Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32-1 - Houston Wire & Cable CO | s105507_ex32-1.htm |

| EX-31.2 - EXHIBIT 31-2 - Houston Wire & Cable CO | s105507_ex31-2.htm |

| EX-31.1 - EXHIBIT 31-1 - Houston Wire & Cable CO | s105507_ex31-1.htm |

| EX-10.12 - EXHIBIT 10.12 - Houston Wire & Cable CO | s105507_ex10-12.htm |

| EX-10.7 - EXHIBIT 10-7 - Houston Wire & Cable CO | s105507_ex10-7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2016

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-52046

| Delaware | 36-4151663 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

10201 North Loop East Houston, Texas |

77029 |

| (Address of principal executive offices) | (Zip Code) |

(713) 609-2100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Name of Each Exchange on Which Registered | |

| Common stock, par value $0.001 per share | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ¨ NO x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated Filer x | Non-Accelerated Filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of June 30, 2016 was $85,365,877.

At March 1, 2017, there were 16,506,525 shares of the registrant’s common stock, $.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates by reference specific portions of the registrant’s definitive Proxy Statement relating to the Annual Meeting of Stockholders to be held on May 5, 2017.

HOUSTON WIRE & CABLE COMPANY

Form 10-K

For the Fiscal Year Ended December 31, 2016

INDEX

2

Overview

We are a provider of industrial products including electrical and mechanical wire and cable, industrial fasteners, hardware and related services to the U.S. market. We sell electrical products through wholesale electrical distributors, steel wire rope products through rigging wholesalers, fastener products through industrial distributors, and fabricated steel wire rope lifting and hardware products to end users. We provide our customers with a single-source solution by offering a large selection of in-stock items, exceptional customer service and high levels of product expertise.

Our wide product selection and specialized services support our position in the supply chain between manufacturers and the customer. The breadth and depth of wire and cable, fasteners and related hardware that we offer requires significant warehousing resources and a large number of SKU’s (stock-keeping units). While manufacturers may have the space and capabilities to maintain a large supply of inventory, we do not believe that any single manufacturer has the breadth and depth of product that we offer. More importantly, manufacturers historically have not offered the services that our customers need, such as complimentary custom cutting, cable coiling, custom manufactured slings and harnesses, paralleling, bundling, striping, cable management for large capital projects, and same day shipment, and do not have multiple distribution centers across the nation.

Our Cable Management Program addresses our customers’ requirement for sophisticated and efficient just-in-time product management for large capital projects. This program entails purchasing and storing dedicated inventory so our customers have immediate product availability for the duration of their project. Advantages of this program include extra pre-allocated safety stock, firm pricing, zero cable surplus and just-in-time delivery. Used on large construction and capital expansion projects, our Cable Management Program combines the expertise of our cable specialists with dedicated project inventory and superior logistics to allow complex projects to be completed on time, within budget and with minimal residual waste.

History

We were founded in 1975 and have a long history of exceptional customer service, broad product selection and high levels of product expertise. In 1987, we completed our first initial public offering and were subsequently purchased in 1989 by ALLTEL Corporation and in 1997 by investment funds affiliated with Code, Hennessy & Simmons LLC. In 2006, we completed our second initial public offering. In 2010, we purchased Southwest Wire Rope LP (“Southwest”), its general partner Southwest Wire Rope GP LLC and its wholly owned subsidiary, Southern Wire (“Southern”), and subsequently merged the acquired businesses into our operating subsidiary. On October 3, 2016 we completed the acquisition of Vertex Corporate Holdings, Inc., and its subsidiaries (“Vertex”) from DXP Enterprises. Vertex is a master distributor of industrial fasteners and this acquisition expands our product offerings to the industrial marketplace that purchases our wire and cable products.

Products

We offer products in most categories of wire and cable, including: continuous and interlocked armor cable; control and power cable; electronic wire and cable; flexible and portable cord; instrumentation and thermocouple cable; lead and high temperature cable; medium voltage cable; premise and category wire and cable, primary and secondary aluminum distribution cable, steel wire rope and wire rope slings, as well as synthetic fiber rope slings, chain, shackles, related hardware and corrosion resistant products including inch and metric bolts, screws, nuts, washers, rivets and hose clamps. We also offer private branded products, including our proprietary brand LifeGuard™, a low-smoke, zero-halogen cable. Our products are used in repair and replacement work, also referred to as Maintenance, Repair and Operations ("MRO"), and related projects, larger-scale projects in the utility, industrial and infrastructure markets and a diverse range of industrial applications including communications, energy, engineering and construction, general manufacturing, marine construction and marine transportation, mining, infrastructure, oilfield services, petrochemical, transportation, utility, wastewater treatment and food and beverage.

Targeted Markets

Our business is driven, in part, by the strength, growth prospects and activity in the end-markets in which our products are used, which are primarily in the continental United States, where we target the utility, industrial and infrastructure markets.

3

Utility Market. The utility market includes large investor-owned utilities, rural cooperatives and municipal power authorities. While we are not a significant distributor of power lines used for the transmission of electricity today, we have added products to our portfolio that are used in this sector. We continue to sell our core products for the construction of power plants and the related pollution control equipment used to comply with environmental standards as well as plant modernizations implemented to extend the life of power generation facilities. Our customers utilize our cable management services to supply the wire and cable required in the construction of new power plants and upgrading of existing power plants. The extension of federal tax credits and production credits into the renewable sectors of solar and wind will also provide expanded opportunities for products we supply.

Industrial Market. The industrial market is one of the largest segments of the U.S. economy and is comprised of a diverse base of manufacturing and production companies. The largest driver of our success in this market results from the level of US investment in upstream, midstream and downstream oil and gas exploration, transportation and production. We provide a wide variety of products specifically designed for use in manufacturing, metal/mineral, and oil and gas upstream, midstream and downstream markets.

Infrastructure Market. Investments in the development, construction and maintenance of infrastructure markets including education and health care; air, ground and rail transportation; telecommunications, and wastewater are opportunities for our product and service offerings.

Distribution Logistics

We believe that our national distribution presence and value-added services make us an essential partner in the supply chain for our suppliers. We have successfully expanded our business from the original location in Houston, Texas to twenty-two locations nationwide, which includes three third-party logistics providers. Our standard practice is to process customers' orders the same day they are received. Our strategically located distribution centers generally allow for ground delivery nationwide within 24 hours of shipment. Orders are delivered through a variety of distribution methods, including less-than-truck-load, truck-load, air or parcel service providers, direct from supplier and cross-dock shipments. Freight costs are typically borne by our customers. Due to our shipment volume, we have preferred pricing relationships with our contract carriers.

Customers

During 2016, we served approximately 8,000 customers, shipping approximately 47,000 SKU’s to approximately 12,000 customer locations nationwide. No customer represented 10% or more of our 2016 sales.

Suppliers

We obtain products from leading suppliers and believe we have strong relationships with our top suppliers. We source a growing portion of our products from offshore. While alternative sources are available for the majority of our products, we have strategically concentrated our purchases with our top suppliers in order to maximize product quality, delivery dependability, purchasing efficiencies, and vendor rebates. As a result, in 2016, approximately 45% of our purchases came from five suppliers. We do not believe we are dependent on any one supplier for any of the industrial products that we sell.

Our top five suppliers in 2016 were Belden Inc., General Cable Corporation, Lake Cable LLC, Nexans Energy USA, Inc. and Southwire Company.

Sales

We market our industrial products and related services through an inside sales force situated in our regional offices, a field sales force focused on key geographic markets and regional sales agencies. By operating under a decentralized process, region managers are able to adapt quickly to market-specific occurrences, allowing us to compete effectively with local competitors. We believe the knowledge, experience and tenure of our sales force are critical to serving our fragmented and diverse customer and end-user base.

Competition

The industrial products market remains very competitive and fragmented, with several hundred electrical wire and cable, steel wire rope, and fastener competitors serving this market. The product offerings and levels of service from the other providers of product with whom we compete vary widely at the national, regional or local levels. Most of our direct competitors are smaller companies that focus on a specific geographical area or feature a select product offering, such as surplus wire. In addition to the direct competition with other product providers, we also face, on a varying basis, competitors that sell products directly or through multiple distribution channels to end-users or other resellers.

In the markets that we sell our industrial products, competition is primarily based on product line breadth, quality, product availability, service capabilities and price.

4

Employees

At December 31, 2016, we had 403 employees. Our sales and marketing staff accounted for 169 employees, including 34 field sales personnel, 16 sales agencies, and 100 inside sales and technical support personnel.

Fourteen warehouse employees at our Attleboro, Massachusetts location are represented by a labor union. We believe that our employee relations are good.

Website Access

We maintain an internet website at www.houwire.com. We make available, free of charge under the “Investor Relations” tab on our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and if applicable, amendments to those reports, as well as proxy and information statements, as soon as reasonably practicable after such documents are electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). Information contained on our website is not part of, and should not be construed as being incorporated by reference into, this Annual Report on Form 10-K.

Government Regulation

We are subject to regulation by various federal, state and local agencies. We believe we are in compliance in all material respects with existing applicable statutes and regulations affecting environmental issues and our employment, workplace health and workplace safety practices.

5

In addition to other information in this Annual Report on Form 10-K, the following risk factors should be carefully considered in evaluating our business, because such factors may have a significant impact on our business, operating results, cash flows and financial condition. As a result of the risks set forth below and elsewhere in this Annual Report, actual results could differ materially from those projected in any forward-looking statements.

Downturns in capital spending and cyclicality in the markets we serve have had and could continue to have a material adverse effect on our financial condition and results of operations.

The majority of our products are used in the construction, maintenance, repair and operation of facilities, plants and projects in the communications, energy, engineering and construction, general manufacturing, infrastructure, oil and gas, marine construction, marine transportation, mining, oilfield services, transportation, utility, wastewater treatment and food and beverage industries. The demand for our products and services depends to a large degree on the capital spending levels of end-users in these markets. Many of these end-users defer capital expenditures or cancel projects during economic downturns or periods of uncertainty. In addition, certain of the markets we serve are cyclical, which affects capital spending by end-users in these industries.

We have risks associated with our customers’ access to credit.

The continuing uncertainty in global financial markets has not impaired our access to credit to finance our operations. However, poor credit market conditions may adversely impact the availability of construction and other project financing, upon which many of our customers depend, resulting in project cancellations or delays. Our utility and industrial customers may also face limitations when trying to access the credit markets to fund ongoing operations or capital projects. Credit constraints experienced by our customers may result in lost revenues, reduced gross margins for us and, in some cases, higher than expected bad debt losses.

We have risks associated with inventory.

Our business requires us to maintain substantial levels of inventory. We must identify the right mix and quantity of products to keep in our inventory to fulfill customer orders. Failure to do so could adversely affect our sales and earnings. However, if our inventory levels are too high, we are at risk that unexpected changes in circumstances, such as a shift in market demand, drop in prices or loss of a customer, could have a material adverse impact on the net realizable value of our inventory.

Our operating results are affected by fluctuations in commodity prices.

Copper, steel, aluminum, nickel and petrochemical products are components of the products we sell. Fluctuations in the costs of these and other commodities have historically affected our operating results. If commodity prices decline, the net realizable value of our existing inventory could be reduced, and our gross profit could be adversely affected. To the extent higher commodity prices result in increases in the costs we pay for our products, we attempt to reflect the increase in the prices we charge our customers. While we historically have been able to pass most of these cost increases on to our customers, to the extent we are unable to do so in the future, it could have a material adverse effect on our operating results. In addition, if commodity costs increase, our customers may delay or decrease their purchases of our products.

Our sales are impacted by the level of oil and gas drilling activity.

We estimate that approximately one-third of our sales depend upon the level of capital and operating expenditures in the oil and gas industry, including capital and other expenditures in connection with exploration, drilling, production, gathering, transportation, refining and processing operations. Demand for the products we distribute is sensitive to the level of exploration, development and production activity of, and the corresponding capital and other expenditures by, oil and gas companies. A material decline in oil or gas prices, inability to access capital, and consolidation within the industry could all depress levels of exploration, development and production activity and, therefore, could lead to a decrease in our sales due to curtailed capital and MRO expenditures.

If we are unable to maintain our relationships with our customers, it could have a material adverse effect on our financial results.

We rely on customers to purchase our industrial products. The number, size, business strategy and operations of these customers vary widely from market to market. Our success depends heavily on our ability to identify and respond to our customers’ needs.

6

In 2016, our ten largest customers accounted for approximately 39% of our sales. If we were to lose one or more of our large customers, or if one or more of our large customers were to significantly reduce their purchases from us, and we were unable to replace the lost sales on similar terms, we could experience a significant loss of revenue and profits. In addition, if one or more of our key customers failed or were unable to pay, we could experience a write-off or write-down of the related receivables, which could adversely affect our earnings. We participate with national marketing groups and engage in joint promotional sales activities with the members of those groups. Any permanent exclusion of us from, or refusal to allow us to participate in, such national marketing groups could have a material adverse effect on our sales and our results of operations.

An inability to obtain the products that we distribute could result in lost revenues and reduced profits and damage our relationships with customers.

In 2016, we sourced products from approximately 282 suppliers. However, we have adopted a strategy to concentrate our purchases with a small number of suppliers in order to maximize product quality, delivery dependability, purchasing efficiencies and vendor rebates. As a result, in 2016 approximately 45% of our purchases came from five suppliers. If any of these suppliers changes its sales strategy or decides to terminate its business relationship with us, our sales and earnings could be adversely affected unless and until we were able to establish relationships with suppliers of comparable products. In addition, if we are not able to obtain the products we distribute from either our current suppliers or other competitive sources, we could experience a loss of revenue, reduction in profits and damage to our relationships with our customers. Supply shortages may occur as a result of unanticipated demand or production cutbacks, shortages of raw materials, labor disputes or weather conditions affecting products or shipments, transportation disruptions or other reasons beyond our control. When shortages occur, suppliers often allocate products among their customers, and our allocations might not be adequate to meet our customers' needs.

Loss of key personnel or our inability to attract and retain new qualified personnel could hurt our ability to operate and grow successfully.

Our success is highly dependent upon the services of James L. Pokluda III, our President and Chief Executive Officer, and Nicol G. Graham, our Chief Financial Officer. Our success will continue to depend to a significant extent on our executive officers, key management and sales personnel. We do not have key man life insurance covering any of our executive officers. We may not be able to retain our executive officers, key personnel or attract additional qualified management and sales personnel. The loss of any of our executive officers or our other key management and sales personnel or our inability to recruit and retain qualified personnel could hurt our ability to operate and make it difficult to maintain our market share and to execute our growth strategies.

A change in vendor rebate programs could adversely affect our gross margins and results of operations.

The terms on which we purchase products from many of our suppliers entitle us to receive a rebate based on the volume of our purchases. These rebates effectively reduce our costs for products. If suppliers adversely change the terms of some or all of these programs, the changes may lower our gross margins on products we sell and may have an adverse effect on our operating results.

If we encounter difficulties with our management information systems, including cyber-attacks, we would experience problems managing our business.

We believe our management information systems are a competitive advantage in maintaining a leadership position in the industrial supply industry. We rely upon our management information systems to manage and replenish inventory, determine pricing, fill and ship orders on a timely basis and coordinate our sales and marketing activities. If we experience problems with our management information systems, we could experience product shortages, diminished inventory control or an increase in accounts receivable. Any failure by us to maintain our management information systems could adversely impact our ability to attract and serve customers and would cause us to incur higher operating costs and experience reduced profitability.

An increase in competition could decrease sales or earnings.

We operate in a highly competitive industry. We compete directly with national, regional and local providers of industrial products. Competition is primarily focused in the local service area and is generally based on product line breadth, product availability, service capabilities and price. Some of our existing competitors have, and new market entrants may have, greater financial and marketing resources than we do. To the extent existing or future competitors seek to gain or retain market share by reducing prices, we may be required to lower our prices, thereby adversely affecting our financial results. Existing or future competitors also may seek to compete with us for acquisitions, which could have the effect of increasing the price and reducing the number of suitable acquisitions. Other companies, including our current customers, could seek to compete directly with our private branded products, which could adversely affect our sales of those products and ultimately our financial results. Our existing customers, as well as suppliers, could seek to compete with us by offering services similar to ours, which could adversely affect our market share and our financial results. In addition, competitive pressures resulting from economic conditions and the industry trend toward consolidation could adversely affect our growth and profit margins.

7

We may not be able to successfully identify acquisition candidates, effectively integrate newly acquired businesses into our operations or achieve expected profitability from our acquisitions.

To supplement our growth, we intend to selectively pursue acquisition opportunities. If we are not successful in finding attractive acquisition candidates that we can acquire on satisfactory terms, or if we cannot complete those acquisitions that we identify, we will not be able to realize the benefit of this growth strategy.

Acquisitions involve numerous possible risks, including unforeseen difficulties in integrating operations, technologies, services, accounting and personnel; the diversion of financial and management resources from existing operations; unforeseen difficulties related to entering geographic regions or target markets where we do not have prior experience; the potential loss of key employees; and the inability to generate sufficient profits to offset acquisition or investment-related expenses. If we finance acquisitions by issuing equity securities or securities convertible into equity securities, our existing stockholders could be diluted, which, in turn, could adversely affect the market price of our stock. If we finance an acquisition with debt, it could result in higher leverage and interest costs. As a result, if we fail to evaluate and execute acquisitions properly, we might not achieve the anticipated benefits of these acquisitions, and we may incur costs in excess of what we anticipate, and goodwill impairments may result.

We are anticipating growth in the businesses we acquired in 2010 and in 2016. However, the investments in the Southern (in 2013 and 2016) and Southwest (in 2015) reporting units have had goodwill and intangible impairment charges as they did not meet their financial objectives. Future goodwill and tradename impairments may result, should the acquired businesses not achieve their currently forecasted growth or profitability targets.

We may be subject to product liability claims that could be costly and time consuming.

We sell industrial products. As a result, from time to time we have been named as defendants in lawsuits alleging that these products caused physical injury or injury to property. We rely on product warranties and indemnities from the product manufacturers, as well as insurance that we maintain, to protect us from these claims. However, if manufacturers' warranties and indemnities and our insurance coverage are not available or inadequate to cover every claim, it could have an adverse effect on our operating results.

Changes to the U.S. tax, tariff and import/export regulations may have a negative effect on our results of operations.

We import a relatively small but growing percentage of our wire and cable products, as well as a significant portion of our hardware products, from foreign manufacturers. Some recent U.S. tax reform proposals could, if enacted, increase the amount of tax paid on imported goods. In addition, the recent presidential and congressional elections have created uncertainty about future trade policies, treaties, government regulations and tariffs. Adoption of some of the proposed tax reforms, or changes in import tariffs or other trade regulations, could have a negative impact on our tax expense and cash flow, require us to change our sourcing and supply chain strategies, and adversely affect our profitability.

8

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Facilities

We operate out of twenty-two distribution centers strategically located throughout the United States with approximately 1,034,000 square feet of distribution space. We own three facilities in Houston, Texas, including our corporate headquarters, and two facilities in Louisiana. All of the other facilities are leased, including three from third-party logistics providers. Nineteen of the facilities, in addition to containing inventory for re-sale, house knowledgeable sales staff. We believe that our properties are in good operating condition and adequately serve our current business operations.

From time to time, we are involved in lawsuits that are brought against us in the normal course of business. We are not currently a party to any legal proceedings that we expect, either individually or in the aggregate, to have a material adverse effect on our business or financial condition. We, along with many other defendants, have been named in a number of lawsuits in the state courts of Minnesota, North Dakota, and South Dakota alleging that certain wire and cable which may have contained asbestos caused injury to the plaintiffs who were exposed to this wire and cable. These lawsuits are individual personal injury suits that seek unspecified amounts of money damages as the sole remedy. It is not clear whether the alleged injuries occurred as a result of the wire and cable in question or whether we, in fact, distributed the wire and cable alleged to have caused any injuries. We maintain general liability insurance that, to date, has covered the defense of and all costs associated with these claims. In addition, we did not manufacture any of the wire and cable at issue, and we would rely on any warranties from the manufacturers of such cable if it were determined that any of the wire or cable that we distributed contained asbestos which caused injury to any of these plaintiffs. In connection with ALLTEL's sale of our company in 1997, ALLTEL provided indemnities with respect to costs and damages associated with these claims that we believe we could enforce if our insurance coverage proves inadequate.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

SUPPLEMENTAL ITEM. EXECUTIVE OFFICERS OF THE REGISTRANT

| Name/Office | Age | Business Experience During Last 5 Years | ||

|

James L. Pokluda III President and Chief Executive Officer |

52 | Chief Executive Officer since January 2012 and President since May 2011. Prior thereto, Vice President Sales & Marketing from April 2007 until May 2011. | ||

|

Nicol G. Graham Chief Financial Officer, Treasurer and Secretary |

64 | Chief Financial Officer, Treasurer and Secretary since 1997. |

9

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on The NASDAQ Global Market under the symbol “HWCC”. As of December 31, 2016, there were 2,217 holders of record, including participants in security position listings. This figure does not include those beneficial holders whose shares may be held of record by brokerage firms and clearing agencies. The following table lists quarterly information on the price range of our common stock based on the high and low reported average sale prices for our common stock as reported by The NASDAQ Global Market for the periods indicated below.

| High | Low | |||||||

| Year ended December 31, 2016: | ||||||||

| First quarter | $ | 5.91 | $ | 5.65 | ||||

| Second quarter | $ | 6.23 | $ | 6.00 | ||||

| Third quarter | $ | 5.86 | $ | 5.67 | ||||

| Fourth quarter | $ | 6.18 | $ | 5.90 | ||||

| Year ended December 31, 2015: | ||||||||

| First quarter | $ | 12.21 | $ | 9.29 | ||||

| Second quarter | $ | 10.55 | $ | 8.80 | ||||

| Third quarter | $ | 10.15 | $ | 6.12 | ||||

| Fourth quarter | $ | 7.60 | $ | 5.08 | ||||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table provides information about our purchases of common stock for the quarter ended December 31, 2016. For further information regarding our stock repurchase activity, see Note 7 to our Consolidated Financial Statements.

| Period | Total number of shares purchased | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs (1) | Maximum number (or approximate dollar value) of shares that may yet be purchased under the plans or programs (1) | ||||||||||||

| October 1 – 31, 2016 | 40,200 | $ | 5.93 | 40,200 | $ | 9,202,422 | ||||||||||

| November 1 – 30, 2016 | 6,703 | $ | 5.30 | 6,703 | $ | 9,166,906 | ||||||||||

| December 1 – 31, 2016 | — | $ | — | — | $ | 9,166,906 | ||||||||||

| Total | 46,903 | $ | 5.84 | 46,903 | ||||||||||||

| (1) | The board authorized a stock repurchase program of $25 million in March 2014. The program has no expiration date. Purchases under the stock repurchase program were suspended in November 2016. |

Stock Performance Graph

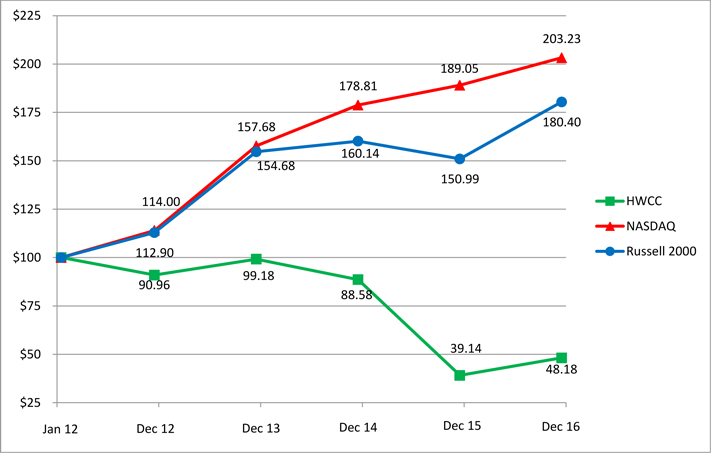

The following graph compares the total stockholder return on our common stock with the total return on the NASDAQ US Index and the Russell 2000 Index. We believe the Russell 2000 Index includes companies with market capitalization comparable to ours. Houston Wire & Cable Company has a unique niche in the marketplace, due to the size and scope of our business platform, and we are unable to identify peer issuers, as the public companies within our industry are substantially more diversified than we are.

10

Total return is based on an initial investment of $100 on January 1, 2012, and reinvestment of dividends.

Dividend Policy

Holders of our common stock are entitled to receive dividends when, as and if declared by our Board of Directors. We paid a quarterly cash dividend from August 2007 until August 2016. Our quarterly cash dividend from May 2013 through February 2014 was $0.11 per share, from May 2014 through August 2015 was $0.12 per share and from November 2015 through May 2016 was $0.06 per share. We paid a cash dividend of $0.03 per share in August 2016. The Board of Directors determined to suspend the regular dividend in November 2016, to redeploy funds for other purposes, including the Vertex acquisition. For the years ended December 31, 2016 and 2015, cash dividends were $0.15 and $0.42 per share, resulting in total dividends paid of $2.5 million and $7.2 million, respectively.

As a holding company, our only source of funds to pay dividends is distributions from our operating subsidiary. Our loan agreement does not limit the amount of dividends we may pay or stock we may repurchase, as long as we are not in default under the loan agreement and we maintain defined levels of fixed charge coverage and/or availability.

Securities Authorized for Issuance under Equity Compensation Plans

The information called for by this Item regarding securities available for issuance is provided in response to Item 12.

11

ITEM 6. SELECTED FINANCIAL DATA

You should read the following selected financial information together with our consolidated financial statements and the related notes and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" appearing elsewhere in this Form 10-K. We have derived the consolidated statement of operations data for each of the years ended December 31, 2016, 2015 and 2014, and the consolidated balance sheet data at December 31, 2016 and 2015, from our audited financial statements, which are included in this Form 10-K. We have derived the consolidated statement of operations data for each of the years ended December 31, 2013 and 2012, and the consolidated balance sheet data at December 31, 2014, 2013 and 2012 from our audited financial statements, which are not included in this Form 10-K.

| Year Ended December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| (Dollars in thousands, except share data) | ||||||||||||||||||||

| CONSOLIDATED STATEMENT OF OPERATIONS DATA: | ||||||||||||||||||||

| Sales | $ | 261,644 | $ | 308,133 | $ | 390,011 | $ | 383,292 | $ | 393,036 | ||||||||||

| Cost of sales | 208,694 | 242,223 | 304,073 | 298,633 | 306,017 | |||||||||||||||

| Gross profit | 52,950 | 65,910 | 85,938 | 84,659 | 87,019 | |||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries and commissions | 29,369 | 28,537 | 31,196 | 30,946 | 30,013 | |||||||||||||||

| Other operating expenses | 24,714 | 25,023 | 26,400 | 26,068 | 25,139 | |||||||||||||||

| Depreciation and amortization | 3,018 | 2,915 | 2,919 | 2,978 | 2,941 | |||||||||||||||

| Impairment charge | 2,384 | 3,417 | — | 7,562 | — | |||||||||||||||

| Total operating expenses | 59,485 | 59,892 | 60,515 | 67,554 | 58,093 | |||||||||||||||

| Operating income (loss) | (6,535 | ) | 6,018 | 25,423 | 17,105 | 28,926 | ||||||||||||||

| Interest expense | 845 | 901 | 1,168 | 992 | 1,252 | |||||||||||||||

| Income (loss) before income taxes | (7,380 | ) | 5,117 | 24,255 | 16,113 | 27,674 | ||||||||||||||

| Income tax expense (benefit) | (1,374 | ) | 3,073 | 9,283 | 8,211 | 10,635 | ||||||||||||||

| Net income (loss) | $ | (6,006 | )(1) | $ | 2,044 | (2) | $ | 14,972 | $ | 7,902 | (3) | $ | 17,039 | |||||||

| Earnings (loss) per share: | ||||||||||||||||||||

| Basic | $ | (0.37 | )(1) | $ | 0.12 | (2) | $ | 0.85 | $ | 0.44 | (3) | $ | 0.96 | |||||||

| Diluted | $ | (0.37 | )(1) | $ | 0.12 | (2) | $ | 0.85 | $ | 0.44 | (3) | $ | 0.96 | |||||||

| Weighted average common shares outstanding : | ||||||||||||||||||||

| Basic | 16,345,679 | 17,012,560 | 17,605,290 | 17,805,464 | 17,723,277 | |||||||||||||||

| Diluted | 16,345,679 | 17,067,593 | 17,683,931 | 17,900,372 | 17,815,401 | |||||||||||||||

| (1) | 2016 net loss excluding the after tax impact of the impairment charge was $4,013, and basic and fully diluted loss per share were each $0.25. | |

| (2) | 2015 net income excluding the after tax impact of the impairment charge was $5,171, and basic and fully diluted earnings per share were each $0.30. | |

| (3) | 2013 net income excluding the after tax impact of the impairment charge was $14,594, and basic and fully diluted earnings per share were each $0.82. |

12

| As of December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| CONSOLIDATED BALANCE SHEET DATA: | ||||||||||||||||||||

| Cash and cash equivalents | $ | — | $ | — | $ | — | $ | — | $ | 274 | ||||||||||

| Accounts receivable, net | $ | 44,677 | $ | 46,250 | $ | 61,599 | $ | 60,408 | $ | 65,892 | ||||||||||

| Inventories, net | $ | 79,783 | $ | 75,777 | $ | 88,958 | $ | 96,107 | $ | 84,662 | ||||||||||

| Total assets | $ | 175,870 | $ | 159,113 | $ | 189,813 | $ | 196,175 | $ | 197,155 | ||||||||||

| Book overdraft (1) | $ | 3,181 | $ | 3,701 | $ | 3,113 | $ | 4,594 | $ | — | ||||||||||

| Total debt | $ | 60,388 | $ | 39,188 | $ | 53,847 | $ | 47,952 | $ | 58,588 | ||||||||||

| Stockholders’ equity | $ | 90,131 | $ | 100,001 | $ | 111,307 | $ | 110,694 | $ | 109,080 | ||||||||||

| (1) | Our book overdraft is funded by our revolving credit facility as soon as the related checks clear our disbursement accounts. |

13

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with our consolidated financial statements and related notes appearing elsewhere in this Form 10-K. In addition to historical information, this discussion contains forward-looking statements that involve risks, uncertainties and assumptions that could cause actual results to differ materially from our expectations. Factors that could cause such differences include those described in “Risk Factors” and elsewhere in this Form 10-K. Certain tabular information may not foot due to rounding.

Overview

Since our founding 41 years ago, we have grown to be a large provider of industrial products to the U.S. market. Today, we serve approximately 8,000 customers. Our products are used in MRO activities and related projects, as well as for larger-scale projects in the utility, industrial and infrastructure markets and a diverse range of industrial applications including communications, energy, engineering and construction, general manufacturing, mining, marine construction and marine transportation, infrastructure, oilfield services, petrochemical, transportation, utility, wastewater treatment and food and beverage. Activity in the MRO market has been inconsistent, while the level of competition has increased.

Our revenue is driven in part by the level of capital spending within the end-markets we serve. Because many of these end-markets defer capital expenditures during periods of economic downturns, our business has experienced cyclicality. Our revenue has been and will continue to be impacted by fluctuations in capital spending and by our ability to drive demand through our sales and marketing initiatives and the continued development and marketing of our private branded products, such as LifeGuard™. The recent diminished level of economic activity and fluctuating commodity prices have impacted sales and the level of demand. This has had and will continue to have an impact on our performance, until economic activity and demand improves.

Our direct costs will continue to be influenced significantly by the prices we pay our suppliers to procure the products we distribute to our customers. Changes in these costs may result, for example, from increases or decreases in raw material costs, changes in our relationships with suppliers or changes in vendor rebates. Our operating expenses will continue to be affected by our investment in sales, marketing and customer support personnel and commissions paid to our sales force for revenue and profit generated. Some of our operating expenses are related to our fixed infrastructure, including rent, utilities, administrative salaries, maintenance, insurance and supplies. To meet our customers’ needs for an extensive product offering and short delivery times, we will need to continue to maintain adequate inventory levels. Our ability to obtain this inventory will depend, in part, on our relationships with suppliers.

Critical Accounting Policies and Estimates

Critical accounting policies are those that both are important to the accurate portrayal of a company’s financial condition and results of operations, and require subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

In order to prepare financial statements that conform to accounting principles generally accepted in the United States, commonly referred to as GAAP, we make estimates and assumptions that affect the amounts reported in our financial statements and accompanying notes. Certain estimates are particularly sensitive due to their significance to the financial statements and the possibility that future events may be significantly different from our expectations.

We have identified the following accounting policies as those that require us to make the most subjective or complex judgments in order to fairly present our consolidated financial position and results of operations. Actual results in these areas could differ materially from management’s estimates under different assumptions and conditions.

Inventories

Inventories are valued at the lower of cost, using the average cost method, or market. We continually monitor our inventory levels at each of our distribution centers. Our reserve for inventory is based on the age of the inventory, movements of our inventory over the prior twelve months and the experience of our purchasing and sales departments in estimating demand for the product in the succeeding year. Our inventories are generally not susceptible to technological obsolescence. A 20% change in our estimate at December 31, 2016 would have resulted in a change in loss before income taxes of $1.3 million.

14

Intangible Assets

The Company’s intangible assets, excluding goodwill, represent purchased tradenames and customer relationships. Tradenames are not being amortized and are treated as indefinite-lived assets. Tradenames are tested for recoverability on an annual basis in October of each year, or when there is a triggering event. The annual test for 2016 combined with the interim test showed an impairment of certain of the tradenames at Southern, and we recorded a pre-tax charge of less than $0.1 million. The Company assigns useful lives to its intangible assets based on the periods over which it expects the assets to contribute directly or indirectly to the future cash flows of the Company. Customer relationships are amortized over 6 to 9 year useful lives. If events or circumstances were to indicate that any of the Company’s definite-lived intangible assets might be impaired, the Company would assess recoverability based on the estimated undiscounted future cash flows to be generated from the applicable intangible asset.

When performing quantitative assessments for impairment, we use various assumptions in determining the current fair value of these indefinite-lived intangible assets, including future expected cash flows and discount rates, as well as other fair value measures. If actual results are not consistent with our assumptions and judgments used in estimating future cash flows and asset fair values, we may be exposed to future impairment charges that could be material to our results of operations.

Vendor Rebates

Many of our arrangements with our vendors entitle us to receive a rebate of a specified amount when we achieve any of a number of measures, generally related to the volume of purchases from the vendor. We account for such rebates as a reduction of the prices of the vendor’s products and therefore as a reduction of inventory until we sell the product, at which time such rebates reduce cost of sales. Throughout the year, we estimate the amount of the rebates earned based on purchases to date relative to the total purchase levels expected to be achieved during the rebate period. We continually revise these estimates to reflect rebates expected to be earned based on actual purchase levels and forecasted purchase volumes for the remainder of the rebate period. A 20% change in our estimate of total rebates earned during 2016 would have resulted in a change in loss before income taxes of $0.8 million for the year ended December 31, 2016.

Goodwill

Goodwill represents the excess of the amount we paid to acquire businesses over the estimated fair value of tangible assets and identifiable intangible assets acquired, less liabilities assumed. Determining the fair value of assets acquired and liabilities assumed requires management’s judgment and often involves the use of significant estimates and assumptions, including assumptions with respect to future cash flows, discount rates and asset lives among other items. At December 31, 2016, our goodwill balance was $22.8 million, representing 12.9% of our total assets.

The Company reviews goodwill for impairment annually, or more frequently if indications of possible impairment exist, using a three-step process. The first step is a qualitative evaluation as to whether it is more likely than not that the fair value of any of the reporting units is less than its carrying value using an assessment of relevant events and circumstances. Examples of such events and circumstances include financial performance, industry and market conditions, macroeconomic conditions, reporting unit-specific events, historical results of goodwill impairment testing and the timing of the last performance of a quantitative assessment. If the Company is unable to conclude that the goodwill associated with any reporting unit is more likely than not impaired, a second step is performed for that reporting unit. This second step, used to quantitatively screen for potential impairment, compares the fair value of the reporting unit with its carrying amount, including goodwill. The third step, employed for any reporting unit that fails the second step, is used to measure the amount of any potential impairment and compares the implied fair value of the reporting unit’s goodwill with the carrying amount of goodwill.

The second and third steps that we use to evaluate goodwill for impairment involve the determination of the fair value of our reporting units. Inherent in such fair value determinations are certain judgments and estimates relating to future cash flows, including our interpretation of current economic indicators and market valuations, and assumptions about our strategic plans. In developing fair values for our reporting units, we may employ a market multiple or a discounted cash flow methodology, or a combination thereof. The market multiple methodology compares us to similar companies on the basis of risk characteristics to determine our risk profile relative to the comparable companies as a group. This analysis generally focuses on quantitative considerations, which include financial performance and other quantifiable data, and qualitative considerations, which include any factors which are expected to impact future financial performance. The most significant assumptions affecting the market multiple methodology are the market multiples and control premium. A control premium represents the value an investor would pay above non-controlling interest transaction prices in order to obtain a controlling interest in the respective unit.

15

The discounted cash flow methodology establishes fair value by estimating the present value of the projected future cash flows to be generated from the reporting unit. The discount rate applied to the projected future cash flows to arrive at the present value is intended to reflect all risks of ownership and the associated risks of realizing the stream of projected future cash flows. The discounted cash flow methodology uses our projections of financial performance. The most significant assumptions used in the discounted cash flow methodology are the discount rate, the customer attrition rate and expected future revenue and operating margins, which vary among reporting units. If actual results are not consistent with our assumptions and judgments used in estimating future cash flows and asset fair values, we may be exposed to future impairment losses that could be material to our results of operations.

During the second quarter of 2016 we concluded that impairment indicators existed at the Houston Wire & Cable (“HWC”) reporting unit due to a decline in the overall financial performance and overall market demand. The carrying value of the HWC reporting unit’s goodwill was $2.4 million and its implied fair value resulting from the impairment test was zero.

During the second quarter of 2015, we concluded that impairment indicators existed at the Southwest reporting unit, due to a decline in the overall financial performance and overall market demand. The carrying value of the Southwest reporting unit’s goodwill was $2.6 million and its implied fair value resulting from the impairment test was zero.

The annual goodwill impairment qualitative test was performed as of October 1, 2016, related to the Southern reporting unit, the one reporting unit with goodwill at that date. This qualitative test, which compared current year to date performance to plan, indicated that it was more likely that the goodwill was not impaired. If there are further reductions in our market capitalization and market multiples, or the projected performance is not achieved, this remaining reporting unit could be at risk of failing the second step in the future.

Sales

We generate most of our sales by providing industrial products to our customers, as well as billing for freight charges. We recognize revenue upon shipment of our products to customers from our distribution centers or directly from our suppliers. Sales incentives earned by customers are accrued in the same month as the shipment is invoiced and are accounted for as a reduction in sales.

Cost of Sales

Cost of sales consists primarily of the average cost of the industrial products that we sell. We also incur shipping and handling costs in the normal course of business. Cost of sales also reflects cash discounts for prompt payment to vendors and vendor rebates generally related to annual purchase targets, as well as inventory obsolescence charges.

Operating Expenses

Operating expenses include all expenses, excluding freight, incurred to receive, sell and ship product and administer the operations of the Company.

Salaries and Commissions. Salary expense includes the base compensation, and any overtime earned by hourly personnel, for all sales, administrative and warehouse employees and stock compensation expense for options and restricted stock granted to employees. Commission expense is earned by inside sales personnel based on gross profit dollars generated, by field sales personnel from generating sales and meeting various objectives, by sales, national and marketing managers for driving the sales process, by region managers based on the profitability of their branches and by corporate managers based primarily on our profitability and also on other operating metrics.

Other Operating Expenses. Other operating expenses include all other expenses, except for salaries and commissions and depreciation and amortization. This includes all payroll taxes, health insurance, travel expenses, public company expenses, advertising, management information system expenses, facility rent and all distribution expenses such as packaging, reels, and repair and maintenance of equipment and facilities.

Depreciation and Amortization. We incur depreciation expense on costs related to capitalized property and equipment on a straight-line basis over the estimated useful lives of the assets, which range from three to thirty years. We incur amortization expense on leasehold improvements and capital leases over the shorter of the lease term or the life of the related asset and on intangible assets over the estimated life of the asset.

Interest Expense

Interest expense consists primarily of interest we incur on our debt.

16

Results of Operations

The following discussion compares our results of operations for the years ended December 31, 2016, 2015 and 2014.

The following table shows, for the periods indicated, information derived from our consolidated statements of operations, expressed as a percentage of sales for the period presented.

| Year Ended December 31, | ||||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Sales | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of sales | 79.8 | % | 78.6 | % | 78.0 | % | ||||||

| Gross profit | 20.2 | % | 21.4 | % | 22.0 | % | ||||||

| Operating expenses: | ||||||||||||

| Salaries and commissions | 11.2 | % | 9.3 | % | 8.0 | % | ||||||

| Other operating expenses | 9.4 | % | 8.1 | % | 6.8 | % | ||||||

| Depreciation and amortization | 1.2 | % | 0.9 | % | 0.7 | % | ||||||

| Impairment charge | 0.9 | % | 1.1 | % | — | % | ||||||

| Total operating expenses | 22.7 | % | 19.4 | % | 15.5 | % | ||||||

| Operating income (loss) | (2.5 | )% | 2.0 | % | 6.5 | % | ||||||

| Interest expense | 0.3 | % | 0.3 | % | 0.3 | % | ||||||

| Income (loss) before income taxes | (2.8 | )% | 1.7 | % | 6.2 | % | ||||||

| Income tax expense (benefit) | (0.5 | )% | 1.0 | % | 2.4 | % | ||||||

| Net income (loss) | (2.3 | )% | 0.7 | % | 3.8 | % | ||||||

Note: Due to rounding, percentages may not add up to total operating expenses, operating income (loss), income (loss) before income taxes or net income (loss).

Comparison of Years Ended December 31, 2016 and 2015

Sales

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2016 | 2015 | Change | |||||||||||||

| Sales | $ | 261.6 | $ | 308.1 | $ | (46.5 | ) | (15.1 | )% | |||||||

Our sales in 2016 (including $7.0 million from Vertex) decreased 15.1% to $261.6 million from $308.1 million in 2015. When adjusted for the fluctuation in metal prices, revenues for the 2016 fiscal year decreased approximately 8% compared to 2015 sales. Excluding the impact of Vertex’s sales, we estimate that our project business, which targets end markets and encompassing Environmental Compliance, Engineering & Construction, Industrials, LifeGuard™, Utility Power Generation, and Mechanical Wire Rope, was down approximately 34% on a metals-adjusted basis, from 2015, while Maintenance, Repair, and Operations (MRO) sales fell approximately 1% on a metals-adjusted basis.

Gross Profit

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2016 | 2015 | Change | |||||||||||||

| Gross profit | $ | 53.0 | $ | 65.9 | $ | (13.0 | ) | (19.7 | )% | |||||||

| Gross profit as a percent of sales | 20.2 | % | 21.4 | % | ||||||||||||

Gross profit decreased 19.7% to $53.0 million in 2016 from $65.9 million in 2015. The decrease in gross profit was primarily attributable to the decrease in sales. Gross margin (gross profit as a percentage of sales) decreased to 20.2% in 2016 from 21.4% in 2015 primarily due to continued competitive market conditions.

17

Operating Expenses

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2016 | 2015 | Change | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Salaries and commissions | $ | 29.4 | $ | 28.5 | $ | 0.8 | 2.9 | % | ||||||||

| Other operating expenses | 24.7 | 25.0 | (0.3 | ) | (1.2 | )% | ||||||||||

| Depreciation and amortization | 3.0 | 2.9 | 0.1 | 3.5 | % | |||||||||||

| Impairment charge | 2.4 | 3.4 | (1.0 | ) | (30.2 | )% | ||||||||||

| Total operating expenses | $ | 59.5 | $ | 59.9 | $ | (0.4 | ) | (0.7 | )% | |||||||

| Operating expenses as a percent of sales | 22.7 | % | 19.4 | % | ||||||||||||

Note: Due to rounding, numbers may not add up to total operating expenses.

Salaries and Commissions. Salaries and commissions increased 2.9% to $29.4 million in 2016 from $28.5 million in 2015. The increase was primarily due to Vertex’s salaries.

Other Operating Expenses. Other operating expenses decreased 1.2% to $24.7 million in 2016 from $25.0 million in 2015 primarily due to the decrease in sales volume and the related decrease in warehouse expenses and lower health insurance claims. These decreases were partially offset by the operating expenses of Vertex. In addition operating expenses include approximately $0.9 million related to the Vertex acquisition.

Depreciation and Amortization. Depreciation and amortization increased slightly to $3.0 million in 2016 from $2.9 million in 2015.

Impairment Charge. The Company recorded a non-cash impairment charge in 2016 with respect to its HWC reporting unit and tradenames at its Southern Wire reporting unit. The Company recorded a non-cash impairment charge in 2015 with respect to its Southwest reporting unit and in respect of tradenames at its Southern and Southwest reporting units. (See Note 4 to our Consolidated Financial Statements)

Operating expenses as a percentage of sales increased to 22.7% in 2016 from 19.4% in 2015. This increase primarily relates to the decrease in sales which fell at a higher rate than total operating expenses.

Interest Expense

Interest expense decreased 6.2% to $0.8 million in 2016 from $0.9 million in 2015 due to lower average debt in the first nine months of the year, offset by higher debt in the last quarter due to the Vertex acquisition. Average debt was $40.0 million in 2016 compared to $43.9 million in 2015. The average effective interest rate increased slightly to 2.0% in 2016 from 1.9% in 2015.

Income Tax Expense

We recorded an income tax benefit of $1.4 million in 2016, due to the pre-tax loss, compared to income tax expense of $3.1 million in 2015. The effective income tax rate decreased to 18.6% in 2016 from 60.1% in 2015. In 2015, the non-deductible portion of the impairment charge increased the rate by 20.0% and the impact of the share-based compensation deficit increased the rate by 3.7%. The Company has exhausted the excess tax benefits arising from stock-based compensation transactions (APIC pool), therefore any future net deficits will result in incremental income tax expense.

Net Income (Loss)

We sustained a net loss of $6.0 million in 2016 compared to net income of $2.0 million in 2015, primarily due to the lower level of sales activity.

18

Comparison of Years Ended December 31, 2015 and 2014

Sales

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2015 | 2014 | Change | |||||||||||||

| Sales | $ | 308.1 | $ | 390.0 | $ | (81.9 | ) | (21.0 | )% | |||||||

Our sales in 2015 decreased 21.0% to $308.1 million from $390.0 million in 2014. When adjusted for the fluctuation in metal prices, revenues for the 2015 fiscal year decreased approximately 14% compared to 2014 sales. Our project business, especially across our key growth initiatives – Environmental Compliance, Engineering & Construction, Industrials, LifeGuard™, Utility Power Generation, and Mechanical wire rope, was down approximately 19% on a metals-adjusted basis. MRO business fell approximately 11% on a metals-adjusted basis.

Gross Profit

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2015 | 2014 | Change | |||||||||||||

| Gross profit | $ | 65.9 | $ | 85.9 | $ | (20.0 | ) | (23.3 | )% | |||||||

| Gross profit as a percent of sales | 21.4 | % | 22.0 | % | (0.6 | )% | ||||||||||

Gross profit decreased 23.3% to $65.9 million in 2015 from $85.9 million in 2014. The decrease in gross profit was primarily attributed to the decrease in sales. Gross margin (gross profit as a percentage of sales) decreased to 21.4% in 2015 from 22.0% in 2014.

Operating Expenses

| Year Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| (Dollars in millions) | 2015 | 2014 | Change | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Salaries and commissions | $ | 28.5 | $ | 31.2 | $ | (2.7 | ) | (8.5 | )% | |||||||

| Other operating expenses | 25.0 | 26.4 | (1.4 | ) | (5.2 | )% | ||||||||||

| Depreciation and amortization | 2.9 | 2.9 | 0.0 | (0.1 | )% | |||||||||||

| Impairment charge | 3.4 | — | 3.4 | n/a | ||||||||||||

| Total operating expenses | $ | 59.9 | $ | 60.5 | $ | (0.6 | ) | (1.0 | )% | |||||||

| Operating expenses as a percent of sales | 19.4 | % | 15.5 | % | 3.9 | % | ||||||||||

Note: Due to rounding, numbers may not add up to total operating expenses.

Salaries and Commissions. Salaries and commissions decreased 8.5% to $28.5 million in 2015 from $31.2 million in 2014. Commissions decreased $1.4 million as sales and gross profit decreased. Salaries decreased $1.3 million primarily due to a headcount reduction as part of our cost savings initiative.

Other Operating Expenses. Other operating expenses decreased 5.2% to $25.0 million in 2015 from $26.4 million in 2014 primarily due to the decrease in sales volume and the related decrease in warehouse expenses, the decrease in facility expenses due to the Southwest consolidation, lower benefits and employee related expenses as the full-time employee headcount decreased, offset by facility moving costs.

Depreciation and Amortization. Depreciation and amortization was flat in both years at $2.9 million.

Impairment Charge. The Company recorded a non-cash impairment charge in 2015 with respect to its Southwest reporting unit and in respect of tradenames at its Southern and Southwest reporting units. (See Note 4 to our Consolidated Financial Statements)

Operating expenses as a percentage of sales increased to 19.4% in 2015 from 15.5%. This increase primarily relates to the impairment of goodwill offset by the savings in salaries and commissions and other operating expenses.

19

Interest Expense

Interest expense decreased 22.9% to $0.9 million in 2015 from $1.2 million in 2014 due to lower average debt and a higher effective interest rate. Average debt was $43.9 million in 2015 compared to $55.6 million in 2014. The average effective interest rate decreased to 1.9% in 2015 from 2.1% in 2014. This decrease was primarily due to the lower interest rates associated with the new Loan and Security Agreement.

Income Tax Expense

Income tax expense decreased 66.9% to $3.1 million in 2015 compared to $9.3 million in 2014. The effective income tax rate increased to 60.1% in 2015 from 38.3% in 2014, primarily due to the non-deductible portion of the impairment charge in 2015, which increased the rate by 20.0% and the impact of the share-based compensation deficit of 3.7%. The Company has exhausted the excess tax benefits arising from stock-based compensation transactions (APIC pool), therefore any future net deficits will result in incremental income tax expense.

Net Income

We achieved net income of $2.0 million in 2015 compared to $15.0 million in 2014, a decrease of 86.3%, primarily due to the lower level of activity and the non-cash impairment charge in 2015.

Impact of Inflation and Commodity Prices

Our results of operations are affected by changes in the inflation rate and commodity prices. Moreover, because copper, steel, aluminum, nickel and petrochemical products are components of the industrial products we sell, fluctuations in the costs of these and other commodities have historically affected our operating results. We estimate decreasing metal prices negatively impacted sales by approximately 8% in 2016. To the extent commodity prices decline, the net realizable value of our existing inventory could also decline, and our gross profit can be adversely affected because of either reduced selling prices or lower of cost or market adjustments in the carrying value of our inventory. If we turn our inventory approximately three times a year, the impact of changes in commodity prices in any particular quarter would primarily affect the results of the succeeding two calendar quarters. If we are unable to pass on to our customers future cost increases due to inflation or rising commodity prices, our operating results could be adversely affected.

Liquidity and Capital Resources

Our primary capital needs are for working capital obligations, capital expenditures, and other general corporate purposes, including acquisitions. We have currently suspended purchases under our stock repurchase program. Our primary sources of working capital are cash from operations supplemented by bank borrowings.

Liquidity is defined as the ability to generate adequate amounts of cash to meet the current need for cash. We assess our liquidity in terms of our ability to generate cash to fund our operating activities. Significant factors which could affect liquidity include the following:

| • | the adequacy of available bank lines of credit; | |

| • | cash flows generated from operating activities; | |

| • | capital expenditures; | |

| • | acquisitions; and | |

| • | the ability to attract long-term capital with satisfactory terms |

Comparison of Years Ended December 31, 2016 and 2015

Our net cash provided by operating activities was $17.2 million in 2016 compared to $31.8 million in 2015. We had a net loss of $6.0 million in 2016 compared to net income of $2.0 million in 2015.

Changes in our operating assets and liabilities resulted in cash provided by operating activities of $16.7 million in 2016. Excluding the operating assets and liabilities acquired as part of the Vertex acquisition, inventories decreased $10.5 million as we continued to improve inventory profiles. Accounts receivable decreased $4.0 million, primarily due to decreased sales in 2016. Accrued and other current liabilities increased $2.6 million primarily due to increased inventory purchases in the latter part of the year.

20

Net cash used in investing activities was $33.7 million in 2016 compared to $3.1 million in 2015. The increase was primarily attributable to the Vertex acquisition in October 2016.

Net cash provided by financing activities was $16.4 million in 2016 compared to net cash used in financing activities of $28.7 million in 2015. Net borrowings under our revolver of $21.2 million due to the impact of funding the Vertex acquisition, the payment of dividends of $2.5 million and the purchase of treasury stock of $2.3 million were the main components of financing activities in 2016.

Comparison of Years Ended December 31, 2015 and 2014

Our net cash provided by operating activities was $31.8 million in 2015 compared to $11.3 million in 2014. Our net income decreased by $12.9 million or 86.3% to $2.0 million in 2015 from $15.0 million in 2014.

Changes in our operating assets and liabilities resulted in cash provided by operating activities of $22.6 million in 2015. Accounts receivable decreased $15.4 million, primarily due to decreased sales in 2015. Inventories decreased $12.8 million to align with the reduction in sales volume. Partially offsetting these sources of cash was the decrease in trade accounts payable of $1.6 million primarily due to lower inventory. Accrued and other current liabilities decreased $3.6 million primarily due to lower accrued wire purchases.

Net cash used in investing activities was $3.1 million in 2015 compared to $2.2 million in 2014. The increase was primarily attributable to renovations related to the purchase of a building in December 2013 used to consolidate the four existing Southwest Houston locations.

Net cash used in financing activities was $28.7 million in 2015 compared to $9.1 million in 2014. Net payments on the revolver of $14.7 million, the payment of dividends of $7.2 million and the purchase of treasury stock of $6.9 million were the main components of financing activities in 2015.

Indebtedness

Our principal source of liquidity at December 31, 2016 was working capital of $102.1 million compared to $104.0 million at December 31, 2015. We also had available borrowing capacity under our loan agreement in the amount of $25.6 million at December 31, 2016 and $41.5 million at December 31, 2015. The decrease in availability is primarily due to borrowings to pay for the Vertex acquisition.

We believe that we will have adequate availability of capital to fund our present operations, meet our commitments on our existing debt, and fund anticipated growth over the next twelve months, including expansion in existing and targeted market areas. We continually seek potential acquisitions and from time to time hold discussions with acquisition candidates. If suitable acquisition opportunities or working capital needs arise that would require additional financing, we believe that our financial position and earnings history provide a solid base for obtaining additional financing resources at competitive rates and terms. Additionally, based on market conditions, we may decide to issue additional shares of common or preferred stock to raise funds.

Loan and Security Agreement

On October 3, 2016, in connection with the Vertex acquisition, we entered into a First Amendment to our existing Fourth Amended and Restated Loan and Security Agreement with Bank of America, N.A. as agent and lender (the “2015 Loan Agreement”) to add Vertex as borrower (and lien grantor) and include Vertex’s eligible accounts receivable and eligible inventory in the borrowing base. The amendment also expanded the 2015 Loan Agreement to include incremental availability on eligible accounts receivable and inventory up to $5 million, which will be amortized quarterly, starting April 1, 2017, over two and a half years. The 2015 Loan Agreement provides a $100 million revolving credit facility and expires on September 30, 2020. Under certain circumstances the Company may request an increase in the commitment by an additional $50 million. Borrowings under the 2015 Loan Agreement bear interest at the British Bankers Association LIBOR Rate plus 100 to 150 basis points based on availability, if a LIBOR loan, or at a fluctuating rate equal to the greatest of the agent’s prime rate, the federal funds rate plus 50 basis points, or LIBOR for a 30-day interest period plus 150 basis points, if a base rate loan. The unused commitment fee is 25 basis points. Availability under the 2015 Loan Agreement is limited to a borrowing base equal to 85% of the value of eligible accounts receivable, plus the lesser of 70% of the value of eligible inventory or 90% of the net orderly liquidation value percentage of the value of eligible inventory, in each case less certain reserves. The 2015 Loan Agreement is secured by substantially all of the property of the Company, other than real estate.

Covenants in the 2015 Loan Agreement require us to maintain certain minimum financial ratios and/or availability levels. Repaid amounts can be re-borrowed subject to the borrowing base. As of December 31, 2016, we met the availability-based covenant.

21

Contractual Obligations

The following table describes our cash commitments to settle contractual obligations as of December 31, 2016.

| Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Loans payable | $ | 60,388 | $ | — | $ | — | $ | 60,388 | $ | — | ||||||||||

| Operating lease obligations | 12,978 | 3,567 | 4,925 | 4,046 | 440 | |||||||||||||||

| Non-cancellable purchase obligations (1) | 33,991 | 33,991 | — | — | — | |||||||||||||||

| Total | $ | 107,357 | $ | 37,558 | $ | 4,925 | $ | 64,434 | $ | 440 | ||||||||||

| (1) | These obligations reflect purchase orders outstanding with manufacturers as of December 31, 2016. We believe that some of these obligations may be cancellable upon negotiation with our vendors, but we are treating these as non-cancellable for this disclosure due to the absence of an express cancellation right. |

Capital Expenditures

We made capital expenditures of $1.3 million, $3.1 million and $2.2 million in the years ended December 31, 2016, 2015 and 2014, respectively. The 2015 and 2014 expenditures included amounts of $1.9 million and $1.0 million, respectively, to complete the renovation and build out of the facility purchased in 2013 which was used to consolidate the Southwest operations in Houston in 2015.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements, other than operating leases.

Financial Derivatives

We have no financial derivatives.

Market Risk Management

We are exposed to market risks arising from changes in market prices, including movements in interest rates and commodity prices.

Interest Rate Risk

Borrowings under our 2015 Loan Agreement bear interest at variable interest rates and therefore are sensitive to changes in the general level of interest rates. At December 31, 2016, the weighted average interest rate on our $60.4 million of variable interest debt was approximately 2.4%.

While our variable rate debt obligations expose us to the risk of rising interest rates, management does not believe that the potential exposure is material to our overall financial performance or results of operations. Based on December 31, 2016 borrowing levels, a 1.0% change in the applicable interest rates would have a $0.6 million effect on our annual interest expense.

Commodity Risk

We are subject to periodic fluctuations in metals prices, as our products have varying levels of metals content including copper, steel, aluminum and nickel, in their construction. In addition, petrochemical prices also impact certain products we purchase. Profitability is influenced by these fluctuations as prices change between the time we buy and sell our products.

Foreign Currency Exchange Rate Risk

Our products are purchased and invoiced in U.S. dollars and in Euros. We believe we have minimal exposure to foreign exchange rate risk.

22

Climate Risk

Our operations are subject to inclement weather conditions including hurricanes, earthquakes and abnormal weather events. Our previous experience from these events has had a minimal effect on our operations.

Factors Affecting Future Results