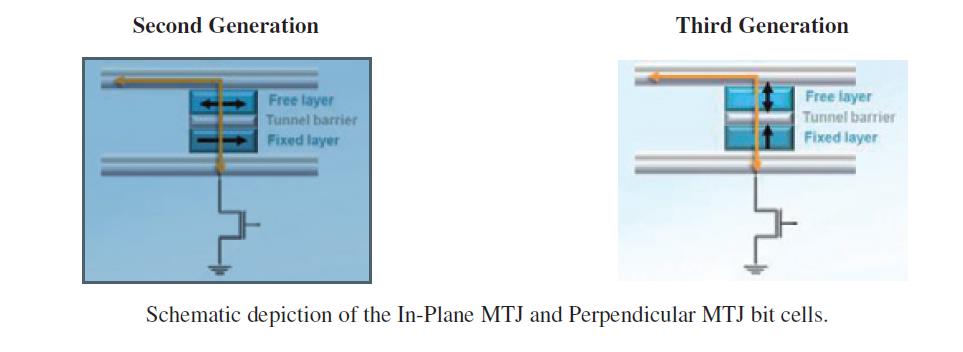

Second and Third Generation MRAM Technology

Our second and third generations of MRAM technologies use the spin-torque transfer property, which is the manipulation of the spin of electrons with a polarizing current, to establish the desired magnetic state of the free layer to program, or write, the bits in the memory array. Spin-torque MRAM, or ST-MRAM, provides a significant reduction in

8

switching energy compared to Field-switched MRAM, and is highly scalable, enabling higher density memory products. Our second generation MRAM technology uses an In-Plane MTJ structure, while our third generation uses a Perpendicular MTJ. We have developed materials and Perpendicular MTJ stack designs with high perpendicular magnetic anisotropy, which provides long data retention, small cell size, greater density, high endurance and low power.

Embedded MRAM Technology

MRAM technology is more easily embedded than most other memory technologies, due to the way the MRAM module is integrated in standard CMOS. Since the MRAM module is inserted between metal layers in the back-end-of-line part of the fabrication process, above the transistor layers, it does not disturb the CMOS fabrication process. Integrating MRAM in standard CMOS for SoC applications does not impact the performance of the integrated circuit.

Customers

Our MRAM products are used by industry-leading customers in the industrial, automotive and transportation, and enterprise storage markets. Representative customers using our discrete products in these end markets include:

|

Industrial |

|

Automotive and Transportation |

|

Enterprise Storage |

|

Honeywell |

|

Airbus |

|

Broadcom |

|

ifm |

|

Hyundai Mobis |

|

Dell |

|

Nikkiso |

|

|

|

IBM |

|

Siemens |

|

|

|

Lenovo |

We sell our products through our direct sales force and through a network of distributors and contract manufacturers. Direct, distributor and contract manufacturer customers purchase our solutions on an individual purchase order basis, rather than pursuant to long-term agreements.

We consider our customer to be the end customer purchasing either directly from a distributor, a contract manufacturer or us. An end customer purchasing through a contract manufacturer typically instructs the contract manufacturer to obtain our products and to incorporate our products with other components for sale by the contract manufacturer to the end customer. Although we actually sell the products to, and are paid by, the distributors and contract manufacturers, we refer to the end customer as our customer.

During the year ended December 31, 2016, more than 600 end customers purchased our products. No end customers accounted for more than 10% of our revenue during 2016. Sales to NXP Semiconductors N.V. (NXP) and Avago Technologies Ltd. (Broadcom) whether directly by us or through distributors or contract manufacturers, each accounted for 13% of our revenue for the year ended December 31, 2015. No other end customers accounted for more than 10% of our revenue during 2015. Sales to NXP and Dell accounted for 12% and 10%, respectively, of our revenue for the year ended December 31, 2014. NXP is a customer for our embedded and sensor solutions. Broadcom and Dell are customers for our Gen 1 MRAM products.

9

Sales and Marketing

We sell our products through a direct sales channel and a network of representatives and distributors. The majority of our customers, and their associated contract manufacturers, buy our products through our distributors. We maintain sales, supply chain and logistics operations and have distributors in Asia to service the production needs of contract manufacturers such as us Flextronics, Foxconn, Inventec and Sanmina. We also maintain direct selling relationships with several strategic customers. Our direct sales representatives are located in North America, the United Kingdom, Germany, Hong Kong, and Taiwan.

Our typical sales cycle consists of a sales and development process in which our field engineers and sales personnel work closely with our customers’ design engineers. This process can take from three to 12 months to complete, and a successful sales cycle culminates in a design win. Once we establish a relationship with a customer, we continue a sales process to maintain our position and to secure subsequent new design wins at the customer. Each customer lead, whether new or existing, is tracked through our CRM tool and followed in stages of prospect, design in, design win and production. This tracking results in a design win pipeline that provides a measure of the future business potential of the opportunities.

Our technical support personnel have expertise in hardware and software, and have access to our development team to ensure proper service and support for our OEM customers. Our field application and engineering team provides technical training and design support to our customers.

Manufacturing

We rely on third-party suppliers for most phases of the manufacturing process, including initial fabrication and assembly.

Wafer Manufacturing

We manufacture our first generation and second generation MRAM discrete products, and provide foundry services for embedded MRAM, licensed MRAM products and MTJ-based sensors in our 200mm manufacturing facility. Our facility is in an ISO‑4 clean room and is qualified for the production of automotive grade products. We actively manage inventory, including automated process flows, process controls and recipe management, and we use standard equipment to manufacture our products.

For our second generation products, GLOBALFOUNDRIES will manufacture our 256Mb in-plane MTJ discrete memory on 40nm CMOS on 300mm wafers. Our third generation of ST-MRAM, based on perpendicular MTJ, is in development in our 200mm fabrication facility and at GLOBALFOUNDRIES. Volume production of our third generation of ST-MRAM products is planned to be at more advanced process nodes at GLOBALFOUNDRIES on 300mm wafers.

Assembly and Test

We have designed test protocols to maximize yields at assembly and final test, reduce manufacturing costs and improve quality. Our design and product engineering teams have developed and implemented wafer-level test programs to characterize the behavior of our MRAM devices. We create predictive models and test each of our parts to assure the reliability of the products in the field. We also add unique electronic part identification numbers to provide material traceability.

To protect the MRAM devices from stray magnetic fields, we developed packaging solutions, which we have qualified at independent, industry-leading sub-contractors, including Amkor, ASE and UTAC. We have successfully qualified our MRAM devices in various packages at temperatures ranging from commercial to automotive grade. As part of our commitment to quality, our quality management system has been certified to ISO 9001:2000 standards. Our foundry vendors and sub-contractors are also ISO 9001 certified.

10

ST-MRAM Joint Development Agreement

On October 17, 2014, we entered into a joint development agreement with GLOBALFOUNDRIES Inc., a semiconductor foundry, for the joint development of our ST-MRAM technology. The term of the agreement is the later of four years from the effective date or until the completion, termination, or expiration of the last statement of work entered into pursuant to the joint development agreement.

The joint development agreement also states that the specific terms and conditions for the production and supply of the developed MRAM technology would be pursuant to a separate manufacturing agreement entered into between the parties. See “—ST-MRAM Manufacturing Agreement” below.

Under the joint development agreement, each party granted licenses to its relevant intellectual property to the other party. For certain jointly developed works, the parties have agreed to follow an invention allocation procedure to determine ownership. In addition, GLOBALFOUNDRIES possesses the exclusive right to manufacture our discrete and embedded spin torque MRAM devices developed pursuant to the agreement until the earlier of three years after the qualification of the MRAM device for a particular technology node or four years after the completion of the relevant statement of work under which the device was developed. For the same exclusivity period associated with the relevant device, GLOBALFOUNDRIES agreed not to license intellectual property developed in connection with the agreement to named competitors of ours.

Generally, unless otherwise specified in the agreement or a statement of work, we and GLOBALFOUNDRIES share defined project costs equally under the joint development agreement. If GLOBALFOUNDRIES manufactures, sells or transfers wafers containing production qualified MRAM devices that utilized certain Everspin design information to its customers, GLOBALFOUNDRIES will pay royalties to us for each such wafer transferred or sold to a customer.

Except for breaches of confidentiality provisions and each party’s indemnification obligations to one another under the agreement, liability under the agreement is capped at a range depending on project costs and royalty amounts. Either party may terminate the agreement if the other party materially breaches a term of the agreement, and fails to remedy the breach after receiving notice from the non-breaching party. If a party terminates the manufacturing agreement for material breach in accordance with its terms, that party may also terminate the joint development agreement.

On May 27, 2016, we entered into an amendment to the joint development agreement to modify the payment schedule and to clarify our payment obligations for certain past project costs. Under the amendment, GLOBALFOUNDRIES may terminate the joint development agreement with us if we materially breach a term of the agreement, such as, but not limited to, by our failing to pay any undisputed sum which has been outstanding for 45 or more days from the date of invoice, and fail to remedy the breach within 60 days after receiving notice from GLOBALFOUNDRIES. See “Risk Factors” for further discussion of our agreements with GLOBALFOUNDRIES.

ST-MRAM Manufacturing Agreement

On October 23, 2014, we entered into a manufacturing agreement with GLOBALFOUNDRIES Singapore Pte. Ltd. that sets forth the specific terms and conditions for the production and supply of wafers manufactured using our spin torque MRAM technology developed under the joint development agreement with GLOBALFOUNDRIES. Pursuant to that joint development agreement, GLOBALFOUNDRIES possesses certain exclusive rights to manufacture such wafers for our discrete and embedded spin torque MRAM devices. Our manufacturing agreement with GLOBALFOUNDRIES includes a customary forecast and ordering mechanism for the supply of certain of our wafers, and we are obligated to order and pay for, and GLOBALFOUNDRIES is obligated to supply, wafers consistent with the binding portion of our forecast. GLOBALFOUNDRIES also has the ability to discontinue its manufacture of any of our wafers upon due notice and completion of the notice period. The initial term of the manufacturing agreement is for three years, which automatically renews for successive one year periods thereafter unless either party provides sufficient advance notice of non-renewal.

Except for breaches of confidentiality provisions and each party’s indemnification obligations to one another under the agreement, liability under the agreement is capped at the lesser of a set amount or the total purchase price received by GLOBALFOUNDRIES from us in the twelve months immediately preceding the claim for the specific product that caused the damages. Either party may terminate the agreement if the other party materially breaches a term of the

11

agreement, and fails to remedy the breach after receiving notice from the non-breaching party. GLOBALFOUNDRIES may terminate the agreement if we fail to pay any undisputed sum which has been outstanding for sixty or more days from the date of invoice.

Backlog

As of December 31, 2016, our backlog was $7.4 million and includes all purchase orders scheduled for delivery within the subsequent 12 months. Our business and, to a large extent, that of the entire semiconductor industry, is characterized by short-term orders and shipment schedules. Orders constituting our current backlog are subject to changes in delivery schedules, or to cancellation at the customer's option without significant penalty. Thus, while backlog is useful for scheduling production, backlog as of any particular date may not be a reliable measure of sales for any future period.

Competition

Our products, all of which offer the persistence of non-volatile memory with the speed and endurance of random access memory, enable the protection of mission critical data particularly in the event of power interruption or failure. Our solutions are designed for use in applications in the industrial, automotive and transportation, and enterprise storage markets where the combination of high write-cycle endurance and fast write-speeds are of critical importance.

Our principal competitors to our first generation Field Switched MRAM products, which are tailored primarily for the industrial, automotive and transportation, and enterprise storage markets, include companies that offer nonvolatile SRAM (NVSRAM), SRAM, and ferroelectric RAM (FRAM) products, such as Cypress, Fujitsu, Integrated Silicon Solution (ISSI), Macronix, Microchip, Micron, Renesas, Samsung and Toshiba. Our second and third generation STMRAM products are designed primarily for the enterprise storage market, which includes high performance SSDs, RAID systems and servers. Our second and third generation ST-MRAM products are intended to replace DRAM-based solutions, which comprised DRAM and additional back-up power supply components, such as super capacitors and batteries that are required to make DRAM persistent. Customers typically purchase DRAM and super capacitors and batteries from separate vendors, and pair them together in order to create a DRAM-based solution capable of protecting data against power interruption or loss. Companies that offer DRAM devices include Hynix, Micron, Samsung, and several other smaller companies. In the future we may also face competition from companies developing MRAM technologies, such as Avalanche, Spin Transfer Technologies, Samsung and other larger and smaller semiconductor companies.

Our sensor products compete with giant magnetoresistive (GMR), anisotropic magnetoresistive (AMR) and Hall effect sensors supplied by Alps, Asahi Kasei Microdevices, Crocus, Fairchild, Invensys (now Schneider), Kionix and Micronix.

Our ability to compete successfully in the market for our products is based on a number of factors, including:

|

· |

our product attributes and specifications; |

|

· |

successful customer engagements from throughout the product life cycle; |

|

· |

high quality and reliability as measured by our customers; |

|

· |

the ease of implementation of our products by customers; |

|

· |

preferred supplier status at numerous customers and ODMs |

|

· |

manufacturing expertise and strength; |

|

· |

reputation and strength of customer relationships; |

|

· |

competitive pricing in the market against the competition while maintaining our gross margin profile; |

and

|

· |

our success in meeting the needs of future customer requirements through continued development of new products. |

12

We believe we compete favorably with respect to each of these factors.

Intellectual Property

Our success depends, in part, on our ability to protect our products and technologies from unauthorized third-party copying and use. To accomplish this, we rely on a combination of intellectual property rights, including patents, trade secrets, copyrights and trademarks, as well as customary contractual protections. As of December 31, 2016, we held 341 issued patents that expire at various times between December 31, 2016 and September 2034, and had 157 patent applications pending. Included in our issued patents and pending applications are patents/applications in the United States, China, Europe, France, Germany, Japan, the Republic of Korea, Italy, Singapore, Taiwan, and the United Kingdom.

We seek to file for patents that have broad application in the semiconductor industry and that would be helpful in the magnetoresistive memory and sensor markets. However, there can be no assurance that our pending patent applications or any future applications will be approved, that any issued patents will provide us with competitive advantages or will not be challenged by third parties, or that the patents or applications of others will not have an adverse effect on our ability to do business. In addition, there can be no assurance that others will not independently develop substantially equivalent intellectual property or otherwise gain access to our trade secrets or intellectual property, or disclose such intellectual property or trade secrets, or that we can effectively protect our intellectual property.

We generally control access to and use of our confidential information through employing internal and external controls, including contractual protections with employees, contractors and customers. We rely in part on U.S. and international copyright laws to protect our mask work. All employees and consultants are required to execute confidentiality agreements in connection with their employment and consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived or made in connection with the employment or consulting relationship.

Environmental Regulation

We must comply with many different federal, state, local and foreign governmental regulations related to the use, storage, discharge and disposal of certain chemicals and gases used in our manufacturing processes. Our facilities have been designed to comply with these regulations and we believe that our activities are conducted in material compliance with such regulations. Any changes in such regulations or in their enforcement could require us to acquire costly equipment or to incur other significant expenses to comply with environmental regulations. Any failure by us to adequately control the storage, use, discharge and disposal of regulated substances could result in significant future liabilities.

Increasing public attention has been focused on the environmental impact of electronic manufacturing operations. While we have not experienced any materially adverse effects on our operations from recently adopted environmental regulations, our business and results of operations could suffer if for any reason we fail to control the storage or use of, or to adequately restrict the discharge or disposal of, hazardous substances under present or future environmental regulations.

Employees

At December 31, 2016, we had 90 employees in the United States and 19 full time equivalent contractors and consultants in Singapore, China, Taiwan, the United Kingdom, the United States and Germany. None of our employees are either represented by a labor union or subject to a collective bargaining agreement. We have not experienced any work stoppages, and we consider our relations with our employees to be good.

Financial Information

Revenue from customers is designated based on the geographic region or country to which the product is delivered or licensee is located are set forth in Note 10 to our financial statements, which information is incorporated by reference

13

here. All of our assets are located in the United States. Our research and development expenses were $19.2 million, $21.1 million and $12.7 million for the years ended December 31, 2016, 2015 and 2014, respectively.

Corporate Information

We were incorporated in Delaware in May 2008. In June 2008, Freescale Semiconductor, Inc. (now a wholly-owned subsidiary of NXP Semiconductors N.V.), spun-out its MRAM business as Everspin. Our offices are located at 1347 N. Alma School Road, Suite 220, Chandler, Arizona 85224. Our telephone number is (480) 347-1111. Our corporate website is at www.Everspin.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge on our website. The information contained on or that can be accessed through our website is not incorporated by reference into this report, and you should not consider information on our website to be part of this report.

The following are important factors that could cause actual results or events to differ materially from those contained in any forward-looking statements made by us or on our behalf. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we deem immaterial also may impair our business operations. If any of the following risks or such other risks actually occurs, our business could be harmed.

Risk Factors Related to Our Business and Our Industry

We have a history of losses which may continue in the future, and we cannot be certain that we will achieve or sustain profitability.

We have incurred net losses since our inception. We incurred net losses of $16.7 million, $18.2 million and $10.2 million for the years ended December 31, 2016, 2015 and 2014, respectively. As of December 31, 2016, we had an accumulated deficit of $96.4 million. We expect to incur significant expenses related to the continued development and expansion of our business, including in connection with our efforts to develop and improve upon our products and technology, maintain and enhance our research and development and sales and marketing activities and hire additional personnel. Our ability to generate sufficient revenue and to transition to profitability and generate consistent positive cash flows is uncertain. In addition, as a public company, we will incur significant additional legal, accounting and other expenses that we did not incur as a private company. We do not know whether our revenue will grow rapidly enough to absorb these costs, and our limited operating history makes it difficult to assess the extent of these expenses, or their impact on our results of operations.

Further, our revenue may not increase or may decline for a number of possible reasons, many of which are outside our control, including a decline in demand for our products, increased competition, business conditions that adversely affect the semiconductor memory industry, including reduced demand for products in the end markets that we serve, or our failure to capitalize on growth opportunities. If we fail to generate sufficient revenue to support our operations, we may not be able to achieve or sustain profitability.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We have been in existence as a stand-alone company since 2008, when Freescale Semiconductor, Inc. spun-out its MRAM business as Everspin. We have been shipping magnetoresistive random access memory (MRAM) products since our incorporation in 2008, and we have experienced a high rate of growth for our products. However, we may not be able to sustain the growth rate for sales of these products and our revenue could decline. We have also been developing our next-generation of Spin-Torque MRAM (ST-MRAM) products. Adoption of these products is important to the future growth of our business, but revenue associated with these products has not been material to date.

Our limited operating history and limited experience selling products, combined with the rapidly evolving and competitive nature of our market, makes it difficult to evaluate our current business and future prospects. In addition, we have limited insight into emerging trends that may adversely affect our business, financial condition, results of

14

operations and prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including unpredictable and volatile revenue and increased expenses as we continue to grow our business. The viability and demand for our products may be affected by many factors outside of our control, such as the factors affecting the growth of the industrial, automotive and transportation, and enterprise storage industries and changes in macroeconomic conditions. If we do not manage these risks and overcome these difficulties successfully, our business will suffer.

We may be unable to match production with customer demand for a variety of reasons including our inability to accurately forecast customer demand or the capacity constraints of our suppliers, which could adversely affect our operating results.

We make planning and spending decisions, including determining production levels, production schedules, component procurement commitments, personnel needs and other resource requirements, based on our estimates of product demand and customer requirements. Our products are typically purchased pursuant to individual purchase orders. While our customers may provide us with their demand forecasts, they are not contractually committed to buy any quantity of products beyond purchase orders. Furthermore, many of our customers may increase, decrease, cancel or delay purchase orders already in place without significant penalty. The short-term nature of commitments by our customers and the possibility of unexpected changes in demand for their products reduce our ability to accurately estimate future customer requirements. On occasion, customers may require rapid increases in production, which can strain our resources, necessitate more onerous procurement commitments and reduce our gross margin. If we overestimate customer demand, we may purchase products that we may not be able to sell, which could result in decreases in our prices or write-downs of unsold inventory. Conversely, if we underestimate customer demand or if sufficient manufacturing capacity is unavailable, we could lose sales opportunities and could lose market share or damage our customer relationships. We manufacture MRAM products at our 200mm facility we lease in Chandler, Arizona and use a single foundry, GLOBALFOUNDRIES Singapore Pte. Ltd., for production of higher density products on advanced technology nodes, which may not have sufficient capacity to meet customer demand. The rapid pace of innovation in our industry could also render significant portions of our inventory obsolete. Excess or obsolete inventory levels could result in unexpected expenses or write-downs of inventory values that could adversely affect our business, operating results and financial condition.

We may require additional capital to fund our business, which may not be available to us on favorable terms or at all.

We believe that our existing cash and cash equivalents as of December 31, 2016, together with the additional borrowings available under our credit facility, will be sufficient to meet our anticipated cash requirements through March 31, 2018. Our ability to access the revolving loan under our credit facility depends upon levels of our accounts receivable and, therefore, the full amount may not be available to us at any specific time. Our future capital requirements will depend on many factors, including our growth rate, the timing and extent of our spending to support research and development activities, the timing and cost of establishing additional sales and marketing capabilities, and the introduction of new products. We may be required to seek additional equity or debt financing, and we cannot assure you that any such additional financing will be available to us on acceptable terms or at all. If we are unable to raise additional capital or generate sufficient cash from operations to adequately fund our operations, we will need to curtail planned activities to reduce costs. Doing so will likely harm our ability to execute on our business plan.

If we raise additional funds through issuances of equity, convertible debt securities or other securities convertible into equity, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences and privileges senior to those of holders of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to grow or support our business and to respond to business challenges could be significantly limited.

The audit report from our independent registered public accounting firm for the year ended December 31, 2015, states that our recurring losses raise substantial doubt about our ability to continue as a going concern. This report does not take into account the net proceeds received in our initial public offering and the concurrent private placement or our ability to draw down amounts under our line of credit. If we are unable to grow our revenue substantially to achieve and sustain profitability, we may not be able to continue as a going concern.

15

As we expand into new potential markets, we expect to face intense competition, including from our customers and potential customers, and may not be able to compete effectively, which could harm our business.

We expect that our new and future generation MRAM products will be applicable to markets in which we are not currently operating. Selling into these markets, including higher density memory markets and the module business could put us into direct competition with our current or potential customers or other competitors with substantially more resources and experience than us. The markets in which we operate and may operate in the future are extremely competitive and are characterized by rapid technological change, continuous evolving customer requirements and declining average selling prices. We may not be able to compete successfully against current or potential competitors, which include our current or potential customers as they seek to internally develop solutions competitive with ours or as we develop products potentially competitive with their existing products. If we do not compete successfully, our market share and revenue may decline. We compete with large semiconductor manufacturers and designers and others, and our current and potential competitors have longer operating histories, significantly greater resources and name recognition and a larger base of customers than we do. This may allow them to respond more quickly than we can to new or emerging technologies or changes in customer requirements. In addition, these competitors may have greater credibility with our existing and potential customers. Some of our current and potential customers with their own internally developed solutions may choose not to purchase products from third-party suppliers like us.

We rely on third parties to manufacture, package, assemble and test our products, which exposes us to a number of risks, including reduced control over manufacturing and delivery timing and potential exposure to price fluctuations, which could result in a loss of revenue or reduced profitability.

Although we operate an integrated magnetic fabrication line located in Chandler, Arizona, we purchase wafers from third parties and outsource the manufacturing, packaging, assembly and testing of our products to third-party foundries and assembly and testing service providers. We use a single foundry, GLOBALFOUNDRIES Singapore Pte. Ltd., for production of higher density products on advanced technology nodes. Our primary product package and test operations are located in China, Taiwan and other Asian countries. We also use standard CMOS wafers from third-party foundries, which we process at our Chandler, Arizona, facility.

Relying on third-party manufacturing, assembly, packaging and testing presents a number of risks, including but not limited to:

|

· |

capacity and materials shortages during periods of high demand; |

|

· |

reduced control over delivery schedules, inventories and quality; |

|

· |

the unavailability of, or potential delays in obtaining access to, key process technologies; |

|

· |

the inability to achieve required production or test capacity and acceptable yields on a timely basis; |

|

· |

misappropriation of our intellectual property; |

|

· |

the third party’s ability to perform its obligations due to bankruptcy or other financial constraints; |

|

· |

limited warranties on wafers or products supplied to us; and |

|

· |

potential increases in prices. |

We currently do not have long-term supply contracts with our third-party contract manufacturers for our MRAM products, including NXP, United Microelectronics Corporation, Taiwan Semiconductor Manufacturing Company, Limited (TSMC), United Test and Assembly Center (UTAC), Advanced Semiconductor Engineering (ASE), and Amkor, and we typically negotiate pricing on a per-purchase order basis and in some cases on an annual basis. Therefore, they are not obligated to perform services or supply components to us for any specific period, in any specific quantities, or at any specific price, except as may be provided in a particular purchase order. During periods of high demand and tight inventories, our third-party foundries and packaging, assembly and testing contractors may allocate capacity to the production of other companies’ products while reducing deliveries to us, or significantly raise their prices. In particular, they may allocate capacity to other customers that are larger and better financed than us or that have long-term agreements, decreasing the capacity available to us. Shortages of capacity available to us may be caused by the actions of their other, large customers that may be difficult to predict, such as major product launches.

16

Our manufacturing agreement with GLOBALFOUNDRIES includes a customary forecast and ordering mechanism for the supply of certain of our wafers, and we are obligated to order and pay for, and GLOBALFOUNDRIES is obligated to supply, wafers consistent with the binding portion of our forecast. However, our manufacturing arrangement is also subject to both a minimum and maximum order quantity that while we believe currently addresses our projected foundry capacity needs, may not address our maximum foundry capacity requirements in the future. We may also be obligated to pay for unused capacity if our demand decreases in the future, or if our estimates prove inaccurate. GLOBALFOUNDRIES also has the ability to discontinue its manufacture of any of our wafers upon due notice and completion of the notice period. This could cause us to have to find another foundry to manufacture those wafers or redesign our core technology and would mean that we may not have products to sell until such time. Any time spent engaging a new manufacturer or redesigning our core technology could be costly and time consuming and may allow potential competitors to take opportunities in the market place. Moreover, if we are unable to find another foundry to manufacture our products or if we have to redesign our core technology, this could cause material harm to our business and operating results.

If we need other foundries or packaging, assembly and testing contractors, or if we are unable to obtain timely and adequate deliveries from our providers, we might not be able to cost-effectively and quickly retain other vendors to satisfy our requirements. Because the lead-time needed to establish a relationship with a new third-party supplier could be several quarters, there is no readily available alternative source of supply for any specific component. In addition, the time and expense to qualify a new foundry could result in additional expense, diversion of resources or lost sales, any of which would negatively impact our financial results.

If any of our current or future foundries or packaging, assembly and testing subcontractors significantly increases the costs of wafers or other materials or services, interrupts or reduces our supply, including for reasons outside of their control, or if any of our relationships with our suppliers is terminated, our operating results could be adversely affected. Such occurrences could also damage our customer relationships, result in lost revenue, cause a loss in market share or damage our reputation.

Our joint development agreement and strategic relationships involve numerous risks.

We have entered into strategic relationships to manufacture products and develop new manufacturing process technologies and products. These relationships include our joint development agreement with GLOBALFOUNDRIES to develop advanced MTJ technology and ST-MRAM. These relationships are subject to various risks that could adversely affect the value of our investments and our results of operations. These risks include the following:

|

· |

our interests could diverge from those of our foundries, or we may not be able to agree with them on ongoing development, manufacturing and operational activities, or on the amount, timing, or nature of further investments in our joint development; |

|

· |

we may experience difficulties in transferring technology to a foundry; |

|

· |

we may experience difficulties and delays in getting to and/or ramping production at foundries; |

|

· |

our control over the operations of foundries is limited; |

|

· |

due to financial constraints, our joint development collaborators may be unable to meet their commitments to us and may pose credit risks for our transactions with them; |

|

· |

due to differing business models or long-term business goals, our collaborators may decide not to join us in funding capital investment, which may result in higher levels of cash expenditures by us; |

|

· |

our cash flows may be inadequate to fund increased capital requirements; |

|

· |

we may experience difficulties or delays in collecting amounts due to us from our collaborators; |

|

· |

the terms of our arrangements may turn out to be unfavorable; |

|

· |

we are migrating toward a fabless model as 300mm production becomes required and this increases risks related to less control over our critical production processes; and |

|

· |

changes in tax, legal, or regulatory requirements may necessitate changes in our agreements. |

17

Further, GLOBALFOUNDRIES may terminate the joint development agreement with us if we materially breach a term of the agreement, such as, but not limited to, by our failing to pay any undisputed sum which has been outstanding for 45 or more days from the date of invoice, and fail to remedy the breach within 60 days after receiving notice from GLOBALFOUNDRIES. If GLOBALFOUNDRIES terminates the joint development agreement, our ability to continue to develop our MRAM technology will be significantly impaired.

If our strategic relationships are unsuccessful, our business, results of operations, or financial condition may be materially adversely affected.

The market for semiconductor memory products is characterized by declines in average selling prices, which we expect to continue, and which could negatively affect our revenue and margins.

Our customers expect the average selling price of our products to decrease year-over-year and we expect this trend to continue. When such pricing declines occur, we may not be able to mitigate the effects by selling more or higher margin units, or by reducing our manufacturing costs. In such circumstances, our operating results could be materially and adversely affected. Our stand-alone and embedded MRAM products have experienced declining average selling prices over their life cycle. The rate of decline may be affected by a number of factors, including relative supply and demand, the level of competition, production costs and technological changes. As a result of the decreasing average selling prices of our products following their launch, our ability to increase or maintain our margins depends on our ability to introduce new or enhanced products with higher average selling prices and to reduce our per-unit cost of sales and our operating costs. We may not be able to reduce our costs as rapidly as companies that operate their own manufacturing, assembly and testing facilities, and our costs may even increase because we rely in part on third parties to manufacture, assemble and test our products, which could also reduce our gross margins. In addition, our new or enhanced products may not be as successful or enjoy as high margins as we expect. If we are unable to offset any reductions in average selling prices by introducing new products with higher average selling prices or reducing our costs, our revenue and margins will be negatively affected and may decrease.

The semiconductor memory market is highly cyclical and has experienced severe downturns in the past, generally as a result of wide fluctuations in supply and demand, constant and rapid technological change, continuous new product introductions and price erosion. During downturns, periods of intense competition, or the presence of oversupply in the industry, the selling prices for our products may decline at a high rate over relatively short time periods as compared to historical rates of decline. We are unable to predict selling prices for any future periods and may experience unanticipated, sharp declines in selling prices for our products.

Unfavorable economic and market conditions, domestically and internationally, may adversely affect our business, financial condition, results of operations and cash flows.

We have significant customer sales both in the U.S. and internationally. We also rely on domestic and international suppliers, manufacturing partners and distributors. We are therefore susceptible to adverse U.S. and international economic and market conditions. If any of our manufacturing partners, customers, distributors or suppliers experience serious financial difficulties or cease operations, our business will be adversely affected. In addition, the adverse impact of an unfavorable economy may adversely impact customer spending, which may adversely impact demand for our products.

We must continuously develop new and enhanced products, and if we are unable to successfully market our new and enhanced products for which we incur significant expenses to develop, our results of operations and financial condition will be materially adversely affected.

To compete effectively in our markets, we must continually design, develop and introduce new and improved products with improved features in a cost-effective manner in response to changing technologies and market demand. This requires us to devote substantial financial and other resources to research and development. We are developing next-generation products, which we expect to be one of the drivers of our revenue growth in the future. However, we may not succeed in developing and marketing these new and enhanced products. We also face the risk that customers may not value or be willing to bear the cost of incorporating our new and enhanced products into their products, particularly if they believe their customers are satisfied with current solutions. Regardless of the improved features or superior performance of our new and enhanced products, customers may be unwilling to adopt our solutions due to design or pricing constraints, or because they do not want to rely on a single or limited supply source. Because of the

18

extensive time and resources that we invest in developing new and enhanced products, if we are unable to sell customers new generations of our products, our revenue could decline and our business, financial condition, results of operations and cash flows would be negatively affected. For example, we generated limited revenue from sales of our ST-MRAM products to date. While we expect revenue from our ST-MRAM products to increase, if we are unable to scale MRAM to gigabit densities to address applications currently served by DRAM, we may not be able to materially increase our revenue. If we are unable to successfully develop and market our new and enhanced products that we have incurred significant expenses developing, our results of operations and financial condition will be materially and adversely affected.

Our success and future revenue depend on our ability to secure design wins and on our customers’ ability to successfully sell the products that incorporate our solutions. Securing design wins is a lengthy, expensive and competitive process, and may not result in actual orders and sales, which could cause our revenue to decline.

We sell to customers that incorporate MRAM into their products. A design win occurs after a customer has tested our product, verified that it meets the customer’s requirements and qualified our solutions for their products. We believe we are dependent on the adoption of our 256Mb and 1Gb MRAM products by our customers to secure design wins. Our customers may need several months to years to test, evaluate and adopt our product and additional time to begin volume production of the product that incorporates our solution. Due to this generally lengthy design cycle, we may experience significant delays from the time we increase our operating expenses and make investments in our products to the time that we generate revenue from sales of these products. Moreover, even if a customer selects our solution, we cannot guarantee that this will result in any sales of our products, as the customer may ultimately change or cancel its product plans, or efforts by our customer to market and sell its product may not be successful. We may not generate any revenue from design wins after incurring the associated costs, which would cause our business and operating results to suffer. Any delay in the development of our 256Mb and 1Gb MRAM products, or failure of our customers to adopt our 256Mb and 1Gb MRAM products, could inhibit revenue growth or cause declines, which would significantly harm our business and prevent us from becoming profitable.

If a current or prospective customer designs a competitor’s solution into its product, it becomes significantly more difficult for us to sell our solutions to that customer because changing suppliers involves significant time, cost, effort and risk for the customer even if our solutions are superior to other solutions and remain compatible with their product design. Our ability to compete successfully depends on customers viewing us as a stable and reliable supplier to mission critical customer applications when we have less production capacity and less financial resources compared to most of our larger competitors. If current or prospective customers do not include our solutions in their products and we fail to achieve a sufficient number of design wins, our results of operations and business may be harmed.

We rely on our relationships with OEMs and ODMs to enhance our solutions and market position, and our failure to continue to develop or maintain such relationships in the future would harm our ability to remain competitive.

We develop our products for leading OEMs and ODMs that serve a variety of end markets and are developing devices for automotive, transportation, industrial and storage applications. For each application, manufacturers create products that incorporate specialized semiconductor technology, which makers of memory products use as the basis for their products. These manufacturers set the specifications for many of the key components to be used on each generation of their products and, in the case of memory components, generally qualify only a few vendors to provide memory components for their products. As each new generation of their products is released, vendors are validated in a similar fashion. We must work closely with OEMs and ODMs to ensure our products become qualified for use in their products. As a result, maintaining close relationships with leading OEMs and ODMs that are developing devices for automotive, transportation, industrial and storage applications is crucial to the long-term success of our business. We could lose these relationships for a variety of reasons, including our failure to qualify as a vendor, our failure to demonstrate the value of our new solutions, declines in product quality, or if OEMs or ODMs seek to work with vendors with broader product suites, greater production capacity or greater financial resources. If our relationships with key industry participants were to deteriorate or if our solutions were not qualified by our customers, our market position and revenue could be materially and adversely affected.

19

The loss of one or several of our customers or reduced orders or pricing from existing customers may have a significant adverse effect on our operations and financial results.

We have derived and expect to continue to derive a significant portion of our revenues from a small group of customers during any particular period due in part to the concentration of market share in the semiconductor industry. Our four largest end customers together accounted for 32% of our total revenue for the year ended December 31, 2016, but none of these customers individually accounted for more than 10% of our total revenue during the period. Our four largest end customers together accounted for 41% of our total revenue for the year ended December 31, 2015, and two customers each accounted for more than 10% of our total revenue during the period. Our four largest end customers together accounted for 37% of our total revenue for the year ended December 31, 2014, and two customers each accounted for more than 10% of our total revenue during the period. The loss of a significant customer, a business combination among our customers, a reduction in orders or decrease in price from a significant customer or disruption in any of our commercial or distributor arrangements may result in a significant decline in our revenues and could have a material adverse effect on our business, liquidity, results of operations, financial condition and cash flows.

Our results of operations can fluctuate from period to period, which could cause our share price to fluctuate.

Our results of operations have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following factors, as well as other factors described elsewhere in this report:

|

· |

the receipt, reduction, delay or cancellation of orders by large customers; |

|

· |

the gain or loss of significant customers or distributors; |

|

· |

the timing and success of our launch of new or enhanced products and those of our competitors; |

|

· |

market acceptance of our products and our customers’ products; |

|

· |

the level of growth or decline in the industrial, automotive and transportation, enterprise storage and other markets; |

|

· |

the timing and extent of research and development and sales and marketing expenditures; |

|

· |

the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

|

· |

changes in our product mix; |

|

· |

our ability to reduce the manufacturing costs of our products; |

|

· |

competitive pressures resulting in lower than expected average selling prices; |

|

· |

fluctuations in sales by and inventory levels of OEMs and ODMs that incorporate our memory products in their products; |

|

· |

cyclical and seasonal fluctuations in our markets; |

|

· |

fluctuations in the manufacturing yields of our third-party manufacturers; |

|

· |

quality issues that arise from manufacturing issues at our third-party manufacturers; |

|

· |

events that impact the availability of production capacity at our third-party subcontractors and other interruptions in the supply chain including due to geopolitical events, natural disasters, materials shortages, bankruptcy or other causes; |

|

· |

supply constraints for and changes in the cost of the other components incorporated into our customers’ products; |

|

· |

the timing of expenses related to the acquisition of technologies or businesses; |

|

· |

product rates of return or price concessions in excess of those expected or forecasted; |

|

· |

costs associated with the repair and replacement of defective products; |

|

· |

unexpected inventory write-downs or write-offs; |

20

|

· |

costs associated with litigation over intellectual property rights and other litigation; |

|

· |

the length and unpredictability of the purchasing and budgeting cycles of our customers; |

|

· |

loss of key personnel or the inability to attract qualified engineers; and |

|

· |

geopolitical events, such as war, threat of war or terrorist actions, or the occurrence of natural disasters. |