Attached files

Carolina Trust Bancshares, Inc. - 10-K

Exhibit 13

Carolina Trust BancShares Inc.

2016 Annual Report

Carolina Trust BancShares, Inc.

TABLE OF CONTENTS

| Page No. | ||

| Forward-Looking and Cautionary Statements | 1 | |

| Report of Management | 2 | |

| Selected Financial and Other Data | 4 | |

| Management’s Discussion and Analysis | 5 | |

| Report of Independent Registered Public Accounting Firm | 26 | |

| Consolidated Financial Statements | ||

| Consolidated Balance Sheets | 27 | |

| Consolidated Statements of Operations | 28 | |

| Consolidated Statements of Comprehensive Income | 29 | |

| Consolidated Statements of Changes in Stockholders’ Equity | 30 | |

| Consolidated Statements of Cash Flows | 31 | |

| Notes to Consolidated Financial Statements | 32 | |

| General Corporate Information | 75 |

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “1995 Act”) provides a safe harbor for forward-looking statements made by or on behalf of the Company. These forward-looking statements involve risks and uncertainties and are based on the beliefs and assumptions of our management and on information available at the time these statements and disclosures were prepared.

This report includes forward-looking statements within the meaning of the 1995 Act. These statements are included throughout this report and relate to, among other things, projections of revenues, earnings, earnings per share, cash flows, capital expenditures, or other financial items, expectations regarding acquisitions, discussions of estimated future revenue enhancements, potential dispositions, and changes in interest rates. These statements also relate to our business strategy, goals and expectations concerning our market position, future operations, margins, profitability, liquidity, and capital resources. The words “believe”, “anticipate”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “will”, and similar terms and phrases identify forward-looking statements in this report.

Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and determine whether or not the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a number of factors. Factors that may cause actual results to differ materially from those expected include the following:

| ● | General economic conditions may deteriorate and negatively impact the ability of borrowers to repay loans and depositors to maintain balances; |

| ● | A general decline in the residential real estate construction and finance market; |

| ● | The in market value of real estate in the Company’s markets may decline; |

| ● | Changes in interest rates could reduce net interest income and/or borrowers’ ability to repay loans; |

| ● | Competitive pressures among financial institutions may reduce yields and profitability; |

| ● | Legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which the Company is engaged; |

| ● | Increased regulatory supervision could limit our ability to grow and could require considerable time and attention of our management and board of directors; |

| ● | New products developed or new methods of delivering products by competitors could result in a reduction in business and income for the Company; |

| ● | The Company’s ability to continue to improve operating efficiencies; |

| ● | Natural events and acts of God such as earthquakes, fires and floods; |

| ● | Loss or retirement of key executives; and |

| ● | Adverse changes in the capital market. |

These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein. We caution readers not to place undue reliance on those statements, which speak only as of the date of this report.

- 1 -

Carolina Trust BancShares, Inc.

Report of Management

Dear Shareholders:

Your company, Carolina Trust BancShares, Inc. (NASDAQ: CART), completed its 16th year of business with impressive growth and earnings as we served the financial needs of individuals, businesses and other organizations in the North Carolina counties of Lincoln, Gaston, Rutherford, Catawba, and Iredell. We value each of our customers’ 11,804 deposit accounts and 2,655 loan accounts. Our commitment to serve our customers well, to operate in a safe and sound manner, and to prepare for future success led to the following accomplishments in 2016:

| √ | Reorganized into a bank holding company in August 2016 |

| √ | Issued $10 million in subordinated debt in October 2016 |

| √ | Added experience and depth to our Board of Directors with the appointment of Ralph Strayhorn in November 2016 |

| √ | Redeemed $2.6 million in preferred stock with a 9% dividend |

| √ | Continued balance sheet growth |

| Ø | Assets increased by 12% to $375 million |

| Ø | Loans increased by 6% to $308 million |

| Ø | Deposits increased by 12% to $319 million |

| √ | Increased Book Value per Common Share by $0.24 to $6.24 |

| √ | Increased Net income available to Common Shareholders to by 36% to $1.1 million |

| √ | Increased the subsidiary Bank’s Total Risk-Based Capital Ratio to 12.46%, up from 10.30% in 2015 |

| √ | Continued branch growth and consolidation activities |

| Ø | Received approval to convert the Mooresville, NC Loan Production Office to a full service |

| Ø | Received approval to relocate the Hickory, NC branch from a storefront to a stand-alone building |

| Ø | Received approval to consolidate the Boger City, NC branch to the main office |

| √ | Progressed as planned on our timeline for converting our core banking system to Jack Henry Banking’s SilverLake System in April 2017 |

| √ | Completed our 2015-2017 Strategic Plan Goals and developed a new 3 Year Strategic Plan |

In response to the Board of Directors’ recommendation and the Shareholders’ vote at the annual meeting in May 2016, Carolina Trust Bank (the “Bank”) reorganized into a bank holding company in August 2016. Common shares in Carolina Trust Bank were exchanged for shares of our new parent company, Carolina Trust BancShares, Inc. (“BancShares”). The reorganization went smoothly with no impact on the Bank’s customers. BancShares subsequently issued $10 million in subordinated debt, of which $8.8 million was invested into common equity of the Bank. These transactions strengthened the Bank’s capital ratios and provided the foundation for continued growth.

The primary drivers of sustained earnings growth are loan and deposit growth, while maintaining strong credit quality, net interest margins, and efficiency. In 2016 we grew loans and deposits, maintained good credit quality, and improved efficiency, while net interest margin declined as we enhanced our liquidity.

| ● | As shown on our Net Interest Income table on page 10 in this report, we increased the average balance for loans by 10% from $271 million in 2015 to $299 million in 2016 and average deposits by 17% from $271 million to $316 million. |

| ● | Credit quality remained high in 2016 as the ratio of net charge-offs to average loans was 0.10%, up from 0.00% in 2015. The ratio of non-performing assets to total assets was 1.04% at year end, down from 1.24% at the end of 2015. |

| ● | Our net yield on average interest-earning assets, commonly referred to as net interest margin, declined to 3.80% in 2016 from 4.20% in 2015. The decrease was primarily attributed to our plan to increase the overnight funds as a percentage of total earning assets, in order to improve liquidity as growth continued. |

| ● | As a measure of efficiency, the ratio of net non-interest expenses (i.e. non-interest expense minus non-interest income) to average assets, improved to 3.02% in 2016 from 3.32% in 2015. We leveraged our management, operations, and information technology infrastructure during this year of asset growth. |

Construction on our new Hickory Branch was nearly completed at year end, and we look forward to serving our current and new customers in 2017 from this state of the art facility. The open floor plan is marked by pod stations where Bank employees stand side by side with customers in providing a range of financial services. Offices in the lobby are available for more privacy. In our Mooresville loan production office, loan growth has been excellent, and we received regulatory approval for a full service branch. We are in the process of converting the office to a full service branch where we can open deposit accounts and offer cash management services in this robust growth market on the eastern side of Lake Norman. To improve efficiency and make the best use of limited resources, we planned and received approval to close our Boger City branch. We have notified our valued Boger City customers that they will continue to receive the same level of personal service at the nearby main office, located only 2 miles away in Lincolnton.

- 2 -

Rosalind Welder, a dedicated and talented Bank board member since incorporation in 2000, will be retiring in 2017. On behalf of the Carolina Trust Bank team, I thank Rosalind for her service as a Board member, as chair of the Marketing Committee, and as a member of the Audit Committee. Our Bank and community have benefited from her energetic leadership here and at numerous civic and community organizations. Best wishes to Rosalind and her family in what I am confident will be a very active retirement.

I want to thank our team, which includes employees and management, advisory boards, and boards of directors for the bank and holding company. I also appreciate each our stockholders, for investing your hard earned savings in our Company, as we strive to provide the return on investment that you deserve. If you are a Bank customer, thank you for banking with us and allowing our talented staff to serve you. If you are not yet a customer, we look forward to earning your business through service that is second to none and an array of financial services that will meet your every need.

Sincerely,

Jerry L. Ocheltree

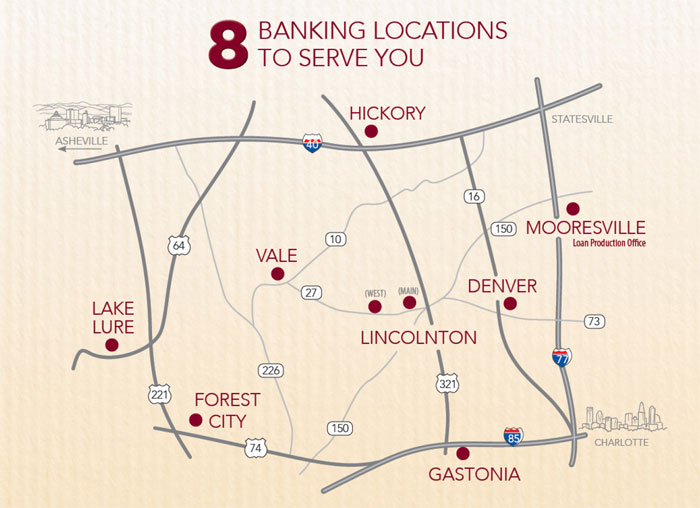

Carolina Trust Bank Branch Map |

- 3 -

Carolina Trust BancShares, Inc.

Selected Financial and Other Data

In thousands, except share and per share data

| As of or for the Years Ended December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Summary of Operations: | ||||||||||||||||||||

| Interest income | $ | 16,222 | $ | 14,905 | $ | 13,042 | $ | 12,815 | $ | 13,337 | ||||||||||

| Interest expense | 2,872 | 2,311 | 1,951 | 2,140 | 2,876 | |||||||||||||||

| Net interest income | 13,350 | 12,594 | 11,091 | 10,675 | 10,461 | |||||||||||||||

| Provision (recovery) for loan losses | (27 | ) | (270 | ) | (80 | ) | 2,285 | 2,367 | ||||||||||||

| Net interest income after provision for loan losses | 13,377 | 12,864 | 11,171 | 8,390 | 8,094 | |||||||||||||||

| Non-interest income | 1,229 | 1,109 | 936 | 1,019 | 1,281 | |||||||||||||||

| Non-interest expense | 12,388 | 11,751 | 9,789 | 10,857 | 9,158 | |||||||||||||||

| Income (loss) before income taxes | 2,218 | 2,222 | 2,318 | (1,448 | ) | 217 | ||||||||||||||

| Provision (benefit) for income taxes | 877 | 1,164 | (4,539 | ) | — | — | ||||||||||||||

| Net income (loss) | $ | 1,341 | $ | 1,058 | $ | 6,857 | $ | (1,448 | ) | $ | 217 | |||||||||

| Preferred stock dividend and accretion of discount on warrants | 222 | 234 | 227 | 191 | 71 | |||||||||||||||

| Net income (loss) available (attributable) to common stockholders | $ | 1,119 | $ | 824 | $ | 6,630 | $ | (1,639 | ) | $ | 146 | |||||||||

| Per Share Data and Shares Outstanding Data: | ||||||||||||||||||||

| Basic net income (loss) per common share | $ | 0.24 | $ | 0.18 | $ | 1.43 | $ | (0.35 | ) | $ | 0.03 | |||||||||

| Diluted net income (loss) per common share | 0.24 | 0.18 | 1.42 | (0.35 | ) | 0.03 | ||||||||||||||

| Book value per common share at period end | 6.24 | 6.00 | 5.87 | 4.25 | 4.84 | |||||||||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||||||

| Basic | 4,649,405 | 4,645,408 | 4,635,096 | 4,634,565 | 4,634,379 | |||||||||||||||

| Diluted | 4,697,765 | 4,685,814 | 4,678,108 | 4,634,565 | 4,635,954 | |||||||||||||||

| Shares outstanding at period end | 4,650,808 | 4,646,225 | 4,635,422 | 4,634,702 | 4,634,482 | |||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Total assets | $ | 374,917 | $ | 334,049 | $ | 293,041 | $ | 266,435 | $ | 271,051 | ||||||||||

| Loans receivable | 308,492 | 292,362 | 244,646 | 223,891 | 221,480 | |||||||||||||||

| Allowance for loan and lease losses | 3,393 | 3,723 | 4,002 | 4,066 | 4,773 | |||||||||||||||

| Other interest-earning assets | 47,589 | 25,341 | 29,677 | 28,619 | 30,751 | |||||||||||||||

| Deposits | 318,665 | 284,794 | 237,176 | 228,885 | 233,861 | |||||||||||||||

| Borrowings | 23,973 | 15,681 | 22,373 | 12,152 | 9,457 | |||||||||||||||

| Stockholders’ equity | 29,033 | 30,464 | 29,807 | 22,256 | 24,935 | |||||||||||||||

| Selected Performance Ratios: | ||||||||||||||||||||

| Return on average assets | 0.33 | % | 0.33 | % | 2.53 | % | (0.54 | %) | 0.08 | % | ||||||||||

| Return on average common equity | 3.87 | % | 3.46 | % | 28.30 | % | (6.08 | %) | 0.81 | % | ||||||||||

| Net interest margin | 3.80 | % | 4.20 | % | 4.33 | % | 4.22 | % | 4.10 | % | ||||||||||

| Net interest spread | 3.65 | % | 4.06 | % | 4.21 | % | 4.11 | % | 3.98 | % | ||||||||||

| Noninterest income to average assets | 0.36 | % | 0.35 | % | 0.37 | % | 0.38 | % | 0.46 | % | ||||||||||

| Noninterest expense to average assets | 3.35 | % | 3.66 | % | 3.63 | % | 4.02 | % | 3.28 | % | ||||||||||

| Efficiency ratio (1) | 84.98 | % | 85.75 | % | 81.48 | % | 92.85 | % | 77.99 | % | ||||||||||

| Asset Quality Ratios: | ||||||||||||||||||||

| Nonperforming loans to period-end loans | 0.93 | % | 0.74 | % | 1.70 | % | 1.70 | % | 3.83 | % | ||||||||||

| Allowance for loan losses to period-end loans | 1.10 | % | 1.27 | % | 1.64 | % | 1.82 | % | 2.16 | % | ||||||||||

| Allowance for loan losses to nonperforming loans | 118.02 | % | 172.85 | % | 96.09 | % | 106.92 | % | 56.20 | % | ||||||||||

| Nonperforming assets to total assets | 1.04 | % | 1.24 | % | 2.12 | % | 2.70 | % | 4.67 | % | ||||||||||

| Net loan charge-offs (recoveries) to average loans outstanding | 0.10 | % | 0.00 | % | (0.01 | %) | 1.36 | % | 0.93 | % | ||||||||||

| Capital Ratios: (* indicates subsidiary bank ratio) | ||||||||||||||||||||

| Common equity tier 1 capital ratio* | 11.40 | % | 8.67 | % | N/A | N/A | N/A | |||||||||||||

| Total risk-based capital ratio* | 12.46 | % | 10.30 | % | 11.03 | % | 10.80 | % | 11.86 | % | ||||||||||

| Tier 1 risk-based capital ratio* | 11.40 | % | 9.10 | % | 9.77 | % | 9.54 | % | 10.60 | % | ||||||||||

| Tier 1 Leverage ratio* | 9.64 | % | 8.48 | % | 9.02 | % | 8.24 | % | 8.61 | % | ||||||||||

| Equity to assets ratio | 7.74 | % | 9.12 | % | 10.17 | % | 8.35 | % | 9.20 | % | ||||||||||

| Average equity (common and preferred) to average assets | 8.49 | % | 9.52 | % | 8.94 | % | 8.81 | % | 9.63 | % | ||||||||||

| Average common equity to average assets | 7.83 | % | 8.72 | % | 7.99 | % | 7.85 | % | 8.70 | % | ||||||||||

| Other Data: | ||||||||||||||||||||

| Number of banking offices | 9 | 9 | 7 | 7 | 6 | |||||||||||||||

| Number of full time equivalent employees | 80 | 83 | 74 | 61 | 60 | |||||||||||||||

| (1) | Efficiency ratio is noninterest expense divided by the sum of net interest income and noninterest income. |

- 4 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following is management’s discussion and analysis of the financial condition and results of operations of Carolina Trust BancShares, Inc. (the “Company”) as of and for the years ended December 31, 2016 and 2015. The purpose of this discussion is to focus on important factors affecting our financial condition and results of operations. The discussion should be read in conjunction with the audited financial statements and related notes to assist in the evaluation of our 2016 performance.

DESCRIPTION OF BUSINESS

Carolina Trust BancShares, Inc. is a North Carolina corporation formed in 2016 to become the bank holding company for Carolina Trust Bank (the “Bank). On August 16, 2016, the Company announced that it had consummated the statutory share exchange pursuant to which it became the parent company of the Bank. Shares of the Bank’s common stock were exchanged for shares of the Company’s common stock at a one-for-one exchange ratio. The Company is a North Carolina business corporation that is operating as a registered bank holding company under the Bank Holding Company Act of 1956, as amended. The Bank is the only subsidiary of the Company.

The Bank commenced operations on December 8, 2000 in Lincolnton, North Carolina. We moved into our permanent headquarters in June 2001. We opened our first de novo branch in West Lincolnton in September 2002, and purchased a branch in Vale, ten miles west of Lincolnton, in March 2003. In September 2004, we expanded our market area by opening a de novo branch in Denver, fifteen miles east of Lincolnton adjacent to Lake Norman, a rapidly growing and upscale commuter corridor for the Charlotte area. In 2007, we opened a loan production office in Forest City, NC in Rutherford County and a de novo branch in Boger City on the east side of Lincolnton. In October 2009, we acquired Carolina Commerce Bank, which had one office in Gastonia, NC. We merged Carolina Commence Bank with and into our bank and their former headquarters is now operated as a full service branch of Carolina Trust Bank. In February of 2012, the Bank opened a loan production office in Hickory, NC in Catawba County and in August of 2013, the loan production office in Forest City was converted into a full service branch. In November 2014 the Bank opened a loan production office in Mooresville, NC. In March of 2015 the Bank opened a de novo branch in Lake Lure, NC in Rutherford County and converted the loan production office in Hickory into a full service branch.

We are the only independent publicly held bank, headquartered in Lincoln County, which is adjacent to the Charlotte/Rock Hill/Gastonia Metropolitan Statistical Area. Our headquarters and Denver (Lake Norman) offices are both approximately twenty-five miles northwest of Charlotte’s Douglas International Airport.

At December 31, 2016, we had total assets of $374,917,000, net loans of $305,099,000, deposits of $318,665,000, and stockholders’ equity of $29,033,000. Net income for the year ended December 31, 2016 was $1,341,000, and after dividends to non-controlling interest, net income available to common shareholders was $1,119,000, or $0.24 per diluted share.

Our executive and lending officers and some of our directors have many years of experience in commercial banking and insurance in the Lincoln County market as well as Gastonia and Gaston County to the immediate south, Hickory and Catawba County to the immediate north and Cleveland and Rutherford Counties to the west. Our President and Chief Executive Officer, Jerry L. Ocheltree, was formerly the President and Chief Executive Officer for First Bank in Southern Pines, North Carolina, and was chair of the North Carolina’s Bankers Association for 2012-2013. He currently serves as a member of the board of the Charlotte Branch of the Federal Reserve Bank of Richmond. Richard M. Rager, our Executive Vice President and Chief Credit Officer, has been involved in bank lending since 1981, including service with the Federal Deposit Insurance Corporation in the evaluation of problem loans.

- 5 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The primary purpose of the Company is to serve the banking needs of individuals and businesses in our market areas. We emphasize personalized service, access to decision makers, and a quick response on lending decisions. We have been, and intend to remain, a community-focused financial institution offering a full range of financial services to small-to medium-sized businesses, professionals, and individual consumers in our community. The Company offers a wide range of banking services including checking and savings accounts; commercial, installment, mortgage, and personal loans; safe deposit boxes; and other associated services.

Our website is located at http://www.carolinatrust.com. Carolina Trust Bank is a member of the Federal Home Loan Bank of Atlanta and its deposits are insured up to applicable limits by the Deposit Insurance Fund of the Federal Deposit Insurance Corporation. The address of our headquarters is 901 East Main Street, Lincolnton, North Carolina 28092, and our telephone number is (704) 735-1104.

CRITICAL ACCOUNTING POLICIES

General

The Company’s financial statements are prepared in accordance with US GAAP and with general practices within the banking industry. In connection with the application of those principles, we have made judgments and estimates, which in the case of the determination of our allowance for loan losses, deferred tax assets, and foreclosed assets have been critical to the determination of our financial position and results of operations.

Management considers accounting estimates to be critical to reported financial results if (i) the accounting estimate requires management to make assumptions about matters that are highly uncertain and (ii) different estimates that management reasonably could have used for the accounting estimate in the current period, or changes in the accounting estimate that are reasonably likely to occur from period to period, could have a material impact on the Company’s financial statements.

Allowance for Loan and Lease Losses

The most critical estimate concerns the Company’s allowance for loan losses. The Company records provisions for loan losses based upon known problem loans and estimated probable losses in the existing loan portfolio. The Company’s methodology for assessing the appropriations of the allowance for loan losses consists of two key components, which are a specific allowance for identified problem or impaired loans and a formula allowance for the remainder of the portfolio.

The Company considers the allowance for loan and lease losses of $3,393,000 appropriate to cover losses inherent in the loan and lease portfolio as of December 31, 2016. However, no assurance can be given that the Company will not in any particular period, sustain loan and lease losses that exceed the amount reserved, or that subsequent evaluations of the loan and lease portfolio, in light of factors then prevailing, including economic conditions, the Company’s ongoing credit review process or regulatory requirements, will not require significant changes in the allowance for loan and lease losses. Among other factors, a prolonged economic slowdown and/or a decline in commercial or residential real estate values in the Company’s market area may have an adverse impact on the current adequacy of the allowance for loan and lease losses by increasing credit risk and the risk of potential loss.

The total allowance for loan and lease losses is generally available to absorb losses from any segment of the portfolio. The allocation of the Company’s allowance for loan and lease losses disclosed in the asset quality table presented in this report is subject to change based on the changes in criteria used to evaluate the allowance and is not necessarily indicative of the trend or future losses in any particular portfolio.

- 6 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The discussion and analysis included in this section contains detailed information regarding the Company’s allowance for loan and lease losses, net charge-offs, non-performing assets, past due loans and leases and potential problem loans and leases. Included in this data are numerous portfolio ratios that must be carefully reviewed in relation to the nature of the underlying loan and lease portfolios before appropriate conclusions can be reached regarding the Company or for purposes of making comparisons to other companies. Most of the Company’s non-performing assets and past due loans are secured by real estate. Given the nature of these assets and the related mortgage foreclosure and property sale, it can take 12 months or longer for a loan to migrate from initial delinquency to final disposition. This resolution process generally takes much longer for loans secured by real estate than for unsecured loans or loans secured by other property primarily due to state real estate foreclosure laws.

Deferred Taxes

The Company uses the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. If current available information raises doubt as to the realization of the deferred tax assets, a valuation allowance may be established. Management considers the determination of this valuation allowance to be a critical accounting policy due to the need to exercise significant judgment in evaluating the amount and timing of recognition of deferred tax liabilities and assets, including projections of future taxable income. These judgments and estimates are reviewed on a continual basis as regulatory and business factors change. A valuation allowance for deferred tax assets may be required if the amounts of taxes recoverable through loss carry backs decline, or if we project lower levels of future taxable income. If such a valuation allowance is deemed necessary in the future, it would be established through a charge to income tax expense that would adversely affect our operating results.

Foreclosed Assets

Foreclosed assets represent properties and equipment acquired through foreclosure or physical repossession. Appraisals are obtained at the time of foreclosure and any necessary write-downs to fair value at the time of transfer to foreclosed assets are charged to the allowance for loan losses. Subsequent to foreclosure, we periodically evaluate the value of foreclosed assets held for sale and record an impairment charge for any subsequent declines in fair value less selling costs. Subsequent declines in value are charged to operations. Fair value is based on our assessment of information available to us at the end of a reporting period and depends upon a number of factors, including our historical loss experience, economic conditions, and issues specific to individual properties. Our evaluation of these factors involves subjective estimates and judgments that may change.

FINANCIAL CONDITION

At December 31, 2016, the Company’s total assets were $374,917,000, total loans stood at $308,492,000, total investments were $27,063,000, total deposits were $318,665,000 and total shareholders’ equity was $29,033,000. Compared with December 31, 2015, total assets increased $40,868,000 or 12.2%, total loans increased $16,130,000 or 5.5%, total investments increased $4,130,000 or 18.0%, total deposits increased $33,871,000 or 11.9% and total shareholders’ equity attributable to common shareholders increased $1,149,000 or 4.1%. The portion of equity representing noncontrolling interest at December 31, 2015 was preferred stock issued by the Bank that was redeemed on December 12, 2016.

Capital for the Bank exceeded “well-capitalized” requirements for each of the four primary capital ratios monitored by state and federal regulators. As of December 31, 2016, the Bank’s common equity tier 1 capital ratio was 11.40%; tier 1 risk-based capital ratio was 11.40%; total risk-based capital ratio was 12.46%; and the tier 1 leverage ratio was 9.64%.

- 7 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

RESULTS OF OPERATIONS

The Company is reporting net income available to common shareholders of $1,119,000, or $0.24 per diluted common share for the year ended December 31, 2016, an increase of $295,000 and 35.8% as compared to the year ended December 31, 2015. Pre-tax net income decreased $4,000 or 0.2% for the year ended December 31, 2016 as compared to the same prior year period. The Company earned net income of $1,341,000 for the year ended December 31, 2016. Return on average total assets was 0.36% and return on average shareholder’s equity was 3.87% for the year ended December 31, 2016.

Select financial highlights for 2016:

| ● | 2016 earnings attributable to common shareholders of $1,119,000 a 35.8% or $295,000 increase as compared to 2015. |

| ● | Increase in total loans outstanding of $16,130,000 or 5.5% over the prior year. |

| ● | Increase in total deposits outstanding of $33,871,000 or 11.9%. |

| ● | Increase in net interest income of $756,000 or 6.0% as compared to the prior year. |

| ● | Total nonperforming assets (“NPAs”) decreased $272,000 from $4,158,000 at December 31, 2015 to $3,886,000 at December 31, 2016. This resulted in a 20 basis point reduction in the Bank’s NPAs as a percentage of total assets, from 1.24% at December 31, 2015 to 1.04% at December 31, 2016. |

| ● | The Bank’s Allowance for Loan and Lease Losses (“ALLL”) to total loans decreased from 1.27% at December 31, 2015 to 1.10% at December 31, 2016 due to continued improvement in credit quality as demonstrated by the reduction in NPAs. |

Net Interest Income

Like most financial institutions, the primary component of earnings for the Company is net interest income. Net interest income is the difference between interest income, principally from loan and investment securities portfolios, and interest expense, principally on customer deposits and borrowings. Changes in net interest income result from changes in volume, spread and margin. For this purpose, volume refers to the average dollar level of interest-earning assets and interest-bearing liabilities, spread refers to the difference between the average yield on interest-earning assets and the average cost of interest-bearing liabilities, and margin refers to net interest income divided by average interest-earning assets. Margin is influenced by the level and relative mix of interest-earning assets and interest-bearing liabilities, as well as by levels of non-interest-bearing liabilities and capital.

Net interest income was $13,350,000 for the year ended December 31, 2016, an increase of $756,000 or 6.0% as compared to December 31, 2015. Average interest-earning assets for 2016 were $350,962,000; an increase of $50,821,000 from 2015. For 2016, loans and investment securities represented 85.08% and 7.82% respectively of average total interest earning assets for the year. Comparatively, 2015 loans and investment securities represented 90.43% and 8.12% respectively of average total interest-earning assets for the year. The change in mix of interest earning assets from the higher yield categories, loans and investments, to the lower yielding overnight funds resulted in both a lower net interest spread and a lower net interest margin. The average yield on total interest-earning assets decreased by 35 basis points to 4.62% in 2016 compared to 4.97% for 2015 and the average rate of interest paid on interest-bearing liabilities increased by 6 basis points to 0.97% in 2016, compared to 0.91% in 2015. For the year ended December 31, 2016, the net interest spread was 3.65% compared to 4.06% for the year ended December 31, 2015, a decrease of 41 basis points. The net interest margin was 3.80% for the year ended December 31, 2016 compared to 4.20% for the year ended December 31, 2015, a decrease of 40 basis points. The decrease in the Company’s net interest margin year over year was primarily due to significant pressure on asset yields from the current prolonged low interest rate environment.

- 8 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

Asset Quality

We continue to make improvement in our nonperforming and classified loan categories which has allowed us to reduce the balance of our overall allowance for loan and lease losses during the fiscal years ended December 31, 2016 and 2015. The Company’s ratio of non-performing assets as a percentage of total assets decreased 20 basis points to 1.04% as compared to the 1.24% reported at December 31, 2015. In comparison to the prior year, nonaccrual loans increased $581,000 and foreclosed assets decreased $983,000. There were net loan charge-offs of $303,000 and $9,000 in 2016 and 2015, respectively.

The Bank recorded a negative $27,000 provision for loan losses in 2016 as compared to the negative $270,000 provision made in 2015. The ratio of allowance for loan and lease losses as a percentage of total loans decreased from 1.27% at December 31, 2015 to 1.10% at December 31, 2016. The negative provisions and the lower allowance ratio are primarily attributed to the continued low loan loss experience affecting the general allowance for performing loans. The ratios of net charge-offs (recoveries) to gross loans were 0.10%, 0.00% and (0.01%) for 2016, 2015, and 2014, respectively.

At December 31, 2016, the Bank’s total reserves amounted to $3,393,000; of which $914,000 are specific reserves on impaired loans and $2,479,000 are general reserves to cover inherent risks in the loan portfolio. Comparatively, at December 31, 2015, the total reserves amounted to $3,723,000, comprised of specific reserves of $214,000 and general reserves of $3,509,000. Total reserves represented 129% of the non-accrual loan balances as of December 31, 2016 as compared to 182% reported at December 31, 2015.

Noninterest Income

For the year ended December 31, 2016, noninterest income was $1,229,000, a $120,000 or 10.8% increase when compared to the prior year. Interchange fee income increased $64,000 or 16.9% as a result of deposit growth and promotions related to debit card usage. Overdraft fees on deposits increased $13,000 or 3.4% year over year. The Bank also recorded a $55,000 gain on the sale of an investment security in 2016. Management remains focused on business development efforts to generate additional sources of non-interest income.

Noninterest Expense

Noninterest expense for the year ended December 31, 2016 totaled $12,388,000, up $637,000 or 5.4% as compared to the $11,751,000 recorded for the year ended December 31, 2015. Specific items to note are as follows:

| ● | Compensation expense increased $140,000 or 2.1% in comparison to 2015 as the result of health insurance increases, merit increases and performance bonus increases. |

| ● | Data processing expense increased $145,000 or 21.8% due to an increase in the number of customer accounts and also due to expenses for conversion of our core products that is currently in process. The conversion is expected to be completed in second quarter of 2017. |

| ● | Professional fees increased $286,000 or 89.1% due to legal fees, audit fees, compliance support, strategic planning, and other consulting services. Most of the increase was attributed to legal fees related to the reorganization to a bank holding company and to contracted accounting and finance services while the chief financial officer position was vacant. |

Provision for Income Taxes

The Company recorded income tax expense of $877,000 in 2016 resulting in an effective tax rate of 39.5%, as compared to an income tax expense of $1,164,000 in 2015 which represented an effective tax rate of 52.4%. The effective tax rate for 2015 was elevated above normal levels due to the write-off of an expired NOL relating to the Carolina Commerce Bank acquisition totaling $235,000 as well as an approximate $100,000 reduction in the deferred tax asset due to the State of North Carolina reducing its corporate tax rate to 4% for 2016. The Company also had a reduction of approximately $80,000 in the deferred tax asset in 2016 due to the State of North Carolina reducing its corporate tax rate to 3%.

- 9 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

NET INTEREST INCOME

Average Balances and Average Rates Earned and Paid. The following table sets forth, for the years ended December 31, 2016, 2015 and 2014, information with regard to average balances of assets and liabilities, as well as the total dollar amounts of interest income from interest-earning assets and interest expense on interest-bearing liabilities, resultant yields or costs, net interest income, net interest spread, net interest margin and ratio of average interest-earning assets to average interest-bearing liabilities. Non-accrual loans have been included in determining average loans and did not have a material impact on net interest income.

| For the Years Ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest Income/ Expense | Average Interest Rate(1) | Average Balance | Interest Income/ Expense | Average Interest Rate(1) | Average Balance | Interest Income/ Expense | Average Interest Rate(1) | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||

| Loans(2) | $ | 298,600 | $ | 15,213 | 5.09 | % | $ | 271,404 | $ | 13,897 | 5.12 | % | $ | 226,607 | $ | 12,049 | 5.32 | % | ||||||||||||||||||

| Investment securities available for sale | 27,447 | 815 | 2.97 | % | 24,358 | 948 | 3.89 | % | 24,923 | 926 | 3.72 | % | ||||||||||||||||||||||||

| Other interest-earning assets | 24,915 | 194 | 0.78 | % | 4,379 | 60 | 1.37 | % | 4,596 | 67 | 1.46 | % | ||||||||||||||||||||||||

| Total interest-earning assets | 350,962 | 16,222 | 4.62 | % | 300,141 | 14,905 | 4.97 | % | 256,126 | 13,042 | 5.09 | % | ||||||||||||||||||||||||

| Other assets | 18,324 | 20,813 | 14,890 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 369,286 | $ | 320,954 | $ | 271,016 | ||||||||||||||||||||||||||||||

| Interest-bearing liabilities Deposits: | ||||||||||||||||||||||||||||||||||||

| Savings, NOW and money market deposits | $ | 110,981 | $ | 278 | 0.25 | % | $ | 95,899 | $ | 210 | 0.22 | % | $ | 88,887 | 208 | 0.23 | % | |||||||||||||||||||

| Time deposits $250,000 or more | 39,041 | 567 | 1.45 | % | 36,348 | 479 | 1.32 | % | 14,479 | 195 | 1.35 | % | ||||||||||||||||||||||||

| Other time deposits | 127,581 | 1,665 | 1.31 | % | 108,801 | 1,437 | 1.32 | % | 105,367 | 1,330 | 1.26 | % | ||||||||||||||||||||||||

| Capital lease obligation | 299 | 21 | 7.02 | % | 352 | 25 | 7.10 | % | 396 | 28 | 7.07 | % | ||||||||||||||||||||||||

| Other interest-bearing liabilities | 18,250 | 341 | 1.87 | % | 13,958 | 160 | 1.15 | % | 11,208 | 190 | 1.70 | % | ||||||||||||||||||||||||

| Total interest-bearing liabilities | 296,152 | 2,872 | 0.97 | % | 255,358 | 2,311 | 0.91 | % | 220,337 | 1,951 | 0.89 | % | ||||||||||||||||||||||||

| Non-interest bearing deposits | 38,662 | 30,428 | 22,953 | |||||||||||||||||||||||||||||||||

| Other liabilities | 3,102 | 4,616 | 3,493 | |||||||||||||||||||||||||||||||||

| Stockholders’ equity | 31,370 | 30,552 | 24,233 | |||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 369,286 | $ | 320,954 | $ | 271,016 | ||||||||||||||||||||||||||||||

| Net interest income and interest rate spread (3) | $ | 13,350 | 3.65 | % | $ | 12,594 | 4.06 | % | $ | 11,091 | 4.20 | % | ||||||||||||||||||||||||

| Net yield on average interest-earning assets (4) | 3.80 | % | 4.20 | % | 4.33 | % | ||||||||||||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities | 118.51 | % | 117.54 | % | 116.24 | % | ||||||||||||||||||||||||||||||

(1) All rates/yields are annualized based on average daily balances.

(2) Interest income on loans and average rates are affected by accretion of fair value discounts in each period reported.

(3) Represents the difference between the yield on total average earning assets and the cost of total interest-bearing liabilities.

(4) Represents the ratio of net interest-earnings to the average balance of interest earning assets.

- 10 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

RATE/VOLUME ANALYSIS

The following table analyzes the dollar amount of changes in interest income and interest expense for major components of interest-earning assets and interest-bearing liabilities. The table distinguishes between (i) changes attributable to volume (changes in volume multiplied by the prior period’s rate), (ii) changes attributable to rate (changes in rate multiplied by the prior period’s volume), and (iii) net change (the sum of the previous columns). The change attributable to both rate and volume (changes in rate multiplied by changes in volume) has been allocated equally to both the changes attributable to volume and the changes attributable to rate. Interest income on loans is affected by accretion of fair value discounts in 2016 and 2015.

| Years Ended | ||||||||||||

| December 31, 2016 vs. 2015 | ||||||||||||

| Increase (Decrease) Due to | ||||||||||||

| In thousands | Volume | Rate | Net | |||||||||

| Interest income: | ||||||||||||

| Loans | $ | 1,393 | $ | (77 | ) | $ | 1,316 | |||||

| Investment securities | 120 | (253 | ) | (133 | ) | |||||||

| Other interest-earning assets | 281 | (147 | ) | 134 | ||||||||

| Total interest income | 1,794 | (477 | ) | 1,317 | ||||||||

| Interest expense: | ||||||||||||

| Deposits: | ||||||||||||

| Savings, NOW and money market deposits | 33 | 35 | 68 | |||||||||

| Time deposits $250,000 or more | 35 | 53 | 88 | |||||||||

| Other time deposits | 248 | (20 | ) | 228 | ||||||||

| Capital lease obligation | (4 | ) | — | (4 | ) | |||||||

| Other interest-bearing liabilities | 49 | 132 | 181 | |||||||||

| Total interest expense | 361 | 200 | 561 | |||||||||

| Net interest income increase (decrease) | $ | 1,433 | $ | (677 | ) | $ | 756 | |||||

- 11 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

Interest Rate Sensitivity

The Company’s results of operations depend substantially on its net interest income. Like most financial institutions, the Company’s interest income and cost of funds are affected by general economic conditions and by competition in the marketplace.

The purpose of asset/liability management is to provide stable net interest income growth by protecting the Company’s earnings from undue interest rate risk, which arises from changes in interest rates and the balance sheet mix, and by managing the risk/return relationships between liquidity, interest rate risk, market risk, and capital adequacy. The Company maintains, and has complied with, a Board-approved asset/liability management policy that provides guidelines for controlling exposure to interest rate risk by utilizing the following ratios and trend analyses: liquidity, equity, volatile-liability dependence, portfolio maturities, maturing assets and maturing liabilities. The Company’s policy is to control the exposure of its earnings to changing interest rates by generally endeavoring to maintain a position within a narrow range around an “earnings neutral position,” which is defined as the mix of assets and liabilities that generate a net interest margin that is least affected by interest rate changes.

When suitable lending opportunities are not sufficient to utilize available funds, the Company has generally invested such funds in securities, primarily securities issued by governmental agencies and government sponsored enterprises. The securities portfolio contributes to the Company’s profits and plays an important part in overall interest rate management. However, management of the securities portfolio alone cannot balance overall interest rate risk. The securities portfolio must be used in combination with other asset/liability techniques to actively manage the balance sheet. The primary objectives in the overall management of the securities portfolio are safety, liquidity, yield, asset/liability management (interest rate risk), and investing in securities that can be pledged for public deposits.

In reviewing the needs of the Company with regard to proper management of its asset/liability program, the Company’s management estimates its future needs, taking into consideration estimated loan and deposit increases (due to increased demand through marketing) and forecasted interest rate changes.

The analysis of an institution’s interest rate gap (the difference between the re-pricing of interest-earning assets and interest-bearing liabilities during a given period of time) is a standard tool for the measurement of exposure to interest rate risk. The following table sets forth the amounts of interest-earning assets and interest-bearing liabilities outstanding at December 31, 2016 which are projected to re-price or mature in each of the future time periods shown. Except as stated below, the amounts of assets and liabilities shown which re-price or mature within a particular period were determined in accordance with the contractual terms of the assets or liabilities. Loans with adjustable rates are shown as being due at the end of the next upcoming adjustment period. Included in adjustable rate loans are loans currently at floor rates. These floored loans will not have rate adjustments until the floor plus the index (e.g. Wall Street Journal prime rate) exceed the floor rates. For example, an adjustable rate loan with a rate index based on prime, currently 3.75%, plus and a spread of 0.50% would normally have a current rate of 4.25% and would adjust when the prime rate adjusts. However, if the loan agreement includes a 4.75% floor rate, the prime rate would have to increase from 3.75% to 4.25% before that loan rate would be able to adjust above the current rate, 4.75%. Money market deposit accounts and negotiable order of withdrawal or other transaction accounts are assumed to be subject to immediate re-pricing and depositor availability and have been placed in the shortest period. In making the gap computations, none of the assumptions sometimes made regarding prepayment rates and deposit decay rates have been used for any interest-earning assets or interest-bearing liabilities. In addition, the table does not reflect scheduled principal payments, which will be received throughout the lives of the Mortgage Backed Investment Securities. The interest rate sensitivity of the Company’s assets and liabilities illustrated in the following table would vary substantially if different assumptions were used or if actual experience differs from that indicated by such assumptions.

- 12 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following table presents the Bank’s interest sensitivity gap between interest-earning assets and interest-bearing liabilities for the period indicated.

| Terms to repricing at December 31, 2016 | ||||||||||||||||||||

| Within 3 | 4 to 12 | 1 Year to 5 | Over 5 | |||||||||||||||||

| Dollars in thousands | Months | Months | Years | Years | Total | |||||||||||||||

| INTEREST-EARNING ASSETS: | ||||||||||||||||||||

| Loans receivable: | ||||||||||||||||||||

| Adjustable rate | $ | 132,878 | $ | — | $ | — | $ | — | $ | 132,878 | ||||||||||

| Fixed rate | 5,356 | 9,716 | 133,830 | 26,712 | 175,614 | |||||||||||||||

| Investment securities available for sale | 3,109 | — | 1,371 | 22,583 | 27,063 | |||||||||||||||

| Interest-earning deposits in other banks | 18,086 | — | 748 | 750 | 19,584 | |||||||||||||||

| Stock in FHLB of Atlanta | — | — | — | 942 | 942 | |||||||||||||||

| Total interest-earning assets | $ | 159,429 | $ | 9,716 | $ | 135,949 | $ | 50,987 | $ | 356,081 | ||||||||||

| INTEREST-BEARING LIABILITIES: | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Savings, NOW and money market | $ | 120,143 | $ | — | $ | — | $ | — | $ | 120,143 | ||||||||||

| Time deposits $250,000 or more | 3,629 | 6,459 | 26,478 | — | 36,566 | |||||||||||||||

| Other time deposits | 21,275 | 38,481 | 63,607 | — | 123,363 | |||||||||||||||

| Capital lease obligation | 15 | 46 | 207 | — | 268 | |||||||||||||||

| Long Term – Subordinated Debt | — | — | 9,605 | — | 9,605 | |||||||||||||||

| Advances from FHLB | 2,100 | — | 12,000 | — | 14,100 | |||||||||||||||

| Total interest-bearing liabilities | $ | 147,162 | $ | 44,986 | $ | 111,897 | $ | — | $ | 304,045 | ||||||||||

| Interest sensitivity gap per period | $ | 12,267 | $ | (35,270 | ) | $ | 24,052 | $ | 50,987 | $ | 52,036 | |||||||||

| Cumulative interest sensitivity gap | $ | 12,267 | $ | (23,003 | ) | $ | 1,049 | $ | 52,036 | $ | 52,036 | |||||||||

| Cumulative gap as a percentage of total interest-earning assets | 7.69 | % | (13.60 | %) | 0.34 | % | 14.61 | % | 14.61 | % | ||||||||||

| Cumulative interest-earning assets as a percentage of interest-bearing liabilities | 108.34 | % | 88.03 | % | 100.35 | % | 117.11 | % | 117.11 | % | ||||||||||

Capital Resources

Future growth and expansion of the Company are dictated by the ability to create capital, which is generated principally by retained earnings. Adequacy of the Company’s capital is also monitored to ensure compliance with regulatory requirements. One of management’s primary objectives is to maintain a strong capital position in order to warrant confidence from customers, investors, bank regulators and stockholders. A measure of capital position is capital adequacy, defined as the amount of capital needed to maintain future asset growth and absorb unforeseen losses. Regulators consider a variety of factors in determining an institution’s capital adequacy, including quality and stability of earnings, asset quality, guidance and expertise and liquidity. Regulatory guidelines place an emphasis on stockholders’ equity in relationship to total assets adjusted for risk.

- 13 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

In July 2013, the Federal Reserve issued final rules to include technical changes to its market risk capital rules to align them with the Basel III regulatory capital framework and meet certain requirements of the Dodd-Frank Act. Effective January 1, 2015, the final rules require the Company and the Bank to comply with the following minimum capital ratios: (i) a new common equity Tier 1 capital ratio of 4.5% of risk-weighted assets; (ii) a Tier 1 capital ratio of 6.0% of risk-weighted assets (increased from the prior requirement of 4.0%); (iii) a total capital ratio of 8.0% of risk-weighted assets (unchanged from the prior requirement); and (iv) a leverage ratio of 4.0% of total assets (unchanged from the prior requirement). These are the initial capital requirements, which will be phased in over a four-year period. When fully phased in on January 1, 2019, the rules will require the Company and the Bank to maintain (i) a minimum ratio of common equity Tier 1 to risk-weighted assets of at least 4.5%, plus a 2.5% “capital conservation buffer” (which is added to the 4.5% common equity Tier 1 ratio as that buffer is phased in, effectively resulting in a minimum ratio of common equity Tier 1 to risk-weighted assets of at least 7.0% upon full implementation), (ii) a minimum ratio of Tier 1 capital to risk-weighted assets of at least 6.0%, plus the 2.5% capital conservation buffer (which is added to the 6.0% Tier 1 capital ratio as that buffer is phased in, effectively resulting in a minimum Tier 1 capital ratio of 8.5% upon full implementation), (iii) a minimum ratio of total capital to risk-weighted assets of at least 8.0%, plus the 2.5% capital conservation buffer (which is added to the 8.0% total capital ratio as that buffer is phased in, effectively resulting in a minimum total capital ratio of 10.5% upon full implementation), and (iv) a minimum leverage ratio of 4.0%, calculated as the ratio of Tier 1 capital to average assets.

The capital conservation buffer requirement began January 1, 2016, at 0.625% of risk-weighted assets and will increase by the same amount each year until fully implemented at 2.5% on January 1, 2019. The capital conservation buffer is designed to absorb losses during periods of economic stress. Banking institutions with a ratio of common equity Tier 1 to risk-weighted assets above the minimum but below the conservation buffer will face constraints on dividends, equity repurchases, and compensation based on the amount of the shortfall.

Management considers the Company and the Bank to be well-capitalized and expects to be able to meet future needs caused by growth and expansion, as well as capital requirements implemented by the regulatory agencies.

Beginning January 1, 2015, the Company and the Bank calculate regulatory capital under the U.S. Basel III Standardized Approach.

The Table below presents the regulatory capital ratios for the Bank.

| At December 31, 2016 | ||||||||||||

| Actual | Minimum | Well-Capitalized | ||||||||||

| Ratio | Requirement | Requirement | ||||||||||

| Common equity tier 1 capital ratio | 11.40 | % | 4.50 | % | 6.50 | % | ||||||

| Total risk-based capital ratio | 12.46 | % | 8.00 | % | 10.00 | % | ||||||

| Tier 1 risk-based capital ratio | 11.40 | % | 6.00 | % | 8.00 | % | ||||||

| Tier 1 leverage ratio | 9.64 | % | 4.00 | % | 5.00 | % | ||||||

Liquidity

The Company’s liquidity is a measure of its ability to fund loans, withdrawals and maturities of deposits, and other cash outflows in a cost effective manner. The Company’s principal sources of liquidity are deposits, scheduled payments and prepayments of loan principal, maturities of investment securities, access to liquid assets, and funds provided by operations. While scheduled loan payments and maturing investments are relatively predictable sources of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition. Liquid assets, which consist of cash and due from banks, interest-earning deposits with banks, certificates of deposits with banks, federal funds sold and investment securities classified as available for sale, comprised 14.59% and 8.75% of total assets at December 31, 2016 and December 31, 2015, respectively.

- 14 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

Should the need arise management believes the Bank would have the capability to sell securities classified as available for sale or to borrow funds as necessary. The Bank has established credit lines with other financial institutions to purchase up to $13 million in federal funds and to borrow up to $10 million under a reverse repurchase agreement. There were no borrowings outstanding against these credit lines at December 31, 2016 and $2.4 million outstanding at December 31, 2015. The Bank has also established a credit line with the Federal Home Loan Bank of Atlanta. The credit line is secured by a portion of the Bank’s loan portfolio that qualifies under FHLB guidelines as eligible collateral. Total availability, based on collateral pledged at December 31, 2015 was $62.8 million, of which $14.1 million was advanced.

Total deposits were $318,665,000 and $284,794,000 at December 31, 2016 and December 31, 2015 respectively. Time deposits, which are the only deposit accounts that have stated maturity dates, are generally considered to be rate sensitive. Time deposits represented 50.19% and 53.29% of total deposits at December 31, 2016 and December 31, 2015 respectively. Time deposits of $250,000 or more represented 11.47% and 14.70% of the Bank’s total deposits at December 31, 2016 and December 31, 2015, respectively. At December 31, 2016 and December 31, 2015 the Bank had brokered time deposits of $25,439,000 and $27,330,000 respectively. Management does accept time deposits from outside the Bank’s local market areas when such funding sources are useful to supplement funding and to add liquidity. Management believes most time deposits are relationship-oriented. While the Bank will need to pay competitive rates to retain these deposits at their maturities, there are other subjective factors that will determine their continued retention. Based upon prior experience, the Bank anticipates that a substantial portion of outstanding certificates of deposit will renew upon maturity.

Management believes that the Company’s current sources of funds provide adequate liquidity for its current cash flow needs.

ASSET QUALITY

Summary of Allowance for Loan and Lease Losses

The allowance for loan and lease losses represents management’s estimate of an amount adequate to provide for probable losses inherent in the loan portfolio. Management determines the allowance for loan losses based on a number of factors, including a review and evaluation of the Company’s loan portfolio and current and projected economic conditions locally and nationally. The allowance is monitored and analyzed in conjunction with the Company’s loan analysis and grading program and provisions for loan losses are made to maintain the balance of the allowance for loan losses at a level that is appropriate in light of the risk inherent in the Company’s loan portfolio. The allowance for loan losses is created by direct charges to operations. Losses on loans are charged against the allowance for loan losses in the accounting period in which they are determined by management to be uncollectible. Recoveries during the period are credited to the allowance. The provision for loan losses is the amount necessary to adjust the allowance for loan losses to the amount that management has determined to be adequate to provide for potential losses inherent in the loan portfolio.

The Company recorded negative loan loss provisions totaling $27,000 and $270,000 for the years ended December 31, 2016 and December 31, 2015, respectively. The improving charge-off history over the past three years as shown in the table below reduced the required reserve for performing loans. Management realizes that general economic trends greatly affect loan losses, and no assurances can be made that future charges to the loan loss allowance may not be significant in relation to the amount provided during a particular period, or that future evaluations of the loan portfolio based on conditions then prevailing will not require sizable additions to the allowance, thus necessitating similarly sizable charges to income. Based on its best judgment, evaluation, and analysis of the loan portfolio, management believes the level of the allowance for loan losses to be appropriate in light of the risk inherent in the Company’s loan portfolio for the reporting periods.

- 15 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following table represents the Company’s activity in its allowance for loan losses:

Analysis Of The Allowance For Loan Losses

| Dollars in thousands | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Balance at January 1 | $ | 3,723 | $ | 4,002 | $ | 4,066 | $ | 4,773 | $ | 4,366 | ||||||||||

| Recoveries: | ||||||||||||||||||||

| Commercial real estate | 95 | 141 | 276 | 112 | 50 | |||||||||||||||

| Commercial | 17 | 95 | 23 | 43 | 8 | |||||||||||||||

| Residential mortgage | — | — | 1 | 34 | 37 | |||||||||||||||

| Consumer | 25 | 12 | 6 | 8 | 6 | |||||||||||||||

| Total Recoveries | 137 | 248 | 306 | 197 | 101 | |||||||||||||||

| Charged-off loans: | ||||||||||||||||||||

| Commercial real estate | (71 | ) | (108 | ) | (226 | ) | (1,331 | ) | (1,377 | ) | ||||||||||

| Commercial | (301 | ) | — | (18 | ) | (1,546 | ) | (11 | ) | |||||||||||

| Residential mortgage | — | (132 | ) | — | (62 | ) | (415 | ) | ||||||||||||

| Consumer | (68 | ) | (17 | ) | (46 | ) | (250 | ) | (258 | ) | ||||||||||

| Total Charge-offs | (440 | ) | (257 | ) | (290 | ) | (3,189 | ) | (2,061 | ) | ||||||||||

| Net charge-offs | (303 | ) | (9 | ) | 16 | (2,992 | ) | (1,960 | ) | |||||||||||

| Provision for loan losses | (27 | ) | (270 | ) | (80 | ) | 2,285 | 2,367 | ||||||||||||

| Balance at December 31 | $ | 3,393 | $ | 3,723 | $ | 4,002 | $ | 4,066 | $ | 4,773 | ||||||||||

| Ratio of allowance to total loans outstanding at end of year | 1.10 | % | 1.27 | % | 1.64 | % | 1,82 | % | 2.16 | % | ||||||||||

| Ratio of net charge-offs to average loans outstanding during the period | 0.10 | % | 0.00 | % | (0.01 | %) | 1.36 | % | 0.93 | % | ||||||||||

The balance in the allowance and the allowance as a percentage of loans decreased during 2016 when compared to 2015 due to the following:

| ● | Downward trend in classified loans. |

| ● | Decrease in the historical charge offs used in the model which uses the prior three years of losses that are components of the general allowance for non-impaired loans. |

Potential problem loans consist of loans that are performing in accordance with contractual terms, but for which management has concerns about the ability of an obligor to continue to comply with repayment terms, because of the obligor’s potential operating or financial difficulties. Management monitors these loans closely and reviews their performance on a regular basis. These loans do not meet the standards for, and are therefore not included in, non-performing assets. A summary of potential problem loans follows:

| ||||||||||||||||

| December 31, 2016 | December 31, 2015 | |||||||||||||||

Category Dollars in thousands | Number | Balance | Number | Balance | ||||||||||||

| Commercial real estate | 14 | $ | 2,996 | 14 | $ | 3,145 | ||||||||||

| Home equity lines | 9 | 1,598 | 10 | 1,699 | ||||||||||||

| Residential mortgage | 14 | 2,120 | 20 | 3,669 | ||||||||||||

| Commercial & Industrial | 3 | 22 | 6 | 1,629 | ||||||||||||

| Consumer | 5 | 167 | 5 | 195 | ||||||||||||

| Construction/land development | 1 | 497 | 1 | 516 | ||||||||||||

| Total | 46 | $ | 7,400 | 56 | $ | 10,853 | ||||||||||

- 16 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following table summarizes the allocation for loan losses for the past five years ended December 31. The percentage in the table below refers to the percent of loans outstanding in each category to total loans at the years ended.

| Dollars in thousands | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||||||||||||||||||||||

| $ | % | $ | % | $ | % | $ | % | $ | % | |||||||||||||||||||||||||||||||

| Commercial real estate* | 1,607 | 58.63 | 2,302 | 56.57 | 2,456 | 53.07 | 2,498 | 51.09 | 2,994 | 51.21 | ||||||||||||||||||||||||||||||

| Commercial | 1,171 | 14.16 | 570 | 14.93 | 705 | 15.32 | 516 | 14.20 | 1,028 | 14.05 | ||||||||||||||||||||||||||||||

| Residential mortgage | 427 | 14.46 | 505 | 16.18 | 464 | 18.46 | 547 | 20.25 | 504 | 19.50 | ||||||||||||||||||||||||||||||

| Home equity lines | 175 | 11.36 | 336 | 10.95 | 361 | 11.69 | 501 | 12.60 | 242 | 13.32 | ||||||||||||||||||||||||||||||

| Consumer – other | 13 | 1.39 | 10 | 1.37 | 16 | 1.46 | 4 | 1.86 | 5 | 1.92 | ||||||||||||||||||||||||||||||

| Balance at December 31 | 3,393 | 100.00 | 3,723 | 100.00 | 4,002 | 100.00 | 4,066 | 100.00 | 4,773 | 100.00 | ||||||||||||||||||||||||||||||

*Note: Commercial real estate loans in the table above include construction loans and multi-family housing loans

Non-Performing Assets (“NPAs”)

Non-performing assets include non-accrual loans, loans past due 90 days or more and still accruing, and foreclosed assets. A loan will be placed on nonaccrual status when collection of all principal or interest is deemed unlikely. A loan will be placed on nonaccrual status automatically when principal or interest is past due 90 days or more, unless the loan is both well secured and in the process of being collected. In this case, the loan will continue to accrue interest despite its past due status.

Foreclosed assets represent properties and equipment acquired through foreclosure or physical possession. Appraisals are obtained at the time of foreclosure and any necessary write-downs to fair value at the time of transfer to foreclosed assets are charged to the allowance for loan losses.

Based on generally accepted accounting standards for receivables, a loan is impaired when, based on current information and events, it is likely that a creditor will be unable to collect all amounts, including both principal and interest, due according to the contractual terms of the loan agreement.

The Company’s ratio of NPAs to total assets decreased 20 basis points to 1.04% as compared to 1.24% reported at December 31, 2015. In comparison to the prior year, nonaccrual loans increased $581,000, loans past due 90 days or more and still accruing interest increased $130,000 and foreclosed assets decreased $983,000.

Non-performing assets for the five years ended December 31, 2016 are detailed as follows:

| Dollars in thousands | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Nonaccrual loans | $ | 2,628 | $ | 2,047 | $ | 3,991 | $ | 3,286 | $ | 8,494 | ||||||||||

| Past due 90 days and accruing interest | 247 | 117 | 175 | 517 | — | |||||||||||||||

| Total non-performing loans | $ | 2,875 | $ | 2,164 | $ | 4,166 | $ | 3,803 | $ | 8,494 | ||||||||||

| Foreclosed assets | 1,011 | 1,994 | 2,048 | 3,908 | 4,169 | |||||||||||||||

| Total non-performing assets | $ | 3,886 | $ | 4,158 | $ | 6,214 | $ | 7,711 | $ | 12,662 | ||||||||||

| Non-performing assets to total assets | 1.04 | % | 1.24 | % | 2.12 | % | 2.89 | % | 4.67 | % | ||||||||||

- 17 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

Troubled Debt Restructurings

A restructured loan is a loan in which the original contract terms have been modified due to a borrower’s financial condition or there has been a transfer of assets in full or partial satisfaction of the loan. A modification of original contractual terms is generally a concession to a borrower that a lending institution would not normally consider. No troubled debt restructurings are included in the loans on nonaccrual status for 2016 and one troubled debt restructuring in the amount of $128,000 is included in the loans on nonaccrual status for 2015.

Accruing troubled debt restructurings for the five years ending December 31, 2016 are as follows:

| Dollars in thousands | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Accruing troubled debt restructurings | $ | 4,616 | $ | 4,725 | $ | 4,242 | $ | 2,840 | $ | 2,438 | ||||||||||

Loan Portfolio

Our total gross loans were $308,492,000 at December 31, 2016, an increase of $16,130,000 or 5.52% from the $292,362,000 reported one year earlier. The loan portfolio primarily consists of real estate (including real estate term loans, construction loans and other loans secured by real estate), commercial, and loans to individuals for household, family and other consumer purposes. We adjust the mix of lending and the terms of our loan programs according to economic and market conditions, asset/liability management considerations and other factors. Loans typically are made to businesses and individuals within our primary market area, most of whom maintain deposit accounts with the Bank. There is no concentration of loans exceeding 10% of total loans that is not disclosed in the Financial Statements and the Notes to the Financial Statements contained in this annual report or discussed below.

The following table summarizes the loan portfolio by category for the five years ended December 31, 2016:

| December 31, | ||||||||||||||||||||

| Dollars in thousands | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Construction | $ | 19,014 | $ | 13,084 | $ | 13,391 | $ | 11,066 | $ | 14,020 | ||||||||||

| Commercial | 96,749 | 79,144 | 47,025 | 39,212 | 37,452 | |||||||||||||||

| Residential 1-4 family | 44,811 | 47,072 | 44,777 | 47,208 | 47,183 | |||||||||||||||

| Home equity lines of credit | 34,806 | 31,694 | 28,218 | 27,815 | 28,590 | |||||||||||||||

| Total real estate loans | 195,380 | 170,994 | 133,411 | 125,301 | 127,245 | |||||||||||||||

| Other loans: | ||||||||||||||||||||

| Commercial | 108,904 | 117,043 | 106,799 | 93,642 | 88,895 | |||||||||||||||

| Loans to individuals | 4,801 | 4,828 | 4,754 | 5,211 | 5,572 | |||||||||||||||

| Total other loans | 113,705 | 121,871 | 111,553 | 98,853 | 94,467 | |||||||||||||||

| 309,085 | 292,865 | 244,964 | 224,154 | 221,712 | ||||||||||||||||

| Deferred loan origination fees, net | (593 | ) | (503 | ) | (318 | ) | (263 | ) | (232 | ) | ||||||||||

| Total loans | $ | 308,492 | $ | 292,362 | $ | 244,646 | $ | 223,891 | $ | 221,480 | ||||||||||

- 18 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following table presents maturity information (based upon interest rate repricing dates) on the loan portfolio based upon scheduled repayments at December 31, 2016.

Dollars in thousands | Due within one year | Due one to five years | Due after five years | Total | ||||||||||||

| Commercial real estate | $ | 72,758 | $ | 85,312 | $ | 22,619 | $ | 180,689 | ||||||||

| Commercial | 22,038 | 18,814 | 2,925 | 43,777 | ||||||||||||

| Residential real estate | 16,234 | 27,404 | 1,057 | 44,695 | ||||||||||||

| Home equity lines of credit | 34,826 | 290 | — | 35,116 | ||||||||||||

| Consumer - other | 2,094 | 2,010 | 111 | 4,215 | ||||||||||||

| Total | $ | 147,950 | $ | 133,830 | $ | 26,712 | $ | 308,492 | ||||||||

The following table presents maturity information based upon contractual terms and scheduledrepayments at December 31, 2016.

Dollars in thousands | Due within one year | Due one to five years | Due after five years | Total | ||||||||||||

| Fixed | $ | 15,072 | $ | 133,830 | $ | 26,712 | $ | 175,614 | ||||||||

| Variable | 27,303 | 37,604 | 67,971 | 132,878 | ||||||||||||

| Total | $ | 42,375 | $ | 171,434 | $ | 94,683 | $ | 308,492 | ||||||||

The following table sets forth information with respect to the asset quality of our loan portfolio.

Asset Quality – Loan Portfolio Analysis

| As of December 31, 2016 | ||||||||||||||||||||

Loans Outstanding | Nonaccrual Loans | Nonaccrual Loans to Loans Outstanding | Allowance for Loan Losses | ALLL

to Loans Outstanding | ||||||||||||||||

| Dollars in thousands | ||||||||||||||||||||

| Commercial real estate: | ||||||||||||||||||||

| Residential ADC | $ | 2,463 | $ | — | 0.00 | % | $ | 15 | 0.61 | % | ||||||||||

| Commercial ADC | 24,583 | 1,022 | 4.16 | % | 152 | 0.62 | % | |||||||||||||

| Farmland | 3,826 | 43 | 1.12 | % | — | 0.00 | % | |||||||||||||

| Multifamily | 11,980 | 153 | 1.28 | % | 12 | 0.10 | % | |||||||||||||

| Owner occupied | 69,686 | 55 | 0.08 | % | 733 | 1.05 | % | |||||||||||||

| Non-owner occupied | 68,079 | 37 | 0.05 | % | 696 | 1.02 | % | |||||||||||||

| Total commercial real estate | 180,617 | 1,310 | 0.73 | % | 1,608 | 0.89 | % | |||||||||||||

| Commercial: | ||||||||||||||||||||

| Commercial and industrial | 41,935 | 1,139 | 2.72 | % | 1,171 | 2.79 | % | |||||||||||||

| Agriculture | 209 | — | 0.00 | % | — | 0.00 | % | |||||||||||||

| Other | 1,636 | — | 0.00 | % | — | 0.00 | % | |||||||||||||

| Total commercial | 43,780 | 1,139 | 2.60 | % | 1,171 | 2.67 | % | |||||||||||||

| Residential mortgage: | ||||||||||||||||||||

| First lien, closed-end | 43,811 | 179 | 0.41 | % | 420 | 0.96 | % | |||||||||||||

| Junior lien, closed-end | 887 | — | 0.00 | % | 7 | 0.79 | % | |||||||||||||

| Total residential mortgage | 44,698 | 179 | 0.40 | % | 427 | 0.96 | % | |||||||||||||

| Home equity lines | 35,119 | — | 0.00 | % | 174 | 0.50 | % | |||||||||||||

| Consumer – other | 4,278 | — | 0.00 | % | 13 | 0.30 | % | |||||||||||||

| Total gross loans | $ | 308,492 | $ | 2,628 | 0.85 | % | $ | 3,393 | 1.10 | % | ||||||||||

- 19 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

The following table summarizes the activity in foreclosed assets for the years ended December 31, 2016 and 2015:

In thousands | December

31, | December 31, | ||||||

| Balance, beginning of period | $ | 1,994 | $ | 2,048 | ||||

| Additions | 609 | 957 | ||||||

| Proceeds from sales | (1,165 | ) | (576 | ) | ||||

| Valuation adjustments | (373 | ) | (285 | ) | ||||

| Gains (losses) from sales | (54 | ) | (150 | ) | ||||

| Balance, end of period | $ | 1,011 | $ | 1,994 | ||||

OFF-BALANCE SHEET ARRANGEMENTS

The Company is a party to financial instruments with off-balance sheet risk in the normal course of business to meet the financing needs of its customers. These financial instruments include commitments to extend credit and standby letters of credit. Those instruments involve, to varying degrees, elements of credit and interest rate risk in excess of the amount recognized in the balance sheet. The contract or notional amounts of those instruments reflect the extent of involvement the Company has in particular classes of financial instruments. The Company uses the same credit policies in making commitments and conditional obligations as it does for on-balance sheet instruments.

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of conditions established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since some of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. The Company evaluates each customer’s creditworthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary by the Company, upon extension of credit is based on management’s credit evaluation of the borrower. Collateral obtained varies but may include real estate, stocks, bonds, and certificates of deposit.

A summary of financial instruments whose contract amounts represent the Company’s exposure to off-balance sheet credit risk for the periods indicated is as follows:

December 31, | December 31, | |||||||

| Dollars in thousands | ||||||||

| Undisbursed lines of credit | $ | 49,853 | $ | 43,121 | ||||

| Commercial letters of credit | 697 | 303 | ||||||

| Total | $ | 50,550 | $ | 43,424 | ||||

The Company does not have any outstanding commitments to any classified borrowers.

- 20 -

Carolina Trust BancShares, Inc.

Management’s Discussion and Analysis

INVESTMENT ACTIVITIES

The Company’s portfolio of investment securities, all of which are available for sale, consists of U.S. Government and federal agency, government sponsored enterprises, mortgage-backed securities, corporate debt and equity securities.

Securities to be held for indefinite periods of time and not intended to be held to maturity are classified as available for sale and carried at fair value with any unrealized gains or losses reflected as an adjustment to stockholders’ equity. Securities held for indefinite periods of time include securities that management intends to use as part of its asset/liability management strategy and that may be sold in response to changes in interest rates and/or significant prepayment risks.

The following table summarizes the amortized costs, gross unrealized gains and losses and the resulting market value of investment securities:

| Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||||

| Dollars in thousands | ||||||||||||||||

| December 31, 2016 | ||||||||||||||||

| U.S. Government and federal agency | $ | 6,664 | $ | 17 | $ | (138 | ) | $ | 6,543 | |||||||

| Government-sponsored enterprises * | 18,841 | 101 | (284 | ) | 18,658 | |||||||||||

| Corporate debt securities | 750 | — | — | 750 | ||||||||||||

| Equity securities | 1,204 | — | (92 | ) | 1,112 | |||||||||||

| $ | 27,459 | $ | 118 | $ | (514 | ) | $ | 27,063 | ||||||||

| December 31, 2015 | ||||||||||||||||

| U.S. Government and federal agency | $ | 15,935 | $ | 17 | $ | (409 | ) | $ | 15,543 | |||||||

| Government-sponsored enterprises * | 5,391 | 212 | (1 | ) | 5,602 | |||||||||||

| Corporate debt securities | 750 | — | — | 750 | ||||||||||||

| Equity securities | 1,204 | — | (166 | ) | 1,038 | |||||||||||

| $ | 23,280 | $ | 229 | $ | (576 | ) | $ | 22,933 | ||||||||

| December 31, 2014 | ||||||||||||||||

| U.S. Government and federal agency | $ | 16,093 | $ | 27 | $ | (381 | ) | $ | 15,739 | |||||||

| Government-sponsored enterprises * | 6,893 | 321 | — | 7,214 | ||||||||||||

| States and political subdivisions | 115 | 2 | — | 117 | ||||||||||||

| Corporate debt securities | 750 | — | (112 | ) | 638 | |||||||||||

| Equity securities | 1,204 | 333 | (1 | ) | 1,536 | |||||||||||