Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HYSTER-YALE MATERIALS HANDLING, INC. | d325447d8k.htm |

Exhibit 99

HYSTER-YALE

MATERIALS HANDLING

2016 Annual Report

Solutions

THAT DRIVE Productivity

HYSTER-YALE

MATERIALS HANDLING

Hyster-Yale maintains leading market share positions in the Americas and worldwide

HYSTER

YALE

UTILEV

NUVERA

BOLZONI AURAMO

MEYER

Contents

About the Company

1

Selected Financial and Operating Data

2

Letter to Stockholders

4

Form 10-K

15

Directors and Officers

106

Corporate Information

Inside Back Cover

Cover Photo Captions

Inside Back Cover

Mission Statement: To be a leading, globally integrated designer, manufacturer and marketer of a complete range of lift truck solutions by leveraging its high-quality,

application-tailored lift trucks, attachments and power solutions that offer the lowest cost of ownership and the best overall value.

2016 Annual Report

About the Company

Hyster-Yale Materials Handling, Inc., headquartered in Cleveland, Ohio, is a leading, globally integrated, full-line lift truck manufacturer. The Company offers a broad array of

solutions aimed at meeting the specific materials handling needs of its customers. These solutions include attachments and hydrogen fuel cell power products provided by its wholly owned subsidiaries and telematics, automation and fleet management

services, as well as an array of other power options for its lift trucks.

Lift Trucks

The Company’s operating subsidiary, Hyster-Yale Group, Inc., designs, engineers, manufactures, sells and services a comprehensive line of lift trucks and after-market parts

marketed globally primarily under the Hyster® and Yale® brand names. The Company manufactures lift trucks and component parts in the United States, Northern Ireland, Mexico, Italy, the Netherlands, Vietnam, Japan, the Philippines, Brazil and

China.

Lift truck unit volumes drive the Company’s economic engine, and its worldwide distribution strength drives market share, volume, economies of scale

and installed truck population. Hyster-Yale had an estimated installed population base of approximately 827,000 lift trucks in operation at the end of 2016 in more than 750 industries worldwide. This population, in turn, generates profitable

aftermarket revenue for both Hyster-Yale and its dealers.

Attachments, Forks and Lift Tables

In 2016, the Company acquired Bolzoni S.p.A., a leading worldwide producer of attachments, forks and lift tables marketed under the Bolzoni Auramo and Meyer brand names. The

acquisition allows the Company to provide integrated solutions for attachments and lift trucks and expand its market reach while leveraging Bolzoni’s manufacturing capacity. Bolzoni products are manufactured in Italy, China, Germany, Finland

and the United States.

Hydrogen Power

In 2014, the Company acquired Nuvera

Fuel Cells, an alternative-power technology company with locations in Billerica, Massachusetts, and San Donato, Italy. Nuvera is focused on hydrogen fuel-cell stacks and related systems, as well as supporting

on-site hydrogen production and dispensing systems that are designed to deliver clean energy solutions to customers. The Company sees great opportunity to integrate fuel cell-powered engines into its product

line, as well as developing partner relationships with companies requiring a reliable source of high-efficiency, fuel-cell engines and hydrogen generation.

Goals

and Strategic Initiatives

The Company’s objective is to generate profitable growth through increasing volumes, primarily by providing solutions to its

customers, which in turn are expected to generate market share gains and drive improved margins. The Company plans to accomplish these objectives by implementing its core strategic initiatives:

• Enhancing Understanding of Customer Needs

• Driving for Lowest Cost of Ownership

• Strengthening Independent Distribution

• Improving the

Company’s Warehouse Position

• Focusing on Increased Success in Asia

• Enhancing the Company’s Big Truck Market Position

•

Strengthening the Sales and Marketing Organization

• Leveraging Solutions and Technology Drivers

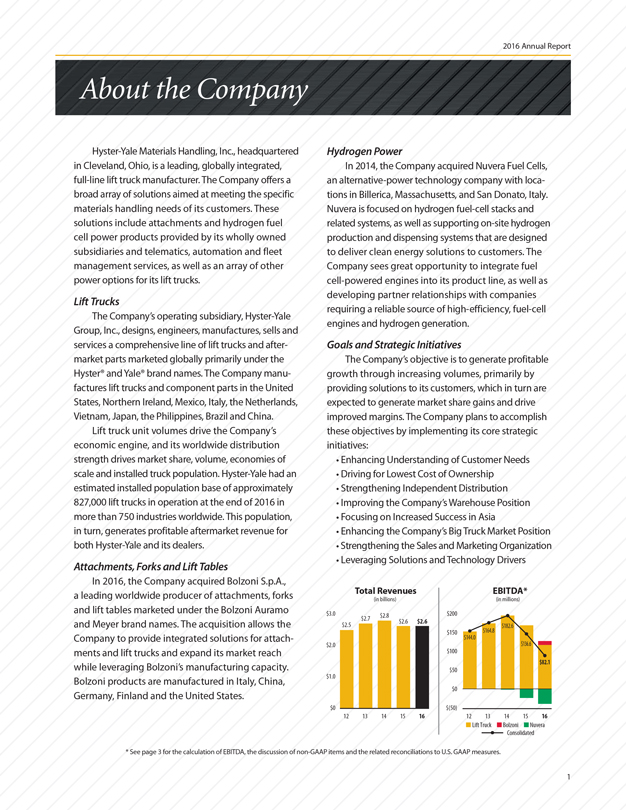

Total Revenues

(in billions)

EBITDA*

(in millions)

$3.0 $2.7 $2.8 $200

$2.6 $2.6

$2.5 $182.6 $150 $164.8 $144.0

$2.0 $136.6 $100

$82.1 $50

$1.0 $0

$0 $(50)

12 13 14 15 16 12 13 14 15 16

Lift TruckBolzoniNuveraConsolidated

* See page 3 for the calculation of EBITDA, the discussion

of non-GAAP items and the related reconciliations to U.S. GAAP measures.

1

Hyster-Yale Materials Handling

Selected Financial

and Operating Data

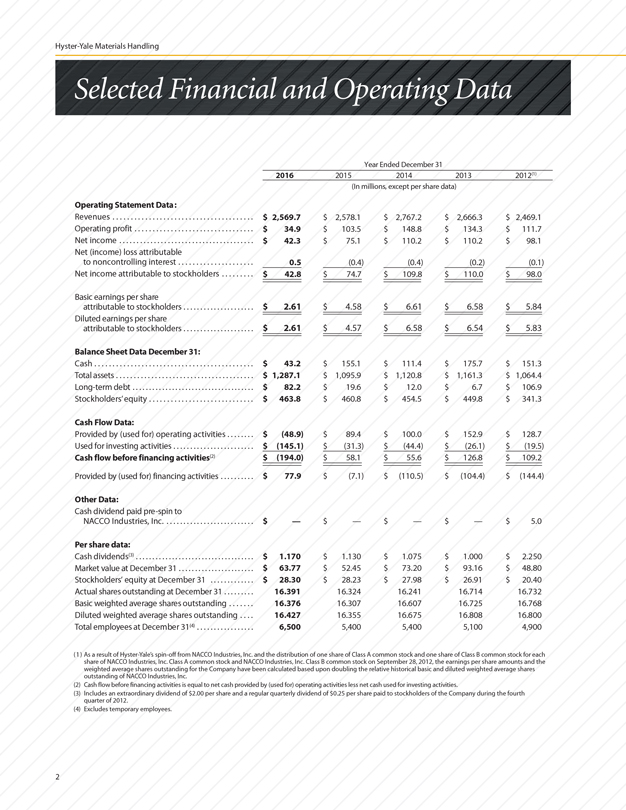

Year Ended December 31

2016

2015

2014

2013

2012(1)

(In millions, except per share data)

Operating Statement Data:

Revenues

$2,569.7

$2,578.1

$2,767.2

$2,666.3

$2,469.1

Operating profit

$34.9

$103.5

$148.8

$134.3

$111.7

Net income

$42.3

$75.1

$110.2

$110.2

$98.1

Net (income) loss attributable to noncontrolling interest

0.5

(0.4)

(0.4)

(0.2)

(0.1)

Net income attributable to stockholders

$42.8

$74.7

$109.8

$110.0

$98.0

Basic earnings per share attributable to stockholders

$2.61

$4.58

$6.61

$6.58

$5.84

Diluted earnings per share attributable to stockholders

$2.61

$4.57

$6.58

$6.54

$5.83

Balance Sheet Data December 31:

Cash

$43.2

$155.1

$111.4

$175.7

$151.3

Total assets

$1,287.1

$1,095.9

$1,120.8

$1,161.3

$1,064.4

Long-term debt

$82.2

$19.6

$12.0

$6.7

$106.9

Stockholders’ equity

$463.8

$460.8

$454.5

$449.8

$341.3

Cash Flow Data:

Provided by (used for) operating activities

$(48.9)

$89.4

$100.0

$152.9

$128.7

Used for investing activities

$(145.1)

$(31.3)

$(44.4)

$(26.1)

$(19.5)

Cash flow before financing activities(2)

$(194.0)

$58.1

$55.6

$126.8

$109.2

Provided by (used for) financing activities

$77.9

$(7.1)

$(110.5)

$(104.4)

$(144.4)

Other Data:

Cash dividend paid pre-spin to

NACCO Industries, Inc.

$—

$—

$—

$—

$5.0

Per share data:

Cash dividends(3)

$1.170

$1.130

$1.075

$1.000

$2.250

Market value at December 31

$63.77

$52.45

$73.20

$93.16

$48.80

Stockholders’ equity at December 31

$28.30

$28.23

$27.98

$26.91

$20.40

Actual shares outstanding at December 31

16.391

16.324

16.241

16.714

16.732

Basic weighted average shares outstanding

16.376

16.307

16.607

16.725

16.768

Diluted weighted average shares outstanding

16.427

16.355

16.675

16.808

16.800

Total employees at December 31(4)

6,500

5,400

5,400

5,100

4,900

(1) As a result of Hyster-Yale’s spin-off

from NACCO Industries, Inc. and the distribution of one share of Class A common stock and one share of Class B common stock for each share of NACCO Industries, Inc. Class A common stock and NACCO Industries, Inc. Class B common

stock on September 28, 2012, the earnings per share amounts and the weighted average shares outstanding for the Company have been calculated based upon doubling the relative historical basic and diluted weighted average shares outstanding of

NACCO Industries, Inc.

(2) Cash flow before financing activities is equal to net cash provided by (used for) operating activities less net cash used for investing

activities.

(3) Includes an extraordinary dividend of $2.00 per share and a regular quarterly dividend of $0.25 per share paid to stockholders of the Company

during the fourth quarter of 2012.

(4) Excludes temporary employees.

2

2016 Annual Report

Year Ended December 31

2016

2015

2014

2013

2012

(In millions)

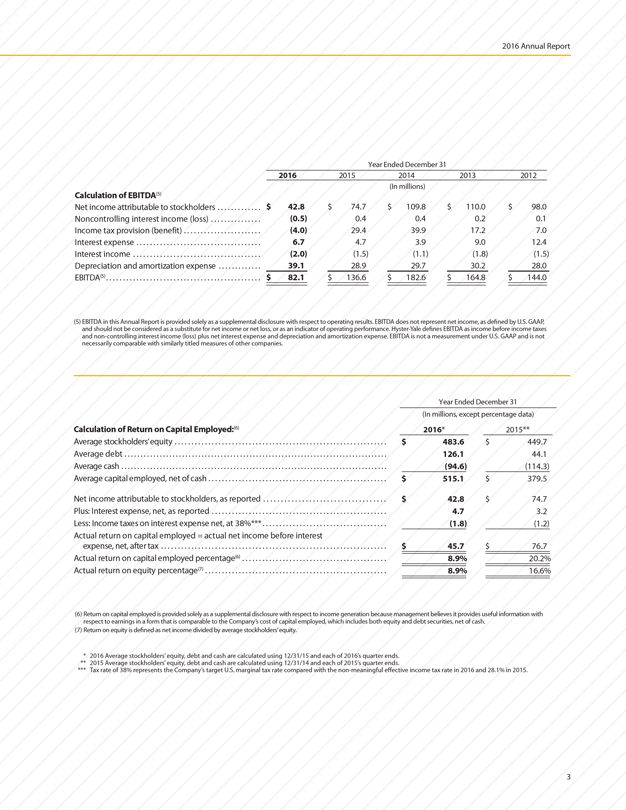

Calculation of EBITDA(5)

Net income attributable to stockholders

$42.8

$74.7

$109.8

$110.0

$98.0

Noncontrolling interest income (loss)

(0.5)

0.4

0.4

0.2

0.1

Income tax provision (benefit)

(4.0)

29.4

39.9

17.2

7.0

Interest expense

6.7

4.7

3.9

9.0

12.4

Interest income

(2.0)

(1.5)

(1.1)

(1.8)

(1.5)

Depreciation and amortization expense

39.1

28.9

29.7

30.2

28.0

EBITDA(5)

$82.1

$136.6

$182.6

$164.8

$144.0

(5) EBITDA in this Annual Report is provided solely as a supplemental disclosure with

respect to operating results. EBITDA does not represent net income, as defined by U.S. GAAP, and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. Hyster-Yale defines EBITDA as income

before income taxes and non-controlling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable

with similarly titled measures of other companies.

Year Ended December 31

(In millions, except percentage data)

Calculation of Return on Capital

Employed:(6)

2016*

2015**

Average stockholders’ equity

$483.6

$449.7

Average debt

126.1

44.1

Average cash

(94.6)

(114.3)

Average capital employed, net of cash

$515.1

$379.5

Net income attributable to stockholders, as reported

$42.8

$74.7

Plus: Interest expense, net, as reported

4.7

3.2

Less: Income taxes on interest expense net, at 38%***

(1.8)

(1.2)

Actual return on capital employed = actual net income before interest expense, net,

after tax

$45.7

$76.7

Actual return on capital employed percentage(6)

8.9%

20.2%

Actual return on equity percentage(7)

8.9%

16.6%

(6) Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful

information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash.

(7) Return on equity is defined as net income divided by average stockholders’equity.

*

2016 Average stockholders’ equity, debt and cash are calculated using 12/31/15 and each of 2016’s quarter ends.

** 2015 Average stockholders’

equity, debt and cash are calculated using 12/31/14 and each of 2015’s quarter ends.

*** Tax rate of 38% represents the Company’s target U.S. marginal

tax rate compared with the non-meaningful effective income tax rate in 2016 and 28.1% in 2015.

3

Hyster-Yale Materials Handling

To Our Stockholders

Introduction

Hyster-Yale’s vision is to be the leading, globally

integrated designer, manufacturer and marketer of a complete range of lift truck solutions, leveraging high-quality, application-tailored lift trucks, attachments and power solutions that offer the lowest cost of ownership and the best overall

value. During 2016, the Company continued to invest in its strategic initiatives and made substantial progress in many areas. The foundation has been laid for more rapid market share gains and profitable growth in the years ahead, including through

the acquisitions of Bolzoni S.p.A, a major global manufacturer of attachments, forks and lifting tables, and certain distribution businesses of Speedshield Technology, a leading provider of telemetry solutions. The Company also continued to invest

in Nuvera and is moving closer to high volume manufacturing of fuel-cell engines and associated systems.

Hyster-Yale has a significant number of core competencies,

but its goal is to become a broader lift truck solutions partner to the materials handling market, one industry and one customer at a time. With this singular focus, Hyster-Yale invested heavily in businesses and technologies during 2016. The

addition of Bolzoni added a wider offering to the Company’s suite of products and enhanced the Company’s ability to better meet the needs of its customers. It is also expected to expand Hyster-Yale’s market reach, while leveraging

Bolzoni’s manufacturing capacity. Bolzoni contributed $115.6 million to revenues since its acquisition in the second quarter of 2016.

The telematics

installation and distribution businesses acquired in the United States and the United Kingdom from Speedshield Technology provide a solid platform for expansion of the Company’s offering of Hyster® and Yale® fleet management solutions.

This acquisition provides Hyster-Yale with the exclusive distribution rights of these businesses’ telemetry products for forklift truck applications in all regions outside of Australia. The acquired businesses are now included in the

Company’s aftermarket business.

Hyster-Yale’s goal is to become the lift truck solutions partner to the materials handling market.

After almost two years of ownership and substantial investment in product development, the Company’s alternative-power technology company, Nuvera, completed shipments to its

launch customer of its first Class 1, 2 and 3 battery-box replacement fuel-cell systems. With initial commercialization and deliveries underway, as well as successful trials and demonstrations at other

customers, the Company is confident there is adequate demand to begin volume production of the battery-box replacements and integrated solutions at its Greenville, North Carolina, manufacturing plant, as

originally planned at the time of the acquisition. As a result, responsibility for the next

4

2016 Annual Report

generation of battery-box replacements, as well as the integration of Nuvera’s fuel-cell engines directly into the lift truck product range, will be moved to the Lift Truck business during 2017. This structure will permit

Nuvera to focus on its core intellectual property in developing fuel cells and on commercialization of the fuel-cell stacks, engines and associated products. In turn, the Lift Truck business will focus on its core competency of integrating engines

of all types into forklift trucks.

The Company is pleased with the progress made on its strategic initiatives during 2016, but the year did not come without

challenges. The strong U.S. dollar unfavorably affected results, as did a soft market for higher-capacity Class 5 trucks, including Big Trucks, and a shift in product mix away from internal combustion engine (“ICE”) products, where

the Company has historically been strong. In addition, the Company made large investments in its strategic initiatives through deal-specific pricing at less than target margins to gain targeted accounts, and it incurred additional expenses for

product development and marketing to transition Nuvera’s products from development to commercialization and production.

Given these factors, the 2016

consolidated net income decreased to $42.8(1) million from $74.7 million in 2015. Consolidated revenues of $2.6 billion were comparable to 2015. The Company’s balance sheet remained strong, but the Company used more cash and increased

its leverage as a result of the investments made in its strategic initiatives.

The Company operates three separate businesses: its core Lift Truck business,

Bolzoni and Nuvera. To understand the Company, it is important to understand each of these businesses.

Our Lift Truck Business

Both the internal decisions to incur certain up-front costs to achieve longer-term benefits and the external factors previously mentioned

had a substantial impact on the near-term profitability of the Company’s core Lift Truck business. The operating profit margin at the Lift Truck business declined to

3.0% and net income decreased to $66.9 million in 2016. However, while the results declined from the prior year, solid progress was made on the strategic initiatives and,

despite these challenges, the Company continues to focus on achieving its Lift Truck target operating margin of 7% during this market cycle.

Hyster-Yale has been

positioning itself for operating profit margin and share growth improvement in the Lift Truck business since before the Great Recession. Initially, this process was focused on strengthening products and cost position. The Company upgraded its

comprehensive global product line and introduced new models, and it rationalized its global manufacturing footprint around assembly of lift trucks largely in the market of sale, including implementing a modern, lean and flexible manufacturing

system. As a result of these changes, the Company enhanced throughput capabilities, which increased effective capacity by over 45% from current levels, with fewer plants. The

(1) For purposes of this annual report, discussions about net income refer to net income attributable to stockholders.

(left to right)

The

direct-to-store delivery (DSD) package on the Yale® MPB045-VG offers specially designed features and lithium-ion power for fast, efficient replenishment in retail operations.

The Hyster® 60XT pneumatic-tire, internal

combustion engine standard lift truck has a lifting capacity of up to 6,000 pounds and is engineered to benefit a wide range of applications from building materials and home centers to agriculture and distribution.

The Yale® MPE080-VG end-rider lift truck, utilizing “Driven by Balyo” technology, can

move loads up to 8,000 pounds and can autonomously navigate through warehouse environments.

5

Hyster-Yale Materials Handling

Company also re-engineered its products to utilize common components across multiple lift truck classes to reduce costs and complexity, including outsourcing certain components to achieve high quality at lowest cost, capture

procurement cost savings, increase manufacturing efficiency and allow for faster design upgrades, in addition to centralizing its supply chain management to leverage best practices and gain economies of scale. Further, improvements in product

development, engineering, manufacturing and sourced components have led to higher levels of product quality, resulting in significantly reduced warranty costs and enhanced customer satisfaction. All of these efforts continue to gain momentum with

the focus now shifting to continuous improvement.

Most recently, through its commitment to being a broader lift truck solutions provider, the Lift Truck business

has shifted its focus to organic growth driven by market share gain. The Company has a geographic focus, but to gain share it is also focusing on identifying strategies that apply across an industry and then executing those strategies with a one-by-one customer focus. The Company has a high share in customers with which it does business, but obviously, no share in customers where it does not. To increase its

profile, the Company has improved its targeted messaging, as well as increased coverage through direct sales to major accounts and through an improved account identification and coverage process. This process is specifically aimed at identifying and

understanding customers in each industry so the Company can craft solutions that provide those customers with the lowest cost of ownership, maximum uptime

and

highest value. The Company is confident in its process, but attracting new customers and gaining their trust and acceptance takes time.

Unit volume drives the

Company’s economic engine. Increased volumes generate greater economies of scale, resulting in more favorable operating margin leverage in all areas of the business, particularly in manufacturing overhead and operating expenses. These higher

volumes ultimately result in a larger installed lift truck population base, which is estimated at 827,000 units at the end of 2016. This growing installed base generates a large, profitable parts business, which is a key element of operating profit

margins. The Company believes that with market share growth and some external market growth, it can reach adequate volumes to achieve its financial objectives. The Company’s current goal is to achieve annual sales of $3.6 billion on annual

volume of 115,000 properly balanced, Hyster-Yale-produced trucks during this economic cycle. At this volume level, the Company expects to be able to achieve its Lift Truck business’ 7% operating profit margin target through improved fixed

manufacturing capacity utilization and leverage of the Company’s selling, general and administrative costs. In 2016, the Company shipped approximately 79,200 Hyster-Yale-produced units. However, to achieve the 7% target an appropriate mix of

35,800 additional units is needed to fill its assembly lines. Given the nature of the Company’s path forward, it is difficult to forecast the timing of achieving these targets with great specificity, but the Company is confident it has the

right programs in place to accomplish its objectives and expects to reach them in the next three to four years.

6

2016 Annual Report

During 2016, the overall global

lift truck market grew 7.5% to 1.2 million units. The Europe, Middle East and Africa (“EMEA”) region experienced growth of 10.5%, driven primarily by strong Western Europe growth of over 12%. The Americas market grew 1.3% during the

year, as growth of 2.1% in North America and Latin America was partly offset by a decline in the Brazil market of almost 17%. The Japan, Asia-Pacific, India and China (“JAPIC”) region grew 8.3% in 2016, primarily because of increased

demand in the China market, which increased 14.7% from the lower prior-year levels.

customers toward solutions that provide them the lowest cost of ownership. All

customers must be given attention, but additional attention needs to go to growth customers in the fast-growing warehousing sector and support for them needs to come through the Company’s worldwide, independent distribution network, which the

Company continues to strengthen. Although Hyster-Yale wants to improve everywhere, focused attention is being given to the Asia market as demand there is high, and this is the area where the Company has significant opportunities to strengthen its

overall market presence. Targeted attention on the

Through its commitment to being a solutions provider, the Lift Truck business’ focus is on organic growth

driven by market share gain.

Looking forward, the global market for lift truck units is expected to remain stable at a high level in 2017. Anticipated improvements

in the Western and Eastern European markets and a positive but weakening JAPIC market are expected to be offset by an anticipated small decline in the Americas market from the record level achieved in 2016. Despite this market environment,

Hyster-Yale is optimistic it can grow in 2017 through market share gains.

To achieve its long-term goals, the Company is focused on the customer, everywhere and in

every industry, and on meeting these customers’ needs through the execution of its core strategic initiatives, including identifying and satisfying needs at both the product and aftermarket levels, while driving

Company’s Big Truck market is also important as it drives high revenues and margins. Finally, the Company’s sales and marketing organization, which has been strengthened

with additional talent and enhanced to include focused organizational teams and Solutions Groups charged with developing specialized, industry-specific solutions for customers, needs to work with Bolzoni, Nuvera and the other technology accelerators

to ensure these solutions bring value to customers. These core strategic initiatives are expected to help Hyster-Yale gain sufficient market share to generate the appropriate mix of volume necessary to achieve its financial targets. The

Company’s initiatives are inter-related, but more specific information on certain initiatives follows.

(left to right)

The newly released Yale® GP50MX, internal combustion engine, pneumatic-tire lift truck, with lifting capacities of up to 5,000 pounds, shown here with the Hi-Vis™2 mast and bar-on-edge overhead guard offering enhanced visibility for operator comfort.

The Yale® ERC-VG electric, counterbalanced four-wheel warehouse truck is shown being powered by a Nuvera® fuel-cell engine.

The new European Hyster® R1.4-2.5 Reach Truck for warehouse applications is available in lifting capacities between 1.4

and 2.5 tons.

The European Yale® MS pedestrian stacker has lift capabilities suitable for a range of user heights and experience levels, ranging from

approximately 12 to 20 feet.

7

Hyster-Yale Materials Handling

Understanding

Customer Needs: Hyster-Yale aims to create and provide a full range of differentiated products and develop solutions for specific industry applications. Hyster-Yale’s product portfolio spans all five major product classes. To meet the specific

application needs of its customers, the Company continues to invest in broadening its product range and has focused on designing and developing utility, standard and premium products for its electric-rider, warehouse, ICE and Big Truck product lines

in all appropriate market segments. The Company offers over 260 different lift truck models with a full range of power options, including lead-acid and lithium-ion batteries and fuel-cell engines for its

electric trucks, and liquid propane gas, compressed natural gas, gasoline and diesel fuel for its ICE trucks. Having the right product at the right price for each application allows the Company to focus on delivering products that consistently meet

the specific and varied needs of customers, at appropriate margins, giving customers the ability to move goods in a more productive and cost-effective manner, and to lower the life cycle cost of operating their trucks.

The Company’s product pipeline is expected to provide a continuous stream of new products over the next several years aimed at addressing application-specific needs of

customers in virtually all major industries. In 2016, the Company introduced its new “heart-of-market” 2.0 to 3.0 ton standard Class 5 ICE lift truck,

which has been well received by customers. Production also began on the Company’s new European 1.0 to 1.6 ton pedestrian pallet stacker. Early in the second quarter of 2017, the Company expects to launch a new ReachStacker Big Truck dedicated

to high-volume, container-handling applications in defined markets. As these new products gain traction and other new products in the pipeline are introduced, these products are expected to help increase market share, improve revenues and enhance

operating margins in 2017 and in the long term.

Delivering Lowest Cost of Ownership: The Company is focused on providing products that reduce the life cycle cost

of operating its trucks. The Company has been successful in reducing fuel consumption, a significant direct cost for its customers, on certain ICE truck models by up to 20%, and it has

improved the energy efficiency and controllability of its electric trucks, which also reduces customers’ direct costs. The Company is introducing automation and telemetry

capabilities in its lift trucks to reduce operating costs further. Telemetry delivers additional information and value to customers, allowing them to monitor the use of trucks and ensure they are being properly operated and serviced in a timely

manner, thereby reducing lifetime maintenance costs. Hyster-Yale has seen substantial growth in the use of telemetry on its trucks, with over 25,000 trucks in the field currently using this option. The Company can also lower the cost of ownership by

offering attractive lease rates for its customers through an improved understanding of applications and operating costs.

The Company is introducing automation and

telemetry capabilities in its lift trucks as a way to provide solutions that reduce operating costs.

Growing in Warehouse: In most markets around the world,

electric-powered trucks are gaining in popularity, due in part to environmental concerns but also due to growth of the retail, warehousing and distribution markets, particularly in North America and Western Europe. As a result, the industry is

experiencing a secular shift from ICE trucks to electric power trucks. Worldwide orders for warehouse trucks were approximately 44% of total lift truck orders in 2016, compared with 42% in 2015 and 37% ten years ago. To meet this industry shift, the

Company has strengthened its warehouse market position through enhancing dealer and customer support, adding products and implementing programs to increase focus on key customers. Sales of electric lift trucks accounted for 27% of Hyster-Yale’s

revenues in 2016. As part of the Company’s efforts to penetrate the growing warehouse equipment market more deeply, it has upgraded its warehouse and electric-rider product lines, including launching new Reach and Stacker trucks in Europe and

an enclosed end-rider warehouse truck in both the United States and

8

2016 Annual Report

(left to right)

A Yale Vision telematics solution shown mounted on a Yale® lift truck. The Yale Vision tracks over five usage meters, including impact sensing, access control and preventive

maintenance and, ultimately, helps promote both operator safety and increased productivity.

A Hyster® LO 2.5 multi-level warehouse order picker is designed for

time-sensitive order-picking operations that demand reliability.

Europe. In addition, the Company has helped dealers strengthen their specialized capabilities for

serving this segment and increased coverage through direct sales to major accounts, as well as improved account identification and coverage processes. As a result of these efforts, the Company has been successful in winning business at many of its

targeted warehouse accounts. The Company has also achieved early success in developing automated products using its own resources and in combination with partners. In addition, the Company expects that the Nuvera products will help the Lift Truck

business penetrate heavy-duty warehouse applications, which are ideal customers for lift trucks with fuel-cell power solutions.

Strengthening Independent

Distribution: The Company continues to believe that having entrepreneurial, exclusive, independent dealers that are committed to customer satisfaction is a competitive advantage. Hyster-Yale works with its dealers on excellence programs aimed at

enhancing their capabilities and broadening their account coverage, including increasing sales specialization and improving sales messaging, which allows for mutual profitable growth. The Company continues to strengthen its exclusive, independent

distribution network by adding strong dealers, encouraging, where appropriate, more dual-brand ownership by dealers and attracting best-in-class dealers from

competitors. In both 2015 and 2016, Hyster-Yale completed major enhancements to its North American dealer network, which included a large competitor dealer conversion in 2015 and expansion of its dual-brand coverage. The Company is also working to

improve its Asian and European distribution and continues to add dealers in these areas.

Succeeding in Asia: Hyster-Yale, as a global company, is focused on

expanding in all markets but is giving particular focus to the JAPIC region, which is the biggest market globally and where Hyster-Yale has the lowest market share. The Company continues to add sales resources and appoint new dealers in the area.

Attention is also being given to expanding the product range, as well as the competitiveness of its products produced in the region, either in its own facility in China, through its Japanese joint venture or with its partners in China and India.

Enhancing Big Truck Market Position: Overall, the Company has a strong market position in Big Trucks but believes there is significant growth potential remaining,

especially given the Big Truck market weakness experienced in 2016. Hyster-Yale will continue to introduce additional new Big Truck products, providing a comprehensive Tier 4 engine offering, including a new ReachStacker in 2017 that, as previously

mentioned, is dedicated to high-volume, container-handling applications. Further, Hyster-Yale has already gained Tier-4 engine-emission leadership by achieving substantial improvements in fuel efficiency with

these new engines. The Company has expanded its global Big Truck team and is highlighting its Big Truck global capabilities to customers who need global coverage and specialized application sales capabilities, as well as working closely with its

dealers to drive growth plans. Hyster-Yale’s Big Truck efforts are focused on both container-handling equipment and the many industries requiring products using forks or special attachments. Increasing specialization allows Hyster-Yale to

increase penetration in all industries more effectively.

9

Hyster-Yale Materials Handling

BOLZONI

The Material Handling Group

Our Attachment Business

Bolzoni has been active for over 70 years in the design, production and distribution of a wide range of products utilized in industrial materials handling. Bolzoni products, which

include integral and hook-on sideshifters, fork positioners, forks, push pulls, multi-pallet handlers, rotators, paper roll, bale and carton clamps and lift tables, are manufactured in Italy, China, Germany,

Finland and the United States. Bolzoni holds a leading position in the lift truck attachment market, predominantly in Europe, and is represented globally by direct branches and independent dealers.

Bolzoni, acquired by the Company during the second quarter of 2016, is a stand-alone business under Hyster-Yale’s umbrella and is committed to meeting the product and handling

solutions needs of its customers, which include many of the main lift truck manufacturers. Since the acquisition and through December 31, 2016, it has generated revenues of $115.6 million and operating and net losses of

$0.1 million and $0.3 million, respectively, including

$2.7 million pre-tax of one-time purchase accounting adjustments and $4.8 million pre-tax of expenses related to the amortization of acquired

assets.

The association of Bolzoni and Hyster-Yale is a natural fit. Class 1 and Class 5 counterbalanced trucks are the primary users of attachments. For

many of these customers, the attachment purchase is more important than the actual lift truck purchase because the attachment is what is directly handling their goods. Bolzoni is focused on making sure the attachment has the appropriate

characteristics to move those goods around the facility efficiently and undamaged, through its intelligent lift truck attachments, which include its iMove technology that has the capability to analyze loads and apply the appropriate pressure to

ensure products are not damaged in transport. By providing access to a full range of attachments and lift trucks that meet the exact needs of customers, the Company views the acquisition of Bolzoni as another way it can offer its customers a

complete product solution.

While maintaining Bolzoni’s independence is critical to its customer relationships, the Company has many opportunities to create

synergies and improve results at both businesses going forward. The majority of Bolzoni’s revenues are generated in the growing EMEA market, primarily Eastern and Western Europe, where Hyster-Yale currently has a smaller presence,

(left to right)

The European Hyster® 4.5 Fortens internal combustion engine pneumatic-tire

lift truck, with a lifting capacity of up to 4.5 tons, moves a bale of hay with a Bolzoni Auramo bale clamp.

The

Bolzoni-Auramo manufacturing plant in Wuxi Xishan District, Jiangsu Province, China. Bolzoni has a total of six manufacturing facilities located in Italy, China, Germany, Finland and the United States.

10

2016 Annual Report

and to a lesser degree, in the

North America market, where Hyster-Yale’s presence is very strong. This combination, along with the anticipated growth in the EMEA market in 2017, provides the Company with a platform for improved global market penetration.

Bolzoni, through its research and development facilities, is focused on innovation and providing customized solutions to its customers. The combination of these innovative

qualities with Hyster-Yale’s, and the ability to match the attachment and forklift truck

through the integration of attachment sourcing for the Lift Truck

business, is expected to create significant opportunity in the future. This, in addition to the implementation of integrated lift truck and Bolzoni programs, primarily related to supplier and material cost synergies, are expected to generate growth

in operating profit and net income over time and generate more operating leverage from sales growth. As these programs mature, the Company expects Bolzoni to exceed its 7% operating profit margin target.

NUVERA®

Our Hydrogen Power Business

The Company’s acquisition of Nuvera in late 2014 was driven by its view that having fuel-cell power options, specifically for industrial mobility markets, could be a product

differentiator and that the hydrogen fuel-cell market for lift trucks had significant growth opportunities. This view has been reinforced by the strong interest shown in Nuvera® products by customers, dealers and potential partners. Hyster-Yale

believes the commercialization of the Nuvera fuel-cell-related technologies is an investment that will reinforce the Company’s core strategies and help drive additional lift truck unit market share growth. It also provides the Company with the

ability to expand its power solutions offerings, as well as best-in-class energy solutions to customers, by integrating fuel cells with lift trucks in a way that is

expected to optimize the performance and energy efficiency of the total lift truck system. This, in conjunction with the Company’s capability to provide full life cycle maintenance, service and fueling requirements, is expected to provide

Hyster-Yale with an opportunity to meet customers’ needs, drive market share, enhance Hyster-Yale’s margins and offer a low overall cost of ownership alternative. In addition, the Company expects that once Nuvera’s technology is fully

commercialized, participation in the fuel-cell market could be a significant profit generator and will add a value-chain profit opportunity for sales and margins of fuel-cell and hydrogen-supply products, across a broad spectrum of industries and

applications.

Nuvera’s primary goal is to be a major supplier of fuel-cell engines to power lift trucks. Currently, more than 150,000 electric trucks are sold

each year in the North America market and more than 700,000 are sold worldwide. The Company estimates that between 25% and 50% of those users could potentially use fuel cells to make their operations more cost-effective and efficient. Currently,

Nuvera offers a fuel-cell engine that is a direct replacement for a lead-acid battery. In 2016, Nuvera completed shipments to its launch customer of its first Class 1, 2 and 3 battery-box replacement

fuel-cell systems, which have been well received, and the Company will be shipping units to additional customers. While commercialization of these products is taking longer than anticipated, the Company is pleased with the design innovation in

Nuvera’s core technologies, as well as in its current generation of battery-box replacements. However, production costs for these units are currently higher than target costs. As a result, Nuvera reported

a net loss of $23.8 million in 2016 compared with $14.6 million in 2015. Nuvera and the Company are focused on reducing manufacturing costs per unit as production increases and greater economies of scale are achieved, but it will take time

to get the target cost structure in place.

11

Hyster-Yale Materials Handling

New orders for

Nuvera’s current generation of battery-box replacements are being received and further customer demonstrations are planned, which are expected to provide additional sales opportunities. The Company has

expanded its commercial efforts, including enhancing its sales, marketing and business development teams, to prepare for a broad roll-out of Nuvera® products. A growing team of internal field service

professionals are leveraging the resources of Hyster-Yale and its dealer networks to ensure products meet the demanding and rigorous needs of lift truck customers. The Company has made significant investments to automate production, testing and

quality verification and will continue to invest in the future as Nuvera focuses on fuel-cell stack, engine and associated products manufacturing. All units undergo the full reliability growth testing and validation processes that are used for all

new products introduced from Hyster-Yale’s development and testing facilities.

Nuvera will continue, for now, to build out its current inventory and continue

to manufacture its current generation battery-box replacements as a contract manufacturer for the Lift Truck business and will provide ongoing design assistance to the Lift Truck business development group.

This structure will permit Nuvera to focus on its core competencies of developing its fuel-cell technology, including its next

generation Orion® Gen 2

technology with increased power density and scalability, commercialization of the fuel-cell stacks and engines as a fuel-cell engine supplier to the Lift Truck business, and continuing development of its hydrogen-generation appliance and its

electrochemical compressor. In turn, the Lift Truck business will focus on its core competency of integrating engines of all types into forklift trucks, using its established expertise in product development, supply chain, manufacturing and end-product and aftermarket sales. Production at the Greenville location is expected to commence during the second half of 2017.

The combination of the core competencies of both the Lift Truck and Nuvera businesses allows the Company to provide a unique,

all-in fuel cell solution to its customers, from the generation of hydrogen, to conversion of that hydrogen into power that can be used to refuel the fuel-cell engine in a lift truck. The Company believes

these capabilities will help to drive adoption of this technology going forward.

There is also growing interest in Nuvera’s fuel-cell solutions from other

industrial equipment manufacturers, as well as from major third parties in the hydrogen supply business. Both are attracted to the unique combination of strong innovation, technology development and solutions from Nuvera, combined

Nuvera® power solutions offer fast-fueled power options for Class 1, 2 and 3 electric lift truck fleets to help achieve productivity improvements, fast fills and

reductions in total energy use and greenhouse gas emissions.

Drop-in power alternatives with standard lead-acid battery

connections support a variety of electric forklift makes and models and offer a highly productive alternative to the changing and recharging of lead-acid batteries.

Nuvera’s drop-in power alternatives are shown here, from left to right, in a Class 3 Hyster® B60-80ZHD end-rider warehouse truck, a Class 1 Yale® ERP50-VM four-wheel, pneumatic-tire, counterbalanced lift truck and a

Class 2 Hyster® N35ZR Reach truck.

12

2016 Annual Report

with the global strength of the

Hyster-Yale manufacturing and supply chain organizations. Finally, in addition to its existing technology, Nuvera has continued to invest in its other innovations, with several new technologies showing significant progress toward breakthrough

improvements in the use and distribution of hydrogen in industrial applications, including the capability to use the technology internationally and in larger lift trucks once the technology is fully developed for an integrated fuel-cell hybrid

engine solution with greater power density.

Hyster-Yale is committed to achieving its core Lift Truck target operating margin of

7% and believes it can leverage its two other businesses to achieve this target. Looking Forward The Company has a long-term focus. Goals have been established and strategic

initiatives are in place to help achieve the Company’s long-term business objectives. The Company’s goal is to invest wisely in the future, with the ability to leverage, but also to control, the expense structure as it moves forward.

Lift Trucks: Hyster-Yale is committed to achieving its core Lift Truck target operating margin of 7% and believes it can achieve this with an annual volume of

115,000 properly balanced, Hyster-Yale-produced trucks, and that it can leverage its two other businesses to achieve this target. With the substantial investments made in 2016, and additional momentum from the continued focus on execution of the

core strategic initiatives, the Company believes it is poised to grow through the rest of this market cycle, irrespective of industry growth, by focusing on increasing market share to reach its long-term financial goals. While the Company’s

2016 Lift Truck business operating profit margin of 3% was well below its 7% operating profit margin target, Hyster-Yale believes this gap can be closed mainly by increasing unit volumes at target margins through improved market share, leveraging

the technology accelerators and the business acquisitions that were made, and through modest market growth. The Company expects operating margins to increase as it grows volume and controls its operating expenses. Attachments, Forks and Lift Tables:

The

Company expects to develop its Attachment business into a larger, long-term business through growth in lower-share markets, through leverage of Bolzoni’s

manufacturing capacity and through the integration of attachment sourcing for the Lift Truck business, allowing Bolzoni to ultimately achieve and exceed its operating margin target of 7%. Hydrogen Power: The Company expects its Hydrogen Power

business, over the longer term, to move from a significant loss position to significant profitability as it introduces new products, grows volume, lowers product costs and develops partner arrangements. Nuvera’s focus on fuel-cell stacks and

engines, while continuing development of its hydrogen generation appliance and its electro-chemical compressor, is expected to allow it to reach its break even target during 2018 as it ramps up supply to the Lift Truck business and becomes a trusted

supplier to other customers. The Lift Truck business will focus on the integration of the engine into its product range either in a battery box replacement or as an integrated solution. This is expected to result in increased new unit market share

and profitability over time as customer demand for this value-added solution grows.

Valuation: Hyster-Yale’s value creation strategy encompasses all of its

business units. However, when all of the businesses are viewed as one, the valuation picture is misleading. The Company believes its

13

Hyster-Yale Materials Handling

valuation should be

considered differently among the individual businesses. The Lift Truck and Attachment businesses, which are in a mature, cyclical industry with market-leading positions and solid operating cash generation, are focused on creating value by increasing

unit volume and market share through the execution of core strategic initiatives. These initiatives are expected to lead to achieving the Company’s financial targets and gaining significant aftermarket parts business over the longer term as a

result of the continued increase in the Company’s installed lift truck population base.

The picture is much different at the Hydrogen Power business, where

the priority remains on commercializing products that are complementary and additive to the Lift Truck business. Nuvera is in a developing technology industry with its own distinct characteristics. The use of hydrogen as an alternative and clean

energy source is growing and the Company aims to be a key player in this industry over the long term. The Company believes this business has substantial growth potential, which it expects to attain by leveraging Nuvera’s significant patent

portfolio and a ready market in core Hyster® and Yale® forklift trucks. Nuvera’s fuel-cell stacks, engines and other products are also likely to be used across a very broad spectrum of industries and applications and the Company intends

to enter into partnerships with third parties as appropriate to leverage these opportunities. However, because of the early stages of commercialization of Nuvera’s products, the Company believes this business should be valued more as a venture

business.

Dividend and Uses of Cash:The Company increased its annual dividend 3.5% to $1.18, or $0.295 per share per quarter, during 2016, and will continue to

evaluate its dividend level in 2017.

Overall, Hyster-Yale expects strong cash generation in 2017 and beyond. The Company expects to continue to focus on utilizing

its cash to support its strategic growth initiatives and fund related strategic acquisitions should opportunities arise, and then, as appropriate, return capital to its stockholders through dividends. In the future, the Company will consider

additional share repurchases at prices attractive to its stockholders.

We are a customer-focused and solutions-oriented business. We have strategies in place to

gain market share in all segments and in all markets of our business and we have made investments in growth and game-changing technologies. We believe that our business strategy, combined with a strong balance sheet, financial flexibility, a solid

cash position and solid returns on capital employed in our core business, as well as a commitment to shareholder returns over time, makes Hyster-Yale a compelling long-term investment opportunity. By clearly articulating and executing our core

strategies in our various businesses, we believe the Company can achieve an enhanced market multiple valuation in the future.

◾ ◾ ◾

We have great confidence in the ability of our management team to achieve the Company’s market share and financial objectives in the years ahead as our many experienced and

highly motivated professionals build on the Company’s 2016 financial results. We would like to take this opportunity to thank all of the Company’s customers, dealers and suppliers and all of the Hyster-Yale stockholders for their continued

support. We also want to thank our employees for their hard work and commitment to achieving our long-term goals. We have a strategic plan we are excited about executing and a decades-old business with strong

brands that have earned the trust of our customers who depend upon the performance of our products every day. We look forward to building successfully on this legacy for many years to come.

Alfred M. Rankin, Jr.

Chairman, President and Chief Executive Officer, Hyster-Yale Materials

Handling, Inc. and Chairman, Hyster-Yale Group, Inc.

Colin Wilson

President

and Chief Executive Officer, Hyster-Yale Group, Inc.

14

Directors and Officers

Directors and Officers of

Hyster-Yale Materials Handling, Inc.

Directors:

J.C. Butler, Jr.

Senior Vice President-Finance, Treasurer and Chief Administrative Officer, NACCO Industries, Inc. President and Chief Executive Officer of The North American Coal Corporation

Carolyn Corvi

Retired Vice President and General Manager –Airplane

Programs of The Boeing Company

John P. Jumper

Retired Chief of Staff, United

States Air Force

Dennis W. LaBarre

Retired Partner, Jones Day

F. Joseph Loughrey

Retired Vice Chairman, President and Chief Operating Officer of Cummins,

Inc.

H. Vincent Poor

Distinguished Professor of Electrical Engineering of

Princeton University

Alfred M. Rankin, Jr.

Chairman, President and Chief

Executive Officer of Hyster-Yale Materials Handling, Inc.

Chairman of Hyster-Yale Group, Inc.

Chairman, President and Chief Executive Officer of NACCO Industries, Inc.

Claiborne R. Rankin

Manager of NCAF Management, LLC, the managing member of North Coast Angel Fund, LLC

John M. Stropki

Retired Executive Chairman of Lincoln Electric Holdings Inc.

Britton T. Taplin

Self-employed (personal investments)

Eugene Wong

Professor Emeritus of the University of California at Berkeley

Officers:

Alfred M. Rankin, Jr.

Chairman, President and Chief Executive Officer

Colin Wilson

President and Chief Executive Officer, Hyster-Yale Group, Inc.

Gregory J. Breier

Vice President, Tax

Brian K. Frentzko

Vice President, Treasurer

Amy E. Gerbick

Associate General Counsel, Director of Corporate Compliance and Assistant Secretary

Jennifer

M. Langer

Vice President, Controller

Lauren E. Miller

Senior Vice President, Chief Marketing Officer

Kenneth C. Schilling

Senior Vice President and Chief Financial Officer

Suzanne S. Taylor

Senior Vice President, General Counsel and Secretary

Executives and Officers of Hyster-Yale

Group, Inc. and its Subsidiary Companies

Alfred M. Rankin, Jr.

Chairman

Colin Wilson

President and Chief Executive Officer

Gregory J. Breier

Vice President, Tax

Brian K. Frentzko

Vice President, Treasurer

Amy E. Gerbick

Associate General Counsel, Director of Corporate Compliance and Assistant

Secretary

Stephen J. Karas

Vice President, Global Supply Chain

Jennifer M. Langer

Vice President, Controller

Lauren E. Miller

Senior Vice President, Chief Marketing Officer

Charles F. Pascarelli

Senior Vice President, President, Americas

Rajiv K. Prasad

Senior Vice President, Global Product Development, Manufacturing and Supply

Chain Strategy

Anthony J. Salgado

Senior Vice President, Japan, Asia-Pacific,

India and China

Harry Sands

Senior Vice President, Managing Director, Europe,

Middle East and Africa

Kenneth C. Schilling

Senior Vice President and Chief

Financial Officer

Roberto Scotti

President and Chief Executive Officer of

Bolzoni S.p.A.

Gopichand Somayajula

Vice President, Global Product

Development

Jon C. Taylor

President and Chief Executive Officer of Nuvera

Fuel Cells, LLC

Suzanne S. Taylor

Senior Vice President, General Counsel and

Secretary

Mark H. Trivett

Vice President Finance, Europe, Middle East and

Africa

Raymond C. Ulmer

Vice President Finance, Americas

Corporate Information

Annual Meeting

The Annual Meeting of Stockholders of Hyster-Yale Materials Handling, Inc. will be held on May 3, 2017, at 3:00 p.m. at the corporate office located at: 5875 Landerbrook

Drive, Cleveland, Ohio 44124

Form 10-K

Additional copies of the Company’s Form 10-K filed with the Securities and Exchange Commission are available free of

charge through Hyster-Yale’s website (www.hyster-yale.com) or by request to: Investor Relations Hyster-Yale Materials Handling, Inc.

5875 Landerbrook Drive,

Suite 300 Cleveland, Ohio 44124 (440) 229-5168

Stock Transfer Agent and Registrar

Stockholder Correspondence:

Computershare P.O. Box 30170

College Station, TX 77842-3170

Overnight Correspondence:

Computershare

211 Quality Circle, Suite 210 College Station, TX 77845

(877) 373-6374 (U.S., Canada and Puerto Rico) (781) 575-2879 (International)

Legal Counsel

Jones Day North Point

901 Lakeside Avenue Cleveland, Ohio 44114

Independent Registered Public Accounting Firm

Ernst & Young LLP

950 Main Avenue, Suite 1800 Cleveland, Ohio 44113

Stock Exchange Listing

The New York Stock Exchange Symbol: HY

Investor Relations Contact

Investor questions may be addressed to: Investor Relations

Hyster-Yale Materials Handling, Inc.

5875 Landerbrook Drive, Suite 300 Cleveland, Ohio 44124 (440) 229-5168 E-mail: ir@hyster-yale.com

Hyster-Yale Materials Handling, Inc. Website

Additional information on Hyster-Yale may be found at the corporate website, www.hyster-yale.com. The Company considers this website to be one of the primary sources of information

for investors and other interested parties.

Hyster Global:www.hyster.com Yale Global:www.yale.com Nuvera Fuel Cells:www.nuvera.com Bolzoni

S.p.A:www.bolzonigroup.com

On the Cover (from top, left to right)

◾ The

new European Yale® MS warehouse truck is a highly controllable and agile pedestrian stacker suitable for lift heights ranging from 12 to 20 feet.

◾The

newly released Hyster® XT 2.0 to 3.0 ton standard pneumatic tire, internal combustion engine lift truck series is available in 4,000 to 6,000 pound load capacities and is designed to fit into almost any application or industry needing a

hard-working forklift.

◾The Yale® MPE080-VG end-rider truck with

“Driven by Balyo” technology, designed for use in warehouse applications, has a carrying capacity of up to 8,000 pounds and can transfer loads over long distances or to staging areas without the presence of an operator.

◾This Hyster® 350-volt lithium-ion counterbalanced, electric-rider lift truck, has a

lifting capacity of 8 to 9 tons and is ideal for applications such as ports, lumber yards and the paper industry.

◾ Hyster® ReachStackers with Tier 4i

emissions-compliant engines, load containers at a port in Rotterdam, The Netherlands.

◾The Hyster® H360-36HD internal combustion engine truck with a Tier

4 Final engine, pictured with a coil-handling attachment. This unit has a lifting capacity of 36,000 pounds at a 36-inch load center and is designed for use in tough industrial applications.

◾Hyster’s S120FT Fortis® internal combustion engine cushion-tire “Cool” truck, has a lifting capacity of up to 12,000 pounds and was designed to

specifically meet the needs of customers in the paper industry. This truck is shown with a Bolzoni Auramo paper clamp attachment.

◾ A Yale® Reach truck

powered by a Nuvera fuel-cell engine is designed for use in warehouse applications.

◾Yale offers two options of lift truck equipped with “Driven by

Balyo” technology. An end rider with a load capacity of up to 8,000 pounds for automating repetitive picking tasks in warehouses, and a MO70T tow-tractor for stock replenishment and material hauling.

FSC

www.fsc.org

MIX

Paper from responsible sources

FSC® C003197

The FSC® Trademark identifies wood fibers coming from forests which have

been certified in accordance with the rules of the Forest Stewardship Council®.

Environmental Benefits

This Annual Report on Form 10-K is printed using post-customer waste recycled paper and vegetable-based inks. By using this environmental

paper, Hyster-Yale Materials Handling, Inc. saved the following resources:

27 trees preserved for the future

79 lbs. water-borne waste not created

11,505 gal. wastewater flow saved

1,273 lbs. solid waste not generated

2,506 lbs. net greenhouse gases prevented

19,184,500 BTUs energy not consumed

FSC is not responsible for these calculations.

Calculations per Mohawk Environmental Calculator.

HYSTER-YALE

MATERIALS HANDLING

5875 Landerbrook Drive, Suite 300 Cleveland, Ohio 44124

www.hyster-yale.com

An Equal Opportunity Employer