Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EURONET WORLDWIDE, INC. | d360728dex991.htm |

| 8-K - FORM 8-K - EURONET WORLDWIDE, INC. | d360728d8k.htm |

| Exhibit 99.2

|

Exhibit 99.2

EURONET WORLDWIDE

Euronet’s Proposal to Acquire MoneyGram

MARCH 14, 2017

|

|

Forward Looking Statements

This document contains “forward-looking statements” related to the proposed transaction between

Euronet and MoneyGram, including, but not limited to, statements regarding the benefits of the transaction and the timing of the transaction as well as statements regarding the companies’ services and markets. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including the following, among others: MoneyGram and Euronet may not sign a definitive merger agreement on the terms outlined in the document or at all; MoneyGram’s stockholders may not approve the transaction; closing of the transaction may not occur or may be delayed; expected synergies and other financial benefits of the transaction may not be realized; integration of the acquisition post-closing may not occur as anticipated; litigation related to the transaction or limitations or restrictions imposed by regulatory authorities may delay or negatively impact the transaction; unanticipated restructuring costs may be incurred or undisclosed liabilities assumed; attempts to retain key personnel and customers may not succeed; actions by competitors may negatively impact results; and, there may be negative changes in general economic conditions in the regions or the sectors in which Euronet and MoneyGram operate. In addition, please refer to the documents that Euronet and MoneyGram have filed with the SEC on Forms 10-K, 10-Q and 8-K. These filings identify and address other important risks and uncertainties that could cause events and results to differ materially from those contained in the forward-looking statements set forth in this document. Any forward-looking statements made in this document speak only as of the date of this document. Readers are cautioned not to put undue reliance on forward-looking statements, and Euronet assumes no obligation and does not intend to update these forward-looking statements, whether as a result of new information, future events or otherwise.

1

|

|

Defined Terms

Unless specifically noted otherwise within this presentation, the following terms are hereby defined as follows:

Adjusted EBITDA is a non-GAAP measure that is defined as net income excluding interest, income tax expense, depreciation, amortization, share-based compensation expenses and other non-operating or non-recurring items that are considered expenses or income under U.S. GAAP. Adjusted EBITDA represents a performance measure and is not intended to represent a liquidity measure.

Adjusted earnings per share (Adjusted EPS) is a non-GAAP measure that is defined as diluted U.S. GAAP earnings per share excluding, to the extent incurred in the period, the tax-effected impacts of: a) foreign currency exchange gains or losses, b) goodwill impairment charges, c) gains or losses from the early retirement of debt, d) share-based compensation, e) acquired intangible asset amortization, f) non-cash interest expense, g) non-cash income tax expense, and h) other non-operating or non-recurring items. Adjusted earnings per share represents a performance measure and is not intended to represent a liquidity measure.

The reconciliation of non-GAAP items to their most directly comparable U.S. GAAP financial measure is included in the attached supplemental data. The non-GAAP measures may not be comparable to similarly titled non-GAAP measures used by other companies and should be used in addition to, and not a substitute for, measures computed in accordance with U.S. GAAP.

The Company does not provide a reconciliation of its forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for GAAP and the related GAAP to non-GAAP reconciliation, including adjustments that could be made for currency exchange rate fluctuations and other charges reflected in the Company’s reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

2

|

|

Euronet Worldwide Overview

Founded: 1994

Leading electronic payments processor and distributor

Market Cap: ~$4.3 Billion

Employees: 6,200 worldwide

Market: NASDAQ (EEFT) since 1997

2016 Revenue: $2.0 Billion

2016 Adjusted EBITDA: $345.2 Million

Adjusted EPS: >20% CAGR since 2011

EFT Segment

epay Segment

Operates in 53 countries(1)

~$38 billion in cash dispensed from ATMs annually(2)

1.9 billion transactions processed(2)

>35,000 ATMs under management(1)

Provides services on ~125,000 ATMs(1)

Driving ~163,000 POS terminals(1)

Operate independent ATM networks in 21 countries (1)

Processing in 35 countries across Europe, Asia and the Americas(1)

~661,000 POS terminals(1)

~305,000 retailer locations(1)

~$13 billion prepaid volume(2)

1.3 billion transactions(2)

Money Transfer Segment

146 Money Transfer delivered countries(1)

32 Money Transfer originating countries(1)

~317,000 transfer locations(1)

$33 billion transfers processed(2)

82.3 million transactions processed(2)

53 million XE App Downloads(1)

(1) As of Q4 2016

(2) As of 2016 3

|

|

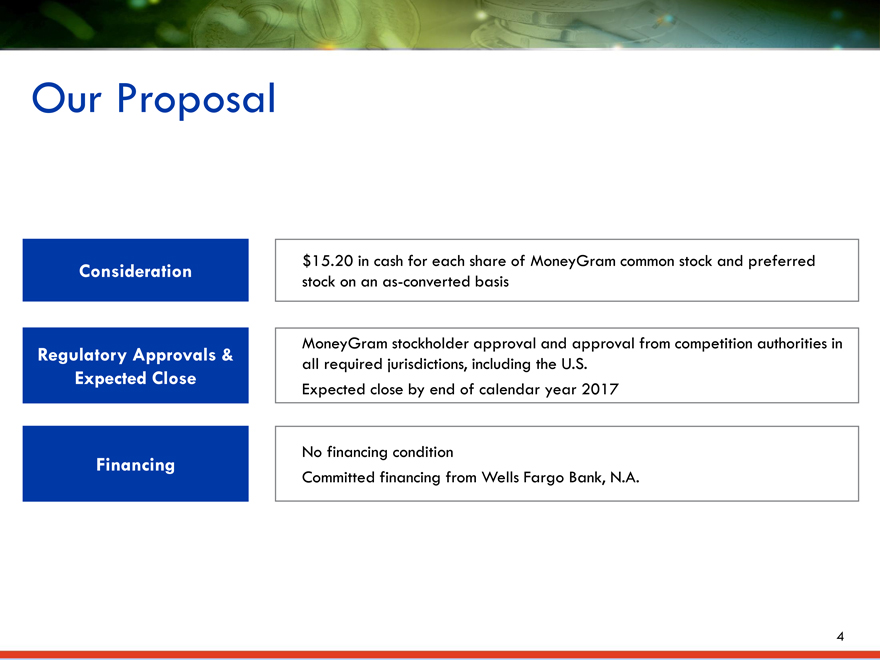

Our Proposal

Consideration $15.20 in cash for each share of MoneyGram common stock and preferred

stock on an as-converted basis

MoneyGram stockholder approval and approval from competition authorities in

Regulatory Approvals & all required jurisdictions, including the U.S.

Expected Close Expected close by end of calendar year 2017

No financing condition

Financing

Committed financing from Wells Fargo Bank, N.A.

4

|

|

A Clearly Superior Offer

Substantial premium to current offer by Ant in all cash offer

~15% to agreed upon purchase price per share with Ant

Compelling Value ~28% to MoneyGram’slast trading share price on January 25, 2017

~38% to MoneyGram’s three-month Volume Weighted Average Price (“VWAP”) ending

on January 25, 2017

Provides clear path to closing

No CFIUS review

Significantly Improved No closing condition requiring consents to change of control of money transmitter

Certainty & Speed licenses

Confident in ability to secure antitrust approval following detailed analysis by

outside advisors

5

|

|

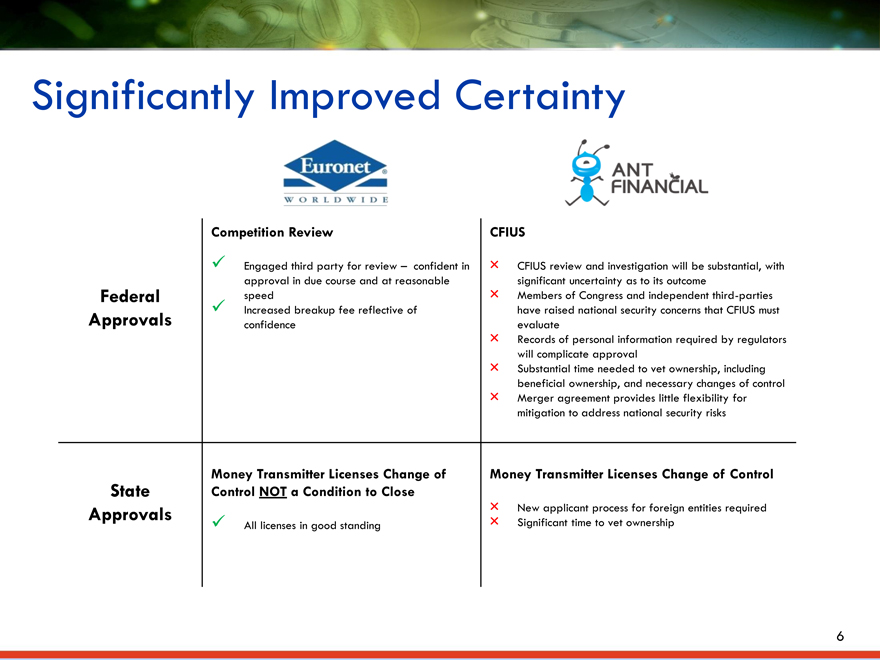

Significantly Improved Certainty

Competition Review CFIUS

Engaged third party for review – confident in CFIUS review and investigation will be substantial, with

approval in due course and at reasonablesignificant uncertainty as to its outcome

Federal speed Members of Congress and independent third-parties

Increased breakup fee reflective ofhave raised national security concerns that CFIUS must

Approvals confidenceevaluate

Records of personal information required by regulators

will complicate approval

Substantial time needed to vet ownership, including

beneficial ownership, and necessary changes of control

Merger agreement provides little flexibility for

mitigation to address national security risks

Money Transmitter Licenses Change of Money Transmitter Licenses Change of Control

State Control NOT a Condition to Close

Approvals New applicant process for foreign entities required

All licenses in good standing Significant time to vet ownership

6

|

|

Compelling Value for Euronet Stockholders

Scale in a Highly

Complementary

Fragmented Market Platforms

Proven Management Immediately

Team Accretive

Creating a Leader Positioned for Growth

7

|

|

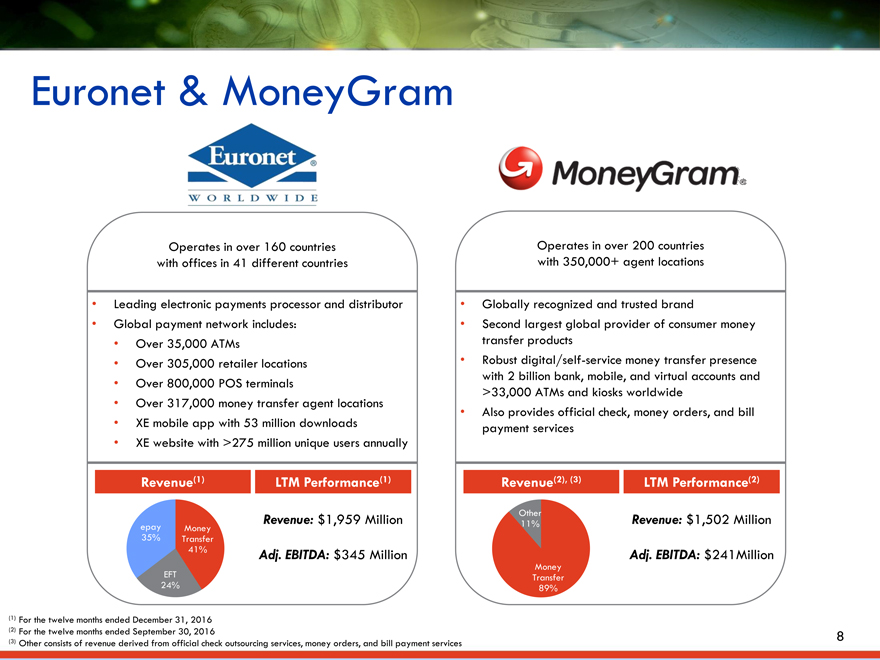

Euronet & MoneyGram

Operates in over 160 countries

with offices in 41 different countries

Leading electronic payments processor and distributor

Global payment network includes:

Over 35,000 ATMs

Over 305,000 retailer locations

Over 800,000 POS terminals

Over 317,000 money transfer agent locations

XE mobile app with 53 million downloads

XE website with >275 million unique users annually

Operates in over 200 countries with 350,000+ agent locations

Globally recognized and trusted brand

Second largest global provider of consumer money transfer products

Robust digital/self-service money transfer presence with 2 billion bank, mobile, and virtual accounts and >33,000 ATMs and kiosks worldwide

Also provides official check, money orders, and bill payment services

Revenue(1) LTM Performance(1) Revenue(2), (3)LTM Performance(2)

Revenue: $1,959 MillionOther 11%Revenue: $1,502 Million

epay Money

35% Transfer

41% Adj. EBITDA: $345 MillionAdj. EBITDA: $241Million

Money

EFT Transfer

24% 89%

(1) For the twelve months ended December 31, 2016

(2) For the twelve months ended September 30, 2016 8

(3) Other consists of revenue derived from official check outsourcing services, money orders, and bill payment services

|

|

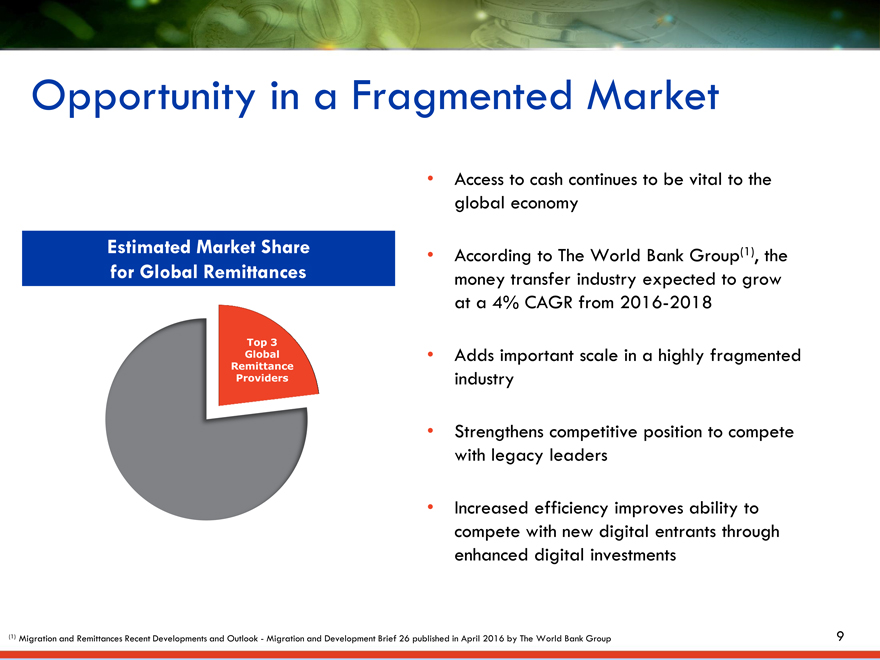

Opportunity in a Fragmented Market

Access to cash continues to be vital to the

global economy

Estimated Market Share According to The World Bank Group(1), the

for Global Remittances money transfer industry expected to grow

at a 4% CAGR from 2016-2018

Top 3

Global Adds important scale in a highly fragmented

Remittance

Providers industry

Strengthens competitive position to compete

with legacy leaders

Increased efficiency improves ability to

compete with new digital entrants through

enhanced digital investments

(1) Migration and Remittances Recent Developments and Outlook—Migration and Development Brief 26 published in April 2016 by The World Bank Group

9

|

|

Highly Complementary Platforms

Complementary Greater diversification to accelerate growth

Distribution Euronet has a primary focus on independent agents

MoneyGram has a primary focus on large retailers and post offices

Augments Incremental revenue opportunities and additional operational scale

Product Suite Bill payment services, addition of official check and money order products

enhance the value proposition to the independent agents

Euronet’s EFT and ePay segments enhance value proposition to large

retailers

Best-in-class compliance organization will help the company to capitalize on

Enhanced Compliance future growth opportunities and increased compliance demand in global

Organization market

10

|

|

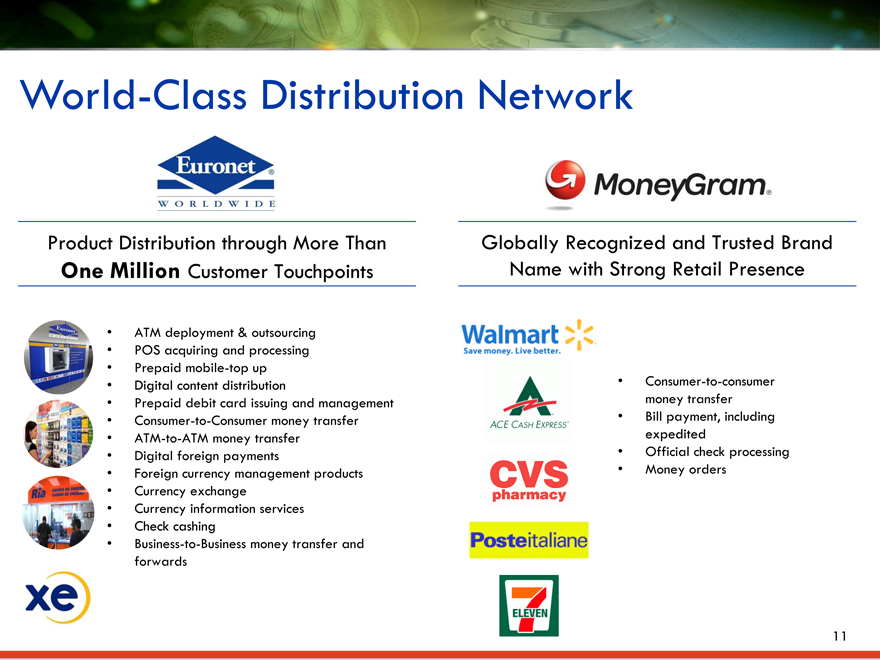

World-Class Distribution Network

Product Distribution through More Than One Million Customer Touchpoints

ATM deployment & outsourcing

POS acquiring and processing

Prepaid mobile-top up

Digital content distribution

Prepaid debit card issuing and management

Consumer-to-Consumer money transfer

ATM-to-ATM money transfer

Digital foreign payments

Foreign currency management products

Currency exchange

Currency information services

Check cashing

Business-to-Business money transfer and forwards

Globally Recognized and Trusted Brand Name with Strong Retail Presence

Consumer-to-consumer money transfer

Bill payment, including expedited

Official check processing

Money orders

11

|

|

Proven Global Management Team

Significant collective industry experience and

a proven track record of growth

Successfully integrated 35+ transactions

Since 2011, Euronet has recorded:

>20% adjusted earnings per share growth 11% revenue growth 10% growth in transactions

Rapid expansion of Euronet’s Money Transfer segment growing from

$205 million in pro forma revenue to $802 million, representing a CAGR of revenue of 16%, since 2007

Integrated several acquisitions in the money transfer industry (Ria, IME, HiFX, and XE)

Growing headcount at a >12% CAGR to support a 7x increase in agents

Expanding pro forma Adjusted EBITDA margin by >325 basis points for Euronet’s Money Transfer segment since 2007

12

|

|

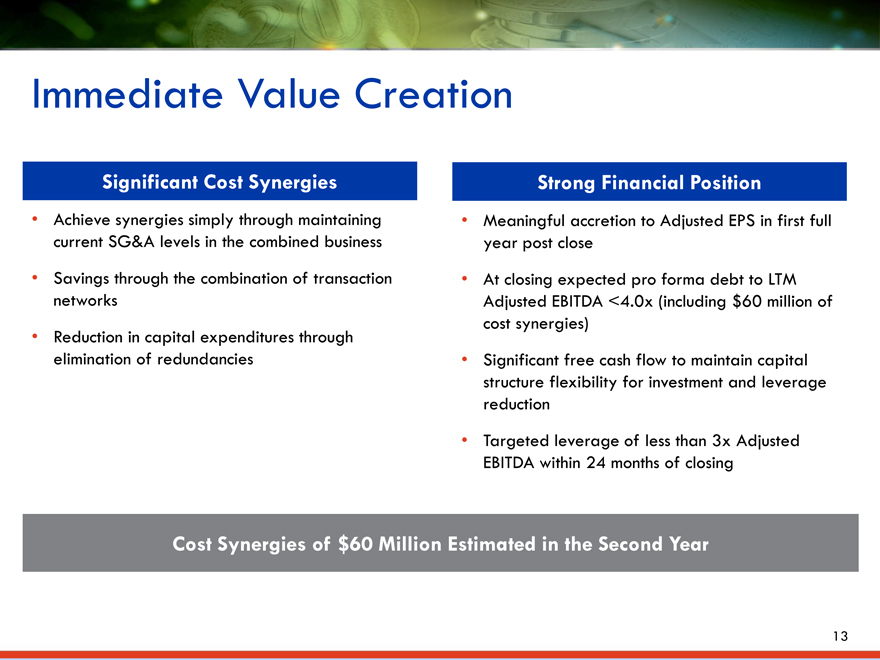

Immediate Value Creation

Significant Cost Synergies

Achieve synergies simply through maintaining current SG&A levels in the combined business

Savings through the combination of transaction networks

Reduction in capital expenditures through elimination of redundancies

Strong Financial Position

Meaningful accretion to Adjusted EPS in first full year post close

At closing expected pro forma debt to LTM Adjusted EBITDA <4.0x (including $60 million of cost synergies)

Significant free cash flow to maintain capital structure flexibility for investment and leverage reduction

Targeted leverage of less than 3x Adjusted EBITDA within 24 months of closing

Cost Synergies of $60 Million Estimated in the Second Year

13

|

|

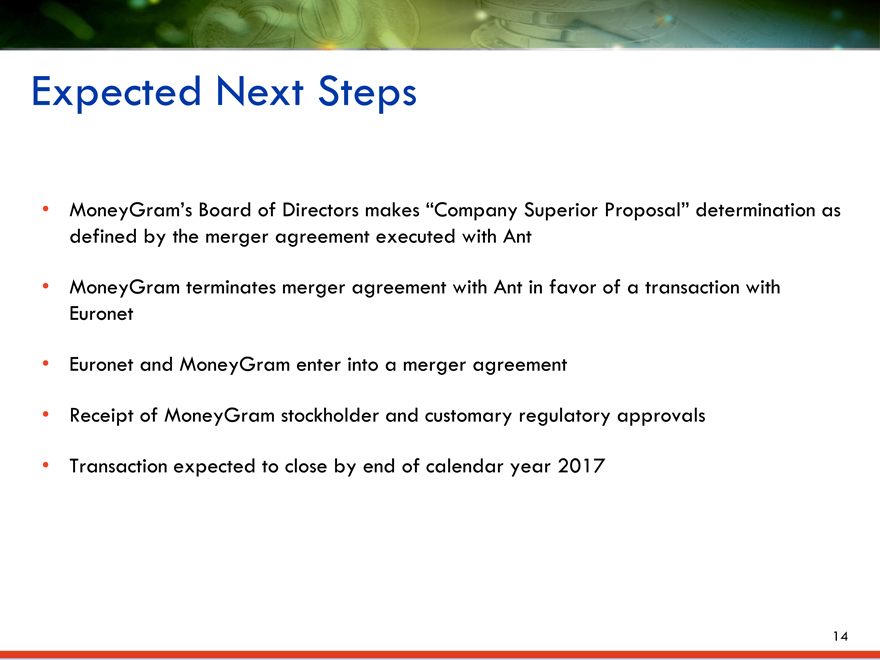

Expected Next Steps

MoneyGram’s Board of Directors makes “Company Superior Proposal” determination as defined by the merger agreement executed with Ant

MoneyGram terminates merger agreement with Ant in favor of a transaction with Euronet

Euronet and MoneyGram enter into a merger agreement

Receipt of MoneyGram stockholder and customary regulatory approvals

Transaction expected to close by end of calendar year 2017

14

|

|

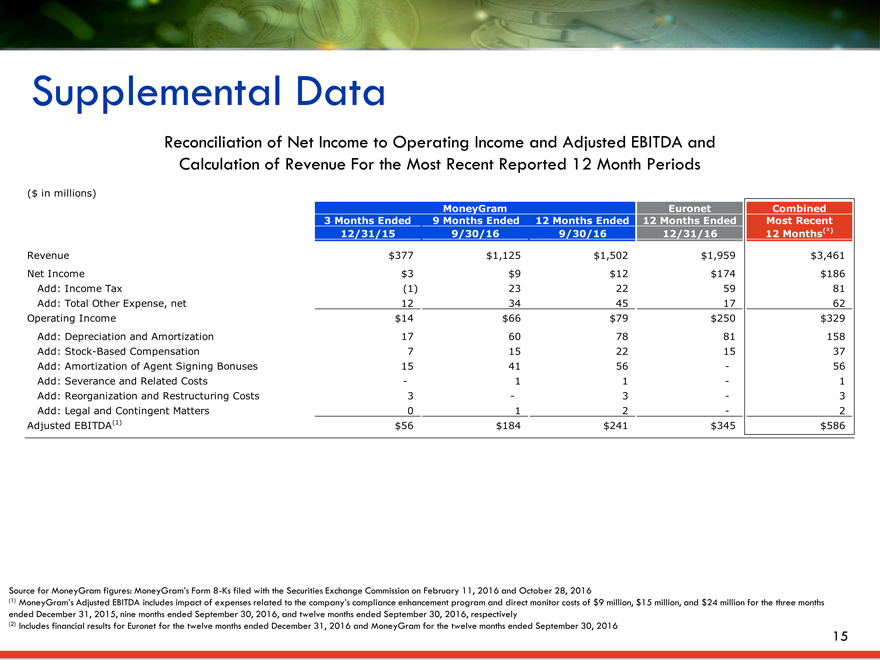

Supplemental Data

Reconciliation of Net Income to Operating Income and Adjusted EBITDA and

Calculation of Revenue For the Most Recent Reported 12 Month Periods

($ in millions)

MoneyGramEuronetCombined

3 Months Ended 9 Months Ended12 Months Ended12 Months EndedMost Recent

12/31/15 9/30/169/30/1612/31/1612 Months(²)

Revenue $377 $1,125$1,502$1,959$3,461

Net Income $3 $9$12$174$186

Add: Income Tax (1) 23225981

Add: Total Other Expense, net 12 34451762

Operating Income $14 $66$79$250$329

Add: Depreciation and Amortization 17 607881158

Add: Stock-Based Compensation 7 15221537

Add: Amortization of Agent Signing Bonuses 15 4156-56

Add: Severance and Related Costs - 11-1

Add: Reorganization and Restructuring Costs 3 -3-3

Add: Legal and Contingent Matters 0 12-2

Adjusted EBITDA(1) $56 $184$241$345$586

Source for MoneyGram figures: MoneyGram’s Form 8-Ks filed with the Securities Exchange Commission on February 11, 2016 and October 28, 2016

(1) MoneyGram’s Adjusted EBITDA includes impact of expenses related to the company’s compliance enhancement program and direct monitor costs of $9 million, $15 million, and $24 million for the three months ended December 31, 2015, nine months ended September 30, 2016, and twelve months ended September 30, 2016, respectively

(2) Includes financial results for Euronet for the twelve months ended December 31, 2016 and MoneyGram for the twelve months ended September 30, 2016

15

|

|

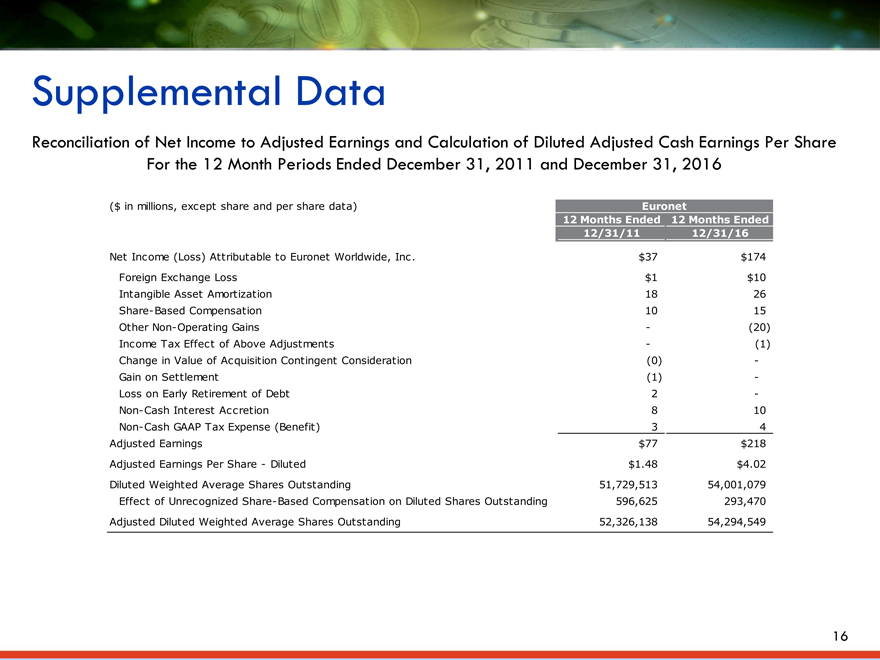

Supplemental Data

Reconciliation of Net Income to Adjusted Earnings and Calculation of Diluted Adjusted Cash Earnings Per Share

For the 12 Month Periods Ended December 31, 2011 and December 31, 2016

($ in millions, except share and per share data) Euronet

12 Months Ended 12 Months Ended

12/31/11 12/31/16

Net Income (Loss) Attributable to Euronet Worldwide, Inc . $37 $174

Foreign Exchange Loss $1 $10

Intangible Asset Amortization 18 26

Share- Based Compensation 10 15

Other Non- Operating Gains - (20)

Income Tax Effect of Above Adjustments - (1)

Change in Value of Acquisition Contingent Consideration (0) -

Gain on Settlement (1) -

Loss on Early Retirement of Debt 2 -

Non- Cash Interest Accretion 8 10

Non- Cash GAAP Tax Expense (Benefit) 3 4

Adjusted Earnings $77 $218

Adjusted Earnings Per Share—Diluted $1.48 $4.02

Diluted Weighted Average Shares Outstanding 51,729,513 54,001,079

Effect of Unrecognized Share- Based Compensation on Diluted Shares Outstanding 596,625 293,470

Adjusted Diluted Weighted Average Shares Outstanding 52,326,138 54,294,549

16

|

|

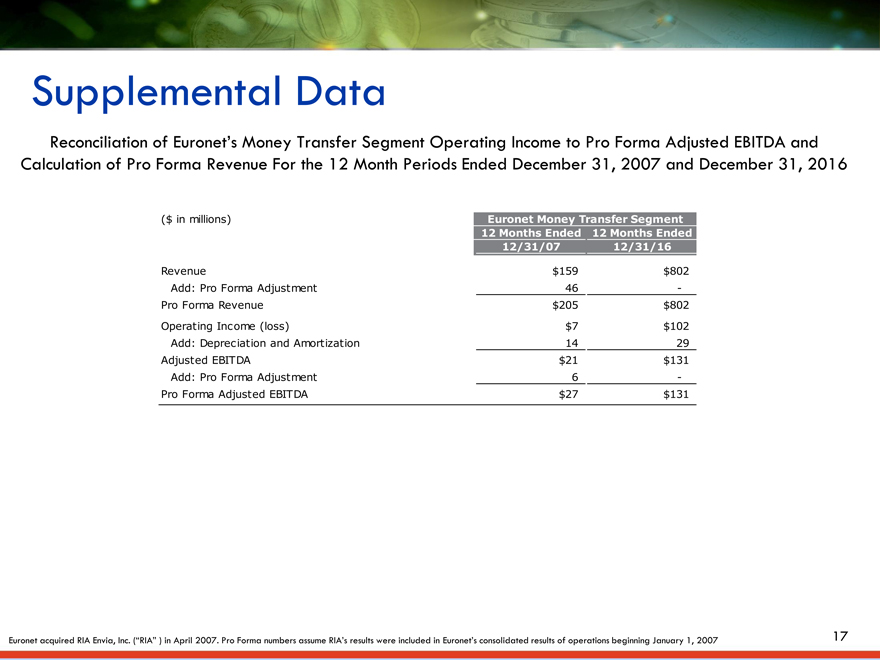

Supplemental Data

Reconciliation of Euronet’s Money Transfer Segment Operating Income to Pro Forma Adjusted EBITDA and Calculation of Pro Forma Revenue For the 12 Month Periods Ended December 31, 2007 and December 31, 2016

($ in millions) Euronet Money Transfer Segment

12 Months Ended 12 Months Ended

12/31/07 12/31/16

Revenue $159 $802

Add: Pro Forma Adjustment 46 -

Pro Forma Revenue $205 $802

Operating Income (loss) $7 $102

Add: Depreciation and Amortization 14 29

Adjusted EBITDA $21 $131

Add: Pro Forma Adjustment 6 -

Pro Forma Adjusted EBITDA $27 $131

Euronet acquired RIA Envia, Inc. (“RIA” ) in April 2007. Pro Forma numbers assume RIA’s results were included in Euronet’s consolidated results of operations beginning January 1, 2007 17

|

|

Euronet WORLD WIDE