Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to

Commission file number: 001-37563

KLONDEX MINES LTD.

(Exact name of registrant as specified in its charter)

British Columbia | 98-1153397 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

6110 Plumas Street Suite A Reno, Nevada | 89519 | |

(Address of principal executive offices) | (Zip Code) | |

(775) 284-5757

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of exchange on which registered | |

Common Shares, no par value | NYSE MKT LLC | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | ý | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of common stock held by non-affiliates of the registrant was approximately $509.4 million on June 30, 2016 (the last business day of the registrant's most recently completed second fiscal quarter). On March 21, 2017, there were 177,312,560 shares of the registrant’s common stock with no par value per share, outstanding.

Documents Incorporated by Reference

To the extent specifically referenced in Part III, portions of the registrant’s definitive Proxy Statement on Schedule 14A to be filed with the Securities and Exchange Commission (the "SEC") in connection with the registrant's 2017 Annual Meeting of Stockholders are hereby incorporated by reference into this report.

KLONDEX MINES LTD.

FORM 10-K

For the Year Ended December 31, 2016

TABLE OF CONTENTS

Page | ||||

Cautionary statement regarding forward-looking statements

This Annual Report on Form 10-K contains forward-looking statements or information within the meaning of Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and are intended to be covered by the safe harbors provided by these regulations. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Our forward-looking statements may include, without limitation, statements with respect to:

• | estimates of future mineral production, mining activities and sales; |

• | estimates of future production costs and other expenses for specific operations and on a consolidated basis; |

• | estimates of future capital expenditures, construction or production activities and other cash needs, for specific operations and on a consolidated basis, and expectations as to the funding or timing thereof; |

• | estimates as to the projected development of certain mineral projects, such as Hollister (as defined herein), including the timing of such development, the costs of such development and other capital costs, financing plans for these deposits and expected production commencement dates; |

• | estimates of mineral reserves and mineral resources, timing of updated studies and statements regarding future exploration; |

• | statements regarding the availability of, and, terms and costs related to, future borrowing and financing; |

• | estimates regarding future exploration expenditures, results and reserves; |

• | estimates regarding potential cost savings, productivity and operating performance; |

• | expectations regarding the start-up time, design, mine life, mill availability, production and costs applicable to sales and exploration potential of our mines and projects; |

• | statements regarding future transactions; and |

• | statements regarding the impacts of changes in the legal and regulatory environment in which we operate. |

Forward-looking statements and forward-looking information have been based upon our current business and operating plans, as approved by our Board of Directors (the “Board”); our cash and other funding requirements and timing and sources thereof; results of pre-feasibility and technical reports; mineral resource and reserve estimates; exploration activities; any required permitting processes; and current market conditions and project development plans. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

• | the price of gold, silver and other metal prices and commodities; |

• | the cost of operations; |

• | currency fluctuations; |

• | inflation or deflation; |

• | geological and metallurgical assumptions; |

• | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of our mineral deposits; |

• | operating performance of equipment, processes and facilities; |

• | timing of receipt of necessary governmental permits or approvals; |

• | domestic and foreign laws or regulations, particularly relating to the environment, mining and processing; |

• | changes in tax laws; |

• | domestic and international economic and political conditions; |

• | our ability to obtain or maintain necessary financing; |

• | other risks and hazards associated with mining operations. uncertainty of estimates of capital costs, operating costs, production and economic returns; |

• | uncertainty related to inferred mineral resources; |

• | labor relations and our need to attract and retain qualified management and technical personnel; and |

i

• | increased regulatory compliance costs relating to the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"). |

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this Annual Report on Form 10-K under the heading “Risk Factors” and elsewhere.

Our forward-looking statements contained in this Annual Report on Form 10-K are based on the beliefs, expectations and opinions of management as of the date of this report. We do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Currency information

All dollar amounts included in this Annual Report on Form 10-K are expressed in thousands of United States dollars unless otherwise noted. References to CDN$ refer to Canadian dollars.

Cautionary note to U.S. investors regarding estimates of measured, indicated and inferred resources and proven and probable reserves

As used in this Annual Report on Form 10-K, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)-CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (“CIM Definition Standards”).

These definitions differ from the definitions in the SEC Industry Guide 7 (“SEC Industry Guide 7”) under the Securities Act. However, despite the differences in the definition between NI 43-101 and SEC Industry Guide 7:

• | P&E Mining Consultants Inc. has stated that with respect to the proven and probable reserves reported in the amended and restated technical report titled “Technical Report and Pre-Feasibility Study on the True North Gold Mine, Bissett, Manitoba, Canada” dated November 22, 2016, effective June 30, 2016, such proven and probable reserves are equivalent to those determined under SEC Industry Guide 7 and the study meets SEC Industry Guide 7 standards for estimating and reporting reserves; |

• | Practical Mining LLC has stated that the proven and probable reserves reported in the amended and restated technical report titled "Preliminary Feasibility Study for the Midas Mine, Elko County, Nevada", dated April 2, 2015, effective as of August 31, 2014 and the Mineral Reserve and Mineral Resource update for Midas effective as of May 31, 2016 are equal to the proven and probable reserves which would have been reported had the reports been prepared pursuant to SEC Industry Guide 7 standards, and in such disclosures, the procedures and definitions employed in the estimation of proven and probable reserves is also consistent with SEC Industry Guide 7 definitions; and |

• | Practical Mining LLC has stated that the proven and probable reserves reported in the technical report titled "Technical Report for the Fire Creek Project, Lander County, Nevada" dated March 28, 2016, effective June 30, 2015, and the Mineral Reserve and Mineral Resource update for Fire Creek effective as of June 30, 2016 are equal to the proven and probable reserves which would have been reported had the reports been prepared pursuant to SEC Industry Guide 7 standards and in such disclosures the procedures and definitions employed in the estimation of proven and probable reserves is also consistent with SEC Industry Guide 7 definitions. |

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in, and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report in place tonnage and grade without reference to unit measures for mineralization that does not constitute “reserves” by SEC standards. Accordingly, information contained in this report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “mineralized material” as used in this Annual Report on Form 10-K, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain that any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of

ii

the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

The scientific and technical information contained in this Annual Report on Form 10-K relating to the Company's Fire Creek mine up to June 30, 2015 is derived from the technical report titled "Technical Report for the Fire Creek Project, Lander County, Nevada", dated as of and filed on SEDAR on March 28, 2016 (with an effective date of June 30, 2015) (the "Fire Creek Technical Report"). The Fire Creek Technical Report was prepared by Mark Odell, P.E., Laura Symmes, SME and Sarah Bull, P.E. of Practical Mining LLC.

The scientific and technical information contained in this Annual Report on Form 10-K relating to the Company's Midas mine up to August 31, 2014 is derived from the technical report titled "Preliminary Feasibility Study for the Midas Mine, Elko County, Nevada", as amended and re-filed on SEDAR on April 2, 2015 (with an effective date of August 31, 2014) (the "Midas Technical Report"). The Midas Technical Report was prepared by Mark Odell, P.E., Laura Symmes, SME, Sarah Bull, P.E. of Practical Mining LLC and Karl Swanson, M.Eng., SME, AusIMM, Independent Mining & Geological Consultant.

The scientific and technical information contained in this Annual Report on Form 10-K relating to the Company's True North mine up to June 30, 2016 is derived from the technical report titled "Technical Report and Pre-Feasibility Study on the True North Gold Mine, Bissett, Manitoba, Canada", as amended and re-filed on SEDAR on November 28, 2016 (with an effective date of June 30, 2016) (the "True North Technical Report"). The True North Technical Report was prepared by Eugene Puritch, P.Eng., Alexandru Veresezan, P.Eng., Fred Brown, P.Geo., William Stone, P.Geo., Alfred Hayden, P.Eng., David Orava, P.Eng., and Kirk Rodgers, P.Eng. of P&E Mining Consultants Inc.

The scientific and technical information contained in this Annual Report on Form 10-K relating to the Company's Hollister mine up to May 30, 2016 is derived from the technical report titled "Independent Technical Report for the Hollister Gold Project, Nevada, USA", dated as of October 25, 2016 (with an effective date of May 30, 2016) (the "Hollister Technical Report"). The Hollister Technical Report was prepared by Marek Nowak, Peng., of SRK Consulting (Canada) Inc.

The technical reports mentioned above are subject to certain assumptions, qualifications and procedures described therein. Reference should be made to the full text of the technical reports, which have been filed with Canadian securities regulatory authorities pursuant to NI 43-101 and are available for review under the Corporation's profile on SEDAR at www.sedar.com. The technical reports are not, and shall not be deemed to be, incorporated by reference in this Annual Report on Form 10-K. Where appropriate, certain information contained in this Annual Report on Form 10-K updates information derived from such technical reports.

All scientific or technical information relating to the Fire Creek mine subsequent to June 30, 2015, all scientific or technical information relating to the Midas mine subsequent to August 31, 2014, all scientific or technical information relating to the True North mine subsequent to June 30, 2016 and all scientific or technical information relating to Hollister subsequent to May 30, 2016 have been prepared by or under the supervision of Brian Morris, who is a "qualified person" for purposes of NI 43-101. Brian Morris has approved the disclosure of all such scientific and technical information contained in this Annual Report on Form 10-K.

iii

PART I

Item 1. Business

About the Company

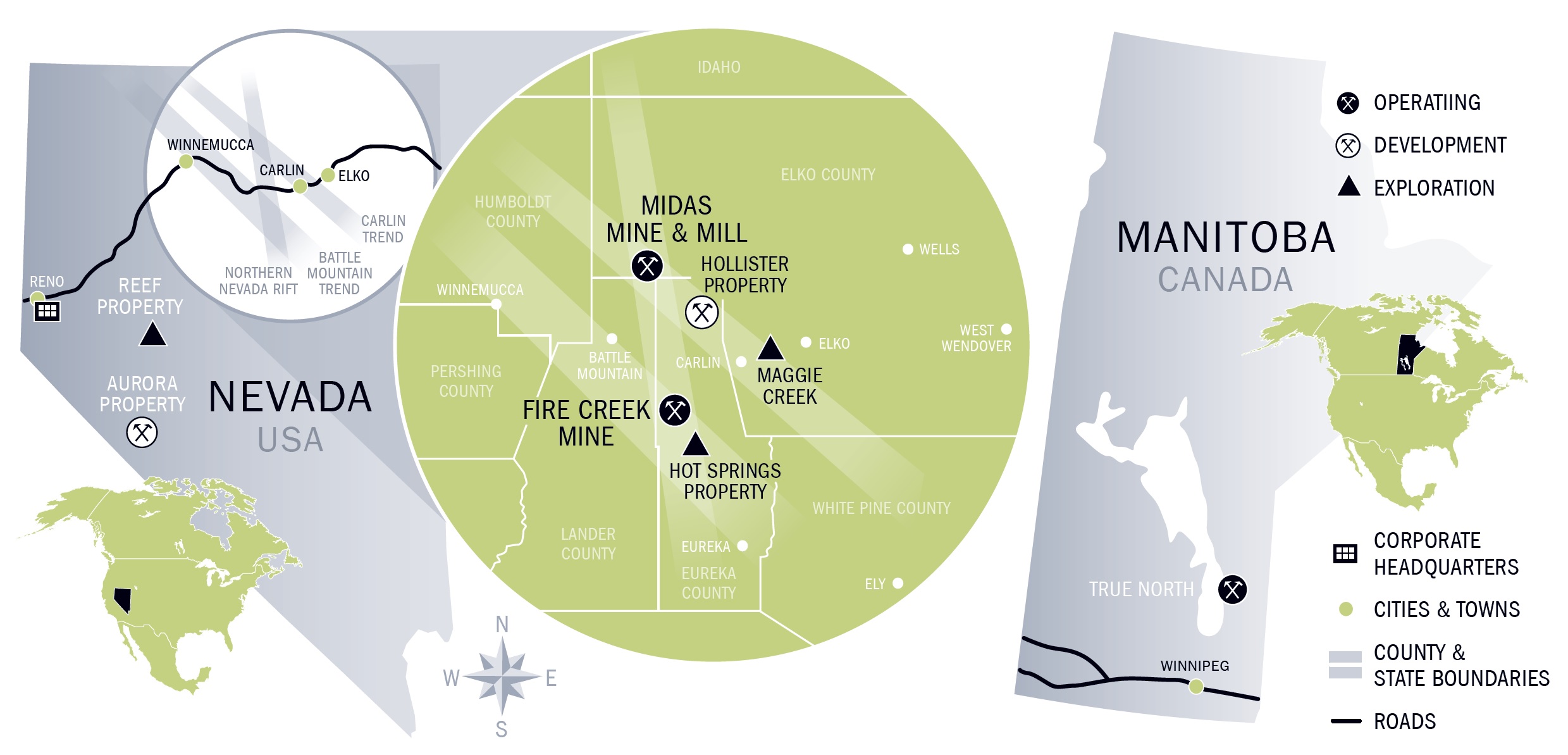

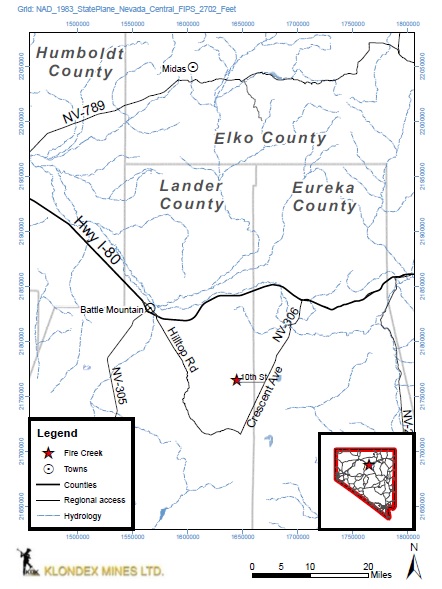

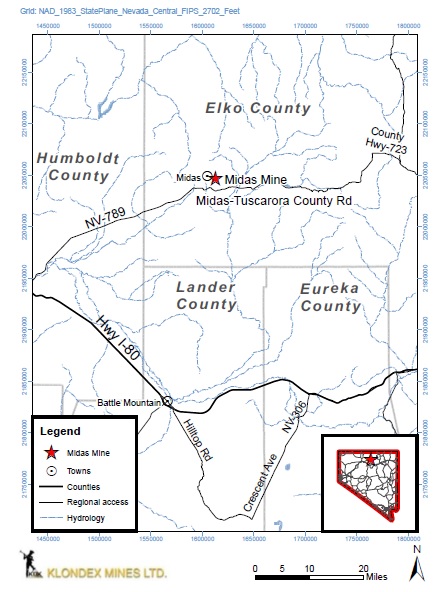

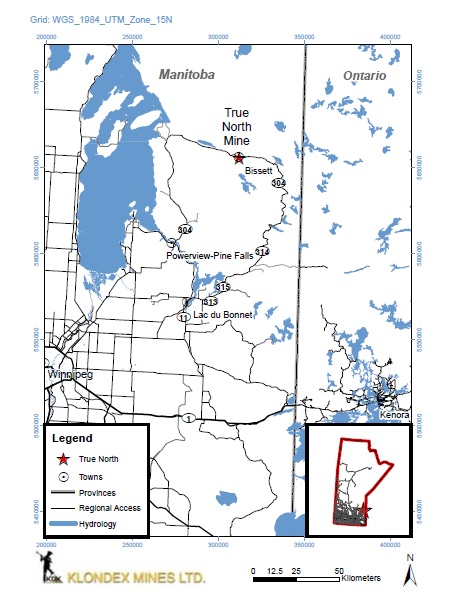

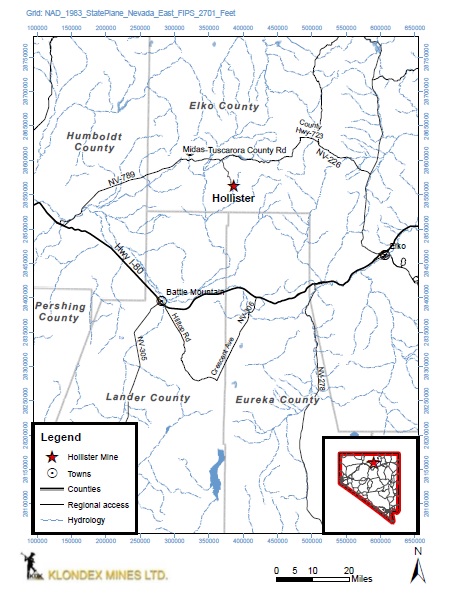

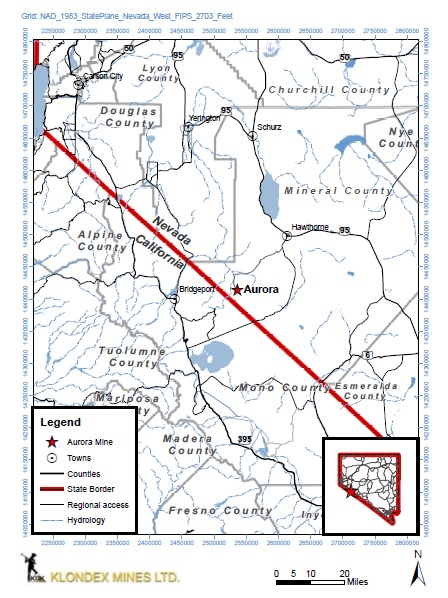

Klondex Mines Ltd. is a well–capitalized, junior–tier gold and silver mining company focused on mining, exploration, development, and production in a safe, environmentally responsible, and cost–effective manner. As of December 31, 2016, Klondex Mines Ltd. had 100% interests in three producing mines: (1) the Fire Creek mine ("Fire Creek") and (2) the Midas mine and ore milling facility ("Midas"), both of which are located in the state of Nevada, USA, and (3) the True North gold mine and mill in Manitoba, Canada ("True North", formerly known as the Rice Lake mine). The Company also has 100% interests in two recently acquired projects: (1) the Hollister mine ("Hollister"), and (2) the Aurora mine and ore milling facility ("Aurora", formerly known as Esmeralda), both of which are also located in Nevada, USA.

Klondex Mines Ltd. was incorporated on August 25, 1971 under the laws of British Columbia, Canada and its common shares are listed on the Toronto Stock Exchange ("TSX") under the symbol "KDX" and on the NYSE MKT LLC ("NYSE MKT") under the symbol "KLDX".

Klondex Mines Ltd.'s registered office is located at 1055 West Hastings Street, Suite 2200, Vancouver, British Columbia, Canada V6E 2E9 and its corporate headquarters is located at 6110 Plumas St, Suite A, Reno, NV 89519.

In this report, “we”, “us”, “our”, the “Company”, "its", and “Klondex” refer to Klondex Mines Ltd. and its subsidiaries.

Business development and strategy

Prior to February 2014, our only mine was Fire Creek and since that time we have experienced growth in our annual gold and silver production, total assets, and workforce largely due to the acquisitions outlined below:

Acquisitions:(1) | Midas | True North | Hollister and Aurora | Total | ||||||||||||

Date acquired: | February 11, 2014 | January 22, 2016 | October 3, 2016 | |||||||||||||

Purchase consideration (thousands): | $ | 63,645 | $ | 31,100 | $ | 109,568 | $ | 204,313 | ||||||||

(1) Refer to Note 4. Business Combinations to the Notes to Consolidated Financial Statements for additional detail. | ||||||||||||||||

The acquisition of Midas allowed us to begin processing Fire Creek's ore, together with Midas' ore, at the Midas mill, which is located approximately 120 miles away from Fire Creek. True North has a mill and processes its ore on-site. It is currently anticipated that mineralized material from Hollister, which does not have a mill and is an exploration and development stage mineral property, will be processed at the nearby Midas mill (approximately 17 miles away) or, in the case of mineral-bearing concentrate, at the Aurora mill.

During 2016, our producing mines were Fire Creek, Midas, and True North, and in 2017 we expect to produce from these same mines in addition to the mining activities at the Hollister Project under a bulk sampling program. Refer to the 2017 Full Year Outlook section of Part II, Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations ("MDA") for a summary of our expected 2017 production volumes, costs, capital, development, and exploration expenditures.

Gold and silver sales represent 100% of our revenues and the market prices of gold and silver significantly impact our financial position, operating results, and cash flows. Our primary strategy is to increase shareholder value by responsibly achieving our production, cost, and capital targets while attempting to extend our mine lives through development and exploration programs. We also consider acquisitions or other arrangements in the normal course which strategically fit our future growth objectives. We have an experienced management team, a strong financial position, a low-cost production profile, and high-quality assets located in mining-friendly jurisdictions.

Segment information

Our segments include Fire Creek, Midas, True North, Hollister, Aurora, and Corporate and other. The Fire Creek, Midas, True North, Hollister, and Aurora segments include the operations, development, and exploration activities of each respective segment. The Corporate and other segment includes general and administrative costs of the Company. Our segments generally have revenues, earnings or losses, or assets exceeding 10% of the respective consolidated totals, and each segment is individually reviewed by our Chief Executive Officer to make decisions about resources to be allocated to the segments and to assess their performance. See Note 20. Segment information to the Notes to Consolidated Financial Statements for additional information on our segments.

1

Principal products and market overview

Principal products and revenues

During 2016, our principal products were produced at Fire Creek, Midas, and True North and consisted of gold and silver doré bars which were sent to a third-party refiner to produce bullion that met the required market standards of 99.95% pure gold and 99.90% pure silver before being sold to financial institutions and precious metals traders. Under the terms of our refining agreements, doré bars are refined for a fee, and the separately-recovered gold and silver ounces are credited to our account or, at our instruction, delivered to our buyers' accounts.

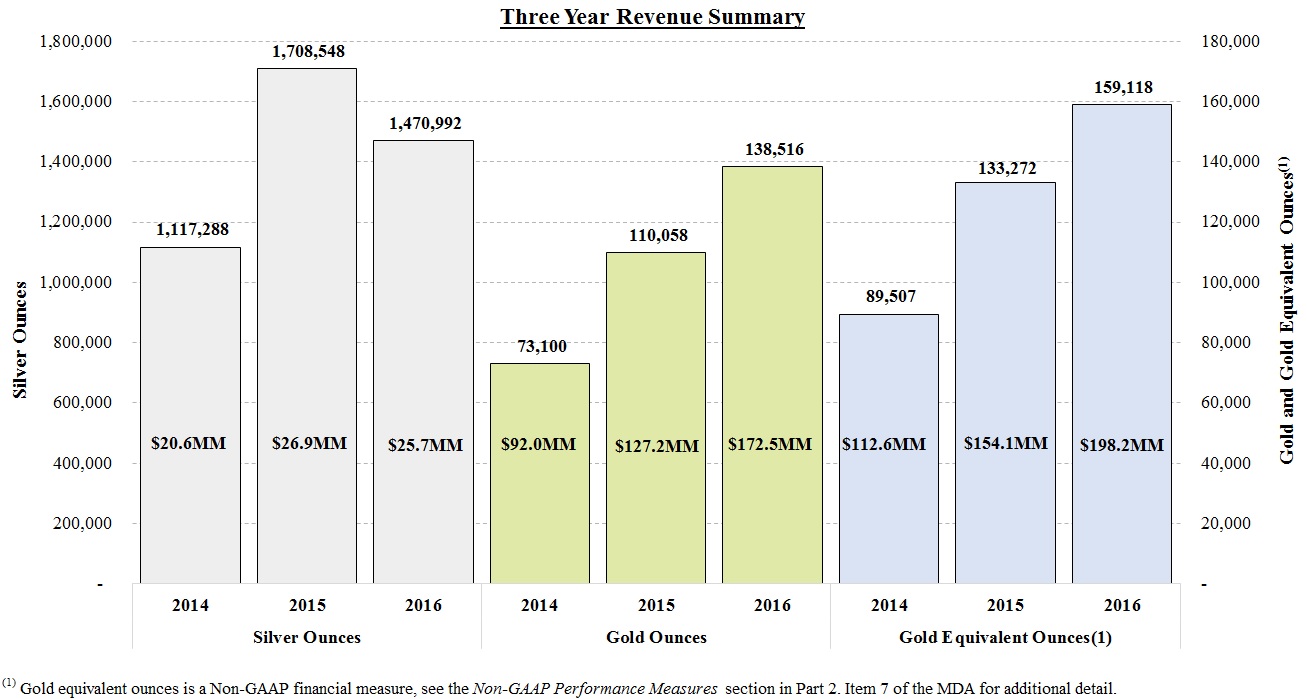

In 2016, 2015, and 2014, revenues from gold and silver made up 87.1% and 12.9%, 82.6% and 17.4%, and 81.7% and 18.3%, respectively, of our total revenue and, as such, we currently consider gold to be our principal product. We expect gold and silver sales to be our only source of future revenues. The following charts provide details about our ounces sold and associated revenues for the last three years (revenue labels within bars in millions):

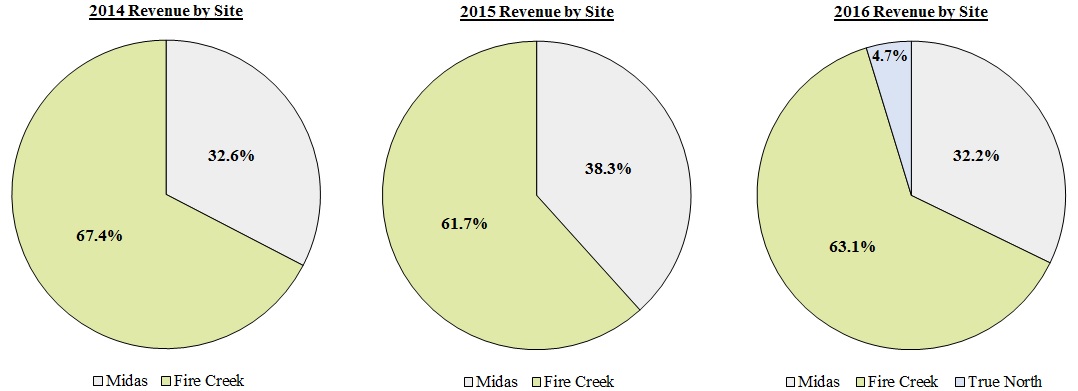

The following charts provide details about the percentage of revenue by site for the last three years:

2

Principal product uses and prices

Generally, gold and silver have two main categories of use: fabrication and investment. Fabricated precious metals have a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions, and coins. Investors buy gold and silver bullion, coins, and jewelry as investments. Gold prices and silver prices are volatile and are affected by many factors beyond our control, such as sales or purchases by central banks and financial institutions, inflation or deflation and monetary policies, fluctuation in the value of the US dollar and foreign currencies, global and regional demand, and political and economic conditions of countries throughout the world.

The following table presents the annual high, low, and average afternoon fixing prices for gold and silver over the past three years on the London Bullion Market ("LBMA") compared to our average realized sales prices (in U.S. dollars per ounce):

Gold | Silver | |||||||||||||||||||||||

Year | High | Low | Average | High | Low | Average | ||||||||||||||||||

2014 LBMA | $ | 1,385 | $ | 1,142 | $ | 1,266 | $ | 22.05 | $ | 15.28 | $ | 19.08 | ||||||||||||

2014 Klondex Average | 1,258 | 18.47 | ||||||||||||||||||||||

2015 LBMA | 1,296 | 1,049 | 1,160 | 18.23 | 13.71 | 15.68 | ||||||||||||||||||

2015 Klondex Average | 1,156 | 15.72 | ||||||||||||||||||||||

2016 LBMA | 1,366 | 1,077 | 1,251 | 20.71 | 13.58 | 17.14 | ||||||||||||||||||

2016 Klondex Average | 1,245 | 17.44 | ||||||||||||||||||||||

On March 21, 2017, the afternoon fixing prices for gold and silver on the London Bullion Market were $1,242 per ounce and $17.31 per ounce, respectively.

Major customers

We have historically sold our metal to five customers. Because our metal is refined to produce bullion that meets the required market standards, we believe the loss of any one of our customers would not adversely affect our ability to sell due to the liquidity of gold and silver markets and the availability of alternative trading counterparties. See Note 20. Segment information to the Notes to Consolidated Financial Statements for a listing of revenues by customer.

Employees and contractors

None of our employees are represented by unions. The estimated number of employees and contractors employed by us as at December 31, 2016 was as follows:

Segment | Employees | Contractors | Total | ||||||

Fire Creek | 70 | 116 | 186 | ||||||

Midas | 138 | 124 | 262 | ||||||

True North | 139 | 135 | 274 | ||||||

Hollister | 8 | 39 | 47 | ||||||

Aurora | 5 | — | 5 | ||||||

Corporate and other | 40 | — | 40 | ||||||

Total | 400 | 414 | 814 | ||||||

Competition

We compete with other mining companies that operate in a general proximity to our mines, some of which are larger and better capitalized, for skilled employees and contractors residing in small communities like Winnemucca, Nevada, Elko, Nevada, and Bissett, Manitoba, Canada. Although we have not historically experienced such, material shortages of skilled employees could lead to production inefficiencies and/or additional costs.

From time-to-time certain production inputs have been in short supply. Shortages of production supplies and raw materials rarely lead to operational issues, but would require us to either substitute with lower quality supplies or to ship these supplies from longer distances. These substitutions and changes could result in production inefficiencies and/or additional costs. To date, we have not experienced any material shortages in production inputs.

3

Mine safety and health

Despite high-levels of health and safety performance, our philosophy is one of "continuous improvement" combined with a belief that "the miner is the most important thing to come out of a mine." We have mandatory mine safety and health programs that include employee and contractor training, risk management, workplace inspection, emergency response, accident investigation and program auditing. We consider these programs to be essential at all levels to ensure that our employees, contractors, and visitors operate safely.

During 2016, we had no lost-time injuries at our properties and as of December 31, 2016, had operated 1,539 days (~4.0 years) at Fire Creek, 815 days (~2.0 years) at Midas, 344 days (~0.7 years) at True North, and 89 days (~0.3 years) at Hollister and Aurora, without a lost-time injury.

Our United States operations and exploration properties are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). MSHA inspects our mines on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. The Dodd-Frank Act requires us to provide a mine safety disclosure, which we have done in Part I-Item 4. Mine Safety Disclosure of this Form 10-K.

Government regulation of mining-related activities

Government and environmental regulation

Our exploration and development activities are subject to various national, state, provincial and local laws and regulations in the United States and Canada, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our exploration and development programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and regulations in the United States and Canada. For a more detailed discussion of the various government laws and regulations applicable to our operations and potential negative effects of these laws and regulations, see section Item 1A. Risk Factors - Environmental and Regulatory Risks, below.

Available information

We maintain an internet website at www.klondexmines.com. Through the "Investors" section of the website, we make available, free of charge, any previously filed annual and quarterly reports on Forms 10-K and 10-Q and current reports on Form 8-K, and all amendments to those reports, as soon as reasonably practical after such material is electronically filed or furnished with the SEC. We do not currently make available our Current Reports on Form 8-K on our website, but we will provide you with electronic or paper copies of such reports free of charge (not including any exhibits thereto) upon written request to Klondex Mines Ltd., 6110 Plumas Street, Suite A, Reno, Nevada 89519 Attn: Investor Relations. Our website does not currently contain Interactive Data Files filed or furnished pursuant to Rule 405 of Regulation S-T as we will begin, and be subject to, such filings with the Quarterly Report on Form 10-Q for the three months ended March 31, 2017. In addition, our "Code of Ethics, Trading Restrictions, and Whistleblowing" policy as well as the charters of key committees of our Board are also available on our web site. Our website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this Annual Report on Form 10-K.

You may also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Copies of such materials also can be obtained free of charge at the SEC’s website, www.sec.gov, or by mail from the Public Reference Room of the SEC, at prescribed rates. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

Item 1A. Risk Factors

Any investment in Klondex involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this Annual Report on Form 10-K when making an investment decision related to the Company. Our operations and financial results are subject to various risks and uncertainties, including those described below, that could materially adversely affect our business, financial condition, results of operations, cash flows and the trading price of our securities. The risks described below are not the only ones we face and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business.

The risk factors described below are grouped into the following categories: Financial, Operational, Environmental and Regulatory, and Other.

Financial Risks

Extended declines in the prices of gold and silver would have a material adverse effect on our earnings and cash flows and our ability to repay our outstanding debt as it comes due. Fluctuations in the prices of gold and silver can cause significant volatility in our financial performance and materially and adversely affect the trading prices of our securities.

4

Our core business is dependent on the prices of gold and silver, which are highly volatile and are affected by numerous factors beyond our control. During the year ended December 31, 2016, the low-high prices per ounce of gold and silver ranged from $1,077-$1,366 and $13.58-$20.71, respectively. Factors tending to influence such metals prices include the following:

• | the rates of global economic growth; |

• | industrial and retail demand, including worldwide demand for products containing gold and silver; |

• | short-term changes in supply and demand because of speculative hedging activities; |

• | worldwide supply of these metals including the expected near-term supply from new mine sources; |

• | the availability and cost of substitute materials; |

• | inventory levels; |

• | the industry production cost curve and the expected cost to develop new sources of supply; |

• | expectations with respect to the rate of inflation; |

• | the relative strength of the US dollar (the currency in which the prices of gold and silver are generally quoted), the Canadian dollar and certain other currencies; |

• | interest rates; |

• | global or regional political conditions, including terrorism and war; |

• | global or regional economic conditions, including interest rates, central bank lending and currency values; and |

• | sales by central banks and other holders, speculators and producers in response to any of the above factors. |

The Company historically has not entered into material, long-term hedging arrangements for gold and silver prices longer than 12 months and even if such hedging transactions were entered into, there can be no assurance that the intent to reduce the risk associated with fluctuations in metal prices will be successful.

Any decline in the prices of gold or silver adversely impacts our revenues, net earnings (loss), cash flows, and credit quality and could affect our ability to make necessary capital investments, repay our debt and meet our debt service and other fixed obligations, and depress the trading prices of our securities. Sustained declines in prices could also:

• | cause us to revise our operating plans, resulting in reduced output, the placement of our mines on care and maintenance or closure of one or more of our mines or other facilities; |

• | further reduce revenues through production declines due to cessation of mining of deposits that have become uneconomic; |

• | reduce funds available for capital expenditures; |

• | delay or prevent our ability to make accretive acquisitions or conduct exploration work; |

• | reduce existing reserves due to economic viability; and |

• | cause us to write down assets and accelerate depletion, reclamation and closure charges. |

Substantial leverage and debt service obligations may adversely affect our cash flows, liquidity and operations.

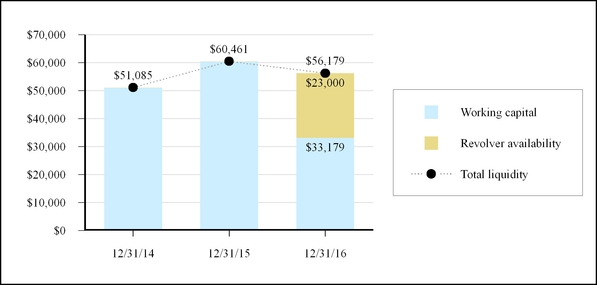

As of December 31, 2016, the aggregate consolidated carrying value of our indebtedness totaled approximately $30.2 million, consisting of $18.0 million for the Gold Purchase Agreement (as defined herein), $11.2 million outstanding under our Revolver (as defined in Note 8. Debt to the Notes to Consolidated Financial Statements), and $1.1 million for capital lease obligations. During the year ended December 31, 2016, we recorded $5.3 million of interest expense, net to service our indebtedness. Our ability to make scheduled payments of the principal of, to pay interest on, or to refinance our indebtedness depends on our future performance, which is subject to economic, financial, competitive and other factors many of which are not under our control. Liquidity risk is the risk that we will not be able to meet our financial obligations as they become due, including, among others, debt repayments, interest payments and contractual commitments. We may not continue to generate cash flow from operations in the future sufficient to service the debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations. In addition, much of our debt is secured by our subsidiaries or operating assets, and a default would result in the right of our lenders to enforce that security.

From time to time, debt instruments to which we are or may become party may require us to satisfy various affirmative and negative covenants and to meet certain financial ratios and tests, as further described in Note 8. Debt to the Notes to Consolidated Financial Statements. These covenants may limit, among other things, our ability to incur further indebtedness, create certain liens on assets or engage in certain types of transactions. There are no assurances that, in the future, we will not, as a result of such covenants, be limited in our ability to respond to changes in business or competitive activities or be restricted in our ability to engage in mergers, acquisitions

5

or dispositions of assets. Furthermore, a failure to comply with such covenants could result in an event of default under the debt instruments and may allow the lenders thereunder to accelerate repayment obligations or enforce security (if any).

An extended decline in prices of gold and silver, an increase in operating or capital costs, or a reduction in mineral resource or mineral reserve estimates, among other things, may cause us to record write-downs to long-lived assets or asset groups or production-related inventories, which could negatively impact our results of operations.

When events and circumstances indicate that the carrying amount of our long-lived assets or production-related inventories may not be recoverable or realizable, we evaluate such pursuant to our United States generally accepted accounting principles ("U.S. GAAP") accounting policies which are described in Note 2. Summary of significant accounting policies to the Notes to Consolidated Financial Statements. The economic environment, gold and silver prices, operating margins, projections of future results and costs, and our share price may be used when considering impairment indicators or net realizable value thresholds for purposes of applying our accounting policies. We may incur write-downs in the future if commodity prices experience a sustained decline, if there are significant downward adjustments to estimates of recoverable quantities to be produced from estimated proven and probable mineral reserves or production quantities and if there are upward adjustments to estimated operating costs and capital expenditures and/or changes in CDN$ to USD$ foreign exchange rates, all based on life-of-mine plans and projections. Asset impairments and production-related inventory write-downs have an adverse impact on our results of operations and may negatively limit our ability to obtain any additional financing and could decrease the outlook of our share price performance.

As discussed in Note 5. Inventories to the Notes to Consolidated Financial Statements, the application of our lower of average cost or net realizable value accounting policy resulted in write-downs to production inventories of $2.9 million, $1.2 million, and nil during the years ended December 31, 2016, 2015, and 2014, respectively. We did not experience any impairments of long-lived assets during the years ended December 31, 2016, 2015, and 2014.

Mine closure and reclamation costs for environmental liabilities may exceed the provisions we have made and our inability to provide reclamation bonding or maintain insurance could adversely affect our operating results and financial condition.

As of December 31, 2016, our asset retirement obligations totaled $25.4 million, the amount of which represents a discounted cash flow estimate of future expenditures required to reclaim disturbed areas. We are required by United States federal and state laws and Canadian federal and provincial laws to provide financial assurance sufficient to allow a third party to implement approved closure and reclamation plans if we are unable to do so. These laws are complex and vary from jurisdiction to jurisdiction. The laws govern the determination of the scope and cost of the closure and reclamation obligations and the amount and forms of financial assurance. The amount and nature of the financial assurances are dependent upon a number of factors, including our financial condition and reclamation cost estimates.

As of December 31, 2016, we had in place surety bonds totaling $48.2 million, which were partially collateralized by restricted cash totaling $10.0 million. As our operations expand or reclamation expenses increase, our reclamation obligations and the financial assurances that we are required to provide may increase accordingly. In addition, any perceived challenges to our liquidity may cause our surety bond holders to increase the amount of cash collateral required or refuse to provide the same level of surety bonding going forward. On December 1, 2016, the United States Environmental Protection Agency proposed the Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA") regulations requiring mining companies to obtain supplemental financial assurance beyond the current bonding requirements administered by federal and state agencies. Increases in our reclamation obligations and financial assurances, as well as the nature of the security to be provided, could significantly increase our costs, making the maintenance and development of existing and new mines less economically feasible. To the extent that the value of the security provided to the regulatory authorities is or becomes insufficient to cover the amount of financial assurance we are required to post, we may be required to replace or supplement the existing security with more expensive forms of security, which might include cash deposits, which would reduce our cash available for operations and financing activities.

In addition, the costs of surety bonds and financial assurance have fluctuated in recent years while the market terms of such bonds and financial assurance have generally become less favorable to mine operators. These changes in the terms of the bonds and financial assurance have been accompanied at times by a decrease in the number of companies willing to issue surety bonds and financial assurance. Increased costs related to surety bonds and financial assurance could have a material adverse effect on our financial condition and liquidity.

Our operations may require further capital, and current global financial conditions and volatility may negatively impact our ability to obtain such further capital.

During the year ended December 31, 2016, our cash expenditures for plant, equipment and mine development totaled $61.7 million and during 2017 we expect to spend $57 - $62 million on capital expenditures, $7 - $9 million on Hollister development, and $3 - $5 million on regional exploration. The mining, processing, development and exploration of our properties may require substantial additional financing above and beyond what we currently expect in 2017 and later years. Current global financial conditions have been subject to significant volatility, and access to public financing, particularly for resource companies, has been negatively impacted in recent years. These factors may impact our ability to obtain equity or debt financing in the future and additional financing may not be available if needed or, if available, the terms of such financing may be unfavorable to us. Failure to obtain sufficient financing may

6

result in the delay or indefinite postponement of exploration, development or production on any or all of our properties, or even a loss of property interest.

Our operations are subject to currency fluctuations, which could adversely affect our results of operations and financial condition.

Exchange rate fluctuations may affect the costs that we incur in our operations. Gold and silver are typically sold throughout the world based principally on the U.S. dollar price, but a portion of our metal sales and operating expenses incurred at True North and our corporate headquarters are principally in Canadian dollars. As a result, we are subject to foreign exchange risks relating to the relative value of the U.S. dollar as compared to the Canadian dollar. The appreciation of the Canadian dollar against the US dollar can increase the cost of our production and capital expenditures in US dollars, and our results of operations and financial condition could be materially adversely affected.

We may engage in certain gold, silver and commodity hedging activities which may reduce the realized prices we receive for our gold and silver and may involve credit risk, market liquidity risk and unrealized mark-to-market risk.

From time to time, we may use certain derivative products to hedge or manage the risks associated with changes in gold prices, silver prices or consumable prices. There is no assurance that any hedging program or transactions which we may adopt or utilize in order to reduce the risk associated with changes in gold prices, silver prices or consumable prices will be successful. Although hedging may protect us from an adverse price change, it may also prevent us from benefiting fully from a positive price change. Our hedging activities or similar transactions could impact our earnings in various ways, including recognition of certain mark-to-market gains and losses on derivative instruments. The fair value of our derivative instruments could fluctuate significantly between periods. During the year ended December 31, 2016, we recorded losses on forward metal sales of $3.7 million.

We entered into a Gold Purchase Agreement with Franco-Nevada GLW Holdings Corp., a subsidiary of Franco-Nevada Corporation, on February 11, 2014 (the "Gold Purchase Agreement"), pursuant to which we have agreed to deliver an aggregate of 38,250 ounces of gold on a monthly basis over a five-year period ending on December 31, 2018. Under the terms of the Gold Purchase Agreement, we are required to deliver an annual amount of 8,000 ounces of gold in each of 2017 and 2018. In addition, we entered into a Gold Offering Agreement with Waterton Global Value, L.P. (“Waterton”), dated March 31, 2011, as amended and restated October 4, 2011 (the "Gold Supply Agreement"), in which we granted Waterton the right to purchase refined bullion (as defined therein) produced from Fire Creek, on a monthly basis, for a five-year period ending February 28, 2018. In the event that Waterton exercises its purchase right, the purchase price is calculated as the average afternoon settlement price per gold ounce on the LBMA for the 30 days immediately preceding the relevant pricing date. Our obligations relating to delivery of gold ounces under each of the Gold Purchase Agreement and the Gold Supply Agreement may require us to engage in hedging activities from time to time. During the year ended December 31, 2016, we recorded losses on the Gold Purchase Agreement and Gold Offering Agreement of $2.2 million and $1.1 million, respectively.

Generally, the use of derivative instruments involves certain inherent risks, including, among other things:

• | credit risk - the risk of an unexpected loss arising if a counterparty with which we have entered into transactions fails to meet its contractual obligations; |

• | market liquidity risk - the risk that we have entered into a derivative position that cannot be closed out quickly, by either liquidating such derivative instrument or by establishing an offsetting position; and |

• | unrealized mark-to-market risk - the risk that, in respect of certain derivative products, an adverse change in market prices for commodities, currencies or interest rates will result in our incurring an unrealized mark-to-market loss in respect of such derivative products. |

Forecasts of future production are estimates and actual production may be less than estimated.

Forecasts of future production are estimates based on interpretation and assumptions and actual production may be less than estimated. We prepare estimates of future production for our operating mines. Our ability to achieve and maintain the production rates on which such estimates are based is subject to a number of risks and uncertainties. Our production estimates are dependent on, among other things, the accuracy of mineral reserve estimates, the accuracy of assumptions regarding ore grades and recovery rates, ground conditions, physical characteristics of ores, such as hardness and the presence or absence of particular metallurgical characteristics, and the accuracy of estimated rates and costs of mining and processing. Our actual production may vary from our estimates for a variety of reasons. Any possible failure to achieve our production estimates could have a material adverse effect on our results of operations and financial condition.

There is no guarantee that anticipated production costs will be achieved at our mineral projects. Failure to achieve anticipated production costs may have a material adverse impact on our ability to repay certain loans and generate revenue and cash flow to fund operations and future profitability.

Operational Risks

Our business is subject to production and operational risks that could adversely affect our business and our insurance may not cover these risks and hazards adequately or at all.

7

Mining and metals processing involve significant production and operational risks normally encountered in the exploration, development and production of gold and other base or precious metals, some of which are outside of our control, including, without limitation, the following:

• | unanticipated ground and water conditions; |

• | adverse claims to water rights and shortages of water to which we have rights; |

• | adjacent or adverse land or mineral ownership that results in constraints on current or future mine operations; |

• | geological problems, including seismic activity, earthquakes and other natural disasters; |

• | metallurgical and other processing problems; |

• | unusual or unexpected mineralogy or rock formations; |

• | ground or slope failures; |

• | tailings design or operational issues, including dam breaches or failures; |

• | structural cave-ins, wall failures or rock-slides; |

• | flooding or fires; |

• | equipment failures; |

• | periodic interruptions due to inclement or hazardous weather conditions or operating conditions and other force majeure events; |

• | lower than expected ore grades or recovery rates; |

• | accidents; |

• | delays in the receipt of or failure to receive necessary government permits; |

• | the results of litigation, including appeals of agency decisions; |

• | delays in transportation; |

• | interruption of energy supply; |

• | labor disputes; |

• | inability to obtain satisfactory insurance coverage; |

• | the availability of drilling and related equipment in the area where mining operations will be conducted; and |

• | the failure of equipment or processes to operate in accordance with specifications or expectations. |

These risks could result in damage to, or destruction of, our mines and milling facilities, resulting in partial or complete shutdowns, personal injury or death, environmental or other damage to our properties or the properties of others, delays in mining, reduced production, monetary losses and potential legal liability. Milling operations are subject to hazards, such as equipment failure or failure of retaining dams around tailings disposal areas that may result in personal injury or death, environmental pollution and consequential liabilities.

In addition, we rely on a few key vendors for our operations. A breach of the applicable contract by any of these vendors, a significant dispute with any of these vendors, a force majeure event or other operational or financial issues affecting one or more of these vendors, including labor strikes or work stoppages, or any other event that would significantly impede the ability of these vendors to perform their contractual obligations to us or that would have a significant negative impact on our contractual relationship with them would adversely affect our ability to produce our primary products, which could have a material impact on our financial condition and results of operations.

Our insurance will not cover all the potential risks associated with our operations. In addition, although certain risks are insurable, we may be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or, if available, may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration, development and production may be prohibitively expensive to obtain for a company of our size and financial means. We might also become subject to liability for pollution or other hazards against which we may not be insured or against which we may elect not to insure because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our business, financial condition and results of operations. Furthermore, should we be unable to fund fully the cost of remedying an environmental problem, we might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy.

We are dependent on the success of the Fire Creek Mine, the Midas Mine and mill and the True North Mine and mill.

Our principal operations are the Fire Creek Mine and the Midas Mine, both in Nevada, and the True North Mine in Canada. We are primarily dependent upon the success of these mines and continual operation of their mills as sources of future revenue and profits. The continued development or expansion of mining operations at these mines may require the commitment of substantial additional

8

resources for operating expenses and capital expenditures, which may increase in subsequent years as needed, and for consultants, personnel and equipment associated with additional development and commercial production of such properties.

The development of Hollister may require substantial investment.

The exploration, development and anticipated commercial production at Hollister will require substantial additional financing. During 2017, we expect to spend between $7 - $9 million in development at Hollister. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, development or production at Hollister. Additional capital or other types of financing may not be available if needed or, if available, the terms of such financing may be unfavorable to us.

Our exploration activities may not be commercially successful.

Our long-term success depends on our ability to identify additional mineral deposits that we can develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold exploration is determined in part by the following factors:

• | the identification of potential gold mineralization; |

• | the availability of government-granted exploration permits; |

• | the quality of management and geological and technical expertise; and |

• | the capital available for exploration. |

Substantial expenditures are required, but not guaranteed, to establish mineral proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which may fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. There is no certainty that we will discover or acquire any mineralized material in sufficient quantities to justify continued commercial operations at Fire Creek, Midas or True North or to justify operations at any of our other properties.

Increased operating costs could affect our profitability.

Costs at any particular mining location are subject to variation due to a number of factors, such as changing ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs at our mining locations may be affected by the price of input commodities, such as fuel, electricity, labor, chemical reagents, grinding media, mill liners, explosives, steel and concrete. The costs of our operating consumables are, at times, subject to volatile price movements, including increases that could make production at certain operations less profitable and changes in laws and regulations affecting their price, use and transport. Reported costs may also be affected by changes in accounting standards. A material increase in costs at any particular mining location could have a significant effect on our profitability and operating cash flow.

Our mining production depends on the availability of sufficient water supplies.

Our operations require significant quantities of water for mining, ore processing and related support facilities. Continuous production at our mines depends on our ability to maintain our water rights and claims. Although our current operations have sufficient water rights and claims to cover current operational demands, we cannot predict the potential outcome of future legal proceedings affecting our water rights, claims and uses. The failure to obtain needed water permits, the loss of some or all water rights for any of our mines, in whole or in part, or shortages of water to which we have rights due to weather, equipment issues or other factors could require us to curtail or close mining production and could prevent us from pursuing expansion opportunities.

A temporary or extended shutdown of any of our operations could expose us to significant costs and adversely affect our access to skilled labor.

From time to time, we may have to temporarily shut down one or more of our operating sites or place one or more of our operating sites on care and maintenance or permanent shutdown, if they are not commercially viable due to factors such as declines in metal prices, increased costs or adverse changes in interest rates or currency exchange rates. During temporary shutdowns or while a site is on care and maintenance, we will have to continue to expend capital to maintain the site or facility and equipment. In addition, reductions in workforce, advance notice requirements under collective labor agreements or applicable law, and severance obligations arising from such suspension or shutdown could cause us to incur significant labor costs. Furthermore, temporary or extended shutdowns may adversely affect our future access to skilled labor, as employees who are laid off may seek employment elsewhere.

In addition, if our operations are shut down for an extended period of time, we may be required to engage in environmental remediation of the plant sites or accelerated reclamation of our mines, which would require us to incur additional costs. The costs of ramping up production at one of our operations following a temporary shutdown could be significant. Given the costs involved in a temporary

9

shutdown of our operations, we may instead choose to continue to operate those operations at a loss. Such a decision could have a material adverse effect on our results of operations and financial condition.

We are subject to substantial government regulation. Changes to regulation or more stringent implementation could have a material adverse effect on our results of operations and financial condition.

Our mining, processing, development and mineral exploration activities are subject to various laws governing prospecting, development, production, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Mining and exploration activities are also subject to various laws and regulations relating to the protection of the environment, such as the federal Clean Water Act and the Nevada Water Pollution Control Law. Although we currently believe that we are in compliance with existing environmental and mining laws and regulations and that our proposed exploration programs will also meet those standards, no assurance can be given that we will remain in compliance with applicable regulations or that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail production or development of our properties.

At present, there is no royalty payable to the United States or to the province of Manitoba on production from unpatented mining claims, although legislative attempts to impose a royalty have occurred in recent years. Amendments to current laws and regulations governing our operations and activities of exploration, development mining and milling or more stringent implementation thereof could have a material adverse effect on our business, financial condition and results of operations and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production or require delays or abandonment in the development of new mining properties.

In addition, we are required to expend significant resources to comply with numerous corporate governance and disclosure regulations and requirements adopted by U.S. federal and state and Canadian federal and provincial governments, as well as the TSX and NYSE MKT. These additional compliance costs and related diversion of the attention of management and key personnel could have a material adverse effect on our business, financial condition and results of operations.

Reform of the General Mining Law could adversely impact our results of operations.

A portion of our U.S. mining properties are on unpatented mining claims on federal lands. Legislation has been introduced regularly in the U.S. Congress over the last decade to change the General Mining Law of 1872, as amended (the "Mining Law"), under which we hold these unpatented mining claims. It is possible that the Mining Law may be amended or replaced by less favorable legislation in the future. Previously proposed legislation contained a production royalty obligation, new environmental standards and conditions, additional reclamation requirements and extensive new procedural steps which would likely result in delays in permitting. The ultimate content of future proposed legislation, if enacted, is uncertain. If a royalty on unpatented mining claims were imposed, the profitability of our U.S. operations could be materially adversely affected.

Any such reform of the Mining Law could increase the costs of mining activities on unpatented mining claims, or could materially impair our ability to develop or continue operations which derive ore from federal lands, and as a result, could have an adverse effect on us and our results of operations.

Mineral reserves are only estimates which may be unreliable.

Although mineralization may not be classified as a “reserve” unless the mineralization can be economically and legally extracted or produced at the time the “reserve” determination is made, “mineral reserves” are estimates only, and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that mineral reserves can be mined or processed profitably. Mineral reserve and mineral resource estimates may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing and other relevant issues. There are numerous uncertainties inherent in estimating mineral reserves and mineral resources, including many factors beyond our control. Such estimation is a subjective process, and the accuracy of any mineral reserve or mineral resource estimate is a function of the quantity and quality of available data, the nature of the ore body and of the assumptions made and judgments used in engineering and geological interpretation. These estimates may require adjustments or downward revisions based upon further exploration or development work or actual production experience.

Fluctuations in gold or silver prices, results of drilling, metallurgical testing and production, the evaluation of mine plans after the date of any estimate, permitting requirements or unforeseen technical or operational difficulties may require revision of mineral reserve estimates. Prolonged declines in the market price of gold or silver may render mineral reserves containing relatively lower grades of mineralization uneconomical to recover and could materially reduce our mineral reserves. Should reductions in mineral reserves occur, we may be required to take a material write-down of our investment in mining properties, reduce the carrying value of one or more of our assets or delay or discontinue production or the development of new projects, resulting in increased net losses and reduced cash flow. Mineral reserves should not be interpreted as assurances of mine life or of the profitability of current or future operations. There is a degree of uncertainty attributable to the calculation and estimation of mineral reserves and corresponding grades being mined and, as a result, the volume and grade of mineral reserves mined and processed and recovery rates may not be the same as currently anticipated. Any material reductions in estimates of mineral reserves, or of our ability to extract these mineral reserves, could have a material adverse effect on our results of operations and financial condition.

10

Estimates of mineral reserves, mineral resources and projected cash flows may prove to be inaccurate, which could negatively impact our results of operations and financial condition.

There are numerous uncertainties inherent in estimating mineral reserves and mineral resources and the future cash flows that might be derived from production of mineral reserves. Accordingly, any figures for mineral reserves and future cash flows contained in this Annual Report on Form 10-K are estimates only, including for Hollister which has no mineral reserves. Although we believe that the estimated mineral reserves and mineral resources at Fire Creek, Midas and True North have been delineated with appropriately spaced drilling, inherent variability exists between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances may have a positive effect and others may have a negative effect on mining and processing operations. In respect of mineral reserve and mineral resource estimates, no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that mineral reserves can be mined or processed profitably. The ore grade actually recovered may differ from the estimated grades of the mineral reserves.

In addition, actual future cash flows may differ materially from estimates. Estimates of mineral reserves and future cash flows to be derived from the production of such mineral reserves necessarily depend upon a number of variable factors and assumptions, including, among others, geological and mining conditions that may not be fully identified by available exploration data or that may differ from experience in current operations; historical production from the area compared with production from other producing areas; the assumed effects of regulation by governmental agencies and assumptions concerning metal prices; exchange rates; interest rates; inflation; operating costs; development and maintenance costs; reclamation and post-reclamation costs; and the availability and cost of labor, equipment, raw materials and other services required to mine and refine the ore. Market price fluctuations of gold and silver, as well as increased production costs or reduced recovery rates, may render mineral reserves containing relatively lower grades of mineralization uneconomical to recover and may ultimately result in a restatement of mineral reserves. We may be required to make significant downward revisions to estimates of mineral reserves and future cash flows to be derived from the production of such mineral reserves, if commodity prices experience a sustained decline. In addition, there can be no assurance that mineral recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

For these reasons, estimates of our mineral reserves contained in this Annual Report on Form 10-K, including classifications thereof based on probability of recovery, and any estimates of future cash flows expected from the production of those mineral reserves, prepared by different engineers or by the same engineers at different times may vary substantially. The actual volume and grade of mineral reserves mined and processed, and the actual cash flows derived from that production, may not be as currently anticipated in such estimates. If our actual mineral reserves or cash flows are less than our estimates, our results of operations and financial condition may be materially impaired.

Future growth depends on our ability to replenish our mineral reserves, which involves extending our mine lives through development and exploration and acquiring quality mining assets.

Our ability to replenish our mineral reserves is important to our long-term viability. Depleted mineral reserves can be replaced in several ways, including by expanding known ore bodies, locating new deposits or acquiring new mineral reserves from third parties. Exploration projects involve many risks, require substantial expenditures and may not result in the discovery of sufficient additional mineral deposits that can be mined profitably. Once a site with mineralization is discovered, it may take several years from the initial phases of drilling until production is possible, if ever, during which time the economic feasibility of production may change. As a result, there is no assurance that current or future exploration programs, and additional drilling at our existing operating mines, will be successful.

We also intend to grow our business by acquiring quality mining assets. However, our capital available for new exploration projects and acquisitions may be constrained. In addition, there can be no assurance that suitable acquisition opportunities will be identified or, if identified, that acquisitions will be consummated on favorable terms or at all. Our ability to identify, consummate and to integrate effectively any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources, competition from other mining companies and, to the extent necessary, our ability to obtain financing on satisfactory terms, or at all. In addition, we compete for attractive acquisition targets with other potential buyers that have more financial and other resources. There is a risk that depletion of reserves will not be offset by discoveries or acquisitions. As a result, we cannot provide assurance that our exploration, development or acquisition efforts will result in any new commercial mining operations or yield new mineral reserves to replace or expand current mineral reserves. If we are not able to replace depleted reserves, it could have a material adverse effect on our business, prospects, results of operations and financial position.

Certain of our mines and exploration properties are located on land that is or may become subject to traditional territory, title claims and/or claims of cultural significance by certain Native American tribes or Aboriginal communities and stakeholders, and such claims and the attendant obligations of the provincial and federal governments to those tribal or Aboriginal communities and stakeholders may affect our current and future operations.

Native American and Aboriginal interests and rights as well as related consultation issues may impact our ability to pursue exploration, development and mining at our U.S. and Canadian properties. There is no assurance that claims or other assertion of rights by tribal

11

or Aboriginal communities and stakeholders or consultation issues will not arise on or with respect to our properties or activities. These could result in significant costs and delays or materially restrict our activities. Opposition by Native American tribes or Aboriginal communities and stakeholders to our presence, operations or development on land subject to their traditional territory or title claims or in areas of cultural significance could negatively impact us in terms of public perception, costly legal proceedings, potential blockades or other interference by third parties in our operations, or court-ordered relief impacting our operations. In addition, we may be required to, or may voluntarily, enter into certain agreements with such Native American tribes or Aboriginal communities and stakeholders in order to facilitate development of our properties, which could reduce the expected earnings or income from any future production.

Shortages of critical parts, equipment and skilled labor may adversely affect our operations and development projects.

The mining industry has been impacted, from time to time, by increased demand for critical resources such as input commodities, drilling equipment, milling equipment, tires and skilled labor. These shortages have, at times, impacted the efficiency of our operations and resulted in cost increases and delays. Any such shortages, cost increases and delays in the future may adversely affect operating costs, capital expenditures and production and construction schedules.

We are required to obtain government approvals and permits in order to conduct operations.

Government approvals and permits are currently required in connection with all of our operations, and further approvals and permits may be required in the future. We must obtain and maintain a variety of licenses and permits, which include or cover without limitation, air quality, water quality, water rights, dam safety, fire safety, emergency preparedness, hazardous materials, mercury control, waste rock management, solid waste disposal, storm water runoff, water pollution control, water treatment, rights of way and tailings operations. Such licenses and permits are subject to change in regulations and in various operating circumstances. The duration and success of our efforts to obtain permits are contingent upon many variables outside of our control. Obtaining governmental approvals and permits may increase costs and cause delays depending on the nature of the activity to be permitted and the applicable requirements implemented by the permitting authority. There can be no assurance that all necessary approvals and permits will be obtained or timely obtained or that they would remain in effect if we were forced into a reorganization, bankruptcy or insolvency proceeding. In addition, there can be no assurance that, if obtained, the costs of the approvals and permits will not exceed our estimates or that we will be able to maintain such approvals and permits. To the extent such approvals or permits are required and not obtained or maintained, our operations may be curtailed, or we may be prohibited from proceeding with planned exploration, development or operation of our mineral properties.

Title to some of our mineral properties may be subject to other claims. Any impairment or defect in title could have a negative impact on our results of operations and financial condition.