Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - CardConnect Corp. | exhibit311-certofpeo123120.htm |

| EX-21 - EXHIBIT 21 - CardConnect Corp. | exhibit21-sublistofcardcon.htm |

| EX-32.2 - EXHIBIT 32.2 - CardConnect Corp. | exhibit322-pfocertificatio.htm |

| EX-32.1 - EXHIBIT 32.1 - CardConnect Corp. | exhibit321-peocertificatio.htm |

| EX-31.2 - EXHIBIT 31.2 - CardConnect Corp. | exhibit312-certofpfo123120.htm |

| EX-23 - EXHIBIT 23 - CardConnect Corp. | exhibit23-consentofmarcuml.htm |

| EX-3.2(B) - EXHIBIT 3.2(B) - CardConnect Corp. | exhibit32b-amendmentno1tob.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36846

CARDCONNECT CORP.

(Exact name of registrant as specified in its charter)

Delaware | 46-5380892 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

1000 Continental Drive, Suite 300 King of Prussia, PA | 19406 | |

(Address of principal executive offices) | (Zip Code) | |

(484) 581-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.001 per share | NASDAQ Capital Market | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2016, the aggregate market value of the registrant’s voting stock held by non-affiliates was approximately $63.5 million based on the number of shares held by non-affiliates as of June 30, 2016, and the last reported sale price of the registrant’s common stock on June 30, 2016.

As of February 28, 2017, there were 29,136,783 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Certain portions of the registrant’s definitive proxy statement to be provided to its shareholders in connection with

its May 23, 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) of CardConnect Corp. (the “Company”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. These forward-looking statements include, but are not limited to, statements regarding the Company’s or management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “will,” “approximately,” “shall” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Report may include, for example, statements about the benefits of the Merger (as defined herein) and the future financial performance of the Company.

The forward-looking statements contained in this Report are based on current expectations and beliefs concerning future developments and their potential effects on the Company. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the Company’s or management’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to:

• | the Company’s future financial performance; | |

• | changes in the market for the Company’s products and our ability to adapt to changes in the electronic payments industry; | |

• | the possibility that the Company may be adversely affected by other economic, business and/or competitive factors; | |

• | our ability to integrate our acquisitions; | |

• | the ability to recognize the anticipated benefits of the Merger, which may be affected by, among other things, competition, and the ability of the Company to grow and manage growth profitably; | |

• | changes in applicable laws or regulations; | |

• | the ability to maintain the listing of the Company’s common stock on NASDAQ; and | |

• | other risks and uncertainties, including those described under the heading “Risk Factors.” | |

A more complete discussion of these factors and other risks applicable to our business is contained in “Item 1A. Risk Factors” included elsewhere in this Annual Report. All forward looking statements apply only as of the date of this annual report or as of the date they were made. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PART I

Item 1. BUSINESS

Company Overview

History

CardConnect Corp. (f/k/a FinTech Acquisition Corp.) (“CardConnect” or the “Company”) is a holding company that does not have any operations or material assets other than the direct ownership of CardConnect, LLC. Prior to January 14, 2015, CardConnect, LLC’s legal name was Financial Transaction Services, LLC, which had been doing business as CardConnect since April 2013.

1

The Company was originally incorporated in Delaware in November 2013 as a special purpose acquisition company, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more businesses or assets. On July 29, 2016 (the “Closing Date”), the Company consummated its business combination with FTS Holding Corporation (“FTS”) pursuant to the agreement and plan of merger dated as of March 7, 2016, as amended, by and among the Company, FinTech Merger Sub, Inc., a wholly-owned subsidiary of the Company (“Merger Sub”) and FTS (the “Merger Agreement”). Under the Merger Agreement, FTS merged with and into Merger Sub (the “Merger”), with Merger Sub surviving the Merger. In connection with the closing of the Merger, the Company changed its name from FinTech Acquisition Corp. to CardConnect Corp. and FinTech Merger Sub, Inc. changed its name to FTS Holding Corporation. Unless the context otherwise requires, the “we”, “us” and the “Company” refers to the combined company and its consolidated subsidiaries following the Merger, “FinTech” refers to the company prior to the closing of the Merger and “FTS” refers to FTS Holding Corporation prior to the Merger. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations -Merger” for further discussion of the Merger.

The following description of our business describes the business historically operated by FTS and its consolidated subsidiaries under the “CardConnect” name as an independent enterprise prior to the Merger and as subsidiaries of CardConnect Corp. (f/k/a FinTech Acquisition Corp.) after the Merger.

Introduction

We are a provider of payment processing solutions to merchants throughout the United States. Our secure, proprietary platform allows us to provide payment solutions, superior customer support and first-rate tools for our distribution partners and merchants. Our solutions and services enable distribution partners to effectively manage their business and for merchants to securely accept electronic payments.

We sell our solutions through distribution partners which consist primarily of independent sales organizations, our direct sales staff and integrated software vendors. We have built our diverse network of over 1,000 distribution partners by offering industry leading tools and exceptional partner support since FTS was founded in 2006. Our distribution partners serve as a consistent and predictable source of merchant accounts. We believe this offering has created loyal distribution partners and increased partner retention. Our distribution channels are comprised of:

• | Independent Sales Organizations. We support independent sales organizations and sales agents, which operate in a self-sufficient manner utilizing our products and sales automation tools to secure merchant relationships; |

• | Direct Sales Staff. Our direct sales staff is segmented and either targets small and medium business ("SMB") merchants or Enterprise customers; and |

• | Integrated Software Vendors. Our integrated software vendors are software companies that partner with us to provide payment services to their customer base. |

We combine our secure platform, solutions and distribution strategy to provide Merchant Acquiring services and Enterprise services to small and mid-sized merchants and larger businesses. We served over 67,000 SMB merchants and processed over $22 billion in bankcard transaction volume in 2016. We generate revenues from the fees charged to merchants for card-based processing services and other services. We also generate revenues by selling our technology solutions. Our revenues are recurring in nature because they are generated from our merchants’ sales and merchants are under multi-year contracts and/or because of our integration with customers’ necessary ERP systems (as defined below). Our efficient distribution strategy and proprietary platform drive scale and allow us to generate strong profit margins. Our revenue for the years ended December 31, 2016, 2015 and 2014 was $589.3 million, $458.6 million and $390.0 million, respectively, representing a 22.9% compound annual growth rate over the period.

Merchant Acquiring Services

Our primary business is to provide Merchant Acquiring services throughout the United States. Merchant Acquiring services involves providing end-to-end electronic payment processing services to merchants by facilitating the exchange of information and funds between them and cardholders’ financial institutions. To accomplish this, we undertake, or facilitate through third parties, merchant set-up and training, transaction authorization, settlement, merchant funding, merchant assistance and support, and risk management. Our card-accepting customers are primarily SMB merchants.

SMB merchants often lack the resources and sophistication to address the complex payments landscape. As a result, merchants often rely on independent sales organizations or software vendors to provide payments solutions. For merchants

2

utilizing software providers for important business services, we provide an integrated solution that utilizes our proprietary gateway, which encrypts sensitive payment information. In addition, our platform provides merchants multiple benefits, including account management, a single source for payment processing data and reporting, transaction management, alerts, e-statements, and a marketplace for add-on functionality, all of which is accessible via our native iOS and Android app. These capabilities allow us to provide an enhanced experience for our merchants.

Our partner focused distribution strategy allows us to efficiently access the large pool of SMB merchants in the United States. In 2016, we served over 67,000 SMB merchants across many industries that are well dispersed across the country. Our merchant base lacks concentration, with no single merchant accounting for more than 1.0% of our revenue during 2016. For the years ended December 31, 2016, 2015 and 2014, revenue includes $582.2 million, $453.3 million and $387.3 million, respectively, of revenue related to Merchant Acquiring services, including Merchant Acquiring service fees paid by our Enterprise customers.

Enterprise Services

We also provide services to Enterprise customers that primarily utilize sophisticated Enterprise Resource Planning (“ERP”) systems to manage their businesses. These services are primarily ERP integration services utilizing our secure hosted payment gateway, and also include secure, point-to-point encryption (“P2PE”) payment terminals and acceptance devices. We also provide Merchant Acquiring services to certain of our Enterprise customers.

Our hosted payment gateway is enabled through the robust ERP middleware that we have developed internally. This solution benefits Enterprise customers in several different capacities including:

• | Addressing ERP payment needs. Our solution supports a variety of payment card streams and addresses ERP payment needs in several payment function areas, including authorizations, reversals and/or split deliveries, settlement, automated reconciliation and security; |

• | Cost reduction. Our solution removes ERP systems from Payment Card Industry (“PCI”) scope, considerably reducing operational and third-party expenses while protecting cardholder data; and |

• | Information integration and security. Our solution integrates information flow between the ERP system and various points of customer interaction and ensures encryption for sensitive payment data travelling externally. |

Enterprise customers are often concerned about securing sensitive cardholder data and faced with the potential risks associated with a data breach. Our proprietary tokenization and encryption technology offering mitigates these risks by encrypting sensitive card data for both card-present and card-not-present transactions. Our tokenization technology and off-site vault keeps our Enterprise customers’ information private and out of their ERP systems. The tokens are “smart” and will comply with data integrity checks performed by various ERP systems, while encrypted card numbers are stored in a 100% PCI compliant environment. We believe that our solutions have become increasingly important as data breaches have become more prevalent and visible in the marketplace.

We believe we are an industry leader in card-present P2PE systems. Our solution for securing card-present transactions includes secure, P2PE payment terminals and acceptance devices. P2PE provides for the encryption of sensitive card data upon swipe or card data input. This data is instantly encrypted, which secures cardholder data at the point of entry.

Our secure hosted payment gateway and P2PE offering create a compelling value proposition that enables us to sell into the Enterprise market. We sell our Enterprise services primarily through a division of our direct sales staff focused exclusively on our Enterprise customers. Revenues from our Enterprise services are largely driven by recurring fees charged for ERP integration and hosting services and recurring P2PE device fees. For the years ended December 31, 2016, 2015 and 2014, revenue includes $5.1 million, $3.6 million and $2.4 million, respectively, of revenue related to Enterprise services, excluding Merchant Acquiring service fees paid by our Enterprise customers.

Acquisitions

Acquisitions are part of our growth strategy. On October 31, 2015, we purchased certain assets and assumed certain liabilities of Vanco Payment Solutions, Inc. (“Vanco”), a provider of card-based payment processing services.

For more information regarding our acquisitions, see Note 3 to our annual consolidated financial statements included elsewhere in this Report.

3

Business Structure

Our Merchant Acquiring revenue is recurring in nature, as we typically enter into multi-year service contracts with our merchants. Our Merchant Acquiring revenue is generated primarily from payment processing fees, which is comprised of a fee equal to a percentage of the dollar amount of each transaction we process, which we refer to as a Merchant Acquiring service fee. We make mandatory payments of interchange fees to the card issuer through the card networks and dues, assessments and other network fees to Visa, MasterCard, American Express and Discover. Our Merchant Acquiring revenue is largely driven by the Visa and MasterCard volume processed by our merchants. We also realize card processing revenues from processing transactions for our merchants accepting American Express and from processing Discover transactions.

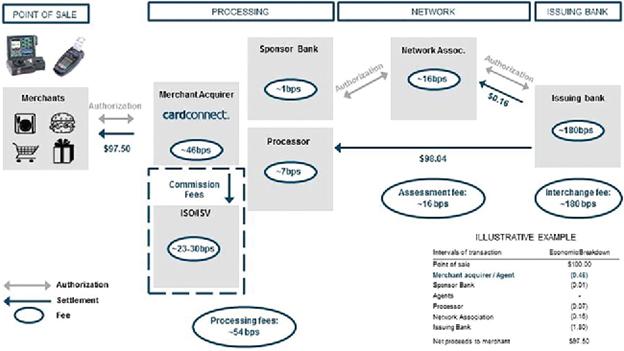

Providing Merchant Acquiring services requires us to closely coordinate with a number of industry participants that provide the services and infrastructure necessary to allow merchants to access and use the card payments ecosystem. These participants consist of merchant acquirers, third-party processors, sponsor banks, payment card networks (card associations), and issuing banks. Within this ecosystem, we serve as a merchant acquirer, acting as the touch point for the merchant to the payments ecosystem. The definitions and diagram below outline this payment ecosystem and the economics for a typical payment processing transaction for a $100 retail transaction.

• | Merchant—accepts payment from the cardholder. |

• | Merchant Acquirer—provides payment processing services to the merchant, enabling the merchant to accept payments from cardholders. Merchant acquirers own the merchant relationships. To provide these services, merchant acquirers undertake, or facilitate with third parties, merchant set-up and training, transaction authorization, settlement, merchant funding, merchant assistance and support and risk management. |

• | Third-Party Processors—provide authorization and settlement services that facilitate the flow of payment information through the card networks to the issuing bank. We utilize two third-party processors with agreements in effect through November 2020 and December 2021, which automatically renew for consecutive two-year terms. |

• | Sponsor Bank—provides settlement and funding services that enable merchant acquirers to settle funds between cardholders and merchants. We utilize two sponsor banks with agreements in effect through October 2020 and December 2021, which automatically renew for consecutive two-year terms. Our sponsorship agreements with the sponsor banks require, among other things, that we abide by the bylaws and regulations of the card networks. |

• | Card Networks—providers of the infrastructure for card payment information to flow between the sponsor bank and the issuing bank. Card networks establish rules and regulations for participants in the payments ecosystem, including merchant acquirers and issuing banks. We are contractually obligated to abide by the card networks’ rules and regulations under our contractual agreements with sponsor banks. |

• | Issuing Banks—financial institutions that issue the cardholder’s payment card and which are required to complete the card transaction in accordance with the terms of the cardholder agreement. |

4

Our Merchant Base

Our merchants vary in size and span various industries. We focus on merchants that we believe present relatively low risk, as their consumers are generally present and the products or services are generally delivered at the time the transaction is processed.

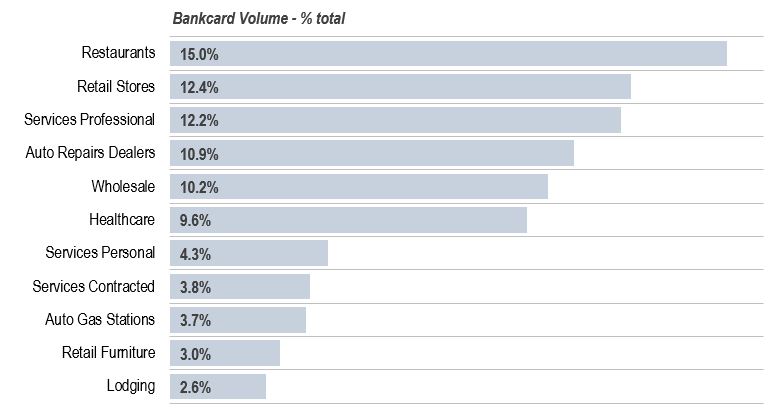

The following table summarizes bankcard volume by industry for the year ended December 31, 2016.

The number of our active SMB merchants located across the United States was 51,825, 48,400 and 38,059 as of December 31, 2016, 2015 and 2014, respectively. An active SMB merchant is a merchant that has processed transactions in the relevant period. We grow the number of active SMB merchants through various distribution channels, which include our partnerships with independent sales organizations, integrated software vendors and direct sales efforts. We also grow the number of active SMB merchants through acquisitions of complementary businesses.

Merchant attrition is expected in the Merchant Acquiring industry in the ordinary course of business. We experience attrition in bankcard volume as a result of several factors, including business closures, transfers of merchants’ accounts to our competitors and account closures that we initiate due to heightened credit risks.

No single merchant accounted for more than 1.0% of our revenue during 2016, and our top 25 merchants represented 4.1% of our revenue during 2016. In 2016, approximately 86% of our revenue came from merchants we added in 2015 and earlier.

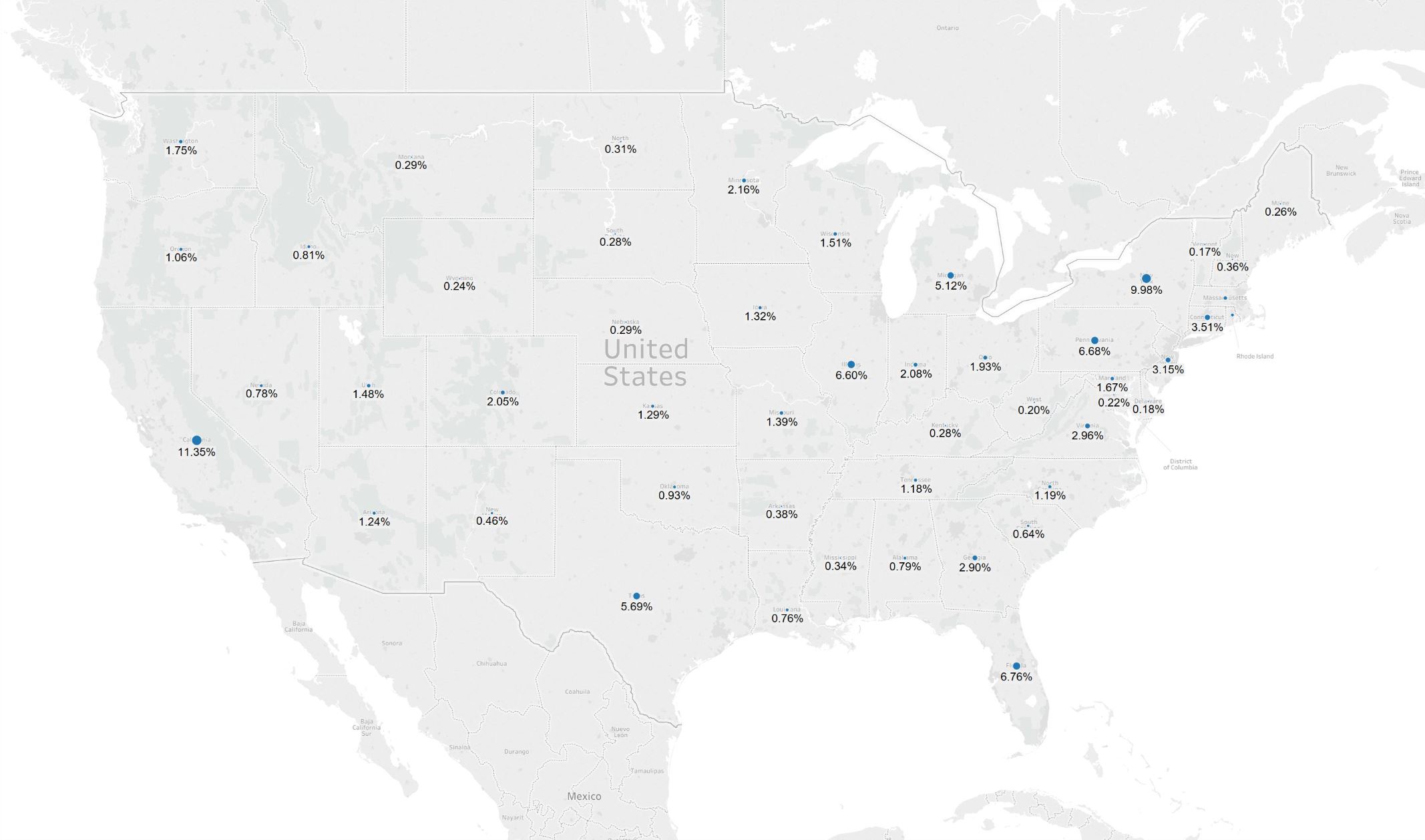

For the year ended December 31, 2016, merchants located in the following states represented the largest percentages of our bankcard processing volume: California represented 11%, New York represented 10%, Florida represented 7%, Pennsylvania represented 7%, Illinois represented 7%, Texas represented 6% and Michigan represented 5%. No other state represented more than 5% of our total bankcard processing volume. Our geographic concentration tends to reflect the states with the highest economic activity, as well as certain states where we have stronger distribution partners. This industry and geographic diversification makes us less sensitive to changing economic conditions in any particular industry or region. We believe that the loss of any single merchant would not have a material adverse effect on our financial condition or results of operations.

The following graphic summarizes our bankcard volume by state for the year ended December 31, 2016.

5

Our Solutions

We provide a comprehensive set of products and services to our merchants and distribution partners. Our offerings are designed to support the payment needs of any potential merchant. We have a flexible and open platform where our products and capabilities are simple to mix, match and, most importantly, integrate into the merchant’s current environment.

Payments Solutions for Distribution Partners

6

CoPilot | Distribution Partner Management | ● | Residual/commission reporting | ||

● | Communication—account alerts, marketing and industry updates | ||||

● | Portfolio management | ||||

● | Sub-agent performance reporting | ||||

Merchant Enrollment | ● | Lead management | |||

● | Digital Merchant Application | ||||

● | Online E-Signature | ||||

● | Automated underwriting & approval process | ||||

● | Application status tracking | ||||

Product Enrollment | ● | Easy enrollment for CardConnect product suite | |||

● | Self Service and Activation | ||||

Customer Support | ● | Account reconciliation | |||

● | Statement review | ||||

● | Online ticketing management | ||||

● | Customer retention | ||||

● | Collections/ACH reject recovery | ||||

● | Risk monitoring | ||||

Commission Processing | ● | In depth reporting with summary and line item detail | |||

● | Provide agents flexible commission system for sub-agents calculation & payment | ||||

● | Multiple agents with unique pricing schedules per account | ||||

Data Management | ● | Processor residual reconciliation | |||

● | Exception reporting | ||||

● | Multi-source data aggregation and standardization | ||||

● | Flexible user driven data mapping | ||||

7

Payments Solutions for Merchants and Enterprise Customers

CardPointe | ● | Allows merchants to manage their account and view all payment processing data in one place with robust reporting and account alerts | |

● | A self-service marketplace provides access to add-on products and features, including: Virtual Terminal, CardPointe Terminal, CardPointe Mobile App, Recurring Billing, ACH/eCheck and out-of-box integrations | ||

● | PCI Compliance Management via integration with Trustwave | ||

● | Accessible via a browser or using a native iOS/Android app | ||

SMB Gateway & Application | ● | Developer-friendly API facilitating integration | |

Programming Interface (“API”) | ● | Library of gateway features, including account updater, PIN-less debit, and 3-D Secure | |

● | API includes use of all proprietary payment security processes, including P2PE for card-present and tokenization for card-not-present transactions | ||

● | Gateway usage provides merchants with real-time, full transaction lifecycle reporting in CardPointe | ||

CardSecure | ● | Patented tokenization and PCI validated P2PE application provide payment security for card-present and card-not-present environments | |

● | Delivers instant PCI compliance to merchants who integrate CardSecure into all sales channels | ||

ERP Middleware | ● | Integrates information flow between ERP system, various points of sale/customer interaction, and processor/banking system | |

● | Ensures encryption for sensitive payment data travelling externally | ||

● | Tokenizes all payment related data within merchant network/systems | ||

● | Automates the reconciliation of card-to-receipts | ||

Our Technology

Our technology consists of a secure payments platform for SMB and Enterprise solutions. A powerful, feature-rich payment gateway and patented payment security technology – tokenization and P2PE – establish the foundation of our platform. We offer a comprehensive online merchant portal, virtual terminal, mobile app, APIs and additional technology products to our SMB merchants. For the Enterprise market, we integrate payment acceptance, security and reconciliations into ERPs such as Oracle, SAP and JD Edwards. In addition to this customer-facing technology, we also support an extensive network of independent sales organizations with an online merchant and residual management system.

8

CoPilot—Our customer management system is used by our distribution partners and our internal operational staff. This online portfolio management tool provides automated customer onboarding, product enrollment, a digital merchant application, customer service ticketing, risk monitoring, residual payment calculation and commission processing. This system is critical to optimizing our operational efficiencies and provides a scalable platform to attract quality distribution partners.

CardPointe—Our core payments system provides a single location for merchant account management, including transaction processing, full transaction-lifecycle management, custom reporting and product enrollment. The CardPointe system extends a variety of value-add products, including:

• | CardPointe App—a native iOS and Android app that includes all the key benefits of the online, browser-based application. Merchants can process both card-present and card-not-present transactions via our virtual terminal, while receiving in depth transaction and funding reporting. |

• | CardPointe Terminal—a retail terminal device application that runs on third-party terminals and is integrated through our payment gateway. This integrated terminal secures transactions at the point of entry, with our proprietary encryption technology. This terminal also supports Europay, MasterCard, Visa ("EMV") cards and near-field communication standards, while providing cost-saving interchange optimization capabilities. Additionally, the terminal is integrated to the CardPointe system so merchants can view and manage transactions instantly, and create customer profiles from any transaction. |

• | Virtual Terminal—our virtual terminal allows our SMB merchants to process transactions directly from an online and mobile application and is compatible with USB and mobile payment devices. For recurring transactions, extensive support of billing plans is included. |

• | eCommerce Solutions—our out-of-box shopping cart, accounting software integrations and proprietary hosted payment pages cover an array of merchants’ eCommerce needs. |

CardConnect Gateway & APIs—We have developed a secure payment gateway that facilitates payment acceptance in both card-present and card-not-present environments. We have integrated and certified our payment gateway with numerous third-party processors. Our payment architecture allows us to continually add new connections and capabilities. Our payment gateway facilitates authorizations, settlement and funding from the third party processor to the customer. Customers can leverage our payment gateway and transaction security features with a variety of developer-friendly APIs.

CardSecure Tokenization and Point-to-Point Encryption—With the critical need to secure payment card information, we developed industry leading and patented encryption and tokenization solutions that have been scaled to protect our entire customer base. These solutions have been recognized and validated by the PCI Council, the organization established by the payment networks to set payment security standards. These security solutions simplify the PCI compliance requirements for our merchants, while allowing us to securely interact with the third party processor.

9

Industry Overview

The payment processing industry provides merchants with credit, debit, gift and loyalty card and other payment processing services, along with related information services. The industry continues to grow as a result of wider merchant acceptance, increased consumer use of bankcards and advances in payment processing and telecommunications technology. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. This increased use of bankcards and prepaid cards, payment processing via smart phones, enhanced technology initiatives, efficiencies derived from economies of scale and the availability of more sophisticated products and services to all market segments has resulted in a highly competitive and specialized industry.

SMB merchants’ payment processing needs generally are served by a large number of smaller payment processors, including banks and independent sales organizations, which generally procure most of the payment processing services they offer from large payment processors. It is difficult, however, for banks and independent sales organizations to customize payment processing services for the SMB merchant on a cost-effective basis or to provide sophisticated value-added services.

Services to the SMB merchant market historically have been characterized by basic payment processing without the availability of the more customized and sophisticated processing, information-based services or customer service that are offered to large merchants. The continued growth in bankcard transactions is expected to cause SMB merchants to increasingly value sophisticated payment processing and information services similar to those provided to large merchants.

Key Trends Impacting SMB Merchants

The following are key trends impacting SMB merchants:

• | Shift to Integrated POS—SMB merchants are increasingly using software to manage everyday business functions such as inventory management, customer engagement and loyalty. SMB merchants now look to merchant acquirers who can integrate seamlessly with these software providers to simplify their business operations. We believe merchant acquirers that can effectively support these bundled solutions will have the most success attracting and retaining SMB merchants. |

• | Adoption of New Technologies—Cloud-based computing and software-as-a-service delivery models are lowering the costs and complexity of technology. As a result, SMB merchants are looking for new technologies, including mobile and tablet-based solutions delivered by applications, to make use of sophisticated payment offerings that were previously not accessible to them. We believe merchant acquirers need to be able to offer new, complementary technology solutions that can effectively leverage data and new applications seamlessly and conveniently. |

• | Utilization of Value-Added Services—SMB merchants looking to grow and expand their business are adopting and promoting their own rewards and loyalty programs. They are also demanding more sophisticated tools to analyze the data collected from their payment transactions to utilize business intelligence and more effectively manage their operations. We believe merchant acquirers that have the technology to provide these value-added services through a flexible integrated platform that can integrate these solutions will be able to capitalize on the growth of these high-margin offerings. |

• | Need for Multi-Channel Commerce—As commerce trends continue to evolve, SMB merchants are increasingly looking for multi-channel solutions which enable them to sell their goods and services at their brick and mortar locations, on the Internet or remotely via mobile devices, such as smart phones and tablets, on a single integrated platform provided by a single vendor. To meet this demand, we believe merchant acquirers can gain a competitive advantage by offering a payment gateway that provides a single point of access for POS, e-commerce and mobile commerce capabilities at an affordable price. |

• | Demand for Greater Security—Merchants continue to face new security challenges as the electronic payments industry continues to grow in size and complexity. With the evolution of more payment channels, access devices and card types, we believe that maintaining the integrity of the payment system has never been more challenging or more critical for merchant acquirers. In addition, new initiatives by the payment networks to shift from magnetic stripe to chip-enabled cards, using the EMV technology standard, will lead many SMB merchants to upgrade their legacy POS hardware, including IPOS. As a result, merchant acquirers will need to have the technical capabilities, expertise and partnerships to deploy new security solutions and safely integrate with new solutions. |

10

• | New Industry Adoption—We believe that industries such as healthcare, education and government, as well as other industries, will continue to see higher transaction volume growth as migration from paper-based payments to electronic payments continues. These industries often utilize software with embedded payment processing technology tailored specifically for their business type. Merchant acquirers will need to possess the industry and business expertise to deliver targeted POS and online processing solutions to these industries that seamlessly integrate into their existing business management software. |

Our Sales and Distribution

Merchant Acquiring Services

Our strategy for acquiring SMB merchant relationships is to leverage our distribution partners, which consist primarily of independent sales organizations, integrated software vendors and our direct sales staff. Our distribution partners act as a consistent and predictable source of SMB merchant accounts. Through our products and solutions, we believe we provide first-rate service for our partners to support their referred merchants. We believe our focus on offering industry leading tools and partner support has led to loyal distribution partners and increased partner retention.

Independent Sales Organizations. We primarily support independent sales organizations with products and tools that enable them to secure SMB merchant relationships. A majority of our independent sales organizations leverage the CardConnect brand while marketing Merchant Acquiring services. We provide valuable back office support, training and the tools necessary for independent sales organizations to manage their business.

Direct Sales Staff. Our direct sales staff primarily sells to association-based SMB merchants through telesales efforts. Associations are typically industry trade groups that have a loyal and trusted relationship with their members. We work with these associations to offer merchant services as a benefit to its members, and create a marketing plan to market our products and services to the members of the association.

Integrated Software Vendors. Our integrated software vendors are software companies that partner with us to provide payment services to their merchant base. These software based partners integrate their business management software into our platform which provides a consolidated solution for merchants, which we believe leads to increased retention. We are establishing positions in several industries, including not-for-profit and event management.

Our SMB marketing strategy is to promote our brand and generate demand for our products and solutions that target distribution partners and SMB merchants. Our distribution partners, primarily independent sales organizations and integrated software vendors, market their own businesses in order to refer merchant accounts for which they receive commissions. Our primary SMB marketing activities include:

• | Presence and participation in payments conferences, tradeshows and industry events to create brand awareness and recruit new distribution partners; |

• | Website development that educates prospective partners and merchants; |

• | Press and industry relations to garner third-party validation and generate positive coverage; |

• | Multi-channel advertising; and |

• | Webinars that we host, featuring our employees and product offering. |

Enterprise Services

We provide services to Enterprise customers that primarily utilize sophisticated ERP systems to manage their businesses. We sell these services with a direct sales staff focused exclusively on these prospective Enterprise customers. This direct sales staff is comprised of several sales personnel located throughout the United States and is supported by our marketing efforts. These solutions provide integration and hosting for payment acceptance, security and reconciliations into ERP systems. Our focus has been to solely provide these solutions for Oracle, SAP and JD Edwards' ERP systems.

Our Enterprise marketing strategy is to promote our brand and generate demand for our Enterprise services offerings. We use a variety of marketing efforts across traditional and social media channels to target prospective Enterprise customers. Our primary Enterprise marketing activities include:

• | Presence and participation in ERP user conferences, tradeshows and industry events to create brand awareness; |

11

• | Website development that educates prospective customers through product information, blogs and white papers; |

• | Digital advertising through social media channels, such as LinkedIn and Twitter; |

• | Search engine marketing and advertising optimized for ERP customers; |

• | Email marketing campaign with high quality content on ERP payments; |

• | Press and industry relations to garner third-party validation and generate positive coverage; and |

• | Customer testimonials. |

Our Operations

Our Operations division is designed to efficiently support the needs of all of our merchants and distribution partners. Our Technology division is structured to enhance and maintain our products and services.

Business Operations

Merchant Onboarding. Our underwriting and onboarding process leverages both our third-party processors’ systems and our proprietary customer management system, CoPilot, to timely and efficiently activate new merchants. Our distribution partners are also provided access to CoPilot to ensure transparency and consistency in this process and to track the progress of each merchant application. CoPilot provides real-time workflow and status updates to both the merchant and the distribution partner from submission to full account activation.

Merchant Support. Our merchant support is available from phone, email and web inquiries. All inquiries are managed through CoPilot and provide both our partners and merchants with tracking and visibility into each merchant interaction with our team. Our support offerings are available 24/7 and focus on educating our merchants and distribution partners on our solutions and services.

Risk and Underwriting. Our credit underwriting and risk management function is designed to prevent and detect fraud and credit risk exposure, while helping to ensure our merchants and distribution partners remain profitable. We adhere to sponsor bank guidelines and card brand rules and regulations in underwriting and fraud, including monitoring of merchant transactions, volumes, chargebacks and customer disputes.

Partner Support. Our partner support function provides our distribution partners with comprehensive support for our solutions, products and services to enable them to attract new merchants and support existing merchants. Distribution partners have access to our comprehensive online support center that details our products, our operational procedures and industry guidelines.

Technology Operations

Network & Security. Our network and security function ensures that our systems are secure and fully operational while meeting industry and PCI security standards.

Information Management. Our information management function manages the acceptance, processing and storage of all transaction, customer and partner data interfacing between our systems and third parties. Our executive management team and employees utilize information made available through analytics constructed by our information management capabilities.

SMB Product Development. Our SMB product development function manages the development and deployment of our SMB merchant product suite, primarily including CardPointe and CoPilot.

Enterprise Development & Integration. Our Enterprise development and integration function manages our Enterprise services solutions. Enterprise integrations are executed with knowledge of secure payment processing in certain ERP systems, primarily Oracle, SAP and JD Edwards. Our project managers ensure that our implementations and solutions do not alter our Enterprise customer’s existing ERP environment.

Technical Support. Our technical support function is responsible for technical inquires on our Merchant Acquiring and Enterprise services products. This staff provides 24/7 support with phone, email and web inquiries all managed through our automated CoPilot ticketing system.

12

Security, Disaster Recovery and Back-up Systems

In the course of our operations, we maintain a large database of information relating to our merchants and their transactions, and large amounts of card information across our network. We maintain a high level of security to attempt to protect the information of our merchants and their customers. We update our network and operating system security releases and virus definitions, and have engaged a third party to regularly test our systems for vulnerability to unauthorized access. Further, we encrypt the cardholder numbers and merchant data that are stored in our databases using what we believe are the strongest commercially available encryption methods.

We have a dedicated team responsible for security incident response. This team develops, maintains, tests and verifies our Incident Response Plan. The primary function of this team is to react and respond to intrusions, denial of service, data leakage, malware, vandalism and many other events that could potentially jeopardize data availability, integrity, and confidentiality. This team is responsible for investigating and reporting on any and all malicious activity in and around our information systems. In addition to handling security incidents, the incident response team continually educates themselves and the company on information security matters.

Disaster recovery is built in to our infrastructure through our hosting provider. Our hosting provider has locations in Philadelphia, Pennsylvania and St. Louis, Missouri that are configured and operating in parallel with each other to immediately replicate all data and application updates. We monitor the availability of services in each site, and if one becomes unavailable, all traffic is automatically switched to the other site. This duplicate processing capability ensures uninterrupted transaction processing during maintenance windows and other times processing may be interrupted in one data center.

Third Party Processors and Sponsor Banks

In the course of facilitating bankcard processing services, we rely on third parties to provide or supplement these services, which primarily include authorization, settlement and funding services.

We utilize FirstData Merchant Services Corporation ("First Data") and TSYS Acquiring Solutions, LLC ("TSYS") to provide authorization and settlement services. As of December 31, 2016, 91% and 9% of our bankcard volume was processed through FirstData and TSYS, respectively. Each merchant’s internal payment acceptance infrastructure dictates which third party processor will be utilized.

Our processing agreement with FirstData (the “FirstData Agreement”) was entered into in April 2012, amended in October 2015, and is in effect through December 2021 and automatically renews for successive two-year terms unless either party provides written notice of non-renewal to the other party.

In connection with the Vanco acquisition in October 2015, we entered into a processing agreement with TSYS and assumed the processing arrangements that were in place with existing Vanco merchants (collectively, the “TSYS Agreement”). The TSYS Agreement is effective through November 2020 and automatically renews for consecutive two-year terms unless either party provides written notice of non-renewal to the other party.

We utilize Wells Fargo Bank and Synovus Bank to provide settlement and funding services for our merchants. Additionally, we adhere to the underwriting guidelines provided by the sponsor bank. Because we are not a “member bank’’ as defined by Visa and MasterCard, in order to process and settle these bankcard transactions for our merchants, we have entered into sponsorship agreements with member banks. Visa and MasterCard rules restrict us from performing funds settlement or accessing merchant settlement funds and require that these funds be in the possession of the member bank until the merchant is funded.

Our sponsorship agreements enable us to route Visa and MasterCard bankcard transactions under the member bank’s control and bank identification numbers to clear credit and signature debit bankcard transactions through Visa and MasterCard. Our sponsorship agreements also enable us to settle funds between cardholders and merchants by delivering funding files to the member bank, which in turn transfers settlement funds to the merchants’ bank accounts. These restrictions place the settlement assets and liabilities under the control of the member bank.

Our sponsorship agreements with the member banks require, among other things, that we abide by the bylaws and regulations of the Visa and MasterCard networks. If we were to breach these sponsorship agreements, the sponsor banks can terminate the agreement and, under the terms of the agreement, we would have 180 days to identify an alternative sponsor bank. As of December 31, 2016, we have not been notified of any such issues by our sponsor banks, Visa or MasterCard. See “Risk Factors—Risks Related to Our Business—We rely on bank sponsors, which have substantial discretion with respect to

13

certain elements of our business practices, in order to process electronic payment transactions. If these sponsorships are terminated and we are not able to secure new bank sponsors, we will not be able to conduct our business.”

The sponsorship agreement with Wells Fargo Bank is for a five-year term expiring in December 2021 and will automatically renew for successive two-year periods unless either party provides three months written notice of non-renewal to the other party. The sponsorship agreement with Synovus Bank is for a five-year term expiring on October 8, 2020 and will automatically renew for successive two-year periods unless either party provides six months written notice of non-renewal to the other party. Wells Fargo Bank sponsors transactions for FirstData and Synovus Bank sponsors transactions for TSYS.

Merchant and Transaction Risk Management

We focus on low-risk merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses. We have established merchant bases in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These industries include restaurants, brick-and-mortar retailers, professional service providers, auto repair and others. See “—Business Structure—Our Merchant Base.”

Effective risk management helps us minimize merchant losses relating to chargebacks, reject losses and merchant fraud for the mutual benefit of our merchants and ourselves. We believe our knowledge and experience in dealing with attempted fraud has resulted in our development and implementation of effective risk management and fraud prevention systems and procedures for the types of fraud discussed in this section. The card brand networks generally allow chargebacks up to four months after the later of the date the transaction is processed or the delivery of the product or service to the cardholder. If the merchant incurring the chargeback is unable to fund the refund to the card issuing bank, we are required to do so. In 2016, 2015 and 2014, we experienced merchant losses of $2.5 million, $1.5 million and $1.9 million, respectively, or 1.1 basis points, 0.9 basis points and 1.3 basis points, respectively, on total bankcard dollar volumes processed of $22.3 billion, $17.1 billion and $14.7 billion, respectively.

Underwriting of Our Merchants. New applications are submitted to our credit underwriting department for review and consideration. Our credit underwriting department performs a number of verification and credit related checks on all applicants. As part of the underwriting process, credit risk exposure is calculated based on the nature of business, requested volume, transaction size, industry, non-delivery of services or goods and dispute levels. This becomes a primary factor used when deciding whether to accept or reject a merchant account. Pricing, transaction thresholds, processing history and/or the financial condition of the applicant/business are reviewed during this process. As a condition of approval, cash or non-cash collateral may also be a requirement. These reviews and conditions are documented and help to assist the risk management team in the ongoing monitoring of merchant transactions and volume.

Depending upon their experience level, our underwriting staff is assigned a signing authority equal to an established credit risk exposure amount. This allows them to render autonomous decisions on new applications based on exposure, but to also include adjusting transaction and volume thresholds, establishing funding delays, and/or requesting cash or non-cash collateral. These levels are set by management and appropriate concurrence sign offs are required for approval based upon the credit risk exposure of each application. Our sponsor banks review and approve our merchant underwriting policies and procedures to ensure compliance with all card brand operating rules and regulations.

Risk Management /Merchant Monitoring. We rely on third-party and internal reporting to identify and monitor credit/fraud risk. Our systems compile daily and historical merchant activity in a number of customized reports. The risk management team reviews all unusual activity, which may include average ticket, rolling volume levels, refund and chargeback levels as well as authorization history. Merchant parameters are utilized in order to identify suspicious processing activity. Risk management tools and reporting are reviewed daily in order to suspend unusual merchant processing activity. All accounts with suspended funds are investigated daily and the risk management team decides if any transactions should be held for further review. This allows us to minimize credit and fraud risk by providing time to formally review the processing with the merchant, the customers and or the issuing banks. Validating merchant activity is a daily process within risk management. Certain merchants may require special monitoring and periodic internal reviews may be completed. We also have engaged a web-crawling solution that scans all merchant websites for content and adherence to card brand rules and regulations.

Investigation and Loss Prevention. If a merchant exceeds the parameters established by our underwriting and/or risk management staff or is found to have violated card brand operating rules or the terms of our merchant agreement, one of our team members will identify and document the incident. The review will include the actions taken to reduce our exposure to loss and the exposure of our merchant. These actions may include requesting additional transaction information, withholding or

14

diverting funds, verifying delivery of merchandise or even deactivating the merchant account. The financial condition of the business may also be considered during these investigations.

Collateral. We require some of our merchants to establish cash or non-cash collateral which may include certificates of deposit, letters of credit, rolling merchant reserves or upfront cash. This collateral is utilized in order to offset potential credit or fraud risk liability that we may incur. We hold such cash deposits or letters of credit for as long as we are exposed to a loss resulting from a merchant’s payment processing activity.

Our Competition

The payment processing industry is highly competitive. We primarily compete in the SMB merchant industry and our competitors have different business models, go-to-market strategies and technical capabilities. Competition has increased in recent years as other providers of payment processing services have established a sizable market share in the SMB merchant industry, with the ten largest processors presenting approximately 80% of the SMB market. We believe the most significant competitive factors in our markets are: (1) economics, including fees charged to merchants and commission payouts to distribution partners; (2) product offering, including emerging technologies and developments by other participants in the payments ecosystem; (3) service, including product functionality, value-added solutions and strong customer support for both distribution partners and merchants; and (4) trust, including a strong reputation for quality service and trusted distribution partners. Our competitors range from large and well established companies to smaller, earlier-stage business. See “Risk Factors—Risks relating to Our Business—The payment processing industry is highly competitive and such competition is likely to increase, which may adversely influence the prices we can charge to merchants for our services and the compensation we must pay to our distribution partners, and as a result, our profit margins.”

Government Regulation

We operate in an increasingly complex legal and regulatory environment. Our business and the products and services that we offer are subject to a variety of federal, state and local laws and regulations and the rules and standards of the payment networks that we utilize to provide our electronic payment services, as more fully described below.

Dodd-Frank Act

The Dodd-Frank Act and the related rules and regulations have resulted in significant changes to the regulation of the financial services industry. Changes impacting the electronic payments industry include providing merchants with the ability to set minimum dollar amounts for the acceptance of credit cards and to offer discounts or incentives to entice consumers to pay with cash, checks, debit cards or credit cards, as the merchant prefers. New rules also contain certain prohibitions on payment network exclusivity and merchant routing restrictions of debit card transactions. Additionally, the Durbin Amendment to the Dodd-Frank Act provides that the interchange fees that certain issuers charge merchants for debit transactions will be regulated by the Federal Reserve and must be “reasonable and proportional” to the cost incurred by the issuer in authorizing, clearing and settling the transactions. Rules released by the Federal Reserve in July 2011 to implement the Durbin Amendment mandate a cap on debit transaction interchange fees for issuers with assets of $10 billion or greater.

The Dodd-Frank Act also created the Consumer Financial Protection Bureau (the “CFPB”), which has assumed responsibility for most federal consumer protection laws, and the Financial Stability Oversight Council, which has the authority to determine whether any non-bank financial company, such as us, should be supervised by the Board of Governors of the Federal Reserve System because it is systemically important to the U.S. financial system. Any new rules or regulations implemented by the CFPB or the Financial Stability Oversight Council or in connection with Dodd-Frank Act that are applicable to us, or any changes that are adverse to us resulting from litigation brought by third parties challenging such rules and regulations, could increase our cost of doing business or limit permissible activities.

Payment Network Rules and Standards

While not legal or governmental regulation, we are subject to the rules and standards established by the payment networks. These rules and standards, including the Payment Card Industry and Data Security Standards ("PCI DSS"), govern a variety of areas including how consumers and merchants may use their cards, data security and allocation of liability for certain acts or omissions including liability in the event of a data breach. The payment networks may change these rules and standards from time to time as they may determine in their sole discretion and with or without advance notice to their participants. Participants are subject to audit by the payment networks to ensure compliance with applicable rules and standards. The networks may fine, penalize or suspend the registration of participants for certain acts or omissions or the failure of the participants to comply with applicable rules and standards.

15

An example of a recent standard is EMV, which is mandated by Visa, MasterCard, American Express and Discover. This mandate sets new requirements and technical standards, including requiring IPOS systems to be capable of accepting the more secure “chip” cards that utilize the EMV standard and set new rules for data handling and security. Processors and merchants that do not comply with the mandate or do not use systems that are EMV compliant risk fines and liability for fraud-related losses. We have invested significant resources to ensure our systems’ compliance with the mandate, and to assist our merchants in becoming compliant by the applicable deadlines.

To provide our electronic payments services, we must be registered either indirectly or directly as service providers with the payment networks that we utilize. Because we are not a bank, we are not eligible for membership in certain payment networks, including Visa and MasterCard, and are therefore unable to directly access these networks. The operating regulations of certain payment networks, including Visa and MasterCard, require us to be sponsored by a member bank as a service provider. We are registered with certain payment networks, including Visa and MasterCard, through Wells Fargo and Synovus Bank. The agreements with our bank sponsors give them substantial discretion in approving certain aspects of our business practices including our solicitation, application and qualification procedures for merchants and the terms of our agreements with merchants. We are registered directly as service providers with Discover, American Express and certain other networks. We are also subject to network operating rules promulgated by the National Automated Clearing House Association relating to payment transaction processed by us using the Automated Clearing House Network.

Privacy and Information Security Regulations

We provide services that may be subject to privacy laws and regulations of a variety of jurisdictions. Relevant federal privacy laws include the Gramm-Leach-Bliley Act of 1999, which applies directly to a broad range of financial institutions and indirectly, or in some instances directly, to companies that provide services to financial institutions. These laws and regulations restrict the collection, processing, storage, use and disclosure of personal information, require notice to individuals of privacy practices and provide individuals with certain rights to prevent the use and disclosure of protected information. These laws also impose requirements for safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. Our business may also be subject to the Fair Credit Reporting Act, which regulates the use and reporting of consumer credit information and also imposes disclosure requirements on entities who take adverse action based on information obtained from credit reporting agencies. In addition, there are state laws restricting the ability to collect and utilize certain types of information such as Social Security and driver’s license numbers. Certain state laws impose similar privacy obligations as well as obligations to provide notification of security breaches of computer databases that contain personal information to affected individuals, state officers and consumer reporting agencies and businesses and governmental agencies that possess data.

Anti-Money Laundering and Counter-Terrorism Regulation

Our business is subject to U.S. federal anti-money laundering laws and regulations, including the Bank Secrecy Act of 1970, as amended by the USA PATRIOT Act of 2001, or “BSA.” The BSA, among other things, requires money services businesses to develop and implement risk-based anti-money laundering programs, report large cash transactions and suspicious activity and maintain transaction records. We are also subject to certain economic and trade sanctions programs that are administered by the Treasury Department’s Office of Foreign Assets Control (“OFAC”), that prohibit or restrict transactions to or from or dealings with specified countries, their governments and, in certain circumstances, their nationals, narcotics traffickers and terrorists or terrorist organizations. Similar anti-money laundering, counter-terrorist financing and proceeds of crime laws apply to movements of currency and payments through electronic transactions and to dealings with persons specified on lists maintained by organizations similar to OFAC in several other countries and which may impose specific data retention obligations or prohibitions on intermediaries in the payment process. We have developed and continue to enhance compliance programs and policies to monitor and address related legal and regulatory requirements and developments.

Unfair or Deceptive Acts or Practices

We and many of our merchants are subject to Section 5 of the Federal Trade Commission Act prohibiting unfair or deceptive acts or practices, or UDAP. In addition, the UDAP and other laws, rules and or regulations, including the Telemarketing Sales Act, may directly impact the activities of certain of our merchants, and in some cases may subject us, as the merchant’s payment processor or provider of certain services, to investigations, fees, fines and disgorgement of funds if we are deemed to have aided and abetted or otherwise provided the means and instrumentalities to facilitate the illegal or improper activities of the merchant through our services. Various federal and state regulatory enforcement agencies including the Federal Trade Commission and the states attorneys general have authority to take action against non-banks that engage in UDAP or violate other laws, rules and regulations and to the extent we are processing payments or providing services for a merchant that

16

may be in violation of laws, rules and regulations, we may be subject to enforcement actions and as a result may incur losses and liabilities that may impact our business.

Indirect Regulatory Requirements

A number of our clients are financial institutions that are directly subject to various regulations and compliance obligations issued by the CFPB, the Office of the Comptroller of the Currency and other agencies responsible for regulating financial institutions. While these regulatory requirements and compliance obligations do not apply directly to us, many of these requirements materially affect the services we provide to our clients and us overall. The banking agencies, including the Office of the Comptroller of the Currency, have imposed requirements on regulated financial institutions to manage their third-party service providers. Among other things, these requirements include performing appropriate due diligence when selecting third-party service providers; evaluating the risk management, information security, and information management systems of third-party service providers; imposing contractual protections in agreements with third-party service providers (such as performance measures, audit and remediation rights, indemnification, compliance requirements, confidentiality and information security obligations, insurance requirements, and limits on liability); and conducting ongoing monitoring of the performance of third-party service providers. Accommodating these requirements applicable to our clients imposes additional costs and risks in connection with our financial institution relationships. We have expended and expect to continue to expend significant resources on an ongoing basis in an effort to assist our clients in meeting their legal requirements.

Banking Regulations

We are considered by the Federal Financial Institutions Examination Council to be a technology service provider (“TSP”) based on the services we provide to financial institutions. As a TSP, we are subject to audits by an interagency group consisting of the Federal Reserve System, FDIC, and the Office of the Comptroller of the Currency.

Other Regulation

We are subject to U.S. federal and state unclaimed or abandoned property (escheat) laws which require us to turn over to certain government authorities the property of others we hold that has been unclaimed for a specified period of time such as account balances that are due to a distribution partner or merchant following discontinuation of its relationship with us. The Housing Assistance Tax Act of 2008 requires certain merchant acquiring entities and third-party settlement organizations to provide information returns for each calendar year with respect to payments made in settlement of electronic payment transactions and third-party payment network transactions occurring in that calendar year. Reportable transactions are also subject to backup withholding requirements.

The foregoing is not an exhaustive list of the laws and regulations to which we are subject and the regulatory framework governing our business is changing continuously. See “Risk Factors—Risks Related to Our Business—We are subject to extensive government regulation, and any new laws and regulations, industry standards or revisions made to existing laws, regulations or industry standards affecting the electronic payments industry may have an unfavorable impact on our business, financial condition and results of operations.”

Our Intellectual Property

We have developed a payments platform that includes many instances of proprietary software, code sets, work flows and algorithms. It is our practice to enter into confidentiality, non-disclosure, and invention assignment agreements with our employees and contractors, and into confidentiality and non-disclosure agreements with other third parties, in order to limit access to, and disclosure and use of, our confidential information and proprietary technology. In addition to these contractual measures, we also rely on a combination of trademarks, copyrights, registered domain names, and patent rights to help protect the CardConnect brand and our other intellectual property.

As of December 31, 2016, we have two patents for tokenization, which relates to our payment security solution, CardSecure. We also have ten active trademarks and one additional pending trademark that pertain to company, product names and logos. We intend to file additional patent applications as we innovate through our research and development efforts, and to pursue additional patent protection to the extent we deem it beneficial and cost-effective. We also own a number of domain names including cardconnect.com and cardpointe.com.

Seasonality

17

Historically, our revenues have been strongest in our third and fourth quarters, and weakest in our first quarter. Some variability results from seasonal retail events and the number of business days in a month or quarter. Service and fee based revenue derived from our Enterprise services generally demonstrates less seasonality than our transaction-based revenue.

Our Employees

As of December 31, 2016, we employed 189 employees, consisting of 58 operations employees, 57 IT employees, 53 sales and marketing employees, and 21 general and administrative employees. None of our employees is represented by a labor union and we have experienced no work stoppages. We consider our employee relations to be good.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). In accordance with the Exchange Act, we file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission. You may view our financial information, including the information contained in this report, certain items related to corporate governance matters and other reports we file with the Securities and Exchange Commission, on the Internet, without charge as soon as reasonably practicable after we file them with the Securities and Exchange Commission, in the “SEC Filings” page of the Investor Relations section of our website at https://cardconnect.com. References to our website in this Annual Report are provided as a convenience and do not constitute an incorporation by reference of the information contained on, or accessible through, the website. Therefore, such information should not be considered part of this Annual Report. You may also obtain a copy of any of these reports, without charge, from our corporate secretary, 1000 Continental Drive, Suite 300, King of Prussia, PA 19406. Alternatively, you may view or obtain reports filed with the Securities and Exchange Commission at the SEC Public Reference Room at 100 F Street, N.E. in Washington, D.C. 20549, or at the Securities and Exchange Commission's Internet site at www.sec.gov. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

18

Item 1A. RISK FACTORS

You should consider carefully all of the risks described below, which we believe are the principal risks that we face and of which we are currently aware, and all of the other information contained in this report. If any of the events or developments described below occur, our business, financial condition or results of operations could be negatively affected.

Risks Relating to Our Business and Industry

The payment processing industry is highly competitive and such competition is likely to increase, which may adversely influence the prices we can charge to merchants for our services and the compensation we must pay to our distribution partners, and as a result, our profit margins.

The payment processing industry is highly competitive. We primarily compete in the small and medium business (“SMB”) merchant industry. Competition has increased in recent years as other providers of payment processing services have established a sizable market share in the SMB merchant industry, with the largest ten processors representing approximately 80% of the SMB market. Our primary competitors for SMB merchants in these markets include financial institutions and their affiliates and well-established payment processing companies that target SMB merchants directly and through third parties, including Bank of America Merchant Services, Chase Paymentech, Elavon, Inc. (a subsidiary of U.S. Bancorp), First Data Corporation, Vantiv, Inc., Global Payments, Inc., Heartland Payment Systems, Inc. (an affiliate of Global Payments, Inc.), BluePay and Square, Inc. Competing with financial institutions is challenging because, unlike us, they often bundle processing services with other banking products and services. We also compete with many of these same entities for the assistance of distribution partners. For example, many of our distribution partners do not have exclusive relationships with us but also have relationships with our competitors, such that we have to continually expend resources to maintain those relationships. Our continued growth will depend on the continued growth of payments with prepaid, debit and credit cards and bitcoin, which we refer to as “Electronic Payments,” and our ability to increase our market share through successful competitive efforts to gain new merchants and distribution partners.

In addition, many financial institutions, subsidiaries of financial institutions or well-established payment processing companies with which we compete, have substantially greater capital, technological, management and marketing resources than we have. In addition, our competitors that are financial institutions or affiliated with financial institutions may not incur the sponsorship costs we incur for registration with the payment networks. These factors may allow our competitors to offer better pricing terms to merchants and more attractive compensation to distribution partners, which could result in a failure to establish relationships with potential, and loss of our existing, merchants and distribution partners. This competition may limit the prices we can charge our merchants, cause us to increase the compensation we pay to our distribution partners and require us to control costs aggressively in order to maintain acceptable profit margins. Our future competitors may also develop or offer services that have price or other advantages over the services we provide. Such competition could result in a loss of existing clients, and greater difficulty attracting new clients. These factors could have a material adverse effect on our business, financial condition and results of operations.