Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - WHITEWAVE FOODS Co | d359101dex312.htm |

| EX-31.1 - EX-31.1 - WHITEWAVE FOODS Co | d359101dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-35708

The WhiteWave Foods Company

(Exact name of Registrant as specified in its charter)

| Delaware | 46-0631061 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1225 Seventeenth Street, Suite 1000

Denver, Colorado 80202

(303) 635-4500

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned-issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant at June 30, 2016, based on the closing price for the registrant’s common stock on the New York Stock Exchange on June 30, 2016, was approximately $8.1 billion.

As of March 20, 2017, there were 177,683,543 outstanding shares of common stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended December 31, 2016 filed by The WhiteWave Foods Company with the Securities and Exchange Commission (the “SEC”) on February 24, 2017 (the “2016 Form 10-K”). This Form 10-K/A is being filed to include certain information that was previously omitted from Part III of the 2016 Form 10-K because the Company no longer intends to file a definitive proxy statement for an annual meeting of stockholders within 120 days after the end of its fiscal year ended December 31, 2016. In particular, this Form 10-K/A amends the cover page, Items 10 through 14 of Part III and the Exhibit Index of the 2016 Form 10-K and includes certifications as required by Section 302 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), as exhibits in accordance with Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Except as otherwise expressly noted above, this Form 10-K/A does not amend any other information set forth in the 2016 Form 10-K. This Form 10-K/A continues to speak as of the date of the 2016 Form 10-K and, except where expressly noted, we have not updated disclosures contained therein to reflect any events that occurred at a date subsequent to the date of the 2016 Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the 2016 Form 10-K and our other filings with the SEC.

Unless the context requires otherwise, all references to “WhiteWave”, the “Company”, “we”, “us” or “our” mean The WhiteWave Foods Company, a Delaware corporation, and its consolidated subsidiaries.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Information Regarding Directors

Our Board of Directors (the “Board”) consists of seven members. Set forth below is the name, age, period of service, biographical information and certain other information with respect to each member of the Board. The Board has identified specific attributes of each director that the Board has determined qualify the person for service on the Board.

Gregg L. Engles

Director since August 2012

Mr. Engles, age 59, has served as Chairman of the Board of Directors and Chief Executive Officer since August 2012. Mr. Engles previously served as the Chief Executive Officer of Dean Foods Company, a leading food and beverage company and former parent company of WhiteWave, from the formation of Dean Foods in October 1994 until WhiteWave’s initial public offering in October 2012. Mr. Engles serves as a director of Liberty Expedia Holdings, Inc., which owns interests in Expedia, Inc. and its subsidiary Bodybuilding.com, LLC, where he Chairs the Audit Committee and serves as a member of the Compensation, Nominating and Corporate Governance and Common Stock Director Committees. He also serves on the board of trustees of Dartmouth College, where he serves on the Finance, Facilities and Master Planning Committees, and is Chair of the Organizational Strategy and the Compensation Committees. Mr. Engles also serves on the board of directors of the Grocery Manufacturers of America, where he serves on the Executive Committee. He previously served as a director and as Chairman of the Board of Dean Foods and as a director of Treehouse Foods, Inc.

Mr. Engles is uniquely qualified to serve as our Chairman and Chief Executive Officer. As the founder and former Chief Executive Officer and Chairman of the Board of Dean Foods Company, he has been the principal architect of our Company’s business platforms, having built Dean Foods’ WhiteWave - Alpro segment through a series of successful strategic acquisitions. Thus, he has unmatched experience with our Company’s business and a deep knowledge of the food and beverage industry.

Michelle P. Goolsby

Director since November 2012

Ms. Goolsby, age 59, was appointed to our Board of Directors in November 2012. Since 2008, she has been a Venture Partner and a member of the Investment Committee of Greenmont Capital Partners II, a private equity firm based in Boulder, Colorado, which focuses on investments in the natural products industry. From 1998 to 2008, Ms. Goolsby held multiple offices with Dean Foods Company, a leading beverage company, including Executive Vice President, General Counsel and Chief Administrative Officer, and Executive Vice President, Development, Sustainability and Corporate

Affairs. Before joining Dean Foods, she spent more than 13 years in private law practice with two major Texas law firms, specializing in mergers and acquisitions, public and private securities offerings and other capital markets transactions. Ms. Goolsby also serves on the board of directors of Capstead Mortgage Corporation, a real estate investment trust, where she chairs the Compensation Committee and serves on the Executive Committee; SACHEM Inc., a private chemical science company, where she serves on the Strategic Planning and HR/Compensation Committees; and Vitamin Angels Alliance, Inc., where she currently serves as chair of the board of directors. Ms. Goolsby is a Founding Member of the Center for Women in Law at the University of Texas School of Law and a former Trustee of the Law School Foundation. She is also a member of the National Association of Corporate Directors, Women Corporate Directors and the Texas State Bar and American Bar Associations.

Ms. Goolsby acquired a deep knowledge of our business, and the food and beverage industry generally, during her 10-year tenure with Dean Foods, which included the period during which our business was built through a series of acquisitions. We believe that this unique knowledge, combined with her continued focus on the organic and natural products industry, plus her broad experience in the areas of legal, corporate development, sustainability, corporate governance, human resources, and communications, qualifies her to serve on our Board of Directors.

Stephen L. Green

Director since August 2012

Mr. Green, age 66, was appointed to our Board of Directors in August 2012. From November 1991 until his retirement in December 2012, Mr. Green was a partner with Canaan Partners, a venture capital firm. From 1985 until 1991, Mr. Green served as Managing Director of the Corporate Finance Group at GE Capital, the financial services unit of General Electric, a multinational conglomerate. Mr. Green previously served on the board of directors of Dean Foods Company from 1994 to May 1, 2013, where he chaired the Compensation Committee; and The Active Network, Inc., a software firm, from 2001 to 2013, where he served on the Compensation Committee and chaired the Audit Committee.

Mr. Green has a broad background in financing companies involved in manufacturing, retail, radio, television, cable broadcasting, and financial services. During his 25-year career in private equity, he has analyzed hundreds of financial statements and served on numerous boards of directors. In addition, Mr. Green held a variety of financial roles over a 12-year period at General Electric, including a five-year term as a Corporate Auditor. Mr. Green also served as Chairman of the Audit Committee at Advance PCS, a NYSE-listed Fortune 500 company, from 1993 to 2005. We believe that Mr. Green is qualified to serve as our director because his comprehensive experience and responsibility for financial and accounting issues serves the Company well in his role as a director and a member of the Audit Committee.

Joseph S. Hardin, Jr.

Director since August 2012

Mr. Hardin, age 71, was appointed to our Board of Directors in August 2012. From 1997 until his retirement in 2001, he served as Chief Executive Officer of Kinko’s, Inc., a leading provider of printing, copying, and binding services. From 1986 to 1997, Mr. Hardin held a variety of positions with increasing responsibility at Wal-Mart Stores, Inc., a leading retailer, ultimately serving as its Executive Vice President and as the President and Chief Executive Officer of Sam’s Club, the wholesale division of Wal-Mart Stores, Inc. Mr. Hardin previously served on the boards of directors of PetSmart, Inc. until it was taken private in March 2015, where he served on the Corporate Governance and Compensation Committees; and Dean Foods Company from 1998 to May 1, 2013, where he served on the Compensation and Executive Committees.

Mr. Hardin’s qualifications include serving as chief executive officer of three different companies with market capitalizations ranging from $2.0 billion to $22.0 billion. He has also previously served on the board of, and as a supply chain consultant to, American Greetings Corporation. We believe that Mr. Hardin is qualified to serve as a director because he has wide ranging leadership experience, including leadership roles with Wal-Mart Stores, Inc., our largest customer.

Anthony J. Magro

Director since January 2016

Mr. Magro, age 63, was appointed to our Board of Directors in January 2016. He is a Senior Advisor of Evercore, an independent investment banking advisory firm where he was Senior Managing Director, Corporate Advisory from 2011 to 2015. Prior to this role, he held various positions with Bank of America Merrill Lynch from 2001 to 2011, including Vice Chairman of Global Investment Banking from 2009 to 2011, and Group Head & Managing Director of Global Investment Banking for Banc of America Securities from 2001 to 2009. Mr. Magro also headed the Merger & Acquisition Group of Bear, Stearns & Co., and worked in mergers and acquisitions at Kidder, Peabody & Co., and Dillon, Read & Co. from 1980 to 2001.

2

We believe that Mr. Magro is qualified to serve as a director because he brings more than 40 years of leadership and hands-on experience in the investment and corporate advisory services industry, and has extensive experience in identifying, evaluating and executing complex merger and acquisition transactions. We believe his experience will be valuable to WhiteWave as we seek to strategically grow the business, both in North American and globally.

W. Anthony Vernon

Director since January 2016

Mr. Vernon, age 61, was appointed to our Board of Directors in January 2016. He served as Chief Executive Officer of Kraft Foods Group, Inc., one of the largest consumer packaged food and beverage companies in North America, from October 2012, when Kraft was spun-off from Mondelēz International, until December 2014. He also served as a member of the Kraft Foods Group, Inc.’s Board of Directors until May 2015. Prior to October 2012, he served as Executive Vice President of the former parent of Kraft Foods Group, Inc. and President, Kraft Foods North America. Prior to joining Kraft, he was the Healthcare Industry Partner of Ripplewood Holdings LLC, a private equity firm, from 2006 until August 2009. Prior to that Mr. Vernon spent 23 years with Johnson & Johnson, a pharmaceutical company, in a variety of leadership positions, most recently serving as Company Group Chairman of DePuy Inc., an orthopedics company and subsidiary of Johnson & Johnson, from 2004 to 2005. Mr. Vernon is a director of Intersect ENT, Inc., a medical device company, where he chairs the Nominating and Corporate Governance Committee and serves on the Compensation Committee; and NovoCure Ltd., an oncology company, where he serves as the Lead Independent Director, chairs the Nominating and Corporate Governance Committee and serves on the Compensation Committee. He previously served as a director of Medivation, Inc., a biopharmaceutical company, from 2006 until September 2016, where he served on the Compensation and Nominating and Corporate Governance Committees.

Mr. Vernon brings a strong background in the consumer packaged food and beverage industry and deep operational experience to his role as a WhiteWave director. We believe that his leadership experience as the CEO of a global food and beverage company strengthens the board’s ability to oversee WhiteWave’s growth initiatives and qualifies him to serve on our Board of Directors. Mr. Vernon also has extensive experience as a public company director and has chaired several Compensation and Nominating and Corporate Governance committees.

Doreen A. Wright

Director since August 2012

Ms. Wright, age 60, was appointed to our Board of Directors in August 2012. Ms. Wright currently works as an information technology and business transformation consultant. She previously served as Senior Vice President and Chief Information Officer of Campbell Soup Company, a global food company, from 2001 to 2008, and as Interim Chief of Human Resources for Campbell Soup Company in 2002. Prior to that, Ms. Wright served as Executive Vice President and Chief Information Officer for Nabisco Inc., a cookie and snacks company, from 1999 to 2001 and, from 1995 to 1998, held the position of Senior Vice President, Operations & Systems, Prudential Investments, for Prudential Insurance Company of America. Prior to that she held various positions with American Express Company, Bankers Trust Corporation, and Merrill Lynch & Co. From 2009 to May 1, 2013, she served on the board of directors of Dean Foods Company, where she served on the Audit and Governance Committees. Ms. Wright currently serves on the board of directors of Crocs, Inc., a global leader in innovative, casual footwear, where she chairs the Compensation Committee and the Information Technology Committee and is a member of the Audit Committee. She also serves as a director of the Bucks County Playhouse Artists and is director emeritus of New Hope Arts, Inc., which are nonprofit regional arts organizations.

We believe that Ms. Wright is qualified to serve as a director because she brings more than 30 years of leadership experience in the financial services and consumer products industries, with emphasis in the area of information technology, operations, and human resources. Ms. Wright also has extensive experience as a public company director, including service on Audit, Compensation, and Corporate Governance committees.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. Based solely on our review of these forms or written representations from the executive officers and directors, we believe that all Section 16(a) filing requirements were met during fiscal year 2016, except the following: Anthony J. Magro filed a Form 4 one day late due to WhiteWave’s difficulties in obtaining electronic SEC filing codes for him, and each of W. Anthony Vernon and Kevin C. Yost failed to timely file one transaction report due to administrative errors by WhiteWave.

3

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors has established certain standing committees to assist in the performance of its various functions. All Committee members are appointed by our Board of Directors upon recommendation of the Nominating and Corporate Governance Committee. The charters adopted by the Audit, Compensation and Nominating and Corporate Governance Committees are available on our website at www.whitewave.com on the “Investor Relations” page under the link “Corporate Governance.”

The chart below lists the standing committees of our Board of Directors and indicates which directors currently serve on each committee.

| Director |

Audit (1) | Compensation | Nominating and Corporate Governance | ||||||||||||

| Gregg L. Engles |

— | — | — | ||||||||||||

| Michelle P. Goolsby |

X | * | — | X | |||||||||||

| Stephen L. Green |

X | X | * | — | |||||||||||

| Joseph S. Hardin, Jr. |

— | X | — | ||||||||||||

| Anthony J. Magro |

X | — | X | ||||||||||||

| W. Anthony Vernon |

— | X | — | ||||||||||||

| Doreen A. Wright |

X | — | X | * | |||||||||||

| * | Committee Chair |

| (1) | Our Board of Directors has determined, based upon recommendation of the Nominating and Corporate Governance Committee, that each of Ms. Goolsby and Messrs. Green and Magro is an “audit committee financial expert,” as that term is defined by the SEC and that all members of the Audit Committee are “financially literate,” as that term is used in the NYSE rules. |

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis is intended to provide investors with an understanding of our compensation policies and practices with respect to our Chief Executive Officer, Chief Financial Officer and our three other most highly compensated executive officers for the year ended December 31, 2016. These executive officers, whom we refer to as our Named Executive Officers, and their current positions are:

| • | Gregg L. Engles, Chairman and Chief Executive Officer; |

| • | Gregory S. Christenson, Executive Vice President, Chief Financial Officer; |

| • | Blaine E. McPeak, Executive Vice President and Chief Operating Officer; |

| • | Bernard P.J. Deryckere, Executive Vice President and President, Europe Foods & Beverages; and |

| • | Kevin C. Yost, Executive Vice President and U.S. Group President, Americas Foods & Beverages. |

For 2016, Kelly J. Haecker also is a Named Executive Officer. Mr. Haecker was not an executive officer as of December 31, 2016 but he is a Named Executive Officer because he served as WhiteWave’s Chief Financial Officer for a portion of 2016.

2016 Financial and Strategic Highlights

In evaluating WhiteWave’s overall executive compensation program and payouts under the 2016 programs, the Compensation Committee considered WhiteWave’s strategic and financial performance in 2016. WhiteWave’s strong positions in on-trend categories translated into continued top and bottom line growth. The following were among the highlights and accomplishments considered by the Compensation Committee.

4

2016 Financial & Operating Performance

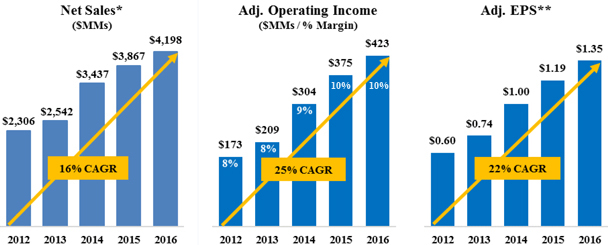

| • | WhiteWave delivered adjusted net sales of $4.2 billion, a 9% increase from full year 2015. This marked the first year with sales over $4 billion, as well as the fourth quarter of 2016 representing the 6th consecutive quarter with net sales over $1 billion. Net sales have grown at a 16% compounded annual rate since 2012. This growth was driven by robust performance in Europe Foods & Beverages and continued strong growth in Americas Foods & Beverages that was driven by organic growth, along with contributions from strategic acquisitions and partially offset by lower sales in the Fresh Foods platform. |

| • | We increased our adjusted operating income by 13% from full year 2015, to $423 million for full year 2016. We have delivered adjusted operating income growth of 25% on a compounded annual basis since 2012. On a constant currency basis, adjusted operating income increased by 17%, and in line with our original expectation of high-teen to low twenty percentage growth for the year. Our margin improvement trend continued in 2016, as we delivered nearly 70 basis points of constant currency operating margin expansion. |

| • | We reported adjusted diluted earnings per share growth of 14% to $1.35, excluding investments associated with our China joint venture, compared with full year 2015. Adjusted earnings per share have grown at a 22% compounded annual rate since 2012. This was in line with our original expectations for the year for earnings per share between $1.33 and $1.37. |

2016 Strategic Accomplishments

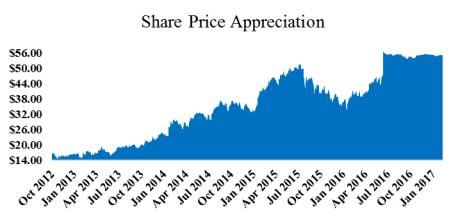

| • | Entered into an agreement for Danone S.A. to acquire the Company for $56.25 per share in cash, representing a premium of approximately 24% over WhiteWave’s 30-day average closing trading price prior to the announcement. |

| • | Completed a strategic acquisition of Innovation Packaging and Process, S.A. DE C.V. (“IPP”), an aseptic beverage manufacturer based in San Luis Potosi, Mexico that produces a variety of products for WhiteWave and other parties. The acquisition supports WhiteWave’s growth initiatives in Latin America with internal production capacity. |

| • | Completed the integration of previously acquired businesses Wallaby and Magicow and the transition of the Vega business to WhiteWave. |

| • | Launched several new and innovative products, including Silk high protein nut-based milk beverages, Wallaby purely unsweetened yogurt, Alpro Greek-style plant-based yogurts and plant-based frozen desserts, new Horizon yogurts, cheeses, and macaroni and cheese products, Sir Bananas bananamilk, International Delight Simply Pure creamers, Stok cold-brew iced coffee beverages, Vega nutritional shakes and protein bars, and expanded Silk and Horizon into single-serve bottles and International Delight and Silk into large size bottles. |

| • | Further expanded our internal production capacity in the United States and Europe. |

| • | Continued to foster a diverse and engaged workforce, receiving a perfect score of 100 percent on the 2016 Corporate Equality Index (CEI) and increasing the percentage of females and persons of color holding mid- and senior-management positions since our initial public offering. |

| • | Scored “A- Leadership” Ranking in CDP (formerly Carbon Disclosure Project), an international, not-for-profit organization providing the only global system for companies and cities to measure, disclose, manage and share vital environmental information. The A- leadership score acknowledges that WhiteWave successfully demonstrated advancement in environmental stewardship, provided a thorough understanding of its risks and opportunities related to climate change, and that we have formulated and implemented strategies to mitigate or capitalize on these risks and opportunities. |

| • | Recognized as an AgWater Steward by joining the AgWater Challenge, a collaborative initiative organized by Ceres and World Wildlife Fund (WWF) to protect freshwater by developing roadmaps to address agricultural water challenges, as well as supporting policy aimed at strengthening water management in priority sourcing regions. WhiteWave is proud of its progress and commitments and believes its attention to mitigating water risk will benefit its business and the environment. |

5

Long-Term Performance Highlights

| * | Net Sales are presented on a pro forma adjusted basis in 2012 and on an adjusted basis in 2015. |

| ** | Adjusted EPS excludes investments associated with our China joint venture. |

See Annex A for a reconciliation of GAAP to non-GAAP information used in this Form 10-K/A.

As a result of our strong financial results, stockholder value has significantly increased since our IPO. Since our IPO, our share price has appreciated by 229% through March 6, 2017.

6

Summary of Compensation Committee Actions in 2016

The Compensation Committee evaluates our compensation philosophy each year and makes changes, as it deems appropriate, to our executive compensation program. In approving the 2016 compensation program, the Compensation Committee determined that the Company’s compensation program was appropriately positioned relative to the Benchmark Peer Group and did not approve any significant changes to the overall program. The Compensation Committee did, however, approve changes in the total compensation of three Named Executive Officers who were promoted, which compensation changes reflect their new positions. On December 1, 2015, Blaine E. McPeak was appointed to the newly created position of Chief Operating Officer of WhiteWave and assumed responsibility for all of WhiteWave’s global operations, and Kevin C. Yost was promoted to U.S. Group President, Americas Foods and Beverages, overseeing WhiteWave’s U.S. businesses. On April 1, 2016, Gregory S. Christenson was promoted to Chief Financial Officer of the Company.

The compensation paid to the Named Executive Officers in 2016 was primarily determined by WhiteWave’s strong financial performance for the year and reflects our pay for performance programs. In February 2017, the Compensation Committee approved payouts under our 2016 short-term incentive (“STI”) plan, which has two components: specific financial performance measures for the corporate functions and each of our business segments, which account for 80% of the payout, and individual objectives, which account for 20% of the payout. In 2016, the financial performance objectives, which consisted of consolidated and segment net sales, segment operating income and EPS, were achieved within a range of 63% to 135% of target performance. With respect to the individual objectives, the Compensation Committee concluded that our Named Executive Officers met or exceeded their respective individual objectives, with one Named Executive Officer below target, and rated such achievements within a range of 75% to 130% of target. As a result, the Compensation Committee approved total payouts under the 2016 STI plan to our Named Executive Officers within a range of 65.5% to 134.1%. The actual payout for each executive correlates to his individual performance, the performance of his respective business and WhiteWave’s overall performance, which reflects our pay for performance compensation philosophy.

Further details regarding our 2016 executive compensation program and decisions made by the Compensation Committee are described in this “—2016 Compensation Program.”

Significant Compensation Practices

Our Compensation Committee regularly evaluates WhiteWave’s compensation programs, practices, and policies and implements modifications to incorporate evolving best practices, as appropriate, and changing regulatory requirements. Listed below are some of our more significant practices and policies:

| • | Performance-Based Pay. In accordance with the Company’s pay for performance philosophy, the majority of 2016 compensation for our executive officers was performance-based and equity-based, including our STI plan and LTI awards, and paid in the form of variable, or “at risk,” compensation. |

| • | Weight of Financial Metrics in the STI Plan. In 2016, the STI plan was 100% based on performance, with 80% based on financial objectives and 20% based on individual objectives. |

7

| • | Double Trigger for LTI Vesting. All equity awards granted to our executive officers after 2014 are subject to “double trigger” accelerated vesting upon a change in control, unless the acquiring company does not assume (and continue) the awards following the change in control. |

| • | Performance Stock Units (“PSUs”). One-third of the annual LTI grants to our executive officers is comprised of PSUs that vest based on WhiteWave’s adjusted diluted earnings per share growth over a three-year performance period relative to the adjusted diluted earnings per share growth of companies in the S&P 500 over the same period. |

| • | Multiple Performance Measures. The Compensation Committee uses multiple performance measures, including various financial metrics and achievement of individual objectives, to evaluate executive officer performance. |

| • | Hedging, Pledging and Trading Policies. WhiteWave’s anti-hedging and pledging policies apply to all directors and executive officers. In addition, all directors and employees are prohibited from trading in WhiteWave securities while aware of material nonpublic information, and our directors and executive officers are subject to a trading window policy. |

| • | Stock Ownership Requirements. We require our senior management team and directors to be meaningfully invested in WhiteWave common stock and, therefore, be personally invested in our performance and strongly aligned with stockholder interests. Our Stock Ownership Guidelines require our executives to own WhiteWave stock with a market value at least equal to six times base salary, for our Chief Executive Officer, and at least three times base salary, for our other executive officers. |

| • | Change in Control Agreements. All change in control agreements with WhiteWave’s executive officers require a double trigger for severance benefits and do not include a tax “gross-up” for taxes imposed on any change in control payments. |

| • | Clawback Policy. Our clawback policy provides that if WhiteWave is required to file restated financial statements with the SEC as a result of the misconduct of an executive officer, the Compensation Committee may require the executive officer to repay to WhiteWave or forfeit, if not yet paid, any overpayment of compensation that was predicated on the original financial statements that were subsequently restated. |

| • | Few Perquisites. We offer very few perquisites to our executive officers, and none of our U.S.-based Named Executive Officers participates in a defined pension benefit plan. |

2016 Compensation Program

Executive Compensation Objectives

We operate in a competitive and challenging industry, where competitive compensation is important in attracting and retaining the talent we need to be successful. As a result, our compensation objectives include attracting and retaining top talent; motivating and rewarding the performance of senior executives in support of achievement of strategic, financial, and operating performance objectives; and aligning our executives’ interests with the long-term interests of our stockholders. We designed our executive compensation program to achieve these objectives by following these principles and practices:

| • | Pay for Performance. Our compensation program is designed so that a significant portion of a Named Executive Officer’s pay is linked to WhiteWave’s performance through “performance-based” pay programs, such as our STI plan and equity awards, including three-year performance stock units and stock options. Under our compensation program, the majority of compensation is in the form of variable or “at risk” compensation to motivate our executive officers to achieve our long-term performance objectives. |

| • | Compensation Based on Individual Performance and Potential. The Compensation Committee makes determinations regarding incentive awards based in part on the executive’s overall performance and contribution to his or her business and potential for advancement within the Company. |

| • | Alignment of the Interests of Our Named Executives Officers and Stockholders. We align the interests of our Named Executive Officers with our stockholders by maintaining robust stock ownership requirements, by having a significant portion of a Named Executive Officer’s target total compensation be stock-based and by using incentive compensation that is tied to key financial metrics that we believe drive stockholder value. |

| • | Competitive Pay Analysis. The Compensation Committee compares our target and actual compensation, total direct compensation amounts and pay mix against our Benchmark Peer Group and against industry survey data for specific positions to evaluate whether our executive compensation program and our target compensation levels are consistent with market practice and competitive with the companies with which we compete for talent. |

8

Components of Our Compensation Program

The components of our compensation and benefits programs for our Named Executive Officers were approved by the Compensation Committee and consist generally of the following:

|

Compensation Component |

Objectives |

Characteristics | ||

| Base Salaries |

• Compensates executives for their level of experience, responsibility and sustained individual performance.

• Helps attract and retain talent.

|

• Fixed component; evaluated annually. | ||

| Short-Term Incentive (STI) Plan |

• Promotes achieving our annual corporate and business unit financial goals, as well as other objectives deemed important to the Company’s long-term success. |

• Variable, performance-based component; target opportunity is set based on the executive’s job responsibilities and sustained performance in role/potential.

• Actual payout primarily depends on company and business segment results and, to a lesser extent, individual performance.

| ||

| Long-Term Incentive (LTI) Awards |

• Promotes achieving our long-term corporate financial goals with the acquisition of common stock through PSUs, restricted stock units (“RSUs”) and restricted stock awards (“RSAs”), and stock price appreciation through stock options.

• Further aligns management and stockholder interests. |

• Variable, performance-based component; annual grant is set based on market positioning, the executive’s experience, company performance, time in position, sustained performance in role and growth potential.

• Actual value realized will vary from the targeted grant-date fair value based on actual financial and stock price performance.

| ||

| Retirement and Other Benefit Plans |

• Provides a market competitive level of replacement income upon retirement.

• Also provides an incentive for a long-term career with WhiteWave, which is a key objective. |

• Fixed component; however, company contributions that are based on percentage of pay may vary as the executive’s pay varies, based on his or her performance.

• Intended to prevent against catastrophic expenses (healthcare, disability and life insurance) and encourage saving for retirement.

| ||

|

Post-Termination Compensation |

• Facilitates attracting and retaining high caliber executives in a competitive labor market in which formal severance plans are common.

• Provides orderly and smooth transition and knowledge transfer. |

• Contingent component; only payable if the executive’s employment is terminated under certain circumstances and, in the case of a change in control, to help provide continuity of management through the transition.

| ||

9

Benchmark Peer Group for Executive Compensation Purposes

The Compensation Committee reviews WhiteWave’s total compensation compared with our peer companies and competitors for purposes of assessing and establishing our compensation programs and setting base salaries, STI target levels and LTI opportunities for our Named Executive Officers. To facilitate this comparison, the Compensation Committee and its independent compensation consultant select a group of peer companies of WhiteWave to serve as a benchmark, which we refer to as the Benchmark Peer Group. For purposes of evaluating our 2016 executive compensation, the Benchmark Peer Group consisted of the following companies, which is the same Benchmark Peer Group used for 2015:

| 2016 Benchmark Peer Group |

||

| • Brown-Forman Corporation |

• Kellogg Company | |

| • Campbell Soup Company |

• Keurig Green Mountain Inc. | |

| • The Clorox Company |

• McCormick & Company, Incorporated | |

| • Constellation Brands, Inc. |

• Mead Johnson Nutrition Company | |

| • Dr. Pepper Snapple Group Inc. |

• Molson Coors Brewing Company | |

| • Flowers Foods Inc. |

• Pinnacle Foods Inc. | |

| • The Hain Celestial Group, Inc. |

• Snyder’s-Lance, Inc. | |

| • The Hershey Company |

• TreeHouse Foods, Inc. | |

| • Hormel Foods Corporation |

||

In developing the Benchmark Peer Group, the Compensation Committee considered companies with the following attributes:

| • | are dynamic, high-growth branded companies, particularly in the consumable food segment, that are innovative and acquisitive; |

| • | have annual revenues generally between $1.0 billion to $10.0 billion; |

| • | have a market capitalization generally between one-third to three times WhiteWave’s market capitalization; |

| • | generate sales outside the U.S. and have a complexity and scale of operations that is comparable to WhiteWave; and |

| • | appear in the respective peer groups of WhiteWave’s Benchmark Peer Group multiple times. |

The Compensation Committee evaluates the appropriate companies to include in the Benchmark Peer Group at least annually and with assistance from its independent compensation consultant.

Compensation Methodology

The Compensation Committee is comprised solely of non-management directors who our Board of Directors has determined are independent within the meaning of the NYSE rules. The Compensation Committee is responsible for determining the executive compensation strategy and philosophy for WhiteWave and its subsidiaries, and reviews and approves individual compensation packages for the most senior executives of WhiteWave, including the Named Executive Officers.

Overall Compensation Philosophy

Our compensation program is designed to emphasize our performance-driven compensation philosophy and to reward individual performance, as well as to reward execution of our business strategies and the creation of value for our stockholders. Accordingly, a significant portion of each executive’s total compensation depends on WhiteWave’s

10

performance and on the executive’s individual performance measured against specific financial and operational objectives. In addition, a substantial portion of each executive’s compensation is delivered in the form of equity awards that tie the executive’s compensation directly to creating stockholder value. With respect to the LTI component, our objective is to offer our executive officers “leading median” target total cash compensation (base salary and target STI) that is at or within a competitive range of the 50th percentile of our Benchmark Peer Group, but with a broader target total direct compensation range of between the 40th and 75th percentiles of our Benchmark Peer Group. Target LTI compensation generally will be within the 40th to 75th percentile of our Benchmark Peer Group, except where the Committee adjusts LTI to achieve target total direct compensation between the 40th and 75th percentiles. Target total direct compensation for each executive officer will vary depending on market positioning, the executive’s unique experience, time in position, company performance and individual performance. We intend for actual total direct compensation to fall between the 40th and 75th percentiles of our Benchmark Peer Group, which may be above or below an executive’s target total compensation opportunity to the extent WhiteWave’s performance and/or the executive’s individual performance fluctuates above or below targeted levels.

Our Compensation Committee reviews and adjusts our executive compensation programs and policies from time to time, as appropriate, to remain aligned with our target percentile ranges; however, the Committee retains discretion to provide compensation outside of our target range, as the Committee deems appropriate, to reflect an executive’s unique skills, time in role, sustained performance and strategic corporate-wide factors, such as succession planning and retention.

We believe that our compensation strategy helps ensure that the Company remains focused on delivering strong annual operating results while simultaneously creating sustainable long-term value. The Compensation Committee also believes that this strategy allows us to attract and retain high-performing executives from key consumer packaged goods companies with which we compete for talent.

Principal Components of our 2016 Compensation Program for Executive Officers

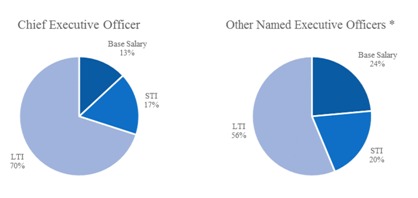

We believe that our executive officers directly influence WhiteWave’s overall performance and that it is critical to pay executives at a competitive level relative to our Benchmark Peer Group in order to attract and retain the talent we need to drive long-term high performance. Accordingly, and consistent with our performance-driven compensation philosophy, the Compensation Committee allocates a significant portion of our executive officers’ compensation to performance-based STI and LTI programs. In addition, as an executive’s responsibility and ability to affect our financial results increases, base salary becomes a relatively smaller component of his or her total compensation and STI and LTI compensation becomes a larger component of total compensation. As illustrated below, in 2016 the majority of total direct compensation for our Named Executive Officers was provided as variable or “at risk” compensation:

| * | Excludes compensation for Kelly Haecker, since he did not receive an LTI grant in 2016. |

We review competitive pay levels (i.e., our salary structure, the leveling of our positions, our annual target bonus levels and our long-term incentive award guidelines) on an annual basis to evaluate whether our total compensation targets remain competitive. We also use market competitive size-adjusted pay levels to help determine individual pay decisions. See the “Summary Compensation Table for 2016” and the “Grants of Plan-Based Awards in Fiscal Year 2016” table for more information on our 2016 executive compensation program.

Annual Cash Compensation

Base Salary. Base salary is the only fixed component of our executive officers’ total direct compensation. Base salaries for our executive officers are targeted at or within a competitive range of the median of our Benchmark Peer Group, and are set based on each executive officer’s individual contributions, such as unique job responsibilities, level of

11

experience and sustained performance in role, as well as strategic corporate-wide factors, such as succession planning, retention and other business needs. In some cases, such as when an executive is recruited from another company, we may exceed our target base salary level in order to attract and ultimately retain the executive, while in other cases an executive’s base salary may be below our target base salary level due to internal equity or other circumstances.

The Compensation Committee annually reviews base salaries of our executive officers and makes adjustments based on the performance of the executive, their position relative to comparable positions in the Benchmark Peer Group, and WhiteWave’s performance. The Compensation Committee separately reviews the performance of Mr. Engles and makes adjustments as warranted.

In February 2016, our Compensation Committee reviewed the base salaries of our Named Executive Officers to determine if they were within a competitive range around the median of the Benchmark Peer Group. The Committee determined that the base salary of each Named Executive Officer was appropriately positioned relative to the Benchmark Peer Group; however the Committee adjusted the salaries of Blaine E. McPeak and Gregory S. Christenson to reflect their promotions to new positions. Mr. McPeak was promoted from President, Americas Foods & Beverages to Chief Operating Officer of WhiteWave and Mr. Christenson was promoted from Chief Financial Officer, North America to Executive Vice President, Chief Financial Officer of WhiteWave. In acknowledgement of such promotions, Mr. McPeak’s annual base salary was increased from $650,000 to $675,000 and Mr. Christenson’s annual base salary was increased from $400,000 to $450,000.

Short-Term Incentive Compensation. The STI component of our compensation program is designed to motivate senior executives to achieve annual financial and non-financial goals based on our strategic, financial, and operating performance objectives. STI amounts for our executive officers for 2016 were targeted at the 50th to 60th percentile of the Benchmark Peer Group.

In February 2016, our Compensation Committee reviewed the STI target bonus opportunities of our Named Executive Officers to determine if they were within a competitive range around the median of the Benchmark Peer Group. As a result of this review, the Committee adjusted the target STI for several Named Executive Officers to (i) reflect the promotions of Messrs. McPeak, Yost and Christenson, and (ii) maintain internal pay equity. The changes in 2016 STI target bonus opportunities for the Named Executive Officers are shown in the table below:

| 2016 STI Target As Percentage of Base Salary |

2015 STI Target As Percentage of Base Salary | |||||||||

| Gregory S. Christenson |

70 | % | 50 | % | ||||||

| Blaine E. McPeak |

100 | % | 90 | % | ||||||

| Bernard P.J. Deryckere |

75 | % | 60 | % | ||||||

| Kevin C. Yost |

85 | % | 80 | % | ||||||

The Committee did not make any changes to the 2016 STI targets of the other Named Executive Officers.

For 2016, cash annual incentive payments were based on the 2016 Short-Term Incentive Compensation Plan (the “2016 STI Plan”) approved by the Compensation Committee, which established specific performance measures for the corporate functions and our two business segments. The following table provides, for each Named Executive Officer, the relative weight assigned to each element of the 2016 STI Plan:

| Name |

Corporate Objectives |

Business Segment Performance |

Individual Objective Performance |

Total | ||||||||||||||||

| Gregg L. Engles |

80 | % | — | 20 | % | 100 | % | |||||||||||||

| Gregory S. Christenson |

80 | % | — | 20 | % | 100 | % | |||||||||||||

| Blaine E. McPeak |

80 | % | — | 20 | % | 100 | % | |||||||||||||

| Bernard P.J. Deryckere |

20 | % | 60 | % | 20 | % | 100 | % | ||||||||||||

| Kevin C. Yost |

20 | % | 60 | % | 20 | % | 100 | % | ||||||||||||

| Kelly J. Haecker |

80 | % | — | 20 | % | 100 | % | |||||||||||||

Under the 2016 STI Plan, the financial performance measures for Messrs. Engles, Christenson, McPeak and Haecker were consolidated earnings per share (60%) and net sales (20%), and for Messrs. Deryckere and Yost, the financial

12

performance measures were consolidated earnings per share (20%), business segment operating income (40%) and business segment net sales (20%). The Compensation Committee believes that placing significant weight on the achievement of financial objectives and using consolidated earnings per share as a measure for all executive officers provides incentive to our executives to continue to grow both revenues and overall profitability. In approving the 2016 STI Plan, the Compensation Committee considered earnings per share and net sales as appropriate performance criteria to measure the achievement of our overall corporate objectives, and segment operating income and net sales as appropriate performance criteria to measure the achievement of each business segment’s objectives, because each is representative of the profitability and operating efficiency of WhiteWave and each business segment. In addition, the net sales performance measure for our business segments underscores WhiteWave’s priority on continuing to grow our core businesses.

The payout factor for the 2016 STI compensation for each executive officer ranged from 65.5% to 134.1% of each executive’s target payment, depending on actual performance in 2016 against the financial objectives established by the Compensation Committee and on the executive’s performance in 2016 against their specific individual objectives approved by the Compensation Committee. Below is a description of how the Compensation Committee determined actual payout amounts under the 2016 STI Plan.

2016 Corporate and Business Segment Financial Performance

In February 2017, the Compensation Committee assessed the performance of our Named Executive Officers against the corporate and business segment financial goals that had been established at the beginning of 2016. For the financial measures of the STI Plan, achievement at the target level of performance results in 100% payout and the threshold for payout under the STI Plan is achievement of performance in excess of 90% or 95% of target, depending on the performance measure. The target and actual financial performance measures under the 2016 STI Plan are set forth in the table below. Each financial performance measure under the 2016 STI Plan was computed on an adjusted basis, as reported in our earnings press release for fiscal year 2016 that was issued on February 16, 2017, as further adjusted only for currency translation.

| Financial Performance Measures |

Performance at Target |

Actual Performance |

Performance as a Percentage of Target |

Payout as a Percentage of Target |

||||||||||||

| (Dollars in millions, except EPS) | ||||||||||||||||

| Corporate |

||||||||||||||||

| Consolidated Net Sales (20%) (1) |

$ | 4,312.1 | $ | 4,205.1 | 97.5 | % | 50.4 | % | ||||||||

| WhiteWave Adjusted Earnings Per Share, excluding China joint venture (60%) (2) |

$ | 1.349 | $ | 1.379 | 102.2 | % | 122.3 | % | ||||||||

| Americas Foods & Beverages (3) |

||||||||||||||||

| Segment Net Sales (20%) (4) |

$ | 3,557.1 | $ | 3,446.2 | 96.9 | % | 37.6 | % | ||||||||

| Adjusted Segment Operating Income (40%) (5) |

$ | 430.4 | $ | 407.3 | 94.6 | % | 46.3 | % | ||||||||

| WhiteWave Adjusted Earnings Per Share, excluding China joint venture (20%) |

$ | 1.349 | $ | 1.379 | 102.2 | % | 122.3 | % | ||||||||

| Europe Foods & Beverages |

||||||||||||||||

| Segment Net Sales (20%) (6) |

$ | 601.6 | $ | 593.1 | 98.6 | % | 71.7 | % | ||||||||

| Adjusted Segment Operating Income (40%) (6) |

$ | 73.9 | $ | 79.4 | 107.4 | % | 173.4 | % | ||||||||

| WhiteWave Adjusted Earnings Per Share, excluding China joint venture (20%) |

$ | 1.349 | $ | 1.379 | 102.2 | % | 122.3 | % | ||||||||

| (1) | On a consolidated basis, actual net sales were increased by $7.0 million for unfavorable foreign currency movements. |

| (2) | On a consolidated basis, actual earnings per share were increased by $0.027 per share for unfavorable foreign currency movements. |

| (3) | Segment net sales and adjusted segment operating income exclude results for the Vega business. |

| (4) | For the Americas Foods & Beverages segment, actual net sales were decreased by $7.0 million for unfavorable foreign currency movements. |

| (5) | For the Americas Foods & Beverages segment, actual operating income was decreased by $8.0 million for unfavorable foreign currency movements. |

| (6) | For the Europe Foods & Beverages segment, actual net sales were increased by $15.0 million and actual segment operating income was increased by $10.4 million to reflect the impact of foreign currency movements. |

13

2016 Individual Performance

In addition to the financial performance measures discussed above, the Compensation Committee assessed the performance of our Named Executive Officers against their respective strategic individual objectives, which comprised 20% of the payout determination. The individual objective portion of the 2016 STI Plan, by its nature, has an element of subjectivity. Performance is measured against each executive’s leadership and execution of strategic and organizational objectives established at the beginning of 2016. With respect to the individual objectives under the 2016 STI Plan compensation, our Named Executive Officers met or exceeded their objectives, resulting in ratings ranging from “on target” to “significantly above target” for their respective individual objectives, with one Named Executive Officer receiving a “below target” rating due to missed financial objectives at one business unit. An overview of key objectives achieved by our Named Executive Officers is set forth below.

| Gregg L. Engles | As Chief Executive Officer, Mr. Engles is responsible for developing and implementing WhiteWave’s overall short-term and long-term strategy and for recruiting, developing and leading a qualified executive leadership team to implement this strategy. The successful execution by our executive leadership team of their respective individual objectives impacts our consolidated financial results, and therefore affects Mr. Engles’ performance rating and payout. The Compensation Committee determined that Mr. Engles achieved his individual performance objectives at 100% of target performance, and the individual objectives he achieved in 2016 included the following:

• delivered adjusted net sales of $4.2 billion in 2016, which is a 9% increase over the prior year, and adjusted diluted EPS, excluding investments in our China joint venture, of $1.35, which is a 14% increase over the prior year;

• successfully negotiated and executed an agreement for Danone S.A. to acquire the Company at a price that represents a premium of approximately 24% over WhiteWave’s 30-day average closing trading price prior to the announcement;

• successfully executed our capital expenditure strategy to expand capacity to support business growth and reduce costs, with total spending below budget;

• with respect to our goal of fostering a diverse engaged workforce, received a perfect score of 100 percent on the 2017 Corporate Equality Index (CEI), for the second year in a row, introduced two new employee resource groups and launched a best-in-class leadership and development program for employees; and

• exceeded WhiteWave’s waste reduction target as part of its 2016 sustainability goals and scored an “A- Leadership” ranking for the quality of climate change related information disclosed to investors and the global marketplace through the Carbon Disclosure Project. | |

| Gregory S. Christenson | As Chief Financial Officer, Mr. Christenson is responsible for implementing WhiteWave’s overall strategy and overseeing WhiteWave’s finance, accounting and audit services, IT, tax services, treasury and investor relations functions. Mr. Christenson assumed his new position on April 1, 2016 and the Compensation Committee determined that he achieved his individual performance objectives at 100% of target performance. The individual objectives he achieved in 2016 included the following:

• achieved year-over-year total adjusted operating income growth, excluding investments in our China joint venture, of 13% in 2016;

• provided effective financial leadership to the development of key growth initiatives and execution of capital projects, including international business expansion and increasing the Company’s internal operating capacity;

• strategically and proactively managed WhiteWave’s strong relationship with the investment community;

• continued to strengthen and streamline WhiteWave’s accounting and financial forecasting, and reporting and internal control structures and capacity; | |

14

|

• successfully integrated the accounting, financial reporting and treasury functions of several acquired businesses, including our Wallaby and Vega businesses, and provided continued financial support to our China joint venture; and

• provided financial leadership in connection with the negotiation of our agreement to be acquired by Danone S.A. and in integration and value capture planning with respect to the merger. | ||

| Blaine E. McPeak | As Chief Operating Officer, Mr. McPeak was responsible for all global operations of WhiteWave, including maintaining robust organizational capabilities across the company to support WhiteWave’s growth initiatives, developing and implementing global short- and long-term strategies, overseeing WhiteWave’s international expansion and developing qualified executives to execute the strategies of each business segment. The Compensation Committee determined that Mr. McPeak achieved his individual performance objectives at 120% of target performance, and the individual objectives he achieved in 2016 included the following:

• delivered adjusted net sales of $4.2 billion in 2016, which is a 9% increase over the prior year, and adjusted segment operating income growth of 12%;

• successfully gained alignment around overall three-year strategic growth, which reflects WhiteWave’s strategic priorities, including geographic expansion and increased investment in nascent platforms;

• executed robust capital investment plan to meet growth and cost objectives, including the additional of processing capacity, the acquisition of a new production facility and the expansion of warehouse capacity;

• successfully integrated and increased the scale of the recently acquired Vega business and progressed the development and expansion of our businesses in Mexico and Canada; and

• provided effective leadership of succession planning within the Americas Foods & Beverages business segment and the planned organizational transitions relating to WhiteWave’s pending merger with Danone S.A. | |

| Bernard P.J. Deryckere | As President of the Europe Foods & Beverages business segment, Mr. Deryckere is responsible for developing and implementing the overall short and long-term strategies for the Europe plant-based foods and beverages platforms and overseeing product innovation. He also is responsible for the recruitment and development of qualified executives to execute the strategies of each business platform. The Compensation Committee determined that Mr. Deryckere achieved his individual performance objectives at 130% of target performance, and the individual objectives he achieved in 2016 included the following:

• achieved year-over-year net sales growth of 13% on a constant currency basis, and operating income growth of 25% on an adjusted, constant currency basis from the prior year;

• successfully increased sales in core European countries and expanded the Alpro brand through breakthrough product innovations, such as high protein plant-based yogurt and other ingredient beverages, such as oat milk;

• successfully executed our capital expenditure strategy to expand capacity to support business growth and reduce excess costs, including the building of distribution and warehouse facilities in Europe;

• continued our geographic expansion in France;

• achieved strong volume growth across all platforms, especially in nut-based beverages, soy beverages and plant-based yogurts; and

• expanded our strategic partnerships with key business partners through our Champions League leadership development program. | |

15

| Kevin C. Yost | As U.S. Group President, Americas Foods & Beverages business segment, Mr. Yost was responsible for developing and implementing the overall short and long-term strategies for the North America plant-based food and beverage, premium dairy, coffee creamer and beverages and fresh foods platforms, overseeing product innovation, and recruiting and developing qualified executives to execute the strategies of each business platform. He also was responsible for the recruitment and development of qualified executives to execute the strategies of each business platform. The Compensation Committee determined that Mr. Yost achieved his individual performance objectives at 75% of target performance. Some of the individual objectives he achieved in 2016 and the operational challenges that impacted his overall score included the following:

• grew net sales Americas Foods & Beverages business segment by 9%, to a record $3.6 billion, and adjusted segment operating income 14%, from the prior year;

• successfully recruited and onboarded three new members of the Americas Foods & Beverages leadership team and transitioned two general managers to new stretch positions;

• successfully developed and launched innovative new products, such as Silk vanilla high-protein nut-based milks, almond-based yogurt and Stōk ready-to-drink coffee, and implemented key marketing initiatives to build WhiteWave’s brands; and

• executed a capital investment strategy to meet growth and cost objectives, including the additional of processing capacity, the acquisition of a new production facility and the expansion of warehouse capacity.

Results in the Americas Foods & Beverages segment were negatively impacted by operating difficulties experienced in the Fresh Foods platform, which incurred elevated supply chain costs and lower than planned sales for full year 2016, and by a Silk beverages packaging design change implemented in third quarter, which negatively impacted sales and market share performance. Mr. Yost’s rating for his individual objectives reflect these challenges. | |

| Kelly J. Haecker | Mr. Haecker served as Executive Vice President, Chief Financial Officer, until March 31, 2016, when he relinquished his role as an executive office but remained with WhiteWave as Senior Vice President, Special Projects. The Compensation Committee determined that Mr. Haecker achieved his individual performance objectives at 80% of target performance, and the individual objectives he achieved in 2016 included the following:

• ensured the successful transition of the principal financial officer responsibilities to Mr. Christenson;

• supported financial leadership in connection with the negotiation of our agreement to be acquired by Danone S.A.; and

• coordinated WhiteWave’s collection of information and response to the second request for information from the U.S. Department of Justice regarding the pending Danone S.A. merger.

Mr. Haecker’s individual performance rating was negatively impacted by business disruptions in the Fresh Foods platform due to the implementation of SAP in the business in late 2015. | |

16

2016 Overall Performance

The table below shows the STI Plan payout targets for fiscal year 2016 and the actual payouts for our Named Executive Officers. The actual payout for 2016 reflects WhiteWave’s pay for performance philosophy, with actual payouts to individual executive officers reflecting the financial results of their respective business segment or corporate function as well as their respective achievement of preapproved individual objectives.

| Weighted Payout as a % of Target |

Actual STI Payouts | |||||||||||||||||||||||||||||||||||||||

| Name |

Target Payout as % of Salary |

STI Target Payout |

Corporate Financial Objectives |

Segment Financial Objectives |

Individual Objectives |

Financial Objectives |

Individual Objectives |

Total Actual Payout | ||||||||||||||||||||||||||||||||

| Gregg L. Engles |

125 | % | $ | 1,400,000 | 80 | % | — | 20 | % | $ | 1,168,160 | $ | 280,000 | $ | 1,448,160 | |||||||||||||||||||||||||

| Gregory S. Christenson |

70 | % | $ | 315,000 | 80 | % | — | 20 | % | $ | 262,836 | $ | 63,000 | $ | 325,836 | |||||||||||||||||||||||||

| Blaine E. McPeak |

100 | % | $ | 675,000 | 80 | % | — | 20 | % | $ | 563,220 | $ | 162,000 | $ | 725,220 | |||||||||||||||||||||||||

| Bernard P.J. Deryckere |

75 | % | $ | 376,842 | 20 | % | 60 | % | 20 | % | $ | 407,290 | $ | 97,904 | $ | 505,194 | ||||||||||||||||||||||||

| Kevin C. Yost |

85 | % | $ | 467,500 | 20 | % | 60 | % | 20 | % | $ | 235,994 | $ | 70,125 | $ | 306,119 | ||||||||||||||||||||||||

| Kelly J. Haecker |

70 | % | $ | 350,000 | 80 | % | — | 20 | % | $ | 292,040 | $ | 56,000 | $ | 348,040 | |||||||||||||||||||||||||

Long-Term Incentive Compensation

We believe that a substantial portion of each executive officer’s compensation should be dependent on the creation of long-term value for our stockholders. Our LTI program is designed to align the value created for our stockholders with the rewards provided to our executives, and to motivate our executive officers to improve our multi-year financial performance. Our Compensation Committee believes that our mix of PSU, RSU and stock option awards provides meaningful focus on share price appreciation through the use of stock options and PSUs, while at the same time providing some retention reinforcement through the use of service-based RSUs. For 2016, the Compensation Committee approved the following mix of LTI awards, which is the same mix used for 2015:

| 2016 LTI Awards | |||||

| Stock Options |

33.33 | % | |||

| Restricted Stock Units (RSUs) |

33.34 | % | |||

| Performance Stock Units (PSUs) |

33.33 | % | |||

The Compensation Committee annually reviews market practices and trends, as well as the number of shares available to grant to employees under our plans, in determining the mix of awards. The Committee believes stock options motivate our executives to increase stockholder value, since a stock option has value only to the extent the Company’s stock price appreciates after grant; RSUs provide an ongoing retention element and a continuing link to stockholder value; and PSUs reward our executives only if our profitability growth exceeds the market and aligns the Company’s performance metrics with WhiteWave’s strategic focus and priorities.

The PSUs vest based on WhiteWave’s adjusted diluted earnings per share growth over the three-year performance period relative to the adjusted diluted earnings per share growth of companies in the S&P 500, and have one, two and three year performance cycles, with one-third of the award subject to vesting in each performance cycle.

| 2016 | 2017 | 2018 | ||||

| 1-year performance cycle |

33% of target shares |

|||||

| 2-year performance cycle |

33% of target shares | |||||

|

3-year performance cycle |

33% of target shares |

17

In the first performance cycle, WhiteWave’s one-year adjusted diluted earnings per share growth will be measured against the one-year adjusted diluted earnings per share growth of S&P 500 companies; in the second performance cycle, WhiteWave’s cumulative adjusted diluted earnings per share growth over the prior two years will be measured against the cumulative two-year adjusted diluted earnings per share growth of S&P 500 companies; and in the final performance cycle, WhiteWave’s cumulative adjusted diluted earnings per share growth over the prior three years will be measured against the cumulative three-year adjusted diluted earnings per share growth of S&P 500 companies. EPS growth rate will be measured as a simple, average growth rate. There is no “catch up” or “retesting” at the end of the three-year performance period for previous performance cycles. The payout range is:

| Relative EPS Growth Rank |

Performance Stock Units Earned as a Percentage of Target* | ||||||

| Maximum |

75th percentile or above |

200 | % | ||||

| Target |

50th percentile |

100 | % | ||||

| Threshold |

25th percentile |

25 | % | ||||

| No Payout |

Less than 25th percentile |

0 | % | ||||

| * | Linear interpolation for performance between percentiles shown |

The first PSU awards were granted in February 2015. In April 2016, the Compensation Committee certified WhiteWave’s relative performance and the payout percentage for the first performance cycle, which comprises one-third of the 2015 PSUs. The Committee certified that the Company achieved a 78th percentile rank relative to the companies in the Comparison Group with respect to the PSU performance criteria, and approved the payout of the 2015 PSUs at 200% of target.

In determining the design of the PSUs, the Compensation Committee chose relative EPS because it believes that EPS is a better measure of WhiteWave’s overall financial performance than other relative measures; EPS provides a stronger and more direct incentive to senior management to focus on WhiteWave’s profitability; and growth in EPS ultimately should drive sustainable long-term value creation for stockholders. The Compensation Committee chose the S&P 500 as the comparison group (rather than the Benchmark Peer Group or another self-constructed or index peer group) because back-testing confirmed that the S&P 500 historically has had stronger overall performance (and, therefore, would provide a more rigorous performance standard), and includes more high growth, acquisitive companies. The Compensation Committee also believes that the S&P 500 will be less volatile or susceptible to performance aberrations than a smaller comparison group.

In determining the amount of individual LTI awards granted to each executive officer, the Compensation Committee considers WhiteWave’s financial and operational performance; the executive’s individual performance, potential future contributions, and his or her prior year’s award value; and strategic corporate-wide factors, such as succession planning and retention considerations, as well as market data for the executive officer’s position at the companies in the Benchmark Peer Group. LTI awards also may be granted when an executive is promoted to, or within, a senior executive position to recognize the increase in the scope of his or her role and responsibilities. Once individual LTI award amounts have been set, the Compensation Committee compares the aggregate LTI award amount to the Benchmark Peer Group to evaluate whether the overall size of the LTI program is competitive and consistent with market practice.

The table below shows the LTI awards granted to our Named Executive Officers in 2016:

| 2016 LTI Grant Date Fair Value($)(1) |

Options(#) | RSUs(#) | PSUs(#) (2) |

|||||||||||||

| Gregg L. Engles |

$ | 5,999,974 | 179,193 | 55,428 | 55,411 | |||||||||||

| Gregory S. Christenson |

$ | 949,976 | 28,372 | 8,776 | 8,773 | |||||||||||

| Blaine E. McPeak |

$ | 1,999,979 | 59,731 | 18,476 | 18,470 | |||||||||||

| Bernard P.J. Deryckere |

$ | 999,984 | 29,865 | 9,238 | 9,235 | |||||||||||

| Kevin C. Yost |

$ | 1,249,968 | 37,331 | 11,547 | 11,544 | |||||||||||

| Kelly J. Haecker (3) |

— | — | — | — | ||||||||||||

| (1) | The Grant Date Fair Value is calculated in accordance with ASC Topic 718 related to “Compensation—Stock Compensation,” without taking into account estimated forfeitures, and is based on $36.09, the closing stock price on the date of grant. |

18

| (2) | PSUs are reported at target level performance. Under the terms of the award agreements, vesting of the PSUs may range from 0% to 200%, depending on our adjusted EPS growth relative to the adjusted EPS growth of S&P 500 companies. |

| (3) | Mr. Haecker stepped down as an executive officer on March 31, 2016 and had planned to retire from WhiteWave; however he subsequently agreed to remain in a non-executive officer capacity. As a result, he did not receive an equity award grant in 2016. |

Determination of the 2016 Compensation of our Named Executive Officers

Compensation of Our Chief Executive Officer. With respect to the compensation of Gregg L. Engles, our Chairman and Chief Executive Officer, the Compensation Committee is responsible for approving relevant corporate goals and objectives, evaluating his performance in light of those goals and objectives and, together with the other independent directors, determining and approving his compensation based on their evaluation. At the beginning of 2016, the Compensation Committee established Mr. Engles’ specific objectives for 2016. In January 2017, Mr. Engles prepared a self-assessment of his performance for 2016, which was presented to our Lead Director and the Chair of the Compensation Committee for review. Our Lead Director and the Chair of the Compensation Committee then coordinated the review and discussion of Mr. Engles’ performance by the Compensation Committee and all of the independent directors, and the independent directors approved a performance rating and individual payout factor for Mr. Engles. Other than preparation of his performance self-assessment, Mr. Engles does not participate in the process of determining his own compensation, nor was he present for the discussions regarding his compensation. An overview of key achievements that were considered when evaluating Mr. Engles’ 2016 performance is discussed under the heading “—Annual Cash Compensation—Short-Term Incentive Compensation.”

When considering Mr. Engles’ compensation under the applicable compensation programs and policies, the Compensation Committee and our other independent directors considered Mr. Engles’ base salary, STI compensation, LTI compensation, and total direct compensation compared to the compensation of the chief executive officers of companies in the Benchmark Peer Group, WhiteWave’s financial, strategic and stock performance in the past year, and Mr. Engles’ extensive skills and experience. The Compensation Committee also applied the metrics described under “—Annual Cash Compensation—Short-Term Incentive Compensation,” and “—Long-Term Incentive Compensation.” The difference in magnitude and mix of target total compensation between Mr. Engles’ compensation and the compensation of our other Named Executive Officers reflects the significant difference in their responsibilities. Mr. Engles is directly responsible for establishing and driving our strategy and for ensuring that the strategy is fully executed across our organization. In addition, Mr. Engles is directly responsible for selecting, retaining, managing, and developing the executive team that will develop and execute corporate strategy.

Role of Chief Executive Officer in Compensation of Other Named Executive Officers. At the beginning of 2016, performance objectives for 2016 were established for all of our Named Executive Officers. Mr. Engles worked with the Named Executive Officers to develop their specific objectives to present to the Compensation Committee for approval. The Compensation Committee approved the specific objectives for each of our Named Executive Officers at the beginning of 2016, and monitored performance against those specific objectives throughout the year.

In February 2017, Mr. Engles presented to the Compensation Committee his assessments of the 2016 performance of the Named Executive Officers against their respective performance objectives and recommended payout percentages under the 2016 STI plan and changes to each Named Executive Officer’s compensation for 2017. Mr. Engles based his compensation recommendations with respect to our Named Executive Officers on the same Benchmark Peer Group market data reviewed by the Compensation Committee, his subjective review of each Named Executive Officer’s overall performance and contributions to WhiteWave as a whole and their respective business segment, and the overall performance of WhiteWave and the Named Executive Officer’s applicable business segment. While they considered Mr. Engles’ recommendations with respect to the compensation of our Named Executive Officers, our Compensation Committee made all final compensation decisions relating to such Named Executive Officers.