Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - AZURE MIDSTREAM PARTNERS, LP | a17-8625_3ex2d1.htm |

| 8-K - 8-K - AZURE MIDSTREAM PARTNERS, LP | a17-8625_38k.htm |

Exhibit 2.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

|

|

§ |

|

|

In re: |

§ |

Chapter 11 |

|

|

§ |

|

|

AZURE MIDSTREAM |

§ |

Case No. 17-30461 (DRJ) |

|

PARTNERS, LP, et al., |

§ |

|

|

|

§ |

Jointly Administered |

|

|

§ |

|

|

Debtors.1 |

§ |

|

|

|

§ |

|

DISCLOSURE STATEMENT FOR DEBTORS’ JOINT PLAN OF LIQUIDATION

THIS IS NOT A SOLICITATION FOR ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THE DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT TO DATE.

|

Christopher M. López (24041356) |

Gary T. Holtzer |

|

WEIL, GOTSHAL & MANGES LLP |

Robert J. Lemons |

|

700 Louisiana Street, Suite 1700 |

Charles M. Persons |

|

Houston, Texas 77002 |

WEIL, GOTSHAL & MANGES LLP |

|

Telephone: (713) 546-5000 |

767 Fifth Avenue |

|

Facsimile: (713) 224-9511 |

New York, New York 10153 |

|

Email: chris.lopez@weil.com |

Telephone: (212) 310-8000 |

|

|

Facsimile: (212) 310-8007 |

|

|

Email: gary.holtzer@weil.com |

|

|

Email: robert.lemons@weil.com |

|

|

Email: charles.persons@weil.com |

|

|

|

|

|

Attorneys for the Debtors and Debtors in Possession |

Dated: March 20, 2017

Houston, Texas

1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number are: Azure Midstream Partners, LP (7595), Azure ETG, LLC (3388), Azure Holdings GP, LLC (0537), Azure Midstream Partners GP, LLC (8089), Azure TGG, LLC (6233), Marlin G&P I, LLC (6073), Marlin Logistics, LLC (8460), Marlin Midstream Finance Corp. (0130), Marlin Midstream, LLC (2587), Murvaul Gas Gathering, LLC (0826), Talco Midstream Assets, Ltd. (7004), and Turkey Creek Pipeline, LLC (1161).

TABLE OF CONTENTS

|

|

|

Page | |||

|

|

|

| |||

|

I. |

INTRODUCTION |

3 | |||

|

|

A. |

VOTING PROCEDURES |

4 | ||

|

|

B. |

THE DEBTORS’ PROFESSIONALS |

4 | ||

|

|

C. |

BRIEF OVERVIEW OF THE PLAN |

5 | ||

|

|

D. |

SUMMARY OF DISTRIBUTIONS AND VOTING ELIGIBILITY |

5 | ||

|

|

E. |

CONFIRMATION UNDER SECTION 1129(b) |

6 | ||

|

|

F. |

CONFIRMATION HEARING |

6 | ||

|

II. |

OVERVIEW OF THE DEBTORS’ OPERATIONS |

7 | |||

|

|

A. |

THE DEBTORS’ BUSINESSES |

7 | ||

|

|

B. |

OPERATING ASSETS |

7 | ||

|

|

|

1. |

NATURAL GAS GATHERING SYSTEMS |

7 | |

|

|

|

|

A. |

ETG SYSTEM |

7 |

|

|

|

|

B. |

LEGACY SYSTEM |

8 |

|

|

|

|

C. |

TURKEY CREEK PIPELINE |

8 |

|

|

|

|

D. |

BETHANY LATERAL AND STATELINE FACILITY |

8 |

|

|

|

2. |

STANDALONE PROCESSING PLANTS |

8 | |

|

|

|

|

A. |

PANOLA SYSTEM |

8 |

|

|

|

|

B. |

TYLER FACILITY |

8 |

|

|

|

3. |

LOGISTICS ASSETS |

9 | |

|

|

C. |

ORGANIZATIONAL STRUCTURE |

9 | ||

|

|

D. |

CORPORATE HISTORY AND CAPITAL STRUCTURE |

9 | ||

|

|

|

1. |

CURRENT OWNERSHIP OF PARTNERSHIP INTERESTS AND IDR UNITS |

9 | |

|

|

|

2. |

FORMATION OF THE PARTNERSHIP |

10 | |

|

|

|

|

A. |

THE NUDEVCO CONTRIBUTION |

10 |

|

|

|

|

B. |

THE PARTNERSHIP AGREEMENT |

10 |

|

|

|

|

C. |

THE ORIGINAL OMNIBUS AGREEMENT |

11 |

|

|

|

|

D. |

THE AES SERVICES AGREEMENT |

11 |

|

|

|

|

E. |

THE IPO |

11 |

|

|

|

3. |

ACQUISITION OF THE LEGACY ASSETS |

11 | |

|

|

|

4. |

THE OMNIBUS AGREEMENT |

11 | |

|

|

|

5. |

ACQUISITION OF THE ETG SYSTEM |

12 | |

TABLE OF CONTENTS

(continued)

|

|

|

Page | |||

|

|

|

|

|

| |

|

|

|

6. |

THE AES SETTLEMENT |

12 | |

|

|

|

7. |

THE PANOLA AND MURVAUL SALE |

13 | |

|

|

|

8. |

PREPETITION INDEBTEDNESS |

13 | |

|

|

|

|

A. |

THE PREPETITION CREDIT AGREEMENT AND PREPETITION CREDIT FACILITY |

13 |

|

|

|

|

B. |

OTHER INDEBTEDNESS |

13 |

|

|

E. |

PENDING LITIGATION |

14 | ||

|

III. |

KEY EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES |

14 | |||

|

|

A. |

THE SUSTAINED DROP IN OIL AND GAS PRICES |

14 | ||

|

|

B. |

DEFAULT UNDER THE PREPETITION CREDIT AGREEMENT |

14 | ||

|

|

C. |

NEGOTIATIONS WITH STAKEHOLDERS |

16 | ||

|

|

D. |

MARKETING PROCESS |

16 | ||

|

IV. |

KEY EVENTS DURING THE CHAPTER 11 CASES |

17 | |||

|

|

A. |

COMMENCEMENT OF THE CHAPTER 11 CASES AND FIRST DAY MOTIONS |

17 | ||

|

|

B. |

CASH COLLATERAL |

17 | ||

|

|

C. |

BID PROCEDURES |

18 | ||

|

|

D. |

AUCTION AND SALE HEARING |

19 | ||

|

|

E. |

SCHEDULES AND BAR DATES |

20 | ||

|

|

F. |

REJECTION MOTION AND RIGHTS NOTICE |

20 | ||

|

|

G. |

SEVERANCE MOTION |

20 | ||

|

V. |

THE PLAN |

21 | |||

|

|

A. |

INTRODUCTION |

21 | ||

|

|

B. |

CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS UNDER THE PLAN |

21 | ||

|

|

C. |

UNCLASSIFIED CLAIMS |

22 | ||

|

|

|

1. |

Administrative Expense Claims |

23 | |

|

|

|

2. |

Fee Claims |

23 | |

|

|

|

3. |

Priority Tax Claims |

23 | |

|

|

D. |

CLASSIFICATION OF CLAIMS AND INTERESTS |

24 | ||

|

|

|

1. |

Class 1 — Other Priority Claims |

24 | |

|

|

|

|

a. |

Classification |

24 |

|

|

|

|

b. |

Treatment |

24 |

TABLE OF CONTENTS

(continued)

|

|

|

Page | |||

|

|

|

|

|

|

|

|

|

|

|

c. |

Voting |

24 |

|

|

|

2. |

Class 2 — Other Secured Claims |

24 | |

|

|

|

|

a. |

Classification |

24 |

|

|

|

|

b. |

Treatment |

24 |

|

|

|

|

c. |

Voting |

24 |

|

|

|

3. |

Class 3 — Lender Claims |

25 | |

|

|

|

|

a. |

Classification |

25 |

|

|

|

|

b. |

Allowance |

25 |

|

|

|

|

c. |

Treatment |

25 |

|

|

|

|

d. |

Voting |

25 |

|

|

|

4. |

Class 4 —General Unsecured Claims |

25 | |

|

|

|

|

a. |

Classification |

25 |

|

|

|

|

b. |

Treatment |

25 |

|

|

|

|

c. |

Voting |

26 |

|

|

|

5. |

Class 5 — Intercompany Claims |

26 | |

|

|

|

|

a. |

Classification |

26 |

|

|

|

|

b. |

Treatment |

26 |

|

|

|

|

c. |

Voting |

26 |

|

|

|

6. |

Class 6 — Existing Azure Interests |

26 | |

|

|

|

|

a. |

Classification |

26 |

|

|

|

|

b. |

Stock Exchange |

26 |

|

|

|

|

c. |

Treatment |

26 |

|

|

|

|

d. |

Voting |

27 |

|

|

|

|

e. |

Non-Transferable |

27 |

|

|

|

7. |

Class 7 — Other Equity Interests |

27 | |

|

|

|

|

a. |

Classification |

27 |

|

|

|

|

b. |

Treatment |

27 |

|

|

|

|

c. |

Voting |

27 |

|

|

E. |

MEANS FOR IMPLEMENTATION |

27 | ||

|

|

|

1. |

Joint Chapter 11 Plan |

27 | |

|

|

|

2. |

Plan Administrator |

27 | |

|

|

|

3. |

Merger of Debtors; Closing Cases of Debtors |

29 | |

|

|

|

4. |

Corporate Action |

29 | |

|

|

|

5. |

Withholding and Reporting Requirements |

29 | |

|

|

|

6. |

Exemption from Certain Transfer Taxes |

30 | |

TABLE OF CONTENTS

(continued)

|

|

|

Page | ||

|

|

|

|

|

|

|

|

|

7. |

Effectuating Documents; Further Transactions |

30 |

|

|

|

8. |

Closing of the Azure Case |

30 |

|

|

F. |

CORPORATE GOVERNANCE |

31 | |

|

|

|

1. |

Board of Directors and Officers |

31 |

|

|

|

2. |

Wind Down |

31 |

|

|

|

3. |

Partnership Agreement |

31 |

|

|

G. |

DISTRIBUTIONS |

31 | |

|

|

|

1. |

Distribution Record Date |

31 |

|

|

|

2. |

Date of Distributions |

31 |

|

|

|

3. |

Delivery of Distributions |

32 |

|

|

|

4. |

Manner of Payment Under Plan |

32 |

|

|

|

5. |

Minimum Cash Distributions |

32 |

|

|

|

6. |

Setoffs |

32 |

|

|

|

7. |

Distributions After Effective Date |

33 |

|

|

|

8. |

Payment of Disputed Claims |

33 |

|

|

H. |

PROCEDURES FOR DISPUTED CLAIMS |

33 | |

|

|

|

1. |

Allowance of Claims |

33 |

|

|

|

2. |

Objections to Claims |

33 |

|

|

|

3. |

Estimation of Claims |

33 |

|

|

|

4. |

No Distributions Pending Allowance |

34 |

|

|

|

5. |

Resolution of Claims |

34 |

|

|

I. |

EXECUTORY CONTRACTS AND UNEXPIRED LEASES |

34 | |

|

|

|

1. |

Assumption and Assignment of Executory Contracts and Unexpired Leases |

34 |

|

|

|

2. |

Claims Based on Rejection of Executory Contracts and Unexpired Leases |

34 |

|

|

|

3. |

Purchase Agreement |

35 |

|

|

|

4. |

Modifications, Amendments, Supplements, Restatements, or Other Agreements |

35 |

|

|

|

5. |

Insurance Policies |

35 |

|

|

|

6. |

Reservation of Rights |

35 |

|

|

J. |

CONDITIONS PRECEDENT TO THE EFFECTIVE DATE |

35 | |

|

|

|

1. |

Conditions Precedent to the Effective Date |

35 |

|

|

|

2. |

Waiver of Conditions Precedent |

36 |

|

|

|

3. |

Effect of Failure of Conditions to Effective Date |

36 |

TABLE OF CONTENTS

(continued)

|

|

|

Page | ||

|

|

|

|

| |

|

|

K. |

EFFECT OF CONFIRMATION |

36 | |

|

|

|

1. |

Vesting of Assets |

36 |

|

|

|

2. |

Release of Liens |

37 |

|

|

|

3. |

Subordinated Claims |

37 |

|

|

|

4. |

Binding Effect |

37 |

|

|

|

5. |

Term of Injunctions or Stays |

37 |

|

|

|

6. |

Releases by the Debtors |

37 |

|

|

|

7. |

Releases By Holders of Claims and Interests |

38 |

|

|

|

8. |

Exculpation |

39 |

|

|

|

9. |

Plan Injunction |

39 |

|

|

|

10. |

Injunction Related to Releases and Exculpation |

40 |

|

|

|

11. |

Waiver of Statutory Limitation on Releases |

40 |

|

|

|

12. |

Preservation of Rights of Action |

41 |

|

|

|

13. |

Solicitation of the Plan |

41 |

|

|

|

14. |

Plan Supplement |

41 |

|

|

|

15. |

Corporate Action |

41 |

|

|

L. |

RETENTION OF JURISDICTION |

42 | |

|

|

M. |

MISCELLANEOUS PROVISIONS |

43 | |

|

|

|

1. |

Payment of Statutory Fees |

43 |

|

|

|

2. |

Substantial Consummation |

43 |

|

|

|

3. |

Amendments |

43 |

|

|

|

4. |

Revocation or Withdrawal of the Plan |

44 |

|

|

|

5. |

Severability of Plan Provisions upon Confirmation |

44 |

|

|

|

6. |

Governing Law |

44 |

|

|

|

7. |

Time |

44 |

|

|

|

8. |

Additional Documents |

45 |

|

|

|

9. |

Immediate Binding Effect |

45 |

|

|

|

10. |

Successors and Assigns |

45 |

|

|

|

11. |

Entire Agreement |

45 |

|

|

|

12. |

Notices |

45 |

|

VI. |

CERTAIN RISK FACTORS AFFECTING THE DEBTORS |

46 | ||

|

|

A. |

CERTAIN BANKRUPTCY LAW CONSIDERATIONS |

46 | |

|

|

|

1. |

Risk of Non-Confirmation of the Plan |

46 |

|

|

|

2. |

Non-Consensual Confirmation |

46 |

TABLE OF CONTENTS

(continued)

|

|

|

Page | |||

|

|

|

|

|

| |

|

|

|

3. |

Risk Related to Cash Collateral Order |

47 | |

|

|

B. |

ADDITIONAL FACTORS TO BE CONSIDERED |

47 | ||

|

|

|

1. |

The Debtors Have No Duty to Update |

47 | |

|

|

|

2. |

No Representations Outside This Disclosure Statement Are Authorized |

47 | |

|

|

|

3. |

No Legal or Tax Advice Is Provided to You by This Disclosure Statement |

47 | |

|

|

|

4. |

No Admission Made |

47 | |

|

|

|

5. |

Failure to Identify Litigation Claims or Projected Objections |

47 | |

|

|

|

6. |

No Waiver of Right to Object or Right to Recover Transfers and Assets |

48 | |

|

|

|

7. |

Information Was Provided by the Debtors and Was Relied Upon by the Debtors’ Advisors |

48 | |

|

VII. |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES |

48 | |||

|

|

A. |

CONSEQUENCES TO THE DEBTORS |

49 | ||

|

|

|

1. |

Sale Transaction and Other Disposition of Assets |

49 | |

|

|

|

2. |

Cancellation of Debt Income |

50 | |

|

|

B. |

CONSEQUENCES TO HOLDERS OF ALLOWED LENDER CLAIMS AND GENERAL UNSECURED CLAIMS |

51 | ||

|

|

|

1. |

Gain or Loss |

51 | |

|

|

|

2. |

Distributions in Respect of Accrued Interest |

52 | |

|

|

C. |

WITHHOLDING ON DISTRIBUTIONS AND INFORMATION REPORTING |

52 | ||

|

VIII. |

CONFIRMATION OF THE PLAN |

52 | |||

|

|

A. |

CONFIRMATION HEARING |

52 | ||

|

|

B. |

OBJECTIONS |

53 | ||

|

|

C. |

REQUIREMENTS FOR CONFIRMATION OF THE PLAN |

53 | ||

|

|

|

1. |

Requirements of Section 1129(a) of the Bankruptcy Code |

53 | |

|

|

|

|

a. |

General Requirements |

53 |

|

|

|

|

b. |

Best Interests Test |

54 |

|

|

|

|

c. |

Feasibility Analysis |

55 |

|

|

|

2. |

Requirements of Section 1129(b) of the Bankruptcy Code |

55 | |

|

|

|

|

a. |

No Unfair Discrimination |

55 |

|

|

|

|

b. |

Fair and Equitable Test |

55 |

|

|

|

|

c. |

Application to the Plan |

56 |

|

|

|

3. |

Alternative to Confirmation and Consummation of the Plan |

56 | |

|

|

|

|

a. |

Liquidation Under Chapter 7 |

56 |

|

|

|

|

b. |

Alternative Plans |

57 |

|

EXHIBIT A |

The Plan |

|

|

|

|

EXHIBIT B |

The Debtors’ Prepetition Organizational Structure |

|

|

|

|

EXHIBIT C |

Liquidation Analysis |

DISCLAIMER

THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT (THE “DISCLOSURE STATEMENT”) IS INCLUDED HEREIN FOR THE PURPOSES OF SOLICITING ACCEPTANCES OF THE DEBTORS’ JOINT PLAN OF LIQUIDATION, DATED MARCH 20, 2017 (AS MAY BE AMENDED, MODIFIED, OR SUPPLEMENTED FROM TIME TO TIME, THE “PLAN”), AND MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN TO DETERMINE HOW TO VOTE ON THE PLAN.2 A COPY OF THE PLAN IS ANNEXED HERETO AS EXHIBIT A. NO SOLICITATION OF VOTES TO ACCEPT OR REJECT THE PLAN MAY BE MADE EXCEPT PURSUANT TO SECTION 1125 OF THE BANKRUPTCY CODE.

ALL HOLDERS OF CLAIMS OR INTERESTS ARE ADVISED AND ENCOURAGED TO READ THE DISCLOSURE STATEMENT AND THE PLAN IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. IN PARTICULAR, ALL HOLDERS OF CLAIMS SHOULD CAREFULLY READ AND CONSIDER FULLY THE RISK FACTORS SET FORTH IN SECTION VI OF THIS DISCLOSURE STATEMENT BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. THE PLAN SUMMARIES AND STATEMENTS MADE IN THIS DISCLOSURE STATEMENT ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE PLAN AND THE EXHIBITS ANNEXED TO THE PLAN AND THIS DISCLOSURE STATEMENT. IN THE EVENT OF ANY CONFLICTS BETWEEN THE DESCRIPTIONS SET FORTH IN THIS DISCLOSURE STATEMENT AND THE TERMS OF THE PLAN, THE TERMS OF THE PLAN GOVERN.

THE DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(b) AND NOT NECESSARILY IN ACCORDANCE WITH OTHER NON-BANKRUPTCY LAW.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING WITH RESPECT TO PROJECTED CREDITOR RECOVERIES AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBE HEREIN.

AS TO CONTESTED MATTERS AND OTHER ACTIONS OR THREATENED ACTIONS, THIS DISCLOSURE STATEMENT WILL NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, STIPULATION OR WAIVER, BUT RATHER AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS. THIS DISCLOSURE STATEMENT ALSO WILL NOT BE CONSTRUED TO BE CONCLUSIVE ADVICE ON THE TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE PLAN AS TO HOLDERS OF CLAIMS AGAINST, OR INTERESTS IN, THE DEBTORS AND DEBTORS IN POSSESSION IN THE CHAPTER 11 CASES. THE DEBTORS URGE EACH HOLDER OF A CLAIM OR INTEREST TO CONSULT WITH ITS OWN

2 Unless otherwise expressly set forth herein, capitalized terms used but not otherwise defined herein have the same meanings ascribed to such terms in the Plan.

ADVISORS WITH RESPECT TO ANY TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE PLAN ON SUCH HOLDER’S CLAIM OR INTEREST.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS ANOTHER TIME IS SPECIFIED HEREIN, AND THE DELIVERY OF THIS DISCLOSURE STATEMENT WILL NOT CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION STATED SINCE THE DATE HEREOF.

I.

INTRODUCTION

The Debtors submit this Disclosure Statement in connection with the solicitation of votes on the Debtors’ Plan attached hereto as Exhibit A. The Debtors filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) on January 30, 2017 (the “Petition Date”). To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan will govern.

The purpose of this Disclosure Statement is to provide holders of Claims entitled to vote to accept or reject the Plan with adequate information about (i) the Debtors’ businesses and certain historical events, (ii) the Chapter 11 Cases, (iii) the Plan, (iv) the rights of holders of Claims and Interests under the Plan, and (v) other information necessary to enable each holder of a Claim entitled to vote on the Plan to make an informed judgment as to whether to vote to accept or reject the Plan. Holders of Interests are not entitled to vote on the Plan (see discussion at Section V of the Disclosure Statement).

Pursuant to section 1125 of the Bankruptcy Code, the Debtors submit this Disclosure Statement to all holders of Claims against the Debtors entitled to vote on the Plan to provide information in connection with the solicitation of votes to accept or reject the Plan. The Disclosure Statement is also available to all holders of Claims against and Interests in the Debtors for informational purposes, including to detail the impact the Plan will have on such holders’ Claims and/or Interests. The Disclosure Statement is organized as follows:

· Section I provides an introduction and general information about the Plan and Confirmation of the Plan.

· Section II provides an overview of the Debtors’ businesses.

· Section III sets forth key events leading to the Chapter 11 Cases.

· Section IV discusses the Chapter 11 Cases.

· Section V provides a summary of the Plan.

· Section VI describes certain risk factors affecting the Debtors.

· Section VII discusses certain U.S. federal income tax consequences of the Plan.

· Section VIII addresses confirmation of the Plan.

· Section IX concludes this Disclosure Statement and recommends that eligible creditors vote to accept the Plan.

A. VOTING PROCEDURES

As set forth in more detail in Section V.B of this Disclosure Statement, certain holders of Claims are entitled to vote to accept or reject the Plan. For each holder of a Claim entitled to vote, the Debtors have enclosed, among other things, a copy of the Disclosure Statement, a ballot, and voting instructions regarding how to properly complete the ballot and submit a vote with respect to the Plan. Holders of more than one Claim will receive an individual ballot for each Claim. The individual ballots must be used to vote each individual Claim. For detailed voting instructions, please refer to the voting instructions and the ballot enclosed with this Disclosure Statement.

All completed ballots must be actually received by the Debtors’ balloting agent Kurtzman Carson Consultants LLC (“KCC”) at the below address no later than [•], 2017 (the “Voting Deadline”).

Via Regular Mail, Overnight Couriers, or Hand Delivery:

Azure Midstream Partners, LP

Ballot Processing Center

c/o Kurtzman Carson Consultants LLC

2335 Alaska Avenue

El Segundo, California 90245

If you are holder of a Claim that is entitled to vote on the Plan and you did not receive a ballot, received a damaged ballot or lost your ballot, or if you have any questions concerning the Disclosure Statement, the Plan, or the procedures for voting with respect to the Plan, please contact KCC at (888) 733-1434 (domestic toll-free) or (310) 751-2633 (international) or email (azureballots@kcc.com).

THE VOTING AGENT WILL NOT COUNT

ANY BALLOTS RECEIVED AFTER THE VOTING DEADLINE.

B. THE DEBTORS’ PROFESSIONALS

The Debtors have retained, or plan to retain, the following professionals pursuant to separate orders of the Bankruptcy Court: (i) Weil, Gotshal & Manges LLP (“Weil”), as restructuring counsel [Dkt. No. 145]; (ii) Evercore Group L.L.C. (“Evercore”) as investment banker [Dkt. No. 147]; (iii) Alvarez & Marsal North America, LLC (“A&M”) as financial advisor [Dkt. No. 146]; (iv) Vinson & Elkins LLP (“V&E”) as special counsel; (v) KCC as claims, noticing, and balloting agent [Dkt. No. 39]; and (vi) KMPG LLP as auditor. The contact information for each of these professionals is set forth below:

|

Weil, Gotshal & Manges LLP |

Vinson & Elkins LLP | ||

|

767 Fifth Avenue |

2001 Ross Avenue, Suite 3700 | ||

|

New York, NY 10153 |

Dallas, Texas 75201 | ||

|

Attn: |

Gary T. Holtzer, Esq. |

Attn: |

Michael Saslaw, Esq. |

|

|

Robert J. Lemons, Esq. |

|

Bradley Foxman, Esq. |

|

|

Charles M. Persons, Esq. |

|

Elena Sauber, Esq. |

|

Tel: (212) 310-8000 |

Tel: (214) 220-7700 | ||

|

|

| ||

|

Evercore Group L.L.C. |

Alvarez & Marsal North America, LLC | ||

|

666 Fifth Avenue |

700 Louisiana Street, Suite 900 | ||

|

New York, NY 10103 |

Houston, TX 77002 | ||

|

Attn: |

Stephen Hannan |

Attn: |

R. Seth Bullock |

|

|

Avinash D’Souza |

|

Ed Mosley |

|

|

Wariz A. Anifowoshe |

|

Cari L. Turner |

|

Tel: (212) 446-5600 |

Tel: (713) 571-2400 | ||

|

|

| ||

|

Kurtzman Carson Consultants LLC |

KMPG LLP | ||

|

2335 Alaska Avenue |

2323 Ross Avenue, Suite 1400 | ||

|

El Segundo, California 90245 |

Dallas, TX 75201 | ||

|

Attn: |

Drake D. Foster |

Attn: |

Mark L. Moses |

|

|

Leanne V. Rehder Scott |

Tel: (214) 840-2000 | |

|

Tel: (866) 381-9100 |

| ||

C. BRIEF OVERVIEW OF THE PLAN3

The Debtors have received two competing bids to purchase substantially all of the Debtors’ assets (the “Assets”). Pursuant to the Bid Procedures Order, the Debtors held an auction for the Assets on March 10, 2017.

The purpose of the Plan is to effectuate the completion of a sale of the Assets (the “Sale Transaction”) and the orderly wind down of the Debtors’ affairs through the distribution of: (i) the proceeds from the Sale Transaction (the “Sale Proceeds”) and (ii) other assets of the Estate for the benefit of holders of Allowed Claims pursuant to the Plan and the Bankruptcy Code’s priority distribution requirements. Under the Plan, Debtor Azure Midstream Partners, LP will serve as Plan Administrator to, among other things, resolve Disputed Claims, investigate and pursue any Claims and Causes of Action not otherwise released under the Plan (if appropriate), make distributions to holders of Allowed Claims, and close the Chapter 11 Cases. The Plan constitutes a single chapter 11 plan for all of the Debtors and the classifications and treatment of Claims and Interests therein apply to all of the Debtors.

Section V of this Disclosure Statement provides a detailed description of the Plan.

D. SUMMARY OF DISTRIBUTIONS AND VOTING ELIGIBILITY

The following summary table briefly outlines the classification and treatment of Claims against and Interests in the Debtors under the Plan, and the voting eligibility of the holders of such Claims and Interests. As set forth in the Plan, the classification of Claims and Interests set forth herein will apply separately to each of the Debtors. The following summary table is qualified in its entirety by reference to the full text of the Plan.

3 This summary is qualified in its entirety by reference to the Plan. Statements as to the rationale underlying the treatment of Claims and Interests under the Plan are not intended to, and will not, waive, compromise or limit any rights, claims, defenses, or causes of action in the event that the Plan is not confirmed. You should read the Plan in its entirety before voting to accept or reject the Plan.

|

Class |

|

Designation |

|

Treatment |

|

Entitled to Vote |

|

Approx. |

|

1 |

|

Other Priority Claims |

|

Unimpaired |

|

No |

|

100% |

|

2 |

|

Other Secured Claims |

|

Unimpaired |

|

No |

|

100% |

|

3 |

|

Lender Claims |

|

Impaired |

|

Yes |

|

[TBD] |

|

4 |

|

General Unsecured Claims |

|

Impaired |

|

Yes |

|

[TBD] |

|

5 |

|

Intercompany Claims |

|

Impaired |

|

No |

|

0% |

|

6 |

|

Existing Azure Interests |

|

Impaired |

|

No |

|

0% |

|

7 |

|

Other Equity Interests |

|

Impaired |

|

No |

|

0% |

Section V of this Disclosure Statement provides a more detailed description of the treatment of Claims and Interests under the Plan.

Pursuant to the provisions of the Bankruptcy Code, only those holders of claims or interests in classes that are impaired under a plan of reorganization or liquidation and that are not deemed to have rejected the plan are entitled to vote to accept or reject such proposed plan. Classes of claims or interests in which the holders of claims are unimpaired under a proposed plan are deemed to have accepted such proposed plan and are not entitled to vote to accept or reject the plan. Classes of claims or interests in which the holders of claims or interests receive no distribution under a proposed plan are deemed to have rejected such proposed plan and are not entitled to vote to accept or reject the plan.

E. CONFIRMATION UNDER SECTION 1129(b)

If a Class of Claims entitled to vote on the Plan rejects the Plan, the Debtors reserve the right to amend the Plan or request confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code, or both. In addition, with respect to the Classes that are deemed to have rejected the Plan, the Debtors intend to request confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code. Section 1129(b) permits the confirmation of a chapter 11 plan notwithstanding the rejection of such plan by one or more impaired classes of claims or interests. Under section 1129(b), a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and reasonable” with respect to each rejecting class. A more detailed description of the requirements for confirmation of a non-consensual plan is set forth in Section VI.A.2 of this Disclosure Statement.

F. CONFIRMATION HEARING

Pursuant to section 1128 of the Bankruptcy Code, the Confirmation Hearing will be held on [•], 2017 at [•] [a.m/p.m.] (Central Time) before the Honorable Judge David R. Jones at the United States Bankruptcy Court for the Southern District of Texas, Courtroom 400, 515 Rusk Street, Houston, Texas 77002.

Objections and responses to confirmation of the Plan, if any, must be served and filed as to be received on or before the Plan Objection Deadline [•], 2017 at [•] [a.m/p.m.] (Central Time) in the

manner described in any order scheduling the Confirmation Hearing and Section VIII.B of this Disclosure Statement. The Confirmation Hearing may be adjourned from time to time without further notice except for the announcement of the adjournment date made at the Confirmation Hearing or at any subsequent adjourned Confirmation Hearing.

II.

OVERVIEW OF THE DEBTORS’ OPERATIONS

A. THE DEBTORS’ BUSINESSES

The Debtors are a midstream oil and gas service business that provides natural gas gathering, compression, dehydration, treating, processing, and hydrocarbon dew-point control and transportation services to natural gas marketers and third-party pipeline companies, and transloading services to crude oil producers and refiners. As a midstream service provider, the Debtors are a critical link between companies that explore for and produce natural gas and industrial, commercial, and residential end-user markets. The midstream industry is generally characterized by regional competition based on the proximity of gathering systems and processing plants to natural gas and crude oil producing wells.

The Debtors’ key assets consist of: (a) natural gas gathering systems that include (i) 963 miles of natural gas pipeline with a total gathering capacity of 1.9 Bcfe/d4 and (ii) 12 miles of liquid natural gas pipeline with a total capacity of 20,000 Bbl/d,5 (b) two standalone gas processing plants with a combined processing capacity of 205 MMcf/d, and (c) crude oil transloading assets with a capacity of 33,541 Bbl/d.

The Debtors are headquartered in Dallas, Texas and maintain substantial business operations and office space in Katy, Texas.6

B. OPERATING ASSETS

1. Natural Gas Gathering Systems

a. ETG System

As of the Petition Date, Debtor Azure ETG, LLC (“ETG”) owned and operated approximately 256 miles of gathering pipelines spread across San Augustine, Nacogdoches, Sabine, Panola, and Shelby Counties in eastern Texas, as well as DeSoto Parish in Louisiana (the “ETG System”). The ETG System contains two treatment plants with a combined 350 MMcf/d of processing capacity and a LNG processing facility with a processing capacity of 5 MMcf/d (the “Fairway Plant”). The ETG System also contains four interconnections with major interstate pipelines providing 1.75 Bcfe/d of access to

4 Bcfe/d” and “MMcf/d” mean billions or millions, respectively, of cubic feet equivalent per day, and refer to the equivalent amount of energy liberated by the burning natural gas versus crude oil, with every 6,000 cubic feet of natural gas being equal to one barrel of oil.

5 One barrel or “Bbl” means one stock tank barrel, or 42 U.S. gallons liquid volume, and is used herein in reference to crude oil or other liquid hydrocarbons.

6 The Debtors’ Chief Financial Officer, Director of Human Resources, and customer support service division are based out of the Debtors’ Katy office.

downstream markets. A total of approximately 336,000 gross acres in the Haynesville Shale and Bossier Shale formations are dedicated to the ETG System.

b. Legacy System

As of the Petition Date, Debtors Azure, LLC and Talco Midstream Assets, Ltd. (“Talco”) owned and operated approximately 666 miles of high-and low-pressure gathering lines with a total gathering capacity of 500 MMcf/d, serving approximately 100,000 dedicated acres within Harrison, Panola, and Rusk counties in Texas, and Caddo Parish in Louisiana (the “Legacy System”). The Legacy System connects to seven major downstream markets, three third-party processing plants. The Legacy System is not physically connected to the Tyler Facility (as defined below).

c. Turkey Creek Pipeline

As of the Petition Date, Debtor Turkey Creek Pipeline, LLC owned and operated (i) a 4-inch diameter LNG pipeline with a total capacity of 10,000 Bbls/d (expandable to 15,000 Bbls/d) extending approximately two miles from the Panola System (as defined below) and (ii) a 6-inch diameter LNG pipeline with a total capacity of 10,000 Bbls/d extending approximately 11 miles from the Tyler Facility, located in Panola and Tyler Counties, Texas (the “Turkey Creek System”). The Turkey Creek System receives LNG processed at the Panola and Tyler Facilities and connects to a trading hub located in Mont Belvieu, Texas through a third-party pipeline.

d. Bethany Lateral and Stateline Facility

As of the Petition Date, Debtor Marlin Midstream, LLC (“Marlin Midstream”) owned and operated approximately six miles of 6-inch natural gas pipeline (the “Bethany Lateral”) and a natural gas treating facility (the “Stateline Facility”) that are adjacent to each other and located southeast of the town of Bethany, Louisiana. The Stateline Facility has an aggregate CO2 treating capacity of approximately 20 MMcf/d.

2. Standalone Processing Plants

a. Panola System

As of the Petition Date, Debtor Marlin Midstream owned and operated a natural gas treatment and cryogenic processing plant (“Panola II”), northeast of the town of Carthage in eastern Texas, that connects to an 11-mile natural gas pipeline with a capacity of 100 MMcf/d (the “Oak Hill Lateral,” and, together with Panola II, the “Panola System”). The Panola System consists of six dedicated residue gas compression units, amine treating equipment, and dehydration equipment with a capacity to process up to 125 MMcf/d of natural gas. The Oak Hill Lateral gathers natural gas through a connection to a gathering system owned by Anadarko Petroleum Company. In addition to the Oak Hill Lateral, Panola II includes interconnects to nine separate pipelines.

b. Tyler Facility

As of the Petition Date, Debtor Marlin Midstream owned and operated a natural gas treatment and cryogenic processing facility in Tyler County, northeast of the town of Woodville in eastern Texas (the “Tyler Facility”). The Tyler Facility consists of three cryogenic processing trains, two glycol dehydration units, two amine units, and three natural gas compression units with a capacity to process up to 80 MMcf/d. Persistent low volumes have made it unprofitable to continue operating the Tyler Facility, and the Debtors idled it in the fourth quarter of 2015.

3. Logistics Assets

Through mid-2016, Debtor Marlin Logistics, LLC (f/k/a FuelCo Energy, LLC) (“Marlin Logistics”) owned and operated four crude oil transloading facilities with a combined transloading capacity of 33,542 Bbls/d. The transloading facilities, which included eight skid transloaders and eight ladder transloaders (the “Logistics Assets”), transferred crude oil from third-party tanker trucks to railcars using either a skid transloader or a ladder transloader. For the year ended December 31, 2015, Associated Energy Services, LP (“AES”), a subsidiary affiliate of NuDevco, accounted for all of the revenues generated by the Debtors’ Logistics Assets. In early 2016, pursuant to the AES Settlement discussed in further detail below, all of the Debtors’ contracts with AES relating to the Logistics Assets were terminated. The Debtors have been unsuccessful in procuring contracts to replace a substantial amount of the revenue formerly generated by AES. In order to minimize operational costs, the Debtors shut down two of the transloading facilities and consolidated operations of the Logistics Assets in the operating footprint of the Debtors’ facility in Salt Lake City, Utah.

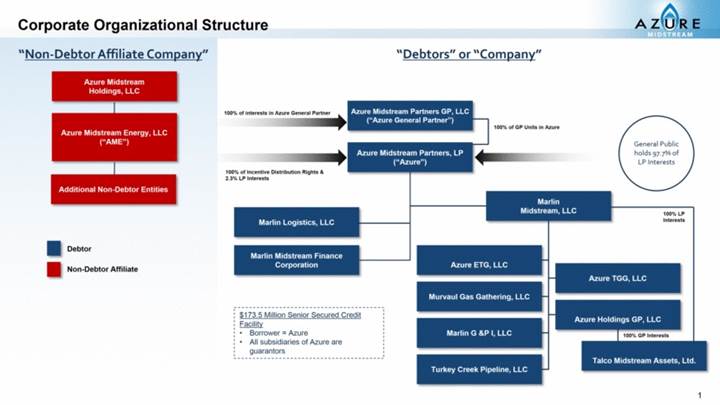

C. ORGANIZATIONAL STRUCTURE

The Debtors are a publicly-traded master limited partnership organized for the purpose of acquiring, developing, and operating midstream energy assets relating to (i) the gathering, transport, and processing of liquid natural gas and (ii) crude oil logistics services. The Debtors consist of eight operating entities, including Azure Midstream Partners (“Azure”) and Azure Midstream Partners GP, LLC (“Azure General Partner,” and, together with Azure, the “Partnership”), and four non-operating entities (collectively, with the Partnership and the operating entities, the “Company”). Azure General Partner owns the general partnership interest in Azure. Non-Debtor privately-held affiliate Azure Midstream Energy LLC (“AME”) owns all the member interests of Azure General Partner. AME also owns midstream energy assets, independent of its interests in Azure General Partner, either directly or through its affiliates (AME and such non-Debtor affiliates, collectively, the “Non-Debtor Affiliate Company”).

Since the formation of the Partnership, the Debtors have expanded and contracted through the purchase and sale of midstream assets. A diagram that reflects the Debtors’ current corporate structure is annexed hereto as Exhibit B.

D. CORPORATE HISTORY AND CAPITAL STRUCTURE

1. Current Ownership of Partnership Interests and IDR Units

Azure is a publicly traded master limited partnership that was first listed on the NASDAQ global exchange (“NASDAQ”) on July 31, 2013, trading under the symbol “FISH”. Beginning on May 29, 2015, Azure’s Common Units (defined below) traded on the New York Stock Exchange, (the “NYSE”) under the symbol “AZUR” until June 3, 2016, when they were delisted for failure to comply with the NYSE’s continued listing standards. Thereafter, the Common Units continued to trade over the counter. As of the Petition Date, individual Common Units traded at $0.84 per unit, representing a total market capitalization of $9.84 million.

As of the date of this Disclosure Statement, non-Debtor affiliate AME owned and controlled all of Azure General Partner through its ownership of 429,365 general partner units representing all of the outstanding member interests in Azure General Partner. Additionally, AME owns 255,319 of the limited partner interests in Azure (the “Common Units”), comprising approximately 2.3% of all outstanding Common Units and 100% of all outstanding incentive distribution rights (discussed in more

detail below).7 The remaining 11,029,022 Common Units, comprising approximately 97.7% of all outstanding limited partner interests in Azure, are publicly held. With the exception of Azure General Partner, all Debtors are wholly owned, either directly, or indirectly, by Azure.

2. Formation of the Partnership

In July of 2013 NuDevco formed the Partnership through a series of coordinated transactions described in detail below:

a. The NuDevco Contribution

Before the formation of the Partnership, Debtors Marlin Midstream and Marlin Logistics were subsidiaries of NuDevco. NuDevco formed the Partnership in July 2013 and contributed to the Partnership Marlin Midstream and Marlin Logistics, whose primary midstream assets at that time consisted of: (a) the Panola System, (b) Panola I (as defined below), (c) the Tyler Facility, (d) certain of the Logistics Assets, (e) the Turkey Creek Pipeline, and (f) the Lake Murvaul System (as defined below). As discussed in further detail below, the Debtors sold the Lake Murvaul System and Panola I in August 2016.

In exchange for NuDevco’s contribution to the Partnership of Marlin Midstream and Marlin Logistics: (i) NuDevco Midstream Development, LLC (a wholly owned subsidiary of NuDevco) (“NuDevco Midstream”) received (a) 1,849,545 Common Units comprising a 10.4% limited partner interest in the Partnership; and (b) 8,724,545 subordinated units (the “Subordinated Units”) comprising a 49.0% limited partner interest in the Partnership, and all of the ownership interests in Azure General Partner8 and (ii) Marlin IDR Holdings, LLC (a wholly owned subsidiary of NuDevco Midstream) (“IDRH”) received all issued IDR Units (as defined below). Azure General Partner received 356,104 Common Units, comprising 2.0% of the limited partner interests. The remaining 38.6% of limited partner interests were sold to the general public in the IPO (as defined below).

b. The Partnership Agreement

In connection with the formation of the Partnership, on July 31, 2013, Azure and Azure General Partner entered into a partnership agreement (as amended on February 27, 2015, the “Partnership Agreement”). Pursuant to the Partnership Agreement, 45 days after the end of each quarter, holders of Common Units are entitled to receive, out of any operating surplus, a minimum quarterly distribution of $0.35 per unit (the “Minimum Quarterly Distributions”). Holders of incentive distribution rights (“IDR Units”) are entitled to receive an increasing percentage of 13%, 23%, and 48% of quarterly distributions of available cash from operating surplus after all Minimum Quarterly Distributions have been made and certain target distribution levels have been achieved (the “IDR Distributions”). The target distribution levels are defined within the Partnership Agreement. All Minimum Quarterly Distributions and IDR Distributions have been suspended since February 1, 2016.

7 AME also owns midstream energy assets, independent of its interests in the Debtors, either directly or through its affiliates.

8 The Partnership contemporaneously transferred to affiliates of NuDevco: (i) a 50% interest in a CO2 processing facility located in Monell, Wyoming; (ii) certain transloading assets and purchase commitments owned by Marlin Logistics, but not subject to any service contracts; (iii) certain property, plant, and equipment and other equipment not yet in service; and (iv) certain other immaterial contracts.

c. The Original Omnibus Agreement

On July 31, 2013, the Debtors entered into an omnibus agreement with NuDevco (the “Original Omnibus Agreement”). Under the Original Omnibus Agreement, the Debtors received a right of first offer to purchase certain of NuDevco’s midstream energy assets during the five-year period following the closing of the IPO. The Original Omnibus Agreement also provided that NuDevco would provide management and administrative services to the Debtors and that the Debtors would reimburse NuDevco for any corresponding fees and expenses in connection therewith.

d. The AES Services Agreement

On July 31, 2013, Marlin Midstream entered into a series of three-year agreements with AES pursuant to which Marlin Midstream would provide gas gathering, processing, and crude oil logistics and transloading services to AES (the “AES Services Agreements”). The AES Service Agreements provided for a minimum volume commitment of 18,980 Bbls/d in connection with gas gathering and processing services and 577,309 Bbls/month in connection with transloading services. AES’ obligations under the AES Service Agreements were supported by a $15 million letter of credit (the “AES LC”). When the AES Service Agreements were executed in 2013 they generated approximately $16.2 million in total annual revenue for the Partnership. By the end of 2015, they generated approximately $29 million in total annual revenue.

e. The IPO

On July 31, 2013, Azure completed an initial public offering, placing 6,875,000 Common Units comprising 38.6% of the limited partner interests in the Partnership (the “IPO”). Azure’s Common Units initially traded on NASDAQ under the symbol FISH. From May 29, 2015 through June 3, 2016, the Common Units traded on the NYSE under the symbol “AZUR”, when they were delisted for failure to comply with the NYSE’s continued listing standards. Thereafter, the Common Units continued to trade over the counter.

3. Acquisition of the Legacy Assets

On January 14, 2015, the Partnership entered into an agreement (the “Transaction Agreement”) with AME, NuDevco Midstream, and IDRH, whereby the Partnership acquired the Legacy System. Specifically, under the terms of the Transaction Agreement, the Partnership acquired Debtors Talco Midstream Assets, Ltd. and Azure TGG, LLC, which own and operate the assets that constitute the Legacy System, from AME. In return, AME received (i) $99.5 million in cash, (ii) 90% of all IDR Units, and (iii) all of the General Partner Units in Azure General Partner. To effectuate the transfer of the IDR Units from IDRH to AME, the Partnership redeemed 90% of the IDR Units from IDRH for $63 million in cash. Following consummation of the Transaction Agreement, IDRH owned 10% of all IDR Units. The Debtors financed the acquisition of the Legacy System by drawing on their Prepetition Credit Facility. As part of the transaction, the AES Services Agreements were extended for five years from the closing of the Transaction Agreement.

4. The Omnibus Agreement

On February 27, 2015, the Partnership and AME entered into a new omnibus services agreement (the “Omnibus Agreement”) that superseded the Original Omnibus Agreement. Under the Omnibus Agreement, AME (a) procures insurance coverage on behalf of the Partnership and pays all costs related to such coverage (the “Insurance Coverage”), (b) pays certain costs related to the Debtors’

employees,9 including wages, payroll taxes, and other related administrative costs (the “Payroll Obligations”), (c) pays certain of the Debtors’ general administrative costs, including real property and equipment lease obligations, supplies, utilities, and property taxes (the “G&A Obligations”), and (d) pays certain costs related to services provided by third-parties for the benefit of the Debtors, including outside audit services, outside legal services, an employee credit card program, and other services (the “Third-Party Services,” and, together with the Payroll Obligations, the Insurance Coverage, and the G&A Obligations, the “Covered Obligations”).

Under the Omnibus Agreement, AME submits invoices to the Debtors on the 25th day of each month for reimbursement of all costs associated with provision of the Covered Obligations attributable to the Debtors in such month. However, the Debtors directly cover all costs for all Employees that relate to (a) paid time off including sick days and vacation days, short-term disability benefits (includes maternity leave), bereavement leave, jury duty leave, and military leave; (b) medical, dental, vision, and prescription drug benefits, life insurance, accidental death and dismemberment insurance, long-term disability, and health savings accounts; and (c) any matching contributions pursuant to the Debtors’ 401(k) plan (collectively, the “Employee Benefits”).10 Any Employee Benefits that are allocable to AME on account of the Shared Employees or the Employees who provide services exclusively to AME are credited against the Debtors’ reimbursement obligations under the Omnibus Agreement. As of the Petition Date, the Debtors have paid all amounts invoiced by AME under the Omnibus Agreement.

5. Acquisition of the ETG System

On August 6, 2015, the Partnership entered into a contribution agreement (the “Contribution Agreement”) with AME. Pursuant to the Contribution Agreement, AME contributed to the Partnership all outstanding membership interests in ETG, the entity that owns and operates the ETG System. As consideration for the contribution of ETG, AME received $80 million in cash and 255,319 Common Units. The Partnership financed the cash portion of the ETG acquisition price by drawing on the Prepetition Credit Facility.

6. The AES Settlement

In early 2016, AES defaulted on its obligations to the Debtors under the AES Service Agreements. The Debtors ultimately settled the matter with AES by entering into a settlement agreement with AES, NuDevco Midstream, and IDRH, on March 30, 2016 (the “AES Settlement Agreement”). Under the AES Settlement Agreement: (i) the Debtors drew the full amount of the $15 million AES LC and applied the proceeds to pay down outstanding debt under the Prepetition Credit Facility; (ii) the AES Service Agreements were terminated effective as of January 1, 2016; (iii) NuDevco Midstream surrendered all of the Subordinated Units and 1,939,265 Common Units to the Partnership; (iv) IDRH surrendered 10

9 The Debtors currently employ ninety-six (96) employees (the “Employees”). Thirty-eight (38) Employees provide services exclusively for the Debtors (“Dedicated Employees”), twenty-six (26) Employees provide services exclusively for AME, and thirty-two (32) Employees provide services for the Debtors and AME (the “Shared Employees”).

10 For a more detailed discussion of the Employee Benefits, see the Debtors’ Emergency Motion for Entry of Interim and Final Orders (I) Authorizing Debtors To (A) Pay Prepetition Wages, Salaries, Employee Benefits, and Other Compensation, (B) Maintain Employee Benefit Programs and Pay Related Administrative Obligations, and (C) Pay Temporary Employee Obligations, and (II) Directing Financial Institutions to Receive, Process, Honor, and Pay All Checks Presented for Payment and to Honor All Fund Transfer Requests Related to Such Obligations Pursuant to Sections 105(a), 363(b), and 507 of the Bankruptcy Code and Bankruptcy Rules 6003 and 6004 (the “Employee Motion”)[Dkt. No. 7].

IDR Units (comprising 10% of all outstanding IDR Units) to the Partnership; and (v) the parties to the AES Settlement released each other from all claims relating to the AES Service Agreements and certain other related claims.

7. The Panola and Murvaul Sale

By the fourth quarter of 2016, as described below, the Debtors had been operating under default waivers of certain leverage covenants in the Credit Agreement for nearly 15 months. The Debtors sought to come into compliance with their Consolidated Total Leverage Ratio, as defined in the Credit Agreement by increasing their EBITDA through the elimination of fixed operating costs and reducing outstanding debt. To that end, on August 4, 2016, Marlin Midstream entered into an agreement for the sale to AMP ETX Gathering, LLC of (a) a 51.1 mile piece of natural gas pipeline, including related compression and gathering facilities and associated tracts of real property, surface leases, easements, and rights-of-way, located in Panola and Rusk Counties, Texas (the “Murvaul System”) and (b) a 100 MMcf/d natural gas processing plant located in Panola County Texas (“Panola I”) for an agreed purchase price of $44.9 million in cash, less certain agreed-upon adjustments in respect of ad valorem taxes. The Debtors used $41 million of the sale proceeds to pay down outstanding debt under the Prepetition Credit Facility. The Debtors estimate that sale of the Murvaul System and Panola I increased annual EBITDA by about $1.5 million through fixed expense reductions associated therewith.

8. Prepetition Indebtedness

a. The Prepetition Credit Agreement and Prepetition Credit Facility

The Debtors are parties to that certain credit agreement, dated as of February 27, 2015 (as amended from time to time, the “Prepetition Credit Agreement,” and the senior secured revolving credit facility thereunder, the “Prepetition Credit Facility”), by and among Azure, all of its Debtor subsidiaries, as guarantors, Wells Fargo Bank, N.A., as administrative agent (the “Administrative Agent”), and certain lenders thereto. The Prepetition Credit Facility provides a total borrowing capacity of up to $250 million. Borrowings under the Prepetition Credit Facility bear interest at: (i) the LIBOR Rate, as defined in the Prepetition Credit Agreement, plus an applicable margin of 3.25% to 4.25%; or (ii) the Base Rate, as defined in the Prepetition Credit Agreement plus an applicable margin of 2.25% to 3.25%, in each case, based on the Consolidated Total Leverage Ratio, as defined in the Prepetition Credit Agreement. The maturity date of the Prepetition Credit Facility is February 27, 2018. The Debtors’ obligations under the Prepetition Credit Facility are secured by substantially all the Debtors’ assets. As discussed in further detail below, since October of 2015, to prevent a default under the Prepetition Credit Agreement, the Debtors have entered into seven limited duration waiver agreements and two amendments to the Prepetition Credit Agreement. As of the Petition Date, approximately $174.5 million was outstanding under the Prepetition Credit Facility.

b. Other Indebtedness

As of the Petition Date, in addition to their secured debt obligations under the Prepetition Credit Facility, the Debtors owed approximately $2.3 million in outstanding secured obligations under their various gas gathering agreements. The Debtors also owed approximately $5.4 million in outstanding unsecured prepetition obligations, which include (a) $444,000 in employee claims, (b) $688,000 in vendor and trade claims, and (c) $4.2 million in tax and other priority claims.

E. PENDING LITIGATION

· The Debtors are currently involved in proceedings in the Harrison County Central Appraisal District (the “CAD”) related to certain ad valorem tax assessments for the years 2014, 2015, and 2016. Case No. 2016-01595/Protest No. 30352. On March 13, 2017, Debtor Azure TGG, LLC (“TGG”) filed suit against the CAD under Case No. 17-0196T, 71st Judicial District Court, Harrison County, Texas. TGG’s suit asserts that the CAD and its Appraisal Review Board incorrectly appraised Azure’s oil and gas pipelines and gathering systems located within Harrison County as of January 1, 2014, 2015 and 2016.

· Debtor ETG is involved in eminent domain proceedings in the 273rd District Court of Sabine County, Texas in connection with a right-of-way granted to ETG. TPF II East Texas Gathering, LLC v. Bobbie Torrence, et al., Case No. 12664.

· The Debtors are involved in employment litigation in Harris County, Texas. Floyd Woodfork v. Nudevco Midstream Development LLC and Marlin Midstream LP, EEOC Charge No. 460-2105-00673, Cause No. 2106-47188, 334th Judicial District, Harris County, Texas.

III.

KEY EVENTS LEADING TO THE COMMENCEMENT

OF THE CHAPTER 11 CASES

A. THE SUSTAINED DROP IN OIL AND GAS PRICES

The oil and gas industry has been enduring one of the longest and deepest troughs in oil and gas prices in recent history. The downturn has led many exploration and production companies, whose businesses are directly impacted by price fluctuations in commodities, to sizably reduce their capital and operating expenditures relating to hydrocarbon production and drilling activities, causing a substantial reduction in the volumes serviced by midstream service providers such as the Debtors. In early 2016, crude oil and natural gas spot prices reached multi-year lows of approximately $26 per Bbl and $1.50 per MMBtu, respectively. This represented a decline in oil prices of more than 75% from a peak of over $105 per Bbl in mid-year 2014 and a decline in natural gas prices of more than 74% from a peak of over $5.8 per MMBtu in early 2014.

As a result of the downturn, in 2015, Anadarko Petroleum Corporation (“Anadarko”), one of the Debtors’ largest customers, chose not to renew a significant contract that generated approximately $7.5 million in total revenue in 2015. The continued weakness in natural gas and crude oil prices pushed AES to default on its obligations under the AES Agreements in early 2016. The AES Agreements generated $29.1 million of the Debtors’ total revenue in 2015, comprising 36% of the Debtors’ total annual revenue. Collectively, the Anadarko contracts and the AES Agreements generated 45% of the Debtors’ total revenues in 2015. Although the Debtors were able to make up for some of the lost revenues through other contracts, total revenue in the first three quarters of 2016 decreased approximately 14% from total revenue in the first three quarters of 2015 (from $61.3 million to $53.0 million).

B. DEFAULT UNDER THE PREPETITION CREDIT AGREEMENT

The reduction in the Debtors’ revenues also led to a material reduction in their EBITDA, and by the fourth quarter of 2015, the Debtors had fallen out of compliance with certain debt and liquidity covenants under the Credit Agreement (the “Covenant Defaults”). To comply with leverage covenants under the Credit Agreement, on October 26, 2015, the Debtors entered into the second amendment to the

Credit Agreement (the “Second Amendment”), retroactively raising the Debtors’ Consolidated Total Leverage Ratio from 5:1 (as defined in the Credit Agreement) for the quarter ended September 30, 2015, to 5.25:1, and further increasing the Consolidated Total Leverage Ratio for the quarter ending December 31, 2015 to 6:1. The Second Amendment also reduced the borrowing capacity under the Prepetition Credit Facility from $250 million to $238 million and mandated the suspension of distributions to holders of Common Units.

Due to the drop in revenue from the loss of several of their key revenue-generating contracts, the report of the Debtors’ independent registered public accounting firm that accompanied the Debtors’ 2015 audited consolidated financial statements expressed substantial doubt about the Debtors’ ability to continue as a going concern, which constituted an event of default under the Credit Agreement. On March 29, 2016, the Debtors entered into the third amendment to the Credit Agreement (“Third Amendment”), which permanently waived this event of default and waived the Debtors’ obligations to comply with the Consolidated Total Leverage Ratio and the Consolidated Interest Ratio through June 30, 2016.

On June 30, 2016, the Debtors entered into a Limited Duration Waiver Agreement (the “First Waiver”) extending the waiver of the Covenant Defaults through August 12, 2016 and further reducing the borrowing capacity under the Credit Agreement to $214.7 million.

On August 12, 2016, the Debtors entered into a second Limited Duration Waiver Agreement (the “Second Waiver”) extending the waiver of the Covenant Defaults through September 27, 2016, further reducing the borrowing capacity under the Credit Agreement to $173.7 million, and imposing restrictions on capital expenditures.

On September 27, 2016, the Debtors entered into a third Limited Duration Waiver Agreement (the “Third Waiver”). The terms of the Third Waiver extended the waiver of the Covenant Defaults through October 28, 2016. The Third Waiver also required the Debtors to deliver to the Prepetition Secured Lenders either a sale plan or a capital raise plan by October 11, 2016.

On October 28, 2016, the Debtors entered into a fourth Limited Duration Waiver Agreement (the “Fourth Waiver”) extending the waiver of the Covenant Defaults through November 30, 2016. The Fourth Waiver also required that by November 15, 2016 the Debtors set up a data room containing information to be provided to potential equity investors or potential purchasers of the Assets.

On November 30, 2016, the Debtors entered into a fifth Limited Duration Waiver Agreement (the “Fifth Waiver”) extending the waiver of the Covenant Defaults through December 18, 2016. The Fifth Waiver also required the Debtors to enter into an agreement with respect to a sale of the Assets no later than December 18, 2016.

On December 16, 2016, the Debtors entered into a sixth Limited Duration Waiver Agreement (the “Sixth Waiver”) further extending the waiver of the Covenant Defaults through January 15, 2017. The Sixth Waiver also required that the Debtors submit by January 12, 2017 a certification to the Prepetition Secured Lenders that the sale and marketing process of the Assets had been substantially completed.

On January 14, 2017, the Debtors entered into a seventh Limited Duration Waiver Agreement (the “Seventh Waiver”) further extending the waiver of the Covenant Defaults through January 30, 2017. The Debtors were unable to obtain an additional waiver thereafter.

C. NEGOTIATIONS WITH STAKEHOLDERS

Over the course of the last 17 months, the Debtors, with the cooperation of the Prepetition Secured Lenders, have explored various paths toward compliance with the Credit Agreement. The Debtors were able to sell the Murvaul System and Panola I, as discussed above, resulting in a $40 million paydown of the Prepetition Credit Facility and an effective increase of $1.5 million in annual EBITDA on account of related cost-savings. The Debtors sought an equity infusion as well, but because of the continued weakness in the energy sector there was little appetite for an equity offering. With limited options available to remedy their leverage concerns and Covenant Defaults, the Debtors, with the support of the Prepetition Secured Lenders, began to explore a sale of their businesses as a going concern.

In light of these circumstances, the Debtors engaged Weil as restructuring counsel and Evercore as financial advisor and investment banker to work with Azure’s management to solicit and evaluate bids for the Assets. The Debtors subsequently engaged A&M as restructuring advisors to assist them with operations during the Chapter 11 Process.

D. MARKETING PROCESS

On November 23, 2015, the Debtors retained Evercore to market a sale of the Assets. In late 2015 and continuing into 2016, Evercore, along with certain of the Debtors’ other advisors, advised on a dual-track process to explore options for either a potential sale of the Debtors or a preferred equity investment in the Debtors. As part of the sale process, the Debtors’ advisors contacted 20 potential transaction partners, including strategic buyers (i.e., companies already operating in the oil and gas industry) and financial buyers (such as private equity firms) to gauge interest in a potential transaction. The Debtors received four proposals for a potential sale during this phase of the marketing process. Of the sale proposals received, two proposals implied values for the Debtors below prepetition debt levels, another proposal contemplated a joint venture with no cash consideration, and the final proposal was to only acquire Panola I. Subsequently, Evercore and the Debtors continued discussions with private equity firms and other parties potentially interested in either an equity investment in the Debtors or an outright purchase of the Assets, and engaged in a new marketing process for the Assets.

From November 2016, Evercore had engaged with over 70 strategic and financial counterparts, including MLPs, public midstream C-Corporations, privately-held midstream oil and gas companies, and potential financial sponsors in its efforts to market the Assets. During this second-stage marketing process, parties that executed confidentiality agreements were granted access to an electronic data room containing significant diligence and other confidential information about the Debtors’ businesses. Twenty-five different parties ultimately executed confidentiality agreements. As a result of Evercore’s extensive marketing efforts, the Debtors received eleven indications of interest for either an acquisition of all or a portion of the Assets or for a partial refinancing of the Debtors’ prepetition secured debt. From those indications of interest, the Debtors qualified seven bidders to move to a second stage process. Bidders moving to the second stage were provided with access to a second data room with additional information about the Assets. The Debtors received three second-stage bids on January 26, 2017. In evaluating the proposals, the Debtors and Evercore analyzed, among other things: (i) the consideration offered by each potential buyer, (ii) the conditions to be imposed by each potential buyer, including the conditions to closing, (iii) the potential buyer’s ability to close a transaction, (iv) the proposal’s impact on the Debtors’ secured lenders and trade creditors, and (v) the proposals’ treatment of and effect on the Debtors’ employees.

After extensive deliberations with their advisors and separate negotiations with the potential bidders that participated in the second stage of the process, the Debtors elected to proceed with

the bid submitted by M5 Midstream LLC (the “Stalking Horse Bidder”) as the highest or otherwise best bid received for the Assets, subject to the Debtors’ receipt of any higher or otherwise better bids.

On February 10, 2017, the Debtors and the Stalking Horse Bidder entered into a purchase and sale agreement (the “Stalking Horse Agreement”) representing a binding bid for the Assets, subject to overbid. The total consideration available to the Debtors under the Stalking Horse Agreement was approximately $151,100,000.00, subject to certain adjustments (the “Stalking Horse Purchase Price”). The Stalking Horse Agreement included provisions for the payment of a break-up fee and a capped expense reimbursement payable to the Stalking Horse Bidder should the Debtors ultimately enter into a sale transaction for substantially the same assets that are the subject of the Stalking Horse Agreement with another bidder (the “Bid Protections”). As described in greater detail in Section IV.C below, the Debtors subsequently filed a motion seeking (i) approval of the Stalking Horse Agreement and (ii) approval of certain Bid Procedures (as defined below).

On March 6, 2017, BTA Gathering LLC (“BTA”) submitted a competing bid to purchase the Assets for $160,000,000.00 and provided to the Debtors a draft purchase and sale agreement (the “BTA Purchase Agreement”). As discussed in more detail in Section IV.D below, pursuant to the Bid Procedures Order, the Debtors conducted an auction for the Assets on March 10, 2017.

IV.

KEY EVENTS DURING THE CHAPTER 11 CASES

A. COMMENCEMENT OF THE CHAPTER 11 CASES AND FIRST DAY MOTIONS

On the Petition Date, the Debtors filed various “first-day” motions (collectively, the “First Day Pleadings”) seeking certain immediate relief from the Bankruptcy Court designed to allow the Debtors to continue to operate in chapter 11 and avoid irreparable harm due to the commencement of the Chapter 11 Cases. A description of the First Day Pleadings is set forth in the Declaration of Ed Mosley in Support of the Debtors’ Chapter 11 Petitions and Related Relief [Dkt. No. 15]. The Bankruptcy Court granted substantially all of the relief requested in the First Day Pleading on either a final or interim basis and entered various orders authorizing the Debtors to, among other things:

· Continue the use of the Debtors’ cash management system, bank accounts, and business forms;

· Continue paying employee wages and benefits;

· Pay prepetition claims of trade creditors and vendors;

· Pay certain prepetition taxes and assessments; and

· Establish procedures for utility companies to request adequate assurance of payment and to prohibit utility companies from altering or discontinuing service.

B. CASH COLLATERAL

On the Petition Date, the Debtors filed a motion to use cash collateral and provide adequate protection to the Prepetition Secured Lenders in connection therewith. The Bankruptcy Court entered a final order approving the use of cash collateral on February 23, 2017 [Dkt. No. 121]. The Cash Collateral Order permits the Debtors to use Cash Collateral through May 31, 2017.

The Cash Collateral Order contains the following milestones that establish a dual-track process for the Debtors to pursue the Sale Transaction followed by a liquidating plan. The Debtors successfully met all such milestones.

Case Milestones:

|

Milestone |

|

Date |

|

File Motion to Approve Bid Procedures and Establish Auction Date |

|

February 10, 2017 |

|

Each Debtor shall filed their respective statement of financial affairs and schedule of assets and liabilities |

|

February 20, 2017 |

|

Obtain Order Approving Stalking Horse Agreement and Bid Procedures Motion |

|

March 6, 2017 |

|

Conduct Auction |

|

March 13, 2017 |

|

Obtain Sale Order |

|

March 16, 2017 |

|

File Plan of Liquidation and Disclosure Statement |

|

March 20, 201711 |

|

Consummate Sale |

|

March 31, 2017 |

C. BID PROCEDURES

On February 10, 2017, the Debtors filed the Expedited Motion for Entry of (I) Order Approving (A) Bid Procedures, Including Procedures for Selection of Stalking Horse Bidder, (B) Procedures for Assumption and Assignment of Certain Executory Contracts and Unexpired Leases and Related Notices, (C) Notice of Auction, Stalking Horse Hearing and Sale Hearing, and (D) Related Relief and (II) Order (A) Approving Sale of Substantially All of Debtors’ Assets Free and Clear of Liens, Claims, Encumbrances and other Interests, (B) Approving Assumption, Assignment and Sale of Certain Executory Contracts and Unexpired Leases and Related Cure Amounts, and (C) Granting Related Relief [Dkt. No 78] (the “Sale and Bid Procedures Motion”). On February 23, 2017, without objection, the Bankruptcy Court entered the Order Approving (A) Bid Procedures, (B) Procedures for Assumption and Assignment of Certain Executory Contracts and Unexpired Leases and Related Notices, (C) Notice of Auction, Stalking Horse Hearing and Sale Hearing, and (D) Related Relief [Dkt. No. 116] (the “Bid Procedures Order”).

The Bid Procedures Order, as set forth below, establishes a timeline and related deadlines in connection with the Sale Transaction. The Debtors have complied with all the deadlines set forth in the Bid Procedures Order.

Bid Procedures Timeline:

|

Deadlines/Key Dates |

|

Date |

|

Deadline to File Notice of Assumption and Assignment and Schedule of Proposed Cure Costs |

|

February 24, 2017 |

|

Deadline to Serve Sale Hearing Notice |

|

February 27, 2017 |

|

Sale Hearing Notice Publication Deadline |

|

March 1, 2017 |

|

Bid Deadline |

|

March 6, 2017 |

|

Deadline to File Rights Notice |

|

March 6, 2017 |

|

Deadline to Notify Qualified Bidders |

|

March 8, 2017 |

|

Auction (if required) |

|

March 10, 2017 |

|

Deadline to Object to Sale Transaction |

|

March 13, 2017 |

|

Assumption and Assignment Objection Deadline |

|

March 13, 2017 |

|

Sale Hearing |

|

March 15, 2017 |

11 The Cash Collateral Order originally contained a milestone establishing February 10, 2017 as the deadline to file a plan of liquidation and related disclosure statement. The Debtors and the Prepetition Secured Lenders subsequently amended this milestone on several occasions to reflect the current deadline of March 20, 2017.

The bid procedures (the “Bid Procedures”) required that any competing bid for the Assets must, at a minimum, exceed the Stalking Horse Purchase Price by an amount equal to or greater than the aggregate amount of: (i) 3% of the Stalking Horse Purchase Price (the “Break-Up Fee”), (ii) an expense reimbursement capped at $1,000,000.00 (the “Expense Reimbursement”), and (iii) an initial overbid amount of $1,000,000.00. All subsequent overbids were to be at least $500,000.00. The Bid Procedures also required any party seeking to make a competing bid to deposit an amount equal to 10% of the offered purchase price for the Assets (the “Good Faith Deposit”) in an escrow account established by the Debtors. Pursuant to the Bid Procedures, the Debtors were required to designate any competing bidder as a “Qualified Bidder” no later than March 8, 2017 (the “Qualified Bid Deadline”). If the Debtors designated a competing bidder as a Qualified Bidder by the Qualified Bid Deadline, then the Debtors could conduct an auction for the Assets as early as March 10, 2017, or such other time as designated by the Debtors.