Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Tracon Pharmaceuticals, Inc. | d309060dex231.htm |

| EX-10.39 - EX-10.39 - Tracon Pharmaceuticals, Inc. | d309060dex1039.htm |

| EX-5.1 - EX-5.1 - Tracon Pharmaceuticals, Inc. | d309060dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 27, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TRACON PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2836 | 34-2037594 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

8910 University Center Lane, Suite 700

San Diego, California 92122

(858) 550-0780

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Charles P. Theuer, M.D., Ph.D.

President and Chief Executive Officer

TRACON Pharmaceuticals, Inc.

8910 University Center Lane, Suite 700

San Diego, California 92122

(858) 550-0780

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Patricia Bitar | Sean M. Clayton, Esq. | |

| Chief Financial Officer | Cooley LLP | |

| TRACON Pharmaceuticals, Inc. | 4401 Eastgate Mall | |

| 8910 University Center Lane, Suite 700 | San Diego, CA 92121 | |

| San Diego, CA 92122 | (858) 550-6000 | |

| (858) 550-0780 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be Registered |

Proposed Maximum Offering Price per Share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common Stock, par value $0.001 per share |

3,231,515(1) | $4.18(2) | $13,507,733 | $1,566 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Represents 417,948 shares of common stock currently outstanding and 2,813,567 shares of common stock that are issuable pursuant to a common stock purchase agreement with the selling stockholder named herein. Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this registration statement also covers any additional shares of common stock which may become issuable to prevent dilution from stock splits, stock dividends and similar events. |

| (2) | Pursuant to Rule 457(c) under the Securities Act of 1933, as amended, calculated on the basis of the average high and low prices per share of the registrant’s common stock reported on The NASDAQ Global Market on March 24, 2017. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholder is not soliciting offers to buy these securities, in any state where the offer or sale of these securities is not permitted.

PROSPECTUS, SUBJECT TO COMPLETION, DATED MARCH 27, 2017

3,231,515 Shares

Common Stock

This prospectus relates to the sale of up to 3,231,515 shares of our common stock by Aspire Capital Fund, LLC. Aspire Capital is also referred to in this prospectus as the selling stockholder. The prices at which the selling stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $21.0 million from the sale of our common stock to the selling stockholder, pursuant to a common stock purchase agreement entered into with the selling stockholder on March 14, 2017, once the registration statement, of which this prospectus is a part, is declared effective.

The selling stockholder is an “underwriter” within the meaning of the Securities Act of 1933, as amended. We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder.

Our common stock is listed on The NASDAQ Global Market under the ticker symbol “TCON.” On March 24, 2017, the last reported sale price per share of our common stock was $4.10 per share.

You should read this prospectus and any prospectus supplement, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. Please see “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

i

Table of Contents

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to invest in our common stock.

Neither we nor the selling stockholder have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholder is offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling stockholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

ii

Table of Contents

The following summary highlights information contained or incorporated by reference elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and other documents incorporated by reference in this prospectus, as well as the information under the caption “Risk Factors” herein and under similar headings in the other documents that are incorporated by reference into this prospectus.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “TRACON,” “the company,” “we,” “us” and “our” refer to TRACON Pharmaceuticals, Inc.

Company Overview

We are a biopharmaceutical company focused on the development and commercialization of novel targeted therapeutics for cancer, wet age-related macular degeneration, or wet AMD, and fibrotic diseases. We are a leader in the field of endoglin biology and are using our expertise to develop antibodies that bind to the endoglin receptor. Endoglin is essential to angiogenesis, the process of new blood vessel formation required for solid cancer growth and for wet AMD, and a key contributor to the development of fibrosis, or tissue scarring. We are developing our lead product candidate, TRC105 (INN carotuximab), an endoglin antibody, for the treatment of multiple solid tumor types in combination with inhibitors of the vascular endothelial growth factor, or VEGF, pathway. The VEGF pathway regulates vascular development in the embryo, or vasculogenesis, and angiogenesis. We believe treatment with TRC105 in combination with VEGF inhibitors may improve survival in cancer patients when compared to treatment with a VEGF inhibitor alone. TRC105 has been studied in eight completed Phase 2 clinical trials and three completed Phase 1 clinical trials, and is currently being dosed in one Phase 3 clinical trial, four Phase 2 clinical trials and three Phase 1 clinical trials. Our TRC105 oncology clinical development plan is broad and involves a tiered approach. We are initially focused on two indications, angiosarcoma and gestational trophoblastic neoplasia, or GTN, both of which are tumors that highly express endoglin, the target of TRC105, and therefore may be more responsive to treatment with TRC105. We have seen complete ongoing responses in these tumor types and have initiated dosing in an international multicenter Phase 3 trial in angiosarcoma and an international multicenter Phase 2 trial in GTN. We obtained Special Protocol Assessment (SPA) agreement from the U.S. Food and Drug Administration (FDA) on our clinical trial design for the Phase 3 trial in angiosarcoma and also incorporated scientific advice from the European Medicines Agency (EMA) regarding the adequacy of the trial design. We also received orphan drug designation from the FDA and the EMA for TRC105 for the treatment of soft tissue sarcoma, including angiosarcoma, in 2016.

The next tier of TRC105 development includes ongoing Phase 2 trials in renal cell carcinoma, which is a randomized trial expected to produce top-line data in the second half of 2017, and hepatocellular carcinoma, that is expected to produce top-line data in the first half of 2018. Positive data from either of these Phase 2 trials could enable Phase 3 development. We consider these indications attractive because the endpoints for regulatory approval may be attained more quickly than the endpoints for other indications. We also expect that these initial indications would be for the same lines of treatment for which the companion VEGF inhibitor is approved.

Finally, the third tier of TRC105 development includes large indications including an ongoing Phase 1 trial in lung cancer and a Phase 1/2 trial in breast cancer. Positive data in these larger indications would enable further development.

We have produced a formulation of TRC105 for development in ophthalmology, which is being developed for the treatment of wet AMD, the leading cause of blindness in the Western world. In March 2014, Santen licensed from us exclusive worldwide rights to develop and commercialize our endoglin antibodies, including

1

Table of Contents

TRC105, for ophthalmology indications. We retain global rights to develop our endoglin antibodies outside of the field of ophthalmology. In June 2015, Santen filed an Investigational New Drug, or IND, application with the FDA for the initiation of clinical studies for DE-122, the ophthalmic formulation of TRC105, in patients with wet AMD. The Phase 1/2 PAVE trial is recruiting patients with wet AMD, including patients receiving a VEGF inhibitor, and top-line data are expected in the second half of 2017. We also expect Santen to initiate the Phase 2 AVANTE trial in wet AMD in 2017.

TRC205, a humanized, deimmunized endoglin antibody, is being developed for the treatment of fibrotic diseases. Diseases characterized by fibrosis, the harmful buildup of excessive fibrous tissue from cells, including the fibroblast, that leads to scarring and ultimately organ failure, include nonalcoholic steatohepatitis, or NASH, idiopathic pulmonary fibrosis, or IPF, renal fibrosis, cardiac fibrosis and scleroderma. Clinical data have demonstrated increased endoglin expression on fibroblasts in patients with heart failure and inhibiting endoglin reduced cardiac fibrosis, preserved heart function and improved survival in mouse models of heart failure. Subsequent preclinical research in mouse models indicated that antibodies to endoglin inhibit cardiac, liver, and pulmonary fibrosis. These findings indicate endoglin’s importance in cardiac, lung and liver fibrosis, and we believe these findings may be applicable to multiple fibrotic diseases, including NASH, IPF, myelofibrosis and other indications.

In addition, a patient with cutaneous neurofibromatosis treated with TRC105 and a VEGF inhibitor in an oncology trial demonstrated reduction in the cutaneous lesions that characterize the disease. We may study TRC105 in additional patients with cutaneous neurofibromatosis.

Our second clinical stage product oncology candidate is TRC102, a small molecule being developed for the treatment of mesothelioma, lung cancer and glioblastoma. TRC102 is in clinical development to reverse resistance to specific chemotherapeutics by inhibiting base-excision repair, or BER. In initial clinical trials of more than 100 patients, TRC102 has shown good tolerability and promising anti-tumor activity in combination with alkylating and antimetabolite chemotherapy, including agents approved for the treatment of lung cancer and glioblastoma. TRC102 is being studied in Phase 2 trials with Temodar (temozolomide) in glioblastoma and with Alimta (pemetrexed) in mesothelioma, in addition to three ongoing Phase 1 trials.

We are also developing TRC253 and TRC694, small molecule compounds we licensed from Janssen Pharmaceutica N.V. (Janssen) in September 2016. TRC253 is a novel small molecule high affinity competitive inhibitor of wild type androgen receptor (AR) and multiple AR mutant receptors which display drug resistance to currently approved treatments, and is intended for the treatment of men with prostate cancer. We filed an IND in December 2016, which was cleared by the FDA in January 2017, and expect to initiate first in human testing for TRC253 in a Phase 1/2 clinical study in the first half of 2017. Until 90 days after we complete the initial Phase 1/2 study, Janssen has an exclusive option to reacquire full rights to TRC253 for an upfront payment of $45.0 million to us, and obligations to make regulatory and commercialization milestone payments totaling up to $137.5 million upon achievement of specified events and a low single-digit royalty. If Janssen does not exercise its exclusive option to reacquire the program, we would then retain worldwide development and commercialization rights to the program, in which case we would be obligated to pay Janssen a total of up to $45.0 million in development and regulatory milestones upon achievement of specified events, in addition to a low single digit royalty.

TRC694 is a novel, potent, orally bioavailable inhibitor of NF-kB inducing kinase (NIK), which is intended for the treatment of patients with hematologic malignancies, including myeloma. We plan to conduct preclinical activities, including formulation development and companion diagnostic development, and expect to file an IND for TRC694 in 2018.

We operate a product development platform that emphasizes capital efficiency. Our experienced clinical operations, data management, quality assurance and regulatory affairs groups are responsible for significant

2

Table of Contents

aspects of our clinical trials, including site monitoring, regulatory compliance, database management and clinical study report preparation. We use this internal resource to minimize the costs associated with hiring contract research organizations, or CROs, to manage clinical, regulatory and database aspects of the clinical trials that we sponsor. In our experience, this model has resulted in capital efficiencies and improved communication with clinical trial sites, which expedites patient enrollment and access to patient data as compared to a CRO-managed model, and we have begun to leverage this capital efficient model in our recently initiated international clinical trials. In addition, we have an experienced chemistry, manufacturing and controls (CMC) group that completes our product development platform.

We have collaborated with the National Cancer Institute (NCI), which has selected TRC105 and TRC102 for federal funding of clinical development, as well as Case Western Cancer Center (Case Western) and certain other academic institutions. Under these collaborations, NCI has sponsored or is sponsoring nine completed or ongoing clinical trials of TRC105 and TRC102, and Case Western has sponsored or is sponsoring three clinical trials of TRC102. We anticipate that NCI will complete ongoing Phase 1 and Phase 2 clinical trials of TRC105 and TRC102 and may initiate other clinical trials. If merited by Phase 2 data, we expect to fund additional Phase 3 clinical trials of TRC105 in certain indications beyond angiosarcoma and initial Phase 3 clinical trials of TRC102 and, based on NCI’s past course of conduct with similarly situated pharmaceutical companies in which it has sponsored pivotal clinical trials following receipt of positive Phase 2 data, we anticipate that NCI would sponsor Phase 3 clinical trials in additional indications.

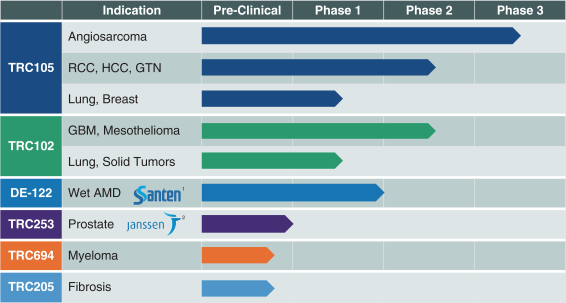

The following chart summarizes our pipeline of product candidates:

| 1 | Partnered with Santen Pharmaceutical Co., Ltd. (Santen) |

| 2 | Janssen Pharmaceutica N.V. (Janssen) retains a buyback option |

3

Table of Contents

The following table summarizes key information regarding ongoing and planned development of our product candidates:

| Phase | Data Expected | |||||||

| TRC105 |

||||||||

| Ongoing trials: |

||||||||

| Angiosarcoma |

Phase 3 | Interim analysis first half 2018 | ||||||

| Renal Cell Carcinoma |

Randomized Phase 2 | Second half 2017 | ||||||

| Soft Tissue Sarcoma |

Phase 2 | Second half 2017 | ||||||

| Gestational Trophoblastic Neoplasia (GTN) |

Phase 2 | Interim data second half 2017 | ||||||

| Hepatocellular Carcinoma |

Phase 1/2 | 2018 | ||||||

| Hepatocellular Carcinoma (NCI Sponsored) |

Phase 1/2 | 2017 | ||||||

| Lung Cancer |

Phase 1 | 2017 | ||||||

| Breast Cancer |

Phase 1/2 | 2017 | ||||||

| Wet AMD (Santen) (DE-122) |

Phase 1/2 | 2017 | ||||||

| TRC102 |

||||||||

| Ongoing trials: |

||||||||

| Mesothelioma |

Phase 2 | 2018 | ||||||

| Glioblastoma |

Phase 2 | 2018 | ||||||

| Solid tumors |

Phase 1 | 2017 | ||||||

| Solid tumors (Oral) and Lymphomas |

Phase 1 | 2018 | ||||||

| Lung Cancer |

Phase 1 | 2018 | ||||||

| TRC253 |

||||||||

| Planned trials: |

||||||||

| Prostate Cancer |

Phase 1/2 | 2018 | ||||||

Corporate Information

We were incorporated in the state of Delaware in October 2004 as Lexington Pharmaceuticals, Inc. and we subsequently changed our name to TRACON Pharmaceuticals, Inc. in March 2005, at which time we relocated to San Diego, California. Our principal executive offices are located at 8910 University Center Lane, Suite 700, San Diego, CA 92122, and our telephone number is (858) 550-0780.

Our corporate website address is www.traconpharma.com and we regularly post copies of our press releases as well as additional information about us on our website. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies or products.

4

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

| • | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions through 2020 or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of some reduced reporting burdens in this prospectus and the documents incorporated by reference into this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

5

Table of Contents

The Offering

| Common stock being offered by the selling stockholder |

3,231,515 shares |

| Common stock outstanding |

16,165,659 shares (as of March 14, 2017, excluding the Initial Purchase Shares and the Commitment Shares, as defined below) |

| Use of proceeds |

The selling stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive up to $21.0 million in proceeds from the sale of our common stock to the selling stockholder under the common stock purchase agreement described below. Proceeds that we receive under the common stock purchase agreement will be used to advance our research and development activities and for working capital and general corporate purposes. |

| NASDAQ Global Market Symbol |

TCON |

| Risk Factors |

Investing in our securities involves a high degree of risk. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 9 for a discussion of factors to consider before deciding to invest in shares of our common stock. |

The number of shares of our common stock outstanding is based on an aggregate of 16,165,659 shares outstanding as of March 14, 2017 and excludes the 222,222 Initial Purchase Shares and 195,726 Commitment Shares as defined below, and also excludes:

| • | 2,266,831 shares of common stock issuable upon the exercise of options outstanding as of March 14, 2017 at a weighted average exercise price of $7.90 per share; |

| • | 241,902 shares of common stock issuable upon the vesting of restricted stock units outstanding as of March 14, 2017; |

| • | 826,948 shares of common stock reserved for future issuance under the 2015 Equity Incentive Plan as of March 14, 2017; |

| • | 422,687 shares of common stock reserved for future issuance under the 2015 Employee Stock Purchase Plan as of March 14, 2017; and |

| • | 103,865 shares of common stock issuable upon the exercise of warrants outstanding as of March 14, 2017 at a weighted average exercise price of $7.12 per share. |

On March 14, 2017, we entered into a common stock purchase agreement, or the Purchase Agreement, with Aspire Capital Fund, LLC, an Illinois limited liability company, or Aspire Capital, or the selling stockholder, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $21.0 million of shares of our common stock over the 30-month term of the Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital 195,726 shares of our common stock, or the Commitment Shares, as a commitment fee and sold to Aspire Capital 222,222 shares of common stock, or the Initial Purchase Shares, at $4.50 per share for proceeds of $1.0 million. Concurrently with entering into the Purchase Agreement, we also entered into a registration rights agreement with Aspire Capital, or the Registration Rights Agreement, in which we agreed to file one or more registration statements, including the registration

6

Table of Contents

statement of which this prospectus is a part, as permissible and necessary to register under the Securities Act of 1933, as amended, or the Securities Act, the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the Purchase Agreement.

As of March 14, 2017, there were 16,165,659 shares of our common stock outstanding, excluding the 3,231,515 shares offered that have been issued or may be issuable to Aspire Capital pursuant to the Purchase Agreement. If all of such 3,231,515 shares of our common stock offered hereby were issued and outstanding as of the date hereof, such shares would represent 19.9% of the total common stock outstanding as of the date hereof. The number of shares of our common stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

The aggregate number of shares that we may issue to Aspire Capital under the Purchase Agreement, including the Commitment Shares, may in no case exceed 3,231,515 shares of our common stock (which is equal to 19.99% of the common stock outstanding on the date of the Purchase Agreement) unless (i) shareholder approval is obtained to issue more, in which case this 3,231,515 share limitation will not apply, or (ii) shareholder approval has not been obtained and at any time the 3,231,515 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement (including the Commitment Shares) is equal to or greater than $4.15, referred to as the Minimum Price, a price equal to the closing sale price of our common stock on the business day prior to the date of the Purchase Agreement; provided that at no one point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 3,231,515 shares of our common stock under the Securities Act, which includes the Commitment Shares and the Initial Purchase Shares that have already been issued to Aspire Capital, and 2,813,567 shares of common stock that we may issue to Aspire Capital after this registration statement is declared effective under the Securities Act. All 3,231,515 shares of common stock are being offered pursuant to this prospectus. If we elect to sell more than the 3,231,515 shares of common stock offered hereby, we must first register under the Securities Act the sale by Aspire Capital of such additional shares.

After the Securities and Exchange Commission has declared effective the registration statement of which this prospectus is a part, on any trading day on which the closing sale price of our common stock exceeds $0.50, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice (each, a Purchase Notice), directing Aspire Capital (as principal) to purchase up to 75,000 shares of our common stock per trading day, up to $21.0 million of our common stock in the aggregate at a per share price, or the Purchase Price, calculated by reference to the prevailing market price of our common stock (as more specifically described below in the section titled “The Aspire Capital Transaction”).

In addition, on any date on which we submit a Purchase Notice for 75,000 shares to Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice (each, a VWAP Purchase Notice) directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Company’s common stock traded on The NASDAQ Global Market on the next trading day, or VWAP Purchase Date, subject to a maximum number of shares we may determine, or VWAP Purchase Share Volume Maximum, and a minimum trading price, or VWAP Minimum Price Threshold (as more specifically described below). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the VWAP Purchase Price, is calculated by reference to the prevailing market price of our common stock (as more specifically described below in the section titled “The Aspire Capital Transaction”).

The Purchase Agreement provides that the Company and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than $0.50

7

Table of Contents

per share, or the Floor Price. This Floor Price and the respective prices and share numbers in the preceding paragraphs will be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction. There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. Aspire Capital may not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

8

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks and uncertainties as well as the risks and uncertainties described in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the Securities and Exchange Commission, or SEC, on March 1, 2017, as well as in our subsequent Quarterly and Annual Reports filed with the SEC, which descriptions are incorporated in this prospectus by reference in their entirety, as well as in any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment. You should carefully consider the following information about risks, together with the other information contained in this prospectus, before making an investment in our common stock.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms.

We will need to raise substantial additional capital in the future to fund our operations. The extent to which we utilize the Purchase Agreement with Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock, the volume of trading in our common stock and the extent to which we are able to secure funds from other sources. The number of shares that we may sell to Aspire Capital under the Purchase Agreement on any given day and during the term of the Purchase Agreement is limited. See “The Aspire Capital Transaction” for additional information. Additionally, we and Aspire Capital may not effect any sales of shares of our common stock under the Purchase Agreement during the continuance of an event of default or on any trading day that the closing sale price of our common stock is less than $0.50 per share. Even if we are able to access the full $21.0 million under the Purchase Agreement, we will still need additional capital to fully implement our business, operating and development plans.

The sale of our common stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of common stock acquired by Aspire Capital could cause the price of our common stock to decline.

We are registering for sale the Commitment Shares and Initial Purchase Shares that we have issued and 2,813,567 additional shares that we may sell to Aspire Capital from time to time under the Purchase Agreement. It is anticipated that shares registered in this offering will be sold over a period of up to approximately 30 months from the date of this prospectus. The number of shares ultimately offered for sale by Aspire Capital under this prospectus is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending on a variety of factors, including market liquidity of our common stock, the sale of shares under the Purchase Agreement may cause the trading price of our common stock to decline.

Aspire Capital may ultimately purchase all, some or none of the $21.0 million of common stock that, together with the Commitment Shares and Initial Purchase Shares, is the subject of this prospectus. Aspire Capital may sell all, some or none of our shares that it holds or comes to hold under the Purchase Agreement. Sales by us to Aspire Capital of shares pursuant to the Purchase Agreement may result in dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock by Aspire Capital in this offering, or anticipation of such sales, could cause the trading price of our common stock to decline or make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire.

9

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements that reflect our management’s beliefs and views with respect to future events and are subject to substantial risks and uncertainties within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this prospectus and the documents incorporated by reference herein, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management, are forward-looking statements. Forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “plans,” “intends,” “estimates,” “could,” “should,” “would,” “continue,” “seeks,” “aims,” “projects,” “predicts,” “pro forma,” “anticipates,” “potential” or other similar words (including their use in the negative), or by discussions of future matters such as the development of product candidates or products, technology enhancements, possible changes in legislation, and other statements that are not historical.

The forward-looking statements in this prospectus include, among other things, statements about:

| • | the success, cost, design and timing of results of our and our collaborators’ ongoing clinical trials; |

| • | our and our collaborators’ plans to develop and commercialize our product candidates; |

| • | the potential benefits of our collaboration arrangements, including our strategic licensing collaboration with Janssen, and our ability to enter into additional collaboration arrangements; |

| • | our regulatory strategy and potential benefits associated therewith; |

| • | the timing of, and our ability to obtain and maintain, regulatory approvals for our product candidates; |

| • | the rate and degree of market acceptance and clinical utility of any approved product candidate; |

| • | the impact of competing products that are or may become available; |

| • | the size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

| • | our commercialization, marketing and manufacturing capabilities and strategy; |

| • | our intellectual property position; |

| • | our estimates regarding expenses, future revenues, capital requirements, the sufficiency of our current and expected cash resources, and our need for additional financing; |

| • | the anticipated benefits associated with our capital efficient clinical development model; |

| • | our ability to sell shares of common stock to Aspire Capital pursuant to the terms of the Purchase Agreement and our ability to register and maintain the registration of the shares issued and issuable thereunder; and |

| • | our anticipated use of the net proceeds from the potential sale of shares of our common stock to Aspire Capital. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. We operate in a very competitive and rapidly changing environment. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make, and accordingly you should not place undue reliance on our forward-looking statements. We have included important factors in the cautionary statements included in this prospectus, particularly in the “Risk Factors” section in this prospectus and

10

Table of Contents

the documents incorporated by reference herein, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus, the documents incorporated by reference herein and the documents that we have filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus and the documents incorporated by reference herein by these cautionary statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

11

Table of Contents

THE ASPIRE CAPITAL TRANSACTION

General

On March 14, 2017, we entered into the Purchase Agreement, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $21.0 million of our shares of common stock over the term of the Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase Agreement, we issued to Aspire Capital the 195,726 Commitment Shares. Upon execution of the Purchase Agreement, we also sold to Aspire Capital the 222,222 Initial Purchase Shares for proceeds of $1.0 million. Concurrently with entering into the Purchase Agreement, we also entered into the Registration Rights Agreement, in which we agreed to file one or more registration statements as permissible and necessary to register under the Securities Act, the sale of the shares of our common stock that have been and may be issued to Aspire Capital under the Purchase Agreement.

As of March 14, 2017, there were 16,165,659 shares of our common stock outstanding, excluding the 3,231,515 shares offered that have been issued or may be issuable to Aspire Capital pursuant to the Purchase Agreement. If all of such 3,231,515 shares of our common stock offered hereby were issued and outstanding as of the date hereof, such shares would represent 19.9% of the total common stock outstanding. The number of shares of our common stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

The aggregate number of shares that we may issue to Aspire Capital under the Purchase Agreement, including the Commitment Shares, may in no case exceed 3,231,515 shares of our common stock (which is equal to 19.99% of the common stock outstanding on the date of the Purchase Agreement) unless (i) shareholder approval is obtained to issue more, in which case this 3,231,515 share limitation will not apply, or (ii) shareholder approval has not been obtained and at any time the 3,231,515 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement (including the Commitment Shares) is equal to or greater than $4.15, referred to as the Minimum Price, a price equal to the closing sale price of our common stock on the business day prior to the date of the Purchase Agreement; provided that at no one point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 3,231,515 shares of our common stock under the Securities Act, which includes the Commitment Shares and Initial Purchase Shares that have already been issued to Aspire Capital and 2,813,567 shares of common stock which we may issue to Aspire Capital after this registration statement is declared effective under the Securities Act. All 3,231,515 shares of common stock are being offered pursuant to this prospectus. Under the Purchase Agreement, we have the right but not the obligation to issue more than the 3,231,515 shares of common stock included in this prospectus to Aspire Capital under some circumstances. If we elect to sell more than the 3,231,515 shares of common stock offered hereby, we must first register under the Securities Act the sale by Aspire Capital of any such additional shares.

After the Securities and Exchange Commission has declared effective the registration statement of which this prospectus is a part, on any trading day on which the closing sale price of our common stock is not less than $0.50 per share, we have the right, in our sole discretion, to present Aspire Capital with a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 75,000 shares of our common stock per business day, up to $21.0 million of our common stock in the aggregate over the term of the Purchase Agreement, at a Purchase Price calculated by reference to the prevailing market price of our common stock over the preceding 10-business day period (as more specifically described below); however, no sale pursuant to a Purchase Notice may exceed $500,000 per trading day.

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for 75,000 Purchase Shares, we also have the right, in our sole discretion, to present Aspire Capital with a VWAP Purchase Notice

12

Table of Contents

directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of our common stock traded on the NASDAQ Global Market on the next trading day, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold. The VWAP Purchase Price is calculated by reference to the prevailing market price of our common stock (as more specifically described below).

The Purchase Agreement provides that we and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than the Floor Price. There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement.

Aspire Capital may not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

Purchase of Shares under the Purchase Agreement

Under the Purchase Agreement, on any trading day selected by us on which the closing sale price of our common stock exceeds $0.50 per share, we may direct Aspire Capital to purchase up to 75,000 shares of our common stock per trading day. The Purchase Price of such shares is equal to the lesser of:

| • | the lowest sale price of our common stock on the purchase date; or |

| • | the average of the three lowest closing sale prices for our common stock during the ten consecutive trading days ending on the trading day immediately preceding the purchase date. |

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for the purchase of up to 75,000 shares, we also have the right to direct Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the our common stock traded on the NASDAQ Global Market on the next trading day, subject to the VWAP Purchase Share Volume Maximum and the VWAP Minimum Price Threshold, which is equal to the greater of (a) 80% of the closing price of the Company’s common stock on the business day immediately preceding the VWAP Purchase Date or (b) such higher price as set forth by the Company in the VWAP Purchase Notice. The VWAP Purchase Price of such shares is the lower of:

| • | the closing sale price on the VWAP Purchase Date; or |

| • | 97% of the volume-weighted average price for our common stock traded on the NASDAQ Global Market: |

| • | on the VWAP Purchase Date, if the aggregate shares to be purchased on that date have not exceeded the VWAP Purchase Share Volume Maximum or |

| • | during that portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate shares traded on the NASDAQ Global Market exceed the VWAP Purchase Share Volume Maximum or (ii) the time at which the sale price of the Company’s common stock falls below the VWAP Minimum Price Threshold. |

The Purchase Price will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the trading day(s) used to compute the Purchase Price. We may deliver multiple Purchase Notices and VWAP Purchase Notices to Aspire Capital from time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed.

13

Table of Contents

Minimum Share Price

Under the Purchase Agreement, we and Aspire Capital may not effect any sales of shares of our common stock under the Purchase Agreement on any trading day that the closing sale price of our common stock is less than $0.50 per share.

Events of Default

Generally, Aspire Capital may terminate the Purchase Agreement upon the occurrence of any of the following, among other, events of default:

| • | the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the Registration Rights Agreement between us and Aspire Capital lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable to Aspire Capital for sale of our shares of common stock, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of 30 business days in any 365-day period, which is not in connection with a post-effective amendment to any such registration statement; in connection with any post-effective amendment to such registration statement that is required to be declared effective by the SEC such lapse or unavailability may continue for a period of no more than 40 consecutive business days; |

| • | the suspension from trading or failure of our common stock to be listed on our principal market for a period of three consecutive business days; |

| • | the delisting of our common stock from our principal market, provided our common stock is not immediately thereafter trading on the New York Stock Exchange, the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Select Market, the Nasdaq Global Market, the OTB Bulletin Board or the OTCQB marketplace or OTCQX marketplace of the OTC Markets Group; |

| • | our transfer agent’s failure to issue to Aspire Capital shares of our common stock which Aspire Capital is entitled to receive under the Purchase Agreement within five business days after an applicable purchase date; |

| • | any breach by us of the representations or warranties or covenants contained in the Purchase Agreement or any related agreements which could have a material adverse effect on us, subject to a cure period of five business days; |

| • | if we become insolvent or are generally unable to pay our debts as they become due; or |

| • | any participation or threatened participation in insolvency or bankruptcy proceedings by or against us. |

Our Termination Rights

The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

No Short-Selling or Hedging by Aspire Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or all of the 3,231,515 shares registered in this offering. It is anticipated that shares registered in this offering will be sold over a period of up to

14

Table of Contents

approximately 30 months from the date of this prospectus. The sale by Aspire Capital of a significant amount of shares registered in this offering at any given time could cause the market price of our common stock to decline and/or to be highly volatile. Aspire Capital may ultimately purchase all, some or none of the 2,813,567 shares of common stock not yet issued but registered in this offering. After it has acquired such shares, it may sell all, some or none of such shares. Therefore, sales to Aspire Capital by us pursuant to the Purchase Agreement also may result in substantial dilution to the interests of other holders of our common stock. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any time at our discretion without any penalty or cost to us.

Percentage of Outstanding Shares after Giving Effect to the Purchased Shares Issued to Aspire Capital

In connection with entering into the Purchase Agreement, we authorized the sale to Aspire Capital of up to $21.0 million of our shares of common stock. However, we estimate that we will sell no more than 3,231,515 shares to Aspire Capital under the Purchase Agreement (including the Commitment Shares and Initial Purchase Shares), all of which are included in this offering. Subject to any required approval by our board of directors, we have the right but not the obligation to issue more than the 3,231,515 shares included in this prospectus to Aspire Capital under the Purchase Agreement under some circumstances. In the event we elect to issue more than 3,231,515 shares under the Purchase Agreement, we will be required to file a new registration statement and have it declared effective by the SEC. The number of shares ultimately offered for sale by Aspire Capital in this offering is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement. The following table sets forth the number and percentage of outstanding shares to be held by Aspire Capital after giving effect to the sale of shares of common stock sold to Aspire Capital at varying purchase prices:

| Assumed Average Purchase Price |

Proceeds from the Sale of Shares to Aspire Capital Under the Purchase Agreement Registered in this Offering |

Number of Shares to be Issued in this Offering at the Assumed Average Purchase Price (1) |

Total Number of Outstanding Shares After Giving Effect to the Shares Issued to Aspire Capital (2) |

Percentage of Outstanding Shares After Giving Effect to the Purchased Shares Issued to Aspire Capital (3) |

||||||||||||||

| $ | 0.50 | $ | 1,517,895 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 1.00 | $ | 3,035,789 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 2.00 | $ | 6,071,578 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 3.00 | $ | 9,107,367 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 4.00 | $ | 12,143,156 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 5.00 | $ | 15,178,945 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 6.00 | $ | 18,214,734 | 3,035,789 | 19,397,174 | 16.7 | % | |||||||||||

| $ | 7.00 | $ | 21,000,000 | 3,000,000 | 19,361,385 | 16.5 | % | |||||||||||

| (1) | Excludes the 195,726 Commitment Shares issued under the Purchase Agreement between us and Aspire Capital, but includes the 222,222 Initial Purchase Shares. |

| (2) | Based on an assumed number of shares outstanding as of March 14, 2017, which includes the 16,165,659 shares of common stock outstanding immediately prior to the execution of the Purchase Agreement, 195,726 Commitment Shares previously issued to Aspire Capital and the number of shares set forth in the adjacent column (including the Initial Purchase Shares) that we would have sold to Aspire Capital. |

| (3) | The numerator includes the 195,726 Commitment Shares plus the number of shares set forth in the column titled, “Number of Shares to be Issued in this Offering at the Assumed Average Purchase Price.” The denominator is set forth in the adjacent column. |

15

Table of Contents

This prospectus relates to shares of our common stock that may be offered and sold from time to time by Aspire Capital. We will not receive any proceeds upon the sale of shares by Aspire Capital. However, we have received proceeds of $1.0 million, and may receive additional proceeds of up to $20.0 million, for an aggregate of $21.0 million gross proceeds, from the sale of shares under the Purchase Agreement to Aspire Capital. The proceeds will be used for the advancement of our research and development activities, working capital and general corporate purposes. This anticipated use of net proceeds from the sale of our common stock to Aspire Capital under the Purchase Agreement represents our intentions based upon our current plans and business conditions.

The selling stockholder may from time to time offer and sell any or all of the shares of our common stock set forth below pursuant to this prospectus. When we refer to the “selling stockholder” in this prospectus, we mean the entity listed in the table below, and its respective pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of the selling stockholder’s interests in shares of our common stock other than through a public sale.

The following table sets forth, as of the date of this prospectus, the name of the selling stockholder for whom we are registering shares for sale to the public, the number of shares of common stock beneficially owned by the selling stockholder prior to this offering, the total number of shares of common stock that the selling stockholder may offer pursuant to this prospectus and the number of shares of common stock that the selling stockholder will beneficially own after this offering. Except as noted below, the selling stockholder does not have, or within the past three years has not had, any material relationship with us or any of our predecessors or affiliates and the selling stockholder is not or was not affiliated with registered broker-dealers.

Based on the information provided to us by the selling stockholder, assuming that the selling stockholder sells all of the shares of our common stock beneficially owned by it that have been registered by us and does not acquire any additional shares during the offering, the selling stockholder will not own any shares, as reflected in the column entitled “Beneficial Ownership After This Offering.” We cannot advise you as to whether the selling stockholder will in fact sell any or all of such shares of common stock. In addition, the selling stockholder may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of our common stock in transactions exempt from the registration requirements of the Securities Act after the date on which it provided the information set forth in the table below.

| Shares of Common Stock Owned Prior to this Offering |

Additional Shares of Common Stock Being Offered |

Beneficial Ownership After this Offering (1) |

||||||||||||||

| Name |

Number of Shares |

% | ||||||||||||||

| Aspire Capital Fund, LLC (2) |

474,268 | (3) | 2,813,567 | 56,320 | * | |||||||||||

| * | Less than 1%. |

| (1) | Assumes the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholder is under no obligation known to us to sell any shares of common stock at this time. |

| (2) | Aspire Capital Partners LLC (“Aspire Partners”) is the Managing Member of Aspire Capital Fund LLC (“Aspire Fund”). SGM Holdings Corp (“SGM”) is the Managing Member of Aspire Partners. Mr. Steven G. Martin (“Mr. Martin”) is the president and sole shareholder of SGM, as well as a principal of Aspire Partners. Mr. Erik J. Brown (“Mr. Brown”) is the president and sole shareholder of Red Cedar Capital Corp (“Red Cedar”), which is a principal of Aspire Partners. Mr. Christos Komissopoulos (“Mr. Komissopoulos”) is president and sole shareholder of Chrisko Investors Inc. (“Chrisko”), which is a principal of Aspire Partners. Each of Aspire Partners, SGM, Red Cedar, Chrisko, Mr. Martin, Mr. Brown, and |

16

Table of Contents

| Mr. Komissopoulos may be deemed to be a beneficial owner of common stock held by Aspire Fund. Each of Aspire Partners, SGM, Red Cedar, Chrisko, Mr. Martin, Mr. Brown, and Mr. Komissopoulos disclaims beneficial ownership of the common stock held by Aspire Fund. |

| (3) | As of the date hereof, 417,948 shares of our common stock have been acquired by Aspire Capital under the Purchase Agreement, consisting of the 195,726 Commitment Shares we issued to Aspire Capital as a commitment fee and the 222,222 Initial Purchase Shares sold to Aspire Capital. We may elect in our sole discretion to sell to Aspire Capital up to an additional 2,813,567 shares under the Purchase Agreement but Aspire Capital does not presently beneficially own those shares as determined in accordance with the rules of the SEC. |

17

Table of Contents

The common stock offered by this prospectus is being offered by Aspire Capital, the selling stockholder. The common stock may be sold or distributed from time to time by the selling stockholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus may be effected in one or more of the following methods:

| • | ordinary brokers’ transactions; |

| • | transactions involving cross or block trades; |

| • | through brokers, dealers, or underwriters who may act solely as agents; |

| • | “at the market” into an existing market for the common stock; |

| • | in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents; |

| • | in privately negotiated transactions; or |

| • | any combination of the foregoing. |

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the registration or qualification requirement is available and complied with.

The selling stockholder may also sell shares of common stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. In addition, the selling stockholder may transfer the shares of common stock by other means not described in this prospectus.

Brokers, dealers, underwriters, or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling stockholder and/or purchasers of the common stock for whom the broker-dealers may act as agent. Aspire Capital has informed us that each such broker-dealer will receive commissions from Aspire Capital which will not exceed customary brokerage commissions.

Aspire Capital is an “underwriter” within the meaning of the Securities Act.

Neither we nor Aspire Capital can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Aspire Capital, any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from the selling stockholder, and any other required information.

We will pay all of the expenses incident to the registration, offering, and sale of the shares by Aspire Capital to the public other than commissions or discounts of underwriters, broker-dealers, or agents. We have agreed to indemnify Aspire Capital and certain other persons against certain liabilities in connection with the offering of shares of common stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Aspire Capital has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Aspire Capital specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

18

Table of Contents

Aspire Capital and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our common stock during the term of the Purchase Agreement.

We have advised Aspire Capital that while it is engaged in a distribution of the shares included in this prospectus it is required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the selling stockholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

We may suspend the sale of shares by Aspire Capital pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

This offering will terminate on the date that all shares offered by this prospectus have been sold by Aspire Capital.

19

Table of Contents

The validity of the securities offered hereby is being passed upon for us by Cooley LLP, San Diego, CA.

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2016, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act, with respect to the securities being offered by this prospectus. This prospectus does not contain all of the information in the registration statement and its exhibits. For further information with respect to us and the securities offered by this prospectus, we refer you to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

We are subject to the information and periodic reporting requirements of the Exchange Act, and we file periodic reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities at 100 F Street NE, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities. You may also request a copy of these filings, at no cost, by writing us at 8910 University Center Lane, Suite 700, San Diego, CA 92122 or telephoning us at (858) 550-0780. We also maintain a website at www.traconpharma.com, at which you may access these materials free of charge after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference in, and is not part of, this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus.

We incorporate by reference into this prospectus and the registration statement of which this prospectus form a part the information or documents listed below that we have filed with the SEC, and any future filings we will make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, and until the termination of the offering of the shares covered by this prospectus (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K):

| • | our Annual Report on Form 10-K for the year ended December 31, 2016 filed on March 1, 2017; |

20

Table of Contents

| • | our Current Reports on Form 8-K (other than information furnished rather than filed) filed on January 3, 2017, January 31, 2017, February 6, 2017, February 10, 2017, March 14, 2017 and March 27, 2017; and |

| • | the description of our common stock which is registered under Section 12 of the Exchange Act, in our registration statement on Form 8-A, filed on January 27, 2015, including any amendment or reports filed for the purposes of updating this description. |

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits to these documents. You should direct any requests for documents to TRACON Pharmaceuticals, Inc. 8910 University Center Drive, Suite 700 San Diego CA 92122; telephone: (858) 550-0780.

You also may access these filings on our website at www.traconpharma.com. We do not incorporate the information on our website into this prospectus or any supplement to this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus or any supplement to this prospectus (other than those filings with the SEC that we specifically incorporate by reference into this prospectus).

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITY

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

21

Table of Contents

3,231,515 Shares

Common Stock

PROSPECTUS

, 2017

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth the expenses to be incurred in connection with the offering described in this registration statement, all of which will be paid by the registrant. All amounts are estimates except the SEC registration fee.

| Amount | ||||

| SEC registration fee |

$ | 1,566 | ||

| Accounting fees and expenses |

17,500 | |||

| Legal fees and expenses |

25,000 | |||

| Printing and related expenses |

2,000 | |||

| Miscellaneous |

5,000 | |||

|

|

|

|||

| Total expenses |

$ | 51,066 | ||

|

|

|

|||

Item 14. Indemnification of Directors and Officers