Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - OCI Partners LP | exhibit322201610k.htm |

| EX-32.1 - EXHIBIT 32.1 - OCI Partners LP | exhibit321201610k.htm |

| EX-31.2 - EXHIBIT 31.2 - OCI Partners LP | exhibit312201610k.htm |

| EX-31.1 - EXHIBIT 31.1 - OCI Partners LP | exhibit311201610k.htm |

| EX-24.1 - EXHIBIT 24.1 - OCI Partners LP | exhibit241201610k.htm |

| EX-23.1 - EXHIBIT 23.1 - OCI Partners LP | exhibit231201610k.htm |

| EX-21.1 - EXHIBIT 21.1 - OCI Partners LP | exhibit211201610k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________

Form 10-K

________________________________________________________________________________________

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36098

________________________________________________________________________________________

OCI Partners LP

(Exact name of registrant as specified in its charter)

________________________________________________________________________________________

Delaware | 90-0936556 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Mailing Address: | Physical Address: |

P.O. Box 1647 Nederland, Texas 77627 | 5470 N. Twin City Highway Nederland, Texas 77627 |

(Address of principal executive offices) (Zip Code)

(409) 723-1900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Units Representing Limited Partner Interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ý | ||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of common units held by non-affiliates as of June 30, 2016 was approximately $132.1 million.

As of March 13, 2017, the registrant had 86,997,590 common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

Page | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

ITEM 15. | ||

i

EXPLANATORY NOTE

OCI Partners LP, a Delaware limited partnership (“OCIP”), closed its initial public offering (“IPO”) of common units representing limited partner interests (“common units”) on October 9, 2013 (the “IPO Closing Date”). As used in this report, the terms “the partnership,” “we,” “our,” “us” and similar terms, when used in a historical context for periods prior to the IPO Closing Date, refer to the business and operations of OCI Beaumont LLC, a Texas limited liability company (“OCIB”), that OCI USA Inc. contributed to OCIP in connection with the IPO. When used in the historical context for periods after the IPO Closing Date or when used in the present tense or future tense, those terms refer to OCIP and its subsidiary, OCIB. References to “our general partner” refer to OCI GP LLC, a Delaware limited liability company, and a direct, wholly-owned subsidiary of OCI USA Inc. References to “OCI” refer to OCI N.V., a Dutch public limited liability company, and its consolidated subsidiaries other than us, our subsidiaries and our general partner. References to “OCI USA” refer to OCI USA Inc., a Delaware corporation, which is an indirect, wholly-owned subsidiary of OCI. References to “OCI Fertilizer” refer to OCI Fertilizer International B.V., a Dutch private limited liability company, which is an indirect, wholly-owned subsidiary of OCI.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements and may address certain plans, activities or events which will or may occur in the future and relate to, among other things, the proposal pursuant to which OCI would acquire the publicly held common units of OCIP not already directly or indirectly owned by OCI in a stock for unit exchange with OCI (the "Proposed Transaction") and the overall impact of the Proposed Transaction on the partnership. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “will,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include statements about our business strategy, our industry, our expected revenues, our future profitability, our expected capital expenditures (including for maintenance or expansion projects and environmental expenditures) and the impact of such expenditures on our performance, and the costs of operating as a publicly traded partnership. These statements involve known and unknown risks, uncertainties and other factors, including the factors described under Item 1A—“Risk Factors” in this Annual Report that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. Such risks and uncertainties include, among other things:

• | our ability to make cash distributions on our common units; |

• | the volatile nature of our business, our ability to remain profitable and the variable nature of our cash distributions; |

• | planned and unplanned downtime (including in connection with maintenance turnarounds), shutdowns (either temporary or permanent) or restarts of existing methanol and ammonia facilities, including, without limitation, the timing and length of planned maintenance outages; |

• | the ability of our general partner to modify or revoke our distribution policy at any time; |

• | our ability to forecast our future financial condition or results of operations and our future revenues and expenses; |

• | our reliance on a single facility for conducting our operations; |

• | intense competition from other methanol and ammonia producers, including recent announcements by other producers, including other OCI affiliates, of their intentions to relocate, restart or construct methanol or ammonia plants in the Texas Gulf Coast region or elsewhere in the United States; |

• | risks relating to our relationships with OCI or its affiliates, including competition from Natgasoline LLC ("Natgasoline"), which is currently in the construction phase on its 1.8 million metric ton methanol plant in Beaumont, Texas; |

• | potential operating hazards from accidents, fire, severe weather, floods or other natural disasters; |

• | our lack of contracts that provide for minimum commitments from our customers; |

• | the cyclical nature of our business; |

• | expected demand for methanol, ammonia and their derivatives; |

1

• | expected methanol, ammonia and energy prices; |

• | anticipated methanol and ammonia production rates at our plant; |

• | our reliance on insurance policies that may not fully cover an accident or event that causes significant damage to our facility or causes extended business interruption; |

• | our reliance on natural gas delivered to us by our suppliers, including a subsidiary of Kinder Morgan Energy Partners, L.P. (“Kinder Morgan”) and Houston Pipe Line Company, LP ("Houston Pipe Line Company"), a subsidiary of Energy Transfer Partners, L.P.; |

• | expected levels, timing and availability of economically priced natural gas and other feedstock supplies to our plant; |

• | expected operating costs, including natural gas and other feedstock costs and logistics costs; |

• | expected new methanol or ammonia supply or restart of idled plant capacity and timing for start-up of new or idled production facilities; |

• | our expected capital expenditures; |

• | the impact of regulatory developments on the demand for our products; |

• | global and regional economic activity (including industrial production levels); |

• | the dependence of our operations on a few third-party suppliers, including providers of transportation services and equipment; |

• | the risk associated with changes, or potential changes, in governmental policies affecting the agricultural industry; |

• | the hazardous nature of our products, potential liability for accidents involving our products that cause interruption to our business, severe damage to property or injury to the environment and human health and potential increased costs relating to the transport of our products; |

• | our potential inability to obtain or renew permits; |

• | existing and proposed environmental laws and regulations, including those relating to climate change, alternative energy or fuel sources, and the end-use and application of our products; |

• | new regulations concerning the transportation of hazardous chemicals, risks of terrorism and the security of chemical manufacturing facilities; |

• | our lack of asset and geographic diversification; |

• | our dependence on a limited number of significant customers; |

• | our ability to comply with employee safety laws and regulations; |

• | our potential inability to successfully implement our business strategies, including the completion of significant capital programs; |

• | additional risks, compliance costs and liabilities from expansions or acquisitions; |

• | our reliance on our senior management team; |

• | the potential shortage of skilled labor or loss of key personnel; |

• | our ability to obtain debt or equity financing on satisfactory terms to fund additional acquisitions, expansion projects, working capital requirements and the repayment or refinancing of indebtedness; |

• | restrictions in our debt agreements, including those on our ability to distribute cash or conduct our business; |

2

• | potential increases in costs and distraction of management resulting from the requirements of being a publicly traded partnership; |

• | exemptions we rely on in connection with New York Stock Exchange ("NYSE") corporate governance requirements; |

• | control of our general partner by OCI; |

• | the conflicts of interest faced by our senior management team, which manages both our business and the businesses of various affiliates of our general partner; |

• | limitations on the fiduciary duties owed by our general partner to us and our limited partners under our partnership agreement; |

• | the impact of regulations recently issued by the Internal Revenue Service ("IRS") and the U.S. Department of the Treasury on our status as a partnership for U.S. federal income tax purposes; and |

• | changes in our treatment as a partnership for U.S. federal income or state tax purposes. |

In addition, the risks and uncertainties related to the Proposed Transaction and the impact of those transaction on OCIP include, but are not limited to:

• | the inability to enter into a definitive agreement with OCI or, if such a definitive agreement is reached, to consummate the transaction provided for in such definitive agreement; |

• | the effects of future litigation, including litigation relating to the Proposed Transaction; |

• | risks related to disruption of management’s attention from our ongoing business operations due to the Proposed Transaction; and |

• | risks relating to anticipated and unanticipated costs in connection with the Proposed Transaction. |

You should not place undue reliance on our forward-looking statements. Although forward-looking statements reflect our good faith beliefs, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, unless required by law.

3

PART I

ITEM 1. BUSINESS

OVERVIEW

We are a Delaware limited partnership formed in February 2013 whose focus is on the production, marketing and distribution of methanol and anhydrous ammonia. Our production facility is strategically located on the U.S. Gulf Coast near Beaumont, Texas and commenced full operations during August 2012. Our facility has pipeline connections to adjacent customers, port access with dedicated methanol and ammonia import/export jetties, allowing us to ship both products along the Gulf Coast, and truck loading facilities for both methanol and ammonia.

We are currently one of the larger merchant methanol producers in the United States with an annual methanol production design capacity of approximately 912,500 metric tons and an annual ammonia production design capacity of approximately 331,000 metric tons. We executed a debottlenecking project on our production facility that included a maintenance turnaround and environmental upgrades, which we collectively refer to as our “debottlenecking project.” This project increased our annual methanol and ammonia production design capacity by 25%. Beginning in January 2015, we shut down our methanol production unit for 82 days and our ammonia production unit for 71 days in order to complete the debottlenecking project. We began start-up of the ammonia production facility on April 9, 2015 and reached daily ammonia production design capacity on May 5, 2015. We began start-up of the methanol production facility on April 22, 2015, and we reached daily methanol production design capacity on May 23, 2015.

Both methanol and ammonia are global commodities that are essential building blocks for numerous end-use products. Methanol is a liquid petrochemical that is used in a variety of industrial and energy-related applications. The primary use of methanol is to make other chemicals, with approximately 55% of global methanol demand being used to produce formaldehyde, acetic acid and a variety of other chemicals that form the foundation of a large number of chemical derivatives. These derivatives are used to produce a wide range of products, including adhesives for the lumber industry, plywood, particle board and laminates, resins to treat paper and plastic products, and also paint and varnish removers, solvents for the textile industry and polyester fibers for clothing and carpeting. Energy related applications consume the remaining 45% of methanol demand. In recent years, there has been a strong demand for methanol in energy applications such as gasoline blending, biodiesel and as a feedstock in the production of dimethyl ether (“DME”), methyl tertiary-butyl ether (“MTBE”) and methanol-to-olefins (“MTO”), particularly in China. Methanol blending in gasoline is currently not permitted in the United States. Ammonia, produced in anhydrous form (containing no water) from the reaction of nitrogen and hydrogen, constitutes the base feedstock for nearly all of the world’s nitrogen chemical production. In the United States, ammonia is primarily used as a feedstock to produce nitrogen fertilizers, such as urea and ammonium sulfate, and is also directly applied to soil as a fertilizer. In addition, ammonia is widely used in industrial applications, particularly in the Texas Gulf Coast market, including in the production of plastics, synthetic fibers, resins and numerous other chemical derivatives.

Proposed Transaction

On December 6, 2016, OCIP received a proposal from OCI pursuant to which OCI would acquire the publicly held common units not already directly or indirectly owned by OCI in a stock for unit exchange. Subject to negotiation and execution of a definitive agreement, OCI is proposing consideration of 0.5200 OCI shares for each issued and outstanding publicly-held common unit of OCIP as part of a transaction that would be structured as a merger of OCIP with an indirect wholly-owned subsidiary of OCI. There can be no assurance that any discussions that may occur between us and OCI in connection with the proposal will result in the entry into a definitive agreement concerning a transaction or, if such a definitive agreement is reached, will result in the consummation of a transaction provided for in such definitive agreement.

4

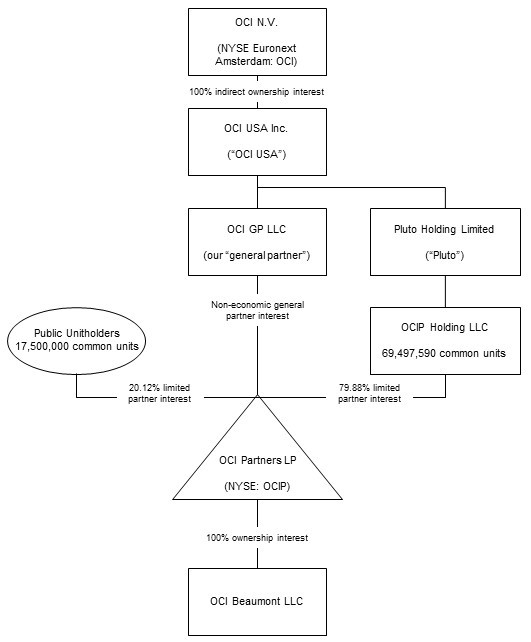

Organizational Structure

The following diagram depicts our organizational structure as of March 13, 2017:

5

Our Facility

We purchase natural gas from third parties and process the natural gas into synthesis gas, which we then further process in the production of methanol and ammonia. We store and sell the processed methanol and ammonia to industrial and commercial customers for further processing or distribution.

Our integrated methanol and ammonia production facility is located on a 62-acre site south of Beaumont, Texas on the Neches River. We acquired our facility (which had been idled by the previous owners since 2004) in May 2011, commenced an upgrade that was completed in July 2012 and began operating our facility at full capacity in the fourth quarter of 2012. Our facility began ammonia production in December 2011 and began methanol production in July 2012, with revenues first generated from ammonia sales in the first quarter of 2012 and from methanol sales in the third quarter of 2012.

The following table sets forth our facility’s production capacity and storage capacity:

Annual Production Design Capacity as of December 31, 2016 | Production during the Year Ended December 31, 2016 | Product Storage Capacity as of December 31, 2016 | |||||||||

Product | Metric Tons/Day | Metric Tons/Year (1) | Metric Tons | Metric Tons | |||||||

Methanol | 2,500 | 912,500 | 822,974 | 42,000 | (2 tanks) | ||||||

Ammonia | 907 | 331,000 | 331,501 | 33,000 | (2 tanks) | ||||||

_______________________________

(1) | Assumes facility operates 365 days per year. |

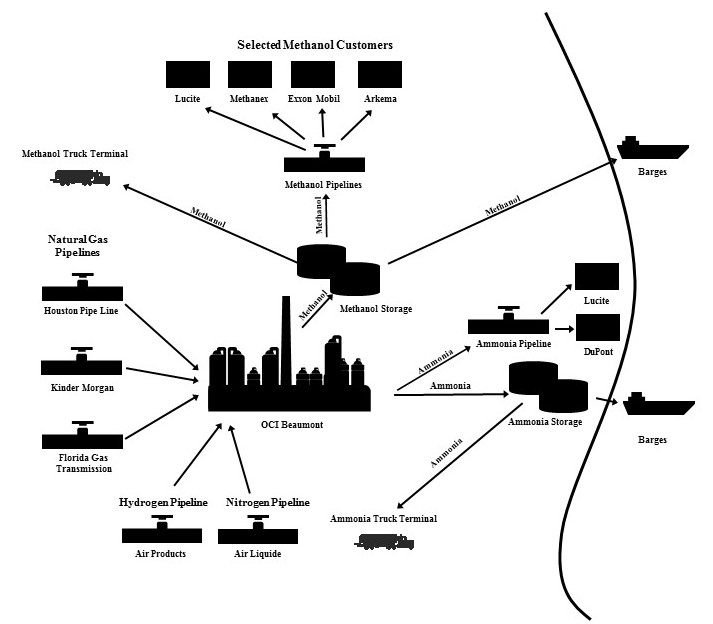

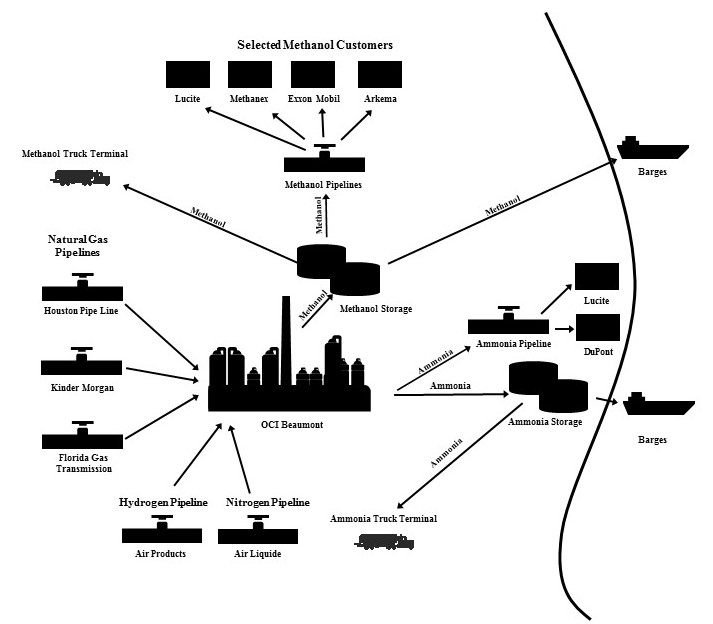

Our facility is located on the Texas Gulf Coast, which provides us access and connectivity to our existing and prospective customers and to natural gas feedstock supplies. Our facility is connected to established infrastructure and transportation facilities, including pipeline connections to adjacent customers, port access with dedicated methanol and ammonia export barge docks and state-of-the-art methanol and ammonia truck loading facilities, which have improved delivery options for our customers. We own a 15-acre tract of land adjacent to our facility that provides us access to an ammonia pipeline and the flexibility to install a methanol and ammonia railcar loading facility. In addition, we also own a 19-acre tract of land adjacent to our facility that may serve as the future location of our administrative offices.

We have connections to one major interstate and three major intrastate natural gas pipelines that provide us access to significantly more natural gas supply than our facility requires and flexibility in sourcing our natural gas feedstock. We are currently receiving our natural gas from the Kinder Morgan and Houston Pipe Line Company. In addition, our facility is connected to natural gas pipelines owned by Florida Gas Transmission and DCP Midstream Partners, LP. Our facility is located in close proximity to many of our major customers, which allows us to deliver our products to those customers at competitive prices compared to overseas suppliers that are subject to significant transportation costs associated with transporting product to our markets.

6

The following table indicates ownership of the pipelines connected to our facility. Although we transport methanol and ammonia to various customers, we do not have ownership of all the pipelines that we use.

Manufactured Product:

Pipeline | Product | Ownership |

ExxonMobil/Arkema Pipeline | Methanol | OCI Partners LP |

Enterprise (Huntsman) | Methanol | OCI Partners LP |

Lucite/DuPont | Ammonia | OCI Partners LP |

Feedstocks:

Pipeline | Product | Ownership |

Kinder Morgan Pipeline | Natural Gas | Kinder Morgan |

DCP Midstream Pipeline | Natural Gas | DCP Midstream |

Florida Gas Transmission Natural Gas Pipeline | Natural Gas | Florida Gas Transmission Company |

Houston Pipeline | Natural Gas | Houston Pipe Line Company LP |

Air Liquide Nitrogen Pipeline | Nitrogen | Air Liquide |

Air Products Hydrogen Pipeline | Hydrogen | Air Products |

7

The following diagram illustrates key elements of our methanol and ammonia value chain:

8

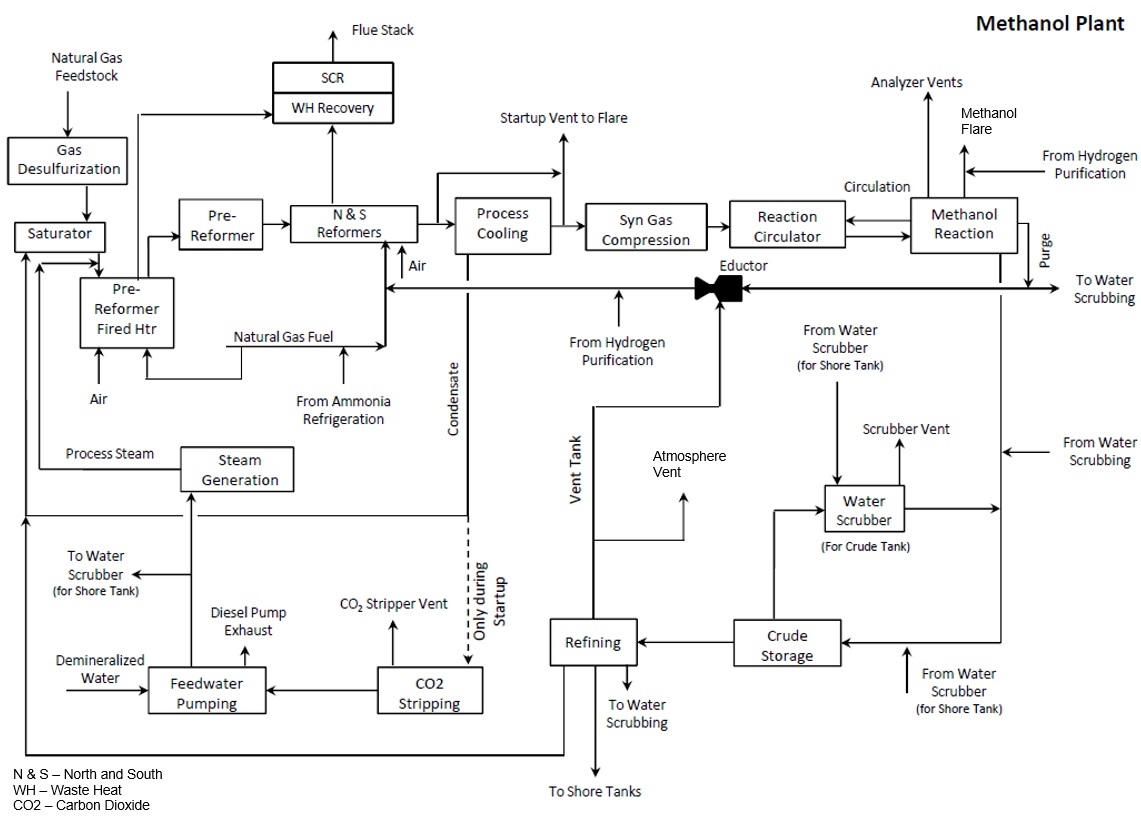

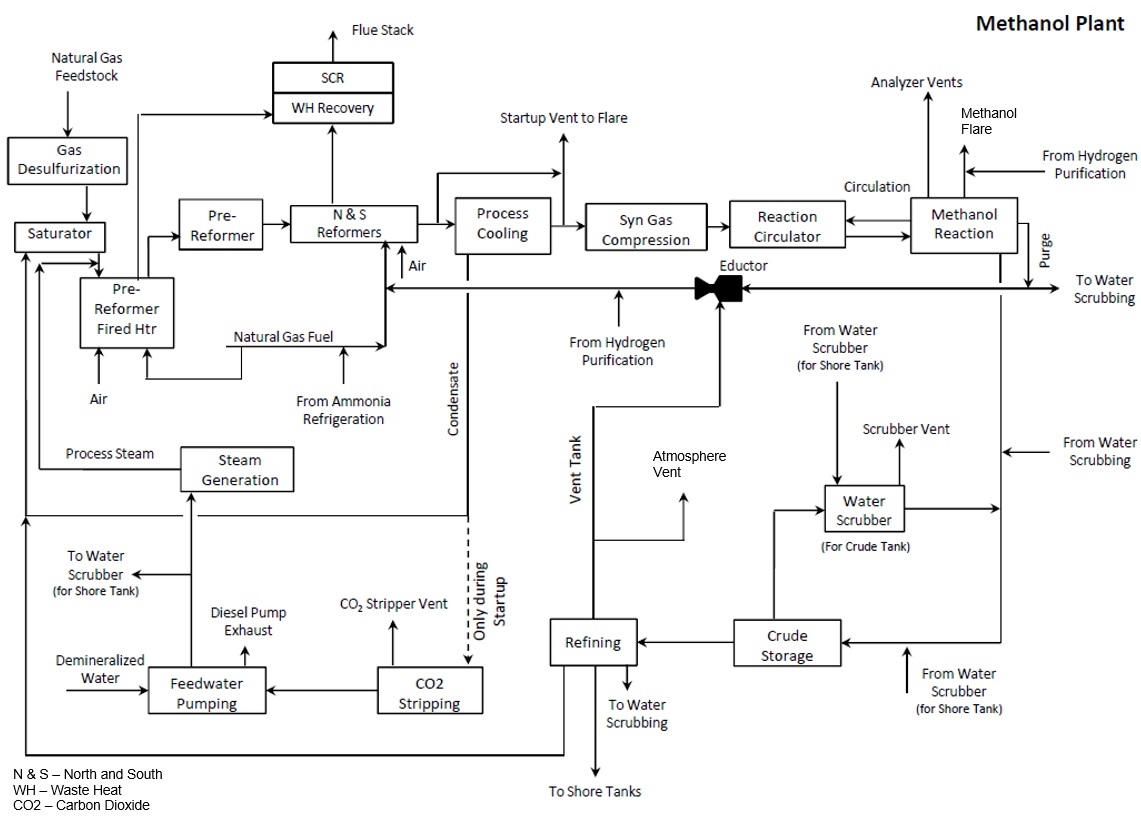

Our Methanol Production Unit

Our methanol production unit is a 912,500 metric ton per year unit that is comprised of Foster-Wheeler-designed twin steam methane reformers for synthesis gas production, two Lurgi-designed parallel low-pressure, water-cooled reactors and four distillation columns. Our methanol production unit contains two methanol storage tanks with a combined storage capacity of 42,000 metric tons. In addition, our methanol production unit has a crude methanol surge tank, refined receiver tank, storage tank scrubber and crude tank scrubber. During the year ended December 31, 2016, our methanol production unit produced approximately 822,974 metric tons of methanol. We expect our methanol production unit to undergo an approximate four-week turnaround once approximately every four years. Please see below for a simplified process flow diagram.

9

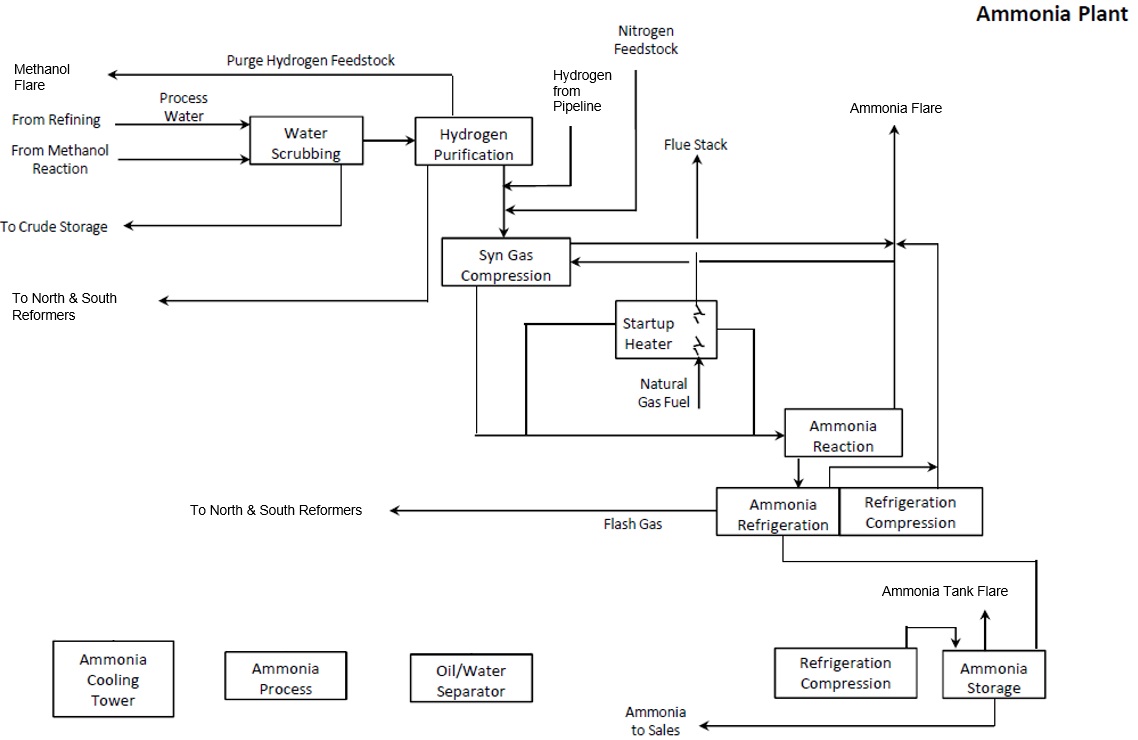

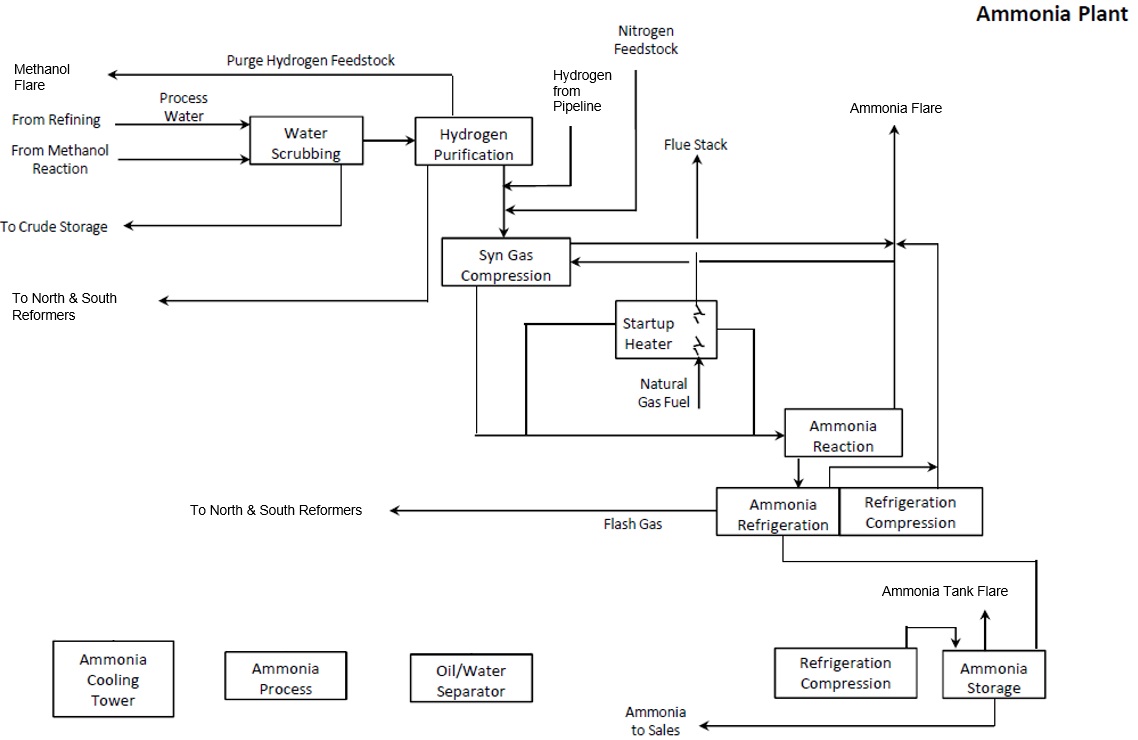

Our Ammonia Production Unit

Our ammonia production unit is a 331,000 metric ton per year unit. The Haldor-Topsøe-designed ammonia synthesis loop at our facility processes hydrogen produced by our methanol production process as the feedstock to produce ammonia. Our ammonia production unit also uses hydrogen we purchase from third parties to supplement the hydrogen produced by our methanol production process. Our ammonia production unit contains two refrigerated ammonia storage tanks with a combined storage capacity of 33,000 metric tons. During the year ended December 31, 2016, our ammonia production unit produced approximately 331,501 metric tons of ammonia. We expect our ammonia production unit to undergo an approximate four-week turnaround once approximately every four years coinciding with the turnaround of our methanol production unit. Please see below for a simplified process flow diagram.

Our Initial Upgrade of the Original Facility

We commenced an upgrade of our facility in May 2011 that was completed in July 2012. In connection with our upgrade, we installed an advanced distributed control system at our facility to efficiently control our integrated production process. We opened, inspected and hydrostatically tested all of the static equipment at our facility. We also hydrostatically tested the piping at our facility and performed other integrity tests, including thickness measurements, and we replaced connecting gaskets and bolts and any out-of-code piping. We completely refurbished our rotating equipment, including pumps, compressors and fans, and we cleaned and, if necessary, re-tubed our heat exchangers. In addition, our storage tanks were emptied, cleaned and inspected. Moreover, our furnaces were inspected and the related burners and refractory were overhauled. After completing our upgrades, our methanol and ammonia production units underwent commissioning and testing of the safety interlocks.

10

Our Debottlenecking Project

As a means of maximizing our production efficiencies and reducing our energy consumption, we executed a debottlenecking project on our production facility that included a maintenance turnaround and environmental upgrades. This project increased our maximum annual methanol production capacity by 25% to approximately 912,500 metric tons and our maximum annual ammonia production capacity by 25% to approximately 331,000 metric tons. Beginning in January 2015, we shut down our methanol and ammonia production units for 82 and 71 days, respectively, in order to complete the debottlenecking project. We began start-up of the ammonia production facility on April 9, 2015 and reached daily ammonia production design capacity of 907 metric tons on May 5, 2015. We began start-up of the methanol production facility on April 22, 2015 and reached daily methanol production design capacity of 2,500 metric tons on May 23, 2015. The total cost of the debottlenecking project (including costs associated with a turnaround and environmental upgrades) was approximately $384.0 million (excluding capitalized interest).

As part of our debottlenecking project, we completed the following:

• | installed a selective catalytic reduction unit; |

• | replaced reformer tubes, which resulted in increased synthesis gas production; |

• | installed a pre-reformer; |

• | installed a saturator; |

• | installed an additional flare; |

• | modified the synthesis gas compressor and steam turbine to handle the increased volume of synthesis gas; |

• | modified the convection section and the heat exchangers; |

• | replaced refractories; |

• | increased the capacity of the synthesis gas compressor and the refrigeration compressor on our ammonia production unit and replaced several heat exchangers and vessels to handle the higher volume; and |

• | replaced and/or refurbished equipment that caused unplanned downtime. |

Our depreciation expense has increased from the additional assets placed into service from our debottlenecking project. In addition, due to the increase in our production capacity, our production volumes and cost of goods sold are greater in subsequent periods following the completion of the debottlenecking project than in prior periods. Thus, our results of operations for periods prior to and after the completion of our debottlenecking project may not be comparable.

Feedstock Supply

The primary feedstock that we use to produce methanol and ammonia is natural gas. Operating at full capacity, our methanol and ammonia production units together require approximately 110,000 to 120,000 MMBtu per day of natural gas, as of December 31, 2016. For the year ended December 31, 2016, natural gas feedstock costs represented approximately 55% of our cost of goods sold (exclusive of depreciation). Accordingly, our profitability depends in large part on the price of our natural gas feedstock. Please read Item 7A—“Quantitative and Qualitative Disclosure about Market Risk” included in this report for additional information.

We have connections to one major interstate and three major intrastate natural gas pipelines that provide us access to significantly more natural gas supply than our facility requires and flexibility in sourcing our natural gas feedstock. We are currently receiving our natural gas from the Kinder Morgan and Houston Pipe Line Company. In addition, our facility is connected to natural gas pipelines owned by Florida Gas Transmission and DCP Midstream Partners, LP. We believe that we have ready access to an abundant supply of natural gas for the foreseeable future due to our location and connectivity to major natural gas pipelines.

11

We procure our hydrogen and nitrogen supply needs from Air Products LLC (“Air Products”) and Air Liquide Large Industries U.S. LP (“Air Liquide”), respectively. Our supply contract with Air Products provides for 31.0 MMscf per day of dedicated hydrogen and expires in 2021. The price we pay under the Air Products contract is linked to natural gas prices. Our supply contract with Air Liquide provides for up to 24.8 MMscf of dedicated nitrogen per day, expiring in 2024. The price we pay under our contract with Air Liquide is based on a combination of the cost of electric power, average gross hourly earnings and the latest value of the U.S. Bureau of Statistics Producer Price Index for Industrial Commodities.

Customers and Contracts

We generate our revenues from the sale of methanol and ammonia manufactured at our facility. We sell our products, primarily under contract, to industrial users and commercial traders for further processing or distribution. For the years ended December 31, 2016 and 2015, we derived approximately 62% and 53%, respectively, of our revenues from the sale of our products to commercial traders for further processing or distribution and derived approximately 38% and 47%, respectively, of our revenues from the sale of our products to industrial users. In addition, we derive a portion of our revenues from uncontracted and contracted sales with our customers that have pricing terms based upon published spot prices. For the years ended December 31, 2016 and 2015, we derived approximately 11% and 7%, respectively, of our revenues from spot price-based sales of ammonia. For the years ended December 31, 2016 and 2015, we derived approximately 18% and 27%, respectively, of our revenues from spot price-based sales of methanol.

We currently are party to methanol sales contracts with several customers, including but not limited to Methanex and Southern Chemical Distribution, L.L.C. One of our customers is obligated to use best efforts to purchase a certain quantity of methanol from us each year, but generally our customers may determine not to purchase any more methanol from us at any time and may purchase methanol from other suppliers. Consistent with industry practice, our methanol sales contracts set our pricing terms to reflect a specified discount to a published monthly benchmark methanol price (Argus or Southern Chemical), and our methanol is sold on an Free on Board (“FOB”) shipping point basis when transported by barge, pipeline, and our methanol truck loading facility. The payment terms under our methanol sales contacts are net 25-30 days. For the year ended December 31, 2016, methanol sales contracts with Methanex and Koch Methanol LLC accounted for approximately 35% and 17%, respectively, of our total revenues. For the year ended December 31, 2015, methanol sales contracts with Methanex and Koch Methanol LLC accounted for approximately 26% and 24%, respectively, of our total revenues.

We are party to ammonia sales contracts with several customers, including but not limited to Interoceanic Corporation (the new owner of Rentech Nitrogen Partners, L.P.'s Pasadena, Texas facility) and Lucite. Our customers have no minimum volume purchase obligations under these contracts, may determine not to purchase any more ammonia from us at any time and may purchase ammonia from other suppliers. Consistent with industry practice, these contracts set our pricing terms to reflect a specified discount to a published monthly benchmark ammonia price (CFR Tampa), and our ammonia is sold on an FOB shipping point basis when transported by barge, pipeline and our ammonia truck loading facility. The payment terms under our ammonia sales contacts are net 30 days. For the years ended December 31, 2016 and 2015, ammonia sales contracts with Interoceanic Corporation ("IOC") accounted for approximately 14% and 15%, respectively, of our total revenues.

During the year ended December 31, 2016, we delivered approximately 53% of our total sales by barge, 40% of our total sales by pipeline, and approximately 7% of our total sales through our truck loading facilities.

Quality Assurance

On December 20, 2016 we became ISO 9001 certified. ISO 9000 (which includes ISO 9001) is an international standard on quality assurance developed by the International Organization for Standardization. ISO 9001 certification indicates that a company has established and follows a rigorous set of requirements aimed at achieving customer satisfaction by preventing nonconformity in design, development, production, installation and servicing of products.

12

Competition

The industries in which we operate are highly competitive. Methanol and ammonia are global commodities, and we compete with a number of domestic and foreign producers of methanol and ammonia. In addition, a long period of low natural gas prices in the United States has made it economical for companies to upgrade existing plants and initiate construction of new methanol and nitrogen projects. Methanex and the Celanese-Mitsui joint venture have brought their new methanol facilities online in the last two years and OCI is currently in the construction phase on its 1.8 million metric ton Natgasoline methanol facility in Beaumont, Texas, which is expected to commence operations later in 2017. In addition, Big Lake Fuels, S. Louisiana Methanol, Yuhuang Chemical and Lake Charles Methanol have each announced plans to construct methanol plants in the U.S. Gulf Coast region over the next few years, which, if constructed, would increase overall U.S. production capacity and the availability of methanol supply to our customers from competing sources. On the ammonia side, there have been significant capacity additions in the U.S. Gulf Coast region including CF Industries' Donaldsonville plant and Dyno Nobel's ammonia plant in Louisiana. In addition, BASF/Yara are projecting to commission an ammonia plant later in 2017 in Freeport, Texas and other companies and developers have announced plans to construct new ammonia and nitrogen facilities in the U.S. However, over the past few years, several methanol and ammonia projects have been canceled or not proceeded as a result of higher capital expenditure estimates than originally anticipated, among other reasons.

While the methanol and ammonia industries are global in nature, we believe that our strategic location on the Texas Gulf Coast positions us as a key local supplier. Our proximity to customers and access to major infrastructure and transportation facilities, including pipeline connections to adjacent customers, port access with dedicated methanol and ammonia barge docks and state-of-the-art methanol and ammonia truck loading facilities provide us with a competitive advantage over other suppliers. Furthermore, because the majority of our competitors are based outside of the United States or are commodity traders, we believe that we are well positioned to offer our products at attractive prices to our customers while maintaining strong margins in the near term.

The majority of methanol consumed in the U.S. Gulf Coast is either sourced from Trinidad or produced in-house by U.S.-based chemical companies as part of a vertically integrated industrial process. During 2016, methanol sourced from Trinidad accounted for approximately 50% of total imported methanol in the United States. Producers in Trinidad have been facing significant natural gas feedstock shortages, thereby reducing the supply of all natural gas-based products from Trinidad to the United States. Furthermore, we believe that transportation and port-handling costs for methanol imported from Trinidad and other countries provide us with a cost advantage over foreign producers.

Similarly, the majority of ammonia consumed in our market is sourced overseas, particularly from Trinidad, and is transported through the U.S. Gulf Coast. Our close proximity to our customers allows us to maintain a significant cost advantage over foreign producers that import ammonia into the U.S. Gulf Coast. During 2016, ammonia sourced from Trinidad accounted for approximately 67% of total imported ammonia in the United States. Although ammonia sourced from Trinidad historically enjoyed a competitive cost advantage, natural gas supply shortages and higher production costs in recent years have eroded this competitive advantage. Furthermore, we believe that transportation and port-handling costs for all imported ammonia provide us with a cost advantage over foreign producers.

Our major competitors in the methanol industry include Methanex, Koch Methanol, Mitsui, Mitsibushi and Southern Chemical Corporation and our major competitors in the ammonia industry include Agrium, Koch Fertilizer, Potash Corporation and CF Industries. Based on 2016 data regarding total United States use of methanol and ammonia, we estimate that our production in 2016 represented approximately 14% and 2%, respectively, of total United States methanol and ammonia use.

Seasonality and Volatility

While most United States methanol is sold pursuant to long-term contracts based on market index pricing and fixed volumes, the market price of methanol can be volatile. Methanol is an internationally traded commodity chemical, and the methanol industry has historically been characterized by cycles of oversupply caused by either excess supply or reduced demand, resulting in lower prices and idling of capacity, followed by periods of shortage and rising prices as demand exceeds supply until increased prices lead to new plant investment or the restart of idled capacity. Methanol prices have historically been cyclical and sensitive to overall production capacity relative to demand, the price of feedstock (primarily natural gas or coal), energy prices and general economic conditions.

13

The seasonality of the United States ammonia business largely tracks the seasonality of the fertilizer business in the United States because the substantial majority of all domestic ammonia consumption in the United States is for fertilizer use. The fertilizer business is seasonal, based upon the planting, growing and harvesting cycles. Inventories must be accumulated to allow for customer shipments during the spring and fall fertilizer application seasons, which require significant storage capacity. The accumulation of inventory to be available for seasonal sales requires fertilizer producers to maintain significant working capital. This seasonality generally results in higher fertilizer prices during peak periods, with prices normally reaching their highest point in the spring, decreasing in the summer, and increasing again in the fall. Fertilizer products are sold both on the spot market for immediate delivery and under product prepayment contracts for future delivery at fixed prices. The terms of the product prepayment contracts, including the percentage of the purchase price paid as a down payment, can vary from season to season. Variations in the proportion of product sold through forward sales and variations in the terms of the product prepayment contracts can increase the seasonal volatility of fertilizer producers’ cash flows and cause changes in the patterns of seasonal volatility from year to year. Nitrogen fertilizer prices can also be volatile as a result of a number of other factors, including weather patterns, field conditions, quantities of fertilizers imported to the United States, current and projected grain inventories and prices and fluctuations in natural gas prices. In addition, governmental policies may directly or indirectly influence the number of acres planted, the level of grain inventories, the mix of crops planted and crop prices, which would also affect nitrogen fertilizer prices.

Environmental Matters

Our business is subject to extensive and frequently changing federal, state and local, environmental, health and safety regulations governing the emission and release of hazardous substances into the environment, the treatment and discharge of waste water and the storage, handling, use and transportation of our methanol and ammonia. These laws include the federal Clean Air Act (“CAA”), the federal Water Pollution Control Act (also known as the Clean Water Act, or the “CWA”), the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Toxic Substances Control Act and various other federal, state and local laws and regulations. These laws, their underlying regulatory requirements and the enforcement thereof impact us by imposing:

• | restrictions on operations or the need to install enhanced or additional controls; |

• | the need to obtain and comply with permits and authorizations; |

• | liability for the investigation and remediation of contaminated soil and groundwater at current and former facilities and off-site waste disposal locations (if any); and |

• | specifications for the products we market. |

Our operations require numerous permits and authorizations. Failure to comply with these permits or environmental laws generally could result in substantial fines, penalties or other sanctions, court orders to install pollution-control equipment, permit revocations and facility shutdowns. In addition, environmental, health and safety laws may impose joint and several liability, without regard to fault, for cleanup costs on potentially responsible parties who have released or disposed of hazardous substances into the environment. We may experience delays in obtaining or be unable to obtain required permits, which may delay or interrupt our operations and limit our growth and revenue. Private parties, including the owners of properties adjacent to other facilities where our wastes are taken for disposal, also may have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property or natural resource damage. In addition, the risk of accidental spills or releases could expose us to significant liabilities that could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The laws and regulations to which we are subject are complex, change frequently and have tended to become more stringent over time. The ultimate impact on our business of complying with existing laws and regulations is not always clearly known or determinable due in part to the fact that our operations may change over time and certain implementing regulations for laws, such as the CAA, have not yet been finalized, are under governmental or judicial review or are being revised. These laws and regulations could increase our capital, operating and compliance costs.

Our facility has experienced some level of regulatory scrutiny in the past, and we may be subject to further regulatory inspections, future requests for investigation or assertions of liability relating to environmental issues. In the future, we could incur material liabilities or costs related to environmental matters, and these environmental liabilities or costs (including fines or other sanctions) could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

14

The principal environmental regulations and risks associated with our business are outlined below.

The Federal Clean Air Act. The CAA and its implementing regulations, as well as the corresponding state laws and regulations that regulate emissions of pollutants into the air, affect us through the CAA’s permitting requirements and emission control requirements relating to specific air pollutants, as well as the requirement to maintain a risk management program to help prevent accidental releases of certain substances. Some or all of the standards promulgated pursuant to the CAA, or any future promulgations of standards, may require the installation of controls or changes to our facility in order to comply. If new controls or changes to operations are needed, the costs could be significant. In addition, failure to comply with the requirements of the CAA and its implementing regulations could result in fines, penalties or other sanctions.

The regulation of air emissions under the CAA requires that we obtain various construction and operating permits, including Title V and Prevention of Significant Deterioration (“PSD”) air permits issued by the Texas Commission on Environmental Quality (the “TCEQ”). Requirements under these permits will cause us to incur capital expenditures for the installation of certain air pollution control devices at our operations. Various regulations specific to our operations have been implemented, such as National Emission Standard for Hazardous Air Pollutants, New Source Performance Standards and New Source Review. We have incurred, and expect to continue to incur, substantial capital expenditures to maintain compliance with these and other air emission regulations that have been promulgated or may be promulgated or revised in the future, including in connection with the projects discussed below under “—Material Estimated Capital Expenditures for Environmental Matters” that are designed to comply with our emission limits and requirements of our Title V CAA permit.

Release Reporting. The release of hazardous substances or extremely hazardous substances into the environment is subject to release reporting requirements under federal and state environmental laws, including the Emergency Planning and Community Right-to-Know Act. We occasionally experience minor releases of hazardous or extremely hazardous substances from our equipment. We report such releases to the U.S. Environmental Protection Agency (the “EPA”), TCEQ and other relevant state and local agencies as required by applicable laws and regulations. If we fail to properly report a release, or if the release violates the law or our permits, it could cause us to become the subject of a governmental enforcement action or third-party claims. Government enforcement or third-party claims relating to releases of hazardous or extremely hazardous substances could result in significant expenditures and liability.

Clean Water Act. The CWA and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into regulated waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by an appropriately issued permit. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms and similar structures to help prevent the contamination of navigable waters by a petroleum hydrocarbon tank spill, rupture or leak. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations.

Greenhouse Gas Emissions. Currently, legislative and regulatory measures to address greenhouse gas (“GHG”) emissions (including CO2, methane and nitrous oxides) are in various phases of discussion or implementation. At the federal legislative level, Congress has previously considered legislation requiring a mandatory reduction of GHG emissions. Although Congressional passage of such legislation does not appear likely at this time, it could be adopted at a future date. It is also possible that Congress may pass alternative climate change bills that do not mandate a nationwide cap-and-trade program and instead focus on promoting renewable energy and energy efficiency.

15

In the absence of congressional legislation curbing GHG emissions, the EPA is moving ahead administratively under its CAA authority. In October 2009, the EPA finalized a rule requiring certain large emitters of GHGs to inventory and report their GHG emissions to the EPA. In accordance with the rule, we monitor our GHG emissions from our facility and have reported the emissions to the EPA annually beginning in September 2011. On December 7, 2009, the EPA finalized its “endangerment finding” that GHG emissions, including CO2, pose a threat to human health and welfare. The finding allows the EPA to regulate GHG emissions as air pollutants under the CAA. In May 2010, the EPA finalized the “Greenhouse Gas Tailoring Rule,” which establishes new GHG emissions thresholds that determine when stationary sources, such as our facility, must obtain permits under the PSD and Title V programs of the CAA. The permitting requirements of the PSD program apply only to newly constructed or modified major sources. Obtaining a PSD or Title V permit requires a source to install best available control technology (“BACT”) for those regulated pollutants that are emitted in certain quantities. In June 2014, the U.S. Supreme Court recently invalidated that portion of the rule that would require facilities that only emitted GHG emissions (and not other regulated pollutants) in excess of specified thresholds to obtain PSD and Title V permits. Sources that emit other regulated pollutants in excess of specified thresholds that also trigger greenhouse gas emissions thresholds still must obtain a PSD permit for greenhouse gas emissions. Our debottlenecking project was a major modification for other pollutants, which required us to obtain a PSD permit for greenhouse gas emissions. We received our PSD permit from the EPA in August 2014. The TCEQ has since been authorized by the EPA to implement a greenhouse gas permitting program.

The implementation of additional EPA regulations and/or the passage of federal or state climate change legislation will likely result in increased costs to (i) operate and maintain our facilities, (ii) install new emission controls on our facilities and (iii) administer and manage any GHG emissions program. Increased costs associated with compliance with any future legislation or regulation of GHG emissions, if it occurs, may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions. In addition, climate change legislation and regulations may result in increased costs not only for our business but also for our customers that utilize our products, thereby potentially decreasing demand for our products. Decreased demand for our products may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Further, in December 2015, over 190 countries, including the United States, reached an agreement to reduce global greenhouse gas emissions ("Paris Accord"). The Paris Accord entered into force in November 2016. The United States is one of over 70 countries that has ratified or otherwise indicated its intent to be bound by the agreement. To the extent the United States implements the Paris Accord in addition to the GHG regulations, it could have an adverse impact on our operations.

Environmental Remediation. Under CERCLA and related state laws, certain persons may be liable for the release or threatened release of hazardous substances. These persons can include the current owner or operator of property where a release or threatened release occurred, any persons who owned or operated the property when the release occurred and any persons who disposed of, or arranged for the transportation or disposal of, hazardous substances at a contaminated property. Liability under CERCLA is strict, retroactive and, under certain circumstances, joint and several, so that any responsible party may be held liable for the entire cost of investigating and remediating the release of hazardous substances. As is the case with all companies engaged in similar industries, depending on the underlying facts and circumstances, we face potential exposure from future claims and lawsuits involving environmental matters, including soil and water contamination, personal injury or property damage allegedly caused by hazardous substances that we manufactured, handled, used, stored, transported, spilled, disposed of or released. We cannot assure you that we will not become involved in future proceedings related to our release of hazardous or extremely hazardous substances or that, if we were held responsible for damages in any existing or future proceedings, such costs would be covered by insurance or would not be material.

Government Assessments of Methanol. In September 2013, EPA issued a final Toxicological Review of Methanol under its Integrated Risk Information System (“IRIS”). This Review concluded that daily exposures to the human population (including sensitive subgroups) are “likely to be without an appreciable risk of deleterious effectives during a lifetime”. This Review did not address carcinogenicity, however, and EPA has no plans at this time to conduct a Health Hazard Assessment under IRIS for cancer effects. The European Chemicals Agency (“ECHA”) has recently adopted the report prepared by Poland in support of a proposal to restrict the sale of methanol to the general public and to limit its presence as an additive in consumer products. A decision on this proposal is currently pending before the European Commission, and action by the European Commission to restrict methanol sales and uses for certain markets and products could have a material adverse effect on our business. ECHA’s Committee for Risk Assessment declined to endorse a separate proposal from Italy and Holland to reclassify methanol as a Category 1B or Category 2 Reproductive Toxin on grounds of insufficient evidence, but it is possible that this proposal may be revisited in the future if new evidence becomes available.

16

Derivatives of Methanol-Formaldehyde. Methanol has many commercial uses, including as a building block to manufacture formaldehyde, among other chemicals. Formaldehyde is a component of resins used as wood adhesives and as a raw material for engineering plastics and a variety of other products, including elastomers, paints, building products, foams, polyurethane and automotive products. As discussed below, changes in environmental, health and safety laws, regulations or requirements relating to formaldehyde are being considered, and if adopted, could restrict formaldehyde uses and exposures, and as a result, could lead to a material adverse impact on our business by reducing the demand for methanol to manufacture formaldehyde.

Formaldehyde has been classified as a known human carcinogen by the International Agency for Research on Cancer and as a probable human carcinogen by EPA. On July 7, 2010, President Obama signed the Formaldehyde Standards for Composite Wood Products Act into law. This legislation, which adds a Title VI to the Toxic Substances Control Act, establishes limits for formaldehyde emissions from composite wood products and requires EPA to evaluate and establish limits for other types of wood products. In December 2016, EPA finalized a regulation to implement this Act with two components: (1) formaldehyde emissions standards for hardwood plywood, medium-density fiberboard, particleboard, and finished goods containing these products that are sold, supplied, offered for sale, or manufactured (including imported) in the United States and (2) a third-party certification program to assure compliance by composite wood panel producers with the formaldehyde emissions limits established directly in the Act. This regulation will become effective in December 2017.

A risk assessment process for formaldehyde has been underway in the European Union for the past several years and has resulted in classification of formaldehyde as a category 1B carcinogen ("known to have carcinogenic potential for humans") and a category 2 mutagen (“suspected of being toxic for human reproduction”). No decision has yet been made whether this classification will result in restrictions under REACH, or in new classification, labeling and packing obligations; however, to support its decision-making, ECHA is requiring an update by October 2017 of all Registrations for aqueous formaldehyde solutions containing methanol above 10% with information pertaining to various formaldehyde exposure scenarios, including from composite wood products.

Derivatives of Methanol—methyl tertiary butyl ether (“MTBE”). Changes in environmental, health and safety laws, regulations or requirements could also impact methanol demand for the production of MTBE. Several years ago, environmental concerns and legislative action related to gasoline leaking into water supplies from underground gasoline storage tanks in the United States resulted in the phase-out of MTBE as a gasoline additive in the United States. However, methanol is used in the United States to produce MTBE for export markets, where demand for MTBE has continued at strong levels. While we currently expect demand for methanol for use in MTBE production in the United States to remain steady or to decline slightly, it could decline materially if export demand is impacted by governmental legislation or policy changes. The EPA is currently reviewing the human health effects of MTBE, including its potential carcinogenicity. The European Union issued a final risk assessment report on MTBE in 2002 that permitted the continued use of MTBE, although several risk reduction measures relating to the storage and handling of fuels were recommended. Governmental efforts in recent years in some countries, primarily in the European Union and Latin America, to promote biofuels and alternative fuels through legislation or tax policy are also putting competitive pressures on the use of MTBE in gasoline in these countries. Declines in demand for methanol for use in MTBE production could have an adverse impact on our results of operations, financial condition and ability to make cash distributions.

Material Capital Expenditures for Environmental Matters. We incurred approximately $84.4 million in capital expenditures for the year ended December 31, 2015, relating to the installation of a selective catalytic reduction (“SCR”) unit for nitrogen oxide control; the installation of a saturator column system to improve plant efficiency, decrease nitrogen oxide emissions and decrease wastewater treatment from distillation; and the installation of a new flare to decrease carbon monoxide emissions during start-ups and shutdowns of our facility. These capital expenditures assist us in complying with federal, state and local environmental, health and safety regulations. None of the capital expenditures incurred during the year ended December 31, 2016, were related to environmental matters.

On December 20, 2016 we became ISO 14001 certified. ISO 14000 (which includes ISO 14001) is an international standard on environmental management developed by the International Organization for Standardization that was developed to help organizations manage the environmental impacts of their processes, products and services. ISO 14001 defines an approach to setting and achieving environmental objectives and targets, within a structured management framework.

17

Safety, Health and Security Matters

We are subject to a number of federal and state laws and regulations related to safety, including the Occupational Safety and Health Act (“OSHA”), and comparable state statutes, the purpose of which are to protect the health and safety of workers. We also are subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. These regulations apply to any process that involves a chemical at or above the specified thresholds or any process that involves flammable liquid or gas, pressurized tanks, caverns and wells in excess of 10,000 pounds at various locations. We also are subject to EPA Chemical Accident Prevention Provisions, known as the Risk Management Plan requirements, which are designed to prevent the accidental release of toxic, reactive, flammable or explosive materials, and the U.S. Coast Guard’s Maritime Security Standards for Facilities, which are designed to regulate the security of high-risk maritime facilities.

On March 1, 2016 we achieved Star status in OSHA's Voluntary Protection Program (“VPP”). OSHA’s VPP is a program in which companies voluntarily participate that recognizes facilities for their exemplary safety and health programs.

Employees

We are managed and operated by the board of directors and executive officers of OCI GP LLC, our general partner. Neither we nor our subsidiary have any employees. Our general partner has the sole responsibility for providing the employees and other personnel necessary to conduct our operations. All of the employees that conduct our business are employed by our general partner or its affiliates. Our general partner and its affiliates have approximately 121 employees performing services for our operations. We believe that our general partner and its affiliates have a satisfactory relationship with those employees.

Insurance

Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage, and suspension of operations. We are currently insured under casualty, environmental, property and business interruption insurance policies. The following conversions from Euros to U.S. dollars with respect to our insurance policies are based on a conversion rate of €1.00 to $1.0569 as of February 24, 2017, reported by the Financial Times, London Edition. The property and business interruption insurance policies have a combined loss limit of €750 million (or approximately $792.7 million) which is placed in three layers. The primary layer has a loss limit of €200 million (or approximately $211.4 million), with a deductible of €4 million (or approximately $4.2 million) for physical damage. The first excess layer of the property and business interruption insurance policy has a loss limit of €250 million (or approximately $264.2 million) for all risks coverage and the second excess layer has a loss limit of €300 million (or approximately $317.1 million) for damage caused by fire, lightning, explosion or aircraft. Business interruption losses under the primary layer are subject to a time element 45-day-equivalent-deductible per occurrence.

Our primary property policy provides coverage on an all risk basis and contains a number of sub-limits, such as a full primary limit of $228.1 million for losses due to business interruptions caused by machinery breakdown and a sub-limit of $79.8 million for damage caused by a named windstorm, with a $16.5 million deductible per occurrence as a first excess layer and a stand-alone deductible buy-down policy limit of $34.7 million per occurrence provides coverage as the primary layer. In addition, our current named windstorm policy contains an additional limit second excess layer of $131.1 million for damage caused by named windstorms to be triggered once the $79.8 million first excess layer and the stand-alone primary deductible buy down policy limit of $34.7 million is consumed, which increases our coverage up to $195.2 million for damage caused by a named windstorm. We are fully exposed to all losses in excess of the applicable limits and sub-limits of our policies. We are also exposed to losses due to business interruptions caused by machinery breakdown of fewer than 45 days per occurrence and losses due to property damage that are less than $4.6 million per occurrence.

With regard to environmental claims due to pollution, we currently have a policy limit of $25.0 million, and this policy has a deductible of $250,000. Our current construction floater policy contains a specific limit of $20.0 million for losses incurred during the construction of any equipment or facilities at our site. We continue to evaluate our policy limits and risk retentions as they relate to the overall cost and scope of our insurance program.

Financial Information about Geographical Areas

We have no international activities. For all periods included in this report, all of our revenue was derived from operations conducted in, and all of our assets were located in, the U.S.

18

Available Information

Our website address is www.ocipartnerslp.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are available free of charge through our website under “Investor and Media Relations,” as soon as reasonably practical after they are filed with or furnished to the SEC. In addition, our Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Charter of the Audit Committee and the Conflicts Committee of the Board of Directors of our general partner are available on our website. These guidelines, policies and charters are also available in print without charge to any unitholder requesting them. Materials we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The information contained on our website does not constitute part of this report.

ITEM 1A. RISK FACTORS

Set forth below are certain risk factors related to the Proposed Transaction, our business, our partnership structure and tax matters. Actual results could differ materially from those anticipated as a result of these and various other factors, including those set forth in our other periodic and current reports filed with the SEC from time to time. If any risks or uncertainties develop into an actual event, our business, financial condition, cash flow or results of operations could be materially adversely affected. In that case, the trading price of our common units could decline and you could lose all or part of your investment. The risks described in this report are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may materially adversely affect our business, cash flow and ability to make cash distributions to our unitholders.

Risks Relating to the Proposed Transaction

OCIP and the other parties will incur substantial transaction-related costs in connection with the Proposed Transaction.

OCIP and the other parties to the Proposed Transaction expect to incur a number of non-recurring transaction-related costs associated with the Proposed Transaction. Non-recurring transaction costs include, but are not limited to, fees paid to legal, financial and accounting advisors, filing fees and printing costs. A significant portion of these transaction costs will be incurred even if the Proposed Transaction is not completed.

Failure to reach a definitive agreement to accomplish the Proposed Transaction could negatively affect the trading price of OCIP common units and the future business and financial results of OCIP.

If we fail to enter into a definitive agreement with OCI to accomplish the Proposed Transaction, we may face negative reactions from the financial markets, including declines in the price of OCIP common units. Additionally, the future business and financial results of OCIP could be negatively affected if the attention of OCIP's management is diverted to the Proposed Transaction rather than its own operations and the pursuit of other opportunities that could have been beneficial to OCIP.

19

Risks Related to Our Business

We may not have sufficient cash available for distribution to pay any quarterly distribution on our common units.

We may not have sufficient cash available for distribution each quarter to enable us to pay any distributions to our common unitholders. The amount of cash we will be able to distribute on our common units principally depends on the amount of cash we generate from our operations, which is directly dependent upon the operating margins we generate. Our profit margins are significantly affected by the level of our cost of goods sold (exclusive of depreciation), including the cost of natural gas, our primary feedstock, as well as the costs of hydrogen and nitrogen and other costs, the market-driven prices for methanol and ammonia we are able to charge our customers, seasonality, weather conditions, governmental regulation and global and domestic economic conditions and demand for methanol and ammonia, among other factors. In addition, our results of operations and our ability to pay distributions are affected by:

• | planned and unplanned maintenance at our facility, which may result in downtime and thus negatively impact our cash flows in the quarter in which such maintenance occurs; |

• | the level of our capital expenditures; |

• | our debt service requirements; |

• | the level of our expenses that are incurred by our general partner and its affiliates on our behalf and reimbursed by us; |

• | fluctuations in our working capital needs; |

• | our ability to access capital markets; |

• | fluctuations in interest rates; |

• | the level of competition in our market and industry; |

• | restrictions on distributions and on our ability to make working capital borrowings; and |

• | the amount of cash reserves established by our general partner, including for turnarounds and related expenses. |

Our partnership agreement does not require us to pay a minimum quarterly distribution. The amount of distributions that we pay, if any, and the decision to pay any distribution at all, will be determined by the board of directors of our general partner. Our quarterly distributions, if any, will be subject to significant fluctuations based on the above-listed factors.

The amount of our quarterly cash distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to maintain or increase quarterly cash distributions over time.

Investors who are looking for an investment that will pay regular and predictable quarterly distributions should not invest in our common units. We expect our business performance will be more volatile, and our cash flows will be less stable, than the business performance and cash flows of most publicly traded partnerships. As a result, the amount of our quarterly cash distributions, if any, will be volatile and are expected to vary quarterly and annually. For example, we did not pay any quarterly cash distributions with respect to the quarters ended March 31, 2015, June 30, 2015, June 30, 2016, September 30, 2016, or December 31, 2016. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to maintain or increase quarterly cash distributions over time. The amount of our quarterly cash distributions will be directly dependent on the performance of our business, which is subject to volatility. Methanol prices have historically been, and are expected to continue to be, characterized by significant cyclicality. Additionally, ammonia and natural gas prices are volatile, and seasonal and global fluctuations in demand for nitrogen fertilizer products and other ammonia-based products could affect our revenues. Because our quarterly cash distributions will be subject to significant fluctuations directly related to the cash we generate after payment of our fixed and variable expenses and other cash reserves established by our general partner, future quarterly cash distributions paid to our unitholders will vary significantly from quarter to quarter and may be zero. Given the volatile nature of our business, we expect that our unitholders will have direct exposure to fluctuations in the price of methanol and ammonia and the cost of natural gas.

20

The amount of cash we have available for distribution to unitholders depends primarily on our cash flow and not solely on profitability.

You should be aware that the amount of cash we have available for distribution depends primarily on our cash flow and not solely on our profitability, which may be affected by non-cash items. As a result, we may make cash distributions during periods when we record losses for financial accounting purposes and may not make cash distributions during periods when we record net earnings for financial accounting purposes. Please read “Market for Registrant's Common Equity, Related Unitholder Matters and Issuer Purchases of Equity Securities—Cash Distribution Policy.”

The board of directors of our general partner may modify or revoke our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay any distributions at all.

Under our current cash distribution policy, we intend to distribute 100% of the cash available for distribution that we generate each quarter to unitholders of record on a pro rata basis. However, the board of directors may change such policy at any time at its discretion and could elect not to pay distributions for one or more quarters. For example, we did not pay any quarterly cash distributions with respect to the quarters ended March 31, 2015, June 30, 2015, June 30, 2016, September 30, 2016, or December 31, 2016.

Our partnership agreement does not require us to pay any distributions at all. Accordingly, investors are cautioned not to place undue reliance on the permanence of such a policy in making a decision to invest in our common units. Any modification or revocation of our cash distribution policy could substantially reduce or eliminate the amounts of distributions to our unitholders. The amount of distributions we make, if any, and the decision to make any distribution at all will be determined by the board of directors of our general partner, whose interests may differ from those of our common unitholders. Our general partner has limited fiduciary and contractual duties, which may permit it to favor its own interests or the interests of OCI to the detriment of our common unitholders.

Our facility faces operating hazards and interruptions, including unscheduled maintenance or downtime. We could face significant reductions in revenues and increases in expenses to the extent these hazards or interruptions cause a material decline in production and are not fully covered by our existing insurance coverage. Insurance companies that currently insure companies in our industry may cease to do so, may change the coverage provided or may substantially increase premiums in the future.

Our operations, located at a single location, are subject to significant operating hazards and interruptions. Any significant curtailing of production at our facility or individual units within our facility could result in materially lower levels of revenues and cash flow and materially increased expenses for the duration of any downtime and materially adversely impact our results of operations, financial condition and ability to make cash distributions. Operations at our facility could be curtailed or partially or completely shut down, temporarily or permanently, as the result of a number of circumstances, most of which are not within our control, such as:

• | unscheduled maintenance or catastrophic events such as a major accident, fire, damage by severe weather, flooding or other natural disaster; |

• | labor difficulties that result in a work stoppage or slowdown; |

• | environmental proceedings or other litigation that compel the cessation of all or a portion of the operations at our facility; |

• | increasingly stringent environmental regulations; |

• | a disruption in the supply of natural gas to our facility; and |

• | governmental limitations on the use of our products, either generally or specifically those manufactured at our plant. |

21