Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Yext, Inc. | a2231476zex-23_1.htm |

| EX-5.1 - EX-5.1 - Yext, Inc. | a2231476zex-5_1.htm |

| EX-4.1 - EX-4.1 - Yext, Inc. | a2231476zex-4_1.htm |

| EX-1.1 - EX-1.1 - Yext, Inc. | a2231476zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As Filed with the Securities and Exchange Commission on March 28, 2017.

Registration No. 333-216642

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

YEXT, INC.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7370 (Primary Standard Industrial Classification Code Number) |

20-8059722 (I.R.S. Employer Identification Number) |

Yext, Inc.

1 Madison Ave, 5th Floor

New York, NY 10010

(212) 994-3900

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Howard Lerman

Chief Executive Officer

Yext, Inc.

1 Madison Ave, 5th Floor

New York, NY 10010

(212) 994-3900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

Larry W. Sonsini, Esq. Robert D. Sanchez, Esq. Michael C. Labriola, Esq. Megan J. Baier, Esq. Wilson Sonsini Goodrich & Rosati, Professional Corporation 1301 Avenue of the Americas New York, NY 10019 (212) 999-5800 |

Ho Shin, Esq. EVP & General Counsel Yext, Inc. 1 Madison Ave, 5th Floor New York, NY 10010 (212) 994-3900 |

Brent B. Siler, Esq. Brian F. Leaf, Esq. Nicole C. Brookshire, Esq. Cooley LLP 1299 Pennsylvania Avenue, NW Suite 700 Washington, DC 20004 (202) 842-7800 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.001 per share |

12,075,000 | $10.00 | $120,750,000 | $13,995 | ||||

|

||||||||

- (1)

- Includes

1,575,000 shares that the underwriters have the option to purchase.

- (2)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended.

- (3)

- The Registrant previously paid a registration fee of $11,590 in connection with the initial filing of this Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to completion)

Issued March 28, 2017

10,500,000 Shares

COMMON STOCK

Yext, Inc. is offering 10,500,000 shares of its common stock. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price of the common stock will be between $8.00 and $10.00 per share.

We have applied to list our common stock on the New York Stock Exchange under the symbol "YEXT."

We are an "emerging growth company" as defined under the federal securities laws. Investing in our common stock involves risks. See "Risk Factors" beginning on page 13.

PRICE $ A SHARE

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Yext |

|||

|---|---|---|---|---|---|---|

| | | | | | | |

Per Share |

$ | $ | $ | |||

Total |

$ | $ | $ |

(1) See "Underwriting" for a description of compensation payable to the underwriters.

We have granted the underwriters an option to purchase up to an additional 1,575,000 shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2017.

| MORGAN STANLEY | J.P. MORGAN | RBC CAPITAL MARKETS |

| PACIFIC CREST SECURITIES a division of KeyBanc Capital Markets |

PIPER JAFFRAY |

, 2017

You should rely only on the information contained in this prospectus and in any free writing prospectus. We and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus. We and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Through and including , 2017 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

i

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before buying shares in this offering. Therefore, you should read this entire prospectus carefully, including the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections and our consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding to purchase shares of our common stock. Unless the context requires otherwise, the words "we," "us," "our" and "Yext" refer to Yext, Inc. and its wholly owned subsidiaries.

Overview

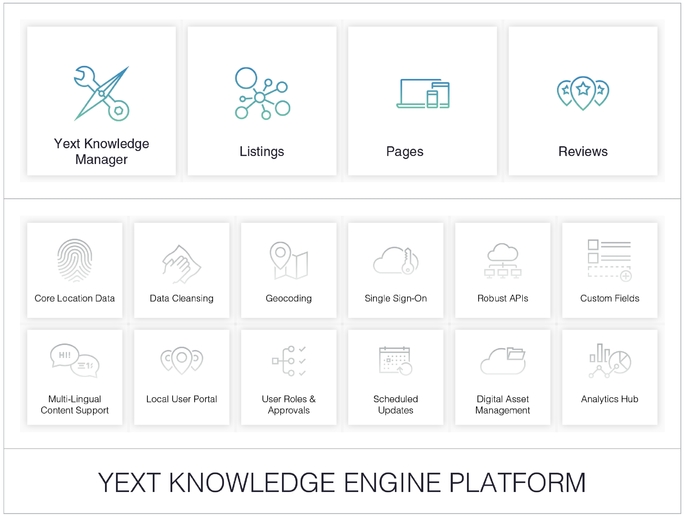

Yext is a knowledge engine. Our platform lets businesses manage their digital knowledge in the cloud and sync it to over 100 services, including Apple Maps, Bing, Cortana, Facebook, Google, Google Maps, Instagram, Siri and Yelp. Digital knowledge is the structured information that a business wants to make publicly accessible. For example, in food service, the address, phone number or menu details of a restaurant; in healthcare, the health insurances accepted by a physician or the precise drop-off point of the emergency room at a hospital campus; or in finance, the ATM locations, retail bank holiday hours or insurance agent biographies. We believe a business is the ultimate authority on its own digital knowledge, and it is our mission to put that business in control of it everywhere.

Intelligent search, which are searches of digital knowledge that combine context and intent, has grown significantly in recent years. In particular, searches that return maps in the results have grown significantly with the proliferation of mobile devices and now make up 30% of all mobile searches. For example, searches for categories, such as "restaurants", "wine", "insurance", "wealth advisor" or "doctor", or for specific brands, such as "Marriott", "McDonald's" or "Home Depot", return maps directly in the search results. The source of the results for each of these searches is not a web page—it is structured data. Businesses and service providers want their information to be accurate, compelling and more prominent than that of their competitors when consumers look for them on search platforms, applications, social media, connected devices and other digital sources. Our solution drives commerce by providing real-time digital knowledge that allows consumers to find the businesses and service providers that are most relevant to them.

The vast majority of digital knowledge provided by searches currently comes from third-party sources such as data aggregators, governmental agencies and consumers. The net result of this third-party sourcing has been to produce "best guess" data that can often miss or misstate the true digital knowledge about businesses worldwide. We have built our business on the fundamental premise that the best source of accurate and timely digital knowledge about a business is the business itself. We have established direct data integrations between our software and the over 100 members of our PowerListings Network that end consumers around the globe use to discover new businesses, read reviews and find accurate answers to their queries. These integrations include Apple Maps, Bing, Facebook, Google, Google Maps, Instagram, Yelp and many others. Our platform uses our patented Match & Lock process to ensure that our customers' digital knowledge is in sync across our PowerListings Network. Businesses can directly control their own digital knowledge rather than leaving it in the hands of third parties, thereby making our platform the system of record for such vital knowledge.

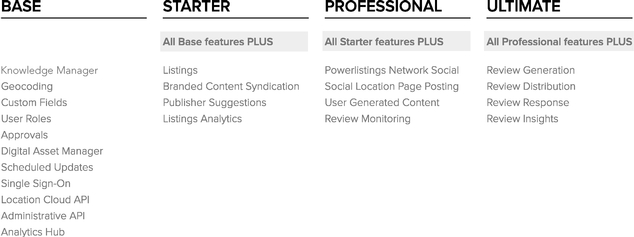

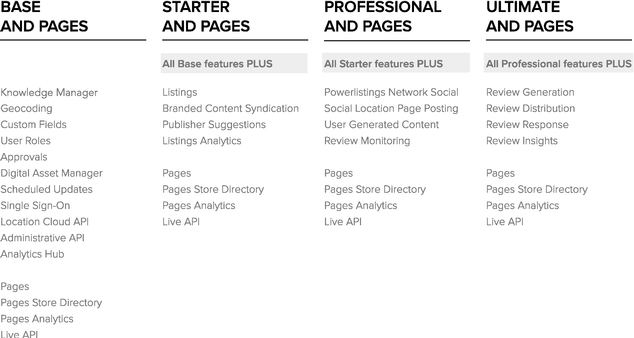

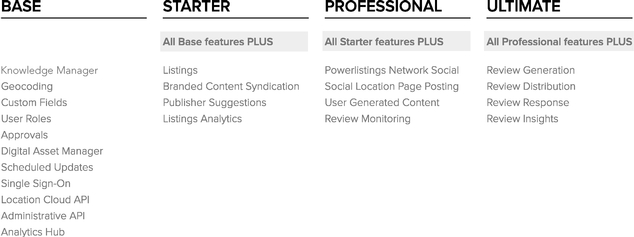

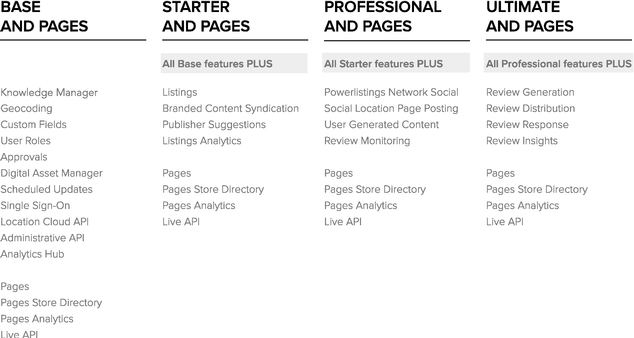

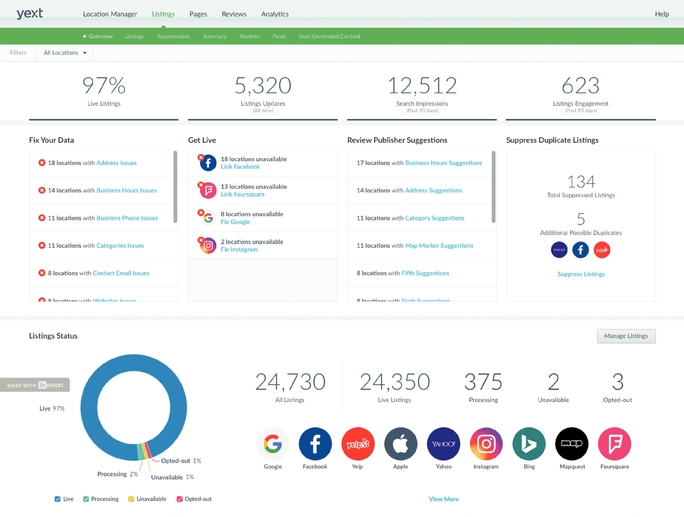

We offer our cloud-based digital knowledge platform, the Yext Knowledge Engine, to customers on a subscription basis in several packages. Each package provides varying levels of access to our key Listings, Pages, Reviews and other features. Our Listings feature provides customers with control over their digital presence, including their location and other related attributes published on the most widely used third-party applications. Our Pages feature allows customers to establish landing pages on their own websites and to manage rich and compelling digital content on those sites, including calls to action. Our Reviews

1

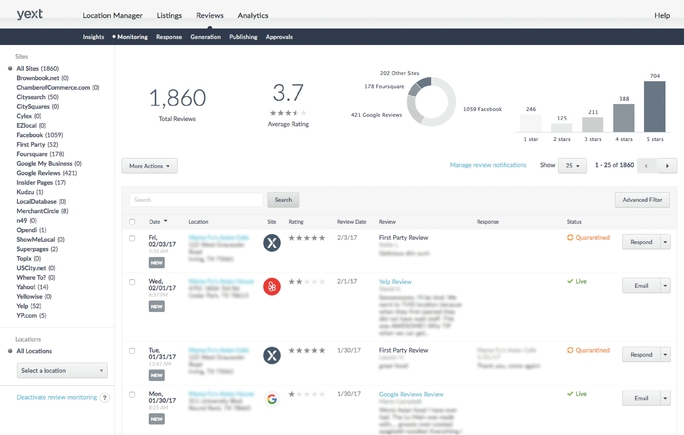

feature enables customers to encourage and facilitate reviews from end consumers, thereby increasing the quantity and quality of the reviews available to potential consumers and improving the search relevance for businesses on our PowerListings Network.

Our customers use our platform to manage their digital knowledge covering over 17 million attributes and over 925,000 locations. These customers include leading businesses in a diverse set of industries, such as healthcare and pharmaceuticals, retail, financial services, manufacturing and technology. Our customers include AutoZone, Ben & Jerry's, Best Buy, Citi, Denny's, Farmers Insurance Group, H&R Block, HCA, Infiniti, Marriott, Michael's, McDonald's, Rite Aid, Steward Health Care and many others.

We believe that the market for digital knowledge management is a large and mostly untapped market. As a subset of digital knowledge, we estimate that there are currently over 100 million potential business locations and points of interest in the world that could benefit from our platform, representing an estimated addressable market, solely with respect to locations, of approximately $10 billion annually for our existing platform in 2017. Our estimate however is subject to risks and uncertainties as described in "Risk Factors—Risks Related to Our Business and Industry—If the assumptions we use to estimate the size of our total addressable market are inaccurate, our future growth may be affected."

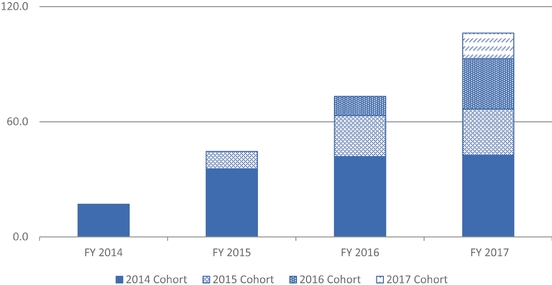

We have experienced rapid growth in recent periods. For our fiscal years ended January 31, 2015, 2016 and 2017, our revenues were $60.0 million, $89.7 million and $124.3 million, respectively, our net loss was $17.3 million, $26.5 million and $43.2 million, respectively, and our non-GAAP net loss1 was $14.4 million, $22.0 million and $33.3 million, respectively.

Industry Background

Consumer Discovery Has Changed. Intelligent search has grown significantly in recent years. Businesses are now able to leverage intelligent search to help individuals discover what they need without having to necessarily visit the business's own website and return digital knowledge, such as location and other related data, for nearly any search.

Knowledge Is Fundamental. Businesses spend significant sums on developing their brands and creating product and market awareness. When potential consumers reached through those efforts want to make a purchase, businesses need their digital knowledge to be widely available and correct so that they can be found efficiently. Inaccurate or incomplete information results in lost sales opportunities, negative brand experiences and organizational inefficiencies.

Intelligent Search Drives Commerce. According to the U.S. Census Bureau, approximately 92% of U.S. retail sales occurred at physical locations during 2016. When searching for a business, consumers need to know many relevant attributes such as the address, phone number, menu options of a restaurant or operating hours. According to Think with Google, 76% of location searches in the United States in May 2016 resulted in visits to a business within one day of the search and 28% of those searches resulted in a purchase.

Managing Digital Knowledge Is Challenging. Many businesses lack the capabilities to effectively control, structure and manage digital knowledge across the digital ecosystem where consumers discover businesses. This lack of management capability is due to several factors:

- •

- Lack of Control of Digital Knowledge. The vast majority of digital knowledge currently comes from third-party sources such as data aggregators, governmental agencies and consumers. The net result

- 1

- Non-GAAP net loss is a financial measure not calculated in accordance with accounting principles generally accepted in the United States, or GAAP. A reconciliation of this non-GAAP measure to the most directly comparable GAAP-based measure along with a summary of the definition and material limitations of this measure are included under "Selected Consolidated Financial Data—Non-GAAP Net Loss."

2

- •

- Attributes that Comprise Digital Knowledge Are Expanding. Businesses need

to be able to define their digital knowledge using detailed, category-specific attributes about their business, ranging from name, address and phone number to more detailed items such as whether a

hotel accepts pets, a restaurant has a gluten-free menu or a doctor accepts certain insurance plans.

- •

- Digital Knowledge Is Dynamic. Digital knowledge increasingly includes

dynamic attributes that change frequently, such as opening hours, holiday hours, menus and promotions.

- •

- Digital Knowledge Exists in Many Places. The number of applications that leverage digital knowledge continues to increase, both from the proliferation of vertical search applications and intelligent search using mobile, voice-based and in-app search. Businesses need an efficient way to manage their digital knowledge across a multitude of services, such as Google, Facebook and Yelp.

of this third-party sourcing has been to produce "best guess" data that can often miss or misstate the true digital knowledge for businesses worldwide.

Businesses Need to Provide Customers with Relevant and Actionable Information. When consumers search for businesses, they expect to be able to quickly find all of the relevant information they need about those organizations, such as a description, the nearest store if it is a chain, the actual location on a map, the ability to make an appointment if it is a professional service provider, such as an insurance agent, or the ability to search for a menu item if it is a restaurant.

Existing Alternatives Are Inadequate. Traditional methods for managing digital knowledge about location include paper or legacy software-based solutions, such as word processors or spreadsheets. Simply managing and updating the few core search engines, such as Google and Bing, through these traditional methods is already very challenging, and becomes even more so when implementing updates on newer services such as Instagram, Snapchat and Uber.

Our Solution—the Yext Knowledge Engine

We offer our Yext Knowledge Engine, a cloud-based global platform that enables businesses to control and manage their digital knowledge and make it available through our PowerListings Network of over 100 third-party maps, apps, search engines, intelligent GPS systems, digital assistants, vertical directories and social networks in a complete, up to date and accurate manner. Our platform serves as the system of record for the vital information used internally to execute operations and distributed externally across the web, mobile listings, search platforms, applications, social media and connected devices that leverage intelligent search. The core of our platform is our global Knowledge Engine, which powers our Listings, Pages and Reviews features. We currently offer subscription packages that include some or all of these and other features based on the edition purchased. The key features of our platform are as follows:

- •

- Our Listings feature allows customers to manage their location-related data across our PowerListings Network on the most widely used maps,

apps, search engines, intelligent GPS systems, digital assistants, vertical directories and social networks from a single source.

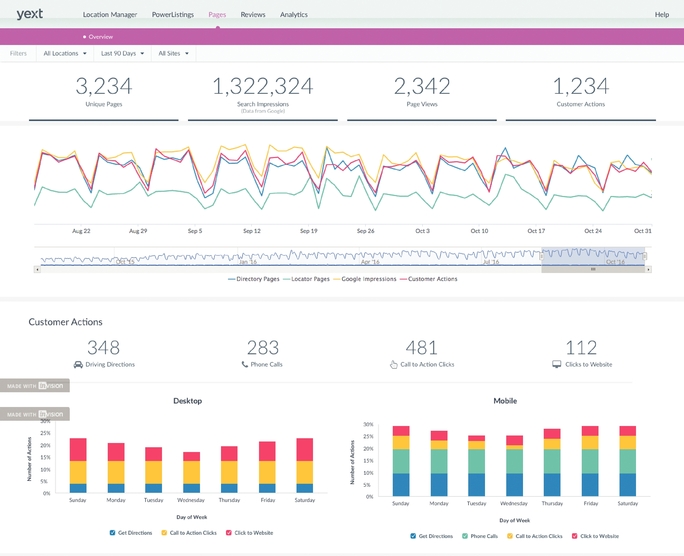

- •

- Our Pages feature allows customers to establish landing pages for their business on their own websites, including for individual locations or

for individual professional service providers that vary by location, and to manage rich and compelling digital content on those sites, including calls to action.

- •

- Our Reviews feature enables customers to encourage and facilitate reviews from their end consumers, thereby increasing the quantity and quality of the reviews available to potential consumers, the tools to manage their reviews from multiple sources from a single location and the ability to help strengthen their reviews across our PowerListings Network.

3

Key Benefits of Our Platform

Our global Knowledge Engine provides the following benefits depending on a customer's subscription level and enabled solutions and features:

- •

- Control over Digital

Knowledge. Our platform is the system of record that enables our customers to control their digital knowledge and be the single source of truth

for their information everywhere. Our customers quickly gain control of their digital knowledge, such as their location data, listings and related attributes, resulting in the elimination of

inaccurate and duplicate data and the ability to seamlessly and simultaneously update data across our PowerListings Network.

- •

- Flexibility for Optimized Management of Digital Knowledge

Attributes. Our technology enables businesses to develop structured digital knowledge using standardized best practices that suit their business

needs and is optimized for search and discovery. Our solution gives businesses the ability to organize, edit and update digital knowledge based on numerous standard attribute fields, such as address

or operating hours, and increase the depth of their digital knowledge using our extensible custom fields, such as menu options or accepted insurance plans.

- •

- Direct Integrations with the Most Relevant

Services. Our platform, coupled with our PowerListings Network of over 100 maps, apps, search engines, intelligent GPS systems, digital

assistants, vertical directories and social networks, provides our customers with the ability to update their digital knowledge and content across this network with a single click.

- •

- Ability to Create Compelling Local Pages for

Consumers. Our Pages feature enables businesses to create a compelling online consumer experience utilizing rich content that accurately

represents their brands and establishes a consumer call to action. With Pages, our platform automatically creates and publishes individual pages that a business can manage, such as separate pages for

each store, insurance agent or doctor's office. Our content customization technology allows customers to publish information that is easily crawled by search engines, rich in content and optimized for

any device. Customer pages built with our Pages feature can also include calls to action, which allow customers to embed applications that permit end consumers to book an appointment with a financial

advisor or order a meal. Our software allows those calls to action to be integrated with existing enterprise systems used by the business.

- •

- Ability to Drive More Reviews and Increase Consumer

Engagement. Our Reviews feature helps our customers gather additional genuine consumer reviews, which typically raises their published overall

consumer satisfaction score by encouraging consumers who may not otherwise write reviews to do so. This increased review activity helps improve our customers' prominence in intelligent search results

on providers in our PowerListings Network and can help drive incremental sales.

- •

- Analytics. Our platform's

advanced analytics informs businesses as to their digital public presence.

- •

- Global Reach and Local Expertise. Our platform integrates with both global and country-specific search engines and applications, accepts international address and phone number data, and allows local employees to contribute individual expertise, providing a consumer experience that respects local languages, address formats and customs.

Our Competitive Strengths

We believe our competitive strengths include:

- •

- Leading Technology Platform. Our solution was built from the ground up as a cloud application. As a result, our total cost of ownership for a customer is low, our deployment times are short, and we can easily deploy the latest updates and upgrades to all of our customers via our cloud-based platform. Our platform currently supports over 17 million digital knowledge attributes such as address, business hours, menus and professional credentials.

4

- •

- Extensive PowerListings

Network. We have deep technology integrations with over 100 maps, apps, search engines, intelligent GPS systems, digital assistants,

vertical directories and social networks, such as Apple Maps, Bing, Facebook, Google, Google Maps, Instagram and Yelp. We have established strong, long-term relationships with many of our

PowerListings Network services. Direct integrations and custom application program interfaces, or APIs, between our Knowledge Engine and our PowerListings Network services position us to deliver

control and value to our customers.

- •

- Authoritative and Growing Data

Set. We provide integrated application providers and their end consumers with digital knowledge on over 17 million attributes and

over 925,000 locations as of January 31, 2017. Many of these attributes change frequently, such as holiday hours or menus, and our platform allows our customers to ensure that their

digital knowledge data is maintained accurately and is complete. This high-quality data set is valuable to apps that want to provide their users with accurate and complete information.

- •

- Focus on Product Innovation. We

have a history of adding innovative new features to our platform. For example, we initially created Listings in 2011, Pages in 2014 and Reviews in 2016. We also have expanded our platform to work with

new application types as they have emerged, such as Snapchat and Uber.

- •

- Global Footprint. We have

integrated with global search engines and map providers such as TomTom, thereby allowing our customers to control their digital knowledge data worldwide and make it available to consumers around the

globe. Our platform enables our customers to publish digital knowledge in over 160 countries and in over 90 languages and dialects. For example, an individual searching for a restaurant in Quebec

would be provided with results in French as well as in English. Our platform is also able to distinguish between differing address formats across countries.

- •

- Strong Brand and Thought Leadership. We believe we are a recognized brand and thought leader in the field of digital knowledge management.

Growth Strategy

The key elements of our strategy include:

- •

- Grow Our Customer Base. We

believe that there is a substantial opportunity to continue to increase the size of our customer base across a broad range of industries and companies and to include more professional service

providers, such as individual doctors, insurance agents and financial services professionals, in addition to businesses. We also plan to continue to invest in our direct sales force to grow our

customer base, both domestically and internationally.

- •

- Continue to Enter Attractive Industry

Verticals. We have addressed specific industry segments, such as financial services and healthcare, and plan to continue this go-to-market

strategy.

- •

- Expand Existing Customer

Relationships. We plan to expand our relationships with existing customers. For example, some businesses may initially purchase our solution only

for their stores in a particular country. We also plan to up-sell additional features such as Pages and Reviews to existing customers, who generally start with our entry-level Listings feature.

- •

- Expand Internationally. We

believe that we have a significant opportunity to expand the use of our software outside the United States. We derived more than 6% of our revenues from non-U.S. sales in the fiscal year ended

January 31, 2017, and we believe there are substantial opportunities to increase sales to customers outside of the United States as well as to help our existing U.S.-based customers manage data

for more of their international business. We have an established presence in the United Kingdom and we intend to further expand our footprint in Europe and other regions.

- •

- Develop and Market New Products and Features. We are committed to developing and marketing innovative capabilities for our customers to meet their digital knowledge management needs. We

5

- •

- Extend the PowerListings

Network. We plan to continue to expand our PowerListings Network. We are increasing our focus on adding more industry vertical-specific and

international services to our PowerListings Network as well as including new services that may become more commonly used in the future.

- •

- Expand Our Developer Platform. We have recently opened up our Knowledge Engine to developers with the introduction of our Yext/Developer platform. Yext/Developer offers our customers the ability to integrate into other systems to give our customers programmatic control of their organization's digital knowledge. We believe that the introduction of our Yext/Developer platform will further expand the ways that our Knowledge Engine can be utilized and increase customer retention.

will continue to invest in platform and features development to help our customers better manage their digital knowledge.

Risks Related to Our Business

Investing in our common stock involves risk. You should carefully consider all the information in this prospectus prior to investing in our common stock. These risks are discussed more fully in the section entitled "Risk Factors" immediately following this prospectus summary. These risks and uncertainties include, but are not limited to, the following:

- •

- we have a history of losses and may not achieve profitability in the future;

- •

- we have a limited operating history as a digital knowledge software company, which makes it difficult to predict our future operating results;

- •

- we have recently experienced rapid growth and significant changes to our organization and structure and may not be able to effectively manage

such growth;

- •

- failure to adequately expand our sales force will impede our growth;

- •

- we are in the process of expanding our international operations, which exposes us to significant risks;

- •

- our growth depends in part on the success of our strategic relationships with existing and prospective PowerListings Network application

providers;

- •

- we do not have a long history with our subscription or pricing models and changes could adversely affect our operating results;

- •

- our success depends on a fragmented internet environment for finding information about physical business locations;

- •

- our platform faces intense competition in the marketplace;

- •

- business and professional service providers may not widely adopt our platform to manage the important aspects of their digital knowledge, which

would limit our ability to grow our business; and

- •

- because we recognize revenue from subscriptions for our platform over the term of the subscription, downturns or upturns in new business may not be immediately reflected in our operating results.

Ownership of Capital Stock

Upon the completion of this offering, our executive officers, directors and current beneficial owners of 5% or more of our common stock, together with their respective affiliates, will beneficially own, in the aggregate, approximately 73,807,346 shares of our common stock, or approximately 82% of our

6

outstanding common stock, assuming no exercise of the underwriters' option to purchase additional shares of our common stock in this offering.

Company Information

We were incorporated in 2006 as a Delaware corporation. Our headquarters are located at 1 Madison Avenue, 5th Floor, New York, NY 10010 and our telephone number is (212) 994-3900. You can access our website at www.yext.com. The information contained on, or that can be accessed through, our website is not part of this prospectus or the registration statement of which it forms a part and is not incorporated by reference in this prospectus or the registration statement of which it forms a part.

"Yext" and "PowerListings" as well as the Yext logo are registered trademarks in the United States and, in some cases, in certain other countries. Our other unregistered trademarks and service marks in the United States include, but are not limited to, "LocationWorld" and "We put business on the map." This prospectus also contains trademarks of other persons and entities.

Implications of Being an Emerging Growth Company

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

- •

- an exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting;

- •

- an exemption from implementation of new or revised financial accounting standards until they would apply to private companies and from

compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation;

- •

- reduced disclosure obligations regarding executive compensation; and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions.

We have elected to take advantage of the extended transition period to comply with new or revised accounting standards and to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies, which may make comparison of our financials to those of other public companies more difficult. Additionally, because we have taken advantage of certain reduced reporting requirements, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

7

Common stock offered by us |

10,500,000 shares | |

Common stock outstanding after this offering |

85,489,470 shares |

|

Over-allotment option |

1,575,000 shares |

|

Use of proceeds |

We estimate that the net proceeds from our sale of shares of common stock in this offering will be approximately $83.5 million (or approximately $96.7 million if the underwriters exercise their over-allotment option in full), based upon an assumed initial public offering price of $9.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use the net proceeds from this offering for working capital, capital expenditures and other general corporate purposes. We may also use a portion of our net proceeds to fund potential acquisitions of, or investments in, technologies or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or make any such investments. See "Use of Proceeds." |

|

New York Stock Exchange symbol |

"YEXT" |

|

Risk factors |

See "Risk Factors" and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

The number of shares of common stock that will be outstanding after this offering is based on 74,989,470 shares outstanding as of January 31, 2017. This number excludes:

- •

- 27,420,108 shares of common stock issuable upon exercise of options that were outstanding as of January 31, 2017 at a weighted-average

exercise price of $4.24 per share;

- •

- 330,000 shares of common stock issuable upon the vesting and settlement of restricted stock units that were outstanding as of

January 31, 2017;

- •

- 195,937 shares of common stock issuable upon exercise of warrants that were outstanding as of January 31, 2017 at a weighted-average

exercise price of $1.65 per share;

- •

- 799,250 shares of common stock issuable upon the exercise of options granted after January 31, 2017 at a weighted-average exercise price

of $8.64 per share;

- •

- 6,913,791 shares of common stock reserved for future issuance under our 2016 Equity Incentive Plan, which became effective in December 2016

(after giving effect to the shares of our common stock issuable upon the exercise of options to purchase 799,250 shares of common stock granted after January 31, 2017), plus any shares returned

to our 2008 Equity Incentive Plan as the result of expiration or termination of options or other awards; and

- •

- 1,500,000 shares of common stock reserved for future issuance under our 2017 Employee Stock Purchase Plan.

8

We refer to our Series A Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D Preferred Stock, Series E Preferred Stock and Series F Preferred Stock herein as our "convertible preferred stock." Except as otherwise indicated, all information in this prospectus assumes:

- •

- the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 43,594,753 shares of common stock, which will

occur automatically upon the closing of this offering;

- •

- the automatic conversion of outstanding warrants exercisable for shares of our convertible preferred stock into warrants exercisable for

110,937 shares of our common stock upon the closing of this offering;

- •

- the effectiveness of our amended and restated certificate of incorporation, which we will file immediately prior to the closing of this

offering;

- •

- no exercise of outstanding options and warrants and no settlement of outstanding restricted stock units; and

- •

- no exercise of the underwriters' over-allotment option.

9

SUMMARY CONSOLIDATED FINANCIAL DATA

In the following tables, we provide our summary consolidated financial data. You should read the summary historical financial data set forth below in conjunction with our consolidated financial statements, the notes to our consolidated financial statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus. Our fiscal year ends on January 31. References to fiscal year 2017, for example, refer to the fiscal year ended January 31, 2017.

The historical statement of operations data for the fiscal years ended January 31, 2015, 2016 and 2017 and balance sheet data as of January 31, 2017 have been derived from our audited consolidated financial statements that are included elsewhere in this prospectus.

Our historical results are not necessarily indicative of our future results. The summary consolidated financial data in this section are not intended to replace the consolidated financial statements and are qualified in their entirety by the consolidated financial statements and related notes included elsewhere in this prospectus.

10

| |

Fiscal year ended January 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2016 | 2017 | |||||||

| |

(in thousands, except share and per share data) |

|||||||||

Consolidated Statement of Operations Data: |

||||||||||

Revenues |

$ | 60,002 | $ | 89,724 | $ | 124,261 | ||||

Cost of revenues(1) |

24,832 | 31,033 | 36,950 | |||||||

| | | | | | | | | | | |

Gross profit |

35,170 | 58,691 | 87,311 | |||||||

Operating expenses: |

||||||||||

Sales and marketing(1) |

31,588 | 49,822 | 81,529 | |||||||

Research and development(1) |

11,945 | 16,201 | 19,316 | |||||||

General and administrative(1) |

8,988 | 18,806 | 29,166 | |||||||

| | | | | | | | | | | |

Total operating expenses |

52,521 | 84,829 | 130,011 | |||||||

| | | | | | | | | | | |

Loss from operations |

(17,351 | ) | (26,138 | ) | (42,700 | ) | ||||

Other income (expense), net |

78 | (412 | ) | (382 | ) | |||||

| | | | | | | | | | | |

Loss from operations before income taxes |

(17,273 | ) | (26,550 | ) | (43,082 | ) | ||||

Benefit from (provision for) income taxes |

— | 55 | (68 | ) | ||||||

| | | | | | | | | | | |

Net loss |

$ | (17,273 | ) | $ | (26,495 | ) | $ | (43,150 | ) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Net loss per share attributable to common stockholders, basic and diluted(2) |

$ | (0.61 | ) | $ | (0.89 | ) | $ | (1.39 | ) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted-average number of shares used in computing net loss per share attributable to common stockholders, basic and diluted(2) |

28,519,917 | 29,917,814 | 31,069,695 | |||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

$ | (0.58 | ) | |||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted-average number of shares used in computing pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

74,664,448 | |||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Includes stock-based compensation expense as follows:

| |

Fiscal year ended January 31, |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2016 | 2017 | |||||||

| |

(in thousands) |

|||||||||

Cost of revenues |

$ | 399 | $ | 533 | $ | 590 | ||||

Sales and marketing |

920 | 1,559 | 4,359 | |||||||

Research and development |

1,104 | 1,300 | 1,954 | |||||||

General and administrative |

480 | 1,115 | 2,948 | |||||||

| | | | | | | | | | | |

Total stock-based compensation |

$ | 2,903 | $ | 4,507 | $ | 9,851 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (2)

- See Note 12, "Net Loss Per Share Attributable to Common Stockholders and Unaudited Pro Forma Net Loss Per Share," to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted net loss per common share attributable to common stockholders.

11

The following table presents our consolidated balance sheet data as of January 31, 2017:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to (i) the conversion of all then outstanding shares of our convertible preferred stock into an

aggregate of 43,594,753 shares of our common stock, which will occur automatically upon the closing of this offering; and (ii) the automatic conversion of outstanding warrants exercisable for

shares of our convertible preferred stock into warrants exercisable for 110,937 shares of our common stock immediately prior to the completion of this offering and the reclassification of the related

warrant liability to additional paid-in-capital; and

- •

- on a pro forma as adjusted basis to give further effect to the receipt by us of the net proceeds from the sale of 10,500,000 shares of common stock in this offering at an assumed initial public offering price of $9.00 per share, which is the midpoint of the estimated offering price range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| |

As of January 31, 2017 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma | Pro Forma As Adjusted(1) |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 24,420 | $ | 24,420 | $ | 108,075 | ||||

Total current assets |

61,829 | 61,829 | 145,484 | |||||||

Total assets |

86,465 | 86,465 | 167,601 | |||||||

Total liabilities |

93,605 | 92,661 | 90,312 | |||||||

Convertible preferred stock |

120,615 | — | — | |||||||

Total stockholders' (deficit) equity |

(127,755 | ) | (6,196 | ) | 77,289 | |||||

- (1)

- Each $1.00 increase or decrease in the assumed initial public offering price of $9.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease pro forma as adjusted cash and cash equivalents, total current assets, total assets and total stockholders' equity by $9.8 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. An increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease pro forma as adjusted cash and cash equivalents, total current assets, total assets and total stockholders' equity by $8.4 million, assuming an initial public offering price of $9.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus.

The pro forma as adjusted balance sheet data is presented for informational purposes only and does not purport to represent what our consolidated financial position actually would have been had the transactions reflected occurred on the date indicated or to project our financial condition as of any future date.

Non-GAAP Net Loss

In addition to our financial results determined in accordance with U.S. generally accepted accounting principles, or GAAP, we believe that non-GAAP net loss is useful in evaluating our operating performance. Non-GAAP net loss is a financial measure not calculated in accordance with GAAP. We define non-GAAP net loss as our GAAP net loss as adjusted to exclude the effects of stock-based compensation expenses. We regularly review non-GAAP net loss as we evaluate our business.

A reconciliation of this non-GAAP measure to the most directly comparable GAAP-based measure, along with a summary of the material limitations of this measure, are included under "Selected Consolidated Financial Data—Non-GAAP Net Loss".

| |

Fiscal year ended January 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2016 | 2017 | |||||||

| |

(in thousands) |

|||||||||

Non-GAAP net loss |

$ | (14,370 | ) | $ | (21,988 | ) | $ | (33,299 | ) | |

12

An investment in our common stock offered by this prospectus involves a substantial risk of loss. You should carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to purchase shares of our common stock. The occurrence of any of the following risks could materially adversely affect our business, financial condition or operating results. In that case, the trading price of our common stock could decline, and you may lose part or all of your investment.

Risks Related to Our Business and Industry

We have a history of losses and may not achieve profitability in the future.

We generated a net loss of $17.3 million, $26.5 million and $43.2 million in fiscal years 2015, 2016 and 2017, respectively. As of January 31, 2017, we had an accumulated deficit of $166.9 million, reflecting our losses recognized historically on a GAAP basis. We will need to generate and sustain increased revenue levels in future periods to become profitable, and, even if we do, we may not be able to maintain or increase our level of profitability. As a result, we may continue to experience operating losses for the indefinite future. Further, we expect our operating expenses to increase over the next several years as we hire additional personnel, expand our distribution channels, develop our technology and new features and face increased compliance costs associated with growth and entry into new markets and geographies and operations as a public company. If our revenue does not increase to offset these and other potential increases in operating expenses, we may not be profitable in future periods. If we are unable to achieve and sustain profitability, the market price of our common stock may significantly decrease.

We have a limited operating history as a digital knowledge software company, which makes it difficult to predict our future operating results.

We were incorporated in 2006 and originally operated as an advertising services company. Our business has evolved several times since then. For example, we sold our advertising business to IAC/InterActiveCorp in 2012 to focus our operations on becoming a leading digital knowledge software company. Many of the most popular features of our platform have only been launched in the past few years. Our Listings feature was launched in 2011, our Pages feature was launched in 2014, and our Reviews feature was launched in 2016.

As a result of our limited operating history and recent changes to our platform and our sales model, our ability to forecast our future operating results is limited and subject to a number of uncertainties, including our ability to plan for and model our future growth. The dynamic nature of our business and our industry may make it difficult to evaluate our current business and future prospects, and as a result our historical performance should not be considered indicative of our future performance. We have encountered and will encounter risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as the risks and uncertainties described in this prospectus. If our assumptions regarding these risks and uncertainties are incorrect or change due to changes in our industry, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations and our business could suffer.

We have recently experienced rapid growth and significant changes to our organization and structure and may not be able to effectively manage such growth.

Our headcount and operations have grown substantially in recent years. We increased the number of our full-time employees from over 450 as of January 31, 2016 to over 630 as of January 31, 2017 and have hired several members of our senior management team in recent years.

We believe that our corporate culture has been a critical component of our success. We have invested substantial time and resources in building our team and nurturing our culture. As we expand our business

13

and operate as a public company, we may find it difficult to maintain our corporate culture while managing our personnel growth. Any failure to manage our anticipated growth and organizational changes in a manner that preserves the key aspects of our culture could hurt our chance for future success, including our ability to recruit and retain personnel, and effectively focus on and pursue our corporate objectives.

In addition, to manage the expected growth of our headcount and operations, we will need to continue to improve our information technology infrastructure and our operational, financial and management systems and procedures. We have implemented many of these systems and procedures only recently, and they may not work as we expect or at all. Our anticipated additional headcount and capital investments will increase our costs, which will make it more difficult for us to address any future revenue shortfalls by reducing expenses in the short term.

Finally, in order to successfully manage our rapid growth, our organizational structure has become more complex. We have added personnel and may need to continue to scale and adapt our operational, financial and management controls, as well as our reporting systems and procedures. The expansion of our systems and infrastructure may require us to commit additional financial, operational and management resources before our revenue increases and without any assurances that our revenue will increase. If we fail to successfully manage our growth, we likely will be unable to successfully execute our business strategy, which could have a negative impact on our business, operating results and financial condition.

Failure to adequately expand our sales force will impede our growth.

Our revenue growth is substantially reliant on our sales force. Our sales process is relationship-driven, which requires a significant sales force. While we plan to continue to expand our direct sales force, both domestically and internationally, we have historically had difficulty recruiting a sufficient number of sales personnel. If we are unable to adequately scale our sales force, we will not be able to reach our market potential and execute our business plan.

Identifying and recruiting qualified sales personnel and training them on our products requires significant time, expense and attention. Our financial results will suffer if our efforts to expand and train our direct sales force do not generate a corresponding increase in revenue. In particular, if we are unable to hire, develop and retain talented sales personnel or if new direct sales personnel are unable to achieve desired productivity levels in a reasonable period of time, we may not be able to realize the expected benefits of this investment or increase our revenue.

We are in the process of expanding our international operations, which exposes us to significant risks.

In 2014, we opened our first office outside the United States, and we intend to continue to expand our operations abroad. Our revenues from non-U.S. operations has grown from an immaterial amount of our total revenues in fiscal year 2015 to more than 6% of our total revenues in fiscal year 2017. Our international expansion has created and will create significant challenges for our management, administrative, operational and financial infrastructure. Operating in international markets requires significant resources and management attention and will subject us to regulatory, economic and political risks in addition to those we already face in the United States. Because of our limited experience with international operations and developing and managing sales in international markets, our international expansion efforts may not be successful.

Some of the specific risks we will face in conducting business internationally that could adversely affect our business include:

- •

- the difficulty of recruiting and managing international operations and the increased operations, travel, infrastructure and legal compliance

costs associated with numerous international locations;

- •

- our ability to effectively price our multi-tiered subscriptions in competitive international markets;

14

- •

- our ability to identify and manage sales partners;

- •

- new and different sources of competition in each country or region;

- •

- potentially greater difficulty collecting accounts receivable and longer payment cycles;

- •

- the need to adapt and localize our products for specific countries, including differences in the location attributes and formats used in each

country;

- •

- the need to offer customer support in various languages;

- •

- difficulties in understanding and complying with local laws, regulations and customs in foreign jurisdictions;

- •

- expanded demands on, and distraction of, senior management;

- •

- difficulties with differing technical and environmental standards, data privacy and telecommunications regulations and certification

requirements outside the United States;

- •

- varying levels of internet technology adoption and infrastructure;

- •

- tariffs and other non-tariff barriers, such as quotas and local content rules;

- •

- more limited protection for intellectual property rights in some countries;

- •

- adverse tax consequences;

- •

- fluctuations in currency exchange rates, which could increase the price of our products outside of the United States, increase the expenses of

our international operations and expose us to foreign currency exchange rate risk;

- •

- currency control regulations, which might restrict or prohibit our conversion of other currencies into U.S. dollars;

- •

- restrictions on the transfer of funds;

- •

- deterioration of political relations between the United States and other countries; and

- •

- political or social unrest or economic instability in a specific country or region in which we operate, which could have an adverse impact on our operations in that location.

Also, our network service provider fees outside of the United States are generally higher than domestic rates, and our gross margin may be affected and fluctuate as we expand our operations and customer base worldwide.

Our failure to manage any of these risks successfully could harm our international operations, and adversely affect our overall business, operating results and financial condition.

Some of our resellers and PowerListings Network application providers also have international operations and are subject to the risks described above. Even if we are able to successfully manage the risks of international operations, our business may be adversely affected if these resellers and application providers are not able to successfully manage these risks.

Our growth depends in part on the success of our strategic relationships with existing and prospective PowerListings Network application providers.

We have established strategic relationships with over 100 third-party application providers, including Apple Maps, Bing, Facebook, Google, Google Maps, Instagram, Yelp and many others, which comprise our PowerListings Network. These application providers provide us with direct access to update content on their websites and applications. This direct access enables us to control our customers' business listings on the PowerListings Network application providers' websites and applications and to push real-time or nearly

15

real-time updates to those business listings. If we were to lose access to these applications, either in whole or in part, our PowerListings Network would not be as efficient, accurate or competitive.

In order to grow our business, we anticipate that we will need to continue to maintain and potentially expand these relationships. We may be unsuccessful in renegotiating our agreements with these third-party application providers or third-party application providers may insist on fees to access their applications. Additionally, our contracts with these third-party application providers are generally cancellable upon 30 days' notice. We believe we will also need to establish new relationships with third-party application providers, including third-party application providers in new geographic markets that we enter, and third-party application providers that may emerge in the future as leading sources of digital knowledge for end consumers. Identifying potential third-party application providers, and negotiating and documenting relationships with them, requires significant time and resources. Our competitors may be more effective than us in providing incentives to application providers to favor their products or services or to prevent or reduce subscriptions to our products. In addition, the acquisition of a competitor by one of our third-party application providers could result in the termination of our relationship with that third-party application provider, which, in turn, could lead to decreased customer subscriptions. If we are unsuccessful in establishing or maintaining our relationships with third-party application providers, our ability to compete in the marketplace or to grow our revenues could be impaired and our operating results could suffer.

We do not have a long history with our subscription or pricing models and changes could adversely affect our operating results.

We have limited experience with respect to determining the optimal prices and contract length for our platform. As the markets for our features grow, as new competitors introduce new products or services that compete with ours or reduce their prices, or as we enter into new international markets, we may be unable to attract new customers or retain existing customers at the same price or continue to migrate customers to our multi-tiered subscription model. Moreover, large customers, which have historically been the focus of our direct sales efforts, may demand greater price discounts.

As we expand internationally, we also must determine the appropriate price to enable us to compete effectively internationally. In addition, if the mix of features we sell changes, then we may need to, or choose to, revise our pricing. As a result, in the future we may be required to reduce our prices or offer shorter contract durations, which could adversely affect our revenue, gross margin, profitability, financial condition and cash flow.

Our success depends on a fragmented internet environment for finding digital knowledge, particularly information about physical business locations.

We believe that our Knowledge Engine offers value to our customers in part because of the difficulty for a customer to update digital knowledge, particularly about its physical business locations and other attributes across many websites and apps, many of which are owned or controlled by different entities and receive information from a variety of sources. Industry consolidation or technological advancements could result in a small number of websites or applications emerging as the predominant sources of digital knowledge, including information about physical business locations, thereby creating a less fragmented internet environment for purposes of end consumer searches about physical business locations or digital knowledge generally. Additionally, we may enter new geographies with less fragmented internet environments. If most end consumers relied on a few websites or applications for this information, or if reliably accurate information across the most used websites and applications were generated from a single source, the need for digital business listing synchronization and our platform could decline significantly. In particular, if larger providers of internet services were able to consolidate or control key websites and apps from which end consumers seek digital knowledge, including regarding physical locations, our platform may become less necessary or attractive to our customers, and our revenue would suffer accordingly.

16

Our platform faces competition in the marketplace. If we are unable to compete effectively, our operating results could be adversely affected.

The market for our features is competitive, rapidly evolving and fragmented, and is subject to changing technology and shifting customer needs. Many vendors develop and market products and services that compete to varying extents with our features, and we expect competition in our market to intensify. Moreover, industry consolidation may increase competition. Additionally, new entrants, specifically application providers, that enter our industry through acquisitions or otherwise, would increase competition in our industry significantly.

We currently face many competitors with a variety of product offerings. These companies have developed, or are developing, products that currently, or in the future are likely to, compete with some or all of our features. Also, a number of potential new competitors may have longer operating histories, greater name recognition, more established customer bases or significantly greater financial, technical, marketing and other resources than we do. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. We could lose customers if our competitors introduce new competitive products, add new features to existing competitive products, acquire competitive products, reduce prices, form strategic alliances with other companies or are acquired by third parties with greater available resources. If our competitors' products, services or technologies become more accepted than our features, if they are successful in bringing their products or services to market earlier than we bring our features to market, or if their products or services are more technologically capable than our features, then our revenue growth could be adversely affected. In addition, some of our competitors offer their products and services at a lower price. If we are unable to achieve our target pricing levels, our margins and operating results could be negatively affected.

Business and professional service providers may not widely adopt our platform to manage the important aspects of their digital knowledge, which would limit our ability to grow our business.

Our ability to grow our business and increase revenue depends on our success in educating businesses and professional service providers about the potential benefits of our cloud-based platform. Cloud applications for organizing and managing digital knowledge, particularly for location and location-related data, have not previously been widely adopted. Concerns about cost, security, reliability and other issues may cause businesses and professional service providers not to adopt our platform. Moreover, businesses and professional service providers who have already invested substantial resources in other digital knowledge and location data management systems or methods may be reluctant to adopt a new approach like ours to supplement or replace existing systems or methods. If businesses and professional service providers do not widely adopt software such as ours, our ability to grow our business will be limited.

Because we recognize revenue from subscriptions for our platform over the term of the subscription, downturns or upturns in new business may not be immediately reflected in our operating results.

We generally recognize revenue from customers ratably over the terms of their agreements, which are typically one year in length but may be up to three years or longer in length. As a result, most of the revenue we report in each quarter is the result of subscription agreements entered into during previous quarters. Consequently, a decline in new or renewed subscriptions in any one quarter may not be reflected in our revenue results for that quarter. Any such decline, however, will negatively affect our revenue in future quarters. Accordingly, the effect of significant downturns in sales and market acceptance of our products, and potential changes in our attrition rate, may not be fully reflected in our results of operations until future periods. Our subscription model also makes it difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable subscription term.

17

If customers do not renew their subscriptions for our platform or reduce their subscriptions at the time of renewal, our revenue will decline and our business will suffer.

Our customers have no obligation to renew their subscriptions for our platform after the expiration of their subscription periods. In the normal course of business, some customers have elected not to renew their subscriptions with us. However, because our recent growth has resulted in the rapid expansion of our business and we have changed our subscription model in recent years, we do not have a long history upon which to base forecasts of renewal rates with customers or future operating revenue. Our customers may seek to renew their subscriptions for fewer features, at renegotiated rates, or for shorter contract lengths, all of which could reduce the amount of the subscription. Our renewal rates may decline or fluctuate as a result of a number of factors, including limited customer resources, pricing changes, customer satisfaction with our platform, the acquisition of our customers by other companies and deteriorating general economic conditions. If our customers do not renew their subscriptions for our platform or decrease the amounts they spend with us, our revenue will decline and our business will suffer. If our renewal rates fall significantly below the expectations of the public market, equity research analysts or investors, the price of our common stock could also be harmed.

If we are unable to attract new customers, our revenue growth could be slower than we expect and our business may be harmed.

To increase our revenue, we must add new customers. If competitors introduce lower cost or differentiated products or services that are perceived to compete with our features, our ability to sell our features based on factors such as pricing, technology and functionality could be impaired. As a result, we may be unable to attract new customers at rates or on terms that would be favorable or comparable to prior periods, which could negatively affect the growth of our revenue.

If we fail to integrate our platform with a variety of third-party technologies, our platform may become less marketable and less competitive or obsolete and our operating results would be harmed.

Our platform must integrate with a variety of third-party technologies, and we need to continuously modify and enhance our platform to adapt to changes in cloud-enabled hardware, software, networking, mobile, browser and database technologies. Any failure of our platform to operate effectively with future technologies could reduce the demand for our platform, resulting in customer dissatisfaction and harm to our business. If we are unable to respond to these changes in a cost-effective manner, our platform may become less marketable and less competitive or obsolete and our operating results may be negatively affected. In addition, an increasing number of customers are utilizing mobile devices to access the internet and conduct business. If we cannot continue to effectively make our platform available on these mobile devices and offer the information, services and functionality required by enterprises that widely use mobile devices, we may experience difficulty attracting and retaining customers.

If we are unable to successfully develop and market new features, make enhancements to our existing features, or expand our offerings into new market segments, our business, results of operations and competitive position may suffer.

The software industry is subject to rapid technological change, evolving standards and practices, as well as changing customer needs, requirements and preferences. Our ability to attract new customers and increase revenue from existing customers depends, in part, on our ability to enhance and improve our existing features, increase adoption and usage of our platform and introduce new features. We expend significant resources on research and development to enhance our platform and to incorporate additional features, improve functionality or add other enhancements in order to meet our customers' rapidly evolving demands. The success of any enhancements or new features depends on several factors, including timely completion, adequate quality testing, actual performance quality, market-accepted pricing levels

18

and overall market acceptance. We may not be successful in these efforts, which could result in significant expenditures that could impact our revenue or distract management's attention from current offerings.

Increased emphasis on the sale of new features could distract us from sales of our core platform, negatively affecting our overall sales. We have invested and expect to continue to invest in new businesses, products, features, services, and technologies. Such endeavors may involve significant risks and uncertainties, including insufficient revenue from such investments to offset any new liabilities assumed and expenses associated with these new investments, inadequate return of capital on our investments, distraction of management from current operations, and unidentified issues not discovered in our due diligence of such strategies and offerings that could cause us to fail to realize the anticipated benefits of such investments and incur unanticipated liabilities. Because these new strategies and offerings are inherently risky, no assurance can be given that they will be successful.

Even if we are successful in these endeavors, diversifying our platform offerings will bring us more directly into competition with other providers that may be better established or have greater resources than we have. Our new features or enhancements could fail to attain sufficient market acceptance for many reasons, including:

- •

- delays in introducing new, enhanced or modified features;

- •

- failure to accurately predict market demand or end consumer preferences;

- •

- defects, errors or failures in any of our features or our platform;

- •

- introduction of competing product performance or effectiveness;

- •

- poor business conditions for our customers or poor general macroeconomic conditions;

- •

- changes in the legal or regulatory requirements, or increased legal or regulatory scrutiny, adversely affecting our platform;

- •

- failure of our brand promotion activities or negative publicity about the performance or effectiveness of our existing features; and

- •

- disruptions or delays in the availability and delivery of our platform.

There is no assurance that we will successfully identify new opportunities or develop and bring new features to market on a timely basis, or that products and technologies developed by others will not render our platform obsolete or noncompetitive, any of which could materially and adversely affect our business and operating results and compromise our ability to generate revenues. If our new features or enhancements do not achieve adequate acceptance in the market, or if our new features do not result in increased sales or subscriptions, our brand and competitive position will be impaired, our anticipated revenue growth may not be achieved and the negative impact on our operating results may be particularly acute because of the upfront technology and development, marketing, advertising and other expenses we may incur in connection with the new feature or enhancement.

If we fail to adapt and respond effectively to rapidly changing technology, evolving industry standards and changing customer needs or requirements, our platform may become less competitive.

Our future success depends on our ability to adapt and innovate our platform. To attract new customers and increase revenue from existing customers, we need to continue to enhance and improve our offerings to meet customer needs at prices that our customers are willing to pay. Such efforts will require adding new functionality and responding to technological advancements, which will increase our research and development costs. If we are unable to develop new features that address our customers' needs, or to enhance and improve our platform in a timely manner, we may not be able to maintain or increase market acceptance of our platform. Our ability to grow is also subject to the risk of future disruptive technologies. Access and use of our platform is provided via the cloud, which, itself, was disruptive to the previous

19

enterprise software model. If new technologies emerge that are able to deliver software and related applications at lower prices, more efficiently, more conveniently or more securely, such technologies could adversely affect our ability to compete.

If customers do not expand their use of our platform beyond their current subscriptions, our ability to grow our business and operating results may be adversely affected.