Attached files

| file | filename |

|---|---|

| EX-10.54 - EXHIBIT 10.54 - Nobilis Health Corp. | exhibit1054hamiltonpromiss.htm |

| 10-K - FORM 10-K - Nobilis Health Corp. | nhc-123116x10k.htm |

| EX-32.2 - EXHIBIT 32.2 - Nobilis Health Corp. | exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Nobilis Health Corp. | exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Nobilis Health Corp. | exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Nobilis Health Corp. | exhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - Nobilis Health Corp. | exhibit232croweharwarthcon.htm |

| EX-23.1 - EXHIBIT 23.1 - Nobilis Health Corp. | exhibit231calvetticonsent.htm |

| EX-21.1 - EXHIBIT 21.1 - Nobilis Health Corp. | exhibit211nobilishealthcor.htm |

| EX-10.53 - EXHIBIT 10.53 - Nobilis Health Corp. | exhibit1053hamilton-xemplo.htm |

| EX-10.52 - EXHIBIT 10.52 - Nobilis Health Corp. | exhibit1052hamilton-xphysi.htm |

| EX-10.50 - EXHIBIT 10.50 - Nobilis Health Corp. | exhibit1050bbvacreditagree.htm |

| EX-10.49 - EXHIBIT 10.49 - Nobilis Health Corp. | exhibit1049hamilton-assetp.htm |

AMENDED AND RESTATED ASSET PURCHASE AGREEMENT

AMONG

NORTHSTAR HEALTHCARE ACQUISITIONS, L.L.C.,

as Buyer,

as Buyer,

and

NOBILIS HEALTH CORP.

and

HAMILTON PHYSICIAN SERVICES, LLC,

CARLOS R. HAMILTON III, M.D., P.A.

each as a Seller,

and

CARLOS R. HAMILTON III, M.D.

as Owner

as Owner

DATED

March 8, 2017

3774916.5

TABLE OF CONTENTS

ARTICLE I | PURCHASE AND SALE OF ASSETS | 1 | |

Section 1.1 | Purchase and Sale; Post-Closing Adjustment; Closing | 1 | |

Section 1.2 | Excluded Assets | 4 | |

Section 1.3 | Assumed Liabilities | 6 | |

Section 1.4 | Retained Liabilities | 6 | |

Section 1.5 | Closing | 7 | |

Section 1.6 | Closing Deliveries. | 7 | |

Section 1.7 | Allocation of Purchase Price | 8 | |

ARTICLE II | REPRESENTATIONS OF SELLERS | 9 | |

Section 2.1 | Existence, Authority and Binding Obligation | 9 | |

Section 2.2 | Organization; Subsidiaries | 9 | |

Section 2.3 | No Conflict | 9 | |

Section 2.4 | Title, Sufficiency and Condition of Assets | 10 | |

Section 2.5 | Financial Statements | 10 | |

Section 2.6 | Liabilities | 11 | |

Section 2.7 | Legal Compliance | 11 | |

Section 2.8 | Taxes | 11 | |

Section 2.9 | Intellectual Property | 12 | |

Section 2.10 | Agreements | 13 | |

Section 2.11 | Legal Proceedings | 13 | |

Section 2.12 | Medicare Participation and Reimbursement. | 13 | |

Section 2.13 | Compliance | 14 | |

Section 2.14 | Clinical Staff Matters | 14 | |

Section 2.15 | Employment Matters | 14 | |

Section 2.16 | Inventory | 15 | |

Section 2.17 | Certain Books and Records | 15 | |

Section 2.18 | Investment Experience | 15 | |

Section 2.19 | No SEC Review | 15 | |

Section 2.20 | Purchase For Own Account | 15 | |

Section 2.21 | Rule 144 | 15 | |

Section 2.22 | Unregistered Registration Shares | 16 | |

Section 2.23 | No Public Offering | 16 | |

ARTICLE III | REPRESENTATIONS OF BUYER AND NHC | 16 | |

Section 3.1 | General | 16 | |

ARTICLE IV | OTHER COVENANTS OF THE PARTIES | 17 | |

Section 4.1 | Conduct of Business Prior to Closing | 17 | |

Section 4.2 | Access to Books, Records and Personnel | 17 | |

Section 4.3 | Tax Matters | 18 | |

Section 4.4 | Further Assurances | 18 | |

Section 4.5 | Sellers’ Employees | 18 | |

Section 4.6 | Covenant Not to Compete | 19 | |

Section 4.7 | Confidentiality | 20 | |

Section 4.8 | Mail | 21 | |

i | ||

3774916.5

TABLE OF CONTENTS

(continued)

Page

Section 4.9 | Third Party Consents | 21 | |

Section 4.10 | Insurance | 21 | |

Section 4.11 | Financial Statements | 21 | |

Section 4.12 | Sellers' Indebtedness | 22 | |

Section 4.13 | Cooperation after Closing | 22 | |

Section 4.14 | Transition Period | 22 | |

Section 4.15 | Release of Sellers and Owner | 22 | |

ARTICLE V | CONDITIONS TO CLOSING | 24 | |

Section 5.1 | Conditions to Obligations of the Parties | 23 | |

Section 5.2 | Conditions to Obligations of Sellers and Owner | 23 | |

Section 5.3 | Conditions to Obligations of Buyer and NHC | 23 | |

ARTICLE VI | PURCHASE PRICE HOLDBACK CASH | 24 | |

Section 6.1 | Holdback Cash | 24 | |

Section 6.2 | Distribution of Holdback Cash | 24 | |

ARTICLE VII | INDEMNIFICATION | 24 | |

Section 7.1 | Loss and Indemnitees Defined | 24 | |

Section 7.2 | Indemnification by Sellers | 24 | |

Section 7.3 | Indemnification by Buyer and NHC | 25 | |

Section 7.4 | Procedures for Indemnification. | 25 | |

Section 7.5 | Survival of Limitation | 26 | |

Section 7.6 | Limitations on Indemnification and Payment of Damages. | 27 | |

Section 7.7 | Characterization of Indemnification Payments | 27 | |

Section 7.8 | Express Negligence Rule | 27 | |

ARTICLE VIII | TERMINATION | 28 | |

Section 8.1 | Termination | 28 | |

Section 8.2 | Effect of Termination | 28 | |

ARTICLE IX | GENERAL PROVISIONS | 28 | |

Section 9.1 | Expenses | 28 | |

Section 9.2 | Notices | 29 | |

Section 9.3 | Severability | 29 | |

Section 9.4 | Entire Agreement | 29 | |

Section 9.5 | Assignment | 29 | |

Section 9.6 | No Third-Party Beneficiaries | 30 | |

Section 9.7 | Amendment; Waiver | 30 | |

Section 9.8 | Governing Law | 30 | |

Section 9.9 | Dispute Resolution | 30 | |

Section 9.10 | Counterparts | 30 | |

Section 9.11 | Press Releases | 30 | |

ii | ||

3774916.5

EXHIBITS: | ||

Exhibit A | - | Form of Convertible Note |

Exhibit B | - | Form of Bill of Sale, Assignment and Assumption |

Exhibit C | - | Form of Physician Employment Agreement and Medical Director Agreement |

Exhibit D | - | Form of IP License – Intentionally Omitted |

Exhibit E-1 | - | Form of Sellers’ Closing Certificate |

Exhibit E-2 | - | Form of Owner’s Closing Certificate |

Exhibit F Exhibit G | - | Form of Buyer’s Closing Certificate Transition Services Agreement |

SCHEDULES: | ||

Schedule 1.1(a) | - | Purchased Assets/Contracts |

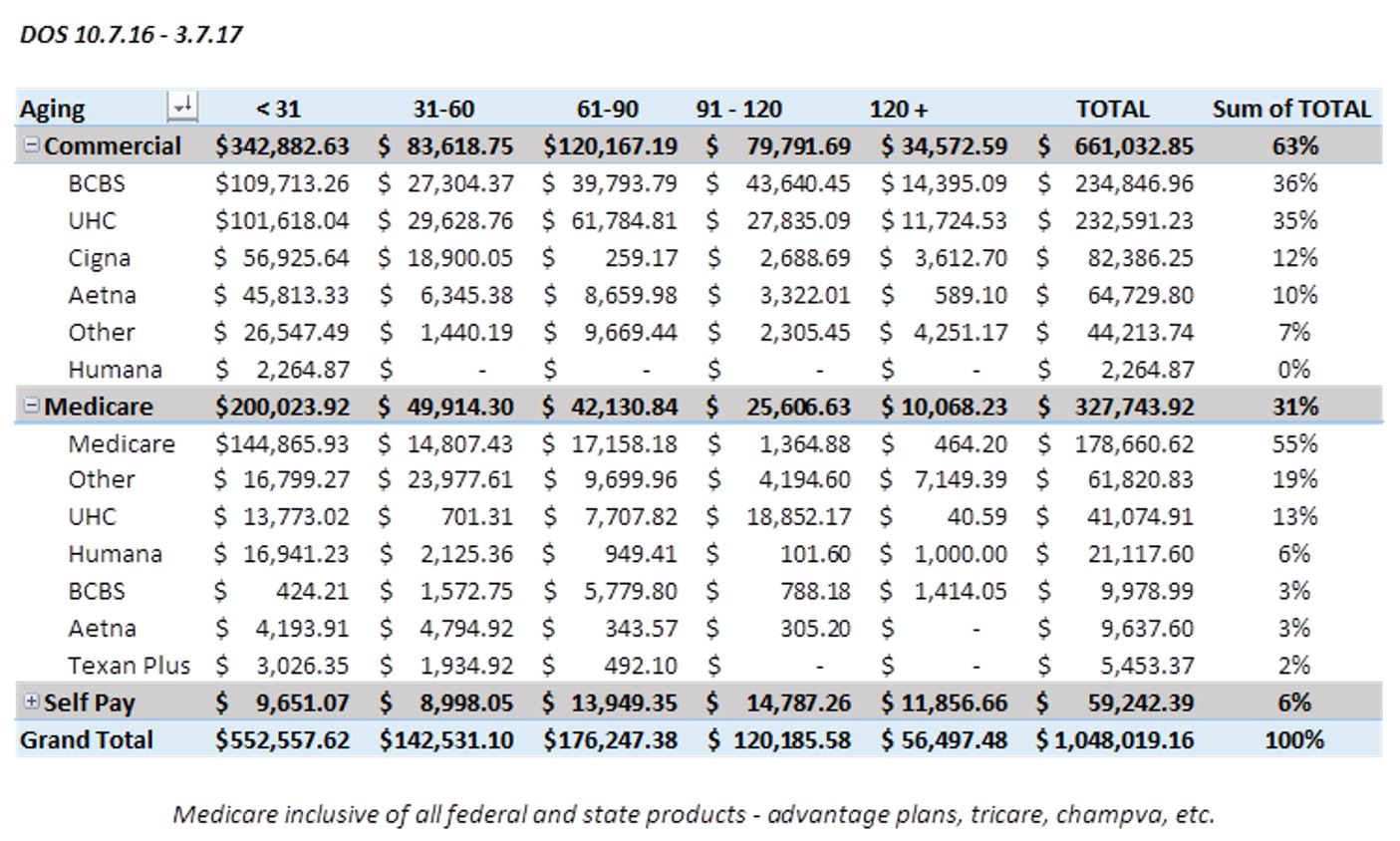

Schedule 1.1(b) | - | Accounts Receivable |

Schedule 1.2(c) | - | Excluded Assets – Contracts |

Schedule 1.2(d) | - | Excluded Assets – Other Assets |

Schedule 1.3(a) | - | Assumed Accounts Payable |

Schedule 1.3(c) | - | Equipment Indebtedness |

Schedule 1.3(e) | - | Clinic Leases |

Schedule 1.3(f) Schedule 1.4 | - | Other Assumed Liabilities Retained Liabilities |

Schedule 2.3 | - | No Conflicts, Consents, etc. |

Schedule 2.4 | - | Title, Sufficiency and Condition of Assets |

Schedule 2.5 | - | Financial Statements |

Schedule 2.7 | - | Permits |

Schedule 2.9 | - | Excluded IP Assets |

Schedule 2.10(b) | - | Health Care Professional Agreements |

Schedule 2.10(c) | - | Related Party Agreements |

Schedule 2.10(d) | - | Lease Payments |

Schedule 2.11 | - | Sellers’ Legal Proceedings |

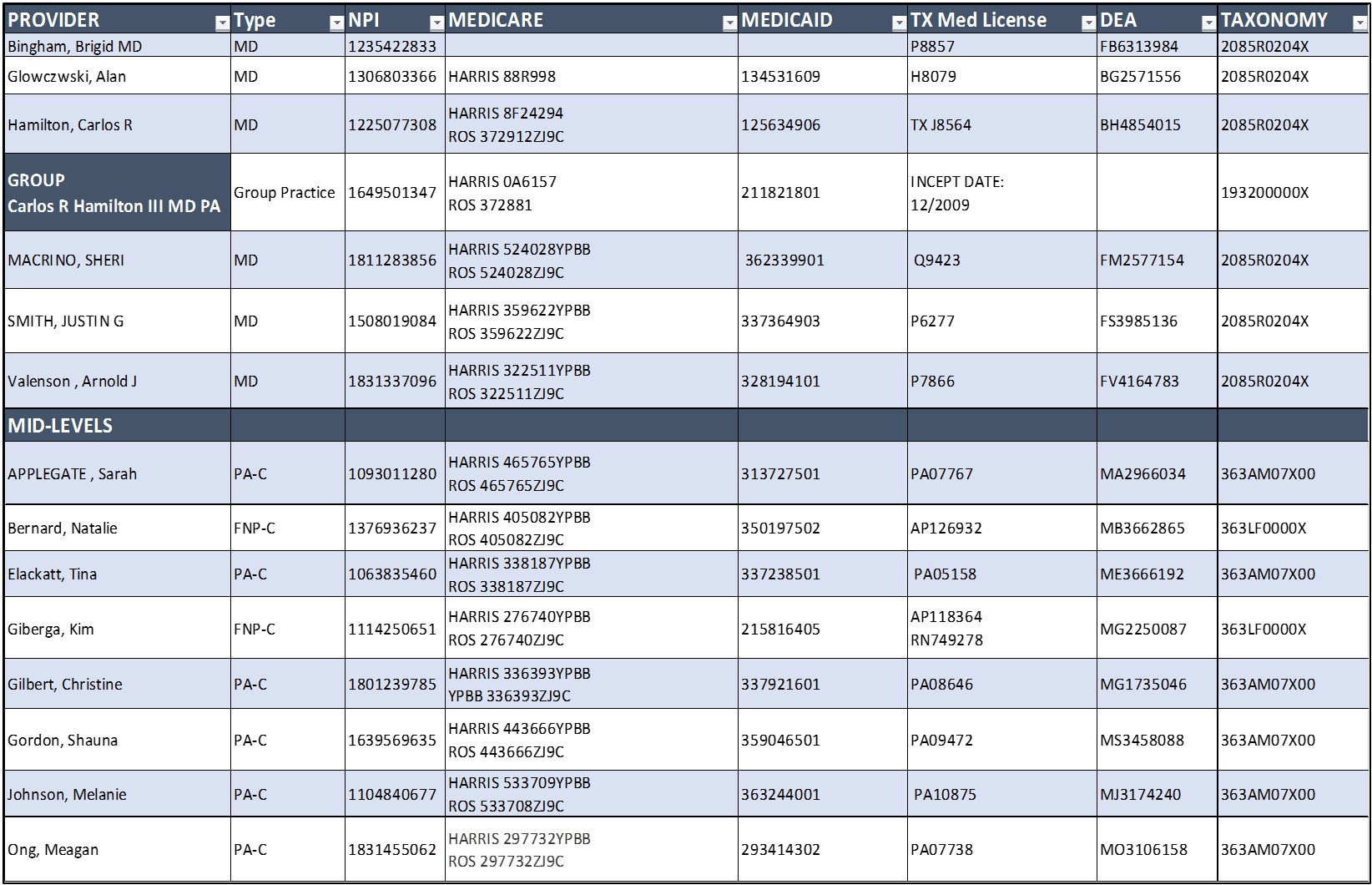

Schedule 2.12(a) | - | NPIs/Provider Numbers |

Schedule 2.12(b) | - | Billing Practices |

Schedule 2.14 | - | Clinical Staff |

Schedule 3.1(b) | - | Buyer Consents |

Schedule 4.5 | - | Transferred Employees |

Schedule 4.6 | - | Exceptions to Non-Compete |

[Remainder of Page Intentionally Left Blank]

iii | ||

3774916.5

INDEX OF DEFINED TERMS

Defined Term | Section |

Accounts Receivable | 1.1(b) |

Affiliate | 2.10(c) |

Agreement | Preamble |

Applicable Laws | 1.2(b) |

AP | 1.3(a) |

AR | 1.1(b) |

Assumed Liabilities | 1.3 |

Business | Recitals |

Buyer | Preamble |

Buyer Indemnitees | 7.1(b) |

Clinic Leases | 1.3(e) |

Closing | 1.5 |

Closing Cash | 1.1(a)(i) |

Closing Date | 1.5(a) |

Closing Working Capital | 1.1(d)(i)(1) |

Closing Working Capital Statement | 1.1(ii)(3) |

Code | 1.7(a) |

Converted Financial Statements | 4.11 |

Current Assets | 1.1(d)(i)(2) |

Current Liabilities | 1.1(d)(i)(3) |

Disputed Amounts | 1.1(ii)(d)(7) |

Effective Date | Preamble |

Equipment Indebtedness | 1.3(c) |

ERISA | 1.2(a) |

Estimated Closing Working Capital | 1.1(ii)(1) |

Estimated Closing Working Capital Statement | 1.1(ii)(1) |

Excluded Assets | 1.2 |

Financial Statements | 2.5(a)(ii) |

Fundamental Representations | 7.5(a)(ii) |

GAAP | 1.1(d)(i)(4) |

Government Programs | 1.2(g) |

Governmental Authority | 1.2(b) |

Health Care Professional Agreements | 2.10(b) |

Holdback Cash | 1.1(a)(iii) |

HPS | Preamble |

Independent Accountant | 1.1(d)(ii)(7) |

Indemnified Party | 7.4(a) |

Indemnifying Party | 7.4(a) |

Intellectual Property | 2.9(a) |

-iv-

3774916.5

Interim Financial Statements | 2.5(a)(ii) |

Inventory and Inventories | 2.16 |

Loss | 7.1(a) |

NHC | Preamble |

NPIs | 1.2(g) |

Non-Transferred Purchased Asset | 4.9 |

Note | 1.1(a)(ii) |

Owner | Preamble |

Parties | Preamble |

Party | Preamble |

PA | Preamble |

Payoff Amount | 4.12 |

Payoff Letters | 4.12 |

Permits | 1.2(b) |

Permitted Encumbrances | 2.4 |

Physician Employment & Medical Director Agreement | 1.6(a)(ii) |

Plans | 1.2(a) |

Post-Closing Adjustment | 1.1(ii)(4) |

Program Agreements | 2.12(a) |

PTO | 4.5(b) |

Purchase Price | 1.1(a) |

Purchased Assets | 1.1(a) |

Resolution Period | 1.1(ii)(6) |

Restricted Period | 4.6 |

Restricted Territory | 4.6 |

Retained Liabilities | 1.4(b) |

Review Period | 1.1(ii)(5) |

SEC | 2.19 |

Securities Act | 2.19 |

Seller(s) | Preamble |

Seller Indemnitees | 7.1(c) |

Seller Insurance | 4.10 |

Sellers’ Knowledge | 2.6 |

Statement of Objections | 1.1(ii)(6) |

Tax Returns | 1.7(b) |

Taxes | 1.3(d) |

Third Party Claim | 7.4(a) |

Trade Secrets | 2.9(a)(iv) |

Transaction Documents | 2.1(a) |

Transactions | 2.1(a) |

Transferred Employees | 4.5(a) |

Transferred IP Assets | 2.9(a) |

Unaudited Financial Statements | 2.5(a)(i) |

-v-

3774916.5

Undisputed Amounts | 1.1(d)(ii)(7) |

[Remainder of Page Intentionally Left Blank]

-vi-

3774916.5

AMENDED AND RESTATED ASSET PURCHASE AGREEMENT

This Amended and Restated Asset Purchase Agreement (this “Agreement”) is dated March 8, 2017 (the “Effective Date”), among Northstar Healthcare Acquisitions, L.L.C., a Delaware limited liability company (“Buyer”), Nobilis Health Corp., a British Columbia corporation (“NHC”), Hamilton Physician Services, LLC, a Texas limited liability company (“HPS”), Carlos R. Hamilton, III, M.D., P.A. a Texas Professional Association (“PA”) (HPS and PA are each a “Seller” and collectively “Sellers”), and Carlos R. Hamilton III, M.D, a resident of the State of Texas (“Owner”). Buyer, NHC, Sellers and Owner are referred to collectively as the “Parties” and each individually as a “Party.”

A. Buyer, NHC, Sellers and Owner entered into that certain Asset Purchase Agreement, dated January 6, 2017 (the “Original Agreement”), pursuant to which Sellers agreed to sell to Buyer, and Buyer agreed to purchase from Sellers, substantially all of the assets of the vascular medical practice owned and operated by Sellers.

B. Buyer, NHC, Sellers and Owner desire to amend and restated the Original Agreement, upon the terms and conditions of this Agreement, which supersedes and replaces the Original Agreement in its entirety.

C. Sellers collectively own and operate an independent, vascular medical practice focused on the diagnosis and treatment of venous disease with eight (8) clinic locations located in the Houston, Austin, and San Antonio, Texas at which medical practitioners treat patients with venous diseases and provide certain other vascular services (the “Business”).

D. Sellers desire to sell to Buyer, and Buyer desires to purchase from Sellers, substantially all of the assets, and certain specified liabilities, of the Business.

E. Owner owns all of the limited liability company interests in HPS and all of the stock of PA.

In consideration of the mutual covenants and agreements in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

ARTICLE I

PURCHASE AND SALE OF ASSETS

PURCHASE AND SALE OF ASSETS

Section 1.1 Purchase and Sale; Post-Closing Adjustment; Closing.

(a) At the Closing, Sellers shall sell to Buyer, and Buyer shall purchase from Sellers, all of Sellers’ right, title and interest in all of the assets of Sellers listed or described on Schedule 1.1(a), including the Accounts Receivable but excluding the Excluded Assets (collectively, the “Purchased Assets”), free and clear of all encumbrances, for a purchase price to be paid at the Closing equal to Thirteen Million Three Hundred Twenty Thousand Six Hundred Forty-Five Dollars and Fifty-Two Cents ($13,320,645.52) (the “Purchase Price”), consisting of the following:

3774916.5

(i) Seven Million Eight Hundred Twenty Thousand Six Hundred Forty-Five Dollars and Fifty-Two Cents ($7,820,645.52) in cash delivered at Closing (the “Closing Cash”);

(ii) a convertible note, substantially in the form attached hereto as Exhibit A, in the principal amount of Five Million Dollars ($5,000,000) executed by Buyer and NHC in favor of Owner (the “Note”); and

(iii) Five Hundred Thousand Dollars ($500,000) as a holdback to the cash portion of the Purchase Price (the “Holdback Cash”) which shall be distributed in accordance with Article VI.

(b) For the purposes of this Agreement, “Accounts Receivable” means all accounts receivable and other rights to payment from patients and customers of Sellers, but excluding Government Programs, with respect to goods sold and services provided within the 90-day period immediately preceding the Closing (the “AR”), set forth on Schedule 1.1(b).

(c) Notwithstanding the foregoing, between the Effective Date and Closing Sellers shall permit Buyer, during normal business hours and with advance notice, to reasonably inspect and take a physical inventory of the Purchased Assets to verify the accuracy and completeness of Schedule 1.1(a).

(d) Working Capital Matters.

(i) Definitions: For purposes of this Article I:

(1) “Closing Working Capital” means (a) the Current Assets of the Sellers, less (b) the Current Liabilities of the Sellers, determined as of the close of business on the Closing Date.

(2) “Current Assets” means cash and cash equivalents, accounts receivable, inventory and prepaid expenses, but excluding (a) the portion of any prepaid expense of which Buyer will not receive the benefit following the Closing; and (b) deferred tax assets.

(3) “Current Liabilities” means accounts payable, accrued Taxes and accrued expenses.

(4) “GAAP” means United States generally accepted accounting principles.

(ii) Post-Closing Adjustment.

(1) At least three (3) business days before the Closing, the Sellers shall prepare and deliver to Buyer a statement setting forth its good faith estimate of Closing Working Capital (the “Estimated Closing Working Capital”), which statement shall contain an estimated balance sheet of the Sellers as of the Closing Date (without giving effect to the transactions

2

3774916.5

contemplated herein) and a calculation of Estimated Closing Working Capital calculated in accordance with GAAP (the “Estimated Closing Working Capital Statement”).

(2) Within thirty (30) days after the Closing Date, Sellers shall deliver to Buyer the Converted Financial Statements in accordance with Section 4.11 (“the Converted Financials Date”).

(3) Within sixty (60) days after the Converted Financials Date, Buyer shall prepare and deliver to Sellers a statement setting forth Buyer’s calculation of Closing Working Capital, which statement shall contain an opening balance sheet of the Sellers as of the Closing Date (without giving effect to the transactions contemplated herein) and a calculation of Closing Working Capital calculated in accordance with GAAP (the “Closing Working Capital Statement”).

(4) The post-closing adjustment shall be an amount equal to the Closing Working Capital set forth on the Closing Working Capital Statement minus the Estimated Closing Working Capital (the “Post-Closing Adjustment”). If the Post-Closing Adjustment is a positive number, Buyer shall pay to Sellers an amount equal to the Post-Closing Adjustment. If the Post-Closing Adjustment is a negative number, Sellers shall pay to Buyer an amount equal to the Post-Closing Adjustment.

(5) After receipt of the Closing Working Capital Statement, Sellers shall have thirty (30) days (the “Review Period”) to review the Closing Working Capital Statement. During the Review Period, Sellers and Sellers' accountants shall have full access to the personnel of, and work papers prepared by, Buyer and/or Buyer's accountants to the extent that they relate to the Closing Working Capital Statement and to such historical financial information (to the extent in Buyer's possession) relating to the Closing Working Capital Statement as Sellers may reasonably request for the purpose of reviewing the Closing Working Capital Statement and to prepare a Statement of Objections (defined below); provided, that such access shall be in a manner that does not interfere with the normal business operations of Buyer.

(6) On or prior to the last day of the Review Period, Sellers may object to the Closing Working Capital Statement by delivering to Buyer a written statement setting forth Sellers’ objections in reasonable detail, indicating each disputed item or amount and the basis for Sellers’ disagreement therewith (the “Statement of Objections”). If Sellers fail to deliver the Statement of Objections before the expiration of the Review Period, the Closing Working Capital Statement and the Post-Closing Adjustment, as the case may be, reflected in the Closing Working Capital Statement shall be deemed to have been accepted by Sellers. If Sellers deliver the Statement of Objections before the expiration of the Review Period, Buyer and Sellers shall negotiate in good faith to resolve such objections within thirty (30) days after the delivery of the Statement of Objections (the “Resolution Period”), and, if the same are so resolved within the Resolution Period, the Post-Closing Adjustment and the Closing Working Capital Statement with such changes as may have been previously agreed in writing by Buyer and Sellers, shall be final and binding.

3

3774916.5

(7) Resolution of Disputes. If Sellers and Buyer fail to reach an agreement with respect to all of the matters set forth in the Statement of Objections before expiration of the Resolution Period, then any amounts remaining in dispute (“Disputed Amounts”) and any amounts not so disputed, the “Undisputed Amounts”) shall be submitted for resolution to the office of Weaver L.L.P. or, if Weaver L.L.P. is unable to serve, Buyer and Sellers shall appoint by mutual agreement the office of an impartial nationally recognized firm of independent certified public accountants other than Sellers’ accountants or Buyer's accountants (the “Independent Accountants”) who, acting as experts and not arbitrators, shall resolve the Disputed Amounts only and make any adjustments to the Post-Closing Adjustment, as the case may be, and the Closing Working Capital Statement. The Parties agree that all adjustments shall be made without regard to materiality. The Independent Accountants shall only decide the specific items under dispute by the parties and their decision for each Disputed Amount must be within the range of values assigned to each such item in the Closing Working Capital Statement and the Statement of Objections, respectively.

(8) Any fees and expenses of the Independent Accountant shall be paid by Sellers, on the one hand, and by Buyer, on the other hand, based upon the percentage that the amount actually contested but not awarded to Sellers or Buyer, respectively, bears to the aggregate amount actually contested by Sellers and Buyer.

(9) The Independent Accountants shall make a determination as soon as practicable within thirty (30) days (or such other time as the Parties shall agree in writing) after their engagement, and their resolution of the Disputed Amounts and their adjustments to the Closing Working Capital Statement and/or the Post-Closing Adjustment shall be conclusive and binding upon the Parties hereto.

(10) Except as otherwise provided herein, any payment of the Post-Closing Adjustment, shall (a) be due (x) within five (5) business days of acceptance of the applicable Closing Working Capital Statement or (y) if there are Disputed Amounts, then within five (5) business days of the resolution described above; and (b) be paid by wire transfer of immediately available funds to such account as is directed by Sellers, or by way of setoff against the Holdback Cash by Buyer, as the case may be.

(11) Any payments made pursuant to this Section 1.1(d)(ii) shall be treated as an adjustment to the Purchase Price by the Parties for tax purposes, unless otherwise required by law.

Section 1.2 Excluded Assets. The Purchased Assets do not include the following assets of Sellers (collectively, the “Excluded Assets”):

(a) all ownership and other rights with respect to any Plans including, without limitation, all assets and contracts of or relating to any Plans, except as set forth in Sections 1.3(b). With respect to Sellers, the term “Plans” means all employee welfare benefit plans within the meaning of Section 3(1) of the Employee Retirement Income Security Act of 1974, as amended, and the regulations and rulings issued thereunder (“ERISA”), all employee pension benefit plans

4

3774916.5

within the meaning of Section 3(2) of ERISA, all employee stock option or stock purchase plans, bonus or incentive plans or programs, severance pay plans, policies, practices or agreements, fringe benefits, and employment agreements;

(b) any franchises, authorizations, licenses, permits, variances, consents, registrations, accreditations, certifications, certificates of need, enrollments, qualifications, operating authority, concessions, exemptions, approvals, orders, grants or permissions issued by, or otherwise granted from Governmental Authorities (collectively, “Permits”) necessary to own, lease and operate the Sellers’ properties and to carry on their businesses as they are now being conducted that by its terms is not transferable to Buyer. The term “Governmental Authority” means any domestic, foreign or multi-national federal, state, provincial, regional, municipal or local governmental or administrative authority, including any court, tribunal, agency, bureau, committee, board, regulatory body, administration, commission or instrumentality constituted or appointed by any such authority, and shall include any agency, branch or other governmental body charged with the responsibility and/or vested with the authority to administer and/or enforce any applicable laws, statutes, orders, ordinances, rules, regulations, policies, or guidelines (collectively, “Applicable Laws”), including but not limited to the Centers for Medicare and Medicaid Services, The Food and Drug Administration, the United States Department of Health and Human Services Office of Inspector General, and any Medicare or Medicaid contractors, auditors, intermediaries or carriers;

(c) all claims and rights under the contracts set forth on Schedule 1.2(c);

(d) the assets set forth on Schedule 1.2(d);

(e) the corporate seals, organizational documents, minute books, and Tax Returns (defined in Section 1.7), or other records having to do with the corporate organization of Sellers;

(f) any equity interests in any Seller;

(g) all national provider identifiers (“NPIs”), all Medicare, Medicaid, TRICARE, Department of Labor and other governmental payor program (collectively, the “Government Programs”) provider numbers and related provider agreements;

(h) all personnel records and other records that a Seller is required by Applicable Laws to retain in its possession, subject to Buyer’s right to receive copies thereof to the extent permitted by Applicable Laws;

(i) right to settlements and retroactive adjustments, if any, for reporting periods ending on or prior to the Closing Date, whether open or closed, arising from or against the United States government under the Government Programs and against any third party payor programs which settle upon a basis other than on individual claims basis;

(j) Sellers’ rights under the Transaction Documents; and

5

3774916.5

(k) Except as otherwise set forth in the Transition Services Agreement (as further described under Section 4.14), all accounts receivables and other rights to payment from Government Programs with respect to goods sold and services provided by Sellers prior to the Closing Date.

6

3774916.5

Section 1.1 Assumed Liabilities. Buyer agrees to assume and perform when due only the following liabilities of Sellers, as applicable (the “Assumed Liabilities”):

(a) trade accounts payable incurred in the ordinary course of business of Sellers through the Closing that are not delinquent (i.e., consistent with historical payment of such accounts), as set forth on Schedule 1.3(a) (the “AP”). Seller hereby agrees that for the purposes of this Section 1.3(a), AP specifically excludes Sellers’ or Owner’s personal expenses. Buyer will not assume such personal expenses and other expenses not incurred in the ordinary course of Sellers’ business;

(b) the non-debt liabilities arising out of the ownership and operation of the Purchased Assets or the Business after the Closing;

(c) all remaining payment obligations under capital leases and other equipment-related indebtedness and obligations for equipment included in the Purchased Assets or constituting Non-Transferred Purchased Assets (collectively, “Equipment Indebtedness”), set forth on Schedule 1.3(c), and all other liabilities arising after the Closing with respect to Equipment Indebtedness;

(d) all liabilities with respect to any federal, provincial, state, local or foreign tax or other assessment (“Taxes”) related to the Purchased Assets incurred for any period on or after the Closing;

(e) all “Clinic Leases” which, for purposes of this Agreement, shall mean those real property leases set forth on Schedule1.3(e); and

(f) Those liabilities listed on Schedule 1.3(f).

Section 1.2 Retained Liabilities.

(a) Sellers shall retain responsibility for performing when due, and Buyer shall not assume or have any responsibility for, all liabilities of Sellers related to the Business and the Purchased Assets other than the Assumed Liabilities, including (i) the ownership and operation of the Business and the Purchased Assets prior to the Closing; (ii) the Excluded Assets; (iii) the termination of any employees of Sellers who are not Transferred Employees; (iv) Transferred Employees who do not report for work with Buyer upon the Closing; (v) certain indebtedness of the Sellers set forth on Schedule 1.4; (vi) any refund, recoupment, and any penalty obligations for services rendered and billed by the Business or its employees prior to Closing, regardless of when such obligations are discovered or due; and (vii) any liability relating to or arising out of any employment action or practice in connection with Seller’s employment or termination of employment of any persons currently or formerly employed or seeking to be employed by the Sellers, including liabilities based upon breach of employment contract, employment discrimination, wrongful termination, wage and hour compliance (including, without limitation, employee classification, overtime and minimum wage obligations), independent contractor classification, health and safety requirements, immigration and/or worker authorization requirements, disability

7

3774916.5

accommodation and leave laws, workers’ compensation, constructive termination, failure to give reasonable notice or pay in lieu of notice, severance or termination pay or the Consolidated Omnibus Budget Reconciliation Act, as amended, the Employee Retirement Income Security Act of 1974, as amended, the Worker Adjustment Retraining Notification Act of 1988, as amended, the Fair Labor Standards Act, as amended, or the National Labor Relations Act, as amended, or any equivalent state, municipal, county, local, foreign or other Applicable Law. Notwithstanding anything to the contrary contained herein, any amounts that come due pursuant to this Section 1.4(a)(vi) or related to the liabilities listed on Schedule 2.12(b), if any, shall be offset as set forth in Section 7.6(e) subject to Sellers’ and Owner’s prior written consent.

(b) For the purposes of this Agreement, the liabilities described in Section 1.4(a) shall collectively be the “Retained Liabilities”.

Section 1.3 Closing. The consummation of the sale and purchase of the Purchased Assets (the “Closing”) will take place at the offices of Nobilis Health Corp. 11700 Katy Freeway, Suite 300, Houston, Texas 77079, at 10:00 a.m. local time on the sooner of March ____, 2017 or the second business day after all of the conditions to closing in Sections 5.1, 5.2, and 5.3 are satisfied or waived (other than conditions which are to be satisfied on the Closing Date), or at such other time, date or place as Sellers, Owner and Buyer may mutually agree upon in writing (the “Closing Date”). The Closing shall be deemed effective as of 12:00 a.m., Houston time, on the Closing Date.

Section 1.6 Closing Deliveries.

(a) At the Closing, unless waived by Buyer, Sellers and Owner, as applicable, shall deliver to Buyer:

(i) a bill of sale, assignment and assumption with respect to the Purchased Assets substantially in the form attached hereto as Exhibit B, duly executed by Sellers and Owner, in favor of certain direct or indirect, wholly-owned subsidiaries of Buyer, as designated by Buyer to Seller prior to the Closing Date;

(ii) an employment agreement, substantially in the form attached hereto as Exhibit C (the “Physician Employment & Medical Director Agreement”), executed by Owner;

(iii) Certificates of Account Status with respect to each Seller, issued by the Texas Comptroller within five (5) business days prior to the Closing Date;

(iv) a closing certificate, substantially in the form attached hereto as Exhibit E-1, executed by each Seller, and a certificate, substantially in the form attached hereto as Exhibit E-2, executed by Owner;

(v) any approvals or consents required by Section 4.4;

8

3774916.5

(vi) any evidence of payoff of debt required by Section 4.12 (excluding Equipment Indebtedness) of each Seller or Owner or release of liens encumbering any of the Purchased Assets requested by Buyer;

(vii) all books and records of Sellers or Owner related to the Purchased Assets;

(viii) the Transition Services Agreement, upon terms mutually agreeable to Buyer, Sellers and Owner, executed by Sellers;

(ix) assignment and assumption agreements for each of the Clinic Leases, executed by Sellers and Owner; and

(x) such other documents as Buyer may reasonably request.

(b) At the Closing, unless waived by Sellers, Buyer shall deliver to Sellers:

(i) the Closing Cash via wire transfer;

(ii) the Note, upon terms mutually agreeable to Buyer and Seller, executed by Buyer;

(iii) any approvals or consents of any rulemaking authority, person or entity applicable to Buyer required by Section 4.4;

(iv) the Physician Employment & Medical Director Agreement, executed by Buyer;

(v) the Transition Services Agreement, upon terms mutually agreeable to Buyer, Sellers and Owner, executed by Buyer;

(vi) a closing certificate, substantially in the form attached hereto as Exhibit F, executed by Buyer;

(vii) assignment and assumption agreements for each of the Clinic Leases, executed by Buyer;

(viii) Certificates of Account Status with respect to Buyer and NHC (or equivalent documentation applicable to each entity’s jurisdiction of formation), issued by the applicable jurisdiction of formation within five (5) business days prior to the Closing Date; and

(ix) such other documents as Sellers may reasonably request.

9

3774916.5

Section 1.1 Allocation of Purchase Price.

(a) The Parties shall allocate the Purchase Price in accordance with Section 1060 of the Internal Revenue Code of 1986, as amended (together with any rules or regulations issued thereunder, “Code”). Within ninety (90) days after the Closing Date, Buyers shall provide Sellers a draft allocation of the Purchase Price and the liabilities of Sellers and Owner among the Purchased Assets.

(b) The Parties shall timely file any information that may be required pursuant to Treasury Regulations promulgated under Section 1060(b) of the Code, and shall use the allocation of the Purchase Price as finally determined pursuant to this Section 1.7, in connection with the preparation of Internal Revenue Service Form 8594 as that form relates to the Transactions. The Parties shall not file any returns, declarations, reports, statements and other documents of, relating to, or required to be filed in respect of, any and all Taxes (“Tax Returns”) or otherwise take any position which is inconsistent with such allocation, except as may be adjusted by subsequent agreement following an audit by the Internal Revenue Service or by court decision. The Parties agree that the amount of the Purchase Price allocated to the covenant not to compete in Section 4.6 is not intended to be a liquidated damages amount or to place a value or ceiling on the amount of damages that could be suffered by Buyer if such covenants are breached.

ARTICLE II

REPRESENTATIONS OF SELLERS

REPRESENTATIONS OF SELLERS

Owner and each of the Sellers, jointly and severally, represent to Buyer and NHC as follows, as of the date of this Agreement and the Closing Date:

Section 2.1 Existence, Authority and Binding Obligation.

(a) Each Seller is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation, with full power and authority to enter into and deliver this Agreement and the other agreements, documents or instruments contemplated hereby (collectively, the “Transaction Documents”), to carry out its obligations under, and to consummate the transactions contemplated by, the Transaction Documents (collectively, the “Transactions”).

(b) This Agreement constitutes, and, when executed and delivered, the Transaction Documents will constitute, the legal, valid and binding obligations of Sellers, enforceable against them in accordance with their terms, except as such enforceability may be limited by laws affecting the enforcement of creditors’ rights and general principles of equity.

(c) Each Seller is not qualified to do business in any jurisdiction other than its jurisdiction of formation.

(d) There are no outstanding powers of attorney relating to or binding on the Business or the Purchased Assets.

Section 2.2 Organization; Subsidiaries.

10

3774916.5

(a) Each Seller is in compliance with all provisions of its governing documents.

(b) No Seller owns any direct or indirect interest or other rights in any other entity.

(c) There are no outstanding third party rights for the issuance, sale or purchase of any security or equity interest of any Seller.

Section 2.3 No Conflict. Except as set forth in Schedule 2.3, the execution, delivery and performance of this Agreement, does not and will not:

(a) breach, or require the consent of any person or entity pursuant to, Sellers’ governing documents;

(b) breach, or require the consent of any person or entity pursuant to, any law, regulation, permit, order, award or other non-contractual restriction or rule applicable to Sellers, their respective assets, the Purchased Assets or the Business;

(c) result in the creation of any encumbrance upon Sellers, their respective assets or the Purchased Assets; or

(d) (whether with notice or the lapse of time or both) under any contract or other instrument binding on Sellers:

(i) result in any breach of any contract included in the Purchased Assets;

(ii) provide any other person or entity rights of termination, rescission, amendment, acceleration or cancellation of any contract included in the Purchased Assets; or

(iii) require any authorization or approval of any person or entity.

Section 2.4 Title, Sufficiency and Condition of Assets. Owner owns, directly or indirectly, one hundred percent (100%) of the equity interests of Sellers. Sellers own, and at Closing shall transfer to Buyer, good and valid title to all of the Purchased Assets, free and clear of all encumbrances other than Permitted Encumbrances. Except as set forth in Schedule 2.4, none of the Purchased Assets is leased or licensed from or to any third party. The Purchased Assets, whether tangible or intangible, are all the assets necessary for the operation of the Business in the manner presently operated by Seller. All of the Purchased Assets are in good condition and repair, ordinary wear and tear excepted, and are usable in the ordinary course of business. For the purposes of this Agreement, “Permitted Encumbrances” means:

(a) those items set forth on Schedule 2.4 identified as Permitted Encumbrances;

(b) liens for Taxes not yet due and payable;

(c) mechanics', carriers', workmen's, repairmen's or other like liens arising or incurred in the ordinary course of business consistent with past practice or amounts that are not

11

3774916.5

delinquent and which are not, individually or in the aggregate, material to the Business or the Purchased Assets; and

(d) easements, rights of way, zoning ordinances and other similar encumbrances affecting real property which are not, individually or in the aggregate, material to the Business or the Purchased Assets, which do not prohibit or interfere with the current operation of any Purchased Asset.

Section 2.5 Financial Statements.

(a) Sellers have delivered to Buyer true and correct copies of:

(i) Sellers’ combined unaudited financial statements for the year ended December 31, 2015, consisting of (A) the balance sheet of the Business as of such date, and (B) the related statements of income and retained earnings, stockholders' equity and cash flow for the year then ended (the “Unaudited Financial Statements”); and

(ii) Sellers’ unaudited financial statements for the ten-month period ended October 31, 2016 (the “Interim Financial Statements”, and together with the Unaudited Financial Statements, the “Financial Statements”).

(b) Except as disclosed on Schedule 2.5, the Financial Statements have been prepared on a cash basis from the books and records of Sellers in accordance with standard accounting principles applied on a consistent basis throughout the periods covered by the Financial Statements and present fairly, in all material respects, the financial condition of Sellers as of such dates and the results of operations for such periods.

(c) Except as disclosed on Schedule 2.5, since the date of the Interim Financial Statements, there has been no material adverse change in the assets, liabilities or financial condition of Sellers from that set forth in the Financial Statements or the Converted Financial Statements (defined under Section 4.11).

Section 2.6 Liabilities. Except as set forth in the Financial Statements, there are no material obligations or liabilities (potential or otherwise) of Seller of any nature pending, or to Sellers’ Knowledge, threatened, against any Seller, Owner or the Purchased Assets, other than contractual liabilities incurred in the ordinary course of business that are not required to be disclosed in the Financial Statements under standard accounting practices and other than liabilities that have arisen after the date of the Interim Financial Statements in the ordinary course of business, consistent with past practices. There is no reasonable basis for any other obligation or liability to be imposed upon Sellers. For the purposes of this Agreement, “Sellers’ Knowledge” means the actual knowledge of Owner or any director or officer of Sellers.

Section 2.7 Legal Compliance. Sellers have materially complied with all Applicable Laws. Neither Sellers nor any person or entity acting on behalf of Sellers has made or received any unlawful payments or contributions. Except as set forth on Schedule 2.7, Sellers hold all Permits necessary to own the Purchased Assets and conduct the Business, and to Sellers' Knowledge except as set

12

3774916.5

forth on Schedule 2.7 or as may result from the Closing, no event has occurred or other fact exists with respect to such Permits that allows, or after notice or the lapse of time or both, would allow, revocation or termination of any such Permits or would result in any other impairment in the rights of any holder thereof.

Section 2.8 Taxes. Sellers have filed all material Tax Returns that they were respectively required to file. All such Tax Returns were correct and complete in all material respects and were prepared in compliance with all Applicable Laws. To Sellers’ Knowledge, Sellers have not received any notice of deficiency or assessment or proposed deficiency or assessment with respect to the Purchased Assets, the Business or any Tax Returns. All Taxes due and owing by Sellers through the Closing have been paid. All Taxes required to be withheld by any Seller have been withheld and timely paid to the relevant taxing authority. Sellers have complied with all information reporting related to any Taxes. No Seller is currently the beneficiary of any extension of time within which to file any Tax Returns. To Sellers’ Knowledge, no claim has ever been made by an authority in a jurisdiction where Seller does not file Tax Returns that a Seller is or may be subject to taxation by that jurisdiction. Sellers have not waived any statute of limitations in respect of Taxes or agreed to any extension of time with respect to a Tax assessment or deficiency.

Section 2.9 Intellectual Property.

(a) Except as set forth in Schedule 2.9, the Purchased Assets include all of the Intellectual Property in existence on or before the Closing Date that is or has been used or useful with respect to the conduct of the Business excluding any included in the Excluded Assets (collectively, the “Transferred IP Assets”). The term “Intellectual Property” means:

(i) all patents, patent applications, and inventions and discoveries regardless of whether they may be patentable;

(ii) all business and trade names and registered and unregistered trademarks and service marks;

(iii) all copyrights in both published and unpublished works; and

(iv) all know-how, trade secrets, confidential information, customer lists, software, technical information, data, process technology, plans, drawings, and blue prints (collectively, “Trade Secrets”), as well as any other documentation in Sellers’ possession in which such Trade Secrets are embodied or otherwise identified.

(b) All required filings and fees related to the Transferred IP Assets have been timely filed with and paid to the relevant authorities and authorized registrars, and all applicable Transferred IP Assets are otherwise in good standing.

(c) To the Sellers’ Knowledge, none of the Transferred IP Assets infringe or otherwise violate the rights of any other person or entity, nor are they being infringed or otherwise violated by any other person or entity. There are no claims by any person, entity or authority, settled,

13

3774916.5

pending or, to Sellers’ Knowledge, threatened, alleging that use of the Transferred IP Assets by Sellers or by any other person or entity infringes the Intellectual Property rights of any third party.

(d) With respect to each Trade Secret included as part of the Transferred IP Assets:

(i) Sellers have taken all reasonable precautions to protect the secrecy, confidentiality and value of such Trade Secret; and

(ii) such Trade Secret is not to the Sellers’ Knowledge part of the public knowledge or literature, and to Sellers’ Knowledge, has not been used, divulged or appropriated either for the benefit of any third party or to the detriment of the Sellers.

Section 2.1 Agreements.

(a) Sellers are not, and, to Sellers’ Knowledge, no other party is in breach of (and no event has occurred which, with notice or the lapse of time or both, would constitute a breach of) any of the agreements listed on Schedule 1.1(a). Each such agreement constitutes, to Sellers’ Knowledge, the legal, valid and binding obligation of the applicable Seller, enforceable against such Seller and any other party thereto, in accordance with their respective terms, except as such enforceability may be limited by laws affecting the enforcement of creditors’ rights and general principles of equity.

(b) Schedule 2.10(b) lists all of the agreements between any Seller and clinical staff currently used or usable in connection with the Business (the “Health Care Professional Agreements”). Seller has provided Buyer with true and correct copies of each Health Care Professional Agreement.

(c) Except as set forth on Schedule 2.10(c), none of the agreements or contracts set forth on Schedule 1.1(a) are agreements or contracts between or among Sellers, on the one hand, and Owner or any Affiliate of Sellers or Owner, on the other hand. For the purposes of this Agreement, “Affiliate” means any individual, corporation, partnership, limited liability company, association, trust or any other entity or organization, including a Governmental Authority that, directly or indirectly through one of more intermediaries, controls or is controlled by or is under common control with a Party.

(d) Except as set forth on Schedule 2.10(d), Sellers are current on all lease payments and other payments required under the capital leases and equipment-related obligations included in the Purchased Assets.

Section 2.2 Legal Proceedings. Except as set forth on Schedule 2.11, there are no claims, actions or investigations pending or, to Sellers’ Knowledge, threatened against or by Sellers (a) relating to or affecting the Business or the Purchased Assets; or (b) that challenge or seek to prevent, enjoin or otherwise delay the Transactions. To Sellers’ Knowledge, no event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such claim, action or investigation.

14

3774916.5

Section 2.3 Medicare Participation and Reimbursement.

(a) PA is certified or otherwise qualified for participation in the Government Programs and has current and valid contracts for participation in certain Government Program (the “Program Agreements”), all of which are in full force and effect, and PA is currently in receipt of all approvals or qualifications necessary for their reimbursement by the Government Programs. Schedule 2.12(a) contains a list of all NPIs and all provider numbers of Sellers under applicable Government Programs and private third party payor programs, including any insurance company or health care provider (such as a health maintenance organization, preferred provider organization, or any other managed care program). To Sellers’ Knowledge, no events or facts exist that would cause any Program Agreement to be suspended, terminated, restricted, withdrawn, subjected to an administrative hold or otherwise not to remain in force and effect after the Closing.

(b) Except as described on Schedule 2.12(b) all billing practices of Sellers with respect to all third party payors, including the Government Programs and private insurance companies, have been conducted in material compliance with all Applicable Laws and the billing guidelines of such third party payors. Except for routine overpayments that occur in the ordinary course of business, Sellers have not billed or received any payment or reimbursement in excess of amounts allowed by Applicable Laws or the billing guidelines of any third party payor, including the Government Programs or any private insurance companies. Sellers have made available to Buyer true and correct copies of any and all Government Program survey reports and correspondence issued since the later of the Business's inception or January 1, 2007, with respect to Sellers and all plans of correction which the applicable governmental agency required any Seller to submit in response to such reports. Sellers have corrected any deficiencies noted therein.

Section 2.4 Compliance. Sellers (a) are not party to a Corporate Integrity Agreement with the Office of Inspector General of the Department of Health and Human Services, (b) do not have reporting obligations pursuant to any settlement agreement entered into with any Governmental Authority, or (c) to Sellers’ Knowledge are not and have not been a defendant in any qui tam/False Claims Act litigation, or (d) have not received any complaints from employees, independent contractors, vendors, physicians, or any other person that would indicate that any Seller has violated in any material respect any applicable material law, rule, or regulation. Sellers have provided Buyer with complete and accurate descriptions of each audit and investigation conducted with respect to its compliance with Applicable Laws during the last three years.

Section 2.5 Clinical Staff Matters. There are no pending or, to Sellers’ Knowledge, threatened adverse actions, appeals, challenges, disciplinary or corrective actions, or disputes involving Seller’s clinical staff, or allied health professionals, except as set forth on Schedule 2.14. Sellers have delivered to Buyer a written disclosure containing a brief general description of all material adverse actions taken in the six months prior to the date hereof against any Seller’s clinical staff members or allied health professionals which could result in claims or actions against such Seller. Schedule 2.14 sets forth a complete and accurate list of the name and medical specialty of each current member of the clinical staff of Sellers. Except as set forth on Schedule 2.14, no clinical staff member has resigned or been terminated since January 1, 2014. To Sellers’ knowledge, there are no claims, actions, suits, proceedings, or investigations pending or, to threatened against or

15

3774916.5

affecting any member of any Seller’s clinical staff at law or in equity, or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality wherever located relating to medical practice or conduct in connection therewith.

Section 2.6 Employment Matters. Except for past violations for which the Sellers are not subject to any current liability and cannot become subject to any future liability, the Sellers are and have been, to Sellers’ Knowledge, in material compliance with all applicable laws, regulations and orders relating to employment and employment practices, terms and conditions of employment and wages and hours, and the Sellers are not and have not engaged in any unfair labor practice. There are no written charges or complaints of employment discrimination, harassment, retaliation, equal pay or any other employment related matter arising under applicable laws, pending or threatened or, to Seller’s Knowledge, anticipated against the Sellers. The Sellers have, to Sellers’ Knowledge, properly classified as an employee or independent contractor each person who provides or has provided services to the Sellers, and as to each such person that is an employee, the Sellers have properly classified such employee as exempt or non-exempt under applicable wage and hour laws, except for such misclassifications as would not have a material adverse effect.

Section 2.7 Inventory. The inventory of the Business (the “Inventory” or “Inventories”) consists of a quality and quantity useable and saleable in the ordinary course of business except for obsolete items and items of below standard quality, all of which have been written off or written down to net realizable value.

Section 2.8 Certain Books and Records. Excluding the minute books of Sellers, the operational books and records of Sellers related to the three years prior to the date of Closing are in the possession of Sellers and are correct and complete in all material respects

Section 2.9 Investment Experience. Sellers and Owner hereby acknowledge and represent that (a) they have prior investment experience, including investment in non-listed and unregistered securities, and that they have employed the services of an investment advisor, attorney and/or accountant to read all of the documents furnished or made available by Buyer to evaluate the merits and risks of such an investment on their behalf; (b) they recognize the highly speculative nature of an investment in the Shares; and (c) they are able to bear the economic risk and illiquidity which they assume by investing in the Shares. Sellers and Owner have had the opportunity to retain, and to the extent necessary they have retained, at their own expense, and relied upon the advice of appropriate professionals, including an investment advisor, attorney and/or accountant regarding the investment, tax and legal merits and consequences of this Agreement and its acquisition of the Shares hereunder.

Section 2.10 No SEC Review. Sellers and Owner hereby acknowledge that this transaction has not been reviewed by the Securities and Exchange Commission (“SEC”) because of NHC’s representations that this transaction is intended to be exempt from the registration requirements of Section 5 of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to Section 4(a)(2) thereof and Regulation D promulgated under said act. Sellers and Owner further acknowledge that no federal or state agency or authority has made any finding or determination as to the accuracy or adequacy of this Agreement or as to the fairness of the terms of this transaction or any recommendation or endorsement of the Shares. Any representation to the contrary is a

16

3774916.5

criminal offense. In making an investment decision, Sellers and Owner must rely on their own examination of NHC and the terms of this transaction, including the merits and risks involved.

Section 2.11 Purchase For Own Account. The Shares to be acquired by Sellers and Owner hereunder will be acquired for investment for their own account, not as a nominee or agent, and not with a view to the public resale or distribution thereof within the meaning of the Securities Act, and no Seller or Owner has the present intention of selling, granting any participation in, or otherwise distributing the same. Owner and each Seller also represents that no Seller has been formed for the specific purpose of acquiring the Shares.

Section 2.12 Rule 144. Sellers and Owner acknowledge that the Shares must be held indefinitely unless subsequently registered under the Securities Act or an exemption from such registration is available. Sellers and Owner are aware of the provisions of Rule 144 promulgated under the Securities Act, which permits limited resale of shares purchased in a private placement subject to the satisfaction of certain conditions, including, among other things, the existence of a public market for such shares, the availability of certain current public information about the company that issued such shares, the resale occurring following the period of time prescribed by Rule 144, the sale being effected through a “broker's transaction” and the number of shares being sold during any three-month period not exceeding specified limitations.

Section 2.13 Unregistered Registration Shares. Each Seller and Owner understands and hereby acknowledges that NHC is under no obligation to register the Shares under the Securities Act. Each Seller and Owner consents that NHC may, if it desires, permit the transfer of the Shares out of a Seller's or Owner’s name only when such Party’s request for transfer is accompanied by an opinion of counsel reasonably satisfactory to NHC that neither the sale nor the proposed transfer results in a violation of the Securities Act or any applicable state “blue sky” laws.

Section 2.14 No Public Offering. Sellers and Owner hereby acknowledge that the sale and issuance of the Shares hereunder has not been (a) accompanied by the publication of any advertisement nor (b) effected by or through a broker-dealer in a public offering.

ARTICLE III

REPRESENTATIONS OF BUYER AND NHC

Section 3.1 General. Buyer and NHC, jointly and severally, represent to each of the Sellers and Owner as follows, as of the date of this Agreement, and the Closing Date:

(a) Existence, Authority and Binding Obligation.

(i) Each of Buyer and NHC is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation, with full power and authority to enter into and deliver the Transaction Documents, to carry out its obligations under the Transaction Documents, and to consummate the Transactions.

17

3774916.5

(ii) This Agreement constitutes, and, when executed and delivered, the Transaction Documents will constitute, the legal, valid and binding obligations of each of Buyer and NHC, enforceable against such Party in accordance with their terms, except as such enforceability may be limited by laws affecting the enforcement of creditors’ rights and general principles of equity.

(b) No Conflict. The execution, delivery and performance of this Agreement, does not and will not:

(i) breach, or require the consent of any person or entity pursuant to, Buyer or NHC’s governing documents;

(ii) breach, or require the consent of any person or entity pursuant to, any law, regulation, permit, order, award or other non-contractual restriction or rule applicable to Buyer or NHC or its respective assets;

(iii) result in the creation of any encumbrance upon Buyer or NHC or its respective assets; or

(iv) (whether with notice or the lapse of time or both) under any agreement or other instrument binding on Buyer or NHC:

(1) result in any breach;

(2) provide any other person or entity rights of termination, rescission, amendment, acceleration or cancellation; or

(3) except as described on Schedule 3.1(b)(iv)(3), require any authorization or approval of any person or entity.

ARTICLE IV

OTHER COVENANTS OF THE PARTIES

OTHER COVENANTS OF THE PARTIES

Section 4.1 Conduct of Business Prior to Closing. Until the Closing, Sellers:

(a) shall conduct the Business in the ordinary course of business consistent with their past practice, except for actions expressly permitted or limited by this Agreement;

(b) shall maintain Inventories of supplies, drugs, and other disposables and consumables in the ordinary course of business consistent with their past practice; and

(c) shall not, without the prior written consent of Buyer:

(i) make or authorize any capital expenditure for the Business of more than $50,000;

18

3774916.5

(ii) enter into any agreement that, if existing as of the date of this Agreement, would have to be listed in Schedule 1.1(a) as part of the Purchased Assets; or

(iii) enter into any agreement, commitment or understanding, whether or not in writing, with respect to any of the foregoing.

Section 4.2 Access to Books, Records and Personnel. If before or after the Closing it is necessary that any Party be furnished with additional information relating to the Purchased Assets or the Business, and such information is in the possession of any other Party, such Party agrees to use commercially reasonable efforts to furnish such information to the requesting Party, at the requesting Party’s cost and expense, and to make its employees available on a mutually convenient basis to provide additional information and explanation of such materials. Any such disclosure shall be subject to the confidentiality or other applicable terms of any agreement to which the disclosing Party is bound as well as any Applicable Laws.

19

3774916.5

Section 4.3 Tax Matters.

(a) With respect to the Purchased Assets and the Business, Sellers shall prepare and file all Tax Returns for any period ending on or before the Closing Date, and Buyer shall prepare all Tax Returns for all other periods.

(b) The Parties shall cooperate fully, as reasonably requested by each other Party, in connection with the filing of Tax Returns as contemplated by Section 4.3(a) and any audit or other proceeding with respect to the Purchased Assets or the Business. Sellers and Owner agree to retain all books and records with respect to Tax matters pertinent to the Purchased Assets or the Business relating to any taxable period beginning before the Closing until the expiration of the statute of limitations of the respective taxable periods, and to abide by all record retention agreements entered into with any Taxing authority.

Section 4.4 Further Assurances. The Parties shall use their reasonable efforts (a) to obtain all approvals and consents requested by any other Party and required by or necessary for the transactions contemplated by the Transaction Documents, including those set forth on Schedule 2.3, and (b) to take all appropriate action and to do all things necessary, proper or advisable under Applicable Laws, regulations and the Transaction Documents to effect the Transactions and to timely satisfy the conditions set forth in Article V. However, nothing in this Section 4.4 shall require any Party to (y) hold separate or make any divestiture of any asset or otherwise agree to any restriction on operations or other condition that would be materially adverse to the assets, liabilities or business of Buyer or Sellers, or (z) offer or grant financial accommodations to any third party or to remain secondarily liable with respect to any liability. Prior to the Closing, no Party shall make any filing or request any consent related to the Transactions without the approval of the other Party, which approval shall not be unreasonably withheld or delayed.

Section 4.5 Sellers’ Employees.

(a) Subject to Buyer’s hiring policies, Buyer shall offer employment to all employees of Sellers, which are set forth on Schedule 4.5 at the same levels of benefits and compensation as set forth thereon. Employees of Sellers who accept employment with Buyer and become employees of Buyer at the Closing shall be referred to herein as “Transferred Employees.”

(b) Each Transferred Employee’s sick leave, vacation and other paid time off (collectively, “PTO”) accrued as of the Closing Date, is set forth on Schedule 4.5. Sellers shall deliver, at the Closing, an updated Schedule 4.5 setting forth the PTO accrued as of the Closing Date. Each Transferred Employee who consents to such transfer shall be credited by Buyer for any such accrued PTO, but Buyer shall have no obligation to make any payments to the Transferred Employees for such accrued PTO other than in accordance with the terms and conditions applicable to Buyer’s employees or applicable law. Other than as expressly set forth herein, Buyer shall have no obligation whatsoever for, any compensation or other amounts payable to any current or former employee, officer, director, independent contractor or consultant of Sellers or the Business, including, without limitation, hourly pay, commission, bonus, salary, accrued PTO, fringe, pension

20

3774916.5

or profit sharing benefits or severance pay for any period relating to the service with Sellers at any time on or prior to the Closing Date.

(c) The terms of the Transferred Employees’ employment with Buyer shall otherwise be upon such terms and conditions as Buyer, in its sole discretion, shall determine. This provision shall neither be construed to create any third party beneficiaries nor to vest any rights in parties other than those signatories to this Agreement.

Section 4.6 Covenant Not to Compete. To more effectively protect the value of the Purchased Assets, for two years after the Closing Date (the “Restricted Period”), Sellers and Owner shall not, without the prior consent of Buyer, directly or indirectly (whether as an owner, principal, employee, agent, consultant, independent contractor, partner or otherwise), anywhere in the State of Arizona, State of Texas or any other State in which Buyer has a facility, at which medical practitioners treat patients with venous diseases and provide certain other vascular and interventional radiology services on or prior to the first anniversary of the Closing (the “Restricted Territory”):

(a) engage in any business in competition with the Business; provided, however, that Sellers and Owner, may own, solely as an investment, securities in any entity that is in competition with the Business if (i) Sellers or Owner, as applicable, do not, directly or indirectly, beneficially own more than 2% in the aggregate of such class of securities, (ii) such class of securities is publicly traded, and (iii) Sellers or Owner, as applicable, has no active participation in the business of such entity that is in competition with the Business;

(b) excluding those Transferred Employees listed on Schedule 4.6, solicit business of the same or similar type being carried on by the Buyer in the operation of the Business from any person or entity known by Sellers or the Owner to be a customer of the Business as operated by Buyer;

(c) request any past, present or future customer or supplier of Sellers or Buyer to curtail or cancel its business with the Business as operated by Buyer;

(d) excluding the Transferred Employees listed on Schedule 4.6, without Buyer’s consent, solicit, employ or otherwise engage as an employee or independent contractor any person who is an employee or independent contractor of the Business as operated by Buyer, unless such person’s employment or engagement with the Business (i) was terminated by Buyer, or (ii) ended more than 12 months prior to the date of solicitation, employment or engagement;

(e) induce or attempt to induce any employee or independent contractor of the Business as operated by Buyer to terminate their employment or engagement with the Business; provided, however, that it shall not constitute a breach of the foregoing if any person or entity which employs or otherwise engages Owner solicits and/or hires an employee or former employee of the Business through a general solicitation not directed at such employee or former employee, and further provided the Owner does not have hiring authority or influence over hiring for the applicable position; or

21

3774916.5

(f) unless otherwise required by law, subject to the confidentiality provisions of this Agreement, disclose to any person or entity details of the organization or business affairs of the Business, any names of past or present customers of the Business, any Trade Secrets, or any other non-public information concerning the Business or its affairs; notwithstanding the foregoing, the Sellers may publically disclose information related to or arising from the filing, prosecution, and enforcement of intellectual property rights pertaining to the Excluded Assets.

Notwithstanding anything to the contrary above in this Section 4.6, this Section 4.6 shall not: (i) restrict Owner from providing medical services as a physician in private medical practice to any of the past, present or future patients or customers of the Business, provided Owner does not use any marketing or advertising directed at such past, present or future patients, (ii) this Section 4.6 shall not restrict Owner and his Affiliates from leasing any real property, including real property no longer leased by Buyer and its Affiliates, to any third party, including any third party that may be competitive with the Business; (iii) restrict Owner from engaging in discussions or negotiations related to business activities that, if executed or performed, might otherwise be prohibited by this Section 4.6; or (iv) restrict Owner from engaging in any activities set forth on Schedule 4.6, so long as such activities do not interfere with the obligations of Owner under the Physician Employment & Medical Director Agreement.

Sellers and Owner agree that the covenants set forth in this Section 4.6 are drafted to and are intended to comply with and be enforceable under Texas Business & Commerce Code Section 15.50(a) and other applicable laws and regulations. The Parties acknowledge that if the scope of the covenants in this Section 4.6 is deemed to be too broad in any court proceeding, the court may reduce the scope as deemed reasonable under the circumstances. Sellers and Owner also agree that in the event that the covenants are reformed and Sellers and/or the Owner has breached the reformed covenants, Buyer may be entitled to recover attorneys’ fees and costs in enforcing the covenants in the same manner and to the same extent as if they had been enforced as written against the breaching Party. The Parties acknowledge that Buyer may not have any adequate remedy at law for the breach or threatened breach by Sellers or Owner of this Section 4.6 and, accordingly, Buyer may, in addition to remedies that may be available under this Agreement, file suit in equity to enjoin Sellers or Owner from that breach or threatened breach, and Sellers and Owner consent to the issuance of injunctive relief. Sellers and Owner agree that Buyer’s performance under this Agreement constitutes sufficient consideration for the covenant not to compete in this Section 4.6.

Notwithstanding anything to the contrary contained herein, Buyer and NHC agree that Owner shall be released from any and all restrictions under this Section 4.6 if the Physician Employment & Medical Director Agreement is terminated (i) for cause by Owner; or (ii) without cause by Nobilis Health Network, Inc. or other employer to which the Physician Employment & Medical Director Agreement is assigned.

Section 4.7 Confidentiality. Sellers and Owner acknowledge that irreparable damage would occur if any confidential or proprietary information regarding the Business, the Purchased Assets or Buyer were disclosed to or utilized on behalf of any person or entity that is in competition in any respect with the Business as conducted by the Buyer following the Closing. Without the prior written consent of Buyer, Sellers and Owner agree that they shall not, directly or indirectly,

22

3774916.5

use or disclose any of such information. The provisions of this Section 4.7 shall not prohibit a Party from disclosing information covered by this Section 4.7 pursuant to a subpoena or other validly issued administrative or judicial process requesting the information; provided, however, that prompt notice is provided to the other Party of the required disclosure.

Section 4.8 Mail. Sellers and Owner authorize Buyer, on and after the Closing Date, to receive and open all mail received by Buyer relating to the Purchased Assets or the related Assumed Liabilities and to deal with the contents of such communications in any proper manner.

Section 4.9 Third Party Consents.

(a) If Sellers’ or Owner’s rights to any Purchased Asset may not be transferred without the consent of another person or entity, and if such consent has not been obtained as of the Closing Date as applicable, despite the exercise by Sellers or Owner of their respective reasonable efforts, this Agreement shall not constitute an agreement to transfer such Purchased Asset (a “Non-Transferred Purchased Asset”) if an attempted transfer thereof would constitute a breach or be unlawful. In any such case, Sellers and Owner, to the maximum extent permitted by law, (i) shall act as the Buyer’s agent to obtain for Buyer the benefits and satisfy the associated obligations related to the Non-Transferred Purchased Asset, and (ii) shall cooperate with Buyer in any other reasonable arrangement designed to provide those benefits to the Buyer, including by agreeing to remain liable under any applicable contract, and Buyer shall with cooperation from Sellers make any payments with respect to a Non-Transferred Purchased Asset required to obtain the benefit thereof.

(b) With respect to any Equipment Indebtedness that is not a Non-Transferred Purchased Asset and may not be transferred without the consent of another person or entity, and if such consent has not been obtained as of the Closing Date despite the exercise by Sellers or Owner of their respective reasonable efforts, Sellers shall continue to perform, and make all payments required, under the terms of such Equipment Indebtedness until such time as such Equipment Indebtedness is transferred to Buyer and Buyer assumes the related Equipment Indebtedness. Until such transfer and assumption, the Parties shall cooperate to allow Buyer to make any payments required pursuant to such Equipment Indebtedness on behalf of Sellers. The Parties shall cooperate to obtain a release of Owner and Sellers, as applicable, from the applicable Equipment Indebtedness at the time of its transfer and assumption.

(c) Nothing contained in this Section 4.9 shall relieve the Sellers or Owner of their respective obligations under any other provisions of this Agreement, including the obligation pursuant to Section 4.4 to use their respective reasonable efforts to obtain the consent of the applicable person or entity to transfer the Non-Transferred Purchased Asset to Buyer.

Section 4.10 Insurance. Sellers shall maintain existing insurance or “tail” insurance, in form and substance reasonably acceptable to Buyer (“Seller Insurance”), to insure against liabilities in connection with the development, business or operation of the Sellers and/or the Purchased Assets. The Seller Insurance coverage shall be retroactive such that it covers all periods prior to the Closing Date, as applicable, and shall remain in effect for at least three years from the Closing Date. The minimum coverage of the Seller Insurance shall be One Million Dollars ($1,000,000) per occurrence and Three Million Dollars ($3,000,000) in the aggregate.

23

3774916.5

Section 4.11 Financial Statements. Sellers shall, at Sellers’ and Owner’s sole expense, deliver to Buyer and NHC copies of revised Financial Statements prepared from the books and records of Sellers on an accrual basis in accordance with GAAP applied on a consistent basis throughout the periods covered by the Financial Statements (the “Converted Financial Statements”).

Section 4.12. Sellers’ Indebtedness. In connection with the Closing, Sellers shall negotiate and obtain payoff letters with respect to certain indebtedness of the Sellers as set forth on Schedule 1.4 (the “Payoff Letters”). The Payoff Letters shall (i) indicate the total amount required to be paid to fully satisfy all principal, interest, prepayment premiums, penalties, breakage costs or similar obligations (other than ordinary course and contingent indemnification obligations) related to the Sellers’ indebtedness (the “Payoff Amount”), (ii) state that all liens in connection therewith relating to the assets of the Sellers’ shall be, upon the payment of the Payoff Amount on the Closing Date, released and (iii) authorize the Sellers to file UCC-3 termination statements in all applicable jurisdictions to evidence the release and termination of the Sellers’ indebtedness. Sellers shall deliver all notices and take all other actions necessary to facilitate the termination of obligations and commitments under the Sellers’ indebtedness, the repayment in full of all obligations then outstanding thereunder, and the release of all liens in connection therewith on the Closing Date.

(a) In connection with the Closing, Sellers shall pay the applicable portion of the Payoff Amount pursuant to the terms of the Payoff Letters. If requested by Sellers or Owner, Buyer shall wire a portion of the Closing Cash directly to the applicable lenders to pay the Payoff Amount on Sellers’ behalf.

Section 4.1 Cooperation after Closing. Each Party and its subsidiaries and affiliates agrees to cooperate with the other Parties and their subsidiaries and affiliates as necessary to permit timely responses to any audits or other similar requests for information or records not otherwise addressed above. Without limiting the generality of the foregoing, Buyer and NHC agree to timely assist Sellers with respect to payor repayment obligations, if any, including without limitation by providing staffing assistance and access to records as reasonably requested.

Section 4.2 Transition Period. At Closing, Sellers and Buyer, and/or Buyer’s designee shall enter into the Transition Services Agreement, attached and incorporated as Exhibit G, until the first to occur of: (i) the date selected by Buyers, at Buyers’ discretion, following the date on which Buyer and/or its designee, as applicable, is a participating provider in the Medicare program and is credentialed with certain commercial payors (as specified in the Transition Services Agreement) and has received its respective provider numbers; or (ii) one hundred twenty (120) days following the Closing Date.

Section 4.15 Release of Sellers and Owner. Notwithstanding anything contained herein to the contrary, in the event the Parties have agreed to waive as a condition to Closing the delivery of the assignment and assumption agreements for each of the Clinic Leases, then Buyer and NHC hereby acknowledge and agree that, to the fullest extent possible, Buyer and NHC shall promptly execute any and all instruments or other documentation required to assign the Clinic Leases to Buyer or NHC and to fully release Sellers and Owner from

24

3774916.5