Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Schneider National, Inc. | d238359dex231.htm |

| EX-5.1 - EX-5.1 - Schneider National, Inc. | d238359dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 24, 2017

Registration No. 333-215244

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Schneider National, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Wisconsin | 4213 | 39-1258315 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3101 Packerland Drive

Green Bay, WI 54313

(920) 592-2000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher B. Lofgren

Chief Executive Officer

Schneider National, Inc.

3101 Packerland Drive

Green Bay, WI 54313

(920) 592-2000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| William J. Whelan, III Johnny G. Skumpija Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

Paul J. Kardish General Counsel, Secretary and Executive Vice President Schneider National, Inc. 3101 Packerland Drive Green Bay, WI 54313 (920) 592-2000 |

Kenneth B. Wallach Ryan R. Bekkerus Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(2) |

Amount Of Registration Fee(3) | ||||

| Class B Common Stock, no par value |

33,289,000 |

$20.00 | $665,780,000 | $77,164 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 4,342,000 shares of Class B Common Stock which may be purchased pursuant to the underwriters’ over-allotment option. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

| (3) | The registrant previously paid $11,590 of this amount in connection with the initial filing of the registration statement on December 22, 2016. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated March 24, 2017

28,947,000 shares

Schneider National, Inc.

Class B Common Stock

This is Schneider National, Inc.’s initial public offering. We are selling 16,842,000 shares of our Class B common stock and the selling shareholders identified in this prospectus are selling 12,105,000 shares of our Class B common stock. We will not receive any proceeds from the sale of shares being sold by the selling shareholders. This is our initial public offering and no public market exists for our Class B common stock. We anticipate that the initial public offering price of our Class B common stock will be between $18.00 and $20.00 per share. Our Class B common stock will be listed on The New York Stock Exchange (“NYSE”) under the symbol “SNDR.”

Immediately following this offering, we will have two classes of authorized and outstanding common stock, Class A common stock and Class B common stock. The rights of holders of Class A common stock and Class B common stock are identical, except with respect to certain voting and conversion rights. The record holder of our Class A common stock, the Schneider National, Inc. Voting Trust, is entitled to ten votes per share and holders of our Class B common stock are entitled to one vote per share. Each share of Class A common stock is convertible into one share of Class B common stock at any time and automatically converts into one share of Class B common stock if it is withdrawn from the Schneider National, Inc. Voting Trust and/or is transferred outside the Schneider family. See “Description of Capital Stock—Class A Common Stock.” Outstanding shares of Class A common stock will represent approximately 90.2% of the voting power of our outstanding capital stock following this offering.

Immediately following this offering, the Schneider National, Inc. Voting Trust, our controlling shareholder, will continue to control a majority of the votes among all shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance rules of the NYSE. See “Management—Controlled Company Status.”

We have granted the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to an additional 4,342,000 shares of Class B common stock at the public offering price, less underwriting discounts and commissions.

Investing in our Class B common stock involves risks. See “Risk Factors” beginning on page 20.

| Per Share |

Total |

|||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions* |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to selling shareholders** |

$ | $ | ||||||

| * | We have agreed to reimburse the underwriters for certain Financial Industry Regulatory Authority, or FINRA, related expenses. The underwriters have agreed to reimburse us for certain expenses of the offering. See “Underwriting (Conflict of Interest)” for a description of all compensation payable to the underwriters. |

| ** | We have agreed to pay all underwriting discounts and commissions and certain other offering expenses for the selling shareholders incurred in connection with the sale. |

The underwriters expect to deliver the shares to purchasers on or about , 2017 through the book-entry facilities of The Depository Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Morgan Stanley | UBS Investment Bank | |||||

| BofA Merrill Lynch | ||||||

| Citigroup | Credit Suisse | J.P. Morgan | Wells Fargo Securities |

| Baird | Wolfe Capital Markets and Advisory |

The date of this prospectus is , 2017.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. We do not, and the underwriters do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others provide to you. We are offering to sell, and seeking offers to buy, shares of Class B common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Class B common stock.

i

Table of Contents

ABOUT THIS PROSPECTUS

In this prospectus, unless the context otherwise requires, “the company,” “we,” “us” and “our” refers to Schneider National, Inc., a Wisconsin corporation, together with its consolidated subsidiaries. Unless otherwise indicated, the information contained in this prospectus is as of , 2017, and assumes that the underwriters’ over-allotment option is not exercised.

In this prospectus, we refer to our Class A common stock, no par value per share, and our Class B common stock, no par value per share, as our Class A common stock and our Class B common stock, respectively, and, together, as our common stock. Unless otherwise indicated, all references to our common stock refer to our common stock as in effect at the time of the completion of this offering.

Prior to the completion of this offering, our Class A and Class B common stock was considered redeemable under GAAP because of certain repurchase rights granted to our shareholders pursuant to the Schneider National, Inc. Employee Stock Purchase Plan and certain agreements governing ownership of our common stock held by existing shareholders, including members of the Schneider family and their family trusts. All such repurchase rights will be terminated contemporaneously with, and contingent upon, the completion of this offering via amendments to these documents. References to our redeemable Class A common stock or redeemable Class B common stock refer to our common stock prior to the termination of these repurchase rights contemporaneously with this offering.

This prospectus contains references to fiscal year 2016, fiscal year 2015, fiscal year 2014, fiscal year 2013 and fiscal year 2012, which represent our fiscal years ended December 31, 2016, December 31, 2015, December 31, 2014, December 31, 2013 and December 31, 2012, respectively.

“GAAP” as used in this prospectus refers to United States generally accepted accounting principles.

NON-GAAP FINANCIAL MEASURES

In addition to our net income determined in accordance with U.S. GAAP, we evaluate operating performance at an enterprise level using certain non-GAAP measures, including adjusted income from operations, adjusted EBITDA, adjusted net income, adjusted net income per share, adjusted enterprise revenue (excluding fuel surcharge) and adjusted operating ratio. Management believes the use of non-GAAP measures assists investors in understanding the ongoing operating performance of our business by presenting comparable financial results between periods. The non-GAAP information provided is used by our management and may not be comparable to similar measures disclosed by other companies, because of differing methods used by other companies in calculating adjusted income from operations, adjusted EBITDA, adjusted net income, adjusted net income per share, adjusted enterprise revenue (excluding fuel surcharge) and adjusted operating ratio. The non-GAAP measures used herein have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

GLOSSARY OF TRUCKING AND OTHER TERMS

As used in this prospectus:

“Asset-light network intermodal provider” means a provider that uses company-owned containers (and potentially chassis) or trailers and company-owned dray trucks in providing intermodal service. This model is less asset intensive than a truckload model but affords more control over equipment quality and availability than a traditional non-asset intermodal provider.

“Associate” means our employees and does not include owner-operators, which are independent contractors, or their owner-operator drivers or other employees.

ii

Table of Contents

“Brokerage” or “freight brokerage” means the customer loads for which we contract with third-party trucking companies to haul the load under third-party authority.

“Bulk tanker trailers” means trailers capable of transporting large quantities of unpackaged cargo. The cargo is moved either as a single undivided whole (one type of product), or in multiple divided compartments within the trailer (one or more types of product).

“Chassis” means the frame and wheels of a trailing unit upon which a container may be placed.

“Company assets” means assets owned by the company as well as those acquired under capital and/or operating leases.

“Company containers” means cargo containers owned or leased by the company.

“Company trucks” means trucks owned or leased by the company.

“Container” means a cargo container used in the domestic intermodal market with dimensions approximately the same as a 53-foot dry van that can be lifted from a detachable chassis and placed on a railcar (as opposed to international intermodal containers, which are 20-foot or 40-foot International Standards Organization (ISO) containers). Domestic intermodal containers are often double stacked on rail cars to minimize transportation cost.

“Core carrier” means one of a shipper’s preferred truckload carriers. Generally, shippers utilize a core carrier or core carrier group to improve service levels, reduce the complexity involved with managing a large number of carriers and experience efficiencies created through the level of trust, shipment density and communication frequency associated with a core carrier.

“Cross docking” means the practice in logistics of unloading materials from an incoming trailer or railroad car and loading these materials directly into outbound trailers or containers, with little or no storage in between.

“CSA” means the Federal Motor Carrier Safety Administration’s Compliance, Safety, Accountability initiative, which ranks both fleets and individual drivers based on multiple categories of safety-related data in an online Safety Measurement System.

“C-TPAT ” means the Customs-Trade Partnership Against Terrorism, a program designed to improve cross-border security between the United States and Canada and the United States and Mexico. Carrier members of the C-TPAT are entitled to shorter border delays and other priorities over non-member carriers.

“Dedicated contracts” means those contracts in which we have agreed to dedicate certain truck and trailer capacity for use by a specific customer. Dedicated contracts often have predictable routes and revenue and frequently replace all or part of a shipper’s private fleet. Our dedicated contracts generally average three years and are priced using a model that analyzes the cost elements, including revenue equipment, insurance, fuel, maintenance, drivers needed and mileage.

“Drayage” or “dray” means the transport of shipping containers from a dock or port to an intermediate or final destination or the transport of containers or trailers between pickup or delivery locations and a railhead. We directly provide drayage or utilize third parties in the pick-up and delivery associated with an intermodal movement, or for the pick-up and delivery to and from an ocean shipping port and an inland destination.

“Dry van” or “standard trailer” means a simple, enclosed, non-climate controlled 53-foot trailer that carries general cargo, including food and other products that do not require refrigeration.

iii

Table of Contents

“Electronic On-board Recorder” or “EOBR” means an electronic logging device that enables professional truck drivers and commercial motor carriers to track Hours of Service (HOS) compliance by monitoring the time spent by the driver in operating a truck.

“Final mile” means the movement of goods from a distribution center, warehouse or cross-dock to a final destination at the consumer’s home or business.

“First-to-final mile” means the movement of goods from a shipper to a distribution center, warehouse or cross-dock and then to a final destination at the consumer’s home or business.

“Flatbed trailer” means an open trailer with no sides used to carry large objects such as heavy machinery and building materials.

“For-hire truckload carriers” means a truckload carrier available to shippers for hire.

“For-hire contract” means a contract with a customer providing for services based on spot market or lane-based pricing rates.

“Fuel surcharge” means fees that are charged to a customer by a shipping company to pass through the costs of fuel in excess of a predetermined cost per gallon base (generally based on the average price of fuel in the United States as determined by the Department of Energy). Shipping company customers, such as our truckload customers, pay surcharges. In our intermodal business, our railroad partners charge fuel surcharge to us as their customers.

“Fuel surcharge revenue” means revenue attributable to fuel surcharges generated by Schneider.

“Intermodal” means the transport of shipping containers (COFC) or trailers (TOFC) on railroad flat cars before or after a movement by truck from the point of origin to the railhead or from the railhead to the destination.

“Less-than-truckload carriers” or “LTL carriers” means carriers that pick up and deliver multiple shipments, each typically weighing less than 10,000 pounds, for multiple customers in a single trailer.

“Line haul” means the movement of freight on a designated route between cities and terminals.

“Loads/orders” or “loads” is used to refer to requests from our customers other than our intermodal customers for services.

“Omni-channel retailers” means retailers that offer a variety of channels for a customer’s shopping experience, which may involve pre-purchase research. Such channels may include retail, online, mobile and mobile app stores and telephone sales.

“Orders” means requests from our intermodal customers for services.

“Over-dimensional” means freight of a certain size or dimension that renders traditional shipping and packing methods used by less-than-truckload carriers inefficient or time-consuming for at least a portion of the transportation route when compared to trucks.

“Owner-operator” means a trucking business with whom we contract to move freight utilizing our operating authority, generally by pulling Schneider trailers attached to the owner-operator trucks driven by owner-operator

iv

Table of Contents

drivers. The driver of an owner-operator truck may also be the owner of the associated owner-operator trucking business. Owner-operators have the ability to select the loads that they choose to move. Owner-operators are generally compensated on a percentage of revenue basis and must pay their own operating expenses, such as fuel, maintenance, the truck’s physical damage insurance and driver costs, and must meet our specified standards with respect to safety. Owner-operators hired by other companies in our industry are generally compensated on a per-mile basis.

“Preferred lanes” means the routes along which we strive to direct most of our trucks.

“Private fleet” means the trucks and trailers owned or leased, and operated, by a shipper to transport its own goods.

“Private fleet outsourcing” means the decision by shippers using a private fleet to outsource all or a portion of their transportation and logistics requirements to for-hire truckload carriers. Some shippers that previously maintained their own private fleets outsource this function to for-hire truckload carriers, like us, to reduce operating costs and to focus their resources on their core businesses.

“Revenue per order” means revenue (excluding fuel surcharge) per order.

“Revenue per truck per week” means the revenue (excluding fuel surcharge) that a truck, available to work, generates (on average) over a work week.

“Specialty equipment” means trailing equipment, other than dry vans, used in our truckload segment. Examples would be flatbed trailers, bulk tanker trailers and temperature controlled trailers.

“Stop-off pay” means the compensation we receive from customers for stopping a haul to pick up or unload a portion of the load or to allow for a sample testing of the product being transported.

“Straight truck” means a vehicle with the cargo body and tractor mounted on the same chassis.

“Team driving” means two drivers occupying a single truck who alternate between driving and non-driving time (such as time spent sleeping and resting) in order to expedite the shipment and maximize the overall production of the truck by decreasing idle time in transit to its destination.

“Temperature controlled” means an enclosed, temperature controlled trailer, generally used to carry perishable goods.

“Third-party logistics provider” or “3PL” means a provider of outsourced logistics services. In logistics and supply chain management, it means a company’s use of third-party businesses, the 3PL(s) to outsource elements of the company’s distribution, fulfillment and supply chain management services.

“Total miles” means the miles driven both with and without revenue-generating freight being transported.

“Tractor” means a vehicle with the ability to tow a trailer, generally by the use of the fifth wheel mounted over the tractor’s drive axle.

“Trailer” means a cargo body that is mounted on a separate chassis and attached to the back of a tractor or, in the case of a tandem rig, the tail of another trailer attached to a tractor.

“Trans-loading” means the process of transferring a shipment from one mode of transportation to another, through multiple forms of transportation including ship and rail. It is most commonly employed when one mode of transportation or one vehicle cannot be used for the entire trip, such as when goods must be shipped internationally from one inland point to another.

v

Table of Contents

“Truck” means a vehicle that carries goods in a cargo body mounted to its chassis, such as a straight truck, and/or in a trailer towed by the vehicle, such as a tractor. Our truck fleet is mostly comprised of Class 8 tractors, which are generally over 33,000 pounds in gross vehicle weight rating.

“Truckload carrier” means a carrier that generally dedicates an entire trailer to one customer from origin to destination.

“Unbilled miles” means miles driven without revenue generation for us.

“White glove” means a delivery service in which the shipped items are unloaded from a truck and then unpackaged and placed into a specific location designated by the customer.

vi

Table of Contents

The following summary highlights information about our business and the offering of our Class B common stock that appears elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class B common stock. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus.

OUR COMPANY

We are a leading transportation and logistics services company providing a broad portfolio of premier truckload, intermodal and logistics solutions and operating one of the largest for-hire trucking fleets in North America. We believe we have developed a differentiated business model that is difficult to replicate due to our scale, breadth of complementary service offerings and proprietary technology platform. Our highly flexible and balanced business combines asset-based truckload services with asset-light intermodal and non-asset logistics offerings, enabling us to serve our customers’ diverse transportation needs. Since our founding in 1935, we believe we have become an iconic and trusted brand within the transportation industry by adhering to a culture of safety “first and always” and upholding our responsibility to our associates, our customers and the communities that we serve.

We are the second largest truckload company in North America by revenue, one of the largest intermodal transportation providers in North America by revenue and an industry leader in specialty equipment services and e-commerce fulfillment. We categorize our operations into the following reportable segments:

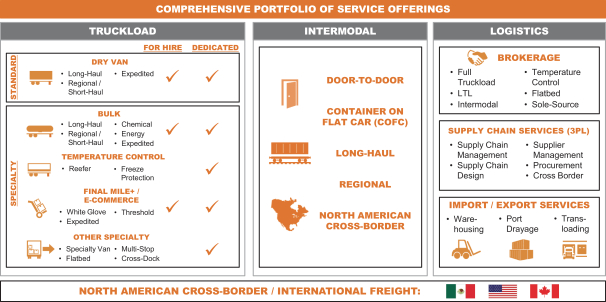

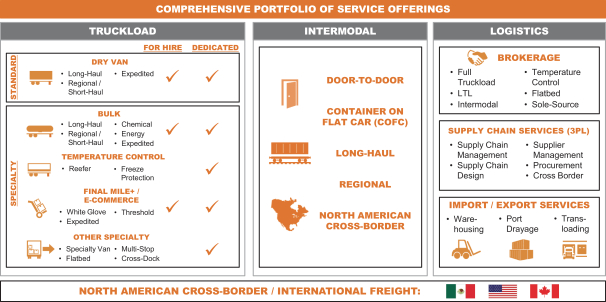

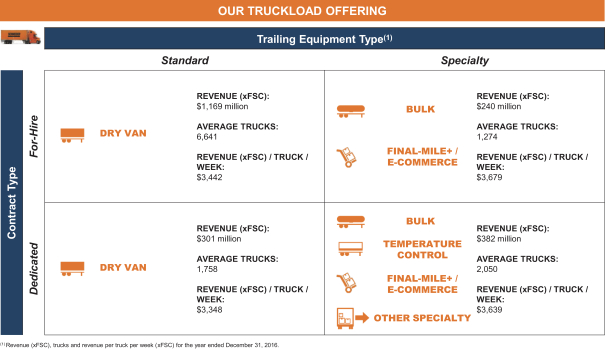

| • | Truckload – which consists of freight transported and delivered with standard and specialty equipment by our company-employed drivers in company trucks and by owner-operators, executed through either for-hire or dedicated contracts. |

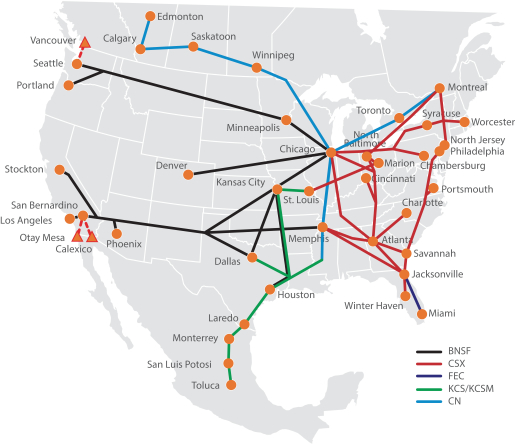

| • | Intermodal – which consists of door-to-door, container on flat car service by a combination of rail and over-the-road transportation, in association with our rail carrier partners. Our intermodal service offers vast coverage throughout North America, including cross-border freight through company containers and trucks. |

| • | Logistics – which consists of non-asset freight brokerage services, supply chain services (including 3PL) and import/export services. Our logistics business typically provides value-added services using third-party capacity, augmented by our assets, to manage and move our customers’ freight. |

We also engage in equipment leasing and provide insurance to support owner-operators, which combined with our limited Chinese truck brokerage and logistics operations, account for our remaining operating revenue.

Our portfolio consists of approximately 10,500 company and 2,850 owner-operator trucks, 37,900 trailers and 18,100 intermodal containers across North America and approximately 19,300 enterprise associates. We serve a diverse customer base across multiple industries represented by approximately 16,000 customers, including nearly 200 Fortune 500 companies. Each day, we transit over 8.9 million miles, equivalent to circling the globe approximately 360 times. Our logistics business manages nearly 23,000 qualified carrier relationships and, in 2016, managed approximately $2 billion of third-party freight. Our portfolio diversity, network density throughout North America and large fleet allow us to provide an exceptional level of service to our customers and consistently excel as a reliable partner, especially at times of peak demand.

1

Table of Contents

We believe we offer one of the broadest arrays of services in the transportation and logistics industries, ranging from dry van to bulk transport, intermodal to supply chain management and first to final mile “white glove” delivery. We believe we differentiate ourselves through expertise in services that utilize specialty equipment, which have high barriers to entry. With our recent acquisitions of Watkins and Shepard Trucking, Inc. (Watkins & Shepard) and Lodeso, Inc. (Lodeso) we have established a national footprint and expertise in shipping difficult-to-handle consumer items, such as furniture, mattresses and other household goods, which based on internal research conducted by management have been in the forefront of the transition in consumer purchasing patterns to the e-commerce channel. Our comprehensive and integrated suite of industry leading service offerings allows us to better meet customer needs and capture a larger share of our customers’ transportation spend. Customers value our breadth of services, demonstrated by 21 of our top 25 customers utilizing services from all three of our reportable segments.

The following graphic demonstrates the breadth and diversity of our service offerings:

In 2007, we launched Quest, a multi-year, comprehensive business processes and technology transformation program, using technology from our strategic development partner, Oracle Corporation. As part of this transformation, we created a quote-to-cash technology platform, which we refer to as our Quest platform, that serves as the backbone of our business and seamlessly integrates all business lines and functions. Our state-of-the-art Quest platform allows us to make informed decisions at every level of our business, providing real-time data analytics to optimize network density and equipment utilization across our entire network, which drives better customer service, operational efficiency and load optimization. We also realigned our organization to give our associates a direct line of sight to profit-and-loss responsibility both within their business lines and across the organization. This organizational change combined with our Quest platform empowers our associates to proactively pursue business opportunities that enhance profitability while maintaining high levels of customer service. We believe our over $250 million investment in technology and our related organizational realignment over the past several years have enabled us to improve our profit margins and put us in a favorable position to expand our profit margins and continue growing our business.

2

Table of Contents

Since refocusing our strategy and initiating our Quest technology and business transformation in 2007, we have experienced strong revenue growth and margin expansion, which is demonstrated in the following table.

| (in thousands) | 2016 Fiscal Year | 3-Year CAGR(1) | ||||||

| Operating revenue |

$ | 4,045,736 | 3.7 | % | ||||

| Adjusted enterprise revenue (excluding fuel surcharge)(2) |

$ | 3,751,696 | 7.7 | % | ||||

| Net income |

$ | 156,851 | 18.0 | % | ||||

| Adjusted EBITDA(3) |

$ | 559,130 | 13.1 | % | ||||

| Adjusted net income(3) |

$ | 158,443 | 17.7 | % | ||||

| (1) | Three-year compound annual growth rate from January 1, 2014 through December 31, 2016. |

| (2) | Adjusted enterprise revenue (excluding fuel surcharge) is a non-GAAP financial measure. For a reconciliation of operating revenue, the most closely comparable GAAP measure, to adjusted enterprise revenue (excluding fuel surcharge), see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.” |

| (3) | Adjusted EBITDA and adjusted net income are non-GAAP financial measures. For a reconciliation of net income to adjusted EBITDA and adjusted net income, in each case for which net income is the most comparable GAAP measure, see “—Summary Historical Consolidated Financial and Other Data.” |

Schneider was founded in 1935 by Al J. Schneider in Green Bay, Wisconsin, and further developed under the leadership of his son, Donald J. Schneider. Schneider’s deeply-rooted culture embodies several core values:

| • | Safety First and Always |

| • | Integrity in Every Action |

| • | Respect for All |

| • | Excellence in What We Do |

We put these values into practice through the Schneider “Value Triangle” of operational excellence. A guiding tenet of our business for over a decade, our “Value Triangle” provides a key reference for our associates to consider when making business decisions at each level of the company, including the needs of our customers, our associates and our business and its shareholders. We believe managing and balancing these often competing interests compels us to weigh the collective benefits to all of our stakeholders for every business decision.

3

Table of Contents

OUR INDUSTRY

Truckload

Trucking is the primary means of serving the North American transportation market and hauls approximately 70% of freight volume within the United States, which is embodied in a common phrase used within our industry: “if you’ve got it—a truck brought it.” Trucking continues to attract shippers due to the mode’s cost advantages relative to air transportation and flexibility relative to rail. Truckload growth is largely tied to U.S. economic activity such as GDP growth and industrial production and moves in line with changes in sales, inventory and production within various sectors of the U.S. economy. Truckload volumes are also positioned to benefit from secular trends in e-commerce retail, which is expected to grow at a 13% CAGR from 2014 to 2019 according to e-Marketer. Based on estimates by the American Trucking Associations (ATA), the U.S. trucking industry generated approximately $726 billion in revenue in 2015 and is expected to grow at a CAGR of 4.8% from 2016 to 2022.

The U.S. truckload industry is large and fragmented, characterized by many small carriers with revenues of less than $1 million per year, less than 50 carriers with revenues exceeding $100 million per year and 10 carriers with revenues exceeding $1 billion per year, according to 2015 data published by Transport Topics, an ATA publication. According to Department of Transportation (DOT) data, there were over 550,000 trucking companies in the United States at the end of 2015, approximately 90% of which owned 10 or fewer trucks.

Regulations and initiatives to improve the safety of the U.S. trucking industry have impacted industry dynamics. We believe the recent trend is for industry regulation to become progressively more restrictive and complex, which constrains the overall supply of trucks and drivers in the industry. Examples of recently enacted and upcoming regulations and initiatives include the Comprehensive Safety Analysis (CSA) initiative (2010), Hours of Service (HOS) rules (2013) and mandatory use of electronic logging devices to enforce Hours of Service (HOS) rules (2015), hair follicle (2016) and sleep apnea screening (upcoming), installation of speed limiters (2016) and phase 2 emission standards (2016). We believe small carriers will likely be challenged to maintain the utilization required for acceptable profitability under this regulatory framework.

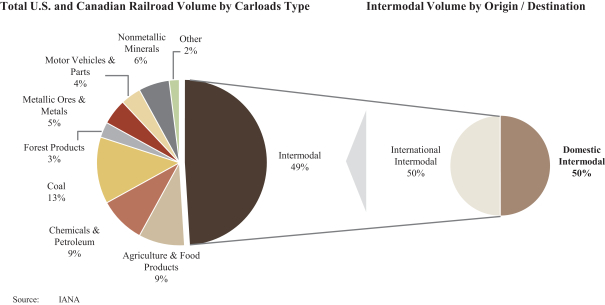

Domestic Intermodal

Domestic intermodal transportation involves the transportation of freight in a 53-foot container or trailer, combining multiple modes of transportation (rail and truck) within the United States, Canada and Mexico. Eliminating the need for customers to directly handle freight when changing modes between rail and truck, intermodal transportation holds significant productivity, cost and fuel-efficiency advantages when moving mass freight. Domestic intermodal volumes are largely driven by over-the-road conversions from truckload to intermodal and from the volume of overseas imports into the United States, such as from China. Our management estimates the North American intermodal and drayage market to be $22 billion. According to the Association of American Railroads (AAR), intermodal has grown from 27% of all railcar loads in 1990 to 49% in 2015. Domestic intermodal accounts for 50% of total intermodal volume according to the Intermodal Association of North America (IANA). With fuel costs likely to increase in the long-term, fuel efficiency regulations set to tighten and labor shortages in the trucking industry, the intermodal market is well-positioned to take on freight capacity as trucking markets face external pressures.

The intermodal market is comprised of service providers of differing asset intensity, with customers being served by either non-asset intermodal marketing companies (IMCs) or asset-light network intermodal providers such as Schneider. While IMCs are the most prevalent intermodal solution provider, asset-light network intermodal providers offer differentiated higher-value solutions to customers given the reliability, geographic breadth and high service levels of company assets (trucks, containers and even chassis) compared to non-asset IMCs.

4

Table of Contents

The domestic intermodal segment is highly consolidated, where the top three intermodal providers operate over 50% of the U.S. dry van domestic container fleet, according to management estimates. Network density, size and scale are critical barriers to entry in the intermodal market. Increasing sophistication and complexity of shippers’ needs require network density and the ability to deliver reliable capacity. According to AAR, railroads have been spending record amounts in recent years to maintain and improve their infrastructure and equipment, which we believe supports growth of the intermodal industry and improves the efficiency and reliability of the railroad component of our intermodal service.

Logistics

The logistics industry is a large, fast-growing and fragmented market that represents an integral part of the global economy. As supply chain complexity increases, corporations have elected to focus on innovation, design, sales and marketing of their products rather than supply chain operations. Increased material costs coupled with enhanced global competition impose margin pressure on manufacturers, requiring the outsourcing of noncore transportation logistics to supply chain specialists who offer a combination of scale, strong technology platforms and lower costs. Additionally, more shipments of inputs and products will be transported using multiple modes and technical expertise, driving shipper preferences for logistics providers with an asset-based network to complement their third-party capacity. Transportation asset owners often provide logistics services to meet excess demand and provide customers with greater breadth of services.

OUR COMPETITIVE STRENGTHS

We believe the following key strengths have been instrumental to our success and position us well to continue growing our business and market share:

Iconic large-scale diversified North American truckload provider with a modern fleet

Over the past 80 years, we have become one of North America’s largest and most trusted providers of truckload services, including specialty equipment services. We have established a leading position through our commitment to provide an outstanding level of customer service. In 2016, we received 27 awards from customers and the media in recognition of our exceptional service and reliability. We operate one of North America’s largest truckload fleets with approximately 11,900 trucks and 37,900 trailers used in our truckload business. Given our large scale, we offer both network density and broad geographic coverage to meet our customers’ transportation needs across North America. Our scale and strong balance sheet provides us with access to capital necessary to consistently invest in our capacity, technology and people to drive performance and growth, and to comply with regulations. Our scale also gives us significant purchasing benefits in third-party capacity, fuel, equipment and MRO (maintenance, repair and operations), lowering our costs compared to smaller competitors.

Over the past several years, we have made significant investments in safety-enhancing equipment and technology, including roll stability, collision avoidance, forward facing cab cameras, training simulators and real-time truck sensor monitoring. Our relentless focus on safety not only enables us to better uphold our responsibility towards our associates, customers and the community, but also provides a critical competitive advantage in an industry with increasingly stringent safety and regulatory requirements and results in lower operating risk and insurance costs. In 2010, we were among the first large-scale carriers to fully equip our fleet with EOBRs, providing improved network management and safety. Unlike carriers that have yet to undertake the electronic logging device implementation process, we have significant experience operating with EOBRs and are well-positioned to benefit from the upcoming legislation on mandatory electronic logging device standards, which we expect will tighten truckload capacity and subsequently increase rates.

5

Table of Contents

Industry leading and highly scalable Quest technology platform integrated across all business lines and functions

Our early investment and adoption of next generation technology and data analytics is a competitive advantage. We believe we are the only truckload and intermodal industry player of size to have completed, integrated and culturally adopted a comprehensive quote-to-cash technology transformation that allows us to efficiently match capacity with customer loads/orders. Our Quest platform allows us to assess our entire network every 90 seconds, resulting in real-time, round-the-clock visibility into every shipment and delivery, route schedules, truck and driver capacity and the profitability of each load/order. Our Quest platform enables us to minimize unbilled miles, optimize driver efficiency and improve safety, resulting in increased service levels and profitability. We manage the purchasing of over 500,000 gallons of fuel per day and communicate to our drivers optimal timing and locations for refueling through our Quest platform, which increases our fuel efficiency and lowers our fuel purchasing costs. We have become a pioneer in applying “decision science” technology to trucking and intermodal freight that enhances driver and asset efficiency, leading to higher profitability and driver satisfaction. We receive and process millions of driver and equipment location updates daily, allowing us to select the optimal driver, truck and trailer for each load/order. This has been a key driver of increased profitability per load and operating margin improvements over the last few years. We believe that our Quest technology and business transformation provides us with a clear advantage within the transportation industry from which we are continuing to realize the financial benefits.

Leadership in fast-growing e-commerce, final mile and other specialty equipment markets

Our recent acquisitions of Watkins & Shepard and Lodeso have allowed us to rapidly expand our customized home, commercial and retail delivery offerings with “white glove” service for brick and mortar and e-commerce customers. New components of our final mile services include real-time shipment tracking for customers and our proprietary Simplex technology, which integrates with retailers’ e-commerce infrastructure, providing seamless end-to-end solutions and visibility for complex final mile deliveries. E-commerce has increasingly become the preferred channel for purchasing difficult-to-handle items, an area in which Watkins & Shepard and Lodeso specialize. Our expertise in this channel and national footprint in the final mile market positions us well to capitalize on this high-growth market opportunity that traditional less-than-truckload and package delivery operations generally cannot serve.

We have established a major nationwide presence in numerous specialty equipment freight markets with premium pricing and higher barriers to entry, including bulk chemicals, energy services and other specialty liquids. Our large specialty equipment asset base positions us to serve customers across the country, which differentiates us from most of our regional-based competitors and positions us well to take market share with large customers who value our geographic reach.

A leading intermodal business with built-in cost reductions through transition to a company-owned chassis model driving profitability

We are currently one of the largest intermodal providers in North America by revenue and are well-positioned for future growth in intermodal freight through our nationwide network and company container model. Our long-standing railroad relationships with BNSF Railway, CSX Transportation, Canadian National Railway, Kansas City Southern Railway and other regional rail carriers, such as Florida East Coast Railway, provide rail access nationwide. Our customers value our intermodal network over IMCs due to our consistent access to capacity through our company assets and high-quality drayage services that provide a larger geographic reach around intermodal terminals. We are in the process of converting from our rented chassis model to a company-owned chassis model. This conversion will lower our all-in chassis operating costs, improve service reliability, as well as increase driver efficiency and satisfaction, by increasing our control over the chassis

6

Table of Contents

operations of our intermodal business. We expect to complete our conversion to a company-owned chassis fleet by December 2017. We believe that our balanced network and large base of company assets provide a significant competitive advantage that would be difficult for other carriers to replicate.

Fast-growing non-asset logistics business expanding our customer base and complementing our asset-based network

Our non-asset logistics business represents our fastest-growing segment and complements our asset-based businesses with freight brokerage services and comprehensive supply chain management. In the three years from January 1, 2014, through December 31, 2016, our logistics segment operating revenue grew at a CAGR of 16.5%. Our logistics business not only provides additional services to existing customers and incremental freight to our assets, but helps to facilitate the expansion of our customer base and offers opportunities for cross-selling our suite of services. In 2016, our logistics business helped generate approximately $147 million in revenue for our truckload and intermodal segments. The scale of our asset-based network and our relationships with over 20,000 third-party carriers allow us to provide our brokerage and supply chain services (including 3PL) to our customers at competitive rates. By also offering warehousing, trans-loading and port drayage, we can provide customers with a suite of services that covers their entire North American transportation supply chain.

Diversified and resilient revenue mix supporting stable growth through business cycles

Our diverse portfolio of services, equipment, customers and end markets allows for resilient and consistent financial performance through all business cycles. We believe we offer the broadest portfolio of services in our industry, including in our truckload business, which consists of freight transported and delivered with dry van and specialty equipment by drivers in company trucks and by owner-operators. In addition to both long-haul and regional shipping services, our truckload services include team-based shipping for time-sensitive loads (utilizing dry van equipment) and bulk, temperature controlled, final mile “white glove” delivery and customized solutions for high-value and time-sensitive loads (utilizing specialty equipment). Our primarily asset-based truckload business is complemented by our asset-light intermodal and non-asset logistics businesses. Asset-based operations have the benefit of providing shippers with certainty of capacity and continuity of operations, while non-asset operations generally have lower capex requirements, higher returns on invested capital and lower fixed costs. We also manage a balanced mix of spot rates and contracted rates, through for-hire and dedicated contracts, to take advantage of freight rate increases in the short-term while benefiting from more resilient contracted revenue. Our dedicated contracts typically average three years in duration and provide us with greater revenue stability across economic cycles, promote customer loyalty and increase driver retention due to higher predictability in number of miles along familiar routes and time at home.

Our broad portfolio also limits our customer and industry concentration as compared to other carriers. We receive revenue from a diversified customer base with no single customer representing 10% or more of our operating revenue. The percentage of our adjusted enterprise revenue (excluding fuel surcharge) derived from our top ten customers has decreased by approximately 810 basis points over the past five years. New business increased by approximately $450 million in 2016. We maintain a broad end-market footprint, encompassing over ten distinct industries including general merchandise, chemicals, electronics & appliances, and food & beverage, among others. Our diversified revenue mix and customer base drives stability throughout the fiscal year, even though many of our customers are affected by seasonal fluctuations.

Proven and motivated management team with deep transportation industry expertise

We have a premier management team with extensive experience in the transportation and logistics industry, as well as a proven track record of success through various business environments. Our Chief Executive Officer

7

Table of Contents

and President, Christopher B. Lofgren, has over 22 years of experience at Schneider, a PhD in Industrial and Systems Engineering and is responsible for spearheading our Quest technology and business transformation. Our senior management team has spent on average over 14 years with Schneider and is composed of highly experienced transportation and logistics industry experts overseeing day-to-day operations. Our management team’s compensation structure and ownership of common stock provide further incentive to improve business performance and profitability. Our governance structure provides key independent oversight, complementing the strengths of the management team. A majority of the members of our Board of Directors are independent, a structure that has been in place since 1988. Our senior management team’s experience and commitment to upholding deeply-rooted values of safety, respect, integrity and excellence will continue to be critical to our future growth and performance. We believe our leadership team is well-positioned to execute our strategy and remains a key driver of our financial and operational success.

OUR GROWTH STRATEGIES

Our goals are to grow profitably, drive strong and consistent return on capital and increase stakeholder value. We believe our competitive strengths position us to pursue our goals through the following strategies:

Strengthen core operations to drive organic growth and maintain a leading market position

We intend to drive organic growth through leveraging our existing customer relationships, as well as expanding our customer base. With a broad, comprehensive service offering and a true North American footprint, we believe we have substantial cross-selling opportunities and the potential to capture a greater share of each customer’s annual transportation and logistics expenditures. We also plan to drive revenue growth by increasing market share amid a fragmented marketplace by marketing our services to customers seeking to outsource their transportation services. Our Quest platform serves as an instrumental factor in driving profitable growth from both new and existing customers as it enables real-time, data-driven decision support and business analysis of every load/order, assisting our associates in proactively cross-selling our broad suite of offerings. Together with our highly incentivized and proactive sales organization, our data-driven Quest platform will drive better service and organic growth in each of our reportable segments.

Expand capabilities in specialty equipment freight market and continue growing our freight brokerage business

We believe that our capabilities position us to grow in the specialty equipment market, which enjoys higher barriers to entry and a premium to conventional dry van pricing. The complexity and time-sensitivity of the loads often require enhanced collaboration with, and greater understanding of, our customers’ business needs and processes. The transportation of specialty equipment freight requires specially trained drivers with appropriate licenses and special hauling permits, as well as equipment that can handle items with unique requirements in terms of temperature, freight treatment, size and shape. As such, there are few carriers that have comparable network scale and capabilities in the specialty equipment market, which we believe will allow us to profitably grow in that segment.

The growth of our freight brokerage business, which is a significant part of our logistics segment, contributed to the growth of our logistics segment operating revenue, which grew at a CAGR of 16.5%, in the three years from January 1, 2014 through December 31, 2016. As shippers increasingly consolidate their business with fewer freight brokers, we are well-positioned to become one of their select providers due to our customer service and established, dense network of third-party carriers. Large shippers in particular see the value of working with providers like us that have scale, capacity and lane density, as they are more reliable, efficient and

8

Table of Contents

cost effective at covering loads. Our freight brokerage business provides us with the opportunity to serve our customers more broadly where we might not otherwise serve them, building diversity and resiliency in our existing customer portfolio in a non-asset manner with minimal capital deployment.

Capitalize on the growth of e-commerce fulfillment

As a leading “first, final and every mile” carrier for difficult-to-handle consumer items, such as furniture and mattresses, one of the fastest-growing e-commerce markets, we are well-positioned to capitalize on continued e-commerce growth. According to e-Marketer, the e-commerce industry is set to grow at four times the rate of traditional retail in North America (13% vs. 3% 2014-2019 CAGR) and is anticipated to reach 13% of total retail sales worldwide by 2019 (up from 6% in 2014). We provide services for many online retailers, offering first-to-final mile delivery from warehouses to consumer living rooms. Unlike many competitors, we have the technological capability, national footprint and the ability to utilize team driver capacity to provide network breadth and density to meet growing e-commerce fulfillment needs. We intend to leverage our end-market expertise, leading technology platform and end-to-end integrated capabilities to continue taking the complexity out of the supply chain for omni-channel retailers, further driving our revenue in the fast-growing e-commerce market.

Continue to improve our operations and margins by leveraging benefits from recent investments in our Quest technology and business transformation

We continue to benefit from the operational improvements related to our Quest technology and business transformation and continue to improve the effectiveness with which we utilize data to increase revenue and lower costs. We are able to better service customers, retain drivers and generate repeat business by anticipating our customers’ and drivers’ needs and preferences. We believe the future implementation of simple and intuitive customer interfaces will also enable a stronger connection with our customers through increased interaction and an enhanced user experience. We expect additional margin improvement as we continue to leverage data analytics within the Quest platform. The strong foundation we have established with our continuing Quest transformation will allow us to incorporate new technologies and build new capabilities into the platform over time, maintaining our competitive edge and setting the base for future growth.

Allocate capital across businesses to maximize return on capital, and selectively pursue opportunistic acquisitions

Our broad suite of services provides us with a greater opportunity to allocate growth capital in a manner that maximizes returns throughout the seasonal and economic business cycles. For example, we can efficiently move our equipment between services and regions when we see opportunities to maximize our return on capital. We continually monitor our performance to ensure appropriate allocation of capital and resources to grow our businesses while optimizing returns across reportable segments. Furthermore, our strong balance sheet enables us to selectively pursue opportunistic acquisitions that complement our current portfolio. We are positioned to leverage our scalable platform and experienced operations team to acquire high-quality businesses that meet our disciplined selection criteria in order to expand our service offerings and customer base.

Attract and retain top talent at all levels to ensure sustainable growth

Our people are our strongest assets, and we believe they are key to growing our customer base and driving our performance. Our goal is to attract, retain and develop the best talent in the industry across all levels. We strive to foster a collaborative environment and seek individuals who are passionate about our business and fit within our culture. We value the direct relationships we have with our associates and we intend to continue working together without third-party representation. Our compensation structure is performance-based and

9

Table of Contents

aligned with our strategic objectives. Amid today’s driver shortage environment, we seek to maintain our reputation as a preferred carrier within the driver community. Our culture, which from its founding was focused on the well-being of our associates, helps us attract and retain high quality drivers. In addition to mandatory physical check-ups, covering among other things sleep apnea, we enforce hair follicle drug testing alongside mandatory urine testing and invest in the well-being of our drivers, which we believe helps us maintain a high quality driver base. Our leading technology platform facilitates the application, screening and onboarding of top talent. As a stable industry leader with a respected safety culture and underlying core values, we believe that we will continue to be the employer of choice for both driving and non-driving associates.

RECENT DEVELOPMENTS

Share Dividend

Our Board of Directors has approved a pro rata share dividend to all of our shareholders as of the record date of March 21, 2017, which we refer to as the pre-IPO split dividend. The pre-IPO split dividend entitles each shareholder to receive 29 shares of our Class A or Class B Common Stock for each share of Class A or Class B Common Stock, respectively, held by the shareholder as of the record date. Unless otherwise indicated, all references in this prospectus to shares of common stock, per share data and related information have been retroactively adjusted, where applicable, to reflect the pre-IPO split dividend as if it had occurred at the beginning of the earliest period presented.

10

Table of Contents

RISKS RELATED TO OUR BUSINESS AND THIS OFFERING

Investing in our Class B common stock involves a high degree of risk. Before you invest in our Class B common stock, you should carefully consider all the information in this prospectus, including matters set forth in the section entitled “Risk Factors.” If any of these risks actually occur, our business, financial condition and results of operations may be materially adversely affected. In such case, the trading price of our Class B common stock may decline and you may lose part or all of your investment. Below is a summary of the primary risks to our business:

| • | economic and business risks inherent in the truckload industry, including competitive pressures pertaining to pricing, capacity and service; |

| • | the significant portion of revenue we derive from our largest customers, including approximately 30% in the aggregate of our adjusted enterprise revenue (excluding fuel surcharge) for fiscal year 2016 with respect to our 10 largest customers; |

| • | fluctuations in the price or availability of fuel, the volume and terms of diesel fuel purchase commitments and surcharge collection; |

| • | our ability to attract and retain qualified drivers, including owner-operators, in the operation of our intermodal and trucking businesses, which is difficult to predict and is subject to factors outside of our control; |

| • | our third-party logistics customers improving their internal logistics operations and transportation services and therefore decreasing their reliance on our service offerings; |

| • | our ability to recruit, develop and retain our key associates and drivers; |

| • | increased costs of compliance with, or liability for violation of, existing or future federal or state regulations in our industry, which is highly regulated; |

| • | significant systems disruptions, including those caused by cybersecurity breaches, affecting our data networks and systems, including tracking and communications systems; |

| • | negative seasonal patterns generally experienced in the trucking industry during traditionally slower shipping periods and winter months; |

| • | we will be a “controlled company” within the corporate governance rules of the NYSE and, as a result, qualify for, and intend to rely on, the exemption from the requirement that our corporate governance committee be composed entirely of independent directors; and |

| • | the interests of our controlling shareholder may conflict with yours in the future, and, for so long as the Schneider National, Inc. Voting Trust (the “Voting Trust”) maintains control of us, our other shareholders will be unable to affect the outcome of proposed corporate actions supported by the Voting Trust trustees or, in the case of certain actions including a change of control, the Schneider family and trusts for their benefit. |

Corporate Information

Our principal executive offices are located at 3101 Packerland Drive, Green Bay, Wisconsin, and our telephone number is (920) 592-2000. We also maintain a website at https://schneider.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not part of this prospectus.

11

Table of Contents

THE OFFERING

| Class A common stock offered |

None. | |

| Class B common stock offered |

||

| By us |

16,842,000 shares. | |

| By the selling shareholders |

12,105,000 shares. | |

| Option to purchase additional shares of Class B |

We have granted the underwriters a 30-day option from the date of this prospectus to purchase up to 4,342,000 additional shares of our Class B common stock at the initial public offering price, less underwriting discounts. | |

| Class A common stock to be outstanding after this |

83,029,500 shares, representing a 90.2% voting interest (or a 89.7% voting interest, if the underwriters exercise in full their option to purchase additional shares of Class B common stock). | |

| Class B common stock to be outstanding after this |

90,508,890 shares, representing a 9.8% voting interest (or 94,850,890 shares, representing a 10.3% voting interest, if the underwriters’ exercise in full their option to purchase additional shares of Class B common stock). | |

| Voting rights |

Shares of Class A common stock are entitled to ten votes per share.

Shares of Class B common stock are entitled to one vote per share.

Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law. After this offering, the Voting Trust will control almost 90.2% of the voting power of our outstanding capital stock, will continue to hold all of our Class A common stock and effectively control all matters submitted to our shareholders for a vote, except for the vote in any Major Transactions (as defined under “Description of Capital Stock—Shareholder Approval of Major Transactions”), which will be controlled by certain trusts for the benefit of the Schneider family members holding the trust certificates issued by the Voting Trust. See “Description of Capital Stock.” | |

| Controlled company |

Upon the completion of this offering, we will be a “controlled company” under the corporate governance rules of the NYSE . Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements. We intend to take advantage of the exemption from the requirement to have a corporate governance committee that is | |

12

Table of Contents

| composed entirely of independent directors. We have elected not to take advantage of any of the other available exemptions. See “Management—Controlled Company Status.” | ||

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $281 million, or approximately $359 million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $19.00 per share (the mid-point of the estimated price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use approximately $100 million of the net proceeds from this offering to repay the senior note outstanding under our Note Purchase Agreement dated May 7, 2010 and approximately $50 million of the net proceeds from this offering to repay amounts outstanding under our Amended and Restated Receivables Purchase Agreement dated as of March 31, 2010, as amended as of December 17, 2013 (the “Accounts Receivable Facility”). We intend to use the remaining net proceeds for general corporate purposes, including capital expenditures, such as chassis purchases (current intention is in an amount of approximately $110 million) as part of our conversion from a rented chassis model to a company-owned chassis model as described on pages 6-7, 86 and 91 of this prospectus, and potential acquisitions. We will not receive any of the proceeds from the sale of our Class B common stock by the selling shareholders named in this prospectus but we will be required to pay the underwriting discounts and commissions associated with such sales of shares. See “Use of Proceeds.” | |

| Dividend policy |

As a public company we anticipate paying a quarterly dividend to holders of our Class A and Class B common stock.

The declaration and payment of all other future dividends to holders of our common stock will be at the discretion of our Board of Directors and will depend on many factors, including our financial condition, earnings, legal requirements and any debt agreements we are then party to and other factors our Board of Directors deems relevant. “See Dividend Policy.” | |

| Risk factors |

Investing in shares of our Class B common stock involves a high degree of risk. See “Risk Factors” for | |

13

Table of Contents

| a discussion of factors you should carefully consider before you decide to invest in our Class B common stock. | ||

| Proposed listing and symbol |

Our Class B common stock will be listed on the New York Stock Exchange under the symbol “SNDR.” | |

| Conflict of Interest |

An affiliate of Wells Fargo Securities, LLC will receive at least 5% of the net proceeds of this offering in connection with the repayment of amounts outstanding under the Accounts Receivable Facility. See “Use of Proceeds.” Accordingly, this offering is being made in compliance with the requirements of Rule 5121 of Financial Industry Regulation Authority (“FINRA”). Because Wells Fargo Securities, LLC is not primarily responsible for managing this offering, pursuant to Rule 5121, the appointment of a qualified independent underwriter is not necessary. | |

Except where expressly indicated otherwise, references to the total number of shares of our Class A common stock and Class B common stock outstanding after this offering is based on 83,029,500 shares of our Class A common stock and 73,666,890 shares of our Class B common stock outstanding as of March 21, 2017, and excludes the following shares:

| • | 83,029,500 shares of Class B common stock issuable upon the conversion of our Class A common stock that will be outstanding after this offering; |

| • | 8,000,000 shares of Class B common stock reserved as of the closing date of this offering for future issuance under our 2017 Omnibus Incentive Plan; and |

| • | 3,900,000 shares of Class B common stock reserved as of the closing date of this offering for future issuance under our Omnibus Long-Term Incentive Plan. |

Unless we indicate otherwise or the context otherwise requires, this prospectus reflects and assumes:

| • | No exercise of the underwriters’ option to purchase additional shares of our Class B common stock; |

| • | An initial public offering price of $19.00 per share, which is the mid-point of the estimated price range set forth on the cover page of this prospectus; and |

| • | The issuance of the pre-IPO split dividend on March 24, 2017, pursuant to which each of our shareholders as of the record date of March 21, 2017 will receive 29 shares of Class A or Class B Common Stock for each share of Class A or Class B Common Stock, respectively, held by the shareholder as of the record date. |

14

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary historical consolidated financial and other data as of and for the periods indicated. We have derived the summary historical consolidated financial data for the years ended December 31, 2016, December 31, 2015 and December 31, 2014 from the audited consolidated financial statements included elsewhere in this prospectus.

Contemporaneously with the completion of this offering, we will amend the Schneider National, Inc. Employee Stock Purchase Plan and certain agreements governing ownership of our common stock held by existing shareholders, including members of the Schneider family and their family trusts, in order to remove provisions that currently grant each of our shareholders the right to require us to repurchase our common stock held by such shareholder under certain circumstances. The as adjusted consolidated balance sheet data as of December 31, 2016 presents our consolidated balance sheet to give effect to the reclassification of our Class A and Class B common stock, which is, before giving effect to these amendments, considered redeemable under GAAP, to shareholders’ equity, including common stock and additional paid-in capital upon the elimination of the repurchase rights from the shareholders.

The summary historical consolidated financial and other data set forth below should be read in conjunction with the information included under the headings “Use of Proceeds,” “Capitalization,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited and unaudited consolidated financial statements and related notes included elsewhere in this prospectus.

| Consolidated Statements of Income Data ($ in thousands) |

Year Ended December 31, | |||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Operating revenue |

$ | 4,045,736 | $ | 3,959,372 | $ | 3,940,576 | ||||||

| Operating expenses: |

||||||||||||

| Purchased transportation |

1,465,994 | 1,430,164 | 1,384,979 | |||||||||

| Salaries, wages, and benefits |

1,129,304 | 1,076,512 | 1,037,781 | |||||||||

| Fuel and fuel taxes |

252,918 | 290,454 | 455,751 | |||||||||

| Depreciation and amortization |

266,031 | 236,330 | 230,008 | |||||||||

| Operating supplies and expenses |

449,871 | 452,452 | 435,753 | |||||||||

| Insurance and related expenses |

89,076 | 82,007 | 62,846 | |||||||||

| Other general expenses |

102,137 | 125,176 | 94,107 | |||||||||

| Goodwill impairment charge |

— | 6,037 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

3,755,331 | 3,699,132 | 3,701,225 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income from operations |

$ | 290,405 | $ | 260,240 | $ | 239,351 | ||||||

| Non-operating expenses: |

||||||||||||

| Interest expense—net |

21,376 | 18,730 | 11,732 | |||||||||

| Other—net |

3,431 | 2,786 | 1,756 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-operating expenses |

24,807 | 21,516 | 13,488 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

265,598 | 238,724 | 225,863 | |||||||||

| Provision for income taxes |

108,747 | 97,792 | 92,295 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 156,851 | $ | 140,932 | $ | 133,568 | ||||||

|

|

|

|

|

|

|

|||||||

15

Table of Contents

| Consolidated Statements of Income Per Share Data(1) |

Year Ended December 31, | |||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Net income per share attributable to common shareholders |

||||||||||||

| Basic |

$ | 1.00 | $ | 0.91 | $ | 0.86 | ||||||

| Diluted |

$ | 1.00 | $ | 0.91 | $ | 0.86 | ||||||

| Weighted average number of shares used in per share amounts |

||||||||||||

| Basic |

156,566,057 | 155,289,954 | 154,983,767 | |||||||||

| Diluted |

156,836,987 | 155,566,434 | 155,330,117 | |||||||||

| Other Financial Data ($ in thousands, except per share data) |

||||||||||||

| Adjusted income from operations(2) |

$ | 293,099 | $ | 293,008 | $ | 244,276 | ||||||

| Adjusted EBITDA(3) |

$ | 559,130 | $ | 529,338 | $ | 474,284 | ||||||

| Adjusted net income(4) |

$ | 158,443 | $ | 162,740 | $ | 136,474 | ||||||

| Adjusted net income per share(1)(5) |

||||||||||||

| Basic |

$ | 1.01 | $ | 1.05 | $ | 0.88 | ||||||

| Diluted |

$ | 1.01 | $ | 1.05 | $ | 0.88 | ||||||

| Operating Statistics ($) | ||||||||||||

| Truckload |

||||||||||||

| Revenue per truck per week(6) |

$ | 3,488 | $ | 3,520 | $ | 3,518 | ||||||

| Average trucks:(7) |

||||||||||||

| Company |

9,026 | 8,536 | 8,336 | |||||||||

| Owner-operator |

2,696 | 2,446 | 2,048 | |||||||||

| Intermodal |

||||||||||||

| Orders (in thousands) |

381.4 | 386.9 | 376.9 | |||||||||

| Containers (at period end) |

17,653 | 17,397 | 17,280 | |||||||||

| Revenue per order(8) |

$ | 1,986 | $ | 2,040 | $ | 1,918 | ||||||

| Consolidated Balance Sheet Data ($ in thousands) |

As of December 31, 2016 | |||||||

| Actual | As Adjusted(9) |

|||||||

| Cash and cash equivalents |

$ | 130,787 | $ | 130,787 | ||||

| Property and equipment (net) |

1,758,055 | 1,758,055 | ||||||

| Total assets |

3,054,641 | 3,054,641 | ||||||

| Long-term debt and obligations under capital leases |

439,627 | 439,627 | ||||||

| Temporary equity—Redeemable common stock, Class A |

563,217 | — | ||||||

| Temporary equity—Redeemable common stock, Class B |

497,175 | — | ||||||

| Accumulated earnings |

125,175 | — | ||||||

| Accumulated other comprehensive income |

883 | 883 | ||||||

| Common stock, Class A |

— | — | ||||||

| Common stock, Class B |

— | — | ||||||

| Additional paid-in capital |

— | 1,060,392 | ||||||

| Retained earnings |

— | 125,175 | ||||||

16

Table of Contents

| Cash Flow Data

($ in thousands) |

Year Ended December 31, | |||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Cash provided by (used in) operating activities |

$ | 455,313 | $ | 485,557 | $ | 345,749 | ||||||

| Cash provided by (used in) investing activities |

(513,347) | (483,302 | ) | (475,724 | ) | |||||||

| Cash provided by (used in) financing activities |

28,145 | 8,536 | 109,028 | |||||||||

| (1) | Share data gives retroactive effect to the issuance of the pre-IPO split dividend. |

| (2) | We define “adjusted income from operations” as income from operations, adjusted to exclude certain litigation costs, goodwill impairment, acquisition costs and one-time preparation costs in connection with this offering and initiating the transition from privately held to public company status. We describe these adjustments reconciling income from operations to adjusted income from operations in the table below. |

We believe that using adjusted income from operations is helpful in analyzing our performance because it removes the impact of items from our operating results that, in our opinion, do not reflect our core operating performance. Our management and our Board of Directors focus on adjusted income from operations as a key measure of our performance. We believe our presentation of adjusted income from operations is helpful to investors because it provides investors the same information that we use internally for purposes of assessing our core operating performance.