Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | allyfinancialoutlookconfer.htm |

1

Ally Financial Inc.

Financial Outlook Update

March 21, 2017

2

Forward-Looking Statements and Additional Information

This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements

about targets and expectations for various financial and operating metrics. Forward-looking statements often use words such as “believe,” “expect,”

“anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,”

“initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.”

Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking

statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our

control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies,

plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the

factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our

Annual Report on Form 10-K for the year ended December 31, 2016, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form

8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”).

Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any

forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as

required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we

may make in any subsequent SEC filings.

This presentation and related communications should be read in conjunction with our Annual Report on Form 10-K for the year ended December

31, 2016, and other SEC filings. Financial and other information for any period after December 31, 2016, is preliminary and is based on internal or

external information available to us at the time of this presentation. This presentation and related communications contain specifically identified

non-GAAP financial measures, which supplement the results that are reported according to generally accepted accounting principles (“GAAP”).

These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results.

Differences between non-GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation.

Our use of the term “loans” describes all of the products associated with our direct and indirect lending activities. The specific products include

loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term “lend” or “originate” refers to our direct

origination of loans or our purchase or acquisition of loans.

3 CONFIDENTIAL

Summary Outlook Chris Halmy, Chief Financial Officer

Customer and Products Overview

Chris Halmy, Chief Financial Officer

Dave Shevsky, Chief Risk Officer

Net Financing Revenue Brad Brown, Corporate Treasurer

Near-term Outlook Chris Halmy, Chief Financial Officer

1

2

3

4

Agenda

4

Executive Summary

Deliver consistently improving results

Financially

Operationally

Relentless focus on customer

Auto and Deposits are “entry” products

Mortgage, Credit Card and Wealth Management as new additions

Unmatched expertise in auto lending as a true relationship business

Natural development from a ground-up brand

Ally’s model today provides substantial runway for future

From “auto-finance lender” to leader in digital financial services

Online platform provides nimble and scalable approach

Business model stable and diversified

Positioned for next-chapter evolutions for dealer, customer and commercial relationships

5

Summary Financial Outlook

(1) Represents a non-GAAP financial measure. See pages 39 and 40 for details.

Expect over 15% Adjusted EPS(1) CAGR while driving to 12% Core ROTCE(1) over

medium-term

Expect 5 - 15% Adjusted EPS(1) growth in 2017

Near-term will be impacted by lease and used vehicle price declines and provision build

Capital optimization - repurchasing significant shares at a discount to book value

Built company to provide long runway for growth beyond medium-term

Leveraged to long term trends in digital financial services

Established path to drive long-term shareholder value

Tax and regulatory changes could be long term positive

Not currently contemplated in guidance/outlook

Do not expect material 2017 impact regardless

6

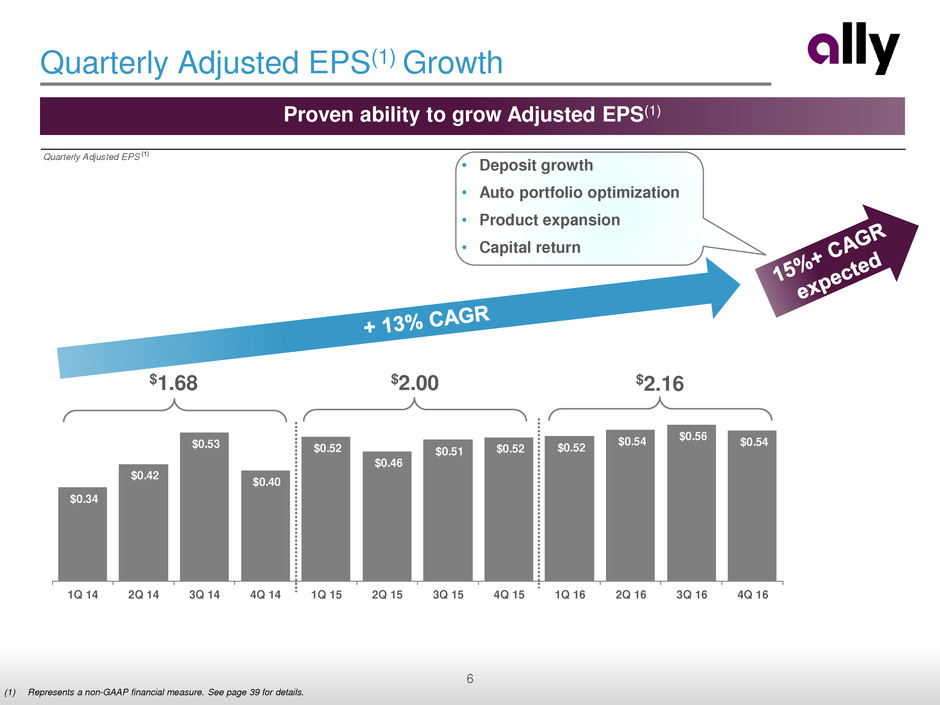

Quarterly Adjusted EPS (1)

$0.34

$0.42

$0.53

$0.40

$0.52

$0.46

$0.51 $0.52 $0.52

$0.54 $0.56 $0.54

1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16

Quarterly Adjusted EPS(1) Growth

(1) Represents a non-GAAP financial measure. See page 39 for details.

$1.68 $2.00 $2.16

• Deposit growth

• Auto portfolio optimization

• Product expansion

• Capital return

Proven ability to grow Adjusted EPS(1)

7

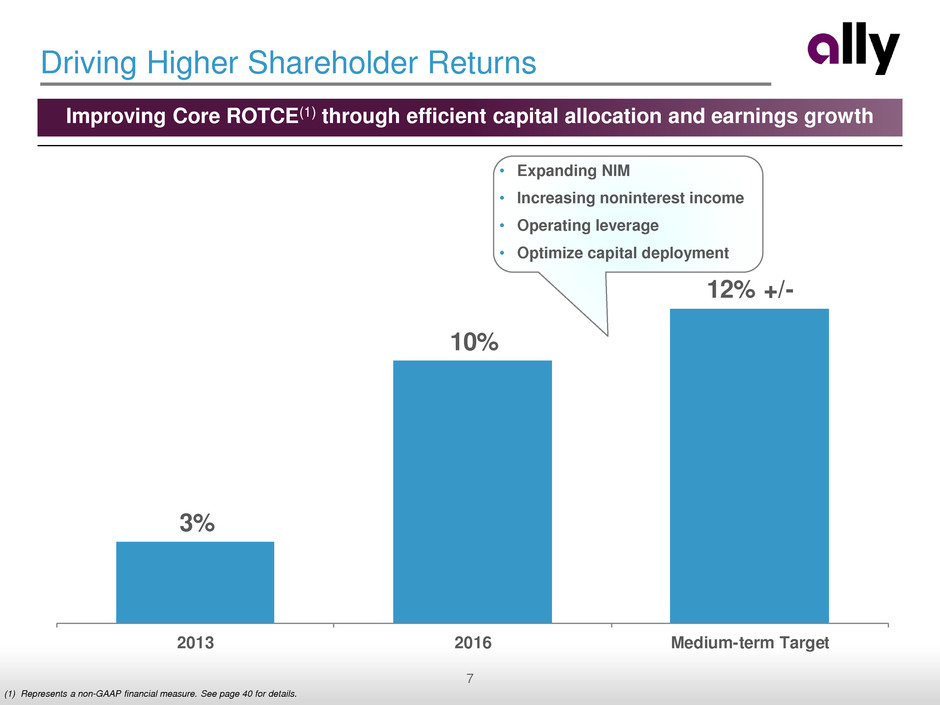

Driving Higher Shareholder Returns

(1) Represents a non-GAAP financial measure. See page 40 for details.

Improving Core ROTCE(1) through efficient capital allocation and earnings growth

• Expanding NIM

• Increasing noninterest income

• Operating leverage

• Optimize capital deployment

3%

10%

12% +/-

2013 2016 Medium-term Target

8

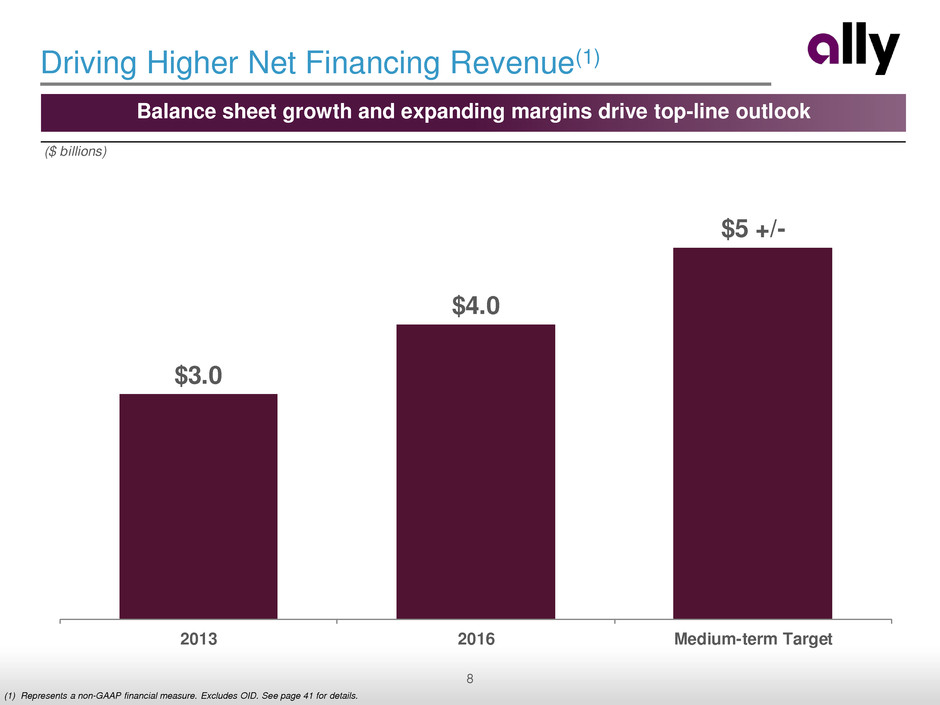

Driving Higher Net Financing Revenue(1)

Balance sheet growth and expanding margins drive top-line outlook

(1) Represents a non-GAAP financial measure. Excludes OID. See page 41 for details.

($ billions)

$3.0

$4.0

$5 +/-

2013 2016 Medium-term Target

9

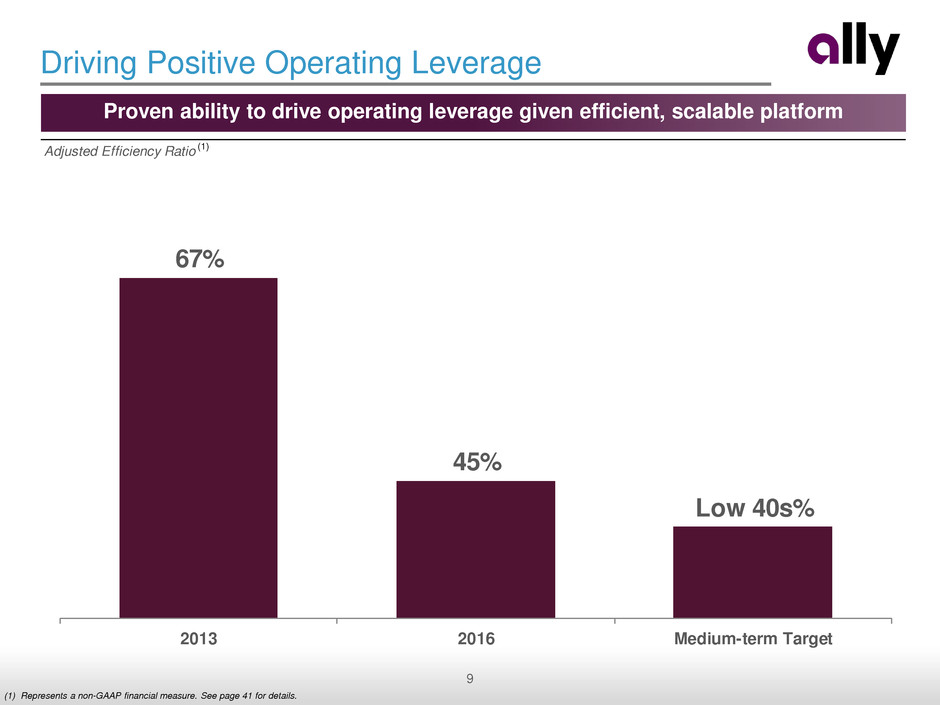

Driving Positive Operating Leverage

Proven ability to drive operating leverage given efficient, scalable platform

(1) Represents a non-GAAP financial measure. See page 41 for details.

Adjusted Efficiency Ratio (1)

67%

45%

Low 40s%

2013 2016 Medium-term Target

10 CONFIDENTIAL

Summary Outlook Chris Halmy, Chief Financial Officer

Customer and Products Overview

Chris Halmy, Chief Financial Officer

Dave Shevsky, Chief Risk Officer

Net Financing Revenue Brad Brown, Corporate Treasurer

Near-term Outlook Chris Halmy, Chief Financial Officer

1

2

3

4

11

Customer Product Suite

(1) The Ally CashBack Credit Card is issued by TD Bank N.A.

A L L Y A U T O

I N S U R A N C E

Co-brand product(1)

C A S H B A C K C A R D

A L L Y H O M E

D E P O S I T S

C O R P O R A T E

F I N A N C E

A L L Y I N V E S T

12

Customer Growth Through Brand and New Offerings

Consumer

Auto

Retail

Deposit

Wealth

Management

Other

(includes Credit Card,

Mortgage)

Commercial

Auto

4.4

million customers

18

thousand dealer relationships

1.2

million customers

250

thousand customers

Note: primary, active customers based on period-end 2016

(1) Year-end 2016, monthly online survey by Hansa, a market research firm, on behalf of Ally – consumers age 35+ with household income of $75K+ and open to working with online banks.

• Stable as retail offsets

lease

• Large, diversified

dealer clients

• 4k commercial loan

relationships

• Strong, steady growth

• 18% CAGR 2010 –

2016

~50

thousand customers

• Growth opportunities

as products marketed

under Ally brand

+ Deepening

existing

relationships

+ New offerings

+ Growing

brand

awareness

=

Positioned to

deliver steady

customer growth

Brand

Awareness(1) 57% • Up from 45% in 2014

13

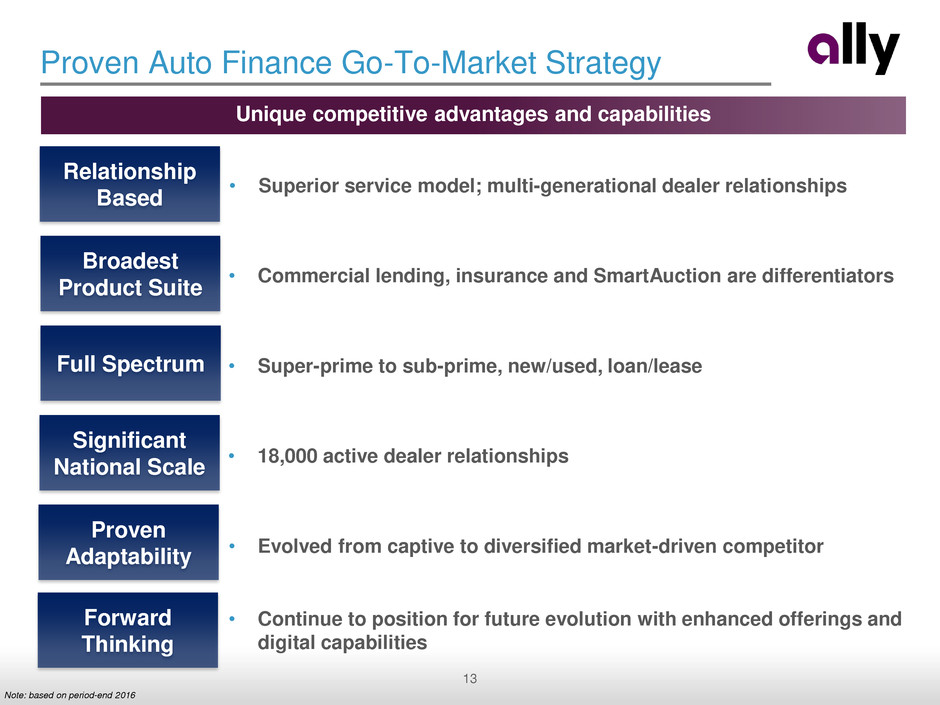

Proven Auto Finance Go-To-Market Strategy

Note: based on period-end 2016

Unique competitive advantages and capabilities

• Superior service model; multi-generational dealer relationships

Relationship

Based

Broadest

Product Suite

Full Spectrum

• Commercial lending, insurance and SmartAuction are differentiators

• Super-prime to sub-prime, new/used, loan/lease

Significant

National Scale

• 18,000 active dealer relationships

Proven

Adaptability

• Evolved from captive to diversified market-driven competitor

Forward

Thinking

• Continue to position for future evolution with enhanced offerings and

digital capabilities

14

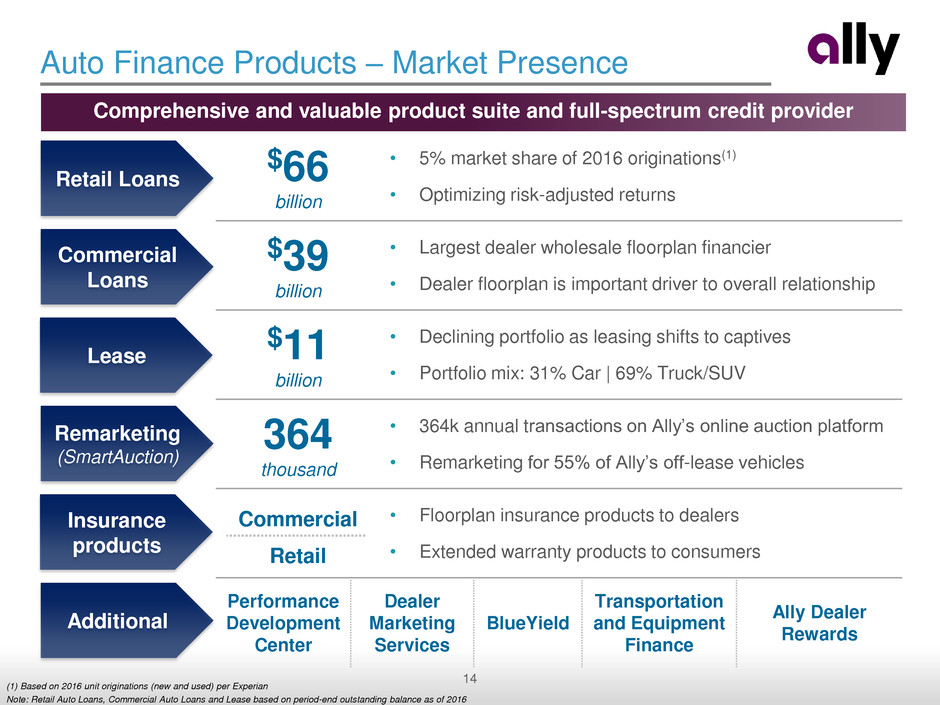

Auto Finance Products – Market Presence

Comprehensive and valuable product suite and full-spectrum credit provider

Theme:

Retail Loans

Commercial

Loans

Lease

Remarketing

(SmartAuction)

Insurance

products

$66

billion

• 5% market share of 2016 originations(1)

• Optimizing risk-adjusted returns

$39

billion

• Largest dealer wholesale floorplan financier

• Dealer floorplan is important driver to overall relationship

$11

billion

• Declining portfolio as leasing shifts to captives

• Portfolio mix: 31% Car | 69% Truck/SUV

364

thousand

• 364k annual transactions on Ally’s online auction platform

• Remarketing for 55% of Ally’s off-lease vehicles

Commercial

Retail

• Floorplan insurance products to dealers

• Extended warranty products to consumers

Performance

Development

Center

Dealer

Marketing

Services

BlueYield

Transportation

and Equipment

Finance

Ally Dealer

Rewards

Additional

(1) Based on 2016 unit originations (new and used) per Experian

Note: Retail Auto Loans, Commercial Auto Loans and Lease based on period-end outstanding balance as of 2016

15

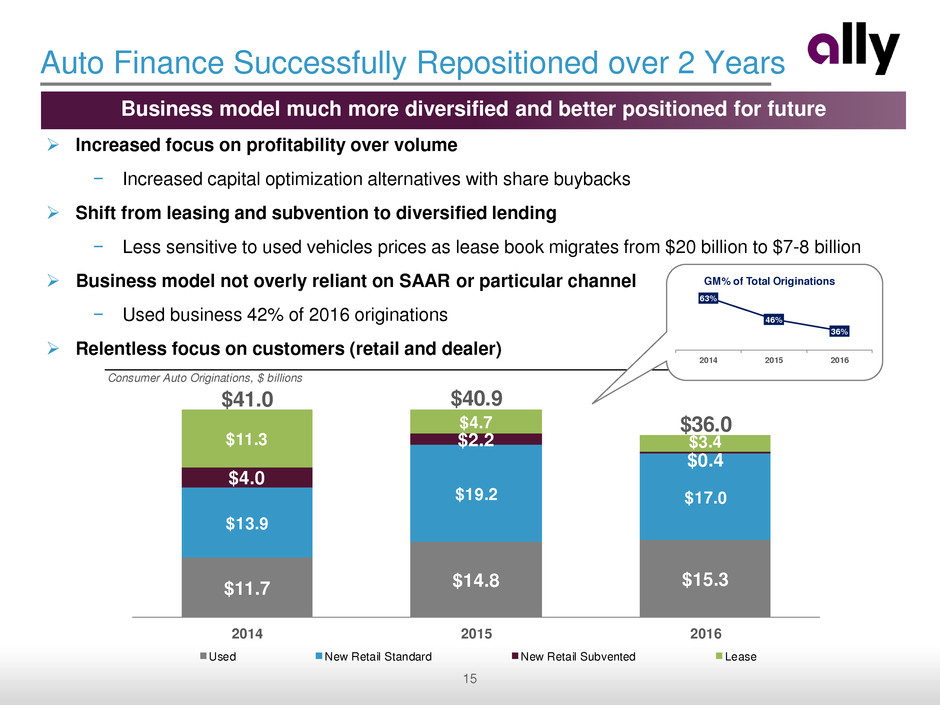

Consumer Auto Originations, $ billions

$11.7 $14.8 $15.3

$13.9

$19.2 $17.0

$4.0

$2.2

$0.4

$11.3

$4.7

$3.4

$41.0 $40.9

$36.0

2014 2015 2016

Used New Retail Standard New Retail Subvented Lease

Auto Finance Successfully Repositioned over 2 Years

Increased focus on profitability over volume

− Increased capital optimization alternatives with share buybacks

Shift from leasing and subvention to diversified lending

− Less sensitive to used vehicles prices as lease book migrates from $20 billion to $7-8 billion

Business model not overly reliant on SAAR or particular channel

− Used business 42% of 2016 originations

Relentless focus on customers (retail and dealer)

Business model much more diversified and better positioned for future

63%

46%

36%

2014 2015 2016

GM% of Total Originations

16

Auto Finance Market Update

Auto lenders, including Ally, continue to respond to market trends

− Higher interest rates and interest rate expectations

− Consumer credit losses continue to migrate higher, particularly in lower credit tiers

− Declining used vehicle prices

− Increasing manufacturer incentive levels

− Many captive arms of manufacturers continue to increase leasing presence

Several banks, including Ally, are closely monitoring credit trends and adjusting pricing and/or

underwriting

− Noticeable shift over past few months

− Market generally exhibiting price and risk discipline

− Short dated asset allows for continual repricing of portfolio

We continue to see attractive risk-adjusted return opportunities and expect portfolio profitability to

further improve

17

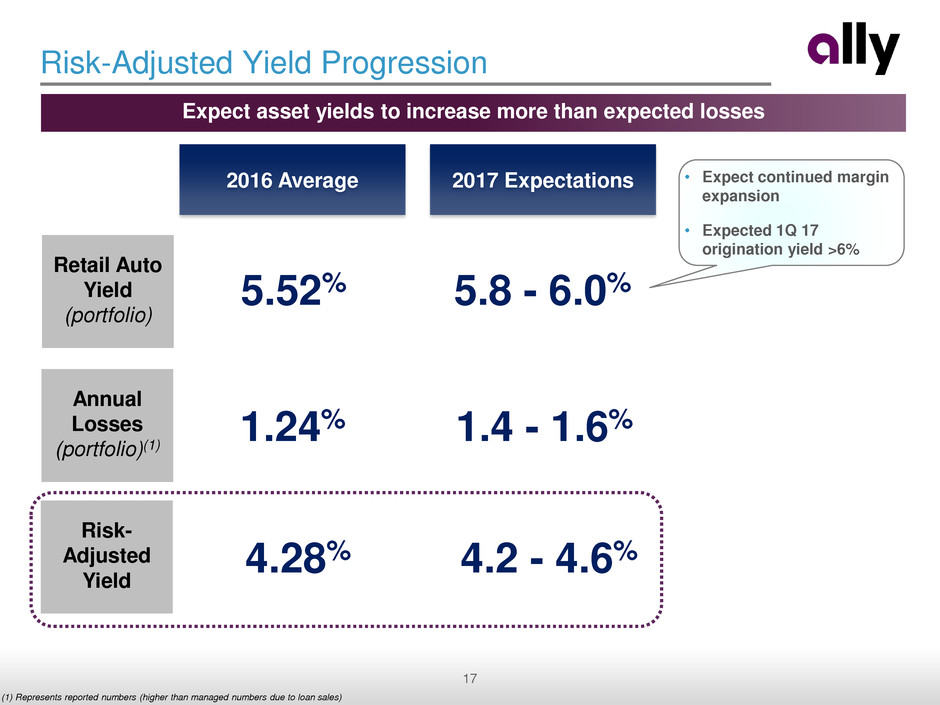

Risk-Adjusted Yield Progression

Expect asset yields to increase more than expected losses

2016 Average 2017 Expectations

Retail Auto

Yield

(portfolio)

Annual

Losses

(portfolio)(1)

Risk-

Adjusted

Yield

5.52% 5.8 - 6.0%

1.24% 1.4 - 1.6%

4.28% 4.2 - 4.6%

(1) Represents reported numbers (higher than managed numbers due to loan sales)

• Expect continued margin

expansion

• Expected 1Q 17

origination yield >6%

18

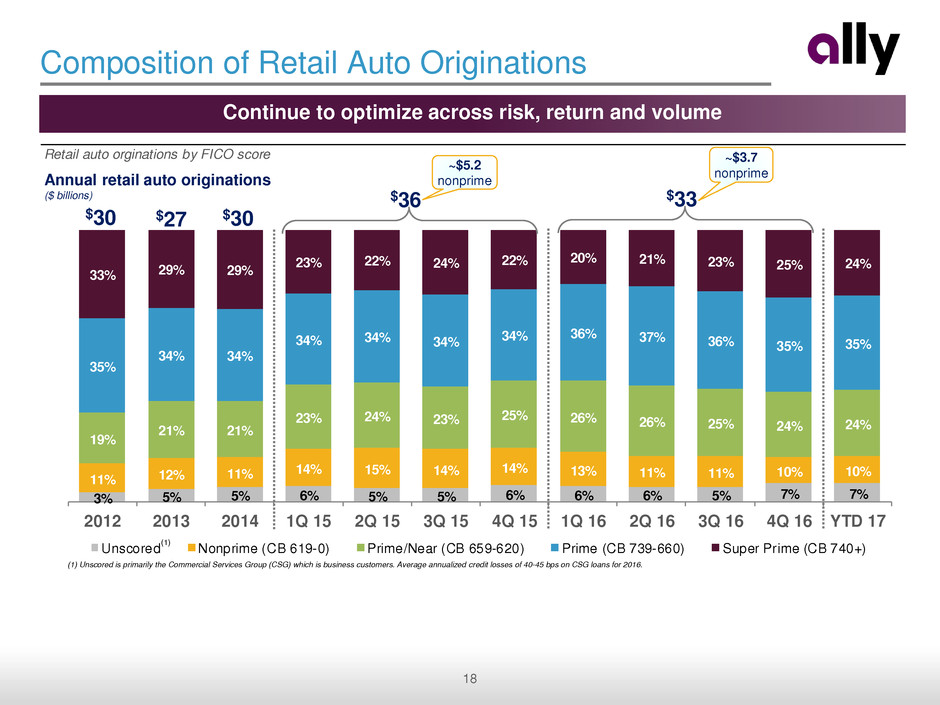

Retail auto orginations by FICO score

3% 5% 5% 6% 5% 5% 6% 6% 6% 5% 7% 7%

11% 12% 11%

14% 15% 14% 14% 13% 11% 11% 10% 10%

19%

21% 21%

23% 24% 23% 25% 26% 26% 25% 24% 24%

35%

34% 34%

34% 34% 34% 34%

36% 37% 36% 35% 35%

33% 29% 29%

23% 22% 24% 22% 20% 21% 23% 25% 24%

2012 2013 2014 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 YTD 17

Unscored Nonprime (CB 619-0) Prime/Near (CB 659-620) Prime (CB 739-660) Super Prime (CB 740+)

Composition of Retail Auto Originations

Continue to optimize across risk, return and volume

Annual retail auto originations

($ billions)

$30 $27 $30

$36 $33

~$5.2

nonprime

~$3.7

nonprime

(1) Unscored is primarily the Commercial Services Group (CSG) which is business customers. Average annualized credit losses of 40-45 bps on CSG loans for 2016.

(1)

19

9% 7% 5% 4% 3%

15%

13%

10%

9% 7% 6% 4% 3% 3%

23%

19%

16%

14%

12%

10%

8%

7% 6%

38%

33%

27%

24%

21%

18%

15%

13%

12%

14%

28%

41%

50%

44%

39%

35%

31%

29%

13%

25%

36%

44%

41%

8%

1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 YTD 17

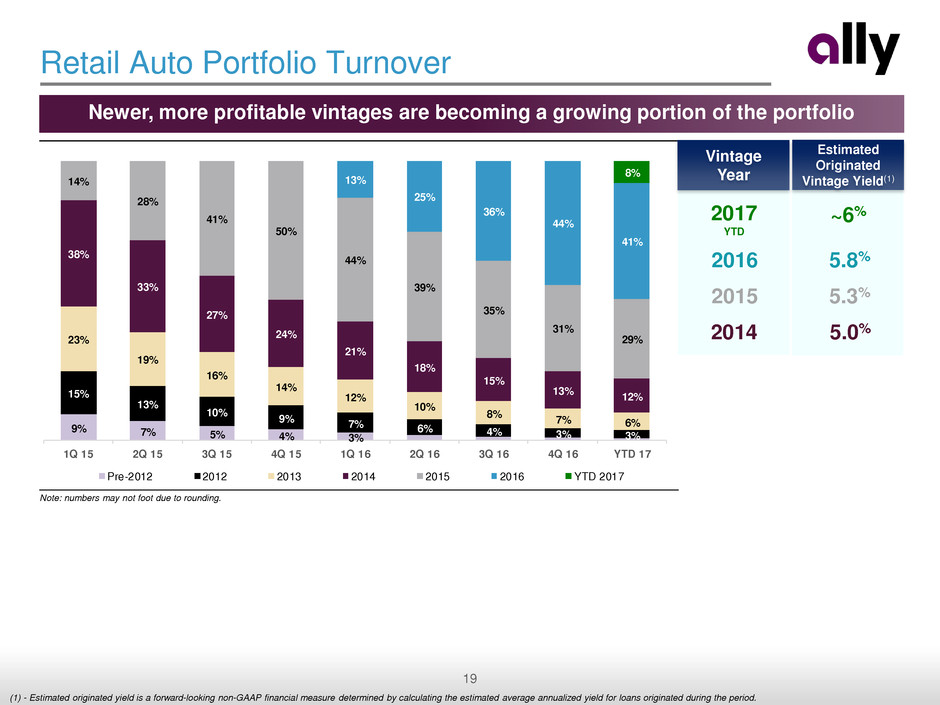

Pre-2012 2012 2013 2014 2015 2016 YTD 2017

Retail Auto Portfolio Turnover

Newer, more profitable vintages are becoming a growing portion of the portfolio

Estimated

Originated

Vintage Yield(1)

~6%

Vintage

Year

2017

YTD

5.8% 2016

5.3% 2015

5.0% 2014

(1) - Estimated originated yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period.

Note: numbers may not foot due to rounding.

20

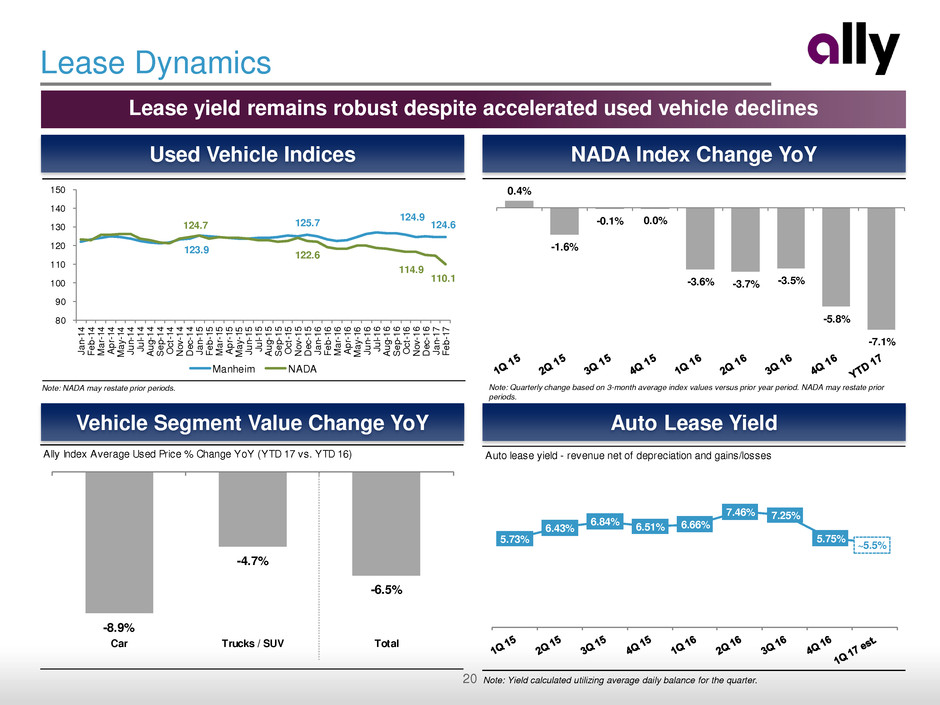

0.4%

-1.6%

-0.1% 0.0%

-3.6% -3.7% -3.5%

-5.8%

-7.1%

Ally Index Average Used Price % Change YoY (YTD 17 vs. YTD 16)

-8.9%

-4.7%

-6.5%

Car Trucks / SUV Total

Lease Dynamics

Vehicle Segment Value Change YoY Auto Lease Yield

Used Vehicle Indices NADA Index Change YoY

Lease yield remains robust despite accelerated used vehicle declines

Note: Quarterly change based on 3-month average index values versus prior year period. NADA may restate prior

periods.

Note: Yield calculated utilizing average daily balance for the quarter.

Auto lease yield - revenue net of depreciation and gains/losses

5.73%

6.43%

6.84%

6.51% 6.66%

7.46% 7.25%

5.75%

~5.5%

Note: NADA may restate prior periods.

123.9

125.7

124.9

124.6 124.7

122.6

114.9

110.1

80

90

100

110

120

130

140

150

Ja

n-1

4

Fe

b-1

4

Ma

r-1

4

Ap

r-1

4

Ma

y-1

4

Ju

n-1

4

Ju

l-1

4

Au

g-1

4

Se

p-1

4

Oc

t-1

4

No

v-1

4

De

c-1

4

Ja

n-1

5

Fe

b-1

5

Ma

r-1

5

Ap

r-1

5

Ma

y-1

5

Ju

n-1

5

Ju

l-1

5

Au

g-1

5

Se

p-1

5

Oc

t-1

5

No

v-1

5

De

c-1

5

Ja

n-1

6

Fe

b-1

6

Ma

r-1

6

Ap

r-1

6

Ma

y-1

6

Ju

n-1

6

Ju

l-1

6

Au

g-1

6

Se

p-1

6

Oc

t-1

6

No

v-1

6

De

c-1

6

Ja

n-1

7

Fe

b-1

7

Manheim NADA

21

Ally Hom

e

Total M

ortgage M

arket

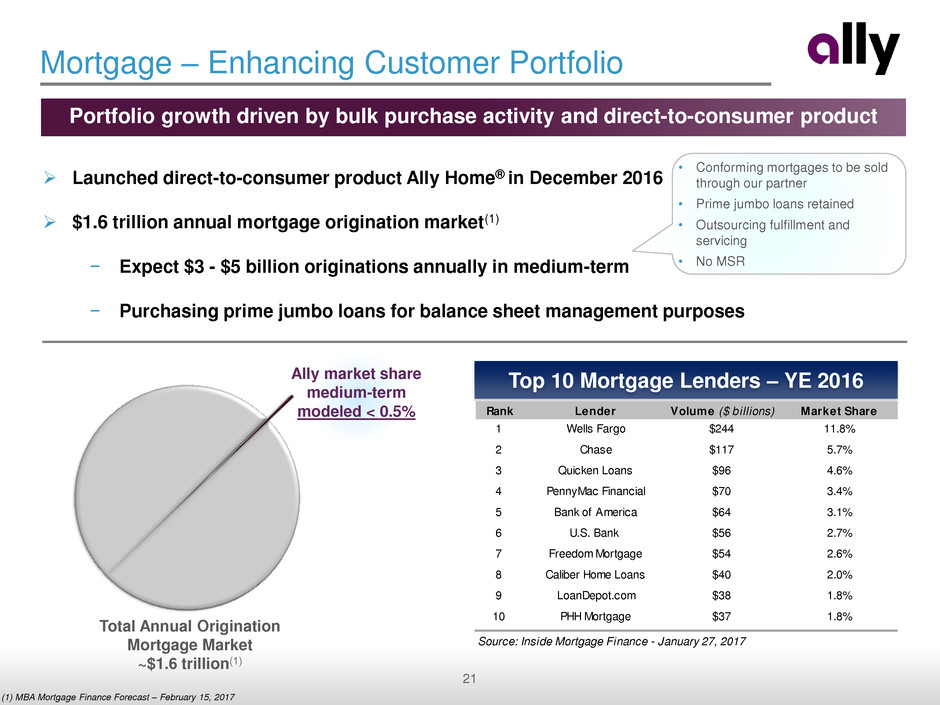

Mortgage – Enhancing Customer Portfolio

Portfolio growth driven by bulk purchase activity and direct-to-consumer product

Launched direct-to-consumer product Ally Home® in December 2016

$1.6 trillion annual mortgage origination market(1)

− Expect $3 - $5 billion originations annually in medium-term

− Purchasing prime jumbo loans for balance sheet management purposes

Ally market share

medium-term

modeled < 0.5%

Total Annual Origination

Mortgage Market

~$1.6 trillion(1)

Top 10 Mortgage Lenders – YE 2016

Rank Lender Volume ($ billions) Market Share

1 Wells Fargo $244 11.8%

2 Chase $117 5.7%

3 Quicken Loans $96 4.6%

4 PennyMac Financial $70 3.4%

5 Bank of America $64 3.1%

6 U.S. Bank $56 2.7%

7 Freedom Mortgage $54 2.6%

8 Caliber Home Loans $40 2.0%

9 LoanDepot.com $38 1.8%

10 PHH Mortgage $37 1.8%

Source: Inside Mortgage Finance - January 27, 2017

(1) MBA Mortgage Finance Forecast – February 15, 2017

• Conforming mortgages to be sold

through our partner

• Prime jumbo loans retained

• Outsourcing fulfillment and

servicing

• No MSR

22

Ally Invest – Enhancing Customer Portfolio

Natural combination of digital, self-directed savings and investing

Self-Directed Trading

For the hands-on investor

Ally Managed Portfolios

Automated investing, professionally managed

Low fees

Variety of investment products

In-depth research tools

24/7 customer service

Current 2020 est.

Online

Brokerage(1)

$5.7

trillion

$7.0+

trillion

(1) Source: Cerulli 2015 Retail and Advice Report

Digitally

Managed

Portfolios(1)

$50

billion

$489

billion

Large and growing addressable market

NIM Benefits

Benefit from growing

customer sweep deposits

Online Brokerage

Digitally Managed

Portfolios

Commission growth

driving noninterest

income

Asset management fee

growth

“3-channel” revenue growth

23

Corporate Finance

Senior secured leveraged cash flow and asset-based loans to middle market companies

Experienced management team and business joined Ally in 1999

− Highly regarded market participant backed by a stable source of capital

− Reputation for speed, certainty and reliability throughout the loan life cycle

− Higher ROE specialized lending business with low historical loss rate

Private equity sponsored middle-market leveraged lending landscape is highly fragmented

Product line breadth

Speed of execution

Relationship orientation

Certainty of delivery

Industry and product specialization

Strong risk management

Reputation as “cycle tested” & “steady handed”

Go-To-Market Strategy Niche business positioned to grow

• $3.2 billion outstandings(1) - expected to

grow to $6-7 billion by 2019

• Typical deal transaction $25-$250 million

− Larger commercial banks usually

compete in $500+ million deal market

− Ally deposit funding advantage over

wholesale funded specialty lenders

• Growing teams in technology and healthcare

space

(1) Outstandings as of year-end 2016

24

Total deposits; $ billions

$35

$41

$48

$53

$58

$66

$79

$115 +

2010 2011 2012 2013 2014 2015 2016 2017 est. 2018 est. 2019 est.

Deposit Growth as Value Driver & Customer Acquirer

Deposit growth a meaningful driver of franchise value over time

Growth from:

• Existing retail customers

• New retail customers

• Ally Invest sweep deposits

• Brokered

Note: Domestic deposits for all periods.

25

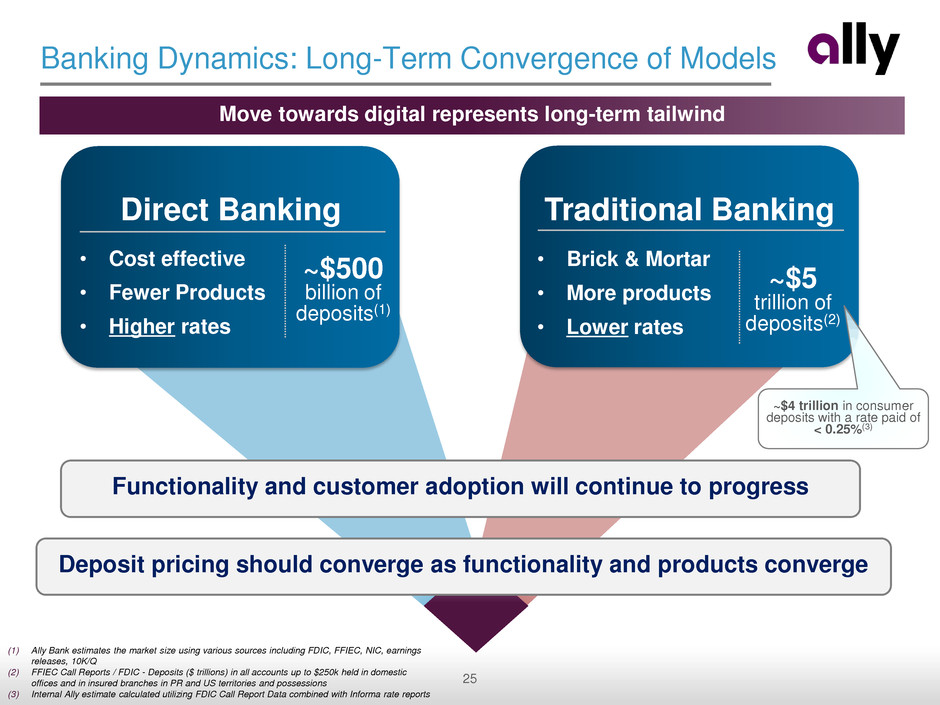

Banking Dynamics: Long-Term Convergence of Models

Direct Banking

• Cost effective

• Fewer Products

• Higher rates

~$500

billion of

deposits(1)

Traditional Banking

• Brick & Mortar

• More products

• Lower rates

~$5

trillion of

deposits(2)

Functionality and customer adoption will continue to progress

Deposit pricing should converge as functionality and products converge

Move towards digital represents long-term tailwind

~$4 trillion in consumer

deposits with a rate paid of

< 0.25%(3)

(1) Ally Bank estimates the market size using various sources including FDIC, FFIEC, NIC, earnings

releases, 10K/Q

(2) FFIEC Call Reports / FDIC - Deposits ($ trillions) in all accounts up to $250k held in domestic

offices and in insured branches in PR and US territories and possessions

(3) Internal Ally estimate calculated utilizing FDIC Call Report Data combined with Informa rate reports

26

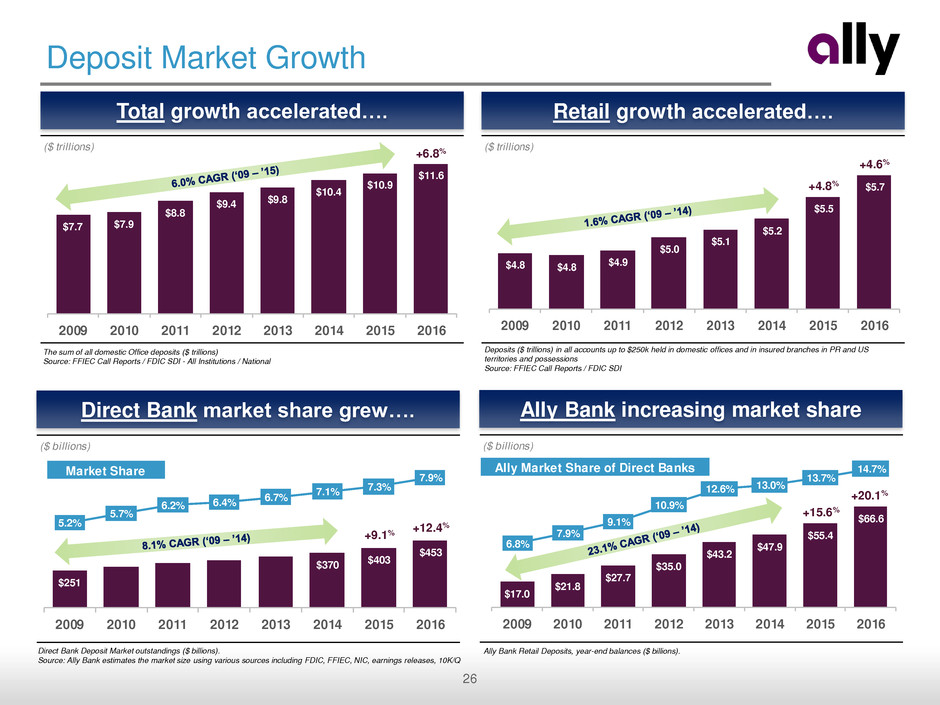

($ billions)

$251

$370 $403

$453

5.2%

5.7%

6.2% 6.4%

6.7%

7.1% 7.3%

7.9%

2009 2010 2011 2012 2013 2014 2015 2016

Market Share

($ billions)

$17.0

$21.8

$27.7

$35.0

$43.2

$47.9

$55.4

$66.6

6.8%

7.9%

9.1%

10.9%

12.6% 13.0%

13.7%

14.7%

2009 2010 201 2012 2013 2014 2015 2016

Ally Market Share of Direct Banks

($ trillions)

$4.8 $4.8 $4.9

$5.0

$5.1

$5.2

$5.5

$5.7

2009 2010 2011 20 2 2013 2014 2015 2016

($ trillions)

$7.7 $7.9

$8.8

$9.4 $9.8

$10.4

$10.9

$11.6

2009 2010 2 11 2012 2013 14 5 6

Deposit Market Growth

Total growth accelerated…. Retail growth accelerated….

Direct Bank market share grew…. Ally Bank increasing market share

+6.8%

The sum of all domestic Office deposits ($ trillions)

Source: FFIEC Call Reports / FDIC SDI - All Institutions / National

+4.8%

+4.6%

Deposits ($ trillions) in all accounts up to $250k held in domestic offices and in insured branches in PR and US

territories and possessions

Source: FFIEC Call Reports / FDIC SDI

+9.1%

+12.4%

Direct Bank Deposit Market outstandings ($ billions).

Source: Ally Bank estimates the market size using various sources including FDIC, FFIEC, NIC, earnings releases, 10K/Q

+15.6%

+20.1%

Ally Bank Retail Deposits, year-end balances ($ billions).

27 CONFIDENTIAL

Summary Outlook Chris Halmy, Chief Financial Officer

Customer and Products Overview

Chris Halmy, Chief Financial Officer

Dave Shevsky, Chief Risk Officer

Net Financing Revenue Brad Brown, Corporate Treasurer

Near-term Outlook Chris Halmy, Chief Financial Officer

1

2

3

4

28

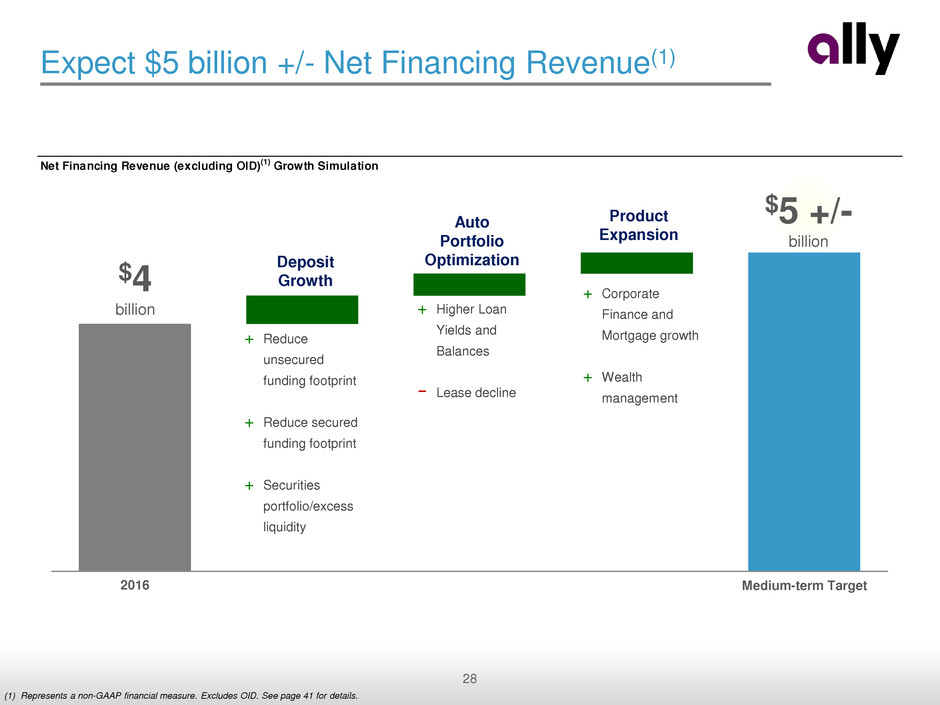

Net Financing Revenue (excluding OID)(1) Growth Simulation

(1) Represents a non-GAAP financial measure. Excludes OID. See page 41 for details.

Deposit

Growth

2016 Medium-term Target

Auto

Portfolio

Optimization

Product

Expansion

+ Corporate

Finance and

Mortgage growth

+ Wealth

management

$4

billion

Expect $5 billion +/- Net Financing Revenue(1)

$5 +/-

billion

+ Higher Loan

Yields and

Balances

− Lease decline

+ Reduce

unsecured

funding footprint

+ Reduce secured

funding footprint

+ Securities

portfolio/excess

liquidity

29

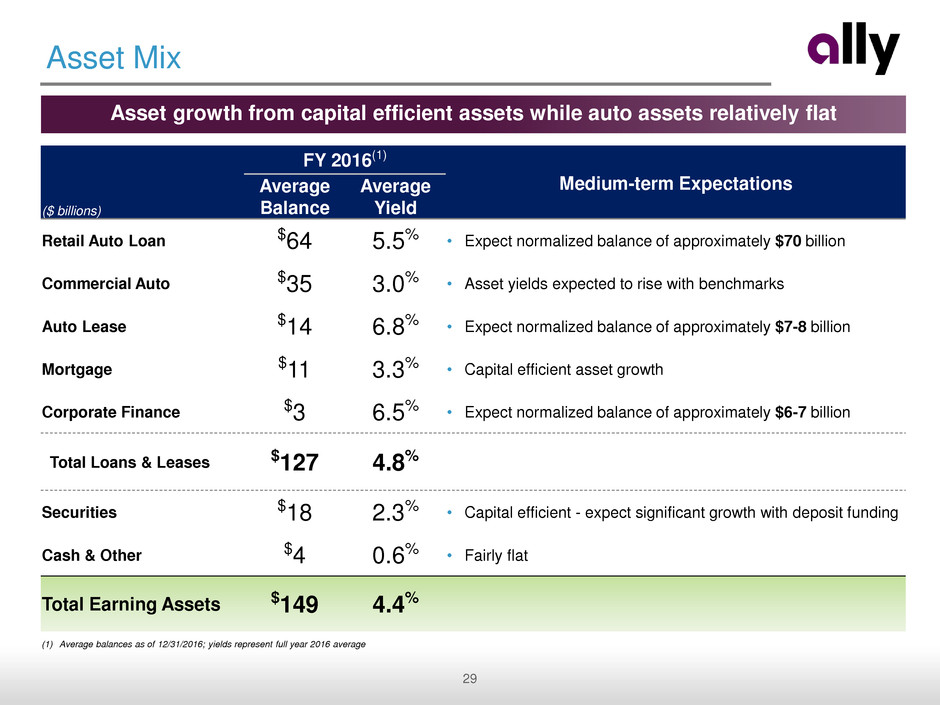

Asset Mix

($ billions)

FY 2016(1)

Medium-term Expectations Average

Balance

Average

Yield

Retail Auto Loan $64 5.5% • Expect normalized balance of approximately $70 billion

Commercial Auto $35 3.0% • Asset yields expected to rise with benchmarks

Auto Lease $14 6.8% • Expect normalized balance of approximately $7-8 billion

Mortgage $11 3.3% • Capital efficient asset growth

Corporate Finance $3 6.5% • Expect normalized balance of approximately $6-7 billion

Total Loans & Leases $127 4.8%

Securities $18 2.3% • Capital efficient - expect significant growth with deposit funding

Cash & Other $4 0.6% • Fairly flat

Total Earning Assets $149 4.4%

Asset growth from capital efficient assets while auto assets relatively flat

(1) Average balances as of 12/31/2016; yields represent full year 2016 average

30

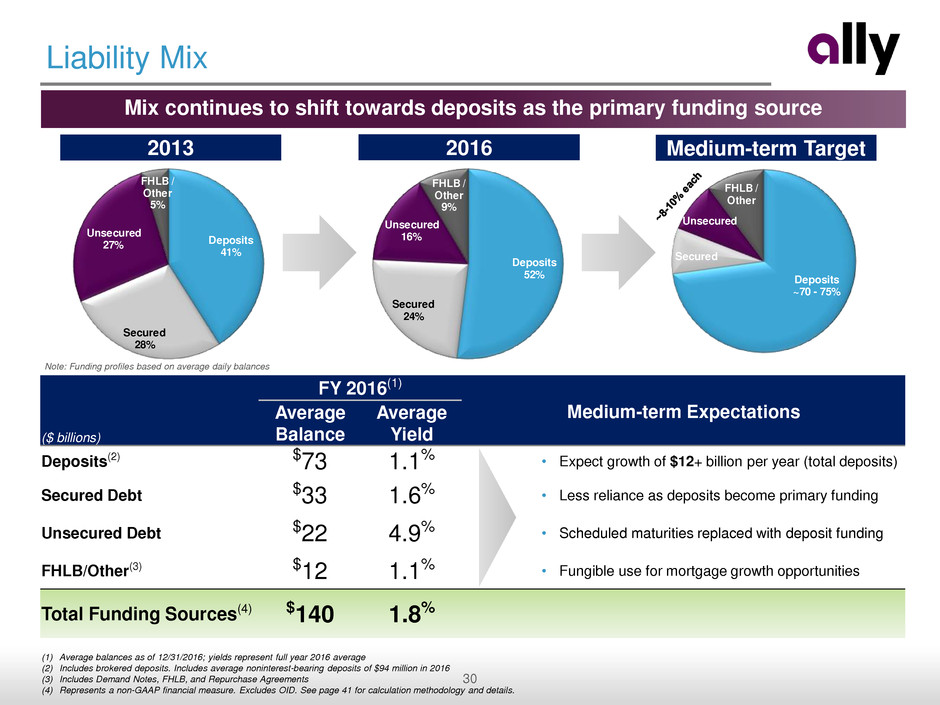

Deposits

41%

Secured

28%

Unsecured

27%

FHLB /

Other

5%

Deposits

52%

Secured

24%

Unsecured

16%

FHLB /

Other

9%

Secured

Unsecured

FHLB /

Other

Deposits

~70 - 75%

Liability Mix

($ billions)

FY 2016(1)

Medium-term Expectations Average

Balance

Average

Yield

Deposits(2) $73 1.1% • Expect growth of $12+ billion per year (total deposits)

Secured Debt $33 1.6% • Less reliance as deposits become primary funding

Unsecured Debt $22 4.9% • Scheduled maturities replaced with deposit funding

FHLB/Other(3) $12 1.1% • Fungible use for mortgage growth opportunities

Total Funding Sources(4) $140 1.8%

Mix continues to shift towards deposits as the primary funding source

2013 2016 Medium-term Target

Note: Funding profiles based on average daily balances

(1) Average balances as of 12/31/2016; yields represent full year 2016 average

(2) Includes brokered deposits. Includes average noninterest-bearing deposits of $94 million in 2016

(3) Includes Demand Notes, FHLB, and Repurchase Agreements

(4) Represents a non-GAAP financial measure. Excludes OID. See page 41 for calculation methodology and details.

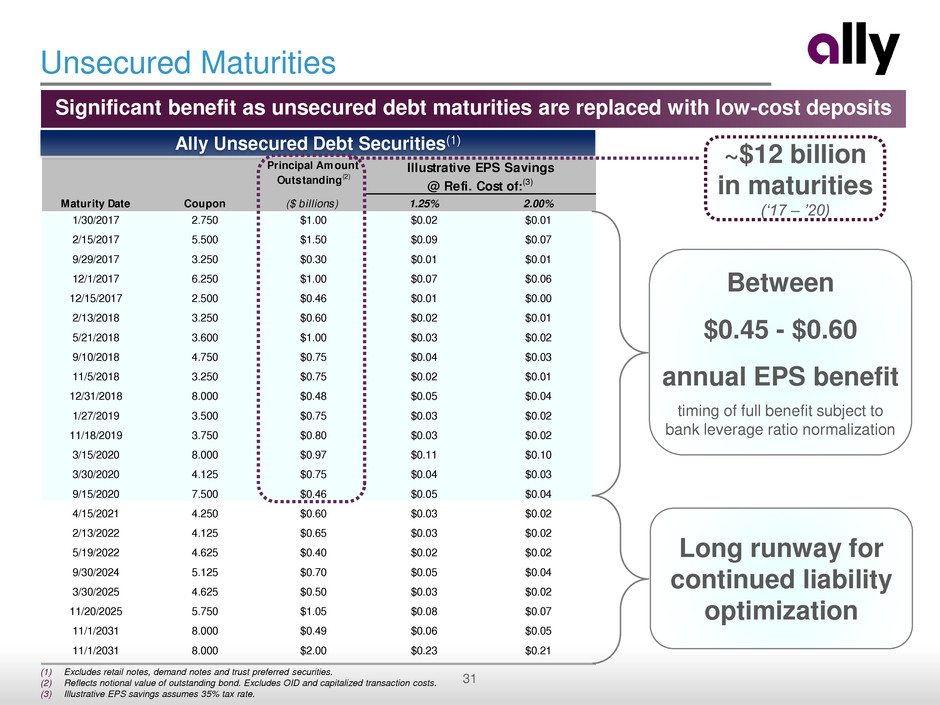

31

Principal Amount

Outstanding(2)

Maturity Date Coupon ($ billions) 1.25% 2.00%

1/30/2017 2.750 $1.00 $0.02 $0.01

2/15/2017 5.500 $1.50 $0.09 $0.07

9/29/2017 3.250 $0.30 $0.01 $0.01

12/1/2017 6.250 $1.00 $0.07 $0.06

12/15/2017 2.500 $0.46 $0.01 $0.00

2/13/2018 3.250 $0.60 $0.02 $0.01

5/21/2018 3.600 $1.00 $0.03 $0.02

9/10/2018 4.750 $0.75 $0.04 $0.03

11/5/2018 3.250 $0.75 $0.02 $0.01

12/31/2018 8.000 $0.48 $0.05 $0.04

1/27/2019 3.500 $0.75 $0.03 $0.02

11/18/2019 3.750 $0.80 $0.03 $0.02

3/15/2020 8.000 $0.97 $0.11 $0.10

3/30/2020 4.125 $0.75 $0.04 $0.03

9/15/2020 7.500 $0.46 $0.05 $0.04

4/15/2021 4.250 $0.60 $0.03 $0.02

2/13/2022 4.125 $0.65 $0.03 $0.02

5/19/2022 4.625 $0.40 $0.02 $0.02

9/30/2024 5.125 $0.70 $0.05 $0.04

3/30/2025 4.625 $0.50 $0.03 $0.02

11/20/2025 5.750 $1.05 $0.08 $0.07

11/1/2031 8.000 $0.49 $0.06 $0.05

11/1/2031 8.000 $2.00 $0.23 $0.21

Illustrative EPS Savings

@ Refi. Cost of:(3)

Unsecured Maturities

Significant benefit as unsecured debt maturities are replaced with low-cost deposits

Ally Unsecured Debt Securities(1)

Between

$0.45 - $0.60

annual EPS benefit

timing of full benefit subject to

bank leverage ratio normalization

Long runway for

continued liability

optimization

~$12 billion

in maturities

(‘17 – ’20)

(1) Excludes retail notes, demand notes and trust preferred securities.

(2) Reflects notional value of outstanding bond. Excludes OID and capitalized transaction costs.

(3) Illustrative EPS savings assumes 35% tax rate.

32

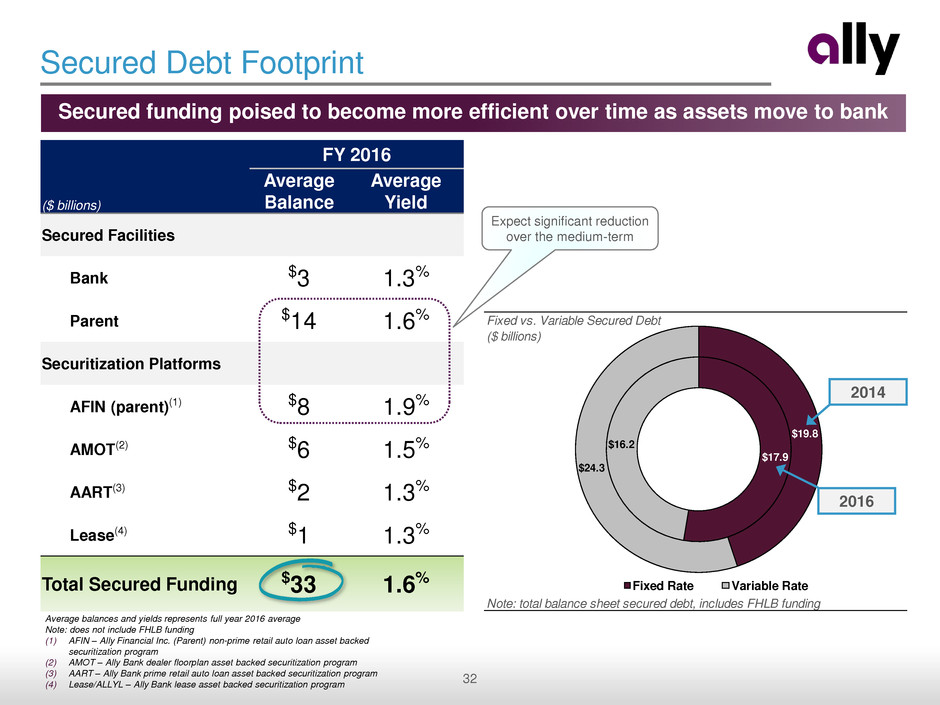

Fixed vs. Variable Secured Debt

($ billions)

Note: total balance sheet secured debt, includes FHLB funding

$17.9

$16.2

$19.8

$24.3

Fixed Rate Variable Rate

Secured Debt Footprint

Secured funding poised to become more efficient over time as assets move to bank

($ billions)

FY 2016

Average

Balance

Average

Yield

Secured Facilities

Bank $3 1.3%

Parent $14 1.6%

Securitization Platforms

AFIN (parent)(1) $8 1.9%

AMOT(2) $6 1.5%

AART(3) $2 1.3%

Lease(4) $1 1.3%

Total Secured Funding $33 1.6%

Average balances and yields represents full year 2016 average

Note: does not include FHLB funding

(1) AFIN – Ally Financial Inc. (Parent) non-prime retail auto loan asset backed

securitization program

(2) AMOT – Ally Bank dealer floorplan asset backed securitization program

(3) AART – Ally Bank prime retail auto loan asset backed securitization program

(4) Lease/ALLYL – Ally Bank lease asset backed securitization program

2016

2014

Expect significant reduction

over the medium-term

33

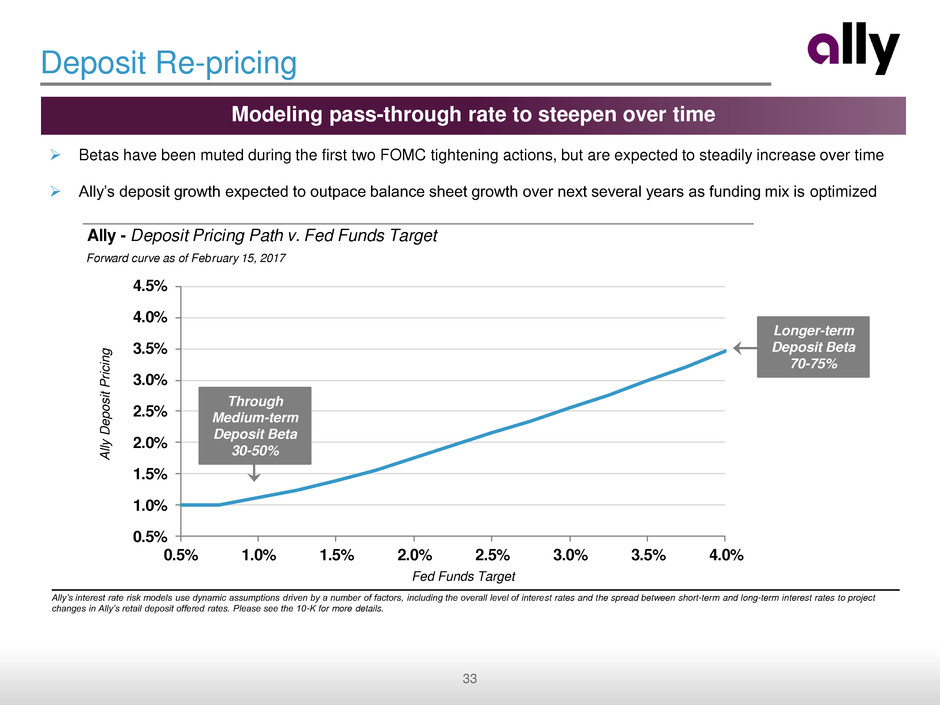

Deposit Re-pricing

Modeling pass-through rate to steepen over time

Betas have been muted during the first two FOMC tightening actions, but are expected to steadily increase over time

Ally’s deposit growth expected to outpace balance sheet growth over next several years as funding mix is optimized

Ally - Deposit Pricing Path v. Fed Funds Target

Forward curve as of February 15, 2017

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0%

A

lly

Dep

o

s

it

P

ri

c

in

g

Fed Funds Target

Longer-term

Deposit Beta

70-75%

Through

Medium-term

Deposit Beta

30-50%

Ally’s interest rate risk models use dynamic assumptions driven by a number of factors, including the overall level of interest rates and the spread between short-term and long-term interest rates to project

changes in Ally’s retail deposit offered rates. Please see the 10-K for more details.

34 CONFIDENTIAL

Summary Outlook Chris Halmy, Chief Financial Officer

Customer and Products Overview

Chris Halmy, Chief Financial Officer

Dave Shevsky, Chief Risk Officer

Net Financing Revenue Brad Brown, Corporate Treasurer

Near-term Outlook Chris Halmy, Chief Financial Officer

1

2

3

4

35

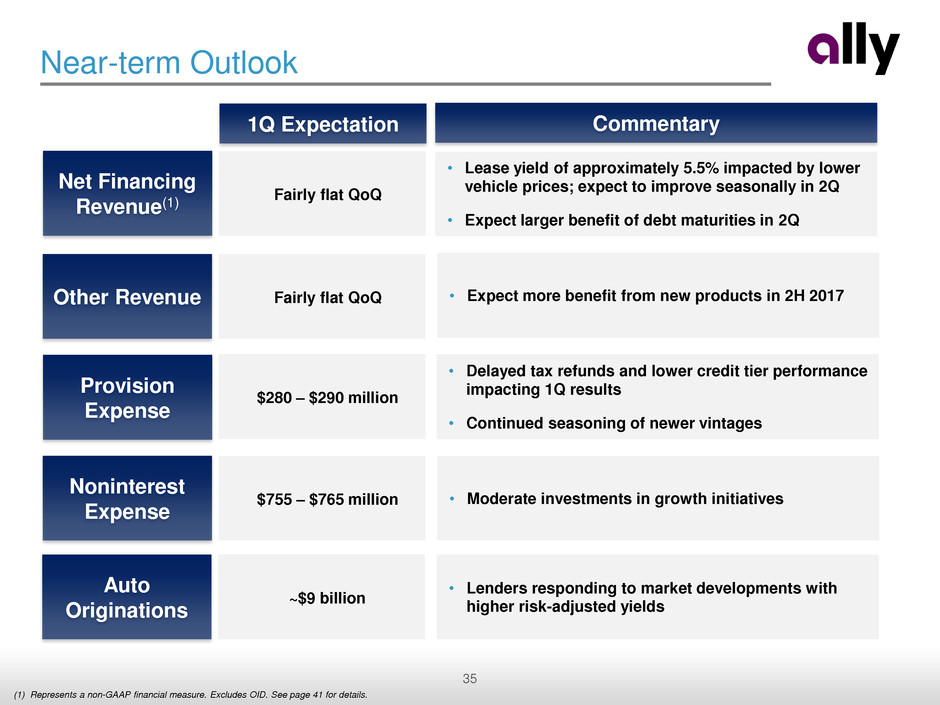

Near-term Outlook

Net Financing

Revenue(1)

Provision

Expense

Noninterest

Expense

Fairly flat QoQ

Fairly flat QoQ

$280 – $290 million

$755 – $765 million

1Q Expectation Commentary

• Lease yield of approximately 5.5% impacted by lower

vehicle prices; expect to improve seasonally in 2Q

• Expect larger benefit of debt maturities in 2Q

Other Revenue • Expect more benefit from new products in 2H 2017

• Delayed tax refunds and lower credit tier performance

impacting 1Q results

• Continued seasoning of newer vintages

• Moderate investments in growth initiatives

Auto

Originations

~$9 billion

• Lenders responding to market developments with

higher risk-adjusted yields

(1) Represents a non-GAAP financial measure. Excludes OID. See page 41 for details.

36

Summary of Financial Targets

2017

Medium-term

Target

Adjusted EPS(1) Growth

Core ROTCE(1)

Adjusted Efficiency Ratio(1)

Conclusion and Long-term Trajectory

Progressing down financial path to drive long-term value

5 - 15% 15%+ CAGR

10% +/-

45 - 47% Low 40s%

12% +/-

Attractive and achievable financial targets over time

Self-help drivers are tangible and meaningful – liability and capital management

Quarterly progression subject to manageable variability

Interest rate curve

Quarterly retail auto loss and lease performance

Bank leverage ratio requirement

(1) Represents a non-GAAP financial measure. See pages 39, 40 and 41 for details.

37 CONFIDENTIAL

Supplemental

38

Notes on non-GAAP and other financial measures

Supplemental

1) Core net income available to common is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that,

like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate

earnings. Core net income available to common adjusts GAAP net income available to common for discontinued operations net of tax, tax-effected OID expense, tax-

effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital

actions. See page 39 for calculation methodology and details.

2) Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in

nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader

better understand the operating performance of the core businesses and their ability to generate earnings. See page 39 for calculation methodology and details.

3) Tangible Common Equity is defined as common stockholders’ equity less goodwill and identifiable intangible assets (other than mortgage servicing rights), net of

deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Tangible common equity is not formally

defined by GAAP or codified in the federal banking regulations and, therefore, is considered to be a non-GAAP financial measure. Ally believes that tangible common

equity is important because we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to

compare certain aspects of our capital adequacy on the same basis to other companies in the industry. For purposes of calculating Core return on tangible common

equity (Core ROTCE), tangible common equity is further adjusted for unamortized original issuance discount and net deferred tax asset. See page 40 for more details.

4) Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending

businesses with those of its peers. In the numerator of Adjusted efficiency ratio, total noninterest expense is adjusted for Insurance segment expense, repositioning

items primarily related to strategic activities and rep and warrant expense. In the denominator, total net revenue is adjusted for Insurance segment revenue,

repositioning items primarily related to the extinguishment of high-cost legacy debt and original issue discount (OID). See page 41 for more details.

5) Net financing revenue (ex. OID) is a non-GAAP financial that adjusts non-cash expense bond exchange original issue discount (OID). See page 41 for more details.

6) Total Funding Sources (ex. OID) is a non-GAAP financial that adjusts bond exchange original issue discount (OID). See page 41 for more details.

The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements,

but which are supplemental to and not a substitute for U.S. GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Net Income

Available to Common, Core Return on Tangible Common Equity (Core ROTCE) and Adjusted Efficiency Ratio. These measures are used by

management and we believe are useful to investors in assessing the company’s operating performance and capital measures. Refer to the

Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document.

39

Notes on non-GAAP and other financial measures

Supplemental

Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in

nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better

understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income available to

common is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses

and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash expense bond exchange original issue

discount (OID), (3) adds back tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes certain

discrete tax items that do not relate to the operating performance of the core businesses, and (5) adjusts for preferred stock capital actions (e.g., Series A and Series G) that

have been taken by the company to normalize its capital structure.

Adjusted Earnings per Share ("Adjusted EPS")

FY 2016 4Q '16 3Q '16 2Q '16 1Q '16 FY 2015 4Q '15 3Q '15 2Q '15 1Q '15 FY 2014 4Q '14 3Q '14 2Q '14 1Q '14

Numerator ($ millions)

GAAP net income available to common shareholders 1,037$ 248$ 209$ 345$ 235$ (1,282)$ (953)$ 230$ (1,069)$ 509$ 882$ 109$ 356$ 258$ 159$

less: Disc Ops, net of tax 44 (2) 52 (3) (3) (392) 13 5 (13) (397) (225) (26) (130) (40) (29)

add back: Original issue discount expense ("OID expense") 59 15 15 14 15 59 12 11 18 17 186 42 47 53 44

add back: Repositioning Items 11 - - 4 7 349 3 2 154 190 187 167 - 16 3

less: OID & Repo. Tax (35% in '16, 34% in '15 and prior) (24) (5) (5) (6) (8) (139) 5 (5) (58) (71) (127) (71) (16) (24) (16)

Significant Discrete Tax Items (84) - - (91) 7 - - - - - (91) (30) - (62) -

Series G Actions - - - - - 2,350 1,179 - 1,171 - - - - - -

Series A Actions 1 - - 1 - 22 - - 22 - - - - - -

Core et income available to common shareholders [a] 1,043$ 256$ 271$ 263$ 253$ 967$ 249$ 244$ 224$ 249$ 812$ 192$ 257$ 203$ 161$

Denominator

Weighted-Average Shares Outstanding - (Diluted, thousands) [b] 482,182 474,505 483,575 486,074 484,654 483,934 484,845 484,399 483,687 482,782 481,934 483,091 482,506 482,343 479,768

Adjusted EPS [a] / [b] 2.16$ 0.54$ 0.56$ 0.54$ 0.52$ 2.00$ 0.52$ 0.51$ 0.46$ 0.52$ 1.68$ 0.40$ 0.53$ 0.42$ 0.34$

QUARTERLY TREND

40

Notes on non-GAAP and other financial measures

Supplemental

Core Return on Tangible Common Equity ("Core ROTCE")

FY 2016 FY 2013

Numerator ($ millions)

GAAP net income available to common shareholders 1,037$ (688)$

less: Disc Ops, net of tax 44 55

add back: Original issue discount expense ("OID expense") 59 249

add back: Repositioning Items 11 244

less: OID & Repo. Tax (35% in '16, 34% in '15) (24) (168)

Significant Discrete Tax Items & Other (84) 602

Series G Actions - -

Series A Actions 1 -

Core net income available to common shareholders [a] 1,043$ 294$

Denominator (2-period average, $ billions)

GAAP shareholder's equity 13.4$ 17.1$

less: Preferred equity 0.3 4.1

less: Goodwill & identifiable intangibles, net of deferred tax liabilities ("DTLs") 0.2 0.3

Tangible common equity 12.9$ 12.7$

less: Unamortized original issue discount ("OID discount") 1.3 1.7

less: Net deferred tax asset ("DTA") 1.2 1.6

Normalized common equity [b] 10.4$ 9.4$

Core Return on Tangible Common Equity [a] / [b] 10.0% 3.1%

Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the

ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for

unamortized OID and net DTA. Ally’s Core net income available to common utilized a static 34% tax rate for purposes of calculating Core ROTCE through 4Q 2015. As of

1Q 2016, Ally’s Core net income available to common for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any

discrete tax items including tax reserve releases, which aligns with the methodology used calculating adjusted earnings per share.

(1) In the numerator of Core ROTCE, GAAP net income available to common is adjusted for discontinued operations net of tax, tax-effected OID expense, tax-effected

repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital

actions.

(2) In the denominator, GAAP shareholder’s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, unamortized OID, and net DTA.

41

Notes on non-GAAP and other financial measures

Supplemental

Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending

businesses with those of its peers. In the numerator of Adjusted efficiency ratio, total noninterest expense is adjusted for Insurance segment expense, repositioning items

primarily related to strategic activities and rep and warrant expense. In the denominator, total net revenue is adjusted for Insurance segment revenue, repositioning items

primarily related to the extinguishment of high-cost legacy debt and original issue discount (OID).

Adjusted Efficiency Ratio

FY 2016 FY 2013

Numerator ($ millions)

Total noninterest expense 2,939$ 3,405$

less: Rep and warrant expense (6) 32

less: Insurance expense 940 999

less: Repositioning items 9 123

Adjusted noninterest expense [a] 1,997$ 2,251$

Denominator ($ millions)

Total et revenue 5,437$ 4,263$

add: Original issue discount 59 249

add: Repositioning items 3 121

less: Insurance revenue 1,097 1,253

Adjusted net revenue [b] 4,401$ 3,380$

Adjusted Efficiency Ratio [a] / [b] 45% 67%

Net financing revenue (ex. OID) is a non-GAAP financial that adjusts non-cash expense bond exchange original issue discount (OID).

Total Funding Sources (ex. OID) is a non-GAAP financial that adjusts bond exchange original issue discount (OID).

Net Financing Revenue (ex. OID) Total Funding Sources (ex. OID)

$ in millions FY 2016 FY 2013 $ in b illions FY 2016

GAAP Net Financing Revenue 3,907$ 2,779$ GAAP Total Funding Sources 139$

Original Issue Discount ("OID") 57 249 Original Issue Discount ("OID") 1

Net Financing Revenue (ex. OID) 3,964$ 3,028$ Total Funding Sources (ex. OID) 140$