Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PIERIS PHARMACEUTICALS, INC. | d326324d8k.htm |

Exhibit 99.1

Exhibit 99.1

Pieris Pharmaceuticals, Inc.

Nasdaq:PIRS

27th Annual Oppenheimer Healthcare Conference

Stephen Yoder, President & CEO

Forward Looking Statements

Statements in this presentation that are not descriptions of historical facts are forward-looking statements that are based on management’s current expectations and assumptions and are subject to risks and uncertainties. In some cases, you can identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or the negative of these terms or other comparable terminology. Factors that could cause actual results to differ materially from those currently anticipated include, without limitation, risks relating to the results of our research and development activities, including uncertainties relating to the discovery of potential drug candidates and the preclinical and clinical testing of our drug candidates; the early stage of our drug candidates presently under development; our ability to obtain and, if obtained, maintain regulatory approval of our current drug candidates and any of our other future drug candidates; our need for substantial additional funds in order to continue our operations and the uncertainty of whether we will be able to obtain the funding we need; our future financial performance; our ability to retain or hire key scientific or management personnel; our ability to protect our intellectual property rights that are valuable to our business, including patent and other intellectual property rights; our dependence on third-party manufacturers, suppliers, research organizations, testing laboratories and other potential collaborators; our ability to successfully market and sell our drug candidates in the future as needed; the size and growth of the potential markets for any of our approved drug candidates, and the rate and degree of market acceptance of any of our approved drug candidates; developments and projections relating to our competitors and our industry; our ability to establish collaborations; our expectations regarding the time which we will be an emerging growth company under the JOBS Act; our use of proceeds from this offering; regulatory developments in the U.S. and foreign countries; and other factors that are described more fully in our Annual Report on form 10-K filed with the SEC on March 23, 2016. In light of these risks, uncertainties and assumptions, the forward-looking statements regarding future events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements included in this presentation speak only as of the date hereof, and except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations.

Non-Confidential 2

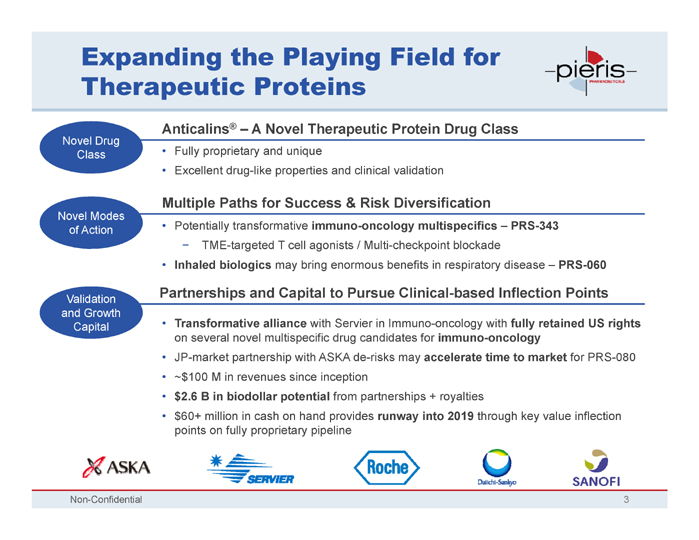

Expanding the Playing Field for

Therapeutic Proteins

Anticalins® – A Novel Therapeutic Protein Drug Class

Novel Drug

Class • Fully proprietary and unique

| • |

|

Excellent drug-like properties and clinical validation |

Multiple Paths for Success & Risk Diversification

Novel Modes of Action • Potentially transformative immuno-oncology multispecifics –PRS-343

- TME-targeted T cell agonists / Multi-checkpoint blockade

• Inhaled biologics may bring enormous benefits in respiratory disease –PRS-060

Partnerships and Capital to Pursue Clinical-based Inflection Points

Validation and Growth • Transformative alliance with Servier in Immuno-oncology with fully retained US rights

Capital on several novel multispecific drug candidates for immuno-oncology

| • |

|

JP-market partnership with ASKA de-risks may accelerate time to market for PRS-080 |

| • |

|

~$100 M in revenues since inception |

| • |

|

$2.6 B in biodollar potential from partnerships + royalties |

| • |

|

$60+ million in cash on hand provides runway into 2019 through key value inflection points on fully proprietary pipeline |

Non-Confidential 3

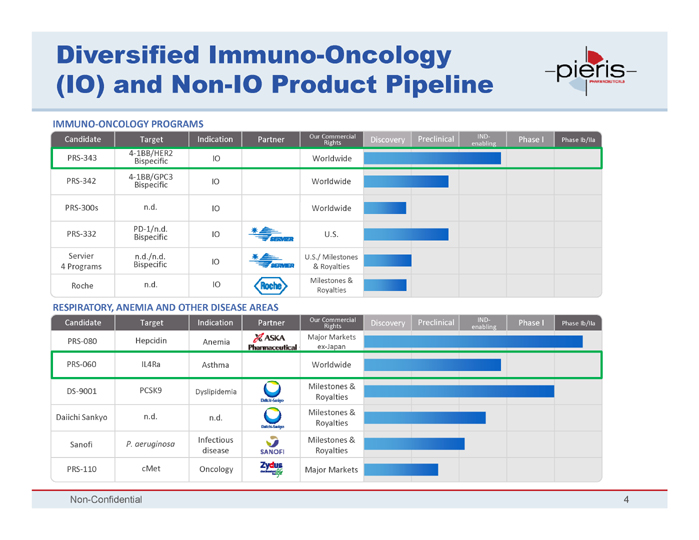

Diversified Immuno-Oncology (IO) and Non-IO Product Pipeline

IMMUNO?ONCOLOGY PROGRAMS

Our Commercial Preclinical IND?

Candidate Target Indication Partner Discovery Phase I Phase Ib/IIa

Rights enabling

4?1BB/HER2

PRS?343 Bispecific IO Worldwide 4?1BB/GPC3 PRS?342 IO Worldwide Bispecific

PRS?300s n.d. IO Worldwide

PD?1/n.d.

PRS?332 Bispecific IO U.S. Servier n.d./n.d. U.S./ Milestones Bispecific IO

4 Programs & Royalties Milestones &

Roche n.d. IO

Royalties

RESPIRATORY, ANEMIA AND OTHER DISEASE AREAS

Our Commercial Preclinical IND?

Candidate Target Indication Partner Discovery Phase I Phase Ib/IIa

Rights enabling

Major Markets

PRS?080 Hepcidin Anemia ex?Japan PRS?060 IL4Ra Asthma Worldwide

Milestones & DS?9001 PCSK9 Dyslipidemia Royalties Milestones & Daiichi Sankyo n.d. n.d. Royalties Infectious Milestones & Sanofi P. aeruginosa disease Royalties PRS?110 cMet Oncology Major Markets

Non-Confidential 4

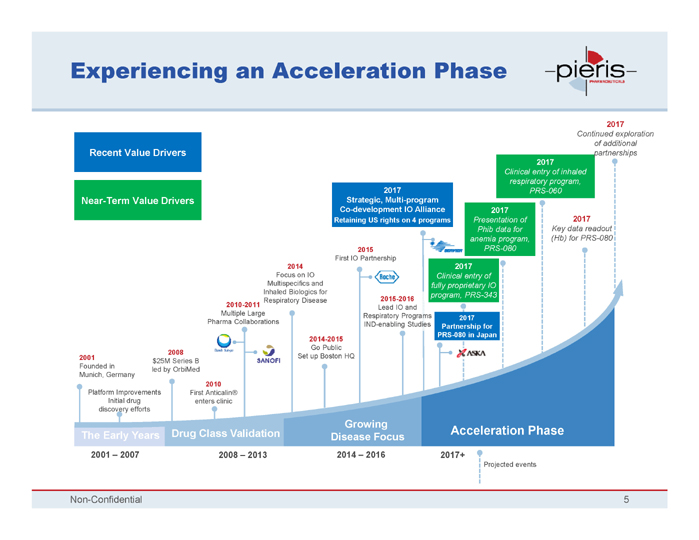

Experiencing an Acceleration Phase

2017

Continued exploration of additional

Recent Value Drivers partnerships

2017

Clinical e

ntry of inhaled respiratory program, 2017 PRS-060

Near-Term Value Drivers Strategic, Multi-program

Co-development IO Alliance 2017

Retaining US rights on 4 programs Presentation of 2017

Phib data f

or Key data readout anemia program, (Hb) for PRS-080 2015 PRS-080

First IO Partnership

2014 2017

Focus on IO Clinical entry of Multispecifics and fully proprietary IO

Inhaled Biologics for program, PRS-343

2010-2011 Respiratory Disease 2015-2016

Multiple Large Lead IO and

Pharma Collaborations Respiratory Programs 2017 IND-enabling Studies Partnership for PRS-080 in Japan 2014-2015

Go Public

2008

2001 Set up Boston HQ $25M Series B

Founded in led by OrbiMed Munich, Germany

2010

Platform Improvements First Anticalin® Initial drug enters clinic discovery efforts

Growing

The Early Years Drug Class Validation Acceleration Phase Disease Focus

2001 – 2007 2008 – 2013 2014 – 2016 2017+

Projected events

Non-Confidential 5

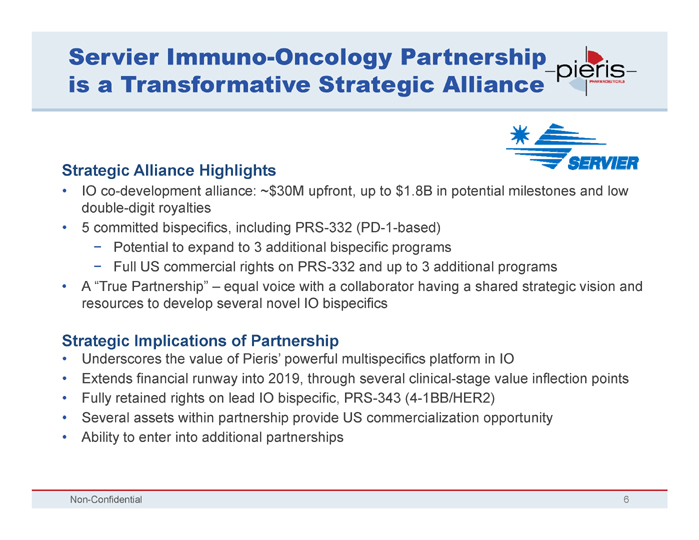

Servier Immuno-Oncology Partnership is a Transformative Strategic Alliance

Strategic Alliance Highlights

| • |

|

IO co-development alliance: ~$30M upfront, up to $1.8B in potential milestones and low double-digit royalties |

| • |

|

5 committed bispecifics, including PRS-332 (PD-1-based) |

- Potential to expand to 3 additional bispecific programs

- Full US commercial rights on PRS-332 and up to 3 additional programs

| • |

|

A “True Partnership” – equal voice with a collaborator having a shared strategic vision and resources to develop several novel IO bispecifics |

Strategic Implications of Partnership

| • |

|

Underscores the value of Pieris’ powerful multispecifics platform in IO |

| • |

|

Extends financial runway into 2019, through several clinical-stage value inflection points |

| • |

|

Fully retained rights on lead IO bispecific, PRS-343 (4-1BB/HER2) |

| • |

|

Several assets within partnership provide US commercialization opportunity |

| • |

|

Ability to enter into additional partnerships |

Non-Confidential 6

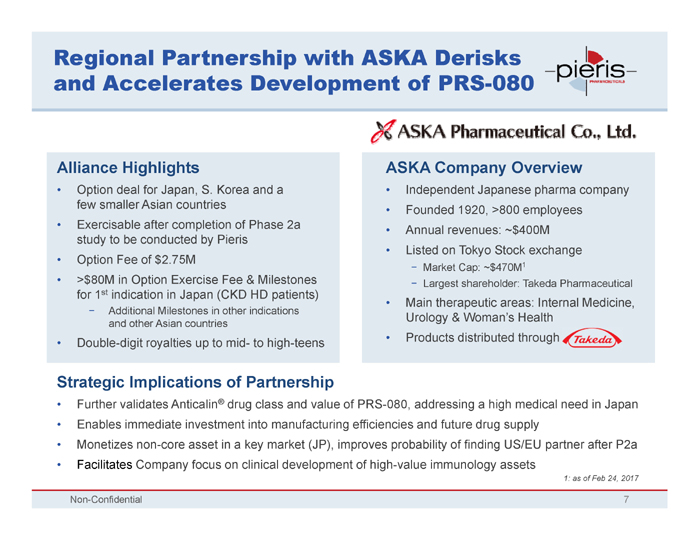

Regional Partnership with ASKA Derisks and Accelerates Development of PRS-080

Alliance Highlights ASKA Company Overview

| • |

|

Option deal for Japan, S. Korea and a Independent Japanese pharma company few smaller Asian countries Founded 1920, >800 employees |

| • |

|

Exercisable after completion of Phase 2a Annual revenues: ~$400M study to be conducted by Pieris |

| • |

|

Listed on Tokyo Stock exchange |

| • |

|

Option Fee of $2.75M |

- Market Cap: ~$470M1

| • |

|

>$80M in Option Exercise Fee & Milestones—Largest shareholder: Takeda Pharmaceutical for 1st indication in Japan (CKD HD patients) |

| • |

|

Main therapeutic areas: Internal Medicine, |

- Additional Milestones in other indications

Urology & Woman’s Health and other Asian countries

| • |

|

Double-digit royalties up to mid- to high-teens Products distributed through |

Strategic Implications of Partnership

| • |

|

Further validates Anticalin® drug class and value of PRS-080, addressing a high medical need in Japan |

| • |

|

Enables immediate investment into manufacturing efficiencies and future drug supply |

| • |

|

Monetizes non-core asset in a key market (JP), improves probability of finding US/EU partner after P2a |

| • |

|

Facilitates Company focus on clinical development of high-value immunology assets |

1: as of Feb 24, 2017

Non-Confidential 7

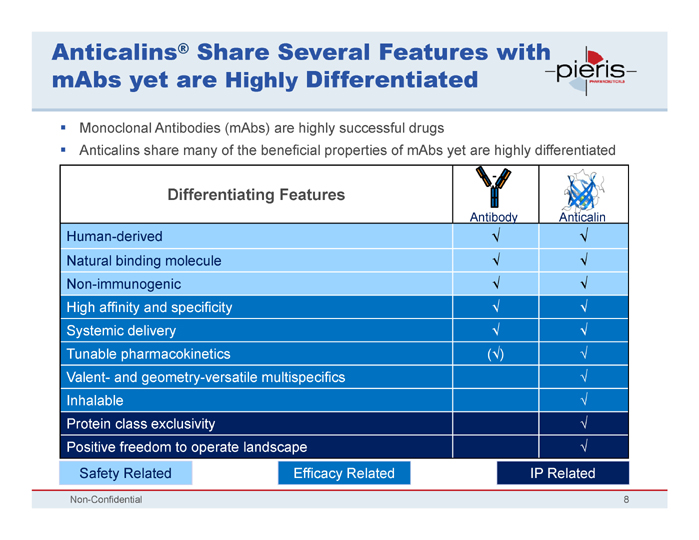

Anticalins® Share Several Features with mAbs yet are Highly Differentiated

? Monoclonal Antibodies (mAbs) are highly successful drugs

? Anticalins share many of the beneficial properties of mAbs yet are highly differentiated

Differentiating Features

Antibody Anticalin

Human-derived ?? Natural binding molecule ? ? Non-immunogenic ? ? High affinity and specificity ? ? Systemic delivery ? ? Tunable pharmacokinetics (?) ? Valent- and geometry-versatile multispecifics ? Inhalable ? Protein class exclusivity ? Positive freedom to operate landscape ? Safety Related Efficacy Related IP Related

Non-Confidential 8

Anticalins in Immuno-Oncology

Non-Confidential

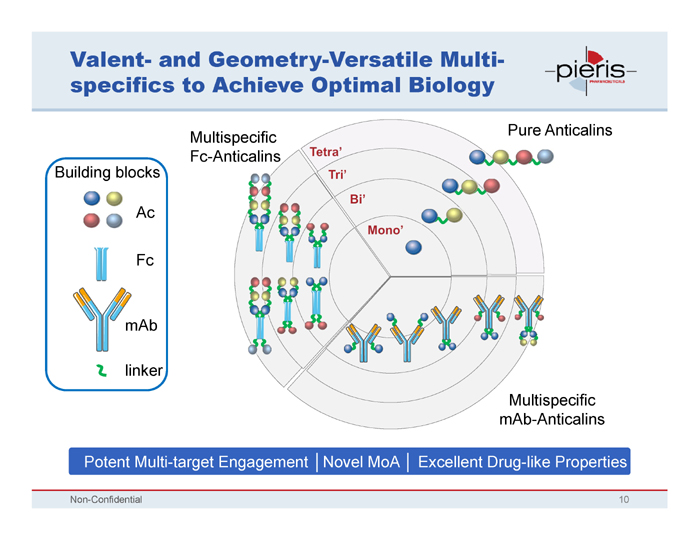

Valent- and Geometry-Versatile Multi-specifics to Achieve Optimal Biology

Pure Anticalins Multispecif

ic Fc-Anticalins Building bloc

ks

Ac

Fc

mAb

linker

Multispecific mAb-

Anticalins

? Potent Multi-target Engagement ?Novel MoA ? Excellent Drug-like Properties

Non-Confidential 10

pieris

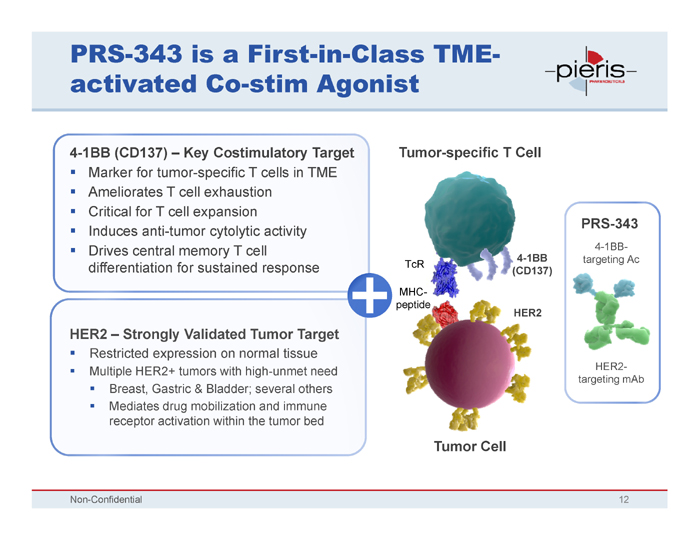

PRS-343 is a First-in-Class TME-activated Co-stim Agonist

4-1BB (CD137) – Key Costimulatory Target Tumor-specific T Cell

? Marker for tumor-specific T cells in TME? Ameliorates T cell exhaustion? Critical for T cell expansion? Induces anti-tumor cytolytic activity? Drives central memory T cell

4-1BB

differentiation for sustained response TcR

(CD137)

MHC-peptide

HER2

HER2 – Strongly Validated Tumor Target

? Restricted expression on normal tissue

? Multiple HER2+ tumors with high-unmet need? Breast, Gastric & Bladder; several others? Mediates drug mobilization and immune receptor activation within the tumor bed

Tumor Cell

Non-Confidential 12

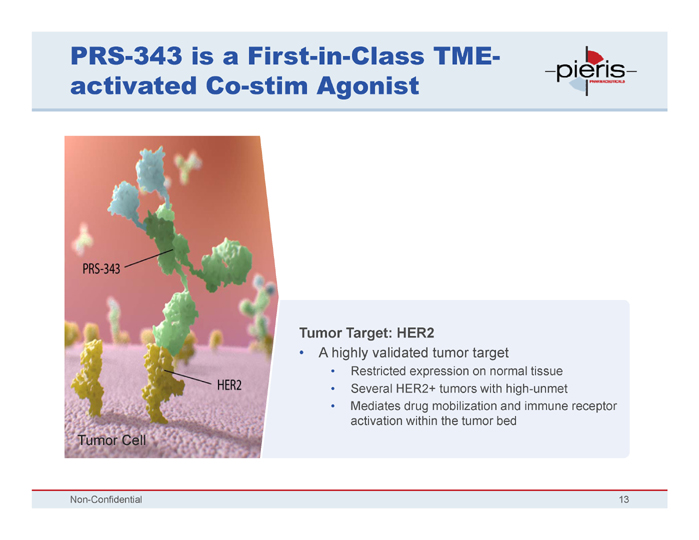

PRS-343 is a First-in-Class TME-activated Co-stim Agonist

Tumor Target: HER2

| • |

|

A highly validated tumor target |

| • |

|

Restricted expression on normal |

| • |

|

Several HER2+ tumors with high- |

| • |

|

Mediates drug mobilization and activation within the tumor bed |

Tumor Cell

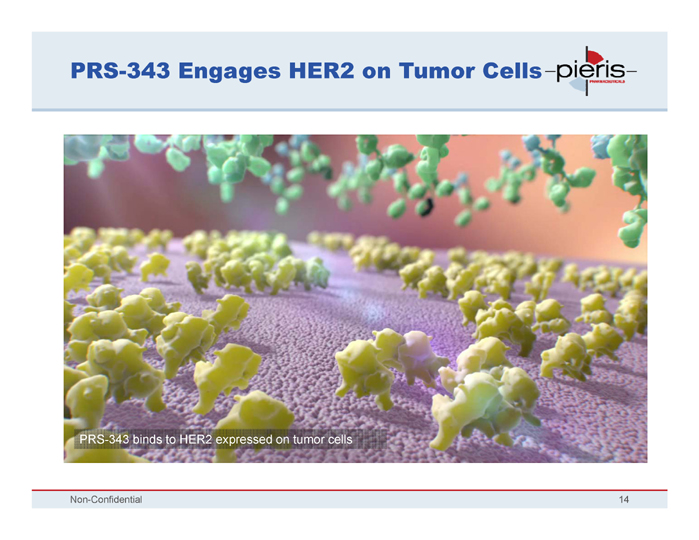

PRS-343 Engages HER2 on Tumor Cells

PRS-343 binds to HER2 expressed on tumor cells

Non-Confidential 14

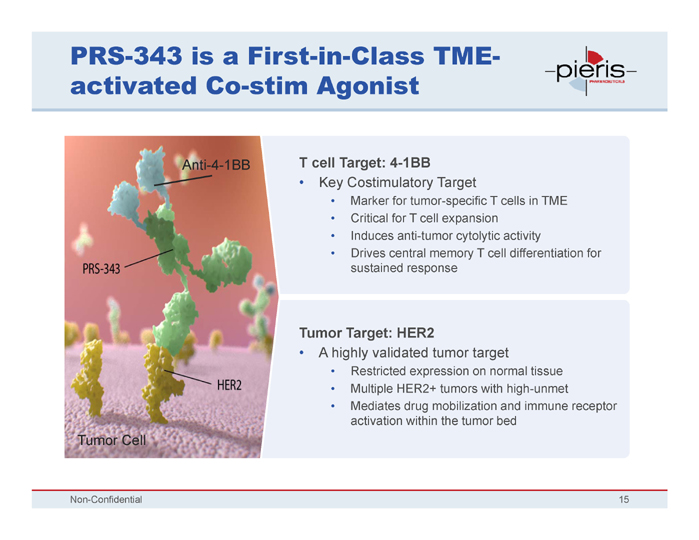

PRS-343 is a First-in-Class TME-activated Co-stim Agonist

Anti-4-1BB T cell Target: 4-1BB

| • |

|

Key Costimulatory Target |

| • |

|

Marker for tumor-specific T cells in TME |

| • |

|

Critical for T cell expansion |

| • |

|

Induces anti-tumor cytolytic activity |

| • |

|

Drives central memory T cell differentiation for sustained response |

Tumor Target: HER2

| • |

|

A highly validated tumor target |

| • |

|

Restricted expression on normal tissue |

| • |

|

Multiple HER2+ tumors with high-unmet |

| • |

|

Mediates drug mobilization and immune receptor activation within the tumor bed |

Tumor Cell

Non-Confidential 15

4-1BB Engagement by PRS-343, Alone, Does Not Cause T Cell Activation

T Cell

PRS-343 binds to 4-1BB expressed on T cells (including, as desired, tumor-specific T cells)

By design, PRS-343 requires an additional factor to activate T cells

Non-Confidential 16

PRS-343 is a First-in-Class TME-activated Co-stim Agonist

Anti-4-1BB

Potential Benefits of Pieris’ Approach

| • |

|

Localized T cell activation |

| • |

|

Reduced T cell-mediated systemic toxicity |

| • |

|

Increased therapeutic index in patients unresponsive to standard of care |

Tumor Cell

Non-Confidential 17

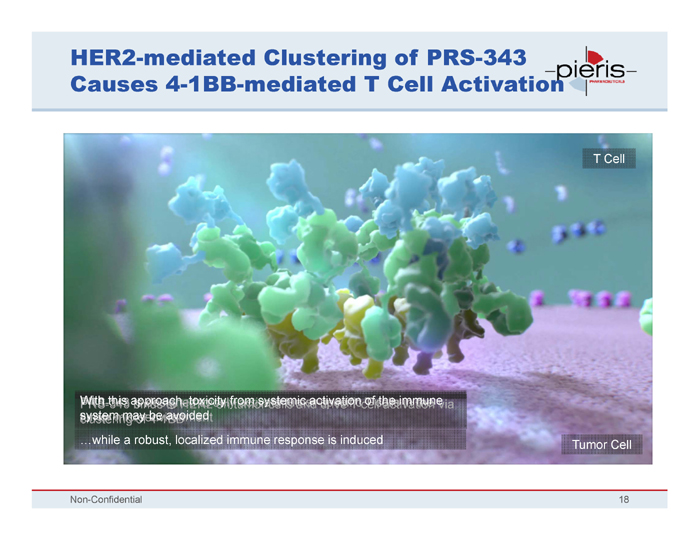

HER2-mediated Clustering of PRS-343 Causes 4-1BB-mediated T Cell Activation

T Cell

With this approach, toxicity from systemic activation of the immune system may be avoided

…while a robust, localized immune response is induced Tumor Cell

Non-Confidential 18

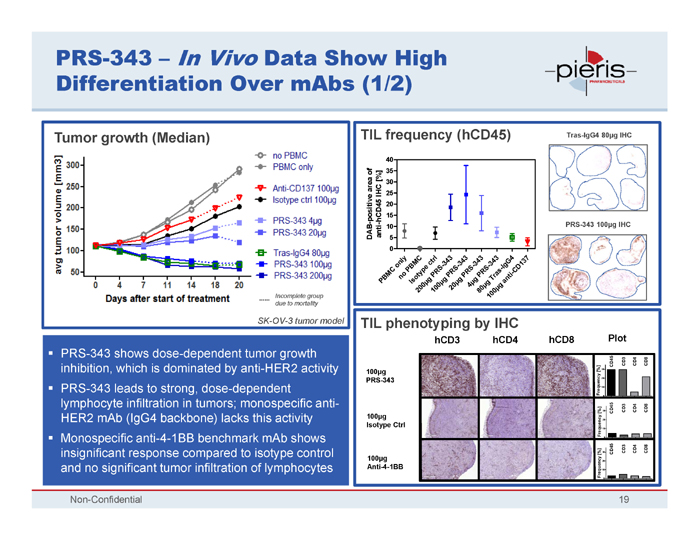

PRS-343 –In Vivo Data Show High Differentiation Over mAbs (1/2)

Tumor growth (Median) TIL frequency (hCD45) Tras-IgG4 80µg IHC

40 of 35 [%] area 30 IHC 25 20 positive hCD45 15

— 10 PRS-343 100µg IHC

DAB anti 5 0

y C r l 3 3 3 4 7 l 4 4 4 3 n M ct 3 3 343 3 G 1 o — — Ig

B S S S S—D

P s C

MC o type R R R i -nPPRPP ra

B o g g gT ant

P Is 0 µ 0 µ 4 µ g

µg

0 20µg µ

| 2 |

|

10 80 0 |

Incomplete group 10 due to mortality

SK-OV-3 tumor model TIL phenotyping by IHC

hCD3 hCD4 hCD8 Plot

? PRS-343 shows dose-dependent tumor growth

CD45 CD3 CD4 CD8

inhibition, which is dominated by anti-HER2 activity [%] 30

100µg PRS-343 20

? PRS-343 leads to strong, dose-dependent Frequency 10

0

lymphocyte infiltration in tumors; monospecific anti-

[%]

30 CD45 CD3 CD4 CD8

100µg

HER2 mAb (IgG4 backbone) lacks this activity 20

Isotype Ctrl Frequency 10

? Monospecific anti-4-1BB benchmark mAb shows 0

[%] 30 CD45 CD3 CD4 CD8

insignificant response compared to isotype control 100µg

20

Anti-4-1BB

and no significant tumor infiltration of lymphocytes Frequency 10

0

Non-Confidential 19

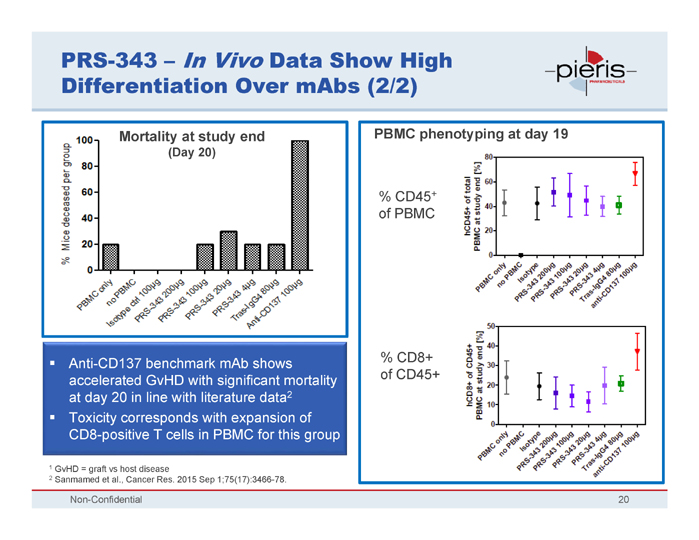

PRS-343 –In Vivo Data Show High Differentiation Over mAbs (2/2)

Mortality at study end PBMC phenotyping at day 19

(Day 20)

% CD45+ of PBMC

? Anti-CD137 benchmark mAb shows % CD8+ accelerated GvHD with significant mortality of CD45+ at day 20 in line with literature data2? Toxicity corresponds with expansion of CD8-positive T cells in PBMC for this group

| 1 |

|

GvHD = graft vs host disease |

| 2 |

|

Sanmamed et al., Cancer Res. 2015 Sep 1;75(17):3466-78. |

Non-Confidential 20

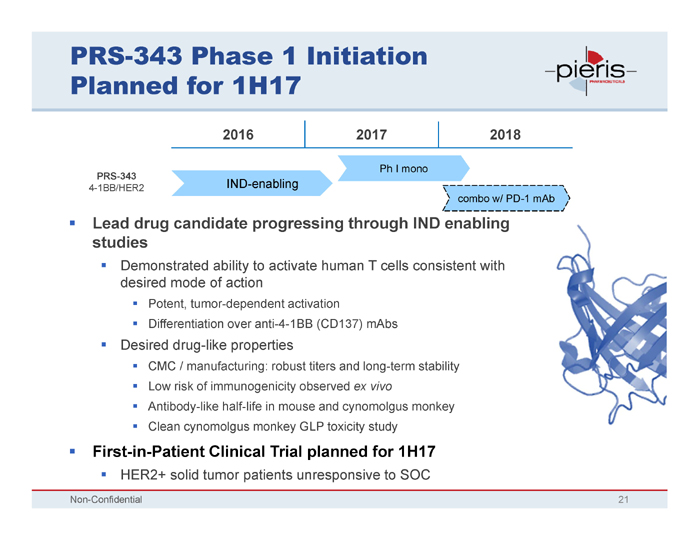

PRS-343 Phase 1 Initiation

Planned for 1H17

2016 2017 2018

Ph I mono

PRS-343

4-1BB/HER2 IND-enabling

combo w/ PD-1 mAb

? Lead drug candidate progressing through IND enabling

studies

? Demonstrated ability to activate human T cells consistent with

desired mode of action

? Potent, tumor-dependent activation

? Differentiation over anti-4-1BB (CD137) mAbs

? Desired drug-like properties

? CMC / manufacturing: robust titers and long-term stability

? Low risk of immunogenicity observed ex vivo

? Antibody-like half-life in mouse and cynomolgus monkey

? Clean cynomolgus monkey GLP toxicity study

? First-in-Patient Clinical Trial planned for 1H17

? HER2+ solid tumor patients unresponsive to SOC

Non-Confidential 21

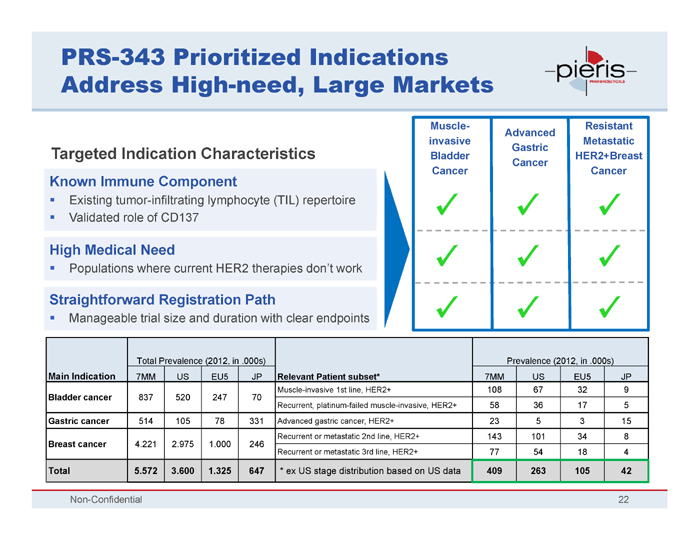

PRS-343 Prioritized Indications Address High-need, Large Markets

Muscle- Resistant Advanced invasive Metastatic

Targeted Indication Characteristics Gastric

Bladder HER2+Breast Cancer Cancer Cancer

Known Immune Component

? Existing tumor-infiltrating lymphocyte (TIL) repertoire? Validated role of CD137

High Medical Need

? Populations where current HER2 therapies don’t work

Straightforward Registration Path

? Manageable trial size and duration with clear endpoints

Total Prevalence (2012, in .000s) Prevalence (2012, in .000s)

Main Indication 7MM US EU5 JP Relevant Patient subset* 7MM US EU5 JP

Bladder cancer 837 520 247 70 Muscle-invasive 1st line, HER2+ 108 67 32 9 Recurrent, platinum-failed muscle-invasive, HER2+ 58 36 17 5 Gastric cancer 514 105 78 331 Advanced gastric cancer, HER2+ 23 5 3 15 Breast cancer 4.221 2.975 1.000 246 Recurrent or metastatic 2nd line, HER2+ 143 101 34 8 Recurrent or metastatic 3rd line, HER2+ 77 54 18 4

Total 5.572 3.600 1.325 647 * ex US stage distribution based on US data 409 263 105 42

Non-Confidential 22

Anticalins in Respiratory Disease & Anemia

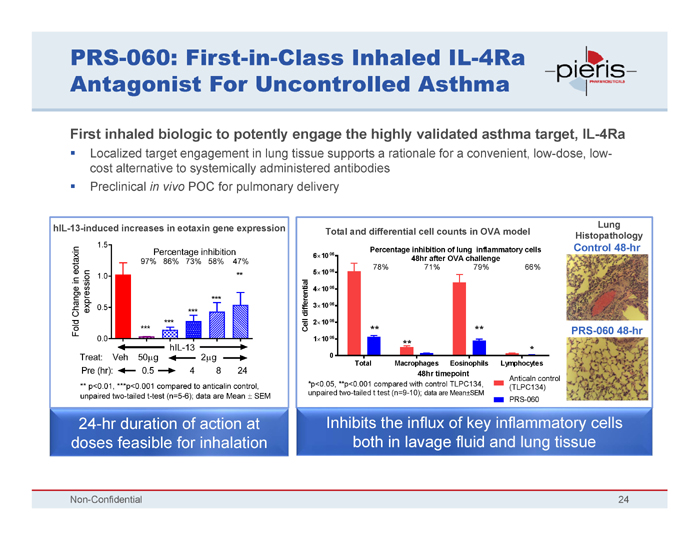

PRS-060: First-in-Class Inhaled IL-4Ra Antagonist For Uncontrolled Asthma

First inhaled biologic to potently engage the highly validated asthma target, IL-4Ra

? Localized target engagement in lung tissue supports a rationale for a convenient, low-dose, low-cost alternative to systemically administered antibodies? Preclinical in vivo POC for pulmonary delivery

hIL-13-induced increases in eotaxin gene expression Lung Total and differential cell counts in OVA model Histopathology

06 Percentage inhibition of lung inflammatory cells Control 48-hr

| 6 |

|

10 48hr after OVA challenge |

78% 71% 79% 66% eotaxin 5 1006 in

| 4 |

|

1006 |

Change expression differential 3 1006

Cell 2 1006

Fold ** ** PRS-060 48-hr

| 1 |

|

1006 |

**

| * |

|

0

Total Macrophages Eosinophils Lymphocytes

48hr timepoint

Anticaln control *p<0.

05, **p<0.001 compared with control TLPC134, (TLPC134) unpaired tw

o-tailed t test (n=9-10); data are Mean SEM PRS-060

24-hr duration of action at Inhibits the influx of key inflammatory cells doses feasible for inhalation both in lavage fluid and lung tissue

Non-Confidential 24

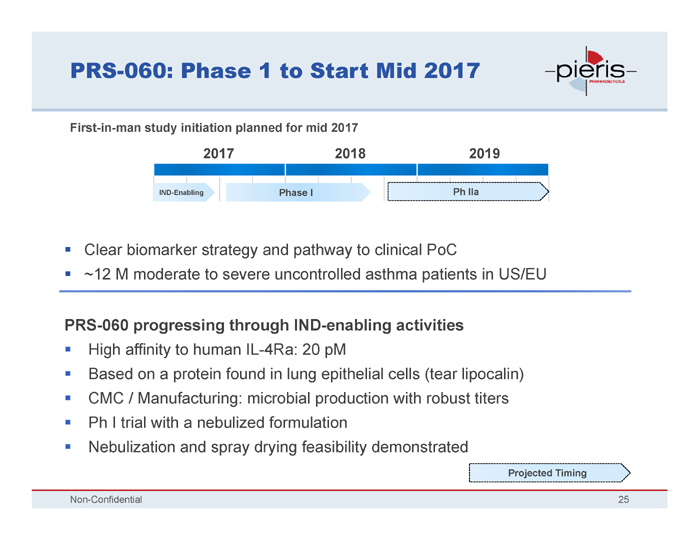

PRS-060: Phase 1 to Start Mid 2017

First-in-man study initiation planned for mid 2017

2017 2018 2019

IND-Enabling Phase I Ph IIa

? Clear biomarker strategy and pathway to clinical PoC? ~12 M moderate to severe uncontrolled asthma patients in US/EU

PRS-060 progressing through IND-enabling activities

? High affinity to human IL-4Ra: 20 pM

? Based on a protein found in lung epithelial cells (tear lipocalin)? CMC / Manufacturing: microbial production with robust titers? Ph I trial with a nebulized formulation? Nebulization and spray drying feasibility demonstrated

Projected Timing

Non-Confidential 25

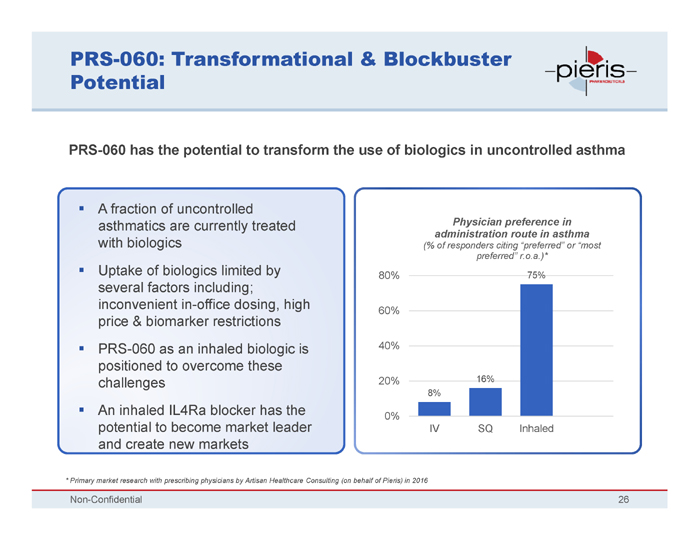

PRS-060: Transformational & Blockbuster Potential

PRS-060 has the potential to transform the use of biologics in uncontrolled asthma

? A fraction of uncontrolled asthmatics are currently treated Physician preference in

administration route in asthma with biologics (% of responders citing “preferred” or “most preferred” r.o.a.)*

? Uptake of biologics limited by 80% 75% several factors including; inconvenient in-office dosing, high

60%

price & biomarker restrictions

? PRS-060 as an inhaled biologic is 40% positioned to overcome these challenges 20% 16%

8%

? An inhaled IL4Ra blocker has the 0% potential to become market leader IV SQ Inhaled and create new markets

| * |

|

Primary market research with prescribing physicians by Artisan Healthcare Consulting (on behalf of Pieris) in 2016 |

Non-Confidential 26

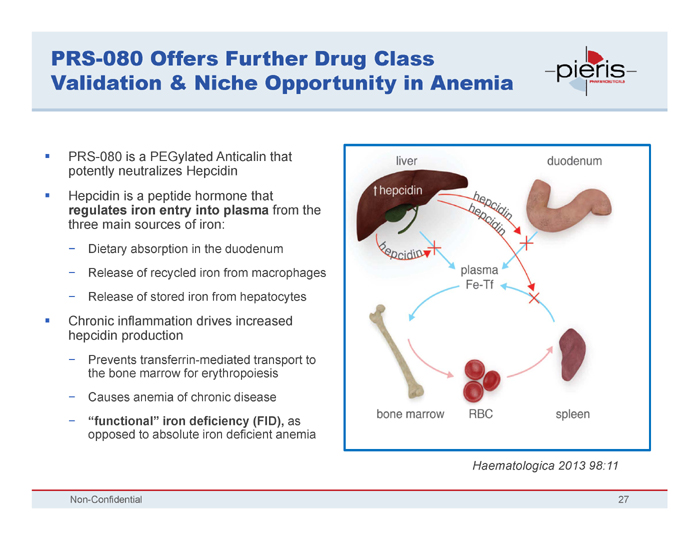

PRS-080 Offers Further Drug Class Validation & Niche Opportunity in Anemia

? PRS-080 is a PEGylated Anticalin that potently neutralizes Hepcidin? Hepcidin is a peptide hormone that regulates iron entry into plasma from the three main sources of iron:

- Dietary absorption in the duodenum

- Release of recycled iron from macrophages

- Release of stored iron from hepatocytes

? Chronic inflammation drives increased hepcidin production

- Prevents transferrin-mediated transport to the bone marrow for erythropoiesis

- Causes anemia of chronic disease

- “functional” iron deficiency (FID), as opposed to absolute iron deficient anemia

Haematologica 2

013 98:11

Non-Confidential 27

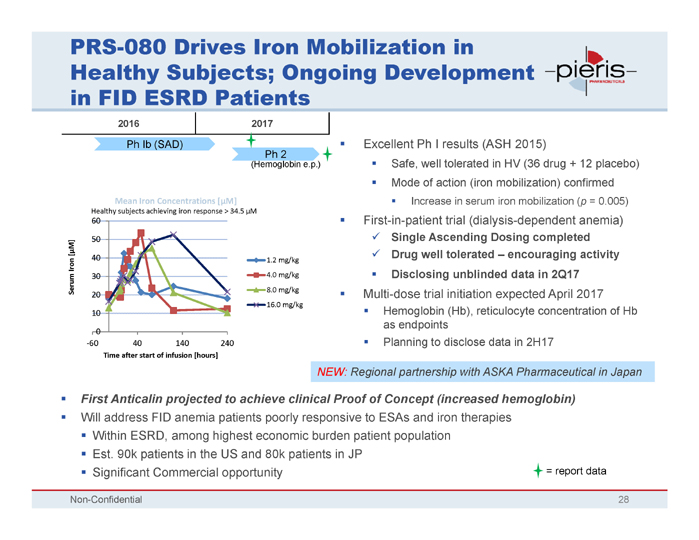

PRS-080 Drives Iron Mobilization in Healthy Subjects; Ongoing Development in FID ESRD Patients

2016 2017

Ph Ib (SAD) Ph 2? Excellent Ph I results (ASH 2015)

(Hemoglobin e.p.)? Safe, well tolerated in HV (36 drug + 12 placebo)? Mode of action (iron mobilization) confirmed

Mean Iron Concentrations [µM]? Increase in serum iron mobilization (p = 0.005)

Healthy subjects achieving iron response > 34.5 µM

60? First-in-patient trial (dialysis-dependent anemia)

50? Single Ascending Dosing completed [µM]? Drug well tolerated – encouraging activity

40 1.2 mg/kg Iron 4.0 mg/kg

30? Disclosing unblinded data in 2Q17

Serum 8.0 mg/kg

20? Multi-dose trial initiation expected April 2017

16.0 mg/kg

10? Hemoglobin (Hb), reticulocyte concentration of Hb as endpoints

0

?60 40 140 240? Planning to disclose data in 2H17

Time after start of infusion [hours]

NEW: Regional partnership with ASKA Pharmaceutical in Japan

? First Anticalin projected to achieve clinical Proof of Concept (increased hemoglobin)

? Will address FID anemia patients poorly responsive to ESAs and iron therapies? Within ESRD, among highest economic burden patient population? Est. 90k patients in the US and 80k patients in JP

? Significant Commercial opportunity = report data

Non-Confidential 28

Senior Management Financials & Milestones

Management and Board Profile

Senior Management Team

Stephen Yoder, J.D. Louis Matis, M.D. Lance Thibault Claude Knopf

President & CEO SVP, Chief Development Officer Interim CFO SVP, Chief Business Officer

CGI Pharmaceuticals

Board of Directors

Stephen Yoder Michael Richman Jean-Pierre Bizzari, M.D. Christopher Kiritsy

President & CEO CEO, NextCure, Inc. Celgene, Servier, Rhone- CEO, Arisaph Pharmaceuticals Amplimune, Chiron, Poulenc, Sanofi-Aventis Kos Pharmaceuticals MedImmune, Macrogenics

Chau Khuong (Chairman) Steven Prelack Julian Adams, PH.D.

Partner, OrbiMed Advisors SVP, COO, VetCor Clal Biotechnology, Infinity, Velquest Corp., Galectin Millennium Pharm., Therapeutics, BioVex Group LeukoSite Inc.

Non-Confidential 30

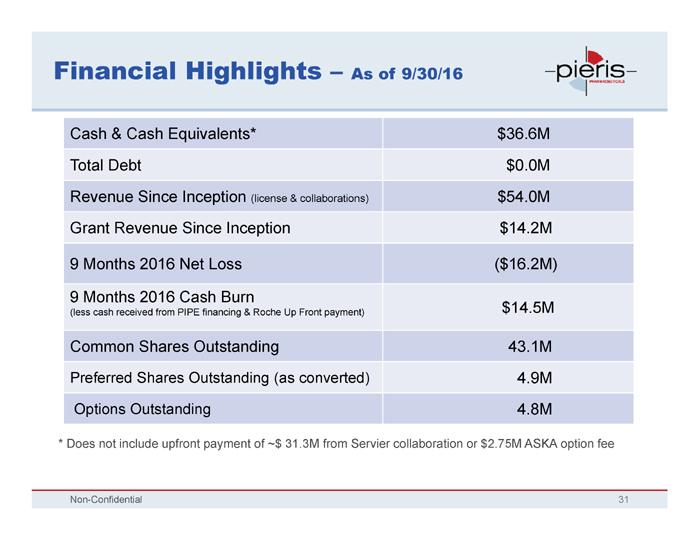

Financial Highlights – As of 9/30/16

Cash & Cash Equivalents* $36.6M Total Debt $0.0M Revenue Since Inception (license & collaborations) $54.0M Grant Revenue Since Inception $14.2M

9 Months 2016 Net Loss ($16.2M)

9 Months 2016 Cash Burn

(less cash received from PIPE financing & Roche Up Front payment) $14.5M

Common Shares Outstanding 43.1M

Preferred Shares Outstanding (as converted) 4.9M Options Outstanding 4.8M

| * |

|

Does not include upfront payment of ~$ 31.3M from Servier collaboration or $2.75M ASKA option fee |

Non-Confidential 31

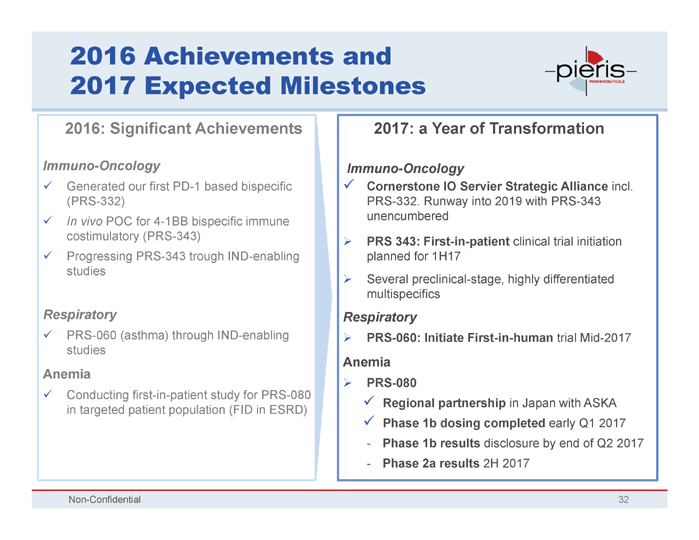

2016 Achievements and 2017 Expected Milestones

2016: Significant Achievements 2017: a Year of Transformation

Immuno-Oncology Immuno-Oncology

? Generated our first PD-1 based bispecific? Cornerstone IO Servier Strategic Alliance incl. (PRS-332) PRS-332. Runway into 2019 with PRS-343? In vivo POC for 4-1BB bispecific immune unencumbered costimulatory (PRS-343)? PRS 343: First-in-patient clinical trial initiation? Progressing PRS-343 trough IND-enabling planned for 1H17 studies? Several preclinical-stage, highly differentiated multispecifics

Respiratory Respiratory

? PRS-060 (asthma) through IND-enabling? PRS-060: Initiate First-in-human trial Mid-2017 studies Anemia Anemia

? PRS-080

? Conducting first-in-patient study for PRS-080

? Regional partnership in Japan with ASKA in targeted patient population (FID in ESRD)

? Phase 1b dosing completed early Q1 2017

- Phase 1b results disclosure by end of Q2 2017

- Phase 2a results 2H 2017

Non-Confidential 32

Pieris Pharmaceuticals, Inc.

255 State Street, 9th Floor Boston, MA 02109 USA info@pieris.com www.pieris.com

Non-Confidential 33