Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k20170315presentation.htm |

1

03. 2017

INVESTOR

PRESENTATION

UPDATED 3.15.2017

2

FORWARD-LOOKING STATEMENTS

Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such

statements include, in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties,

including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore,

such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally

be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe,"

"continue," or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements. We make no

representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this

presentation, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information,

future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions

involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or

impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results

expressed in such forward-looking statements, including our ability to generate positive cash flow from operations, make distributions to

stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in the Company's most

recently filed Annual Report on Form 10-K for the year ended December 31, 2016, for a discussion of some of the risks and uncertainties

that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our

Annual Report are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional

risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. For additional

information, including reconciliations of any non-GAAP financial measures found herein, please reference the supplemental report

furnished by the Company as Exhibit 99.2 to the Company Form 8-K furnished with the Securities and Exchange Commission in February,

2017.

The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their

respective companies. When evaluating the Company’s performance and capital resources, management considers the financial impact

of investments held directly and through unconsolidated joint ventures. This report includes financial and operational information for our

wholly-owned investments and our proportional interest in unconsolidated investments. We do not control the Market Square Joint

Venture and recognize that proportional financial data may not accurately depict all of the legal and economic implications of our interest

in this joint venture. Unless otherwise noted, all data herein is as of December 31, 2016, and pro forma for the sale of the Houston

portfolio completed on January 6, 2017, the sale of Key Center Tower and Marriott in Cleveland completed on January 31, 2017, and the

planned return of 263 Shuman Boulevard to the lender.

3

COLUMBIA PROPERTY TRUST

$2.6B invested in high-barrier markets since 2011

More than 50 non-core assets sold, totaling $3.3B

FOCUSED

STRATEGY

Experienced senior management team

Regional leadership platforms in NYC, SF and DC

EXPERIENCED

LEADERSHIP

22.1% Net Debt to Real Estate Assets2

Investment grade rating (Baa2 Stable / BBB Stable)

FLEXIBLE

BALANCE SHEET

Proactive leasing: 2.5M SF since 2014YE

Effective capital program across portfolio

PROVEN

VALUE CREATOR

77% of portfolio in four high-barrier markets1

Prime CBD locationsTOP MARKETS

1Based on gross real estate assets under management; represents 100% of Market Square, which Columbia owns through an unconsolidated

joint venture. High-barrier markets are New York, San Francisco, Washington, D.C., and Boston.

2 As of 1/31/2017 pro forma for the return of 263 Shuman to the lender.

4

COMPANY OVERVIEW

6.9

Yrs. avg. weighted

lease term

7.8M

Total SF1

93.0%

Leased

1Includes 100% of the Market Square joint venture, in which the company owns a 51% interest.

NEW YORK

SAN FRANCISCO

WASHINGTON, D.C. ATLANTA

LOS ANGELES

PITTSBURGH

222 E. 41st Street

229 W. 43rd Street

315 Park Avenue S.

95 Columbus

221 Main Street

333 Market Street

650 California Street

University Circle

Market Square

80 M Street

Lindbergh Center

One Glenlake Parkway

Three Glenlake Parkway

BOSTON

116 Huntington Avenue

Pasadena Corporate Park

Cranberry Woods Drive

CXP

NYSE-Listed

Baa2 / BBB

Rated, Investment Grade

PO

R

TF

O

LI

O

5

EMBEDDED GROWTH DRIVERS

MARKET

CURRENTLY IN

ABATEMENT

LEASES SIGNED

BUT NOT YET

COMMENCED

VACANCY

LEASE-UP

ROLLOVER

THROUGH 2018

New York 480 - 45 207

San Francisco 18 26 138 361

Washington, D.C. 173 103 122 9

Atlanta 4 9 89 71

Boston - 6 54 41

TOTAL 675 144 448 689

SF in 000s1

1All as of 12.31.2016, pro forma for signing of WeWork lease at 650 California Street, the dispositions of Houston and Cleveland properties, and

the planned return of 263 Shuman to the lender; Reflects 51% of the SF for the Market Square joint venture, in which CXP owns a 51% interest.

6

EMBEDDED GROWTH FROM SIGNED LEASES1

TENANT PROPERTY MARKET

SF

(000s)

CURRENTLY IN

ABATEMENT

NOT YET

COMMENCED

NYU Langone Medical Center 222 E. 41st Street NY 390 ✔

Winton Capital 315 Park Avenue

South

NY 35 ✔

Equinox 315 Park Avenue

South

NY 45 ✔

Gryphon Technologies 80 M Street DC 24 ✔

Other Abated Leases 183 ✔

WeWork 80 M Street DC 69 ✔

WeWork 650 California Street SF 61 ✔

Other Leases Not Yet

Commenced

73 ✔

Total Embedded NOI – GAAP RENTS - $11.6M

Total Embedded NOI – CASH RENTS $30.0M $10.8M

1All as of 12.31.2016, pro forma for signing of WeWork lease at 650 California Street, the dispositions of Houston and Cleveland properties, and the

planned return of 263 Shuman to the lender; reflects 51% of the SF and NOI for the Market Square joint venture, in which CXP owns a 51% interest.

7

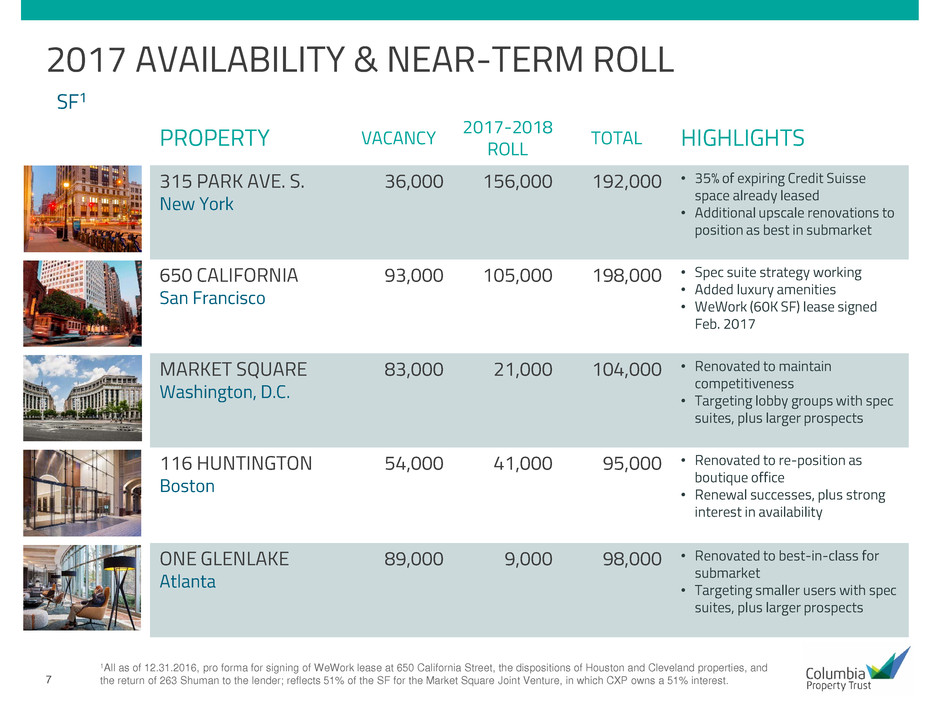

2017 AVAILABILITY & NEAR-TERM ROLL

PROPERTY VACANCY 2017-2018 ROLL TOTAL HIGHLIGHTS

315 PARK AVE. S.

New York

36,000 156,000 192,000 • 35% of expiring Credit Suisse

space already leased

• Additional upscale renovations to

position as best in submarket

650 CALIFORNIA

San Francisco

93,000 105,000 198,000 • Spec suite strategy working

• Added luxury amenities

• WeWork (60K SF) lease signed

Feb. 2017

MARKET SQUARE

Washington, D.C.

83,000 21,000 104,000 • Renovated to maintain

competitiveness

• Targeting lobby groups with spec

suites, plus larger prospects

116 HUNTINGTON

Boston

54,000 41,000 95,000 • Renovated to re-position as

boutique office

• Renewal successes, plus strong

interest in availability

ONE GLENLAKE

Atlanta

89,000 9,000 98,000 • Renovated to best-in-class for

submarket

• Targeting smaller users with spec

suites, plus larger prospects

SF1

1All as of 12.31.2016, pro forma for signing of WeWork lease at 650 California Street, the dispositions of Houston and Cleveland properties, and

the return of 263 Shuman to the lender; reflects 51% of the SF for the Market Square Joint Venture, in which CXP owns a 51% interest.

8

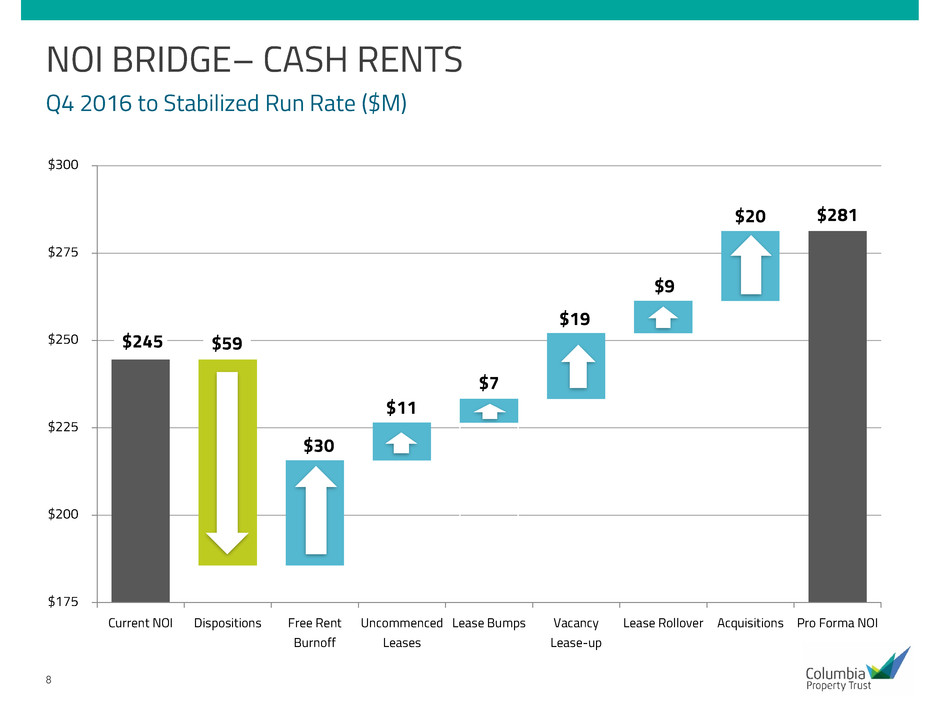

$245

$281

$30

$11

$7

$19

$9

$20

$59

$175

$200

$225

$250

$275

$300

Current NOI Dispositions Free Rent

Burnoff

Uncommenced

Leases

Lease Bumps Vacancy

Lease-up

Lease Rollover Acquisitions Pro Forma NOI

NOI BRIDGE– CASH RENTS

Q4 2016 to Stabilized Run Rate ($M)

9

NET ASSET VALUE AND IMPLIED CAP RATE

Per Share

Cash NOI $ 281,300

Cap Rate 5.50%

Capped NOI $ 41.86 $ 5,114,545

Debt1 (12.28) (1,500,000)

NAV $ 29.58 $3,614,545

Stock Price

Implied

Cap Rate

$ 22.50 6.62%

$ 25.00 6.18%

$ 27.50 5.79%

$30.00 5.45%

$ 32.50 5.14%

$35.00 4.87%

1Assumes cash on hand, disposition proceeds, and operation cash flows are used to fund the dividend, capital expenditures, and acquisitions in

2017 and 2018.

10

FLEXIBLE AND POISED FOR GROWTH

CONSERVATIVE

LEVERAGE LIQUIDITY

• Unencumbered asset pool of

$3.0 billion (80% of total

portfolio)

• $500M line of credit

• $670M cash balance

• $700M of investment grade

bonds issued in 2015-16

25% / 75%

Secured Unsecured

22.1%

Net Debt to Real-

Estate Assets1

Baa2

Stable /

Ratings

BBB

Stable

1Based on gross real estate assets as of 1.31.2017, pro forma for the return of 263 Shuman to the lender.

11

D

EB

T

O

U

TS

TA

N

D

IN

G

($

M

)

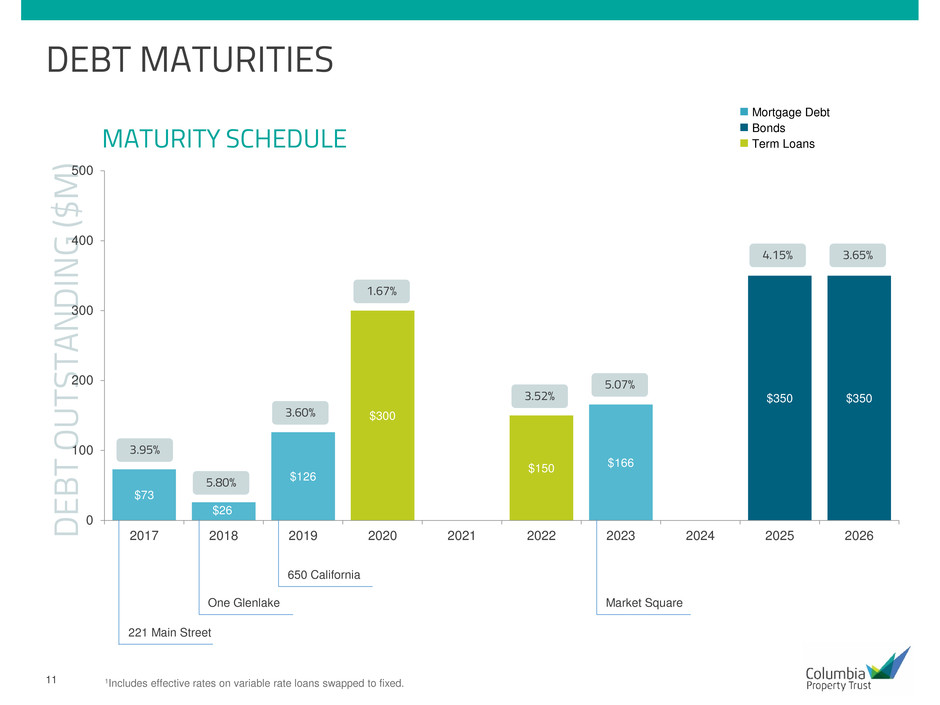

DEBT MATURITIES

$73

$26

$126

$166

$300

$150

$350 $350

0

100

200

300

400

500

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

MATURITY SCHEDULE

Mortgage Debt

Bonds

Term Loans

1Includes effective rates on variable rate loans swapped to fixed.

3.95%

3.60%

1.67%

3.52%

5.07%

4.15% 3.65%

5.80%

221 Main Street

One Glenlake

650 California

Market Square

12

LOOKING AHEAD

OPPORTUNITIES FOR INVESTMENT

• Acquisitions in target markets

• Mergers & Acquisitions

• Portfolio Acquisitions

• Individual Assets

• Share repurchases

ADDITIONAL SOURCES OF CAPITAL

• Recycle mature assets

• Strategic joint ventures

$670M

Cash on hand1

$500M

Available line of

credit balance

1As of February 9, 2017.

13

FOR MORE INFORMATION

Columbia Property Trust

INVESTOR RELATIONS

404.465.2227

ir@columbia.reit

www.columbia.reit

14

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(in thousands) Three Months

Ended 12/31/16 Annualized

Net Cash Provided by Operating Activities $ 43,387 $ 173,548

Straight line rental income 6,405 25,620

Depreciation of real estate assets (24,026) (96,104)

Amortization of lease-related costs (13,259) (53,036)

Loss from unconsolidated joint venture (2,120) (8,480)

Other non-cash expenses 20,412 81,648

Net changes in operating assets & liabilities (3,399) (13,596)

Net Income $ 27,400 $ 109,600

Interest expense (net) 15,158 60,632

Interest income from development authority bonds (1,800) (7,200)

Income tax expense 58 232

Depreciation of real estate assets 24,026 96,104

Amortization of lease-related costs 13,873 55,492

Adjustments from unconsolidated joint venture 4,216 16,864

EBITDA $ 82,931 $ 331,724

Loss on sale of real estate assets (22,242) (88,968)

Adjusted EBITDA $ 60,689 $ 242,756

General and administrative 8,158 32,632

Straight line rental income (6,152) (24,608)

Net effect of above (below) market amortization (611) (2,444)

Adjustments from unconsolidated joint venture (952) (3,808)

Net Operating Income (based on cash rents) $ 61,132 $ 244,528

15

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(continued from prior page)

(in thousands) Three Months

Ended 12/31/16 Annualized

Current NOI (based on cash rents) $ 61,132 $ 244,528

Dispositions (14,700) (58,800)

Free rent burnoff 7,500 30,000

Uncommenced leases 2,700 10,800

Lease bumps 1,700 6,800

Vacancy lease-up 4,700 18,800

Lease rollover 2,300 9,200

Acquisitions 5,000 20,000

Pro forma NOI (based on cash rents) $ 70,332 $ 281,328