Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Byrna Technologies Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Byrna Technologies Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Byrna Technologies Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended November 30, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. - None

SECURITY DEVICES INTERNATIONAL,

INC.

(Name of Small Business Issuer in its charter)

| Delaware | 71-1050654 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) |

| 9325 Puckett Road, | |

| Perry, FL, 32348 | |

| (Address of Principal Executive Office) | Zip Code |

Registrant’s telephone number, including Area Code: (905) 582-6402

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ]

Indicate by check mark whether the registrant (1) has filed all

reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Larger accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act):

Yes [

] No [X]

The aggregate market value of the Common Stock held by non-affiliates of the issuer, as of May 31, 2016, was approximately $6,800,000 based upon a share valuation of $0.17 per share. This share valuation is based upon the closing price of the Company’s shares as of May 31, 2016 (the date of the last sale of the Company’s shares closest to the end of the Company’s second fiscal quarter). For purposes of this disclosure, shares of Common Stock held by persons who the issuer believes beneficially own more than 5% of the outstanding shares of Common Stock and shares held by officers and directors of the issuer have been excluded because such persons may be deemed to be affiliates of the issuer.

As of March 9, 2017, the Company had 56,197,158 issued and outstanding shares of common stock.

Documents incorporated by reference: None

ITEM 1. BUSINESS

It is the Company’s belief that the United States, along with most parts of the world are in the very early stages of a significant spike in the growth curve for “less-lethal” products. Most law enforcement agencies do not have a proper working knowledge of a less-lethal program in place. Rather they are using an assortment of less-lethal devices out of necessity for varying degrees of effectiveness with little coordination or approved tactical plans for their deployment. Law enforcement budget constraints usually play a role in this behavior. It is for this reason that unintended deaths of unarmed suspects at the hands of police departments throughout the country (and in fact throughout the world) continue to happen.

With a rise in social and civil unrest both here and abroad and with more and more of these incidents being caught on video and posted on social media, the pressure on law enforcement and governments to find reasonable and effective alternatives to lethal force is mounting daily. As a result, it is management’s opinion that the less-lethal market will be one of the faster growing segment in the law enforcement, correctional services, crowd control and security services markets over the next decade.

Less-lethal weapons include a wide variety of products designed to disorient, slow down and stop would be assailants, rioters and other malfeasants. In the Company’s opinion, the less-lethal weapon that is growing the fastest in popularity and adoption is the 40mm launcher along with the various less-lethal munitions that can be fired from these launchers. These munitions include both impact rounds designed to stop an individual without causing permanent injury to payload rounds carrying a variety of powders and liquids including tear gas, pepper spray, DNA marking liquids, mal-odorants and other marking liquids and powders designed to identify instigators in a riot situation.

Historically, these munitions were fired from 37mm launchers, however, the industry has been moving to 40mm launchers due to the fact that the 40mm launcher barrel is rifled (while the 37mm is a smooth bore barrel less accurate munition) which allows the operator to more accurately fire the rounds at distances in excess of 100’. This makes the 40mm launcher an effective tool in a wide range of situations.

1

Business

History

Security Devices International Inc. (the “Company” or the “Corporation”) was incorporated on March 1, 2005. The Company began as a research and development company focused on the development of 40mm less-lethal ammunition.

The Company initiated with the development of a wireless electric projectile (the “WEP”), named the Lektrox. The Company hired a ballistics engineering firm to collaborate in the development of the WEP.

Commencing in December 2008, the Joint Non-Lethal Weapons Directorate (“JNLWD”) of the US Department of Defense, an organization responsible for the development and coordination of non-lethal weapons activities within the United States, tested the WEP through its evaluation facility at Penn State University. An executive summary was released to the Company indicating a positive outcome.

In the fall of 2010 the Company underwent a change in the board of directors and management. This precipitated a change in the direction of the company as development of the WEP was discontinued and the company shifted its focus to a new product – the Blunt Impact Projectile (BIP). The Company concluded that the cost and time required to complete development and testing of the BIP were significantly less than that required to complete development and testing of the WEP. The goal was to develop a product that it could bring to market more quickly. The Company was able to exploit some of the patent pending technology of the WEP into the BIP. In 2011, the Company moved its engineering, intellectual property and production facilities to the operator (the “BIP Manufacturer”) of an injection molding facility outside of Boston, Massachusetts.

The Blunt Impact Projectile (BIP) – A Transformative Technology

When the less-lethal industry was dominated by the 37mm launcher, a number of less-lethal companies developed “impact munition rounds” designed to “stop” an assailant. These round were nothing more than a piece of plastic, wood baton, rubber baton, or a piece of plastic with a piece of sponge rubber or foam rubber affixed to the head of the round.

There were several problems with these rounds. First, they were inaccurate due to the lack of barrel rifling. Since most SWAT teams carry single shot launchers, a round that cannot be shot accurately is of little value. Second, because of their lightweight, they did not have much stopping power. Suspects that were “committed” would often “shake off” a direct hit. Finally, the rounds would bounce off walls or other hard surfaces which made them dangerous to use in confined areas such as a jail cell. Numerous corrections officers have been hurt by impact rounds ricocheting off of jail cell walls.

Security Devices International solved all three issues with the development of its “Blunt Impact Projectile” (BIP). The BIP was developed as an outgrowth of a research and development project to create a conductive electric device bullet (project name WEP – Wireless Electric Projectile).

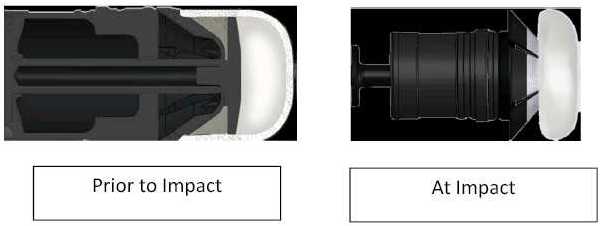

In order to ensure that the projectile did not injure the targeted individual, SDI needed to develop a way to cushion the impact of the round upon contact with the target. The solution was a collapsible head that compressed upon impact. (See below). When it became clear that SDI did not have sufficient funds to complete development of the WEP, it was decided to use the collapsible head design to create an impact round. The hope was that with this new, state-of-the-art impact round, SDI could generate enough profitability that it would be able to complete development of the WEP.

2

This collapsible head technology allowed SDI to build a heavier projectile that did not require a rubber or foam tip. This meant that it could take advantage of the rifling of the 40mm launcher. This made the BIP by far the most accurate round on the market in comparison to previous 37mm projectiles. The target for an impact round is to be a large muscle group such as the thigh muscle.

The gel collapsible head of the BIP spreads out upon impact, dispersing the energy over a larger area thus reducing blunt trauma to the subject. This allows the BIP round to be fired at close range on a target.

The Company believes that its patented collapsible head technology will transform the industry as law enforcement agencies recognize the tactical advantages of a less-lethal weapon that can be safely, accurately and effectively deployed at close range distances between 3 feet and 100 feet. There is simply nothing else on the market today that can compete with the BIP. SDI has been in discussions several industry players about licensing SDI’s technology.

Early in 2011 the Company focused its attention on a new 40mm product, the blunt impact projectile (“BIP”), and discontinued further development work on the WEP.

2012

In June 2012, the Company contracted CRT Less Lethal Inc. (“CRT”) to test the BIP. Based on data obtained from the three-stage evaluation, the BIP passed the CRT testing protocol for accuracy, consistency, relative safety and effectiveness.

In July 2012, the Company signed a five-year development, supply and manufacturing agreement with a subcontractor to Manufacture the BIP.

In November 2012, the Company obtained a United States Department of Transportation number (DOT#) required in order for the Company to ship BIP rounds.

3

In 2012, the Company began the development of five new less-lethal ammunition rounds. These new rounds will be a modified version of the BIP, four of which carry a payload, including; BIP MP (temporary powder-based marking agent), BIP ML (semi-permanent liquid marking agent), BIP OC (Oleoresin Capsicum - a pepper spray powder), BIP MO (malodorant liquid), and the BIP TR (training round).

2013

The Company moved its full manufacturing and supply chain operations to the BIP manufacturer, a supply manufacturing and engineering company, in the Boston, MA area.

The Company undertook an Initial Public Offering (IPO) in January and became a public reporting issuer on the TSX-Venture Exchange in September 2013.

2014

SDI began another globally recognized testing protocol with a military agency called HECOE (the Human Effects Centre of Excellence). This world-renowned agency is located in the Air Force Research Laboratory (AFRL), in partnership with the US Joint Non-lethal Weapons Directorate (JNLWD). This group conducts research to assist Non-lethal Weapon (NLW) Program Managers across the U.S. Department of Defense (DoD) in assessing effectiveness and risks of NLWs. The positive conclusion of this testing allows DOD to purchase SDI rounds.

April - SDI appointed Keith Morrison to the board of directors as non-executive Chairman

May - SDI’s BIP rounds were used at the Mock Prison Riot in West Virginia. Law enforcement and correctional services officers provided feedback on new technologies (such as SDI’s products) to assist in the effectiveness of their jobs.

August - The Company completed the issuance of 1,549 convertible unsecured debentures at $1,000 per debenture for gross proceeds of $1,549,000 (the “Private Placement”).

October - Security Devices International Inc. announced that the Company and a division of Abrams Airborne Manufacturing Inc. (AAMI), namely Milkor USA (MUSA), have agreed to partner for a joint cross-selling / marketing initiative.

November - The Company named Karim Kanji to the board of directors as an independent member.

SDI has sold their BIP products into nine new agencies during the fiscal year of 2014 including Sheriff Departments, Correctional Services, and SWAT teams in; Saskatoon, SK, Watertown, SD, Abbotsford, BC, Sacramento, CA, Kingston, ON, Rustburg, VA, Orlando, FL, Montreal, QC, and Bedford, VA. These agencies are additions to SDI’s customer base that have adopted its 40mm less-lethal rounds.

2015

In January 2015, SDI commenced a public relations program and through the year, SDI has been featured in over 700 media outlets globally, including live interviews on FOX television, News One in New York, and CP24 in Toronto.

4

March - SDI was invited to speak at the Launch festival in San Francisco, to present their innovative less-lethal technology during a panel discussion on the future of policing. The Launch festival focuses on start-up and emerging technology companies and the festival was streamed to approximately 4 million viewers.

During the second quarter, SDI attended the American Jail Association’s annual conference in North Carolina and performed a live fire demonstration to numerous State and local Agencies while in North Carolina.

During Q2, SDI also attended the Canadian Tactical Conference in Collingwood, Ontario as well as the New York Tactical Conference in Verona, New York.

Through SDI’s distributor (U.S. Tactical Supply– GSA) the Company was able to leverage their relationship to facilitate a live-fire demonstration for the Pentagon Protection Force in Alexandria, Virginia.

In May - SDI participated in the “Mock Prison Riot” which takes place annually at a decommissioned penitentiary in Moundsville, West Virginia. The Mock Prison Riot is a four-day, comprehensive law enforcement and corrections tactical and technology experience, including 40,000 square feet of exhibit space, training scenarios, technology demonstrations, certification workshops, a Skills Competition, and unlimited opportunities for feedback and networking on a global scale.

SDI enhanced their customer base in the quarter by adding 9 new agencies in multiple States and Provinces both in Canada and the US.

SDI staff attended the Ohio Tactical officers conference in June where the Company not only had a full exhibit booth set up to bring awareness to SDI’s full line of less lethal 40MM products but also conducted live fire demonstrations to several agencies. These agencies had requested seeing the projectiles fired to move forward with evaluation of SDI’s products for potential inclusion in their less lethal arsenal.

July - SDI was invited to present the company’s full line of products to the New York City Police Department. Representatives of SDI attended the NYPD range and conducted in-class presentations followed by a live fire demonstration showcasing the full line on 40MM products that SDI can offer for Law Enforcement operational missions.

July - The Associated Press (“AP”), conducted interviews with SDI management and attended SDI’s manufacturing partners’ location for an in depth look at the company and the technology. The AP completed a story on the uniqueness of the product line and the increased element of safety that SDI’s products offer, and released the story to the newswire, where it was picked up by approximately 800 media outlets, worldwide.

August - SDI was invited to present to the Toronto Police Service (“TPS”), who are currently exploring less lethal options for front line officers. A full presentation was given to decision makers of the TPS and a follow-up live fire demonstration is to occur.

September – SDI conducted their Annual General Meeting and shareholders approved the following:

| 1) |

The Board of Directors, as it stands today, was re-elected. | |

| 2) |

Schwartz Levitsky Feldman, LLP was re-appointed as SDI’s auditors. | |

| 3) |

Approval of an amendment to Company’s by-laws concerning the quorum required to hold a meeting of shareholders. | |

| 4) |

Approval of the Company’s incentive stock option plan. | |

| 5) |

Approval of an amendment to the Company’s articles to prohibit the issuance of shares of preferred stock having multiple voting attributes. |

In FY2015, SDI added 24 new Law Enforcement and Correctional Agencies to its paid customer base. The Company as at fiscal yearend holds 40 agencies as customers.

5

Q1 FY2016

In December 2015, SDI was invited to conduct a full product briefing and live fire demonstration for key Management with the United Sates Federal Bureau of Prisons. SDI was able to showcase the innovation of the BIP family of products and demonstrate the clear difference between SDI’s products and other products on the market.

In January 2016, SDI management attended the SHOT show in Las Vegas and met with numerous existing partners and explored future partnerships with several other Industry leaders.

During the SHOT show SDI’s rounds were used by AAMI, an existing partner of SDI, during a new product innovation range day that was attended by the majority of Companies in the firearms industry.

During Q1, SDI is pleased to announce that it received its first sale of 40MM launchers to a Law Enforcement Agency. This is an important step for SDI to be seen as having the availability to access other less lethal products to fulfil customer requests.

In January, SDI and Clyde Armory, signed a distribution agreement whereas Clyde will offer SDI’s product line to Law Enforcement customers in their catchment area. Clyde is a full service gun store which supplies firearms, ammunition and accessories to Law Enforcement and Civilian customers. They are based in Athens, Georgia.

During this quarter, the non-exclusive renewable Technology License and Supply Agreement that was signed with United Tactical Solutions on April 17, 2015, was terminated by SDI management effective February 25, 2016.

On February 29, 2016, SDI signed a term sheet with an existing defense technology (less lethal) company to acquire that Company. This acquisition, if completed, will give SDI a diversified line of less lethal munitions, launchers and accessories as well as opening domestic and global distribution channels.

Q2 FY2016

During the second quarter of 2016, the Company continued to pursue the targeted acquisition through several funding sources, and financing structures. Subsequent to the quarter, on July 8, 2016, the Company announced that it had identified a number of items in the target company’s (the “Target”) financial statements that raised concerns in support of the negotiated price of the transaction. SDI has terminated discussions with the Target at this time.

Subsequent to the quarter, the Company announced that Gregory Sullivan had resigned as President and CEO to pursue other opportunities, effective July 15, 2016. Dean Thrasher, the current COO and a member of the SDI board of directors will assume the interim role of President and CEO. Mr. Sullivan will remain on the board of directors until his replacement is appointed and receives stock exchange clearance, or September 1, 2016, whichever occurs first.

The Company signed a one-year consulting agreement with Northeast Industrial Partners LLP (“Northeast”), which is headed up by Mr. Bryan Ganz. Northeast will assist SDI with sales & marketing, expansion of the Company’s product range, review of operations, implementation of cost control measures, development of strategic alliances and financial oversight. Mr. Ganz brings more than 30 years of experience in sales management, manufacturing, new product design and development as well as mergers & acquisitions. During his career Mr. Ganz has bought, built and sold more than half a dozen global businesses with combined sales in excess of $1.0 billion. Most recently, Mr. Ganz sold Maine Industrial Tire LLC to Trelleborg (based out of Sweden), for $67 million generating a 7.0x return to investors over a three-year period.

6

For their services and subject to stock exchange approval, Northeast will be issued a value of US$200,000 in SDI stock in four quarterly instalments over the 12-month period ending May 15, 2017. The first quarterly instalment is due August 15, 2016. The stock will be priced at the volume weighted average trading price per common share over the 20-day period preceding the due date. The stock will vest at the end of the contract with Northeast.

NEIP is currently the controlling shareholder in two operating businesses and a 250-unit residential real estate portfolio in the New England area. Northeast also owns minority stakes in a number of public and private businesses including a California company developing wireless electricity. Mr. Ganz is a graduate of Columbia Law School in New York City and completed his accounting designation at Georgetown University in Washington DC.

The Company wishes to inform the market that a Schedule 13D was filed with the SEC on June 8, 2016 by SDI’s largest group of shareholders in the US, holding approximately 10,474,522 shares. The 13D filing by the “reporting persons” relates to the maximizing of shareholder value with the intention of engaging more substantively with management, the board of directors and other relevant parties on matters concerning the business, assets, capitalization, operations and strategy of SDI. The 13D filing says that the reporting person may also discuss strategic alternatives with interested parties to propose or consider extraordinary transactions including joint ventures, mergers or a sale transaction of the Company.

Q3 FY2016

During Q3 2016 SDI announced that it has terminated its proposed acquisition of a less-lethal company, as previously released on May 13, 2016, and April 21, 2016.

During the Company’s due diligence process, SDI identified a number of items in the target company’s (the “Target”) financial statements that raised concerns in support of the negotiated price of the transaction. SDI terminated discussions with the Target during this quarter.

SDI’s management continues to look for acquisitions and strategic partnerships in the less-lethal sector, to broaden its product offering and increase its distribution reach. SDI is currently in preliminary discussions to license its collapsible technology to other less lethal market participants. SDI’s objective is to both (1) increase revenues and (2) gain greater market acceptance for the BIP.

7

During Q3, SDI appointed Bryan Ganz to the board of directors. With the appointment of Mr. Ganz to the board of directors, the previously announced resignation of Greg Sullivan (previous CEO) as a director becomes effective.

During Q3 SDI reported that it has made the first share issuance to Northeast Industrial Partners under the consulting agreement announced on June 20, 2016. SDI issued 488,851 common shares at a deemed price of $ 0.1023 (CAD $0.1322) per share to satisfy the payment of USD $50,000 due on August 15, 2016. The shares will be subject to a four-month hold period expiring on January 13, 2017, and will not vest until May 2017.

The issuance of shares to Northeast Industrial Partners is the first of four such issuances to occur over the period ending May 15, 2017, as described in the June 20, 2016 news release.

Q4 FY2016

During Q4 the Company announced the signing of a sales and distribution agreement with the Bob Barker Company (“Bob Barker”), the nation’s preeminent correctional services supplier, for distribution of SDI’s products through their Officers Only distribution network.

A division of the Bob Barker Company, “Officers Only” is a reliable source for quality apparel and offers a broad and diverse product line-up of protective and essential equipment that are brand recognized and trusted by law enforcement, corrections, military and public service office. SDI will continue to look for qualified distributors as part of its new sales and marketing strategy with a goal of tripling the number of SDI distributors by the end of 2017.

On September 15, 2016 Allen Ezer resigned as Executive Vice President to pursue other opportunities.

During the quarter, the Company appointed Karen Bowling to the board of directors. Ms. Bowling brings more than 25 years of diverse executive management experience to the board of SDI. Some of her skill-sets include; government affairs, lobbying, public relations, government procurement, marketing, communications, operations, and local and state level legislation. Ms. Bowling has also spent part of her career in the less-lethal sector for a long-range acoustic hailing device company.

Karen's recent positions include; Public Affairs Director at Foley & Lardner LLP, CEO at WiseEye AI, (an artificial intelligence company focussed on the healthcare sector for CT scan identification and classification), Chief Administration Officer for the city of Jacksonville, FL (with a budget in excess of one billion dollars and over 5,000 employees), and Co-Founder and CEO of the Solantic Walk-In Urgent Care Centers. Ms. Bowling has sat on and chaired numerous boards across a dozen sectors, and has recently been Gubernatorial appointed to the board of the Florida State College in Jacksonville.

During the quarter SDI signed a three-year distribution agreement with Tac Wear Inc. Tac Wear is a supplier to law enforcement, military, corrections, and private security professionals in Canada and the US. SDI and Tac Wear have developed a buy-sell arrangement where Tac Wear will distribute SDI’s 40mm line of products through their distribution networks in Canada, the US and internationally. In turn, SDI will sell and distribute specific items from Tac Wear’s line of gear.

After the year, SDI issued 589,414 common shares at a deemed price of $0.0848 (CAD$0.1142) per share to satisfy the payment of USD $50,000 due on November 15, 2016. The shares are subject to a four-month hold period expiring on May 14, 2017. The issuance of shares to Northeast Industrial Partners is the second of four such issuances to occur over the period ending May 15, 2017, as described in the June 20, 2016 news release.

Northeast Industrial Partners is controlled by Bryan Ganz, who was appointed to the board of directors of SDI after the consulting agreement was entered into. As a condition of stock exchange approval, SDI was required to obtain disinterested shareholder approval of the share issuance reported in this news release. That approval was received on December 15, 2016 at the Annual General Meeting of shareholders.

Subsequent to the quarter, the Company completed the issuance of senior secured convertible notes (the “Senior Secured Notes”) to raise USD $1,500,000. This offering was announced and described in the Company’s news release of October 18, 2016.

It was a condition of the offering of Senior Secured Notes that not less than 80% of SDI’s outstanding unsecured debentures (the “Unsecured Debentures”) be exchanged for subordinate convertible secured debentures (the “Subordinate Secured Debentures”). $1,402,000 of the Unsecured Debentures (being $1,363,000 of principal and $29,000 of interest) were exchanged for Subordinate Secured Debentures, representing approximately 88% of the outstanding Unsecured Debentures due to mature in June of 2019. The issuances of Senior Secured Notes and Subordinate Secured Debentures were non-brokered transactions.

The Company hired a new Director of Sales, Marketing and Training with over 24 years of extensive law enforcement experience. His duties included: SWAT/SRT, patrol, criminal investigations, and various joint federal task forces. He is an armorer for numerous weapon platforms. He has served as an instructor for the following: Taser, defensive tactics/officer survival, impact weapons, active shooter response, SWAT tactics, chemical munitions, handgun, submachine gun, shotgun, and patrol rifle. Additionally, he worked as an instructor training foreign law enforcement and Military personnel in ant-terrorism operations. He has also developed training programs for the US Military (Reserve, National Guard, and Coast Guard) , Federal Agencies, various local and state agencies, as well as private security.

During Q4, the Company applied for its Federal Firearms and Federal Explosives Licenses. These licenses will permit the Company to enhance its product line to a much broader less-lethal offering. The licensing will also allow the Company to house and travel with 40mm launchers and munitions for demonstrations globally.

Operations

Subsequent to the year the Company secured a new office and distribution warehouse in Perry, Florida. This facility sets the foundation for regional distribution of SDI’s future and existing products, and a new presence in Florida, one of the target markets of the Company.

Website Update

SDI continues to update its website to manage its digital presence, as well as maintain its top positioning in search engines for the less-lethal industry. The Company has also revised it messaging to respond to recent global law enforcement confrontations, such as incidents in the US, South America and in Europe.

Products

SDI’s business is the development, manufacture and sale of less-lethal ammunition. This ammunition is used by the military, correctional services, and police agencies for crowd control.

The Company has two products:

| a) |

The Company has developed the BIP, a blunt impact projectile which uses pain compliance to control a target. The Company has developed six versions of the standard BIP, five of which contain a payload and one of which is a cheaper cost, training round. A payload is an internal medium within the BIP, holding a liquid or powder substance. | |

|

| ||

| b) |

The Company has undertaken substantial work to develop the WEP, a wireless electric projective which releases an electrical pulse that induces a muscle spasm and causes the target to fall to the ground helpless. |

Intellectual Property

Five patent applications, four non-provisional and one provisional, have been filed by the Company with the U.S. Patent Office. The Patents have been granted on the four non-provisional patents.

Non-Provisional (granted patents):

(a) Less-lethal Projectile: This issued patent relates to the Company’s distinctive collapsible ammunition head technology that absorbs kinetic energy of the projectile upon impact. The Corporation’s collapsible head is used in both the BIP and the WEP.

(b) Electronic Circuitry for Incapacitating a Living Target: This issued patent relates to the electronic circuitry incapacitation system which forms part of the WEP. The patent describes an electronic circuit which provides an electrical incapacitation current to a living target.

8

(c) Less-lethal Wireless Stun Projectile System for Immobilizing a Target by Neuro-Muscular Disruption: This issued patent describes the process by which the WEP operates with its attachment system to halt a target through a neuro-muscular-disruption system.

(d) Autonomous Operation of a Less-lethal Projectile: This patent describes a motion sensing system within the WEP. The sensor will monitor movement of the target and enable the electrical output until the target is subdued. The electrical pulse is programmed for an exact time-frame to specifications of the user.

Provisional Patent:

(e) Payload carrying arrangement for a non-lethal projectile: This Provisional patent relates to the process of carrying liquid and powder payloads in the head of the BIP munitions that upon impact release from the head and are dispersed upon the target.

The Company’s policy has been to write off cost incurred in connection with non-provisional and provisional patent costs as they are incurred as a recoverability of such expenditure is uncertain.

General

| • | As of November 30, 2016, SDI had consultants and no full-time employees. | |

| • | SDI’s offices are located at 25 Sawyer Passway, Fitchburg, Massachusetts, 01420 and 125 Lakeshore Road East, Unit 300, Oakville, Ontario L6J 1H3 Canada. | |

| • | SDI’s website is www.securitydii.com. |

ITEM 2. DESCRIPTION OF PROPERTY

See Item 1 of this report.

ITEM 3. LEGAL PROCEEDINGS.

In November of 2013, a former officer filed a law suit against the Company in the Ontario Superior Court of Justice (Province of Ontario) seeking, among other things, $60,000 in damages for wrongful dismissal, damages of $35,000 on account of vacation pay and damages to be determined for out of pocket expenses, breach of contract, unjust enrichment and loss of business opportunity. During the quarter ended February 28, 2015, the Company and the former officer executed a settlement agreement at CAD $15,000.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

On December 15, 2016, the Company held an annual meeting (the “Meeting”) Company’s shareholders. At the Meeting, the shareholders of the Company (1) elected all five (5) of the Company’s director nominees; (2) ratified the appointment of Schwartz Levitsky Feldman LLP as the Company’s independent registered public accounting firm for the fiscal year ended November 30, 2016; and (3) approved the consulting agreement (the “Northeast Consulting Agreement”) between the Company and Northeast Industrial Partners LLC (“Northeast”).

The following is a tabulation of the votes for each individual director nominee:

| Director | For | Withheld |

| Dean Thrasher | 23,254,463 | 706,633 |

| Keith Morrison | 23,254,463 | 706,633 |

| Karim Kanji | 9,272,897 | 14,688,199 |

| Bryan Ganz | 23,654,463 | 306,633 |

| Karen Bowling | 23,855,121 | 105,975 |

There were no broker non-votes or abstentions with regards to the election of directors.

The following is a tabulation of the votes for (1) the ratification of the appointment of Schwartz Levitsky Feldman LLP (“SLF”) as the Company’s independent registered public accounting firm and (2) the approval of the Northeast Consulting Agreement:

| Item Approved | For | Withheld/Against | Abstain | Broker Non-Vote |

| Ratification of SLF | 23,862,992 | 98,104 | 0 | 0 |

| Northeast Consulting Agreement | 23,364,141 | 108,104 | 488,851 | 0 |

Item 9.01 Financial Statements and Exhibits

ITEM 5. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND OTHER SHAREHOLDER MATTERS.

SDI’s common stock is listed on the OTC Bulletin Board under the symbol “SDEV” and is also listed in Canada on TSXV under the symbol “SDZ.V”. The following shows the high and low closing prices for SDI’s common stock for the periods indicated:

OTC Bulletin Board

| Three Months Ended | High | Low | ||||

| February 2015 | $ | 0.34 | $ | 0.20 | ||

| May 2015 | $ | 0.50 | $ | 0.27 | ||

| August 2015 | $ | 0.41 | $ | 0.20 | ||

| November 2015 | $ | 0.36 | $ | 0.20 | ||

| February 2016 | $ | 0.28 | $ | 0.19 | ||

| May 2016 | $ | 0.27 | $ | 0.19 | ||

| August 2016 | $ | 0.24 | $ | 0.20 | ||

| November 2016 | $ | 0.20 | $ | 0.20 |

TSXV*

| Three Months Ended | High | Low | ||||

| CAD $ | CAD$ | |||||

| February 2015 | $ | 0.38 | $ | 0.23 | ||

| May 2015 | $ | 0.49 | $ | 0.33 | ||

| August 2015 | $ | 0.49 | $ | 0.34 | ||

| November 2015 | $ | 0.41 | $ | 0.31 | ||

| February 2016 | $ | 0.33 | $ | 0.19 | ||

| May 2016 | $ | 0.32 | $ | 0.21 | ||

| August 2016 | $ | 0.22 | $ | 0.11 | ||

| November 2016 | $ | 0.20 | $ | 0.10 |

* Trading commenced in the last quarter of 2013.

As of February 18, 2017, SDI had 55,693,907 outstanding shares of common stock.

Holders of common stock are entitled to receive dividends as may be declared by the Board of Directors. SDI’s Board of Directors is not restricted from paying any dividends but is not obligated to declare a dividend. No dividends have ever been declared and it is not anticipated that dividends will ever be paid.

9

ITEM 6. SELECTED FINANCIAL DATA

The selected financial information set forth and the discussion and analysis of financial position and results of operations should be read in conjunction with the audited annual financial statements and related notes for SDI for the fiscal years ended November 30, 2016 and 2015. Those financial statements have been prepared in accordance with U.S. generally accepted accounting principles. All dollar figures included therein and in the following management discussion and analysis ("MD&A") are expressed in U.S. dollars.

The following is a summary of selected annual financial data for the periods indicated:

| Selected Financial Information |

Year ended November

30, 2016 (audited) |

Year ended November

30, 2015 (audited) (Restated) |

| Sales | $154,015 | $151,005 |

| Cost of sales | $95,017 | $115,940 |

| General and Administrative Expenses | $1,723,310 | $2,306,940 |

| Convertible debt currency translation gain | ($18,749) | ($179,537) |

| Depreciation | $46,515 | $47,165 |

| Net Loss | ($1,924,110) | ($2,370,901) |

| Loss per Share (Basic and Diluted) | ($0.04) | ($0.05) |

| Current Assets | $318,489 | $2,015,245 |

| Total Assets | $405,859 | $2,148,280 |

| Current Liabilities | $1,399,451 | $173,329 |

| Long Term Liabilities | $- | $1,161,750 |

| Stockholders' Equity (Deficiency) | $(993,592) | $813,201 |

| Accumulated Deficit | ($28,298,613) | ($26,374,503) |

| Dividends | $Nil | $Nil |

10

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF OPERATION

This management discussion and analysis ("MD&A") in respect of the fiscal year ended November 30, 2016 includes information from, and should be read in conjunction with, the audited annual financial statements and related notes for SDI for the fiscal year ended November 30, 2016.

Comparison of Year Ended November 30, 2016 to Year Ended November 30, 2015

i. Overview

The Corporation has $154,015 of revenue during the year ended November 30, 2016 (2015: $151,005) and we continue to operate at a loss. We expect our operating losses to continue for so long as we do not generate adequate revenue. As of November 30, 2016, we had accumulated losses of $28,298,613 (November 30, 2015 - $26,374,503). Our ability to generate significant revenue and conduct business operations is dependent, in large part, upon our raising additional equity financing.

As described in greater detail below, the Corporation’s major financial endeavor over the years has been its effort to raise additional capital.

ii. Assets

Total assets as of November 30, 2016, includes cash of $192,826, accounts receivable of $32,534, prepaid expenses and other receivables of $50,037, Inventory of $7,323, Deferred financing costs (current and non-current) for $72,643 and plant and equipment for $50,496 net of depreciation. Total assets as of November 30, 2015 includes cash of $1,851,021, accounts receivable of $39,676, prepaid expenses and other receivables of $27,283, Inventory of $44,319, Deferred financing costs (current and non-current) for $88,970 and plant and equipment for $97,011 net of depreciation. Total assets decreased from $2,148,280 on November 30, 2015 to $405,859 on November 30, 2016. This decrease is primarily the result of expenses incurred in normal course of business without any additional raise of funds.

iii. Revenues

Revenue from operations during the year ended November 30, 2016 was $154,015 as compared to $151,005 during the year ended November 30, 2015.

iv. Net Loss

The Company’s expenses are reflected in the Statements of Operation under the category of Operating Expenses. The significant components of expense that have contributed to the total operating expense are discussed as follows:

(a) General and Administration Expense

General and administration expense represents professional, consulting, office and general, stock based compensation and other miscellaneous costs incurred during the years covered by this report.

General and administration expense for the year ended November 30, 2016 was $1,723,310, as compared with $2,306,940 for the year ended November 30, 2015. General and administration expense decreased by $583,630 in the current year, as compared to the prior year. The primary reasons for the change in general and administrative costs is as follows:

The Company expensed stock based compensation expense (included in general and administrative expenses) for issue of options and modification of warrants for $639,143 during the year ended November 30, 2015. In 2016, the Company expensed stock based compensation expense (included in general and administrative expenses) for issue of options and modification of warrants for $77,936. Stock based compensation expense does not require the use of cash (non-cash expenses), associated with the issuance of options and modification of warrants.

11

v. Quarterly Results

The net loss and comprehensive loss (unaudited) of the Corporation for the quarter ended November 30, 2016 as well as the seven quarterly periods completed immediately prior thereto are set out below:

| For the three | For the | For the | For the | For the three | For the | For the | For the | |||||||||||||||||

| months | three | three | three | months | three | three | three | |||||||||||||||||

| ended | months | months | months | ended | months | months | months | |||||||||||||||||

| November30, | ended | ended | ended | November30 | ended | ended | ended | |||||||||||||||||

| 2016 | August | May 31, | February | , 2015 | August | May 31, | February | |||||||||||||||||

| ($) | 31, 2016 | 2016 | 28, 2016 | ($) | 31, 2015 | 2015 | 28, 2015 | |||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||

| Revenues | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | ||||||||||||||||

| Net Loss | (580,156 | ) | (491,928 | ) | (472,224 | ) | (379,802 | ) | (1,108,472 | ) | (403,621 | ) | (473,151 | ) | (385,657 | ) | ||||||||

|

Loss per Weighted Average Number of Shares Outstanding –Basic and Fully Diluted |

(0.01 | ) | (0.01 | ) | (0.01 | ) | (0.01 | ) | (0.02 | ) | (0.01 | ) | (0.01 | ) | (0.01 | ) |

Quarterly activities and financial performance are impacted by the Company’s ability to raise capital for its activities.

12

vi. Liquidity and Capital Resources

The following table summarizes the Company’s cash flows and cash in hand:

| Year ended | Year ended | |||||

| November | November | |||||

| 30, | 30, | |||||

| 2016 | 2015 | |||||

| Cash and cash equivalent | $ | 192,826 | $ | 1,851,021 | ||

| Working capital (deficit) | $ | (1,080,962 | ) | $ | 1,841,916 | |

| Cash used in operating activities | $ | (1,660,139 | ) | $ | (1,738,824 | ) |

| Cash used in investing activities | $ | - | $ | - | ||

| Cash provided (used) by financing activities | $ | (36,874 | ) | $ | 2,523,770 |

As of November 30, 2016, the Company had working capital deficit of $(1,080,962) as compared to working capital surplus of $1,841,916 as of November 30, 2015. Working capital decreased primarily as a result of expenses incurred in the normal course of business without raising any funds and re-class of convertible debentures from non-current liabilities in 2015 to current liabilities in 2016. Also, refer to the subsequent events note wherein the terms of the convertible debentures were modified.

Net cash used in operations for the year ended November 30, 2016, was $1,660,139 as compared to $1,738,824 used for the year ended November 30, 2015. The major components of change relate to:

1) Items not affecting cash:

Stock based compensation of $77,936 in 2016, as compared to $639,143 in 2015.

November 30, 2016

On June 9, 2016, the board of directors extended the expiry dates of 400,000 warrants issued in 2012 to a director at exercise price of $0.20, from original expiry date of August 9, 2016 to August 7, 2020. The change in the terms of the warrants was determined to be a modification and not a cancellation and issuance of a new warrant. Because of these modifications, the fair value of 400,000 warrants increased by $49,912.

On August 18, 2016, the board of directors granted options to a consultant to acquire a total of 25,000 common shares. These options were issued at an exercise price of $0.11 (CAD $0.14) per share and vest immediately with an expiry term of five years. The Company expensed stock based compensation expense for $2,574.

On October 20, 2016, the board of directors granted options to a new director to acquire a total of 350,000 common shares. These options were issued at an exercise price of $0.08 (CAD $0.11) per share and vest immediately with an expiry term of five years. The Company expensed stock based compensation expense for $25,450.

November 30, 2015

On September 24, 2015, the board of directors extended the expiry dates of 572,000 warrants issued in 2010 to directors and officers at exercise price of $0.20, from original expiry date of September 30, 2015 to September 23, 2019. In addition, on same date, the board of directors extended the expiry dates of 1,470,000 warrants issued to directors and officers and 35,000 to a consultant, all issued in 2012 at exercise price of $0.13, from original expiry date of January 4, 2016 to September 23, 2019. The change in the terms of the warrants was determined to be a modification and not a cancellation and issuance of a new warrant. As a result of these modifications, the fair value of 2,077,000 warrants increased by $216,684.

On October 20, 2015, the board of directors granted 1,350,000 options to directors and officers and 325,000 options to consultants to acquire a total of 1,675,000 common shares. These options were issued at an exercise price of $0.29 (CAD $0.38) per share and vest immediately with an expiry term of five years. The Company expensed stock based compensation expense for $422,459.

13

2) Changes in non- cash balances relating to operations:

The Company’s inventory decreased by $36,996 as compared to a decrease of $75,927 in 2015. The decrease resulted in reduction in the Company’s investment in Inventory. Account receivables was $32,534 in 2016 as compared to 39,676 in 2015.

Net cash outflow from investing activities was $nil during the year ended November 30, 2016 as compared to $ nil for the year ended November 30, 2015. The Company did not acquire any fixed assets during these years.

Net Cash flow from financing activities was an outflow of $36,874 for the year ended November 30, 2016 as compared to an inflow of $2,523,770 for the year ended November 30, 2015. The outflow in 2016 reflect deferred financing costs incurred till end of the year to raise funds after the year.

Year ended November 30, 2015

On June 3, 2015, the Company received $16,775 and $6,995 for the exercise of 105,600 warrants and 35,000 options respectively.

On June 19, 2015, the Company issued 7,575,757 common stock at price of $0.33 (CAD $0.40) per share on a non-brokered private placement basis and raised $2,500,000. There were no broker commissions or fees associated with this subscription. The closing of the private placement was approved by the TSX-Venture Exchange, as required under stock exchange rules.

vii. Off-Balance Sheet Arrangement. The Company had no off- balance sheet arrangements as of November 30, 2016 and 2015

14

viii. Commitments

a) Consulting agreements:

The non-independent directors of the Company executed consulting agreements with the company on the following terms:

Effective October 1, 2014, SDI executed a renewal agreement with a private company in which the Chief Operating Officer Dean Thrasher has an ownership interest in, for a period which expires on December 31, 2017 for services rendered. The total consulting fees are estimated at $648,000 (CAD$864,000) for the three-year period. In the event of termination without cause due to change in control brought out by sale, lease, merger or transfer, the Company is obligated to pay 18 months’ fees at current rate at time of change in control. SDI paid cash and expensed $ 221,217 (CAD $230,892) during the year ended November 30, 2015. The company may also accept common shares in lieu of cash. As of November 30, 2016, the company has not exercised its right to accept this compensation in shares. Effective February 1, 2015, the Company and director agreed to reduce the monthly remuneration by 10% to $16,200 (CAD $21,600). This reduction continued until the completion of the next round of financing, which was completed in May 2015. On July 16, 2016, Dean Thrasher was appointed interim CEO and President of the Company. Effective August 1, 2016, the Company and director agreed to reduce the monthly consulting fees to $10,550 (CAD $14,000).

Effective July 21, 2016, Bryan Ganz was elected as a director of the Company. Prior to his appointment, effective May 1, 2016, the Company executed a one-year consulting agreement with a Corporation in which the said director has an ownership interest. The said Corporation will assist the Company with sales & marketing, expansion of the Company’s product range, review of operations, implementation of cost control measures, development of strategic alliances and financial oversight. For the consultant services and subject to TSX Venture Exchange Inc. (the “Stock Exchange”) approval, the consultant was paid cash for $50,000 and issued a value of $200,000 in Company’s stock in four quarterly installments over the 12-month period ending May 15, 2017. The first quarterly installment was issued in September 2016. The stock will be priced at the volume weighted average trading price per common share over the 20- day period preceding the due date. (See also note 18 Subsequent events)

Effective November 1, 2013, SDI executed an agreement with a non-related consultant to pay compensation of $3,750 (CAD $5,000) per month. The consultant has agreed to provide corporate market advisory services. The agreement is for a period of a minimum of three months and will continue unless otherwise terminated by either party by giving 30 days’ written notice.

Effective May 1, 2015, SDI executed an agreement with another non-related consultant to pay compensation of $3,750 (CAD $5,000) per month. The consultant is to assist with sales initiatives, demos and participate in trade shows. The agreement unless renewed by mutual consent expires December 31, 2015. The consultant is also entitled to a 5% cash commission for all completed direct sales to end users and a 2% cash commission for all completed indirect sales. In addition, as a sales incentive, the company may grant stock options at market prices, being 25,000 stock options for every 5,000 rounds sold, to a maximum of 200,000 options. Either party may terminate the consulting agreement by giving 60 days’ written notice. Subsequent to the year this agreement was terminated (refer to Note 18)

Effective April 2014, SDI executed an agreement with a non-related consultant to set up its social media sites and optimization of search engines for the Company, at a start- up fee for $2,250 (CAD$3,000) (Phase 1) and payment of $2,250 (CAD$3,000) per month and issued 150,000 stock options at $0.32 (CAD$0.38) when Phase 2 of the project was implemented. Either party can terminate the agreement by giving 30 days’ notice.

Effective July 1, 2016, SDI renewed an agreement with a non-related consultant to pay compensation of $5,250 per month. The consultant is to assist with sales initiatives, demos and participate in trade shows. The agreement unless renewed by mutual consent expires December 31, 2016. The consultant is also entitled to a 5% cash commission for all completed direct sales to end users and a 2% cash commission for all completed indirect sales. The Company agreed to grant 25,000 stock options for every 5,000 rounds sold to a maximum of an additional 175,000 options. Either party may terminate the consulting agreement by giving 30 days’ written notice. Subsequent to the year this agreement was terminated (refer to Note 18)

Effective September 1, 2016, the Company executed an agreement with a non-related consultant to pay compensation of $12,500 per month. The consultant is to assist with sales initiatives, licensing, DOT testing, distributorship set-up and forecast. The agreement expires December 31, 2016, after which the same may continue at Company discretion on a month to month basis.

b) The Company has commitments for leasing office premises in Oakville, Ontario, Canada to April 30, 2018 at a monthly rent of $4,800 (CAD $6,399).

15

EXCLUSIVE SUPPLY AGREEMENT

The Company entered a Development, Supply and Manufacturing Agreement with the BIP Manufacturer on July 25, 2012. This Agreement provides the Company to order and purchase only from the BIP Manufacturer certain 40MM assemblies and components for use by the Company to produce less-lethal and training projectiles as described in the Agreement. The Agreement is for a term of five years with an automatic extension for an additional year if neither party has given written notice of termination prior to the end of the five-year period.

The Company and a division of Abrams Airborne Manufacturing Inc. (AAMI), namely Milkor USA (MUSA), agreed to partner for a joint cross-selling / marketing initiative. This arrangement allows both companies to leverage existing and future sales channels by offering a comprehensive, full-package of Milkor USA’s 40mm Multi-Shot Grenade Launchers in conjunction with SDI’s 40mm Less-Lethal ammunition product-line to end-users globally.

Cash Requirements

At November 30, 2016, the Company had cash of $192,826, accounts receivable of $32,534, Inventory of $7,323 and prepaid expense and other receivables of $50,037. Current liabilities comprise accounts payable and accrued liabilities for $245,911 and convertible debentures (re-classed to current liabilities in 2016) for $1,153,540. For the year ended November 30, 2016, the Company’s cash outflow from operations was $1,660,139. Subsequent to the year, in December 2016, the Company raised additional funds for $1,500,000 (gross) by issue of convertible debentures (refer to subsequent event note) and as such subsequent to the year raised adequate cash to meet its expenses over the next twelve months of its operations.

x. Critical Accounting Policies

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires us to make estimates and assumptions that affect reported amounts of assets and liabilities at the date of the financial statements, the reported amount of revenues and expenses during the reporting period and related disclosure of contingent assets and liabilities. These estimates are based on our best knowledge of current events and actions the Corporation may undertake in the future. On an ongoing basis, we evaluate our estimates and judgments. To the extent actual results differ from those estimates; our future results of operations may be affected.

16

Recent Accounting Pronouncements

In January 2015, the FASB issued ASU No. 2015-01, "Income Statement - Extraordinary and Unusual Items (Subtopic 225-20) Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items" (ASU 2015-01). The amendments in ASU 2015-01 eliminate the GAAP concept of extraordinary items and no longer requires that transactions that met the criteria for classification as extraordinary items be separately classified and reported in the financial statements. ASU 2015-01 retains the presentation and disclosure guidance for items that are unusual in nature or occur infrequently and expands them to include items that are both unusual in nature and infrequently occurring. ASU 2015-01 will become effective in fiscal 2017. The Company is in the process of evaluating the amendments to determine if they have a material impact on the Company’s financial position, results of operations or cash flow.

In February, 2015, the FASB issued ASU No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. ASU No. 2015-02 provides guidance on the consolidation evaluation for reporting organizations that are required to evaluate whether they should consolidate certain legal entities such as limited partnerships, limited liability corporations, and securitization structures (collateralized debt obligations, collateralized loan obligations, and mortgage-backed security transactions). ASU No. 2015-02 is effective for periods beginning after December 15, 2015, with early adoption permitted. The Company is in the process of evaluating the amendments to determine if they have a material impact on the Company’s financial position, results of operations or cash flow.

In April 2015, the FASB issued ASU No. 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. ASU No. 2015-03 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015 with early adoption permitted. The Company is in the process of evaluating the amendments to determine if they have a material impact on the Company’s financial position, results of operations or cash flow.

In November 2015, the FASB issued ASU No. 2015-17, “Balance Sheet Classification of Deferred Taxes,” as part of its simplification initiative. Under the ASU, organizations that present a classified balance sheet are required to classify all deferred taxes as noncurrent assets or noncurrent liabilities. ASU No. 2015-17 is effective for annual periods beginning after December 15, 2016, and interim periods within those annual periods. The Company is in the process of evaluating the amendments to determine if they have a material impact on the Company’s financial position, results of operations or cash flow.

In January 2016, the FASB issued ASU 2016-01, which makes limited amendments to the guidance in U.S. GAAP on the classification and measurement of financial instruments. The new standard significantly revises an entity’s accounting related to (1) the classification and measurement of investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. It also amends certain disclosure requirements associated with the fair value of financial instruments. ASU No. 2016-01 is effective for fiscal years beginning after December 15, 2017, and interim periods within those annual periods. The Company is in the process of evaluating the amendments to determine if they have a material impact on the Company’s financial position, results of operations or cash flow.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (ASU 2016-02). The FASB issued the update to require the recognition of lease assets and liabilities on the balance sheet of lessees. ASU 2016-02is effective for fiscal years beginning after December 15, 2018. ASU 2016-02 requires a modified retrospective transition method with the option to elect a package of practical expedients. Early adoption is permitted. The Company is evaluating the effect that ASU 2016-02 will have on its financial statements and related disclosures.

In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net) (ASU 2016-08). The FASB issued the amendment to clarify the implementation guidance on principal versus agent considerations. The effective date and transition requirements for the amendments in this update is for annual reporting period beginning after December 15, 2017. The Company is evaluating the effect that ASU 2016-08 will have on its financial statements and related disclosures.

In March 2016, the FASB issued ASU 2016-09, Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016-09). The FASB issued the amendment to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. Some of the areas for simplification apply only to nonpublic entities. ASU 2016-09 is effective for the Company for annual periods beginning after December 15, 2016, with early adoption permitted. The adoption of ASU 2016-09 is not expected to have a material impact on the financial statements of the Company.

In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing (ASU 2016-10). The FASB issued the amendment to clarify the following two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance, while retaining the related principles for those areas. The effective date and transition requirements for the amendments in this update is for annual reporting periods beginning after December 15, 2017. The Company is evaluating the effect that ASU 2016-10 will have on its financial statements and related disclosures.

In May 2016, the FASB issued ASU 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients (ASU 2016-12). The FASB issued the amendment to improve Topic 606 by reducing the potential for diversity in practice at initial application and reducing the cost and complexity of applying Topic 606 both at transition and on an ongoing basis. The effective date and transition requirements for the amendments in this update are the same as the effective date and transition requirements of ASU 2014-09. The Company is evaluating the effect that ASU 2016-12 will have on its financial statements and related disclosures.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13). The FASB issued the amendment to require a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected. The updates will be effective for the Company for fiscal years beginning after December 15, 2019. The Company is evaluating the effect that ASU 2016-13 will have on its financial statements and related disclosures.

In August 2016, the FASB issued ASU 2016-15, "Statement of Cash Flows (Topic 230) Classification of Certain Cash Receipts and Cash Payments" (ASU 2016-15. The new guidance clarifies eight cash flow classification issues where current GAAP was either unclear or has no specific guidance. The new standard is effective for annual reporting periods beginning after December 15, 2017 and interim periods within those fiscal years. All entities may elect to early adopt ASU 2016-15 in any interim period. If an entity early adopts it must adopt all eight of the amendments in the same period and if early adopted in an interim period any adjustments should be reflected as of the beginning of the year. The amendments in ASU 2016-15 will be applied using the modified retrospective transition method for each period presented. The Company is evaluating the impact the adoption of this guidance will have on the classification of certain items on its consolidated statements of cash flows.

In January 2017, the FASB issued ASU No. 2017-01 Business Combinations (Topic 805) - Clarifying the Definition of a Business. This update clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The amendments provide a screen to determine when a set of assets and activities is not a business. If the screen is not met, the amendments require further consideration of inputs, substantive processes and outputs to determine whether the transaction is an acquisition of a business. The new update is effective for annual periods beginning after December 15, 2017. The amendments in ASU 2017-01 will be implemented on a prospective basis.

17

Risk Factors

Senior and Subordinate Secured Convertible Debentures

On December 7, 2016, the Company entered a Securities Purchase Agreement with several accredited investors to sell $1,500,000 of 10% senior secured convertible notes, convertible into shares of the Company’s common stock, in a private placement pursuant to Regulation D under the Securities Act of 1933. Concurrent with the sale of the Secured Notes, CAD$1,364,000 of the Company’s outstanding Unsecured Debentures, were exchanged for an equal principal amount of the Subordinate Secured Debentures and an additional CAD$37,000 of Subordinated Secured Debentures were issued in satisfaction of a portion of the accrued interest on the Unsecured Debentures. Both senior and subordinated secured debentures mature on June 6, 2019 unless converted or extended and are fully secured against the undertaking, property and assets of the Company including its patents. Inability to repay the secured debt on maturity, if the debt is neither converted nor extended, will result in the financial condition of the Company to be materially adversely affected.

Additional Financing

The Corporation does not have adequate revenue to fund all of its operational needs and may require additional financing to continue its operations if it is unable to generate substantial revenue growth. There can be no assurance that such financing will be available at all or on favorable terms. Failure to generate substantial revenue growth may result in the Corporation looking to obtain such additional financing could result in delay or indefinite postponement of the Corporation’s deployment of its products, resulting in the possible dilution. Any such financing will dilute the ownership interest of the Corporation’s shareholders at the time of the financing, and may dilute the value of their shareholdings.

General Venture Company Risks

The Common Shares must be considered highly speculative due to the nature of the Corporation’s business, the early stage of its deployment, its current financial position and ongoing requirements for capital. An investment in the Common Shares should only be considered by those persons who can afford a total loss of investment, and is not suited to those investors who may need to dispose of their investment in a timely fashion. Investors should consult with their own professional advisors to assess the legal, financial and other aspects of an investment in Common Shares.

Uncertainty of Revenue Growth

There can be no assurance that the Corporation can generate substantial revenue growth, or that any revenue growth that is achieved can be sustained. Revenue growth that the Corporation has achieved or may achieve may not be indicative of future operating results. In addition, the Corporation may increase further its operating expenses in order to fund increase its sales and marketing efforts and increase its administrative resources in anticipation of future growth. To the extent that increases in such expenses precede or are not subsequently followed by increased revenues, the Corporation’s business, operating results and financial condition will be materially adversely affected.

18

Dependence on Management and Key Personnel

The Corporation is dependent on certain members of its management. The loss of the services of one or more of them could adversely affect the Corporation. The Corporation’s ability to maintain its competitive position is dependent upon its ability to attract and retain highly qualified managerial, specialized technical, manufacturing, sales and marketing personnel. There can be no assurance that the Corporation will be able to continue to recruit and retain such personnel. The inability of the Corporation to recruit and retain such personnel would adversely affect the Corporation’s operations and product development.

Dependence on Key Suppliers

The Corporation may be able to purchase certain key components of its products from a limited number of suppliers. Failure of a supplier to provide sufficient quantities on favorable terms or on a timely basis could result in possible lost sales.

Product Liability

The Corporation may be subject to proceedings or claims that may arise in the ordinary conduct of the business, which could include product and service warranty claims, which could be substantial. If its products fail to perform as warranted and it fails to quickly resolve product quality or performance issues in a timely manner, sales may be lost and it may be forced to pay damages. Any failure to meet customer requirements could materially affect its business, results of operations and financial condition. The occurrence of product defects and the inability to correct errors could result in the delay or loss of market acceptance of its products, material warranty expense, diversion of technological and other resources from its product development efforts, and the loss of credibility with customers, manufacturer’s representatives, distributors, value added resellers, systems integrators, original equipment manufacturers and end-users, any of which could have a material adverse effect on the Corporation’s business, operating results and financial conditions.

The Corporation currently has general liability insurance that includes product liability coverage. There is no assurance this insurance policy will cover all potential claims which may have a material adverse effect on the business or financial condition of the Corporation. A product recall could have a material adverse effect on the business or financial condition of the Corporation.

Strategic Alliances

The Corporation relies upon, and expects to rely upon, strategic alliances with original equipment manufacturers for the manufacturing and distribution of its products. There can be no assurance that such strategic alliances can be achieved or will achieve their goals.

Marketing and Distribution Capabilities

In order to commercialize its technology, the Corporation must either acquire or develop an internal marketing and sales force with technical expertise and with supporting distribution capabilities or arrange for third parties to perform these services. In order to market any of its products, the Corporation must either acquire or develop a sales and distribution infrastructure. The acquisition or development of a sales and distribution infrastructure would require substantial resources, which may divert the attention of its Management and key personnel, and defer its product development and deployment efforts. To the extent that the Corporation enters into marketing and sales arrangements with other companies, its revenues will depend on the efforts of others. These efforts may not be successful. If the Corporation fails to develop substantial sales, marketing and distribution channels, or to enter into arrangements with third parties for those purposes, it will experience delays in product sales and incur increased costs.

Rapid Technological Development

The markets for the Corporation’s products and services are characterized by rapidly changing technology and evolving industry standards, which could result in product obsolescence or short product life cycles. Accordingly, the Corporation’s success is dependent upon its ability to anticipate technological changes in the industries it serves and to successfully identify, obtain, develop and market new products that satisfy evolving industry requirements. There can be no assurance that the Corporation will successfully develop new products or enhance and improve its existing products or that any new products and enhanced and improved existing products will achieve market acceptance. Further, there can be no assurance that competitors will not market products that have perceived advantages over the Corporation’s products or which render the products currently sold by the Corporation obsolete or less marketable. Regardless of the Industry as a whole, the less lethal sector moves somewhat slower in the adaptation and integration of new products.

The Corporation must commit significant resources to developing new products before knowing whether its investments will result in products the market will accept. To remain competitive, the Corporation may be required to invest significantly greater resources then currently anticipated in research and development and product enhancement efforts, and result in increased operating expenses.

Competition

The Corporation’s industry is highly competitive and composed of many domestic and foreign companies. The Corporation has experienced and expects to continue to experience, substantial competition from numerous competitors whom it expects to continue to improve their products and technologies. Competitors may announce and introduce new products, services or enhancements that better meet the needs of end-users or changing industry standards, or achieve greater market acceptance due to pricing, sales channels or other factors. Competitors may be able to respond more quickly than the Corporation to changes in end-user requirements and devote greater resources to the enhancement, promotion and sale of their products.

19

Regulation

The Corporation is subject to numerous federal, provincial, state and local environmental, health and safety legislation and measures relating to the manufacture of ammunition. There can be no assurance that the Corporation will not experience difficulties with its efforts to comply with applicable regulations as they change in the future or that its continued compliance efforts (or failure to comply with applicable requirements) will not have a material adverse effect on the Corporation’s results of operations, business, prospects and financial condition. The Corporation’s continued compliance with present and changing future laws could restrict the Corporation’s ability to modify or expand its facilities or continue production and could require the Corporation to acquire costly equipment or to incur other significant expense.

Intellectual Property

The Corporation’s ability to compete effectively will depend, in part, on its ability to maintain the proprietary nature of its technology and manufacturing processes. Although the Corporation considers certain of its product designs as well as manufacturing processes involving certain of its products to be proprietary, patents or copyrights do not protect all design and manufacturing processes. The Corporation has adopted procedures to protect its intellectual property and maintain secrecy of its confidential business information and trade secrets. However, there can be no assurance that such procedures will afford complete protection of such intellectual property, confidential business information and trade secrets. There can be no assurance that the Corporation’s competitors will not independently develop technologies that are substantially equivalent or superior to the Corporation’s technology.

To protect the Corporation’s intellectual property, it may become involved in litigation, which could result in substantial expenses, divert the attention of its management, cause significant delays and materially disrupt the conduct of its business.

Infringement of Intellectual Property Rights