Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - NATUS MEDICAL INC | exhibit993-unauditedprofor.htm |

| EX-99.2 - EXHIBIT 99.2 - NATUS MEDICAL INC | exhibit992gnotometrics20.htm |

| EX-23.1 - EXHIBIT 23.1 - NATUS MEDICAL INC | exhibit231-ey8xka.htm |

| 8-K/A - 8-K/A - NATUS MEDICAL INC | a20178-kagnotometricsacqui.htm |

Combined financial statements for GN Otometrics A/S

(Carve-out of the Otometrics business from GN Store Nord A/S)

for the period January 1 2015 to December 31 2015

Otometrics A/S

Hoerskaetten 9

DK-2630 Taastrup

Denmark

1

Exhibit 99.1

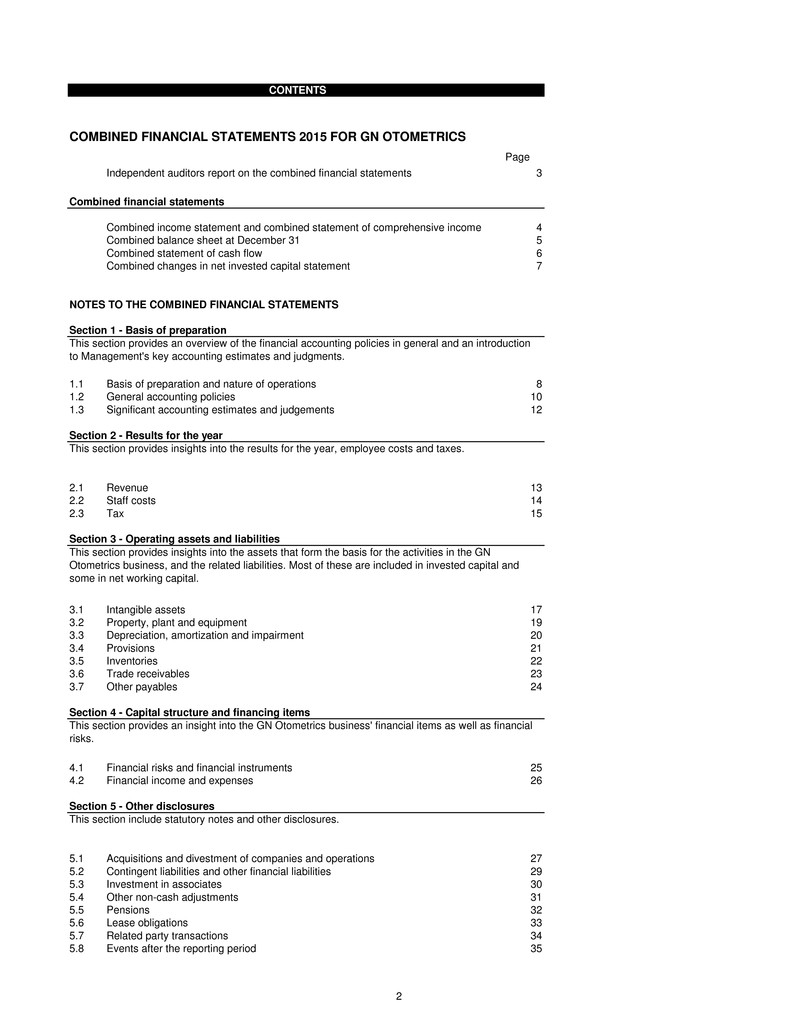

COMBINED FINANCIAL STATEMENTS 2015 FOR GN OTOMETRICS

Page

Independent auditors report on the combined financial statements 3

Combined financial statements

Combined income statement and combined statement of comprehensive income 4

Combined balance sheet at December 31 5

Combined statement of cash flow 6

Combined changes in net invested capital statement 7

NOTES TO THE COMBINED FINANCIAL STATEMENTS

Section 1 - Basis of preparation

1.1 Basis of preparation and nature of operations 8

1.2 General accounting policies 10

1.3 Significant accounting estimates and judgements 12

Section 2 - Results for the year

2.1 Revenue 13

2.2 Staff costs 14

2.3 Tax 15

Section 3 - Operating assets and liabilities

3.1 Intangible assets 17

3.2 Property, plant and equipment 19

3.3 Depreciation, amortization and impairment 20

3.4 Provisions 21

3.5 Inventories 22

3.6 Trade receivables 23

3.7 Other payables 24

Section 4 - Capital structure and financing items

4.1 Financial risks and financial instruments 25

4.2 Financial income and expenses 26

Section 5 - Other disclosures

5.1 Acquisitions and divestment of companies and operations 27

5.2 Contingent liabilities and other financial liabilities 29

5.3 Investment in associates 30

5.4 Other non-cash adjustments 31

5.5 Pensions 32

5.6 Lease obligations 33

5.7 Related party transactions 34

5.8 Events after the reporting period 35

This section include statutory notes and other disclosures.

CONTENTS

This section provides an overview of the financial accounting policies in general and an introduction

to Management's key accounting estimates and judgments.

This section provides insights into the results for the year, employee costs and taxes.

This section provides insights into the assets that form the basis for the activities in the GN

Otometrics business, and the related liabilities. Most of these are included in invested capital and

some in net working capital.

This section provides an insight into the GN Otometrics business' financial items as well as financial

risks.

2

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

To the Board of Directors of Natus Medical Incorporated

We have audited the accompanying combined financial statements of GN Otometrics which comprise the combined

balance sheet as of 31 December 2015 and the related combined income statement, combined statement of

comprehensive income, combined statement of cash flows and combined changes in net invested capital statement for the

year then ended, and the related notes to the combined financial statements (the “combined financial statements”).

Management’s Responsibility for the combined financial statements

Management is responsible for the preparation and fair presentation of these combined financial statements in conformity

with International Financial Reporting Standards as issued by the International Accounting Standards Board; this includes

the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of

combined financial statements that are free of material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these combined financial statements based on our audit. We conducted our

audit in accordance with auditing standards generally accepted in the United States. Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the combined financial statements are free of material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the combined

financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of

material misstatement of the combined financial statements, whether due to fraud or error. In making those risk

assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the

combined financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the

purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such

opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluating the overall presentation of the combined

financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis

for our audit opinion.

Qualification

As discussed in note 1.1 to the combined financial statements, these omits comparative financial information. Such

comparative financial information is not required by Rule 3-05 of the United States Securities and Exchange Commission

Regulation S-X. International Financial Reporting Standards as issued by the International Accounting Standards Board

requires disclosure of comparative information.

Opinion

In our opinion, except for the omission of comparative financial information as discussed in the preceding paragraph, the

combined financial statements referred to above present fairly, in all material respects, the combined financial position of

GN Otometrics at 31 December 2015 and the results of its operations and its cash flows for the year then ended, in

conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Ernst & Young P/S

Copenhagen, Denmark

March 17, 2017

3

COMBINED INCOME STATEMENT

DKK million Note 2015

Revenue 2.1 643

Production costs 2.2, 3.3, 3.5 (300)

Gross profit 343

Development costs 2.2, 3.3 (58)

Selling and distribution costs 2.2, 3.3 (153)

Management and administrative expenses 2.2, 3.3, 5.9 (94)

Operating profit 38

Financial income 4.2 10

Financial expenses 4.2 (6)

Profit before tax 42

Tax on profit 2.3 (13)

Profit for the year 29

COMBINED STATEMENT OF COMPREHENSIVE INCOME

DKK million Note 2015

Profit for the year 29

Other comprehensive income

Items that may be reclassified subsequently to profit or loss

Foreign exchange adjustments 12

Other comprehensive income for the year, net of tax 12

Total comprehensive income for the year 41

COMBINED FINANCIAL STATEMENTS

4

COMBINED BALANCE SHEET AT DECEMBER 31

DKK million Note 2015

ASSETS

Intangible assets 3.1 450

Property, plant and equipment 3.2 20

Deferred tax assets 2.3 21

Investments in associates 5.3 -

Owed by associates 4.1 29

Total non-current assets 520

Inventories 3.5 135

Trade receivables 3.6, 4.1 126

Other receivables 4.1 21

Cash and cash equivalents 15

Total current assets 297

Total assets 817

NET INVESTED CAPITAL AND LIABILITIES

Net invested capital 404

Pension obligations 5.5 2

Provisions 3.4 8

Deferred tax liabilities 2.3 57

Non-current paybles to the GN Group 4.1 27

Total non-current liabilities 94

Bank loans 4.1 2

Current payables to the GN Group 4.1 188

Trade payables 4.1 51

Tax payables 10

Provisions 3.4 9

Other payables 3.7 59

Total current liabilities 319

Total net invested capital and liabilities 817

COMBINED FINANCIAL STATEMENTS

5

COMBINED STATEMENT OF CASH FLOW

DKK million Note 2015

Operating activities

Operating profit 38

Depreciation, amortization and impairment 53

Other non-cash adjustments 5.4 13

Cash flow from operating activities before changes in working capital 104

Change in inventories (17)

Change in receivables (13)

Change in trade payables and other payables 19

Total changes in working capital (11)

Cash flow from operating activities before financial items and tax 93

Interest etc. paid (4)

Tax paid, net (16)

Cash flow from operating activities 73

Investing activities

Investments in intangible assets, excluding development projects (78)

Development projects (92)

Investments in property, plant and equipment (8)

Disposal of property, plant and equipment 1

Disposal/repayment of other non-current assets 112

Acquisition of companies/operations 5.1 (9)

Cash flow from investing activities (74)

Cash flow from operating and investing activities (free cash flow) (1)

Financing activities

Increase/(decrease) of long-term loans (3)

Increase/(decrease) of short-term loans 1

Other adjustments (5)

Cash flow from financing activities (7)

Net cash flow (8)

Cash and cash equivalents, beginning of period 25

Adjustment foreign currency, cash and cash equivalents (2)

Cash and cash equivalents, end of period 15

COMBINED FINANCIAL STATEMENTS

6

COMBINED CHANGES IN NET INVESTED CAPITAL STATEMENT

DKK million 2015

Balance at January 1 206

Contributed operations 160

Profit for the year 29

Other comprehensive income for the year, net of tax 12

Share based payment recharged from parent (3)

Balance at December 31 404

COMBINED FINANCIAL STATEMENTS

7

CONSOLIDATED / SECTION 1: BASIS OF PREPARATION

SECTION 1

Basis of preparation and general accounting policies

The notes are grouped in sections and each note include the accounting policies and significant accounting

estimates applicable to the relevant notes. The description of the accounting policies in the notes are part of the

complete description of GN Otometrics’s accounting policies. The notes are grouped in these five sections:

Section 1 Basis of preparation

Section 2 Results for the year

Section 3 Operating assets and liabilities

Section 4 Capital structure and financing items

Section 5 Other disclosures

Included in Section 1 are required disclosures and general accounting policies, including management’s

judgments and estimates under International Financial Reporting Standards (IFRS) as issued by the Internatinal

Accounting Standards Board, relevant for the understanding of the basis of preparation of the combined

financial statements of GN Otometrics A/S, which is a carve-out of the Otometrics business from GN Store Nord

A/S ("the combined financial statements").

New or revised accounting standards and interpretations are described in addition to how these changes are

expected to impact the financial performance and reporting of GN Otometrics.

1.1 BASIS OF PREPARATION AND NATURE OF OPERATIONS

GN Otometrics A/S (“GN Otometrics” or the “Business”) is wholly owned by GN Store Nord A/S (“GN Group”),

quoted on Nasdaq OMX. GN Otometrics develops, manufactures and markets computer-based audiological,

otoneurologic, vestibular instrumentation and sound rooms under the Madsen, Aurical, Hortmann and ICS brand

names. In 2015 the Business was part of the Hearing Division (“GN ReSound”) of GN Group with sales being

made in over 70 countries and comprises:

- 7 wholly owned entities entirely dedicated to GN Otometrics;

- 2 GN Otometrics distribution operations held within GN Group entities where accounting records specific to GN

Otometrics are held in a separate ERP system – United States and Italy

- 10 GN Otometrics distribution operations co-mingled within other GN Group entities that comprise both GN

Otometrics and GN ReSound operations - Australia, Austria, Brazil, Finland, Netherlands, New Zealand,

Norway, Spain, Sweden, United Kingdom

- A 40% interest in Audio Systems Inc., a United States distributor that is dedicated to GN Otometrics and is

equity accounted

The wholly owned entities are:

GN Otometrics A/S – 100%, Denmark: All research and development activities plus production. This entity also holds the

Otoscan business unit which is an ear scanning system that is currently under development

Primary distributors of GN Otometrics products in respective markets:

Inmedico A/S (Denmark) – 100%, Denmark

GN Otometrics GmbH – 100%, Germany

GN Otometrics SAS – 100%, France

Dan Black Special Instrument Inc – 100%, Canada

Genie Audio Inc – 100%, Canada

Otometrics Shanghai Co. Ltd – 100%, China

The only substantive structural change to the business during the course of 2015, was the acquisition of Biomedica in

February 2015 for consideration of DKK 6 million (refer to note 5.1).

GN Otometric comprises a common business with a common management team and the combined financial statements

present the results and assets and liabilities as if the entities and operations had been subsidiaries of a parent entity for the

period presented, being the financial year ended 31 December 2015

8

IAS 1 requires that financial statements be presented with comparative financial information and IFRS 1 requires the

opening balance in the comparative period to be presented. These combined financial statements have been prepared

solely for the purposes of meeting the requirements of Rule 3-05 of the United States Securities and Exchange commission

regulation S-X. Accordingly, no comparative financial information is presented.

Except for the omission of comparative financial information as discussed in the preceeding paragraph, the combined

financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board. GN Group applies IFRS as endorsed by the European Union (“EU”) in its

consolidated financial statements. For the purposes of the combined financial statements, any differences between IFRS as

issued by the International Accounting Standards Board and IFRS as endorsed by the EU do not have a material impact.

Under IFRS1, “First Time Adoption of International Financial Reporting Standards”, a number of exemptions are permitted to

be taken in preparing the combined balance sheet at the date of transition to IFRS. For the purposes of the combined

financial statements, the Business has measured its assets and liabilities at the carrying amounts that were included in GN

Group’s consolidated financial statements, based on GN Group’s date of transition to IFRS as endorsed by the EU on 1

January 2004.

The Business historically reported financial information under IFRS as endorsed by the EU for the purposes of the

preparation of consolidated financial statements of GN Group. However the Business has not previously prepared or

reported any combined financial information or statements, and therefore no reconciliations from previous financial

information to IFRS have been presented.

The Business has not in the past constituted a separate legal group. The combined financial statements have been

prepared on a “carve-out” basis from the consolidated financial statements of the GN Group based on the divestment of the

Business by the GN Group to Natus Medical Inc. The statements are prepared on a basis that combines the results, cash

flows and assets and liabilities of each of the companies constituting the Business by applying the principles underlying the

consolidation procedures of IFRS10 “Consolidated Financial Statements” and include the assets, liabilities, cash flows,

revenues and expenses that management has determined are specifically attributable to the Business.

The combined financial statements reflect allocations of direct and indirect costs related to the operations of the Business

made by GN Group to depict the Business on a standalone basis. Indirect costs relate to certain support functions that are

provided on a centralised basis within GN Group and GN Group shared service centre locations. As certain expenses

reflected in the combined financial statements are allocated, the combined financial statements may not be indicative of the

financial position, results of operations and cash flows that would have been presented if the Business had been a

standalone entity. Therefore, the combined financial statements may not necessarily be indicative of the future financial

position, results of operations and cash flows of the Business.

As GN Group uses a centralised cash management system, allocated costs and expenses have generally been deemed to

have been paid by the Business to GN Group in the year in which the costs were incurred. Current income taxes, other than

taxes owed to tax jurisdictions, are deemed to have been remitted, in cash, by or to GN Group in the year the related

income taxes were recorded. A discussion of the relationship with GN Group, including a description of the costs that have

been allocated to the Business, is included in Note 5.7 to the combined financial statements.

Cash and bank overdrafts held locally and specifically related to the operations of the Business have been included in the

combined balance sheet.

The combined financial statements have been prepared for GN Otometrics, on the basis of how it was historically managed

by GN Group, for the purpose of facilitating the divestment of the Business by GN Group. All significant intercompany

transactions within the Business have been eliminated. All intercompany transactions with GN Group are considered to be

settled for cash in the combined cash flow statement at the time the transaction is recorded. The total net effect of the

settlement of these intercompany transactions is reflected in the combined cash flow statement as a financing activity and in

the combined carve-out balance sheet within net invested capital.

Since GN Otometrics has not in the past constituted a separate legal group, it is not possible to show share capital or an

analysis of reserves of GN Otometrics. The net assets of GN Otometrics are represented by the cumulative investment of

GN Group in the Business, shown as net invested capital in the combined balance sheet.

The combined carve-out financial statements were authorised for issue by Otometrics A/S on March 17, 2017.

9

1.2 GENERAL ACCOUNTING POLICIES

Adoption of new and revised accounting standards

GN Otometrics has adopted all the relevant new and revised International Financial Reporting Standards and IFRIC

Interpretations effective as of January 1, 2015. The new and revised Standards and Interpretations did not affect recognition

and measurement materially nor did they result in any material changes to disclosures in the notes. Apart from these minor

changes, and the omission of comparative financial information, the combined financial statements is presented in

accordance with the accounting policies applied in the GN Groups prior years’ annual reports.

Accounting standards not yet adopted

A number of new standards, amendments to standards and interpretations are effective for annual periods beginning after

January 1, 2015 and have not been applied in preparing this annual report. Those, which may be relevant to GN Otometrics,

are the following:

• IFRS 16 Leases applies to periods beginning on or after January 1, 2019. The effects of the standard have not yet been

analyzed in detail and the financial impact of the new standard will depend on the lease agreements in effect at the time of

adoption. However, it is expected that EBITA will increase with the so-called implicit lease interest rate. This is due to that

lease payments from operating leases will be replaced by depreciations included above EBITA and a calculated interest

included in financial items. EBITDA is therefore also expected to increase with an amount equal to the operating lease

payments.

• IFRS 9 Financial Instruments applies to annual periods beginning on or after January 1, 2018. The standard is only

expected to have a limited effect on recognition and measurement of financial assets. Disclosure in the financial statements

will change slightly as the classification of financial assets will be simplified to include only two categories: Financial assets

measured at either amortized cost or fair value. The additions to IFRS 9 regarding financial liability accounting are not

expected to affect the financial reporting.

• IFRS 15 Revenue from Contracts with Customers applies to annual periods beginning on or after January 1, 2018. The

standard is only expected to have a limited effect on the revenue recognition in GN Otometrics. GN Otometrics’s existing

accounting policy for revenue recognition is based on transfer of risk to the buyer whereas revenue recognition according to

IFRS 15 will be based on transfer of control to the buyer. This change is not expected to affect the timing of revenue

recognition in GN Otometrics.

Foreign Currency Translation

Functional Currency and Presentation Currency

Financial statement items for each of the reporting enterprises in the Business are measured using the currency used in the

primary financial environment in which the reporting enterprise operates. Transactions denominated in other currencies than

the functional currency are considered transactions denominated in foreign currencies. The combined financial statements

are presented in Danish kroner (DKK), which is the functional currency and presentation currency of GN Otometrics A/S.

Translation of Transactions and Amounts

On initial recognition, transactions denominated in foreign currencies are translated to the functional currency at the

exchange rates at the transaction date. Foreign exchange differences arising between the exchange rates at the transaction

date and at the date of payment are recognized in the combined income statement as financial income or financial

expenses. Receivables, payables and other monetary items denominated in foreign currencies are translated at the

exchange rates at the balance sheet date. The difference between the exchange rates at the balance sheet date and at the

date at which the receivable or payable arose or was recognized at January 1, 2015 is recognized in the combined income

statement as financial income or financial expenses.

Translation of entities included in the combined financial statements

On recognition in the combined financial statements of foreign entities with another functional currency than GN Otometrics'

presentation currency, the combined income statements are translated at the exchange rates at the transaction date, and

the balance sheet items are translated at the exchange rates at the balance sheet date. An average exchange rate for the

month is used as the exchange rate at the transaction date to the extent that this does not significantly distort the

presentation of the underlying transactions. Foreign exchange differences arising on translation of the opening balance of

equity of such enterprises at the exchange rates at the balance sheet date and on translation of the combined income

statements from the exchange rates at the transaction date to the exchange rates at the balance sheet date are recognized

in other comprehensive income.

10

Combined Cash Flow Statement

The combined cash flow statement is presented using the indirect method based on the operating profit. The combined

cash flow statement shows the cash flow from operating, investing and financing activities for the year and the year’s

changes in cash and cash equivalents as well as the cash and cash equivalents at the beginning and end of the year. The

cash flow effect of acquisitions and disposals of enterprises is shown separately in cash flows from investing activities.

Cash flow from acquired enterprises is recognized in the combined cash flow statement from the acquisition date. Cash flow

from disposed of enterprises is recognized up until the disposal date.

Cash flow from operating activities comprises cash flow from the year’s operations adjusted for non-cash operating items

and changes in working capital. Working capital comprises current assets excluding items stated as cash and cash

equivalents and excluding tax receivable, as well as current liabilities excluding bank loans, tax payable and provisions.

Cash flow from investing activities comprises payments in connection with acquisitions and disposals of enterprises and

activities, acquisitions and disposals of intangible assets, property, plant and equipment and other non-current assets and

acquisitions and disposals of securities that are not included in cash and cash equivalents.

Cash flow from financing activities comprises changes in the size or composition of the share capital and related costs as

well as the raising of loans, repayment of interest-bearing debt, acquisition and disposal of treasury shares and payment of

dividends to shareholders.

Cash and cash equivalents comprise cash and short-term marketable securities with a term of three months or less and are

subject to an insignificant risk of changes in value.

Other general accounting policies

Revenue

Revenue from sale of goods and rendering of services is recognized in the combined income statement provided that

delivery and transfer of risk to the buyer has taken place before year-end and that the income can be reliably measured and

is expected to be received. Extended warranties are separated from the sale of goods and recognized on a straight-line

basis over the term of the contract. The value of extended warranties that is not separately priced is estimated. Revenue is

measured excluding VAT, taxes and granted cash and quantity discounts in relation to the sale and expected returns of

goods. The portion of goods sold that is expected to be returned is determined based on historical product returns data.

Production Costs

Production costs comprise costs, including depreciation and salaries, incurred in generating the revenue for the year.

Production costs include direct and indirect costs for raw materials and consumables, wages and salaries, maintenance and

depreciation and impairment of production plant and costs and expenses relating to the operation, administration and

management of factories. Also included are inventory write-downs.

Development costs

Development costs comprise costs, salaries, and depreciation of operating assets and equipment directly or indirectly

attributable to the Business’s development activities. Furthermore, amortization and write-down of capitalized development

projects are included.

Selling and Distribution Costs

Selling and distribution costs comprise costs relating to the sale and distribution of products and services, including salaries,

sales commissions, advertising and marketing costs, depreciation and impairment, etc. Also included are losses on trade

receivables.

Management and Administrative Expenses

Management and administrative expenses comprise expenses incurred for management and administration. Administrative

expenses include office expenses, depreciation and impairment, etc.

11

1.3 SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS

The recognition of certain items of income and expenses and the determination of the carrying amount of certain assets and

liabilities implies making accounting estimates and judgments. Significant accounting estimates and judgments comprise

revenue recognition, computation of amortization, depreciation and impairment, useful lives and remaining useful lives of

non-current assets. Furthermore, recognition of pension obligations and similar non-current obligations, provisions,

contingent assets and liabilities as well as measurement of investment in associates recquires significant accounting

estimates and judgments.

The estimates used are based on assumptions, which by Management are deemed reliable, but by nature are associated

with uncertainty. The assumptions may be incomplete or incorrect, and unexpected events or circumstances may arise.

Accordingly, the Company is subject to risks and uncertainties that may lead to a situation where actual results differ from

estimates.

A description of significant accounting estimates and judgments is included in the relevant notes:

2.1 Revenue

2.3 Tax

3.1 Intangible assets

3.4 Provisions

3.5 Inventories

3.6 Trade receivables

5.2 Contingent liabilities, other financial liabilities and contingent assets

5.3 Associates

5.7 Related party transactions

12

2.1 REVENUE

DKK million 2015

Revenue from sale of goods 601

Revenue from sale of services 42

Total 643

! Significant accounting estimates

Revenue Recognition

SECTION 2: RESULTS FOR THE YEAR

Significant accounting estimates and judgments involve determining the portion of expected returns of goods. The

portion of goods sold that is expected to be returned is estimated based on historical product returns data.

13

2.2 STAFF COSTS

DKK million 2015

Wages, salaries and remuneration (199)

Pensions (10)

Other social security costs (16)

Total (225)

Included in:

Production costs and change in payroll costs included in inventories (59)

Development costs (39)

Selling and distribution costs (89)

Management and administrative expenses (38)

Total (225)

Average number of employees 446

Number of employees, year-end 464

Grant date Expiry date

Outstanding

warrants

Exercise

price

Years to

expiry

March 2013 November 2018 22 19.270 2,8

March 2014 November 2019 26 24.711 3,8

March 2015 November 2020 33 26.729 4,8

November 2015 November 2020 125 24.896 4,8

Outstanding warrants at December 31, 2015 206

SECTION 2: RESULTS FOR THE YEAR

Key management personnel of GN Otometrics A/S is considered to be the CEO and the CFO of GN Otometrics A/S. For 2015 the key

management personnel received short term employee benefits of DKK 3,8 million, pension of DKK 0,3 million and share based

payments of DKK 0,1 million.

Warrants (share based payment in GN Hearing A/S) held by key management personnel at December 31, 2015 have the following

expiry dates and exercise prices:

14

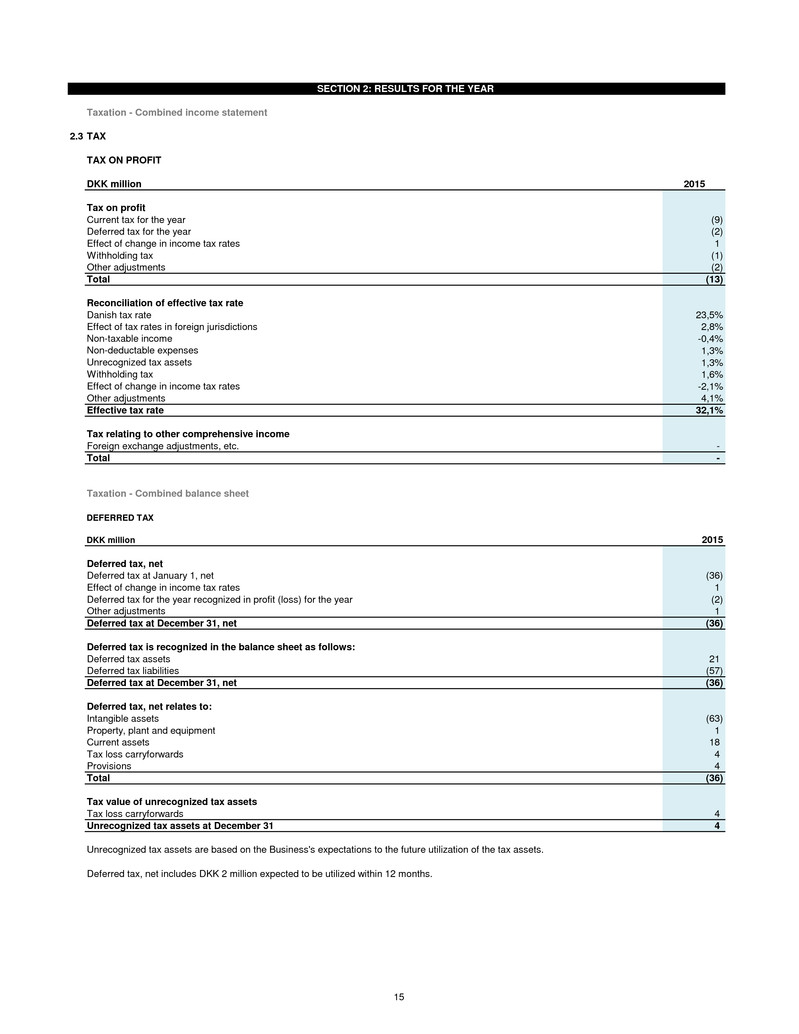

Taxation - Combined income statement

2.3 TAX

TAX ON PROFIT

DKK million 2015

Tax on profit

Current tax for the year (9)

Deferred tax for the year (2)

Effect of change in income tax rates 1

Withholding tax (1)

Other adjustments (2)

Total (13)

Reconciliation of effective tax rate

Danish tax rate 23,5%

Effect of tax rates in foreign jurisdictions 2,8%

Non-taxable income -0,4%

Non-deductable expenses 1,3%

Unrecognized tax assets 1,3%

Withholding tax 1,6%

Effect of change in income tax rates -2,1%

Other adjustments 4,1%

Effective tax rate 32,1%

Tax relating to other comprehensive income

Foreign exchange adjustments, etc. -

Total -

Taxation - Combined balance sheet

DEFERRED TAX

DKK million 2015

Deferred tax, net

Deferred tax at January 1, net (36)

Effect of change in income tax rates 1

Deferred tax for the year recognized in profit (loss) for the year (2)

Other adjustments 1

Deferred tax at December 31, net (36)

Deferred tax is recognized in the balance sheet as follows:

Deferred tax assets 21

Deferred tax liabilities (57)

Deferred tax at December 31, net (36)

Deferred tax, net relates to:

Intangible assets (63)

Property, plant and equipment 1

Current assets 18

Tax loss carryforwards 4

Provisions 4

Total (36)

Tax value of unrecognized tax assets

Tax loss carryforwards 4

Unrecognized tax assets at December 31 4

SECTION 2: RESULTS FOR THE YEAR

Unrecognized tax assets are based on the Business's expectations to the future utilization of the tax assets.

Deferred tax, net includes DKK 2 million expected to be utilized within 12 months.

15

Income taxes

Tax in the combined income statement represents the sum of current tax and deferred tax. Income taxes are presented on a separate tax return

basis as if the Business were a standalone entity. Where entities have consolidated tax returns, current taxes are assumed to be settled with the GN

Group, in the year the related taxes are recorded, through cash transfers to or from the GN Group. The current tax charge is calculated on the basis

of tax laws enacted or substantially enacted at the balance sheet date in countries where the Business operates and generates taxable income.

Judgement is required in determining the provision for income taxes. There are many transactions and calculations whose ultimate tax treatment is

uncertain. The Business recognises liabilities for anticipated tax issues based on estimates of whether additional taxes are likely to be due. The

Business recognises deferred tax assets and liabilities based on estimates of future taxable income and recoverability. Where a change in

circumstance occurs, or the final tax outcome of these matters is different from the amounts that were initially recorded, such differences will impact

the current tax and deferred tax balances in the year in which that change or outcome is known.

! Significant accounting estimates

Tax on Profit for the year

§ Accounting policies

The Business recognises deferred taxes using the liability method. Deferred tax assets and liabilities are recognised for the future tax consequences

attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax bases. Deferred tax

assets have been recognised where it is probable that they will be recovered. In recognising deferred tax assets, the Business has considered if it is

more likely than not that sufficient future profits will be available to absorb any tax losses and other temporary differences. Deferred tax assets and

liabilities are only offset in the combined balance sheet where there is a legally enforceable right of offset and there is an intention to settle the

balance net.

16

SECTION 3

Operating assets and liablities

3.1 INTANGIBLE ASSETS

0 0 0 0 0

0 0 0 0

DKK million Goodwill Software Other Total

Cost at January 1 167 384 11 6 10 578

Additions on company acquisitions - - - - 6 6

Additions - 92 5 73 - 170

Foreign exchange adjustments 6 - - 1 (1) 6

Cost at December 31 173 476 16 80 15 760

Amortization and impairment at January 1 (26) (227) (8) (3) - (264)

Amortization - (40) (2) (1) (2) (45)

Impairment - (1) - - - (1)

Amortization and impairment at December 31 (26) (268) (10) (4) (2) (310)

Carrying amount at December 31, 2015 147 208 6 76 13 450

Goodwill

Carrying amount

of goodwill

Pre-tax

discount rate

Weighted

average

cost of capital

2015 2015 2015

Cash-generating units:

Audiologic Diagnostics Equipment 147 11% 8%

Total 147

Development projects and software

Patents and rights

Other

Goodwill

SECTION 3: OPERATING ASSETS AND LIABILITIES

Development

projects,

developed in-

house

Patents

and rights

GN Otometrics has not capitalized any borrowing costs in the current period as non-current assets are not financed with debt.

Impairment of development projects relates to projects for which the sales forecasts cannot justify the capitalized value.

§ Accounting policies

At the acquisition date goodwill is recognized in the combined balance sheet at cost as described under Business combinations. Subsequently, goodwill is measured at cost less

accumulated impairment losses. Goodwill is not amortized but is tested for impairment at least once a year. The carrying amount of goodwill is allocated to the reporting entities cash-

generating unit at the acquisition date. Identification of cash-generating units is based on the management structure and internal financial control.

Management assesses that the smallest cash-generating unit to which the carrying amount of goodwill can be allocated is Audiologic Diagnostics Equipment.

Patents and rights primarily comprise acquired patents and rights. The most significant patents and rights relate to manufacturing and distribution rights regarding ear scanner

The Business' other intangible assets comprise DKK 13 million related to customer lists.

Software comprises development, design and test of production and planning software and reporting systems, business intelligence etc. Implementation of these systems is expected

to optimize internal procedures and processes. In 2015, management assessed that the expected useful lives were reflected in the carrying amounts at December 31, 2015.

The carrying amount of development projects in progress amount to DKK 111 million.

In-progress and completed development projects comprise development and design of audiologic diagnostics equipment. Most development projects are expected to be completed in

2016 and 2017, after which product sales and marketing can be commenced. Management performs at least one annual impairment test of the carrying amount of recognized

development costs. The recoverable amount is assessed based on sales forecasts. In Management's assessment, the recoverable amount exceeds the carrying amount.

Based on the impairment tests and related assumptions, management has not identified any goodwill impairment at December 31, 2015.

The recoverable amount for Audiologic Diagnostics Equipment at December 31, 2015 has been determined based on a valuation using cash flow projections from budgets and

financial forecasts, covering a five-year period, and the communicated strategy plan as approved by the Board of Directors.

Audiologic Diagnostics Equipment expects to deliver organic growth in line with the market growth. The market growth in the hearing aid industry is driven by four main factors:

- The demographic trends including the increased number of elderly people,

- Increased prevalence of hearing loss due to the increasing noise in the environment,

- Increased penetration rates as more people with a hearing loss will use hearing aids in the future, and

- Increased use of two hearing aids instead of only one, which is relatively common today.

In the impairment test, the discounted future cash flows of the CGU were compared with the carrying amount. Future cash flows are based on the budget for 2016, market forecasts

for 2017 - 2020, strategy plans, etc. Budgets and strategy plans are based on specific assumptions for the CGU regarding sales, operating profit, working capital, investments in non-

current assets, etc. The calculations apply expected growth in the terminal period of 2.5% p.a.

Management has performed an impairment test of the carrying amount of goodwill at December 31, 2015. The impairment test covered the Business's cash-generating unit (CGU) to

which the carrying amount of goodwill is allocated.

17

Development projects are measured at cost less accumulated amortization and impairment. An impairment test is performed of the carrying amount of recognized development

projects. The impairment test is based on assumptions regarding strategy, product life cycle, market conditions, discount rates and budgets, etc., after the project has been completed

and production has commenced. If market-related assumptions etc., are changed, development projects may have to be written down. Management examines and assesses the

underlying assumptions when determining whether or not the carrying amount should be written down. In addition, management continously assess the useful lives of its products to

ensure that amortization of development projects reflects the useful lives.

Development projects

Goodwill

! Significant accounting estimates

Determining whether goodwill is impaired requires a comparison of the recoverable amount with the carrying amount. The recoverable amount is determined as the net present value

of the future cash flows expected to arise from the cash generating unit to which goodwill is allocated.

Intangible assets are measured at cost less accumulated amortization and impairment. Amortization is provided on a straight-line basis over the expected useful lives of the assets.

When changing the depreciation period or the residual value, the effect on the depreciation is recognized prospectively as a change in accounting estimates. Amortization and

impairment is recognized in the combined income statement as production costs, development costs, distribution costs and administrative expenses. The expected useful lives are as

follows:

Completed development projects 1-5 years

Software 1-7 years

Patents, licenses, trademarks and

other intellectual property rights up to 20 years

Goodwill is subject to at least one annual impairment test, initially before the end of the acquisition year. Similarly, in-process development projects are tested for impairment at least

annually.

The carrying amount of goodwill is tested for impairment together with the other non-current assets in the cash-generating unit to which the goodwill is allocated. Goodwill is written

down to the recoverable amount if the carrying amount is higher than the computed recoverable amount. The recoverable amount is computed as the present value of the expected

future net cash flows from the enterprises or activities to which the goodwill is allocated.

An impairment loss is recognized if the carrying amount of an asset or its cash-generating unit exceeds the recoverable amount of the asset or the cash-generating unit. Impairment

of goodwill is recognized in a separate line item in the combined income statement. Impairment of goodwill is not reversed.

Development projects, Software, Patents, Licenses and Other Intangible Assets

Recognition of impairment losses in the combined income statement

Development projects that are clearly defined and identifiable, where the technical utilization degree, sufficient resources and a potential future market or development opportunities in

the reporting entities is evidenced, and where the GN Otometrics business intends to produce, market or use the project, are recognized as intangible assets if it is probable that

costs incurred will be covered by future earnings. The cost of such development projects includes direct wages, salaries, materials and other direct and indirect costs attributable to

the development projects. Amortization and write-down of such capitalized development projects are started at the date of completion and are included in development costs. Other

development costs are recognized in the income statement as incurred.

Impairment of Goodwill and in-process development projects

Gains or losses on the disposal of intangible assets are determined as the difference between the selling price less selling costs and the carrying amount at the disposal date, and are

recognized in the income statement as other operating income or other operating costs, respectively.

18

3.2 PROPERTY, PLANT AND EQUIPMENT

0 0

0

DKK million Total

Cost at January 1 8 24 21 53

Additions 1 4 3 8

Disposals - (1) (2) (3)

Foreign exchange adjustments - 1 1 2

Cost at December 31 9 28 23 60

Depreciation and impairment at January 1 (4) (17) (13) (34)

Depreciation (1) (3) (3) (7)

Disposals - - 1 1

Depreciation and impairment at December 31 (5) (20) (15) (40)

Carrying amount at December 31, 2015 4 8 8 20

The GN Otometrics business has not capitalized any borrowing costs as non-current assets are not financed with debt.

SECTION 3: OPERATING ASSETS AND LIABILITIES

§ Accounting policies

Leasehold improvements, plant and machinery and operating assets and equipment, other plant and equipment are measured at cost less accumulated depreciation and

impairment losses. Cost comprises the purchase price and costs of materials, components, suppliers, direct wages and salaries and indirect production costs until the date when

the asset is available for use. Liabilities related to dismantling and removing the asset and restoring the site on which the asset is located are added to the cost. Where individual

components of an item of property, plant and equipment have different useful lives, they are accounted for as separate items, which are depreciated separately. Depreciation is

provided on a straight-line basis over the expected useful lives of property, plant and equipment. The expected useful lives are as follows:

Leasehold improvements 5-20 years

Plant and machinery 1-7 years

Operating assets and equipment 2-7 years

The basis of depreciation is calculated as the residual value of the asset less impairment losses. The residual value is determined at the acquisition date and reassessed annually.

If the residual value exceeds the carrying amount, depreciation is discontinued. When changing the depreciation period or the residual value, the effect on the depreciation is

recognized prospectively as a change in accounting estimates. Depreciation and impairment is recognized in the combined income statement as production costs, development

costs, distribution costs and administrative expenses.

Expenses for repairs and maintenance of property, plant and equipment are included in the combined income statement. Gains or losses on disposal or scrapping of an item of

property, plant and equipment are determined as the difference between the sales price reduced by costs related to dismantling and removing the asset, selling costs and costs

related to restoring the site on which the asset is located and the carrying amount. Any gains or losses are recognized in the combined income statement as Other operating

income or Other operating costs, respectively.

Leasehold

improve-

ments

Plant and

machinery

Operating

assets and

equipment

Property, plant and Equipment

19

3.3 DEPRECIATION, AMORTIZATION AND IMPAIRMENT

DKK million 2015

Depreciation, amortization and impairment for the year of property, plant and equipment

and intangible assets are recognized in the combined income statement as follows:

Production costs (1)

Development costs (42)

Selling and distribution costs (3)

Management and administrative expenses (4)

Amortization of acquired intangible assets (3)

Total (53)

Amortization of intangible assets is recognized in the combined income statement as follows:

Development costs (40)

Management and administrative expenses (2)

Amortization of acquired intangible assets (3)

Total (45)

Impairment of intangible assets is recognized in the combined income statement as follows:

Development costs (1)

Total (1)

SECTION 3: OPERATING ASSETS AND LIABILITIES

20

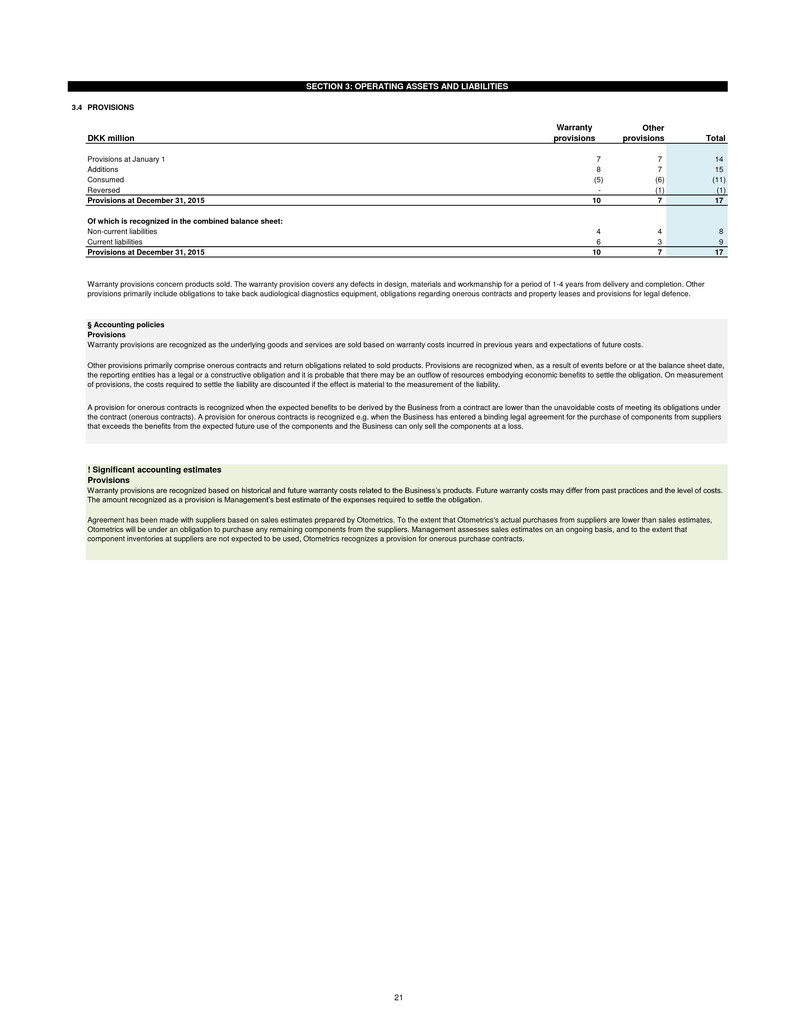

3.4 PROVISIONS

Other 0

DKK million provisions Total

Provisions at January 1 7 7 14

Additions 8 7 15

Consumed (5) (6) (11)

Reversed - (1) (1)

Provisions at December 31, 2015 10 7 17

Of which is recognized in the combined balance sheet:

Non-current liabilities 4 4 8

Current liabilities 6 3 9

Provisions at December 31, 2015 10 7 17

SECTION 3: OPERATING ASSETS AND LIABILITIES

§ Accounting policies

Warranty provisions are recognized based on historical and future warranty costs related to the Business’s products. Future warranty costs may differ from past practices and the level of costs.

The amount recognized as a provision is Management’s best estimate of the expenses required to settle the obligation.

! Significant accounting estimates

Agreement has been made with suppliers based on sales estimates prepared by Otometrics. To the extent that Otometrics's actual purchases from suppliers are lower than sales estimates,

Otometrics will be under an obligation to purchase any remaining components from the suppliers. Management assesses sales estimates on an ongoing basis, and to the extent that

component inventories at suppliers are not expected to be used, Otometrics recognizes a provision for onerous purchase contracts.

A provision for onerous contracts is recognized when the expected benefits to be derived by the Business from a contract are lower than the unavoidable costs of meeting its obligations under

the contract (onerous contracts). A provision for onerous contracts is recognized e.g. when the Business has entered a binding legal agreement for the purchase of components from suppliers

that exceeds the benefits from the expected future use of the components and the Business can only sell the components at a loss.

Provisions

Other provisions primarily comprise onerous contracts and return obligations related to sold products. Provisions are recognized when, as a result of events before or at the balance sheet date,

the reporting entities has a legal or a constructive obligation and it is probable that there may be an outflow of resources embodying economic benefits to settle the obligation. On measurement

of provisions, the costs required to settle the liability are discounted if the effect is material to the measurement of the liability.

Warranty provisions are recognized as the underlying goods and services are sold based on warranty costs incurred in previous years and expectations of future costs.

Provisions

Warranty

provisions

Warranty provisions concern products sold. The warranty provision covers any defects in design, materials and workmanship for a period of 1-4 years from delivery and completion. Other

provisions primarily include obligations to take back audiological diagnostics equipment, obligations regarding onerous contracts and property leases and provisions for legal defence.

21

3.5 INVENTORIES

DKK million 2015

Raw materials and consumables 82

Finished goods and merchandise 53

Total 135

The above includes write-downs amounting to 20

Write-downs recognized in the combined income statement under

production costs 5

Reversed write-downs recognized under production costs -

Production costs include costs of goods sold of 270

SECTION 3: OPERATING ASSETS AND LIABILITIES

§ Accounting policies

Inventories are measured at cost in accordance with the FIFO-principle. Inventories in Otometrics are measured at cost using the

standard cost method. Standard costs take into account normal levels of raw materials and consumables, staff costs, efficiency

and capacity utilization. Standard costs are reviewed regularly and adjusted in accordance with the FIFO-principle.

Raw materials and goods for resale are measured at cost, comprising purchase price plus delivery costs.

Finished goods are measured at cost, comprising the cost of direct materials, wages and salaries and indirect production

overheads. Indirect production overheads comprise indirect materials, wages and salaries, maintenance and depreciation of

production machinery and equipment as well as factory administration and management.

Where the net realizable value is lower than cost, inventories are written down to this lower value. The net realizable value of

inventories is calculated as the sales amount less costs of completion and costs necessary to make the sale.

! Significant accounting estimates

The net realizable value of inventories is calculated based on the size of the inventory and decreases in the recoverable amount

of purchased raw materials, technical obsolescence (e.g., faulty products), physical obsolescence (e.g. damaged products) and

financial obsolescence (e.g., reduced demand or substituting products). The business performs write-downs of inventories based

on an individual assessment of products or product groups and expected product sales from 12 to 24 months following the

balance sheet date.

Inventories

Measurement of inventories

22

3.6 TRADE RECEIVABLES

DKK million 2015

Trade receivables 126

Total 126

Trade receivables have the following maturities:

Not due 77

Due 30 days or less 15

Due more than 30 days but less than 90 days 14

Due more than 90 days 20

Total 126

Write-downs, which are included in total trade receivables, have developed as follows:

Write-downs at January 1 (10)

Write-downs made during the year (5)

Write-downs at December 31 (15)

No security has been pledged to Otometrics for trade receivables.

Trade receivables include the following overdue but not written down receivables:

Due 30 days or less 9

Due more than 30 days but less than 90 days 14

Due more than 90 days 16

Total 39

Measurement of trade receivables

Total write-downs of DKK 15 million are included in trade receivables at the end of 2015. In 2015 a write-

down of DKK 3 million is recognised in respect of an individual receivable. The assessment of credit risk

associated with individual receivables depends primarily on aging, change in customer payment

behavior, current economic conditions etc. as described in significant accounting estimates. Based on

past experience, Otometrics believes that no write-down is necessary in respect of trade receivables not

past due.

SECTION 3: OPERATING ASSETS AND LIABILITIES

§ Accounting policies

Trade receivables are measured at amortized cost less write-down for foreseen bad debt losses. Write-down for bad debt

losses is based on an individual assessment of each receivable and at portfolio level.

If a customer’s financial condition deteriorates, further write-downs may be required in future periods. In assessing the

adequacy of write-downs for bad debt losses, Management specifically analyzes receivables, including doubtful debts,

concentrations of credit risk, credit ratings, current economic conditions and changes in customers’ payment behavior.

! Significant accounting estimates

23

3.7 OTHER PAYABLES

DKK million 2015

Employee costs payable 30

VAT payable 5

Other 24

Total 59

SECTION 3: OPERATING ASSETS AND LIABILITIES

24

SECTION 4

Capital structure and financing items

4.1 FINANCIAL RISKS AND FINANCIAL INSTRUMENTS

Contractual maturity analysis for financial liabilities

Less than Between one More than 0

DKK million one year and five years five years Total

2015

Payables to GN Group 188 27 - 215

Bank loans 2 - - 2

Trade payables 51 - - 51

Total non-derivative financial liabilities 241 27 - 268

Total financial liabilities 241 27 - 268

The maturity analysis is based on non-discounted cash flows excluding interest payments.

Categories of financial assets and liabilities

The financial assets and liabilities presented in the balance sheet can be grouped in the following categories:

DKK million 2015

Trade receivables 126

Other receivables 21

Owed by associates, non-current 29

Loans and receivables 176

Payables to GN Group 215

Bank loans 2

Trade payables 51

Financial liabilities measured at amortized cost 268

Foreign currency risk and interest rate risk

Financial risk management of the Business is mainly exercised and monitored at a GN Group level. It is based on sound economic objectives and good corporate practice. The GN

Groups treasury operations are carried out under policies and parameters approved by the GN Group board of directors. Central treasury activities include managing foreign

exchange risk, the investment of surplus cash, the issuance, repayment and repurchase of short term and long term debt and interest rate management. The Business is not exposed

to significant market based currency, interest or commodity risk in the reported year. GN Otometrics has established policies for credit risk management related to customers

including the use of credit rating agencies. Assessment of credit risks related to customers is further described in note 3.6 Trade receivables.

For financial assets and liabilities, the fair value is approximately equal to the carrying amount.

SECTION 4: CAPITAL STRUCTURE AND FINANCING

Financial risk management

Capital risk management of the Business is also mainly exercised and monitored at a GN Group level. The objective is to minimise its cost of capital by optimising the efficiency of its

capital structure, being the balance between equity and debt. The GN Group views its ordinary share capital as equity. This objective is always subject to an overriding principle that

capital must be managed to ensure the GN Group’s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders. The GN

Group is able to adjust its capital structure through the issue or redemption of either debt or equity and by adjustment to the dividend paid to equity holders as well as share buy back

programs. The GN Group uses a range of financial metrics to monitor the efficiency of its capital structure, including its weighted average cost of capital and net debt to EBITDA and

ensures that its capital structure provides sufficient financial strength to allow it to secure access to debt finance at reasonable cost. The Business is directly impacted by the

objectives and decisions made by the GN Group noted above.

Capital risk management

The business has exposure towards several foreign currencies in connection with commercial transactions, including intercompany balances which are eliminated in the combined

financial statements. As balances are settled short term the impact of currency risk is considered immaterial for the combined financial statements.

The business has primarily loans from the GN Group which holds variable interest rates. Based on the loans at December 31, 2015 a 1%-point increase in the interest rate level

would result in an increase, net in the annual interest expense of DKK 2,1 million.

Amounts owed to credit institutions and banks are recognized at the date of borrowing at fair value of the proceeds received less transaction costs paid. In subsequent periods, the

financial liabilities are measured at amortized cost, corresponding to the capitalized value using the effective interest rate. Accordingly, the difference between the proceeds and the

nominal value is recognized in the income statement over the term of the loan.

Trade payables, amounts owed to group enterprises and associates are measured at amortized cost.

Financial Liabilities

§ Accounting policies

25

4.2 FINANCIAL INCOME AND EXPENSES

DKK million 2015

Financial Income:

Interest income* 4

Financial income, other 1

Foreign exchange gain 5

Total 10

Financial expenses:

Interest expenses to GN Group entities* (4)

Financial expenses, other (2)

Total (6)

Otometrics has not included borrowing costs in the cost price of non-current assets as these are not financed with debt.

*Interest income and expenses from financial assets and liabilities at amortized cost.

SECTION 4: CAPITAL STRUCTURE AND FINANCING

§ Accounting policies

Financial income and expenses comprise interest income and expense, costs of permanent loan facilities, receivables, payables and

transactions denominated in foreign currencies, credit card fees, etc.

Borrowing costs that are directly attributable to the construction or production of a qualifying asset form part of the cost of that asset.

Other borrowing costs are recognized as an expense. A qualifying asset is an asset that necessarily takes a substantial period of time

to get ready for its intended use.

Financial Income and Expenses

26

SECTION 5

Other disclosures

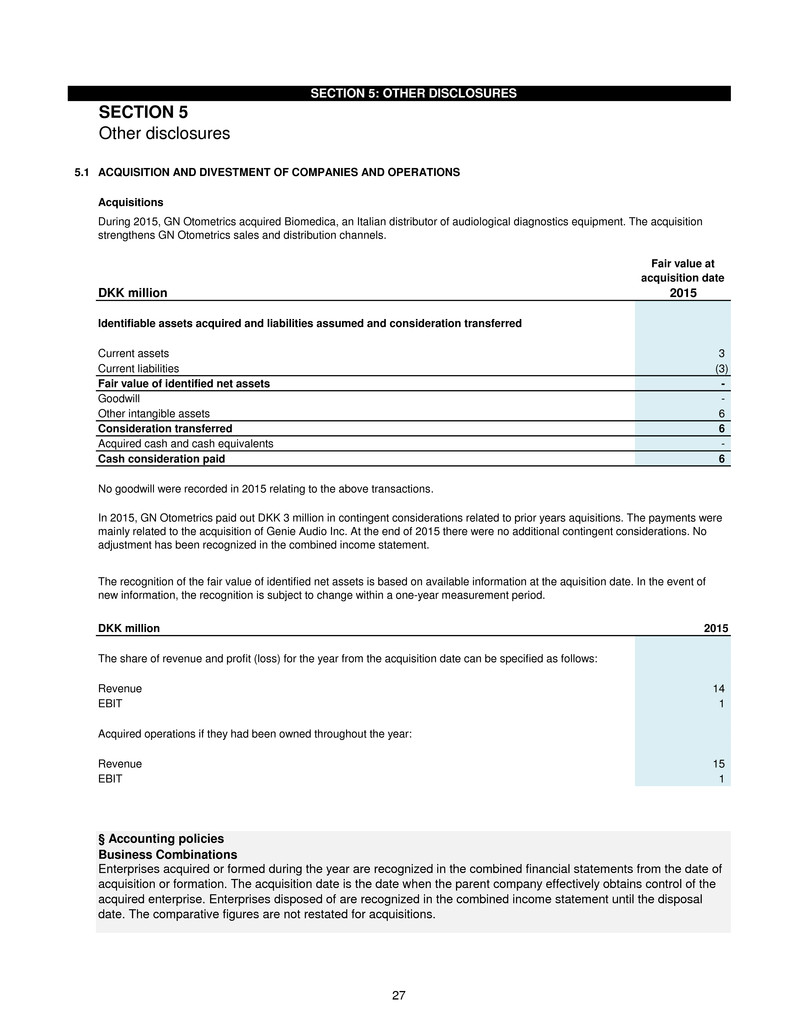

5.1 ACQUISITION AND DIVESTMENT OF COMPANIES AND OPERATIONS

Fair value at

acquisition date

DKK million 2015

Identifiable assets acquired and liabilities assumed and consideration transferred

Current assets 3

Current liabilities (3)

Fair value of identified net assets -

Goodwill -

Other intangible assets 6

Consideration transferred 6

Acquired cash and cash equivalents -

Cash consideration paid 6

DKK million 2015

The share of revenue and profit (loss) for the year from the acquisition date can be specified as follows:

Revenue 14

EBIT 1

Acquired operations if they had been owned throughout the year:

Revenue 15

EBIT 1

SECTION 5: OTHER DISCLOSURES

The recognition of the fair value of identified net assets is based on available information at the aquisition date. In the event of

new information, the recognition is subject to change within a one-year measurement period.

Acquisitions

During 2015, GN Otometrics acquired Biomedica, an Italian distributor of audiological diagnostics equipment. The acquisition

strengthens GN Otometrics sales and distribution channels.

No goodwill were recorded in 2015 relating to the above transactions.

In 2015, GN Otometrics paid out DKK 3 million in contingent considerations related to prior years aquisitions. The payments were

mainly related to the acquisition of Genie Audio Inc. At the end of 2015 there were no additional contingent considerations. No

adjustment has been recognized in the combined income statement.

§ Accounting policies

Business Combinations

Enterprises acquired or formed during the year are recognized in the combined financial statements from the date of

acquisition or formation. The acquisition date is the date when the parent company effectively obtains control of the

acquired enterprise. Enterprises disposed of are recognized in the combined income statement until the disposal

date. The comparative figures are not restated for acquisitions.

27

When acquiring a controlling interest in steps, the Business assesses the fair value of the acquired net assets at the

time control is obtained. At such time, interests acquired previously are also adjusted to fair value. The difference

between the fair value and the carrying amount is recognized in the combined income statement.

Acquisition of additional equity interest after a business combination is not accounted for using the acquisition

method, but rather as equity transactions. Disposals of equity interest while retaining control are also accounted for

as equity transactions. Transactions resulting in a loss of control result in a gain or loss being recognized in the

combined income statement.

When acquiring less than 100% of the shares in a company, the Business recognizes the goodwill on a transaction-

by-transaction basis or as a proportion of goodwill in accordance with the Otometrics business’ ownership interest.

For acquisitions of new enterprises in which the parent company is able to exercise control over the acquired

enterprise, the purchase method is used. The acquired enterprises’ identifiable assets, liabilities and contingent

liabilities are measured at fair value at the acquisition date. Identifiable intangible assets are recognized if they are

separable or arise from a contractual right. Deferred tax on revaluations is recognized.

Any excess of the cost over the fair value of the identifiable assets, liabilities and contingent liabilities acquired is

recognized as goodwill under intangible assets. Goodwill is not amortized but is tested at least annually for

impairment. The first impairment test is performed within the end of the acquisition year. Upon acquisition, goodwill is

allocated to the cash-generating unit, which subsequently form the basis for the impairment test. Goodwill and fair

value adjustments in connection with the acquisition of a foreign entity with another functional currency than the

presentation currency used by the Business are treated as assets and liabilities belonging to the foreign entity and

translated into the foreign entity’s functional currency at the exchange rate at the transaction date.

The cost of a business combination comprises the fair value of the consideration agreed upon. When a business

combination agreement provides for an adjustment to the cost of the combination contingent on future events, the

amount of that adjustment is included in the cost of the combination if the adjustment is probable and can be

measured in a reliable manner. Subsequent changes to contingent considerations are recognized in the income

statement. If uncertainties regarding measurement of identifiable assets, liabilities and contingent liabilities exist at

the acquisition date, initial recognition will take place on the basis of preliminary fair values. If identifiable assets,

liabilities and contingent liabilities are subsequently determined to have different fair value at the acquisition date

than first assumed, goodwill is adjusted up until twelve months after the acquisition. The effect of the adjustments is

recognized in the opening balance of equity and the comparative figures are restated accordingly.

Transaction costs are recognized in the combined income statement.

28

5.2 CONTINGENT LIABILITIES AND OTHER FINANCIAL LIABILITIES

DKK million 2015

Guarantees, warranties and other liabilities 1

Contingent liabilities

Outstanding lawsuits

Other financial liabilities

Security

Purchase obligations

SECTION 5: OTHER DISCLOSURES

Apart from the above, management is not aware of any matter that could be of material importance to the business' financial position.

! Significant accounting estimates

The business has agreed with suppliers based on sales estimates prepared by the business. To the extent that the Business' sales estimates exceed

actual purchases from suppliers, the business is under an obligation to purchase any remaining components from the suppliers. Management assesses

sales estimates on an ongoing basis. To the extent that component inventories at suppliers exceed the volumes expected to be used, the business

recognizes a provision for onerous purchase contracts.

The Business is party to various lawsuits, including cases involving patent infringements. The outcome of cases pending is not expected to be of material

importance to the Otometrics business' financial position.

The Group has not pledged any assets as security.

Otometrics’s Management assesses provisions, contingent assets and contingent liabilities and the likely outcome of pending or

threatened lawsuits on an ongoing basis. The outcome depends on future events that are by nature uncertain. In assessing the likely

outcome of lawsuits and tax disputes, etc., Management bases its assessment on external legal assistance and decided cases.

Provisions, Contingencies and Lawsuits

29

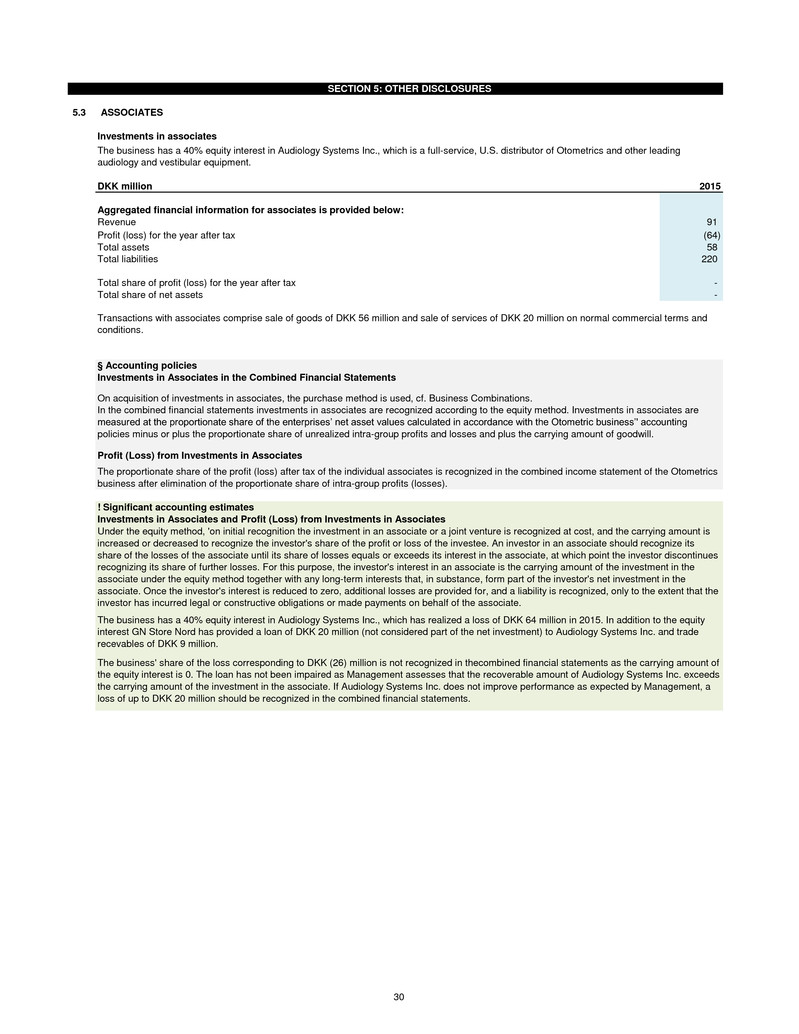

5.3 ASSOCIATES

Investments in associates

DKK million 2015

Aggregated financial information for associates is provided below:

Revenue 91

Profit (loss) for the year after tax (64)

Total assets 58

Total liabilities 220

Total share of profit (loss) for the year after tax -

Total share of net assets -

SECTION 5: OTHER DISCLOSURES

§ Accounting policies

The proportionate share of the profit (loss) after tax of the individual associates is recognized in the combined income statement of the Otometrics

business after elimination of the proportionate share of intra-group profits (losses).

Investments in Associates in the Combined Financial Statements

On acquisition of investments in associates, the purchase method is used, cf. Business Combinations.

In the combined financial statements investments in associates are recognized according to the equity method. Investments in associates are

measured at the proportionate share of the enterprises’ net asset values calculated in accordance with the Otometric business’' accounting

policies minus or plus the proportionate share of unrealized intra-group profits and losses and plus the carrying amount of goodwill.

Profit (Loss) from Investments in Associates

Transactions with associates comprise sale of goods of DKK 56 million and sale of services of DKK 20 million on normal commercial terms and

conditions.

The business has a 40% equity interest in Audiology Systems Inc., which is a full-service, U.S. distributor of Otometrics and other leading

audiology and vestibular equipment.

The business' share of the loss corresponding to DKK (26) million is not recognized in thecombined financial statements as the carrying amount of

the equity interest is 0. The loan has not been impaired as Management assesses that the recoverable amount of Audiology Systems Inc. exceeds

the carrying amount of the investment in the associate. If Audiology Systems Inc. does not improve performance as expected by Management, a

loss of up to DKK 20 million should be recognized in the combined financial statements.

! Significant accounting estimates

Investments in Associates and Profit (Loss) from Investments in Associates

Under the equity method, 'on initial recognition the investment in an associate or a joint venture is recognized at cost, and the carrying amount is

increased or decreased to recognize the investor's share of the profit or loss of the investee. An investor in an associate should recognize its

share of the losses of the associate until its share of losses equals or exceeds its interest in the associate, at which point the investor discontinues

recognizing its share of further losses. For this purpose, the investor's interest in an associate is the carrying amount of the investment in the

associate under the equity method together with any long-term interests that, in substance, form part of the investor's net investment in the

associate. Once the investor's interest is reduced to zero, additional losses are provided for, and a liability is recognized, only to the extent that the

investor has incurred legal or constructive obligations or made payments on behalf of the associate.

The business has a 40% equity interest in Audiology Systems Inc., which has realized a loss of DKK 64 million in 2015. In addition to the equity

interest GN Store Nord has provided a loan of DKK 20 million (not considered part of the net investment) to Audiology Systems Inc. and trade

recevables of DKK 9 million.

30

5.4 OTHER NON-CASH ADJUSTMENTS

DKK million 2015

Provision for bad debt, inventory write-downs, etc. 11

Adjustment of provisions 2

Total 13

SECTION 5: OTHER DISCLOSURES

31

5.5 PENSIONS

DKK million 2015

Pension costs recognized in the combined income statement

Defined contribution plans total (10)

Total pension costs recognized in the combined income statement (10)

The costs are recognized in the following income statement items:

Production costs (3)

Development costs (2)

Selling and distribution costs (4)

Management and administrative expenses (1)

Total (10)

Defined contribution plans

Defined benefit plans

Other plans

SECTION 5: OTHER DISCLOSURES

§ Accounting policies

Contributions to defined contribution plans are recognized in the combined income statement in the period to which they relate and any contributions

outstanding are recognized in the combined balance sheet as other payables.

The Business has no other pension obligations or similar obligations to its employees.

The Business has pension commitments regarding certain employees in Denmark and abroad. Pension plans are generally defined contribution

plans. The pension plans are funded by current payments to independent pension funds and insurance companies, which are responsible for

payment of the pension benefits. When contributions to defined contribution plans have been paid, the business has no further commitments to

present or former employees. Contributions to defined contribution plans are recognized in the income statement when they are due.

The Business has no material defined benefit plans.

Pensions

32

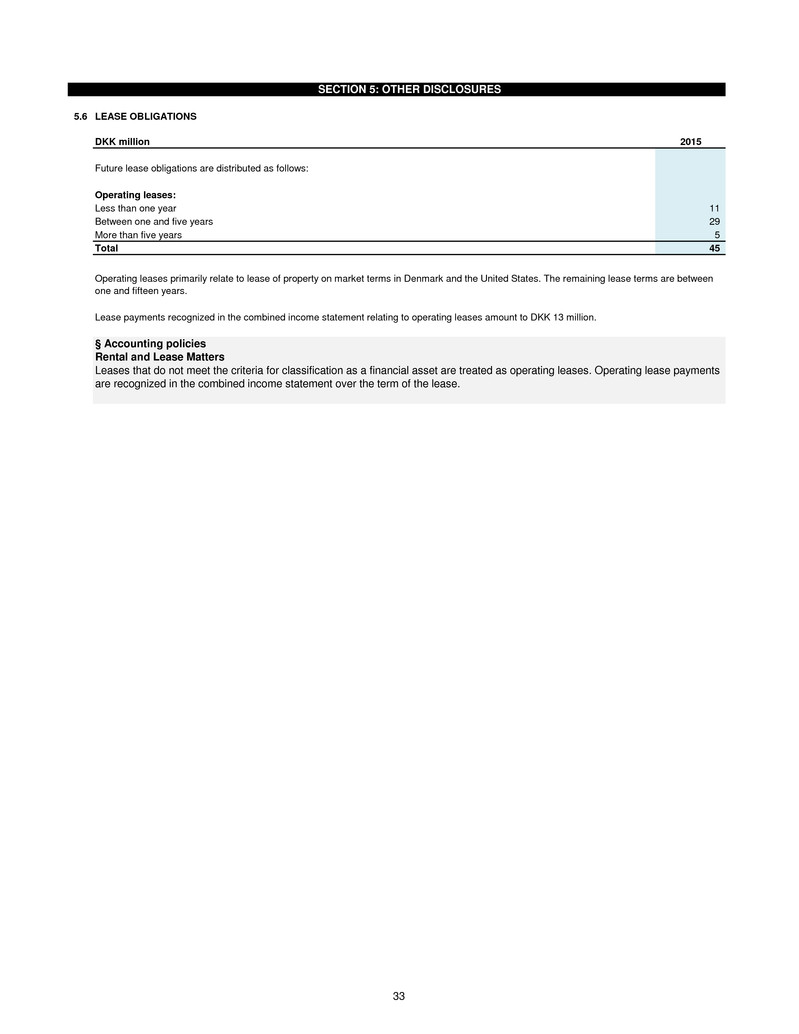

5.6 LEASE OBLIGATIONS

DKK million 2015

Future lease obligations are distributed as follows:

Operating leases:

Less than one year 11

Between one and five years 29

More than five years 5

Total 45

Lease payments recognized in the combined income statement relating to operating leases amount to DKK 13 million.

Leases that do not meet the criteria for classification as a financial asset are treated as operating leases. Operating lease payments

are recognized in the combined income statement over the term of the lease.

Operating leases primarily relate to lease of property on market terms in Denmark and the United States. The remaining lease terms are between

one and fifteen years.

SECTION 5: OTHER DISCLOSURES

§ Accounting policies

Rental and Lease Matters

33

5.7 RELATED PARTY TRANSACTIONS

Corporate allocations

Trade with GN group enterprises and allocated costs

Trade with the GN group enterprises comprised:

DKK million 2015

Sales to related parties 4

Purchases from related parties -

Allocated costs 52

The business receives various administrative services such as tax, treasury, accounting, HR and IT from the GN Group

and hence cost associated with these services are allocated to the business. These allocated costs are primarily related

to corporate administrative expenses and costs for shared local personnel and facilities. The allocation of costs is based

on a number of utilization measures including headcount, revenue and IT users. Generally, such amounts have been

deemed to have been paid by the business in the year in which the costs are recorded.

! Significant accounting estimates

Management believes the assumptions and allocations underlying the combined financial statements are reasonable and

appropriate under the circumstances. The expenses and cost allocations have been determined on a basis considered

by management to be a reasonable reflection of the utilization of services provided to or the benefit received by the

business during the period presented relative to the total cost incurred by the GN Group. However, the amounts recorded

for these transactions and allocations are not necessarily representative of the amounts that would have been reflected in

the financial statements had the business been an entity that operated independently of the GN Group. Consequently,

future results of operations when the business is separated from the GN Group, will include costs and expenses that may

be materially different than the business' historical results of operations, financial position and cash flows. Accordingly,

the combined financial statements for 2015 is not indicative of the business' future results of operations, financial position

and cash flow.

SECTION 5: OTHER DISCLOSURES

The GN Otometrics business' balances with GN Store Nord group enterprises at December 31, 2015 are recognized in the combined

balance sheet. Interest income and expenses with respect to GN Store Nord group enterprises are disclosed in note 4.2. Further,

balances with group enterprises comprise trade balances related to the purchase and sale of goods and services.

No transactions have been carried out with the Board of Directors, the Executive Management, senior employees, major shareholders

or other related parties, apart from ordinary remuneration, as described in note 2.2.

The business' related parties exercising significant influence comprise GN Hearing A/S and The GN Group as well as members of the