Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2016 |

OR

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission File Number: 001-34765

Teucrium Commodity Trust

(Exact name of registrant as specified in its charter)

| Delaware | 61-1604335 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

232 Hidden Lake Road, Building A

Brattleboro, Vermont 05301

(Address of principal executive offices) (Zip code)

(802) 257-1617

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Fund | Name of each exchange on which registered | ||||

| Shares of Teucrium Corn Fund | NYSE Arca, Inc. | ||||

| Shares of Teucrium Sugar Fund | NYSE Arca, Inc. | ||||

| Shares of Teucrium Soybean Fund | NYSE Arca, Inc. | ||||

| Shares of Teucrium Wheat Fund | NYSE Arca, Inc. | ||||

| Shares of Teucrium Agricultural Fund | NYSE Arca, Inc. | ||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent files pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | ||

| Non-accelerated filer ☐ | Smaller reporting company | ||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

The aggregate market value of the units of each series of the registrant held by non-affiliates as of June 30, 2016 are included in the table below:

| Aggregate

Market Value of Each Funds’ Shares Held by Non-Affiliates as of June 30, 2016 | Total Number of Outstanding Shares as of March 13, 2017 | |||||||

| Teucrium Corn Fund | $ | 66,625,000 | 3,675,000 | |||||

| Teucrium Sugar Fund | 7,128,000 | 475,000 | ||||||

| Teucrium Soybean Fund | 12,804,000 | 650,000 | ||||||

| Teucrium Wheat Fund | 36,918,750 | 9,400,000 | ||||||

| Teucrium Agricultural Fund | $ | 1,427,500 | 50,000 | |||||

| Total | $ | 124,903,250 | ||||||

Statement Regarding Forward-Looking Statements

This filing includes “forward-looking statements” which generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this filing that address activities, events or developments that will or may occur in the future, including such matters as movements in the commodities markets and indexes that track such movements, operations of the Funds, the Sponsor’s plans and references to the future success of a Fund or the Funds and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this filing are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the operations of the Funds or the value of the Shares of the Funds.

2

Table of Contents

The Trust and the Funds

Teucrium Commodity Trust (“Trust”), a Delaware statutory trust organized on September 11, 2009, is a series trust consisting of five series: Teucrium Corn Fund (“CORN”), Teucrium Sugar Fund (“CANE”), Teucrium Soybean Fund (“SOYB”), Teucrium Wheat Fund (“WEAT”), and Teucrium Agricultural Fund (“TAGS”). All of the series of the Trust are collectively referred to as the “Funds” and singularly as the “Fund.” Each Fund is a commodity pool that is a series of the Trust. The Funds issue common units, called the “Shares,” representing fractional undivided beneficial interests in a Fund. The Trust and the Funds operate pursuant to the Trust’s Second Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”).

Two additional series, the Teucrium Natural Gas Fund (“NAGS”) and the Teucrium WTI Crude Oil Fund (“CRUD”) commenced operations in 2011; however, on December 18, 2014 CRUD and NAGS ceased trading on the NYSE Arca and the Sponsor liquidated all commodity futures contracts held by these funds. All positions were sold through an exchange to unrelated parties. On December 22, 2014 the Administrator and Custodian proceeded to distribute cash to all shareholders in an amount equal to each shareholder’s pro rata interest in the respective fund. On December 30, 2014, Teucrium Trading, LLC (the “Sponsor”) completed the disposition of all of the assets of these funds. There were zero assets and liabilities as of December 31, 2014. The Form 15 was filed with the SEC on January 9, 2015.

The Sponsor

Teucrium Trading, LLC is the Sponsor of the Trust and each of the series of the Trust. The Sponsor is a Delaware limited liability company, formed on July 28, 2009. The principal office of the Trust and the Sponsor is located at 232 Hidden Lake Road, Brattleboro, Vermont 05301. The Sponsor is registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and became a member of the National Futures Association (“NFA”) on November 10, 2009. The Trust and the Funds operate pursuant to the Trust Agreement.

Under the Trust Agreement, the Sponsor is solely responsible for the management of the Trust and the Funds, and conducts or directs the conduct of the business of the Trust, the Funds, and any other Fund that may from time to time be established and designated by the Sponsor. The Sponsor is required to oversee the purchase and sale of Shares by firms designated as “Authorized Purchasers” and to manage the Funds’ investments, including to evaluate the credit risk of futures commission merchants and swap counterparties and to review daily positions and margin/collateral requirements. The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Funds’ Shares and the conduct of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting the Trustee, Administrator, Distributor, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust. The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and providing any required certification for such reports. No person other than the Sponsor and its principals was involved in the organization of the Trust or the Funds.

Teucrium Trading, LLC designs the Funds to offer liquidity, transparency, and capacity in single-commodity and commodity-baskets, in the case of TAGS, investing for a variety of investors, including institutions and individuals, in an exchange-traded product format. The Funds have also been designed to mitigate the impacts of contango and backwardation, situations that can occur in the course of commodity trading which can affect the potential returns to investors. Backwardation is defined as a market condition in which a futures price of a commodity is lower in the distant delivery months than in the near delivery months, while contango, the opposite of backwardation, is defined as a condition in which distant delivery prices for futures exceed spot prices, often due to the costs of storing and insuring the underlying commodity.

The Funds

On June 5, 2010, the initial Form S-1 for CORN was declared effective by the U.S. Securities and Exchange Commission (“SEC”). On June 8, 2010, four Creation Baskets for CORN were issued representing 200,000 shares and $5,000,000. CORN began trading on the New York Stock Exchange (“NYSE”) Arca on June 9, 2010. The current registration statement for CORN was declared effective by the SEC on April 29, 2016.

On June 17, 2011, the initial Forms S-1 for CANE, SOYB, and WEAT were declared effective by the SEC. On September 16, 2011, two Creation Baskets were issued for each Fund, representing 100,000 shares and $2,500,000, for CANE, SOYB, and WEAT. On September 19, 2011, CANE, SOYB, and WEAT started trading on the NYSE Arca. The current registration statements for CANE and SOYB were declared effective by the SEC on June 30, 2014. The current registration statement for WEAT was declared effective on July 15, 2016. This registration statement for WEAT registered an additional 24,050,000 shares.

On February 10, 2012, the Form S-1 for TAGS was declared effective by the SEC. On March 27, 2012, six Creation Baskets for TAGS were issued representing 300,000 shares and $15,000,000. TAGS began trading on the NYSE Arca on March 28, 2012. The current registration statement for TAGS was declared effective by the SEC on April 30, 2015.

1

Investing Strategy

Overview

The Funds are designed and managed so that the daily changes in percentage terms of the Shares’ Net Asset Value (“NAV”) reflect the daily changes in percentage terms of a weighted average of the closing settlement prices for specific futures contracts for designated commodities (each a “Designated Commodity”) or the closing Net Asset Value per share of the Underlying Funds (as defined below) in the case of TAGS. Each Fund pursues its investment objective by investing in a portfolio of exchange-traded futures contracts (each a “Futures Contract”) that expire in a specific month and trade on a specific exchange in the Specified Commodity comprising the Benchmark (as defined below), as defined below or shares of the Underlying Funds in the case of TAGS. Each Fund may also hold United States Treasury Obligations and/or other high credit quality short-term fixed income securities for deposit with the commodity broker of the Funds as margin.

This weighted average of the closing settlement prices of the referenced specific Futures Contracts for each Fund is referred to herein as the “Benchmark,” and the specific Futures Contracts that at any given time make up the Benchmark for that Fund are referred to herein as the “Benchmark Component Futures Contracts.”

The investment objective of CORN is to have the daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of a weighted average of the closing settlement prices for three futures contracts for corn (“Corn Futures Contracts”) that are traded on the Chicago Board of Trade (“CBOT”), specifically (1) the second-to-expire CBOT Corn Futures Contract, weighted 35%, (2) the third-to-expire CBOT Corn Futures Contract, weighted 30%, and (3) the CBOT Corn Futures Contract expiring in the December following the expiration month of the third-to-expire contract, weighted 35%.

The investment objective of SOYB is to have the daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of a weighted average of the closing settlement prices for three futures contracts for soybeans (“Soybean Futures Contracts”) that are traded on the CBOT. The three Soybean Futures Contracts will generally be: (1) second-to-expire CBOT Soybean Futures Contract, weighted 35%, (2) the third-to-expire CBOT Soybean Futures Contract, weighted 30%, and (3) the CBOT Soybean Futures Contract expiring in the November following the expiration month of the third-to-expire contract, weighted 35%.

The investment objective of CANE is to have the daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of a weighted average of the closing settlement prices for three futures contracts for sugar (“Sugar Futures Contracts”) that are traded on ICE Futures US (“ICE Futures”), specifically: (1) the second-to-expire Sugar No. 11 Futures Contract (a “Sugar No. 11 Futures Contract”), weighted 35%, (2) the third-to-expire Sugar No. 11 Futures Contract, weighted 30%, and (3) the Sugar No. 11 Futures Contract expiring in the March following the expiration month of the third-to-expire contract, weighted 35%.

The investment objective of WEAT is to have the daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of a weighted average of the closing settlement prices for three futures contracts for wheat (“Wheat Futures Contracts”) that are traded on the CBOT, specifically: (1) the second-to-expire CBOT Wheat Futures Contract, weighted 35%, (2) the third-to-expire CBOT Wheat Futures Contract, weighted 30%, and (3) the CBOT Wheat Futures Contract expiring in the December following the expiration month of the third-to-expire contract, weighted 35%.

The investment objective of the TAGS is to have the daily changes in percentage terms of the NAV of its Shares reflect the daily changes in percentage terms of a weighted average (the “Underlying Fund Average”) of the NAVs per share of four other commodity pools that are series of the Trust and are sponsored by the Sponsor: the Teucrium Corn Fund, the Teucrium Wheat Fund, the Teucrium Soybean Fund and the Teucrium Sugar Fund (collectively, the “Underlying Funds”). The Underlying Fund Average will have a weighting of 25% to each Underlying Fund, and the Fund’s assets will be rebalanced, generally on a daily basis, to maintain the approximate 25% allocation to each Underlying Fund.

Each Fund seeks to achieve its investment objective by investing under normal market conditions in Benchmark Component Futures Contracts (“Futures Contracts”) of the Fund or, in certain circumstances, in other Futures Contracts for its Specified Commodity. In addition, and to a limited extent, a Fund also may invest in exchange-traded options on Futures Contracts for its Specified Commodity. Once position limits or accountability levels on Futures Contracts on a Fund’s Specified Commodity are applicable, each Fund’s intention is to invest first in contracts and instruments such as cash-settled options on Futures Contracts and forward contracts, swaps and other over-the-counter transactions that are based on the price of its Specified Commodity or Futures Contracts on its Specified Commodity (collectively, “Other Commodity Interests,” and together with Futures Contracts, “Commodity Interests”). By utilizing certain or all of these investments, the Sponsor will endeavor to cause each Fund’s performance to closely track that of its Benchmark.

The Sponsor operates the Funds with the intent to never hold a Benchmark Component Futures Contract once it becomes the next-to-expire contract (commonly called the “spot” contract). Accordingly, the positions of each Fund in its Specified Commodity Interests are changed or “rolled” on a regular basis in order to track the changing nature of the Benchmark. Using CORN as an example, five times a year (on the dates on which certain Corn Futures Contracts expire), a particular Corn Futures Contract will no longer be a Benchmark Component Futures Contract, and the Corn Fund’s investments will have to be changed accordingly. Corn Futures Contracts traded on the CBOT expire on a specified day in the following five months: March, May, July, September, and December. Therefore, in terms of the Benchmark, in June of a given year the next-to-expire or “spot month” Corn Futures Contract will expire in July of that year, and the Benchmark Component Futures Contracts will be the contracts expiring in September of that year (the second-to-expire contract), December of that year (the third-to-expire contract), and December of the following year. As another example using CORN, in November of a given year the Benchmark Component Futures Contracts will be the contracts expiring in March, May and December of the following year. The Teucrium Corn Fund is designed to roll or replace its contracts five times per year but will always hold a December Corn Futures Contract as an “anchor” month. The Sponsor will determine if the investments of a Fund will be “rolled” in one day or over a period of several days, in order that any trading does not signal unwanted market movements and to make it more difficult for third parties to profit by trading ahead based on such expected market movements. Such “roll” periods are posted to the website for each Fund well in advance of the “roll” date.

2

The Sponsor employs a “neutral” investment strategy intended to track the changes in the Benchmark of each Fund regardless of whether the Benchmark goes up or goes down. The Funds’ “neutral” investment strategy is designed to permit investors generally to purchase and sell the Shares of each Fund for the purpose of investing indirectly in the commodity-specific market in a cost-effective manner. Such investors may include participants in the specific industry and other industries seeking to hedge the risk of losses in their commodity specific-related transactions, as well as investors seeking exposure to that commodity market. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in the commodity-specific market and/or the risks involved in hedging may exist. In addition, an investment in a Fund involves the risks that the changes in the price of the Fund’s Shares will not accurately track the changes in the Benchmark, and that changes in the Benchmark will not closely correlate with changes in the price of the commodity on the spot market. The Sponsor does not intend to operate each Fund in a fashion such that its per share NAV equals, in dollar terms, the spot price of the commodity or the price of any particular commodity-specific Futures Contract related to the Fund or the commodities of the Underlying Funds.

Calculation of the Benchmark

The notional amount of each Benchmark Component Futures Contract included in each Benchmark is intended to reflect the changes in market value of each such Benchmark Component Futures Contract within the Benchmark. The closing level of each Benchmark is calculated on each business day by the U.S. Bancorp Fund Services (the “Administrator”) based on the closing price of the futures contracts for each of the underlying Benchmark Component Futures Contracts and the notional amounts of such Benchmark Component Futures Contracts.

Each Benchmark is rebalanced periodically to ensure that each of the Benchmark Component Futures Contracts is weighted in the same proportion as in the investment objective for each Fund. The following tables reflect the December 31, 2016, Benchmark Component Futures Contracts weights for each of the Funds:

| CORN Benchmark Component Futures Contracts | Notional Value | Weight (%) | ||||||

| CBOT Corn Futures (1,438 contracts, MAY17) | $ | 25,704,250 | 35 | % | ||||

| CBOT Corn Futures (1,207 contracts, JUL17) | 21,982,488 | 30 | ||||||

| CBOT Corn Futures (1,347 contracts, DEC17) | 25,593,000 | 35 | ||||||

| Total at December 31, 2016 | $ | 73,279,738 | 100 | % | ||||

| SOYB Benchmark Component Futures Contracts | Notional Value | Weight (%) | ||||||

| CBOT Soybean Futures (90 contracts, MAR17) | $ | 4,518,000 | 35 | % | ||||

| CBOT Soybean Futures (76 contracts, MAY17) | 3,847,500 | 30 | ||||||

| CBOT Soybean Futures (91 contracts, NOV17) | 4,501,088 | 35 | ||||||

| Total at December 31, 2016 | $ | 12,866,588 | 100 | % | ||||

| CANE Benchmark Component Futures Contracts | Notional Value | Weight (%) | ||||||

| ICE Sugar Futures (89 contracts, MAY17) | $ | 1,918,840 | 35 | % | ||||

| ICE Sugar Futures (79 contracts, JUL17) | 1,667,848 | 30 | ||||||

| ICE Sugar Futures (93 contracts, MAR18) | 1,935,293 | 35 | ||||||

| Total at December 31, 2016 | $ | 5,521,981 | 100 | % | ||||

| WEAT Benchmark Component Futures Contracts | Notional Value | Weight (%) | ||||||

| CBOT Wheat Futures (1,037 contracts, MAY17) | $ | 21,802,925 | 35 | % | ||||

| CBOT Wheat Futures (861 contracts, JUL17) | 18,694,463 | 30 | ||||||

| CBOT Wheat Futures (939 contracts, DEC17) | 21,831,750 | 35 | ||||||

| Total at December 31, 2016 | $ | 62,329,138 | 100 | % | ||||

| TAGS Benchmark Component Futures Contracts | Fair Value | Weight (%) | ||||||

| Shares of Teucrium Corn Fund | $ | 323,979 | 25 | % | ||||

| Shares of Teucrium Soybean Fund | 315,486 | 24 | ||||||

| Shares of Teucrium Wheat Fund | 331,267 | 25 | ||||||

| Shares of Teucrium Sugar Fund | 342,822 | 26 | ||||||

| Total at December 31, 2016 | $ | 1,313,554 | 100 | % | ||||

3

The price relationship between the near month Futures Contract to expire and the Benchmark Component Futures Contracts will vary and may impact both the total return of each Fund over time and the degree to which such total return tracks the total return of the price indices related to the commodity of each Fund. In cases in which the near month contract’s price is lower than later-expiring contracts’ prices (a situation known as “contango” in the futures markets), then absent the impact of the overall movement in commodity prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. In cases in which the near month contract’s price is higher than later-expiring contracts’ prices (a situation known as “backwardation” in the futures markets), then absent the impact of the overall movement in a Fund’s prices the value of the Benchmark Component Futures Contracts would tend to rise as they approach expiration.

The total portfolio composition for each Fund is disclosed each business day that the NYSE Arca is open for trading on the Fund’s website. The website for CORN is www.teucriumcornfund.com; for CANE is www.teucriumcanefund.com; for SOYB is www.teucriumsoybfund.com; for WEAT is www.teucriumweatfund.com; and for TAGS is www.teucriumtagsfund.com. These sites are accessible at no charge. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Futures Contract, Other Commodity Interest and the amount of cash and cash equivalents held in the Fund’s portfolio. The specific types of Other Commodity Interests (in addition to futures contracts, options on futures contracts and derivative contracts) that are tied to various commodities are entered into outside of public exchanges. These “over-the-counter” contracts are entered into between two parties in private contracts, or on a recently formed swap execution facility (“SEF”) for standardized swaps. For example, unlike Futures Contracts, which are guaranteed by a clearing organization, each party to an over-the-counter derivative contract bears the credit risk of the other party (unless such over-the-counter swap is cleared through a derivatives clearing organization (“DCO”)), i.e., the risk that the other party will not be able to perform its obligations under its contract, and characteristics of such Other Commodity Interests.

Consistent with achieving a Fund’s investment objective of closely tracking the Benchmark, the Sponsor may for certain reasons cause the Fund to enter into or hold Futures Contracts other than the Benchmark Component Futures Contracts and/or Other Commodity Interests. Other Commodity Interests that do not have standardized terms and are not exchange-traded, referred to as “over-the-counter” Corn Interests, can generally be structured as the parties to the Corn Interest contract desire. Therefore, each Fund might enter into multiple and/or over-the-counter Interests intended to replicate the performance of each of the Benchmark Component Futures Contracts for the Fund, or a single over-the-counter Interest designed to replicate the performance of the Benchmark as a whole. Assuming that there is no default by a counterparty to an over-the-counter Interest, the performance of the Interest will necessarily correlate with the performance of the Benchmark or the applicable Benchmark Component Futures Contract. Each Fund might also enter into or hold Interests other than Benchmark Component Futures Contracts to facilitate effective trading, consistent with the discussion of the Fund’s “roll” strategy. In addition, each Fund might enter into or hold Interests that would be expected to alleviate overall deviation between the Fund’s performance and that of the Benchmark that may result from certain market and trading inefficiencies or other reasons. By utilizing certain or all of the investments described above, the Sponsor will endeavor to cause the Fund’s performance to closely track that of the Benchmark of the Fund.

An “exchange for related position” (“EFRP”) can be used by the Fund as a technique to facilitate the exchanging of a futures hedge position against a creation or redemption order, and thus the Fund may use an EFRP transaction in connection with the creation and redemption of shares. The market specialist/market maker that is the ultimate purchaser or seller of shares in connection with the creation or redemption basket, respectively, agrees to sell or purchase a corresponding offsetting futures position which is then settled on the same business day as a cleared futures transaction by the FCMs. The Fund will become subject to the credit risk of the market specialist/market maker until the EFRP is settled within the business day, which is typically 7 hours or less. The Fund reports all activity related to EFRP transactions under the procedures and guidelines of the CFTC and the exchanges on which the futures are traded.

The Funds earn interest income from the Treasury securities and/or cash equivalents that it purchases and on the cash it holds through the Custodian or other financial institution. The Sponsor anticipates that the earned interest income will increase the NAV of each Fund. The Funds apply the earned interest income to the acquisition of additional investments or uses it to pay its expenses. If the Fund reinvests the earned interest income, it makes investments that are consistent with its investment objectives. Any Treasury security and cash equivalent invested by a Fund will have original maturity dates of three months or less at inception. Any cash equivalents invested by a Fund will be rated in the highest short-term rating category by a nationally recognized statistical rating organization or will be deemed by the Sponsor to be of comparable quality. As of December 31, 2016, available cash balances in each of the Funds were invested in either the Fidelity Government Money Market Portfolio or in demand deposits at Rabobank, N.A.

In managing the assets of the Funds, the Sponsor does not use a technical trading system that automatically issues buy and sell orders. Instead, the Sponsor will purchase or sell the specific underlying Commodity Interests with an aggregate market value that approximates the amount of cash received or paid upon the purchase or redemption of Shares.

The Sponsor does not anticipate letting the commodity Futures Contracts of any Fund expire, thus taking delivery of the underlying commodity. Instead, the Sponsor will close out existing positions, for instance, in response to ongoing changes in the Benchmark or if it otherwise determines it would be appropriate to do so and reinvest the proceeds in new Commodity Interests. Positions may also be closed out to meet redemption orders, in which case the proceeds from closing the positions will not be reinvested.

4

Market Outlook

The Corn Market

Corn is currently the most widely produced livestock feed grain in the United States, and the majority of the United States’ corn crop is used in livestock feed, with the amount used in ethanol production second. Corn is also processed into food and industrial products, including starch, sweeteners, corn oil, beverages and industrial alcohol. The United States Department of Agriculture (“USDA”) publishes weekly, monthly, quarterly and annual updates for U.S. domestic and worldwide corn production and consumption, and for other grains such as soybeans and wheat which can be used in some cases as a substitute for corn. These reports are available on the USDA’s website, www.usda.gov, at no charge.

The United States is the world’s leading producer and exporter of corn. For the Crop Year 2016-17, the United States Department of Agriculture (“USDA”) estimates that the U.S. will produce approximately 37% of all the corn globally, of which about 15% will be exported. For 2016-2017, global consumption of 1,027.0 Million Metric Tons (MMT) is expected to be slightly less than global production of 1,037.9 MMT. If the global supply of corn exceeds global demand, this may have an adverse impact on the price of corn. Besides the United States, other principal world corn exporters include Argentina, Brazil and the former Soviet Union nations known as the FSU-12 which includes the Ukraine. Major importer nations include Mexico, Japan, the European Union (EU), South Korea, Egypt and parts of Southeast Asia. China’s estimated production for 2016-17 at 219.6 MMT is under its domestic usage of 227.0 MMT.

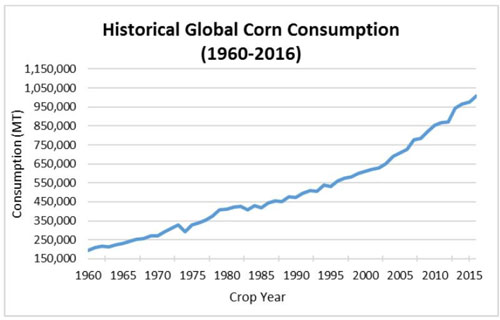

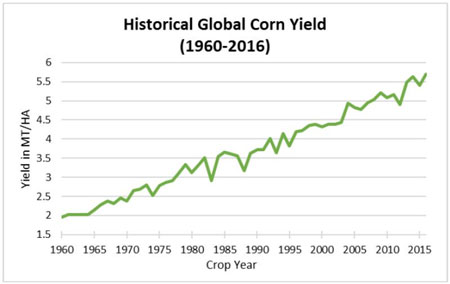

According to the USDA, global corn consumption has increased almost 400% from 1960-2016 as demonstrated by the graph below, and is projected to continue to grow in upcoming years. Consumption growth is the result of a combination of many factors including: 1) global population growth, which, according to the U.S. Census Department, is estimated to increase by approximately 78 million people in the 2016-17 timeframe and reach over 9.4 billion by 2050; 2) a growing global middle class which is increasing the demand for protein and meat-based products globally and most significantly in developing countries; and 3) increased use of bio-fuels, including ethanol in the United States. Based on USDA estimates as of January 12, 2017, for each person added to the population, there needs to be an additional 5.5 bushels of corn, 1.7 bushels of soybeans and 3.7 bushels of wheat produced.

While global consumption of corn has increased over the 1960-2016 period, so has production, driven by increases in acres planted and yield per acre. However, according to the USDA and United Nations, future growth in planted acres and yield may be inhibited by lower-productive land, and lack of infrastructure and transportation. In addition, agricultural crops such as corn are highly weather-dependent for yield and therefore susceptible to changing weather patterns. In addition, given the current production/consumption patterns, nearly 100% of all corn produced globally is consumed which leaves minimal excess inventory if production issues arise.

5

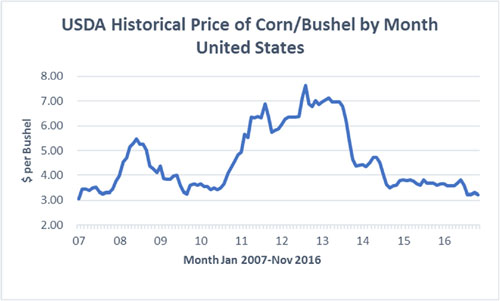

The price per bushel of corn in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2016.

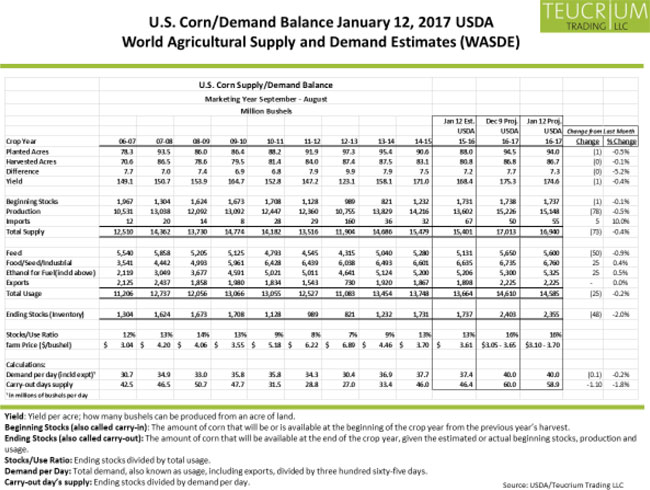

On January 12, 2017, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2016-17. The exhibit below provides a summary of historical and current information for United States corn production.

Standard Corn Futures Contracts trade on the CBOT in units of 5,000 bushels, although 1,000 bushel “mini-corn” Corn Futures Contracts also trade. Three grades of corn are deliverable under CBOT Corn Futures Contracts: Number 1 yellow, which may be delivered at 1.5 cents over the contract price; Number 2 yellow, which may be delivered at the contract price; and Number 3 yellow, which may be delivered at 1.5 cents under the contract price. There are five months each year in which CBOT Corn Futures Contracts expire: March, May, July, September and December.

6

If the futures market is in a state of backwardation (i.e., when the price of corn in the future is expected to be less than the current price), the Fund will buy later-to-expire contracts for a lower price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing corn prices or the price relationship between immediate delivery, soon-to-expire contracts and later-to-expire contracts, the value of a contract will rise as it approaches expiration. Over time, if backwardation remained constant, the differences would continue to increase. If the futures market is in contango, the Fund will buy later-to-expire contracts for a higher price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing corn prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will fall as it approaches expiration. Over time, if contango remained constant, the difference would continue to increase. Historically, the corn futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the corn market and the corn harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

The Soybean Market

Global soybean production is concentrated in the U.S., Brazil, Argentina and China. The United States Department of Agriculture (“USDA”) has estimated that, for the Crop Year 2016-17, the United States will produce approximately 117.2 MMT of soybeans or approximately 35% of estimated world production, with Brazil production at 104 MMT. Argentina is projected to produce about 57 MMT. For 2016-17, global consumption of 330.3 MMT is expected to be slightly less than global production of 337.9 MMT. If the global supply of soybeans exceeds global demand, this may have an adverse impact on the price of soybeans. The USDA publishes weekly, monthly, quarterly and annual updates for U.S. domestic and worldwide soybean production and consumption. These reports are available on the USDA’s website, www.usda.gov, at no charge.

The soybean processing industry converts soybeans into soybean meal, soybean hulls, and soybean oil. Soybean meal and soybean hulls are processed into soy flour or soy protein, which are used, along with other commodities, by livestock producers and the farm fishing industry as feed. Soybean oil is sold in multiple grades and is used by the food, petroleum and chemical industries. The food industry uses soybean oil in cooking and salad dressings, baking and frying fats, and butter substitutes, among other uses. In addition, the soybean industry continues to introduce soy-based products as substitutes to various petroleum-based products including lubricants, plastics, ink, crayons and candles. Soybean oil is also converted to biodiesel for use as fuel.

Standard Soybean Futures Contracts trade on the CBOT in units of 5,000 bushels, although 1,000 bushel “mini-sized” Soybean Futures Contracts also trade. Three grades of soybean are deliverable under CBOT Soybean Futures Contracts: Number 1 yellow, which may be delivered at 6 cents per bushel over the contract price; Number 2 yellow, which may be delivered at the contract price; and Number 3 yellow, which may be delivered at 6 cents per bushel under the contract price. There are seven months each year in which CBOT Soybean Futures Contracts expire: January, March, May, July, August, September and November.

If the futures market is in a state of backwardation (i.e., when the price of soybeans in the future is expected to be less than the current price), the Fund will buy later-to-expire contracts for a lower price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing soybean prices or the price relationship between immediate delivery, soon-to-expire contracts and later-to-expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later-to-expire contracts for a higher price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing soybean prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will fall as it approaches expiration. Historically, the soybeans futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the soybean market and the soybean harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

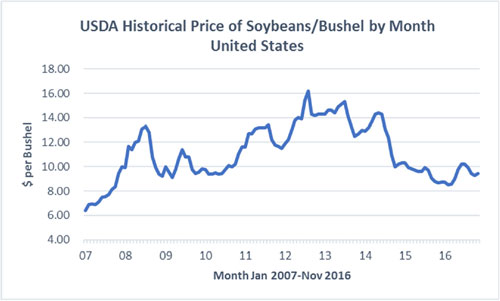

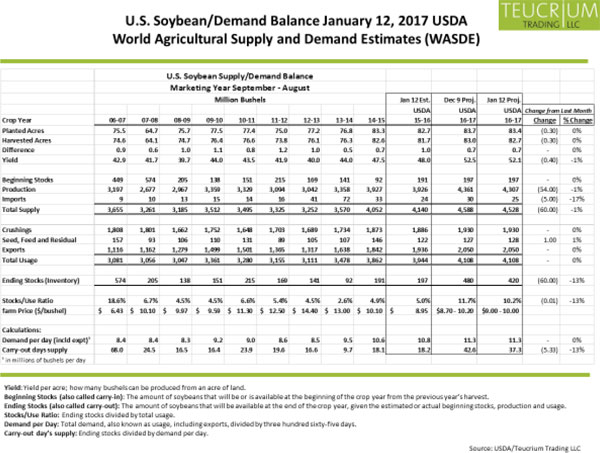

The price per bushel of soybeans in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2016.

7

On January 12, 2017, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2016-17. The exhibit below provides a summary of historical and current information for United States soybean production.

The Wheat Market

Wheat is used to produce flour, the key ingredient for breads, pasta, crackers and many other food products, as well as several industrial products such as starches and adhesives. Wheat by-products are used in livestock feeds. Wheat is the principal food grain produced in the United States, and the United States’ output of wheat is typically exceeded only by that of China, the European Union, the former Soviet nations, known as the FSU-12, including the Ukraine, and India. The United States Department of Agriculture (“USDA”) estimates that for 2016-17, the principal global producers of wheat will be the EU, the former Soviet nations known as the FSU-12, China, India, the United States, Australia and Canada. The U.S. generates approximately 8% of the global production, with approximately 42% of that being exported. For 2016-17, global consumption of 739.9 MMT is estimated to be surpassed by production of 752.7 MMT. If the global supply of wheat exceeds global demand, this may have an adverse impact on the price of wheat. The USDA publishes weekly, monthly, quarterly and annual updates for U.S. domestic and worldwide wheat production and consumption. These reports are available on the USDA’s website, www.usda.gov, at no charge.

8

There are several types of wheat grown in the U.S., which are classified in terms of color, hardness, and growing season. CBOT Wheat Futures Contracts call for delivery of #2 soft red winter wheat, which is generally grown in the eastern third of the United States, but other types and grades of wheat may also be delivered (Grade #1 soft red winter wheat, Hard Red Winter, Dark Northern Spring and Northern Spring wheat may be delivered at 3 cents premium per bushel over the contract price and #2 soft red winter wheat, Hard Red Winter, Dark Northern Spring and Northern Spring wheat may be delivered at the contract price.) Winter wheat is planted in the fall and is harvested in the late spring or early summer of the following year, while spring wheat is planted in the spring and harvested in late summer or fall of the same year.

Standard Wheat Futures Contracts trade on the CBOT in units of 5,000 bushels, although 1,000 bushel “mini-wheat” Wheat Futures Contracts also trade. There are five months each year in which CBOT Wheat Futures Contracts expire: March, May, July, September and December.

If the futures market is in a state of backwardation (i.e., when the price of wheat in the future is expected to be less than the current price), the Fund will buy later-to-expire contracts for a lower price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing wheat prices or the price relationship between immediate delivery, soon-to-expire contracts and later-to-expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later-to-expire contracts for a higher price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing wheat prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will fall as it approaches expiration. Historically, the wheat futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the wheat market and the wheat harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

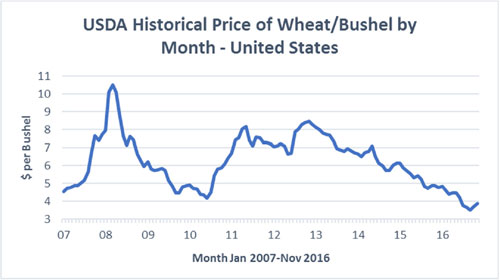

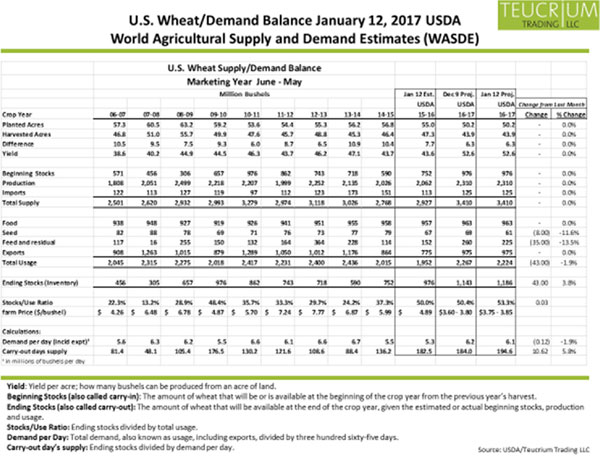

The price per bushel of wheat in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2016.

On January 12, 2017, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2016-17. The exhibit below provides a summary of historical and current information for United States wheat production.

9

The Sugar Market

Sugarcane accounts for about 75% of the world’s sugar production, while sugar beets account for the remainder of the world’s sugar production. Sugar manufacturers use sugar beets and sugarcane as the raw material from which refined sugar (sucrose) for industrial and consumer use is produced. Sugar is produced in various forms, including granulated, powdered, liquid, brown, and molasses. The food industry (in particular, producers of baked goods, beverages, cereal, confections, and dairy products) uses sugar and sugarcane molasses to make sugar-containing food products. Sugar beet pulp and molasses products are used as animal feed ingredients. Ethanol is an important by-product of sugarcane processing. Additionally, the material that is left over after sugarcane is processed is used to manufacture paper, cardboard, and “environmentally friendly” eating utensils.

The Sugar No. 11 Futures Contract is the world benchmark contract for raw sugar trading. This contract prices the physical delivery of raw cane sugar, delivered to the receiver’s vessel at a specified port within the country of origin of the sugar. Sugar No. 11 Futures Contracts trade on the ICE Futures and the NYMEX in units of 112,000 pounds.

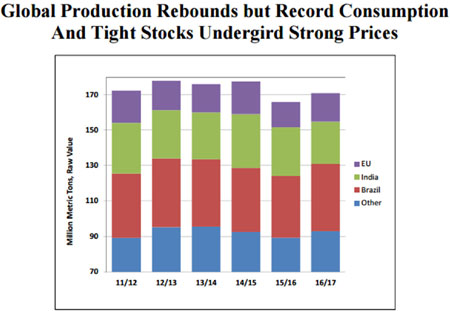

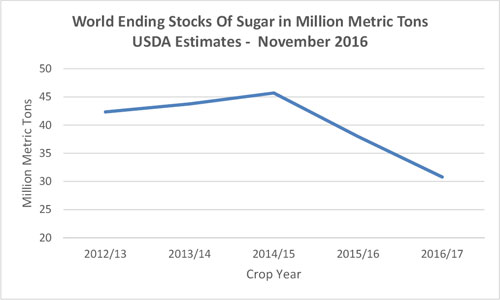

The United States Department of Agriculture (“USDA”) publishes two major reports annually on U.S. domestic and worldwide sugar production and consumption. These are usually released in November and May. In addition, the USDA publishes periodic, but not as comprehensive, reports on sugar monthly. These reports are available on the USDA’s website, www.usda.gov, at no charge. The USDA’s November 2016 report forecasts that Brazil, with estimated production of 37.8 million metric tons, an increase of 3.1 million metric tons, and 9%, from the year before, will continue to be the leading producer of sugarcane. Brazil’s production, which outpaces the other principal global producers, namely India, Thailand and China, equates to approximately 22% of the world’s supply. World estimated production is 170.9 million metric tons. Although world sugar production will increase by 5.1 million metric tons over last year, the USDA’s November 2016 report estimates record global consumption of 173.6 million metric tons will outpace production for the second consecutive year. Record consumption will reduce ending stocks to the lowest level in six years; this includes a 44% reduction of Chinese ending stocks as compared to last year, and a significant reduction in India’s production. The most current period has seen the global demand for sugar exceed supply which has, generally, resulted in price increases. However, if the global supply of sugar exceeds global demand, a situation which has occurred in the recent past, this may have an adverse impact on the price of sugar, and prices will generally fall. The principal producers of sugar beets, as forecasted by the USDA for 2017, include the European Union, the United States, and Russia.

The USDA, in its November 2017 report, highlighted in the graph immediately below, the fact that prices have risen in response to lower ending stocks. The tightening in global ending stocks is illustrated in the second graph.

10

If the futures market is in a state of backwardation (i.e., when the price of sugar in the future is expected to be less than the current price), the Fund will buy later-to-expire contracts for a lower price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing sugar prices or the price relationship between immediate delivery, soon-to-expire contracts and later-to-expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later-to-expire contracts for a higher price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing sugar prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will fall as it approaches expiration. Historically, the sugar futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the sugar market and the sugar harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Funds; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Funds.

Competitive Environment

Investors may choose among several options when considering an investment in agricultural commodities. For instance, an investor may choose to invest directly in commodity futures, although such an investment generally requires significant capital. Additionally, there are a variety of commodity index funds which include baskets of commodity interests; these funds invest in a range of commodity interests, although some are weighted toward, or invest solely in, agricultural commodities. Finally, there are exchange-traded notes which are credit instruments, some of which may invest or mirror investments in agricultural commodities.

11

The Sponsor’s Operations

The Sponsor established the Trust and caused the Trust to establish the first series, the Corn Fund, which commenced offering its Shares to the public on June 9, 2010. Three additional series, namely the Sugar Fund, the Soybean Fund and the Wheat Fund, commenced offering of shares in September, 2011 and the Teucrium Agricultural Fund commenced operation on March 28, 2012. Aside from establishing these series, operating those series that have commenced offering their shares and obtaining capital from a small number of outside investors in order to engage in these activities, the Sponsor did not engage in any business activity.

The Trust and the Funds do not have any employees or officers. Any persons acting as agents of the Trust or the Funds do so as employees or officers of the Sponsor.

Under the Trust Agreement, the Sponsor is solely responsible for the management, and conducts or directs the conduct of the business of the Trust, the Funds, and any other Fund that may from time to time be established and designated by the Sponsor. The Sponsor is required to oversee the purchase and sale of Shares by firms designated as “Authorized Purchasers” and to manage the Funds’ investments, including to evaluate the credit risk of futures commission merchants and swap counterparties and to review daily positions and margin/collateral requirements. The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Funds’ Shares and the conduct of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting the Trustee, Administrator, Distributor, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust. The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and providing any required certification for such reports. No person other than the Sponsor and its principals was involved in the organization of the Trust or the Funds.

The Sponsor maintains websites on behalf of each of the Funds. The total portfolio composition of each Fund is disclosed on the Fund’s website each business day that the NYSE Arca is open for trading. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Commodity Futures Contract held and those that are pending and the amount of cash and cash equivalents held in the Fund’s portfolio. Each Fund’s website also includes the NAV, the 4 p.m. Bid/Ask Midpoint as reported by the NYSE Arca, the last trade price as reported by the NYSE Arca, the shares outstanding, the shares available for issuance, and the shares created or redeemed on that day. The prospectus, Monthly Statement of Account, Quarterly Performance of the Midpoint versus the NAV, and the Roll Dates, as well as Form 10-Qs, Form 10-Ks, and other SEC filings for that Fund, are also posted on the website. Each Fund’s website is publicly accessible at no charge. The website for CORN is www.teucriumcornfund.com; for CANE is www.teucriumcanefund.com; for SOYB is www.teucriumsoybfund.com; for WEAT is www.teucriumweatfund.com; and for TAGS is www.teucriumtagsfund.com. The website address for the Sponsor is www.teucrium.com.

The Sponsor receives a fee as compensation for services performed under the Trust Agreement, except in the case of TAGS where there is no such fee. The Sponsor’s fees accrue daily and are paid monthly at an annual rate of 1.00% of the average daily net assets of each Fund. In addition, each Fund is also generally responsible for other ongoing fees, costs and expenses of its operations, including brokerage fees and SEC registration fees, and legal, printing, accounting, custodial, administration and transfer agency costs, although the Sponsor has borne or will bear the costs and expenses related to the initial offer and sale of Shares. The Funds will generally bear the costs and expenses associated with filing a new registration statement for each Fund every three years, unless the Sponsor waives all or part of such costs and expenses. The Sponsor may choose to waive, for a period of time and at its discretion, the collection of the Sponsor Fee or certain other fees for any of the Funds. Certain aggregate expenses common to all Funds within the Trust are allocated by the Sponsor to the respective funds based on activity drivers deemed most appropriate by the Sponsor for such expenses, including but not limited to relative assets under management and creation and redeem order activity. These aggregate common expenses include, but are not limited to, legal, auditing, accounting and financial reporting, tax-preparation, regulatory compliance, trading activities, and insurance costs, as well as fees paid to the Distributor, which are included in the related line item in the combined statements of operations.

A portion of these aggregate common expenses are related to the Sponsor or related parties of principals of the Sponsor; these are necessary services to the Trust and the Funds, which are primarily the cost of performing accounting and financial reporting, regulatory compliance, and trading activities that are directly attributable to the Trust and the Funds. For the period ended December 31, such expenses, which are primarily included as distribution and marketing fees, totaled $1,825,552 in 2016, $1,601,237 in 2015, and $1,365,214 in 2014; of these amounts, $457,658 in 2016, $138,262 in 2015, and $113,224 in 2014 were waived by the Sponsor.

All asset-based fees and expenses for the Funds are calculated on the prior day’s net assets.

The Sponsor has an information technology plan (the “IT Plan”) in place which is part of the internal controls of the Trust and the Funds. The IT Plan is tested by both the management of the Sponsor and by the independent external auditor as a part of their internal control audit over the financial reporting of the Trust and the Funds. The IT Plan also takes reasonable care to look beyond the controls developed and implemented for the Trust and the Funds directly to the platforms and controls in place for the key service providers. Such review of the IT plans of key service providers is part of the Sponsor’s disaster recovery and business continuity planning. The Sponsor provides regular training to all employees of the Sponsor regarding cybersecurity topics, in addition to real-time dissemination of information regarding cybersecurity matters as needed. The IT plan is reviewed and updated as needed, but at a minimum on an annual basis.

Ownership or “membership” interests in the Sponsor are owned by persons referred to as “members.” The Sponsor currently has three voting or “Class A” members – Mr. Sal Gilbertie, Mr. Dale Riker and Mr. Carl N. Miller III – and a small number of non-voting or “Class B” members who have provided working capital to the Sponsor. Messrs. Gilbertie and Riker each currently own 45% of the Sponsor’s Class A membership interests.

12

Management of the Sponsor

In general, under the Sponsor’s Amended and Restated Limited Liability Company Operating Agreement, as amended from time to time, the Sponsor (and as a result the Trust and each Fund) is managed by the officers of the Sponsor. The Chief Executive Officer of the Sponsor is responsible for the overall strategic direction of the Sponsor and will have general control of its business. The Chief Investment Officer and President of the Sponsor is primarily responsible for new investment product development with respect to the Funds. The Chief Operating Officer has assumed primary responsibility for trade operations, trade execution, and portfolio activities with respect to the Fund. The Chief Financial Officer, Chief Accounting Officer and Chief Compliance Officer acts as the Sponsor’s principal financial and accounting officer, which position includes the functions previously performed by the Treasurer of the Sponsor, and administers the Sponsor’s regulatory compliance programs. Furthermore, certain fundamental actions regarding the Sponsor, such as the removal of officers, the addition or substitution of members, or the incurrence of liabilities other than those incurred in the ordinary course of business and de minimis liabilities, may not be taken without the affirmative vote of a majority of the Class A members (which is generally defined as the affirmative vote of Mr. Gilbertie and one of the other two Class A members). The Sponsor has no board of directors, and the Trust has no board of directors or officers.

The Officers of the Sponsor, two of whom are also Class A members of the Sponsor, are the following:

Sal Gilbertie has been the President of the Sponsor since its inception and its Chief Investment Officer since September 2011, was approved by the NFA as a principal of the Sponsor on September 23, 2009, and was registered as an associated person of the Sponsor on November 10, 2009. He maintains his main business office at 65 Adams Road, Easton, Connecticut 06612. Effective July 16, 2012, Mr. Gilbertie was registered with the NFA as the Branch Manager for this location. Since October 18, 2010, Mr. Gilbertie has been an associated person of the Distributor under the terms of the Securities Activities and Services Agreement (“SASA”) between the Sponsor and the Distributor. Additional information regarding the SASA can be found in the section of this disclosure document entitled “Plan of Distribution.” From October 2005 until December 2009, Mr. Gilbertie was employed by Newedge USA, LLC, an FCM and broker-dealer registered with the CFTC and the SEC, where he headed the Renewable Fuels/Energy Derivatives OTC Execution Desk and was an active futures contract and over-the-counter derivatives trader and market maker in multiple classes of commodities. (Between January 2008 and October 2008, he also held a comparable position with Newedge Financial, Inc., an FCM and an affiliate of Newedge USA, LLC.) From October 1998 until October 2005, Mr. Gilbertie was principal and co-founder of Cambial Asset Management, LLC, an adviser to two private funds that focused on equity options, and Cambial Financing Dynamics, a private boutique investment bank. While at Cambial Asset Management, LLC and Cambial Financing Dynamics, Mr. Gilbertie served as principal and managed the day-to-day activities of the business and the portfolio of both companies. Mr. Gilbertie is 56 years old.

Dale Riker has been the Secretary of the Sponsor since January 2010, and its Chief Executive Officer since September 2011, was approved by the NFA as a principal of the Sponsor on October 29, 2009, and was registered as an associated person of the Sponsor on February 17, 2010. He maintains his main business office at 232 Hidden Lake Road, Brattleboro, Vermont 05301 and is responsible for the overall strategic direction of the Sponsor and has general control of its business. Mr. Riker was Treasurer of the Sponsor from its inception until September 2011. From February 2005 to December 2012, Mr. Riker was the President of Cambial Emerging Markets LLC, a consulting company specializing in emerging market equity investment. As President of Cambial Emerging Markets LLC, Mr. Riker had responsibility for business strategy, planning and operations. From July 1996 to February 2005, Mr. Riker was a private investor. Mr. Riker is married to the Chief Financial Officer, Chief Accounting Officer and Chief Compliance Officer of the Sponsor, Barbara Riker. Mr. Riker is 59 years old.

Barbara Riker began working for the Sponsor in July 2010 providing accounting and compliance support. She has been the Chief Financial Officer, Chief Accounting Officer and Chief Compliance Officer for Teucrium since September 2011, was approved by the NFA as a principal of the Sponsor on October 19, 2011, and has a background in finance, accounting, investor relations, corporate communications and operations. She maintains her main business office at 232 Hidden Lake Road, Brattleboro, Vermont 05301. From September 1980 to February 1993, Ms. Riker worked in various financial capacities for Pacific Telesis Group, the California-based Regional Bell Operating Company, and its predecessors. In February 1993, with the spin-off of AirTouch Communications from Pacific Telesis Group, Ms. Riker was selected to lead the Investor Relations team for the global mobile phone operator. In her capacity as Executive Director – Investor Relations and Corporate Communications from February 1993 to June 1995, AirTouch completed its initial public offering and was launched as an independent publicly-traded company. In June 1995, she was named Chief Financial Officer of AirTouch International and, in addition to her other duties, served on the board of several of the firm’s joint ventures, both private and public, across Europe. In June 1997, Ms. Riker moved into an operations capacity as the District General Manager for AirTouch Paging’s San Francisco operations. In February 1998 she was named Vice President and General Manager of AirTouch Cellular for Arizona and New Mexico. Ms. Riker retired in July 1999, coincident with the purchase of AirTouch by Vodafone PLC and remained retired until she began working for the Sponsor. Ms. Riker graduated with a Bachelor of Science in Business Administration from Cal State – East Bay in 1980. Ms. Riker is married to the Chief Executive Officer of the Sponsor, Dale Riker. Ms. Riker is 58 years old.

Steve Kahler, Chief Operating Officer, began working for the Sponsor in November 2011 as Managing Director in the trading division. He became the Chief Operating Officer on May 24, 2012 and has primary responsibility for the Trade Operations for the Funds. He maintains his main business office at 13520 Excelsior Blvd., Minnetonka, MN 55345. Mr. Kahler was registered as an Associated Person of the Sponsor on November 25, 2011, approved as a Branch Manager of the Sponsor on March 16, 2012 and approved by the NFA as a Principal of the Sponsor on May 16, 2012. Since January 18, 2012, Mr. Kahler has been an associated person of the Distributor under the terms of the SASA between the Sponsor and the Distributor. Additional information regarding the SASA can be found in the section of this disclosure document entitled “Plan of Distribution.” Prior to his employment with the Sponsor, Mr. Kahler worked for Cargill Inc., an international producer and marketer of food, agricultural, financial and industrial products and services, from April 2006 until November 2011 in the Energy Division as Senior Petroleum Trader. In October 2006 and while employed at Cargill Inc., Mr. Kahler was approved as an Associated Person of Cargill Commodity Services Inc., a commodity trading affiliate of Cargill Inc. from September 13, 2006 to November 9, 2011. Mr. Kahler graduated from the University of Minnesota with a Bachelors of Agricultural Business Administration in 1992 and is 49 years old. Mr. Kahler is primarily responsible for making trading and investment decisions for the Fund and other Teucrium Funds, and for directing Fund and other Teucrium Fund trades for execution.

13

The third Class-A member of the Sponsor is the following:

Carl N. (Chuck) Miller III was approved by the NFA as a principal of the Sponsor on November 10, 2009 and was registered as an associated person of the Sponsor on April 19, 2010. He maintains his main business office at 232 Hidden Lake Road, Bldg A, Brattleboro, VT 05301. Mr. Miller has certain voting authority as a Class A member of the Sponsor as described above, but is not involved with the Sponsor’s day-to-day trading or operations or supervises people so engaged. For the period May 13, 2011 to July 24, 2014, Mr. Miller was an associated person of the Distributor under the terms of the SASA between the Sponsor and the Distributor. Additional information regarding the SASA can be found in the section of this disclosure document entitled “Plan of Distribution.”

Messrs. Gilbertie, Riker, Kahler and Miller and Ms. Riker are individual “principals,” as that term is defined in CFTC Rule 3.1, of the Sponsor. These individuals are principals due to their positions and/or due to their ownership interests in the Sponsor. Beneficial ownership interests of the principals, if any, are shown under the section entitled “Security Ownership of Principal Shareholders and Management” below and any of the principals may acquire beneficial interests in the Fund in the future. In addition, each of the three Class A members of the Sponsor are registered with the CFTC as associated persons of the Sponsor and are NFA associate members. GFI Group LLC is a principal for the Sponsor under CFTC Rules due to its ownership of certain non-voting securities of the Sponsor.

The Custodian and Administrator

In its capacity as the Fund’s custodian, the Custodian, currently U.S. Bank, N.A., holds the Funds’ securities, cash and/or cash equivalents pursuant to a custodial agreement. U.S. Bancorp Fund Services, LLC (“USBFS”), an entity affiliated with U.S. Bank, N.A., is the registrar and transfer agent for the Funds. In addition, USBFS also serves as Administrator for the Fund, performing certain administrative and accounting services and preparing certain SEC and CFTC reports on behalf of the Fund. For these services, the Fund pays fees to the Custodian and USBFS set forth in the table entitled “Contractual Fees and Compensation Arrangements with the Sponsor and Third-Party Service Providers.”

The Custodian is located at 1555 North RiverCenter Drive, Suite 302, Milwaukee, Wisconsin 53212. U.S. Bank N.A. is a nationally chartered bank, regulated by the Office of the Comptroller of the Currency, Department of the Treasury, and is subject to regulation by the Board of Governors of the Federal Reserve System. The principal address for USBFS is 615 East Michigan Street, Milwaukee, WI, 53202.

The Distributor

The Funds employ Foreside Fund Services, LLC as the Distributor for the Funds. The Distributor receives, for its services as distributor for the Funds, a fee at an annual rate of 0.01% of each Underlying Fund’s average daily net assets, and an annual fee of $100,000 in the aggregate for all of the Funds. These fees are set forth in the table entitled “Fees and Compensation Arrangements with the Sponsor and Non-Affiliated Service Providers.”

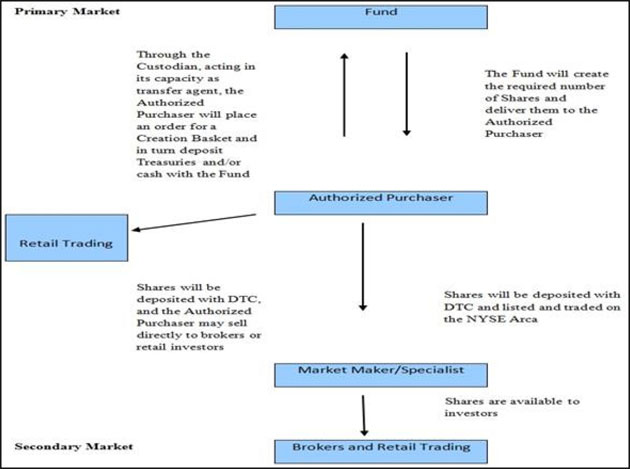

The Distribution Services Agreement among the Distributor, the Sponsor and the Trust calls for the Distributor to work with the Custodian in connection with the receipt and processing of orders for Creation Baskets and Redemption Baskets and the review and approval of all Fund sales literature and advertising materials. The Distributor and the Sponsor have also entered into a Securities Activities and Service Agreement (the “SASA”) under which certain employees and officers of the Sponsor are licensed as registered representatives or registered principals of the Distributor, under FINRA rules. As Registered Representatives of the Distributor, these persons are permitted to engage in certain marketing activities for the Fund that they would otherwise not be permitted to engage in. Under the SASA, the Sponsor is obligated to ensure that such marketing activities comply with applicable law and are permitted by the SASA and the Distributor’s internal procedures.

The Distributor’s principal business address is Three Canal Plaza, Suite 100, Portland, Maine 04101. The Distributor is a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority (“FINRA”).

The Trustee

The sole Trustee of the Trust is Wilmington Trust Company, a Delaware banking corporation. The Trustee’s principal offices are located at 1100 North Market Street, Wilmington, Delaware 19890-0001. The Trustee is unaffiliated with the Sponsor. The Trustee’s duties and liabilities with respect to the offering of Shares and the management of the Trust and the Fund are limited to its express obligations under the Trust Agreement.

The Trustee will accept service of legal process on the Trust in the State of Delaware and will make certain filings under the Delaware Statutory Trust Act. The Trustee does not owe any other duties to the Trust, the Sponsor or the Shareholders. The Trustee is permitted to resign upon at least sixty (60) days’ notice to the Sponsor. If no successor trustee has been appointed by the Sponsor within such sixty-day period, the Trustee may, at the expense of the Trust, petition a court to appoint a successor. The Trust Agreement provides that the Trustee is entitled to reasonable compensation for its services from the Sponsor or an affiliate of the Sponsor (including the Trust), and is indemnified by the Sponsor against any expenses it incurs relating to or arising out of the formation, operation or termination of the Trust, or any action or inaction of the Trustee under the Trust Agreement, except to the extent that such expenses result from the gross negligence or willful misconduct of the Trustee. The Sponsor has the discretion to replace the Trustee.

Under the Trust Agreement, the duty and authority to manage the business affairs of the Trust, and of all of the funds that are a series of the Trust, including control of the Fund and the Underlying Funds, is vested solely with the Sponsor, which the Sponsor may delegate as provided for in the Trust Agreement. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does the Trustee have any liability for the acts or omissions of the Sponsor. As the Trustee has no authority over the operation of the Trust, the Trustee itself is not registered in any capacity with the CFTC.

14

The Clearing Brokers

In 2014 and 2013, Newedge USA, LLC (“Newedge USA”) served as the Funds’ futures commission merchant (“FCM”) and primary clearing broker to execute and clear the Funds’ futures transactions and provide other brokerage-related services. In 2014, the Funds introduced the use of Jefferies LLC (“Jefferies”), for the execution and clearing of the Funds’ futures and options, if any, on futures transactions. On January 2, 2015, Newedge USA, LLC (“Newedge USA”) merged with and into SG Americas Securities, LLC (“SG”), with the latter as the surviving entity.

On February 6, 2015 Jefferies LLC (“Jefferies”) became the Funds’ FCM and primary clearing broker. All futures contracts held by SG were transferred to Jefferies on that date. As of February 23, 2015 all residual cash balances held at SG had been transferred to Jefferies and the balance in all SG accounts was $0.

Effective June 3, 2015, ED&F Man Capital Markets Inc. (“ED&F Man”) replaced Jefferies as the Funds’ FCM and the clearing broker to execute and clear the Funds’ futures and provide other brokerage-related services, other than services for TAGS. As of June 4, 2015 all futures contracts and residual cash balances held at Jefferies had been transferred to ED&F Man and the balance in all Jefferies accounts was $0.

ED&F Man is registered as a FCM with the U.S. CFTC and is a member of the NFA. ED&F Man is also registered as a broker/dealer with the U.S. Securities and Exchange Commission and is a member of the FINRA. ED&F Man is a clearing member of ICE Futures U.S., Inc., Chicago Board of Trade, Chicago Mercantile Exchange, New York Mercantile Exchange, and all other major United States commodity exchanges. There have been no material civil, administrative, or criminal proceedings pending, on appeal, or concluded against E D & F Man Capital Markets Inc. or its principals in the past five (5) years.

The Bank of New York Mellon Capital Markets is the broker for some, but not all, of the equity transactions related to the purchase and sale of the Underlying Funds for TAGS.

Contractual Fees and Compensation Arrangements with the Sponsor and Third-Party Service Providers

| Service Provider | Compensation Paid by the Funds | |

| Teucrium Trading, LLC, Sponsor | 1.00% of average net assets annually | |

U.S. Bank N.A., Custodian

U.S. Bancorp Fund Services, Transfer Agent, Fund Accountant and Fund Administrator

|

For custody services: 0.0075% of average gross assets up to $1 billion, and .0050% of average gross assets over $1 billion, annually, plus certain per-transaction charges

For Transfer Agency, Fund Accounting and Fund Administration services, based on the total assets for all the Funds in the Trust: 0.06% of average gross assets on the first $250 million, 0.05% on the next $250 million, 0.04% on the next $500 million and 0.03% on the balance over $1 billion annually. A combined minimum annual fee of $64,500 for custody, transfer agency, accounting and administrative services is assessed per Fund.

| |

| Foreside Fund Services, LLC, Distributor | The Distributor receives a fee of 0.01% of each Fund’s average daily net assets and an aggregate annual fee of $100,000 for all Funds, along with certain expense reimbursements currently estimated at $3,000 per year related to these services.

Under the Securities Activities and Service Agreement (the “SASA”), the Distributor receives compensation from the fund for its activities on behalf of all the Funds. The fees paid to the Distributor pursuant to the SASA for the offerings of the Funds are not expected to exceed a combined $40,000 per year. In addition, the Distributor receives certain expense reimbursements relating to the registration, continuing education and other administrative expenses of the Registered Representatives in relation to the Funds. These expense reimbursements are estimated not to exceed $25,000 per year.

| |

ED&F Man Capital Markets, Inc.

|

$4.50 per half-turn Futures Contract purchase or sale for corn, soybeans, wheat and sugar.

| |

| Wilmington Trust Company, Trustee | $3,300 annually for the Trust |

15

Asset-based fees are calculated on a daily basis (accrued at 1/365 of the applicable percentage of NAV on that day) and paid on

a monthly basis. NAV is calculated by taking the current market value of the Fund’s total assets and subtracting

any liabilities.

For each of the contractual agreements discussed above, the expense recognized in 2016 by the Trust and each Fund is detailed in the notes to the financial statements included in Part II of this filing.

Form of Shares

Registered Form

For all the Funds, Shares are issued in registered form in accordance with the Trust Agreement. USBFS has been appointed registrar and transfer agent for the purpose of transferring Shares in certificated form. USBFS keeps a record of all Shareholders and holders of the Shares in certificated form in the registry (Register). The Sponsor recognizes transfers of Shares in certificated form only if done in accordance with the Trust Agreement. The beneficial interests in such Shares are held in book-entry form through participants and/or accountholders in DTC.

Book Entry

For all Funds, individual certificates are not issued for the Shares. Instead, Shares are represented by one or more global certificates, which are deposited by the Administrator with DTC and registered in the name of Cede & Co., as nominee for DTC. The global certificates evidence all of the Shares outstanding at any time. Shareholders are limited to (1) participants in DTC such as banks, brokers, dealers and trust companies (DTC Participants), (2) those who maintain, either directly or indirectly, a custodial relationship with a DTC Participant (Indirect Participants), and (3) those who hold interests in the Shares through DTC Participants or Indirect Participants, in each case who satisfy the requirements for transfers of Shares. DTC Participants acting on behalf of investors holding Shares through such participant accounts in DTC will follow the delivery practice applicable to securities eligible for DTC’s Same-Day Funds Settlement System. Shares are credited to DTC Participants securities accounts following confirmation of receipt of payment.

DTC

DTC has advised us as follows: It is a limited purpose trust company organized under the laws of the State of New York and is a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to the provisions of Section 17A of the Exchange Act. DTC holds securities for DTC Participants and facilitates the clearance and settlement of transactions between DTC Participants through electronic book-entry changes in accounts of DTC Participants.

Transfer of Shares

For all Funds, the Shares are only transferable through the book-entry system of DTC. Shareholders who are not DTC Participants may transfer their Shares through DTC by instructing the DTC Participant holding their Shares (or by instructing the Indirect Participant or other entity through which their Shares are held) to transfer the Shares. Transfers are made in accordance with standard securities industry practice.