Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Surgical Care Affiliates, Inc. | d339877dex312.htm |

| EX-31.1 - EX-31.1 - Surgical Care Affiliates, Inc. | d339877dex311.htm |

| EX-10.36 - EX-10.36 - Surgical Care Affiliates, Inc. | d339877dex1036.htm |

| EX-10.35 - EX-10.35 - Surgical Care Affiliates, Inc. | d339877dex1035.htm |

| EX-10.34 - EX-10.34 - Surgical Care Affiliates, Inc. | d339877dex1034.htm |

| EX-10.33 - EX-10.33 - Surgical Care Affiliates, Inc. | d339877dex1033.htm |

| EX-10.32 - EX-10.32 - Surgical Care Affiliates, Inc. | d339877dex1032.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2016

Commission file number: 001-36154

SURGICAL CARE AFFILIATES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-8740447 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 510 Lake Cook Road, Suite 400 Deerfield, IL |

60015 | |

| (Address of principal executive offices) | (Zip Code) | |

(847) 236-0921

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Common Stock, par value $0.01 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold on June 30, 2016 was $1,317,588,837.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class of Common Stock |

Outstanding at February 15, 2017 | |

| Common stock, par value $0.01 per share | 40,605,430 shares |

Table of Contents

GENERAL

Unless the context otherwise indicates or requires, references in this Amendment No. 1 to the Annual Report on Form 10-K to “Surgical Care Affiliates,” the “Company,” “we,” “us” and “our” refer to Surgical Care Affiliates, Inc. and its consolidated affiliates. In addition, unless the context otherwise indicates or requires, the term “SCA” refers to Surgical Care Affiliates, LLC, our direct operating subsidiary.

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment No. 1”) to the Annual Report on Form 10-K (the “Original Form 10-K”) of Surgical Care Affiliates for the fiscal year ended December 31, 2016 is being filed solely for the purpose of setting forth the information required by Part III of Form 10-K which was previously incorporated by reference to portions of the Company’s Proxy Statement for the 2017 Annual Meeting of Stockholders. Additionally, Item 15 of Part IV of the Original Form 10-K has been amended and restated to include as exhibits new certifications by our principal executive officer and principal financial officer, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as additional exhibits under Item 601 of Regulation S-K. The remainder of the Original Form 10-K is unchanged and is not reproduced in this Amendment No. 1. The Original Form 10-K speaks as of the filing date of the Original Form 10-K and this Amendment No. 1 does not reflect events occurring after the filing date of the Original Form 10-K as to any part of the Original Form 10-K or modify or update the disclosures therein in any way other than as required to reflect the amendments discussed above. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K and the Company’s other filings with the Securities and Exchange Commission (the “SEC”).

| Item |

Page | |||||||

| PART III |

10. |

3 | ||||||

| 11. |

8 | |||||||

| 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

43 | ||||||

| 13. |

Certain Relationships and Related Transactions, and Director Independence |

47 | ||||||

| 14. |

50 | |||||||

| PART IV |

15. |

51 | ||||||

2

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

Information about the Directors

Set forth below are the biographies of each of our directors, including their names, their ages (as of March 1, 2017), their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years. Information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion at the time of filing of this Amendment No. 1 that each person listed below should serve as a director is set forth below under “Experience and Qualifications of the Directors.” The stock ownership with respect to each director is set forth in the table entitled “Security Ownership of Certain Beneficial Owners and Management.”

| Name |

Age |

Position(s) with the Company | ||

| Andrew P. Hayek |

42 | Chairman, President and CEO | ||

| Todd B. Sisitsky(2)(3) |

45 | Lead Independent Director | ||

| Thomas C. Geiser |

66 | Director | ||

| Kenneth R. Goulet(1) |

57 | Director | ||

| Frederick A. Hessler(1) |

68 | Director | ||

| Sharad Mansukani, M.D. |

47 | Director | ||

| Jeffrey K. Rhodes(2)(3) |

42 | Director | ||

| Michael A. Sachs(2) |

64 | Director | ||

| Lisa Skeete Tatum(1) |

49 | Director |

| (1) | Member of our Audit Committee |

| (2) | Member of our Compensation Committee |

| (3) | Member of our Nominating and Corporate Governance Committee |

Andrew P. Hayek was appointed to our Board of Directors on October 30, 2013 and the board of directors of SCA in 2008. He has also served as our President and CEO since 2008, and he was elected Chairman of the Board on August 21, 2015. Prior to joining the Company, Mr. Hayek served as the President of a division of DaVita Healthcare Partners (a renal dialysis and medical group provider), as President and Chief Operating Officer of Alliance Healthcare Services (a diagnostic imaging and radiation therapy provider), and in roles at Kohlberg Kravis Roberts & Co. (a global investment firm) and the Boston Consulting Group (a global management consulting firm). Mr. Hayek is a Henry Crown Fellow at the Aspen Institute and serves as Chairman of SCA Medical Missions (a surgical mission program). Mr. Hayek earned a Bachelor of Arts summa cum laude from Yale University.

Todd B. Sisitsky was appointed to our Board of Directors on October 30, 2013 and the board of directors of SCA in 2007. Mr. Sisitsky is a Partner of TPG Global, LLC (“TPG”), where he leads the firm’s investment activities in the healthcare services and pharmaceutical/medical device sectors. He played leadership roles in connection with TPG’s investments in Aptalis Pharma (GI-focused specialty pharmaceutical company), Biomet (leading orthopedic implant manufacturer), Fenwal Transfusion Therapies (blood product technologies business), IASIS Healthcare (Tennessee-based acute care hospital company), HealthScope (hospital and pathology company based in Australia), IMS Health (leading global data services and consulting business to several segments of the healthcare industry), Immucor (leading automated blood screening and testing business), Endo International Plc and Par Pharmaceutical Companies, Inc. Mr. Sisitsky serves on the board of directors of the global not-for-profit organization, The Campaign for Tobacco Free Kids, as well as on the Dartmouth Medical School Board of Overseers. Prior to joining TPG in 2003, Mr. Sisitsky worked at Fortsmann Little & Company and Oak Hill Capital Partners. He received a M.B.A. from the Stanford Graduate School of Business, where he was an Arjay Miller Scholar, and earned his undergraduate degree from Dartmouth College, where he graduated summa cum laude.

Thomas C. Geiser was appointed to our Board of Directors on October 30, 2013 and the board of directors of SCA in 2007. Mr. Geiser has served as a TPG Senior Advisor since 2006 and served as the Executive Vice President and General Counsel of WellPoint Health Networks Inc. (“Wellpoint”) from its inception in 1993 to 2005. Mr. Geiser was responsible for WellPoint’s legal, legislative and regulatory affairs in fifty states and served as its principal contact with state and

3

Table of Contents

federal regulators. Prior to joining WellPoint, Mr. Geiser worked as an attorney in private law practice, coming to WellPoint from Brobeck, Phleger & Harrison LLP in San Francisco. He currently serves on the board of directors of IASIS Healthcare Corp., Imedex Holdco, LLC, the Library Foundation of Los Angeles and Providence Saint John’s Health Center. Mr. Geiser earned his J.D. from the University of California, Hastings College of Law and earned his undergraduate degree in English from the University of Redlands.

Kenneth R. Goulet was elected to our Board of Directors and the board of directors of SCA effective June 1, 2016. Mr. Goulet served as Executive Vice President, and President of Commercial and Specialty Business of Anthem, Inc. (“Anthem”) from 2013 until his retirement effective October 1, 2015. From 2007 until 2013, Mr. Goulet served in a variety of roles in the Commercial Business division of Anthem, including Executive Vice President, Commercial, Individual and Marketing; Executive Vice President, Employer, Medicaid, Individual and Specialty; and Executive Vice President, and President and CEO of the Commercial Business Unit. He also assumed interim responsibility for the Consumer Business Unit in 2012. From 2004 to 2007, he served as the Senior Vice President, National Accounts. Prior to joining Anthem, Mr. Goulet worked at Cigna Healthcare from 1981 to 2004. Mr. Goulet currently serves on several other boards, including Cotiviti Healthcare, Inc., Implantable Provider Group, Inc., Sharecare, Inc. and EmpiRx Health, LLC.

Frederick A. Hessler was elected to our Board of Directors and the board of directors of SCA on October 30, 2013. Mr. Hessler is a retired Managing Director of Citigroup Global Markets Inc., where he headed the Not-for-Profit Health Care Investment Banking Group from 1990 to 2013. Prior to joining Citigroup Global Markets Inc. in 1985, Mr. Hessler was a Partner and Regional Director for healthcare at Ernst & Young LLP, where he was responsible for conducting audits and performing feasibility, corporate reorganization and strategic planning studies for healthcare clients. Mr. Hessler serves on the Operations Committee and chairs the Investment Committee for the American Hospital Association and is a board member of PierianDx, The Center for Health Design, LHP Hospital Group, Inc., the National Center for Healthcare Leadership and the Public Health Institute and was a member of the senior advisory board of MedAssets, Inc. until September 2015. Mr. Hessler served on the board of directors and the audit committee of the board of MedAssets, Inc. from September 2015 until the company was sold in January 2016. Mr. Hessler also previously served as chair of the Board of Trustees of the Health Research and Education Trust and the Health Insights Foundation and was a member of The Center for Healthcare Governance’s Blue Ribbon Panel on Trustee Core Competencies and the Healthcare Executives Study Society. Mr. Hessler earned his bachelor’s degree in accounting from Wayne State University and is a Certified Public Accountant (inactive status).

Sharad Mansukani, M.D. was appointed to our Board of Directors on October 30, 2013 and the board of directors of SCA in 2007. Dr. Mansukani has served as a TPG Senior Advisor since 2005. He serves on the board of directors of Kindred Healthcare Inc., IASIS Healthcare Corp., Immucor Inc., and agilon health, inc. and previously served on the board of Par Pharmaceuticals Companies, Inc. Dr. Mansukani serves as Strategic Advisor to the board of directors of CIGNA and previously served as Vice Chairman of HealthSpring Inc. Dr. Mansukani also serves on the board of directors of the Children’s Hospital of Philadelphia and on the editorial boards of the American Journal of Medical Quality, Managed Care, Biotechnology Healthcare and American Health & Drug Benefits. Dr. Mansukani was appointed to Medicare’s Payment Advisory and Oversight Committee, and he was previously Senior Advisor to Centers for Medicare and Medicaid Services and a member of the Medicare Reform Executive Committee. Dr. Mansukani previously served on the faculty at the University of Pennsylvania and at Temple University School of Medicine. Dr. Mansukani completed his residency and fellowship in ophthalmology at the University of Pennsylvania School of Medicine and a fellowship in quality management and managed care at the Wharton School of the University of Pennsylvania.

Jeffrey K. Rhodes was appointed to our Board of Directors on October 30, 2013 and the board of directors of SCA in 2010. Mr. Rhodes is a Partner of TPG, where he is a leader of the firm’s investment activities in the healthcare services and pharmaceutical/medical device sectors. Mr. Rhodes serves on the board of directors of Zimmer Biomet Holdings, Inc. and Immucor Inc. His previous board memberships include Par Pharmaceuticals Companies, Inc., EnvisionRx and IMS Health Holdings, Inc. Prior to joining TPG in 2005, Mr. Rhodes worked at McKinsey & Company and Article 27 LTD, a software company. Mr. Rhodes earned his M.B.A. from the Harvard Business School, where he was a Baker Scholar, and earned his undergraduate degree in Economics from Williams College, where he graduated summa cum laude.

Michael A. Sachs was elected to our Board of Directors and the board of directors of SCA effective September 1, 2015. Mr. Sachs is Chairman of TLSG, Inc., a firm which provides strategic assistance to early stage companies, a position he has held since September 2014. Previously, Mr. Sachs served as Chairman and Chief Executive Officer of Sg2, a healthcare analytics and consulting firm, from July 2000 until the company was sold to MedAssets in 2014. Prior to founding Sg2, Mr. Sachs served as Chairman and Chief Executive Officer of Sachs Group from 1984 to 2000, a company which provided healthcare planning and marketing services to hospitals and health plans, and founded bSwift, an online benefits administration firm that was acquired by Aetna. Previously, Mr. Sachs was a consultant with Ernst & Whinney and with AT Kearney. He previously served on the board of directors of Lillibridge Healthcare REIT.

4

Table of Contents

Lisa Skeete Tatum was elected to our Board of Directors and the board of directors of SCA effective October 1, 2014. Ms. Skeete Tatum is founder and CEO of Landit.com, a technology platform to increase the success and engagement of women in the workplace. Previously, Ms. Skeete Tatum was a General Partner for over a decade with Cardinal Partners, a $350 million early stage healthcare venture capital firm, where she focused on investments in healthcare technology. Ms. Skeete Tatum previously worked for Procter & Gamble in various global and functional roles including Product Development, Purchasing, and Product Supply. She also worked at GE Capital and was a Managing Director at Circle of Beauty, a health and beauty startup. In addition, she founded her own consumer products consulting practice. Ms. Skeete Tatum is a trustee emeritus and presidential councillor at Cornell University and serves on the boards of McCarter Theater, the Princeton Area Community Foundation and the Harvard Business School Board of Dean’s Advisors. She is a past president of the Harvard Business School Alumni Board and a former board member of Pager, the Kauffman Fellows Program’s Center for Venture Education and the Princeton HealthCare System Foundation. Ms. Skeete Tatum received her B.S. in chemical engineering from Cornell University and her M.B.A. from Harvard Business School. She is a member of the Kauffman Fellows Class 4, a 2012 Henry Crown Fellow of the Aspen Institute and a member of the Aspen Global Leadership Network.

There are no family relationships between or among any of our directors. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. Except as described below under “Related Person Transactions Entered into by the Company—Stockholders’ Agreement with the TPG Funds,” there is no arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she was or is to be selected as a director.

There are no legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Experience and Qualifications of the Directors

The Board of Directors considered information about the specific experience, qualifications, attributes or skills in concluding at the time of filing of this Amendment No. 1 that each person listed above should serve as a director. We believe that Mr. Hayek’s knowledge of the healthcare industry and his leadership experience make him a valuable asset to our management and the Board of Directors. We believe that Mr. Sisitsky’s financial expertise and experience leading investments in numerous healthcare companies make him a valuable asset to the Board. Mr. Geiser has extensive expertise and experience providing leadership in legal, legislative, regulatory and compliance affairs to both public and private companies in the healthcare industry, which we believe make him a valuable asset to the Board. We believe that Mr. Goulet’s past leadership of large health plan organizations and his extensive industry knowledge make him a valuable asset to the Board. Mr. Hessler’s financial and accounting expertise and his substantial investment banking and advisory experience in the healthcare industry make him a valuable asset to the Board. Dr. Mansukani has substantial experience in the healthcare industry and has a deep understanding of the medical community and the dynamic regulatory and reimbursement environment, which we believe make him a valuable asset to the Board. We believe that Mr. Rhodes’ financial expertise and experience overseeing investments in numerous healthcare companies make him a valuable asset to the Board. We believe that Mr. Sachs’experience in the healthcare industry, including in various leadership roles, makes him a valuable asset to the Board. We believe that Ms. Skeete Tatum’s leadership and general corporate experience make her a valuable asset to the Board.

Information about Executive Officers Who Are Not Also Directors

The following table sets forth certain information regarding our executive officers who are not also directors. As described in the Compensation Discussion and Analysis below, we have employment agreements with each of our executive officers.

| Name |

Age1 |

Position | ||

| Tom W. F. De Weerdt |

44 | Executive Vice President and Chief Financial Officer | ||

| Michael A. Rucker |

47 | Executive Vice President and Chief Operating Officer | ||

| Joseph T. Clark |

60 | Executive Vice President and Chief Development Officer | ||

| Richard L. Sharff, Jr. |

48 | Executive Vice President, General Counsel and Corporate Secretary |

| (1) | The ages of the executive officers are presented as of March 1, 2017. |

5

Table of Contents

Tom W. F. De Weerdt is our Executive Vice President and Chief Financial Officer and has served in such capacity since May 19, 2015. Previously, Mr. De Weerdt served as Vice President and Corporate Controller of Mead Johnson Nutrition Company, a publicly traded nutritional products company (“Mead Johnson”), a position he held since September 2012. Prior to joining Mead Johnson, Mr. De Weerdt held multiple leadership roles at Whirlpool Corporation, including Vice President, Finance and Chief Financial Officer for Europe, the Middle East and Africa (EMEA) beginning in September 2010, Vice President Finance, Global Production Organization beginning in October 2008, and various senior financial positions with Whirlpool Corporation and its European subsidiaries. Mr. De Weerdt holds a Masters in Commercial Engineering and Marketing from Katholieke Universiteit Leuven in Belgium, a Masters in Applied Information Technology from Vleckho Business School in Belgium, and a Masters of Business Administration from the University of Chicago.

Michael A. Rucker is our Executive Vice President and Chief Operating Officer and has served in such capacity since 2009. Prior to joining the Company, Mr. Rucker served in a number of capacities at DaVita and its predecessor companies from 1995 to 2008, including most recently as Divisional Vice President of Operations. Mr. Rucker also served as an Associate in the healthcare group of Houlihan, Lokey, Howard & Zukin Inc. and worked in public accounting as a CPA. Mr. Rucker earned his M.B.A. from the Wharton School of the University of Pennsylvania and his bachelor’s degree from Miami University.

Joseph T. Clark is our Executive Vice President and Chief Development Officer and has served in such capacity since 2007. Prior to joining the Company, Mr. Clark served as President of the Surgery Division of HealthSouth Corporation from 2005 to 2007. Mr. Clark also served as the President and Chief Executive Officer of HealthMark Partners, Inc., an owner, operator and developer of ambulatory surgery centers (“ASCs”) and specialty hospitals and in various senior management roles, including Chief Executive Officer of Response Oncology, Inc., a provider of cancer treatment services. Prior to this, he had senior operating roles at AMI and Humana. He earned a bachelor’s degree from Dartmouth College.

Richard L. Sharff, Jr. is our Executive Vice President, General Counsel and Corporate Secretary and has served in such capacity since 2007. Prior to joining the Company, Mr. Sharff practiced law from 1994 to 2007 at Bradley Arant Rose and White LLP (now Bradley Arant Boult Cummings LLP), where he represented a variety of clients in the healthcare industry. Mr. Sharff earned his B.A. and J.D. from the University of Virginia. He is a member of the bars in Alabama and California (inactive status).

There are no family relationships between or among any of our executive officers. There is no arrangement or understanding between any of our executive officers and any other person or persons pursuant to which he was or is to be selected as an executive officer.

There are no legal proceedings to which any of our executive officers is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and officers, and persons who own more than 10% of our common stock, to file with the SEC reports of ownership and changes in ownership of Company common stock held by them. Copies of these reports must also be provided to the Company. Based on our review of these reports, we believe that, during the year ended December 31, 2016, all reports required to be filed during such year were filed on a timely basis.

6

Table of Contents

Audit Committee

The Board of Directors has a separately-designated standing Audit Committee, the functions of which include, among other things:

| • | appointing the independent auditor, reviewing the quality of its work annually, monitoring its independence and replacing it as necessary, pre-approving all the audit and non-audit services, reviewing with the auditor the scope and plan of the annual audit, and reviewing with the auditor any review of the quarterly financial statements that the committee may direct the auditor to perform; |

| • | reviewing with the senior internal audit services executive the results of the audit work at least annually and more frequently as provided in the policy for reporting financial accounting and auditing concerns, as approved by the committee, and at least annually reviewing the experience and qualifications of the senior members of the internal audit services team; |

| • | discussing with management and the auditor the annual audited financial statements, the financial information to be included in our annual and quarterly reports to be filed with the SEC and the adequacy of the internal controls over financial reporting; |

| • | discussing with management and the auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles and any significant issues (material weaknesses or significant deficiencies as such terms are defined in the Sarbanes-Oxley Act) as to the adequacy of our accounting controls; |

| • | reviewing the adequacy of disclosure controls and procedures with the CEO, the Chief Financial Officer and the General Counsel at least quarterly; |

| • | overseeing company policies and practices with respect to financial risk assessment and risk management, including ensuring that the Company has an appropriate information risk management program; |

| • | reviewing related party transactions; |

| • | approving guidelines for the hiring of former employees of the independent auditor; |

| • | establishing and publishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by teammates of concerns regarding questionable accounting or auditing matters, referred to as “whistleblowing” procedures; |

| • | reviewing with management, including the General Counsel, the implementation and effectiveness of the compliance and ethics program, including the “whistleblowing” procedures; |

| • | reviewing and approving our use of derivatives and swaps as part of a strategy to hedge or mitigate commercial risks to our business and reviewing and discussing with management, at least annually, our current hedging strategy in order to evaluate the effectiveness of that strategy and determine whether any changes should be made; |

| • | meeting separately and periodically with management and the auditor; and |

| • | regularly reporting its activities to the Board of Directors. |

The current members of the Audit Committee are Frederick A. Hessler (Chairman), Kenneth R. Goulet, who was appointed to the Committee effective June 1, 2016, and Lisa Skeete Tatum. Our Board of Directors has determined that (i) Mr. Goulet, Mr. Hessler and Ms. Skeete Tatum are each “independent directors” under the listing rules of The NASDAQ Stock Market LLC (“Nasdaq”), (ii) Mr. Goulet, Mr. Hessler and Ms. Skeete Tatum each satisfy the heightened independence requirements of Rule 10A-3 under the Exchange Act, (iii) each of Mr. Goulet, Mr. Hessler and Ms. Skeete Tatum is financially literate and (iv) Mr. Hessler qualifies as an “audit committee financial expert” under the criteria set forth in the rules and regulations of the SEC.

7

Table of Contents

| Item 11. | Executive Compensation |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis (the “CD&A”) provides information regarding our executive compensation program, including the compensation of the teammates who constitute our Named Executive Officers (“NEOs”), as identified in the Summary Compensation Table on page 28 of this Amendment No. 1.

Executive Summary

Since the purchase of our Company in 2007 by TPG and certain other investors, our senior leadership team has focused on building our team and capabilities to position the Company as a leading partner to physicians, health plans and health systems to transform the delivery of outpatient surgical care in markets across the country. We have experienced significant growth in our partnerships, resulting in strong performance in our key operational and financial metrics, including: (1) our patient Net Promoter Score, which is a measure of loyalty based on asking patients whether they would recommend our facilities to a friend or family member, (2) our physician Net Promoter Score, which is a measure of loyalty based on asking physicians whether they would recommend performing cases at our facilities to a physician colleague, and (3) the number of physicians performing procedures in our affiliated facilities, which was over 7,700 in 2016.

Our strategy has also driven strong financial performance. Because our business model is based on creating partnerships with strategic entities in the markets we serve, our operations are accounted for through a combination of consolidation and equity method accounting. Therefore, in evaluating performance, we also review several internal supplemental operating measures that do not comply with generally accepted accounting principles in the United States (“GAAP”), such as Adjusted EBITDA-NCI (as defined below under “Elements of 2016 Executive Compensation—Annual Cash Bonuses”) and systemwide net operating revenues growth, which includes both consolidated and nonconsolidated facilities (without adjustment based on our percentage of ownership). These non-GAAP financial measures should not be considered substitutes for and are not comparable to our GAAP financial measures (see “Reconciliations of Non-GAAP Financial Measures to GAAP Results” below for a reconciliation of Adjusted EBITDA-NCI and systemwide net operating revenues to their most directly comparable GAAP financial measures). In evaluating performance, we review the following measures:

| • | Net income, which increased from $157.1 million in 2014 to $226.3 million in 2016, representing a 20.0% compounded annual growth rate (“CAGR”); |

| • | Adjusted EBITDA-NCI, which increased from $156.7 million in 2014 to $201.1 million in 2016, representing a 13.3% CAGR; |

| • | Consolidated net operating revenues, which increased from $864.7 million in 2014 to $1,281.4 million in 2016, representing a 21.7% CAGR; and |

| • | Systemwide net operating revenues, which increased at a 17.6% CAGR from 2014 to 2016. |

In the first quarter of 2016, we made significant changes to both the annual cash bonus program and the long-term incentive plan designs, which included eliminating the individual performance objectives from the annual cash bonus program and introducing multi-year performance-based equity awards into the long-term incentive plan. These changes were intended to bring our executive compensation program more in line with our “pay for performance” philosophy (as described below), which is accomplished by having a significant portion of each of our senior leaders’ pay tied to Company performance, and make the executive compensation program consistent with good corporate governance practices. For 2016, the NEOs received a significant portion of their targeted long-term incentive compensation in the form of performance share awards. This represents a departure from the Company’s past practice of issuing equity awards solely in the form of time-based restricted stock units (“RSUs”) and time-based stock options. For 2016, 50% of Mr. Hayek’s long-term equity incentive award was issued in performance shares and 50% was issued in time-based RSUs. The other NEOs were also granted a portion of their long-term equity incentive award in the form of performance shares. The performance shares are settled through the delivery of a number of shares of common stock equal to 0% to 120% of the number of performance shares granted, based upon the Company’s level of achievement of two performance targets during a three-year measurement period. The introduction of performance-based equity awards in 2016 further strengthens the alignment between the Company’s executive compensation program and stockholder interests.(1)

| (1) | On January 6, 2017, we announced that the Company entered into an Agreement and Plan of Reorganization with UnitedHealth Group Incorporated (“UnitedHealth”), pursuant to which UnitedHealth would commence an exchange offer to purchase all of the issued and outstanding shares of our common stock. As soon as practicable following the consummation of the exchange offer, a wholly-owned subsidiary of UnitedHealth would merge with and into the Company and then the Company would be merged with and into another wholly-owned subsidiary of UnitedHealth. The effect of the UnitedHealth transaction on the compensation of our NEOs is included in the Schedule 14D-9 filed by the Company with the SEC in connection with the transaction (as it has been amended from time to time, the “Schedule 14D-9”). |

8

Table of Contents

The following two tables highlight important aspects of our executive compensation program, many of which are discussed in more detail in this section.

| What We Do | ||

| Pay for Performance | We set a high percentage of our NEO compensation at-risk. | |

| Performance Thresholds and Caps | We set performance thresholds and caps for our incentive plans. | |

| Stock Ownership Guidelines | We maintain guidelines for significant stock ownership by our NEOs and non-employee directors. | |

| Peer Market Data | The Compensation Committee reviews peer group market data when making executive and director compensation decisions. | |

| Tally Sheets | The Compensation Committee reviews tally sheets when making executive compensation decisions. | |

| Recoupment Policy | We have a recoupment policy applicable to incentive compensation arrangements that is triggered by a restatement of financial statements as a result of material noncompliance with financial reporting requirements. | |

| Review of Dilution and Share Utilization Rates | We annually evaluate and monitor share utilization and equity dilution. | |

| Double-Trigger Change-in-Control Arrangements | Time-based equity awards do not vest solely on account of a change in control; these awards require a qualifying termination of employment following a change in control. | |

| Engagement of an Independent Compensation Advisor | Our Compensation Committee engages an independent compensation consultant to advise on executive compensation matters. | |

| What We Don’t Do | ||

| No Supplemental Executive Retirement Plans | We do not provide separate supplemental executive retirement plans to our NEOs. | |

| No Reloading or Re-Pricing of Stock Options | We do not grant stock option awards with reload features, and we do not re-price stock options. | |

| No Discounted Stock Options | We do not grant discounted stock options. | |

| No Hedging | We prohibit hedging or short sales of Company securities by our directors and officers. | |

| Anti-Pledging | We prohibit pledge arrangements. | |

| No Gross-Ups | We do not provide excise tax gross-ups to our NEOs upon a change in control. | |

| No Benefits Gross-Ups | We do not provide tax gross-ups on ongoing benefits. | |

| No Excessive Perquisites | We do not provide excessive perquisites. | |

9

Table of Contents

Who We Are

In order to better understand our compensation program, it is important for investors to understand our strategy, our business and the markets in which we compete. We are a leading provider of surgical solutions to physicians, health plans (payors) and health systems, providing high-quality, cost-effective surgical care across a network of 197 ASCs and seven surgical hospitals operating in 33 states as of December 31, 2016.

We create strategic partnerships with health plans, medical groups and health systems, and these partnerships vary based on the circumstances of each local market. This strategy requires that we recruit, develop and retain outstanding leaders who can assess each market, develop the appropriate strategy for each market, cultivate and execute the right strategic partnerships, and ultimately operate these partnerships, which are often complex.

In order to support this business model, we have developed a network of six operating groups that are generally organized geographically and are based in a network of five group offices (Birmingham, Alabama, Chicago, Illinois, Dallas, Texas, Pasadena, California and Stamford, Connecticut), and we have sought to recruit and develop strong operating and development teams within these operating groups in order to support our strategy.

Our six operating groups are supported by several departments, which provide strategic value across the groups and organization, including development, managed care, new business development, supply chain, revenue cycle, information technology, compliance, finance, accounting and human resources. The success of our strategy relies on recruiting, developing and retaining outstanding leaders in these areas, so that they can help us secure and execute strategic partnerships across the markets we serve.

Our success in building our brand as a leader and innovator in surgical solutions and growing our business in a capital-efficient manner over the past several years has been driven by the strength of the leadership team we have built and their ability to craft and implement complex strategic partnerships. Similarly, we believe our continued success as an organization is tied to our ability to maintain and grow our group and departmental leadership teams, who will continue to innovate how we partner with health plans, medical groups and health systems in new markets and new structures.

Examples of these innovative partnership structures include strategic partnerships with risk-bearing medical groups in which we help manage total surgical cost of care, strategic partnerships with health plans in which we help manage quality and total cost of care and create alignment mechanisms with surgeons around quality and cost, and strategic partnerships with health systems in which we manage surgical delivery.

Our People

Our senior leadership team plays an important role in our continued growth and success. Competition for senior management generally, and within the healthcare industry specifically, is intense, and our ability to attract, retain and motivate qualified senior leadership is core to our continued success. We could be adversely affected if we either lose members of our senior leadership team or are unable to recruit senior leaders with the required experience or expertise in sufficient numbers. Our compensation program is one of the key elements of our people strategy to help us attract, retain and motivate our leaders and teammates.

Our Total Compensation Philosophy

The goal of our compensation program is to retain and reward leaders for creating long-term value for our stockholders and successfully operating the Company by achieving our vision of becoming the partner of choice for surgical care by caring for our patients, serving our physicians and improving healthcare in America.

To this end, we have designed our compensation program to (i) reward our leaders for sustained clinical, operational and financial performance, as well as leadership excellence, (ii) align our leaders’ interests with those of our stockholders and (iii) encourage our high-performing teammates to remain with the Company. We compensate our leaders and teammates in a manner designed to achieve one or more of our performance, alignment and retention objectives.

Because our leaders are critical to our long-term success and competition for senior management is intense, we need to be competitive not only in our markets and the services we provide, but also in the quality of the leaders we attract. Accordingly, we seek to provide pay at levels that are competitive with other employers in the healthcare services industry and that allow us to compete effectively for talent, both within and outside of our industry.

10

Table of Contents

Our total compensation philosophy aligns pay and performance – achieving strong clinical, operational and financial results and positioning the Company for long-term success.

Our “pay for performance” philosophy is accomplished by having a significant portion of each of our senior leaders’ pay tied to Company performance. We set base salaries (fixed pay) at levels that are competitive in our marketplace. We provide annual cash and long-term equity incentives (variable pay) that are tied to performance outcomes and allow us to retain outstanding leaders in a competitive environment for executive talent. These variable pay elements make up a significant portion of total compensation and, if paid at all, are dependent on Company performance. We believe this structure motivates our leaders to strive for outstanding results, which we expect will translate into long-term value for our stockholders. This design is balanced by the risk of receiving below market median compensation when Company performance does not meet pre-established goals. We believe our program appropriately incentivizes strong performance over a sustained period of time, without encouraging leaders to take unnecessary or excessive risks that could have a material adverse effect on the Company.

Our Guiding Principles

Our total compensation philosophy and guiding principles provide overall direction on how we develop our compensation and benefits programs and deliver pay at SCA. Our guiding principles reflect the values and actions of the organization and provide a foundation for making pay-related decisions. Our philosophy is applied consistently and ensures that rewarding for performance is inherent in our compensation program. Our guiding principles work together, and no one principle is more important than any other. Our leadership uses its judgment in balancing among the principles to ensure our compensation and benefit programs are tailored and effective in supporting our objectives.

We believe that our compensation program should be fair and perceived as such, both internally and externally. Consistent with our focus on pay-for-performance, we do not use benefits as a strong differentiator in our rewards package and seek for our benefits program to be competitive at the median within the healthcare services marketplace. We generally do not provide perquisites or other personal benefits to our leaders. This approach is intended to minimize the non-performance-based components of the overall compensation program.

We have also structured our compensation program in a manner that is understandable to our leaders and stockholders and consistent with good corporate governance practices. We consider affordability of compensation within the Company’s business plans as a factor in determining pay levels and seek tax effective solutions when we can.

| SCA Guiding Principle |

Description | |

| Performance Orientation | Compensation is used to reward the achievement of our Company’s financial and operational results, and incentive-based compensation is tied to Company performance in an objective and predictable manner.

Tenure is not taken into account when determining total compensation. | |

| Annual Competitive Positioning Review |

Each year we review our compensation and benefits programs to ensure that they are aligned with our compensation philosophy and guiding principles. | |

| Fairness | We monitor both the external marketplace and internal parity/comparisons to ensure our compensation program is implemented in a consistent and equitable manner. | |

| Affordability | Compensation and benefits must be affordable to the Company and sustainable over the long term. We seek to ensure that the overall economic cost of compensation is reasonable while allowing the Company to continue to be competitive with other healthcare services providers.

Programs are delivered in a manner that is tax-effective to the Company and teammates, to the extent practicable. | |

| Compensation Process | We follow a thoughtful and deliberate process to review performance and take compensation actions (merit increases, incentive payments and equity grants) each year.

Compensation for our NEOs is approved by our Compensation Committee made up of independent members of our Board of Directors, and none of the NEOs are present when their compensation is being approved. | |

11

Table of Contents

| SCA Guiding Principle |

Description | |

| Delivery Efficiency | We provide leaders the platform and process to review the performance of their teammates efficiently and to recommend compensation actions based on our compensation philosophy and strategy while leveraging economies of scale and technology. | |

| Performance Metrics | Clearly defined performance metrics are developed for the compensation program that are aligned with our business objectives.

Metrics are designed and utilized to measure and continually improve outcomes for the Company and motivate executive officers to achieve superior financial and operational performance. | |

| Easy to Understand and Administer | We understand that our leaders’ perception of the value of our compensation is influenced by how well the programs are communicated and delivered.

We seek to provide compensation, benefit and other related programs that are easy to understand and administer. | |

| Security | Base salary is a fixed annual amount of compensation not subject to financial performance risk, and our benefits program provides teammates with insurance for medical care, death and disability that is competitive in the healthcare services marketplace. | |

| Governance | Our Compensation Committee has responsibility for developing, implementing and monitoring the executive compensation program and policies, as well as adherence to the Company’s compensation philosophy. The Compensation Committee sets the compensation for our NEOs. In administering the Company’s executive compensation program, the Compensation Committee is mindful of our unique structure, culture and history, as well as the growth strategy of our Company and business. | |

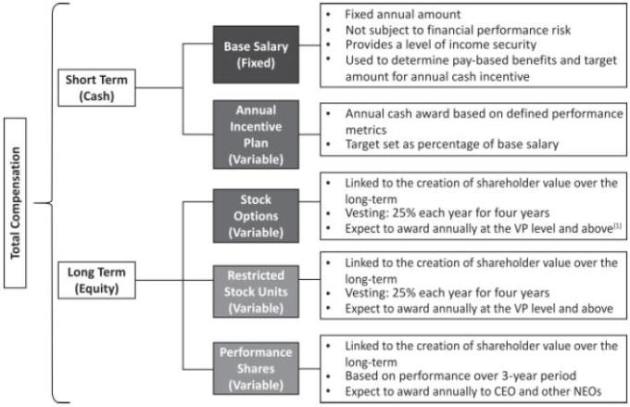

Components of Compensation

As described on the following pages, the elements of our total compensation program have been designed to enable us to recruit, motivate and retain leaders and teammates who have the collective and individual industry experience or specific expertise necessary to leverage our competitive strengths and operationalize our business strategy. The different compensation elements work together as integrated levers to achieve one or more of our performance, alignment and retention objectives.

12

Table of Contents

The total amount of compensation for each leader reflects his or her management experience and continued high performance. Target compensation is set at a level comparable to the 50th percentile of our peers for median performance. Key elements of our compensation program focus on motivating and challenging our leaders to achieve superior, long-term, sustained results, including:

| (1) | The CEO did not receive stock options in 2016 or 2017. |

Mix of Compensation Elements

Our “pay for performance” philosophy is reflected by the fact that more than half of the compensation of our NEOs is tied to the performance of the Company. The Compensation Committee sets base salaries (fixed pay) at levels that are competitive in our marketplace and annual cash bonuses and performance-based equity awards (variable pay) at levels that are competitive in our marketplace, tied to performance outcomes, and allow us to retain outstanding leaders in a competitive environment for executive talent. We believe this compensation structure provides incentives for our NEOs and key teammates to strive for outstanding results, which we expect will create long-term value for our stockholders. Our leaders also understand they will receive below market median compensation when Company performance does not meet pre-established performance goals. We believe our compensation program appropriately incentivizes strong performance, without encouraging NEOs and key teammates to take unnecessary or excessive risks. The designed mix between fixed and variable compensation, as percentages of target total direct compensation (as defined below under “Peer Group and Benchmarking”), for our NEOs in 2016 was as follows:

| Named Executive Officer |

Base Salary Percentage |

Target Annual Cash Bonus Percentage |

Long-Term Equity Incentive Percentage |

Fixed Compensation Percentage |

Variable Compensation Percentage | |||||

| Andrew P. Hayek |

13% | 16% | 71% | 13% | 87% | |||||

| Tom W. F. De Weerdt |

29% | 18% | 53% | 29% | 71% | |||||

| Michael A. Rucker |

23% | 17% | 60% | 23% | 77% | |||||

| Joseph T. Clark |

27% | 19% | 54% | 27% | 73% | |||||

| Richard L. Sharff, Jr. |

30% | 20% | 50% | 30% | 70% |

13

Table of Contents

Role of Compensation Committee and Process

Our Compensation Committee establishes our executive compensation program and reviews and makes recommendations to the full Board of Directors regarding the non-employee director compensation program. The Compensation Committee also administers our incentive plans and looks to the aggregate compensation package for each NEO to determine the individual elements of each such NEO’s pay. Our executive compensation policy, as established by our Compensation Committee, is designed to provide a base salary and incentive compensation that is competitive in the marketplace with other privately and publicly owned healthcare services companies. The Compensation Committee is responsible for determining whether, in its judgment, our executive compensation policies are reasonable and appropriate and whether our executive compensation program meets the stated objectives of those policies and effectively serves the best interests of the Company and our stockholders.

Our Compensation Committee annually reviews our goals and objectives related to the compensation of our NEOs. During that review, the Compensation Committee considers the balance between short-term compensation and long-term incentive compensation, evaluates the performance of our NEOs in light of pre-established goals and objectives, and sets the compensation levels of our NEOs based on that evaluation. In setting the compensation levels, the Compensation Committee reviews a “tally sheet” for each NEO that sets forth the values of all components of the NEO’s current compensation, including base salary, annual target cash bonus, annual equity incentive award, severance and benefits programs. This “tally sheet” analysis allows the Compensation Committee to view each NEO’s total compensation and assess how a potential change to one element of the compensation program would affect a NEO’s overall compensation.

Our Compensation Committee uses information provided by independent advisers and consultants to determine the appropriate compensation of our NEOs. Our Compensation Committee has the ultimate authority and responsibility to engage and terminate any outside adviser or consultant to assist in determining appropriate compensation levels for our NEOs.

Role of Executive Officers in Compensation Decisions

Company management, including our CEO, supports the Compensation Committee, attends portions of its meetings, makes recommendations to the Compensation Committee regarding base salaries, bonuses and equity compensation grants for certain executive officers and key teammates, and performs various day-to-day administrative functions on behalf of the Compensation Committee in connection with our cash and equity compensation programs and plans. Specifically, our CEO provides input for the Compensation Committee to assess the effectiveness of the existing compensation philosophy and program and makes specific recommendations regarding the potential base salaries, annual target cash bonuses and long-term equity incentives to be paid to the remainder of our NEOs and key teammates. Our CEO is not present during deliberations or voting by the Compensation Committee relating to his own compensation. The Compensation Committee has discretion to approve, disapprove or modify recommendations made by the CEO.

Role of Compensation Consultants

The Compensation Committee has engaged an independent compensation consultant, Deloitte Consulting LLP (“Deloitte”), to review, assess and provide input with respect to certain aspects of our compensation program for executive officers and non-employee directors. Deloitte was initially engaged in July 2013 by the Compensation Committee of the board of directors of SCA to assist with executive compensation matters in connection with the possibility of SCA transitioning to become a public company. In its role as compensation consultant, Deloitte has rendered services to the compensation committee of SCA and, since our initial public offering, to our Compensation Committee, including examining the overall pay mix for our executive officers, conducting a competitive assessment of our executive compensation program, and making recommendations and advising on compensation design and competitive market levels. Deloitte has also provided advice on structuring annual and long-term incentive arrangements for our executive officers. In addition, Deloitte has provided advice to the Compensation Committee on the compensation elements and competitive market levels for non-employee directors.

In addition to the compensation consulting services provided by Deloitte to the Compensation Committee, Deloitte affiliates have provided certain services to us and SCA, at the request of management, consisting of advice related to SCA’s service delivery model, which additional services have been approved by the Compensation Committee. Deloitte’s fees for executive and director compensation services in 2016 were $252,537. For the additional services performed by affiliates of Deloitte, as described above, the aggregate fees in 2016 were $347,549. The Compensation Committee believes that, given the nature and scope of these projects, these additional services did not raise a conflict of interest and did not impair

14

Table of Contents

Deloitte’s ability to provide independent advice to the Compensation Committee concerning executive and director compensation matters. In making this determination, the Compensation Committee has considered, among other things, the following factors: (i) the types of non-compensation services provided by the affiliates of Deloitte, (ii) the amount of fees for such non-compensation services, noting in particular that such fees are negligible when considered in the context of the aggregate total revenues of Deloitte and its affiliates for the period, (iii) Deloitte’s policies and procedures concerning conflicts of interest, (iv) the fact that Deloitte representatives who advise the Compensation Committee do not provide any non-compensation related services to us or SCA, (v) the fact that there are no other business or personal relationships between our management or members of the Compensation Committee, on the one hand, and any Deloitte representatives who provide compensation services to us, on the other hand, and (vi) the fact that neither Deloitte nor any of the Deloitte representatives who provide compensation services to the Compensation Committee own any of our common stock.

Peer Group and Benchmarking

In June 2016, at the request of the Compensation Committee, Deloitte performed a review and provided a report on the competitiveness of the annual and long-term incentive practices for the NEOs by comparing their compensation with the compensation of executive officers holding comparable positions at other publicly owned healthcare services companies that are reflective of the companies we compete with for talent and customers. For each NEO, Deloitte compared the NEO’s base salary, target total cash compensation (the sum of base salary and target bonus), actual total cash compensation (the sum of base salary and actual bonus), long-term incentive opportunity, target total direct compensation (the sum of target total cash compensation and long-term incentive opportunity) and actual total direct compensation (the sum of actual total cash compensation and long-term incentives) to the compensation in fiscal 2015 of executive officers with comparable positions among the peer group companies for an individual position analysis. Deloitte also performed an aggregate pay analysis of the top five most highly paid executive officers at the Company compared to companies in the peer group based on target and actual total direct compensation paid in the fiscal year ended December 31, 2015. For Messrs. Rucker and Clark, Deloitte conducted a “rank” analysis in addition to the position analysis, comparing each of them to the second and third, respectively, highest paid officers at companies in the peer group, due to limited data points for the chief operating officer and chief development officer position analysis.

Deloitte’s analysis was based on twelve publicly traded companies for which the median trailing twelve months revenue (as of June 2016) was approximately $2.7 billion. While the Company’s consolidated net operating revenues for the same time period was approximately $1.1 billion, systemwide net operating revenues for the same time period was approximately $1.8 billion, and these companies are reflective of the types of companies with which we compete for the talent required to help us achieve our long-term financial and strategic objectives. As the Company continues to grow in both size and complexity, it will need to recruit and retain top-level executive officers and key teammates against companies that are currently larger than us and spend more on executive compensation. The Compensation Committee has determined that it is appropriate to consider the compensation levels of these larger companies that we believe more closely match the complexity of the Company’s business, as the Company will need to provide competitive compensation in order to recruit and retain executive officers and key teammates in the future. The Compensation Committee and management also believe that the Company’s systemwide net operating revenues is the appropriate benchmarking metric because it is an important financial metric by which management and the Board measure the Company’s performance and growth, including revenues from both consolidated and nonconsolidated facilities (without adjustment based on our percentage of ownership), and it is an important metric used by industry analysts. In order for the Company’s executive compensation program to align with the Company’s strategic objectives, we believe that the same financial metric (systemwide revenues) should be used when benchmarking the Company’s compensation program as when evaluating the Company’s financial performance.

The “peer group” companies reviewed and included in the report were as follows: Acadia Healthcare Company, Inc., AMN Healthcare Services, Inc., AmSurg Corp., Chemed Corp., HealthSouth Corporation, Kindred Healthcare Inc., LifePoint Health, Inc., Mednax, Inc., PharMerica Corporation, Select Medical Holdings Corporation, Team Health Holdings, Inc. and VCA Inc. The results of this report reflect the Company’s emphasis on, and conscious design of the executive compensation philosophy to deliver a large portion of pay through, long-term equity incentives.

The Compensation Committee uses the peer group market data to give context to the executive compensation program and provide the Compensation Committee with a frame of reference for its decision making. The Compensation Committee seeks to set target total direct compensation levels for the NEOs that are comparable to those set by companies in our peer group at the 50th percentile, but the Compensation Committee also considers, among other factors (typically not reflected in benchmarking data): the requirements of the applicable employment agreements, Company and individual performance during the year, projected role and responsibilities for the coming year and actual and potential impact on the

15

Table of Contents

successful execution of Company strategy, recommendations from our CEO and advice from our compensation consultant, the NEO’s prior compensation, experience and professional status, internal pay equity, and employment market conditions. We also take into consideration market trends and compensation practices within our peer group to determine how base salary and incentives are changing from year to year and how each component of compensation relates as a percentage of total compensation. The weighting of these and other relevant factors is determined on a case-by-case basis for each NEO upon consideration of the relevant facts and circumstances.

Consideration of Prior Stockholder Advisor Vote on Executive Compensation

We were first required to provide our stockholders with the opportunity to vote to approve, on an advisory basis, the compensation of our NEOs (often referred to as a “say-on-pay” vote) at the 2016 annual meeting of stockholders. Although the “say-on-pay” vote is advisory and non-binding, the Compensation Committee considers the outcome of the vote as part of its executive compensation planning process. At the 2016 annual meetings of stockholders, over 97% of the votes cast on the “say-on-pay” proposal were voted in favor of the compensation of our NEOs as disclosed in the proxy statement for such meeting. Our Compensation Committee considered this high level of stockholder support when determining the compensation for 2017, and decided not to make any significant changes to the structure of our compensation program. The Committee concluded that the Company’s compensation program should continue to emphasize the performance and retention objectives described herein.

Risk Management

The Compensation Committee has determined that our compensation policies, practices and programs work together to minimize the Company’s exposure to excessive risk while appropriately pursuing growth and profitability strategies that emphasize stockholder value creation. In reaching such determination, the Compensation Committee considered how the Company’s compensation policies may affect the Company’s risk profile and whether the compensation program may encourage undue risk-taking by teammates, including the NEOs. With respect to annual cash incentive awards and long-term equity incentive awards for our NEOs and key teammates, the amount of an individual’s award depends on overall Company performance and is subject to recoupment in the event the Company is required to prepare an accounting restatement of its financial statements due to material noncompliance with financial reporting requirements under the securities laws, which reduces the ability of and incentive for an individual to take undue risks at the expense of Company performance in an effort to increase the amount of his or her award. The Company’s performance goals are reviewed regularly by the Compensation Committee and are considered to be generally of the nature that promote steady growth and that would not encourage or reward excessive risk taking.

Elements of 2016 Executive Compensation

The compensation of our NEOs consists of base salaries, annual cash bonuses, equity awards and employee benefits, as described below. Our NEOs are also entitled to certain compensation and benefits upon qualifying terminations of employment pursuant to their employment agreements and the various award agreements under the Company’s 2013 Omnibus Long-Term Incentive Plan (as amended, the “2013 Omnibus Plan”) and the Company’s 2016 Omnibus Long-Term Incentive Plan (the “2016 Omnibus Plan”), as described below under “Benefits Upon Termination of Employment.”

Base Salaries. Base salaries for our NEOs are determined based on each NEO’s responsibilities and his experience and contributions to our business, and each NEO’s employment agreement provides for a minimum base salary. This fixed compensation provides a level of income security that is not subject to financial performance risk. Base salaries for our NEOs are reviewed annually by our Compensation Committee. When reviewing a base salary for potential increase, our Compensation Committee considers the performance of the Company and the NEO during the prior year, the NEO’s level of base salary and total cash compensation opportunities relative to other executive officers of the Company and executive officers in comparable positions at the Company’s peer group companies (as described above), recommendations of the CEO and the NEO’s skills and experience.

On March 2, 2016, the Compensation Committee approved an increase in Mr. Hayek’s base salary from $800,000 to $820,000, an increase of approximately 2.5%; an increase in Mr. De Weerdt’s base salary from $425,000 to $435,000, an increase of approximately 2.4%; an increase in Mr. Rucker’s base salary from $455,000 to $465,000, an increase of approximately 2.2%; an increase in Mr. Clark’s base salary from $480,000 to $490,000, an increase of approximately 2.1%; and an increase in Mr. Sharff’s base salary from $415,000 to $425,000, an increase of approximately 2.4%, with such increases becoming effective on March 20, 2016. In approving salary increases for these NEOs, the Compensation Committee took into consideration their extensive experience working in or for the healthcare services industry, as well as

16

Table of Contents

their deep knowledge of the Company’s industry and valuable contributions to the Company over the past year. The Compensation Committee also considered the compensation of executive officers holding comparable positions at our peer group companies and market trends related to various compensation components, as described above under “Peer Group and Benchmarking.”

Annual Cash Bonuses. Our NEOs are eligible to participate in our Senior Management Bonus Program, which was established to provide our executive officers and other key teammates with the opportunity to earn cash bonuses based upon the achievement of specific, pre-established and measurable corporate goals. We believe it is important to provide annual cash bonus opportunities to motivate our leaders to attain specific short-term quantitative and qualitative performance objectives that, in turn, further the Company’s achievement of our long-term performance objectives. Each of the NEOs was eligible to participate in the Senior Management Bonus Program for 2016. The target and maximum amounts of any annual bonus that could be earned by an individual, including our NEOs, were expressed as a percentage of the individual’s annual base salary in effect. For fiscal year 2016, Mr. Hayek had a target annual bonus of 120% of base salary, up to a maximum of 240% of base salary. Mr. De Weerdt had a target annual bonus of 65%, up to a maximum of 130% of base salary. Mr. Rucker had a target annual bonus of 77.5% of base salary, up to a maximum of 155% of base salary. Mr. Clark had a target annual bonus of 70% of base salary, up to a maximum of 140% of base salary. Mr. Sharff had a target annual bonus of 65% of base salary, up to a maximum of 130% of base salary. The cap on maximum payouts is one of the practices and procedures the Company uses to discourage unnecessary and excessive risk taking. We seek to offer cash awards in a large enough proportion to base salary to ensure that a significant portion of each NEO’s cash compensation is “at risk” and payable only upon the achievement of defined Company and individual objectives.

The Senior Management Bonus Program provided the NEOs with an opportunity to earn incentive compensation in 2016 based 70% upon the Company’s attainment of the target Adjusted EBITDA-NCI, 15% upon the Company’s achievement of the target Patient Satisfaction Net Promoter Score and 15% upon the Company’s performance of investments in new facilities for the trailing 24 months compared to the projected performance. “Adjusted EBTIDA-NCI” is defined as net income less net income attributable to noncontrolling interests before interest expense, provision (benefit) for income taxes, depreciation and amortization, net loss from discontinued operations, equity method amortization expense, gain on sale of investments, debt modification expense, loss on extinguishment of debt, asset impairments, loss (gain) on disposal of assets, stock compensation expense and other, which includes certain restructuring costs.

The Compensation Committee chose to utilize the Adjusted EBITDA-NCI financial metric, the Patient Satisfaction Net Promoter Score and the performance of investments in new facilities for the trailing 24 months compared to the projected performance metrics for the reasons set forth below:

| 2016 Senior Management Bonus Program Performance Metrics |

Reasons for Utilizing Such Metrics | |

| Adjusted EBITDA-NCI | • Effectively measures overall Company performance; | |

| • Can be considered an important substitute for cash flow; | ||

| • Key metric driving the valuation in the internal Company model, consistent with the valuation approach used by industry analysts; and | ||

| • Compensation Committee considers the components of Adjusted EBITDA-NCI to be primarily within the control of management. | ||

| Patient Satisfaction Net Promoter Score (“NPS”) |

• Aligned with the Company’s core purpose of improving the quality of our clinical outcomes and patient care; | |

| • High NPS demonstrates a strong loyalty to the Company’s brand; | ||

| • Customers who respond with a score of 9 or 10 are called “Promoters” and are likely to remain customers for longer and make positive referrals to other potential customers; and | ||

| • Common metric evaluated by healthcare providers. | ||

| Performance of Investments in New Facilities for the Trailing 24 Months Compared to the Projected Performance |

• Aligned with the Company’s business strategy; and

• Primary metric for management to track the performance of the Company’s completed investments. | |

After the end of the fiscal year, the Compensation Committee specifically reviews whether the performance criteria were satisfied and approves the payout of bonuses to the NEOs.

17

Table of Contents

For 2016, the Company’s Adjusted EBITDA-NCI performance target was fixed at the beginning of the performance period at $205.0 million. The 2016 threshold payout level was set at 90% of this target goal and the maximum payout level was set at 130% of this target goal. To the extent Adjusted EBITDA-NCI was between 90% and 130% of the target amount, the percentage of the bonus opportunity earned would be determined through straight-line interpolation, with a 10% additional payout for each percentage point above threshold performance and a 3.33% additional payout for each percentage point above target performance, with a maximum 200% payout at 130% of target.

With respect to the Patient Satisfaction NPS target for 2016, the target score was fixed at 90. The threshold payout level was set at approximately 92% of the target score and the NEOs would earn 100% of the payout if the Patient Satisfaction NPS met or exceeded the target score for 2016. To the extent Patient Satisfaction NPS was between 92% and 100% of the target score, the percentage of the bonus opportunity earned would be determined through straight-line interpolation, starting at a 50% payout for reaching the threshold payout level, with a 3.33% additional payout for each half point above the threshold level.

With respect to the performance of new investments for the trailing 24 months compared to the projected performance, the target was tied to the new investments achieving 100% of the projected performance. The threshold payout level was set at 75% of the target goal and the maximum payout level was set at 125% of the target goal. To the extent that the performance of new investments for the trailing 24 months was between 75% and 125% of the target performance level, the percentage of the bonus opportunity earned would be determined through straight-line interpolation, starting at a 50% payout for reaching the threshold payout level, with a maximum 200% payout at 125% of target.

Actual 2016 Results

In March 2017, upon review of the Company’s 2016 financial performance, the Compensation Committee determined that the Company’s Adjusted EBITDA-NCI for the fiscal year ended December 31, 2016 was $201.1 million, or slightly below the targeted performance level that had been set by the Compensation Committee, and which, using linear interpolation, resulted in a payout of 80% of the targeted bonus amount attributable to the Adjusted EBITDA-NCI financial goal. The Compensation Committee also determined that the Company’s Patient Satisfaction NPS for the fiscal year ended December 31, 2016 was 91, or slightly above the target score, and which resulted in a payout of 100% of the targeted bonus amount attributable to the Patient Satisfaction NPS goal. Finally, the Compensation Committee also determined that the Company’s new investments achieved 96.9% of the projected performance for the trailing 24 months, or 96.9% of the target goal, and which, using linear interpolation, resulted in a payout of 92% of the targeted bonus amount attributable to this performance objective.

The following table provides the computation of the cash bonus amounts paid to the NEOs for 2016 performance (figures rounded to the nearest dollar and totals may not sum due to rounding):

| Named Executive Officer |

Bonus Attributable to Adjusted EBITDA-NCI(1) |

Bonus Attributable to Patient Satisfaction NPS(2) |

Bonus Attributable to Performance of Investments(3) |

Total 2016 Bonus Earned |

||||||||||||

| Andrew P. Hayek |

$ | 584,105 | $ | 125,165 | $ | 125,165 | $ | 834,432 | ||||||||

| Tom W. F. De Weerdt |

$ | 167,840 | $ | 35,966 | $ | 35,966 | $ | 239,772 | ||||||||

| Michael A. Rucker |

$ | 213,919 | $ | 45,840 | $ | 45,840 | $ | 305,598 | ||||||||

| Joseph T. Clark |

$ | 203,605 | $ | 43,630 | $ | 43,630 | $ | 290,864 | ||||||||

| Richard L. Sharff, Jr. |

$ | 163,982 | $ | 35,139 | $ | 35,139 | $ | 234,260 | ||||||||

| (1) | Represents a payout of 80% of the targeted bonus amount attributed to the Adjusted EBITDA-NCI financial goal. |

| (2) | Represents a payout of 100% of the targeted bonus amount attributed to the Patient Satisfaction NPS goal. |

| (3) | Represents a payout of 92% of the targeted bonus amount attributed to the performance of new investments for the trailing 24 months compared to the projected performance. |